1. Introduction

Energy use can promote economic advancement, but has an environmental footprint that can undermine the derived economic gains; when it does, it often affects the most vulnerable [

1]. As a result, reducing the intensity of energy use, a metric that reflects how energy-efficient an economy is based on the quantity of energy consumed in the production of one unit of economic output [

2], is among the major targets for achieving sustainable development goals (SDG 7.3). The target is to ensure that energy policy choices “meet the needs of the present without jeopardizing future generations’ ability to meet their own needs” [

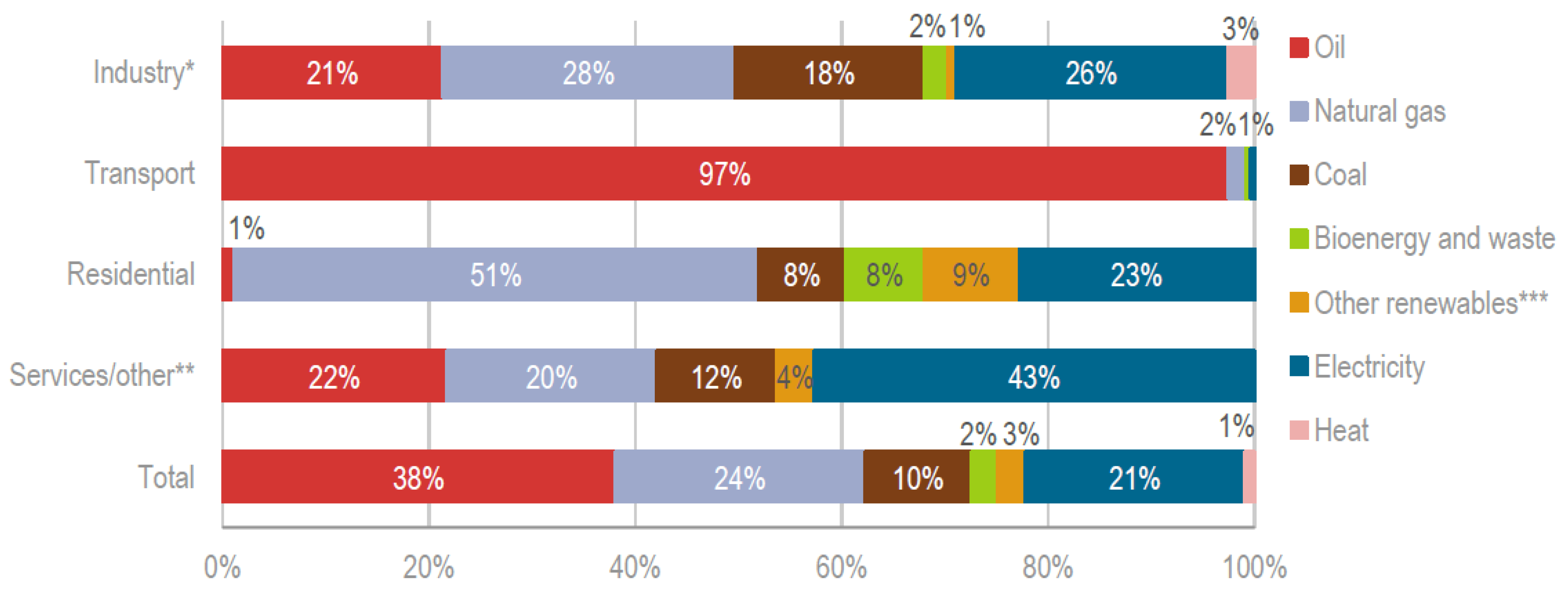

3]. Based on the SDG 7.3 target, we formulated a framework for explaining trends in the intensity of energy use in Turkey. One of the key policy challenges in Turkey is how to balance the economy’s dependence on fossil fuel primary sources (see

Figure 1 and

Figure 2) and concomitantly improve the long-term wellbeing of its immense and growing population. This condition is worsened by the fact that the major industries contributing to the gross domestic product (GDP) are related to manufacturing, and are by nature energy intensive (based on World Bank estimates for 2021).

According to the IEA Energy Policy Review [

4], Turkey’s energy demand has increased across all sectors since 2001, with a slight decrease in most sectors in 2018, except industry. Thus, the sectoral energy consumption shown in

Figure 1 gives credence to this argument; hence, industry is the largest energy-consuming sector, accounting for 36% of total final consumption in 2018, followed by transport (27%), residential (20%) and services (17%), including agriculture and fishing. From 2008 to 2018, energy use in transport increased by 86%, in industry by 60%, and in service sector and residential by 12% and 2%, respectively.

However, irrespective of the increase in Turkey’s energy requirements, in recent years it has considered several policy frameworks targeting energy efficiency as part of a broader effort to reduce the environmental impact of energy use [

5]. These policy actions have generally contributed to the visible presence of renewable and other low-carbon energy sources in the total energy mix of the economy (see

Figure 2). Turkey is increasingly adopting some level of green energy, such as solar energy, which has been upward trending in the energy mix of the country. This singular act benefits the achievement of Turkey’s target of increasing its energy efficiency and sustainable environment. The economic and environmental impact of this policy has been positive, considering the reduction in carbon emissions associated with excessive usage of fossil fuels. This has contributed to a significant savings in funds budgeted towards fossil fuel import. The shift towards the capacity cum utilization of solar energy is presented in

Figure 3.

Figure 4 reveals the progress of the energy transition, and indicates that the share of low-carbon energy sources has more than doubled. In 1973, only 3.79% of total energy use came from non-fossil energy sources. The rate of progress since 2010 has been impressive; an 18.47% share of primary energy from low-carbon sources has been achieved. As an added benefit, Turkey’s economy has achieved a lower intensity of energy use than the world average and, as revealed in the World Development Indicators [

2], has shown a declining energy intensity in recent years. This means that Turkey has been able to generate more economic output with fewer energy inputs. Not surprisingly,

Figure 5 identifies Turkey’s economy as one of the least energy-intensive economies on the Asian continent. Turkey can develop its potential for more energy efficiency gains to continue its trajectory of economic growth in a sustainable pattern [

5].

Facilitating broad-scope energy efficiency measures could reduce Turkey’s environmental impacts and energy-related costs for businesses, thus sustainably boosting the country’s economic growth. However, barriers to large-scale energy efficiency investment, including high upfront costs, long payback periods, and limited availability of capital, could hinder such development. Considering these challenges, recent policy debates have considered the possibility of private sector involvement in the development of energy efficiency potential through cooperative arrangements with the public sector. Regarding the contribution of the private sector, public stakeholders recognize that extensive policy measures are needed to create an attractive environment where collaborations can effectively generate energy efficiency gains. A number of policy steps toward achieving this have been considered in recent years, which involve collaboration between the government, the private sector, and some international agencies. For instance, the International Finance Corporation (IFC), the private-sector lending arm of the World Bank, in partnership with key Turkish financial institutions, implemented a series of strategic and targeted investment projects in Turkey, focusing on energy-intensive industrial and commercial sectors of the economy, including textiles, printing, machinery manufacturing, and metal production. The project also supported local leasing companies in identifying and financing profitable, cost-saving, energy-saving investments and small- and medium-sized firms with energy-efficient equipment. These policy measures were perceived as necessary in order to reduce the industrial and commercial sectors’ energy consumption and environmental impacts, while at the same time increasing their competitiveness.

As Turkey continues to explore alternative policy options for achieving more efficient energy usage, a pertinent policy question is whether the current framework guiding public–private investment partnership increases or reduces the intensity of energy use in the economy. This paper aims to provide an empirical answer to this question to guide policy formulation in Turkey.

2. Literature Review

There is yet no agreement regarding the energy efficiency potentials of public–private partnership investment in energy. One argument emphasizes the necessity of public–private partnerships for decentralizing investment sources in the energy sector. Decentralization of energy sector investment through public–private partnerships is viewed by its supporters as a major policy option for diversifying and balancing the energy mix to allow for more efficient sources in the grid [

6,

7]. Increased private sector involvement in energy sector development is expected to break down barriers to the development and implementation of efficient and energy-saving technologies [

8]. Access to efficient energy technologies is vital if developing economies are to increase domestic production while consuming less energy and having a lower environmental effect [

9,

10]. This explanation has been the key factor encouraging the integration of private sector participants into energy sector development frameworks [

11]. The opposite explanation contends that public–private partnership energy investment boosts economic activity, which may result in increased demand for energy [

6]. This has raised some concerns among policymakers, who claim that with increased emphasis on attaining economic growth, making a profit, and growing output, private firms may take advantage of investment partnership agreements to increase their investment in carbon-intensive technologies and sectors [

12].

The literature has continued to show interest in energy policy [

13,

14,

15,

16,

17,

18,

19,

20,

21,

22,

23,

24,

25,

26,

27,

28,

29]. A summary of the empirical steps and findings in the literature is provided in

Appendix A. There is relatively little empirical evidence to support the link between public–private partnerships and energy intensity. However, few related existing studies have focused on understanding how public–private partnership investments affect environmental quality variables [

6,

7,

30,

31,

32,

33]. Despite the theoretically projected energy efficiency improvements from public–private partnership energy investment, the findings of these studies imply that it has a negative impact on environmental quality. For example, Yang et al. [

33] showed that public–private partnership investment in energy led to carbon emissions in the context of emerging economies, specifically the E-7 countries (China, Turkey, Russia, India, Indonesia, Brazil, and Mexico). Other empirical studies with similar conclusions include Ahmad and Raza [

7] regarding Brazil, Kirikkaleli and Adebayo [

30] regarding India, Shahbaz et al. [

6] and Lu et al. [

32] regarding China, Caglar et al. [

31] regarding the BRICS panel, Chunling et al. [

34] regarding Pakistan’s ecological footprint, and Wen et al. [

35] regarding the ecological footprint of the South Asia and Pacific regions.

Despite data that suggest a positive association between CO

2 emissions and PPP investment in many emerging and developing economies, PPP investment still provides contractual frameworks that can set energy development ambitions. Alloisio and Carraro [

36] examined the status of energy infrastructure development in the MENA region and concluded that emerging countries still require private financial resources and experience to handle energy infrastructure projects. As pointed out by Yurdakul et al. [

17], the PPP architecture used depends on the country, government, and characteristics of the operation. PPP investment is primarily driven by macroeconomic considerations in most emerging countries [

17,

37], but it can also be adjusted to help achieve various sustainability goals. Mirzaee and Sardroud [

38], for example, proposed employing PPP investment to fund and finance enabled smart city projects. Brears [

39] emphasized the importance of PPP investment in nature-based solutions, such as green infrastructure, increased economic efficiency, and the preservation of natural resources and ecosystems. In a similar analysis, Jayasena et al. [

40] proposed using PPP investment architecture in smart infrastructure development in Hong Kong. An empirical assessment by Rasoulinezhad and TaghizadehHesary [

41] of the top ten economies supporting green finance showed that green bonds improve energy efficiency and implicitly pointed out that increased private participation in energy projects can offer efficiency gains. Accordingly, we propose the following hypothesis.

Hypothesis. Public–Private Partnership investment has a positive impact on energy efficiency.

To the best of our knowledge, existing empirical literature on the relevance of PPP investment for achieving sustainability goals is limited to climate goals, especially when modeling CO

2 emissions and environmental degradation. There are few studies regarding green bonds as a means of engaging the private sector in energy efficiency financing. This study complements the literature in this respect by providing an empirical analysis of the role of PPP investment in improving energy efficiency in Turkey. Interestingly, Turkey is one of the leading countries using PPP investment for critical infrastructure development. As highlighted by Ayhan and Üstüner [

37], a total contract value of USD 19.7 billion was created between 1986 and 2021 for the development of energy assets in Turkey. Energy as a broad sector comprises two important but very different industries, fossil fuels and renewable technologies, which offer diverse potential for efficiency. Therefore, policy makers designing the PPP investment architecture can use the results of this study to structure energy efficiency targets.

3. Materials and Methods

This study utilizes quarterly data for Turkey from 1990–2015 due to the availability of data. Energy efficiency (E

t) is defined by the amount of output created per unit of energy used. To calculate (E

t), we divided the real GDP of the economy by the energy consumption of that economy, following the study of Marques et al. [

18]. Foreign direct investment (FDI

t) and public–private partnership investment in energy (PPP

t) were measured in USD, and then deflated (to their real value) by dividing by Turkey’s inflation rate. Real GDP per capita (Y

t) was measured using 2010 constant USD. Lastly, trade (T

t) was measured as a percentage of GDP. All related data were obtained from the World Development Indicator database (data accessed May, 2020). The functional relationship was derived as follows:

Taking the logarithm of Equation (1), the following model was obtained:

3.1. ARDL Bound Testing Approach

This study utilized autoregressive distributed lag (ARDL) bounds testing, which was proposed by Pesaran et al. [

42] to explore the cointegration relationship between energy use, real GDP, trade, foreign direct investment, and public–private partnership in investment. The ARDL cointegration method has crucial advantages relative to prior cointegration approaches, such as Engle and Granger’s [

43] two-step method, Johansen’s [

44,

45] multivariate cointegration test, and Johansen and Juselius’ [

46] maximum likelihood method. A crucial advantage of the ARDL technique is that it can be used without running unit root pre-testing; this technique allows the mixed order of the explanatory variables, i.e., I (0) or I (1). In addition, this approach has the power to overcome the endogeneity problem [

42] and is more suitable for small sample sizes; the sample size in this study was 26.

The Wald test is used to test cointegration under the null hypothesis of the joint significance of the variables. This study used the critical values of F-statistics derived by Narayan [

47] for small sample sizes to compare with computed F-statistics. If the calculated value was greater than the upper bound of the critical values, the null hypothesis of no cointegration could be rejected. However, if the computed value was less than the lower bound, the null hypothesis could not be rejected. Additionally, if the calculated value fell between the bounds, there was no-decision for the hypothesis testing. The optimum lag length for each of the variables was selected based on the Akaike Information Criterion (AIC). In the existence of a cointegration relationship among the variables, the long-run model could be estimated as follows:

Next, the short-run dynamics could be obtained using the following equation:

where

represents the short-run coefficients,

represents the long-run coefficients, and the coefficient of the error correction term (ECT),

, defines the speed of adjustment. This shows how quickly short-run disequilibrium can be corrected to reach long-run equilibrium.

To check the reliability and validity of the estimated ARDL model, diagnostic tests such as heteroskedasticity, serial correlation, the ARCH effect, and model misspecification tests have been applied. In addition, cumulative sum (CUSUM) and cumulative sum of squares (CUSUMsq), as proposed by Brown et al. [

48], used to test the stability of the estimated coefficients.

3.2. Toda–Yamamoto Granger Causality Test

The Granger [

49] causality test examines the direction of causality in the relationship between variables. To overcome specification problems that may cause spurious results, Toda and Yamamota [

50] developed the Granger causality test using modified Wald test statistics (MWALD). This modified test result is robust and efficient, even if there is a lack of cointegration relationship between the variables. This test can be applied without checking the integrated orders of the variables. Therefore, this study employed the Toda–Yamamoto Granger causality test method in a VAR(

p) model framework, as follows:

where

p is the optimum lag order and

is the maximum order of integration in the VAR(

p) model. For example, the null hypothesis,

, was set to investigate the Granger causality relation from

PPP to

E. If the Wald test results showed statistical significance, the null hypothesis could be rejected and we could conclude there was Granger causality running from

PPP to

E.

4. Results and Discussion

This section discusses empirical results. To explore basic summary statistics,

Table 1 reports measures of central tendencies, dispersion, and peakness.

Table 1(a), with over 100 observations regarding Turkey, shows that public–private partnership investment in energy had the highest average over the sampled period, whereas FDI had the lowest average. All series showed considerable dispersion from their means.

Table 1(b) presents the pairwise correlation analysis; there was a strong positive relationship between public–private partnership investment in energy and FDI. Similarly, a positive nexus was observed between GDP growth and public–private partnership investment in energy. These results highlight that investment in energy is key to economic growth in Turkey, implying that the country’s energy sector is key to economic progression. However, an inverse nexus was observed between trade and energy intensification. These outcomes were not sufficient, given that the correlation analysis was not sufficient. Therefore, we used advanced econometric analysis to verify these outcomes.

Table 2 presents this study’s analysis of the unit root test (Ng–Perron), in conjunction with the stationarity test (KPSS), for robustness of the unit root properties of the outlined variables. Both stationarity tests were in agreement for the first difference as stationary; each test declared that the series was non-stationary as level, but became stationarity after first difference. However, both tests held different null hypotheses; the KPSS test result was null of stationary, whereas the Ng–Perron test result was non-stationary. In order to avoid misleading econometric modeling, we used the most parsimonious model, as presented in

Table 3; the Schwarz information criterion was most appropriate for the study sample’s size.

Furthermore, the baseline model was used to address the main motivation of this study regarding the role of public–private partnership investment in energy, foreign direct investment, economic growth, and trade flow in energy efficiency in Turkey. The present study incorporates public–private partnership (PPP) into the energy-growth debate regarding the Turkish economy. From a theoretical standpoint, investment in PPP is generally connected to sustainable development due to its pertinent role in meeting the unprecedented global energy demand [

52]. Thus, PPP is employed as a policy tool and strategy for combating energy efficiency issues. Previous literature documentation outlines divergent impacts of PPP on energy efficiency. To this end, the present study further explored Turkey’s emerging economy to underscore the pertinent role of PPP in its energy efficiency targets.

The baseline model had energy efficiency as a dependent variable as a function of other variables previously highlighted as explanatory variables.

Table 4 shows results of the ARDL model fitted with simultaneous short- and long-run dynamics of the relationship between the variables under consideration. The model showed an error correction term (ECT

t-1), which outlined the model’s convergence speed at approximately 12% on an annual basis, with the contribution of the model explanatory variables. This indicated a long-run bond between the variables. Regarding the short run, we observed an inverse nexus between FDI and energy efficiency; that is, a 1% increase in FDI inflow decreased energy efficiency by 0.1878% in the short run. This suggested that FDI inflow was detrimental to the Turkish economy’s energy efficiency goal in an era of intense energy demand in the short run. This outcome was in contrast with Pan et al.’s [

53] results regarding China. On the other hand, FDI increased energy efficiency in Turkey in the long term. A similar trend was seen between trade and energy efficiency in the long run, as a 1% increase inflow of trade to Turkey increased the country’s energy utilization by 0.335%. This suggested that trade inflow was crucial to Turkey’s energy output and its productive use.

Additionally, GDP growth in Turkey in both the short and long run demonstrated a positive statistical relationship with energy efficiency. That is, the utilization efficiency of energy in development was pivotal to Turkish economic growth, as there was significant potential for such in the country’s energy mix, as posited by [

54]. Turkey’s GDP grew by 1% and energy efficiency increased by 0.0079% and 0.0068% in the short and long runs, respectively. This outcome resonates with the findings of Ang [

55], Gvozdenac-Uroevi et al. [

56], and Gurgun and Touran [

57]. However, a similar study conducted for China by Cheng et al. [

52] highlighted that real income and public–private energy investments increased emissions levels in China. The study also posited the need for energy productivity, innovation, and renewable energy transition.

We also noted a positive relationship between public–private partnership investment in energy and energy efficiency; we observed that in both the short and long run, public–private partnership investment in energy increased Turkish energy efficiency. This is insightful, as policymakers and energy stakeholders in Turkey can glean information from these revelations. There is a greater need for energy efficiency to avoid energy waste, inefficiency, and shortages, which is characteristic of emerging and developing economies, such as Turkey’s. To this end, government administrators are encouraged to exert more efforts to complement public and private sector participation in the energy sector to facilitate sustainable development and energy efficiency, which are essential for achieving Turkey’s inclusive and sustainable energy goals.

Regarding the causality relationship between the study variables as reported by the Toda–Yamamoto Granger causality results, presented in

Table 5, we observed a one-way causal relationship between energy efficiency and PPP in Turkey. That is, energy efficiency drove public–private partnership investment in energy. This result was similar to that of Marques et al. [

18] for eleven European countries. Additionally, bi-directional causality was also noted between public–private partnership investment in energy and GDP growth; both variables had predictive power over each other. The causality outcomes were instructive, as public–private partnership investment in energy (PPP) was essential for Turkish economic growth and trade flow, and for meeting Turkey’s energy efficiency target.

To affirm that the fitted model was suitable and appropriate for policy direction, we conducted diagnostic tests. The model passed all diagnostic tests with satisfactory results; there were no serial correlation issues, no ARCH effect, and no model misspecification as reported by the Ramsey specification test. Our fitted model was also stable, as presented by the CUSUM and CUMSUMsq in

Figure 6 and

Figure 7, respectively.

5. Conclusions and Policy Implication

One of the paramount commitments of any country’s administrators, especially developing countries such as Turkey, is making energy accessible and affordable to its citizens. This resonates with the United Nations Sustainable Development Goals (UNSDG-7). To this end, this study focused on Turkey’s energy efficiency target, distinct from previous studies in the extant literature, by exploring the pertinent role of public–private partnership (PPP) in the energy-growth literature. Previous studies focused on the role of PPP on environmental sustainability and degradation, whereas this study focused on energy efficiency for Turkey. Turkish energy statistics indicate significant energy inefficiency and energy deficit. This study also accounts for key macroeconomic variables, such as trade flow and FDI, in its model’s functional form. To achieve this objective, we leveraged time-series analysis while exploring the pertinent role of public–private partnership investment in energy. We also controlled for key macroeconomic indicators, such as GDP growth, FDI, and trade inflows, in the context of the Turkish economy.

The key findings of this study have some policy implications for the Turkish energy sector’s development, as well as the attainment of energy-related sustainable development targets. This study showed that there is a positive connection between energy efficiency and public–private partnership investment in energy in Turkey. This suggests that the involvement of public–private partnerships in investments in energy will increase the use of energy in the right direction, as the same level of energy input can generate higher output. This suggests to investors in Turkey’s energy sector that the role of the public sector engenders productivity in Turkey’s energy mix. Similarly, there was a positive nexus between GDP growth and energy efficiency, which demonstrated that greater economic output facilitated higher and more productive energy consumption. The implication is that Turkish economic activities engage in productive energy use.

Given the above conclusions, this study presents relevant policy actions to guide the appropriate authorities accordingly. These suggestions are as follows. First, the positive outcomes observed between energy efficiency and public–private partnership investment in energy and GDP growth are indicative that more concerted efforts are needed to maintain the momentum for public–private partnership investment in energy. The results translate into efficient use of the country’s energy resources, which is desirable, especially in an emerging economy such as Turkey’s; this is more apparent given the global pressure for energy consumption in the long run. This study demonstrates the pertinent role of public–private partnerships’ investment in energy in their pursuit of energy efficiency; however, caution is required when executing the PPP model in terms of the country’s economic, environmental, and contractual issues. Caution is also required regarding adequate risk allocation, which serves as a threat to the free flow of the PPP model in the energy sector. Second, it is recommended that government officials pursue strategies that focus on the improvement of regulations and standardization of the PPP project process to promote public–private partnership investment in energy. Third, caution is required regarding the influx of FDI and trade flows in regards to Turkey’s energy mix. This is necessary in order to mitigate inefficient energy use.

In conclusion, PPPs’ positive role in energy and facilitating infrastructural development, especially regarding mixed energy sources, is reiterated in this study in the sense that PPP engendered efficient use of energy, avoiding leakages. However, the PPP model can be a setback if there is no agreement between risk allocation and a county’s economic environment, the establishment of institutions in procurement bureaucracies, and the rules of engagement for the PPP process.

This study explored the role of PPP in Turkey’s mixture of energy sources using annual frequency data. Future studies can consider other dimensions of the energy efficiency debates by accounting for the role of energy prices. Additionally, the roles of demographic indicators, such as urbanization and industrialization, are key drivers for energy demand. Furthermore, future studies can advance the literature by expanding the data to either agree or refute study findings.