A Multi-Agent Integrated Energy Trading Strategy Based on Carbon Emission/Green Certificate Equivalence Interaction

Abstract

:1. Introduction

- Based on the tiered incentive-based carbon trading mechanism, an interactive mechanism between carbon emissions and green certificates was proposed that establishes clear ownership of green rights. Furthermore, the paper utilize the flexible characteristics of loads within the industrial park to develop a demand response model for integrated electricity, heat, and cooling energy;

- A demand response integrated energy trading model that considers the interactive mechanism between carbon emissions and green certificates is established, with the objective of minimizing the system’s operational costs;

- Four different scenarios were compared in the simulation case study, the interactive mechanism between green certificates and carbon emissions, combined with demand response, can effectively increase the rate of renewable energy integration while saving operational costs in trading model.

2. IES Optimization Operation Model

2.1. Demand Response of Electrical Load

2.2. Demand Response of Heat/Cooling Load

3. RIES Trading Strategy Based on Carbon Emission/Green Certificate Equivalent Interaction

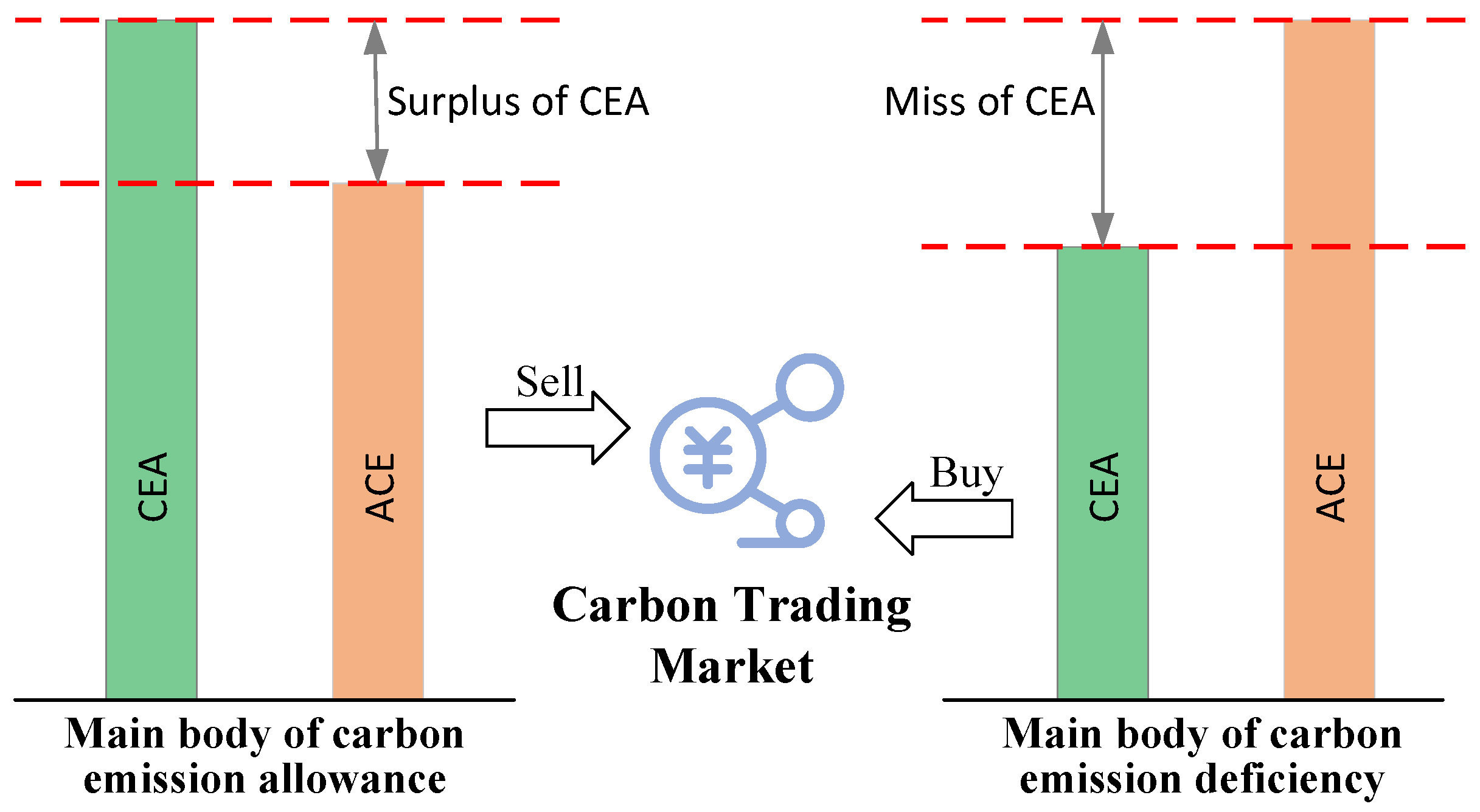

3.1. Tiered Incentive Carbon Trading Market Mechanism and Emission Operators

3.2. Carbon Emission/Green Certificate Equivalent Interaction Mechanism

- (1)

- To compare and analyze the carbon emissions of different power generation methods, carbon footprint, or carbon emission flow, methods are employed to calculate the carbon emissions.

- (2)

- An analysis is conducted to assess the carbon reduction potential embedded in green certificates. The carbon emissions from renewable energy generation and fossil fuel-based power generation are compared to determine the respective carbon reduction implied by different types of green certificates. The calculations are as follows:where represents the carbon reduction potential reflected by the j-th type of green certificate. Meanwhile, and represent the carbon dioxide equivalent emissions associated with coal-powered energy supply and renewable energy supply, respectively, throughout their respective industry value chains.

- (3)

- The operation of the certificate trading platform requires the determination of ownership of green attributes. Once the seller sells green certificates on the certificate subscription platform, the environmental attributes represented by the certificates will be transferred to the buyer. However, when calculating the seller’s carbon emissions and the proportion of green electricity, the corresponding information embedded in the sold green certificates needs to be deducted to avoid duplicate calculations of information. Similarly, when assessing the buyer, appropriate adjustments need to be made. The value of green certificates is only valid during their assessment period. At this time, new energy enterprises do not directly participate in carbon trading. Instead, the buyers of green certificates participate in carbon trading by purchasing green certificates.

- (4)

- Participating in market transactions. Within the same system, renewable energy can offset a portion of carbon emissions, thereby integrating green certificate trading and carbon trading into one process. The carbon cost of the system is as follows:where represents the incremental carbon trading cost when considering the interaction; and represent the actual carbon emissions and carbon quota of unit i, respectively, while represents the carbon offset from green certificates. The IES trading framework with carbon trading and green certificate trading is illustrated in Figure 3.

4. Simulation Analysis

4.1. Example Data

4.2. Analysis of the Influence of Different Scheduling Models on Simulation Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Hussain, H.M.; Narayanan, A.; Nardelli, P.H.J.; Yang, Y. What is Energy Internet? Concepts, Technologies, and Future Directions. IEEE Access 2020, 8, 183127–183145. [Google Scholar] [CrossRef]

- Wang, Y.; Liang, B.; Li, D.; Zheng, H.; Lei, Y.; Teng, H.; Altaf, A.R. A Comprehensive Assessment of Clean Coal Fuels for Residential Use to Replace Bituminous Raw Coal. Energies 2023, 16, 1910. [Google Scholar] [CrossRef]

- Rehman, A.U.; Zhao, T.; Muhammad, I.; Rasheed, S.; Shah, R.; Altaf, A.R.; Zhang, F.; Yun, S. MgCl2-MXene based nanohybrid composite for efficient thermochemical heat storage application. J. Energy Storage 2023, 59, 106509. [Google Scholar] [CrossRef]

- Khan, A.R.; Wang, W.; Altaf, A.R.; Shaukat, S.; Zhang, H.J.; Rehman, A.U.; Jun, Z.; Peng, L. Facial Synthesis, Stability, and Interaction of Ti3C2Tx@PC Composites for High-Performance Biocathode Microbial Electrosynthesis Systems. ACS Omega 2023, 8, 29949–29958. [Google Scholar] [CrossRef]

- Hussain, S.M.S.; Nadeem, F.; Aftab, M.A.; Ali, I.; Ustun, T.S. The Emerging Energy Internet: Architecture, Benefits, Challenges, and Future Prospects. Electronics 2019, 8, 1037. [Google Scholar] [CrossRef]

- Li, Y.; Gao, D.W.; Gao, W.; Zhang, H.; Zhou, J. A Distributed Double-Newton Descent Algorithm for Cooperative Energy Management of Multiple Energy Bodies in Energy Internet. IEEE Trans. Ind. Inform. 2021, 17, 5993–6003. [Google Scholar] [CrossRef]

- Schick, C.; Klempp, N.; Hufendiek, K. Role and Impact of Prosumers in a Sector-Integrated Energy System with High Renewable Shares. IEEE Trans. Power Syst. 2022, 37, 3286–3298. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, H.; Liang, X.; Huang, B. Event-Triggered-Based Distributed Cooperative Energy Management for Multienergy Systems. IEEE Trans. Ind. Inform 2019, 15, 2008–2022. [Google Scholar] [CrossRef]

- Ntomaris, A.V.; Bakirtzis, A.G. Stochastic Scheduling of Hybrid Power Stations in Insular Power Systems with High Wind Penetration. IEEE Trans. Power Syst. 2016, 31, 3424–3436. [Google Scholar] [CrossRef]

- Huang, B.; Li, Y.; Zhan, F.; Sun, Q.; Zhang, H. A Distributed Robust Economic Dispatch Strategy for Integrated Energy System Considering Cyber-Attacks. IEEE Trans. Ind. Inform. 2022, 18, 880–890. [Google Scholar] [CrossRef]

- Huang, B.; Liu, L.; Zhang, H.; Li, Y.; Sun, Q. Distributed Optimal Economic Dispatch for Microgrids Considering Communication Delays. IEEE Trans. Syst. Man Cybern. 2019, 49, 1634–1642. [Google Scholar] [CrossRef]

- Mohammadi, M.; Noorollahi, Y.; Mohammadi-ivatloo, B.; Hosseinzadeh, M.; Yousefi, H.; Khorasani, S.T. Optimal management of energy hubs and smart energy hubs-A review. IEEE Trans. Ind. Inform. 2018, 89, 33–50. [Google Scholar] [CrossRef]

- Li, Y.; Gao, D.W.; Gao, W.; Zhang, H.; Zhou, J. Double-Mode Energy Management for Multi-Energy System via Distributed Dynamic Event-Triggered Newton-Raphson Algorithm. IEEE Trans. Smart Grid 2020, 11, 5339–5356. [Google Scholar] [CrossRef]

- Li, Y.; Wang, J.; Wang, R.; Gao, D.W.; Sun, Q.; Zhang, H. A Switched Newton–Raphson-Based Distributed Energy Management Algorithm for Multienergy System Under Persistent DoS Attacks. IEEE Trans. Autom. 2022, 19, 2985–2997. [Google Scholar] [CrossRef]

- Li, Y.; Li, T.; Zhang, H.; Xie, X.; Sun, Q. Distributed Resilient Double-Gradient-Descent Based Energy Management Strategy for Multi-Energy System Under DoS Attacks. IEEE Trans. Netw. Sci. Eng. 2022, 9, 2301–2316. [Google Scholar] [CrossRef]

- Teng, F.; Zhang, Y.; Yang, T.; Li, T.; Xiao, Y.; Li, Y. Distributed Optimal Energy Management for We-Energy Considering Operation Security. IEEE Trans. Netw. Sci. Eng. 2023. [Google Scholar] [CrossRef]

- Ehjaz, M.; Iqbal, M.; Zaidi, S.S.H.; Khan, B.M. A Novel Scheme for P2P Energy Trading Considering Energy Congestion in Microgrid. IEEE Access 2021, 9, 147649–147664. [Google Scholar] [CrossRef]

- Apostolopoulou, D.; Gross, G.; Güler, T. Optimized FTR Portfolio Construction Based on the Identification of Congested Network Elements. IEEE Trans. Power Syst. 2013, 28, 4968–4978. [Google Scholar] [CrossRef]

- Bautista, G.; Quintana, V.H. Screening and mitigation of exacerbated market power due to financial transmission rights. IEEE Trans. Power Syst. 2005, 20, 213–222. [Google Scholar] [CrossRef]

- Goyat, R.; Kumar, G.; Conti, M.; Devgun, T.; Saha, R.; Thomas, R. BENIGREEN: Blockchain-Based Energy-Efficient Privacy-Preserving Scheme for Green IoT. IEEE Internet Things J. 2023, 10, 16480–16493. [Google Scholar] [CrossRef]

- Ashley, M.J.; Johnson, M.S. Establishing a Secure, Transparent, and Autonomous Blockchain of Custody for Renewable Energy Credits and Carbon Credits. IEEE Eng. Manag. Rev. 2018, 46, 100–102. [Google Scholar] [CrossRef]

- Kumar, A.; Srivastava, S.C.; Singh, S.N. Congestion management in competitive power market: A bibliographical survey. Electric. Power Syst. Res. 2005, 76, 153–164. [Google Scholar] [CrossRef]

- Xu, Y.; Liao, Q.; Liu, D.; Tian, Y.; Chen, Y.; Chen, W. A Two-Layer Integrated Energy Planning Method Considering Active Management Measures in Market Environment. Autom. Electr. Power Syst. 2018, 18, 114–122. [Google Scholar]

- Nolan, S.; O’Malley, M. Challenges and barriers to demand response deployment and evaluation. Appl. Energy 2015, 152, 1–10. [Google Scholar] [CrossRef]

- Mitridati, L.; Kazempour, J.; Pinson, P. Heat and electricity market coordination: A scalable complementarity approach. Eur. J. Oper. Res. 2020, 283, 1107–1123. [Google Scholar] [CrossRef]

- Hou, J.Y.; Yuan, Z.; Wang, W.Q.; He, S. Optimization method of wind power consumption based on thermal storage tanks against the background of stepped carbon trading. Front. Energy Res. 2023, 10, 1050641. [Google Scholar] [CrossRef]

- Shabanpour-Haghighi, A.; Seifi, A.R. An Integrated Steady-State Operation Assessment of Electrical, Natural Gas, and District Heating Networks. IEEE Trans. Power Syst. 2016, 31, 3636–3647. [Google Scholar] [CrossRef]

- Feng, G.; Ge, Y.; Han, L.; Li, Y.; Gao, W.; Zhou, T. Market mechanism involving Carbon Trading of Integrated Energy System based on Stackelberg game. In Proceedings of the 2023 IEEE 6th International Electrical and Energy Conference (CIEEC), Hefei, China, 12–14 May 2023; pp. 1190–1195. [Google Scholar]

- Li, Y.; Tang, W.; Wu, Q. Modified Carbon Trading Based Low-carbon Economic Dispatch Strategy for Integrated Energy System with CCHP. In Proceedings of the 2019 IEEE Milan PowerTech, Milan, Italy, 23–27 June 2019; pp. 1–6. [Google Scholar]

- Teng, H.; Altaf, A.R. Elemental mercury (Hg0) emission, hazards, and control: A brief review. J. Hazard. Mater. Adv. 2022, 5, 100049. [Google Scholar] [CrossRef]

- Altaf, A.R.; Teng, H.; Zheng, M.; Ashraf, I.; Arsalan, M.; Rehman, A.U.; Gang, L.; Pengjie, W.; Yongqiang, R.; Xiaoyu, L. One-step synthesis of renewable magnetic tea-biochar derived from waste tea leaves for the removal of Hg0 from coal-syngas. J. Environ. Chem. Eng. 2021, 9, 105313. [Google Scholar] [CrossRef]

- Coelho, A.; Iria, J.; Soares, F. Network-secure bidding optimization of aggregators of multi-energy systems in electricity gas and carbon markets. Appl. Energy 2021, 301, 117460. [Google Scholar] [CrossRef]

- Davis, D.; Brear, M.J. Decarbonising Australia’s National Electricity Market and the role of firm, low-carbon technologies. J. Clean. Prod. 2022, 373, 133757. [Google Scholar] [CrossRef]

- Peng, Q.; Zhou, X.; Yang, R. Design of Coordination and Balance Mechanism between National Green Power Certificate Trading Market and Provincial Day-ahead Power Market. Power Syst. Technol. 2020, 44, 2565–2571. [Google Scholar]

- Luo, Z.; Qin, J.H.; Liang, J.Y.; Shen, F.; Liu, H.Z.; Zhao, M.; Wang, J.H. Day-ahead Optimal Scheduling of Integrated Energy Systems with Carbon-Green Certificate Joint Trading Mechanism. Electr. Power Autom. Equip. 2021, 41, 248–255. [Google Scholar]

- Li, T.; Chen, L.; Jensen, C.S.; Pedersen, T.B.; Gao, Y.; Hu, J. Evolutionary Clustering of Moving Objects. In Proceedings of the 2022 IEEE 38th International Conference on Data Engineering (ICDE), Kuala Lumpur, Malaysia, 9–12 May 2022; pp. 2399–2411. [Google Scholar]

- Li, T.; Huang, R.; Chen, L.; Jensen, C.S.; Pedersen, T.B. Compression of Uncertain Trajectories in Road Networks. In Proceedings of the 46th International Conference on Very Large Data Bases, Online, 31 August–4 September 2020; Volume 13, pp. 1050–1063. [Google Scholar]

| Parameter | Value | Parameter | Value |

|---|---|---|---|

| a | 3.58 | b | 66.2 |

| c | 100 | 0.9 | |

| 4 | 0.85 | ||

| 1.2 | 0.02 | ||

| 0.95 | 0.95 | ||

| 0.98 | 0.98 | ||

| 0.35 | - | - |

| Parameter | Value/kW | Parameter | Value/kW |

|---|---|---|---|

| 160 | 800 | ||

| 1000 | 500 | ||

| 500 | 0 | ||

| 350 | 0 | ||

| 0.95 | 220 | ||

| 150 | - | - |

| Scheme | Total Cost/RMB | Operating Cost/RMB | Interaction Cost/RMB | Carbon Trading Cost/RMB | Carbon Emission/Kg |

|---|---|---|---|---|---|

| 1 | 18,996.73 | 17,338.48 | 1658.25 | - | 13,959.40 |

| 2 | 18,647.68 | 17,289.83 | 1357.85 | −289.57 | 13,638.36 |

| 3 | 18,168.56 | 17,076.54 | 1092.02 | −556.53 | 13,151.44 |

| 4 | 17,638.19 | 16,652.01 | 986.18 | −535.34 | 12,341.99 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, J.; Huang, B.; Wang, Q.; Du, P.; Zhang, Y.; He, B. A Multi-Agent Integrated Energy Trading Strategy Based on Carbon Emission/Green Certificate Equivalence Interaction. Sustainability 2023, 15, 15766. https://doi.org/10.3390/su152215766

Tian J, Huang B, Wang Q, Du P, Zhang Y, He B. A Multi-Agent Integrated Energy Trading Strategy Based on Carbon Emission/Green Certificate Equivalence Interaction. Sustainability. 2023; 15(22):15766. https://doi.org/10.3390/su152215766

Chicago/Turabian StyleTian, Jiaqi, Bonan Huang, Qiuli Wang, Pengbo Du, Yameng Zhang, and Bangpeng He. 2023. "A Multi-Agent Integrated Energy Trading Strategy Based on Carbon Emission/Green Certificate Equivalence Interaction" Sustainability 15, no. 22: 15766. https://doi.org/10.3390/su152215766

APA StyleTian, J., Huang, B., Wang, Q., Du, P., Zhang, Y., & He, B. (2023). A Multi-Agent Integrated Energy Trading Strategy Based on Carbon Emission/Green Certificate Equivalence Interaction. Sustainability, 15(22), 15766. https://doi.org/10.3390/su152215766