1. Introduction

Transitioning to a circular economy (CE) for plastics in Europe (and beyond) remains an ambitious goal since the way in which plastics are currently being handled must be fundamentally changed. The current European plastics industry appears to remain in a linear system with low levels of resource efficiency (<14% of generated waste recycled); increasing greenhouse gas (GHG) emissions (95 MtCO2e per year); and enormous pollution levels (mismanagement of waste due to landfilling and incineration) [

1]. Thus, an effective transition to a circular model in Europe is urgently needed that enables a complete recycling of plastics with decreased environmental impacts and pollution levels [

2]. Systemic and technical innovations, as well as sustainable value creation tailored to the circular plastics economy, are key facilitators to depart from the current linear paradigm.

Moving towards a circular economy model for plastics whereby resources are circled in technical and biological loops to create, maintain, and preserve value [

3], i.e., involving sustainable production and consumption cycles, has been proposed as a promising solution. The concept of the circular economy (CE) aims to realize a restorative and regenerative system by design while maximizing the value of products, materials, and natural resources [

4]. While there appears to exist no globally agreed definition of the CE, a universal consensus has emerged that the concept is one viable trajectory to effectively necessitating a systemic shift through enhancing the relationship between economic systems and the environment, by proposing radical interventions to the current production and consumption patterns through slowing (repair, reuse, remanufacture) or closing (recycling, recovery) resource loops while functioning at the micro-, meso-, and macro-levels with the aim to realize sustainable development for present and future generations [

5]. However, transitioning towards a CE imposes enormous challenges on our socio-economic system [

6,

7,

8].

Existing literature on CE challenges and opportunities has revealed two elementary gaps in the contemporary research. First, although general challenges and opportunities have previously been examined in the available literature, there remains an urgent call for investigating CE challenges and opportunities in an industry- and geography-specific context [

6,

8,

9]. Second, it has become evident that technological challenges are urgent factors that are highly mentioned in the CE literature [

9]. Overcoming technological challenges is one of the most critical aspects of a successful CE transition [

10] that, however, requires additional empirical investigation for specific industries and sectors. A recent study by Schultz and Reinhardt [

7] that investigates CE innovation for the polyurethane plastics industry, advocated to endogenize technological innovation; yet, a thorough assessment and discussion of technological challenges and opportunities is omitted. Adding to and expanding on this study [

7], this communication article is investigating their ‘blind spot’, i.e., by discussing the complementary technology perspective within the European plastics industry in more detail.

To bridge the gap and expand insights within the existing literature, the primary aim of this short communication article is to discuss technological industry-specific CE challenges and opportunities for the European plastics industries. This is of particular importance since the current system must be shifted towards a low-emissions pathway by promoting sustainable production and consumption patterns, which appear to be increasingly addressed in the European context [

11]. The European Union has been leading the transformation to a CE at global scale with total material uses having been decreased by more than 9%, while the share of resources derived from recycled waste increased by almost 50% in the past two decades [

12]. Further, in 2015, the European Commission (EC) launched a vast regulatory reform program, its ambitious Circular Economy Action Plan, as a key pillar of the European Green Deal (i.e., first climate neutral continent by 2050) aimed to achieve a cleaner and more competitive Europe that is not reliant on scarce resources and volatile prices by systematically advancing from a linear system to a CE [

13]. The EU CE action plan is well accommodated with the Sustainable Development Goals of the United Nations (Agenda 2023), and includes five priority sectors, with plastics being one, where the potential and immediate improvement of circularity is estimated to be high. The action plan is further envisaging that not only countries with the European borders but also those beyond are expected to benefit from its implementation and adapt lessons learned in moving towards increasingly sustainable economies.

A considerable development in the EU CE action plan was achieved in 2018 when the EC adopted the European Strategy for Plastics in a CE, setting ambitious targets to achieve high plastic recycling rates by 2025–2030, and enabling a smart, innovative, and sustainable plastics industry in Europe, whereby value chain thinking is adopted while respecting the needs of reuse, repair, and recycling efforts [

14]. It is envisaged that this strategy will lead the transition to a new plastics economy in Europe whereby innovation is boosted; plastic pollution is decreased; and Europe can contribute to progress on global solutions through, inter alia, international partnerships or by advancing to setting international standards for plastics at a global level. However, in the EU and beyond, the present petrochemical and plastic value chains have experienced an annual plastics demand growth of 1–2%, and, relatedly, the sector is still causing one of the most pressing environmental issues of our time [

14]; yet, it is evident that the sector possesses a vast potential to realize and move towards a functional CE [

15,

16].

The remainder of this article is organized as follows: first, we situate our article in the CE context regarding CE challenges and opportunities, followed by the short delineation of our research method. We then present our findings on the European plastic industries. Finally, we discuss our findings and derive vital ‘take-home messages’ for academia, politics, and practice, followed by concluding remarks.

2. Theoretical Background—Challenges and Opportunities for a Circular Economy

According to de Jesus and Mendonça [

9], de Jesus et al. [

17], Grafström and Aasma [

18], Kirchherr et al. [

6], and Paletta et al. [

19] challenges (and opportunities) for a CE can be clustered along four key dimensions: social/cultural, institutional/regulatory, economic/market, and technological. The focus of this study lies on the latter. A comprehensive review by de Jesus and Mendonça [

9] (p. 81) reveals that in the academic literature on CE, “technological challenges are considered to be a key barrier to transition.”

Most of the contemporary research stresses technological factors as challenges regarding technological thresholds [

20,

21] or technical gaps between invention and commercialization [

22]. Accordingly, a limited circular design of products (and services) [

23,

24,

25], quality issues of recycled (remanufactured) products [

26], and reliability of supply for recycled (remanufactured) materials [

27] are hindering a CE transition. Furthermore, the lack of large-scale projects and the absence of industrial scale facilities are obstructive [

8,

28,

29,

30]. The paucity of information and dearth of data on CE impacts [

6] contributes to gaps in technical knowledge and capabilities [

8,

9,

25,

29,

31,

32,

33]. This underlines that there are enormous technological challenges towards a CE.

For opportunities to a CE, a detailed review of 141 articles by de Jesus and Mendonça [

9] shows that institutional/regulatory (36%) and economic/market (35%) drivers are most mentioned in the literature, while social/cultural (21%) and technological (8%) aspects are less prominent opportunities. Opportunities for a CE are available and appropriate technologies that enable change [

20]. The necessary technical inventions provide solutions to overcome issues caused by current technologies [

10]. This availability of technology is essential to improve product durability, efficiency, and quality along the life cycle [

24,

32] and extends lifetime by revealing, e.g., reuse opportunities [

34]. Technical capacities and capabilities are fundamental in the transition process [

9], since new technologies can enable companies to further develop and move towards a CE [

35].

Exemplarily, waste management and recycling opportunities are dependent on technical solutions [

26] and also the use of by-products as input for other products and processes [

36]. Circular design of products and services [

37] enables technological progress for businesses and value chains. Concludingly, technological factors—challenges and opportunities—are crucial to enable a CE transition, but both require further research for the plastics industries in Europe and beyond.

3. Methods

This communication article is building and expanding upon the findings from the contemporary study from Schultz and Reinhardt [

7], by following the qualitative research approach developed by Gioia et al. [

38]. Our contacting procedure was twofold. In a first step, we contacted industry experts and companies by approaching industry associations. In a second step, we approached further relevant interviewees by utilizing a randomized snowball sampling. We conducted semi-structured interviews (45–85 minutes) “to obtain both retrospective and real-time accounts by those people experiencing the phenomenon of theoretical interest” ([

38], p. 19) with 22 plastic industry experts from plastic organizations covering an entire plastics supply chain in Europe.

In using open-ended questions about CE challenges and opportunities for one exemplary plastics industry in Europe, namely polyurethanes, more than 20 h of audio-recording time were obtained. We followed the methodological reasoning from Gioia et al. [

38] to not only ensure that the anonymity of interviewees was ensured but also to gain trust and allow for additional insights from the interview respondents.

For the data analysis, we utilized the computer-assisted tool GABEK-WinRelan (German acronym stands for “GAnzheitliche BEwältigung von Komplexität”—holistic processing of complexity using Windows Relation Analysis) [

39,

40]. This revealed major technological challenges and opportunities for the transition from linear to circular “modi operandi” of firms in the plastics sector in Europe.

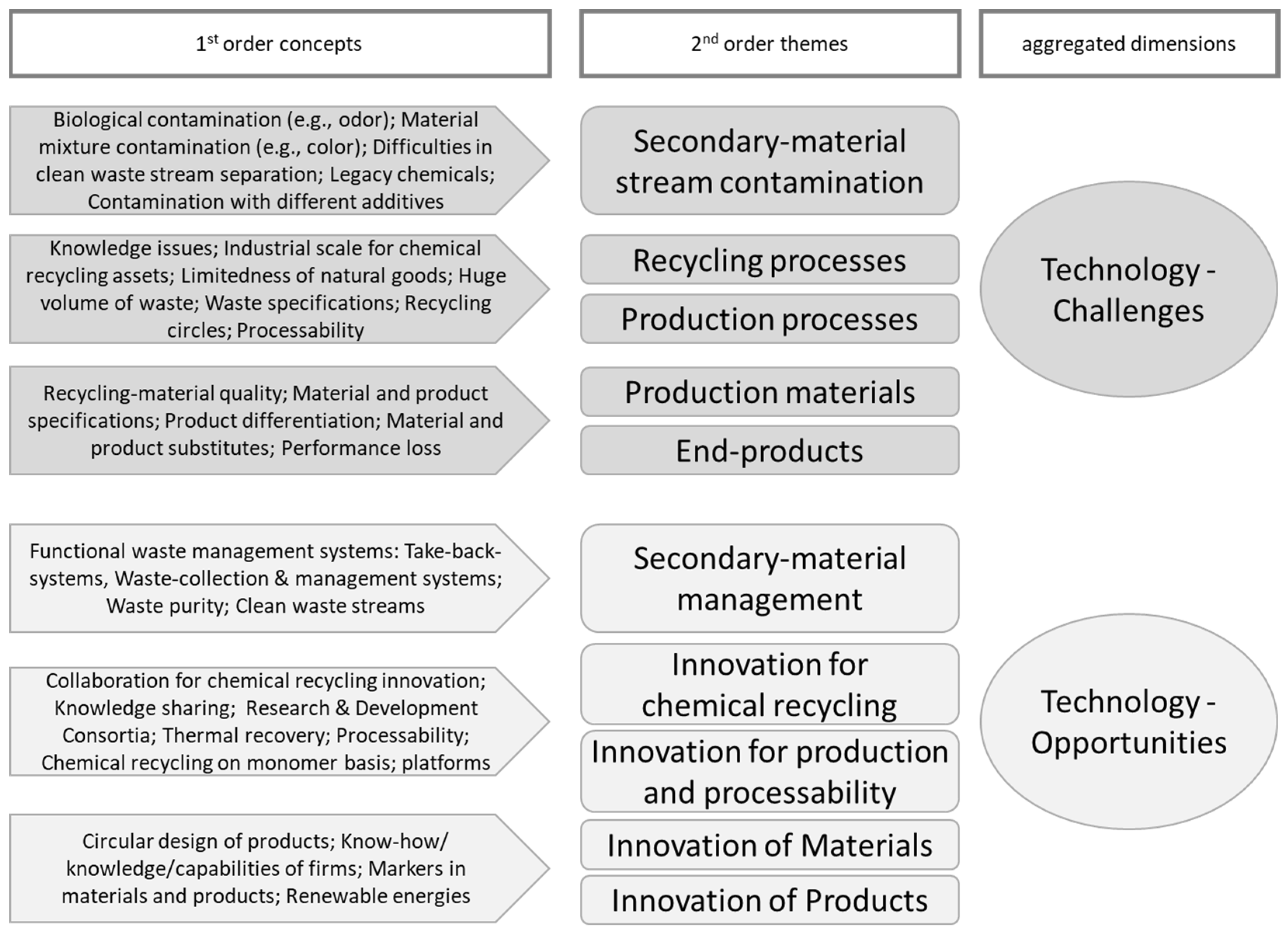

The coding process with GABEK-WinRelan involved multiple iterative coding cycles, resulting in 372 keywords. These codes were then clustered under abstract and theoretical categories [

41] to create

linguistic gestalten. This first-order analysis seeks to identify informant terms making a limited effort to distill categories [

38]. The identified gestalten, which correspond to Corley and Gioia’s [

40] notion of

first-order concepts, are then synthesized and clustered into

hyper-gestalten, which correspond to Corley and Gioia’s [

42] notion of

second-order themes. This second-order analysis queries whether the emerging themes suggest concepts that might benefit us by clarifying the topics we are interested in [

38]. Finally,

hyper-hyper-gestalten, which correspond to Corley and Gioia’s [

42] notion of

aggregated dimensions, were distilled. These eventually provide the basis for building an appropriate data structure (

Figure 1).

4. Findings

Major findings emphasize that technological challenges for plastics are predominantly identified in (C1) secondary material contamination; (C2) recycling processing issues; (C3) production processing issues; (C4) production material quality issues; and (C5) end-product quality issues, while the opportunities promise to lie in (O1) effective secondary material management; (O2) innovation for chemical recycling; (O3) innovation for production and processability; (O4) innovative materials; and (O5) innovative end-products.

At the technological level, detailed challenges and opportunities have intensively been discussed by interviewees. A Secretary General explained that “an issue is also the fear of using recyclates, because companies fear issues of, e.g., biological contamination which is not the issue with virgin materials.” Furthermore, a Senior Manager from a chemicals company highlighted that “[f]or chemical recycling: putting everything in the same pot is probably possible but will create pieces of chemistry which is a mix of very different chemistries”.

Thus, our findings suggest that the material mixture is problematic, as further elaborated by a Technical Manager of a chemicals company stating that “basically, let’s say that re-polyol is of very dark color. In past, it was black, and now dark brown. And due to this fact, even only due to this fact, it cannot be used to higher extent in polyurethane foam because the resulting foam would be yellow or brownish, which is not acceptable, because the white foam has to be white”. Therefore, the purity of waste streams requires more attention since “[n]ow, there is already a certain market for mechanical recycling which was there already, and which will further expand. But next to that, if you don’t get a very clear stream, that’s probably something for chemical recycling in one form or the other.” (Senior Manager, Chemical Company). This is also affecting waste separation of plastics, which is currently very complex and getting even more difficult due to an increasing variety of formulas. Plastic as waste eventually destroys immense value pools for a CE. The different additives can be an additional issue for the recycling assets as underlined by a CEO (PUR consultancy) stating that “[m]any foams contain flame retardants and therefore bromine or chlorine. If you heat those materials in the chemical recycling, there will appear hydrogen bromide or muriatic acid that are extremely corrosive for the recycling facilities.”

Furthermore, recycling plants on an industrial scale are not yet on a “technically ready level” as highlighted by a Manager of a Waste Management & Recycling Company: “[R]egarding chemical recycling … the biggest challenge is that all technologies are not yet stable on industrial scale. ... There are smaller pilot-plants, and they work … but the move to an industrial scale is still missing.” As noted by a Vice President (Chemical Company), recycling often faces legacy chemicals (i.e., critical or even toxic substances) with high-risk exposure. Since high-quality recycling requires high-quality input materials, current mechanical recycling is limited by iteration and mostly ends in downcycling. Current low qualities (e.g., color, hazardous substances) cause processability risks, which are challenging towards using recycled materials. Thus, “[s]imilarly, for mechanical and chemical recycling, you have high requirements for the input material, especially if you like to produce high-quality output. … [I]t holds the rule of thumb ‘trash in, trash out’.” (Manager, Waste Management & Recycler). A Secretary General further emphasized that “[t]he problem is the knowledge. This knowledge is somehow captured along the supply chain. For instance, foam producers (know how to make foam) are small to middle size companies and they do not necessarily know how to make chemical recycling because it’s the chemical producer that know how to make chemicals”. In fact, “[w]e need to distinguish between two types of chemical recycling. The first type converts polymers into monomers. Here, you got almost pure raw materials back. The chemical recycling type in which you do not go into the monomer-level, you get only a mixture of different components that is not pure.” (CEO, Waste Management Company).

Interviewees noted that although product differentiation leads to competitive advantages, the variety and diversity of plastic materials is perceived as a drawback for circularity solutions because of immense variabilities in materials: “We are in an industry where companies are struggling with creating an individual advantage to customers. ... [It needs to become clear] that they can create customer value by closing loops, which then differentiates their products.” (Managing Director, Consultancy). Furthermore, issues in quality of recycled input materials can lead to performance loss or issues along the value chain for (semi-)finished products.

In contrast, opportunities for technical solutions are an efficient waste flow management and waste-management-infrastructure, ensuring pure waste-flows including efficient collection systems and/or take-back systems. Therefore, “we need clean waste. This is very important.” (Senior Manager, Chemical Company). “[O]f course, obviously, it’s the collecting point that enables us to recycle in the end of the day.” (Senior Manager, End-Application Producer & Retailer).

Most interviewees acknowledged research and development for chemical recycling innovation as one technological precondition for a successful and functional CE since “[c]hemical recycling is the missing link between mechanical recycling and waste-to-energy, and I have great hopes for it because there will be not enough market demand for mechanical recycling. Waste to Energy will still exist for some materials. Chemical recycling could absorb everything in between, which would be perfect.” (Secretary General).

This consists of collaborative innovation procedures for chemical recycling on a monomer-basis that is enabling such progress, but also thermal recovery options for residuals. “It is good that the companies from different steps in the supply chain have set up research consortia and eventually joint ventures.” (Secretary General). As noted by a Senior Manager (Chemical Company), product design for circularity can enable the entire value chain to improve on CE. Hence, know-how, capabilities, and resources to innovate circular materials are required, where a huge part is located at chemical companies, as mentioned by a Secretary General.

Finally, a Managing Director (Consultancy) noted that a CE can only be sustainable if renewable energies are further innovated and implemented because of the huge energy intensity of the PUR industry. “A very important driver, which has not been profoundly described in literature concerns (cost of) renewable energies” (Managing Director, Consultancy). This is echoed by a CEO (PUR Consultancy) underlining that “the energy intense production processes required for chemical recycling, however, need renewable energies to work sustainably”.

5. Discussion and Concluding Remarks

This section provides contributions for scholars, policymakers, and practitioners. Thereby, we acknowledge the criticism by Kirchherr and van Santen [

43] that existing CE research is mostly lacking such advice. Our findings contribute to a better understanding on how to advance circularity in the European plastics sector.

A CE will likely follow similar rules to linear economies concerning property rights, rules of law, and price signals [

18]. Therefore, a successful transition towards functional CE markets requires vital technological innovation activities that need to be incentive-compatible with market mechanisms and guided by effective institutional (governance) structures. Our research and data insights from the European plastics industry highlight the necessity of changing the current recycling technology for plastics from mechanical recycling, which is only limitedly able to promote innovative CE ambitions, towards chemical recycling on a monomer-level that contains an enormous potential to enable a fully-fledged CE for plastics. This envisaged technological transition requires intense value chain collaboration activities for innovation between current and new relevant stakeholders to enable chemical recycling on an industrial scale. In this context, it will be crucial that a better collaboration is achieved of those actors that currently are (and expected to be) part of the plastics value chain to, e.g., improve the separate collection of plastic waste and to deliver increased volumes of valuable recycled content to the European market. Adopting such a value chain approach will be instrumental for stakeholders in the plastics value network to successfully transition to a CE while increasing their competitive advantage.

Additionally, it is evident that the availability of renewable energy is key to the plastics industry transition towards circularity. New value chain players (or joint ventures) will also emerge in a redesigned plastics sector, such as companies focusing on effective smart grid solutions including renewable energy integration (e.g., based on battery energy storage systems) in order to deliver effective solutions to the highly energy intensive chemical recycling processes, while leading to shared value creations within the stakeholder value chain network. Thus, it is decisive to accelerate and build upon existing knowledge around the development of sustainable business cases, business model innovations for sustainability, and investments for a functional CE [

44,

45,

46] to fully realize chemical recycling’s promise for a circular plastics industry in Europe.

It is recommended to establish an effective framework for a European Single Market for Plastic Waste to, for instance, ensure a steady flow of plastic waste volumes for chemical recycling facilities. This would effectively lead to increased efforts of exporting plastic wastes outside of Europe while also stimulating access to public and private funding to facilitate the cost distribution to establish new recycling facilities and innovative technologies for chemical recycling (on a monomer-level).

In this context, our findings further suggest that, in order to scale up and implement innovative chemical recycling technologies in the European plastics sector, additional life cycle assessment studies are in high demand, which comprehend the environmental performance and benefits of this technology. It is further recommended that work at the science–policy–business interface should be strengthened to allow for stakeholders in the plastics value network, including relevant policymakers, to evaluate effective approaches through real case data for calculating the environmental effect of plastics-based products over their whole life cycles. This is also relevant across industries with the same efforts of moving towards decarbonization, such as it is the case of the critical raw material lithium, which has experienced an increased demand as a result of the growing diffusion of green technologies, in particular for the electric mobility and energy sector. While lithium can unlock solutions towards a low-carbon CE in Europe, the industry is facing enormous technological (e.g., cost-effective and sustainable recycling), organizational (e.g., limited value chain thinking), and institutional (governance) challenges in moving towards a functional CE that requires further in-depth research to facilitate a fully-fledged CE transition.

Since the technological transition from mechanical toward chemical recycling needs to go hand-in-hand with incentive compatible governance innovation (legislation and self-regulation), politicians need to be encouraged to facilitate these innovation processes by igniting debates moving away from the current narrow perspective on the CE questioning “

who should be accountable to design and implement rules for a CE?” towards the more sensible question of “

what incentives and incentive mechanisms are necessary for creating a functional rule system to promote effective technological CE-innovation?”. Further, policy makers should extend the use of existing powerful instruments, such as the EU Emission Trading System, as well as CE-innovation funds, subsidies, and (research) programs to avoid complex sectoral actions and targets, which somehow imply a risk of managing

ends and not

means, and may lead to enormous inefficiencies, political rent-seeking, and, thus, a weakening of the “free market innovation machine” [

47,

48,

49,

50,

51]. The chemical industry is in need of an enabling legislative framework that offers an open investment environment and a competitive economic model while looking beyond the traditional boundaries of regions and Member States to scale up chemical recycling. In addition, market-based instruments, such as Extended Producer Responsibility (EPR), have been put forward as one promising solution to achieve increased collaboration between prominent value chain stakeholders, such as plastic production companies and waste managers. Considering its potential to significantly contribute to the environmental goals (e.g., on climate change mitigation) as set out in the EU Taxonomy Regulation, the inclusion of chemical recycling in the EU Taxonomy for Sustainable Investment should also be considered. Above all, this study suggests that collaborative public–private regulation will catalyze action to increase recycling volumes and the uptake of innovative recycling technologies.

It is evident that a systemic CE innovation perspective is key for companies to successfully approach change and keep their sustainable competitive advantage. One of the article’s main recommendations is for companies to promote cooperation with relevant stakeholders along their chemical and plastics value chains, including a transparent supply chain management system and due diligence procedures for responsible business conduct that are based on a sustainable and circular value chain approach while also having consensus on a shared vision, i.e., to achieve the targets of the EU CE action plan for plastics. A CE for plastics (in Europe) presents vast opportunities for slowing down the growth of plastic waste while phasing out pollution. However, achieving this aim will require increased collaboration efforts from all significant players in the value chain. One exemplary case appears to be the global commitment of ‘The New Plastics Economy’, which has united more than 500 signatories such as from business and governments behind a common vision of making a fully-fledged CE for plastics become a reality [

52]. Additionally, this study revealed that businesses are in demand of additional awareness raising, knowledge sharing, and technical assistance regarding the crucial shift toward a CE for plastics and relatedly chemical substances, which are having a direct effect on the advancements in recycling technologies that are being implemented.

In addition, we observed that decision-makers at times mistakenly conceive themselves as making selections of existing and discrete options. However, this narrow perspective omits the crucial aspect of decision-making, which is not the selection but the creation of new options by innovation. Managers need to identify and communicate disorders in the market environment and innovatively unleash growth potentials for inter alia chemical recycling innovation to eventually make the CE vision a reality [

48,

49,

50,

51]. However, this requires further inter- and trans-disciplinary research between business administration, economics, sociology, chemistry, and physics.

This research identified that a systemic approach for the European plastics industry is needed, which redesigns how materials are being used across their life cycle through fostering the uptake of innovative chemical recycling technologies that are market competitive, achieve increased economic value, and phase out plastic pollution in the long term, as part of a CE vision with sustainable value chains. We understand this communication article as a facilitator for new ways of thinking in the field of the CE that eventually contributes to enlarging the discourse on CE challenges and opportunities across different industry contexts (e.g., critical raw materials like lithium, cobalt, rare earths, etc.), and encouraging further inquiries in this flourishing research area. We explicitly invite fellow researchers and practitioners to further discuss and constructively criticize our work to advance this important and contemporary field of research.