Abstract

To assess a wine producer’s economic sustainability, it is useful to benchmark its economic indicators against a suitable reference group. Existing research mainly compares wine businesses either by region or by size alone. There is a research gap concerning which of the two benchmarking factors can be more suitable or whether both factors are required. Using a framework of economic sustainability benchmarking figures, the effects of region and size, as well as the effect of their interactions, on 10 economic indicators were estimated through an ANOVA and the estimation of effect sizes. The analysis is based on a unique data set of business data averages of 319 German wine estates across six agricultural years (2014–2019). Region and size both had a significant influence on 7 out of 10 benchmark indicators. Wine estates from distinct regions more strongly differed in their primary indicators of production factors, price and yield as well as secondary indicators of cost and productivity. Contrarily, wine estates of diverse size groups more strongly differed in their tertiary indicators of profitability and return, which are key indicators of economic sustainability. Both size and region should be utilized for suitable economic indicators when benchmarking wine businesses for future assessments of economic sustainability. Hereby, this paper provides a first step in making economic sustainability less subjective for the German wine industry and how to move forward in regards to benchmarking within empirical frameworks and tools of economic sustainability.

1. Introduction and Purpose

Sustainability is perceived as a very important subject by the wine sector in general [1]. This is, among other factors, due to the major effects of climate change observed by the industry, resulting in it currently ranking fourth in terms of the most important challenges and threats recognized by wine businesses [2,3]. While an increasing share of wine producers are already sustainably certified or plan to become so in the future, German wine businesses are lacking behind other countries in this regard [1]. This further underlines the importance for Germany, as a wine-producing country, to increase focus on sustainability.

Thus far, most sustainability certification programs for the wine industry focus mostly on ecological sustainability, while putting less emphasis on or neglecting economic sustainability [4,5,6,7]. Wine producers, however, perceive their economic sustainability as the most important factor and try to plan actions to increase it in the future [1]. Sufficient economic sustainability is an essential prerequisite to generate the investments required to adapt and mitigate the impacts of climate change [3].

In this regard, quantifying economic sustainability can be a means to overcome the perceived hurdles of becoming truly sustainable long-term, such as green washing [1].

A supportive means of gaining more useful insights for economic sustainability is by comparative benchmarking. Here, businesses want to compare and benchmark themselves to the most suitable reference group with the highest relevance. In the past, the region or country of origin has been frequently used, in order to compare performance in various fields of the wine industry. Corkindale and Welsh [8] conducted a qualitative analysis of measuring winery success within and among Australian regions alone, while Chinnici et al. [9] used a national average as a benchmark to compare the financial performance of Sicilian wineries. Further studies resorted to only analyzing performance within regions, or using regions of foreign countries as a frame of reference [10,11,12]. Nonetheless, a comprehensive comparison of winery performance (n = 723 Italian wineries) in Italy by Sellers and Alampi-Sottini [13] revealed a positive relationship between winery size and winery performance, begging the question: Is the region of origin a reliable factor for benchmarking winery performance indicator values, or could a comparison by size groups provide more meaningful insights?

In an attempt to answer this question, this study utilizes an exclusive data set of German wine estate business data from the Geisenheim Business Analysis. Wine estates of various regions and size groups voluntarily provided said data to the Hochschule Geisenheim University across multiple years, allowing for in-depth business insights.

This aggregated data provides a unique opportunity for the detailed comparison of different economic performance indicators potentially applicable for benchmarking within a framework of economic sustainability. Thus far, there is no research available on the relative effect of size and region on economic performance indicators for small- and medium-sized enterprises/businesses (SME) in the wine sector. This study aims at filling this research gap and establishing whether it is more suitable to benchmark wine businesses by size or region of origin to gather the most relevant results for multiple economic performance indicators. The results offer the opportunity for future research to utilize the established importance of providing and choosing the most relevant reference group for benchmarking economic sustainability for SMEs within the agricultural sector, or more specifically the wine sector.

2. Literature Review

2.1. Why Benchmarking Is Important

Benchmarking is of essential importance in promoting continuous improvement in organizational performance [14]. It requires the measurement of the difference between the current performance level of an organization and the best level practically possible, in order to identify causes for each deviation [15]. It is a continuous process of measuring against the best. Benchmarking can be used intra-organizationally, by comparing different sectors or outlets of the same business, yet it is most often used for inter-organizational comparisons between different businesses [16]. Progress should be measured periodically in order to update the organization’s position toward achieving best practice goals. Major benefits of benchmarking include: Determining true measures of productivity, basing goals on a concerted view of external conditions and becoming aware of and searching for industry best practices [14,15]. The application of this technique is also important for the wine industry [17].

A very important part of benchmarking is identifying companies against which to benchmark. While there are multiple bases against which one can choose to benchmark, benchmarking against product competitors is compulsory. A certain level of comparability is essential here, as primary business performance drivers should be similar [8]. Generally, both businesses should transform the same types of inputs (resources) into the same types of outputs [9]. Size is a potentially limiting factor, because it affects the degree of automation or distributional activity of otherwise direct product competitors [8]. To further understand if a winery’s size or region of origin can have a stronger influence on comparability, the paper establishes potential influences of both factors on business success and sustainability.

2.2. A Framework of Economic Sustainability

Since the majority of studies only take into account the environmental dimension of sustainability, it has become increasingly important to develop frameworks for the other dimensions (social and economic), to make measuring them less subjective [18,19,20,21]. Increasing environmental and social sustainability cannot be achieved without including the economic dimension [22].

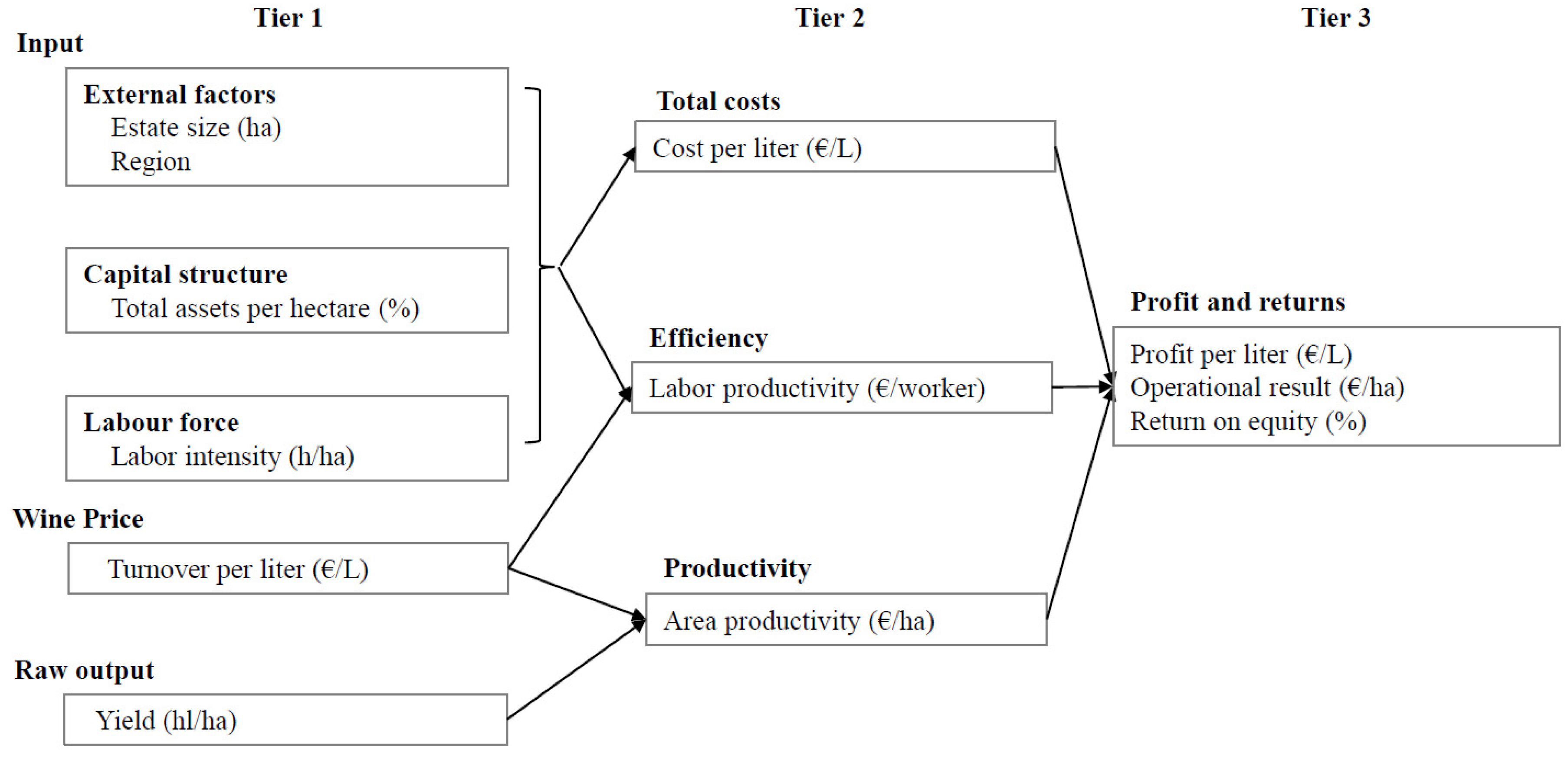

In the search for benchmarking figures for a core framework of economic sustainability in the wine industry, Loose et al. [23] conceptualized multiple factors. This paper draws on this framework by including a similar benchmark structure with a total of seven factors (Figure 1). They are operationalized by two independent external variables of estate size and region of origin and ten benchmark indicators, which represent the dependent variables (Table 1).

Figure 1.

A framework of economic sustainability benchmarking figures (own illustration, concept broadly based on Loose et al. [23]).

Table 1.

Definition of all performance indicators.

The framework will briefly be described from top left to bottom right. Land, capital and labor represent traditional economic input factors, the latter two are operationalized as total assets per hectare and labor intensity. Jointly, the input factors result in the raw output of wine, measured as the yield in hectoliters per hectare. The wine price represents the market valuation of the wine, measured as the average price derived by dividing overall turnover by production volume. The cost per liter is derived from the total cost and an imputed renumeration of family staff divided by the production volume. Efficiency is operationalized as labor productivity that represents the turnover per worker. Similarly, area productivity relates the turnover to the production factor of land (vineyard area). The final set of benchmarks of profit and returns are most comprehensive by relating revenue and cost per output (profit per liter), revenue and cost (operational result), as well as revenue and cost per equity (returns). These performance indicators of Tier 3 (especially the operational result per ha), can be appointed as the goal variables for long-term economic sustainability, while previous performance indicators within the framework serve as measures to locate issues resulting in a lack of success in Tier 3. The dependent performance indicators are defined in detail in Table 1.

This framework offers a good overview over the economic sustainability of a single wine business. It remains unknown by which factor (size or region) to choose the sample of businesses to preferably benchmark the indicators against. As mentioned in Section 2.1, this is an essential question to answer, to gain the most meaningful results for wine businesses.

2.3. The Influence of Wine Regions in the Wine Sector

The German wine market comprises approx. 100,000 hectares of vineyard area, spanning across 13 wine regions [24].

Generally, two main categories of influence tied to the region of origin can be distinguished (Table 2). The first main category relates to structural differences, caused by climatic, geologic, geographic and technological differences, which mainly affect the production of wine. The second main category relates to the wine market and encompasses differences in regional reputation and the utilization of sales channels.

Table 2.

Regional factors of influence on performance indicators.

2.3.1. Structural Differences between Wine Regions

Wine regions differ strongly in their climatic, geologic and geographic conditions. This holds true globally but also within Germany [45].

Climatic: The south of Germany experiences higher mean temperatures and a higher intensity of sunshine, while the continental east of Germany has less precipitation (Franken) and can suffer from late frost [45]. Said differences in terms of hours of sunshine and precipitation, as well as mean temperature, have an effect on yield and the quality of the wines [25,26,27].

Geological: Regions differ in their type of soil with varying fertility, water retention capacity and thermal properties [46]. For instance, regions with stony, dark soils (such as the slate of the Mosel) are able to absorb and retain heat throughout the day, only to radiate it back into the air around the vines at night [29]. Flat areas (such as Rheinhessen) generally experience less run-off, allowing for more water to be absorbed by the soil. Nonetheless, Mosel steep slopes with loamy-soils are able to compensate due to a higher water retention capacity, as opposed to, e.g., the Middle-Rhine region [45]. Generally, regions with a reduced water retention capacity and high evapotranspiration frequently experience induced water stress, which subsequently leads to reduced yields [28], in turn resulting in an increase in cost per liter.

Geographic: Historically, in the cool-climate country of Germany, viticulture was dependent on steep slopes, which have a significant share in the traditional wine growing regions Mosel, Baden, Wuerttemberg, Ahr and Franken to this day [47]. Because of the limited possibilities of mechanization, steep-slope viticulture has a strong influence on machine and labor costs, with German steep-slope wineries experiencing a 1.6- to 2.6-fold cost increase when compared to wineries with comparatively flat vineyard areas [30]. Additionally, the size and dispersion of single vineyards affects transit times between vineyards and shorter rows increase the relative amount of time required for turning machines, allowing regions with the possibility of consolidating vineyards to work more efficiently [30]. Finally, the price and value of land varies greatly from region to region, which flow into and influence the total asset values of wine estates between regions [48].

Technological: Regional geographic differences result in the main differences in mechanization. Efficient mechanical viticulture in large, vastly flat regions such as Rheinhessen and Pfalz (Palatine) benefit from low working hours and low cost. In this regard, steep slopes suffer from a strong cost disadvantage, due to the required manual labor [35].

2.3.2. Market Differences between Wine Regions

Regional reputation: Differences in reputation are the strongest studied regional effect in wine marketing with a large record of studies [36,41,42]. Said differences in reputation relate to objective differences in quality (climate, etc.), but also to historical reasons, such as the role of monasteries in developing viticulture and the distributional time of access to solvent customers (e.g., Bordeaux historically benefiting from trade access to Britain) [49]. Wineries from regions with a comparably higher reputation are able to utilize this, resulting in a significantly positive impact on pricing [36,37,39,42].

Regional differences in sales and distribution structure: Reputation effects can also carry over into the economic impact of wine tourism, which can vary greatly between regions [43]. While this offers wineries access to a higher share of revenue through direct sales (cellar door, self-marketing through consumer fairs) to tourists, Riscinto-Kozub and Childs [38] found that wineries could also profit from increased interest by local consumers. Especially small, local wineries used to be (and many are to this day) more dependent on cellar door sales in order to generate revenue, due to it frequently being their mainly available channel of distribution [49]. However, due to globalization, the distributive network of costumers and wineries has become less limited to vineries’ own wine region.

The share of revenue generated through intermediaries also varies between German regions [50]. Since intermediaries require margins for re-sale, this can reduce the average revenue per liter for a winery, compare to selling directly to the consumer [34]. Larger, expanding wineries in regions such as Rheinhessen and Pfalz outgrow their geographic vicinity and become reliant on selling higher amounts of wine through intermediaries, forcing them to adapt their pricing structure [3,44]. Wineries in smaller wine regions such as Rheingau, Franken or Saxony can mainly distribute their products locally, leading to higher average revenues per unit [51].

2.3.3. Interactions

Of course, interactions between these main categories and sub-categories can lead to additional profiling effects between regions. E.g., geographic differences affect access to labor (cost) and access to local customers (distribution).

2.3.4. Hypotheses Regarding Region

Taking into account the regional factors of influence, the first conclusions can be drawn in terms of their expected influence on the performance indicators explained in Section 2.2.

Strong regional effects can be expected for benchmark indicators of the first tier of input, price and output that will carry over to some extent to the indicators of the second tier with total costs, efficiency and profitability (H1a–H7a).

H1a.

Total assets per hectare—Differences expected mainly due to varying land prices per hectare of vineyard area between regions [48]. As these varying prices of land flow directly into the balance sheets, they are therefore expected to produce great differences in the total assets of wine estates between regions.

H2a.

Labor intensity—Differences expected because of the structural factor of degree of mechanization that differs between regions. Previous literature suggests a cost increase of up to 2.6-fold for wine estates in steep-sloped vineyard areas, as opposed to wineries in regions with flat vineyard areas due to mechanization [30]. Additionally, the higher share of manual labor required for steep-sloped vineyards in said regions result in a decrease in efficiency through the requirement of more working hours [35].

H3a.

Turnover per liter—Difference expected because regions differ strongly in the marketing factor of reputation and utilization of distributional channels [44,51]. On one hand, larger wine estates from regions with larger wine estate structures have to adjust their pricing due to their dependence on sales through intermediaries, while wine estates of smaller regions are able to generate higher average prices by distributing their products directly to the end consumer [44,51]. On the other hand, the general reputation of the wine region also varies greatly between regions and carries over into differences in price structures between them [36,37,39,40].

H4a.

Yield—Difference expected because of structural differences in climate and geology that affect yield [26,27]. Regional differences in mean temperatures and precipitation at multiple stages of the year strongly affect the quality as well as the quantity of the yield [26,27].

H5a.

Cost per liter—Difference expected because regions differ in the degree of mechanization [30,35]. This ties into the higher amount of costs associated with the increase in manual labor utilized in regions with higher shares in steep-slope viticulture [35]. With increased mechanization in predominately flat vineyard area regions, relative labor costs (which often account for a high share of the total costs) reduce [30].

H6a.

Labor productivity—Differences expected. The differentiating effects of price and mechanization are expected to interact and partially offset. The effect should be smaller than that of price [35,44]. Since regions with high shares of steep-slope viticulture are mostly able to generate higher prices through increased reputation, these prices are expected to (partially) offset the cost disadvantage these regions have, due to reduced possibilities of mechanization [35,44].

H7a.

Area productivity—Differences expected. The differentiating effects of price and yield are expected to interact and partially offset. The effect will be smaller than that of price [26,44]. Since both yield and price are expected to vary greatly between regions due to climatic and geologic conditions, as well as reputational and distributional differences, an interaction of both can be expected [26,27,44,51]. Additionally, these interactions could partially offset due to, e.g., regions with a higher reputation being able to balance out potentially reduced yields with higher prices.

Performance indicators of profit and returns are tightly connected and depend on previous indicators of labor intensity, pricing, yield, cost and efficiency, as well as productivity and their interactions. Some of these effects, such as pricing and costs are expected to offset. For instance, smaller regions with higher costs benefit from higher prices and higher area productivity. Because of these offsetting-effects, it is expected that region has a very low or no effect on these indicators of profit and returns (H8a–H10a).

H8a.

Profit per liter—no regional effect expected.

H9a.

Operational result—no regional effect expected.

H10a.

Return on equity—no regional effect expected.

2.4. Influence of Business Size in the Wine Industry

The other overarching variable analyzed in this study is business size. Existing research suggests two main categories of factors related to size, which can affect business performance: Economies of scale and distributional structures (Table 3). Size can have a positive effect on efficiency and significantly reduce relative costs through economies of scale. Larger wine businesses outgrow their geographical vicinity and more strongly depend on wine sales through intermediaries.

Table 3.

Factors of influence on performance indicators through business size.

2.4.1. Economies of Scale

In business theory, economies of scale (EOS) describes the relationship between the scale of use of a properly chosen combination of all productive services and the rate of output of the enterprise, whereby costs increase less than proportionally with scale because of fixed cost digression effects [52,55]. Due to the advantages of increasing business size, large businesses, to a certain extent, tend to operate more efficiently and profitably than small businesses. The Minimum Efficient plant Size (MES) is the size of a firm at which the average cost curve starts flattening out, leading to the increasing of outputs only resulting in an insignificant reduction in unit costs [54,57].

Economies of scale have been observed to vary substantially between industries. A very comprehensive summary of multiple studies by Pratten [56] found moderate economies of scale in alcoholic beverage industries such as breweries, while for industries such as the electrical engineering, printing or the chemical industry, substantial economies of scale were observed. However, other authors suggest that economies of scale are just as achievable in agriculture as they are in other industry sectors [62].

There is ample of evidence for size effects in the wine industry [58,59,60]. Sellers and Alampi-Sottini [13] confirmed a positive correlation of performance indicators with business size, providing the opportunity for companies to achieve higher efficiency and increased returns to scale by increasing size [13].

Similarly, while analyzing the technical efficiency of Hungarian wineries, Fertő and Bojnec [61] confirmed an rise in the efficiency of Hungarian wine farms with increasing size [61].

Perretti [58] analyzed financial data of wineries in the Vulture district of Southern Italy. The minimum farm size to ensure positive financial results with traditional, labor-intensive technology was estimated at 12 ha, far larger than the average size within the district. As a result, the large majority of wine farms were producing at negative returns on investment, with the main cause being high labor costs and a highly fragmented farm structure.

Technological innovations as well as structural consolidation into larger farm sizes were assessed as factors which could improve the economic sustainability of the region by allowing the exploitation of economies of scale [58]. This can lead to cost advantages. For example, Tudisca et al. [60] suggest that the minimum optimal farm size for owning a grape harvester as a wine grape producer lies at around 41 ha; however, smaller grape producers can already benefit from renting grape harvesters.

According to Galindro et al. [31], productivity results varied across regions in three Duoro sub-regions across seven years (2010–2016). In two regions, wineries seemed to benefit from larger farm sizes in terms of overall marginal land productivity, while in the third region more medium-sized farms were preferable [31].

Analyzing French wineries Delord et al. [40] also confirmed the relative increase in profitability by increasing size, although the absolute profitability levels reached by large wineries were only minor—so much so that even large wineries were unable to reach an average revenue per unit that was sufficient in reimbursing the labor force with the national legal minimum wage. The main differences in profitability between wineries were related to their selling price of wine, which is tightly connected to their location and corresponding French designation of origin [40].

Using a new statistical approach of random forest models, Wetzler et al. [63] analyzed drivers and indicators of economic success in wineries. They concluded that business size provided a crucial factor for success, which was in line with findings by Di Montezemolo [64]. Crucially however, this positive effect of increasing scale seemed to occur more strongly in stages, rather than with a gradual increase in vineyard size [63].

Various studies confirmed positive effects of business size but also identified a number of moderating factors that affect business success besides size alone. According to [32], the performance of large Italian companies overall was positive, while the profitability of smaller grape farms was more varied and also influenced by other factors such a geographical location and fluctuating conditions of intermediate markets (grapes and bulk wine). Köhr et al. [65] suggested that internationalization and export opportunities provide a feasible strategy to drive business success regardless of the winery size. An analysis of production efficiency of vineyards in 14 Northern U.S. states by Choi et al. [66] was also able to find a positive correlation between farm size and vineyard productivity. However, other unobservable factors such as farmers’ experience and capability seemed to more strongly define production efficiency, rather than farm size [66].

2.4.2. The Role of Intermediaries

Wine estates of different size usually differ in their sales structure [32]. Smaller wine estates are better able to sell their production volume directly to consumers, e.g., through cellar doors. Growing wineries cannot solely rely on direct consumer sales, forcing them to adapt their pricing structure in order to be able to successfully serve intermediaries [34]. A large study of over 1000 German wine estates by Loose and Pabst [34] indicated a lower revenue per liter for large wine estates related to the margin required for intermediaries.

2.4.3. Hypothesis Regarding Size

A strong size effect can be expected for benchmark indicators of the first tier of input, price and output that will carry over to some extent to the indicators of the second tier with total costs, efficiency and profitability (H1b–H7b).

H1b.

Total assets per hectare—Differences expected due to the varying viability of purchasing, e.g., large machinery between size groups [13,60]. Since the purchasing of said large machinery by larger wine estates directly flows into the total assets, larger size groups are expected to have higher relative total assets as opposed to smaller size groups [60].

H2b.

Labor intensity—Because of economies of scale through mechanization, a negative relationship with size is expected. Previous literature has observed efficiency gains through larger wine businesses, which is in line with the finding of the increased viability of purchasing machinery for larger wine estates [60]. Therefore, through the relative reduction in required manual labor per area, labor intensity is expected to be lower in larger size groups [35,59,61].

H3b.

Turnover per liter—Because of the increasing utilization of intermediaries with growing size, a negative relationship is expected. Larger wine businesses are expected to have a lower turnover per liter due to their reliance on intermediaries and therefore having to compromise their prices [3].

H4b.

Yield—No differences are expected regarding size.

H5b.

Cost per liter—Because of economies of scale through mechanization, we expect a negative relationship with size. Larger wine businesses are expected to have a lower cost per liter through the scale efficiency gains observed in previous literature and the cost disadvantage of smaller wine estates [3,30,53].

H6b.

Labor productivity—Depends on price, yield and degree of manual labor that partially offset. While price decreases with size the amount of manual labor decreases because of efficiency and mechanization. It is expected that efficiency gains outweigh the negative effect of price. A positive relationship is expected. Larger wine businesses are expected to have higher labor productivity [3,53].

H7b.

Area productivity—Depends on price and yield. Because yield is expected to be independent of size, area productivity is expected to decrease with size because of the negative relationship with price [3]. As a result, larger wine businesses are expected to have a lower area productivity [3,32].

As for region, performance indicators of profit and returns are tightly connected and depend on previous indicators and their interactions. Because overall costs (labor productivity) are expected to decrease (increase) with size, we expect the efficiency gains to outweigh the negative effect of area productivity [13]. Therefore, it is expected that size has a positive relationship with the indicators of profit and returns (H8b–H10b).

H8b.

Profit per liter—Positive relationship with size [13,59].

H9b.

Operational result—Positive relationship with size [13,59].

H10b.

Return on equity—Positive relationship with size [13,59].

3. Data and Methodology

This study only focusses on wine estates marketing bottled wines. To qualify for this category, a wine estate had to generate at least 80% of its revenue from selling bottled wine. It is important to discriminate between wine estates selling bottled wine and wine estates only producing grapes or bulk wine, due to the fundamental differences in their cost and revenue structure. Wine estates selling bottled wine represent approximately 27% of the German total production volume [3].

Previous studies on wine business data vary in terms of years analyzed. While studies by Sellers and Alampi-Sottini [13] and Sellers-Rubio [17] focused on winery business data of a single year, respectively, Sellers-Rubio et al. [59] were able to use public data spanning nine years (2005–2013) of 622 Spanish and 609 Italian wineries. Galindro et al. [31] compared public productivity data of different size groups between 3 Duoro sub-regions across three years. The data provided by the Hochschule Geisenheim University business analysis for this study are unique. Participating wine estates provide detailed, confidential balance sheet data, not available in public sources. A trade-off, which the voluntary participation of said wine estates entails, is the difficulty of obtaining sufficient samples sizes of complete data per year. To ensure data integrity, only wine estates providing sufficient data per agricultural year were included in the data set. Furthermore, a conservative approach in selecting retroactive years was carried out, to allow for a stationary observation and to minimize long-term structural change influences. Averages for 10 key attributes and performance indicators to be benchmarked were calculated across six agricultural years from 2013/2014 to 2018/2019. The data set comprises business data of 319 German wineries, spanning across eight regions and divided into four size categories. The two explanatory variables for all performance indicators are the region and size group a wine estate is attributed to.

As put forward in Section 2, there are many factors which cause differences between wine estates of different regions and size groups. However, this analysis only measures the effect the region or size group has on wine estate business data. A table of the quantile values of all performance indicators can be found in Table 4 The size categories were defined as equal to those of Wetzler et al. [63], resulting in the consequent data structure (Table 5).

Table 4.

Summary of the quantile values for all performance indicators.

Table 5.

Sample description: Number of wineries per region and size category (n = 319).

As previously established in Section 2.3, there are major structural differences between the regions, which are also reflected in the data set. While the Mosel region has by far the largest number of wineries belonging to the first size category (<5 ha), Pfalz and Rheinhessen contain predominantly large winery structures, with the majority belonging to the third (10–20 ha) and fourth (>20 ha) size categories. A Pearson’s chi-squared test confirmed no independence between size and region (p < 0.001).

In order to estimate the effects, a two-factor ANOVA in Statistical Product and Service Solutions (SPSS) was conducted, also taking into account the interaction effects between region and size. Depending on the hypothesis, the corresponding indicator was selected as the dependent variable with the size category and the region being chosen as the two fixed factors, as well as their interaction effect.

Hypotheses were tested according to F-statistics, and significance values were provided along with Tukey-b post-hoc tests. The partial eta-squared was computed, allowing the analysis of which of the two fixed factors explains more variance, followed by post-hoc tests, when applicable.

4. Results

4.1. Tier 1—Total Assets per Hectare, Labor Intensity, Turnover per Liter and Yield

For the first tier of four performance indicators Table 6 displays the results for the significance levels of the F-Test and the partial eta-squared values. The total assets per hectare showed a higher amount of 8.1% variance explained by region and only 1.7% by size group, with wineries belonging to regions such as Württemberg and Mosel having significantly higher total assets per hectare compared to wineries from Nahe (Table 7).

Table 6.

Tier 1: Partial eta-squared values of total assets per hectare, labor intensity, turnover per liter and yield.

Table 7.

Post-hoc results for Tier 1 performance indicators: total assets per hectare, labor intensity, turnover per liter and yield.

The variance of labor intensity explained by size (26.7%) almost tripled the variance explained by region (9.3%), with highly significant differences between regions and size groups (Table 6). The variance of labor intensity explained by size is by far the highest variance accounted for by any of the two factors throughout all tiers. Wine estates smaller than 5 ha showed a 2.25-times-higher labor intensity compared to the group of 20 ha or more. The Mosel regions’ average labor intensity was significantly higher than all wine regions, while Rheinhessen, Nahe and Pfalz recorded a significantly lower labor intensity, compared to almost all other regions (Table 7). Wine estates from the Mosel region showed a 1.75-times-higher labor intensity than Rheinhessen.

The variance of the yield was considerably more related to the region of origin (20.2%), with the statistically non-significant size group only explaining 2.2% of the variance. Here, Pfalz and Rheinhessen were at the forefront, generating significantly higher average yields (79 hL/ha and 80 hL/ha) than Franken, Nahe, Rheingau or the Baden region (around 60 hL/ha). Turnover per liter was also influenced by the region to a larger degree than the size group (12.5% vs. 0.8%). Highly significant differences were observed between regions, with the Rheingau and Baden being able to achieve significantly higher average prices (EUR 6.92/L and EUR 6.12/L) as opposed to the regions Pfalz and Rheinhessen (EUR 4.40/L and EUR 3.95/L) (Table 7).

4.2. Tier 2—Cost per Liter, Labor Productivity and Area Productivity

All three indicators of Tier 2 were significantly affected by both factors: region and size. Cost per liter showed a great amount of variance explained by region with 22.3% (Table 8). Only 5.2% of variance was explained by the size group.

Table 8.

Partial eta-squared results for Tier 2: cost per liter, labor productivity and area productivity.

Wineries of the two largest size groups (10–20 ha and >20 ha) had significantly lower costs per liter (EUR 4.82 and EUR 4.95/L), with the smallest wineries (up to 5 ha) facing the significantly highest costs of EUR 7.28 per liter (Table 9). This provides first implications for MES and the existence of economies of scale. The differences between regions were highly significant. Rheinhessen was able to keep costs the lowest, with only EUR 3.86/L. The Rheingaus cost per liter was more than twice as high (EUR 7.73/L), making it the significantly highest cost per liter of all regions, followed by Baden and Mosel with EUR 6.55/L and EUR 6.35/L, respectively.

Table 9.

Post-hoc results for Tier 2: cost per liter, labor productivity and area productivity.

For labor productivity, size explained a higher amount of variance compared to region with 8.7% vs. 4.9%. Both factors showed significant differences between groups; however, the minor significant differences between regions could not be distinguished in the post-hoc test. Differences between size groups were highly significant (Table 8).

The average labor productivity for the two smallest size groups was significantly lower than both larger size groups, with the largest size group being able to generate the significantly highest labor productivity (EUR 100,139/worker) by far, almost doubling the average labor productivity of the smallest size group (EUR 52,085/worker).

In total, 9.4% of area productivity variance was explained by the region, while the size group had a minor influence in comparison (3.5%). Mosel was able to achieve the highest area productivity with EUR 39,291 per hectare, significantly above regions such as Nahe and Rheinhessen (EUR 27,183 and EUR 27,965 per hectare, respectively).

4.3. Tier 3—Results for Profit per Liter, Operational Result and Return on Equity

All of the Tier 3 indicators were significantly affected solely by size. Region did not have any significant effect. In total, 11.6% of variance of profit per liter was related to the size group, with a clear and highly significant result favoring wineries belonging to the highest two size groups (Table 10 and Table 11). On average, wineries below 10 ha in size were unable to generate a profit per liter at all. Correspondingly, the variance related to the operational result was influenced similarly strongly by the size group explaining 11.9% of variance. The highly significant differences between size groups showed wineries below 5 hectares in size were, on average, operating at a loss.

Table 10.

Partial eta-squared results for Tier 3: profit per liter, operational result and return on equity.

Table 11.

Post-hoc results for Tier 3: profit per liter, operational result and ROE.

With regards to return on equity, 9.1% of variance was explained by the size group. Larger size groups of above 10 hectares provided significantly higher returns on equity than wineries below 10 hectares, which remained negative on average.

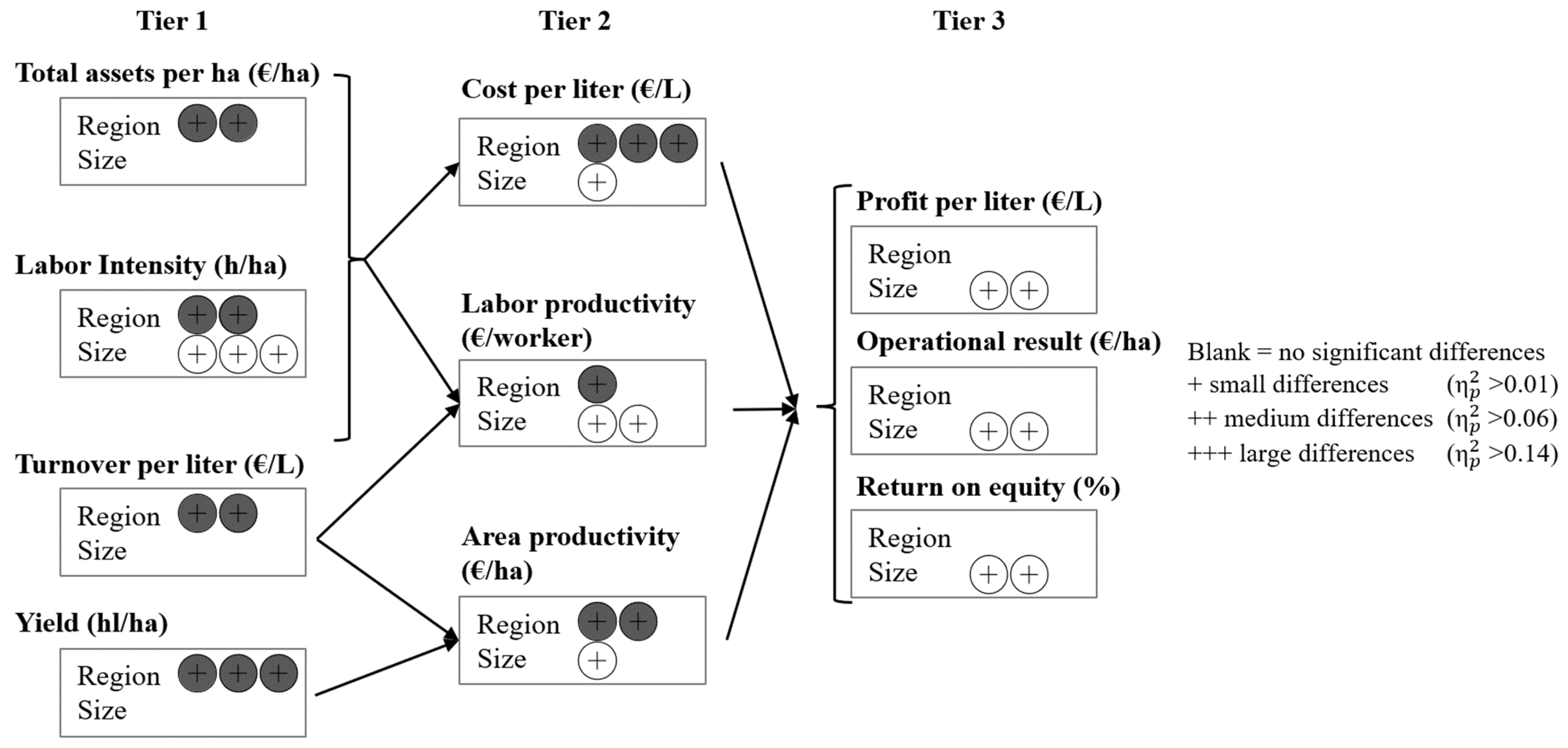

An overview of the results for all hypotheses previously established in detail is summarized in Table 12 and Figure 2 for further discussion in the subsequent Section 5.

Table 12.

Summary of hypothesis tests and effect sizes.

Figure 2.

Summary of effect sizes per key performance indicator (circles in grey indicate a significant difference in variance for the factor region, circles in white indicate a significant difference in variance for the size groups).

5. Discussion

The objective of this paper was to assess whether the region or size group of a wine estate is the more suitable benchmarking factor for performance indicators of economic sustainability. To answer this question, business data of 319 German wine estates were analyzed across the span of 6 years, to account for annual effects of yield fluctuations. Analyzing the variance of a total of ten performance indicators resulted in seven significant effects for region, as well as seven significant effects for size. Conclusively, both region and size are related to variance in performance indicators of German, self-marketing wine estates.

5.1. Tier 1—Region Is the Main Driver of Primary Indicators

The ten indicators are divided into three tiers, wherein the first tier assesses the primary indicators of total assets per hectare, labor intensity, price (as turnover per liter) and yield (Figure 2 and Table 12). Here, with the exception of labor intensity, differences between wine businesses regarding these indicators were more strongly related to region than to size. While the region had a medium effect size for the first three indicators, the effect size for yield was large. Size, on the other hand, was only significantly related to differences in labor intensity, nonetheless with a large effect size. Regional and size effects on labor intensity were equally significant.

In line with Strub and Loose [30], the steep slopes of the Mosel region and the accompanied increase in manual labor and reduced mechanization led to the significantly highest labor intensity as opposed to flat-terrain vineyards such as Pfalz, Nahe and Rheinhessen. Nonetheless, increasing size generally coincided with a significant reduction in labor intensity, as expected by the increased feasibility of technological advancements and reduction in manual labor [58,60].

As anticipated for H3a, a strong regional influence was observable on the turnover per liter. On one hand, this further confirms the importance of high wine region reputation in generating price premiums, as Baden and Rheingau were able to generate the significantly highest pricing [36,37,38,39,40].

On the other hand, the positive distributional effect of self-marketing wine as opposed to using intermediaries is also implied, since said regions with the highest turnover per liter are also the regions with the highest amount/share of self-marketing wineries, while the pricing of Pfalz and Rheinhessen were among the lowest [34,44,51].

H4a and H4b were confirmed with yield being highly significantly influenced by region, suggesting a strong influence of geographic, geologic and climatic factors. Pfalz and Rheinhessen were able to accomplish the highest yields, which may correspond to the lack of negative climatic and geologic yield conditions usually accompanied by steep-slope regions [25,26,28]. Nonetheless, counterintuitively, Mosel, with the highest amount of steep-slope vineyards, had the third highest average yield of all regions [34]. Here, other factors such as the better retention of water in the deep soils and management systems seem to be counterbalancing the adverse effects of steep slopes.

5.2. Tier 2—Both Region and Size Affect Secondary Indicators

In the second tier, the performance indicators of cost, efficiency and productivity are derived from combinations of the first-tier indicators. Effects of region or size in Tier 1 indicators can hence be exaggerated or offset in Tier 2. In this case, the region was significantly related to variance differences between wine businesses for all three indicators: small for labor productivity, medium for area productivity and large for cost. Size had a small effect on cost and area productivity and a medium effect on labor productivity.

The influence of the region on the cost per liter surpassed the size influence by a factor of four (22.3% vs. 5.3% of variance explained), confirming H5a and H5b. The differences within regions are partly in line with findings by Strub and Loose [30] with the steep-slope Mosel region belonging to the group of the second highest cost per liter and flat terrain regions such as Rheinhessen, Pfalz and Nahe having to deal with significantly lower costs per liter. Additionally, this may reflect the positive influence of mechanization possible for flat-terrain regions vs. steep-slope regions, and yet Rheingau and Baden are the regions with the highest cost per liter. As suggested in Table 2, there are a range of other regional factors besides steep slopes, such as geographical differences in cost and access to labor, as well as relative plot-size affecting efficiency. For example, the Rheingau faces the highest competition for scarce labor due to being situated near the metropolitan area of Frankfurt. Baden and Württemberg are disadvantaged by smaller and less efficiently located plots of vineyards resulting in more hours of labor required.

The cost per liter dropped consistently when the size group increased, displaying efficiency gains expected through the increased viability of cost-saving technological advancements for wineries of larger size groups [13,58,60,61]. This effect seems to be limited, however, as the differences in cost per liter between wineries of 10–20 ha and 20 ha+ were not significant, compared to the significant difference of smaller size groups of 5–10 ha and below 5 ha. This implies the MES for German wine estates lying somewhere above 10 ha [57]. This could also be related to differences in wine estate management of different sizes. While estates with a size of 20 hectares can still be managed efficiently as a family business, larger estates often require middle management, resulting in additional costs.

Labor productivity showed significant differences between size groups and regions (8.7% and 4.9% of variance explained). The revenue generated per worker is influenced by strong regional effects on both pricing and labor intensity, which partially offset themselves. Regions with a low labor intensity (such as Rheinhessen and Pfalz), as well as regions able to generate a high turnover per liter (such as the Rheingau), are also leading in labor productivity. Hereby, both H6a and H6b were confirmed, with size having a highly significant positive effect.

Area productivity on the other hand only showed a slightly significant influence of size, while the regional influence was highly significant. This is strongly connected to pricing, with the effect of higher reputation and turnover per liter carrying over to the same regions being able to generate the highest turnover per hectare. The effects of higher yields have a lower effect, with high-yield regions such as Pfalz and Rheinhessen not being able to convert these yields into a significantly higher area productivity. This is also related to the magnitude of absolute differences. Regions with the highest average yields only differ by a factor of 1.3 compared to the regions with the lowest yields, while the differences in turnover per liter differ by a factor of 1.75. Further increasing yields can be a strategic option to increase general productivity, as well as increasing price [2].

While the factor region dominated indicators of Tier 1, region and size both play an important role for all indicators of Tier 2. The strong effect size for labor intensity in Tier 1 carried over to all indicators of Tier 2.

5.3. Tier 3—Only Size Affects Tertiary Indicators of Economic Sustainability

The third tier is comprised of the most aggregated indicators of profit per liter, operational result and return on equity, which represent the overall economic performance of wine businesses and its economic sustainability. As in Tier 2, the effects of prior tiers can offset or exaggerate each other. Here, size dominates in terms of its effect on Tier 3, showing highly significant medium effect sizes for all indicators, confirming H8–H10. Region, however, does not have a significant effect.

The highly significant differences between size groups also supported a MES of approximately 10 ha for German wineries, with smaller wineries operating at a loss, or only barely being able to cover costs, on average. The strong regional influences observed in terms of pricing seem to be cancelled out by the high regional effects on cost, since regions with higher pricing were not able to generate higher average returns.

The results seem to indicate that wine estates in regions with disadvantageous effects on cost structure are only economically sustainable if they manage to generate higher prices. The four regions with the highest costs per liter are simultaneously the ones with the highest turnover per liter. Both effects offset themselves and the regional differences in the first two tiers cancel each other out. In the end, size is the main driver of economic sustainability. On average, wine estates below 10 hectares in size require too many working hours per output to be economically sustainable, revealing that 10 hectares is the MES for German wineries.

The efficiency gains through size increase mentioned by Silberston [52] seem to trump regional business factors, with a strong implication of a MES for German wineries and the existence of EOS in agriculture and more specifically, the wine industry [57,62]. These findings are in line with Perretti [58] and Tudisca et al. [60], making size increase (to at least the MES) a positive factor for increasing efficiency, the viability of technological advancements and profitability of a winery.

6. Conclusions

When comparing the effects of size and region on German wine business data, multiple key-takeaways are revealed. The effects of efficiency gains yielded by reducing labor hours through size growth seem to be a key driver carrying over to subsequent performance indicator-tiers to prevent operating at a loss and becoming more economically sustainable. While the factor region dominated in terms of influence on indicators of general business data concerning land, labor and capital, region and size both play an important role for all indicators of efficiency and productivity. The strong effect size for labor intensity in Tier 1 carried over to all indicators of Tier 2. Finally, moving forward to the final tier of aggregated performance indicators (profit per liter, operational result and return on equity), size is the main driver of economic sustainability. On average, wine estates below 10 hectares in size require too many working hours per output to be economically sustainable, revealing that 10 hectares is the approximate MES for German wineries.

Nonetheless, since benchmarking effectively depends highly on identifying the correct companies to benchmark against, size groups are not consistently the most effective cohort to choose as a group of comparison for German wineries [15]. Although size effects are more strongly related to overall business performance indicators (Tier 3), in order to truly understand and gain more meaningful best practice values for the indicators of Tiers 1 and 2, which build the foundation for Tier 3, regional benchmarking has also been shown to be essential.

The findings of this study provide implications for future research on the economic sustainability of small- and medium-sized businesses in the wine sector and for other agricultural crops. To understand differences in underlying drivers, both the region of origin and size should be taken into account. The results of this analysis served as a foundation for the development of a digital benchmarking tool for economic sustainability [69], which utilizes both region and size groups as benchmarking factors for performance indicators.

7. Limitations

The findings of this study are limited to the German wine sector and could be further validated by business data in other countries. The sample chosen is limited to how many wineries voluntarily choose to participate (and continue participating) in the Geisenheim business analysis every year. In the future, panel regression could be used to extend the sample size and to correct for panel effects. The German wine market is relatively small and fragmented, while other countries, e.g., in the new world, are structured differently, which should be looked at in future research. Additionally, other important factors could influence benchmarks, although not all of these are observable or measurable (e.g., personality traits, etc.). Finally, operationalizing a multitude of external factors such as climatic, geologic or geographic factors and including them in future frameworks of economic sustainability could expand upon and deepen the understanding of their concrete influences on benchmarking factors.

Author Contributions

Conceptualization, S.M.L.; methodology, A.W.B.; software, A.W.B.; validation, A.W.B.; formal analysis, A.W.B.; investigation, A.W.B.; resources, S.M.L.; data curation, A.W.B.; writing—original draft preparation, A.W.B.; writing—review and editing, S.M.L.; visualization, A.W.B.; supervision, S.M.L.; project administration, S.M.L.; funding acquisition, S.M.L. All authors have read and agreed to the published version of the manuscript.

Funding

The project “Profitability and ecological sustainability of wineries: Analysis and digital knowledge transfer”, which this study arose from, is funded by the European research fund for regional development (EFRE). The European Regional Development Fund provides funding to public and private bodies in all EU regions to reduce economic, social and territorial disparities. The Fund supports investments through dedicated national or regional programs. EFRE project grant funding number: 20006442.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Due to the highly sensitive nature of the winery business data provided and used for this study, it is impossible to be made publicly available. All participating wineries require total data protection.

Acknowledgments

We would like to thank our colleague Larissa Strub for her advice.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Loose, S.M. ProWein Business Report 2021 “Sustainability”; Geisenheim University: Geisenheim, Germany, 2022. [Google Scholar] [CrossRef]

- Del Rey, R.; Loose, S. State of the International Wine Markets in 2022: New market trends for wines require new strategies. WEP 2023, 12, 3–18. [Google Scholar] [CrossRef]

- Loose, S.M.; Pabst, E. Current State of the German and International Wine Markets. Ger. J. Agric. Econ. GJAE 2018, 67, 92–101. [Google Scholar]

- SWA. Sustainable Winegrowing Australia. Let’s Make a World of Difference in Wine. Available online: https://sustainablewinegrowing.com.au/ (accessed on 21 September 2023).

- SWNZ. Sustainable Winegrowing New Zealand. Available online: https://www.nzwine.com/en/sustainability/swnz (accessed on 21 September 2023).

- Nachhaltig Austria. Nachhaltig—Weingenuss Mit Verantwortung. Available online: https://www.nachhaltigaustria.at/ (accessed on 21 September 2023).

- CSWA. California Sustainable Winegrowing Alliance. Available online: https://www.sustainablewinegrowing.org/ (accessed on 21 September 2023).

- Corkindale, D.R.; Welsh, A.J. Measuring Success and Marketing in Small Wineries in Australia. Int. J. Wine Mark. 2003, 15, 4–24. [Google Scholar] [CrossRef]

- Chinnici, G.; Pecorino, B.; Rizzo, M.; Rapisarda, P. Evaluation of the Performances of Wine Producers in Sicily. Qual. Access Success 2013, 14, 108–113. [Google Scholar]

- Garcia, F.A.; Marchetta, M.G.; Camargo, M.; Morel, L.; Forradellas, R.Q. A framework for measuring logistics performance in the wine industry. Int. J. Prod. Econ. 2012, 135, 284–298. [Google Scholar] [CrossRef]

- Tomljenović, R.; Getz, D. Life-Cycle Stages in Wine Tourism Development: A Comparison of Wine Regions in Croatia. Tour. Rev. Int. 2009, 13, 31–49. [Google Scholar] [CrossRef]

- Vrontis, D.; Thrassou, A.; Rossi, M. Italian wine firms: Strategic branding and financial performance. Int. J. Organ. Anal. 2011, 19, 288–304. [Google Scholar] [CrossRef]

- Sellers, R.; Alampi-Sottini, V. The influence of size on winery performance: Evidence from Italy. Wine Econ. Policy 2016, 5, 33–41. [Google Scholar] [CrossRef]

- Carpinetti, L.C.R.; de Melo, A.M. What to benchmark? Benchmarking 2002, 9, 244–255. [Google Scholar] [CrossRef]

- Camp, R.C. Benchmarking: The Search for Industry Best Practices That Lead to Superior Performance; Productivity Press: Batavia, IL, USA, 2007; ISBN 9781563273520. [Google Scholar]

- Bogetoft Pedersen, P. Performance Benchmarking: Measuring and Managing Performance; Springer: Boston, MA, USA, 2012; ISBN 9781461460435. [Google Scholar]

- Sellers-Rubio, R. Evaluating the economic performance of Spanish wineries. Int. J. Wine Bus. Res. 2010, 22, 73–84. [Google Scholar] [CrossRef]

- Ferrer, J.R.; García-Cortijo, M.C.; Pinilla, V.; Castillo-Valero, J.S. The business model and sustainability in the Spanish wine sector. J. Clean. Prod. 2022, 330, 129810. [Google Scholar] [CrossRef]

- Sartori, S.; Campos, L.M.S. Analysis of Corporate Sustainability Assessment Tools and Operations Management; Production and Operations Management Society: Austin, TX, USA, 2016. [Google Scholar]

- Hristov, I.; Chirico, A. The Role of Sustainability Key Performance Indicators (KPIs) in Implementing Sustainable Strategies. Sustainability 2019, 11, 5742. [Google Scholar] [CrossRef]

- Montalvo-Falcón, J.V.; Sánchez-García, E.; Marco-Lajara, B.; Martínez-Falcó, J. Sustainability Research in the Wine Industry: A Bibliometric Approach. Agronomy 2023, 13, 871. [Google Scholar] [CrossRef]

- Wagner, M.; Stanbury, P.; Dietrich, T.; Döring, J.; Ewert, J.; Foerster, C.; Freund, M.; Friedel, M.; Kammann, C.; Koch, M.; et al. Developing a Sustainability Vision for the Global Wine Industry. Sustainability 2023, 15, 10487. [Google Scholar] [CrossRef]

- Loose, S.M.; Strub, L.; Kurth, A. Economic sustainability of wine estates: First insights and a roadmap for future research. In Proceedings of the 12th International Conference of the Academy of Wine Business Research, Virtual, 6–8 July 2021. [Google Scholar]

- DESTATIS. Wine. Available online: https://www.destatis.de/DE/Themen/Branchen-Unternehmen/Landwirtschaft-Forstwirtschaft-Fischerei/Wein/_inhalt.html (accessed on 6 October 2021).

- Makra, L.; Vitányi, B.; Gál, A.; Mika, J.; Matyasovszky, I.; Hirsch, T. Wine Quantity and Quality Variations in Relation to Climatic Factors in the Tokaj (Hungary) Winegrowing Region. Am. J. Enol. Vitic. 2009, 60, 312–321. [Google Scholar] [CrossRef]

- Agosta, E.; Canziani, P.; Cavagnaro, M. Regional Climate Variability Impacts on the Annual Grape Yield in Mendoza, Argentina. J. Appl. Meteorol. Climatol. 2012, 51, 993–1009. [Google Scholar] [CrossRef]

- Niklas, B. Impact of Annual Weather Fluctuations on Wine Production in Germany. J. Wine Econ. 2017, 12, 436–445. [Google Scholar] [CrossRef]

- Hofmann, M.; Schultz, H.R. Modeling the water balance of sloped vineyards under various climate change scenarios. BIO Web Conf. 2015, 5, 1026. [Google Scholar] [CrossRef]

- Huggett, J.M. Geology and wine: A review. Proc. Geol. Assoc. 2006, 117, 239–247. [Google Scholar] [CrossRef]

- Strub, L.; Loose, S.M. The cost disadvantage of steep slope viticulture and strategies for its preservation. OENO One 2021, 55, 49–68. [Google Scholar] [CrossRef]

- Galindro, A.; Santos, M.; Santos, C.; Marta-Costa, A.; Matias, J.; Cerveira, A. Wine productivity per farm size: A maximum entropy application. Wine Econ. Policy 2018, 7, 77–84. [Google Scholar] [CrossRef]

- Pomarici, E.; Corsi, A.; Mazzarino, S.; Sardone, R. The Italian Wine Sector: Evolution, Structure, Competitiveness and Future Challenges of an Enduring Leader. Ital. Econ. J. 2021, 7, 259–295. [Google Scholar] [CrossRef]

- McCorkle, D.A.; Dudensing, R.M.; Hanselka, D.D.; Hellman, E.W. The long-term viability of US wine grape vineyards: Assessing vineyard labour costs for future technology development. IJESB 2019, 36, 308. [Google Scholar] [CrossRef]

- Loose, S.M.; Pabst, E. Sales Channels: Which Sales Channels do German Self-Marketing Wineries Choose Depending on Their Size and Region of Origin; Der Deutsche Weinbau: Neustadt, Germany, 2018. [Google Scholar]

- Strub, L.; Kurth, A.; Loose, S.M. Effects of Viticultural Mechanization on Working Time Requirements and Production Costs. Am. J. Enol. Vitic. 2021, 72, 46–55. [Google Scholar] [CrossRef]

- Ling, B.-H.; Lockshin, L. Components of Wine Prices for Australian Wine: How Winery Reputation, Wine Quality, Region, Vintage, and Winery Size Contribute to the Price of Varietal Wines. Australas. Mark. J. 2003, 11, 19–32. [Google Scholar] [CrossRef]

- Bicknell, K.B.; MacDonald, I.A. Regional reputation and expert opinion in the domestic market for New Zealand wine. J. Wine Res. 2012, 23, 172–184. [Google Scholar] [CrossRef]

- Riscinto-Kozub, K.; Childs, N. Conversion of local winery awareness. Int. J. Wine Bus. Res. 2012, 24, 287–301. [Google Scholar] [CrossRef]

- Landon, S.; Smith, C.E. The Use of Quality and Reputation Indicators by Consumers: The Case of Bordeaux Wine. J. Consum. Policy 1997, 20, 289–323. [Google Scholar] [CrossRef]

- Delord, B.; Montaigne, É.; Coelho, A. Vine planting rights, farm size and economic performance: Do economies of scale matter in the French viticulture sector? Wine Econ. Policy 2015, 4, 22–34. [Google Scholar] [CrossRef]

- Easingwood, C.; Lockshin, L.; Spawton, A. The Drivers of Wine Regionality. J. Wine Res. 2011, 22, 19–33. [Google Scholar] [CrossRef]

- Oczkowski, E. A Hedonic price function for australian premium table wine*. Aust. J. Agric. Econ. 1994, 38, 93–110. [Google Scholar] [CrossRef]

- Tafel, M.; Szolnoki, G. Estimating the economic impact of tourism in German wine regions. Int. J. Tourism. Res. 2020, 22, 788–799. [Google Scholar] [CrossRef]

- Loose, S.M.; Pabst, E. Who Generates What Price? Pricing of Self-Marketing Wineries through Various Sales Channels; Der Deutsche Weinbau: Neustadt, Germany, 2019. [Google Scholar]

- Hoppmann, D.; Schaller, K.; Stoll, M. Terroir: Wetter, Klima und Boden im Weinbau, 2, Aktualisierte Auflage; Ulmer: Stuttgart, Germany, 2017; ISBN 3800103508. [Google Scholar]

- Maltman, A. The Role of Vineyard Geology in Wine Typicity. J. Wine Res. 2008, 19, 1–17. [Google Scholar] [CrossRef]

- Strub, L.; Loose, S.M. Steep-Slope Viticulture—An Inventory of Steep Slope Vineyards in Germany; Der Deutsche Weinbau: Neustadt, Germany, 2016; pp. 14–18. [Google Scholar]

- BORIS-D—Bodenrichtwertinformationssystem für Deutschland. Available online: https://www.bodenrichtwerte-boris.de/boris-d/?lang=de (accessed on 25 September 2023).

- Unwin, T. Wine and the Vine: An Historical Geography of Viticulture and the Wine Trade; Taylor and Francis: Hoboken, NJ, USA, 2005; ISBN 9780203013267. [Google Scholar]

- Lockshin, L.; Spawton, T. Using Involvement and Brand Equity to Develop a Wine Tourism Strategy. Int. J. Wine Mark. 2001, 13, 72–81. [Google Scholar] [CrossRef]

- Loose, S.M.; Pabst, E. Structural Differences among Self-Marketing Wineries in Germany; Der Deutsche Weinbau: Neustadt, Germany, 2018. [Google Scholar]

- Silberston, A. Economies of Scale in Theory and Practice. Econ. J. 1972, 82, 369. [Google Scholar] [CrossRef]

- Arcas, N.; García, D.; Guzmán, I. Effect of Size on Performance of Spanish Agricultural Cooperatives. Outlook Agric. 2011, 40, 201–206. [Google Scholar] [CrossRef]

- Duffy, M. Economies of Size in Production Agriculture. J. Hunger Environ. Nutr. 2009, 4, 375–392. [Google Scholar] [CrossRef]

- Stigler, G.J. The Economies of Scale. J. Law Econ. 1958, 1, 54–71. [Google Scholar] [CrossRef]

- Pratten, C. A Survey of the economies of scale. In Economic Papers of the Commission of the European Communities; EU Commission: Brussels, Belgium, 1988. [Google Scholar]

- Junius, K. Economies of Scale: A Survey of the Empirical Literature; Kiel Institute of World Economics (IfW): Kiel, Germany, 1997. [Google Scholar]

- Perretti, B. Economic sustainability of quality wine districts in the South of Italy. The case of Vulture. IJGSB 2020, 11, 356. [Google Scholar] [CrossRef]

- Sellers-Rubio, R.; Alampi Sottini, V.; Menghini, S. Productivity growth in the winery sector: Evidence from Italy and Spain. Int. J. Wine Bus. Res. Int. J. Wine Bus. Res. 2016, 28, 59–75. [Google Scholar] [CrossRef]

- Tudisca, S.; Di Trapani, A.M.; Sgroi, F.; Testa, R. The Cost Advantage of Sicilian Wine Farms. Am. J. Appl. Sci. 2013, 10, 1529–1536. [Google Scholar] [CrossRef]

- Fertő, I.; Bojnec, Š. The common agricultural policy subsidies and the technical efficiency of Hungarian wine farms. Int. J. Wine Bus. Res. 2023, 35, 413–426. [Google Scholar] [CrossRef]

- Nooteboom, B. Service value chains and effects of scale. Serv. Bus 2007, 1, 119–139. [Google Scholar] [CrossRef]

- Wetzler, A.; Bennett, A.; Loose, S.M. The Relative Importance of Benchmarks on the Economic Success of Wine Estates. In Proceedings of the 12th Academy of Wine Business Research, Virtual, 6–8 July 2021. [Google Scholar]

- Di Montezemolo, S.C. Profitability, Growth and Corporate Value of the Wine Companies. In Proceedings of the 3rd International Wine Business Research Conference, Montpellier, France, 6–8 July 2006. [Google Scholar]

- Köhr, C.K.; Malorgio, G.; Aragrande, M. Exploring determinants of internationalisation: The case of late starters. Int. J. Wine Bus. Res. 2017, 29, 159–177. [Google Scholar] [CrossRef]

- Choi, J.-W.; Lee, W.F.; Gartner, W.C. Vineyards in Northern U.S. States: Farm Size and Productivity Relationship. J. Distrib. Sci. 2016, 14, 53–61. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Erlbaum: Hillsdale, NJ, USA, 1988. [Google Scholar]

- Miles, J.; Shevlin, M. Applying Regression & Correlation: A Guide for Students and Researchers; Reprinted; Sage Publications: London, UK, 2008; ISBN 9780761962304. [Google Scholar]

- Bennett, A.; Loose, S.M. Development of an online dashboard of economic sustainability based on producers’ expectations. In Proceedings of the 13th Academy of Wine Business Research Conference, Dijon, France, 5–8 July 2022. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).