1. Background of the Study

In the current context, the rapid expansion of worldwide populations and economic endeavors has intensified apprehensions regarding environmental degradation (ED, hereafter), thereby necessitating an increased emphasis on this matter [

1]. The increasing significance of ED has emphasized the necessity of evaluating the effectiveness of various environmental policy instruments. Upon careful examination of past endeavors in environmental policy implementation, it becomes apparent that the prevailing strategies frequently entailed the establishment of regulatory structures that encompass obligatory directives and punitive actions. These measures were designed to address the escalating environmental challenges and the resulting ecological disturbances [

2,

3,

4]. Paradoxically, despite the longstanding existence of these regulations, which have established a range of standards to protect environmental quality, the prevailing trend has been toward degradation rather than improvement. In situations where the adverse effects of pollution are not immediately apparent, the efficacy of regulatory or “command-and-control” measures in addressing the issue has been called into question [

5].

ED is a significant and pervasive global issue that engenders detrimental consequences for human well-being, air quality, the depletion of the ozone layer, economic stability, biodiversity, and the availability of natural resources [

6,

7]. The interplay between energy, food, water, and infrastructure presents significant challenges to ecosystems, ultimately instigating ecological stress and consequent detrimental impacts on the environment [

8]. In order to tackle this matter effectively, nations must undertake measures aimed at mitigating carbon emissions, curbing energy consumption, and regulating various activities that contribute to the contamination of air, water, and land resources. Notwithstanding, the issue of environmental pollution persists as a formidable global challenge, as discernible and substantial advancements in the reduction of CO

2 emissions and other pollutants have yet to materialize [

1,

9]. While individuals who have been directly impacted by pollution may have the option to seek legal recourse within the existing legal framework, the limitations of such instruments become evident when the harm caused by pollutants is uncertain. Solarin et al. [

10] posit that CO

2 serves as a metric for assessing the extent of environmental degradation. Nevertheless, it is widely acknowledged among scholars that the ecological footprint (EF, hereafter) holds significant value as an indicator for assessing environmental degradation [

11].

The degradation of the environment can arise from a combination of anthropogenic and natural factors. Human-induced ED encompasses a myriad of detrimental factors, including but not limited to water and air pollution, acid rain, agricultural runoff, urban expansion, and habitat fragmentation. The accelerated depletion of natural resources is a consequence of the heightened demand [

1]. Additional factors contributing to ED encompass anthropogenic land disturbance, pollution, population growth, landfills, deforestation, and natural calamities [

12]. The potential degradation of the environment can disrupt the intricate dynamics of the water cycle, thereby impeding the regular functioning of various organisms, both flora and fauna. Additional factors contributing to the ongoing degradation of the environment encompass the detrimental processes of deforestation and mining, as highlighted in the scholarly literature [

13,

14,

15].

Additionally, ED can be ascribed to various macroscopic factors, encompassing economic growth, population growth, land disruption, pollution, overpopulation, landfills, deforestation, natural phenomena, and climate change [

16,

17]. Economic policy uncertainty has been identified as a significant factor that can potentially amplify CO

2 emissions and contribute to ED [

18,

19,

20,

21]. The extant corpus of scholarly literature suggests a discernible correlation between environmental contaminants and a multitude of parameters. Furthermore, it is imperative to acknowledge the substantial implications that arise from the correlation between socioeconomic determinants and ED in the context of evaluating and formulating policy strategies intended to improve environmental quality [

22]. The preservation of the environment poses a substantial challenge to humanity, as it is susceptible to various forms of degradation, including pollution, ecological destruction, depletion of freshwater resources, and loss of arable land [

23,

24]. Therefore, it is imperative to recognize and address these variables when promoting sustainable behavior as a strategy to reduce the ecological footprint and promote ecological sustainability.

The study considered information and communication technology (ICT, hereafter), green finance (GF, hereafter), green technological innovation (GTI, hereafter), environmental tax (ET, hereafter), and clean energy (CE, hereafter) in the equation of the ecological footprint (FF, hereafter). In recent times, ICT has garnered recognition as a powerful tool for addressing pressing ecological issues [

25]. The literature elucidates potential enhancements in efficiency and waste reduction that can be achieved through advancements in ICT [

26]. Smart grids enable the seamless monitoring, control, and optimization of energy distribution by integrating cutting-edge communication technology into power distribution infrastructure. Consequently, the reduction of energy waste leads to an improvement in grid reliability. Through the facilitation of the transition from paper-based to digital workflows, ICT plays a crucial role in the modernization of various business operations. Technological innovation stands as a fundamental driver of economic progress, a notion substantiated by various scholarly works [

27,

28]. Grounded in the Schumpeterian theory of innovation, the premise is that significant transformations in technology are pivotal for accelerating financial gains [

29]. It is within this framework that ecological advancement and eco-friendly innovations have gained prominence, with their dual role in enhancing environmental performance and mitigating harmful emissions well documented. Notably, the confluence of economic development and increased energy consumption for commodity production has given rise to heightened ecological contamination. However, the tide can be turned through the lens of green technological advancement, which holds the potential to enhance energy efficiency and reduce atmospheric pollution [

30]. Moreover, the strategic utilization of efficient energy practices and eco-friendly innovations has demonstrated the capacity to curtail carbon emissions [

31].

The field of GF possesses the inherent capacity to effectively foster ecological sustainability through its active promotion of sustainable development and robust mitigation of adverse environmental impacts. The extant body of research suggests that GF possesses the capacity to yield substantial contributions in the pursuit of ecological sustainability. The achievement of this objective can be facilitated through various approaches, including the reduction of carbon emissions, the improvement of environmental quality, and the mitigation of ecological footprints [

32]. The implementation of GF holds promise for promoting accountability and transparency by incentivizing enterprises to actively monitor and openly disclose their environmental performance [

23]. Policymakers wield the capacity to promote the widespread adoption of environmentally sustainable financial practices through the implementation of regulatory framework modifications, the cultivation of alignment among public financial incentives, and the enhancement of green financing accessibility across diverse sectors. The utilization of GF presents a valuable opportunity for enterprises and regulators alike to effectively foster sustainable growth and address the ecological consequences [

33]. Therefore, the incorporation of GF holds significant promise for augmenting the ecological footprint by fostering sustainable development and mitigating environmental degradation. The facilitation of ecological sustainability can be effectively promoted through the utilization of green financing mechanisms aimed at bolstering clean energy consumption. The utilization of clean energy sources possesses significant potential for effectively mitigating carbon emissions and promoting the progression of sustainable development [

34].

Through the promotion of sustainable growth and mitigation of environmental harm, GF has the potential to safeguard the enduring viability of ecosystems. GF employs environmental levies as a strategic approach to promote and enhance environmental sustainability. Environmental levies have been found to have positive impacts on carbon emissions, water quality, and ecological footprints [

35]. In addition to cultivating a culture of accountability and transparency, the implementation of green financing has the potential to enhance the monitoring and reporting of environmental performance by businesses [

36]. There are several strategies that policymakers can employ to promote GF, including modifications to regulatory frameworks, the alignment of public financial incentives, and the augmentation of green funding from various sectors [

37,

38]. Businesses and governments have the potential to contribute to sustainable development and mitigate their environmental impact through the utilization of green funding mechanisms.

The utilization of CE plays a pivotal role in promoting ecological sustainability through the reduction of carbon emissions and the promotion of sustainable development. The extant literature suggests that the utilization of RE sources holds promise for fostering economic growth while concurrently enhancing environmental quality [

35]. The utilization of RE sources has demonstrated a significant influence on the mitigation of the ecological footprint in diverse geographical regions [

39]. The utilization of RE sources has garnered substantial empirical evidence, thereby substantiating its advantageous influence on the conservation of natural resources [

39,

40]. Alternatively, non-RE sources lead to increased exploitation of limited resources, such as coal and oil, thereby exacerbating the degradation of the environment [

35]. Therefore, the utilization of RE sources has the potential to significantly alleviate the ecological consequences and facilitate the progression of sustainable development. Policymakers and companies possess a unique opportunity to leverage the potential of CE as a means to propel ecological sustainability forward. The desired outcome can be realized through the implementation of strategic investments in RE sources and the facilitation of sustainable energy practices.

The rest of the structure of the study is as follows.

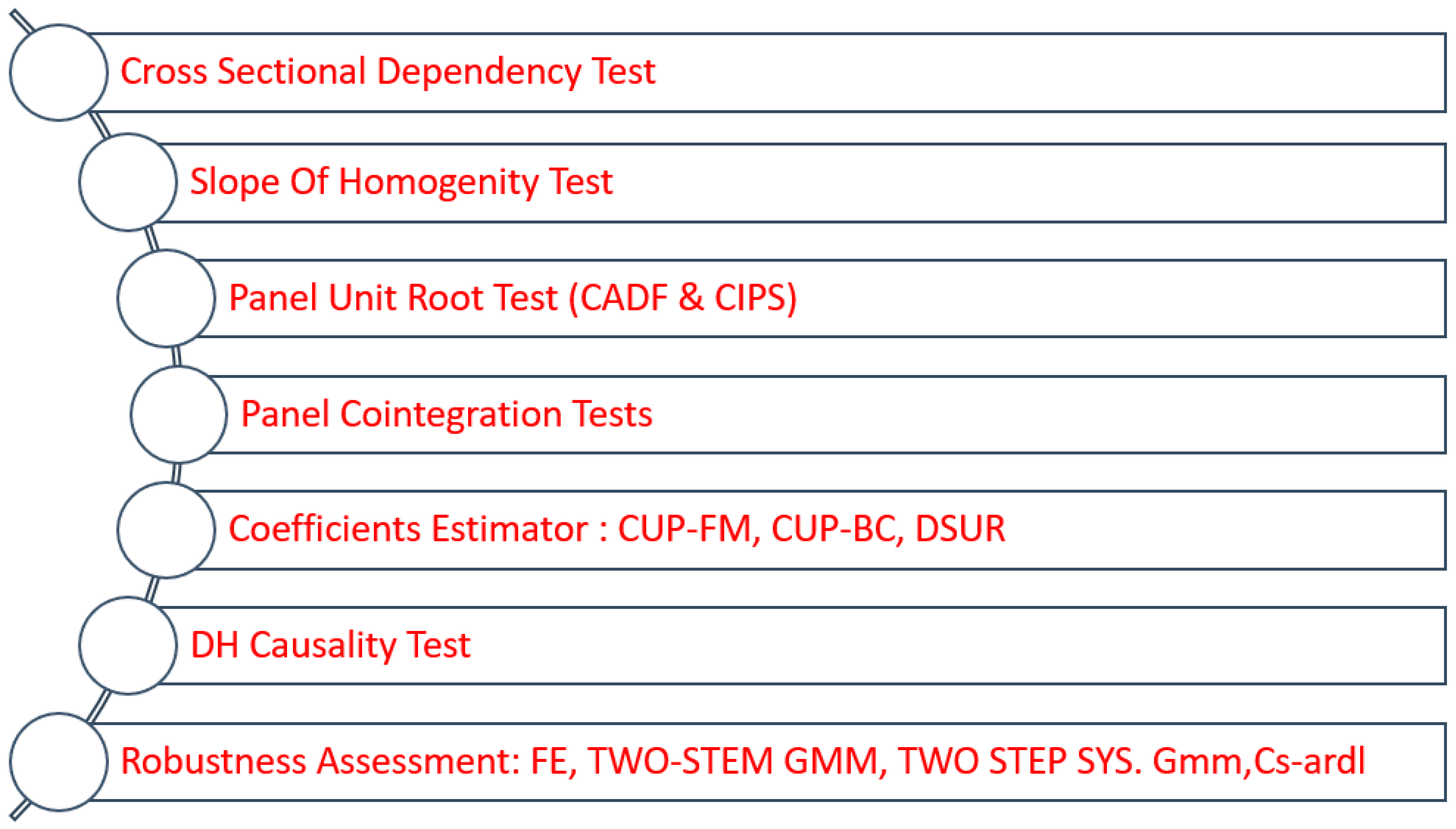

Section 2 deals with the literature review, hypothesis development, data, and methodology of the study presented in

Section 3. Empirical model estimation and interpretation of the results are available in

Section 4. Discussion, conclusion, and policy suggestions are available in

Section 5 and

Section 6, respectively.

5. Discussion

For ICT effects on EF, the findings indicate a noteworthy and statistically significant negative correlation between ICT and ecological footprint (EF). This conclusion is supported by the coefficients obtained through various estimation methods, specifically CUP-FM, CUP-BC, and DSUR, suggesting a 1% change in ICT will result in EF correction by −0.1423%, −0.1369%, and −0.1138%, respectively. The presence of an inverse correlation implies that progress in ICT has the potential to yield favorable results in the realms of ecological restoration and the advancement of environmental sustainability. Our findings are supported by the existing literature posted by [

52,

82,

95]. The utilization of a data-driven approach enables the identification of discernible patterns, prevailing trends, and potential solutions to ecological challenges. In addition, the utilization of ICT enables the implementation of remote monitoring and control systems, which, in turn, reduces the need for direct human intervention and helps to alleviate the negative environmental impacts that are often linked to human activities. The utilization of smart grids and sensors holds great promise in the realm of energy consumption optimization, offering the potential for a noteworthy decrease in carbon emissions [

15,

85,

95].

Furthermore, it is important to acknowledge that the utilization of ICT serves as a pivotal factor in enabling the widespread distribution of knowledge and promoting cooperation among researchers, policymakers, and communities on a worldwide level. The reciprocal exchange of information promotes the development of inventive concepts and the progress of sustainable methodologies. Furthermore, it is crucial to recognize the substantial influence exerted by ICT in fostering environmental awareness and facilitating educational initiatives pertaining to ecological sustainability [

3,

66,

96]. The dissemination of information concerning environmental issues has been greatly improved by utilizing various digital platforms, such as websites, social media platforms, and online courses. The facilitation of the broadening of the audience base, thereby enabling increased access and engagement with said information, has been observed. The platform’s heightened accessibility facilitates the acquisition of knowledge pertaining to the importance of ecological sustainability and the proactive actions that individuals from various backgrounds can undertake to make constructive contributions in this field.

Additionally, the utilization of ICT serves to facilitate the creation and implementation of interactive tools and applications. These tools and applications effectively engage individuals in the adoption and promotion of sustainable practices. Mobile applications possess the inherent capability to provide individuals with current and punctual information pertaining to recycling centers, environmentally friendly products, and sustainable modes of transportation. The availability of information functions as a catalyst for the promotion and encouragement of environmentally conscious decision-making among users. Furthermore, it is important to acknowledge that the utilization of ICT is of utmost significance in facilitating the effective implementation of smart city endeavors. These initiatives encompass the seamless integration of cutting-edge technology into urban infrastructure, thereby augmenting the efficiency of.

The study documented that the coefficient of GTI derived from CUP-FM, CUP-BC, and DSUR exhibited negative signs toward EF, indicating a pivotal role in ecological sustainability. The results of the study offer valuable insights into the role of green technological innovation (GTI) in promoting ecological improvement, indicating that the acceleration of GTI within the economy acts as a catalyst for promoting ecological rectification by facilitating the adoption of energy-efficient technological advancements. Study findings suggest that the adoption and widespread use of eco-friendly technology could result in positive environmental outcomes by reducing energy consumption and promoting sustainable practices. The results align with previous studies that have highlighted the efficacy of GTI in addressing environmental concerns, including the research of Li, Li, Ozturk, and Ullah [

91]. The GTI possesses the capability to make a noteworthy contribution towards the reduction of carbon emissions and the mitigation of adverse environmental effects arising from human activities, which is primarily due to its focus on energy-efficient technical advancements. The significance of this issue is particularly noteworthy in the context of climate change because the achievement of global climate objectives is heavily dependent on the successful implementation of sustainable technical solutions. Additionally, it is of utmost importance to take into account the potential rebound effects that may be linked to GTI. While the utilization of energy-efficient technology holds promise for reducing energy consumption, it is crucial to recognize the possibility of rebound effects across various domains. Both individuals and organizations can increase their energy consumption or participate in other activities that can have negative effects on the environment, thereby undermining the intended ecological benefits. It is crucial to meticulously monitor and manage these rebound effects to ensure that the overall impact of GTI remains positive.

A beneficial role of GF has been documented in all three estimations, and there is a negative tie available between GI and EF. Precisely, a 10% innovation in GF may result in flourishment in ecological correction, which eventually leads to environmental sustainability. Study findings acknowledge the findings offered in the study in [

19,

23,

82,

97,

98]. The successful integration of environmental preservation and economic growth is facilitated by the utilization of green finance, which plays a pivotal role in promoting and maintaining ecological sustainability. Liu and Wu’s [

99] study established that GF can contribute positively to the environment through various means, such as reducing carbon emissions, enhancing environmental standards, and mitigating ecological footprints. A similar line of evidence is available in the study of [

100]. Regions that have underdeveloped credit and capital markets may potentially experience greater benefits from the utilization of green finance, as it has the potential to enhance energy and environmental performance. Additionally, it has the potential to incentivize corporations to disclose their environmental performance, thereby promoting greater accountability and transparency. By prioritizing green companies and low-carbon technological innovation efforts in the allocation of social resources, GF policies have the potential to foster the desired development of the economic and social environment. In situations where farmers are provided with increased awareness regarding the advantages of environmentally friendly products, the implementation of green financing could potentially contribute to poverty alleviation.

The financing for sustainable natural resource-based green economies and climate-smart blue economies needs to be enhanced. There should be a greater emphasis on increasing the utilization of green finance. Additionally, there is a need for modifications to be made to national regulatory frameworks in order to support these initiatives. It is important to harmonize public financial incentives and encourage greater green financing from various sectors. Furthermore, the decision-making process for public sector financing should be aligned with the environmental aspect of the sustainable development goals. It is crucial to promote increased investment in clean and green technologies and foster the greater utilization of green finance. The integration of environmental safeguards and economic growth within GF is a significant driver in promoting ecological sustainability. The potential benefits of carbon emissions reduction include the lowering of carbon emissions, enhancement of environmental quality, and reduction of the ecological footprint. Green financing has the potential to be utilized by policymakers and corporations as a means to promote sustainable development and mitigate its environmental impact.

The findings of our study suggest a statistically significant inverse correlation between the implementation of environmental tax (ET) and the ecological footprint, which implies that the integration of ET has a beneficial effect on fostering ecological rectification. The results of our study suggest that a positive correlation exists between a 10% increase in ET and a significant improvement in ecological sustainability. The conclusion is substantiated by the coefficients obtained from the CUP-FM, CUP-BS, and DSUR models. The findings of this study align with previous research conducted by [

38,

45,

71,

79,

96,

101], thus offering further support for the positive impacts of environmental taxation on ecological sustainability. In their study, Sarıgül and Topçu [

74] found that the implementation of environmental tax policies leads to substantial reductions in environmental pollution levels while also promoting sustainable development. In a similar vein, Shahbaz, Topcu, Sarıgül, and Vo [

75] emphasize the importance of environmental taxation as a strategy for mitigating carbon emissions and improving overall environmental conditions.

The implementation of an environmental tax can serve as a powerful financial incentive for businesses and individuals, encouraging them to adopt and incorporate eco-friendly energy sources as well as make essential adjustments to their operational processes [

33]. By implementing financial penalties that specifically target environmentally detrimental practices and providing incentives to encourage the adoption of sustainable alternatives, environmental tax policies have the potential to promote the integration of eco-friendly energy sources and facilitate the adoption of more sustainable operational procedures [

63,

85]. By implementing financial incentives and disincentives, the utilization of environmental taxation can effectively stimulate the widespread adoption of environmentally sustainable energy sources and motivate businesses to make necessary modifications to their operational procedures, which, in turn, helps to mitigate their ecological disruption [

38,

45,

82,

97,

98]. On the contrary, businesses have the opportunity to proactively embrace environmentally friendly energy sources and modify their operational procedures to align with sustainable principles. By participating in such practices, organizations have the potential to not only make substantial contributions towards ecological restoration but also enhance their reputation as entities dedicated to environmental responsibility.

6. Conclusions and Policy Suggestion

The primary aim of this study is to investigate the interrelationship between several key variables, namely information and communication technology (ICT), green technological innovation (GTI), green finance (GF), environmental tax (ET), and the ecological footprint (EF), across a diverse set of countries. The findings of this research study make noteworthy contributions to our comprehension of the intricate interplay among these variables and their potential ramifications for ecological sustainability. Based on the evidence presented, it can be inferred that the hypothesis put forth in this study is supported. The key findings are as follows.

The research findings elucidate a statistically significant inverse correlation between information and communication technology (ICT) and the ecological footprint (EF). The coefficients derived from various estimation techniques, specifically CUP-FM, CUP-BC, and DSUR, consistently demonstrate that a 1% increment in ICT is associated with a decrease in EF by approximately −0.1423%, −0.1369%, and −0.1138%, correspondingly. The observed inverse correlation implies that advancements in information and communication technology (ICT) hold the potential to yield favorable outcomes in the domains of ecological restoration and environmental sustainability. The correlation between the adoption and extensive utilization of environmentally friendly technologies and the resultant positive environmental outcomes, including reduced energy consumption and the promotion of sustainable practices, has been well established in scholarly research. However, it is imperative to diligently observe any potential rebound effects to ensure that the overall ecological impact remains advantageous. The analysis reveals compelling evidence of a significant inverse correlation between GF and EF across all three estimates. The statement above suggests that a 10% increase in green financing has the potential to yield improvements in ecological remediation, thereby fostering the advancement of environmental sustainability. Governmental policies, specifically those related to Green Finance (GF) policies, possess the inherent potential to significantly mitigate carbon emissions, enhance environmental standards, and alleviate the ecological impact. The adoption of environmental taxation (ET) serves as a compelling economic incentive for individuals and businesses alike to embrace environmentally friendly energy sources and incorporate sustainable operational practices. The implementation of the approach above holds immense potential for effectively fostering the widespread adoption of ecologically sustainable practices, thereby making a substantial and noteworthy contribution towards the restoration of fragile ecological systems.

Based on the findings above, it is prudent to consider the following policy recommendations: First, advocate for the advancement of information and communication technology. The allocation of resources towards the enhancement and widespread use of information and communication technology (ICT) is of utmost importance for governments and organizations. This research paper elucidates the profound importance of information and communication technology (ICT) in the realm of remote monitoring and control systems. ICT assumes a central and indispensable role in diminishing the necessity for direct human intervention and ameliorating the detrimental environmental repercussions. Second, facilitate and nurture the progression of environmentally sustainable technologies through dedicated research and development efforts. The successful execution of strategies designed to foster the responsible and sustainable integration of energy-efficient technological advancements, alongside the proficient monitoring and management of rebound effects, is of utmost importance. Third, the initiative is to enhance the effectiveness and efficiency of green finance mechanisms. By bolstering the framework and infrastructure supporting green finance, we aim to facilitate the flow of capital towards environmentally sustainable projects and initiatives, which will involve conducting, proposing, and championing policy measures aimed at fostering the proliferation of green finance initiatives through incentivization. Fourth, environmental taxation is a mechanism that aims to internalize the external costs associated with environmental degradation by imposing taxes on activities that generate negative environmental impacts. This research aims to provide a comprehensive analysis. The prioritization of the implementation and enforcement of environmental tax laws is imperative, with the objective of penalizing activities that yield adverse environmental consequences while concurrently advocating for sustainable alternatives. The policies above possess the capacity to stimulate the extensive integration of environmentally sustainable energy sources and the execution of sustainable operational strategies by individuals and organizations alike.

Empirical studies with secondary data may not have certain limitations, and the present study does as well. The importance of study findings may limit their impact on the following grounds. First, the influence of data quality and availability on the study’s results is not to be underestimated. Inaccurate data can introduce bias and error, while incomplete data can lead to gaps in understanding. Moreover, outdated or limited data can restrict the study’s ability to provide insights that reflect the most current and relevant trends in the fields of ICT, innovation, eco-taxes, and clean energy, which are critical components of sustainable ecological practices. Addressing these data-related limitations is essential for ensuring the validity and robustness of the study’s conclusions. Second, the study’s policy recommendations provide a valuable foundation for addressing ecological sustainability. However, to enhance their effectiveness, it would be beneficial to conduct a more thorough analysis that considers various aspects that are sometimes overlooked during the early stages of policy development.