The Impact of the Digital Economy on Transformation and Upgrading of Industrial Structure: A Perspective Based on the “Poverty Trap”

Abstract

:1. Introduction

2. Theoretical Logic and Mechanism Analysis

2.1. Theoretical Logic

2.1.1. Macrolevel

2.1.2. Mesolevel

2.1.3. Microlevel

2.2. Mechanism Analysis

3. Model Settings and Sample Selection

3.1. Model Setting

3.2. Indicator Selection and Data Sources

3.3. Evaluation Methodology

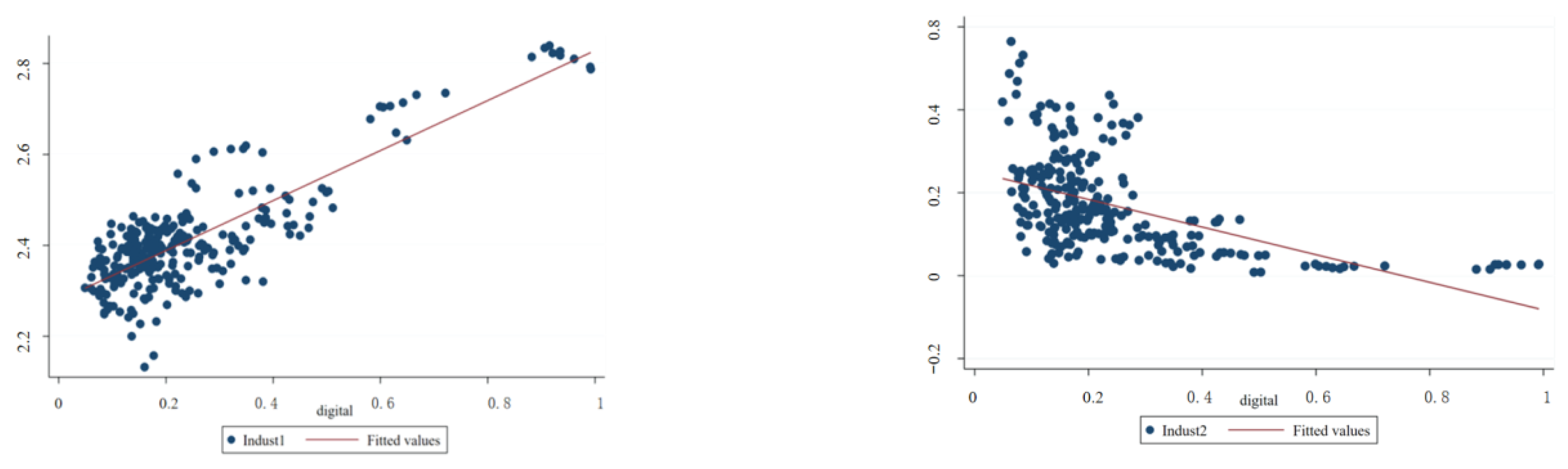

3.4. Descriptive Statistics

4. Empirical Results Analysis

4.1. Result of Baseline Regression

4.2. Endogeneity Bias and Two-Stage Regression

4.3. Heterogeneity Test Based on Different Levels of Development

4.4. Mediation Effect Test

5. Conclusions

6. Limitations and the Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Altig, D.; Baker, S.; Barrero, J.M.; Bloom, N.; Bunn, P.; Chen, S.; Davis, S.J.; Leather, J.; Meyer, B.; Mihaylov, E.; et al. Economic uncertainty before and during the COVID-19 pandemic. J. Public Econ. 2020, 191, 104274. [Google Scholar] [CrossRef] [PubMed]

- Boylan, B.M.; McBeath, J.; Wang, B. US–China relations: Nationalism, the trade war, and COVID-19. Fudan J. Humanit. Soc. Sci. 2021, 14, 23–40. [Google Scholar] [CrossRef]

- Kumar, S.; Maheshwari, V.; Prabhu, J.; Prasanna, M.; Jayalakshmi, P.; Suganya, P.; Benjula Anbu Malar, M.B.; Jothikumar, R. Social economic impact of COVID-19 outbreak in India. Int. J. Pervasive Comp. 2020, 16, 309–319. [Google Scholar]

- Ntasis, L.; Kountzakis, C.E.; Koronios, K.; Dimitropoulos, P.E.; Ratten, V. Developing Digital Marketing: Relationship Perspectives; Emerald Publishing Limited: Bingley, UK, 2021; pp. 65–73. [Google Scholar]

- Leach, M.; MacGregor, H.; Scoones, I.; Wilkinson, A. Post-pandemic transformations: How and why COVID-19 requires us to rethink development. World Dev. 2021, 138, 105233. [Google Scholar] [CrossRef]

- World Bank. Poverty and Shared Prosperity. 2022. Available online: https://www.worldbank.org/en/publication/poverty-and-shared-prosperity (accessed on 10 October 2023).

- Banerjee, A.V.; Duflo, E. Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty; Public Affairs: New York, NY, USA, 2011. [Google Scholar]

- Lin, J.Y.; Treichel, V. Learning from China’s Rise to Escape the Middle-Income Trap: A New Structural Economics Approach to Latin America; World Bank Policy Research Working Paper; The World Bank Group: Washington, DC, USA, 2012; p. 6165. [Google Scholar]

- Ozawa, T. Institutions, Industrial Upgrading, and Economic Performance in Japan: The Flying-Geese Paradigm of Catch-Up Growth; Edward Elgar Publishing: Bingley, UK, 2007. [Google Scholar]

- Zhang, Q.Z.; Xu, M. Objective orientation and key measures of implementing modernization oriented industrial policy of industrial chain and supply chain. Reform 2022, 38, 82–93. [Google Scholar]

- Duan, W.; Madasi, J.D.; Khurshid, A.; Ma, D. Industrial structure conditions economic resilience. Technol. Forecast. Soc. 2022, 183, 121944. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development; Harvard University Press: Cambridge, MA, USA, 1934. [Google Scholar]

- Audretsch, D.B.; Feldman, M.P. Innovative clusters and the industry life cycle. Rev. Ind. Organ. 1996, 11, 253–273. [Google Scholar] [CrossRef]

- Zhou, S.L.; Wang, W.G. Scientific-Technical innovation; the optimization upgrade of industrial structure. J. Manag. World 2001, 16, 70–78. [Google Scholar]

- Lan, Q.X. Digital economy: An important driving force for the development of the world economy. Frontiers 2020, 9, 80–85. [Google Scholar]

- Guan, H.; Guo, B.; Zhang, J. Study on the impact of the digital economy on the upgrading of industrial structures—Empirical analysis based on cities in China. Sustainability 2022, 14, 11378. [Google Scholar] [CrossRef]

- Kraus, S.; Jones, P.; Kailer, N.; Weinmann, A.; Chaparro-Banegas, N.; Roig-Tierno, N. Digital transformation: An overview of the current state of the art of research. Sage Open 2021, 11, 21582440211047576. [Google Scholar] [CrossRef]

- Peron, M.; Sgarbossa, F.; Strandhagen, J.O. Decision support model for implementing assistive technologies in assembly activities: A case study. Int. J. Prod. Res. 2022, 60, 1341–1367. [Google Scholar] [CrossRef]

- Simonetto, M.; Peron, M.; Fragapane, G.; Sgarbossa, F. Digital assembly assistance system in Industry 4.0 era: A case study with projected augmented reality. In Advanced Manufacturing and Automation X 10; Springer: Singapore, 2021; pp. 644–651. [Google Scholar]

- Wu, X.X.; Ren, B.P. The path and policy adjustment of the reconstruction of resource allocation mechanism under the background of digital economy. Reform. Econ. Syst. 2022, 40, 5–10. [Google Scholar]

- Li, J.; Su, Q.L. Empirical analysis of digital economy in promoting industrial structure upgrading. Mod. Manag. Sci. 2022, 26, 127–137. [Google Scholar]

- Su, J.; Su, K.; Wang, S. Does the digital economy promote industrial structural upgrading?—A test of mediating effects based on heterogeneous technological innovation. Sustainability 2021, 13, 10105. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, Y.; Li, H.; Zhong, K. Digital economy development, industrial structure upgrading and green total factor productivity: Empirical evidence from China’s cities. Int. J. Env. Res. Pub. He. 2022, 19, 2414. [Google Scholar] [CrossRef]

- Körner, K.; Schattenberg, M.; Heymann, E.; Schneider, S.; AG, D.B. Digital Economics. Deutsche Bank Research. EU Monitor. 2018. Available online: https://scholar.google.com/scholar?hl=zh-CN&as_sdt=0%2C5&q=K%C3%B6rner%2C+K.%3B+Schattenberg%2C+M.%3B+Heymann%2C+E.%3B+Schneider%2C+S.%3B+AG%2C+D.+B.+Digital+economics.+Deutsche+Bank+Research.+EU+Monitor&btnG= (accessed on 20 October 2023).

- Rozanova, N.M. Competition and monopoly in a digital era. Obs. Nauk. Sovrem. 2021, 1, 63–72. [Google Scholar] [CrossRef]

- Yu, Z.; Liu, S.; Zhu, Z.; Fu, L. Spatial imbalance, dynamic evolution and convergence of the digital economy: Analysis based on panel data of 278 cities in China. Sustainability 2023, 15, 7422. [Google Scholar] [CrossRef]

- Sama, L.M.; Stefanidis, A.; Casselman, R.M. Rethinking corporate governance in the digital economy: The role of stewardship. Bus. Horiz. 2022, 65, 535–546. [Google Scholar] [CrossRef]

- Tao, C.Q.; Ding, Y. How does the digital economic policy affect the innovation of manufacturing enterprise: From the perspective of suitable supply. Contemp. Financ. Econ. 2022, 44, 16–27. [Google Scholar]

- Senadjki, A.; Mohd, S.; Bahari, Z.; Hamat, A.F.C. Assets, risks and vulnerability to poverty traps: A study of northern region of Malaysia. J. Asian Financ. Econ. Bus. 2017, 4, 5–15. [Google Scholar] [CrossRef]

- Heng, R.; Jia, K. Digital econo my promotes the reform of government governance: External challenges, internal causes and institutional innovation. E-Government 2020, 20, 55–62. [Google Scholar]

- Sunigovets, O. Enterprise competitiveness in the digital economy. SHS Web Conf. EDP Sci. 2019, 67, 04012. [Google Scholar] [CrossRef]

- Yao, J.H. Digital Labor in Manufacturing and Services; The Commercial Press: Beijing, China, 2017. [Google Scholar]

- Chen, X.Y. A review of western scholars’ research on capitalist labor-capital relations in the digital economy era. Economist 2022, 34, 37–44. [Google Scholar]

- Li, R.; Rao, J.; Wan, L. The digital economy, enterprise digital transformation, and enterprise innovation. Manag. Decis. Econ. 2022, 43, 875–2886. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Business Cycles; Mcgraw-Hill: New York, NY, USA, 1939. [Google Scholar]

- Zhao, J. The internal mechanism of innovation and division of labor to promote Economic growth-comments on the dicision models of Romer and Yang Xiaokai. J. Beijing Jiaotong Univ. (Soc. Sci. Ed.) 2022, 22, 46–62. [Google Scholar]

- Eliasson, G. Schumpeterian Innovation, Market Structure and the Stability of Industrial Development; IUI Working Paper; Research Institute of Industrial Economics (IFN): Stockholm, Sweden, 1986. [Google Scholar]

- Levin, R.; Reiss, P.C. R&D, Patents, and Productivity; University of Chicago Press: Chicago, IL, USA, 1984; pp. 175–208. [Google Scholar]

- Putsenteilo, P.R.; Humeniuk, O.O. Digital economy as the modern vector of reconstruction of the traditional economy. Innov. Econ. 2018, 5–6, 131–143. [Google Scholar]

- Zhang, T.; Shi, Z.Z.; Shi, Y.R.; Chen, N.-J. Enterprise digital transformation and production efficiency: Mechanism analysis and empirical research. Econ. Res.-Ekon. Istraz. 2022, 35, 2781–2792. [Google Scholar] [CrossRef]

- Manda, M.I.; Ben Dhaou, S. Responding to the challenges and opportunities in the 4th Industrial revolution in developing countries. In Proceedings of the 12th International Conference on Theory and Practice of Electronic Governance, Melbourne, Australia, 3–5 April 2019; pp. 244–253. [Google Scholar]

- Wu, H.Q. New technologies such as the Internet of Things drive the digital economy. China Inf. Secur. 2017, 8, 48–49. [Google Scholar]

- Ren, Z.Z.; Deng, F. Digital technology: Factor structure transformation and high-quality economic development. Soft Sci. 2023, 37, 9–14. [Google Scholar]

- Schmidt, H.; Zhan, F.J. Taming the shrew: Is there a need for a new market power definition for digital economy? Compet. Law Policy Rev. 2018, 4, 137–167. [Google Scholar]

- Fan, M.T.; Zhang, L. Digital economy, allocation of resource elements and coordinated development of urban and rural areas. J. Southwest Minzu Univ. (Humanit. Soc. Sci. Ed.) 2023, 44, 112–120. [Google Scholar]

- Liang, Z.C. Analysis of the characteristics of industrial organization of network economy. Foreign Econ. Relati. Trade 2022, 29, 43–45. [Google Scholar]

- Li, Y. The reformation of industry organization and policy recommendations in the digital economy. J. Commer. Econ. 2021, 40, 181–184. [Google Scholar]

- Yu, D.H.; Wang, M.J. Digital economy, entrepreneurship and high-quality development of manufacturing industry. Reform 2022, 38, 61–81. [Google Scholar]

- He, L. Data elements market-oriented reform, entrepreneurship and manufacturing digital transformation. J. Hunan Univ. Sci. Technol. (Soc. Sci. Ed.) 2022, 25, 65–76. [Google Scholar]

- Zhou, Y. The systematic transformation of industrial innovation and its principle of policy mix in the digital economy. Mod. Manag. 2020, 40, 40–42. [Google Scholar]

- Rosenstein-Rodan, P.N. Problems of industrialisation of eastern and south-eastern Europe. Econ. J. 1943, 53, 202–211. [Google Scholar] [CrossRef]

- Nurkse, R. Problems of Capital Formation in Underdeveloped Countries; Cambridge University Press: Cambridge, UK, 2012. [Google Scholar]

- Tapscott, D. The Digital Economy: Promise and Peril in the Age of Networked Intelligence; McGraw-Hill: New York, NY, USA, 1996. [Google Scholar]

- Brynjolfsson, E.; McAfee, A. The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies; W.W. Norton & Company: New York, NY, USA, 2014. [Google Scholar]

- Steinmueller, W.E. Knowledge-based economies and information and communication technologies. Int. Soc. Sci. J. 2002, 54, 141–153. [Google Scholar] [CrossRef]

- Schultz, T.W. Investment in Human Capital. Am. Econ. Rev. 1961, 51, 1–17. [Google Scholar]

- Becker, G.S. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education; University of Chicago Press: Chicago, IL, USA, 1964. [Google Scholar]

- Autor, D.H. Why are there still so many jobs? The history and future of workplace automation. J. Econ. Perspect. 2015, 29, 3–30. [Google Scholar] [CrossRef]

- Shen, Y.; Zhang, X. Digital economy, intelligent manufacturing, and labor mismatch. J. Adv. Comput. Intell. 2022, 26, 655–664. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef] [PubMed]

- Wen, Z.L.; Zhang, L.; Hou, J.T.; Liu, H.Y. Testing and application of the mediating effect. Acta Psychol. Sinica 2004, 49, 614–620. [Google Scholar]

- Yuan, H.; Zhu, C.L. Do national high-tech zones promote the transformation and upgrading of China’s industrial structure. China Ind. Econ. 2018, 35, 60–77. [Google Scholar]

- Xu, D.Y. A theoretical explanation and verification of the form determination and measurement of industrial structure upgrading. Public Financ. Res. 2008, 29, 46–49. [Google Scholar]

- Gan, C.H.; Zheng, R.G.; Yu, D.F. An empirical study on the effects of industrial structure on economic growth and fluctuationa in China. Econ. Res. J. 2011, 46, 4–16. [Google Scholar]

- Zhao, T.; Zhang, Z.; Liang, S.K. Digital economy, entrepreneurship, and high–quality economic development: Empirical evidence from urban China. J. Manag. World 2020, 36, 65–76. [Google Scholar]

- Zhang, Y.P.; Dong, C.; Luan, Q. Mechanism of digital economy promoting high-quality economy- based on evidence from the provincial panel date. J. Univ. Jinan 2021, 31, 99–115. [Google Scholar]

- Zhu, X.A.; Wei, G.D. The excellent standard of nondimensionalization in entropy method. Stat. Res. 2015, 31, 12–15. [Google Scholar]

- Chen, D.; Xiang, P.C.; Jia, F. Performance measurement of operation and maintenance for infrastructure mega-project based on entropy method and DS evidence theory. Ain Shams Eng. J. 2022, 13, 101591. [Google Scholar] [CrossRef]

- Pols, A. The Role of Information and Communications Technology in Improving Productivity and Economic Growth in Europe: Empirical Evidence and an Industry View of Policy Challenges, 50 Years of EU Economic Dynamics; Springer: Berlin/Heidelberg, Germany, 2007; pp. 183–201. [Google Scholar]

- Xie, K.; Yu, Y.Z.; Zhang, S.L. Quality of convergence between industrialization and informatization in China. Econ. Res. J. 2012, 47, 4–16. [Google Scholar]

- Huang, Q.H.; Yu, Y.Z.; Zhang, X.L. Internet development and productivity growth in manufacturing industry: Internal mechanism and China experiences. China Ind. Econ. 2019, 36, 5–23. [Google Scholar]

- Sun, J.; Chen, J. Digital economy, energy structure transformation, and regional carbon dioxide emissions. Sustainability 2023, 15, 8557. [Google Scholar] [CrossRef]

- Nunn, N.; Qian, N. US Food Aid and Civil Conflict. Am. Econ. Rev. 2014, 104, 1630–1666. [Google Scholar] [CrossRef]

- Sun, Y.; Zhang, X.H.; Zhao, T.Y.; Zhang, Y.F. The influence of digital techology innovation on Industrial Structure upgrade and its spatial effect-evidence from Yangze River economic belt. Soft Sci. 2022, 36, 9–16. [Google Scholar]

- Zhang, X.W. Research on evolution of innovation model under condition of digital economy. Economist 2019, 31, 32–39. [Google Scholar]

- Zhao, Y.; Kong, X.; Ahmad, M.; Ahmed, Z. Digital economy, industrial structure, and environmental quality: Assessing the roles of educational investment, green innovation, and economic globalization. Sustainability 2023, 15, 2377. [Google Scholar] [CrossRef]

| Variable | N | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|---|

| Indust1 | 270 | 1.410 | 0.745 | 0.665 | 5.244 |

| 2013 | 30 | 2.350 | 0.122 | 2.132 | 2.788 |

| 2021 | 30 | 2.435 | 0.114 | 2.259 | 2.814 |

| Indust2 | 270 | 0.170 | 0.115 | 0.008 | 0.565 |

| 2013 | 30 | 0.216 | 0.141 | 0.021 | 0.565 |

| 2021 | 30 | 0.109 | 0.076 | 0.008 | 0.283 |

| Digital | 270 | 0.170 | 0.115 | 0.008 | 0.565 |

| 2013 | 30 | 0.216 | 0.141 | 0.021 | 0.565 |

| 2021 | 30 | 0.109 | 0.076 | 0.008 | 0.283 |

| Capital | 270 | 0.816 | 0.152 | 0.446 | 1.192 |

| Labor | 270 | 0.021 | 0.005 | 0.009 | 0.042 |

| pergdp | 270 | 9.324 | 0.465 | 8.647 | 10.780 |

| market | 270 | 8.239 | 1.848 | 3.580 | 12.390 |

| population | 270 | 5.476 | 1.292 | 2.068 | 8.275 |

| fdi | 270 | 1.780 | 1.396 | 0.010 | 7.960 |

| fiscal | 270 | 0.252 | 0.102 | 0.106 | 0.643 |

| Variables | Indust1 | Indust2 | Indust1 | Indust2 |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Digital | 0.077 * | −0.356 *** | 0.010 ** | −0.011 * |

| (1.71) | (−3.03) | (0.004) | (0.006) | |

| lnpergdp | 0.011 | 0.017 | ||

| (0.39) | (0.25) | |||

| Market | 0.002 | −0.016 ** | ||

| (0.81) | (−2.08) | |||

| Population | 0.057 | 0.131 | ||

| (0.88) | (0.65) | |||

| fdi | −0.003 * | −0.011 *** | ||

| (-1.83) | (v3.04) | |||

| Scale | 0.197 ** | 0.388 | ||

| (2.28) | (1.46) | |||

| Time/region effect | NO | NO | YES | YES |

| Constant | 2.683 *** | 0.404 *** | 2.080 *** | −0.682 |

| (62.82) | (3.59) | (4.87) | (−0.45) | |

| Observations | 270 | 270 | 270 | 270 |

| R-squared | 0.979 | 0.888 | 0.980 | 0.900 |

| Stage Ⅰ | Stage Ⅱ | Stage Ⅱ | |

|---|---|---|---|

| Variables | Digital | Indest1 | Indust2 |

| (1) | (2) | (3) | |

| Digital | 0.574 *** | −2.310 ** | |

| (0.191) | (1.159) | ||

| IV | −2.925 * | ||

| (−1.90) | |||

| Constant | 20.471 *** | 2.250 *** | −1.407 |

| (2.81) | (0.593) | (2.420) | |

| Control variable/time/region effect | YES | YES | YES |

| Observations | 270 | 270 | 270 |

| R-squared | 0.889 | 0.968 | 0.676 |

| Plan: A | ||||||

|---|---|---|---|---|---|---|

| Low | Medium | High | Low | Medium | High | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Variables | Indust1 | |||||

| Digital | 0.393 *** | 0.313 ** | 0.236 *** | 0.233 ** | 0.313 ** | 0.186 *** |

| (4.33) | (2.16) | (3.60) | (2.14) | (2.16) | (3.52) | |

| Constant | −0.361 | 1.728 *** | 1.223 *** | 1.230 * | 1.728 *** | 1.252 *** |

| (−1.10) | (3.01) | (3.30) | (1.67) | (3.01) | (4.01) | |

| R-squared | 0.759 | 0.544 | 0.952 | 0.724 | 0.544 | 0.937 |

| Plan: B | ||||||

| Variables | Indust2 | |||||

| Digital | −0.445 * | −1.049 *** | 0.079 | −0.415 * | −1.049 *** | 0.252 ** |

| (−1.76) | (−2.82) | (1.16) | (−1.74) | (−2.82) | (2.64) | |

| Constant | −3.802 | −5.250 * | 4.018 *** | −2.878 | −5.250 * | 3.570 *** |

| (−0.62) | (−1.74) | (5.31) | (−0.48) | (−1.74) | (5.60) | |

| Control variable/time/regional effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observed | 90 | 90 | 90 | 81 | 90 | 63 |

| R-squared | 0.928 | 0.898 | 0.963 | 0.936 | 0.898 | 0.963 |

| Variables | Labor | Indust1 | Indust2 | Capital | Indust1 | Indust2 |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Digital | 0.009 *** | 0.089 ** | −0.191 * | 0.495 *** | 0.083 * | −0.192 * |

| (3.00) | (2.25) | (−1.81) | (2.94) | (1.94) | (−1.83) | |

| Labor | 1.152 | −10.412 *** | ||||

| (0.90) | (−3.35) | |||||

| Capital | 0.035 * | −0.206 *** | ||||

| (1.77) | (−3.40) | |||||

| Constant | 1.104 | 2.041 *** | −0.454 | 0.132 *** | 1.927 *** | 0.715 |

| (0.82) | (4.84) | (−0.32) | (4.42) | (4.34) | (1.00) | |

| Control variable/time/regional effect | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 270 | 270 | 270 | 270 | 270 | 270 |

| R-squared | 0.867 | 0.980 | 0.910 | 0.968 | 0.980 | 0.909 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pang, J.; Zhang, Y.; Jiao, F. The Impact of the Digital Economy on Transformation and Upgrading of Industrial Structure: A Perspective Based on the “Poverty Trap”. Sustainability 2023, 15, 15125. https://doi.org/10.3390/su152015125

Pang J, Zhang Y, Jiao F. The Impact of the Digital Economy on Transformation and Upgrading of Industrial Structure: A Perspective Based on the “Poverty Trap”. Sustainability. 2023; 15(20):15125. https://doi.org/10.3390/su152015125

Chicago/Turabian StylePang, Jianing, Yimeng Zhang, and Fangyi Jiao. 2023. "The Impact of the Digital Economy on Transformation and Upgrading of Industrial Structure: A Perspective Based on the “Poverty Trap”" Sustainability 15, no. 20: 15125. https://doi.org/10.3390/su152015125