How a Grid Company Could Enter the Hydrogen Industry through a New Business Model: A Case Study in China

Abstract

1. Introduction

2. Materials and Methods

2.1. SWOT Analysis

- Preliminary SWOT factors were identified through brainstorming and a literature review by applying the value chain and PEST models, from which preliminary strategies may be derived.

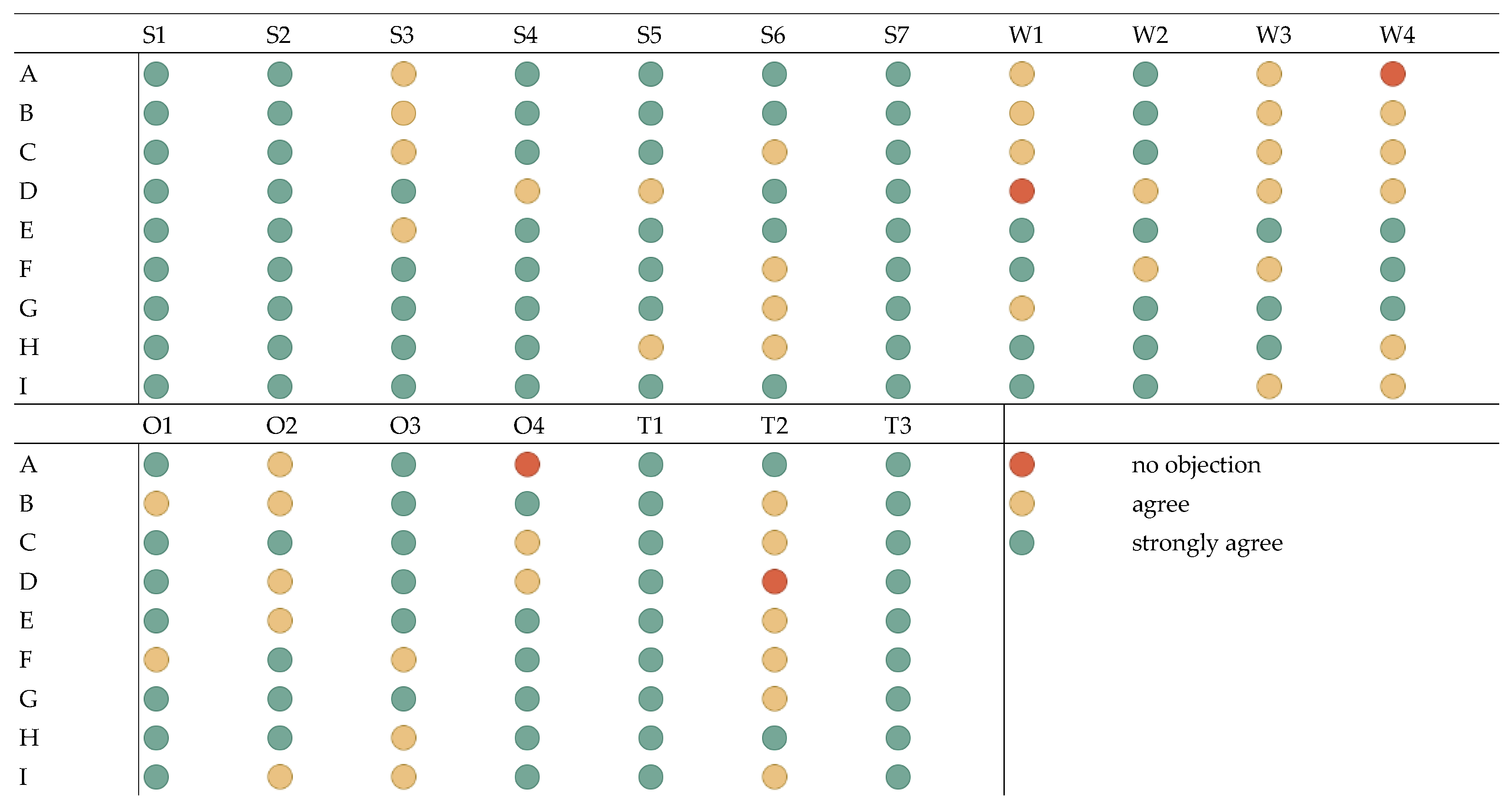

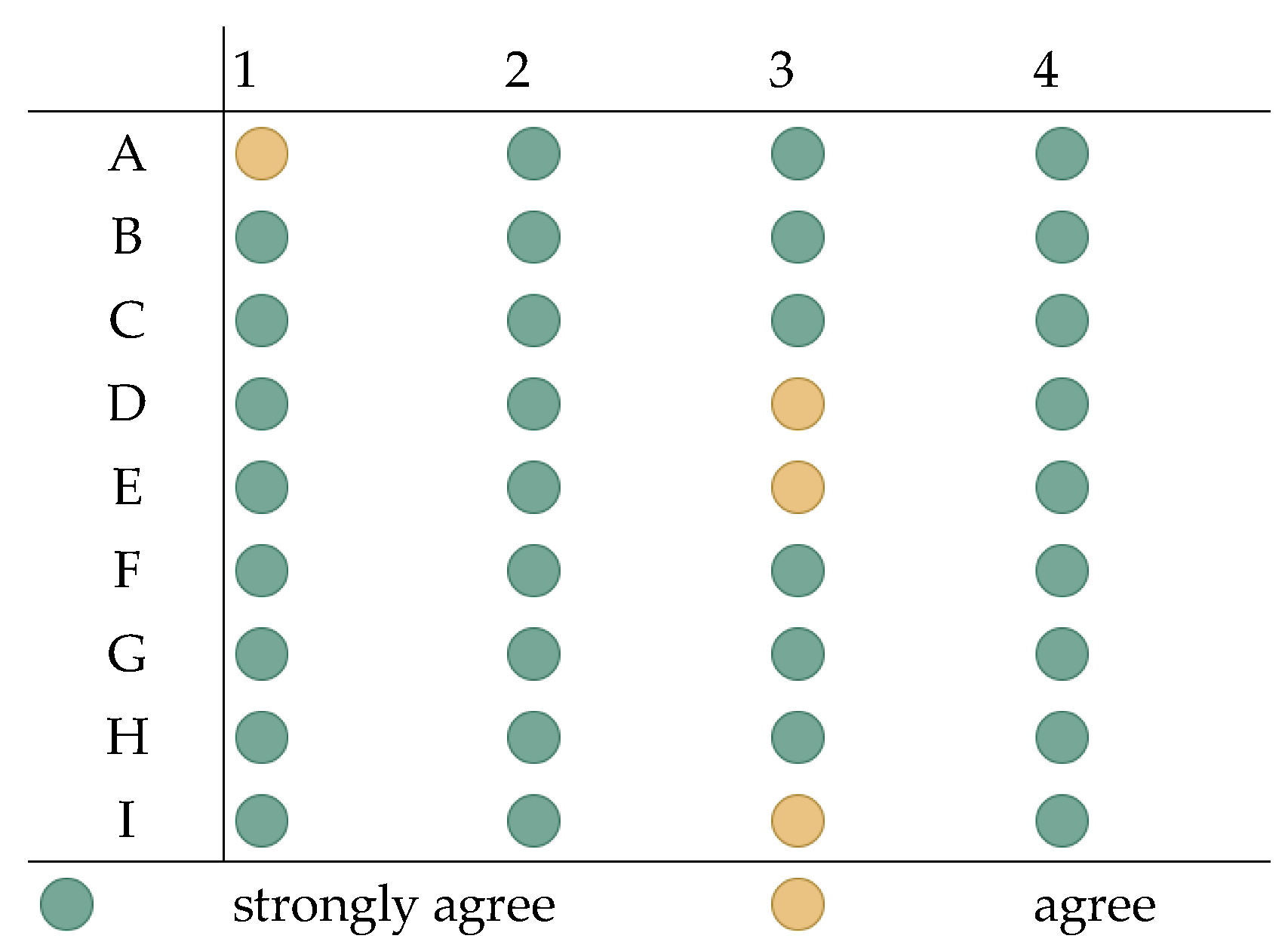

- The preliminary findings on the SWOT factors were subject to revision after receiving feedback, comments, and insights from a small group of experts from the grid sector, academia, and hydrogen-related industries (Table 1).

- Strategies were developed based on the SWOT factors and were further polished based on input from experts via interviews.

2.2. The State Grid Corporation of China

3. Results: SWOT Factor Identification

3.1. Strengths

3.1.1. Leading Electricity Transmission Technology

3.1.2. Leading Smart Grid Technology

3.1.3. Mature and Efficient R&D Mechanism

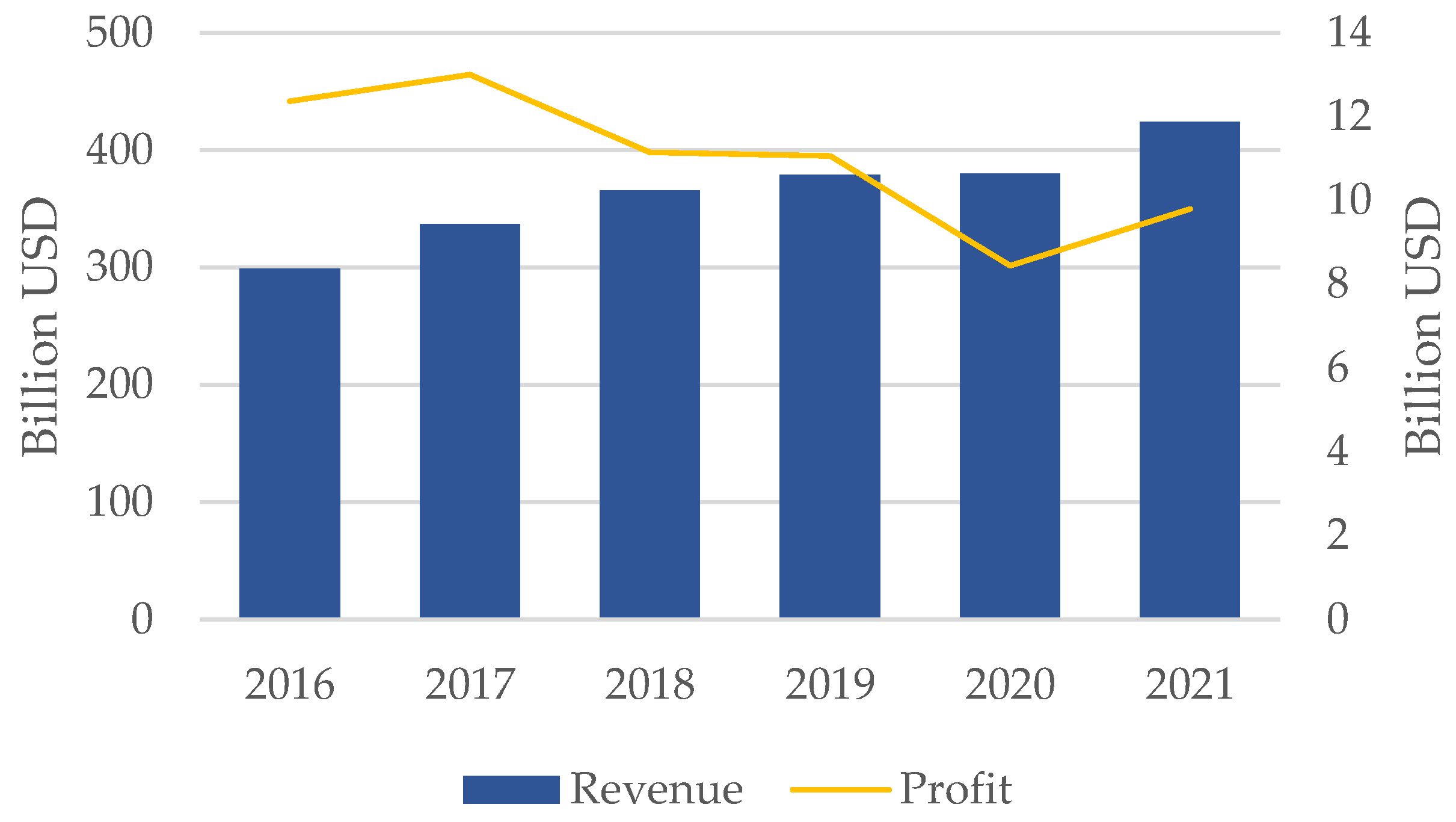

3.1.4. Solid Economic and Operational Foundation

3.1.5. Robust Bargaining Power in Capital Market

3.1.6. Firm Commitment to Carbon Neutrality

3.1.7. Tight Involvement in Policymaking and Implementation

3.2. Weaknesses

3.2.1. Potential Organizational Inertia

3.2.2. Large Readiness Gap in Hydrogen Technology

3.2.3. Potential Impact of Policy Factors on Financial Performance

3.2.4. Potential Anti-Trust Challenges

3.3. Opportunities

3.3.1. Tremendous Governmental Support at Various Levels in China

3.3.2. Growing Hydrogen Demands Resulting from Decarbonization Goals in China

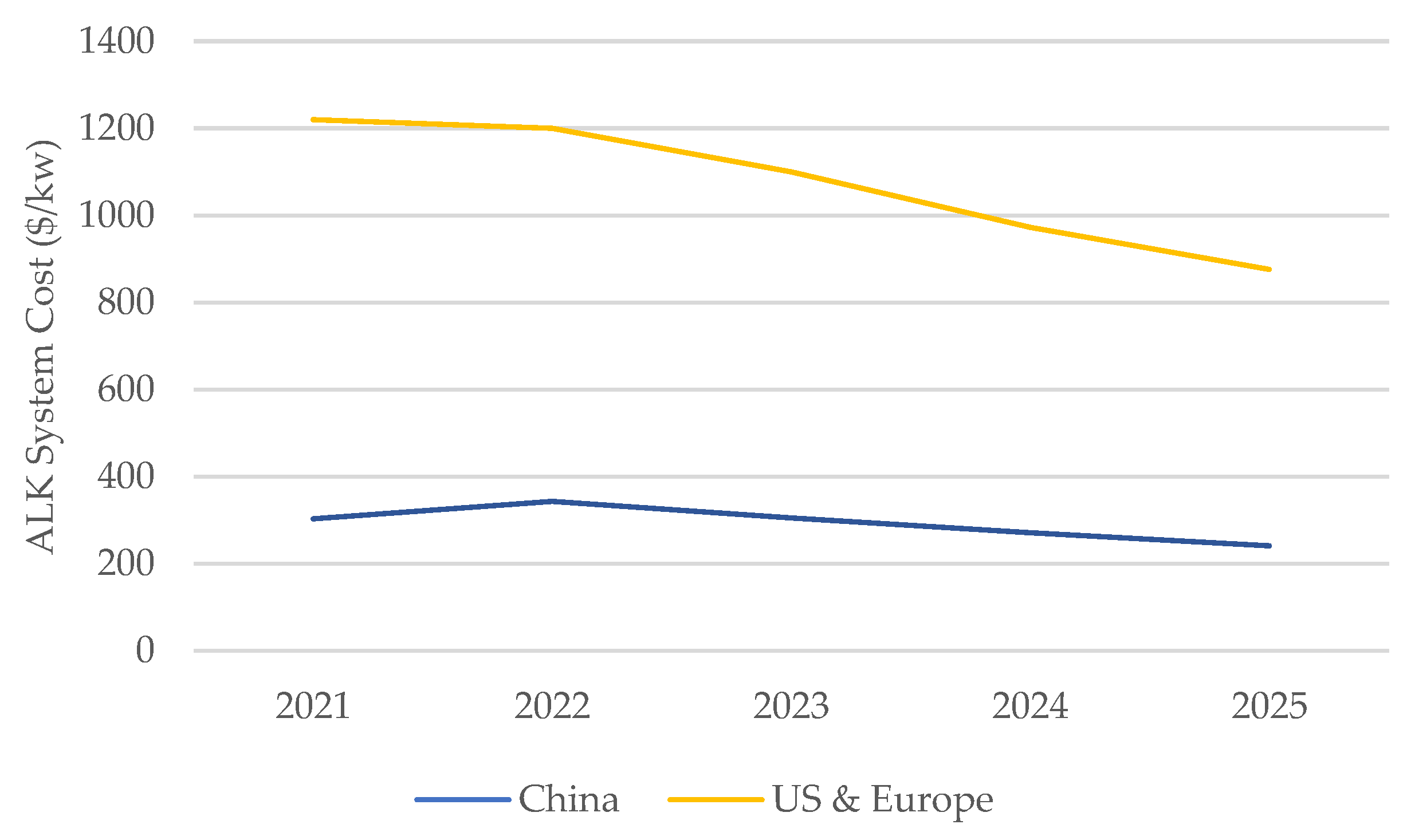

3.3.3. Evident Cost Advantages in Hydrogen Production in China

3.3.4. Emerging Chances to Seize a First-Mover Advantage

3.4. Threats

3.4.1. Amplified Geopolitical Uncertainty to Challenges Supply Chain Stability

3.4.2. Emerging Technologies Disrupt the Existing Competitive Landscape

3.4.3. Heavy Investment Required to Build Hydrogen Infrastructure in China

4. Results: Recommended Strategies

4.1. WO Strategies (Mini-Maxi)

4.2. WT Strategies (Mini-Mini)

4.3. SO Strategies (Maxi-Maxi)

4.4. ST Strategies (Maxi-Mini)

4.5. Strategy Summary

- Build a flexible hydrogen vendor network with limited international suppliers, and establish investment partnerships with electricity generation companies;

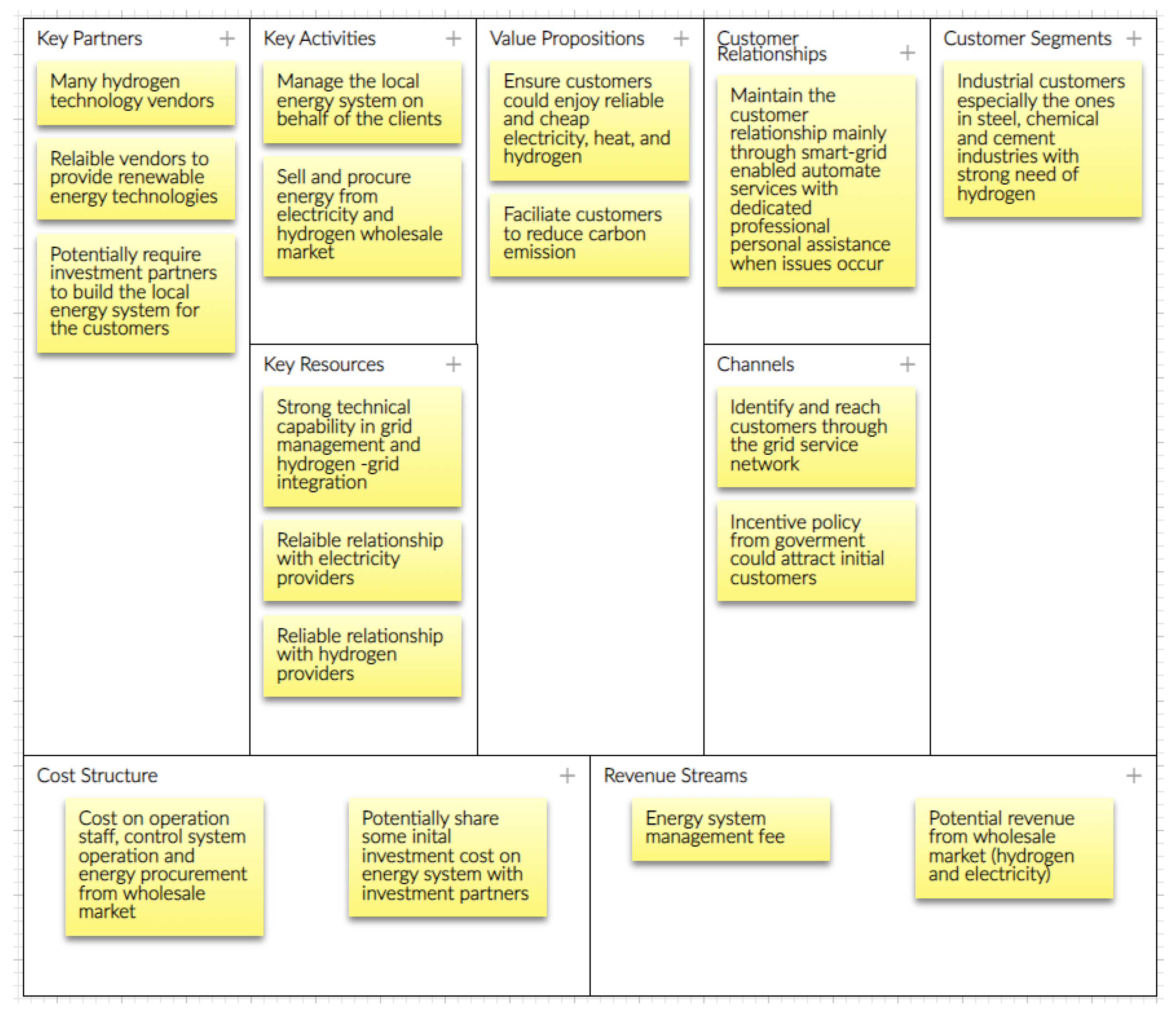

- Integrate hydrogen services into an Energy-as-a-Service (EaaS) model and deliver a more comprehensive portfolio of energy services to industrial customers;

- Create a joint venture with pipeline companies to co-optimize and co-invest in the planning and construction of electricity transmission networks and hydrogen pipelines;

- Engage in domestic policy discussions related to EaaS business models and foreign policy discussions related to the hydrogen supply chain.

5. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Issued Date | Issuing Departments * | Title of the Policy |

|---|---|---|

| June 2022 | MOST, NDRC, MIIT, MEE, MOHURD, MOT, CAS, CAE, NEA | Notice by Nine Ministries and Commissions Including the Ministry of Science and Technology of Issuing the Implementation Plan for Science and Technology Support for Carbon Dioxide Peaking and Carbon Neutrality (2022–2030) |

| March 2022 | NDRC, NEA | Medium and Long-Term Development Plan for Hydrogen Industry (2021–2035) |

| March 2022 | NEA | Notice of the National Energy Administration on Printing and Distributing the “Guiding Opinions on Energy Work in 2022” |

| November, 2021 | MIIT | 14th Five-Year Plan on Industrial Green Development |

| November 2021 | SASAC | Guiding Opinions on Promoting High-Quality Development of Central Enterprises to Achieve Carbon Dioxide Peaking and Carbon Neutrality |

| November 2021 | CCCCP, SC | Opinion on Further Promoting the Nationwide Battle to Prevent and Control Pollution |

| October 2021 | NDRC, NEA, MOF, MNR, MEE, MOHURD, MARA, CMA, NFGA | 14th Five-year plan for renewable energy development |

| October 2021 | NDRC, MEE, MIIT, MOST, SAMR, MOF, MOHURD, MARA, MOFCOM, SAMR | 14th Five-Year Plan on Promoting Clean Production Across All Industrial Sectors |

| October 2021 | SC | Circular of the State Council on an action plan for peaking carbon emissions before 2030 |

| June 2021 | MIIT | Key Points of Automotive Standardization in 2021 |

| June 2021 | NEA | Notice on the Initiation of First Round National Energy R&D Innovation Platform Identification during the Fourteenth Five Year Plan by National Energy Administration |

| February 2021 | SC | Guiding Opinions of the State Council on Accelerating the Establishment of a Sound Economic System with Green, Low-carbon, and Circular Development |

| October 2020 | General Office of the State Council, P.R.C. | New Energy Automobile Industry Development Plan (2021–2035) |

| September 2020 | MOF, MIIT, MOST, NDRC, NEA | Notice on launching fuel cell vehicle demonstration projects |

| June 2020 | NEA | Guiding opinions on 2020 energy tasks |

| April 2020 | NEA | Energy Law of the People’s Republic of China (draft for comments) |

| April 2020 | MOF, MIIT, MOST, NDRC | Notice on Further Improving the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles |

| March 2020 | NDRC, MOJ | Opinion on Accelerating the Establishment of Regulatory and Policy System for Green Production and Consumption |

| February 2019 | NDRC, MIIT, MNR, MEE, MOHURD, PBC, NEA | Catalogue for Guiding Industry Restructuring (2019 version) |

| October 2018 | NDRC, NEA | Clean Energy Consumption Plan (2018–2020) |

| July 2017 | NDRC, NEA | Trial Measures for Promoting the Construction of Grid-Connected Micro-Grids |

| December 2016 | SC | 13th Five-Year Plan Comprehensive Work Plan for Energy Conservation and Emission Reduction |

| December 2016 | NDRC | 13th Five-Year Plan for Renewable Energy Development |

| December 2016 | NDRC, MOST, MIIT, MEE | Development Plan for the 13th Five-Year of the Energy Conservation and Environmental Protection Industry |

| February 2016 | NEA | Guiding Opinions on the Establishment of A Target Setting System for the Development and Utilization of Renewable Energy |

References

- Masson-Delmotte, V.; Zhai, P.; Pörtner, H.-O.; Roberts, D.; Skea, J.; Shukla, P.R.; Pirani, A.; Moufouma-Okia, W.; Péan, C.; Pidcock, R. Global Warming of 1.5 °C: An IPCC Special Report on the Impacts of Global Warming of 1.5° C Above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change; World Meteorological Organization: Geneva, Switzerland, 2018. [Google Scholar]

- Hino, M.; Belanger, S.T.; Field, C.B.; Davies, A.R.; Mach, K.J. High-Tide Flooding Disrupts Local Economic Activity. Sci. Adv. 2019, 5. [Google Scholar] [CrossRef] [PubMed]

- Liu, J.; Hertel, T.W.; Diffenbaugh, N.S.; Delgado, M.S.; Ashfaq, M. Future Property Damage from Flooding: Sensitivities to Economy and Climate Change. Clim. Change 2015, 132, 741–749. [Google Scholar] [CrossRef]

- Vicedo-Cabrera, A.M.; Scovronick, N.; Sera, F.; Royé, D.; Schneider, R.; Tobias, A.; Astrom, C.; Guo, Y.; Honda, Y.; Hondula, D.M.; et al. The Burden of Heat-Related Mortality Attributable to Recent Human-Induced Climate Change. Nat. Clim. Change 2021, 11, 492–500. [Google Scholar] [CrossRef] [PubMed]

- Ebi, K.L.; Vanos, J.; Baldwin, J.W.; Bell, J.E.; Hondula, D.M.; Errett, N.A.; Hayes, K.; Reid, C.E.; Saha, S.; Spector, J.; et al. Extreme Weather and Climate Change: Population Health and Health System Implications. Annu. Rev. Public Health 2021, 42, 293–315. [Google Scholar] [CrossRef]

- Friedlingstein, P.; O’Sullivan, M.; Jones, M.W.; Andrew, R.M.; Hauck, J.; Olsen, A.; Peters, G.P.; Peters, W.; Pongratz, J.; Sitch, S.; et al. Global Carbon Budget 2020. Earth Syst. Sci. Data 2020, 12, 3269–3340. [Google Scholar] [CrossRef]

- Akimoto, K.; Sano, F.; Homma, T.; Oda, J.; Nagashima, M.; Kii, M. Estimates of GHG Emission Reduction Potential by Country, Sector, and Cost. Energy Policy 2010, 38, 3384–3393. [Google Scholar] [CrossRef]

- He, G.; Lin, J.; Sifuentes, F.; Liu, X.; Abhyankar, N.; Phadke, A. Rapid Cost Decrease of Renewables and Storage Accelerates the Decarbonization of China’s Power System. Nat. Commun. 2020, 11, 2486. [Google Scholar] [CrossRef]

- Gowrisankaran, G.; Reynolds, S.S.; Samano, M. Intermittency and the Value of Renewable Energy. J. Political Econ. 2016, 124, 1187–1234. [Google Scholar] [CrossRef]

- Frew, B.; Sergi, B.; Denholm, P.; Cole, W.; Gates, N.; Levie, D.; Margolis, R. The Curtailment Paradox in the Transition to High Solar Power Systems. Joule 2021, 5, 1143–1167. [Google Scholar] [CrossRef]

- Bryant, S.T.; Straker, K.; Wrigley, C. The Typologies of Power: Energy Utility Business Models in an Increasingly Renewable Sector. J. Clean Prod. 2018, 195, 1032–1046. [Google Scholar] [CrossRef]

- Mazur, C.; Hall, S.; Hardy, J.; Workman, M. Technology Is Not a Barrier: A Survey of Energy System Technologies Required for Innovative Electricity Business Models Driving the Low Carbon Energy Revolution. Energies 2019, 12, 428. [Google Scholar] [CrossRef]

- Bichler, M.; Buhl, H.U.; Knörr, J.; Maldonado, F.; Schott, P.; Waldherr, S.; Weibelzahl, M. Electricity Markets in a Time of Change: A Call to Arms for Business Research. Schmalenbach J. Bus. Res. 2022, 74, 77–102. [Google Scholar] [CrossRef]

- Kopin, D.J.; vanden Bergh, R.G. The Rationale for Reforming Utility Business Models. Energy J. 2023, 44. [Google Scholar] [CrossRef]

- Hall, S.; Mazur, C.; Hardy, J.; Workman, M.; Powell, M. Prioritising Business Model Innovation: What Needs to Change in the United Kingdom Energy System to Grow Low Carbon Entrepreneurship? Energy Res. Soc. Sci. 2020, 60, 101317. [Google Scholar] [CrossRef]

- Richter, M. Business Model Innovation for Sustainable Energy: German Utilities and Renewable Energy. Energy Policy 2013, 62, 1226–1237. [Google Scholar] [CrossRef]

- Maciejowska, K. Assessing the Impact of Renewable Energy Sources on the Electricity Price Level and Variability—A Quantile Regression Approach. Energy Econ. 2020, 85, 104532. [Google Scholar] [CrossRef]

- Fares, R.L.; Webber, M.E. The Impacts of Storing Solar Energy in the Home to Reduce Reliance on the Utility. Nat. Energy 2017, 2, 17001. [Google Scholar] [CrossRef]

- Brockway, A.M.; Conde, J.; Callaway, D. Inequitable Access to Distributed Energy Resources Due to Grid Infrastructure Limits in California. Nat. Energy 2021, 6, 892–903. [Google Scholar] [CrossRef]

- Luburić, Z.; Pandžić, H.; Plavšić, T.; Teklić, L.; Valentić, V. Role of Energy Storage in Ensuring Transmission System Adequacy and Security. Energy 2018, 156, 229–239. [Google Scholar] [CrossRef]

- Alova, G. A Global Analysis of the Progress and Failure of Electric Utilities to Adapt Their Portfolios of Power-Generation Assets to the Energy Transition. Nat. Energy 2020, 5, 920–927. [Google Scholar] [CrossRef]

- Pereira, G.I.; Niesten, E.; Pinkse, J. Sustainable Energy Systems in the Making: A Study on Business Model Adaptation in Incumbent Utilities. Technol. Soc. Change 2022, 174, 121207. [Google Scholar] [CrossRef]

- Necoechea-Porras, P.D.; López, A.; Salazar-Elena, J.C. Deregulation in the Energy Sector and Its Economic Effects on the Power Sector: A Literature Review. Sustainability 2021, 13, 3429. [Google Scholar] [CrossRef]

- Anaya, K.L.; Pollitt, M.G. Going Smarter in the Connection of Distributed Generation. Energy Policy 2017, 105, 608–617. [Google Scholar] [CrossRef]

- Horváth, D.; Szabó, R.Z. Evolution of Photovoltaic Business Models: Overcoming the Main Barriers of Distributed Energy Deployment. Renew. Sustain. Energy Rev. 2018, 90, 623–635. [Google Scholar] [CrossRef]

- Hiteva, R.; Foxon, T.J. Beware the Value Gap: Creating Value for Users and for the System through Innovation in Digital Energy Services Business Models. Technol. Soc. Change 2021, 166, 120525. [Google Scholar] [CrossRef]

- Shomali, A.; Pinkse, J. The Consequences of Smart Grids for the Business Model of Electricity Firms. J. Clean. Prod. 2016, 112, 3830–3841. [Google Scholar] [CrossRef]

- Lin, R.H.; Zhao, Y.Y.; Wu, B.D. Toward a Hydrogen Society: Hydrogen and Smart Grid Integration. Int. J. Hydrogen Energy 2020, 45, 20164–20175. [Google Scholar] [CrossRef]

- Bellosta von Colbe, J.; Ares, J.R.; Barale, J.; Baricco, M.; Buckley, C.; Capurso, G.; Gallandat, N.; Grant, D.M.; Guzik, M.N.; Jacob, I.; et al. Application of Hydrides in Hydrogen Storage and Compression: Achievements, Outlook and Perspectives. Int. J. Hydrogen Energy 2019, 44, 7780–7808. [Google Scholar] [CrossRef]

- Valverde, L.; Rosa, F.; Bordons, C.; Guerra, J. Energy Management Strategies in Hydrogen Smart-Grids: A Laboratory Experience. Int. J. Hydrogen Energy 2016, 41, 13715–13725. [Google Scholar] [CrossRef]

- Petrollese, M.; Valverde, L.; Cocco, D.; Cau, G.; Guerra, J. Real-Time Integration of Optimal Generation Scheduling with MPC for the Energy Management of a Renewable Hydrogen-Based Microgrid. Appl. Energy 2016, 166, 96–106. [Google Scholar] [CrossRef]

- Alavi, F.; Park Lee, E.; van de Wouw, N.; de Schutter, B.; Lukszo, Z. Fuel Cell Cars in a Microgrid for Synergies between Hydrogen and Electricity Networks. Appl. Energy 2017, 192, 296–304. [Google Scholar] [CrossRef]

- Bernstein, P.A.; Heuer, M.; Wenske, M. Fuel Cell System as a Part of the Smart Grid. In Proceedings of the 2013 IEEE Grenoble Conference PowerTech, POWERTECH 2013, Grenoble, France, 16–20 June 2013. [Google Scholar] [CrossRef]

- Semeraro, M.A. Renewable Energy Transport via Hydrogen Pipelines and HVDC Transmission Lines. Energy Strategy Rev. 2021, 35, 100658. [Google Scholar] [CrossRef]

- Patel, M.; Roy, S.; Roskilly, A.P.; Smallbone, A. The Techno-Economics Potential of Hydrogen Interconnectors for Electrical Energy Transmission and Storage. J. Clean. Prod. 2022, 335, 130045. [Google Scholar] [CrossRef]

- Wu, W.P.; Wu, K.X.; Zeng, W.K.; Yang, P.C. Optimization of Long-Distance and Large-Scale Transmission of Renewable Hydrogen in China: Pipelines vs. UHV. Int. J. Hydrogen Energy 2022, 47, 24635–24650. [Google Scholar] [CrossRef]

- Van der Zwaan, B.; Lamboo, S.; Dalla Longa, F. Timmermans’ Dream: An Electricity and Hydrogen Partnership between Europe and North Africa. Energy Policy 2021, 159, 112613. [Google Scholar] [CrossRef]

- Hill, T.; Westbrook, R. SWOT Analysis: It’s Time for a Product Recall. Long Range Plann. 1997, 30, 46–52. [Google Scholar] [CrossRef]

- Weihrich, H. The TOWS Matrix—A Tool for Situational Analysis. Long Range Plann. 1982, 15, 54–66. [Google Scholar] [CrossRef]

- Grundy, T. Rethinking and Reinventing Michael Porter’s Five Forces Model. Strateg. Change 2006, 15, 213–229. [Google Scholar] [CrossRef]

- Kutlu Gündoğdu, F.; Kahraman, C. A Novel Spherical Fuzzy Analytic Hierarchy Process and Its Renewable Energy Application. Soft Comput. 2020, 24, 4607–4621. [Google Scholar] [CrossRef]

- Phadermrod, B.; Crowder, R.M.; Wills, G.B. Importance-Performance Analysis Based SWOT Analysis. Int. J. Inf. Manag. 2019, 44, 194–203. [Google Scholar] [CrossRef]

- Madurai Elavarasan, R.; Afridhis, S.; Vijayaraghavan, R.R.; Subramaniam, U.; Nurunnabi, M. SWOT Analysis: A Framework for Comprehensive Evaluation of Drivers and Barriers for Renewable Energy Development in Significant Countries. Energy Rep. 2020, 6, 1838–1864. [Google Scholar] [CrossRef]

- Irfan, M.; Hao, Y.; Panjwani, M.K.; Khan, D.; Chandio, A.A.; Li, H. Competitive Assessment of South Asia’s Wind Power Industry: SWOT Analysis and Value Chain Combined Model. Energy Strategy Rev. 2020, 32, 100540. [Google Scholar] [CrossRef]

- Sibtain, M.; Li, X.; Bashir, H.; Azam, M.I. Hydropower Exploitation for Pakistan’s Sustainable Development: A SWOT Analysis Considering Current Situation, Challenges, and Prospects. Energy Strategy Rev. 2021, 38, 100728. [Google Scholar] [CrossRef]

- Agyekum, E.B.; Ansah, M.N.S.; Afornu, K.B. Nuclear Energy for Sustainable Development: SWOT Analysis on Ghana’s Nuclear Agenda. Energy Rep. 2020, 6, 107–115. [Google Scholar] [CrossRef]

- Ren, J.; Gao, S.; Tan, S.; Dong, L. Hydrogen Economy in China: Strengths–Weaknesses–Opportunities–Threats Analysis and Strategies Prioritization. Renew. Sustain. Energy Rev. 2015, 41, 1230–1243. [Google Scholar] [CrossRef]

- Li, Y.; Shi, X.; Phoumin, H. A Strategic Roadmap for Large-Scale Green Hydrogen Demonstration and Commercialisation in China: A Review and Survey Analysis. Int. J. Hydrogen Energy 2022, 47, 24592–24609. [Google Scholar] [CrossRef]

- National Development and Reform Commission. Organizing the Grid Companies to Purchase Electricity on Behalf of End Customers; National Development and Reform Commission: Beijing, China, 2021.

- Dai, R.; Liu, G.; Zhang, X. Transmission Technologies and Implementations: Building a Stronger, Smarter Power Grid in China. IEEE Power Energy Mag. 2020, 18, 53–59. [Google Scholar] [CrossRef]

- Geng, J.; Du, W.; Yang, D.; Chen, Y.; Liu, G.; Fu, J.; He, G.; Wang, J.; Chen, H. Construction of Energy Internet Technology Architecture Based on General System Structure Theory. Energy Rep. 2021, 7, 10–17. [Google Scholar] [CrossRef]

- Wang, Y.; Ruan, D.; Gu, D.; Gao, J.; Liu, D.; Xu, J.; Chen, F.; Dai, F.; Yang, J. Analysis of Smart Grid Security Standards. In Proceedings of the 2011 IEEE International Conference on Computer Science and Automation Engineering, CSAE 2011, Shanghai, China, 10–12 June 2011; Volume 4, pp. 697–701. [Google Scholar] [CrossRef]

- Ngar-yin Mah, D.; Wu, Y.Y.; Ronald Hills, P. Explaining the Role of Incumbent Utilities in Sustainable Energy Transitions: A Case Study of the Smart Grid Development in China. Energy Policy 2017, 109, 794–806. [Google Scholar] [CrossRef]

- Rikap, C. Becoming an Intellectual Monopoly by Relying on the National Innovation System: The State Grid Corporation of China’s Experience. Res. Policy 2022, 51, 104472. [Google Scholar] [CrossRef]

- State Grid Corporation of China. State Grid Corporation of China 2021 Annual Report; State Grid Corporation of China: Beijing, China, 2022. [Google Scholar]

- State Grid Corporation of China. 2021 Corporate Social Responsibility Report of State Grid Corporation of China; State Grid Corporation of China: Beijing, China, 2022. [Google Scholar]

- Pan, E.; Liu, S.; Liu, J.; Qi, Q.; Guo, Z. The State Grid Corporation of China’s Practice and Outlook for Promoting New Energy Development. Energy Convers. Econ. 2020, 1, 71–80. [Google Scholar] [CrossRef]

- Yi-chong, X. China’s Giant State-Owned Enterprises as Policy Advocates: The Case of the State Grid Corporation of China. China J. 2018, 79, 21–39. [Google Scholar] [CrossRef]

- Pollitt, M.G. Measuring the Impact of Electricity Market Reform in a Chinese Context. Energy Clim. Change 2021, 2, 100044. [Google Scholar] [CrossRef]

- National Development and Reform Commission; National Energy Administration. Guidance about Accelerating National Electricity Market; National Development and Reform Commission, National Energy Administration: Beijing, China, 2022.

- National Development and Reform Commission; National Energy Administration. Hydrogen Energy Development Plan 2021-2035; National Development and Reform Commission, National Energy Administration: Beijing, China, 2022.

- Li, C.; Zhang, L.; Ou, Z.; Ma, J. Using System Dynamics to Evaluate the Impact of Subsidy Policies on Green Hydrogen Industry in China. Energy Policy 2022, 165, 112981. [Google Scholar] [CrossRef]

- H2in-EN.com 14 Provinces Have Published Support Policy for Hydrogen Development. Available online: https://h2.in-en.com/html/h2-2411271.shtml (accessed on 13 October 2022).

- Fan, J.L.; Wang, Q.; Yang, L.; Zhang, H.; Zhang, X. Determinant Changes of Consumer Preference for NEVs in China: A Comparison between 2012 and 2017. Int. J. Hydrogen Energy 2020, 45, 23557–23575. [Google Scholar] [CrossRef]

- Hydrogen Council; McKinsey & Company. Hydrogen Insight 2022; McKinsey & Company: New York, NY, USA, 2022. [Google Scholar]

- China Hydrogen Alliance. China Hydrogen and Fuel Cell Industry White Paper (2020); China Hydrogen Alliance: Beijing, China, 2021. [Google Scholar]

- Song, S.; Lin, H.; Sherman, P.; Yang, X.; Nielsen, C.P.; Chen, X.; McElroy, M.B. Production of Hydrogen from Offshore Wind in China and Cost-Competitive Supply to Japan. Nat. Commun. 2021, 12, 6953. [Google Scholar] [CrossRef]

- China Leading Race to Make Technology Vital for Green Hydrogen—Bloomberg. Available online: https://www.bloomberg.com/news/articles/2022-09-21/china-leading-race-to-make-technology-vital-for-green-hydrogen?leadSource=uverify%20wall (accessed on 13 October 2022).

- IRENA. Renewable Power Generation Costs in 2021; IRENA: Abu Dhabi, United Arab Emirates, 2022. [Google Scholar]

- Peltoniemi, M. Reviewing Industry Life-Cycle Theory: Avenues for Future Research. Int. J. Manag. Rev. 2011, 13, 349–375. [Google Scholar] [CrossRef]

- Ren, X.; Dong, L.; Xu, D.; Hu, B. Challenges towards Hydrogen Economy in China. Int. J. Hydrogen Energy 2020, 45, 34326–34345. [Google Scholar] [CrossRef]

- Sánchez-Bastardo, N.; Schlögl, R.; Ruland, H. Methane Pyrolysis for Zero-Emission Hydrogen Production: A Potential Bridge Technology from Fossil Fuels to a Renewable and Sustainable Hydrogen Economy. Ind. Eng. Chem. Res. 2021, 60, 11855–11881. [Google Scholar] [CrossRef]

- Li, M.; Virguez, E.; Shan, R.; Tian, J.; Gao, S.; Patiño-Echeverri, D. High-Resolution Data Shows China’s Wind and Solar Energy Resources Are Enough to Support a 2050 Decarbonized Electricity System. Appl. Energy 2022, 306, 117996. [Google Scholar] [CrossRef]

- Helms, T. Asset Transformation and the Challenges to Servitize a Utility Business Model. Energy Policy 2016, 91, 98–112. [Google Scholar] [CrossRef]

| Interviewee | Gender | Background | Sector |

|---|---|---|---|

| A | Male | Professor of Chemistry and Material Science at a university in China | Academia |

| B | Male | Assistant professor of economics and management at a university in China | Academia |

| C | Female | Researcher focused on the lifecycle assessment (LCA) of the chemical industry | Academia |

| D | Female | Management member at a grid company | Grids |

| E | Male | Chief executive officer (CEO) of a hydrogen vehicle startup | Hydrogen-related industry |

| F | Male | Engineer at a steel company that focuses on hydrogen application in steelmaking | Hydrogen-related industry |

| G | Male | Senior consultant at an energy and environmental consulting company | Hydrogen-related industry |

| H | Female | Founder of an investment advisory company that focuses on the carbon neutrality area | Hydrogen-related industry |

| I | Male | Senior analyst at a petrochemical company | Hydrogen-related industry |

| Strength: | Weakness: |

|---|---|

| S1: Technology leadership in transmission lines S2: Technology leadership in smart grids S3: Unique and efficient R&D systems S4: Solid economic and operational foundation S5: Robust bargaining power in the capital market S6: Firm commitment to carbon neutrality S7: Tight involvement in policymaking and implementation | W1: Potential organizational inertia W2: Large readiness gap in hydrogen technology W3: Potential impact of policy factors on financial performance W4: Potential anti-trust challenges |

| Opportunities: | Threats: |

| O1: Tremendous governmental support at various levels in China O2: Growing hydrogen demands resulting from decarbonization goals in China O3: Evident cost advantage of hydrogen production in China O4: Emerging chance to seize first-mover advantage | T1: Amplified geopolitical uncertainty challenges supply chain stability T2: Emerging technologies disrupt the existing competitive landscape T3: Heavy investment is required to build hydrogen infrastructure in China |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, D.; Liu, Z.; Shan, R.; Weng, H.; Zhang, H. How a Grid Company Could Enter the Hydrogen Industry through a New Business Model: A Case Study in China. Sustainability 2023, 15, 4417. https://doi.org/10.3390/su15054417

Xu D, Liu Z, Shan R, Weng H, Zhang H. How a Grid Company Could Enter the Hydrogen Industry through a New Business Model: A Case Study in China. Sustainability. 2023; 15(5):4417. https://doi.org/10.3390/su15054417

Chicago/Turabian StyleXu, Danlu, Zhoubin Liu, Rui Shan, Haixiao Weng, and Haoyu Zhang. 2023. "How a Grid Company Could Enter the Hydrogen Industry through a New Business Model: A Case Study in China" Sustainability 15, no. 5: 4417. https://doi.org/10.3390/su15054417

APA StyleXu, D., Liu, Z., Shan, R., Weng, H., & Zhang, H. (2023). How a Grid Company Could Enter the Hydrogen Industry through a New Business Model: A Case Study in China. Sustainability, 15(5), 4417. https://doi.org/10.3390/su15054417