Abstract

In developing nations, environmental policies have not given nearly enough consideration to the role that environmentally friendly innovation plays. Green innovation and long-term financial performance are extremely dependent on one another. Despite the fact that numerous studies have investigated the impact that a variety of corporate social responsibility (CSR) activities have had on environmental sustainability, relatively few have investigated the implications of green innovation strategies and sustainability. From the mid-2021 through to mid-2022, information was gathered from 184 businesses listed on the Pakistan Stock Exchange (PSX) across 12 different industries. Estimates of the results were obtained by the use of structural equation modeling using partial least squares (PLS-SEM). The outcomes of the study indicated that all parts of CSR were positively significant in the process of fostering environmentally sustainable growth, with the exception of one aspect of CSR that was directed toward customers. Additionally, sustainable development contributes to the mediation impact that green innovation has, making this effect even more powerful. The data show that CSR activities have an exceptional impact on financial performance (FP) in all aspects other than one, and that green innovation (GI) also has a high-quality impact on FP, which demonstrates the significance of CSR practices in enhancing sustainable environment.

Keywords:

corporate social responsibility; green innovation; environmentally sustainable development; developing countries; PSX JEL Classification:

O13; P18; Q56

1. Introduction

The terms climate change and global warming are widely disseminated by the most influential environmental groups [1,2,3,4]. According to authorities on the matter [5,6] concentrating primarily on the expenses connected with conservational discussion and the resulting widening restrictions will not sway politically savvy decision-makers. GDP growth rates and employment rates are the only metrics that effect politicians, corporate executives, their constituents, and investors [7,8,9]. In industrialized nations, resources for establishing and executing policies are considerable [10,11,12] The United States and the European Union have established environmental regulations that have a substantial effect on associate nations and countries that do business with the United States and the EU [13,14,15,16,17].

In contrast, environmental concerns are not given much consideration in the emerging nations of Asia and Africa. In addition, the bulk of the world’s commodities are manufactured and processed in these countries [18,19,20,21,22,23]. This issue requires immediate resolution, and manufacturers must be aware of their corporate social responsibilities (CSR), which have four dimensions: employees, environment, community, and customers. The CSR definition is complex and challenging. The nature and context of the difficulties make it challenging. CSR is an integral component of the environment, society, and economy, all of which are extremely complex dynamic systems. CSR is hard because the subjects being discussed are inherently unclear [11,24,25,26,27]. Researchers demonstrated how to include economic, social, and environmental considerations into company planning for sustainability and effectiveness [8,28]. Businesses with ethical and eco-friendly certifications attract more clients as a consequence of their higher reputation and demand for CSR efforts [19,29]. According to [30], corporate social responsibility (CSR) can minimize environmental degradation. We can reduce our influence on the environment by reusing materials, lowering production costs, and reducing industrial waste. Researchers have also emphasized innovation’s importance for corporate social responsibility and commercial success [31].

Researchers have also identified the importance of innovation for CSR and corporate performance [19,32,33]. However, there is a lack of research on the application and implementation of CSR in developing nations such as Pakistan. To protect the environment, developing countries employ green innovation [34,35,36]. In addition, this is a chance to examine the significance of CSR and how it is implemented in developing nations, such as Pakistan, in terms of environmental sustainability and the green innovation process.

The aforementioned criteria and the existing gap in the current literature prompted the establishment of this study’s approach. This study aims to investigate whether CSR policies regarding the environment, consumers, employees, and customers have an effect on financial performance (FP). Through the mediation of green innovation, the impact is directly and indirectly assessed. There is currently no study accessible on emerging nations such as Pakistan. Consequently, our research tries to address the following questions:

How do CSR efforts affect the financial performance of businesses?

How may green innovation impact the financial performance of businesses?

This research will not only expand our understanding of the link between CSR practices, financial performance, and the moderating influence of green innovation, but it will also give valuable insights into the 184 firms listed on the Pakistan Stock Exchange (PSX) across 12 industries. The findings of this article may be utilized by policymakers to promote sustainability and the green innovation process inside their enterprises. Further, the discovered gaps will enable future researchers to make significant contributions.

A Brief of Industrial and Sector Growth in Listed Companies of Pakistan

Despite significant obstacles, Pakistan’s economy advanced in FY2021 toward a reasonable and more sustainable course. According to the economic analysis for 2021–2022, the economy will see inclusive and sustained growth. The economy has had a V-shaped recovery, with 3.94% growth in FY2021. Since 1995, the economy has outperformed. In the previous fiscal year, the government’s sector-specific policies assisted the recovery of all industries. Agricultural production increased due to the agriculture sector’s enhancement. Likewise, manufacturing, building, and exports have flourished, leading to a positive current account balance, manageable budget deficit, and positive foreign currency reserves of USD 22 billion (Ministry of Finance, 2021).

In 2020, the (PSX) was a leading market in Asia and the fourth best-performing market in the world. Returning to the global capital market after a three-year absence, Pakistan raised USD 2.5 billion through Euro bonds. There are 39 sectors and 446 firms listed on the PSX with a total market value of USD 52 billion in January 2021 (PSX 2021).

We select 12 sectors with 184 PSX-listed companies that are concerned with environmental concerns and are interested in Economic Sustainability and Green Innovation. Annex 1 provides a list of companies, industries, and market capitalization.

The remainder of this study is organized as follows. The next part focuses on theoretical foundations and hypothesis building. Section 3 describes the research method. The approaches to data analysis are described in the third section, followed by the results and discussion in the fourth section, and the study is finished with future directions in the fifth section.

2. Literature Background and the Development of Hypotheses

2.1. Sustainability and Environmental Innovation

Due to industrial expansion, natural resource utilization has increased [25,33,37,38,39]. Growing worldwide demand has worsened environmental damage caused by stressing these commodities’ sources. It has had such a huge impact on the environment that climate change and global warming have resulted [23,40,41]. Environmentalists applaud oil, refining, and manufacturing companies for embracing CSR and green innovation to profit from sustainability [35,42]. Conservational management literature emphasized sustainable development (SD). In its report “Our Common Future,” the “World Commission on Economic and Progress” (WCED) defined ecological and financial sustainability as “growth that satisfies present needs without compromising future generations’ ability to do so” (WCED, 1987). Integrating ecological, economic, and social sustainability into global policymaking achieves marketable sustainability [43]. In a holistic approach, administrations should prioritize ecological and green tactics, such as plastic bags, as well as using cutting-edge technologies to make biodegradable items and modernizing the same procedures as needed [44].

Green innovation is based on sustainable development, which outlines the relationship between organizational operations and environmental impact [45]. A company can use “green innovation” to lessen its environmental impact [16,46,47,48,49,50,51,52,53]. Green innovation is based on the link between organizational operations and environmental impact [45]. Green innovation reduces a company’s environmental impact [46,54].

2.2. Corporations and Their Social Responsibility

CSR is a growing issue having corporate consequences in administrative literature. Businesses must consider their society influence [6,29,55,56]. This knowledge reduces client risk and boosts company revenue. Organizations must evaluate all financial aspects that may affect CSR engagement. The paper highlighted five CSR mechanisms: economic, social, stakeholder, and voluntarism [30,36] forecasted multi-stakeholder CSR responsibility for government, customers, and employees. These authors classified persons objectively [12,57,58,59]. “CSR to the community” refers to an organization’s efforts that prioritize the welfare of society and the peripheral community, such as donating to non-governmental groups (NGOs). CSR for consumers covers customer service, customer retention, ethical company activities, such as eco-friendly labeling, and environmental ethics. Social responsibility and employee welfare norms may also be enforced [60]. CSR includes environmental responsibility [51,61,62,63].

Underdeveloped nations view CSR as a humanitarian concern rather than an environmental or social one [13,64]. Six hundred Pakistani companies want to practice CSR [63,65]. CSR aims to improve knowledge, public welfare, and end child labor. CSR-focused organizations enjoy brand recognition, employee enthusiasm, customer delight, and labor productivity [26,66]. Ref. [67] found a correlation between CSR practices and long-term corporate success in Asia, suggesting socially responsible corporations outperform others. According to [35,68,69], CSR and green innovation are linked. CSR holds firms accountable to the environment and society, from which they seek economic success. CSR activities encourage Indian companies’ adoption of environmental measures [42,70].

2.2.1. CSR to Financial Performance

In place of other methods for determining a company’s level of profitability, this research made use of the net profit margin. This provides a visual representation of the ratio of a company’s net income to its total revenue or sales. Improving the organization’s bottom line is the primary emphasis of the many initiatives being taken. Initiatives aimed at improving corporate social responsibility have been related to increased business performance and profitability [44,61,71,72].

2.2.2. CSR to Environment and Financial Performance

Environmental initiatives have constantly improved sustainability. Environmental restrictions have pushed firms to meet environmental standards. TBL improves environmental sustainability in many aspects of life, especially in poor countries. Organizations must follow ISO 14000, 14001, 14006, and OHSAS 18000 [73]. According to polls, firms are actively promoting environmental protection and limiting their environmental impact [56,74]. Environmental issues are significant to CSR stakeholders [35,39]. According to a recent study, environmental CSR boosts corporate competitiveness and leads to conservation [75,76,77]. Environmental CSR affects developing countries’ financial and environmental performance [45,50,71]. Prior research largely ignored CSR’s environmental impacts in favor of its economic benefits [18,46,78,79] This study provides the following hypothesis due to CSR’s impact on financial performance.

H1a.

Environmental CSR (CSREN) has a significant positive impact on an institution’s financial performance (FP).

2.2.3. CSR to Employees and Financial Performance

Employees, or internal stakeholders, are essential for fulfilling company goals and are a major determinant of a firm’s viability [30,52,80,81,82]. When corporations utilize terms such as “market-oriented,” employee engagement diminishes [8,22,37,60]. According to a past study on the reactions of internal participants to CSR, employees have the ability to influence the productivity of a company; their participation is crucial for transforming corporate investment and competitiveness [36,83,84].

In addition, recent research indicates that steps such as the establishment of an institutional code of conduct and worker environment training encourage employees to operate in an environmentally responsible manner. In addition, current research indicates that CSR for employees has a favorable impact on employee performance, ambition, viewpoint, and conduct toward environmental conservation [31,64,85,86,87]. Engaging employees in CSR projects can inspire more innovation and contribute to an organization’s overall sustainability objectives. Consequently, the following hypothesis is proposed:

H1b.

CSR to Employees (CSREM) has a significant positive impact on a company’s financial performance (FP).

2.2.4. CSR to Community and Financial Performance

A successful organization needs community support [5,73,77,88]. CSR helps a company examine its social impact and give back to the community. In the past, several charities in underdeveloped countries claimed to engage in CSR [11,25,41,47]. The company supports philanthropic projects such as education, community service, and clean water and air. These activities strengthen society’s social status and encourage environmental conservation. New research links CSR to community performance in terms of societal and environmental efficiency [14,54,89,90]. Corporate philanthropy and donations increase a company’s effectiveness and reputation. Long-term development advantages can be gained through community-focused CSR programs.

CSR’s contribution to business and society in achieving environmentally sustainable growth is exemplified by generating an equal situation that leads to the creation of the following hypothesis.

H1c.

CSR to community (CSRCO) has a significant positive impact on an institution’s financial performance (FP).

2.2.5. CSR to Consumer and Financial Performance

A company’s success is highly dependent on the satisfaction of its customers, with whom it seeks to establish and maintain positive, long-lasting relationships [82,91,92]. Prior research found that consumer-related CSR activities had a strong positive affect on consumers’ buy impulse, while consumer loyalty, such as immoral acts, had a significant negative influence on consumer purchasing behavior [22,48,74]

Eighty percent of United States customers were eager to fund CSR organizations’ operations, according to a survey [24,49]. As customer demand for eco-friendly products increases, socially responsible firms become more proactive in addressing those demands without negatively impacting the environment [43,56]. In this competitive market, companies with a strong demand for green products place a higher emphasis on implementing better environmental practices to improve their performance in an environmentally conscientious manner [6,20,46,58]. Moreover, [21,93] found that socially responsible consumer initiatives are essential for environmental protection. In this context, we hypothesize the following.

H1d.

CSR to consumers (CSRCS) has a large positive effect on the Financial Performance of an organization.

2.3. Mediating Effect of Green Innovation

Green innovation (GI) is a commercial strategy to reduce environmental impact. Green innovation has conceptual origins in the eco-friendly sustainability movement, which links management activities and environmental repercussions [10,22,45,88]. A recent study has linked market pressures to green innovation. Business ethics boost green innovation, according to [94,95,96]. Customer pressure defines green innovation [7,27,93,97], as do environmental policies, scientific and ecological expertise, competitive pressure, and customer demand for green products. Inspiration aids sustainable development more than green innovation, [41,90,98] found that environmental skills affect green innovation. The link between green innovation and sustainable growth is not frequently understood, despite evidence. This study hypothesizes that CSR efforts may indicate ecologically sustainable development due to green innovation.

2.3.1. CSR to Environment and Green Innovation

According to [41,43,99] the CSR programs had a positive influence on environmentally sustainable development. Moreover, [67,100,101] found that financial performance encourages green innovation. According to a supplementary study, corporate social responsibility (CSR) has no direct effect on environmental performance but is positively associated with environmental strategy and green innovation [8,79,102]. The paper offers general managers of manufacturing companies and policymakers a methodology for managing CSR, environmental strategy, and green innovation. The research hypothesis is proposed and based on the presented literature and reasoning.

H2a.

CSR towards the Environment (CSREN) has a substantial effect on an organization’s adoption of Green Innovation (GI).

2.3.2. CSR to Employees and Green Innovation

CSR and green innovation techniques have a significant impact on environmental and company performance. The moderating effect was found to be negative but statistically significant [72,103,104]. Recent research [69,90,105] demonstrates that employee behavior is essential for enhancing environmental performance. Despite this, the relationship between human resource management and the environment has received less attention. Based on the above-mentioned literature and reasons, the following hypothesis is offered.

H2b.

Corporate social responsibility to employees (CSRE) has a substantial effect on an organization’s adoption of green innovation (GI).

2.3.3. CSR to Community and Green Innovation

Using established measurement frameworks and empirical evidence, [1,67,88,106] discovered that CSR and green innovation had a considerable impact on manufacturing competitiveness in developing economies. To evaluate environmental performance, industrial enterprises and governments must manage CSR, environmental strategy, and green innovation. The findings demonstrated that technology innovation influences environmental performance while concurrently enhancing corporate performance. It can assist huge industrial company management in bolstering their internal resources [19,101]. The information and justifications offered above lead to the proposition of the research hypothesis.

H2c.

CSR to community (CSRC) has a substantial effect on an organization’s adoption of green innovation (GI).

2.3.4. CSR to Consumer and Green Innovation

According to [74,107,108], while assessing environmental performance, industrial enterprises and policymakers must manage CSR, environmental strategy, and green innovation. According to the research, technological innovation improves both the performance of businesses and the environment. Managers of sizable industrial companies may benefit from strengthening their internal resources. The research thesis is put forth as a result of earlier literature and logical reasoning.

H2d.

CSR to consumers (CSRCS) has a major positive impact on an organization’s adoption of Green Innovation (GI).

2.3.5. Green Innovation and Financial Performance

Green innovation is a novel concept, as is its methodology, and research on the subject is growing [70,91,92,93,94,109,110]. Recent academic research has concentrated on how organizational environment initiatives affect green innovation and the competitive performance they provide. The most crucial strategy for improving the idea of green innovation that satisfies customer expectations is sustainability [53,88,91,111]. It serves as the main driver for businesses to create green products. Prior studies have shown that companies must carefully assess environmentally friendly information, and green innovation that shows the effective use of resources in environmental practices and efficiency [57,72,93].

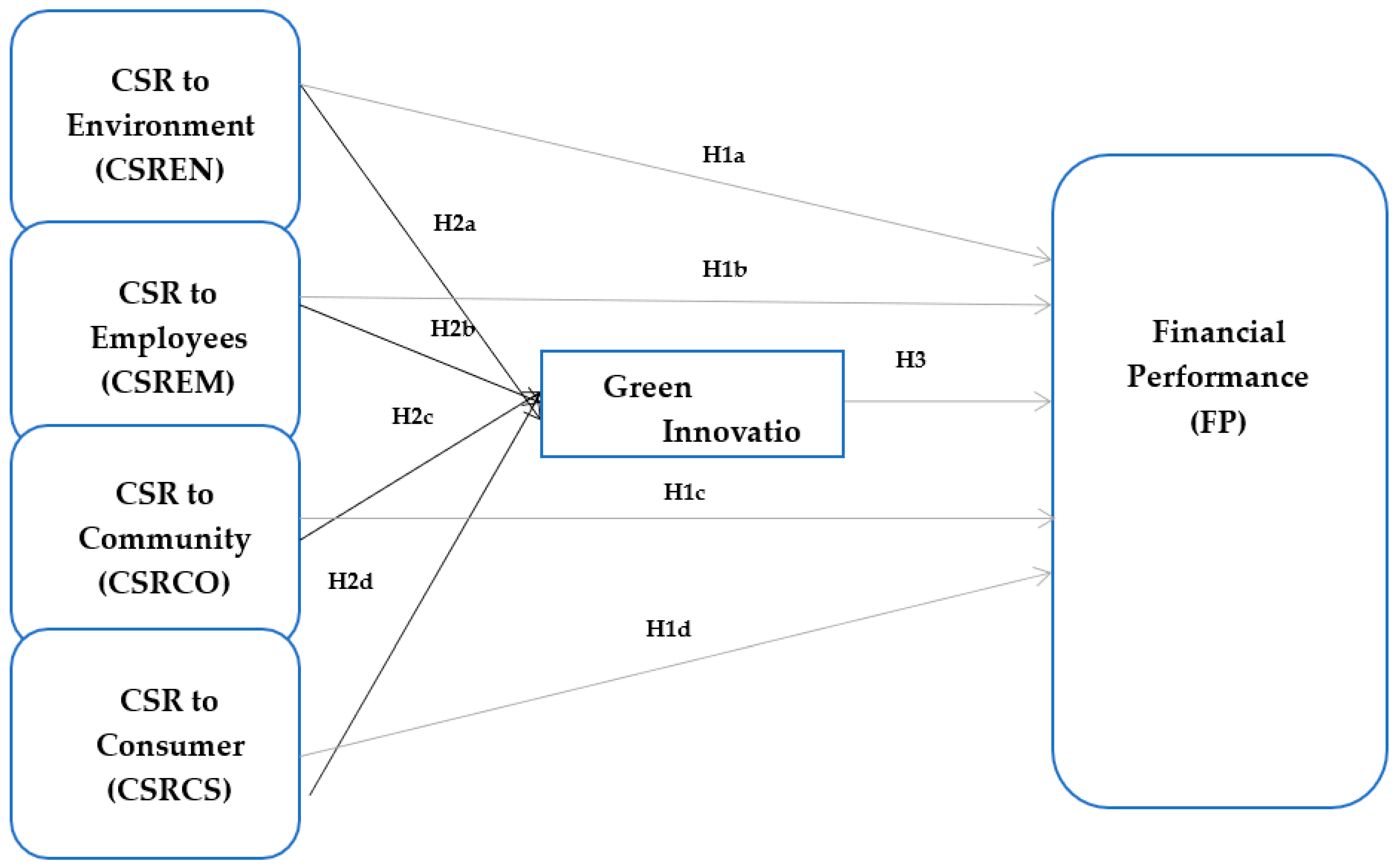

According to [94,109,112,113] the utilization of environmentally friendly expertise offers businesses a double benefit: marketable rewards for creating environmentally friendly products and commercial benefits that can increase the firm’s appeal. In the present world, environmental sensitivity posed risks to GI. On the basis of the existing research and reasons, the following hypothesis is put forth (Figure 1):

Figure 1.

Theoretical model. Model developed by authors.

H3.

Green Innovation (GI) has a positive impact on the financial performance of an organization (FP).

3. Methodology of Research

3.1. Measurement and Validation

According to a scale, the components were measured using three items that tested “CSR to community,” four items that measured “CSR to environment,” six items that measured “CSR to employees,” and three items that measured “CSR to customers” [68]. The questionnaire’s items are listed in Appendix A. The final assessment survey had a total of 28 items with complete information. A Likert scale with five possible outcomes—strongly agree to strongly disagree—was employed in the analysis. The initial survey underwent a few modifications.

3.2. Sample and Process

This inquiry utilized a field survey, cross-sectional analysis, and annual reports to collect data. All survey items with their estimations are available in Appendix B. The target demographic was picked from 184 companies in 12 categories (including oil and gas exploration, refinery, chemical, fertilizer, cement, leather and tanneries, pharmaceuticals, power generation and distribution, sugar and allied industries, synthetic and rayon, textile composite and tobacco). The firms are listed on the Pakistan Stock Exchange (PSX) and the Securities and Exchange Commission of Pakistan (SECP). Their CSR activities are documented in their yearly reports, demonstrating their commitment to CSR. Employees in these industries were surveyed about the corporate social responsibility (CSR), financial performance (FP), and green innovation strategies of their companies (GI). This study collected data using a nonprobability/nonrandom snowball sampling technique, as defined by [75]. Respondents can contribute to a big sample size in this sampling method by providing referrals and providing a positive answer, which maximizes response rate in a short amount of time while minimizing costs. We carefully chose respondents for data collection, contacted them, and arranged both an online and offline meeting. During the last 12 months, from June 2021 to May 2022, a number of automated data collection methods were deployed. Both physical questionnaires and links to online survey forms were sent. We distributed a survey to 350 participants.

3.3. Data Analysis Methodology

According to [114], Smart PLS (version 3.2.8) is capable of managing the measurement and study of structural model analysis concurrently, so this method was used to approximate the data. According to research [99], the structural equation model was most frequently employed for the estimate and investigation of endogenous components in order to account for the maximum variance. According to [114] proposal, the estimate methods for the measurement model and the structural model were conducted separately.

4. Result Analysis

Out of 350 surveys, 291 replies were obtained with no missing values, accounting for 63.57 percent of male respondents and 36.42 percent of female respondents. The majority of responders were between the ages of 20 and 39. Table 1 summarizes all of the demographic findings. This study “followed 10 times the maximum number of structural paths aiming towards a specific latent construct in a structural model,” according to [114]. All of the demographic factors were used as control variables due to their importance (Table 2).

Table 1.

Demographic attributes profile of respondents.

Table 2.

The control variables with their beta values.

4.1. The Analysis of Measurement Model

According to Cohen (1988) [85], in order to investigate the reliability and validity of hypotheses, the composite reliability (CR) and Cronbach’s alpha (CA) were examined, and it was discovered that both of these measures had values that were greater than the critical value threshold of 0.70. The results of additional convergent validity showed that the average variance extracted (AVE) for every single construct was higher than the value of 0.50, and that the standardized factor loading values for every single construct were higher than 0.70, both of which are considered to be acceptable [97]. Two metrics that researchers use to evaluate the discriminant validity of a test are the Fornell–Larcker and the HTMT ratio. The square root of the AVE was significantly higher than the correlation values that were found between it and any other construct (Fornell and Larcker, 1981). Table 3 contain information regarding the dependability and validity of each and every construct.

Table 3.

The results of all constructs with their reliability and validity.

The Heterotrait–Monotrait Ratio (HTMT) is a new method for determining discriminant validity (DV). The ratio value of 0.080 for all constructs indicates that there is no concern with discriminant validity [97]. The outcome of discriminant validity is shown in Table 4.

Table 4.

The Discriminant validity of Heterotrait–Monotrait.

4.2. Structural Model Analysis

According to [114], the structural model (which was evaluated for its expounding power represented by (R2) has causal links between endogenous and exogenous components. Q2 also represents the predictive importance. The model’s predictive ability is shown by the R2 of FP, which was 0.908, and the GI, which was 0.448. The results of Q2 values were 0.404 for FP and 0.453 for GI; however, [97] predicted a higher reproving metric to evaluate the prognostic importance of the research model. For endogenous constructs, this version therefore has the necessary predictive relevance. To further investigate the multicollinearity problem with the data, the variance inflation aspect test (VIF) was calculated. VIF values must be less than 10. (Aiken et al., 1991). There is no multicollinearity problem because the VIF values in Table 5 are all less than 10. Last but not least, the standardized root method rectangular residual (SRMR) price was 0.064 below the threshold of 0.08, suggesting that the test version was well fitting [114]. Table 5 displays the outcome.

Table 5.

Structural model results.

4.3. Path Coefficients

To determine whether the hypotheses were significant, a bootstrapping method was employed. The values of H1a (=0.687, p 0.001), H1b (=0.307, p 0.004), and H1c (=0.502, p 0.000) are significantly and favorably associated in the case of the direct association, whereas the value of H1d (=−0.322, p 0.076) is substantially and adversely associated.

The indirect association between H2a (=1.292, p 0.000), H2b (=1.349, p 0.000), and H2c (=0.534, p 0.000) is substantially and favorably connected, whereas the value of H2d (=−0.217, p 0.025) is significantly and adversely associated. H3 (=0.708, p 0.000) indicates a substantial and favorable association. The empirical evidence demonstrates a strong connection between all proposed routes. It implies that CSR has a positive effect on FP (H1a to H1c). CSR has a positive effect on green innovation as well (H2a to H2c). Economic sustainable development is positively impacted by green innovation. Additionally, the outcomes of the hypotheses are confirmed and displayed in detail in Table 6. The results are aligned with [93,109,110].

Table 6.

Hypotheses model results (Path Coefficient). The pragmatic relationship among all hypothesized paths.

4.4. Discussion of Results

In the context of developing nations, there is not yet a model that adequately addresses the intricate web of interconnections that exists between corporate social responsibility, environmentally conscious innovation, and environmentally responsible business development. When it comes to the viability of businesses in terms of the impact they have on the environment, green innovation can have a moderating effect on society, the environment, and customers. In order to put these hypotheses to the test, we gathered information from the commercial sector of Pakistan with the assistance of lower, middle, and senior management. This was performed for the goal of testing these assumptions.

As part of their charitable and humanitarian obligations, businesses in Pakistan take part in corporate social responsibility, often known as CSR. This practice aims to promote societal education, the preservation of the environment, the well-being of workers and networks, and other related goals (Mehralian et al., 2016). It is probable that this is the reason why customers no longer have an interest in CSR as a means of promoting ecologically sustainable growth [41]. Additionally, the vast majority of businesses only engage in CSR practices on an ad hoc basis; hence, CSR is unrelated to the usual operating strategy that they employ. When incorporated into a company’s day-to-day operations as well as the procedures it uses to make decisions, CSR standards will produce the greatest tangible results.

According to the findings of prior research, GI also possesses an influence that is both beneficial and significant on FP [113,115]. Green innovation provides one such choice for organizations that are looking for ways to satiate the requirements of their clientele without having a detrimental effect on the natural environment. This has become a strategic necessity for companies as they seek to meet the demands of their clients. According to the strategic enterprise theory, putting new ideas into practice inside an organization can enhance both the level of organizational performance achieved by the organization as well as the level of competitiveness achieved by the organization. Both the FP and GI programs serve as an incentive for firms to make investments in contemporary procedures, which ultimately enables the businesses to become more environmentally friendly. In addition to this, it is possible to reduce expenses, decrease energy consumption, and reduce waste, all of which will lead to monetary savings. Businesses that are more conscious of the negative impact their goods have on the environment around them are substantially more likely to be at the forefront of environmentally conscious innovation. This would imply that there is still a demand for purchasing information related to the environment, which is a consequence of the fact that this occurred. The findings that we obtained are in agreement with the studies of [93,109,110].

5. Conclusions

Through an examination of the impacts that corporate social responsibility (CSR) practices have on the long-term viability of an organization’s relationship with its surrounding community and the natural environment, this research makes a significant and useful contribution to the emerging academic field of sustainable studies. The findings are in agreement with the widely held ideas of ecologically responsible development and environmentally friendly innovation. In addition, a structural equation model with a sample of 292 respondents from Pakistan’s industries that had been indexed was used to make a prediction regarding the mediating impact that environmentally friendly innovation will have. This was performed in order to account for the fact that the data had been indexed. We developed nine hypotheses based on the concept of sustainable development, and for each of those hypotheses, we gathered evidence to provide support. The findings indicate that CSR activities, with the exception of one dimension, have a positive influence on FP, and that GI also has a favorable effect on FP. In addition, the findings indicate that CSR activities have a positive influence on GI, which has a positive influence on FP. This demonstrates the importance of engaging in CSR practices when working toward the goal of creating an environment that is environmentally sustainable. In addition, the findings demonstrated that our conclusions were correct and provided support for the validity of the SEM outcomes. These reassuring results make it possible for developing countries such as Pakistan to fulfill their long-term growth goals by implementing corporate social responsibility (CSR) activities within their enterprises. This would allow Pakistan to join the ranks of developed nations. However, in order for a green firm to achieve its objectives, it will need to engage in CSR activities related to both the environment and its network.

Recommendations, Future Research and Limitations

The version that is recommended offers some context, beginning with the limited amount of published material on CSR, GI, and FP in Pakistan’s business sector in particular. By experimentally analyzing the vital importance components of CSR in marketing FP with the support of the concept of sustainable development, this study studied a hitherto undiscovered terrain and aimed to fill a vacuum in the existing body of research on the topic. CSR makes it possible for all stakeholders to engage in conversation on an equal footing, which in turn makes it easier for enterprises to realize their major long-term objectives. Second, this discovery provided further evidence in favor of the requirement outlined in the sustainability literature to implement a green strategy. According to [94], all CSR initiatives involving members and enterprises serve as the fundamental principles for enhancing environmental security by displaying a strong commitment to the environment. This assertion is based on the fact that CSR initiatives involve members and enterprises. As a result of decreases in pollution, CO2 emissions, industrial waste, and energy consumption, achieving environmental sustainability is now a target that may be considered realistic. Thirdly, the version that has been proposed provides an original theoretical perspective on FP as well as the strategy for newbie innovation. This is because there is not enough research on the subject of environmentally conscious creativity and original thought among persons with less experience (Hamann et al., 2017). The most recent discoveries are an addition to the FP and GI literature that already exists. The most important factor is the preservation of the natural environment. According to the findings of the studies, this is because it provides cost-effective solutions to environmental problems. A green innovation strategy has the potential to transform a big carbon-marking enterprise into one that is sustainably profitable. This potential is illustrated by the great appeal of hybrid and electric automobiles. Once stakeholders have committed to long-term goals, the aforementioned examples and our findings indicate how firms can grow through green innovations when conservational safety strategies are implemented throughout the organization. On the basis of the findings of this study, there are some practical outcomes and policy recommendations that can be made regarding the significance of all four CSR activities in an organization’s operations for sustainability as an eco-progressive business. These outcomes and recommendations can be discussed in more detail in the following paragraphs.

It is now advised that the government and top management comply with the achievement of environmental sustainability, and that this commitment must be backed up with a fresh interest in CSR projects. According to the findings of the research, CSR initiatives will contribute to the preservation of the environment. If companies want to produce results that are better for the environment, they need to make corporate social responsibility (CSR) for the environment a primary priority. Despite the significant sums of money that multinational corporations have poured into CSR programs, these organizations have not yet expanded their operations into Asia. This could be due to the fact that firms are unaware of how delicate environmental concerns are (Farooq et al., 2014). For the sake of preventing more ecological damage, governments and politicians ought to take some kind of corrective action.

This study focused on twelve different business sectors in Pakistan; however, the findings might potentially also be applicable to other areas of the economy if caution is exercised. These studies can be helpful to companies that operate in cultural situations that are comparable to one another, with player behaviors and CSR motivators that are also similar. In order to arrive at a conclusion, it may be necessary to do additional research using a pattern that is both more extensive and varied. In the following years, students might expand their knowledge on some of the subjects discussed in the article. Due to time and financial restraints, this research employed a cross-sectional methodology rather than a longitudinal or experimental approach. This choice may have led to a more reliable result regarding the existence of a causal relationship between the variables.

Author Contributions

Methodology, C.M. and R.T.H.; Formal analysis, R.B.; Writing—original draft, M.F.C.; Writing—review & editing, C.M. and M.K.D.; Project administration, S.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Sector-wise detail of companies with market capitalization.

Table A1.

Sector-wise detail of companies with market capitalization.

| Sr. No | Sector | Sector Code | Sector Listed Companies | Market Capitalization in Pak Rupee |

|---|---|---|---|---|

| 1 | Oil and Gas Exploration Companies | 820 | 4 | 894,841,847,304 |

| 2 | Refinery | 825 | 4 | 82,088,923,934 |

| 3 | Chemical | 805 | 27 | 408,003,274,177 |

| 4 | Fertilizer | 809 | 6 | 512,299,572,799 |

| 5 | Cement | 804 | 21 | 596,220,675,671 |

| 6 | Leather and Tanneries | 816 | 5 | 47,195,640,000 |

| 7 | Pharmaceuticals | 820 | 12 | 287,963,514,079 |

| 8 | Power Generation and Distribution | 824 | 17 | 272,382,789,050 |

| 9 | Sugar & Allied Industries | 826 | 19 | 70,963,620,484 |

| 10 | Synthetic and Rayon | 827 | 10 | 79,946,610,839 |

| 11 | Textile Composite | 829 | 56 | 299,277,291,975 |

| 12 | Tobacco | 832 | 3 | 314,095,162,673 |

| 184 | 3,865,278,922,985 |

Available online: https://www.ksestocks.com/ListedSectors (accessed on 1 March 2022).

Appendix B

Table A2.

Survey items.

Table A2.

Survey items.

| Corporate Social Responsibility (CSR) (Farooq et al., 2014; Turker, 2009) [58,92] | |

| CSR is measured by the extent to which you agree or disagree with the following statements on a 5-point Likert-scale (5, Strongly Agree; 1, Strongly Disagree) | Factor Loadings |

| CSR to Community (CSRCO) | |

| CO1—Our organization gives adequate financial contributions to charities. | 0.851 |

| CO2—Our organization supports the non-governmental organizations working in the problematic areas. | 0.818 |

| CO3—Our organization contributes to the campaigns and projects that promote the well-being of the society. | 0.821 |

| CSR to Environment (CSREN) | |

| EN1—Our organization participates in activities which aim to protect and improve the quality of the natural environment. | 0.745 |

| EN2—Our organization makes investments to create a better life for future generations. | 0.840 |

| EN3—Our organization implements special programs to minimize its negative impact on the natural environment. | 0.753 |

| EN4—Our organization targets sustainable growth which considers future generations. | 0.723 |

| CSR to Consumer (CSRCS) | |

| CS1—Our organization protects consumer rights beyond the legal requirements. | 0.521 |

| CS2—Our organization provides full and accurate information about its products to its customers. | 0.573 |

| CS3—Customer satisfaction is highly important for our organization. | 0.510 |

| CSR to Employees (CSREM) | |

| EM1—Our organization encourages its employees to participate in voluntary activities. | 0.818 |

| EM2—Our organizational policies encourage the employees to develop their skills and careers. | 0.724 |

| EM3—The management of our organization is primarily concerned with employees’ needs and wants. | 0.873 |

| EM4—Our organization implements flexible policies to provide a good work and life balance for its employees. | 0.751 |

| EM5—The managerial decisions related to the employees are usually fair. | 0.848 |

| EM6—Our organization supports employees who want to acquire additional education. | 0.735 |

| Green Innovation (GI) (Song and Yu, 2018) [104] | |

| GI is measured by the extent to which you agree or disagree with the following statements on a 5-point Likert-scale (5, Strongly Agree; 1, Strongly Disagree) | |

| GI1—Our organization chooses the materials of the product that produce the least amount of pollution for conducting the product development or design. | 0.758 |

| GI2—Our organization uses the lowest amounts of materials to comprise the product for conducting the product development or design. | 0.744 |

| GI3—Our organization would circumspectly deliberate whether the product is easy to recycle, reuse, anddecompose for conducting the product development or design. | 0.798 |

| GI4—The manufacturing process of our organization reduces the consumption of water, electricity, coal, or oil. | 0.747 |

| GI5—The manufacturing process of our organization effectively reduces the emission of hazardous substances or waste. | 0.741 |

| GI6—The manufacturing process of our organization reduces the use of raw materials. | 0.742 |

References

- Sonnett, J. Climate change risks and global warming dangers: A field analysis of online US news media. Environ. Sociol. 2022, 8, 41–51. [Google Scholar] [CrossRef]

- Waas, T.; Hugé, J.; Block, T.; Wright, T.; Benitez-Capistros, F.; Verbruggen, A. Sustainability assessment and indicators: Tools in a decision-making strategy for sustainable development. Sustainability 2014, 6, 5512–5534. [Google Scholar] [CrossRef]

- Lin, C.H.; Lii, Y.S.; Ding, M.C. The CSR Spillover Effect on Consumer Responses to Advertised Reference Price Promotion. Adm. Sci. 2022, 12, 30. [Google Scholar] [CrossRef]

- Kong, D.; Xiong, M.; Qin, N. Business Tax reform and CSR engagement: Evidence from China. Int. Rev. Financ. Anal. 2022, 82, 102178. [Google Scholar] [CrossRef]

- Effrosynidis, D.; Karasakalidis, A.I.; Sylaios, G.; Arampatzis, A. The climate change Twitter dataset. Expert Syst. Appl. 2022, 45, 117541. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Juárez, L.E.V. Strategic Corporate Social Responsibility Orientation: From Gathering Information to Reporting Initiatives: Orientación estratégica de la Responsabilidad Social Corporativa: De la recopilación de información a la difusión de las actuaciones. Rev. Contab. Span. Account. Rev. 2022, 25, 89–106. [Google Scholar] [CrossRef]

- Grolleau, G.; Mzoughi, N.; Peterson, D.; Tendero, M. Changing the world with words? Euphemisms in climate change issues. Ecol. Econ. 2022, 193, 107307. [Google Scholar] [CrossRef]

- Morea, D.; Fortunati, S.; Martiniello, L. Circular economy and corporate social responsibility: Towards an integrated strategic approach in the multinational cosmetics industry. J. Clean. Prod. 2021, 315, 128232. [Google Scholar] [CrossRef]

- SWS WCED. World commission on environment and development. Our Common Future 1987, 17, 1–91. [Google Scholar]

- Germano, M. ‘Neutral’ Representations of Pacific Islands in the IPCC Special Report of 1.5 °C Global Warming. Aust. Geogr. 2022, 53, 23–39. [Google Scholar] [CrossRef]

- Peng, Y.; Zhang, X.; van Donk, D.P.; Wang, C. How can suppliers increase their buyers’ CSR engagement: The role of internal and relational factors. Int. J. Oper. Prod. Manag. 2022, 72, 231–248. [Google Scholar] [CrossRef]

- Yarram, S.R.; Adapa, S. Board gender diversity and corporate social responsibility: Is there a case for critical mass? J. Clean. Prod. 2021, 278, 123319. [Google Scholar] [CrossRef]

- Litvinenko, V.; Bowbrik, I.; Naumov, I.; Zaitseva, Z. Global guidelines and requirements for professional competencies of natural resource extraction engineers: Implications for ESG principles and sustainable development goals. J. Clean. Prod. 2022, 32, 130530. [Google Scholar] [CrossRef]

- Qiao, F.; Williams, J. Topic Modelling and Sentiment Analysis of Global Warming Tweets: Evidence From Big Data Analysis. J. Organ. End User Comput. (JOEUC) 2022, 34, 1–18. [Google Scholar] [CrossRef]

- Wong, A.K.F.; Kim, S.; Hwang, Y. Effects of Perceived Corporate Social Responsibility (CSR) Performance on Hotel Employees’ Behavior. Int. J. Hosp. Tour. Adm. 2021, 23, 1145–1173. [Google Scholar] [CrossRef]

- Xin, Y.; Senin, A.B.A. Features of Environmental Sustainability Concerning Environmental Regulations, Green Innovation and Social Distribution in China. High. Educ. Orient. Stud. 2022, 2, 45–78. [Google Scholar] [CrossRef]

- Zamora-Polo, F.; Sánchez-Martín, J. Teaching for a better world. Sustainability and sustainable development goals in the construction of a change-maker university. Sustainability 2019, 11, 4224. [Google Scholar] [CrossRef]

- Adams, D.; Adams, K.; Attah-Boakye, R.; Ullah, S.; Rodgers, W.; Kimani, D. Social and environmental practices and corporate financial perfor-mance of multinational corporations in emerging markets: Evidence from 20 oil-rich African countries. Resour. Policy. 2022, 78, 102756. [Google Scholar] [CrossRef]

- Hina, M.; Chauhan, C.; Kaur, P.; Kraus, S.; Dhir, A. Drivers and barriers of circular economy business models: Where we are now, and where we are heading. J. Clean. Prod. 2022, 333, 130049. [Google Scholar] [CrossRef]

- Reinecke, J.; Donaghey, J. Political CSR at the coalface–The roles and contradictions of multinational corporations in developing workplace dialogue. J. Manag. Stud. 2021, 58, 457–486. [Google Scholar] [CrossRef]

- Raszkowski, A.; Bartniczak, B. On the road to sustainability: Implementation of the 2030 Agenda sustainable development goals (SDG) in Poland. Sustainability 2019, 11, 366. [Google Scholar] [CrossRef]

- Reiss, M.J. Reclimating: 0 °C as a target for global warming. J. Biol. Educ. 2022, 56, 1–2. [Google Scholar] [CrossRef]

- Yuan, B.; Cao, X. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- Ahmad, N.; Scholz, M.; Ullah, Z.; Arshad, M.Z.; Sabir, R.I.; Khan, W.A. The nexus of CSR and co-creation: A roadmap towards consumer loy-alty. Sustainability 2021, 13, 523. [Google Scholar] [CrossRef]

- Bian, J.; Liao, Y.; Wang, Y.Y.; Tao, F. Analysis of firm CSR strategies. Eur. J. Oper. Res. 2021, 290, 914–926. [Google Scholar] [CrossRef]

- Liu, G.; Brown, M.T.; Casazza, M. Enhancing the sustainability narrative through a deeper understanding of sustainable development indicators. Sustainability 2017, 9, 1078. [Google Scholar] [CrossRef]

- Zhang, Q.; Ma, Y. The impact of environmental management on firm economic performance: The mediating effect of green innovation and the moderating effect of environmental leadership. J. Clean. Prod. 2021, 292, 126057. [Google Scholar] [CrossRef]

- Zhang, Q.; Oo, B.L.; Lim, B.T.H. Linking corporate social responsibility (CSR) practices and organizational performance in the construction industry: A resource collaboration network. Resources. Conserv. Recycl. 2022, 179, 106113. [Google Scholar] [CrossRef]

- Zhao, L.; Yang, M.M.; Wang, Z.; Michelson, G. Trends in the Dynamic Evolution of Corporate Social Responsibility and Leadership: A Literature Review and Bibliometric Analysis. J. Bus. Ethics 2022, 34, 1–23. [Google Scholar] [CrossRef]

- Ding, X.; Appolloni, A.; Shahzad, M. Environmental administrative penalty, corporate environmental disclosures and the cost of debt. J. Clean. Prod. 2022, 332, 129919. [Google Scholar] [CrossRef]

- Zhao, X.; Wu, C.; Chen, C.C.; Zhou, Z. The influence of corporate social responsibility on incumbent employees: A meta-analytic investigation of the mediating and moderating mechanisms. J. Manag. 2022, 48, 114–146. [Google Scholar] [CrossRef]

- Achi, A.; Adeola, O.; Achi, F.C. CSR and green process innovation as antecedents of micro, small, and medium enterprise performance: Moderating role of perceived environmental volatility. J. Bus. Res. 2022, 139, 771–781. [Google Scholar] [CrossRef]

- Jin, C.; Shahzad, M.; Zafar, A.U.; Suki, N.M. Socio-economic and environmental drivers of green innovation: Evidence from nonlinear ARDL. Econ. Res. Ekon. Istraživanja 2022, 32, 1–21. [Google Scholar] [CrossRef]

- Khalil, M.A.; Nimmanunta, K. Conventional versus green investments: Advancing innovation for better financial and environmental prospects. J. Sustain. Financ. Investig. 2022, 22, 1–28. [Google Scholar] [CrossRef]

- Mehmood, K.K.; Hanaysha, J.R. Impact of Corporate Social Responsibility, Green Intellectual Capital, and Green Innovation on Competitive Advantage: Building Contingency Model. Int. J. Hum. Cap. Inf. Technol. Prof. (IJHCITP) 2022, 13, 1–14. [Google Scholar] [CrossRef]

- Okafor, A.; Adeleye, B.N.; Adusei, M. Corporate social responsibility and financial performance: Evidence from US tech firms. J. Clean. Prod. 2021, 292, 126078. [Google Scholar] [CrossRef]

- Chomvilailuk, R.; Butcher, K. How hedonic and perceived community benefits from employee CSR involvement drive CSR advocacy behavior to co-workers. Business Ethics Environ. Responsib. 2022, 31, 224–238. [Google Scholar] [CrossRef]

- Khan, H.; Weili, L.; Khan, I. Environmental innovation, trade openness and quality institutions: An integrated investigation about environmental sustainability. Environ. Dev. Sustain. 2022, 24, 3832–3862. [Google Scholar] [CrossRef]

- Kong, L.; Sial, M.S.; Ahmad, N.; Sehleanu, M.; Li, Z.; Zia-Ud-Din, M.; Badulescu, D. CSR as a potential motivator to shape employees’ view towards nature for a sustainable workplace environment. Sustainability 2021, 13, 1499. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Change 2020, 160, 120262. [Google Scholar] [CrossRef]

- Schiessl, D.; Korelo, J.C.; Cherobim, A.P.M.S. Corporate social responsibility and the impact on economic value added: The role of environmental innovation. Eur. Bus. Rev. 2022, 66, 32–65. [Google Scholar] [CrossRef]

- Kuo, T.C.; Chen, H.M.; Meng, H.M. Do corporate social responsibility practices improve financial performance? A case study of airline companies. J. Clean. Prod. 2021, 310, 127380. [Google Scholar] [CrossRef]

- Rehman, S.U.; Kraus, S.; Shah, S.A.; Khanin, D.; Mahto, R.V. Analyzing the relationship between green innovation and environmental performance in large manufacturing firms. Technol. Forecast. Soc. Change 2021, 163, 120481. [Google Scholar] [CrossRef]

- Marietza, F.; Nadia, M. The Influence of Green Innovation and CSR on Sustainable Development Mediated by Green Performance. Glob. Financ. Account. J. 2021, 5, 24–36. [Google Scholar] [CrossRef]

- Cancino, C.A.; La Paz, A.I.; Ramaprasad, A.; Syn, T. Technological innovation for sustainable growth: An ontological perspective. J. Clean. Prod. 2018, 179, 31–41. [Google Scholar] [CrossRef]

- Cheng, H.; Ding, H. Dynamic game of corporate social responsibility in a supply chain with competition. J. Clean. Prod. 2021, 317, 128398. [Google Scholar] [CrossRef]

- Fallah Shayan, N.; Mohabbati-Kalejahi, N.; Alavi, S.; Zahed, M.A. Sustainable development goals (SDGs) as a framework for corporate social responsibility (CSR). Sustainability 2022, 14, 1222. [Google Scholar] [CrossRef]

- Feder, M.; Weißenberger, B.E. Towards a holistic view of CSR-related management control systems in German companies: Determinants and corporate performance effects. J. Clean. Prod. 2021, 294, 126084. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. 1981. Available online: https://journals.sagepub.com/doi/abs/10.1177/002224378101800313 (accessed on 1 March 2022).

- Latif, B.; Ong, T.S.; Meero, A.; Abdul Rahman, A.A.; Ali, M. Employee-Perceived Corporate Social Responsibility (CSR) and Employee Pro-Environmental Behavior (PEB): The Moderating Role of CSR Skepticism and CSR Authenticity. Sustainability 2022, 14, 1380. [Google Scholar] [CrossRef]

- Lingyan, M.; Zhao, Z.; Malik, H.A.; Razzaq, A.; An, H.; Hassan, M. Asymmetric impact of fiscal decentralization and environmental innovation on carbon emissions: Evidence from highly decentralized countries. Energy Environ. 2022, 33, 752–782. [Google Scholar] [CrossRef]

- Moehl, S.; Friedman, B.A. Consumer perceived authenticity of organizational corporate social responsibility (CSR) statements: A test of attribution theory. Soc. Responsib. J. 2021, 18, 875–893. [Google Scholar] [CrossRef]

- Vătămănescu, E.M.; Dabija, D.C.; Gazzola, P.; Cegarro-Navarro, J.G.; Buzzi, T. Before and after the outbreak of COVID-19: Linking fashion companies’ corporate social responsibility approach to consumers’ demand for sustainable products. J. Clean. Prod. 2021, 321, 128945. [Google Scholar] [CrossRef]

- Beyeler, N.; Salas, R.N. An unequivocal call to climate action for the health sector. BMJ 2022, 376, 11–19. [Google Scholar] [CrossRef] [PubMed]

- Le, T.T.; Huan, N.Q.; Hong, T.T.T.; Tran, D.K. The contribution of corporate social responsibility on SMEs performance in emerging country. J. Clean. Prod. 2021, 322, 129103. [Google Scholar]

- Martelo-Landroguez, S.; Albort-Morant, G.; Leal-Rodríguez, A.L.; Ribeiro-Soriano, B. The effect of absorptive capacity on green customer capital under an organizational unlearning context. Sustainability 2018, 10, 265. [Google Scholar] [CrossRef]

- Ali, S.S.; Kaur, R. Effectiveness of corporate social responsibility (CSR) in implementa-tion of social sustainability in warehousing of developing countries: A hybrid approach. J. Clean. Prod. 2021, 324, 129154. [Google Scholar] [CrossRef]

- Farooq, O.; Payaud, M.; Merunka, D.; Valette-Florence, P. The impact of corporate social responsibility on organizational commitment: Exploring multiple mediation mechanisms. J. Bus. Ethics 2014, 125, 563–580. [Google Scholar] [CrossRef]

- Lee, Y.; Lin, C.A. The effects of a sustainable vs conventional apparel advertisement on consumer perception of CSR image and attitude toward the brand. Corp. Commun. Int. J. 2021, 54, 145–164. [Google Scholar] [CrossRef]

- Diers-Lawson, A.; Coope, K.; Tench, R. Why can CSR seem like putting lipstick on a pig? Evaluating CSR authenticity by comparing practitioner and consumer perspectives. J. Glob. Responsib. 2020, 11, 329–346. [Google Scholar] [CrossRef]

- Barbosa, M.W.; de Oliveira, V.M. The Corporate Social Responsibility professional: A content analysis of job advertisements. J. Clean. Prod. 2021, 279, 123665. [Google Scholar] [CrossRef]

- Huang, M.; Li, M.; Liao, Z. Do politically connected CEOs promote Chinese listed industrial firms’ green innovation? The mediating role of external governance environments. J. Clean. Prod. 2021, 278, 123634. [Google Scholar] [CrossRef]

- Javeed, S.A.; Lefen, L. An Analysis of Corporate Social Responsibility and Firm Performance with Moderating Effects of CEO Power and Ownership Structure: A Case Study of the Manufacturing Sector of Pakistan. Sustainability 2019, 11, 248. [Google Scholar] [CrossRef]

- Bolourian, S.; Angus, A.; Alinaghian, L. The impact of corporate governance on corporate social responsibility at the board-level: A critical assessment. J. Clean. Prod. 2021, 291, 125752. [Google Scholar] [CrossRef]

- Lu, J.; Wang, J. Corporate governance, law, culture, environmental performance and CSR disclosure: A global perspective. Journal of International Financial Markets. Inst. Money 2021, 70, 101264. [Google Scholar] [CrossRef]

- Babajee, R.B.; Seetanah, B.; Nunkoo, R.; Gopy-Ramdhany, N. Corporate social responsibility and hotel financial performance. J. Hosp. Mark. Manag. 2022, 31, 226–246. [Google Scholar] [CrossRef]

- Sun, H.; Zhu, J.; Wang, T.; Wang, Y. MBA CEOs and corporate social responsibility: Empirical evidence from China. J. Clean. Prod. 2021, 290, 125801. [Google Scholar] [CrossRef]

- Bansal, P.; Jiang, G.F.; Jung, J.C. Managing responsibly in tough economic times: Strategic and tactical CSR during the 2008–2009 global recession. Long Range Plan. 2015, 48, 69–79. [Google Scholar] [CrossRef]

- Marco-Lajara, B.; Úbeda-García, M.; Ruiz-Fernández, L.; Poveda-Pareja, E.; Sánchez-García, E. Rural hotel resilience during COVID-19: The crucial role of CSR. Curr. Issues Tour. 2021, 69, 1–15. [Google Scholar] [CrossRef]

- Wang, H.; Qi, S.; Zhou, C.; Zhou, J.; Huang, X. Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Metzker, Z.; Zvarikova, K. The Perception of Company Employees by SMEs with CSR Concept Implementation. Int. J. Entrep. Knowl. 2021, 9, 81–96. [Google Scholar] [CrossRef]

- Wang, Y.; Lu, T.; Qiao, Y. The effect of air pollution on corporate social responsibility performance in high energy-consumption industry: Evidence from Chinese listed companies. J. Clean. Prod. 2021, 280, 124345. [Google Scholar] [CrossRef]

- Boiral, O.; Heras-Saizarbitoria, I.; Brotherton, M.C. Assessing and improving the quality of sustainability reports: The auditors’ perspective. J. Bus. Ethics 2019, 155, 703–721. [Google Scholar] [CrossRef]

- Rasyid, A.; Nasution, B. Effects of corporate social responsibility communications on community empowerment in Pekanbaru. Linguist. Cult. Rev. 2022, 6, 12–23. [Google Scholar] [CrossRef]

- Bryman, A.; Bell, E. Business Research Methods, 3rd ed.; Oxford University Press: New York, NY, USA, 2011. [Google Scholar]

- Mehralian, G.; Nazari, J.A.; Zarei, L.; Rasekh, H.R. The effects of corporate social responsibility on organizational performance in the Iranian pharmaceutical industry: The mediating role of TQM. J. Clean. Prod. 2016, 135, 689–698. [Google Scholar] [CrossRef]

- Orij, R.P.; Rehman, S.; Khan, H.; Khan, F. Is CSR the new competitive environment for CEOs? The association between CEO turnover, corporate social responsibility and board gender diversity: Asian evidence. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 731–747. [Google Scholar] [CrossRef]

- Ministry of Finance. Available online: https://www.finance.gov.pk/circulars.html (accessed on 11 November 2021).

- Siregar, I. CSR-Based Corporate Environmental Policy Implementation. Br. J. Environ. Stud. 2021, 1, 51–57. [Google Scholar]

- Canning, M.; O’Dwyer, B.; Georgakopoulos, G. Processes of auditability in sustainability assurance–the case of materiality construction. Soc. Environ. Account. J. 2019, 41, 127–129. [Google Scholar] [CrossRef]

- Cheng, Y.; Chen, Y.R.R.; Hung-Baesecke, C.J.F. Social media influencers in CSR endorsement: The effect of consumer mimicry on CSR behaviors and consumer relationships. Soc. Sci. Comput. Rev. 2021, 39, 744–761. [Google Scholar] [CrossRef]

- Qu, K.; Liu, Z. Green innovations, supply chain integration and green information system: A model of moderation. J. Clean. Prod. 2022, 339, 130557. [Google Scholar] [CrossRef]

- Bruna, M.G.; Lahouel, B.B. CSR & financial performance: Facing methodological and modeling issues commentary paper to the eponymous FRL article collection. Financ. Res. Lett. 2022, 44, 102036. [Google Scholar]

- Chien, F.; Sadiq, M.; Nawaz, M.A.; Hussain, M.S.; Tran, T.D.; Le Thanh, T. A step toward reducing air pollution in top Asian economies: The role of green energy, eco-innovation, and environmental taxes. J. Environ. Manag. 2021, 297, 113420. [Google Scholar] [CrossRef] [PubMed]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Lawrence Erlbaum: Hillsdale, NJ, USA, 1988. [Google Scholar]

- Mtapuri, O.; Camilleri, M.A.; Dłużewska, A. Advancing community-based tourism approaches for the sustainable development of destinations. Sustain. Dev. 2021, 30, 423–432. [Google Scholar] [CrossRef]

- Nguyen, V.H.; Agbola, F.W.; Choi, B. Does Corporate Social Responsibility Enhance Financial Performance? Evidence from Australia. Aust. Account. Rev. 2022, 32, 5–18. [Google Scholar] [CrossRef]

- Padilla-Lozano, C.P.; Collazzo, P. Corporate social responsibility, green innovation and competitiveness–causality in manufacturing. Compet. Rev. Int. Bus. J. 2021, 54, 56–89. [Google Scholar] [CrossRef]

- Eng, N.; Buckley, C.; Peng, R.X. Tracking the Path of the Green Consumer: Surveying the Decision-Making Process from Self-Transcendent Values to Supportive CSR Intentions. Sustainability 2022, 14, 1106. [Google Scholar] [CrossRef]

- Tu, Y.; Wu, W. How does green innovation improve enterprises’ competitive advantage? The role of organizational learning. Sustain. Prod. Consum. 2021, 26, 504–516. [Google Scholar] [CrossRef]

- Hongxin, W.; Khan, M.A.; Zhenqiang, J.; Cismaș, L.M.; Ali, M.A.; Saleem, U.; Negruț, L. Unleashing the Role of CSR and Employees’ Pro-Environmental Behavior for Organizational Success: The Role of Connectedness to Nature. Sustainability 2022, 14, 3191. [Google Scholar] [CrossRef]

- Turker, D. Measuring corporate social responsibility: A scale development study. Journal of business ethics 2009, 85, 411–427. [Google Scholar] [CrossRef]

- Rossi, M.; Chouaibi, J.; Chouaibi, S.; Jilani, W.; Chouaibi, Y. Does a board characteristic moderate the relationship between CSR practices and financial performance? Evidence from European ESG firms. J. Risk Financ. Manag. 2021, 14, 354. [Google Scholar] [CrossRef]

- Appolloni, A.; Jabbour, C.J.C.; D’Adamo, I.; Gastaldi, M.; Settembre-Blundo, D. Green recovery in the mature manufacturing industry: The role of the green-circular premium and sustainability certification in innovative efforts. Ecol. Econ. 2022, 193, 107311. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Hussain, N.; Khan, S.A.; Martínez-Ferrero, J. Assurance of corporate social responsibility reports: Examining the role of internal and external corporate governance mechanisms. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 89–106. [Google Scholar] [CrossRef]

- Romero, C.A.; Mijares, V.M. From Chávez to Maduro: Continuity and change in Venezuelan foreign policy. Contexto Int. 2016, 38, 165–201. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial least squares structural equation modeling. Handb. Mark. Res. 2017, 26, 1–40. [Google Scholar]

- Grassmann, M. The relationship between corporate social responsibility expenditures and firm value: The moderating role of integrated reporting. J. Clean. Prod. 2021, 285, 124840. [Google Scholar] [CrossRef]

- Gupta, J.; Das, N. Multidimensional corporate social responsibility disclosure and financial performance: A meta-analytical review. Corp. Soc. Responsib. Environ. Manag. 2022, 32, 171. [Google Scholar] [CrossRef]

- Guo, H.; Lu, W. The inverse U-shaped relationship between corporate social responsibility and competitiveness: Evidence from Chinese international construction companies. J. Clean. Prod. 2021, 295, 126374. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Javed, S.A.; Zafar, A.U.; Rehman, S.U. Relation of environment sustainability to CSR and green innovation: A case of Pakistani manufacturing industry. J. Clean. Prod. 2020, 253, 119938. [Google Scholar] [CrossRef]

- Halkos, G.; Nomikos, S.; Tsilika, K. Evidence for Novel Structures Relating CSR Reporting and Economic Welfare: Environmental Sustainability—A Continent-Level Analysis. Comput. Econ. 2021, 52, 1–30. [Google Scholar] [CrossRef]

- Han, S.L.; Lee, J.W. Does corporate social responsibility matter even in the B2B market? Effect of B2B CSR on customer trust. Ind. Mark. Manag. 2021, 93, 115–123. [Google Scholar] [CrossRef]

- Song, W.; Yu, H. Green innovation strategy and green innovation: The roles of green creativity and green organizational identity. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 135–150. [Google Scholar] [CrossRef]

- Hamann, R.; Smith, J.; Tashman, P.; Marshall, R.S. Why do SMEs go green? An analysis of wine firms in South Africa. Bus. Soc. 2017, 56, 23–56. [Google Scholar] [CrossRef]

- Hang, Y.; Sarfraz, M.; Khalid, R.; Ozturk, I.; Tariq, J. Does corporate social responsibility and green product innovation boost organizational performance? a moderated mediation model of competitive advantage and green trust. Econ. Res. Ekon. Istraživanja 2022, 44, 1–21. [Google Scholar] [CrossRef]

- He, X. Sustainability Assurance: A Call for Specialist Standards: Boiral, O. and Heras- Saizarbitoria, I., 2020. Sustainability reporting assurance: Creating stakeholder accountability through hyperreality? J. Clean. Prod. 2020, 243, 1–17. [Google Scholar]

- Tu, S.; Wu, M.Z.; Wang, J.; Cutter, A.D.; Weng, Z.; Claycomb, J.M. Comparative functional characterization of the CSR-1 22G-RNA pathway in Caenorhabditis nematodes. Nucleic Acids Res. 2015, 43, 208–224. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Henseler, J.; Leal-Millán, A.; Cepeda-Carrión, G. Mapping the field: A bibliometric analysis of green innovation. Sustainability 2017, 9, 1011. [Google Scholar] [CrossRef]

- Xie, X.; Hoang, T.T.; Zhu, Q. Green process innovation and financial performance: The role of green social capital and customers’ tacit green needs. J. Innov. Knowl. 2022, 7, 100165. [Google Scholar] [CrossRef]

- Ang, R.; Shao, Z.; Liu, C.; Yang, C.; Zheng, Q. The relationship between CSR and financial performance and the moderating effect of ownership structure: Evidence from Chinese heavily polluting listed enterprises. Sustain. Prod. Consum. 2022, 30, 117–129. [Google Scholar] [CrossRef]

- Javed, S.; Husain, U. Corporate CSR practices and corporate performance: Managerial implications for sustainable development. Decision 2021, 48, 153–164. [Google Scholar] [CrossRef]

- Wang, Y.; Su, M.; Shen, L.; Tang, R. Decision-making of closed-loop supply chain under Corporate Social Responsibility and fairness concerns. J. Clean. Prod. 2021, 284, 125373. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Sarstedt, M.; Matthews, L.M.; Ringle, C.M. Identifying and treating unobserved heterogeneity with FIMIX-PLS: Part I–method. Eur. Bus. Rev. 2016, 23, 125. [Google Scholar]

- Zhu, H.; Pan, Y.; Qiu, J.; Xiao, J. Hometown ties and favoritism in Chinese corporations: Evidence from CEO dismissals and corporate social responsibility. J. Bus. Ethics 2022, 176, 283–310. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).