Comparative Analysis of the Aviation Maintenance, Repair, and Overhaul (MRO) Industry in Northeast Asian Countries: A Suggestion for the Development of Korea’s MRO Industry

Abstract

:1. Introduction

2. Literature Review

2.1. Understanding the External Environment of the Aviation MRO Industry

2.2. Competitiveness of the National Aviation MRO Industry

2.3. SWOT Analysis

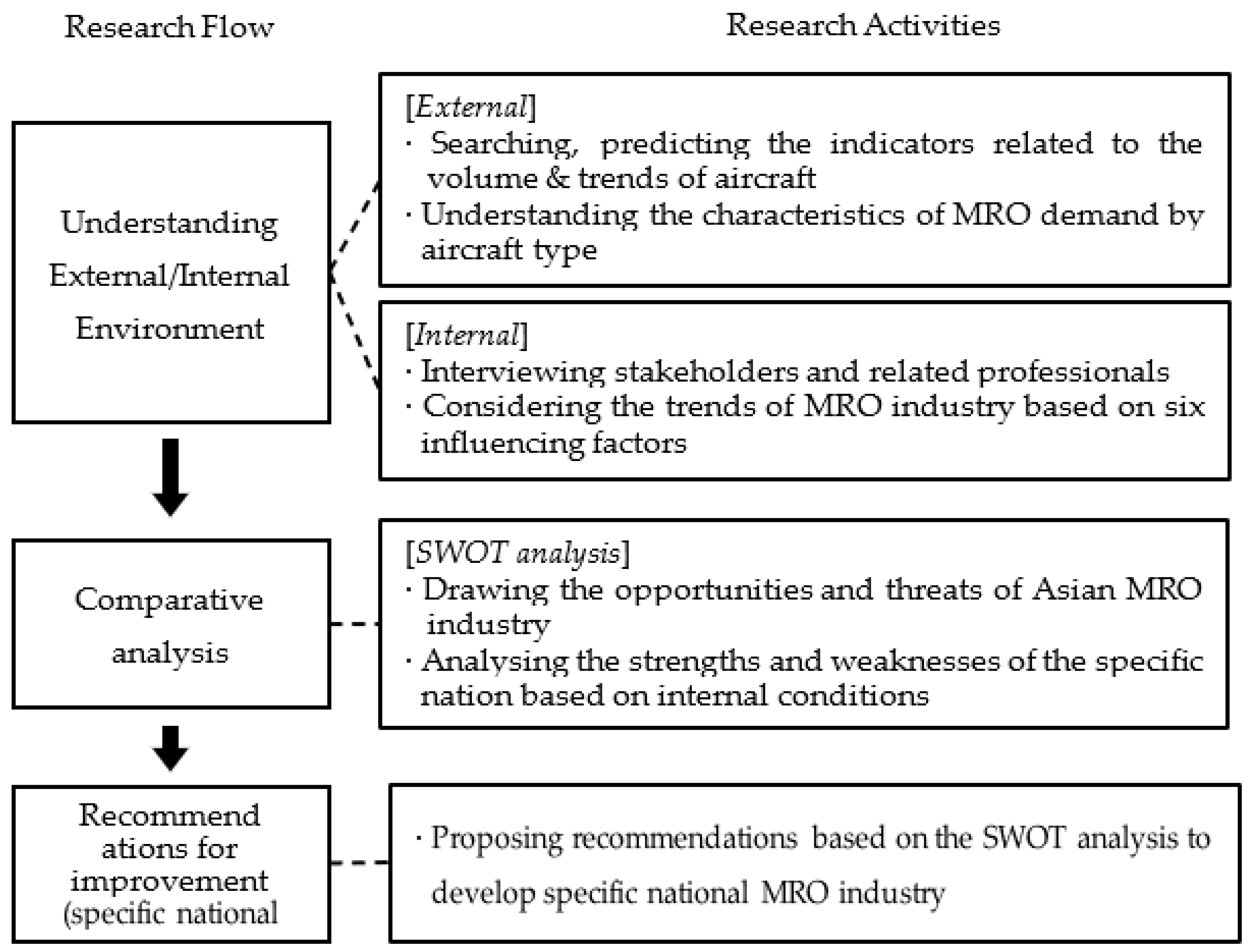

3. Analytical Framework

4. Results of SWOT Analysis

4.1. External Conditions: Opportunities and Threats

4.2. Internal Conditions: Strengths and Weaknesses

4.2.1. Workforce and Cost

4.2.2. Geographic Presence and Quality with Shorter Turnaround Time

4.2.3. Technological Advancement and Certification

5. Comparative Analysis of the MRO Industry: China, Japan, and Korea

Implications for A Specific Country’s MRO Industry: A Case Study of Korea

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Nam, S.; Ha, C.; Lee, H.C. Redesigning in-flight service with service blueprint based on text analysis. Sustainability 2018, 10, 4492. [Google Scholar] [CrossRef] [Green Version]

- Laplace, I.; Lenoir, N.; Roucolle, C. Economic impacts of the ASEAN single aviation market: Focus on Cambodia, Laos, Myanmar, The Philippines and Vietnam. Asia Pac. Bus. Rev. 2019, 25, 656–682. [Google Scholar] [CrossRef]

- Lee, W.K. Risk assessment modeling in aviation safety management. J. Air Transp. Manag. 2006, 12, 267–273. [Google Scholar] [CrossRef]

- Efthymiou, M.; McCarthy, K.; Markou, C.; O’Connell, J.K. An Exploratory Research on Blockchain in Aviation: The Case of Maintenance, Repair and Overhaul (MRO) Organizations. Sustainability 2022, 14, 2643. [Google Scholar] [CrossRef]

- Zhu, H.; Gao, J.; Li, D.; Tang, D. A Web-based Product Service System for aerospace maintenance, repair and overhaul services. Comput. Ind. 2012, 63, 338–348. [Google Scholar] [CrossRef]

- Lee, S.G.; Ma, Y.S.; Thimm, G.L.; Verstraeten, J. Product lifecycle management in aviation maintenance, repair and overhaul. Comput. Ind. 2008, 59, 296–303. [Google Scholar] [CrossRef]

- Nam, S.; Song, W.K.; Yoon, H. An maintenance, repair, and overhaul (MRO) safety oversight system analysis: A case in Korea. J. Air Transp. Manag. 2023, 107, 102349. [Google Scholar] [CrossRef]

- Purvis, B.; Mao, Y.; Robinson, D. Three pillars of sustainability: In search of conceptual origins. Sustain. Sci. 2019, 14, 681–695. [Google Scholar] [CrossRef] [Green Version]

- Zieba, M.; Johansson, E. Sustainability reporting in the airline industry: Current literature and future research avenues. Transp. Res. D Transp. Environ. 2022, 102, 103133. [Google Scholar] [CrossRef]

- Oster, V.; Strong, S.; Zorn, K. Analyzing aviation safety: Problems, challenges, opportunities. Res. Transp. Econ. 2013, 43, 148–164. [Google Scholar] [CrossRef]

- Kim, H.; Lee, N. The Effects of the In-Flight Safety Information Characteristics on the Safety Behavioral Intention of Airline Passengers. Sustainability 2022, 14, 2819. [Google Scholar] [CrossRef]

- Lurkin, V.; Garrow, A.; Higgins, J.; Newman, P.; Schyns, M. Modeling competition among airline itineraries. Transp. Res. A Policy Pract. 2018, 113, 157–172. [Google Scholar] [CrossRef]

- Frost & Sullivan. Commercial Aircraft & Engine MRO Market Assessment 2019; Frost & Sullivan: New York, NY, USA, 2019. [Google Scholar]

- Oliver Wyman. Global Fleet & MRO Market Economic Assessment 2020–2030; Oliver Wyman: New York, NY, USA, 2020; Available online: http://arsa.org/wp-content/uploads/2020/03/ARSA-OW-MarketReport-Final-ExecSum-2020.pdf (accessed on 8 November 2022).

- Rowley, C.; Ishikawa, J.; Oh, I. Changing facets of leadership in East Asia: Globalization, innovation and performance in Japan, South Korea and China. Asia Pac. Bus. Rev. 2019, 25, 161–172. [Google Scholar] [CrossRef]

- Chambers, I.; Russell-Smith, J.; Costanza, R.; Cribb, J.; Kerins, S.; George, M.; James, G.; Pedersen, H.; Lane, P.; Christopherson, P.; et al. Australia’s north, Australia’s future: A vision and strategies for sustainable economic, ecological and social prosperity in northern Australia. Asia Pac. Policy Stud. 2018, 5, 615–640. [Google Scholar] [CrossRef]

- Pickton, W.; Wright, S. What’s swot in strategic analysis? Strat. Change 1998, 7, 101–109. [Google Scholar] [CrossRef]

- ICAO. Manual on Air Traffic Forecasting; ICAO: Montréal, QC, Canada, 2006; Available online: https://www.icao.int/MID/Documents/2014/Aviation%20Data%20Analyses%20Seminar/8991_Forecasting_en.pdf (accessed on 8 November 2022).

- PwC. How Mounting Uncertainty Could Open an Era of Transformation; PwC: London, UK, 2020; Available online: https://www.pwc.com/us/en/industries/industrial-products/library/airlines-uncertainty-transformation.html (accessed on 8 November 2022).

- ACI. ACI Guide to World Airport Traffic Forecasts 2016; ACI: Miami, FL, USA, 2016; Available online: ACI_Guide_to_World_Airport_Traffic_Forecasts_2016.pdf (accessed on 8 November 2022).

- Carmona, B.; Nieto, R. SARIMA damp trend grey forecasting model for airline industry. J. Air Transp. Manag. 2020, 82, 101736. [Google Scholar] [CrossRef]

- Nieto, R.; Carmona, B. ARIMA + GARCH + Bootstrap Forecasting Method Applied to the Airline Industry. J. Air Transp. Manag. 2018, 71, 1–8. [Google Scholar] [CrossRef]

- Tsui, K.; Balli, H.; Gilbey, A.; Gow, H. Forecasting of Hong Kong Airport’s Passenger Throughput. Tour. Manag. 2014, 42, 62–76. [Google Scholar] [CrossRef]

- Yoon, W.; Jeong, J. An Alternative Methodology for Planning Baggage Carousel Capacity Expansion: A Case Study of Incheon International Airport. J. Air Transp. Manag. 2015, 42, 63–74. [Google Scholar] [CrossRef]

- Nam, S.; Choi, C.; Kim, J.; Kim, J.K. Text Analytics Model for Identifying the Airport Industry Trends. Korean Manag. Sci. Rev. 2020, 37, 61–74. [Google Scholar] [CrossRef]

- Choi, S. A Study on Aviation MRO Industries and Growth Strategy in Korean MRO. J. Korean Soc. Aviat. 2017, 15, 3–19. [Google Scholar]

- Patterson, O.; Tonder, C. External Strategic Analysis of the Aviation Maintenance, Repair and Overhaul (MRO) Industry and Potential Market Opportunities for Fleet Readiness Center Southwest; MBA Professional Report; Naval Postgraduate School: Monterey, CA, USA, 2009. [Google Scholar]

- Palmer, D.; Kaplan, K. Framework for Strategic Innovation: Blending Strategy and Creative Exploration to Discover Future Business Opportunities; InnovationPoint LLC: Walnut Creek, CA, USA, 2007; Available online: https://www.innovation-point.com/Strategic%20Innovation%20White%20Paper.pdf (accessed on 8 November 2022).

- Vieira, R.; Loures, L. Maintenance, Repair and Overhaul (MRO) Fundamentals and Strategies: An Aeronautical Industry Overview. Int. J. Comput. Appl. 2016, 135, 21–29. [Google Scholar] [CrossRef]

- Shanmugam, A.; Robert, P. Ranking of Aircraft Maintenance Organization Based on Human Factor Performance. Comput. Ind. Eng. 2015, 88, 410–416. [Google Scholar] [CrossRef]

- Yilmaz, A.K. Strategic approach to managing human factors risk in aircraft maintenance organization: Risk mapping. Aircr. Eng. Aerosp. Technol. 2019, 91, 654–668. [Google Scholar] [CrossRef]

- Samad, A.; Haider, R.; Hairudin, M. Human Factors Affecting Avionics Workshop in MRO 145. Int. J. Eng. Innov. Technol. 2019, 8, 553–555. Available online: https://www.ijitee.org/wp-content/uploads/papers/v8i5s/ES3481018319.pdf (accessed on 8 November 2022).

- Ho, Y.C.; Chang, O.C.; Wang, W.B. An empirical study of key success factors for Six Sigma Green Belt projects at an Asian MRO company. J. Air Transp. Manag. 2008, 14, 263–269. [Google Scholar] [CrossRef]

- Dhanisetty, V.V.; Verhagen, W.J.C.; Curran, R. Multi-criteria weighted decision making for operational maintenance processes. J. Air Transp. Manag. 2018, 68, 152–164. [Google Scholar] [CrossRef]

- Machado, M.C.; Araújo, M.; Urbina, L.M.S.; Macau, F.R. A qualitative study of outsourced aeronautical maintenance: The case of Brazilian organizations. J. Air Transp. Manag. 2016, 55, 176–184. [Google Scholar] [CrossRef]

- Airbus. Technology and Innovation: Passenger Aircraft. 2020. Available online: https://www.airbus.com/aircraft/passenger-aircraft/technology-innovation.html (accessed on 8 November 2022).

- Ali, K.; Raman, R.S.; Zhao, X.L.; Jones, R.; McMillan, A.J. Composite repairs to bridge steels demystified. Compos. Struct. 2017, 169, 180–189. [Google Scholar] [CrossRef]

- Wang, J.; Baker, A.; Chang, P. Hybrid approaches for aircraft primary structure repairs. Compos. Struct. 2019, 207, 190–203. [Google Scholar] [CrossRef]

- FAA. FAA Regulations & Policies. 2020. Available online: https://www.faa.gov/regulations_policies/ (accessed on 8 November 2022).

- Flouris, T.G.; Oswald, S.L. Designing and Executing Strategy in Aviation Management; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Muhmmet, C.; Muharrem, E.C.; Ibrahim, Z.A. Strategical Analysis and the Impact of Istanbul Airport on Turkish Airlines. J. Econ. Soc. Dev. 2020, 7, 71–80. [Google Scholar]

- Parton, J.; Ryley, T. A business analysis of XL Airways: What lessons can be learned from the failure? J. Air Transp. Manag. 2012, 19, 42–48. [Google Scholar] [CrossRef]

- Al-kaabi, H.; Potter, A.; Naim, M. An outsourcing decision model for airlines’ MRO activities. J. Qual. Maint. Eng. 2007, 13, 217–227. [Google Scholar] [CrossRef]

- Frost & Sullivan. Commercial Aircraft & Engine MRO Market Assessment 2020; Frost & Sullivan: New York, NY, USA, 2020. [Google Scholar]

- Beeson, M.; Lee-Brown, T. The future of Asian regionalism: Not what it used to be? Asia Pac. Policy Stud. 2017, 4, 195–206. [Google Scholar] [CrossRef]

- Borroz, N.; Marston, H. How Trump can Avoid War with China. Asia Pac. Policy Stud. 2017, 4, 613–620. [Google Scholar] [CrossRef] [Green Version]

- IBM. Korean Air is Using Watson to Search Vast Amounts of Data to Improve Operational Efficiency and on-Time Performance. 2020. Available online: https://www.ibm.com/watson/stories/airlines-with-watson/ (accessed on 8 November 2022).

- Hale, J. Boeing 787 from the Ground up. 2006. Available online: https://www.boeing.com/commercial/aeromagazine/articles/qtr_4_06/article_04_1.html (accessed on 8 November 2022).

- Airbus. Airbus Technical Magazine-A350XWB Special Edition. 2013. Available online: https://www.airbus.com/content/dam/corporate-topics/publications/fast/FAST_specialA350.pdf (accessed on 8 November 2022).

- Boeing. Pilot & Technician Outlook 2019–2038. 2019. Available online: https://flightsafety.org/wp-content/uploads/2019/07/2019_pto_infographic.pdf (accessed on 8 November 2022).

- Education First. Education First: English Proficiency Index 2019. 2019. Available online: https://27.group/education-firsts-ef-english-proficiency-index-2019-malaysias-in-the-top-30/ (accessed on 8 November 2022).

- Organisation for Economic Co-operation and Development. Education at a Glance 2019. 2019. Available online: http://www.oecd.org/education/education-at-a-glance/ (accessed on 8 November 2022).

- Kim, K.W.; Choi, H.Y. A Study on Aircraft MRO Industries. J. Aviat. Dev. Korea 2011, 12, 87–109. [Google Scholar]

- Asiana Airlines. Comparison of Domestic and International MRO Company Heavy Maintenance Costs; Asiana Airlines: Seoul, Republic of Korea, 2013. [Google Scholar]

- Choi, S. Job Creation Through the Growth of the Aviation MRO Industry. 2019. Available online: https://www.kli.re.kr/kli_eng/engPdicalView.do?key=484&pblctListNo=9254&schPdicalKnd=6&schPblcateDe=&mainPageUnit=10&searchCnd=all&s (accessed on 8 November 2022).

- Yadav, D.K.; Nikraz, H. Implications of evolving civil aviation safety regulations on the safety outcomes of air transport industry and airports. Aviation 2014, 18, 94–103. [Google Scholar] [CrossRef]

- Ministry of Trade Industry and Energy. Competitiveness of Carbon Fiber and Carbon Fiber Based Material Industry 2018. 2018. Available online: http://www.prism.go.kr/homepage/researchCommon/downloadResearchAttachFile.do;jsessionid=37FB0B383F6EB0800E8AA31F922C8183.node02?work_key=001&file_type=CPR&seq_no=001&pdf_conv_yn=N&research_id=1450000–201800124 (accessed on 8 November 2022).

- Amankwah-Amoah, J. Stepping up and stepping out of COVID-19: New challenges for environmental sustainability policies in the global airline industry. J. Clean. Prod. 2020, 271, 123000. [Google Scholar] [CrossRef] [PubMed]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef] [Green Version]

- Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 2022, 145, 642–664. [Google Scholar] [CrossRef]

| Factor | Definition |

|---|---|

| Cost | The amount that must be spent to obtain an item or service. The cost of maintenance, repair, and overhaul services is paid by the airline to the service provider and includes labor and materials. |

| Workforce | The number of people working or available to work. |

| Geographic Presence | Existing or occurring in a specific geographical area/region. |

| Quality with Shorter Turnaround Time | Reduced time required to fulfil a process request without sacrificing service quality. |

| Technological Advancement | MRO-related prowess, maturity of related industries. |

| Certification | An official document attesting to a status or achievement level. |

| Country | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Korea | 242 | 303 | 377 | 429 | 504 |

| China | 2348 | 2964 | 3579 | 3921 | 4412 |

| Japan | 422 | 537 | 636 | 703 | 806 |

| Total | 3012 | 3804 | 4592 | 5053 | 5722 |

| Influencing Factors | |

|---|---|

| Opportunities | Automation and robotics in maintenance, repair, and overhaul (MRO) operations. |

| Predictive maintenance leading to better visibility from scheduled checks. | |

| New airlines entering the industry imply new business for independent MRO companies. | |

| Growing middle class leading to increased orders for aircraft. | |

| Sale and leaseback leading to an increased number of fleet orders. | |

| Threats | Increased competition causing airlines to postpone non-essential MRO work. |

| Consolidation in the market resulting in less opportunity for independent MRO companies, as more operations are handled in-house. | |

| Highly sophisticated MRO processes are returning to Original Equipment Manufacturers (OEMs). | |

| Cybersecurity is an important consideration for MRO companies. | |

| Limited workforce restricts MRO operations. | |

| Aircraft advancements lengthen the interval between scheduled maintenance checks. | |

| Flight time reduction caused by COVID-19 affects MRO spending, accelerates restructuring and retirement of traditional aircraft, and places an emphasis on newer aircraft. |

| Aircraft Model | % of Composites | Proportion of Airframe Spending Attributed to Composites |

|---|---|---|

| B767, B747, B777, A330 | 5% | 10% |

| B737, A319, A320, A321, A321neo | 15% | 30% |

| A220, A380 | 20% | 40% |

| B787 | 50% | 100% |

| A350 | 53% | 100% |

| Influencing Factors | Intensity | |

|---|---|---|

| Strength | Supply of high-quality human resources (high education level and English proficiency) | Medium |

| Price competitiveness owing to relatively low labor costs | Medium | |

| Korea’s geographically advantageous location between China and Japan | Low | |

| Quality with shorter turnaround time | Medium | |

| Weakness | Low technological advancement related to composites | Medium |

| Relatively low number of MRO providers with certifications | Medium |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nam, S.; Choi, S.; Edell, G.; De, A.; Song, W.-K. Comparative Analysis of the Aviation Maintenance, Repair, and Overhaul (MRO) Industry in Northeast Asian Countries: A Suggestion for the Development of Korea’s MRO Industry. Sustainability 2023, 15, 1159. https://doi.org/10.3390/su15021159

Nam S, Choi S, Edell G, De A, Song W-K. Comparative Analysis of the Aviation Maintenance, Repair, and Overhaul (MRO) Industry in Northeast Asian Countries: A Suggestion for the Development of Korea’s MRO Industry. Sustainability. 2023; 15(2):1159. https://doi.org/10.3390/su15021159

Chicago/Turabian StyleNam, Seungju, Sejong Choi, Georgia Edell, Amartya De, and Woon-Kyung Song. 2023. "Comparative Analysis of the Aviation Maintenance, Repair, and Overhaul (MRO) Industry in Northeast Asian Countries: A Suggestion for the Development of Korea’s MRO Industry" Sustainability 15, no. 2: 1159. https://doi.org/10.3390/su15021159