Exploring Primary Aluminum Consumption: New Perspectives from Hybrid CEEMDAN-S-Curve Model

Abstract

1. Introduction

1.1. Literature Review

1.2. Research Gap

1.3. Theory and Purpose of This Study

1.4. Novelty and Contributions

2. Materials and Methods

2.1. Complete EnsembleEmpirical Mode Decomposition with Adaptive Noise

2.2. S-Curve Model

- (1)

- Take-off point. This marks the second GDP growing phase at a high rate of energy and mineral resource consumption and the transition from agricultural society to industrial society.

- (2)

- Turning point. This marks declination in energy and mineral resources consumption rate per capita for a given GDP per capita.

- (3)

- Zero-growth point. This indicates a drastic change from growing to declining in the pattern of energy consumption per capita.

- (1)

- core indicators. Core indicators include economic and social indicators, and resource indicators. Economic and social indicators include GDP and population. GDP per capita, as a specific indicator, is the fundamental driving force for consumption. Resource indicators, including resource consumption growth rate, are important parameters to measure resource consumption.

- (2)

- constraint indicators. Constraint indicators refer to those indicators that have a close impact on resource consumption, such as resource consumption intensity, urbanization rate, industrial structure, resource policy, and price. It can reflect, measure, or constrain resource consumption from different aspects.

- (3)

- reference indicators. Reference indicators include infrastructure construction and social wealth accumulation, such as the number of bridges, ports, and airports, and social building areas. Although those indicators are difficult to directly relate to energy and mineral resource consumption, the level and trend of energy and resource consumption are determined by reference indicators.

2.3. CEEMDAN–S-Curve Model

3. Results

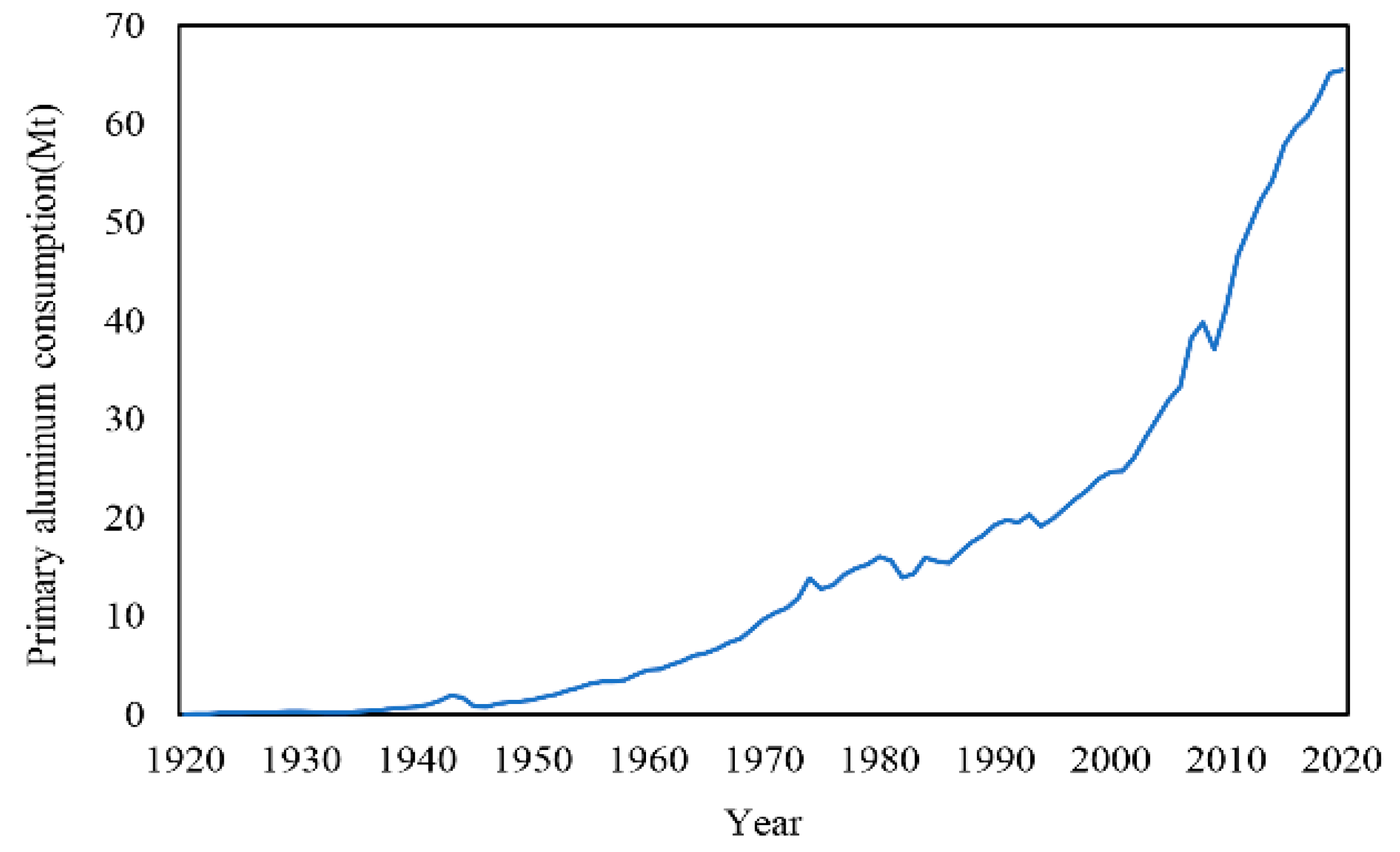

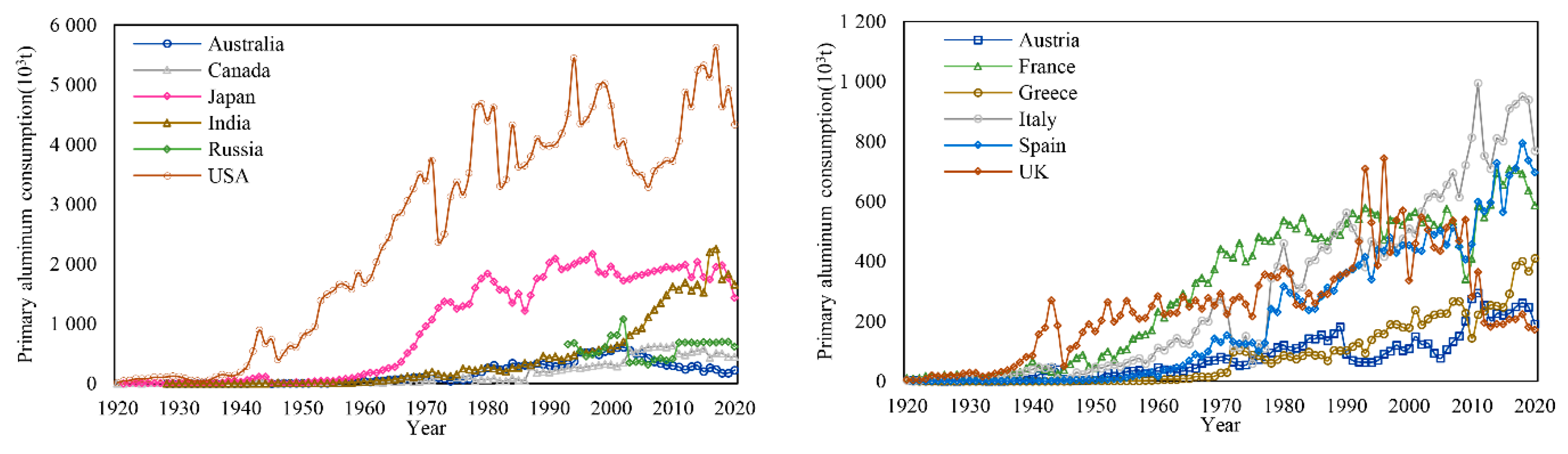

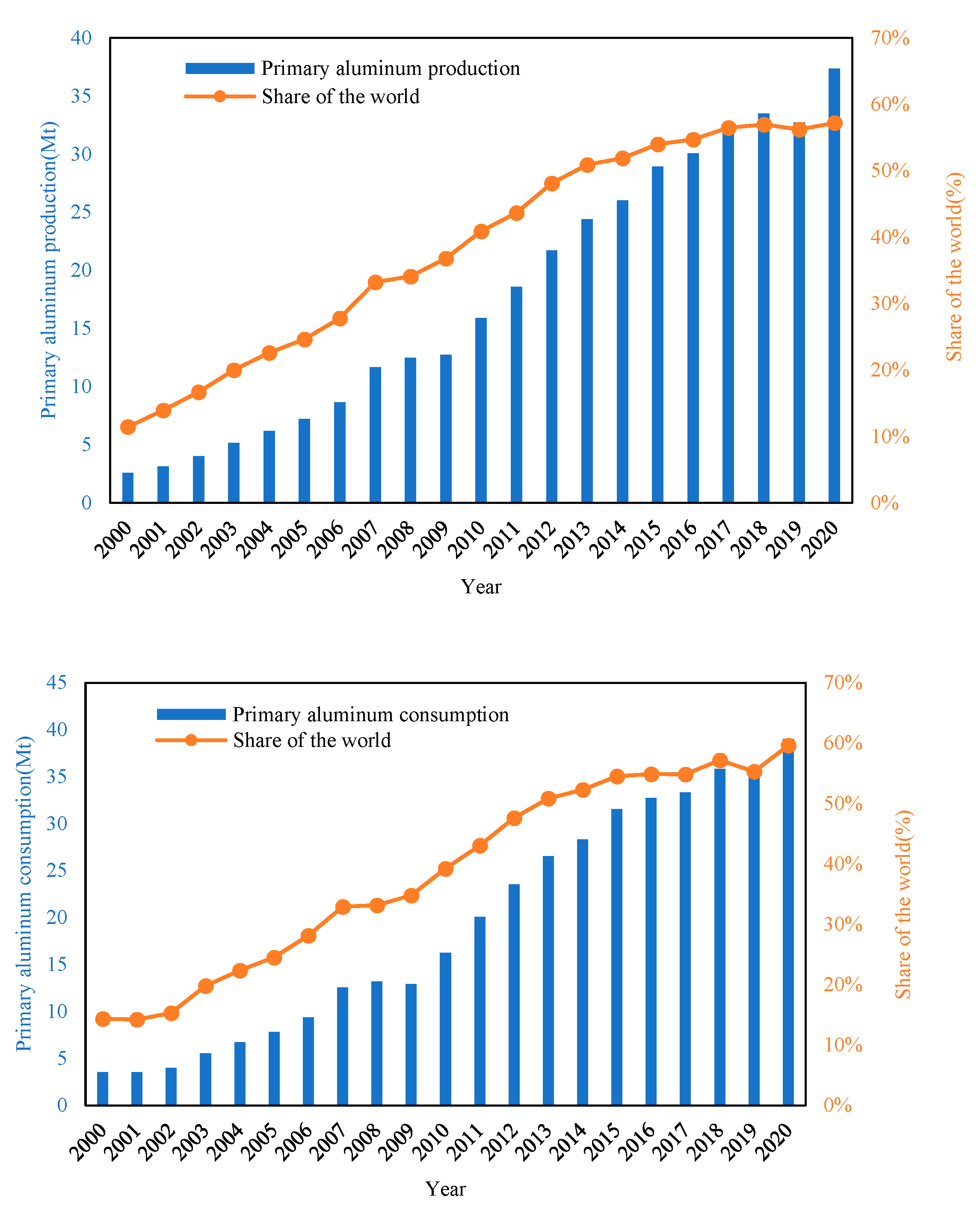

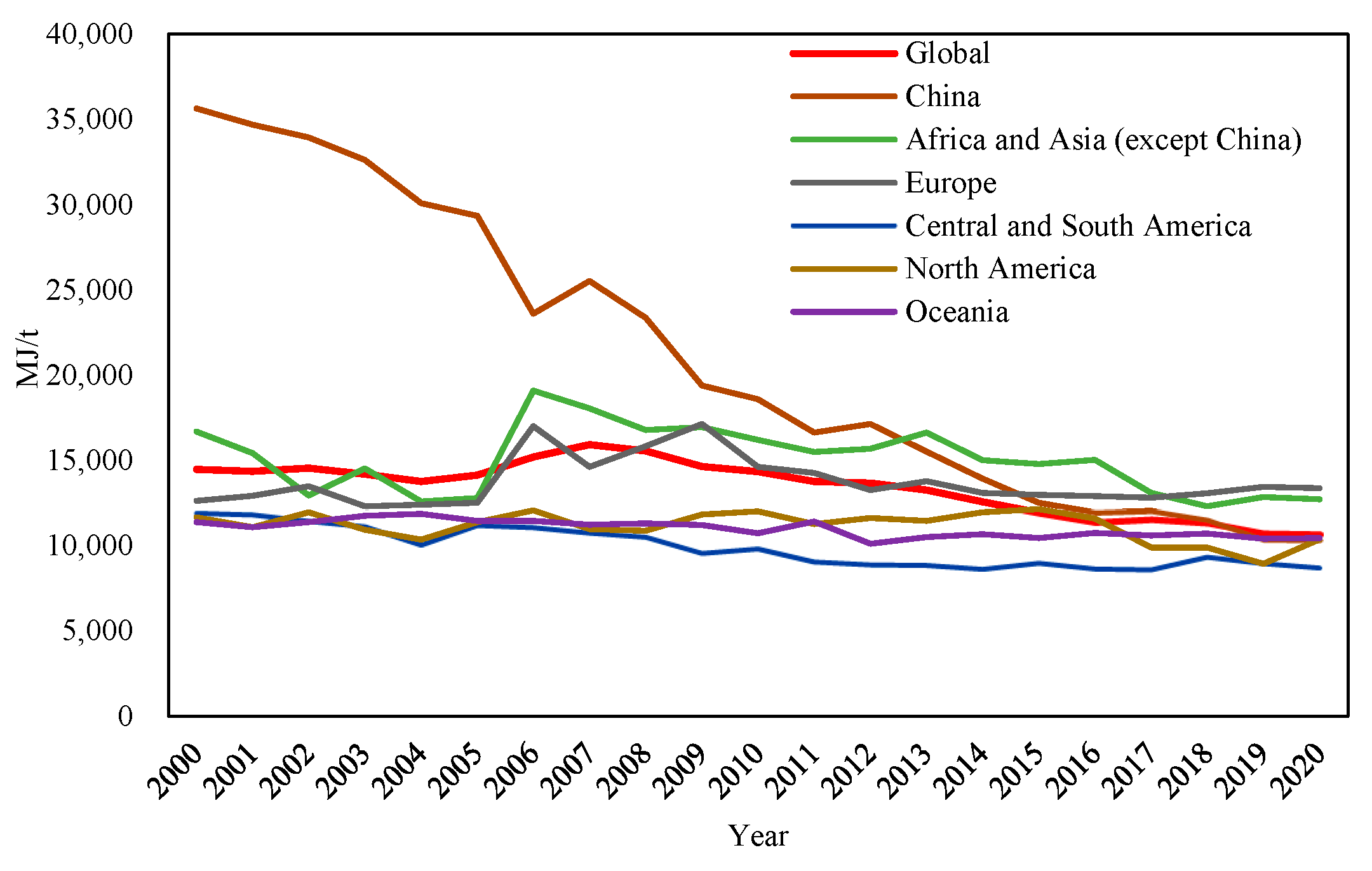

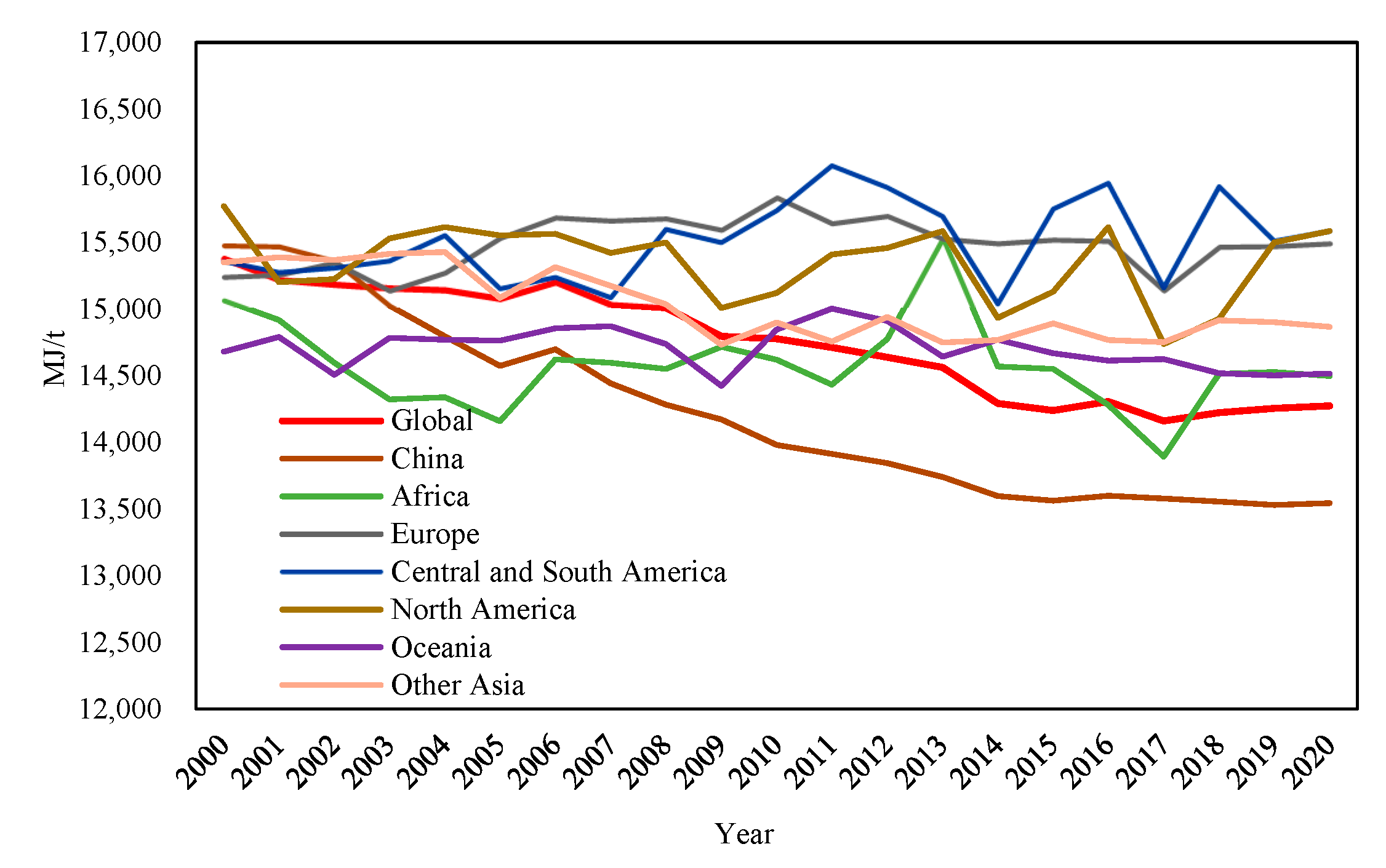

3.1. Data Processing

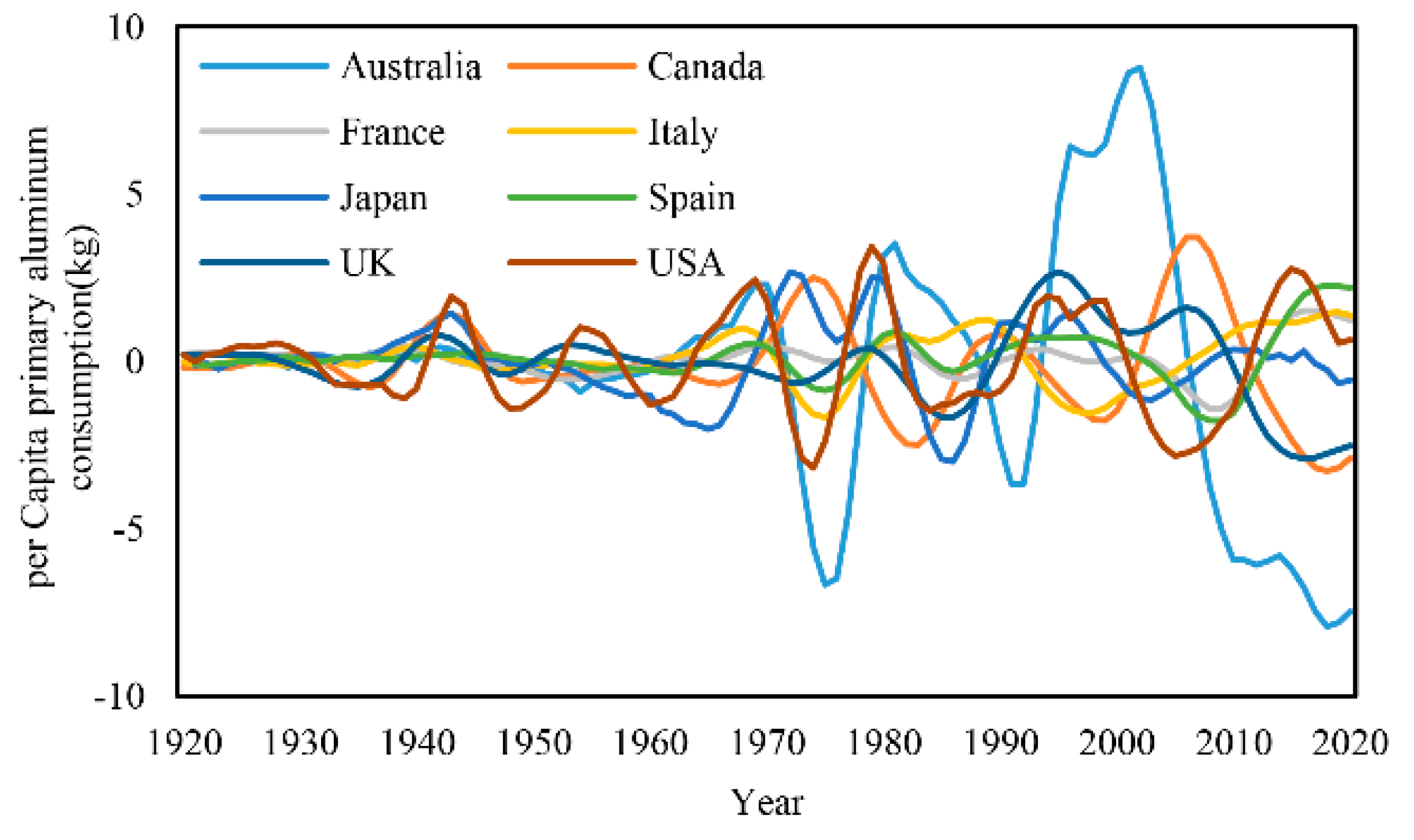

3.2. CEEMDANDecomposition

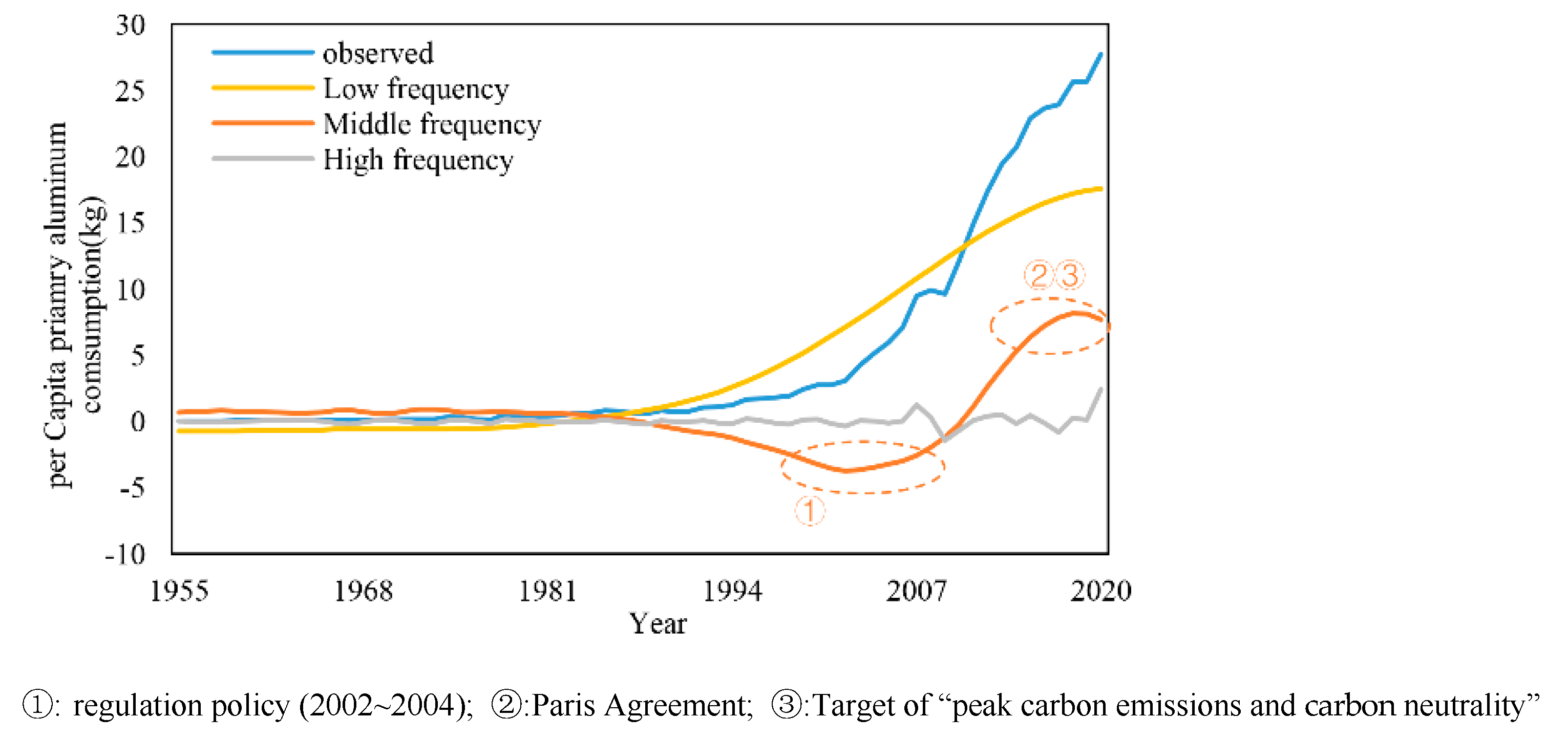

3.3. Components Reconstruction

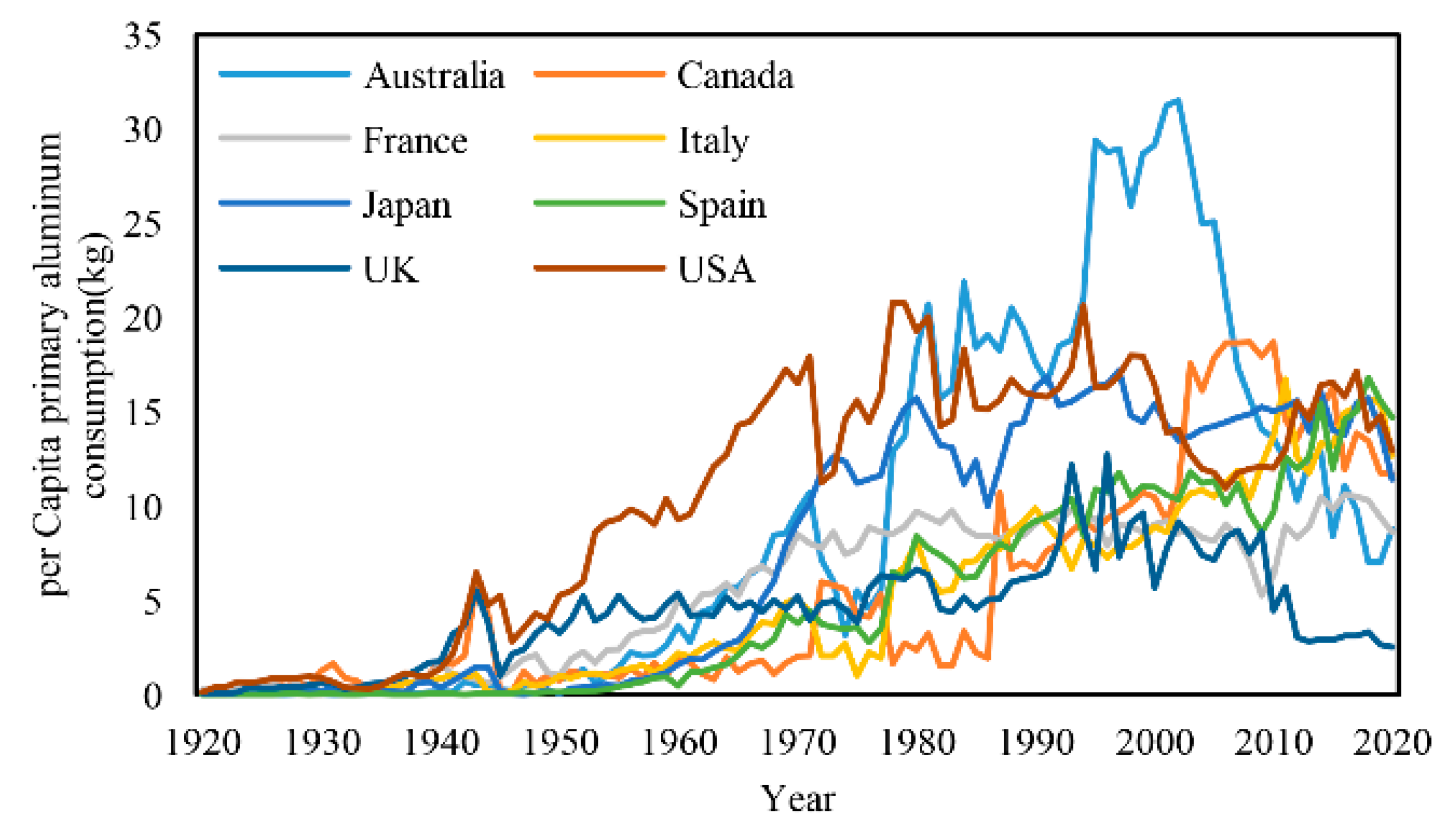

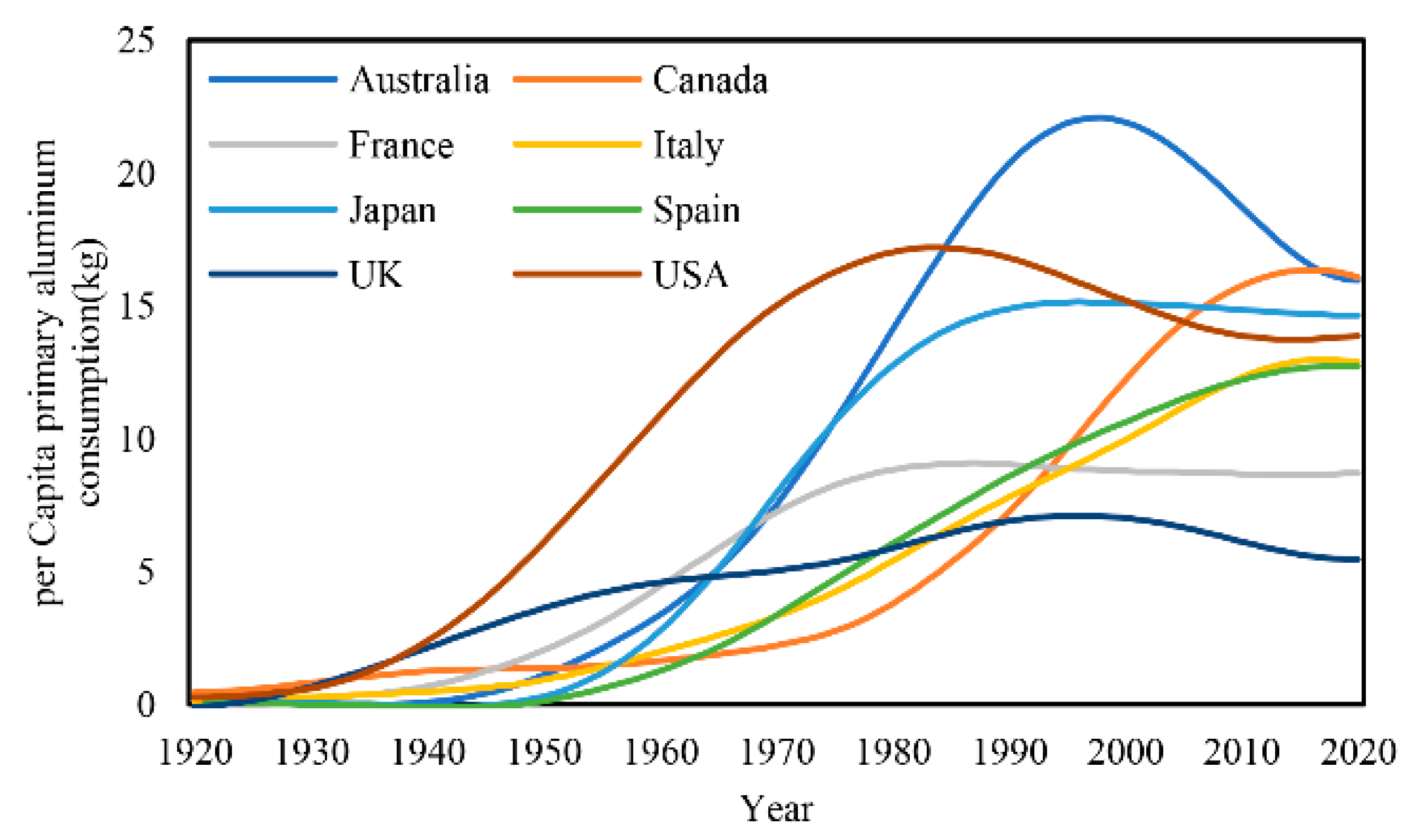

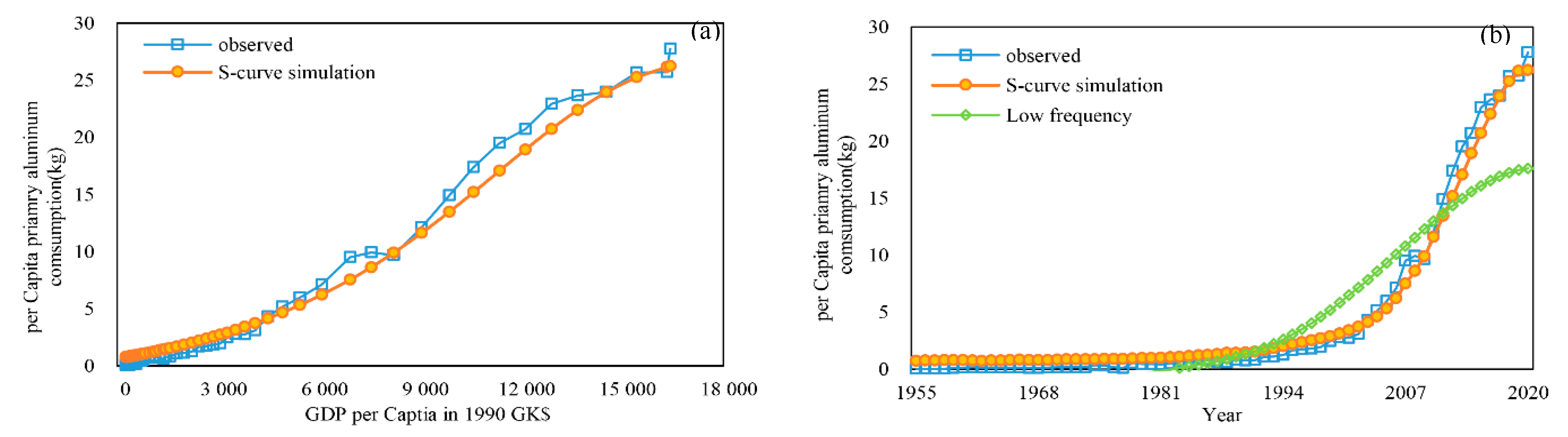

3.4. S-Curve Analysis

3.4.1. Low-Frequency Component

3.4.2. Medium-Frequency Component

3.4.3. High-Frequency Component

3.5. Model Test

3.6. Final Results

3.7. Limitations

- The analysis is highly dependent on abundant data, which can be challenging to obtain and process. This limitation may pose a challenge for researchers who do not have access to relevant data.

- The application of the model needs to be adjusted to fit the specific status of different countries due to their varying levels of development. This may affect the accuracy of the results in some cases.

- The CEEMDAN-S-curve model is designed to capture the impact of predictable factors on primary aluminum consumption and is not able to account for unexpected events or external shocks, which can have some impact on consumption patterns.

4. Discussion

4.1. Comparison between the CEEMDAN-S-Curve and Other Models

4.2. Primary Aluminum Consumption, CO2 Emission, and Recovery

- Governments and investors should increase their support for research and development of technology.

- The aluminum industry should prioritize the development of production plans that reduce carbon emissions.

- Participants in the aluminum industry chain, such as manufacturers, engineers, and construction companies, should use material efficiency strategies to reduce demand for aluminum.

- Policymakers should adopt mandatory emission reduction policies to promote green transformation.

- The collection and monitoring of relevant data are also crucial.

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Liu, G.; Müller, D.B. Addressing sustainability in the aluminum industry: A critical review of life cycle assessments. J. Clean. Prod. 2012, 35, 108–117. [Google Scholar] [CrossRef]

- International Aluminum Institute (IAI). International Aluminum Statistics. Available online: https://international-aluminium.org/statistics/primary-aluminium-production/ (accessed on 10 June 2022).

- World Bureau of Metal Statistics (WBMS). Metals Database Service. Available online: https://world-bureau.co.uk/publications-services/metals-database/ (accessed on 10 June 2022).

- London Metal Exchange (LME). LME Aluminum. Available online: https://www.lme.com/en/Metals/Non-ferrous/LME-Aluminium#Historical+data (accessed on 10 July 2022).

- Yi, X.J.; Lu, Y.L.; He, G.Z.; Li, H.K.; Chen, C.C.; Cui, H.T. Global carbon transfer and emissions of aluminum production and consumption. J. Clean. Prod. 2022, 362, 132513. [Google Scholar] [CrossRef]

- Yta, B.; Ct, C. An assessment of using aluminum and magnesium on CO2 emission in European passenger cars. Clean. Prod. 2019, 247, 119120. [Google Scholar]

- Chen, W.Q.; Shi, L. Analysis of aluminum stocks and flows in mainland China from 1950 to 2009: Exploring the dynamics driving the rapid increase in China’s aluminum production. Resour. Conserv. Recycl. 2012, 68, 18–28. [Google Scholar] [CrossRef]

- Chen, W.Q.; Shi, L.; Qian, Y. Substance flow analysis of aluminum in mainland China for 2001, 2004 and 2007: Exploring its initial sources, eventual sinks and the pathways linking them. Resour. Conserv. Recycl. 2010, 54, 557–570. [Google Scholar] [CrossRef]

- Monica, D.; Saptarshi, M. An outlook into energy consumption in large scale industries in India: The cases of steel, aluminum and cement. Energy Policy 2010, 11, 7286–7298. [Google Scholar]

- Li, S.; Zhang, T.; Niu, L.; Yue, Q. Analysis of the development scenarios and greenhouse gas (ghg) emissions in china’s aluminum industry till 2030. J. Clean. Prod. 2021, 290, 125859. [Google Scholar] [CrossRef]

- Du, J.D.; Han, W.J.; Peng, Y.H.; Gu, C.C. Potential for reducing GHG emissions and energy consumption from implementing the aluminum intensive vehicle fleet in china. Energy 2010, 35, 4671–4678. [Google Scholar] [CrossRef]

- Zhang, Y.; Sun, M.; Hong, J.; Han, X.; He, J.; Shi, W.; Li, X. Environmental footprint of aluminum production in China. J. Clean. Prod. 2016, 133, 1242–1251. [Google Scholar] [CrossRef]

- Linda, W. Trends and developments in long-term steel demand–the intensity-of-use hypothesis revisited. Resour. Policy 2014, 39, 134–143. [Google Scholar]

- Müller, D.B. Stock dynamics for forecasting material flows-case study for housing in The Netherlands. Ecol. Econ. 2006, 59, 142–156. [Google Scholar] [CrossRef]

- Menzie, W.D.; Barry, J.J.; Bleiwas, D.I.; Bray, E.L.; Goonan, T.G.; Matos, G. The Global Flow of Aluminum from 2006 through 2025. 2010. Available online: https://pubs.usgs.gov/of/2010/1256/ (accessed on 20 June 2022).

- Schipper, B.W.; Lin, H.C.; Meloni, M.A.; Wansleeben, K.; Heijungs, R.; van der Voet, E. Estimating global copper demand until 2100 with regression and stock dynamics. Resour. Conserv. Recycl. 2018, 132, 28–36. [Google Scholar] [CrossRef]

- Jia, H.X.; Li, T.J.; Wang, A.J.; Liu, G.W.; Guo, X.Q. Decoupling analysis of economic growth and mineral resources consumption in China from 1992 to 2017: A comparison between tonnage and exergy perspective. Resour. Policy 2021, 74, 102448. [Google Scholar] [CrossRef]

- Zhang, Z.Z.; Jiang, G.Y.; Wang, X.W.; Zhang, J.F. Development and Utilization of the World’s and China’s Bulk Mineral Resources and their Supply and Demand Situation in the Next Twenty Years. Acta Geol. Sin. Engl. Ed. 2016, 90, 1370–1417. [Google Scholar]

- Jiang, G.Y. Proceedings of the 2018 7th International Conference on Energy and Environmental Protection. Adv. Eng. Res. 2018, 9, 1363–1367. [Google Scholar]

- Liu, G.; Bangs, C.E.; Müller, D.B. Stock dynamics and emission pathways of the global aluminum cycle. Nat. Clim. Chang. 2013, 3, 338–342. [Google Scholar] [CrossRef]

- Pauliuk, S.; Wang, T.; Müller, D.B. Moving toward the circular economy: The role of stocks in the Chinese steel cycle. Environ. Sci. Technol. 2012, 46, 148–154. [Google Scholar] [CrossRef]

- Müller, E.; Hilty, L.M.; Widmer, R.; Schluep, M.; Faulstich, M. Modeling metal stocks and flows: A review of dynamic material flow analysis methods. Environ. Sci. Technol. 2014, 48, 2102–2113. [Google Scholar] [CrossRef] [PubMed]

- Dai, M.; Wang, P.; Chen, W.Q.; Liu, G. Scenario analysis of China’s aluminum cycle reveals the coming scrap age and the end of primary aluminum boom. J. Clean. Prod. 2019, 226, 793–804. [Google Scholar] [CrossRef]

- Li, Q.F.; Dai, T.; Gao, T.M.; Zhong, W.Q.; Wen, B.J.; Li, T.B.; Zhou, Y.J. Aluminum material flow analysis for production, consumption, and trade in China from 2008 to 2017. J. Clean. Prod. 2021, 296, 126444. [Google Scholar] [CrossRef]

- Niaz, B.B.; Ramos, P.M. Crude Oil Price Forecasting Techniques: A Comprehensive Review of Literature. SSRN Electron. J. 2013, 7, 1–32. [Google Scholar] [CrossRef]

- Neha, S.; Krishan, K.P. Artificial intelligence methods for oil price forecasting: A review and evaluation. Energy Syst. 2015, 6, 479–506. [Google Scholar]

- Fernando, S.L.; Francisco, C.J.; Ana, S.S.; Alicja, K.; Pedro, R.F. Forecasting the COMEX copper spot price by means of neural networks and ARIMA models. Resour. Policy 2015, 45, 37–43. [Google Scholar]

- Yan, X.J.; Luo, J.C.; Chen, Z.Y. Forecasting of the Demand of Alumina Based on the Coupling Phase-space Reconstruction and Neural Network. Int. J. Bus. Manag. 2010, 5, 146–153. [Google Scholar] [CrossRef]

- Xu, G.D.; Ao, H.; She, Y.G. Research on the consumption law of primary aluminum and prediction of consumption in China. China Man Inf. 2013, 16, 31–35. (In Chinese) [Google Scholar]

- Yuan, W.F.; Zheng, M.G. Scenario analysis of China’s aluminum resource demand based on BP neural network. Res. Ind. 2014, 16, 132–137. (In Chinese) [Google Scholar]

- Ahmed, A.E.; Mohamed, A.E.; Zakaria, A.; Ye, H.W.; Zhang, J.H. Improving multilayer perceptron neural network using chaotic grasshopper optimization algorithm to forecast iron ore price volatility. Resour. Policy 2020, 65, 101555. [Google Scholar]

- Wu, Z.H.; Huang, N.E. Ensemble empirical mode decomposition: A noise-assisted data analysis method. Adv. Adapt. Data Anal. 2009, 1, 1–41. [Google Scholar] [CrossRef]

- Li, H.Z.; Guo, S.; Li, C.J.; Sun, J.Q. A hybrid annual power load forecasting model based on generalized regression neural network with fruit fly optimization algorithm. Knowledge-Based Syst. 2013, 37, 378–387. [Google Scholar] [CrossRef]

- Wang, A.J.; Wang, G.S.; Chen, Q.S.; Yu, W.J.; Yan, K.; Yang, H.B. S-curve model of relationship between energy consumption and economic development. Nat. Resour. Res. 2015, 24, 53–64. [Google Scholar] [CrossRef]

- Tsoularis, A.; Wallace, J. Analysis of logistic growth models. Math. Biosci. 2002, 179, 21–55. [Google Scholar] [CrossRef]

- Colominas, M.A.; Schlotthauer, G.; Torres, M.E. Improved complete ensemble EMD: A suitable tool for biomedical signal processing. Biomed. Signal Process. Control 2014, 14, 19–29. [Google Scholar] [CrossRef]

- Wang, Y.M.; Gu, J.Z.; Zhou, Z.L.; Wang, Z.J. Diarrhoea outpatient visits prediction based on time series decomposition and multi-local predictor fusion. Knowledge-Based Syst. 2015, 88, 12–23. [Google Scholar] [CrossRef]

- Torres, M.E.; Colominas, M.A.; Schlotthauer, G.; Flandrin, P. A complete ensemble empirical mode decomposition with adaptive noise. In Proceedings of the IEEE International Conference on Acoustics, Speech and Signal Processing (ICASSP), Toronto, ON, Canada, 6–11 June 2021. [Google Scholar]

- Gao, X.R.; Wang, A.J.; Liu, G.W.; Liu, C.H.; Yan, K. Expanded S-Curve Model of a Relationship Between Crude Steel Consumption and Economic Development: Empiricism from Case Studies of Developed Economies. Nat. Resour. Res. 2018, 28, 547–562. [Google Scholar] [CrossRef]

- Lempel, A.; Ziv, J. On the complexity of finite sequences. IEEE Trans. Inf. Theory. 1976, 22, 75–81. [Google Scholar] [CrossRef]

- British Geological Survey (BGS). UK and World Mineral Statistics Datasets. Available online: https://www.bgs.ac.uk/geological-data/ (accessed on 20 June 2022).

- U.S. Geological Survey (USGS). Aluminum Statistics and Information. Available online: https://minerals.usgs.gov/minerals/pubs/commodity/aluminum/ (accessed on 10 June 2022).

- The World Bank (WB). World Bank Open Data. Available online: https://data.worldbank.org/ (accessed on 10 June 2022).

- United Nations (UN). World Population Prospects. Available online: https://population.un.org/wpp/DataQuery/ (accessed on 10 June 2022).

- Groningen Growth and Development Centre (GGDC). Total Economy Database. Available online: http://www.ggdc.net (accessed on 10 June 2022).

- Zhang, X.; Lai, K.K.; Wang, S.Y. A new approach for crude oil price analysis based on Empirical Mode Decomposition. Energy Econ. 2008, 30, 905–918. [Google Scholar] [CrossRef]

- Lin, B.Q.; Wang, M. The role of socio-economic factors in China’s CO2 emissions from production activities. Sustain. Prod. Consum. 2021, 27, 217–227. [Google Scholar] [CrossRef]

- Xia, Q.; Tian, G.L.; Wu, Z. Examining embodied carbon emission flow relationships among different industrial sectors in China. Sustain. Prod. Consum. 2022, 29, 100–114. [Google Scholar] [CrossRef]

- China Nonferrous Metal Industry Association. Industry Data. Available online: https://www.chinania.org.cn/html/hangyetongji/chanyeshuju/ (accessed on 10 June 2022).

- National Bureau of Statistics of China. National Data. Available online: https://data.stats.gov.cn/ (accessed on 10 June 2022).

- Ministry of Industry and Information Technology of China. Statistical Analysis. Available online: https://www.miit.gov.cn/gxsj/tjfx/yclgy/ys/index.html (accessed on 10 June 2022).

- Ministry of Natural Resources of China. Data Service. Available online: http://www.mnr.gov.cn/sj/sjfw/ (accessed on 10 June 2022).

- General Administration of Customs of China. Customs Statistics. Available online: http://www.customs.gov.cn/ (accessed on 10 June 2022).

- Li, X.; Zhang, X. Analysis of aluminum supply and demand development trend in China and the United States. Adv. Mater. Res. 2014, 962–965, 1936–1942. [Google Scholar] [CrossRef]

- Graedel, T.E.; Barr, R.; Chandler, C.; Chase, T.; Choi, J.; Christoffersen, L.; Friedlander, E.; Henly, C.; Jun, C.; Nassar, N.T.; et al. Methodology of metal criticality determination. Environ. Sci. Technol. 2012, 46, 1063–1070. [Google Scholar] [CrossRef]

- Bleischwitz, R.; Nechifor, V.; Winning, M.; Huang, B.; Geng, Y. Extrapolation or saturation—Revisiting growth patterns, development stages and decoupling. Glob. Environ. Chang. 2018, 48, 86–96. [Google Scholar] [CrossRef]

- Watari, T.; Nansai, K.; Nakajima, K. Review of critical metal dynamics to 2050 for 48 elements. Resour. Conserv. Recycl. 2020, 155, 104669. [Google Scholar] [CrossRef]

- Watari, T.; Nansai, K.; Nakajima, K. Major metals demand, supply, and environmental impacts to 2100: A critical review. Resour. Conserv. Recycl. 2021, 164, 105107. [Google Scholar] [CrossRef]

- Jerry, B.; Patrik, S. The economics of secondary aluminum supply: An econometric analysis based on European data. Resour. Conserv. Recycl. 2009, 53, 455–463. [Google Scholar]

- Zink, T.; Geyer, R.; Startz, R. Toward estimating displaced primary production from recycling: A case study of U.S. Aluminum. J. Ind. Ecol. 2018, 22, 314–326. [Google Scholar] [CrossRef]

- IEA. Aluminum. Available online: https://www.iea.org/reports/aluminium (accessed on 10 June 2022).

- De, L.L.; Guo, R.; Cao, X.J.; Ni, X.J.; Zhang, W. Accelerating the energy transition to achieve carbon neutrality. Resour. Conserv. Recycl. 2022, 177, 105977. [Google Scholar]

| Country | High-Frequency | Medium-Frequency | Low-Frequency |

|---|---|---|---|

| Australia | IMF1, IMF2 | IMF3, IFM4, IMF5 | Res |

| Canada | IMF1, IMF2, IMF3 | IMF4, IMF5 | Res |

| France | IMF1, IMF2, IMF3 | IMF4, IMF5 | IMF6, Res |

| Italy | IMF1, IMF2, IMF3 | IMF4, IMF5 | Res |

| Japan | IMF1, IMF2 | IMF3, IFM4, IMF5 | Res |

| Spain | IMF1, IMF2, IMF3 | IMF4, IMF5 | Res |

| UK | IMF1, IMF2, IMF3 | IMF4, IMF5 | Res |

| USA | IMF1, IMF2 | IMF3, IMF4, IMF5 | IMF6, Res |

| GPC | S-Curve | UR | IVA | PCEPC | OME | |

|---|---|---|---|---|---|---|

| Pearson correlation | 0.98 * | 0.93 * | 0.99 * | 0.16 | 0.98 * | −0.69 * |

| Kendall correlation | 0.96 * | 0.96 * | 0.92 * | 0.23 * | 1.00 * | −0.49 * |

| Category | Specific Methods | Merits and Drawbacks | Core Data |

|---|---|---|---|

| Hybrid model | CEEMDAN-S-curve | Merits: quantitative analysis; evaluated directly; combining the merits of different models; clear, stable, and reliable results Drawbacks: difficult to access data | major economic and social indicators, significant events, market price, policy |

| Market survey method | Sector analysis method [55] | Merits: clear; solid theoretical foundation; easy to master; reliable results Drawbacks: difficult to access data; complex downstream subdivision | consumption data of different downstream sectors |

| Life cycle | Material flow analysis [1,22,24] | Merits: solid theoretical foundation; easy to master; evaluated directly Drawbacks: difficult to access data; complex downstream subdivision | parameters of virous flows |

| Mathematical model | Neural Network [28] | Merits: simple and easy to operate; reliable results Drawbacks: easy to ignore realistic social factors | per capita consumption |

| S-curve [18,19] | Merits: scenario analysis, quantitative analysis; easy to explain indicators Drawbacks: too dependent on the developed country pattern | per capita consumption, per capita GDP, population, economic growth rate | |

| Expert experience method | Expert forecasting method [49] | Merits: rich experience, strong analytical capability Drawbacks: not objective enough | experts’ judgment |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pan, Z.; Zhang, Z.; Che, D. Exploring Primary Aluminum Consumption: New Perspectives from Hybrid CEEMDAN-S-Curve Model. Sustainability 2023, 15, 4228. https://doi.org/10.3390/su15054228

Pan Z, Zhang Z, Che D. Exploring Primary Aluminum Consumption: New Perspectives from Hybrid CEEMDAN-S-Curve Model. Sustainability. 2023; 15(5):4228. https://doi.org/10.3390/su15054228

Chicago/Turabian StylePan, Zhaoshuai, Zhaozhi Zhang, and Dong Che. 2023. "Exploring Primary Aluminum Consumption: New Perspectives from Hybrid CEEMDAN-S-Curve Model" Sustainability 15, no. 5: 4228. https://doi.org/10.3390/su15054228

APA StylePan, Z., Zhang, Z., & Che, D. (2023). Exploring Primary Aluminum Consumption: New Perspectives from Hybrid CEEMDAN-S-Curve Model. Sustainability, 15(5), 4228. https://doi.org/10.3390/su15054228