3.1. The Partial Adjustment Model with an Error Correction Term

We test for price asymmetry using a cumulative response function estimated from the partial adjustment model with an error correction term. As Borenstein et al. [

2] argue, the advantage of this model is that it accounts for the existence of a long-run relationship between upstream and downstream prices and the inclination to return to the relationship. Therefore, we can specify the long-run relationship between upstream and downstream prices as:

where

is the downstream price per liter,

is the upstream price per liter, and

is a stationary error term. As many authors [

2,

10] point out that gasoline prices are not simply determined by some percent mark-up rule based on oil prices, we use gasoline price levels rather than logs, which would imply percentage mark-ups. Because we use the levels of nominal gasoline prices, we include a time trend,

To test for price asymmetry, we analyze price transmission at three different levels of the distribution process: from spot gasoline to wholesale gasoline, wholesale gasoline to retail gasoline, and spot gasoline to retail gasoline.

The short-run dynamics include contemporaneous and lagged upstream and downstream prices in the first difference and the previous period’s deviation from long-run equilibrium as error correction terms:

where

and

is the error correction term calculated as

from the long-run relationship in Equation (1). We define the positive and negative variables

and

in the same way as

and

Finally, we assume that the error term

follows a stationary error term.

For a richer, more general specification, this asymmetric partial adjustment model incorporates the signed contemporaneous changes in upstream prices, and as well as the signed lagged changes in both upstream and downstream prices, , and Therefore, in Equation (2), the coefficients, and , represent the contemporaneous and lagged effects of positive and negative changes in upstream prices on the change in contemporaneous downstream prices. Moreover, the coefficients, and , represent the lagged effects of positive and negative changes in downstream prices on the change in contemporaneous downstream prices. Unlike most studies using the asymmetric partial adjustment model, our study includes the two signed error correction terms to reflect the asymmetric adjustment process to the long-run relationship. The error correction effects are represented by the coefficients, and . For convergence to the long-run equilibrium, the restrictions that are required.

The number of lagged variables pertaining to increases and decreases in both upstream and downstream prices is equal to

(It is possible to allow the first-differenced variables of upstream and downstream prices to incorporate different lag lengths, as in [

10]. Otherwise, the first-differenced variables of upstream and downstream prices can include different lag lengths for increases and decreases, as in [

4]. However, as Borenstein et al. [

2] argue that incorporating different lengths in the lag structure makes little difference in the results, I assume equal lag lengths for simplicity, as in [

2,

5]. Finally, the cumulative response functions for downstream prices to upstream price increases or decreases are expressed as a nonlinear function of the coefficients in Equations (1) and (2). Borenstein et al. (1997) [

2] and Johnson (2002) [

10] show the derivation of the cumulative response functions for downstream price responses to upstream price increases or decreases (See the Appendix in [

2] and ([

10], p. 39)). However, unlike their studies, since we split the error correction terms into the positive and negative terms, the cumulative response functions are slightly changed as follows:

where

and

are the cumulative response functions for downstream prices to upstream price increases and decreases, respectively. In addition, note that in Equation (3),

and

.

We test asymmetry by focusing the cumulative response functions of downstream prices to upstream price increases and decreases. This is because these cumulative functions estimate the dynamic cumulative adjustment of downstream prices over time to a one-time increase or decrease in upstream prices. Therefore, together with a Wald test, these response functions are able to show some evidence about asymmetry, occurring in the pass-through from upstream prices to downstream prices. Moreover, these response functions can be used in estimating consumer costs of asymmetric pricing.

3.2. Data

We use weekly data for the sample period from the first week of February 2009 to the fourth week of May 2020, (Prior to the sample period, there was a long swing in oil prices starting in 2004 and peaking in July 2008. As weekly data are only available from Opinet after May 2008, the price data pertaining to the ascending phase of the swing do not exit. To impartially reflect the price-setting behavior of oil companies and gas stations, it is important to incorporate both ascending and descending phases of oil prices in the sample. Therefore, the sample excludes the period before February 2009 pertaining to the descending phase of oil prices and is designed to include the new fluctuations of oil prices starting from 2009.) covering a period of almost 11 years. We obtained the data on gasoline prices from the oil price information network of the Korea National Oil Corporation (

http://www.opinet.co.kr/user/main/mainView.do, Accessed on 15 March 2021) (Opinet). As Opinet provides only monthly data for the wholesale prices set by the wholesalers, we take the average factory price (The weekly average price is the amount of oil companies’ sales divided by the amount sold.) as wholesale prices in this analysis. Retail prices are also the average price (The weekly average price is the sum of the sales prices of individual gas stations from Sunday to Thursday divided by the total number of gas stations. This price is announced each Friday.) across the country.

Specifically, we use the common unleaded retail gasoline price (There are two types of gasoline in Korea: premium unleaded gasoline and common unleaded gasoline. The latter is more important because it accounted for 80% of the total amount of gasoline sold in 2018.) to represent gasoline prices, and as its counterpart to represent oil prices, the spot prices of low octane unleaded gasoline (quoted as 92Ron (Another spot gasoline price, known as the 95Ron, is the counterpart input of premium unleaded gasoline in Korea.) in MOPS). Opinet also provides spot prices in terms of KRW or US dollars. As the fuel taxes make up a significant proportion of both wholesale and retail prices, any changes in the taxes can have a significant effect on both prices. Hence, to control for changes in taxes, pre-tax prices are used. Finally, all gasoline prices are expressed in terms of KRW per liter.

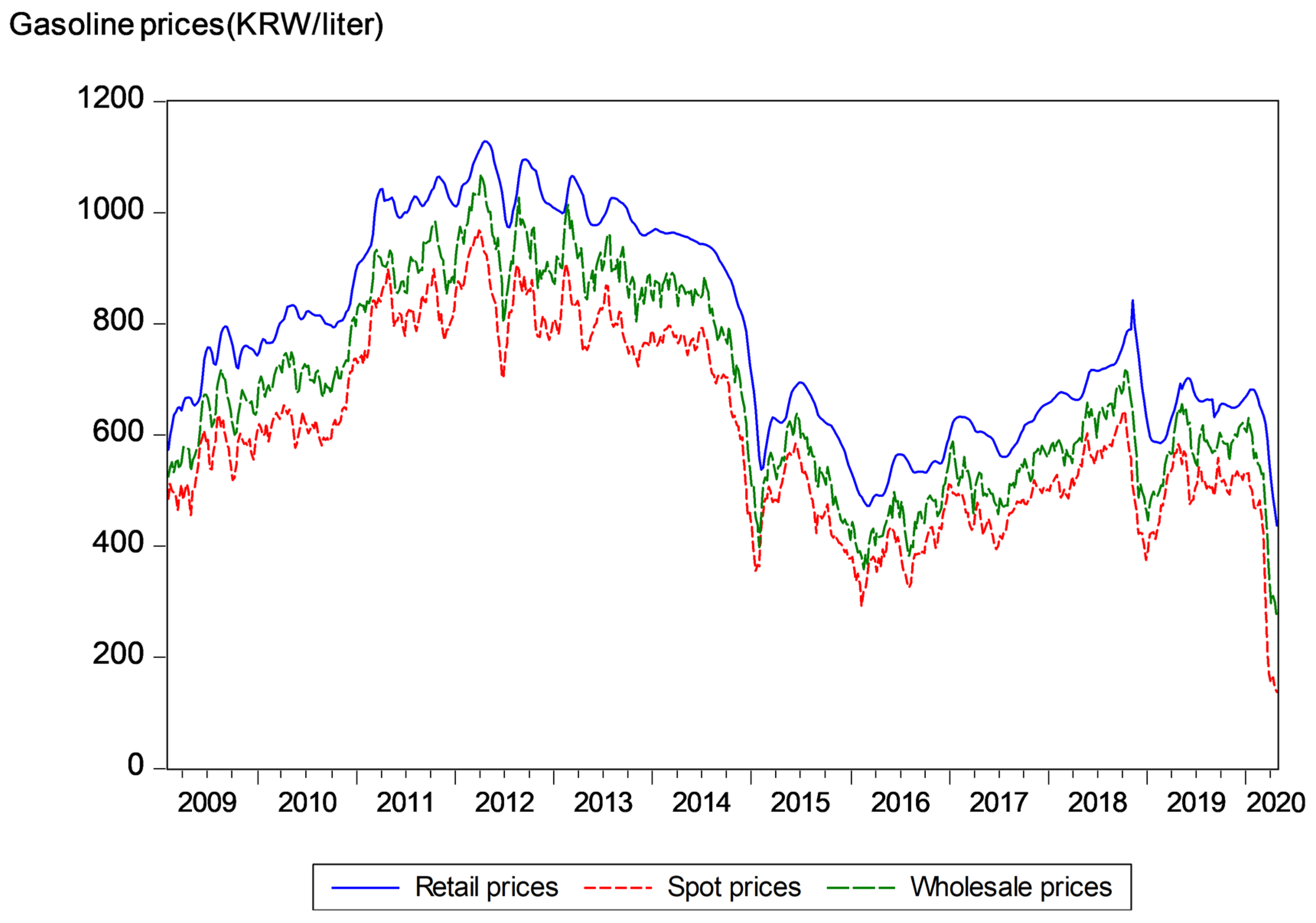

The spot prices, wholesale prices, and retail prices seem to move together with a close relationship. Over the sample period, spot prices, wholesale prices, and retail prices in KRW per liter have average values of 602.090, 679.377, and 776.499, respectively. In

Figure 2, the retail prices are less volatile than the other two upstream prices, whereas wholesale prices seem to be the most volatile. The standard deviations of the weekly changes in spot prices, wholesale prices, and retail prices are 20.107, 22.987, and 10.523, respectively. The smoothness of retail prices implies some substantial lags in the adjustment process of these prices to changes in upstream prices. However, the most volatile wholesale prices seem to reflect the more immediate and frequent adjustment of these prices to both supply and demand shocks to gasoline.

3.3. Results

To estimate the asymmetric partial adjustment model with an error correction term in Equation (2), a stable long-run relationship, as Equation (1) implies, is required. Therefore, we must determine whether the data support the hypothesis of a long-run relationship between upstream and downstream prices. If both upstream and downstream prices are integrated to order one and are co-integrated, an underlying long-run stable relationship would be implied. Therefore, we can use the asymmetric partial adjustment model.

As a first step in testing for co-integration, we conduct the augmented Dickey–Fuller and Phillips–Perron unit root tests of the three price series. The results of the unit root tests are presented in

Table 1. The test statistics for these two unit root tests strongly indicate that spot prices, wholesale prices, and retail prices are integrated of order one.

As a second step, we conduct the Johansen tests for co-integration between upstream and downstream prices at each level of the distribution process.

Table 2 summarizes the results of Johansen co-integration tests. In all cases, the results reject the hypothesis of no co-integration.

As a final step, we test the hypothesis that the residuals of Equation (1) at each price transmission are stationary. We test the unit root tests and the results are shown in

Table 3. In all cases, we cannot reject this hypothesis. Thus, the data indicate that the upstream and downstream prices at each level of the distribution process are co-integrated, and Equation (1) therefore exhibits a stable long-run relationship. Hence, it is possible to utilize the asymmetric partial adjustment model with an error correction term.

Table 4 reports the ordinary least squares estimation results of Equation (1) and Equation (2) at each price transmission. Since heteroscedasticity is found in all cases, White–Hinkley’ heteroscedasticity-corrected standard errors, known as robust standard errors, are presented in

Table 4. From now, we discuss the estimates of the coefficients in the long-run relationship. For the price transmission from spot gasoline to wholesale gasoline, the estimated value of

is 1.048 and the

p-value of the Wald test rejects the hypothesis that

at the 1% level. These results suggest that in the long run, a KRW 1 rise in spot prices results in an increase in wholesale prices of more than KRW 1. For the price transmission from spot gasoline to retail gasoline and wholesale gasoline to retail gasoline, the estimated values of

are 1.021 and 0.986, respectively. The

p-values of the Wald tests in both cases indicate that we cannot reject the hypothesis that

. Therefore, these results imply that a change in spot prices or wholesale prices is fully transmitted to retail prices in the long run.

We next focus on the short-run coefficient estimates. We use the Akaike information criterion (AIC) to determine the number of lags to include in Equation (2) for each price transmission. Based on the AIC, Equation (2) for the price transmission from spot gasoline to retail gasoline includes four lags for increases and decreases. For the price transmission from spot gasoline to wholesale gasoline and wholesale gasoline to retail gasoline, we apply seven and three lags for increases and decreases, respectively (From one lag to twenty lags, I simply choose the lag with the minimum AIC among the specifications with statistically significant estimated values of

and

at the 5% level.). In general, most of the coefficients on the contemporaneous and lagged changes in both upstream and downstream prices are statistically significant at the 1% level. In all cases, the coefficient on the error correction term is significantly negative at the 1% level for convergence to a long-run equilibrium. The point estimates range from −0.0387 to −0.1095 for

and from −0.0561 to −0.2300 for

Finally, we test for the joint hypothesis that the coefficients of increases and decreases of both upstream and downstream prices as well as the error correction terms are equal using a Wald test. Rejection of this hypothesis implies asymmetry in the pass-through of upstream prices to downstream prices. The results reject the hypothesis of symmetry at the 1% significance level for the price transmission from spot gasoline to wholesale gasoline and spot gasoline to retail gasoline. However, for the price transmission from wholesale gasoline to retail gasoline, the Wald test indicates no asymmetric adjustment in retail gasoline prices (Additionally, we test for the same joint hypothesis except for the equality assumption on the coefficients of the positive and negative error correction terms. In all cases, the results lead to the same conclusion on the presence of asymmetry as in

Table 4).

3.4. Cumulative Response Functions

We next turn to the dynamic adjustment path at each price transmission by describing the cumulative response function. This function calculates the cumulative response of downstream prices to a one-unit change in upstream prices. As we express the response in the th week after a one-unit change in upstream prices as the sum of the parameters in Equations (1) and (2), the cumulative response function is nonlinear in the parameters. As the long-run effect of a one-unit change in upstream prices is somewhat different across the price transmissions, we divide the cumulative responses for each price transmission by their corresponding coefficients obtained from Equation (1) to make the cumulative adjustments the proportional measures. Therefore, the cumulative response presented below should approach unity over time.

3.4.1. Wholesale Price Responses to Spot Price Changes

Figure 3 presents the estimated cumulative response functions of wholesale prices to a one-time KRW 1 per liter change in the spot prices for 1–20 weeks. In

Figure 3, the solid and dotted lines denote the difference between the increase and decrease responses and its 95% confidence band, respectively. We calculate the standard error for points in the difference using the delta method.

In

Figure 3, the adjustment paths rise sharply in the first four weeks, so wholesale prices overshoot the long-run equilibrium for both increases and decreases in spot prices. When spot prices increase, wholesale prices start falling over weeks 5–8 and subsequently increase steadily toward the long-run equilibrium. However, when spot prices decrease, wholesale prices overshoot and decline repeatedly, converging to the long-run equilibrium. Therefore, up to week 6, an increase in spot prices seems to transmit more rapidly than a decrease. However, from weeks 7 to 9, the opposite holds, causing the difference in the responses to decline and possibly reverse. Thus, in week 8, the difference is significantly negative at the 5% level. This pattern of dynamic adjustment recurs such that in week 12, the difference is again significantly negative at the 5% level. Consequently, these significant differences demonstrate the asymmetry indicated by the Wald test in

Table 1, but asymmetry is in the opposite direction. Kirchgässner and Kübler [

26] also report that wholesale prices respond even greater to a decline in spot prices (These prices refer to the spot prices of the Rotterdam spot market for gasoline.) in the German gasoline market than an increase, as in our case. They explain that fuel distributors may hesitate to increase prices rapidly to dodge public suspicions of exerting their market power to set prices when spot prices are rising. However, such a motive would disappear when spot prices are falling.

3.4.2. Retail Price Responses to Wholesale Price Changes

Figure 4 shows the cumulative response functions of retail prices to a one-time KRW 1 per liter change in wholesale prices. Retail prices adjust to both increases and decreases in wholesale prices with almost the same speed, so the cumulative responses are fairly symmetric. Consequently, the cumulative response functions are not significantly different from one another and they illustrate the symmetry indicated by the Wald test in

Table 1. Both the positive and negative adjustment paths rise sharply in the first six weeks, and then gradually approach the long-run equilibrium. Hence, 79% of a price increase and 77% of a price decrease are passed through in the first six weeks. Additionally, the speed of adjustment to the long-run equilibrium is fast, so retail prices nearly converge to the long-run equilibrium after 20 weeks for both increases and decreases in wholesale prices.

3.4.3. Retail Price Responses to Spot Price Changes

Figure 5 depicts the estimated cumulative response functions of retail prices to a one-time KRW 1 per liter change in spot prices. A rise in spot prices is passed along to retail prices faster than a fall; hence, the difference between the responses to increases and decreases is significantly different over several weeks. A rise in spot prices by KRW 1 results in a 58% rise in retail prices in the first four weeks, while the estimated response to a decline of KRW 1 is a 38% fall in retail prices. From week 2 to week 11, the difference in the responses is significantly different from zero at the 5% level. After 20 weeks, 92% of a KRW 1 rise in spot prices is transmitted to retail prices, whereas 87% of a KRW 1 decrease is passed along. The speed of retail price adjustment to the long-run equilibrium is somewhat slow, taking more than 20 weeks for both increases and decreases in spot prices.

In sum, there is strong evidence of asymmetric pass-through of spot prices to retail prices. Additionally, the adjustment of wholesale prices to changes in spot prices is also asymmetric, but the negative adjustment sometimes exceeds the positive adjustment, causing a reversal in the direction of asymmetry. However, retail prices respond almost symmetrically to both decreases and increases in wholesale prices. Therefore, the asymmetry of retail prices occurs mainly in the price transmission from spot gasoline to retail gasoline in Korea.

How can we explain the observed asymmetry of retail prices? Any competing theory of asymmetry could account for the asymmetric response of retail prices. However, Borenstein et al. [

2] suggest that the oligopoly theory could be most suitable to describe the price transmission from either spot gasoline (or other upstream inputs) to wholesale gasoline, or from wholesale gasoline to retail gasoline. Additionally, the inventory theory could account for the asymmetry in the adjustment of wholesale prices to spot prices (or other upstream prices).

If there is some evidence of asymmetry in the price transmission from spot gasoline to wholesale gasoline, or wholesale gasoline to retail gasoline, or both, then the transmissions can be the source of the asymmetric response of retail prices to spot price changes. However, as our empirical results show little evidence for the observed asymmetry in retail prices, theories related to the price transmissions could be irrelevant. Thus, theories related to costly search, which can be applied to retail margins, could be more plausible source for the asymmetric adjustment of retail prices to changes in spot prices.

Hence, as the search theory suggests, fluctuating spot prices can induce consumers’ signal-extraction problem, increasing search costs. In turn, this outcome leads to a temporary decline in consumers’ search behavior, strengthening the market power of gas stations. Therefore, gas stations raise prices quickly in response to an increase in spot prices but lower them slowly in response to a decrease in spot prices, resulting in a higher degree of asymmetry.

Alternatively, as Johnson [

10] shows, the search model with Bayesian updating could also be a possible source for the asymmetry. He presumes that consumers form a posterior distribution of retail prices at various gas stations, updating the prior distribution as new information is available. An increase in retail prices will lead consumers to update their old posterior distribution of retail prices. Hence, if the new posterior distribution indicates that the benefits of a search outweigh the search costs, then consumers will increase search. This increased search will trigger a rise in demand for low-priced gas stations that postpone price increases. Thus, they will raise their prices to meet the increased demand, leading to a quick adjustment of retail prices to a spot price increase. However, a decrease in retail prices will reduce the incentive to search. Therefore, when retail prices begin to decline, consumers’ search behavior is likely to decline, and high-priced gas stations are unlikely to suffer a large decrease in demand and adjust prices slowly in response to a decline in spot prices. Therefore, retail prices could asymmetrically respond to changes in spot prices.

3.5. Consumer Costs of Asymmetric Pricing

To assess the unfavorable outcomes of asymmetric pricing, we estimate the asymmetry in the cost to consumers, similar to Borenstein et al. [

2]. For an adjustment period, we subtract the benefit incurred from a given decline in spot prices from the loss incurred from an equal-magnitude increase in spot prices. We can interpolate the change in the consumer’s costs in Week

after a change in spot prices linearly by the area between the two cumulative response functions over the adjustment period. Therefore, we estimate the asymmetry in total costs to the consumer by integrating the differences between the two cumulative response curves over the adjustment period:

where

and

are the estimated cumulative response curves in the

ith week to a KRW 1 per liter increase and decrease in spot prices, respectively.

Given the evidence of asymmetry in the retail price adjustment to changes in spot prices, we focus only on this case to assess the total cost asymmetry.

Figure 6 presents the estimate of the total cost asymmetry and its 95% confidence band. After week 4, the total cost asymmetry is significantly different from zero at the 5% level. It steadily increases until week 20 and then remains unchanged at KRW 2.00 per KRW 1 spot price change per liter when a consumer uses one liter of gasoline each week. Therefore, if a consumer buys 30 L of gasoline per week, a KRW 100 per liter increase in spot prices costs the consumer KRW 6000 more over the adjustment period than what a KRW 100 per liter decrease saves them (

.).

Additionally, assuming a total consumption of 2.53 hundred million liters per week in 2019 (Since the total consumption of 131.70 hundred million liters of gasoline occurred over 52 weeks in 2019, hundred million liters per week.), gas stations earned an additional revenue of KRW 5.07 hundred million over a period of 20 weeks with an increase of KRW 1 per liter ( hundred million.). The difference between the maximum and minimum retail prices in 2019 was KRW 116.78 per liter, so a KRW 116.78 per liter increase enabled gas stations to gain an extra revenue of KRW 591.52 hundred million over the adjustment period (The maximum and minimum retail prices were KRW 702.45 per liter and KRW 585.68 per liter, respectively. Therefore, KRW 116.78 × asymmetry KRW 2 × 2.53 hundred million ≅ KRW 591.52 hundred million.). Assuming an average retail price of KRW 646.82 per liter in 2019, the total revenue of gas stations over the adjustment period was KRW 32,763.13 hundred million (Applying the average retail price, the total revenue in 2019 was 85,184.14 hundred million (), so the total revenue over 20 weeks was 32,763.13 hundred million ().). Therefore, the extra revenue of gas stations from that increase in retail prices is 1.81% of the total revenue over the adjustment period (Therefore, .). The price asymmetry thus indicates that variability in oil prices is costly to consumers.