Energy Consumption, Carbon Emission and Economic Growth at Aggregate and Disaggregate Level: A Panel Analysis of the Top Polluted Countries

Abstract

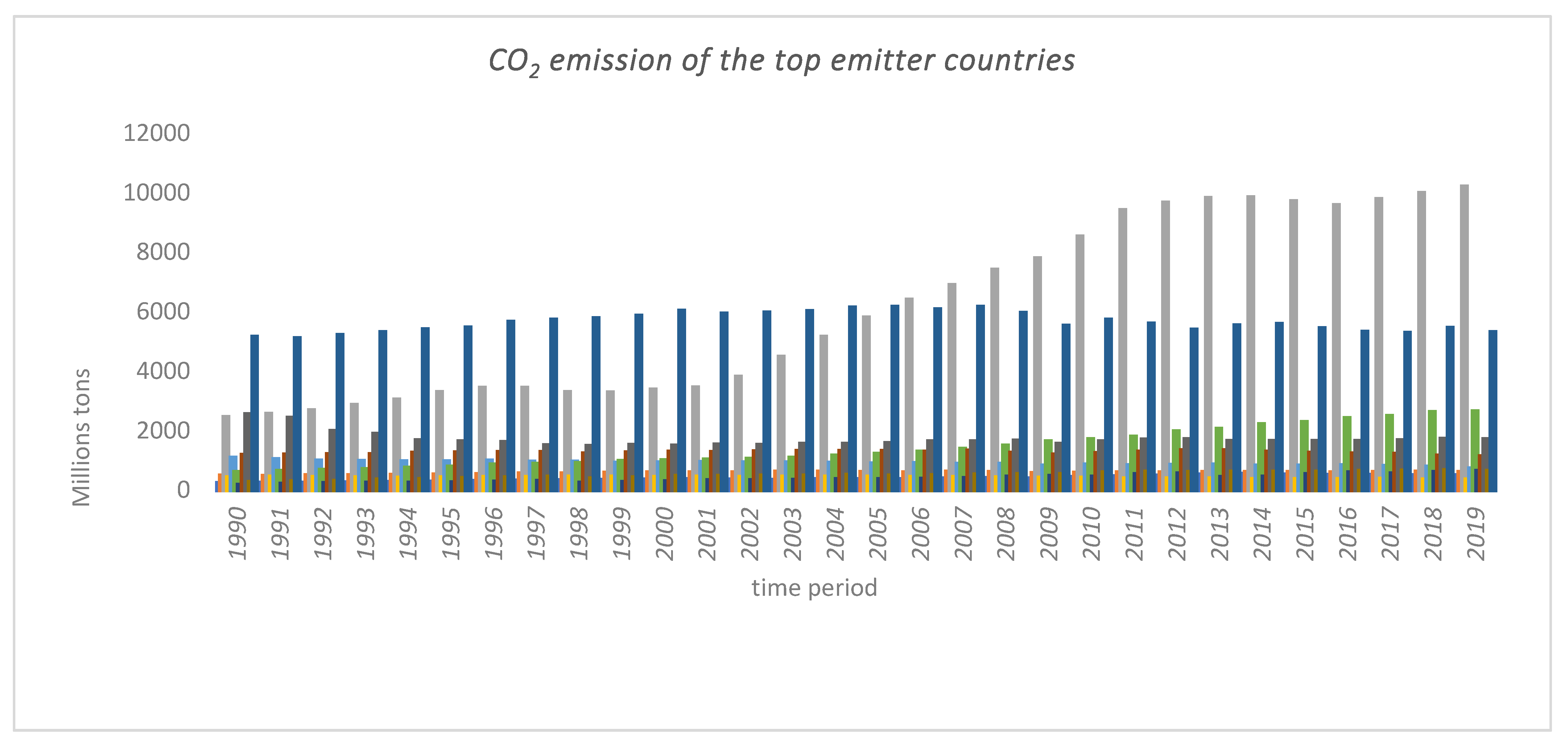

:1. Introduction

1.1. Rationale of Study

1.2. Gap

2. Data and Methodology

2.1. Tests of Cross-Sectional Dependence

Pesaran’s CD Test

2.2. Panel Unit Root Test

2.3. Panel Co-Integration Test

2.4. Panel Autoregressive Distributed Lag (PARDL) Model

3. Results

3.1. Aggregate Model Results of (PARDL)

3.2. Panel ARDL Results of Disaggregate CO2 Emissions from Coal Model

3.3. Panel ARDL Results of Disaggregate CCO2 Emissions from Gas Model

3.4. Panel ARDL Results of Disaggregate CO2 Emissions from Oil Model

4. Conclusions

- ➢

- Optimal pricing of alternative energy is required for the adoption of clean energy;

- ➢

- There is a need to shift the consumption pattern from oil and coal to gas;

- ➢

- The geopolitical crisis can also be resolved by lowering the demand for oil from the international market;

- ➢

- There is a need to adopt environmentally friendly and advanced technology by lowering trade barriers.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable Name | Measurement | Sources |

|---|---|---|

| CO2 | CO2 emissions (million tons) | www.bp.com |

| CCO2 | CO2 emissions from coal (million tons) | www.bp.com |

| GCO2 | CO2 emissions from oil (million tons) | www.bp.com |

| OCO2 | CO2 emissions from oil (million tons) | www.bp.com |

| EC | Energy consumption (kg of oil equivalent per capita) | https://data.worldbank.org |

| GDP | GDP (constant 2010 USD) | https://data.worldbank.org |

| IP | Industrial production (IP, constant 2010 USD) | https://data.worldbank.org |

| PD | Population density (people per sq. km of land area) | https://data.worldbank.org |

| TR | International trade as a (% of GDP) | https://knoema.com/WBGEM2020Mar/world-bank-global-economic-monitor |

References

- Iqbal, J.; Nosheen, M. Exploring the asymmetries between trade and consumption-based carbon emissions: Evidence from NPARDL approach. Environ. Sci. Pollut. Res. 2021, 28, 41780–41793. [Google Scholar]

- Iqbal, J.; Nosheen, M.; Khan, M.W.; Raja, E.U.H.; Jasim, M. An asymmetric analysis of the role of exports and imports in consumption-based carbon emissions in the G7 economies: Evidence from nonlinear panel autoregressive distributed lag model. Environ. Sci. Pollut. Res. 2021, 28, 53804–53818. [Google Scholar]

- Chi, M.; Muhammad, S.; Khan, Z.; Ali, S.; Li, R.Y.M. Is centralization killing innovation? The success story of technological innovation in fiscally decentralized countries. Technol. Forecast. Soc. Change 2021, 168, 120731. [Google Scholar] [CrossRef]

- Rahman, M.S.; Noman, A.H.M.; Shahari, F. Does economic growth in Malaysia depend on disaggregate energy? Renew. Sustain. Energy Rev. 2017, 78, 640–647. [Google Scholar] [CrossRef]

- Rani, R.; Kumar, N. Causality between economic growth, carbon dioxide emissions, oil, and coal consumption: Empirical evidence from India. Int. J. Glob. Energy Issues 2018, 41, 308–322. [Google Scholar] [CrossRef]

- Malik, M.Y.; Latif, K.; Khan, Z.; Butt, H.D.; Hussain, M.; Nadeem, M.A. Symmetric and asymmetric impact of oil price, FDI and economic growth on carbon emission in Pakistan: Evidence from ARDL and non-linear ARDL approach. Sci. Total Environ. 2020, 726, 138421. [Google Scholar] [CrossRef]

- Lazăr, D.; Minea, A.; Purcel, A.A. Pollution, and economic growth: Evidence from Central and Eastern European countries. Energy Econ. 2019, 81, 1121–1131. [Google Scholar] [CrossRef]

- Agboola, O.W. Energy consumption, carbon dioxide emission and sustainable growth in Nigeria. Int. J. Green Econ. 2018, 12, 294–307. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, C.; Lu, A.; Li, L.; He, Y.; ToJo, J.; Zhu, X. A disaggregated analysis of the environmental Kuznets curve for industrial CO2 emissions in China. Appl. Energy 2017, 190, 172–180. [Google Scholar] [CrossRef]

- Akadiri, S.S.; Bekun, F.V.; Taheri, E.; Akadiri, A.C. Carbon emissions, energy consumption and economic growth: Causality evidence. Int. J. Energy Technol. Policy 2019, 15, 320–336. [Google Scholar] [CrossRef]

- Raggad, B. Economic development, energy consumption, financial development, and carbon dioxide emissions in Saudi Arabia: New evidence from a nonlinear and asymmetric analysis. Environ. Sci. Pollut. Res. 2020, 27, 21872–21891. [Google Scholar] [CrossRef] [PubMed]

- Cetin, M.; Ecevit, E.; Yucel, A.G. The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: Empirical evidence from Turkey. Environ. Sci. Pollut. Res. 2018, 25, 36589–36603. [Google Scholar] [CrossRef] [PubMed]

- Zaman, K.; Abd-el Moemen, M. Energy consumption, carbon dioxide emissions and economic development: Evaluating alternative and plausible environmental hypothesis for sustainable growth. Renew. Sustain. Energy Rev. 2017, 74, 1119–1130. [Google Scholar] [CrossRef]

- Gessesse, A.T.; He, G. Analysis of carbon dioxide emissions, energy consumption, and economic growth in China. Agric. Econ. 2020, 66, 183–192. [Google Scholar] [CrossRef]

- Salari, M.; Javid, R.J.; Noghanibehambari, H. The nexus between CO2 emissions, energy consumption, and economic growth in the US. Econ. Anal. Policy 2021, 69, 182–194. [Google Scholar] [CrossRef]

- Ardakani, M.K.; Seyedaliakbar, S.M. Impact of energy consumption and economic growth on CO2 emission using multivariate regression. Energy Strategy Rev. 2019, 26, 100428. [Google Scholar] [CrossRef]

- Musah, M.; Kong, Y.; Mensah, I.A.; Antwi, S.K.; Donkor, M. The link between carbon emissions, renewable energy consumption, and economic growth: A heterogeneous panel evidence from West Africa. Environ. Sci. Pollut. Res. 2020, 27, 28867–28889. [Google Scholar] [CrossRef]

- Ganda, F. The relationship between energy consumption, trade, GDP (economic growth), population growth and carbon emissions: A recent evidence from South Africa. Int. J. Sustain. Econ. 2018, 10, 99–122. [Google Scholar] [CrossRef]

- Alam, M.M.; Murad, M.W.; Noman, A.H.M.; Ozturk, I. Relationships among carbon emissions, economic growth, energy consumption and population growth: Testing Environmental Kuznets Curve hypothesis for Brazil, China, India, and Indonesia. Ecol. Indic. 2016, 70, 466–479. [Google Scholar] [CrossRef]

- Munir, Q.; Lean, H.H.; Smyth, R. CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: A cross-sectional dependence approach. Energy Econ. 2020, 85, 104571. [Google Scholar] [CrossRef]

- Ozcan, B. The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: A panel data analysis. Energy Policy 2013, 62, 1138–1147. [Google Scholar] [CrossRef]

- Acheampong, A.O. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Econ. 2018, 74, 677–692. [Google Scholar] [CrossRef]

- Destek, M.A.; Aslan, A. Disaggregated renewable energy consumption and environmental pollution nexus in G-7 countries. Renew. Energy 2020, 151, 1298–1306. [Google Scholar] [CrossRef]

- Neves, S.A.; Marques, A.C.; Fuinhas, J.A. Is energy consumption in the transport sector hampering both economic growth and the reduction of CO2 emissions? A disaggregated energy consumption analysis. Transp. Policy 2017, 59, 64–70. [Google Scholar] [CrossRef]

- Yang, Z.; Zhao, Y. Energy consumption, carbon emissions, and economic growth in India: Evidence from directed acyclic graphs. Econ. Model. 2014, 38, 533–540. [Google Scholar] [CrossRef]

- Al-mulali, U.; Lee, J.Y.; Mohammed, A.H.; Sheau-Ting, L. Examining the link between energy consumption, carbon dioxide emission, and economic growth in Latin America and the Caribbean. Renew. Sustain. Energy Rev. 2013, 26, 42–48. [Google Scholar] [CrossRef]

- Hussain, M.; Javaid, M.I.; Drake, P.R. An econometric study of carbon dioxide (CO2) emissions, energy consumption, and economic growth of Pakistan. Int. J. Energy Sect. Manag. 2012, 6, 518–533. [Google Scholar] [CrossRef]

- Ehigiamusoe, K.U. A disaggregated approach to analyzing the effect of electricity on carbon emissions: Evidence from African countries. Energy Rep. 2020, 6, 1286–1296. [Google Scholar] [CrossRef]

- Awodumi, O.B.; Adewuyi, A.O. The role of non-renewable energy consumption in economic growth and carbon emission: Evidence from oil producing economies in Africa. Energy Strategy Rev. 2020, 27, 100434. [Google Scholar] [CrossRef]

- Alkhathlan, K.; Javid, M. Energy consumption, CO2 emissions and economic growth in Saudi Arabia: An aggregate and disaggregate analysis. Energy Policy 2013, 62, 1525–1532. [Google Scholar] [CrossRef]

- Hanif, I. Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on CO2 emissions in Sub-Saharan Africa. Environ. Sci. Pollut. Res. 2018, 25, 15057–15067. [Google Scholar] [CrossRef]

- Shahbaz, M.; Lean, H.H.; Farooq, A. Natural gas consumption and economic growth in Pakistan. Renew. Sustain. Energy Rev. 2013, 18, 87–94. [Google Scholar] [CrossRef] [Green Version]

- Shahbaz, M.; Lean, H.H. The dynamics of electricity consumption and economic growth: A revisit study of their causality in Pakistan. Energy 2012, 39, 146–153. [Google Scholar] [CrossRef]

- Liu, X. Aggregate and disaggregate analysis on energy consumption and economic growth nexus in China. Environ. Sci. Pollut. Res. 2018, 25, 26512–26526. [Google Scholar] [CrossRef] [PubMed]

- Breusch, T.S.; Pagan, A.R. The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; Working Papers in Economics No. 0435; University of Cambridge: Cambridge, UK, 2004. [Google Scholar]

- Nickell, S. Biases in dynamic models with fixed effects. Econom. J. Econom. Soc. 1981, 49, 1417–1426. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Smith, R. Estimating long-run relationships from dynamic heterogeneous panels. J. Econom. 1995, 68, 79–113. [Google Scholar] [CrossRef]

- Khan, M.K.; Teng, J.Z.; Khan, M.I. Effect of energy consumption and economic growth on carbon dioxide emissions in Pakistan with dynamic ARDL simulations approach. Environ. Sci. Pollut. Res. 2019, 26, 23480–23490. [Google Scholar] [CrossRef] [PubMed]

- Khan, M.W.A.; Panigrahi, S.K.; Almuniri, K.S.N.; Soomro, M.I.; Mirjat, N.H.; Alqaydi, E.S. Investigating the dynamic impact of CO2 emissions and economic growth on renewable energy production: Evidence from FMOLS and DOLS tests. Processes 2019, 7, 496. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Baltagi, B.H. Econometric Analysis of Panel Data; John Wiley & Sons: Chichester, UK, 2008. [Google Scholar]

- Breitung, J.; Pesaran, M.H. Unit roots and cointegration in panels. In The Econometrics of Panel Data; Springer: Berlin/Heidelberg, Germany, 2008; pp. 279–322. [Google Scholar]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Awosusi, A.A.; Kirikkaleli, D.; Akinsola, G.D.; Mwamba, M.N. Can CO2 emissions and energy consumption determine the economic performance of South Korea? A time series analysis. Environ. Sci. Pollut. Res. 2021, 28, 38969–38984. [Google Scholar] [CrossRef]

- Westerlund, J. New simple tests for panel cointegration. Econom. Rev. 2005, 24, 297–316. [Google Scholar] [CrossRef]

- Breitung, J. Nonparametric tests for unit roots and cointegration. J. Econom. 2002, 108, 343–363. [Google Scholar] [CrossRef]

- Saliminezhad, A.; Bahramian, P. Clean energy consumption and economic growth nexus: Asymmetric time and frequency domain causality testing in China. Energy Sources Part B Econ. Plan. Policy 2020, 15, 1–12. [Google Scholar] [CrossRef]

- Islam, R.; Ghani, A.B.A. Link among energy consumption, carbon dioxide emission, economic growth, population, poverty, and forest area: Evidence from ASEAN country. Int. J. Soc. Econ. 2018, 45, 275–285. [Google Scholar] [CrossRef]

- Zhu, H.; Duan, L.; Guo, Y.; Yu, K. The effects of FDI, economic growth and energy consumption on CO2 emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 2016, 58, 237–248. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, H.; Yuan, J. Economic growth, energy consumption, and carbon emission nexus: Fresh evidence from developing countries. Environ. Sci. Pollut Res. 2019, 26, 26367–26380. [Google Scholar] [CrossRef] [PubMed]

- Al-mulali, U.; Che Sab, C.N.B. The impact of coal consumption and CO2 emission on economic growth. Energy Sources Part B Econ. Plan. Policy 2018, 13, 218–223. [Google Scholar] [CrossRef]

- Bekun, F.V.; Emir, F.; Sarkodie, S.A. Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci. Total Environ. 2019, 655, 759–765. [Google Scholar] [CrossRef]

- Emir, F.; Bekun, F.V. Energy intensity, carbon emissions, renewable energy, and economic growth nexus: New insights from Romania. Energy Environ. 2019, 30, 427–443. [Google Scholar] [CrossRef]

- Fatima, T.; Xia, E.; Ahad, M. An aggregate and disaggregate energy consumption, industrial growth, and CO2 emission: Fresh evidence from structural breaks and combined cointegration for China. Int. J. Energy Sect. Manag. 2018, 12, 130–150. [Google Scholar] [CrossRef]

- Bouznit, M.; Pablo-Romero, M.D.P. CO2 emission and economic growth in Algeria. Energy Policy 2016, 96, 93–104. [Google Scholar] [CrossRef]

| Variables | Breusch–Pagan LM | Pesaran-Scaled LM | Bias-Corrected Scaled LM | Pesaran CD |

|---|---|---|---|---|

| LCO2 | 730.84 *** | 64.44 *** | 64.25 *** | 3.560 * |

| LCCO2 | 995.45 *** | 85.85 *** | 85.66 *** | 0.150 *** |

| LGCO2 | 861.84 *** | 76.93 *** | 76.74 *** | 27.60 *** |

| LOCO2 | 753.17 *** | 66.57 *** | 66.38 *** | 0.750 *** |

| LEC | 758.14 *** | 67.04 *** | 66.85 *** | 1.070 *** |

| LGDP | 1458.02 *** | 133.77 *** | 133.58 *** | 38.02 *** |

| LIP | 623.75 *** | 54.23 *** | 54.04 *** | 9.120 *** |

| PD | 1204.56 *** | 109.61 *** | 109.42 *** | 21.930 *** |

| TR | 557.38 *** | 47.90 *** | 47.71 *** | 15.600 *** |

| Models | Delta | Adjusted Delta Tilde |

|---|---|---|

| Model-1 LCO2 = f (LEC, LGDP, LIP, PD, TR) | −6.30 *** | −10.45 *** |

| Model-2 LCCO2 = f (LEC, LGDP, LIP, PD, TR) | −5.28 *** | −8.75 *** |

| Model-3 LGCO2 = f (LEC, LGDP, LIP, PD, TR) | −6.81 *** | −11.23 *** |

| Model-4 LOCO2 = f (LEC, LGDP, LIP, PD, TR) | −6.76 *** | −11.20 *** |

| Cross-Sectionally Augmented IPS (CIPS, 2007) | ||

|---|---|---|

| Variables | Level | Order of Integration |

| LCO2 | −3.48 *** | I (0) |

| LCCO2 | −3.14 *** | I (0) |

| LGCO2 | −1.94 | I (1) |

| LOCO2 | −2.49 *** | I (0) |

| LEC | −1.61 | I (1) |

| LGDP | −3.06 *** | I (0) |

| LIP | −3.59 *** | I (0) |

| PD | −1.43 | I (1) |

| TR | −1.91 | I (1) |

| Models | Variance Ratio (Statistic) | p-Value | Co-Integration Exists |

|---|---|---|---|

| Model-1 LCO2 = f (LEC, LGDP, LIP, PD, TR) | 4.8812 | 0.0000 | Yes |

| Model-2 LCCO2 = f (LEC, LGDP, LIP, PD, TR) | 2.404 | 0.0081 | Yes |

| Model-3 LGCO2 = f (LEC, LGDP, LIP, PD, TR) | 22.874 | 0.0000 | Yes |

| Model-4 LOCO2 = f (LEC, LGDP, LIP, PD, TR) | 14.567 | 0.0000 | Yes |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. * |

|---|---|---|---|---|

| Dependent variable; CO2 | Long-Run Equation | |||

| LEC | 0.949593 | 0.079269 | 11.97942 | 0.0000 |

| LGDP | 0.123012 | 0.051654 | 2.381476 | 0.0182 |

| LIP | 0.012787 | 0.055625 | 0.229878 | 0.8184 |

| PD | 0.004258 | 0.000412 | 10.33698 | 0.0000 |

| TR | −0.002628 | 0.000558 | −4.707642 | 0.0000 |

| Dependent variable; CO2 | Short-Run Equation | |||

| COINTEQ01 | −0.177040 | 0.082753 | −2.139374 | 0.0337 |

| D(LEC) | 0.446371 | 0.222972 | 2.001913 | 0.0467 |

| D(LGDP) | 0.453656 | 0.156210 | 2.904138 | 0.0041 |

| D(LIP) | −0.057310 | 0.045241 | −1.266792 | 0.2068 |

| D(PD) | −0.044685 | 0.060031 | −0.744370 | 0.4576 |

| D(TR) | 0.000416 | 0.000475 | 0.874857 | 0.3827 |

| C | 1.645752 | 0.717668 | 2.293195 | 0.0229 |

| Mean dependent var | 0.016463 | S.D. dependent var | 0.053726 | |

| S.E. of regression | 0.042846 | Akaike info criterion | −4.717007 | |

| Sum squared resid | 0.354311 | Schwarz criterion | −3.638552 | |

| Log-likelihood | 730.5885 | Hannan–Quinn criteria. | −4.284192 | |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. * |

|---|---|---|---|---|

| Dependent variable; CCO2 | Long-Run Equation | |||

| LEC | 2.349141 | 0.227240 | 10.33773 | 0.0000 |

| LGDP | −0.915808 | 0.134216 | −6.823393 | 0.0000 |

| LIP | −0.020424 | 0.066491 | −0.307166 | 0.7590 |

| PD | 0.011191 | 0.002904 | 3.854142 | 0.0001 |

| TR | 0.006239 | 0.002172 | 2.872824 | 0.0044 |

| Dependent variable; CCO2 | Short-Run Equation | |||

| COINTEQ01 | −0.206805 | 0.054009 | −3.829110 | 0.0002 |

| D(LEC) | 0.166457 | 0.385363 | 0.431948 | 0.6662 |

| D(LGDP) | 0.427531 | 0.209855 | 2.037270 | 0.0427 |

| D(LIP) | 0.067281 | 0.063426 | 1.060782 | 0.2898 |

| D(PD) | 0.198828 | 0.111873 | 1.777273 | 0.0767 |

| D(TR) | 0.002819 | 0.001434 | 1.965354 | 0.0505 |

| C | 5.253246 | 1.467027 | 3.580878 | 0.0004 |

| Mean dependent var | 0.014665 | S.D. dependent var | 0.114659 | |

| S.E. of regression | 0.087832 | Akaike info criterion | −2.868478 | |

| Sum squared resid | 1.913201 | Schwarz criterion | −1.924461 | |

| Log-likelihood | 555.2988 | Hannan–Quinn criteria | −2.491923 | |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. * |

|---|---|---|---|---|

| Dependent variable; GCO2 | Long Run Equation | |||

| LEC | −1.789820 | 0.436701 | −4.098500 | 0.0001 |

| LGDP | −0.733948 | 0.325836 | −2.252506 | 0.0254 |

| LIP | 1.277670 | 0.387333 | 3.298635 | 0.0012 |

| PD | 0.013408 | 0.003536 | 3.791650 | 0.0002 |

| TR | −0.010776 | 0.002707 | −3.980935 | 0.0001 |

| Dependent variable; GCO2 | Short Run Equation | |||

| COINTEQ01 | −0.187061 | 0.070491 | −2.653703 | 0.0086 |

| D(LEC) | 0.896923 | 0.366204 | 2.449241 | 0.0152 |

| D(LGDP) | 0.218600 | 0.276265 | 0.791271 | 0.4298 |

| D(LIP) | −0.402277 | 0.141615 | −2.840650 | 0.0050 |

| D(PD) | 0.031365 | 0.034774 | 0.901971 | 0.3682 |

| D(TR) | 0.000799 | 0.002418 | 0.330425 | 0.7414 |

| C | 3.119797 | 1.125986 | 2.770723 | 0.0061 |

| Mean dependent var | 0.040745 | S.D. dependent var | 0.104016 | |

| S.E. of regression | 0.205264 | Akaike info criterion | −2.823305 | |

| Sum squared resid | 8.131719 | Schwarz criterion | −1.744850 | |

| Log-likelihood | 470.2045 | Hannan–Quinn criteria | −2.390490 | |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. * |

|---|---|---|---|---|

| Dependent variable; OCO2 | Long-Run Equation | |||

| LEC | 0.717997 | 0.109664 | 6.547216 | 0.0000 |

| LGDP | 0.369502 | 0.077766 | 4.751479 | 0.0000 |

| LIP | −0.116989 | 0.067136 | −1.742563 | 0.0826 |

| PD | −0.000982 | 0.001875 | −0.523936 | 0.6008 |

| TR | −0.006615 | 0.000643 | −10.28572 | 0.0000 |

| Dependent variable; OCO2 | Short-Run Equation | |||

| COINTEQ01 | −0.195378 | 0.085964 | −2.272778 | 0.0239 |

| D(LEC) | 0.485550 | 0.125315 | 3.874649 | 0.0001 |

| D(LGDP) | 0.427650 | 0.162573 | 2.630516 | 0.0091 |

| D(LIP) | −0.027958 | 0.048725 | −0.573781 | 0.5666 |

| D(PD) | 0.073759 | 0.051448 | 1.433652 | 0.1529 |

| D(TR) | −0.000374 | 0.000840 | −0.444896 | 0.6568 |

| C | 1.427686 | 0.604875 | 2.360298 | 0.0190 |

| Mean dependent var | 0.011617 | S.D. dependent var | 0.062187 | |

| S.E. of regression | 0.036311 | Akaike info criterion | −3.930103 | |

| Sum squared resid | 0.326993 | Schwarz criterion | −2.986086 | |

| Log-likelihood | 730.4671 | Hannan–Quinn criteria. | −3.553549 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sharif, F.; Hussain, I.; Qubtia, M. Energy Consumption, Carbon Emission and Economic Growth at Aggregate and Disaggregate Level: A Panel Analysis of the Top Polluted Countries. Sustainability 2023, 15, 2935. https://doi.org/10.3390/su15042935

Sharif F, Hussain I, Qubtia M. Energy Consumption, Carbon Emission and Economic Growth at Aggregate and Disaggregate Level: A Panel Analysis of the Top Polluted Countries. Sustainability. 2023; 15(4):2935. https://doi.org/10.3390/su15042935

Chicago/Turabian StyleSharif, Fatima, Ihsanullah Hussain, and Maria Qubtia. 2023. "Energy Consumption, Carbon Emission and Economic Growth at Aggregate and Disaggregate Level: A Panel Analysis of the Top Polluted Countries" Sustainability 15, no. 4: 2935. https://doi.org/10.3390/su15042935

APA StyleSharif, F., Hussain, I., & Qubtia, M. (2023). Energy Consumption, Carbon Emission and Economic Growth at Aggregate and Disaggregate Level: A Panel Analysis of the Top Polluted Countries. Sustainability, 15(4), 2935. https://doi.org/10.3390/su15042935