1. Introduction

The Belt and Road Initiative (BRI) has promoted the deployment of renewable energy to achieve sustainability. It is essential to reveal the influence of renewable energy on low-carbon economic development [

1]. The BRI involves many countries in Asia, Europe, and Africa, most of which are in the stage of industrialization take-off or rapid development, as well as countries such as Pakistan, Laos, Nepal, and Bangladesh that are backward in economic development, lack power and other infrastructure, and face energy shortages. The rapid industrialization of these countries has rapidly increased their demand for energy. However, due to insufficient national financial funds, lagging infrastructure construction, and backward energy development technology, their energy consumption is dominated by fossil energy, and rich clean energy resources have not been effectively developed. Countries and regions along the “Belt and Road” urgently need to improve their own clean energy development and utilization capacity, so as to more effectively improve energy security and reduce dependence on fossil energy to achieve sustainable development. Therefore, China’s foreign investment in renewable energy will continue to inject impetus into the green and low-carbon development of developing countries. Vigorously developing renewable energy is an important strategic measure to promote diversified and clean energy development and cultivate strategic emerging industries, as well as address the urgent need to protect the ecological environment, cope with climate change, and achieve sustainable development.

In 2015, the Paris Agreement issued by the Paris Climate Change Conference made arrangements for addressing global warming after 2020 (UNFCC 2015) [

2]. The Paris Agreement aims to control the rise in global temperature lower than 2 °C relative to the pre-industrial period. To curb global warming, improving energy structure and promoting energy transition towards a clean and low-carbon mode has increasingly become an international consensus. To manage the impacts and minimize the risks of climate change, strong, rapid, and sustained global actions are imperative to limit

emissions in the coming decades. Utilizing the two-step system generalized method of moments model is proposed, which evaluates the effects of climate aid on carbon emissions reduction and the impact mechanism through energy structure optimization [

3]. Thus, the application and promotion of renewable energy become particularly important.

The countries along the Belt and Road have gradually become important destinations for investments in renewable energy (RE) generation projects by China. China invested in eight RE projects in Pakistan, India, and other countries in 2015 and 2016 [

4]. With the international capital, large-scale RE bases will be built along the Belt and Road to meet the demand for clean power in local and neighboring countries, alleviate the energy crisis, and improve the quality of the environment. The International Renewable Energy Agency (IRENA) released the “RENEWABLE CAPACITY” in 2022 [

5], which pointed out the total renewable energy of China, India, Pakistan, and other countries along the Belt and Road from 2012 to 2021, as shown in

Table 1. In 2013, the concept of the Belt and Road was proposed. After the implementation of the concept in 2015, the total renewable energy of countries along the Belt and Road showed an increasing trend. In 2021, the total renewable energy of China increased by 337% compared with 2012, Pakistan increased by 180%, India by 243%, and Bangladesh by 195%. The International Energy Agency (IEA) released the report of the “Carbon Neutralization Road Map of China’s Energy System” in 2021 [

6], which affirmed China’s contribution to the development of clean energy in the world.

Ashwani et al. [

7] reviewed the current situation, development, major achievements, and future development potential of RE in India and analyzed the existing policies to promote RE development. Most countries along the Belt and Road are developing countries whose exchange rates experience large and frequent fluctuations. Guiding enterprises to use the financial instruments available in the financial market to minimize exchange rate risk provides an important strategy [

8]. Given the large investments in energy cooperation projects, project operating periods reaching up to 20 years, and the large number of stakeholders involved, including investors, energy producers, energy accommodation, and allocation countries, many risk factors such as exchange rate fluctuations exist. Therefore, economic analysis and risk assessment prior to project site selection and capacity are especially important. Ximei et al. [

9] researched the existing risk factors such as policy, technology, and market in RE investment projects by using systematic dynamics. Through this model, the relationship between risk and return of renewable energy industry is analyzed, and a more reasonable investment decision is given. Perry [

10] studied the key risk factors of RE investment enterprises by using a variable beta model. Their results showed that the growth in sales can reduce corporate risk, and the rise of oil price can increase corporate risk.

The allocation of resources by means of price is necessary for the sustainable and healthy development of RE power generation projects [

11]. The economic analysis of RE projects includes the analysis of project IRR and levelized cost of energy (LCOE) by using data such as on-grid price, investment cost of power generation equipment, project operating cost rate, project repair cost rate, land lease price, loan interest rate, tariff rate, and VAT rate. Yujin et al. [

12] constructed a cost model of fire coal, wind, and photovoltaic power generation with environmental and resource externalities and conducted an empirical analysis. Taking into account the initial investment cost, operation and maintenance cost, effective utilization hours of resources, loan interest rate, capital ratio, and industry-weighted average cost of capital (WACC), Xiaolu et al. [

13] constructed an economic analysis model of RE power generation technology, analyzed the economics of African wind power bases, estimated the cost of African wind power and photovoltaic power generation and the transmission cost between Africa and Europe, and analyzed the economics of transmission between Africa and Europe. Martin et al. [

14] proposed an LCOE analysis model and analyzed wind power projects, with the costs of the power plant such as the equipment investment cost, loan interest, operation and maintenance cost, tax payable, government subsidy, tax deduction, and land use fee taken into account. Qihe et al. [

15] calculated the IRR of wind power, photovoltaic power plant, and distributed photovoltaic in China’s different provinces by using the LCOE model and analyzed the power plant size, clean energy accommodation and allocation, market competition, and other key problems in the grid parity era of new energy. Hao et al. [

16] believed that the PVC method cannot accurately reflect the investment profitability of power generation projects. They then proposed a method of measuring the LCOE of wind power generation cost on the wind model and conducted sensitivity analysis of the selected wind turbines. Ximei et al. [

17] proposed an LCOE model of wind power that is suitable for China. According to these researchers, the main factors that affect the cost of wind power generation include the utilization hours of the wind power plant, cost of power generation equipment per unit kilowatt hour, interest rate on long-term loans, and cost of operation and maintenance. In the literature [

18,

19,

20], the economics of photovoltaic power generation was analyzed by using the LCOE model.

Many risks are present for foreign investment, which is why the risk factors for the economics analysis of RE projects need to be taken into account. The China Central Asia Multilateral Investment Agreement has been established and Chinese enterprises have been guided to change their energy investment mode to reduce the investment risk of Chinese enterprises in the energy industry in Central Asia. Hui [

21], taking China’s direct investment in Central Asia as an example, pointed out that the energy systems and religious forces of each country aggravate the risks of foreign energy investment. Huiqing [

22] summed up three types of risks in the foreign energy investment process (non-economic risk, economic risk, and internal risk of enterprises), analyzed the causes and measures of various risks, and proposed a strategy that will enable energy enterprises in China to control the risks of overseas investment on the basis of cases of large-scale energy enterprises in the United States and the United Kingdom. Hugo et al. [

23] used the Iberian benchmark as an example to study the impact of market mechanisms, such as technological development, power ancillary services, labor, and carbon trading, on energy markets. Daniel et al. [

24] assessed the value-at-risk and expected shortfall that emerges during the transition from traditional energy to RE by using backtesting techniques. Almona et al. [

25], taking the transition to RE of the Boston area as an example, assessed the role of energy policy in promoting or impeding renewable energy by means of argumentative discourse. Shinji et al. [

26] used Slovakia’s international trade expansion as an example and recommended that enterprises must properly assess exchange rate fluctuation risks and take appropriate measures to reduce corporate losses. On the basis of data from Japan’s foreign direct investment (FDI) panel for nine Asian economic entities from 1987 to 2008, Ivan et al. [

27] found that FDI decreased as Japan devalued against host countries, and investment activity increased with exchange rate fluctuations. In this paper, the role of exchange rate and political environment in the decision-making for investments by multinational corporations in Japan was studied. Panel data analysis of 56 developed countries and developing countries from 1995 to 2012 shows that multinational corporations cannot bear the exchange rate risks and political risks of developing countries. Shamsuddin et al. [

28] studied the determinants of FDI by using the single-equation econometric economic model of 36 developing economic entities. They found that market size, labor cost, and exchange rate stability were important factors that affect the site selection of FDI. Magali et al. [

29] studied the impact of exchange rate fluctuations on FDI from developed economic entities and found that the large fluctuations in exchange rates impede the inflow of FDI.

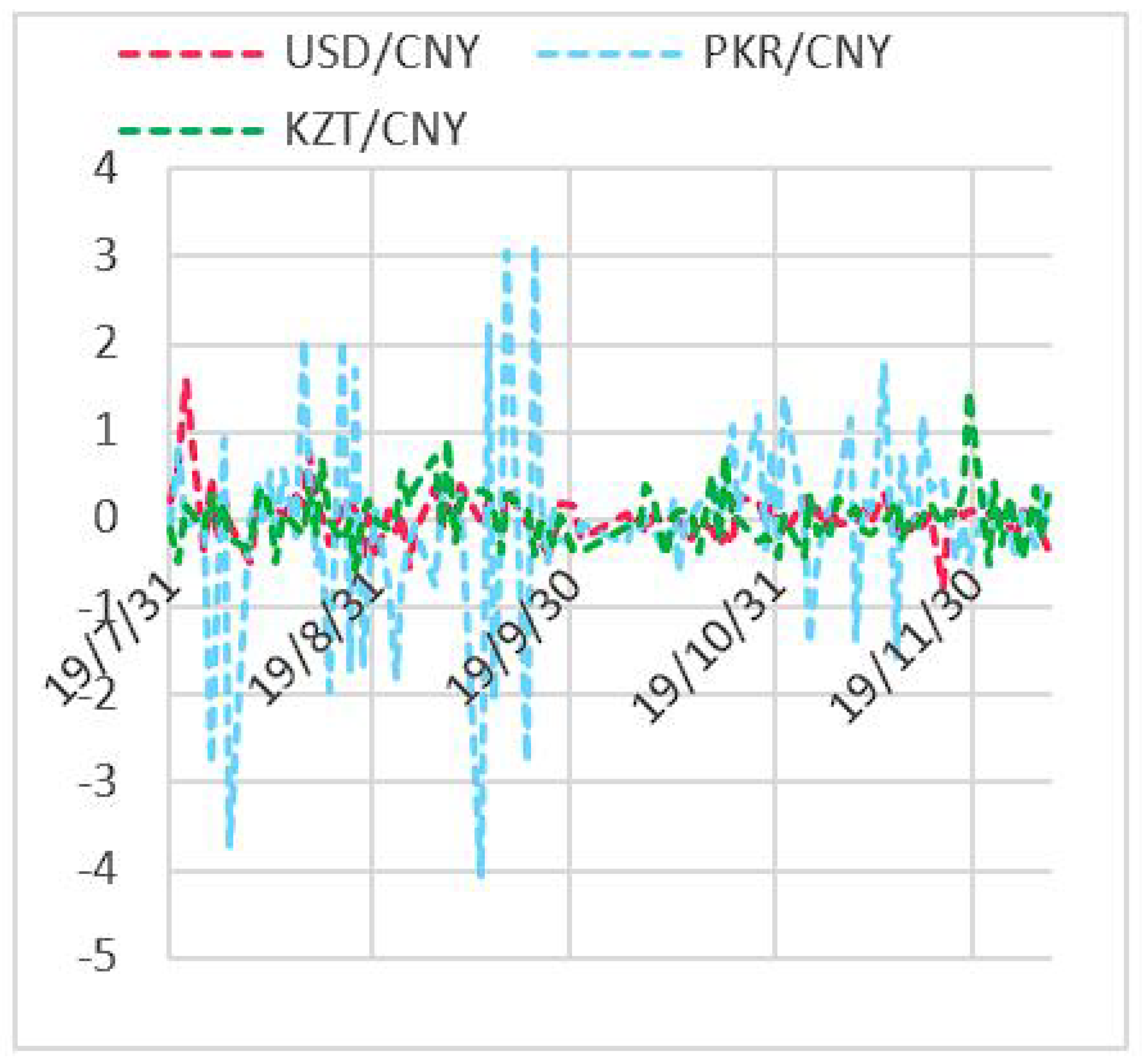

The investment in clean energy investment projects is typically large, with 70%–80% of the investment amount being invested in the early stage of project construction. However, the project earnings need to be obtained year by year throughout approximately 20 years of the project life cycle. The exchange rate of each country’s currency against Chinese currency changes every day. The daily fluctuations of the US dollar, the Pakistan rupee (PKR), and the Kazakhstan tenge against Chinese currency during July to December 2019 are shown in

Figure 1. As can be seen from the figure, the exchange rate fluctuation of the US dollar against Chinese currency is relatively stable with little fluctuation; the daily exchange rate fluctuation of the Kazakhstan tenge against Chinese currency is moderate; and the daily exchange rate fluctuation of the PKR against Chinese currency is large, with a maximum daily fluctuation range of −4.12%. The recent three-year exchange rate trend of the three currencies against Chinese currency is shown in

Figure 2. The exchange rate fluctuation of the US dollar against Chinese currency is between 6.3% and 7.3%, while the exchange rate fluctuations of PKR and tenge against Chinese currency have a downward trend, with the exchange rate of PKR experiencing a sharp decline against Chinese currency. This finding shows that Chinese currency has been appreciating against the PKR and tenge in the past three years.

The annual fluctuation values of PKR, Indian rupee, Bangladesh kata, Kyrgyzstan com, and Kazakhstan tenge against Chinese currency in the past four years are listed in

Table 2. As shown by the table, the exchange rate of the PKR against Chinese currency has decreased significantly year by year, with a decrease of 20.48% in 2018. The exchange rate of the Indian rupee against Chinese currency increased slightly in 2017 compared with that in 2016 and decreased slightly in 2018 and 2019. The exchange rate of the Bangladesh kata against Chinese currency decreased by 7.394% in 2017 compared with that in 2016, and slightly increased in 2018 and 2019. The exchange rate trend of the Kyrgyzstan com against Chinese currency is consistent with that of the Bangladesh kata. The exchange rate of the Kazakhstan tenge against Chinese currency shows a slight downward trend year by year.

Pakistan, India, Bangladesh, and other countries are geographically close to China and have rich amounts of clean energy, but their power generation cannot meet their economic development, which is why they need to develop their power markets with the help of foreign powers. Therefore, they have become the important countries for clean energy power generation along the Belt and Road, in which China is investing. The clean energy Internet along the Belt and Road is constructed, as shown in

Figure 3, to accumulate and allocate the abundant hydropower, photovoltaic power, and wind power in all countries; eliminate the power shortage in Pakistan, India, and Bangladesh; and greatly improve the environmental quality.

In the context of the phasing-out of various subsidies for RE power generation projects, the impact of various risk factors, including exchange rate, on the economic performance of RE power generation projects needs to be fully considered. Xiaolin et al. [

30] analyzed the effect of exchange rate fluctuation on enterprise investment from the micro level on the basis of data from China’s industrial enterprises matching with customs trade. Qingbin et al. [

31] constructed four stochastic volatility models and conducted empirical research on the exchange rate risk of Chinese currency. Guangxu et al. [

32] studied a fuzzy multiattribute information fusion approach for finance investment selection with expert reliability. GuoDing [

33] studied the link between energy prices and real effective exchange rates on the basis of panel data from 10 energy exporters and 23 commodity exporters between 1980 and 2011. Exchange rate fluctuation is an important economic risk in foreign investment projects. In [

34,

35], the impact of exchange rate levels and fluctuations on corporate earnings from an economic perspective was analyzed by using the overall industrial data. In [

36,

37,

38], the risk factors of clean energy investment in the countries along the Belt and Road were summarized and evaluated by using the ANP cloud model. The study points out that the economic risks posed by exchange rates to enterprises tend to change, but it failed to analyze the specific risks of exchange rate levels and fluctuations to energy investment in countries along the Belt and Road.besides, Yan tan et al. [

39] discussed the impact of foreign direct investment on renewable energy consumption, and used the generalized method of moment (GMM) models—both system GMM and difference GMM model—to verify the robustness of the paper’s work. This was more to elaborate the relationship between foreign direct investment and renewable energy consumption from the perspective of environmental regulation, and they did not establish an evaluation model from the perspective of investment and income. Khan et al. [

40] estimated the short-term and long-term impacts of technological innovation, finance, and foreign direct investment on renewable energy, nonrenewable energy, and CO2 emissions in 69 countries of the “Belt and Road Initiative”. Using robust standard error regression and dynamic GMM estimators, the results showed that the technological innovations, economic growth, and foreign direct investment have a negative impact on renewable energy. In contrast, financial developments is a significant positive determinant of the study area’s renewable energy sector. Therefore, it is necessary to study the investment in renewable energy from the perspective of finance and exchange rate. Due to the different research objectives, the evaluation model of the above documents cannot be adapted to the research in this paper.

As one of the important countries investing in renewable energy along the the Belt and Road, China must fully consider the important impact of the appreciation of the RMB and exchange rate fluctuations on energy investment, so as to provide key theoretical basis and response methods for investment decisions of enterprises. This paper aims to study the specific economic risks posed by exchange rate fluctuations to foreign investment in RE projects by using specific economic data, analyzing the exchange rate fluctuation risk capacity that the projects can bear, and proposing effective measures for exchange rate fluctuations.

This paper makes the following contributions:

It deduces the main factors that are affected by exchange rate fluctuations in foreign RE investment: electricity selling income, labor cost, value-added tax, and land use tax.

It presents the concept of real exchange rate in foreign RE investment projects; deduces the flexibility formula of cost, income, and earning of power generation project; and provides a model of foreign RE investment income.

Taking China’s investment in Pakistan wind power project as an example, this work calculates the economic risks caused by the exchange rate fluctuations and provides the range of exchange rate fluctuations that the project can bear.

This work proposes three effective measures to deal with exchange rate fluctuation risks of foreign investment in RE power generation projects: reducing project cost, building energy Internet, and using Chinese currency as the settlement currency.

The structure of this paper is shown in

Figure 4.

Firstly, the paper introduces the basic concept and mathematical expression of the real effective exchange rate of power generation projects; then, the paper focuses on the cost, income, and income models of foreign clean energy investment projects; subsequently, it analyzes the impact of exchange rate fluctuations on investment returns. The next part analyzes the effectiveness of the model through an actual case. Finally, it summarizes that exchange rate instability must be taken into account when investing in renewable energy projects. At the same time, it gives the impact of RMB appreciation on investment income, and summarizes the effective measures to deal with exchange rate fluctuation risk for RE power generation projects invested in abroad.

6. Conclusions

This paper deduces the main factors of RE’s foreign investment subject to exchange rate fluctuations. The concept of real exchange rate in RE foreign investment projects was proposed, the elasticity formula of cost, income, and income of power generation projects to real exchange rate was derived, and the RE foreign investment income model was constructed. Taking China’s investment in Pakistan wind power project as an example, we calculated the economic risks brought by exchange rate fluctuations to the project, and gave the range of exchange rate fluctuations that the project can withstand. Three effective measures to deal with the risk of exchange rate fluctuation for RE power generation projects invested abroad were given: the first measure reduces the project cost and raises yields, hedging the economic risk caused by exchange rate fluctuations with profits. The second measure builds an energy accommodation and allocation Internet, offsetting the economic risks caused by exchange rate fluctuations because the exchange rate fluctuations between currencies vary in size and direction in different periods. The third measure uses Chinese currency as the settlement currency to avoid exchange rate fluctuations and reduces the risk factors of RE power generation projects.

The development and construction of renewable energy in the Belt and Road are subject to many factors. In the investment process, it is necessary to consider the economic factors, political environment, currency stability factors, exchange rate fluctuations, and other factors of the investing country and the invested country. Therefore, in the process of China’s investment in renewable energy, the impact of RMB appreciation on investment is unique. Because of this, the concept of real exchange rate is proposed in this paper, and the cost, income, and benefit model of foreign clean energy investment projects is also unique, which provides an important analysis and decision-making model for the Belt and Road countries’ investment, and provides a very important theoretical basis for enterprises’ investment decisions.

This paper started from the real effective exchange rate and constructed an investment income model. The model mainly considers the impact of RMB appreciation, cost, exchange rate, and other factors on renewable energy investment, and it obtained comparative results. Next, we will further investigate the operation mode of the renewable energy market, and the impact of market regulators, new producers, changes in national policies, and investment environments in different countries on the model. It is expected that the future research can be more comprehensive and accurate for analysis and decision-making.