A Study of the Spatial Mechanism of Financial Agglomeration Affecting Green Low-Carbon Development: Evidence from China

Abstract

:1. Introduction and Review of the Literature

2. Mechanism Analysis and Research Hypothesis

2.1. The Mechanism of the Role of Financial Agglomeration on GTFP

2.2. Spatial Spillover of Financial Agglomeration

3. Models, Variables and Typical Fact Analysis

3.1. Variables Selection

3.1.1. Explanatory Variable: Green Low Carbon Development (GTFP)

3.1.2. Core Explanatory Variable: Financial Agglomeration Level (FAGG)

3.1.3. Control Variables

3.1.4. Mediating Variables

3.2. Data Sources

3.3. Model Setting

3.4. Typical Fact Analysis

3.4.1. Time Evolutionary Characteristics of GTFP

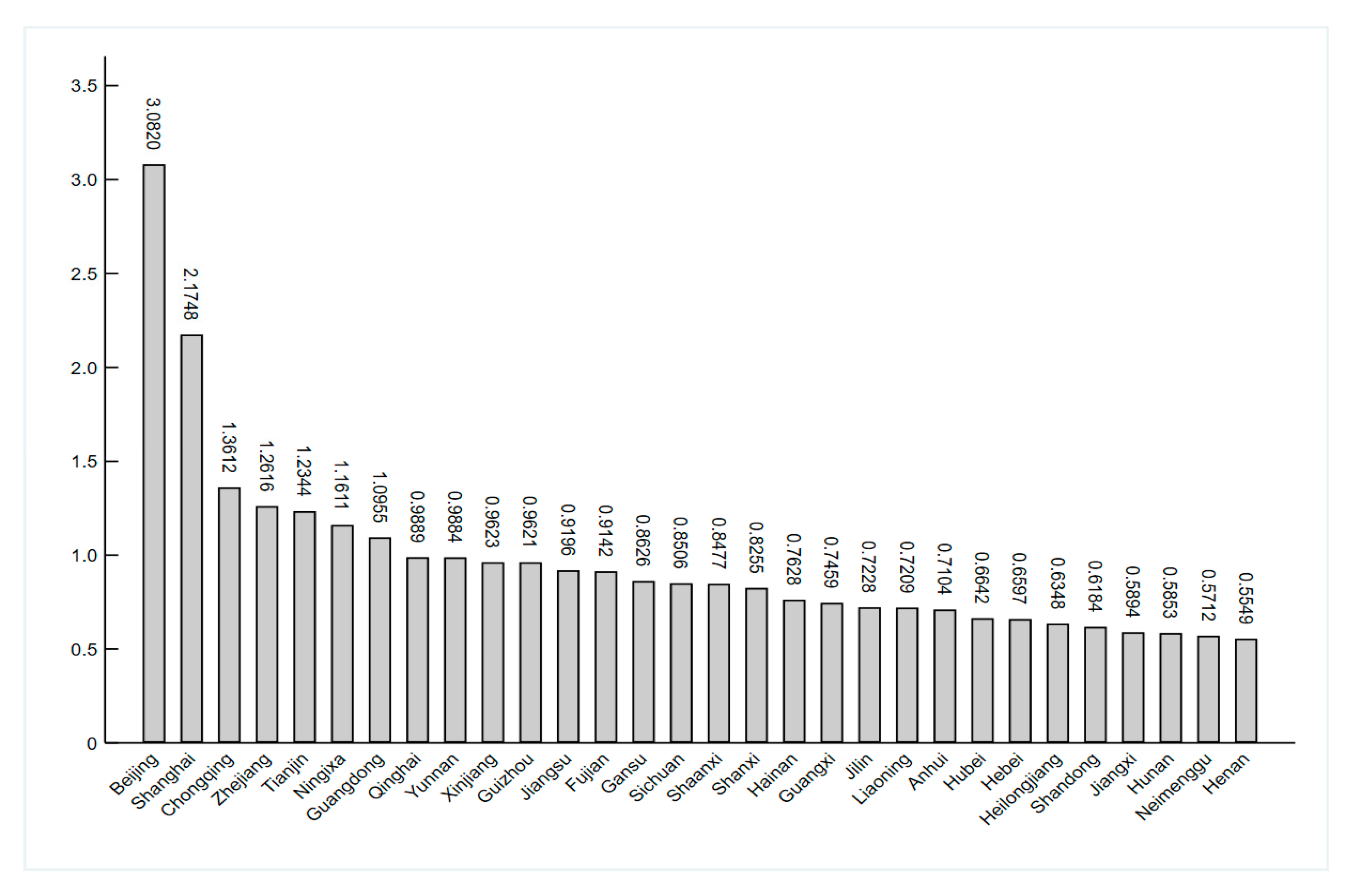

3.4.2. Differences in the Comprehensive Development Level of Provincial Financial Agglomeration (FAGG) in China

4. Measurement Tests and Analysis of Results

4.1. Model Testing

4.2. Benchmark Regression

4.3. Measurement of Spatial Spillover Effect

4.4. Non-Linear Relation Test

4.5. Robustness Check

4.5.1. Test of Matrices in Different Spaces

4.5.2. Panel Quantile Test

5. Mechanism Inspection

6. Conclusions and Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hejduková, P.; Kureková, L.; Krechovská, M. The measurement of industry 4.0: An empirical cluster analysis for EU Countries. Int. J. Econ. Sci. 2020, IX, 121–134. [Google Scholar] [CrossRef]

- Grześkowiak, A. Soft skills and earnings: Evidence from a nationwide survey in Poland. Int. J. Econ. Sci. 2020, IX, 102–120. [Google Scholar] [CrossRef]

- Qu, C.; Shao, J.; Shi, Z. Does financial agglomeration promote the increase of energy efficiency in China? Energy Policy 2020, 146, 111810. [Google Scholar] [CrossRef]

- Marshall, A. The Principles of Economics. In History of Economic Thought Books, 8th ed.; Macmillan: London, UK, 1992. [Google Scholar]

- Forni, M.; Paba, S. Knowledge Spillovers and The Growth of Local Industries. 2001. Available online: https://ssrn.com/abstract=282575 (accessed on 30 October 2022).

- Dupont, V. Do geographical agglomeration, growth and equity conflict? Pap. Reg. Sci. 2007, 86, 193–213. [Google Scholar] [CrossRef]

- Arimoto, Y.; Nakajima, K.; Okazaki, T. Sources of productivity improvement in industrial clusters: The case of the prewar Japanese Silk-reeling Industry. Reg. Sci. Urban Econ. 2014, 46, 27–41. [Google Scholar] [CrossRef]

- Lu, R.; Ruan, M.; Reve, T. Cluster and co-located cluster effects: An empirical study of six Chinese city regions. Res. Policy 2016, 45, 1984–1995. [Google Scholar] [CrossRef]

- He, R.; Baležentis, T.; Štreimikienė, D.; Shen, Z. Sustainable green growth in developing economies: An empirical analysis on the belt and road countries. J. Glob. Inf. Manag. (JGIM) 2021, 30, 1–15. [Google Scholar] [CrossRef]

- Dellink, R.; Chateau, J.; Lanzi, E.; Magné, B. Long-term Economic growth projections in the shared socioeconomic pathways. Glob. Environ. Chang. 2017, 42, 200–214. [Google Scholar] [CrossRef]

- Banica, G.C.; Constantin, D.L.; Profiroiu, A.; Dimian, M. Regional convergence from the perspective of factor mobility and technological change. Econ. Comput. Econ. Cybern. Stud. Res. 2007, 41, 167–177. [Google Scholar]

- Varahrami, V.; Vajari, A.N. FDI, Government budget and efficiency of public infrastructure capital. Int. J. Econ. Sci. 2019, VIII, 148–158. [Google Scholar] [CrossRef]

- Kurekova, L.; Hejdukova, P. Multilevel Research of Migration with a Focus on Internal Migration. Int. J. Econ. Sci. 2021, X, 87–103. [Google Scholar] [CrossRef]

- Hromada, E.; Cermakova, K. Financial unavailability of housing in the Czech Republic and recommendations for its solution. Int. J. Econ. Sci. 2021, X, 47–58. [Google Scholar] [CrossRef]

- Pojar, J.; Macek, D.; Heralová, R.S.; Vitásek, S. Advances in costs optimization methods—Key study of maintenance and restoration of cultural heritage. Int. J. Econ. Sci. 2022, XI, 163–178. [Google Scholar] [CrossRef]

- Wang, H.; Zhang, Y.; Liu, Z.; Liu, R.; Li, K. The impact and mechanisms of the shanghai pilot free-trade zone on the green total factor productivity of the Yangtze River delta urban agglomeration. Environ. Sci. Pollut. Res. 2022, 29, 40997–41011. [Google Scholar] [CrossRef] [PubMed]

- Qian, Y.; Liu, J.; Forrest, J.Y.L. Impact of financial agglomeration on regional green economic growth: Evidence from China. J. Environ. Plan. Manag. 2022, 65, 1611–1636. [Google Scholar] [CrossRef]

- Xie, R.; Fu, W.; Yao, S.; Zhang, Q. Effects of financial agglomeration on green total factor productivity in Chinese cities: Insights from an empirical spatial Durbin model. Energy Econ. 2021, 101, 105449. [Google Scholar] [CrossRef]

- Pala, A. The Relation between Climate Change and Economic Growth: The Investigation The Regional Differences with RCM Model in EU-28 Countries. Int. J. Econ. Sci. 2020, IX, 135–155. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. Natural resource abundance, resource industry dependence and economic green growth in China. Resour. Policy 2020, 68, 101734. [Google Scholar] [CrossRef]

- Song, K.; Bian, Y.; Zhu, C.; Nan, Y. Impacts of dual decentralization on green total factor productivity: Evidence from China’s economic transition. Environ. Sci. Pollut. Res. 2020, 27, 14070–14084. [Google Scholar] [CrossRef]

- Feng, Y.; Zou, L.; Yuan, H.; Dai, L. The spatial spillover effects and impact paths of financial agglomeration on green development: Evidence from 285 prefecture-level cities in China. J. Clean. Prod. 2022, 340, 130816. [Google Scholar] [CrossRef]

- Yuan, H. Financial agglomeration and green development: A two-dimensional perspective based on level and efficiency. Sci. Res. Manag. 2019, 40, 126–143. [Google Scholar]

- Williamson, J.G. Regional Inequality and the Process of National Development: A Description of the Patterns. Econ. Dev. Cult. Change 1965, 13, 1–84. [Google Scholar] [CrossRef]

- Yuan, H.X.; Liu, Y.B.; Feng, Y.D. How does financial agglomeration affect green development Efficiency? Empirical analysis of SPDM and PTR models considering spatio-temporal double fixation. Chin. J. Manag. Sci. 2019, 27, 61–75. [Google Scholar]

- Wen, Y.; Zhao, M.; Zheng, L.; Yang, Y.; Yang, X. Impacts of financial agglomeration on technological innovation: A spatial and nonlinear perspective. Technol. Anal. Strateg. Manag. 2021, 35, 17–29. [Google Scholar] [CrossRef]

- Wu, D.; Tong, X.; Liu, L.; Wang, J. Do regional financial resources affect the concentration of high-end service industries in Chinese cities? Financ. Res. Lett. 2021, 42, 101935. [Google Scholar] [CrossRef]

- Shao, S.; Fan, M.; Yang, L. Economic restructuring, green technology progress and China’s low-carbon transformation and development—An empirical study based on the perspective of overall technological frontier and spatial spillover effect. Manag. World 2022, 38, 24. [Google Scholar]

- Rod, A.; Čermáková, K. Retail banking in the Czech Republic—A comparison of consumer prices between 2011 and 2014. Int. J. Econ. Sci. 2016, V, 42–54. [Google Scholar] [CrossRef]

- Nkoro, E.; Uko, A.K. Foreign Direct Investment and Inclusive Growth: The Role of the Financial Sector Development. Int. J. Econ. Sci. 2022, XI, 144–162. [Google Scholar] [CrossRef]

- Liao, G.; Yao, D.; Hu, Z. The spatial effect of the efficiency of regional financial resource allocation from the perspective of internet finance: Evidence from Chinese provinces. Emerg. Mark. Financ. Trade 2020, 56, 1211–1223. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S.; Lovell, C. Production Frontiers; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Martinus, K.; Suzuki, J.; Bossaghzadeh, S. Agglomeration Economies, Interregional Commuting and Innovation in the Peripheries. Reg. Stud. 2020, 54, 776–788. [Google Scholar] [CrossRef]

- Huang, D.; Chen, G. Can the Carbon Emissions Trading System Improve the Green Total Factor Productivity of the Pilot Cities?—A Spatial Difference-in-Differences Econometric Analysis in China. Int. J. Environ. Res. Public Health 2022, 19, 1209. [Google Scholar] [CrossRef] [PubMed]

- Yang, H.; Li, L.; Liu, Y. The effect of manufacturing intelligence on green innovation performance in China. Technol. Forecast. Soc. Chang. 2022, 178, 121569. [Google Scholar] [CrossRef]

- Krugman, P. Increasing Returns and Economic Geography. J. Political Econ. 1991, 99, 483–499. [Google Scholar] [CrossRef]

- Zheng, Y.; Cheng, Y.; Li, L. Factors affecting regional economic synergy in China–based on research on high-tech industry. IEEE Access 2019, 8, 14123–14133. [Google Scholar] [CrossRef]

- Zhang, J.; Wu, G.; Zhang, J. The estimation of China’s provincial capital stock: 1952–2000. Econ. Res. J. 2004, 10, 35–44. [Google Scholar]

- Shangguan, X.; Ge, B. Digital finance, environmental regulation and high-quality economic development. Mod. Financ. Econ. J. Tianjin Univ. Financ. Econ 2021, 41, 84–98. [Google Scholar]

- Zongyi, H.; Yi, L. Dual effects and threshold characteristics of financial development on environmental pollution. China Soft Sci. 2019, 7, 68–80. [Google Scholar]

- Qiu, B.; Yang, S.; Xin, P. Research on FDI technology spillover channels and China’s manufacturing productivity growth: An analysis based on panel data. World Econ. 2008, 8, 20–31. [Google Scholar]

- Sun, Z.; Gu, W.; Cheng, X. Research on the Interaction between Innovation Spillover and Regional Green All Factors—Based on DEA-ESDA Empirical Analysis. Sci. Technol. Manag. Res. 2022, 42, 62–69. [Google Scholar]

- Arellano, M.; Bover, O. Another Look at the Instrumental Variable Estimation of Error-Components Models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef] [Green Version]

- Lesage, J.P.; Pace, R.K. Introduction to Spatial Econometrics; Chapman and Hall/CRC: Boca Raton, FL, USA, 2009. [Google Scholar]

- Zhang, C.; Wang, X.; Gu, Z. An Empirical Test of the Impact of Financial Agglomeration on High Quality Economic Development—Based on Provincial Panel Data from 2005 to 2019. Ind. Technol. Econ. 2021, 40, 99–109. [Google Scholar]

| Variables | Sample | Size | Mean | Min | Max |

|---|---|---|---|---|---|

| GTFP | 510 | 1.0218 | 0.0336 | 0.9300 | 1.2380 |

| GTC | 510 | 1.0477 | 0.0616 | 0.7470 | 1.6130 |

| GEC | 510 | 0.9782 | 0.0599 | 0.6260 | 1.3670 |

| FAGG | 510 | 0.9678 | 0.5422 | 0.4089 | 4.9602 |

| GS | 510 | 0.3184 | 0.1876 | 0.0849 | 1.0650 |

| ECO | 510 | 0.5337 | 0.5298 | 0.0000 | 2.5853 |

| LNHM | 510 | 2.1595 | 0.1151 | 1.7985 | 2.5401 |

| INV | 510 | 0.7191 | 0.3046 | 0.1847 | 1.9014 |

| URBAN | 510 | 0.5246 | 0.1441 | 0.2477 | 0.8960 |

| LNS | 510 | 8.9527 | 1.0335 | 5.8948 | 11.0556 |

| IS | 510 | 1.1572 | 0.6254 | 0.5271 | 5.2340 |

| LNINOV | 510 | 9.1767 | 1.6871 | 4.3175 | 13.1757 |

| Year | Full Sample | East | Middle | West | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GTFP | GTC | GEC | GTFP | GTC | GEC | GTFP | GTC | GEC | GTFP | GTC | GEC | |

| 2003 | 1.028 | 1.047 | 0.986 | 1.027 | 1.032 | 0.995 | 1.019 | 1.097 | 0.939 | 1.036 | 1.026 | 1.012 |

| 2004 | 1.031 | 1.064 | 0.971 | 1.042 | 1.087 | 0.962 | 1.032 | 1.042 | 0.990 | 1.020 | 1.057 | 0.966 |

| 2005 | 1.022 | 1.035 | 0.988 | 1.029 | 1.048 | 0.983 | 1.018 | 1.024 | 0.994 | 1.017 | 1.029 | 0.989 |

| 2006 | 1.022 | 1.050 | 0.974 | 1.037 | 1.061 | 0.978 | 1.008 | 1.040 | 0.970 | 1.019 | 1.046 | 0.974 |

| 2007 | 1.029 | 1.073 | 0.959 | 1.043 | 1.092 | 0.957 | 1.012 | 1.052 | 0.962 | 1.026 | 1.069 | 0.960 |

| 2008 | 1.017 | 1.021 | 0.996 | 1.025 | 1.023 | 1.001 | 1.003 | 1.020 | 0.983 | 1.018 | 1.018 | 1.001 |

| 2009 | 0.998 | 1.034 | 0.966 | 1.017 | 1.036 | 0.982 | 0.978 | 1.031 | 0.949 | 0.994 | 1.033 | 0.962 |

| 2010 | 1.010 | 1.053 | 0.962 | 1.032 | 1.048 | 0.985 | 0.993 | 1.079 | 0.928 | 1.001 | 1.040 | 0.963 |

| 2011 | 1.011 | 1.069 | 0.951 | 1.021 | 1.084 | 0.957 | 1.011 | 1.063 | 0.951 | 1.002 | 1.059 | 0.946 |

| 2012 | 1.008 | 1.051 | 0.962 | 1.018 | 1.053 | 0.973 | 1.004 | 1.049 | 0.957 | 1.000 | 1.049 | 0.953 |

| 2013 | 1.025 | 1.008 | 1.018 | 1.034 | 1.018 | 1.016 | 1.027 | 1.006 | 1.021 | 1.015 | 0.999 | 1.016 |

| 2014 | 1.005 | 1.070 | 0.942 | 1.023 | 1.093 | 0.943 | 1.001 | 1.058 | 0.946 | 0.989 | 1.054 | 0.938 |

| 2015 | 1.015 | 1.030 | 0.987 | 1.026 | 1.020 | 1.012 | 1.012 | 1.035 | 0.977 | 1.005 | 1.036 | 0.970 |

| 2016 | 1.032 | 1.035 | 0.998 | 1.038 | 1.042 | 0.996 | 1.029 | 1.024 | 1.005 | 1.028 | 1.035 | 0.994 |

| 2017 | 1.021 | 1.046 | 0.982 | 1.024 | 1.044 | 0.998 | 1.043 | 1.048 | 0.995 | 1.001 | 1.046 | 0.957 |

| 2018 | 1.046 | 1.106 | 0.953 | 1.045 | 1.156 | 0.920 | 1.055 | 1.088 | 0.972 | 1.039 | 1.068 | 0.973 |

| 2019 | 1.054 | 1.022 | 1.035 | 1.050 | 1.005 | 1.052 | 1.092 | 1.023 | 1.070 | 1.030 | 1.038 | 0.993 |

| Mean | 1.022 | 1.048 | 0.978 | 1.031 | 1.055 | 0.983 | 1.020 | 1.046 | 0.977 | 1.014 | 1.041 | 0.974 |

| Type | Province |

|---|---|

| Star type area | Beijing, Shanghai, Chongqing, Zhejiang |

| Comparative advantage type areas | Tianjin, Ningxia, Guangdong |

| Mediocre areas | Shanxi, Liaoning, Jilin, Jiangsu, Anhui, Fujian, Guangxi, Hainan, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Xinjiang |

| Backward-looking areas | Hebei, Nei menggu, Heilongjiang, Jiangxi, Shandong, Henan, Hubei, Hunan |

| GTFP | |

|---|---|

| Moran’s I | 0.274 |

| Moran’s I Statistic | 7.707 |

| Marginal Probability | 0.000 |

| Spatial Lag Model | Spatial Error Model | |

|---|---|---|

| LM Test | 31.642 *** | 26.442 *** |

| Robust LM Test | 5.557 *** | 0.357 |

| Explanatory Variable | (1) | (2) | (3) |

|---|---|---|---|

| GTFP | GTC | GEC | |

| GTFPit-1 | 0.0704***(7.40) | ||

| WGTFP | 0.583***(42.59) | ||

| FAGG | 0.0761***(8.12) | 0.0323***(2.89) | 0.0291***(6.01) |

| GTC it-1 | 0.0243***(3.81) | ||

| WGTC | 0.0671**(2.72) | ||

| GEC it-1 | 0.0412*(1.81) | ||

| WGEC | 0.0559***(3.06) | ||

| Control variables | control | Control | Control |

| region | Yes | Yes | Yes |

| time | Yes | Yes | Yes |

| AR(1) (p-value) | 0.003 | 0.042 | 0.009 |

| AR(2) (p-value) | 0.308 | 0.748 | 0.932 |

| Hansen (p-value) | 0.382 | 0.351 | 0.292 |

| N | 480 | 480 | 480 |

| Explanatory Variables | Short-Term Direct Effects | Short-Term Indirect Effects | Long-Term Direct Effects | Long-Term Indirect Effects |

|---|---|---|---|---|

| FAGG | 0.00798**(2.22) | 0.000528(0.93) | 0.00806**(2.22) | 0.00181*(1.74) |

| Control variables | control | Control | Control | Control |

| region | Yes | Yes | Yes | Yes |

| time | Yes | Yes | Yes | Yes |

| N | 480 | 480 | 480 | 480 |

| Explanatory Variable | (1) | (2) | (3) |

|---|---|---|---|

| GTFP | GTC | GEC | |

| GTFP it-1 | 0.123***(6.58) | ||

| WGTFP | 0.512***(18.48) | ||

| FAGG | 0.276***(8.70) | 0.224***(3.93) | 0.233**(2.65) |

| FAGG2 | −0.127***(−7.48) | −0.0650***(−3.64) | −0.0593**(−2.67) |

| GTC IT-1 | 0.0719**(2.54) | ||

| WGTC | 0.115**(2.52) | ||

| GEC it-1 | 0.166***(4.62) | ||

| WGEC | −0.221(−1.50) | ||

| Control variable | control | control | control |

| region | YES | YES | YES |

| time | YES | YES | YES |

| AR(1) (p-value) | 0.041 | 0.040 | 0.012 |

| AR(2) (p-value) | 0.107 | 0.516 | 0.544 |

| Hansen (p-value) | 0.476 | 0.953 | 0.902 |

| N | 480 | 480 | 480 |

| Explanatory Variable | (1) | (2) | (3) |

|---|---|---|---|

| 0–1 | Economics | Geography | |

| GTFP it-1 | 0.622***(7.96) | 0.409***(6.26) | 0.178***(26.66) |

| WGTFP | 0.0126***(5.19) | 0.587***(13.49) | 0.578***(47.16) |

| FAGG | 0.0452***(4.83) | 0.0295***(5.22) | 0.0293***(5.34) |

| Control variable | control | control | control |

| region | YES | YES | YES |

| time | YES | YES | YES |

| AR(1) (p-value) | 0.000 | 0.005 | 0.003 |

| AR(2) (p-value) | 0.149 | 0.107 | 0.199 |

| Hansen (p-value) | 0.214 | 0.194 | 0.365 |

| N | 480 | 480 | 480 |

| Explanatory Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| GTFP | GTFP | GTFP | GTFP | GTFP | |

| 10% | 25% | 50% | 75% | 90% | |

| FAGG | −0.000648 (−0.12) | 0.00945*** (2.93) | 0.00745** (2.26) | 0.00794** (2.51) | 0.0106* (1.72) |

| Control variable | control | control | control | control | control |

| N | 510 | 510 | 510 | 510 | 510 |

| Explanatory Variable | (1) | (2) | (3) |

|---|---|---|---|

| LNS | IS | LNINOV | |

| FAGG | 0.205***(3.96) | 0.525***(11.94) | 0.899***(9.37) |

| Control variable | control | control | control |

| region | Yes | Yes | Yes |

| time | Yes | Yes | Yes |

| N | 510 | 510 | 510 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Quan, T.; Quan, T. A Study of the Spatial Mechanism of Financial Agglomeration Affecting Green Low-Carbon Development: Evidence from China. Sustainability 2023, 15, 965. https://doi.org/10.3390/su15020965

Quan T, Quan T. A Study of the Spatial Mechanism of Financial Agglomeration Affecting Green Low-Carbon Development: Evidence from China. Sustainability. 2023; 15(2):965. https://doi.org/10.3390/su15020965

Chicago/Turabian StyleQuan, Tianshu, and Tianli Quan. 2023. "A Study of the Spatial Mechanism of Financial Agglomeration Affecting Green Low-Carbon Development: Evidence from China" Sustainability 15, no. 2: 965. https://doi.org/10.3390/su15020965