1. Introduction

Recent reports suggest that companies have had a significant impact on global emissions and environmental damage. For instance, just one hundred major companies have been responsible for 71% of global emissions since 1988 [

1], and three thousand major companies incurred

$2.2 trillion of environmental damage due to air and water pollution or resource overuse [

2]. As a result, there has been a growing interest in firms’ actions to reduce their environmental footprint. To address this issue, studies have extensively examined various external and internal factors that influence companies’ environmental decisions [

3,

4,

5]. These factors include financial performance and incentives, regulatory pressures, stakeholder expectations, and social responsibility initiatives.

Although a firm’s financial performance is known to be one of the major determinants of its environmental activity, the relationship between the two has not been straightforward. Previous studies have examined the relationship between financial performance, measured based on return on assets (ROA), and adopting environmental management practices (EMPs), but the results have been inconsistent. For instance, Hardcopf et al. [

6] showed that a firm’s profitability (measured based on ROA) is positively correlated with EMP adoption. On the other hand, Cole et al. [

7] found that ROA is negatively correlated with a firm’s environmental management activities, and evidence from Zhang et al.’s study suggests that ROA does not affect EMP adoption [

8].

This study posits that one possible reason for this inconsistency is that a firm might consider different components of its financial performance when making a decision. This originates from the DuPont analysis, a classical framework for the financial performance assessment that decomposes a firm’s ROA into two distinctive components—profit margin and asset turnover [

9,

10,

11]. According to this analysis, each component measures different aspects of the firm’s financial efficiency. Net profit margin is net income divided by revenue. It measures the firm’s operating efficiency in controlling costs and generating revenues. At the same time, asset turnover is calculated as revenue divided by total assets and measures how efficiently the firm uses its assets, assessing asset-use efficiency. With this distinction, the DuPont analysis provides more detailed insights into financial performance. For instance, Amir et al. [

12] found that the market reacts more strongly to changes in a firm’s profit margin than to changes in asset turnover, which suggests that improving the profit margin has a greater impact on the firm’s market return. Using the same logic, this paper separately examines the effects of profit margin and asset turnover on firms’ EMP adoption.

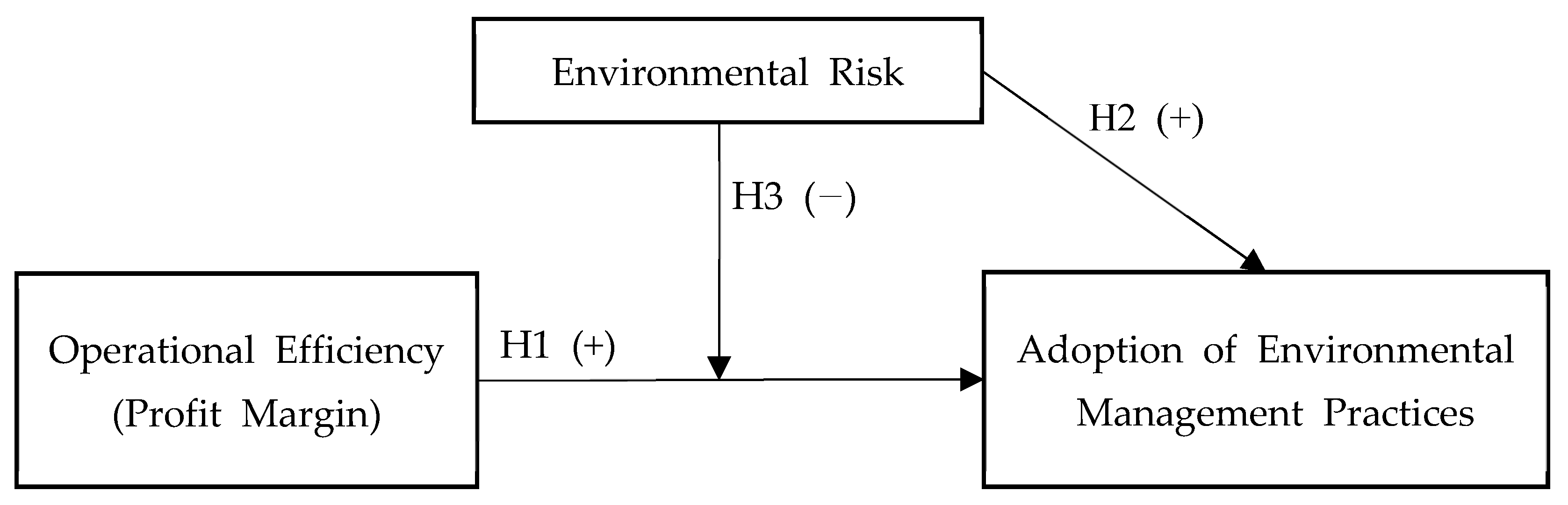

We begin by hypothesizing that higher operational efficiency, as measured based on the net profit margin, will positively impact the adoption of EMPs. Firms with better operational efficiency will have more resources for these costly steps. To emphasize the importance of distinguishing between operational and asset-use efficiency in financial performance analysis, we test whether other measures, such as ROA, ROE, and asset turnover, provide different results than using net profit margin.

Additionally, we explore how environmental risk may moderate the impact of operational efficiency on the EMP adoption rate. Several factors could affect firms that make environmental decisions based on operational efficiency. The environmental risk is one of the most significant candidates among them. We maintain that firms in industries with a high level of environmental risk adopt EMPs, even if they are operationally inefficient, due to the potential for environmental accidents or controversies that can harm the firm’s value [

13]. Therefore, we examine whether environmental risk weakens the effect of operational efficiency on EMPs.

Our study utilizes data from 2002 to 2013, comprising 6224 observations from 776 US firms obtained from two datasets, namely Compustat and Thomson Reuters’ ASSET4. Our findings reveal that firms with higher operational efficiency are more inclined to adopt EMPs, while measures such as ROA, ROE, and asset turnover do not demonstrate any substantial effect. Furthermore, the results confirm that firms with higher environmental risks are more likely to adopt EMPs, and environmental risk mitigates the relationship between operational efficiency and EMP adoption rates.

Our study has several contributions. In terms of theory, we address a gap in the prior literature that has yielded inconsistent findings on the relationship between financial performance and the adoption of EMPs. We achieve this by decomposing a firm’s financial performance into two parts: operational efficiency and asset-use efficiency. This decomposition is crucial to resolving the inconsistency observed in prior studies. As a result, our study enhances our understanding of the factors that truly drive the adoption of EMPs. From a practical standpoint, our results suggest that stakeholders interested in promoting environmentally friendly practices should prioritize improving operational efficiency rather than asset-use efficiency.

The rest of the paper is structured as follows:

Section 2 reviews relevant literature;

Section 3 outlines the development of our research hypotheses;

Section 4 and

Section 5 describe our data and present empirical analysis with robustness checks; and

Section 6 concludes with key insights and implications.

2. Literature Review

As environmental concerns emerged as an issue that firms had to take seriously, numerous studies investigated firms’ environmental management decisions. Our study contributes to the literature on factors affecting those activities. These studies can be broadly divided into two categories: those that examine external and internal factors [

3,

4,

5].

External factors are mostly related to a firm’s stakeholders. For instance, Zhang et al. [

8] found that firms improve their environmental management performance under pressure from supply chain partners and customers, while King et al. [

14] showed that a firm’s relationship with buyers affects its environmental management activities. Government regulation is another external factor that induces firms to step up their environmental activities [

15,

16]. López-Gamero et al. [

17] discovered that voluntary regulation norms are particularly effective. Additionally, stakeholders such as clients, communities, governments, and shareholders can also pressure firms to adopt EMP [

18,

19,

20]. For instance, Nejati et al. [

21] found that among the stakeholders, it is only employees and customers who drive the adoption of environmental practices in micro and small- and medium-sized enterprises. External circumstances such as competition, market leadership [

22], and industry dynamism [

23] are other influential factors. For example, Garcés-Ayerbe et al. [

24] discovered that stakeholder pressure toward environmental activities is reinforced by expectations of competitive advantage in the low-polluting industry, whereas no such influence exists in the high-polluting sector.

Studies of internal factors have explored the relationship between a firm’s size, managerial ownership, prior experience, and other factors and their impact on environmental activities. Some studies have found a positive effect of the firm’s size on its environmental activities [

25,

26]. Shan et al. [

27] found that managerial ownership has a positive relationship with environmental activities when managerial ownership is sufficiently low or high, while the relationship is inverted when ownership is in the entrenchment region. Tung et al. [

28] showed that organizational factors, such as top management support, training, and the linking of performance to rewards, are essential to enhance the effectiveness of environmental management. Frondel et al. [

29] have shown that adopting an environmental management system can increase a firm’s environmental innovation. Additionally, Hardcopf et al. [

30] found that firms that are not sustainability leaders de-escalate the number of EMPs after high-severity accidents. Globalization can contribute to environmental self-regulation [

31], and selecting suppliers based on environmental criteria can enhance environmental innovation [

32].

Recently, there has been another body of literature focusing on the internal determinants of environmental activities. Prado-Lorenzo et al. [

33] examined internal factors’ impacts on greenhouse gas emission reporting practices. They discovered that firm size and market capitalization have a positive impact, while return on equity (ROE) has a negative impact. In a similar vein, Fernandes et al. [

34] explored the influence of boards of directors on the adoption of environmental disclosure practices, while Peters and Romi [

35] examined the relationship between the presence of an environmental committee and a chief sustainability officer (CSO) and environmental risk disclosures. They found a significant impact on board independence and the average age of board members. Fiorini et al. [

36] investigated the role of advanced information systems in facilitating firms’ effective adoption of environmental management practices. Chen et al. [

37] showed that private firms demonstrate a greater willingness to disclose carbon emission information compared to state-owned enterprises. Furthermore, they found that firms operating in highly distorted factor markets are less inclined to disclose carbon information. Additionally, imposing an environmental tax has been found to play a key role in abating pollution [

38].

Other studies have attempted to identify the determinants of environmental management decisions by examining a combination of external and internal factors. Using survey data, Johnstone and Labonne [

39] found that signaling to regulators and customers is a significant driver of EMP adoption. They also found financial assistance and quality management systems to have a positive effect. Hardcopf et al. [

6] integrated external and internal factors to identify the source of heterogeneity in adopting EMP.

Our research is closely related to the literature that examines the combination of external and internal factors. Specifically, we investigate the relationship between financial performance and the adoption of EMPs, building upon previous studies [

6,

7,

8]. It is interesting to note, however, that these studies have provided inconsistent results, despite all employing ROA as a measure of financial performance. Specifically, Hardcopf et al. [

6] found a positive effect, while Cole et al. [

7] found a negative one. On the other hand, Zhang et al. [

8] found that ROA has no significant effect. Our study, thus, aims to contribute to this literature by resolving the inconsistency and introducing operational efficiency as an alternative measure of financial performance. Moreover, we will explore the moderating role of environmental risk as an external factor that affects the relationship between operating efficiency and adopting EMPs.

5. Results

Descriptive statistics and the correlation matrix of all variables used in the analysis are presented in

Table 2. The mean adoption rate of EMP is 0.314, with a standard deviation of 0.313. This indicates that, on average, firms adopt approximately 31.4% of the EMP adopted by all firms in the same industry. The correlation between independent and control variables is low, with a coefficient of less than 0.4. We also ensure that all variance inflation factors are less than 4 to avoid multicollinearity concerns. Thus, we can confidently include these variables in the model.

To represent financial performance, we initially conduct a regression using several variables, such as net profit margin (Model 1), ROA (Model 2), ROE (Model 3), and asset turnover (Model 4).

Table 3 shows the regression results. Our findings reveal that only the net profit margin has a significant impact on a firm’s EMP adoption rates, while the other variables do not show a significant effect. This indicates that a firm’s environmental decision-making process is significantly influenced by its operational efficiency, as measured based on net profit margin rather than other measures of financial performance. Given the result of

Table 3, we only use the net profit margin as a measure of financial performance for the rest of our analyses.

Table 4 presents the estimation results of the main analysis. Model 1 includes only the net profit margin as the independent variable, while Model 2 tests Hypotheses 1 and 2 by including additional main effect variables. In all models, the estimated coefficient of the net profit margin is positive and statistically significant, providing evidence that operating efficiency positively affects the adoption rates of EMP (supporting Hypotheses 1). Our results suggest that firms with efficient operations are likely to have already implemented these practices, have lower marginal costs to adopt them, or have sufficient resources to prioritize environmental concerns. Consequently, more efficient firms are likely to engage in EMP adoption.

Our results also support Hypothesis 2, as the estimated coefficient of environmental risk is positive and statistically significant in Model 2 of

Table 4. This suggests that firms in industries with high environmental risk are more likely to adopt EMPs, potentially due to stricter government regulations that impose penalties and require proactive efforts to mitigate environmental risks compared to those with low environmental risk.

The result in Model 3 of

Table 4, which includes the moderating effect, supports Hypothesis 3. The estimated coefficient of the interaction term with environmental risk is negative and statistically significant. This implies that the impact of operational efficiency on EMP adoption is weakened for firms in riskier industries. Our results suggest that firms in industries with high environmental risks may proactively adopt more sustainable practices, even if they have inefficient operations.

To further investigate tour results regarding Hypothesis 3, we conducted a sub-sample analysis, as shown in

Table 5. Consistent with our result in Model 3 of

Table 4, the estimated coefficient of the net profit margin becomes insignificant in industries with high risk (Model 3), suggesting the effect of operational efficiency on EMP adoption is clearly weakened. The results presented in

Table 5 provide additional confirmation of the support for Hypothesis 3.

Robustness Test

In our main analysis, we eliminated firms that had experienced significant growth or decline, as exceptional revenue could have affected our findings. Specifically, we removed firms that had experienced a tenfold profit change since the previous year. To further confirm the robustness of this criterion, we repeated the analysis, as shown in

Table 6, excluding firms with a fivefold difference in profit difference since the previous year in Models 1 and 2, as well as a threefold difference in Models 3 and 4. We found that the signs and significance of the estimated coefficients were consistent with those of the previous analysis, indicating that our results are robust, irrespective of the sample selection criteria.

6. Discussion and Conclusions

This study investigates the relationship between financial performance and EMP adoption rates. We showed, among various financial performance measures, that only the operational efficiency measured based on net profit margin is positively associated with EMP adoption rates, while other measures’ impacts are insignificant. These suggest several possibilities. Firstly, management practices that lead to high efficiency include practices such as resource reduction, resulting in lowered marginal costs of EMP adoption and, thus, a high EMP adoption rate. Furthermore, efficient firms have sufficient surplus to allocate more resources to environmental stewardship. As a result, the relationship between operational efficiency and EMP adoption rates is significantly positive.

In addition, our study examines whether environmental risk moderates the relationship between financial performance and EMP adoption rates. We found that environmental risk is positively associated with EMP adoption rates but weakens operational efficiency’s impact on them. Firms in industries with high environmental risks might put more effort into reducing their adverse effects on the environment due to strict government regulations. Even if the firm is operationally inefficient, it might adopt EMPs to a certain level to reduce negative press that adversely affects the firm’s reputation and valuation.

Our study offers several contributions. Firstly, our study advances the literature on factors that induce firms to implement EMPs. In particular, our study adds to the stream of research about the impact of financial performance on EMP adoption. Several researchers have tried to figure out the impact of financial performance, but the existing results lack consistency. We addressed this gap by dividing ROA into operational efficiency and asset-use efficiency, as denoted in the DuPont analysis. Our findings reveal that only operational efficiency leads to increased EMP adoption.

Furthermore, our study provides practical insights. We maintain that stakeholders or policymakers who want firms to be more environmentally sustainable can derive intuitive implications from our results. Specifically, if the firm’s operations are inefficient, stakeholders should raise concerns about environmental issues. Moreover, if the firm operates in an industry with low environmental risk and has inefficient operations, they are likely to be unconcerned with adopting environmental practices. This underscores the need for vigilant oversight, as environmental controversies can unexpectedly arise, even in industries that pose a low risk to the environment.

Like many other studies, out study has limitations that point toward directions for future research. Firstly, we only consider environmental risk as a moderating factor, but there are many other possible moderators. For example, a significant operational disruption such as COVID-19 has a strong moderating effect. Firms’ operations tend to become relatively inefficient after such a disruption, which can potentially lead to a shift in their stances on environmental management. Unfortunately, due to the lack of data, we were only able to investigate the period up until 2013, several years before the pandemic. If adequate data are available, however, studying the moderating effect of COVID-19 could yield impressive results. Secondly, our study solely focuses on the financial performance of focal firms. However, it is worth investigating the effect of the financial performance of the supply network. In today’s business landscape, supply networks strongly influence a firm’s decision-making process. A burgeoning research area known as ‘green supply chain management’ examines how supply networks impact decision-making in the pursuit of environmentally conscious performance [

4,

44]. As an extension of our study, exploring the effect of financial performance intertwined with the supply network on EMP adoption and considering the moderating effect of position within the supply network can lead to positive outcomes. Lastly, due to limited data availability, our study was unable to control for various industry and firm-level factors, such as public participation in environmental protection, investment in green technology research, and patent level. These factors may also influence the adoption of environmental management practices. While firm-fixed effects can help to account for time-invariant components of firms, future research can certainly explore factors not addressed in the current study.

In conclusion, there has been growing interest in how firms manage their environmental impact. Researchers and policymakers have made efforts to encourage firms to adopt more environmental management practices (EMPs), such as sustainable practices like waste and pollution reduction. Focusing on financial performance as one way to increase EMP adoption, our research highlights the importance of operational efficiency but not other measures of financial performance as a key determinant. We also consider environmental risk as the context in which the effect of operational efficiency can diminish its impact on EMP adoption. Based on the results of our study, policymakers can effectively monitor firms that are both inefficient and operate in industries with low environmental risk. This strategic monitoring will enable policymakers to take appropriate actions as needed.