Financial Indicators’ Performance and Green Financing Projects: A Comparative Study from PSX and NYSX

Abstract

:1. Introduction

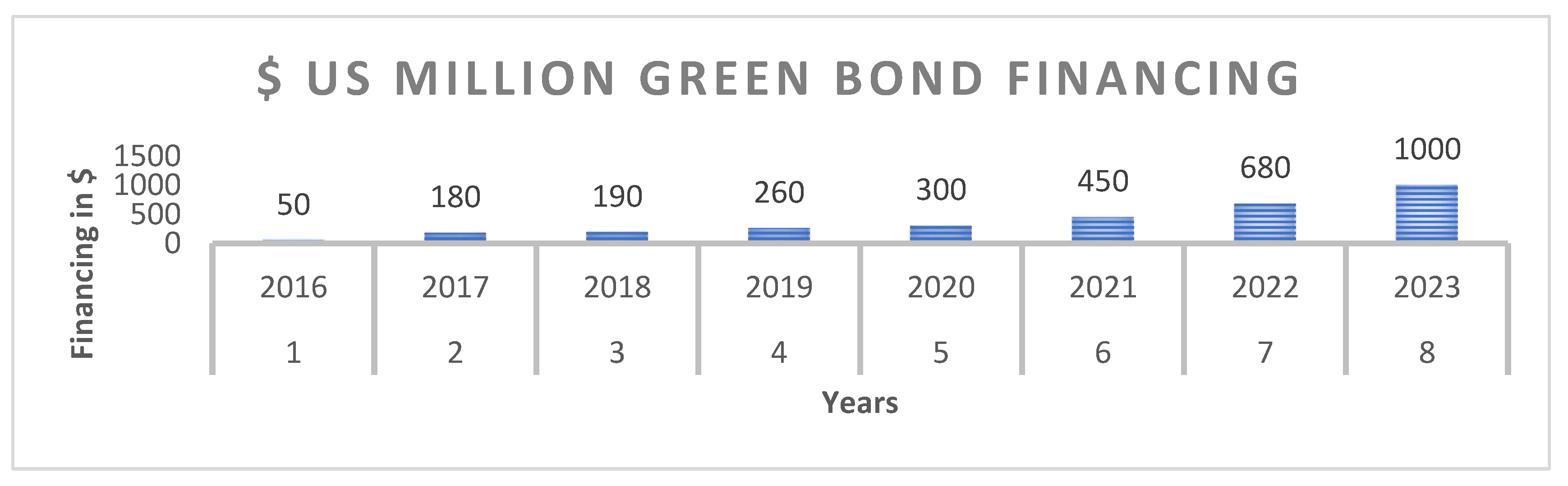

1.1. Green Financing Management in United States of America

1.2. Green Financing Structure in Pakistan

2. Literature Review

2.1. Theoretical Background of the Study

2.2. The Empirical Literature of the Study

3. Methodology of the Study

3.1. Research Design of Study

3.2. Sampling and Data Measurement

3.3. Methodology and Techniques for Estimation and Analysis

+ ∑ δ5∆REGPt−1 + ∑ δ6 ∆PPSGPt−1 + ∑ δ7 ∆FXRt−1 + ∑ δ8 ∆IFHDt−1 +

Ψ1FIPt−1 + Ψ2 GIAFPt−1 + Ψ3 GEATPt−1 + Ψ4 GCAEAt−1 + Ψ5 REGPt−1 +

Ψ6 PPSGPt−1 + Ψ7 FXRt−1 + Ψ8 IFHDt−1 + µt.

∑ α6PPSGPt + ∑ α7 FXRt + ∑ α8 IFHDt + εt.

4. Data Estimated Results, Findings, and Discussion

5. Conclusions, Policy Implications, Limitations, and Recommendations for Future Researchers

5.1. Conclusions and Policy Implications of the Study

5.2. Limitations and Future Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- BIS. Issues in the governance of central banks. In A Report from the Central Bank Governance Group; Bank for International Settlements: Basel, Switzerland, 2009. [Google Scholar]

- Haq, I.U.; Maneengam, A.; Chupradit, S.; Suksatan, W.; Huo, C. Economic Policy Uncertainty and Cryptocurrency Market as a Risk Management Avenue: A Systematic Review. Risks 2021, 9, 163. [Google Scholar] [CrossRef]

- BIS. Central Bank Governance and Financial Stability. A Report by a Study Group; Bank for International Settlements: Basel, Switzerland, 2011. [Google Scholar]

- D’Adamo, I.; Gastaldi, M.; Morone, P. The post COVID-19 green recovery in practice: Assessing the profitability of a policy proposal on residential photovoltaic plants. Energy Policy 2020, 147, 111910. [Google Scholar] [CrossRef]

- Sadiq, M.; Nonthapot, S.; Mohamad, S.; Ehsanullah, S.; Iqbal, N. Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? China Financ. Rev. Int. 2021, 12, 317–333. [Google Scholar] [CrossRef]

- Bogdan, A.; Istudor, N.; Gruia, R.; Tobă, G.F.; Bulz, N.; Gâf-Deac, I.; Paşalău, C. New holistic approach of bioeconomics and ecoeconomics theories, practical bridging from the green economy to blue economy, trough new integrated and innovative paradigm about “bio-eco-geo-economy”. Procedia Econ. Financ. 2014, 8, 83–90. [Google Scholar] [CrossRef] [Green Version]

- Ding, J. The relations study on green finance and upgrading of industrial structure in China-based on grey correlation analysis model. In Proceedings of the 2019 3rd International Conference on Education, Culture and Social Development (ICECSD 2019), Guilin, China, 28–30 June 2019. [Google Scholar]

- Mallick, D.; Rahman, A. Inclusive economic growth and climate-resilient evelopment in Bangladesh. In Bangladesh’s Economic and Socialprogress; Springer: Berlin/Heidelberg, Germany, 2020; pp. 89–114. [Google Scholar]

- Nazir, M.S.; Nawaz, M.M.; Gilani, U.J. Relationship between economic growth and stock market development. Afr. J. Bus. Manag. 2010, 4, 3473–3479. [Google Scholar]

- IPCC. Global Warming of 1.5 °C—Summary for Policymakers; IPCC: Incheon, Republic of Korea, 2018. [Google Scholar]

- NGFS. First Progress Report—October 2018; Central Banks and Supervisors Network for Greening the Financial System: Paris, France, 2018. [Google Scholar]

- Okodua, H.; Ewetan, O.O. Stock market performance and sustainable economic growth in Nigeria: A bounds testing co-integration approach. J. Sustain. Dev. 2013, 6. [Google Scholar] [CrossRef] [Green Version]

- Ponta, L.; Raberto, M.; Teglio, A.; Cincotti, S. An agent-based stock-flow consistent model of the sustainable transition in the energy sector. Ecol. Econ. 2018, 145, 274–300. [Google Scholar] [CrossRef] [Green Version]

- Sinha, A.; Mishra, S.; Sharif, A.; Yarovaya, L. Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J. Environ. Manag. 2021, 292, 112751. [Google Scholar]

- Zhou, X.; Tang, X.; Zhang, R. Impact of green finance on economic development and environmental quality: A study based on provincial panel data from China. Environ. Sci. Pollut. Res. 2020, 27, 19915–19932. [Google Scholar] [CrossRef]

- Raza, S.A.; Jawaid, S.T.; Afshan, S.; Abd Karim, M.Z. Is stock market sensitive to foreign capital inflows and economic growth? Evidence from Pakistan. J. Chin. Econ. Foreign Trade Stud. 2015, 8, 142–164. [Google Scholar] [CrossRef] [Green Version]

- Magani, A.G.; Magani Ochieng, R. Anatomy of Asset Pricing: Single-Factor, Multi-Factor, Arbitrage and Behavioural Asset Pricing Models. 2020. Available online: https://www.researchgate.net/profile/Geofrey-Magani/publication/343682628_Anatomy_of_Asset_Pricing_Single-Factor_Multi-Factor_Arbitrage_and_Behavioural_Asset_Pricing_Models/links/5f38cbff458515b729246a21/Anatomy-of-Asset-Pricing-Single-Factor-Multi-Factor-Arbitrage-and-Behavioural-Asset-Pricing-Models.pdf (accessed on 5 August 2022).

- Dzingai, I.; Fakoya, M.B. Effect of corporate governance structure on the financial performance of Johannesburg Stock Exchange (JSE)-listed mining firms. Sustainability 2017, 9, 867. [Google Scholar] [CrossRef] [Green Version]

- Alshehhi, A.; Nobanee, H.; Khare, N. The impact of sustainability practices on corporate financial performance: Literature trends and future research potential. Sustainability 2018, 10, 494. [Google Scholar] [CrossRef] [Green Version]

- Ngo, T.Q.; Doan, P.N.; Vo, L.T.; Tran HT, T.; Nguyen, D.N. The influence of green finance on economic growth: A COVID-19 pandemic effects on Vietnam Economy. Cogent Bus. Manag. 2021, 8, 2003008. [Google Scholar] [CrossRef]

- Shahbaz, M.; Khan, S.; Tahir, M.I. The dynamic links between energy consumption, economic growth, financial development and trade in China: Fresh evidence from multivariate framework analysis. Energy Econ. 2013, 40, 8–21. [Google Scholar] [CrossRef]

- Wang, X.; Hawkins, C.V.; Lebredo, N.; Berman, E.M. Capacity to sustain sustainability: A study of US cities. Public Adm. Rev. 2012, 72, 841–853. [Google Scholar] [CrossRef]

- Owen, R.; Brennan, G.; Lyon, F. Enabling investment for the transition to a low carbon economy: Government policy to finance early stage green innovation. Curr. Opin. Environ. Sustain. 2018, 31, 137–145. [Google Scholar] [CrossRef]

- Liu, Z.; Lin, M.; Wierman, A.; Low, S.H.; Andrew, L.L. Greening geographical load balancing. ACM SIGMETRICS Perform. Eval. Rev. 2011, 39, 193–204. [Google Scholar]

- Golmohammadi, D.; Mellat-Parast, M. Developing a grey-based decision-making model for supplier selection. Int. J. Prod. Econ. 2012, 137, 191–200. [Google Scholar] [CrossRef]

- Wang, W. Research on the correlation between green finance and solid waste disposal based on grey correlation. In E3S Web of Conferences (Vol. 300); EDP Sciences: Les Ulis, France, 2021. [Google Scholar]

- Cato, M.S. Green Economics: An Introduction to Theory, Policy and Practice; Routledge: Abingdon-on-Thames, UK, 2012. [Google Scholar]

- Hickel, J.; Kallis, G. Is green growth possible? New Political Econ. 2020, 25, 469–486. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Zhang, X.; Jin, Y.; Shen, C. Manufacturers’ green investment in a competitive market with a common retailer. J. Clean. Prod. 2020, 276, 123164. [Google Scholar] [CrossRef]

- Olweny, T.O.; Kimani, D. Stock market performance and economic growth Empirical Evidence from Kenya using Causality Test Approach. Adv. Manag. Appl. Econ. 2011, 1, 177. [Google Scholar]

- Muhammad, N.; Rasheed, A.; Husain, F. Stock prices and exchange rates: Are they related? evidence from south asian countries [with comments]. Pak. Dev. Rev. 2002, 535–550. [Google Scholar] [CrossRef]

- Dikau, S.; Volz, U. Central bank mandates, sustainability objectives and the promotion of green finance. Ecol. Econ. 2021, 184, 107022. [Google Scholar] [CrossRef]

- Aduda, J.; Odera, E.; Onwonga, M. The Behaviours and Financial Performance of Individual Investors in the Trading Shares of Companies Listed at The Nairobi Stock Exchange, Kenya. J. Financ. Invest. Anal. 2012, 1, 33–60. [Google Scholar]

- Ahmed, W.; Najmi, A. Developing and analyzing framework for understanding the effects of GSCM on green and economic performance: Perspective of a developing country. Manag. Environ. Qual. Int. J. 2018, 29, 740–758. [Google Scholar] [CrossRef]

- McDaniels, J. Greening the Rules of the Game: How Sustainability Factors Are Being Incorporated into Financial Policy and Regulation-Inquiry Working Paper 18/01 May 2018. Available online: https://wedocs.unep.org/handle/20.500.11822/25525;jsessionid=2DC5D041960AA6BFD09382E16D5E5FB8 (accessed on 5 August 2022).

- Sewell, M. History of the efficient market hypothesis. Rn 2011, 11, 4. [Google Scholar]

- Malkiel, B.G. Returns from investing in equity mutual funds 1971 to 1991. J. Financ. 1995, 50, 549–572. [Google Scholar] [CrossRef]

- Cooper, M.; Norcross, J.C. A brief, multidimensional measure of clients’ therapy preferences: The Cooper-Norcross Inventory of Preferences (C-NIP). Int. J. Clin. Health Psychol. 2016, 16, 87–98. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Salkind, N.J. (Ed.) Encyclopedia of Research Design; Sage: Newcastle upon Tyne, UK, 2010; Volume 1. [Google Scholar]

- Anigbogu, U.E.; Nduka, E.K. Stock market performance and economic growth: Evidence from Nigeria employing vector error correction model framework. Econ. Financ. Lett. 2014, 1, 90–103. [Google Scholar] [CrossRef]

- Gough, I. Climate Capitalism: Emissions, Inequality, Green Growth: Climate Change, Capitalism and Sustainable Wellbeing; Edward Elgar Publishing: Cheltenham, UK, 2017. [Google Scholar]

- GhaffarianHoseini, A.; Dahlan, N.D.; Berardi, U.; GhaffarianHoseini, A.; Makaremi, N.; GhaffarianHoseini, M. Sustainable energy performances of green buildings: A review of current theories, implementations and challenges. Renew. Sustain. Energy Rev. 2013, 25, 1–17. [Google Scholar] [CrossRef]

- Hongming, X.; Ahmed, B.; Hussain, A.; Rehman, A.; Ullah, I.; Khan, F.U. Sustainability Reporting and Firm Performance: The Demonstration of Pakistani Firms. SAGE Open 2020, 10, 2158244020953180. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Raberto, M.; Ozel, B.; Ponta, L.; Teglio, A.; Cincotti, S. From financial instability to green finance: The role of banking and credit market regulation in the Eurace model. J. Evol. Econ. 2019, 29, 429–465. [Google Scholar] [CrossRef] [Green Version]

- Ullah, H.; Wang, Z.; Mohsin, M.; Jiang, W.; Abbas, H. Multidimensional perspective of green financial innovation between green intellectual capital on sustainable business: The case of Pakistan. Environ. Sci. Pollut. Res. 2021, 29, 5552–5568. [Google Scholar] [CrossRef]

| Factors Names | Acronym | Measurement | Sources |

|---|---|---|---|

| Green Investment and Financial Projects | GIAFP | Proportion of Green loans/GDP | FRS, SBP, WBI, IFS |

| Green Economic and Trading Projects | GEATP | Proportion of trade in green tools/GDP | FRS, SBP, ADBI, WBI, IFS |

| Green Climatic and Environmental Activities | GCAEA | Proportion of funds for environment and climate projects/GDP | FRS, SBP, WBI, IFS |

| Renewable Energy Green Projects | REGP | Proportion of renewable energy investment/GDP | FRS, SBP, ADBI, WBI |

| Public Policies and Social Green Projects | PPSGP | Proportion of funds for social and Public projects/GDP | FRS, SBP, ADBI, WBI |

| Foreign Exchange Rate | FXR | Rs. value/USD value | FRS, SBP, IFS, www.yahoo.fiance.com (accessed on 5 August 2022) |

| Index For Human Development | IFHD | Total Labor/GDP | FRS, SBP, Annual UNDP Reports |

| Financial Indictors Performance (PSX, NYSX) | FIP (PSX, NYSX) | FRS, PSX, Business Recorder, Financial Times |

| Descriptives For FIP of PSX and Green Finance Projects | Descriptives For FIP of NYSX and Green Finance Projects | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variables | Obs. | S.D. | M.V. | Min.V | Max.V | Variables | Obs. | S.D. | M.V. | Min.V | Max.V |

| GIAFP | 20 | 2.76 | 0.81 | 0.78 | 0.84 | GIAFP | 20 | 2.20 | 2.75 | 2.25 | 3.54 |

| GEATP | 20 | 4.97 | 0.65 | 0.48 | 0.74 | GEATP | 20 | 3.85 | 3.12 | 2.76 | 3.40 |

| GCAEA | 20 | −5.56 | 3.76 | 2.48 | 5.87 | GCAEA | 20 | −4.87 | 5.34 | 3.48 | 7.87 |

| REGP | 20 | 0.78 | 76.46 | 40.25 | 110.54 | REGP | 20 | 1.78 | 87.25 | 60.48 | 120.94 |

| PPSGP | 20 | 9.64 | 28.92 | 22.87 | 31.96 | PPSGP | 20 | 7.59 | 100.4 | 50.87 | 150.46 |

| FXR | 20 | 10.52 | 12.86 | 4.87 | 22.67 | FXR | 20 | 4.43 | 46.86 | 24.87 | 70.96 |

| IFHD | 20 | 2.78 | 2.78 | 1.25 | 3.87 | IFHD | 20 | 1.25 | 75.27 | 45.90. | 100.87 |

| FIP | 20 | 112.9 | 458.5 | 298.87 | 770.43 | FIP | 20 | 45.98 | 3205. | 2548.8 | 3500.7 |

| Pearson’s Correlations For FIP of PSX, Green Finance Projects and Controlling Factors | Pearson’s Correlations For FIP of NYSX, Green Finance Projects and Controlling Factors | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GIAFP | GEATP | GCAEA | REGP | PPSGP | FXR | IFHD | FIP | GIAFP | GEATP | GCAEA | REGP | PPSGP | FXR | IFHD | FIP | |

| GIAFP | 1 | 1 | ||||||||||||||

| GEATP | 0.35 | 1 | 0.65 | 1 | ||||||||||||

| GCAEA | 0.42 | 0.76 | 1 | 0.57 | 0.87 | 1 | ||||||||||

| REGP | 0.48 | −0.54 | −0.37 | 1 | 0.76 | −0.74 | 0.56 | 1 | ||||||||

| PPSGP | 0.28 | 0.43 | 0.29 | −0.48 | 1 | 0.56 | 0.49 | 0.45 | −0.72 | 1 | ||||||

| FXR | 0.50 | 0.26 | 0.32 | 0.48 | 0.27 | 1 | 0.62 | 0.43 | 0.52 | −0.59 | 0.47 | 1 | ||||

| IFHD | 0.46 | 0.39 | 0.24 | 0.43 | −0.34 | 0.37 | 1 | 0.38 | 0.60 | 0.44 | −0.68 | 0.53 | 0.56 | 1 | ||

| FIP | 0.58 | −0.47 | 0.26 | 0.51 | 0.53 | 0.28 | 0.22 | 1 | 0.74 | −0.35 | 0.54 | 0.71 | 0.67 | −0.47 | 0.52 | 1 |

| ADF-Results For PSX, CFs, and Green Projects | ADF-Results For NYSX, CFs, and Green Projects | ||||||

|---|---|---|---|---|---|---|---|

| Target Variables | ADF-Test (p-Value) | Critical Value | Decision Order of Integration | Target Variables | ADF-Test (p-Value) | Critical Value | Decision Order of Integration |

| GIAFP | −3.274 | −3.457 | I(0) | ∆GIAFP | −3.981 | −3.457 | I(1) |

| ∆GEATP | −4.573 | −3.457 | I(1) | GEATP | −2.654 | −3.457 | I(0) |

| ∆GCAEA | −7.542 | −3.457 | I(1) | GCAEA | −1.876 | −3.457 | I(0) |

| REGP | 1.847 | −3.457 | I(0) | ∆REGP | 4.653 | −3.457 | I(1) |

| PPSGP | 2.764 | −3.457 | I(0) | PPSGP | 2.907 | −3.457 | I(0) |

| ∆FXR | −5.896 | −3.457 | I(1) | ∆FXR | −6.785 | −3.457 | I(1) |

| ∆IFHD | −6.985 | −3.457 | I(1) | ∆IFHD | −5.634 | −3.457 | I(1) |

| ∆FIP | −8.782 | −3.457 | I(1) | FIP | −3.112 | −3.457 | I(0) |

| Models | F-Value PSX. | Lag Factors for PSX | F-Value for NYSX | Lag Factors For NYSX | Significance Level | Critical Values of Bound Test For PSX-Performance | Critical Values of Bound Test For NYSX | ||

|---|---|---|---|---|---|---|---|---|---|

| FIP/All Predictors | I(0) | I(1) | I(0) | I(1) | |||||

| 35.85 | 5 | 76.25 | 4 | 0.01 | 3.297 | 4.376 | 3.184 | 4.750 | |

| 0.05 | 2.575 | 3.457 | 2.780 | 3.457 | |||||

| 0.10 | 2.201 | 3.094 | 2.438 | 3.347 | |||||

| Robust Analysis For PAK. FIP and All Predictors | Robust Analysis For USA. FIP and All Predictors | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Factors | Beta | S.E. | t-Value | p-Value | Hypotheses | Objectives | Beta | S.E. | t-Value | p-Value | Hypotheses | Objectives |

| GIAFP | −428.654 | 254.980 | 1.681 | 0.197 | H1 is not met | Obj.1 is not met | 692.386 | 244.649 | 2.853 | 0.028 | H1 is met | Obj.1 is met |

| ∆GEATP | 2456.265 | 965.548 | 2.544 | 0.032 * | H2 is met | Obj.2 is also met | −3578.265 | 2293.467 | 1.562 | 0.112 * | H2 is not met | Obj.2 is not met |

| ∆GCAEA | −875.487 | 402.285 | −2.17 | 0.047 * | H3 is met | Obj.3 is also met | −2875.487 | 891.754 | −3.234 | 0.003 * | H3 is met | Obj.3 is also met |

| REGP | 1265.547 | 265. | 4.766 | 0.002 * | H4 is met | Obj.4 is also met | 2784.573 | 2501.347 | 1.113 | 0.234 * | H4 is not met | Obj.4 is not met |

| PPSGP | 457.448 | 384.229 | 1.182 | 0.198 | H5 is not met | Obj.5 is not met | 1485.479 | 415.145 | 3.578 | 0.002 | H5 is met | Obj.5 is met |

| ∆FXR | −715.45 | 355.76 | −2.011 | 0.046 * | H6 is met | Obj.6 is met | 1876.952 | 629.453 | 2.984 | 0.023 * | H6 is met | Obj.6 is met |

| ∆IFHD | 87.293 | 25.498 | 3.423 | 0.004 * | H6 is met | Obj.6 is also met | 486.908 | 383.852 | 1.268 | 0.275 * | H6 is not met | Obj.6 is not met |

| FOR. PAK | FOR. USA | ||||||

|---|---|---|---|---|---|---|---|

| Tests | Coefficients | Tests | Coefficients | Tests | Coefficients | Tests | Coefficients |

| R2 | 0.7854 | Adjusted R2 | 0.7465 | R2 | 0.83 | Adjusted R2 | 0.7930 |

| S.D. of Predicted FIP | 1145.3487 | S.E. of ARDL Regression | 570.9854 | S.D. of Predicted FIP | 895.658 | S.E. of ARDL Regression | 485.2364 |

| F (7, 20) | 14.48 | p-value (F) | 0.0008564 | F (7, 20) | 28.96 | p-value (F) | 0.000065 |

| Mean Dependent Variance | 2450.8769 | Sum Squared Residual | 32,856,498 | Mean Dependent Variance | 1750.5692 | Sum Squared Residual | 5,489,4726 |

| Log-Likelihood | −195.8548 | Akaike Criterion | 428.593 | Log-Likelihood | −148.8520 | Akaike Criterion | 648.728 |

| Schwarz Criterion | 435.674 | Durbin-Watson value | 1.9468 | Schwarz Criterion | 572.740 | Durbin-Watson value | 2.3571 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, J.; Mehdi, M.N.J.; Hafeez, M.; Kaium, M.A.; Salahodjaev, R. Financial Indicators’ Performance and Green Financing Projects: A Comparative Study from PSX and NYSX. Sustainability 2023, 15, 5132. https://doi.org/10.3390/su15065132

Yang J, Mehdi MNJ, Hafeez M, Kaium MA, Salahodjaev R. Financial Indicators’ Performance and Green Financing Projects: A Comparative Study from PSX and NYSX. Sustainability. 2023; 15(6):5132. https://doi.org/10.3390/su15065132

Chicago/Turabian StyleYang, Juan, Mirza Nasir Jahan Mehdi, Muhammad Hafeez, Md. Abdul Kaium, and Raufhon Salahodjaev. 2023. "Financial Indicators’ Performance and Green Financing Projects: A Comparative Study from PSX and NYSX" Sustainability 15, no. 6: 5132. https://doi.org/10.3390/su15065132