Abstract

The extant literature does not provide consolidated knowledge on the use of Industry 4.0 in supply chains of emerging markets. This systematic literature review investigated the benefits, use, challenges, and mitigation measures related to Industry 4.0 technologies in supply chain management within thirteen “major emerging markets”. Industry 4.0 integrates technologies such as the Internet of Things (IoT), big data analytics, and cloud computing, and it offers tangible benefits for manufacturing and supply chains. However, its adoption faces significant obstacles, particularly in emerging economies. This study used the PSALSAR framework and PRISMA methodology to systematically review 87 peer-reviewed research articles on Industry 4.0 in the supply chain context of thirteen major emerging economies. Findings revealed that while IoT, big data, and artificial intelligence are frequently applied, other technologies such as cloud computing and robotics are underutilized. Key challenges identified include data integration, cyber-security, high upfront investment, weak policy, and business risks. Mitigation strategies proposed include the development of supportive policies, management backing, training, and improved data security. Tangible benefits such as sustainably using resources, reducing power use, enabling collaboration among supply chain partners, incorporating asset traceability, and minimizing meat contamination were evident. This research provides useful insights into the current status of Industry 4.0 adoption in emerging markets, helping stakeholders to navigate towards a more digitized, efficient future.

1. Introduction

Industry 4.0, which is also referred to as the fourth industrial revolution, is a novel paradigm that relies on the use of digital technologies to acquire and process data in real time and feed insights into manufacturing systems. The critical technologies that enable Industry 4.0 are the Internet of Things (IoT), big data analytics, and cloud computing [1]. Industry 4.0 transforms manufacturing by increasing productivity, flexibility, and efficiency [2].

The key objective of Industry 4.0 is meeting customer needs in areas such as order management, delivery, recycling, and research and development [3]. There is a growth in the number of organizations and supply chains (SCs) that have adopted Industry 4.0 principles to increase performance and competitiveness [4]. A key driver of the adoption of Industry 4.0 in supply chain management (SCM) is the need to adjust to demand fluctuations and uncertainties [5].

During natural disasters, terrorism, and pandemics, local and global supply chains are disrupted, which is a major challenge to the continuity of manufacturing operations. A shift to Industry 4.0 is expected to increase the interconnectivity of SCs and mitigate disruptions [6]. The adoption of Industry 4.0 will create new supply chain patterns based on complex and connected manufacturing networks where designers, suppliers, logistics providers, and clients will have different roles, enabling a single product to be completely traceable in its complete life cycle [7].

Recently, research on Industry 4.0 and supply chains has been growing and producing valuable insights, but the literature is fragmented, making it difficult to have a high-level overview of what is known and what is not. There are two characteristics of existing studies that hinder the emergence of a comprehensive state of knowledge. First, existing studies present benefits without revealing challenges. Second, the existing studies present few technologies despite there being a broad range of technologies. Systematic literature reviews (SLRs) have begun consolidating the state of knowledge on Industry 4.0 and supply chains. Existing SLRs have consolidated knowledge on specific domains, such as specific technologies, specific industries, or specific elements of the supply chain. There is an absence of SLRs that cover a broad range of technologies, examine positive and negative implications, and present mitigation factors [8]. Existing scholarship focuses on enablers and barriers of digital supply chains, specifically in manufacturing firms [9]. Although there is growing research on Industry 4.0, there are few reviews that focus on its influence in supply chain management [10]. In the past decade, research on Industry 4.0 and manufacturing firms has significantly grown. However, there are few studies that have explored the influence of Industry 4.0 on supply chain sustainability in manufacturing [11]. In the agriculture and food supply chains, existing SLRs examine one technology without providing a broad perspective of Industry 4.0 [12]. Existing studies provide a broad listing of the impact of Industry 4.0 on sustainability or focus on one industry [13]. Existing contributions have individually examined Industry 4.0, circular supply chains, and circular economies without examining an integrated perspective or synergies of the three technologies [14]. Industry 4.0 technological progress has shown promise in mitigating supply chain disruption risks. However, there is a gap in the understanding of the relationship between Industry 4.0 and supply chain resilience. Big data analytics are key in providing supply chain resilience, while the value of other technologies is unclear [15].

From the extant literature, there are no SLRs that provide an integrated perspective of Industry 4.0 and supply chains in emerging countries. This is why it was necessary to undertake this SLR to consolidate the state of knowledge in this area. Besides providing an integrated perspective, this SLR investigated a broad range of Industry 4.0 technologies in multiple industries in contrast to existing SLRs that focus on individual technologies or industries. Consolidated knowledge on the use of Industry 4.0 in emerging countries, benefits, challenges, and mitigation measures is missing in the literature, and this is a novel contribution that this SLR will add.

Although there are multiple benefits, there are major challenges in transitioning to Industry 4.0 among manufacturing organizations. This problem is worse in developing economies where Industry 4.0 remains only a vision [16]. Similarly, firms in emerging markets face major risks, such as high upfront costs, unclear return on investment, scarcity of human resources, and infrastructure challenges [17].

The diffusion of Industry 4.0 technology is low in emerging and developing countries. There are major differences in countries that are driven by government policy, income level, global integration, and the structure of the economy. For example, Ghana faces significant challenges in adopting Industry 4.0. Thailand has over one-quarter of firms using Industry 4.0, while Vietnam has a few firms using Industry 4.0 [18]. In some emerging countries where the adoption of Industry 4.0 is low, finding relevant research will be a challenge. To overcome this challenge, a preliminary search was carried out using a list of 20 countries classified by IMF as emerging countries and relevant keywords. This search aimed to identify countries where relevant research was available. The countries identified through this process are India, China, Brazil, Turkey, Indonesia, Malaysia, Iran, Thailand, South Africa, Saudi Arabia, Egypt, Mexico, and Russia. For the purposes of this research, these 13 countries are defined as “major emerging economies”.

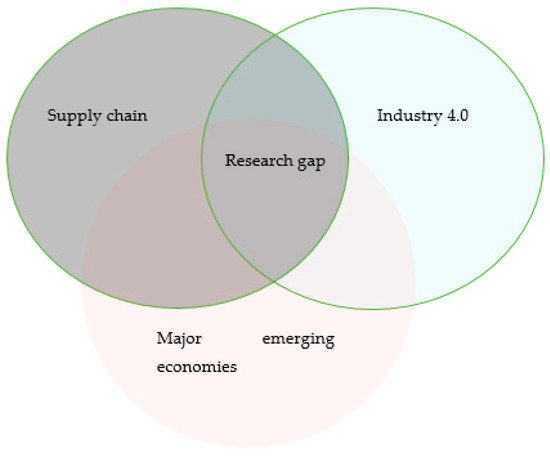

A large body of available research on Industry 4.0 and supply chains has focused on advanced economies. However, there is growing literature on Industry 4.0 and supply chains in emerging economies. This systematic literature review (SLR) aimed to exhaustively summarize this growing research in “major emerging economies”. The research gap is visualized in Figure 1.

Figure 1.

The research gap.

The research gap is at the intersection of Industry 4.0, supply chains, and “major emerging markets”. This SLR aimed to answer the following research questions.

- RQ1. How are Industry 4.0 technologies being used to support supply chains in a novel way in “major emerging markets”?

- RQ2. What are the benefits of using Industry 4.0 in supply chains in “major emerging markets”?

- RQ3. What challenges do “major emerging markets” face in using Industry 4.0 in supply chains?

- RQ4. How can “major emerging markets” mitigate challenges faced in using Industry 4.0 in supply chains?

Definition of Terms

Industry 4.0: A system of production that is connected and incorporates sensing, prediction, and physical world interactions to make decisions for real-time production [19].

Internet of Things (IoT): A network of physical objects consisting of sensors, software, and auxiliary technologies that enable data interchange over the internet [20].

Big data analytics (BDA): The use of advanced techniques and tools to derive insights from large structured, unstructured, and semi-structured data that are characterized by variety, volume, and velocity [21].

Cloud Computing: The provision of computing resources such as servers, networking, storage, and software over the internet [22].

Artificial intelligence (AI): The ability of a computer to carry out tasks performed by intelligent beings [23].

Radio Frequency Identification (RFID): An automatic technology that helps machines identify objects, capture metadata, and control targets over radio waves. This enables the global tracking of objects with a tag [24].

Blockchain: A database technology that enables the transparent sharing of information within a network [25].

Digital twin: A digital model of a process, object, or person in a digital environment context. Digital twins are useful for simulating actual situations [26].

3D printing/Additive manufacturing: The use of computer-aided design to precisely deposit material in layers [27].

Cyber-security: The process of preventing malicious attacks directed at computers, mobile devices, data, and networks [28].

Business risk: An external or internal force that can reduce the profit of a business.

Weak policy and legislation: The absence of government laws, incentives, regulations, or voluntary practices that influence Industry 4.0.

2. Theoretical Background

2.1. Industry 4.0

Since the introduction of the term Industry 4.0 in 2011, the transformation brought by this industrial revolution has captured the attention of governments and leading industrialists. Since the first industrial revolution, the world has faced the challenge of growing consumption, while natural resources have been diminished. Industry 4.0 can potentially contribute to sustainable economic development [29].

By leveraging the core technologies of Industry 4.0, traditional manufacturing objects are transformed into intelligent objects that have sensing and communication capabilities [30]. By shifting from conventional manufacturing to Industry 4.0, productivity gains of up to 55% can be achieved, but the level of preparedness is relatively low. For example, in a survey of 19 countries, less than one-fifth of executives were confident they were prepared to cope with changes brought by Industry 4.0 [31].

The core characteristics that demonstrate the readiness of an economy for Industry 4.0 are the availability of digital infrastructure and the capacity for big data analytics. Variations in countries have been found. For example, five different groups have been observed in the European Union (EU). Major differences across industries were also observed [13]. Developed countries have made significant progress in adopting Industry 4.0, buoyed by policy initiatives, funding, and multi-stakeholder engagement. This suggests that developing countries also need such a framework [32].

However, developing economies face uncertainties in adopting Industry 4.0. For example, South Africa experiences policy, infrastructure, and skills shortages [33]. India faces high investment, skills shortage, and data security challenges [34]. In Thailand, data management and human capital are considered major readiness factors, while software and hardware are minor readiness factors [35].

2.2. Supply Chain

Supply chain management (SCM) is made up of all the processes required to handle, store, and transport raw materials and finished goods [36]. The adoption of Industry 4.0 in SCM is novel, and it provides new opportunities and challenges [10]. When Industry 4.0 is adopted in supply chains, they become supply ecosystems.

The salient features of these digitalized supply chains are: (a) customer focus: the design, production, and sale of personalized products; (b) interconnectivity: actors such as customers and customers have real-time communication; (c) automation: efficiency gains are achieved by automating physical processes using robots; (d) transparency: cellular and global positioning systems provide visibility and traceability in the supply chain; (e) proactivity: artificial intelligence and real-time analytics provide decision makers with insights to anticipate the occurrence of events [37]. Adopting Industry 4.0 in SCM is an individual effort, but supply chains will only have a higher competitive advantage when there is mainstream adoption in manufacturing and supply [38]. When supply chains are digitalized, they become flexible and scalable, and reliance on smart people as the key technology is replaced by analytics and smart devices [39].

2.3. Emerging Markets

The Fiscal Monitor, as of April 2023, classifies countries into three key groups. The advanced economies group consists of 41 countries, the emerging markets and middle-income economies group consists of 95 countries, and the low-income developing countries group consists of 59 countries [40].

The term emerging markets, which is also referred to as emerging economies, originated from the International Finance Corporation in the early 1980s [41]. There is no standard classification of emerging economies, but there are 20 countries that are considered emerging economies. These countries are: “Argentina, Brazil, Chile, China, Colombia, Egypt, Hungary, India, Indonesia, Iran, Malaysia, Mexico, the Philippines, Poland, Russia, Saudi Arabia, South Africa, Thailand, Turkey, and the United Arab Emirates”. These countries are a major economic block, as they make up one-third of global nominal gross domestic product [42]. Of these countries, “China, India, Brazil, Russia, Mexico, Indonesia, and Turkey” are the largest emerging economies that contribute at least 25% of global output [43].

Industry 4.0 has been successfully adopted in developed countries, but in emerging economies, adoption has been hampered by challenges such as a weak legal and policy environment, electricity, and infrastructure weaknesses [44]. Emerging economies that lead the way in adopting Industry 4.0 are China, which has a “Made in China 2025” vision, and Brazil, which has a “Towards Industry 4.0” vision. Adopting new technologies is relatively difficult for emerging economies, as these economies focus on trading in commodities [1]. These countries cannot fully benefit from the deployment of Industry 4.0 when they have a traditional manufacturing sector. These countries need to evolve into a technologically advanced manufacturing economy [19].

3. Methodology

To meet the requirements of a systematic literature review (SLR), the Protocol and Reporting Result with Search, Appraisal, Synthesis, and Analysis (PSALSAR) framework was followed [45]. The preferred reporting items for systematic review and meta-analyses (PRISMA) statement is integrated within the PSALSAR framework. The six steps that were followed are described in the following sections. The PRISMA methodology requirements specified by the PRISMA 2020 statement that were integrated are title, rationale, objectives, eligibility criteria, information sources, search strategy, selection process, data items, discussion, support, competing interests, and availability of data [46]. The primary use of the PRISMA 2020 statement is for reviewing health and non-health interventions [47]. For studies that do not have intervention items, such as study risk of bias assessment, effect measures, synthesis methods, reporting bias assessment, certainty assessment, risk of bias in studies, results, reporting biases, and certainty of evidence, are not relevant.

3.1. Protocol

The research protocol was applied with the goal of ensuring transparency and reproducibility. The application of this framework is shown in Table 1.

Table 1.

PICOC framework elements.

3.2. Search

The databases and search strings used to identify relevant articles are shown in Table 2. There are important differences in advanced search capabilities between Google Scholar and other databases. While the other databases provide the capability to limit the search to title, abstract, and keywords, Google Scholar does not provide these capabilities, as it searches for the occurrence of search terms in any part of an article. Furthermore, Google Scholar does not provide the capability to limit results to peer reviewed journal articles. The effect of this is that Google Scholar is likely to return a high number of irrelevant results. Due to this, only one search string was used on Google Scholar, while four search strings were used on the other databases. A more complex search string was used on Google Scholar to provide more relevant results. Different combinations of search strings were tried, and those reported here provided the most relevant results.

Table 2.

Search strings used to identify relevant articles.

3.3. Selection of Studies

Several inclusion and exclusion criteria were applied to identify the papers for inclusion in the SLR. These criteria are shown in Table 3. Mainly, papers that were peer-reviewed, were published in English from 2018 onwards, and focused on any of the thirteen major emerging economies were included. There may be relevant papers that do not include the search terms in their title or abstract, but these were not included, as they are beyond the scope of this SLR.

Table 3.

Article inclusion and exclusion criteria.

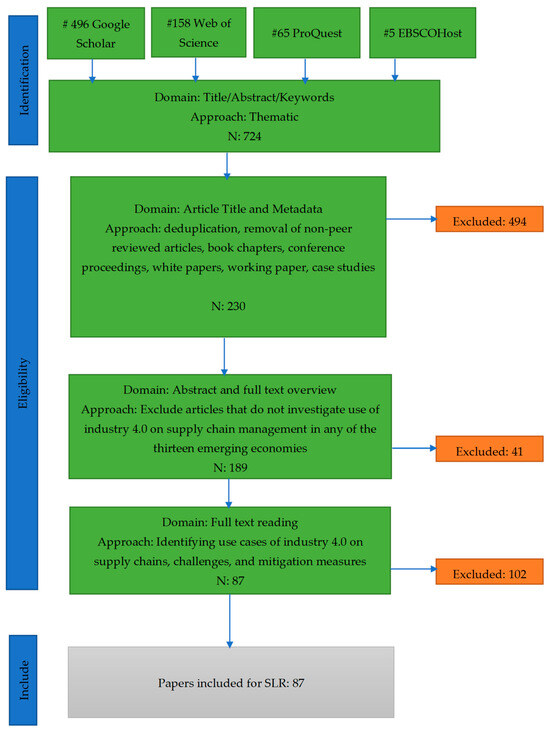

Search results from each database were exported to Zotero, where duplicate papers were dropped. The abstract of each unique paper was screened to assess the inclusion/exclusion criteria. More details are provided in Figure 2.

Figure 2.

The inclusion/exclusion criteria.

3.4. Quality Assessment

The criteria used to evaluate each SLR are listed below:

- (a)

- The inclusion/exclusion criteria are clearly and adequately described.

- (b)

- The literature search strategy provided all relevant papers.

- (c)

- The SLR is peer-reviewed.

- (d)

- The SLR adequately describes the use of Industry 4.0 on supply chains in emerging economies.

Only SLRs that adequately met these four criteria were included.

3.5. Synthesis

The synthesis step involved the extraction and categorization of data from the articles that met the inclusion criteria. Table 4 describes the criteria, categories considered, and justification of data extracted.

Table 4.

Data elements extracted from articles.

3.6. Analysis

For this, SLR bar graphs were used to present the frequency of year of publication, journal name, country, and industry. Thematic analysis [48] was used to analyze the uses of Industry 4.0, challenges, and mitigation measures.

4. Results and Discussion

4.1. Quantitative Results

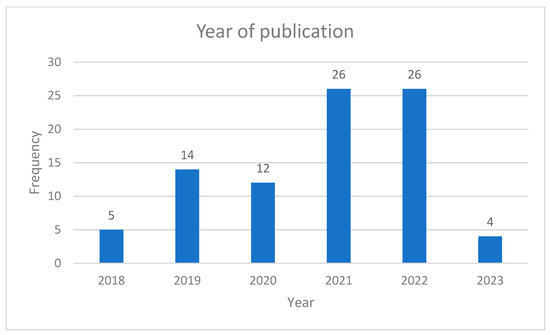

As shown in Figure 3, the majority of the studies were conducted in 2021 and 2022, accounting for over half (59.8%) of the total studies. The search strategy only considered studies published up until May 2023, which explains the limited number of studies from that year. The significant increase in relevant studies from 2020 to 2021 indicates substantial growth in the field.

Figure 3.

Bar chart of the year of publication.

Table 5 shows that the journal Production Planning & Control had the highest frequency of publications.

Table 5.

Frequency and percentage of journals.

Table 6 reveals that Elsevier published the highest number of articles, accounting for over a third of all papers. Other major publishers were Emerald, Taylor & Francis, and MDPI, which together accounted for 74.7% of published papers. These publishers, along with other reputable ones such as Springer, Wiley, Nature, and IEEE, published 81.6% of the papers included in this systematic literature review (SLR). This suggests that the included papers are of high quality, as they are published by reputable publishers.

Table 6.

Frequency and percentage of publishers.

Table 7 shows that the studies were conducted either in multiple countries or a single country. India had the highest number of studies, accounting for over a third of the studies included in the SLR. Studies conducted in India and China made up more than half of the studies (58.6%), suggesting that most of the research in emerging countries is happening in these two nations. However, there were only two studies from Africa, indicating a low adoption of Industry 4.0 in supply chains on the continent.

Table 7.

Frequency and percentage by country.

Table 8 indicates that the manufacturing sector had the highest number of studies, slightly more than a quarter of the included papers. The sectors with a higher frequency, including manufacturing, automotive, circular economy, and food processing, accounted for more than half of the studies (54.0%). There were 14 studies in which the sector was unclear, typically in studies that used an SLR or literature review methodology.

Table 8.

Frequency and percentage by sector.

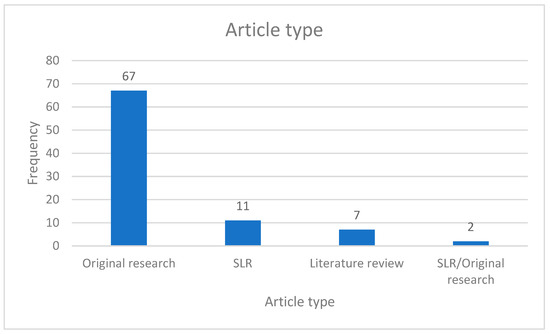

Figure 4 shows that most of the studies were original, with only two studies being a combination of SLR and original research. Articles categorized as SLR were those that explicitly stated that they used a systematic approach to identify primary papers.

Figure 4.

Bar chart of article type.

Table 9 reveals that the included studies used either single or multiple research methodologies. Studies using the survey methodology had the highest frequency. Other commonly used methodologies included modeling, case study, SLR, and literature review. These five methodologies were used in more than half of the studies (64.4%).

Table 9.

Frequency and percentage of research methodology.

4.2. Qualitative Results

Table 10 provides a summary of the qualitative findings from the studies included in the SLR. The table is organized into three main themes: the use of Industry 4.0, the challenges faced, and the mitigation measures proposed. Each theme is further broken down into specific codes, which represent the key topics within each theme. The number of supporting articles for each code is also provided, indicating the frequency of each topic in the reviewed literature.

Table 10.

Summary of qualitative findings.

4.2.1. Industry 4.0 Technologies Being Used to Support Supply Chains in Emerging Markets

From the papers that met the inclusion criteria, it was observed that multiple Industry 4.0 technologies are used to support supply chains in emerging economies.

IoT

RTLS and RFID had low use among Brazilian OEMs, but the deployment of RFID brings visibility and strategic capability to supply chains. More than 60 percent of experts interviewed were optimistic that within five years there will be widespread application in the Advanced Product Quality Planning and Control Plan (APQP) [49]. RFID provides efficient inventory management by providing a mechanism for checking outgoing and incoming goods against receipts. Barcodes are a key technology in logistics. Barcodes can be used in environments where RFID cannot be used, and they have the advantage of being cheaper. However, barcode technology has the limitation of requiring the barcode to be aligned, and tags can be destroyed in transit, leading to data capture errors [36]. Smart packaging is based on sensor technologies, RFID, and barcodes, which ensure that it is aligned with Industry 4.0 [50]. In a pilot project in China, barcode technology was used to successfully enforce rubbish sorting in a residential area. By relying on IoT sensors, waste management organizations can optimize costs by efficiently managing waste collection fleets through intelligence provided by sensors on rubbish bins [51]. RFID can be used for monitoring food conditions and level of freshness and for identifying food wastage [52]. Among SMEs, a credit risk assessment mechanism for supply chain finance that was based on IoT provided superior accuracy [53]. In the wood industry, a combination of IoT, blockchain, and smart contracts can be used to enforce wood traceability [54]. At a transport and logistics firm in Turkey, IoT was used to facilitate the direct delivery of orders and real-time load tracking [55]. In Indonesia, IoT was used to implement a Highway Automatic Tollgate to efficiently manage a paid highway [56]. IoT can be used to manage occupational health and safety and inventory accuracy [57]. Within the food supply chain, IoT can be used for monitoring perishable goods, replenishment management, traceability management, and minimizing warehouse and transport costs. At a paper manufacturer in India, IoT was used to reduce energy consumption by monitoring seal and impeller wear, monitoring coal quality, and monitoring bagasse moisture. RFID is used for tracking stock items in and out, stock taking, inventory automation, fast order filling, and controlling access. Quick response (QR) codes are used to facilitate material flow and connect customer services between online and offline platforms [58]. A manufacturer in Mexico implemented a welding equipment asset visibility solution based on GPS to facilitate asset tracking outside the company [59]. GPS can be used in the Iran pharmaceutical sector to significantly reduce contamination emissions [60].

Big Data and Artificial Intelligence

AI was used to facilitate data collection and inventory management, maximize revenue growth, minimize operational expenses, power chatbots in procurement, and improve service quality within the distribution network [58]. At a supermarket in Turkey, a deep learning model was used to distinguish spoiled meat from fresh meat. Such a system can be deployed in the meat supply chain to minimize meat contamination, improve shelf life, and protect final consumers. This system is superior to human monitoring, which leads to the benefit of minimizing human errors while enhancing productivity and shelf life [61]. More than 60 percent of experts surveyed from the Brazilian automotive OEM reported that AI is expected to be heavily used within the next five years in all phases of APQP [49]. From a case analysis with Indian experts, it was evident that, among SMEs, analytics is the most convenient entry point for adopting Industry 4.0 in supply chains. Analytics is used for developing actionable insights from machine learning and demand and inventory forecasting and for identifying collaboration opportunities with logistics partners, which ultimately leads to minimal financial losses and stock outs. Analytics is attractive to SMEs because the use of open-source software significantly reduces capital investment [53]. Big data analytics (BDA) was found to have a positive impact on e-procurement and supply chain environmental performance. BDA can be used for transportation optimization, which is a key element of logistics activities. Information on optimal routes and traffic jams can positively influence outcomes such as safety, cost, and delivery timelines. Other ways big data can be used in the supply chain are risk management, warehouse and supplier management, and prediction [54]. Supply chain cost and performance can be continuously monitored using BDA [55]. At a paper manufacturing company in India, big data analytics was used to predict raw material supply patterns [62]. BDA and AI were used for predicting market trend prediction, competitor analysis, and quality management [63]. BDA and supply chain connectivity can enhance data quality, supply chain transparency, and IT capabilities [64].

Blockchain

Within the food sector, blockchain can enable food traceability and transparency, as observed in Turkey and India [65]. Blockchain provides capabilities for food tracking within the supply chain, providing farmers with smart contracts, and tracking parcels during shipping [54]. Blockchain has a positive impact on all elements of the circular economy [66]. Within the supply chain, blockchain can be used to secure shared data against cyber-attacks, which improves tracing and transparency [67]. In India, the perceived benefits of blockchain were found to be an important driver of the adoption of blockchain [68]. Blockchain is used to prevent theft and the diversion of grain, manage grain supply, and enforce transparency [58].

Cloud

A survey of experts in Brazilian automotive manufacturing showed that more than 60 percent of experts were confident that cloud technologies will be important in APQP and have a high probability of use over the next five years [49]. The cloud can be used to share and transmit large data volumes among supply chain actors. Tapio and smart trees are cloud-based applications currently being used in the wood industry to manage wood cutting and preparation [54]. Seres Automobile, located in China, uses the SupplyOn Platform for a global electric car supply chain [69].

Robots and Virtualization

Experts surveyed from the Brazilian automotive OEMs were unanimous that adaptive robots will be used in process validation and corrective production. Virtual reality (VR) and augmented reality (AR) had low use in APQP, but their use will grow in the next five years [49]. AR is used for monitoring inventory, reducing errors, sending alerts on damaged goods during transport, and optimizing order picking. Automated guided vehicles (AGVs) and autonomous robots are used for supporting scheduling, minimizing collision in handling materials, fulfilling orders, and enhancing safety [58]. A commercial and military aviation firm in Brazil found the importance of using VR or AR for training and simulation [70].

Digital Twin

Digital twin technology was used in the pharmaceutical industry to provide monthly needs capacity prediction to supply chain managers. In the food industry, digital twins were used to investigate the characteristics of fruits and vegetables [54]. A digital supply chain twin provides resilience in the supply chain structure and mitigates supply chain disruption risk [71].

3D Printing/Additive Manufacturing

Three-dimensional printing provides a solution for “small-scale customized manufacturing” [72]. Three-dimensional printing also provides a solution for a fast design process due to reduced product lifecycle. Three-dimensional printing is used in the product design process to reduce waste and develop products that can be easily recycled [55]. A firm in Brazil uses 3D printing to fabricate custom replacement parts [70]. Additive manufacturing was found to have low use in Brazilian automotive OEMs, but its use is expected to grow in the next five years, where it will be used for product and process validation [58].

4.2.2. Challenges in the Use of Industry 4.0 in Supply Chains in Emerging Markets

The Need for Investment in Industry 4.0

Industry 4.0 requires heavy investment, and this was a major challenge observed in the literature. Capital investments required for Industry 4.0 are heavy, especially for manufacturers located in emerging economies, and this is worsened by the unavailability of funding for new technologies [73]. Financial constraints were found to have the highest relative importance, especially among SMEs, due to the significant financial resources required to acquire Industry 4.0 technology [74]. For small companies operating in developing countries, the systems required for Industry 4.0 are unaffordable. These hindrances exist in every component of the supply chain, including equipment upgrades, training, and system costs [72]. Investing in advanced technology and information systems required to achieve transparency and integration in the supply chain is difficult for SMEs [52]. Financial barriers are a significant limitation to the implementation of Industry 4.0 and the circular economy. The short-term objectives of profit maximization lead to compromises in process sustainability and product quality [75]. Large organizations have resources to invest in technologies to mitigate cyber-attack risks, but this is not the case in small organizations [76]. Resources used to acquire software required for supplier management are insufficient [63]. Among Indian SMEs, financial constraints were the most important barrier relative to other challenges, such as technological and business risks [17]. High Industry 4.0 implementation costs include technology and equipment procurement, engineering services, and equipment and labor costs [77]. The scarcity of resources coupled with a strong perception of low returns of Industry 4.0 investment were significant challenges [12]. In emerging economies, such as Brazil, the low-income segment of the population lacks the resources to acquire Industry 4.0 products and technologies [78].

Business Risks

Adopting new technologies requires heavy financial and skills investments, which have an uncertain return on investment [79]. Indian SMEs are reluctant to invest in Industry 4.0 technology due to unclear benefits or the extended amount of time required to obtain a return on investment [17]. The primary focuses of many firms are innovation and developing partnerships, which are strategic goals. In these firms, cost and delivery are considered operational goals, which are less important. These firms are yet to transition to Industry 4.0, and it is unclear how cost and delivery will influence supplier performance in an Industry 4.0 environment [80]. There is a risk of mis-investment due to a lack of management vision and awareness [75]. There is a risk of stolen trade secrets or intellectual property, which may be worse among SMEs that have not adequately invested in cyber security [17].

There is a risk of employee unrest due to the implementation of Industry 4.0 technologies that require re-skilling and process automation. A lack of vision and strategy for implementing Industry 4.0 and unclear benefits may delay adoption. There is a fear of failure due to the heavy investment required and the long period needed to obtain a return on investment [81]. The adoption of Industry 4.0 involves social risks, such as unemployment and a change in competencies. Managing human resources in an Industry 4.0 environment will be a major challenge [73]. The absence of awareness among stakeholders and the lack of acceptance by customers are major risks to the success of Industry 4.0 [79].

Skills Shortage

The literature reviewed showed that a lack of technical skills in Industry 4.0 is a major challenge. An assessment of a manufacturer in Brazil revealed limited knowledge of VR/AR, cloud computing, BDA, and intelligent manufacturing [73]. Inadequate expertise among organizations means that, even if executive management is committed to implementing Industry 4.0, the right staff to support such implementations cannot be found [72]. Inadequate knowledge and skills are major barriers to implementing circular economies and Industry 4.0. Implementing Industry 4.0 requires the analysis of machine-generated data, and analyzing big data is a challenge among many companies [52]. Lack of awareness, competency, and motivation are linkage barriers that need careful consideration when implementing Industry 4.0 and circular economies [75] when supply chains are digitalized and globalized personnel with a comprehensive understanding of essential practices are required. However, existing practitioners do not have proficiencies for effective Industry 4.0 adoption [81]. A shortage of skilled workers is a major threat to the sustainability of supply chains. Skilled workers are required to implement Industry 4.0 and circular economies [75]. The lack of internal capacity to implement BDA and AI among suppliers is a threat [63]. The lack of Industry 4.0 experts and training programs are major hurdles [82].

Digital awareness within the general population is a prerequisite for effectively using digital systems. However, in rural and semi-urban areas of India, digital awareness is low [83]. India has a literacy rate of 77.77 percent, which, although reasonable, limits the introduction of new technologies in the general population [67].

Data Integration and Cyber-Security

The lack of interoperability is a major challenge to implementing Industry 4.0 and sustainability. The connectivity between machines is unreliable; there is no integration of IT systems used by different supply chain partners, and there is an absence of global standards as well as protocols for sharing data [73]. Smart production systems cannot effectively develop in an environment without “global standards and data sharing protocols” [74]. In the food chain, blockchain is a new technology that has technical challenges that need to be resolved. These challenges include data capture, network issues, and interoperability with cold chains [65]. The absence of standards or inconsistent international standards is a significant technological risk [17]. Poor integration of IT systems among supply chain partners and fear of losing data are challenges [84]. Companies involved in the pharmaceutical supply chain cannot integrate all information in various parts of the supply chain due to the sensitivity of the information. Other supply chain partners are disconnected from manufacturers and cannot swiftly respond to customer requirements [72]. On a global ranking of barriers, data protection was ranked fourth, while the absence of standards and reference architectures was ranked sixth [81].

Cyber-security is a frequently cited hindrance to Industry 4.0 sustainability. A vast amount of digital data can be misused or stolen by hackers. Furthermore, there are trust issues when supply chain partners integrate systems [73]. Data are captured from multiple devices, exposing them to attacks [81]. Prolonged system downtimes resulting from weak cyber security and standards can cripple supply chains and cause heavy financial losses [85]. Systems used in Industry 4.0 heavily rely on internet-enabled devices, such as IoT and GPS, and electricity supply. Failure in any of these devices can lead to disruptions along the supply chain resulting in significant financial losses [58]. Data confidentiality hinders sharing data, and secure data-sharing platforms may be unavailable [63]. IoT generates large volumes of data that are beneficial to an organization. However, due to weak cyber-security practices, data are prone to theft from internal and external actors [17]. Data leakage has severe legal repercussions and reputation damage, which can be more damaging compared to traditional leakage accidents [86].

Weak Policy and Legislation

In developing countries, the regulatory environment is aligned with outdated business models that do not stimulate the application of innovative technologies [87]. In Russia, policy documents used to stimulate the development of Industry 4.0 are only in the formative stages [88]. The absence of support from regulatory agencies and IT legislation hinders the sustainable application of Industry 4.0. Additionally, regulatory and procedural hurdles challenge sustainable supply chain management [73]. Supply chain partners share sensitive data on inventory, which necessitates new ethical and legal solutions in the era of Industry 4.0. These are required for mitigating cyber-crime, as companies are responsible for the security of their data and those shared by supply chain partners [74]. India and China have high software piracy rates, and existing cyber laws are inadequate in an Industry 4.0 environment. The regulatory quality in India is poor. With the development of new technologies, the government needs a proactive approach. The initial ban on drones and crypto-currency was harmful to sustainable supply chains, as they have applications in logistics and the movement of money in supply chains [83]. The absence of government backing, incentives, and policies are major barriers that have a strong driving force [75]. Industry 4.0 has two related barriers. First, there is the challenge of new innovations complying with the law. Second, there is the challenge of the regulatory environment catching up with the pace of innovations in Industry 4.0 [89]. Small and medium-sized warehouses face the challenge of the absence of government support, as there is no interest from top politicians and legislators [58].

Weak Infrastructure

Infrastructure is a major barrier in emerging economies. Specifically, for smart supply chains, the challenges are electricity, connectivity, digital infrastructure, and data processing. The lack of facilities for large-scale experiments has been identified as a key challenge to AI research in India. Sustainable supply chains require the availability of reading-and-writing intensive computing resources everywhere, but currently, India lacks this infrastructure [83]. Lack of infrastructure can be described as an autonomous barrier with low dependence and driving effect and can be easily mitigated [75]. Rural areas in India do not have an internet connection, and some urban areas have slow internet, which slows down technological progress [50]. The supply chains of Indonesian companies were characterized by high uncertainty brought about by poorly developed infrastructure [90].

Organization Culture

Internal resistance and a corporate culture that may be prevalent among older employees are challenges to the adoption of Industry 4.0. Resistance from employees and management as well as inflexible organizational culture are behavioral challenges that are faced in an Industry 4.0 environment [73]. Employees may perceive new technologies as endangering their jobs, leading to resistance [75]. Resistance to the adoption of Industry 4.0 is a major barrier that requires intervention from executive management [91]. A digital culture is absent among Indian manufacturers [74].

Lack of Management Support

In the Indian context, low executive management commitment hindered Industry 4.0 and sustainability adoption. There was a lack of approval for significant investment in newer technologies, probably due to a lack of awareness of the value of Industry 4.0 [73]. Lack of executive management support was one of the six barriers to adopting Industry 4.0 among manufacturers [84].

4.2.3. Mitigation Measures

Conducive Policy and Legislation

Some governments have implemented aggressive policies to support the development of Industry 4.0. For example, China has developed China Manufacturing 2025 [64]. The Chinese government has implemented policies to support manufacturers in acquiring new equipment. For instance, Ningde City provides a 5 percent subsidy to new energy manufacturers who spend more than CNY 5 million on new investments. This will support new energy manufacturers in acquiring Industry 4.0 equipment and developing their supply chain agility [86]. Regulatory pressure influences enterprises to implement Industry 4.0 so as to minimize hazardous waste and comply with environmental regulations [51]. Policy and legislation guide sustainability practices such as food traceability and regulate how information is collected [52]. India has identified two policies, which are the National Strategy for AI and AI Specific Cloud Computing Infrastructure. The Navigation Satellite System and Cartosat-3 will also provide IoT infrastructure [83]. Policymakers need to provide subsidies to organizations implementing sustainable practices so as to develop their interest in green culture and Industry 4.0 [12]. Supportive government policies will significantly influence the implementation of Industry 4.0 and sustainable practices [74]. Due to the threat of job losses from the use of robots, innovative labor and employment laws are required to protect jobs. These laws and policies will lead to the development of sustainable supply chain networks [92]. Central government support is required to develop Industry 4.0 within the South African market. The supportive measures required are cyber security laws and support for the commercialization of local innovations that will ultimately diffuse into supply chains [85]. The Indian government has put in place the Made in India Initiative. The Brazilian government has implemented ten measures aimed at stimulating the growth of Industry 4.0. Some of these measures are linking startups with industry, HUB 4.0, factories of the future, and testbeds-test beds. Additionally, the government aims to provide incentives for importing robots [93]. China has put in place critical cyber-security policies, as supply chain cyber security is a high priority for the government [76]. In 2016, the Cyber Security Law came into effect in China, meaning data security is within the legislation [86]. Government agencies need to provide legal and policy support to support the adoption of Industry 4.0 and circular economies in food supply chains. Policies aimed at availing subsidies and zero-interest loans can stimulate food supply chain actors to implement Industry 4.0 [79].

Executive Management Support

Top management needs to provide support through investments and skill acquisition in AI, cloud computing, BDA, and machine learning [94]. Employees feel their jobs are threatened by IoT technology. Management can address this concern by enlightening employees on smart systems [36]. Management is required to provide support and get involved for Industry 4.0 and sustainability to be successfully adopted in a production environment [74]. Logistics 4.0 requires technology, skills, and policies that need executive management backing and support [5]. Executive management support is required in implementing Industry 4.0 and circular supply chains, as it is the foundation for building other essential organization capabilities [75]. A vision of intelligent factories cannot succeed without adequate management support and governance. Governance will ensure that management is able to develop effective strategies for adopting Industry 4.0 while factoring in economic, environmental, and social requirements for sustainability [95]. The commitment of top management is critical to the success of Industry 4.0. Top management is required to approve investments in technologies to support Industry 4.0 and carry out periodic reviews that will eliminate hindrances in the supply chain [85]. When there is top management support, planning and responding to cyber threats are quicker and stronger [76]. Corporate governance is required to put policies, plans, and regulations that meet Industry 4.0 needs in place. This will improve ownership, transparency, and control [92].

Training

The acceptance of IoT technology will be higher when the workforce has been trained on the benefits to be realized [73]. Equipping workers with digital skills increases their ability to manage Industry 4.0, as they are better placed to analyze data and make the right decisions. Firms need to invest in Industry 4.0 without overlooking the digital skills required to manage Industry 4.0 [96]. Industry 4.0 can be implemented to support the transition from a linear to a circular economy, but employee training on Industry 4.0 is necessary to mitigate transition challenges [55]. The government of India has developed initiatives to link government, institutions, and industry. These initiatives aim to provide a common platform for training and raising awareness through workshops, research, and demonstration [83]. Logistics 4.0 requires analytical and technical skills that can be provided through seminars and workshops [97]. Organizations need to carry out frequent awareness and training to increase workers’ knowledge of Industry 4.0 and circular supply chains. Employee “knowledge of circular supply chain and Industry 4.0” is critical, as it influences the capability of an organization to successfully implement a circular supply chain based on Industry 4.0 [79]. When adopting digital smart factories, firms invest in training to match the requirements for Industry 4.0. Such training readies employees to handle challenges before and after the adoption of Industry 4.0. Furthermore, such employees will pass on skills to employees in supply chain partners. Skilled employees are in a better position to handle cyber threats [85]. In India, in the long run, many professionals will be lost while new ones will appear. To overcome this challenge, firms will either hire fresh employees who have the required skills or reskill existing employees [17]. Managers need to use novel education programs or hire experts from advanced or emerging countries, such as India, that have successfully adopted Industry 4.0. These experts can help develop employees who work independently [82].

Investment and Infrastructure Development

In China, new energy manufacturers have started constructing big data centers to avail IT infrastructure required for extensive data management. This consolidation of IT infrastructure will strengthen supply chain agility [86]. An efficient IT system provides visibility of quality aspects throughout the supply chain and enhances communication among supply chain partners [98]. The success of innovations such as Logistics 4.0 is significantly influenced by the level of investment. Logistics 4.0 needs IT infrastructure, such as cyber-physical systems, IoT, and big data, to be aligned with Industry 4.0 [5]. In the Indian context, manufacturers are required to invest significantly in cyber-physical systems to ensure that the manufacturing environment is sustainable [95]. Organizations with advanced infrastructure are better placed to handle threats, as cyber security requires structural and technical capabilities [76].

Data Security

Industry 4.0 is associated with significant security challenges. Before any implementation starts, all partners need to agree on security issues and appropriate architecture [74]. Using standards and reference architectures will guide organizations in developing common collaboration standards [85]. When new energy manufacturers in China ensure data privacy and security, they can strengthen supply chain agility [86]. Governance is essential in securing the information systems of an organization. An organization needs to use governance for cyber risk management and to monitor security practices [99].

Supply Chain Agility

Supply chain agility has a positive and significant impact on legal, organizational, and technological challenges in Industry 4.0 [100]. Uncertainty within the supply chain can be mitigated by increasing adaptability and agility. SC4.0 will support mitigating uncertainties and improving supply chain integration [85].

Third-Party Audits

A third-party audit can help uncover limitations, hindering firms from achieving a smart factory status. These audits can specifically target security, partner networks, and wireless network links. Auditors need to consider policies that assign cyber security responsibilities, crisis management and mitigation mechanisms, and cyber insurance. These will assure supply chain security and sustainability [85].

4.3. Benefits of Using Industry 4.0 in Supply Chains

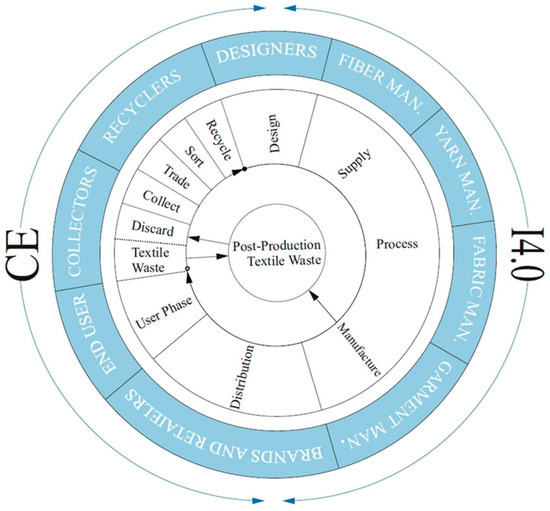

A case study of four textile firms in Turkey was carried out to demonstrate the benefits of adopting Industry 4.0 in a circular economy. Two considerations prompted the selection of the textile industry. The first consideration is sustainability. The textile sector has significant environmental impacts that can be improved through a circular economy. The second consideration is that Industry 4.0 provides opportunities for improved efficiency and productivity. Microfiber textile waste produced by the textile industry is a major polluter of oceans. Recycling this waste is necessary to reduce waste produced from virgin material. Industry 4.0 is already used in some textile processing aspects, but as most textile firms are SMEs, there are significant challenges related to financing, infrastructure, and staffing. For example, RFID tags are used in fiber cones [65]. The key stakeholders in the textile sector are garment manufacturers, brand owners, material converters, and retailers. From the closed loop supply chain illustrated in Figure 5, the circular loop begins with collectors who recycle unusable parts into raw materials, which are then used by manufacturers.

Figure 5.

Textile industry closed-loop supply chain [65].

A paper manufacturer in South India used a linear supply chain that can be transformed into a circular supply chain by leveraging Industry 4.0. The primary raw material used by the paper manufacturer is bagasse, a byproduct of sugar manufacturing. During pulp fermentation by the paper manufacturer, there is a residue produced that is an ingredient for spirit manufacture. This residue is supplied to a local manufacturer. However, with high-quality packaging, the residue can be sold at a higher value to a global spirit manufacturer. After fermentation, the pulp is boiled using coal. During boiling, steam is generated, which can be used to generate electricity. Ash from coal burning can be supplied to cement manufacturers located within. After pulp boiling, bleaching is performed, which uses a large amount of water. This water can be treated and used for irrigation. During bleaching, six pumps are used. IoT informs timely impeller and seal maintenance, saving 20 horsepower in each pump. IoT informs the state of insulation during sheet pressing, which can reduce operational costs by 4%. IoT can also be used to monitor the coal quality and bagasse moisture content, which are critical manufacturing parameters. Externally, IoT can be used to monitor product shortage and enable waste paper collection and recycling [62].

SupplyOn is a cyber-physical system that connects different branches of business to provide adaptability to supply chain dynamics. Seres Automobile, which is a subsidiary of the Chinese Sokon Group, partnered with SupplyOn to manage its global electric car supply chain. This provided a platform for collaborating with all suppliers and enabled smart manufacturing.

A digital supply chain twin uses simulation and data analysis to develop a resilient supply chain and mitigate the risk of disruption. A disaster supply chain for a cyclone hitting the eastern coast of India was illustrated. Modeling and simulation results revealed that information delays from upstream had a higher impact compared to information delays from downstream levels of the supply chain [71].

The Indonesian government uses blockchain to facilitate government, customers, and business collaboration. This integration of upstream and downstream supply chain actors creates better value and competitive advantage [101].

The sustainable supply chain 4.0 of a private healthcare provider in Rio de Janeiro was analyzed. In Rio, temperatures often reach 104 degrees Fahrenheit, necessitating smart and sustainable solutions. Sensors capture light and temperature intensity, and this information is used to control lighting and heat blocking. Healthcare providers can use IoT for water management. Sensors can be used to open pluvial reservoirs that capture rainwater for reuse. Sensors can be used on taps to eliminate water wastage, which happens when staff forget to close taps after washing hands [102].

A case study of Incom Egypt revealed limited automation in the manufacturing of cables and wires. IoT devices can be used to capture information on semi-finished products, which are sent to the cloud. Data analytics can be used to identify solutions [103].

A firm operating in the mechanical sector in Mexico was analyzed. This company faced a challenge in asset reliability and traceability. This company’s key assets are welding equipment in internal and external locations. RFID and GPS were evaluated as potential solutions. Finally, GPS was the preferred solution, as it provides asset visibility in exterior locations. Implementation of the GPS solution asset control and monitoring was improved, and inventory reliability was almost 99%, translating to annual savings of USD 553, 634 [59].

AI was used to reduce meat contamination in a supermarket in Turkey. A deep learning model that discriminated fresh and spoiled meat with 100% accuracy was developed. This system can be used in the meat supply chain to protect consumers against the risks of spoiled food. This system also eliminates human errors prevalent in manual monitoring and increases productivity [61].

4.4. Discussion

The objective of this SLR was to understand how Industry 4.0 is used in supply chains of “major emerging economies”, to understand challenges being faced, and to identify mitigation measures that can be used to stimulate the adoption of Industry 4.0 in supply chains.

Summary of Main Results

Although IMF categorizes 20 countries as emerging countries, significant differences in the use of Industry 4.0 in supply chains were found. A preliminary search revealed that, in seven out of 20 countries, there were no studies on the use of Industry 4.0 in supply chains. This suggests that there is a shallow adoption in these countries, which were consequently excluded in this systematic review. These wide-ranging variations were also observed in the 13 countries included in this SLR. Three groupings can be inferred. The first group consists of China and India, which had a disproportionate number of studies; as close to 60% of studies were from these countries. The second group consists of countries including Indonesia, Malaysia, Turkey, and Brazil, which had between four and six studies. The third group consists of, namely, South Africa, Egypt, Russia, Mexico, Thailand, Iran, and Saudi Arabia, which had two studies or one study. These differences reflect the level of maturity of the use of Industry 4.0 in supply chains. China and India have a higher maturity when compared to the other countries.

Manufacturing, automotive, circular economy, and food processing were the key industries where Industry 4.0 was being applied. These industries have processes that are ideally suited for automation using IoT. Data collected from these sensors can then be pushed to the cloud, where AI and big data analytics can be used to extract insights. This is consistent with the earlier finding that these are the popular technologies being used by SMEs.

The major Industry 4.0 technologies used in supply chains of emerging technologies are IoT, big data analytics, and artificial intelligence. These technologies are attractive to firms in emerging countries, as they have a relatively lower cost of acquisition. The cost of IoT sensors has been consistently falling, and in the future, the capabilities of these low-cost sensors are expected to widen. Similarly, the cost of data storage hardware has also been consistently falling. These lower hardware costs, coupled with the availability of open-source software, are the key drivers of adoption. Blockchain and cloud had a relatively lower level of use, while robots, virtualization, and 3D printing had the lowest level of use. This perhaps can be attributed to the existence of a few large technologically advanced firms that can use technologies such as robotics and 3D printing, while there are many SMEs that only use IoT and analytics. These differences can also exist in various sectors. For example, manufacturing firms have many processes that can be automated by IoT.

The major challenges faced by firms in emerging countries are the high investment needed to acquire Industry 4.0 technologies, business risks, skills shortages, data integration and cyber-security, weak policy and legislation, weak infrastructure, organization culture, and lack of management support. These challenges are not expected to be similar in all emerging countries. Firms operating in China and India are expected to have a lower severity of skills shortage and cyber-security challenges. These countries have a higher level of technological advancement, which is associated with the availability of highly skilled labor. Firms are also likely to face varying levels of lack of supporting policy and legislation. China, India, and Brazil were found to have better-supporting frameworks compared to other countries. Firms in these countries are expected to face lower policy and legislative challenges. China was found to have government incentives that reduced the high investment cost associated with Industry 4.0. Firms in China are expected to have lower investment barriers than other countries. Firms in all countries are expected to face business risks associated with the uncertainty of returns on invested capital. Infrastructure challenges are expected to be lower in more advanced countries, such as China and India, which have a higher level of economic development. These differences are also likely to manifest in firm size. Large firms may have access to more capital, which limits the effect of investment challenges.

The key mitigation measures that can be used to stimulate the use of Industry 4.0 in supply chains of emerging countries are conducive policy and legislation, executive management support, training, infrastructure development, and data security. Brazil, India, and especially China had policies and legislations directly aimed at supporting the use of Industry 4.0. There were no clear, stimulating policies in the other countries under review. This suggests that these countries need to follow the path followed by mature countries, such as India and China, in putting in place a supportive policy and legislation framework. Executive management support is required by firms operating in all countries. Training and infrastructure development are required, especially in less-mature countries. Firms in countries with higher economic development, such as China, are expected to have a lower severity of infrastructure challenges. Other countries can rely on countries such as China and India to improve their training programs.

5. Conclusions, Implications, and Limitations

5.1. Implications for Practice

The advent of Industry 4.0 has brought about a paradigm shift in how supply chains operate, particularly in emerging markets. While promising significant benefits, such as increased efficiency and productivity, have been shown, this transformation also presents a unique set of challenges. These challenges range from high investment costs and business risks to skills shortages, data integration issues, cyber-security concerns, weak policy and legislation, infrastructure deficiencies, organizational culture resistance, and lack of management support. However, these challenges are not insurmountable. Various mitigation measures have been identified, including the development of conducive policy and legislation, executive management support, employee training, investment and infrastructure development, data security measures, supply chain agility, and third-party audits.

The implementation of Industry 4.0 technologies in supply chains has the potential to revolutionize operations, particularly in emerging markets. Using AI, big data analytics, blockchain, cloud technologies, robotics, and other advanced technologies can significantly enhance efficiency, productivity, and transparency in supply chains. However, the successful integration of these technologies requires substantial investment, skilled personnel, and a supportive regulatory environment.

The high investment costs associated with Industry 4.0 technologies can be a significant barrier, particularly for small- and medium-sized enterprises (SMEs) in emerging markets. Additionally, the lack of skilled personnel and the need for data integration and cyber-security measures further complicate the implementation process. The absence of supportive policies and legislation, weak infrastructure, resistance from organizational culture, and lack of management support are also significant challenges that need to be addressed.

Despite the challenges, various mitigation measures can facilitate the successful implementation of Industry 4.0 in supply chains. These include the development of supportive policies and legislation, executive management support, employee training, investment and infrastructure development, data security measures, supply chain agility, and third-party audits. These measures can help overcome the barriers and enable organizations to reap the benefits of Industry 4.0.

The role of government in providing supportive policies and legislation, as well as infrastructure development, is crucial in facilitating the adoption of Industry 4.0. Similarly, the role of management in delivering support, investing in necessary technologies, and training employees is equally important.

In the face of uncertainties and rapid changes, supply chain agility becomes increasingly essential. The ability to quickly adapt to changes can help mitigate risks and ensure the smooth operation of supply chains in an Industry 4.0 environment.

At the same time, the increased use of digital technologies in supply chains underscores the need for robust data security measures. Ensuring data privacy and security can strengthen supply chain operations and build trust among supply chain partners. The use of third-party audits can help identify limitations and enhance the security and sustainability of supply chains. This implies a need for transparency and collaboration with external experts and auditors.

Developing and implementing supportive policies and legislation can significantly facilitate the adoption of Industry 4.0 in supply chains. Government initiatives, such as subsidies for new technology investments and the development of AI strategies, can stimulate the growth of Industry 4.0. However, these policies also imply a need for continuous monitoring and updating to keep pace with technological advancements.

Executive management needs to take an active role in supporting the adoption of Industry 4.0. Their commitment to investing in new technologies and training employees can significantly enhance the organization’s readiness for Industry 4.0. This implies a need for a strategic approach to Industry 4.0 adoption, with a clear vision and strong leadership.

Training employees on the benefits and use of Industry 4.0 technologies can enhance their acceptance and effective use of these technologies. However, this implies a continuous need for learning and development initiatives within organizations, as well as a need for partnerships with educational institutions and industry experts.

5.2. Implications for Research

In this SLR, most of the studies were from India and China, which suggests most of the findings would be relevant to the Indian or Chinese context. Future studies need to explore individual countries or groups of similar countries in detail.

Future studies need to carry out SLRs that include studies prior to 2018 and technical reports that may enrich the literature. Future studies need to develop quality criteria that can be used to assess technical reports and conference papers for inclusion in SLR.

Future studies need to investigate how technology in Industry 4.0 in supply chains needs to be transferred between technologically advanced and less-advanced countries. This would require context-specific research to tailor recommendations to the unique challenges faced by each country.

Ethical issues related to sharing data among supply chain partners were raised. Future studies need to investigate how data-sharing challenges affect supply chain integration.

Future studies need to investigate differences in country, firm size, and economic sector. This will provide more nuanced insights into benefits and challenges in these segments.

5.3. Limitations

Although the IMF classifies 20 countries as emerging economies, this study found significant differences in these countries. China and India were the major hubs of research, while in some countries, there were a few studies. In seven of the 20 countries, there were no studies found. This means the results of this study cannot be generalized to these seven countries.

In this SLR, time, language, and peer review limitations mean that some relevant studies may have been excluded. Although Industry 4.0 is a recent innovation, there could be relevant studies published before 2018. In this SLR, only peer-reviewed studies were considered. There could be technical reports or conference papers that may be relevant. This means there is a risk that relevant material was not included.

5.4. Conclusions

Industry 4.0, in general and specifically in supply chains, has been successfully adopted in countries classified by IMF as advanced and in technologically advanced emerging countries, such as China and India. However, in some emerging countries, there is very little or no adoption of Industry 4.0 in supply chains. This is despite the benefits such as the sustainable use of resources, supply chain collaboration on a global scale, reduction in resource wastage, and process automation.

This study investigated the use, challenges, and mitigation measures in 13 emerging countries. These countries were examined, as they can be considered the second tier of economic and technological advancement. The first tier consists of advanced economies in Europe, Asia, and North America. The second tier consists of emerging countries, which were the focus of this SLR, while the third tier consists of middle- and low-income countries. Industry 4.0 is well established in advanced economies. However, results showed major differences in the diffusion level of Industry 4.0 in emerging countries. Differences within the countries were also observed. Economies of emerging countries are characterized by the existence of a few large firms that have invested in the use of Industry 4.0 and numerous SMEs that were facing challenges. These SMEs deploy IoT, big data, cloud, and AI in their supply chains. Large firms can deploy these technologies and other advanced technologies, such as robots, virtualization, and 3D printing. The key challenges faced in the use of Industry 4.0 are the high investment required, skill shortage, data security, and weak infrastructure. The severity of these challenges varies by country, as firms in some countries such as China and India may face fewer staffing, policy, and infrastructure challenges. Differences in other characteristics, such as firm size or economic sector, may exist. Larger firms may experience lower investment challenges compared to SMEs. Key mitigation measures are conducive government policy, executive management support, training, and investment in infrastructure. These measures are relevant to all countries, especially countries other than China and India, which could face policy and staffing limitations.

For future studies, it is suggested to expand the scope to include studies over a longer time span and include more technical reports and conference papers. This is because Industry 4.0 is an actively evolving field, and such studies could enrich peer-reviewed material. Future studies also need to investigate country, firm size, and economic sector differences.

Funding

This work was supported and funded by the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (grant number IMSIU-RG23053).

Acknowledgments

We would like to thank and acknowledge the funding and support of the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (grant number IMSIU-RG23053).

Conflicts of Interest

The author declares no conflict of interest.

References

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 Technologies: Implementation Patterns in Manufacturing Companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Bai, C.; Dallasega, P.; Orzes, G.; Sarkis, J. Industry 4.0 Technologies Assessment: A Sustainability Perspective. Int. J. Prod. Econ. 2020, 229, 107776. [Google Scholar] [CrossRef]

- Vaidya, S.; Ambad, P.; Bhosle, S. Industry 4.0—A Glimpse. Procedia Manuf. 2018, 20, 233–238. [Google Scholar] [CrossRef]

- Weerabahu, S.; Samaranayake, P.; Nakandala, D.; Hurriyet, H. Digital Supply Chain Research Trends: A Systematic Review and a Maturity Model for Adoption. Benchmarking Int. J. 2022. [Google Scholar] [CrossRef]

- Khan, M.D.; Schaefer, D.; Milisavljevic-Syed, J. Supply Chain Management 4.0: Looking Backward, Looking Forward. Procedia CIRP 2022, 107, 9–14. [Google Scholar] [CrossRef]

- Farooq, M.U.; Hussain, A.; Masood, T.; Habib, M.S. Supply Chain Operations Management in Pandemics: A State-of-the-Art Review Inspired by COVID-19. Sustainability 2021, 13, 2504. [Google Scholar] [CrossRef]

- Prause, G.; Atari, S. On Sustainable Production Networks for Industry 4.0. Entrep. Sustain. Issues 2017, 4, 421. [Google Scholar] [CrossRef]

- Rad, F.F.; Oghazi, P.; Palmié, M.; Chirumalla, K.; Pashkevich, N.; Patel, P.C.; Sattari, S. Industry 4.0 and Supply Chain Performance: A Systematic Literature Review of the Benefits, Challenges, and Critical Success Factors of 11 Core Technologies. Ind. Mark. Manag. 2022, 105, 268–293. [Google Scholar] [CrossRef]

- Chauhan, C.; Singh, A. A Review of Industry 4.0 in Supply Chain Management Studies. J. Manuf. Technol. Manag. 2020, 31, 863–886. [Google Scholar] [CrossRef]

- Abdirad, M.; Krishnan, K. Industry 4.0 in Logistics and Supply Chain Management: A Systematic Literature Review. Eng. Manag. J. 2021, 33, 187–201. [Google Scholar] [CrossRef]

- Naseem, M.H.; Yang, J. Role of Industry 4.0 in Supply Chains Sustainability: A Systematic Literature Review. Sustainability 2021, 13, 9544. [Google Scholar] [CrossRef]

- Yadav, V.S.; Singh, A.R.; Raut, R.D.; Mangla, S.K.; Luthra, S.; Kumar, A. Exploring the Application of Industry 4.0 Technologies in the Agricultural Food Supply Chain: A Systematic Literature Review. Comput. Ind. Eng. 2022, 169, 108304. [Google Scholar] [CrossRef]

- Srhir, S.; Jaegler, A.; Montoya-Torres, J.R. Uncovering Industry 4.0 Technology Attributes in Sustainable Supply Chain 4.0: A Systematic Literature Review. Bus. Strategy Environ. 2023; in print. [Google Scholar] [CrossRef]

- Taddei, E.; Sassanelli, C.; Rosa, P.; Terzi, S. Circular Supply Chains in the Era of Industry 4.0: A Systematic Literature Review. Comput. Ind. Eng. 2022, 170, 108268. [Google Scholar] [CrossRef]

- Spieske, A.; Birkel, H. Improving Supply Chain Resilience through Industry 4.0: A Systematic Literature Review under the Impressions of the COVID-19 Pandemic. Comput. Ind. Eng. 2021, 158, 107452. [Google Scholar] [CrossRef]

- Sayem, A.; Biswas, P.K.; Khan, M.M.A.; Romoli, L.; Dalle Mura, M. Critical Barriers to Industry 4.0 Adoption in Manufacturing Organizations and Their Mitigation Strategies. J. Manuf. Mater. Process. 2022, 6, 136. [Google Scholar] [CrossRef]

- Tamvada, J.P.; Narula, S.; Audretsch, D.; Puppala, H.; Kumar, A. Adopting New Technology Is a Distant Dream? The Risks of Implementing Industry 4.0 in Emerging Economy SMEs. Technol. Forecast. Soc. Chang. 2022, 185, 122088. [Google Scholar] [CrossRef]

- Michele, D.; Carlo, P.; Elisa, C.; Alejandro, L. Are Emerging Economies already Engaging with Industry 4.0 Technologies? Development Matters. Available online: https://oecd-development-matters.org/2022/07/28/are-emerging-economies-engaging-with-industry-4-0-technologies/ (accessed on 9 August 2023).

- Shamika, S. What Is “Industry 4.0” and What Will It Mean for Developing Countries?|UNCTAD. UNCTAD. Available online: https://unctad.org/news/blog-what-industry-40-and-what-will-it-mean-developing-countries (accessed on 5 May 2023).

- Oracle. What Is the Internet of Things (IoT)? Available online: https://www.oracle.com/ke/internet-of-things/what-is-iot/ (accessed on 9 August 2023).

- Microsoft Azure. What Is Big Data Analytics?|Microsoft Azure. Available online: https://azure.microsoft.com/en-us/resources/cloud-computing-dictionary/what-is-big-data-analytics (accessed on 9 August 2023).

- Steve, R. What Is Cloud Computing? Everything You Need to Know about the Cloud Explained. ZDNET. Available online: https://www.zdnet.com/article/what-is-cloud-computing-everything-you-need-to-know-about-the-cloud/ (accessed on 9 August 2023).

- Copeland, B. Artificial Intelligence (AI)|Definition, Examples, Types, Applications, Companies, & Facts|Britannica. Available online: https://www.britannica.com/technology/artificial-intelligence (accessed on 13 August 2023).

- Jia, X.; Feng, Q.; Fan, T.; Lei, Q. RFID Technology and Its Applications in Internet of Things (IoT). In Proceedings of the 2012 2nd International Conference on Consumer Electronics, Communications and Networks (CECNet), Yichang, China, 21–23 April 2012; pp. 1282–1285. [Google Scholar] [CrossRef]

- AWS. What Is Blockchain Technology?—Blockchaining Explained—AWS. Amazon Web Services, Inc. Available online: https://aws.amazon.com/what-is/blockchain/ (accessed on 13 August 2023).

- McKinsey. What Is Digital-Twin Technology?|McKinsey. Available online: https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-digital-twin-technology (accessed on 10 August 2023).

- General Electric. What Is Additive Manufacturing|GE Additive. Available online: https://www.ge.com/additive/additive-manufacturing (accessed on 10 August 2023).

- Kaspersky. What Is Cyber Security? Available online: https://www.kaspersky.com/resource-center/definitions/what-is-cyber-security (accessed on 11 August 2023).

- Ghobakhloo, M. Industry 4.0, Digitization, and Opportunities for Sustainability. J. Clean. Prod. 2020, 252, 119869. [Google Scholar] [CrossRef]

- Guo, D.; Li, M.; Lyu, Z.; Kang, K.; Wu, W.; Zhong, R.Y.; Huang, G.Q. Synchroperation in Industry 4.0 Manufacturing. Int. J. Prod. Econ. 2021, 238, 108171. [Google Scholar] [CrossRef]

- Raj, A.; Dwivedi, G.; Sharma, A.; de Sousa Jabbour, A.B.L.; Rajak, S. Barriers to the Adoption of Industry 4.0 Technologies in the Manufacturing Sector: An Inter-Country Comparative Perspective. Int. J. Prod. Econ. 2020, 224, 107546. [Google Scholar] [CrossRef]