A Demand-Side Inoperability Input–Output Model for Strategic Risk Management: Insight from the COVID-19 Outbreak in Shanghai, China

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Model and Data

3.1. Leontief Input–Output Table and Dynamic Inoperability Input–Output Model (DIIM)

3.1.1. Dynamic Input–Output Model

3.1.2. Applying Dynamic Input–Output Model to Establish DIIM

3.2. Dynamic Inoperability Input–Output Model

3.2.1. Background

3.2.2. Demand-Side Perturbation Model

3.2.3. Dynamic Recovery Model

3.2.4. Sector Recovery and Resilience Analysis

3.3. Risk Management Analysis

3.3.1. Cumulative Economic Loss and Net Profit

3.3.2. Surrogate Worth Trade-Off Function

4. Shanghai COVID-19 Case Study

4.1. Data Selection and Resource

- (1)

- ‘As-planned’ production output

- (2)

- Actual production output

- (3)

- Input–output table

- (4)

- Initial Inoperability

4.2. DIIM Model Parameter Setting

- (1)

- Time setting

- (2)

- Time Inoperability Setting

5. Shanghai COVID-19 Case Result Analysis

5.1. DIIM Model Result Analysis

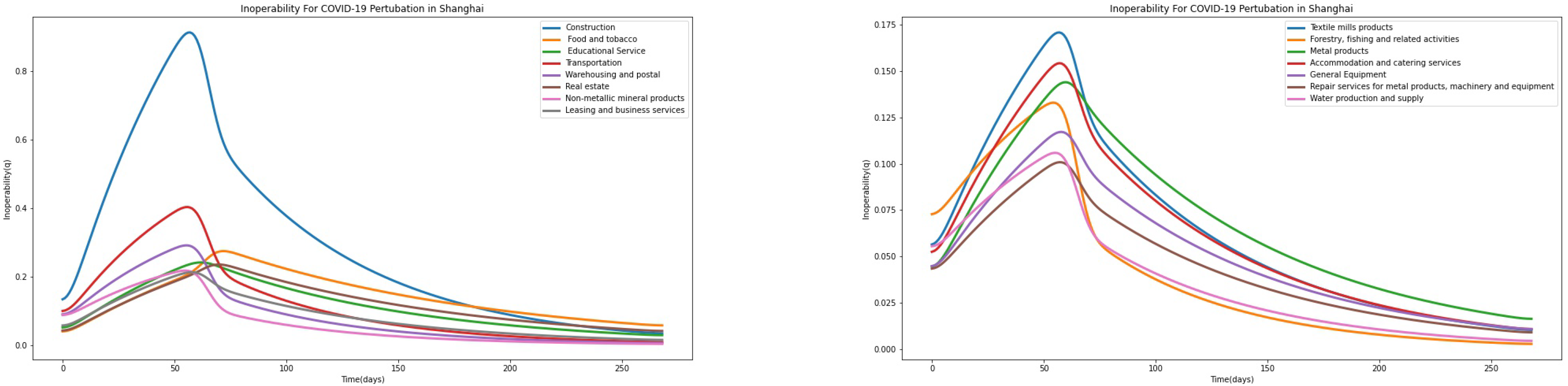

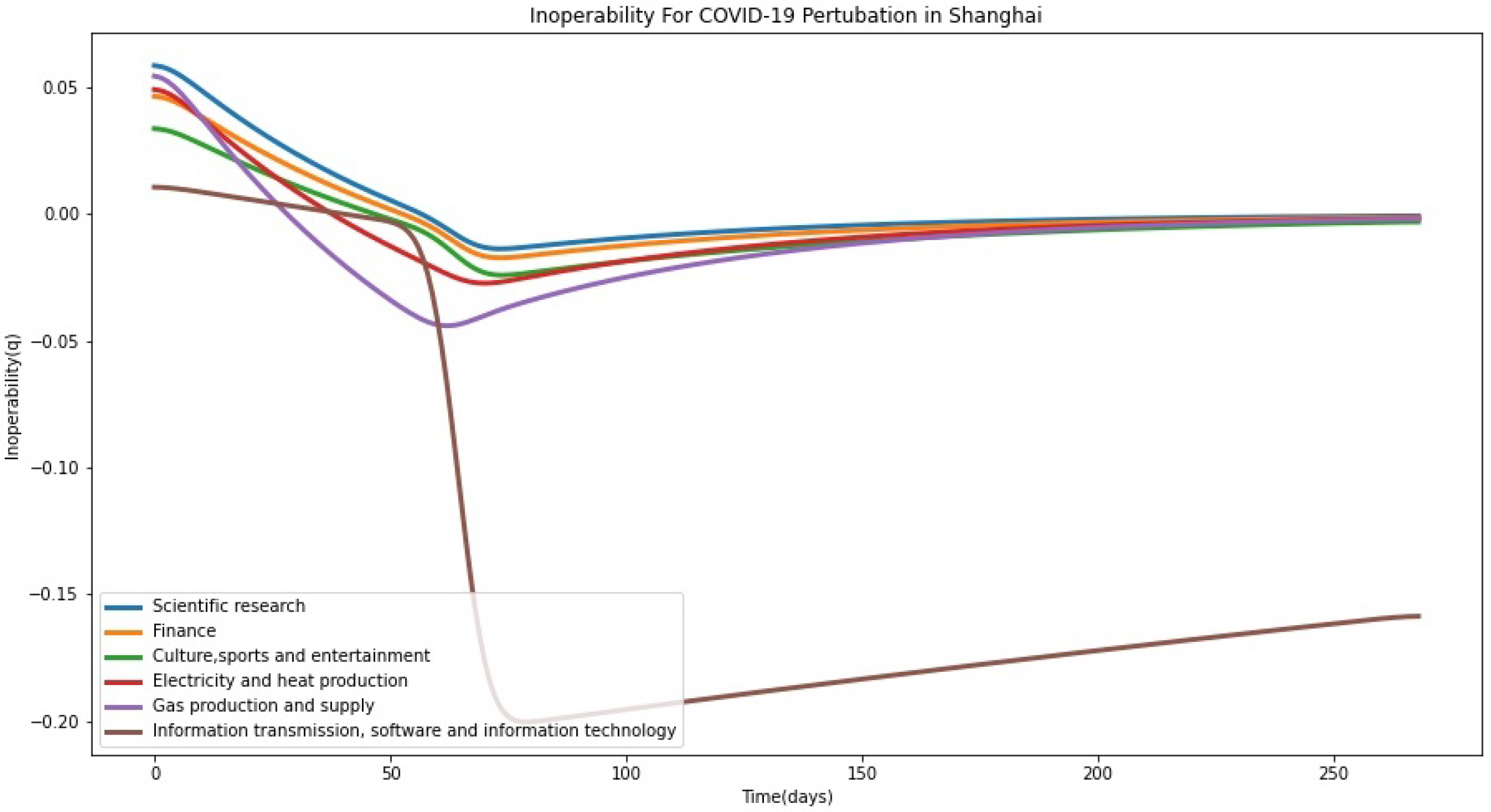

Inoperability Analysis

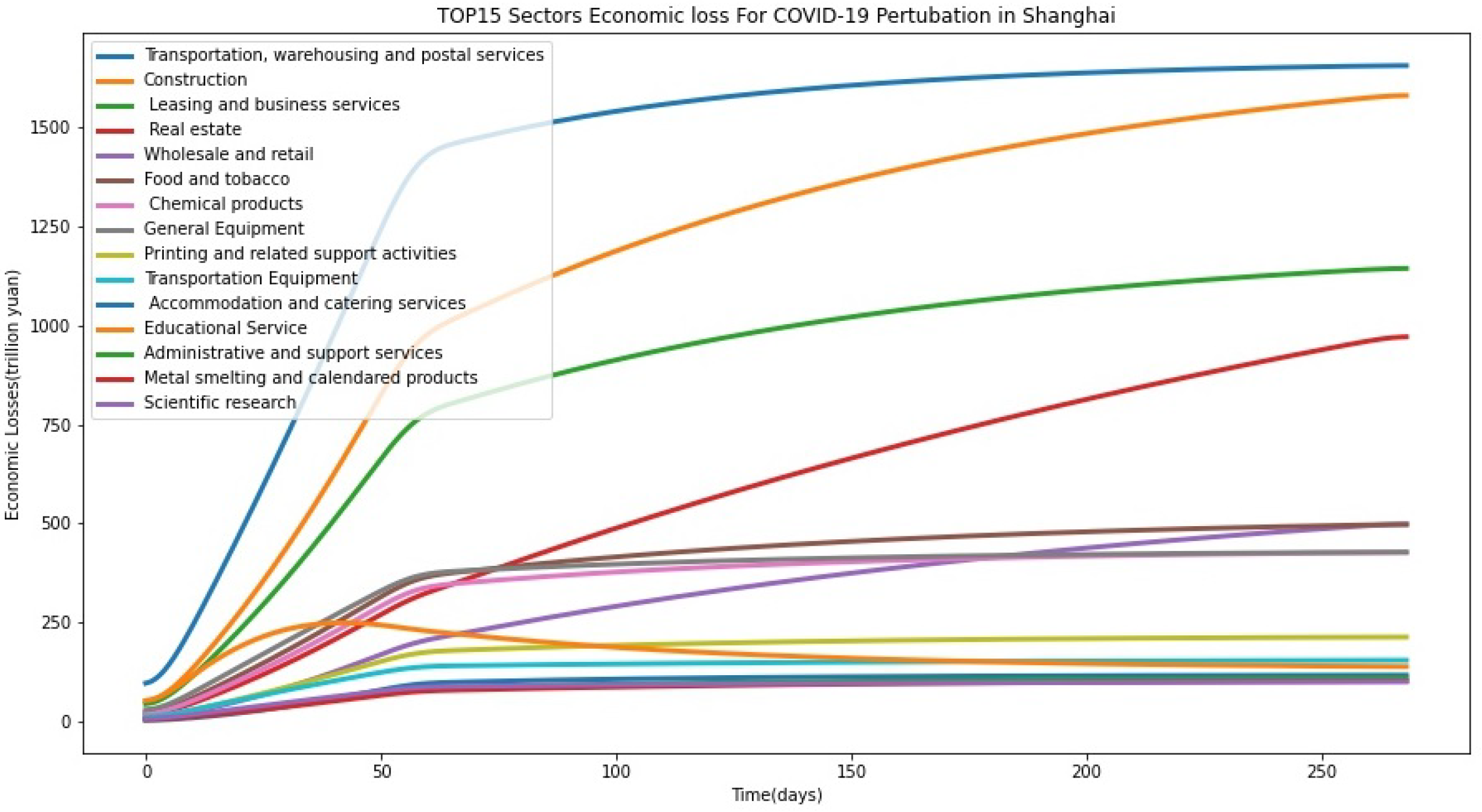

5.2. Economic Loss Analysis

5.2.1. Multi-Criteria Evaluation

5.2.2. Compared with Published Results

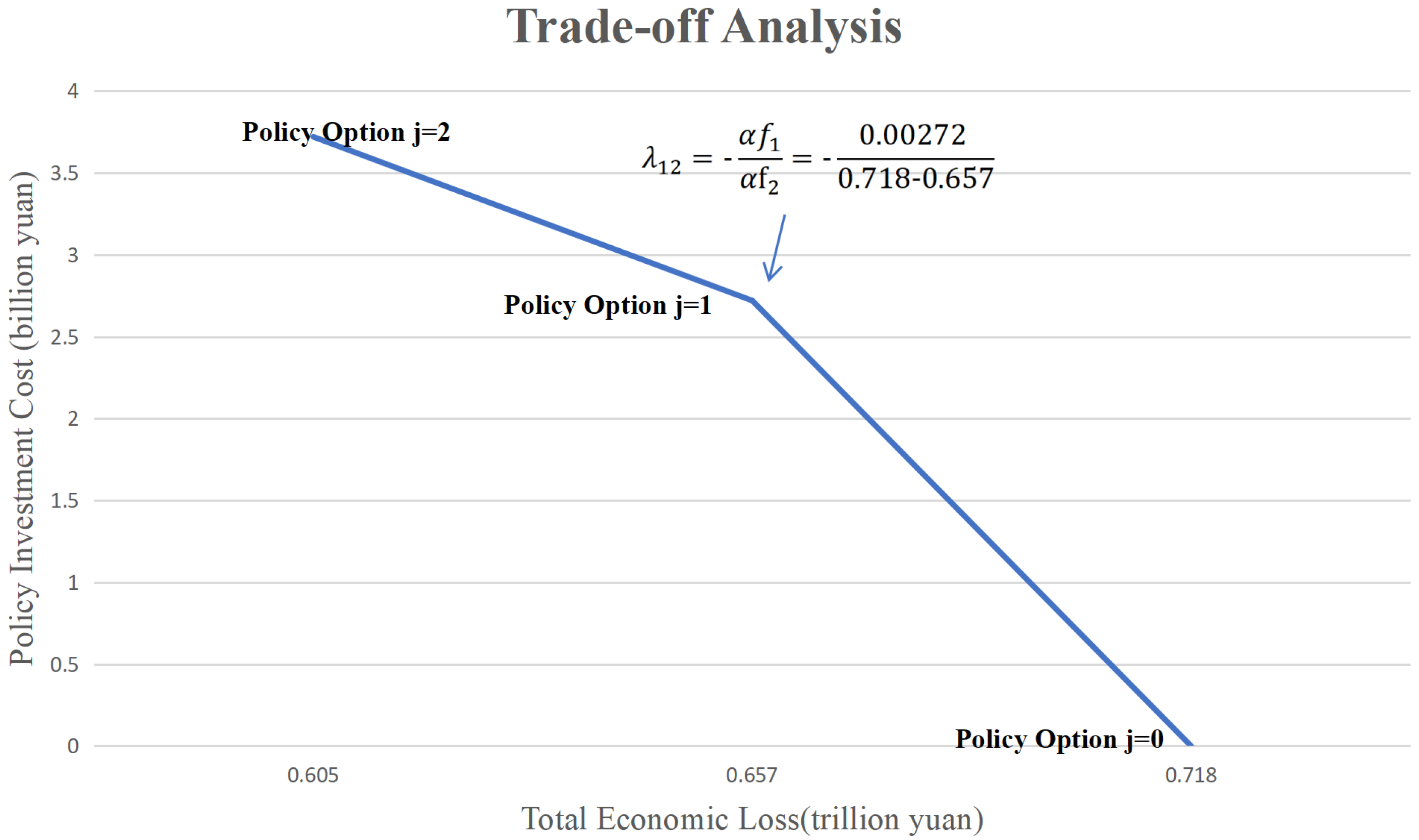

5.3. Risk Management Scenario Analysis

- Scenario 1: assume adopt no risk management policy (set policy option )

- Scenario 2: assume adopt risk management policy (set policy option )

- Scenario 3: assume adopt risk management policy (set policy option )

6. Summary and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Sector Index | Sector Name | q (0) |

|---|---|---|

| S26 | Construction | 0.18793 |

| S6 | Food and tobacco | 0.08323 |

| S38 | Educational Service | 0.07892 |

| S28 | Transportation, warehousing and postal | 0.17893 |

| S32 | Real estate | 0.17345 |

| S12 | Non-metallic mineral products | 0.07890 |

| S33 | Leasing and business services | 0.16537 |

| S37 | Administrative and support services | 0.09873 |

| S6 | Textile mills products | 0.05432 |

| S0 | Forestry, fishing and related activities | 0.07323 |

| S14 | Metal products | 0.04543 |

| S29 | Accommodation and catering services | 0.50123 |

| S15 | General Equipment | 0.04398 |

| S22 | Repair services for metal products, machinery, and equipment | 0.03897 |

| S25 | Water production and supply | 0.053267 |

| Sector Index | Sector Name | ‘As-Planned’ Production Output | Actual Production Output |

|---|---|---|---|

| S26 | Construction | 38.943 | 14.781 |

| S6 | Food and tobacco | 25.616 | 14.782 |

| S38 | Educational Service | 6.779 | 3.216 |

| S28 | Transportation, warehousing and postal | 104.598 | 68.867 |

| S32 | Real estate | 75.058 | 50.896 |

| S12 | Non-metallic mineral products | 5.500 | 3.699 |

| S33 | Leasing and business services | 83.406 | 63.589 |

| S37 | Administrative and support services | 6.995 | 4.215 |

| S6 | Textile mills products | 2.469 | 1.771 |

| S0 | Forestry, fishing and related activities | 6.232 | 4.263 |

| S14 | Metal products | 9.198 | 7.196 |

| S29 | Accommodation and catering services | 11.463 | 8.730 |

| S15 | General Equipment | 34.384 | 26.910 |

| S22 | Repair services for metal products, machinery, and equipment | 2.680 | 2.300 |

| S25 | Water production and supply | 1.688 | 1.278 |

References

- Municipal Bureau of Statistics of Shanghai. Shanghai’s GDP in the First Half of 2022. 2022. Available online: https://tjj.sh.gov.cn/ydsj2/20220719/cb29bc2eb997465faddc45e59ab31cf6.html (accessed on 9 January 2023).

- Cochrane, H.C. Predicting the economic impact of earthquakes. In Social Science Perspectives on the Coming San Francisco Earthquake, Natural Hazards Research Paper; Institute of Behavioral Science, University of Colorado: Boulder, CO, USA, 1974; Volume 25. [Google Scholar]

- Kousky, C. Informing climate adaptation: A review of the economic costs of natural disasters. Energy Econ. 2014, 46, 576–592. [Google Scholar] [CrossRef]

- Skidmore, M.; Toya, H. Do natural disasters promote long-run growth? Econ. Inq. 2002, 40, 664–687. [Google Scholar] [CrossRef]

- Haimes, Y.Y. Risk Modeling, Assessment, and Management; John Wiley & Sons: Hoboken, NJ, USA, 2005; Volume 615, p. 7. [Google Scholar]

- Santos, J. Using input-output analysis to model the impact of pandemic mitigation and suppression measures on the workforce. Sustain. Prod. Consum. 2020, 23, 249–255. [Google Scholar] [CrossRef]

- Tatar, U.; Santos, J.R.; Thekdi, S.A. Managing Physical and Economic Risk for Systems with Multidirectional Network Interdependencies. Risk Anal. 2022, 42, 1106–1123. [Google Scholar] [CrossRef]

- He, K.; Mi, Z.; Coffman, D.M.; Guan, D. Using a linear regression approach to sequential interindustry model for time-lagged economic impact analysis. Struct. Chang. Econ. Dyn. 2022, 62, 399–406. [Google Scholar] [CrossRef]

- Avelino, A.F.; Dall’erba, S. Comparing the economic impact of natural disasters generated by different input–output models: An application to the 2007 Chehalis river flood (wa). Risk Anal. 2019, 39, 85–104. [Google Scholar] [CrossRef] [Green Version]

- Huang, Y.; Chen, C. Impacts of COVID-19 on China’s Economic System Based on Dynamic Inoperability Input-output Model. J. Syst. Manag. 2021, 30, 1152–1158. [Google Scholar]

- El Haimar, A.; Santos, J.R. A stochastic recovery model of influenza pandemic effects on interdependent workforce systems. Nat. Hazards 2015, 77, 987–1011. [Google Scholar] [CrossRef]

- Santos, J.; Roquel, K.I.D.Z.; Lamberte, A.; Tan, R.R.; Aviso, K.B.; Tapia, J.F.D.; Solis, C.A.; Yu, K.D.S. Assessing the economic ripple effects of critical infrastructure failures using the dynamic inoperability input-output model: A case study of the Taal Volcano eruption. Sustain. Resil. Infrastruct. 2022, 23, 68–84. [Google Scholar] [CrossRef]

- Ghosh, A. Input-output approach in an allocation syste m. Economica 1958, 25, 58–64. [Google Scholar] [CrossRef]

- Leung, M.; Haimes, Y.Y.; Santos, J.R. Supply-and output-side extensions to the inoperability input-output model for interdependent infrastructures. J. Infrastruct. Syst. 2007, 13, 299–310. [Google Scholar] [CrossRef]

- Xu, W.; Hong, L.; He, L.; Wang, S.; Chen, X. Supply-driven dynamic inoperability input-output price model for interdependent infrastructure systems. J. Infrastruct. Syst. 2011, 17, 151–162. [Google Scholar] [CrossRef]

- Ocampo, L.; Masbad, J.G.; Noel, V.M.; Omega, R.S. Supply-side inoperability input–output model (SIIM) for risk analysis in manufacturing systems. J. Manuf. Syst. 2016, 41, 76–85. [Google Scholar] [CrossRef]

- Oosterhaven, J. On the limited usability of the inoperability IO model. Econ. Syst. Res. 2017, 29, 452–461. [Google Scholar] [CrossRef] [Green Version]

- Brucker, S.M.; Hastings, S.E.; Latham, W.R., III. The variation of estimated impacts from five regional input-output models. Int. Reg. Sci. Rev. 1990, 13, 119–139. [Google Scholar] [CrossRef]

- Lian, C.; Haimes, Y.Y. Managing the risk of terrorism to interdependent infrastructure systems through the dynamic inoperability input–output model. Syst. Eng. 2006, 9, 241–258. [Google Scholar] [CrossRef]

- Leontief, W. Input-Output Economics; Oxford University Press: Oxford, UK, 1986. [Google Scholar]

- Santos, J.R.; Haimes, Y.Y. Modeling the demand reduction input-output (I-O) inoperability due to terrorism of interconnected infrastructures. Risk Anal. Int. J. 2004, 24, 1437–1451. [Google Scholar] [CrossRef]

- Haimes, Y.Y.; Jiang, P. Leontief-based model of risk in complex interconnected infrastructures. J. Infrastruct. Syst. 2001, 7, 1–12. [Google Scholar] [CrossRef]

- Jiang, P.; Haimes, Y.Y. Risk management for Leontief-based interdependent systems. Risk Anal. Int. J. 2004, 24, 1215–1229. [Google Scholar] [CrossRef]

- Dietzenbacher, E. In vindication of the Ghosh model: A reinterpretation as a price model. J. Reg. Sci. 1997, 37, 629–651. [Google Scholar] [CrossRef]

- Oosterhaven, J. On the plausibility of the supply-driven input-output model. J. Reg. Sci. 1988, 28, 203–217. [Google Scholar] [CrossRef]

- Zaghini, E. Solow Prices and the Dual Stability Paradox in the Leontief Dynamic System. Econometrica 1971, 39, 153. [Google Scholar] [CrossRef]

- Davar, E. Price Discrimination in Input–Output. Econ. Syst. Res. 1993, 5, 3–10. [Google Scholar] [CrossRef]

- Ramos Carvajal, M.D.C.; Blanc Díaz, M. The Foundations of Dynamic Input-Output Revisited: Does Dynamic Input-Output Belong to Growth Theory? Documentos de trabajo; Universidad de Oviedo, Facultad de Ciencias Económicas: Oviedo, Spain, 2002. [Google Scholar]

- Liew, C.J. The dynamic variable input-output model: An advancement from the Leontief dynamic input-output model. Ann. Reg. Sci. 2000, 34, 591–614. [Google Scholar] [CrossRef]

- Haimes, Y.Y. Hierarchical holographic modeling. IEEE Trans. Syst. Man Cybern. 1981, 11, 606–617. [Google Scholar] [CrossRef]

- Sharland, M.; Gattinara di Zub, G.C.; Tomas Ramos, J.; Blanche, S.; Gibb, D.M.; PENTA Steering Committee. PENTA guidelines for the use of antiretroviral therapy in paediatric HIV infection. HIV Med. 2002, 3, 215–226. [Google Scholar] [CrossRef]

- Edwards, C.H.; Penney, D.E. Differential Equations and Boundary Value Problems: Computing and Modeling; Pearson Educación: London, UK, 2000. [Google Scholar]

- Okuyama, Y.; Yu, K.D. Return of the inoperability. Econ. Syst. Res. 2019, 31, 467–480. [Google Scholar] [CrossRef]

- Municipal Bureau of Statistics of Shanghai. Gross Output Value of Industrial Enterprise above Designated Size (by Industry). 2022. Available online: https://tjj.sh.gov.cn/ydsj32/index.html (accessed on 9 January 2023).

- Municipal Bureau of Statistics of Shanghai. Gross Output Value of Tertiary Industry above Designated Size (by Industry). 2022. Available online: https://tjj.sh.gov.cn/ydsj102/index.html (accessed on 9 January 2023).

- Rose, A.; Liao, S.Y. Modeling regional economic resilience to disasters: A computable general equilibrium analysis of water service disruptions. J. Reg. Sci. 2005, 45, 75–112. [Google Scholar] [CrossRef]

- Okuyama, Y.; Sonis, M.; Hewings, G.J. Economic impacts of an unscheduled, disruptive event: A Miyazawa multiplier analysis. In Understanding and Interpreting Economic Structure; Springer: Berlin/Heidelberg, Germany, 1999; pp. 113–143. [Google Scholar] [CrossRef]

- MacKenzie, C.A.; Santos, J.R.; Barker, K. Measuring changes in international production from a disruption: Case study of the Japanese earthquake and tsunami. Int. J. Prod. Econ. 2012, 138, 293–302. [Google Scholar] [CrossRef]

- Burrus, R.T., Jr.; Dumas, C.F.; Farrell, C.H.; Hall, W.W., Jr. Impact of low-intensity hurricanes on regional economic activity. Nat. Hazards Rev. 2002, 3, 118–125. [Google Scholar] [CrossRef]

- National Bureau of Statistics of China. Shanghai’s Urban Unemployment Rate in the Second Quarter of 2022. 2022. Available online: http://www.stats.gov.cn/tjsj/sjjd/202207/t20220715_1886475.html (accessed on 9 January 2023).

- Santos, J.R.; Orsi, M.J.; Bond, E.J. Pandemic recovery analysis using the dynamic inoperability input-output model. Risk Anal. Int. J. 2009, 12, 1743–1758. [Google Scholar] [CrossRef]

- Municipal Bureau of Statistics of Shanghai. Shanghai City Accelerated Economic Recovery and Revitalization Plan. 2022. Available online: https://www.jinshan.gov.cn/yszc-gjshsyszc/20220529/830938.html (accessed on 9 January 2023).

- Akhtar, R.; Santos, J.R. Risk-based input–output analysis of hurricane impacts on interdependent regional workforce systems. Nat. Hazards 2013, 65, 391–405. [Google Scholar] [CrossRef]

- Wangyi. How High Is the Cost of Shanghai’s Pandemic Containment? Available online: https://www.163.com/dy/article/H87MVPAV05534DWL.html (accessed on 9 January 2023).

- Hayes, J.L. Record Floods of Greater Nashville: Including Flooding in Middle Tennessee (TN) and Western Kentucky (KY), May 674 1-4-2010: Service Assessment; DIANE Publishing: Collingdale, PA, USA, 2011. [Google Scholar]

- Yu, K.D.S.; Aviso, K.B. Modelling the economic impact and ripple effects of disease outbreaks. Process Integration and Optimization for Sustainability. Process Integr. Optim. Sustain. 2020, 4, 183–186. [Google Scholar] [CrossRef] [Green Version]

- Santos, J. Reflections on the impact of “flatten the curve” on interdependent workforce sectors. Environ. Syst. Decis. 2020, 40, 185–188. [Google Scholar] [CrossRef]

- Municipal Health Commission of Shanghai. Report on Departmental Budget of Shanghai Municipal Health Commission in 2022. 2022. Available online: https://wsjkw.sh.gov.cn/czgk/20220215/543c8e61f7864f58ae18d49b16e123bc.html (accessed on 9 January 2023).

| Accommodation and Catering Services | Information Transmission, Software and Information Technology | Finance | Real Estate | Leasing and Business Services | |

|---|---|---|---|---|---|

| Accommodation and catering services | 0.00399 | 0.01095 | 0.00422 | 0.00526 | 0.07522 |

| Information transmission, software and information technology | 0.27626 | 0.04018 | 0.00241 | 0.00386 | 0.00381 |

| Finance | 0.03593 | 0.08274 | 0.11787 | 0.06380 | 0.06272 |

| Real estate | 0.04594 | 0.05781 | 0.09688 | 0.14655 | 0.02190 |

| Leasing and business services | 0.01053 | 0.05986 | 0.14228 | 0.02992 | 0.04279 |

| Accommodation and Catering Services | Information Transmission, Software and Information Technology | Finance | Real Estate | Leasing and Business Services | |

|---|---|---|---|---|---|

| Accommodation and catering services | 0.00399 | 0.01084 | 0.00323 | 0.00689 | 0.07432 |

| Information transmission, software and information technology | 0.26983 | 0.04018 | 0.00187 | 0.00298 | 0.00456 |

| Finance | 0.04523 | 0.04983 | 0.11787 | 0.09783 | 0.05983 |

| Real estate | 0.02334 | 0.06723 | 0.09688 | 0.14655 | 0.01190 |

| Leasing and business services | 0.00093 | 0.04398 | 0.09228 | 0.03122 | 0.04279 |

| Sector Index | Sector Name | Inoperability | Rank |

|---|---|---|---|

| S26 | Construction | 0.86543 | 1 |

| S55 | Food and tobacco | 0.41702 | 2 |

| S38 | Educational Service | 0.30833 | 3 |

| S28 | Transportation, warehousing and postal | 0.29914 | 4 |

| S32 | Real estate | 0.26451 | 5 |

| S12 | Non-metallic mineral products | 0.25431 | 6 |

| S33 | Leasing and business services | 0.24850 | 7 |

| S37 | Administrative and support services | 0.24534 | 8 |

| S6 | Textile mills products | 0.17618 | 9 |

| S0 | Forestry, fishing and related activities | 0.17051 | 10 |

| S14 | Metal products | 0.14373 | 11 |

| S29 | Accommodation and catering services | 0.13769 | 12 |

| S15 | General Equipment | 0.12038 | 13 |

| S22 | Repair services for metal products, machinery, and equipment | 0.11124 | 14 |

| S25 | Water production and supply | 0.10534 | 15 |

| Sector Index | Sector Name | Economic Loss (Trillion Yuan) | Rank |

|---|---|---|---|

| S28 | Transportation, warehousing and postal | 0.16580 | 1 |

| S26 | Construction | 0.15857 | 2 |

| S33 | Leasing and business services | 0.11469 | 3 |

| S32 | Real estate | 0.09795 | 4 |

| S27 | Wholesale and retail | 0.05013 | 5 |

| S55 | Food and tobacco | 0.04984 | 6 |

| S11 | Chemical products | 0.04282 | 7 |

| S15 | General Equipment | 0.04274 | 8 |

| S9 | Printing and related support activities | 0.02133 | 9 |

| S17 | Transportation Equipment | 0.01546 | 10 |

| S29 | Accommodation and catering services | 0.01385 | 11 |

| S38 | Educational Service | 0.01171 | 12 |

| S37 | Administrative and support services | 0.01095 | 13 |

| S13 | Metal smelting and calendared products | 0.01022 | 14 |

| S34 | Scientific research | 0.01006 | 15 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jin, J.; Zhou, H. A Demand-Side Inoperability Input–Output Model for Strategic Risk Management: Insight from the COVID-19 Outbreak in Shanghai, China. Sustainability 2023, 15, 4003. https://doi.org/10.3390/su15054003

Jin J, Zhou H. A Demand-Side Inoperability Input–Output Model for Strategic Risk Management: Insight from the COVID-19 Outbreak in Shanghai, China. Sustainability. 2023; 15(5):4003. https://doi.org/10.3390/su15054003

Chicago/Turabian StyleJin, Jian, and Haoran Zhou. 2023. "A Demand-Side Inoperability Input–Output Model for Strategic Risk Management: Insight from the COVID-19 Outbreak in Shanghai, China" Sustainability 15, no. 5: 4003. https://doi.org/10.3390/su15054003