Abstract

The emitted levels of CO2 continue to be a striking topic. These emissions have been growing over the years, thus, making them a predicament to be reckoned with. Eradicating such a predicament has not been easy because finding an optimal determinant has not been achieved by scholars; however, foreign direct investment inflows are known to play a role in such varying instances. Therefore, to analyze the impact that such inflows have on CO2 emissions, this study employs data from 41 African countries from 2005 to 2019 and aims to assess how foreign direct investment and other variables influence CO2 emitted levels. Moreover, this study tests the validity of the pollution haven and halo hypotheses on the employed African countries as its two main objectives. After applying the pooled least squares, fixed and random effects models, and the generalized method of moments, the findings revealed that per the adopted African countries, the pollution haven and halo hypotheses do not hold; however, foreign direct investment inflows contribute to the rising and falling levels of CO2 emissions. In addition, the financial structure and per capita GDP increase the African countries’ CO2 emitted levels, while trade openness causes a reduction. Based on the aforementioned findings, this study recommends that the government, policy-makers, industries, and interested personnel of this study’s employed countries should: apply and execute policies, laws, and regulations that will deter or punish polluting foreign investment and encourage clean ones; since green finance is making waves but is not well established in most African countries, green financing systems should be initiated and implemented; establish preferential trading policies that will highlight an addition of value via clean technology; and practice carbon capture, usage, and storage.

1. Introduction

As the world evolves into a technologically globalized setting, new predicaments have materialized, requiring the use of finance and its factors to analyze and contemplate solutions [1]. Recent events have showcased climate change, specifically global warming, as a predicament to be reckoned with [2]. This is because certain human activities increase the atmospheric concentrations of greenhouse gases (the most frequent greenhouse gas associated with global warming is carbon dioxide (CO2)), gradually increasing Earth’s temperature and bringing about global warming.

It is undoubtedly true that CO2 emissions have been growing these past few years, which is attributable to various causes and reasons [3] to enhance people’s quality of life. Countries, organizations, etc., have prioritized the need for reducing these emissions, but to fully understand and eradicate the predicament (i.e., CO2 emissions), the causes must be known. Since a sole sector or factor has not been singled out over the years as the contributor to such a phenomenon, researchers have taken it upon themselves to research and discover its various determinants. Due to its linkage to the environment, most existing works in the literature explore its correlation with environmental factors. However, it has been realized that financial factors and activities correlate with this phenomenon.

Over the years, some scholars employed foreign direct investment (FDI), financial development, etc., to explore their correlation with carbon emissions. For instance, Seker et al. [4] looked into how Turkey’s FDI and other factors affected CO2 emissions from 1974 to 2010. Analyzing data from 17 Asian countries, Khan and Ozturk [5] explored the causal relationship between CO2 emissions and FDI and a few other variables. Jiang and Ma [6] explored the correlation between financial development and CO2 emissions for 155 countries, while Wen et al. [7] analyzed financial structures’ impact on emission reduction using data from China’s provinces. Due to the dissimilar factors, data, and the methods employed, the conclusions drawn have been mixed.

Nevertheless, FDI has proven to have a significant impact on CO2 emissions. Due to their lax environmental regulations, abundant natural resources, and cheap labor, amongst other factors, African countries are known to be attractive for FDIs. It is commonly known that industrialized businesses from developed countries strive to construct facilities in these (African) countries. As a result, more significant FDI can result in higher carbon emission levels in such countries, thus, introducing the infamous Pollution Haven Hypothesis [8]. However, some scholars refute the notion behind the Pollution Haven Hypothesis and conclude that more significant FDI can result in lower carbon emission levels, thus, introducing the opposing infamous Pollution Halo Hypothesis [9].

Do FDI inflows in African countries possess good attributes that contribute to reducing CO2 emissions? Contrarily, do these inflows pose a threat and cause a rise in their CO2 emissions? These questions have puzzled some financial, research, and policy-making people.

When industrialized facilities are established in African countries through FDI, they provide benefits, such as clean technologies, but sometimes, the cost outweighs the benefits. These facilities release chemicals into the air, thus, polluting and degrading the environment of the host countries. The emissions cause airborne diseases and increase the atmospheric temperature, which contributes to the rise in the world’s temperature, leads to global warming, and affects the health of inhabitants of such countries. Consequently, this affects the government and policy-makers because the time and resources geared towards the countries’ development must be rerouted to combat the rise in CO2 emission levels. This slows down the countries’ development, affects the health of the inhabitants, depletes the environment, and distracts the countries from achieving their set aims within their apportioned times.

Governments, policy-makers, researchers, etc., attach much importance to CO2 emissions due to their intricate nature and effects; many steps have been taken to reduce such a predicament over the years. For instance, the Kyoto Protocol was approved and became efficacious on 11 December 1997 and 16 February 2005, respectively [10]; the Paris Agreement was approved and became efficacious on 12 December 2015 and 4 November 2016, respectively [11]. Other examples include the EU Emissions Trading Scheme [12]; green investments [13]; etc. Although these prevention measures have been implemented previously, with some still in effect, curbing the continuous rise in CO2 emissions is still not achieved, thus, raising the need for further studies.

This research assesses Foreign Direct Investment and other variables influencing carbon dioxide emissions as its main aim. By adopting such variables, this study analyzes the correlation between the selected variables. Additionally, the objectives operationalized from the main aim of this study are (1) to check for the existence of the pollution haven hypothesis, (2) to check for the existence of the pollution halo hypothesis, and (3) to provide researchers, governments, policy-makers, and interested personnel with an empirical conclusion. Moreover, this study’s results offer insight into how finance (represented by FDI, financial structure, and development in this study) plays a role in the context of carbon dioxide emissions. It adds to the corpus of the existing literature by assessing data from African countries and fusing previously used methodologies and variables into a unified paradigm. The findings of this study reveal the determinants or factors that contribute to the growth and reduction in CO2 emissions in African countries. In terms of significance, this study and its outcome will theoretically serve as a precedent for future studies and, practicality wise, provide the adopted African countries’ governments, policy-makers, and individuals with empirical evidence and suggestions to aid in improvements to the environment.

2. Literature Review

This section elucidates the earlier literature relevant to the current study. Most developed countries, such as Switzerland and the US, are reputable for being industrialized. As time proceeds in the early stages, their economic and financial progress begins to rise together with the environmental deterioration caused by pollution; they rely on traditional forms of energy at those stages. However, they reach a particular turning point, in which their progress corresponds to environmental improvement; they turn to clean ways of operating and renewable energy to reduce their ecological footprint [14,15], thus, generating the underlying idea behind the Environmental Kuznets Curve [16]. After reaching the turning point, some of these industrialized countries export and establish their industrial facilities in the form of FDIs in developing countries, since they (developing countries) have a vast array of natural resources, relaxed environmental laws, plus lower labor costs. As such, these developed countries reduce their pollution levels and improve their environment while the developing countries bear the cost. However, is that always the case (see Section 2.1)?

2.1. Pollution Haven (PHVHP) and Halo (PHLHP) Hypotheses

The pollution haven hypothesis propounds that, as countries advance and develop, they adopt stricter environmental regulations than countries in the developing phase. Consequently, this distorts the existing comparative advantage patterns. As a result, the polluting industries relocate their facilities and activities from developed to developing countries, turning the latter into pollution havens [17,18]. On the other hand, the pollution halo hypothesis asserts that international corporations convey their greener technologies to developing countries through FDI. Green innovations, such as those that reduce pollution or use renewable energy sources and highly energy-efficient ones, lessen the need for traditional energy sources [18,19].

Since the introduction of these hypotheses, numerous studies have been undertaken to determine their viability, some involving two or more countries, while others were country specific. Despite trending areas of research, the conclusions drawn concerning these hypotheses have been dissimilar. Due to brevity, Table 1 summarizes some of the works of literature conducted on these two hypotheses.

Table 1.

Succinct works of literature on the PHVPH and PHLHP.

2.2. CO2 Emissions

Carbon dioxide (CO2) is assuredly one of the most emitted greenhouse gases worldwide. In 2021, it recorded the highest figure ever, with 36.3 billion tonnes, a 6% increase from the previous year [40]. Such an increase affects not only the economic setup but also the financial and, obviously, the environmental setup of countries. The top emitting countries have unquestionably been implementing policies and actions to reduce emissions for the betterment of the environment, country, and the world. An instance is China, a developing country and the largest emitter in the world, setting objectives, such as the dual carbon national target, which by 2030, calls for a peak in carbon emissions and to become carbon neutral by 2060 [41]. With this technique, CO2 emissions are significantly reduced through market forces.

For over a decade, researchers have been fixated on CO2 emissions due to the necessity to develop strategies and policies to combat global warming. During this time, a substantial number of studies have developed, many of which have been allotted to examine the determinants. Using the STIRPAT model on data from 2004 to 2013 from China, Zhang and Xu tested and identified a significant effect of land urbanization and finance on carbon emissions [42]. To compare the alikeness and variations in the factors that affect CO2 emissions, Ouyang and Lin conducted comparison research between China and Japan, at various phases of urbanization. Their findings demonstrated that although CO2 emissions in China and Japan exhibited stiff development during urbanization processes, there is still substantial variation in variables, such as CO2 emissions per capita [43]. Hafeez et al., employing data from 1980 to 2016, explored the implications of finance on CO2 emissions of 52 participants in the OBORI. They applied the FMOLS and DOLS models and uncovered that finance and CO2 emissions share bidirectional causality in the short run, and finance significantly accelerates environmental deterioration based on their long-run estimates [44].

The steady increase in CO2 emissions continues to make it a popular research topic due to its impact on the world. As a result, this study purports to establish how foreign direct investment inflows and other factors affect their rise or decline with the study’s chosen dataset.

2.3. FDI vs. CO2 Emissions

The CO2 emissions–FDI nexus has been empirically tested by several studies. Still, like many studies, the conclusions drawn have been dissimilar, attributable to different aims, data spans, variables, etc. For instance, by analyzing a panel of data comprising twenty-five provinces in China with a spatial econometric model, Tang et al. studied the variation in the influence of FDI on carbon productivity under various entry routes from 2007 to 2019. Their research concluded that a positive spatial spillover effect is amenable to boosting China’s carbon productivity when FDI enters China through joint ventures. Still, there is a negative spatial spillover effect when FDI moves into China through wholly foreign-owned enterprises, which will impede the improvement in China’s carbon productivity [45]. Kim used VECM to analyze the causal linkages between CO2 emissions, FDI, and other variables using data from fifty-seven developing nations between 1980 and 2013 and discovered that FDI does not directly cause CO2 emissions in the short run [46]. Abban et al. evaluated data for BRI nations spanning 20 years and discovered a bidirectional causal link between FDI and CO2 [47]. Islam et al. studied FDI’s impact on CO2 emissions in Bangladesh over 44 years while institutional quality was present, revealing that FDI has a negative impact on CO2 emissions [48]. Although dissimilar, these studies provided the theoretical framework for continuous research, including the current study.

2.4. Other Financial Variables vs. CO2 Emissions

Finance plays a role in the emissions of CO2, but with the varieties of finance, extensive study is required to find the other forms or acts that impact CO2 emissions. In earlier times, most research about environmental degradation (referring to CO2 emissions) had FDI as the sole financial determinant but began to incorporate others over time, such as financial development and structure, posited to impact carbon emissions significantly [6,7]. To answer the question, “Does financial structure affect CO2 emissions?”, Yao and Tang employed the G20′s data from 1971 to 2014, applied the STIRPAT method, and uncovered that, based on their analysis, there is significant heterogeneity in the effects of financial structure on carbon dioxide emissions. Moreover, there exists a negative correlation between financial structure and CO2 emissions in developed countries [49].

Funding via an optimal capital structure (thus, finance activities utilizing either more debt or equity) has always been an issue for countries’ governments and management in companies. In retrospect, for countries, [50] found that there would be an 11.5% reduction in global per capita carbon emissions if all nations’ financial structures were converted to at least 50% equity financing, implying that a good financial structure in the form of equity financing will propel a country’s financial and environmental development. Empirically testing the causal nexus between CO2 emissions, financial development, and other indicators, Jamel and Maktouf employed the Cobb–Douglas production function and discovered that the neutrality hypothesis connects carbon emissions and financial sector development inflows in their study [51]. One way or another, [52,53] employed financial development or financial structure as their explanatory variables to explore the correlation effect they have on CO2 emissions. Therefore, this study adopts them as explanatory variables to analyze how other financial variables aside from FDI might play a role in the rise or fall of CO2 emissions.

Some works of literature have been published examining the relationship between CO2 emissions and FDI inflows, financial structure, or financial development. However, very few researchers have attempted to link the three in a unified framework. Moreover, there are not enough works that utilized, if not all, almost all African countries as a sample in such a context; most are country specific. Further, some scholars have tested the validity of the pollution halo and haven hypotheses, but the outcomes have been quite dissimilar. Therefore, this study attempts to fill these literary gaps by combining previously adopted models to analyze the relationship between CO2 emissions and FDI inflows, financial structure, and financial development. Furthermore, this study tests for the validity of both the pollution halo and haven hypotheses by adopting African countries as the study sample. Overall, a unified framework is established to address diverse literary gaps and provide an empirical conclusion to governments and policy-makers to aid in the protection of the environment.

3. Study Settings

The current research adopts data from 41 African countries from 2005 to 2019 as its sample. This research assesses Foreign Direct Investment (FDI) and other variables influencing CO2 emissions as its primary aim. CO2 emission per capita, denoted as CEM, is employed as the response variable. The data are sourced from the website of Our World in Data [54]. FDI annual inflows, denoted as FDI, are chosen as the core explanatory variable. In contrast, financial development and financial structure, denoted as FND and FNS, respectively, are chosen as the other explanatory variables.

Contrary to the findings from [50] of an equity-based financial structure being beneficial, this research analyzes the effect a debt-based financial structure will have on CO2 emissions. Thus, the financial structure in this research is estimated as the private sector’s credit extended to them from banks to analyze how the ease of borrowing provided by the financial systems (i.e., banks) can contribute to CO2 emission levels. The data for the annual FDI inflows and financial structure of the chosen countries were sourced from the World Bank’s World Development Indicators (WDI) database [55].

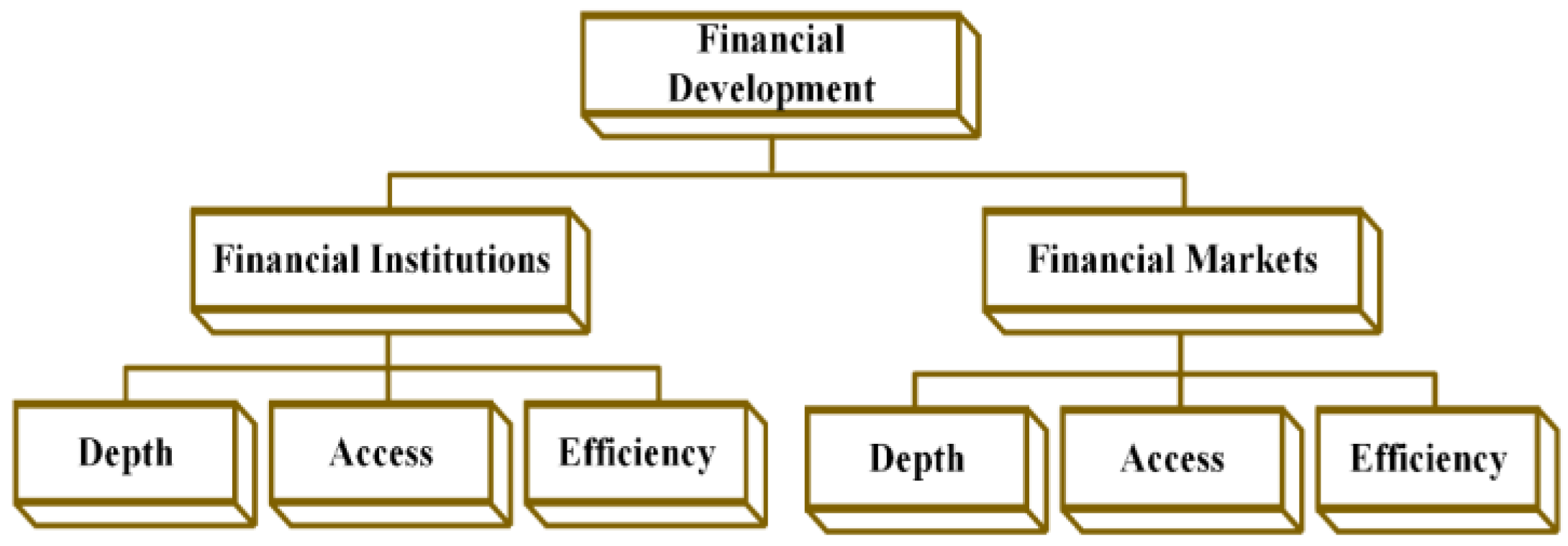

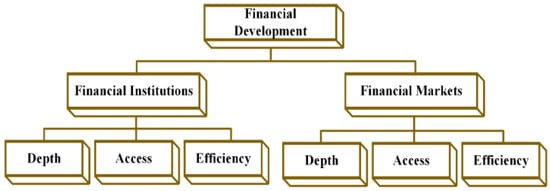

Financial development entails various factors due to its multifaceted process, which is why it has been expressed in diverse forms in different literary works. Due to its complex yet expansive coverage nature, this research applies the financial development index proposed by Katsiaryna Svirydzenka [56]. This index concludes by summarizing the “depth, access, and efficiency” of financial institutions and markets (see Figure 1) to address the limitations of single measures as substitutes for financial development. The data of this index are sourced from the IMF Financial Development Index Database [57].

Figure 1.

Financial development index proposed by Svirydzenka [56]. Source: author’s construct.

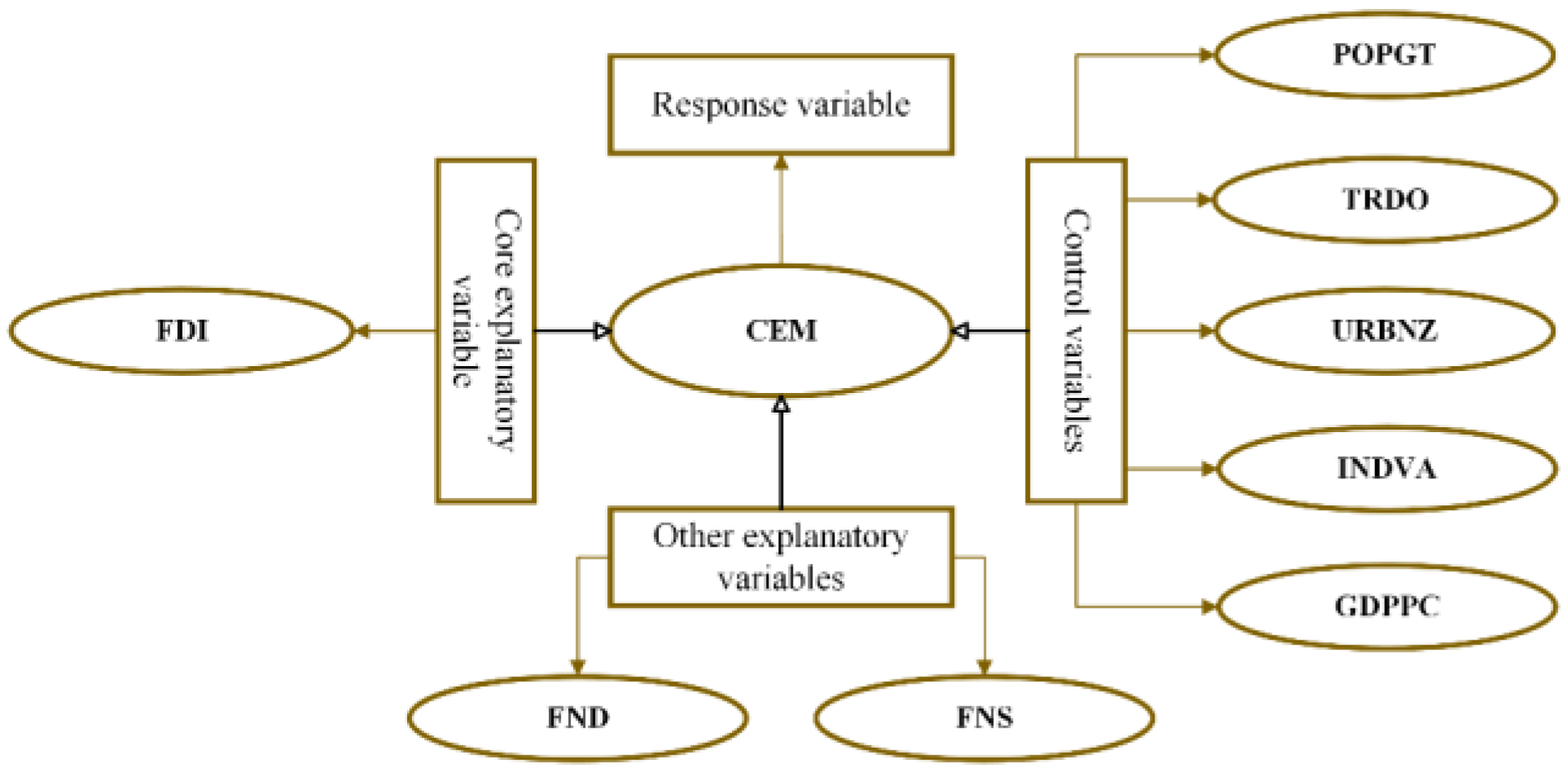

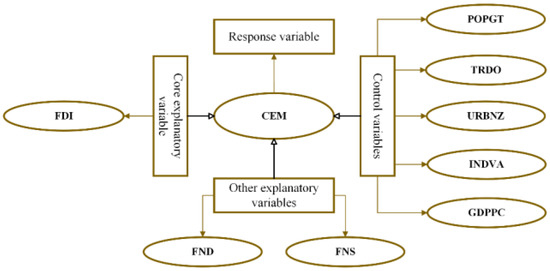

Moreover, to avoid white noise caused by unaccounted factors, provide reasonable model estimates, and follow the works of [37,49,58,59], control variables, namely trade openness, population growth, urbanization, industry value added, and gross domestic product per capita, denoted as TRDO, POPGT, URBNZ, INDVA, and GDPPC, respectively, were employed. The data for the control variables were sourced from the World Bank’s World Development Indicators (WDI) database [55]. A visual representation of the employed variables is depicted in Figure 2.

Figure 2.

Variable specifications. Source: author’s construct.

3.1. Data Normalization

Data used for research sometimes appear sporadic, and this research’s data are no exception. Due to the wide range of figures and different data characteristics, they were normalized to transform into a standard format. As a result, normalizing the data will eradicate the vast differences in the numerical relationships amongst the variables, allowing different types of variables to be evaluated and the data to fall within a narrower specific interval. n number of samples are firstly selected for m number of chosen variables; then, the data are normalized using Equations (1) and (2). Equation (1) is used if the selected variable negatively impacts the CEM; otherwise, Equation (2) is used.

Here, and connotes the normalized and actual figures for a variable with n in all the years; and connote the maximum and minimum figures of each n in all the years for the variable.

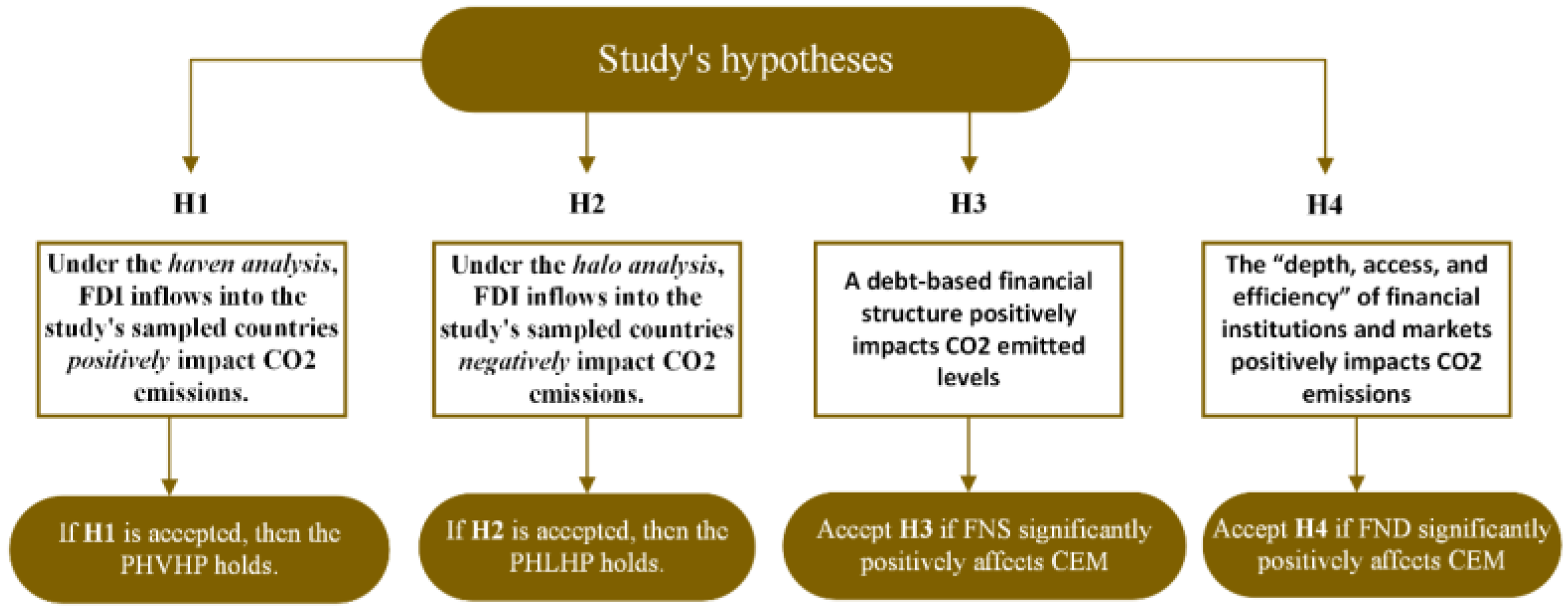

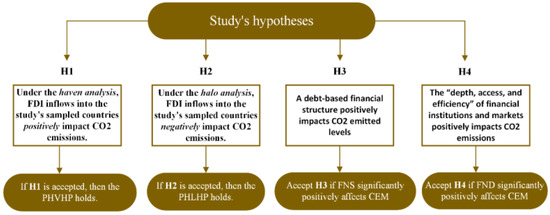

3.2. Study Hypotheses

Howbeit, FDI inflows might harm or protect the host country’s environment by contributing to a rise or fall in CO2 emissions. Therefore, the analyses carried out in this study are in two folds: one for the haven analysis to test and validate the existence of the PHVHP and the other for the halo analysis to test and validate the existence of the PHLHP. Furthermore, this study analyzes the effect finance (represented by a debt-based financial structure and financial development) has on CO2 emissions. Therefore, this study puts forth the hypotheses shown in Figure 3.

Figure 3.

Study’s hypotheses. Source: author’s construct.

4. Results and Discussion

The discoveries made during the analysis of the data acquired for this research are highlighted and discussed in this section. Due to their erratic character, the initial data are first normalized for the estimations before being used.

4.1. Descriptive Statistics and Correlation Analysis

A descriptive analysis was performed before the diagnostic analytics to assess changes in the variables’ patterns. The total data set from 2005 to 2019 includes representation from 41 countries (refer to Table 2). The results of the descriptive analyses’ chosen response, explanatory, and control variables are concentrated on their means, standard deviations, skewness, and kurtosis, as well as 615 observations and 41 cross-sections. Equations 1 and 2 from Section 3.1 were used to normalize the core explanatory variable to determine the validity of the pollution haven and halo hypotheses, accounting for two FDI values being used: FDI and FDI1.

Table 2.

Descriptive analysis of employed variables.

The standard deviation values show that the employed data are fairly clustered around their means. Furthermore, CEM, FDI, and URBNZ have positive skewness outcomes, insinuating a significant number of their distributions lies on the left side of the normal curve, whilst the remaining variables have a significant number of their distributions on the right side of the normal curve. Further, all the variables’ kurtosis values are lower than 3, indicating they have a platykurtic distribution. Moreover, a correlation analysis was conducted, and per the results in Table 3, all the variables strongly correlated.

Table 3.

Correlation analysis of employed variables.

4.2. Diagnostic Statistics

4.2.1. Unit Root Test

Due to the regression analysis carried out in this research to assess the relationship between CEM and the remaining variables, unit root tests were carried out to avoid spurious regression estimates. The LLC and Fisher-type (ADF and PP) tests were applied (see Table 4). At that level, most of the variables were stationary under the three tests, but not all. The variables were integrated to order one and retested; all but the urbanization variable under the LLC were stationary.

Table 4.

Unit root tests of employed variables.

4.2.2. Regression Estimates

The pooled least squares (referred to as Pooled in Table 5 and PLS hereinafter), fixed effects (referred to as Fixed in Table 5 and FE hereinafter), and random effects (referred to as Random in Table 5 and RE hereinafter) models were conducted utilizing the STATA 17MP software(China)’s in-built functions. The two main objectives of this research are to validate the pollution haven and halo hypotheses. As such, the analyses conducted are in two folds, one for the haven hypothesis and the other for the halo hypothesis. Year dummy variables were introduced in the analyses to control for the year effects.

Table 5.

Regression analyses.

The outcome for the haven and halo analyses (refer to Table 5) depicts that the constant coefficient for the PLS, FE, and RE are all significant at the 1% significance level. Under the haven analysis, FDI negatively correlates with CEM, while it correlates positively with CEM under the halo analysis under the three models. However, only its coefficient in the FE model is significant (at the 10% level). Under the FE estimations, on an average, ceteris paribus, a 1% increase in FDI inflows will result in a 0.00065 decrease or increase in CO2 emission levels. Pertaining to the other explanatory variables for the three models’ estimations under the two analyses, FND is insignificant for all, whereas FNS positively correlates with CEM under the 1% significance level.

Moreover, the control variables with significant coefficients are TRDO, INDVA, and GDPPC. TRDO negatively correlates with CEM, and INDVA and GDPPC positively correlate with CEM. The three models under both analyses are deemed a good fit based on the Prob > F and the Prob > chi2; overall, the variables matter jointly in explaining the models. The shows that the data for the employed explanatory and control variables explain approximately 42% of the sample variation in the CO2 emissions data.

4.3. GMM Estimates

The Hausman test was conducted, and its outcome implied that the random effects model fit well overall; as such, this research presents Equation 3 as a random walk model with a persistent and applies the one-step system GMM (SYM-GMM) estimator to test further how dynamic the panels adopted are.

where is CO2 emissions; is lagged order of one of the CO2 emissions; , , and are FDI inflows, financial development, and financial structure; , , , , and are population growth, trade openness, urbanisation, industry value added, and GDP per capita; , , and are the error term, country, and year effects.

Year dummy variables, 574 observations, 41 groups, and 36 instruments (per the STATA 17MP outcome produced during the simulations) were utilized (refer to Table 6). The model’s Prob > F is 0.000, indicating that both the overall model and the regression estimates are valid. The random disturbance term in the model does not exhibit a second-order autocorrelation (AR(2) > 0.05), and the model’s effect is good (Hansen test > 0.05).

Table 6.

SYM-GMM with all variables.

Under the haven and halo analyses: (1) CEMi,t−1 is significant at the 1% level with a coefficient of 0.623, denoting that the adopted countries in this research are affected by their lagged order of one pertaining to significant CO2 emissions, (2) FDI negatively and positively affects CEM with a significant coefficient value of 0.056, (3) FND negatively affects CEM, but its coefficient is insignificant, and FNS with a coefficient of 0.094 significantly affects CEM positively at the 10% significance level, (4) POPGT, URBNZ, and INDVA positively affect the response variable, but their coefficients are insignificant, (5) TROD and GDPPC are the two control variables with significant coefficients, but while TRDO negatively affects CEM, GDPPC positively affects CEM. On the one hand, on an average ceteris paribus, a 1% increase in FDI, FNS, and TRDO will result in 0.00056, 0.00094, and 0.00149 decreases in CEM for the employed African countries in this research, respectively. On the other hand, with all things being equal, a 1% increase in FDI and GDPPC will result in a 0.00056 and 0.00207 increase in CEM.

The significant variables from the GMM estimates from Table 6 were extracted to construct a second one-step system GMM estimate. Per the outcome (refer to Table 7), all the variables are significant, and the overall model fits, with an F-stat value of 819.49 and a Prob > F of 0.000. The model’s effect is good since it does not contain a second-order autocorrelation per the AR(2) value, and the Hansen test is greater than 0.05. Year dummy variables were applied, and the number of observations, groups, and instruments exploited was 574, 41, and 34 (per the STATA 17MP outcome produced during the simulations), respectively.

Table 7.

SYM-GMM with significant variables.

4.4. Discussion

This research discovered that FDI inflows negatively and positively impact CO2 emissions of the selected African countries; these outcomes buttress the points that FDI inflows have both deleterious and advantageous effects, corroborating the findings of Opoku et al. [38] and Huang et al. [60]. The industrial revolution over the years has substantially risen [61,62], tantamount to FDI inflows to African countries [63], because investors have been establishing industries in the form of FDIs. Some industries have been advancing toward and exporting cleaner technologies and manufacturing processes to their host countries, intending to promote sustainability and protect the environment of their host countries. Examples of such industries are M-KOPA, African Clean Energy (ACE), and Daystar power, established in African countries, such as Tanzania, Uganda, Kenya, Nigeria, etc. These industries employ cleaner technologies, such as small-scale wind and hydro energies, solar panels, energy-efficient appliances, etc., to protect their host countries and help with their environmental amelioration, because a sustained environment not only helps the host countries but also yields profitable returns on the investment.

On the contrary, other industries, such as the Volkswagen Group, Nissan, Toyota Motors, etc., maintain and utilize conventional technologies to produce high-end goods to avoid exorbitant costs and expenses. These older technologies tend to be polluting processes, such as generating power and energy from burning coal, oil, natural gas, and petroleum, thus, resulting in high amounts of greenhouse gases, such as CO2, and chemicals being released into the atmosphere of their host countries. These emissions cause air pollution, which is harmful to the host countries’ inhabitants, i.e., resulting in adverse health ramifications [64] and depleting the ozone layer, contributing to global warming [65]. Overall, the findings have revealed that FDI inflows in African countries possess good attributes that contribute to reducing CO2 emissions and, at the same time, pose a threat and cause a rise in their CO2 emissions.

Secondly, the selected African countries’ financial structures have a positive impact on carbon dioxide emissions per capita, indicating that ready access to credit, such as trade credits, loans, nonequity securities purchases, etc., from the financial systems (i.e., banks) results in a rise in CO2 emission levels. Disparate from the findings of De Haas and Popov [50] and Xu et al. [66], this research infers that a debt-based financial structure contributes to environmental degradation in the form of a rise in CO2 emissions.

Thirdly, trade openness of the employed African countries negatively impacts CO2 emissions per capita, which can be justified by technology or technical and composite effects and substantiates the findings of Essandoh et al. [67] and Karedla et al. [68]. Cleaner and more effective technology practices spread throughout partner countries as trade creates a channel for goods exchange and spillover effects [58]. As a result, countries can produce goods by utilizing their comparative advantages. Thanks to the technology spillover effect, they also have access to cleaner or green and more effective operating technologies. Consequently, this will increase trade while reducing CO2 emitted levels.

Fourthly, in line with the findings of Solarin et al. [8] and Xie et al. [37], this study’s employed countries’ GDP per capita positively impacts their CO2 emissions while it refutes the findings of Adewuyi and Awodumi [69] and Zubair et al. [70]; thus, the economy (represented by GDPPC) of the employed countries advances at the expense of the environment. As a continent with emerging economies, Africa is known to host developing countries. Generally, at the developing phase of a country, more resources are allotted to the sectors with a quick progression rate. The oil and gas extraction sector in African countries is known to be one of the sectors that contributes greatly to their economies. However, these extraction activities also release high amounts of greenhouse gases, especially CO2, into the atmosphere, thus, causing a rise in the emitted levels of CO2. In addition, due to the lack of technological knowhow, such countries rely on traditional forms and technologies to generate power and energy. That is, to generate power at a lower cost for the country, technologies, such as coal-generated plants, are employed, releasing chemicals such as CO2 into the air and, thus, causing pollution, which interrupts the ecosystem of such a country and the world.

4.5. Hypothesis Testing

In testing for the hypotheses proposed in Section 3.2, this study’s estimations discovered that:

Under the haven analyses using the PLS, FE, RE, and the one-step SYM-GMM, the FDI inflow coefficient is negative, i.e., FDI inflows negatively affect CO2 emissions. Therefore, the PHVHP does not hold in this study and H1 is not accepted.

Under the halo analyses using the PLS, FE, RE, and the one-step SYM-GMM, the FDI inflow coefficient is positive, i.e., FDI inflows positively affect CO2 emissions. Therefore, the PHLHP does not hold in this study and H2 is not accepted.

The coefficients for FNS revealed there exists a positive relationship between financial structure and CO2 emissions. Thus, FNS positively impacts CEM. Therefore, H3 is accepted.

Although the coefficient of financial development under the PLS, FE, and RE was positive, it was negative under the one-step SYM-GMM. Moreover, none of the coefficients were significant. Therefore, H4 is not accepted.

5. Conclusions and Suggestions

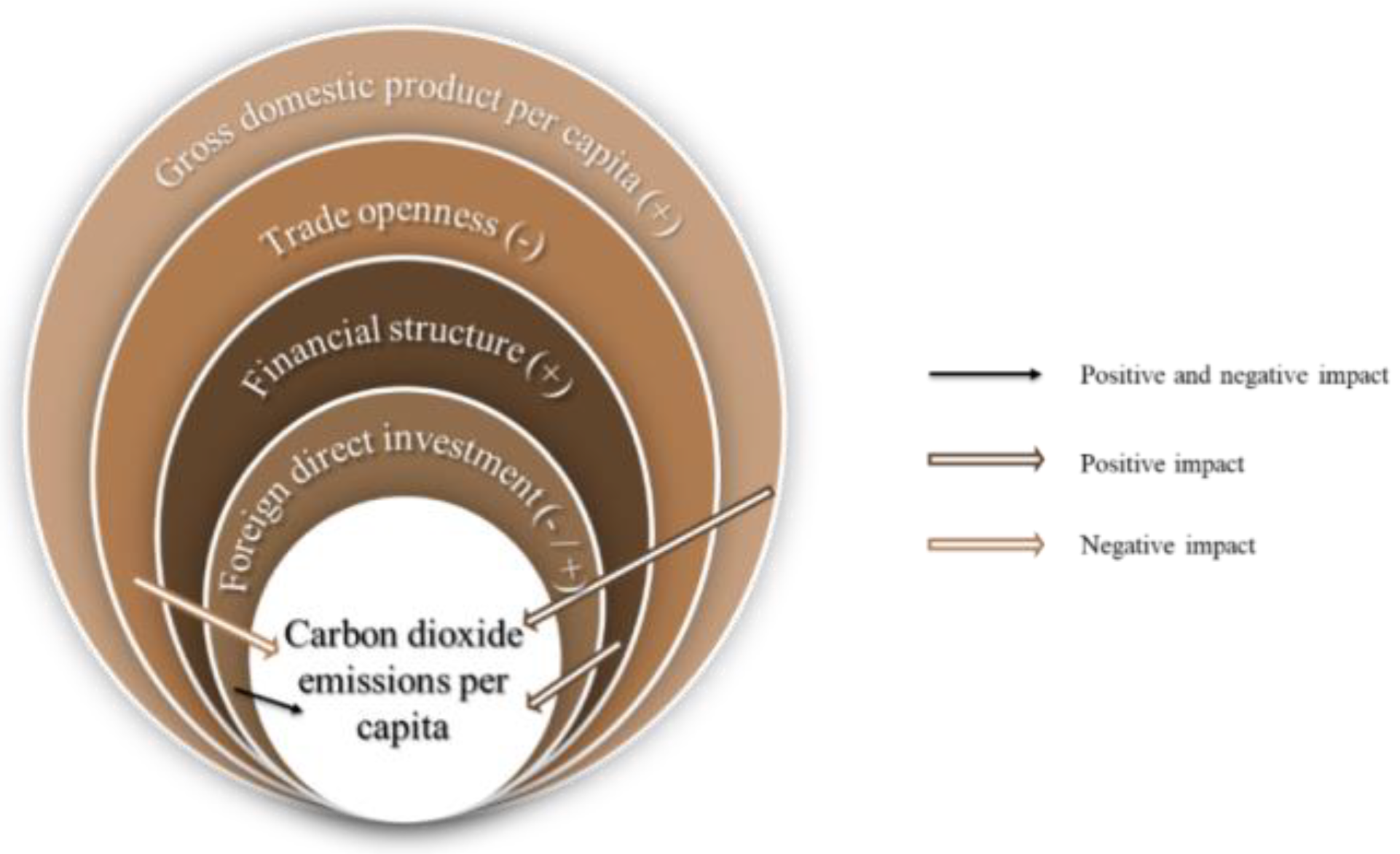

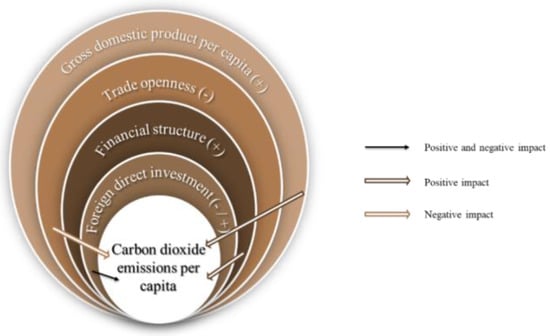

Carbon dioxide emission has been the focal point in conversations and research over the last few decades [65]; however, one impact has not been established due to its intricate nature and effect. Therefore, this study assesses Foreign Direct Investment and other variables that influence carbon dioxide emissions as its main aim by employing panel data from forty-one (41) African countries from 2005 to 2019 (fifteen years). Pooled least squares, fixed and random effects, and the one-step system GMM were applied to analyze the variables. The results obtained denote that regarding CO2 emissions, a graphical notation can be inferred from Figure 4.

Figure 4.

Graphical notation of the study’s concluded results. Source: author’s construct.

(1) FDI has both a negative and positive impact, (2) financial structure has a positive impact, (3) trade openness has a negative impact, and (4) GDP has a positive impact. The pollution halo and haven hypotheses were not validated in this study. However, it was established that from the standpoint of finance, the financial systems (i.e., banks) and direct investments from foreign investors in the adopted African countries play a role in CO2 emission levels rising and falling. Moreover, GDP and trade openness contribute to the varying emitted levels of CO2. Therefore, this study puts forth the following suggestions:

Application and execution of policies, laws, and regulations that deter or punish polluting foreign investment and encourage clean ones. As a hosting nation, the government and policy-makers of this study’s chosen countries should enact and strengthen policies, laws, and regulations requiring polluting foreign investments to pay penalties, such as carbon taxes, to lessen the detrimental effect of FDI on CO2 emissions. Apart from South Africa, which has a carbon tax system applied, none of the African countries have been enacting such actions [54]. Therefore, the remaining African countries can follow the precedent set by South Africa to aid in mitigating CO2 emissions. Additionally, investments that deal with clean technologies, green systems, and green development activities should be supported to further aid in attracting clean investments.

Green finance application. Green finance, according to Xie et al. [71], is a future-focused form of investing that aims to advance the financial sector and enhance the environment. Thus, green finance is a strategy for sustaining the environment that encourages consuming less energy and lowering greenhouse gas (GHG) emissions [72]. However, the practice of green finance has not gained ground all over Africa. Therefore, per this study’s outcome, the financial systems (banks) of the selected countries that extend credit to the private sector should apply green finance in the form of green credit to mitigate CO2 emissions.

Preferential trading policies. The African countries utilized in this study should strategize and implement policies encouraging preferential trade, highlighting an addition of value via clean technology—a country benefits when trade openness is fostered through mutual trade liberalization and removing trade barriers. Therefore, implementing preferential trade policies will assist the chosen African countries in obtaining clean technology, boosting their trade value, and contributing to environmental sustainability. Moreover, the European Union’s (EU) Emission Trading System (ETS) is still in effect, with some African countries, such as Nigeria, Kenya, etc., implementing such a system. With the aim of protecting the environment against emissions caused by greenhouse gasses (GHGs), the remaining non-participating African countries should apply the EU’s ETS to further aid in mitigating highly emitted levels of CO2 that occurs as a result of trade.

Practice carbon capture, usage, and storage. It is known that to achieve sustainable development and promote the economy of a country, green technology innovation is important [73]. As such, the countries sampled for this study (especially the industries and parties in such countries that use traditional technologies and emit high amounts of carbon) should practice how to capture, use, and store their emitted CO2. Applying innovative green technologies, such as carbon capture, usage, and storage, will help protect the environment and progress the country’s economy. Thus, the captured carbon can be stored, reused, and recycled to help promote the country’s economy and protect the environment.

Limitations

This paper has some novel conceptual analysis and research insights; however, it has flaws. Some countries were exempt from the study due to data unavailability, so not all the African countries were sampled. The chosen variables are a representation of the factors that affect CO2 emissions. However, this study did not apply other factors, such as energy consumption. Therefore, the employed variables in this study cannot be considered as the sole impacts of CO2 emissions. Furthermore, the proxy for financial structure used was solely the credit extended to the private sectors from banks; nevertheless, a composite index of several types of financial structure can be created to give a comprehensive understanding of how financial structure affects CO2 emissions. The aforementioned ideas should, therefore, be further explored in future research.

Author Contributions

Conceptualization, V.B., D.T.; Data curation, V.B.; Formal analysis, V.B., D.T. and Q.Z.; Investigation, V.B.; Methodology, V.B. and Q.Z.; Project administration, Q.Z.; Resources, D.T. and V.B.; Software, V.B.; Supervision, D.T., Q.Z. and J.Z.; Visualization, D.T., V.B. and J.Z.; Writing—original draft, V.B.; Writing—review and editing, D.T., Q.Z., J.Z. and V.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Thacker, P.G.; Witte, R.J.; Menaker, R. Key financial indicators and ratios: How to use them for success in your practice. Clin. Imaging 2020, 64, 80–84. [Google Scholar] [CrossRef] [PubMed]

- Dietz, T.; Shwom, R.L.; Whitley, C.T. Climate Change and Society. Annu. Rev. Sociol. 2020, 46, 135–158. [Google Scholar] [CrossRef]

- Georgatzi, V.V.; Stamboulis, Y.; Vetsikas, A. Examining the determinants of CO2 emissions caused by the transport sector: Empirical evidence from 12 European countries. Econ. Anal. Policy 2019, 65, 11–20. [Google Scholar] [CrossRef]

- Seker, F.; Ertugrul, H.M.; Cetin, M. The impact of foreign direct investment on environmental quality: A bounds testing and causality analysis for Turkey. Renew. Sustain. Energy Rev. 2015, 52, 347–356. [Google Scholar] [CrossRef]

- Khan, M.A.; Ozturk, I. Examining foreign direct investment and environmental pollution linkage in Asia. Environ. Sci. Pollut. Res. 2019, 27, 7244–7255. [Google Scholar] [CrossRef]

- Jiang, C.; Ma, X. The Impact of Financial Development on Carbon Emissions: A Global Perspective. Sustainability 2019, 11, 5241. [Google Scholar] [CrossRef]

- Wen, S.; Lin, B.; Zhou, Y. Does financial structure promote energy conservation and emission reduction? Evidence from China. Int. Rev. Econ. Finance 2021, 76, 755–766. [Google Scholar] [CrossRef]

- Solarin, S.A.; Al-Mulali, U.; Musah, I.; Ozturk, I. Investigating the pollution haven hypothesis in Ghana: An empirical investigation. Energy 2017, 124, 706–719. [Google Scholar] [CrossRef]

- Ahmad, M.; Ahmad, M.; Jabeen, G.; Jabeen, G.; Wu, Y.; Wu, Y. Heterogeneity of pollution haven/halo hypothesis and Environmental Kuznets Curve hypothesis across development levels of Chinese provinces. J. Clean. Prod. 2020, 285, 124898. [Google Scholar] [CrossRef]

- Böhringer, C. The Kyoto Protocol: A Review and Perspectives. Oxf. Rev. Econ. Policy 2003, 19, 451–466. [Google Scholar] [CrossRef]

- Falkner, R. The Paris Agreement and the new logic of international climate politics. Int. Aff. 2016, 92, 1107–1125. [Google Scholar] [CrossRef]

- EU Emissions Trading System (EU ETS). Climate Action. 2022. Available online: https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets_en (accessed on 6 September 2022).

- Li, Z.-Z.; Li, R.Y.M.; Malik, M.Y.; Murshed, M.; Khan, Z.; Umar, M. Determinants of Carbon Emission in China: How Good is Green Investment? Sustain. Prod. Consum. 2020, 27, 392–401. [Google Scholar] [CrossRef]

- Raghutla, C.; Padmagirisan, P.; Sakthivel, P.; Chittedi, K.R.; Mishra, S. The effect of renewable energy consumption on ecological footprint in N-11 countries: Evidence from Panel Quantile Regression Approach. Renew. Energy 2022, 197, 125–137. [Google Scholar] [CrossRef]

- Yi, S.; Raghutla, C.; Chittedi, K.R.; Fareed, Z. How economic policy uncertainty and financial development contribute to renewable energy consumption? The importance of economic globalization. Renew. Energy 2023, 202, 1357–1367. [Google Scholar] [CrossRef]

- Stern, D.I. The Environmental Kuznets Curve. In Oxford Research Encyclopedia of Environmental Science; Oxford University Press: Oxford, UK, 2017. [Google Scholar] [CrossRef]

- Gill, F.L.; Viswanathan, K.K.; Abdul Karim, M.Z. The Critical Review of the Pollution Haven Hypothesis. Int. J. Energy Econ. Policy 2018, 8, 167–174. [Google Scholar]

- IGI Global’s Dictionary Search. Igi-global.com. 2022. Available online: https://www.igi-global.com/dictionary/ (accessed on 1 October 2022).

- Mert, M.; Caglar, A.E. Testing pollution haven and pollution halo hypotheses for Turkey: A new perspective. Environ. Sci. Pollut. Res. 2020, 27, 32933–32943. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Tang, C.F. Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 2013, 60, 813–819. [Google Scholar] [CrossRef]

- Ren, S.; Yuan, B.; Ma, X.; Chen, X. International trade, FDI (foreign direct investment) and embodied CO2 emissions: A case study of Chinas industrial sectors. China Econ. Rev. 2014, 28, 123–134. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasreen, S.; Abbas, F.; Anis, O. Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ. 2015, 51, 275–287. [Google Scholar] [CrossRef]

- Riti, J.S.; Sentanu, I.G.E.P.S.; Cai, A.; Sheikh, S. Foreign direct investment, manufacturing export and the environment in Nigeria: A test of pollution haven hypothesis. NIDA Dev. J. 2016, 56, 73–98. [Google Scholar]

- Rasit, N.B.; Aralas, S.B. The pollution haven hypothesis: An analysis of ASEAN and OECD countries. In Proceedings of the International Conference on Economics, No. ICE 2017, Hong Kong, China, 14–15 January 2017; pp. 96–109. [Google Scholar]

- Kathuria, V. Does Environmental Governance Matter for Foreign Direct Investment? Testing the Pollution Haven Hypothesis for Indian States. Asian Dev. Rev. 2018, 35, 81–107. [Google Scholar] [CrossRef]

- Shao, Q.; Wang, X.; Zhou, Q.; Balogh, L. Pollution haven hypothesis revisited: A comparison of the BRICS and MINT countries based on VECM approach. J. Clean. Prod. 2019, 227, 724–738. [Google Scholar] [CrossRef]

- Guzel, A.E.; Okumus, I. Revisiting the pollution haven hypothesis in ASEAN-5 countries: New insights from panel data analysis. Environ. Sci. Pollut. Res. 2020, 27, 18157–18167. [Google Scholar] [CrossRef] [PubMed]

- Singhania, M.; Saini, N. Demystifying pollution haven hypothesis: Role of FDI. J. Bus. Res. 2021, 123, 516–528. [Google Scholar] [CrossRef] [PubMed]

- Musah, M.; Mensah, I.A.; Alfred, M.; Mahmood, H.; Murshed, M.; Omari-Sasu, A.Y.; Boateng, F.; Nyeadi, J.D.; Coffie, C.P.K. Reinvestigating the pollution haven hypothesis: The nexus between foreign direct investments and environmental quality in G-20 countries. Environ. Sci. Pollut. Res. 2022, 29, 31330–31347. [Google Scholar] [CrossRef]

- Elliott, R.J.R.; Zhou, Y. Environmental Regulation Induced Foreign Direct Investment. Environ. Resour. Econ. 2012, 55, 141–158. [Google Scholar] [CrossRef]

- Yildirim, E. Energy use, CO2 emission and foreign direct investment: Is there any inconsistence between causal relations? Front. Energy 2014, 8, 269–278. [Google Scholar] [CrossRef]

- Zugravu-Soilita, N. How does Foreign Direct Investment Affect Pollution? Toward a Better Understanding of the Direct and Conditional Effects. Environ. Resour. Econ. 2015, 66, 293–338. [Google Scholar] [CrossRef]

- Zhang, C.; Zhou, X. Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sustain. Energy Rev. 2016, 58, 943–951. [Google Scholar] [CrossRef]

- Aydemir, O.; Zeren, F. The Impact of Foreign Direct Investment on CO2 Emission. In Handbook of Research on Global Enterprise Operations And Opportunities; IGI Global: Hershey, PA, USA, 2017; pp. 81–92. [Google Scholar] [CrossRef]

- Zhou, Y.; Fu, J.; Kong, Y.; Wu, R. How Foreign Direct Investment Influences Carbon Emissions, Based on the Empirical Analysis of Chinese Urban Data. Sustainability 2018, 10, 2163. [Google Scholar] [CrossRef]

- Nasir, M.A.; Huynh, T.L.D.; Tram, H.T.X. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. J. Environ. Manag. 2019, 242, 131–141. [Google Scholar] [CrossRef]

- Xie, Q.; Wang, X.; Cong, X. How does foreign direct investment affect CO2 emissions in emerging countries?New findings from a nonlinear panel analysis. J. Clean. Prod. 2019, 249, 119422. [Google Scholar] [CrossRef]

- Opoku, E.E.O.; Adams, S.; Aluko, O.A. The foreign direct investment-environment nexus: Does emission disaggregation matter? Energy Rep. 2021, 7, 778–787. [Google Scholar] [CrossRef]

- Caetano, R.V.; Marques, A.C.; Afonso, T.L.; Vieira, I. A sectoral analysis of the role of Foreign Direct Investment in pollution and energy transition in OECD countries. J. Environ. Manag. 2021, 302, 114018. [Google Scholar] [CrossRef]

- Global Energy Review. IEA. 2022. Available online: https://www.iea.org/reports/global-energy-review-co2-emissions-in-2021-2 (accessed on 7 September 2022).

- Hao, J.; Gao, F.; Fang, X.; Nong, X.; Zhang, Y.; Hong, F. Multi-factor decomposition and multi-scenario prediction decoupling analysis of China’s carbon emission under dual carbon goal. Sci. Total Environ. 2022, 841, 156788. [Google Scholar] [CrossRef]

- Zhang, W.; Xu, H. Effects of land urbanization and land finance on carbon emissions: A panel data analysis for Chinese provinces. Land Use Policy 2017, 63, 493–500. [Google Scholar] [CrossRef]

- Ouyang, X.; Lin, B. Carbon dioxide (CO2) emissions during urbanization: A comparative study between China and Japan. J. Clean. Prod. 2017, 143, 356–368. [Google Scholar] [CrossRef]

- Hafeez, M.; Chunhui, Y.; Strohmaier, D.; Ahmed, M.; Jie, L. Does finance affect environmental degradation: Evidence from One Belt and One Road Initiative region? Environ. Sci. Pollut. Res. 2018, 25, 9579–9592. [Google Scholar] [CrossRef]

- Tang, D.; Yi, R.; Kong, H.; Da, D.; Boamah, V. Foreign direct investment entry mode and China’s carbon productivity based on spatial econometric model. Front. Environ. Sci. 2022, 10, 1368. [Google Scholar] [CrossRef]

- Kim, S. CO2 emissions, foreign direct investments, energy consumption, and GDP in developing countries: A more compre-hensive study using panel vector error correction model. Korean Econ. Rev. 2019, 35, 5–24. [Google Scholar]

- Abban, O.J.; Wu, J.; Mensah, I.A. Analysis on the nexus amid CO2 emissions, energy intensity, economic growth, and foreign direct investment in Belt and Road economies: Does the level of income matter? Environ. Sci. Pollut. Res. 2020, 27, 11387–11402. [Google Scholar] [CrossRef] [PubMed]

- Islam, M.; Khan, M.K.; Tareque, M.; Jehan, N.; Dagar, V. Impact of globalization, foreign direct investment, and energy consumption on CO2 emissions in Bangladesh: Does institutional quality matter? Environ. Sci. Pollut. Res. 2021, 28, 48851–48871. [Google Scholar] [CrossRef] [PubMed]

- Yao, X.; Tang, X. Does financial structure affect CO2 emissions? Evidence from G20 countries. Finance Res. Lett. 2020, 41, 101791. [Google Scholar] [CrossRef]

- De Haas, R.; Popov, A. Finance and Carbon Emissions. SSRN Electron. J. 2019. [Google Scholar] [CrossRef]

- Jamel, L.; Maktouf, S. The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ. Finance 2017, 5, 1341456. [Google Scholar] [CrossRef]

- Acheampong, A.O.; Amponsah, M.; Boateng, E. Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ. 2020, 88, 104768. [Google Scholar] [CrossRef]

- Amin, A.; Dogan, E.; Khan, Z. The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Sci. Total Environ. 2020, 740, 140127. [Google Scholar] [CrossRef]

- Our World in Data. Available online: https://ourworldindata.org/ (accessed on 5 September 2022).

- World Bank Open Data. 2022. Available online: https://data.worldbank.org/ (accessed on 13 September 2022).

- Svirydzenka, K. Introducing a New Broad-Based Index of Financial Development. International Monetary Fund. 2016. Available online: https://books.google.com.hk/books?hl=en&lr=&id=nrMaEAAAQBAJ&oi=fnd&pg=PA4&ots=pIItZTF8ua&sig=P9FzqfaK01Z8wn8q43Jy6vsEGBM&redir_esc=y&hl=zh-CN&sourceid=cndr#v=onepage&q&f=false (accessed on 13 September 2022).

- Financial Development Index Database. International Monetary Fund. 2022. Available online: https://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B (accessed on 13 September 2022).

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Awan, A.M.; Azam, M. Evaluating the impact of GDP per capita on environmental degradation for G-20 economies: Does N-shaped environmental Kuznets curve exist? Environ. Dev. Sustain. 2021, 24, 11103–11126. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, X.; Zhu, H.; Huang, C.; Tian, Z. The Heterogeneous Effects of FDI and Foreign Trade on CO2 Emissions: Evidence from China. Math. Probl. Eng. 2019, 2019, 1–14. [Google Scholar] [CrossRef]

- Xu, M.; David, J.M.; Kim, S.H. The Fourth Industrial Revolution: Opportunities and Challenges. Int. J. Financial Res. 2018, 9, 90. [Google Scholar] [CrossRef]

- Stearns, P.N. The Industrial Revolution in World History; Routledge, Taylor & Francis Group: Milton Park, UK, 2021. [Google Scholar]

- Loots, E.; Kabundi, A. Foreign direct investment to Africa: Trends, dynamics and challenges. South Afr. J. Econ. Manag. Sci. 2012, 15, 128–141. [Google Scholar] [CrossRef]

- Mannucci, P.M.; Franchini, M. Health Effects of Ambient Air Pollution in Developing Countries. Int. J. Environ. Res. Public Health 2017, 14, 1048. [Google Scholar] [CrossRef]

- Letcher, T.M. Why do we have global warming. In Managing Global Warming; Elsevier: Amsterdam, The Netherlands, 2019; pp. 3–15. ISBN 978-0-12-814104-5. [Google Scholar]

- Xu, H.; Li, Y.; Huang, H. Spatial Research on the Effect of Financial Structure on CO2 Emission. Energy Procedia 2017, 118, 179–183. [Google Scholar] [CrossRef]

- Essandoh, O.K.; Islam, M.; Kakinaka, M. Linking international trade and foreign direct investment to CO2 emissions: Any differences between developed and developing countries? Sci. Total Environ. 2020, 712, 136437. [Google Scholar] [CrossRef]

- Karedla, Y.; Mishra, R.; Patel, N. The impact of economic growth, trade openness and manufacturing on CO2 emissions in India: An autoregressive distributive lag (ARDL) bounds test approach. J. Econ. Finance Adm. Sci. 2021, 26, 376–389. [Google Scholar] [CrossRef]

- Adewuyi, A.O.; Awodumi, O.B. Biomass energy consumption, economic growth and carbon emissions: Fresh evidence from West Africa using a simultaneous equation model. Energy 2017, 119, 453–471. [Google Scholar] [CrossRef]

- Zubair, A.O.; Samad, A.-R.A.; Dankumo, A.M. Does gross domestic income, trade integration, FDI inflows, GDP, and capital reduces CO2 emissions? An empirical evidence from Nigeria. Curr. Res. Environ. Sustain. 2020, 2, 100009. [Google Scholar] [CrossRef]

- Xie, H.; Ouyang, Z.; Choi, Y. Characteristics and Influencing Factors of Green Finance Development in the Yangtze River Delta of China: Analysis Based on the Spatial Durbin Model. Sustainability 2020, 12, 9753. [Google Scholar] [CrossRef]

- Gao, L.; Tian, Q.; Meng, F. The impact of green finance on industrial reasonability in China: Empirical research based on the spatial panel Durbin model. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Behera, P.; Sethi, N. Nexus between environment regulation, FDI, and green technology innovation in OECD countries. Environ. Sci. Pollut. Res. 2022, 29, 52940–52953. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).