Analysts’ Green Coverage and Corporate Green Innovation in China: The Moderating Effect of Corporate Environmental Information Disclosure

Abstract

1. Introduction

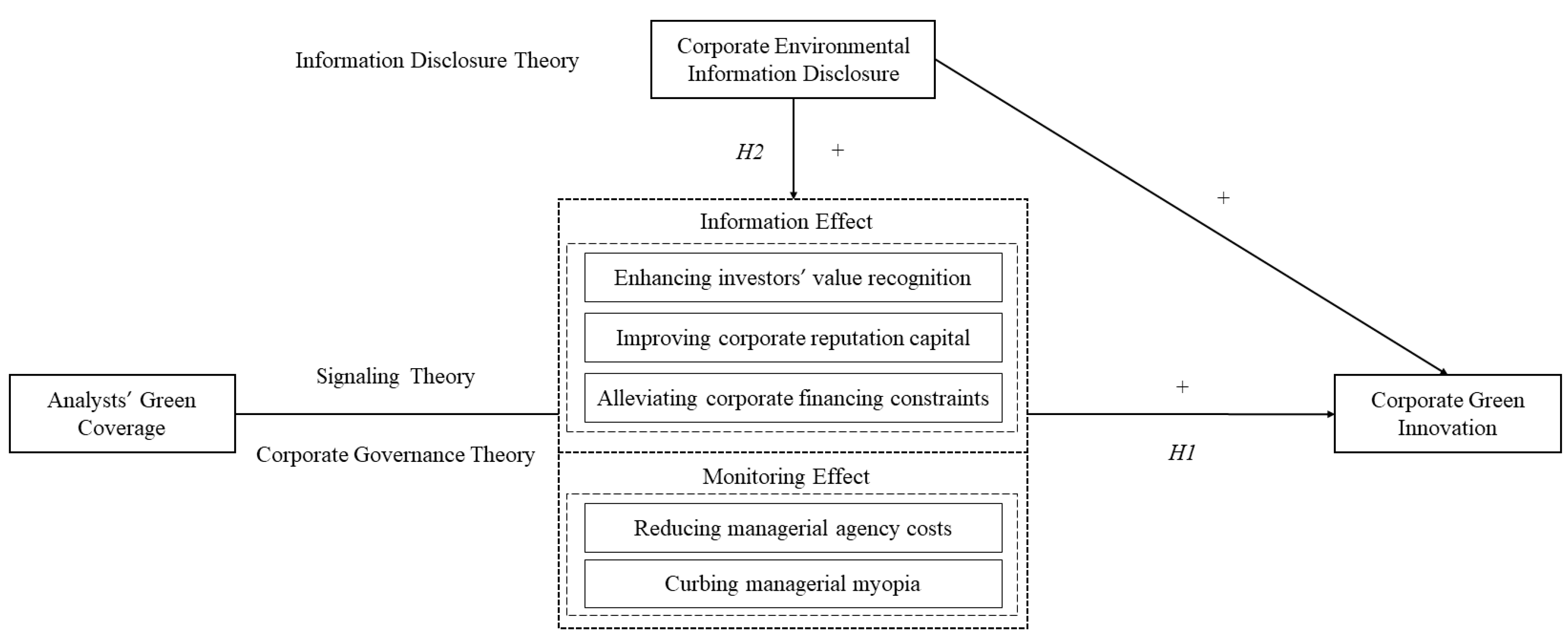

2. Theoretical Analysis and Hypothesis Development

2.1. Analysts’ Green Coverage and Corporate Green Innovation

2.1.1. The Information Effect of Analysts’ Green Coverage

2.1.2. The Monitoring Effect of Analysts’ Green Coverage

2.2. The Moderating Effect of Corporate Environmental Information Disclosure

3. Research Design

3.1. Data Sources and Sample Selection

3.2. Empirical Model and Variable Measurement

3.2.1. Dependent Variable: CGI (Corporate Green Innovation)

3.2.2. Independent Variables: AGC (Analysts’ Green Coverage)

3.2.3. Moderating Variables: CEID (Corporate Environmental Information Disclosure)

3.2.4. Control Variables

4. Empirical Results

4.1. Descriptive Statistics

4.2. Baseline Regression Results

4.3. Robustness Tests

4.3.1. Substituting the Core Variables

4.3.2. Utilizing the Poisson Regression Approach

4.3.3. Conducting the Panel Fixed Effect Regression Approach

5. Mechanism Analysis

5.1. The Information Effect of Analysts’ Green Coverage

5.1.1. Enhancing Investor Value Recognition

5.1.2. Improving Corporate Reputation Capital

5.1.3. Alleviating Corporate Financing Constraints

5.2. The Monitoring Effect of Analysts’ Green Coverage

5.2.1. Reducing Managerial Agency Costs

5.2.2. Curbing Managerial Myopia

6. Heterogeneity Analysis

6.1. Regional Institutional Environment

6.2. Heavily Polluting Industries

6.3. Continuous Innovation Strategy

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Amore, M.D.; Bennedsen, M. Corporate Governance and Green Innovation. J. Environ. Econ. Manag. 2016, 75, 54–72. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, C.; Su, D.; Wu, S. Comparison of Leading-industrialisation and Crossing-industrialisation Economic Growth Patterns in the Context of Sustainable Development: Lessons from China and India. Sustain. Dev. 2020, 28, 1077–1085. [Google Scholar] [CrossRef]

- Qi, G.; Zeng, S.; Tam, C.; Yin, H.; Zou, H. Stakeholders’ Influences on Corporate Green Innovation Strategy: A Case Study of Manufacturing Firms in China. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 1–14. [Google Scholar] [CrossRef]

- Li, G.; Wang, X.; Su, S.; Su, Y. How Green Technological Innovation Ability Influences Enterprise Competitiveness. Technol. Soc. 2019, 59, 101136. [Google Scholar] [CrossRef]

- Hu, G.; Wang, X.; Wang, Y. Can the Green Credit Policy Stimulate Green Innovation in Heavily Polluting Enterprises? Evidence from a Quasi-Natural Experiment in China. Energy Econ. 2021, 98, 105134. [Google Scholar] [CrossRef]

- Liao, Z.; Lu, J.; Yu, Y.; Zhang, Z. Can Attention Allocation Affect Firm’s Environmental Innovation: The Moderating Role of Past Performance. Technol. Anal. Strateg. Manag. 2022, 34, 1081–1094. [Google Scholar] [CrossRef]

- Li, Z.; Liao, G.; Wang, Z.; Huang, Z. Green Loan and Subsidy for Promoting Clean Production Innovation. J. Clean. Prod. 2018, 187, 421–431. [Google Scholar] [CrossRef]

- He, L.; Zhang, L.; Zhong, Z.; Wang, D.; Wang, F. Green Credit, Renewable Energy Investment and Green Economy Development: Empirical Analysis Based on 150 Listed Companies of China. J. Clean. Prod. 2019, 208, 363–372. [Google Scholar] [CrossRef]

- Liu, R.; Wang, D.; Zhang, L.; Zhang, L. Can Green Financial Development Promote Regional Ecological Efficiency? A Case Study of China. Nat. Hazards 2019, 95, 325–341. [Google Scholar] [CrossRef]

- He, J.J.; Tian, X. The Dark Side of Analyst Coverage: The Case of Innovation. J. Financ. Econ. 2013, 109, 856–878. [Google Scholar] [CrossRef]

- Guo, B.; Pérez-Castrillo, D.; Toldrà-Simats, A. Firms’ Innovation Strategy under the Shadow of Analyst Coverage. J. Financ. Econ. 2019, 131, 456–483. [Google Scholar] [CrossRef]

- Chen, Q.; Ma, L.; Yi, Z. Analyst Coverage and Corporate’s Innovation Performance: The Logic of China. Nankai Bus. Rev. 2017, 20, 15–27. (In Chinese) [Google Scholar]

- Fiorillo, P.; Meles, A.; Mustilli, M.; Salerno, D. How Does the Financial Market Influence Firms’ Green Innovation? The Role of Equity Analysts. J. Int. Financ. Manag. Account. 2022, 33, 428–458. [Google Scholar] [CrossRef]

- Han, M.; Lin, H.; Sun, D.; Wang, J.; Yuan, J. The Eco-Friendly Side of Analyst Coverage: The Case of Green Innovation. IEEE Trans. Eng. Manag. 2022. [Google Scholar] [CrossRef]

- Crawford, S.S.; Roulstone, D.T.; So, E.C. Analyst Initiations of Coverage and Stock Return Synchronicity. Account. Rev. 2012, 87, 1527–1553. [Google Scholar] [CrossRef]

- Xu, N.; Chan, K.C.; Jiang, X.; Yi, Z. Do Star Analysts Know More Firm-Specific Information? Evidence from China. J. Bank. Financ. 2013, 37, 89–102. [Google Scholar] [CrossRef]

- Huang, A.H.; Zang, A.Y.; Zheng, R. Evidence on the Information Content of Text in Analyst Reports. Account. Rev. 2014, 89, 2151–2180. [Google Scholar] [CrossRef]

- Huang, A.H.; Lehavy, R.; Zang, A.Y.; Zheng, R. Analyst Information Discovery and Interpretation Roles: A Topic Modeling Approach. Manag. Sci. 2018, 64, 2833–2855. [Google Scholar] [CrossRef]

- Yin, J.; Wang, S. The Effects of Corporate Environmental Disclosure on Environmental Innovation from Stakeholder Perspectives. Appl. Econ. 2018, 50, 905–919. [Google Scholar] [CrossRef]

- Hu, D.; Huang, Y.; Zhong, C. Does Environmental Information Disclosure Affect the Sustainable Development of Enterprises: The Role of Green Innovation. Sustainability 2021, 13, 11064. [Google Scholar] [CrossRef]

- Li, G.; Xue, Q.; Qin, J. Environmental Information Disclosure and Green Technology Innovation: Empirical Evidence from China. Technol. Forecast. Soc. Chang. 2022, 176, 121453. [Google Scholar] [CrossRef]

- Fan, L.; Yao, S. Analyst Site Visits and Corporate Environmental Information Disclosure: Evidence from China. Int. J. Environ. Res. Public. Health 2022, 19, 16223. [Google Scholar] [CrossRef] [PubMed]

- Kanda, W.; Hjelm, O.; Clausen, J.; Bienkowska, D. Roles of Intermediaries in Supporting Eco-Innovation. J. Clean. Prod. 2018, 205, 1006–1016. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A. Corporate Reputation and Philanthropy: An Empirical Analysis. J. Bus. Ethics 2005, 61, 29–44. [Google Scholar] [CrossRef]

- Kelly, B.; Ljungqvist, A. Testing Asymmetric-Information Asset Pricing Models. Rev. Financ. Stud. 2012, 25, 1366–1413. [Google Scholar] [CrossRef]

- Chen, T.; Harford, J.; Lin, C. Do Analysts Matter for Governance? Evidence from Natural Experiments. J. Financ. Econ. 2015, 115, 383–410. [Google Scholar] [CrossRef]

- Billett, M.T.; Garfinkel, J.A.; Yu, M. The Effect of Asymmetric Information on Product Market Outcomes. J. Financ. Econ. 2017, 123, 357–376. [Google Scholar] [CrossRef]

- Bernardi, C.; Stark, A.W. Environmental, Social and Governance Disclosure, Integrated Reporting, and the Accuracy of Analyst Forecasts. Br. Account. Rev. 2018, 50, 16–31. [Google Scholar] [CrossRef]

- Yao, S.; Liang, H. Analyst Following, Environmental Disclosure and Cost of Equity: Research Based on Industry Classification. Sustainability 2019, 11, 300. [Google Scholar] [CrossRef]

- Sánchez-Torné, I.; Morán-Álvarez, J.C.; Pérez-López, J.A. The Importance of Corporate Social Responsibility in Achieving High Corporate Reputation. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2692–2700. [Google Scholar] [CrossRef]

- Tan, X.; Peng, M.; Yin, J.; Xiu, Z. Does Local Governments’ Environmental Information Disclosure Promote Corporate Green Innovations? Emerg. Mark. Financ. Trade 2022, 58, 3164–3176. [Google Scholar] [CrossRef]

- Yang, Y.; Yang, F.; Zhao, X. The Impact of the Quality of Environmental Information Disclosure on Financial Performance: The Moderating Effect of Internal and External Stakeholders. Environ. Sci. Pollut. Res. 2022, 29, 68796–68814. [Google Scholar] [CrossRef] [PubMed]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for Green Finance: Resolving Financing Constraints on Green Innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Zhao, T.; Zhou, H.; Jiang, J.; Yan, W. Impact of Green Finance and Environmental Regulations on the Green Innovation Efficiency in China. Sustainability 2022, 14, 3206. [Google Scholar] [CrossRef]

- Yu, F.F. Analyst Coverage and Earnings Management. J. Financ. Econ. 2008, 88, 245–271. [Google Scholar] [CrossRef]

- Holmstrom, B. Agency Costs and Innovation. J. Econ. Behav. Organ. 1989, 12, 305–327. [Google Scholar] [CrossRef]

- Xiao, G. Legal Shareholder Protection and Corporate R&D Investment. J. Corp. Financ. 2013, 23, 240–266. [Google Scholar] [CrossRef]

- Lu, J.; Wang, W. Managerial Conservatism, Board Independence and Corporate Innovation. J. Corp. Financ. 2018, 48, 1–16. [Google Scholar] [CrossRef]

- Staw, B.M.; Sandelands, L.E.; Dutton, J.E. Threat Rigidity Effects in Organizational Behavior: A Multilevel Analysis. Adm. Sci. Q. 1981, 26, 501–524. [Google Scholar] [CrossRef]

- Bushee, B.J.; Jung, M.J.; Miller, G.S. Conference Presentations and the Disclosure Milieu. J. Account. Res. 2011, 49, 1163–1192. [Google Scholar] [CrossRef]

- Mayew, W.J.; Sharp, N.Y.; Venkatachalam, M. Using Earnings Conference Calls to Identify Analysts with Superior Private Information. Rev. Account. Stud. 2013, 18, 386–413. [Google Scholar] [CrossRef]

- Green, T.C.; Jame, R.; Markov, S.; Subasi, M. Access to Management and the Informativeness of Analyst Research. J. Financ. Econ. 2014, 114, 239–255. [Google Scholar] [CrossRef]

- Solomon, D.; Soltes, E. What Are We Meeting for? The Consequences of Private Meetings with Investors. J. Law Econ. 2015, 58, 325–355. [Google Scholar] [CrossRef]

- Han, B.; Kong, D.; Liu, S. Do Analysts Gain an Informational Advantage by Visiting Listed Companies? Contemp. Account. Res. 2018, 35, 1843–1867. [Google Scholar] [CrossRef]

- Ding, J.; Lu, Z.; Yu, C.-H. Environmental Information Disclosure and Firms’ Green Innovation: Evidence from China. Int. Rev. Econ. Financ. 2022, 81, 147–159. [Google Scholar] [CrossRef]

- He, Z.; Cao, C.; Feng, C. Media Attention, Environmental Information Disclosure and Corporate Green Technology Innovations in China’s Heavily Polluting Industries. Emerg. Mark. Financ. Trade 2022, 58, 3939–3952. [Google Scholar] [CrossRef]

- Du, L.; Wang, X.; Peng, J.; Jiang, G.; Deng, S. The Impact of Environmental Information Disclosure Quality on Green Innovation of High-Polluting Enterprises. Front. Psychol. 2022, 13, 1069354. [Google Scholar] [CrossRef]

- Hummel, K.; Schlick, C. The Relationship between Sustainability Performance and Sustainability Disclosure: Reconciling Voluntary Disclosure Theory and Legitimacy Theory. J. Account. Public Policy 2016, 35, 455–476. [Google Scholar] [CrossRef]

- Evans, M.F.; Gilpatric, S.M.; Liu, L. Regulation with Direct Benefits of Information Disclosure and Imperfect Monitoring. J. Environ. Econ. Manag. 2009, 57, 284–292. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xu, X.D.; Yin, H.T.; Tam, C.M. Factors That Drive Chinese Listed Companies in Voluntary Disclosure of Environmental Information. J. Bus. Ethics 2012, 109, 309–321. [Google Scholar] [CrossRef]

- Gomez-Trujillo, A.M.; Velez-Ocampo, J.; Gonzalez-Perez, M.A. A Literature Review on the Causality between Sustainability and Corporate Reputation: What Goes First? Manag. Environ. Qual. Int. J. 2020, 31, 406–430. [Google Scholar] [CrossRef]

- Fabrizi, A.; Guarini, G.; Meliciani, V. Green Patents, Regulatory Policies and Research Network Policies. Res. Policy 2018, 47, 1018–1031. [Google Scholar] [CrossRef]

- Hong, J.; Feng, B.; Wu, Y.; Wang, L. Do Government Grants Promote Innovation Efficiency in China’s High-Tech Industries? Technovation 2016, 57, 4–13. [Google Scholar] [CrossRef]

- Bradley, D.; Kim, I.; Tian, X. Do Unions Affect Innovation? Manag. Sci. 2017, 63, 2251–2271. [Google Scholar] [CrossRef]

- Franco, G.D.; Hope, O.-K.; Vyas, D.; Zhou, Y. Analyst Report Readability. Contemp. Account. Res. 2015, 32, 76–104. [Google Scholar] [CrossRef]

- Bellstam, G.; Bhagat, S.; Cookson, J.A. A Text-Based Analysis of Corporate Innovation. Manag. Sci. 2021, 67, 4004–4031. [Google Scholar] [CrossRef]

- Katmon, N.; Mohamad, Z.Z.; Norwani, N.M.; Farooque, O.A. Comprehensive Board Diversity and Quality of Corporate Social Responsibility Disclosure: Evidence from an Emerging Market. J. Bus. Ethics 2019, 157, 447–481. [Google Scholar] [CrossRef]

- Lin, H.; Zeng, S.X.; Ma, H.Y.; Qi, G.Y.; Tam, V.W.Y. Can Political Capital Drive Corporate Green Innovation? Lessons from China. J. Clean. Prod. 2014, 64, 63–72. [Google Scholar] [CrossRef]

- Tsagkanos, A.; Sharma, A.; Ghosh, B. Green Bonds and Commodities: A New Asymmetric Sustainable Relationship. Sustainability 2022, 14, 6852. [Google Scholar] [CrossRef]

- Chan, L.K.; Lakonishok, J.; Sougiannis, T. The Stock Market Valuation of Research and Development Expenditures. J. Financ. 2001, 56, 2431–2456. [Google Scholar] [CrossRef]

- Lehavy, R.; Sloan, R.G. Investor Recognition and Stock Returns. Rev. Account. Stud. 2008, 13, 327–361. [Google Scholar] [CrossRef]

- Li, K.K.; You, H. What Is the Value of Sell-Side Analysts? Evidence from Coverage Initiations and Terminations. J. Account. Econ. 2015, 60, 141–160. [Google Scholar] [CrossRef]

- Alhomaidi, A.; Hassan, M.K.; Hippler, W.J.; Mamun, A. The Impact of Religious Certification on Market Segmentation and Investor Recognition. J. Corp. Financ. 2019, 55, 28–48. [Google Scholar] [CrossRef]

- Guan, K.; Zhang, R. Corporate Reputation and Earnings Management: Efficient Contract Theory or Rent-Seeking Theory. Account. Res. 2019, 40, 59–64. (In Chinese) [Google Scholar]

- Gabbioneta, C.; Ravasi, D.; Mazzola, P. Exploring the Drivers of Corporate Reputation: A Study of Italian Securities Analysts. Corp. Reput. Rev. 2007, 10, 99–123. [Google Scholar] [CrossRef]

- Malik, T.H.; Huo, C. Security Analyst Firm Reputation and Investors’ Response to Forecasted Stocks in the Biotechnology Sector. Technol. Anal. Strateg. Manag. 2020, 32, 574–588. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial Constraints Risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Livdan, D.; Sapriza, H.; Zhang, L. Financially Constrained Stock Returns. J. Financ. 2009, 64, 1827–1862. [Google Scholar] [CrossRef]

- Fracassi, C.; Petry, S.; Tate, G. Does Rating Analyst Subjectivity Affect Corporate Debt Pricing? J. Financ. Econ. 2016, 120, 514–538. [Google Scholar] [CrossRef]

- Wang, Z.; LV, Z. Green Finance, Analysts Focus and Financing Constraints Relief of New Energy Enterprises. Contemp. Financ. Econ. 2022, 43, 52–63. (In Chinese) [Google Scholar]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Fama, E.F. Agency Problems and the Theory of the Firm. J. Polit. Econ. 1980, 88, 288–307. [Google Scholar] [CrossRef]

- Luo, W.; Zhang, Y.; Zhu, N. Bank Ownership and Executive Perquisites: New Evidence from an Emerging Market. J. Corp. Financ. 2011, 17, 352–370. [Google Scholar] [CrossRef]

- Conyon, M.J. Executive Compensation and Board Governance in US Firms. Econ. J. 2014, 124, 60–89. [Google Scholar] [CrossRef]

- Moyer, R.C.; Chatfield, R.E.; Sisneros, P.M. Security Analyst Monitoring Activity: Agency Costs and Information Demands. J. Financ. Quant. Anal. 1989, 24, 503–512. [Google Scholar] [CrossRef]

- Doukas, J.A.; Kim, C.; Pantzalis, C. Security Analysis, Agency Costs, and Company Characteristics. Financ. Anal. J. 2000, 56, 54–63. [Google Scholar] [CrossRef]

- Hu, N.; Xue, F.; Wang, H. Does Managerial Myopia Affect Long-Term Investment? Based on Text Analysis and Machine Learning. Manage. World 2021, 37, 139–156. (In Chinese) [Google Scholar] [CrossRef]

- Cao, Q.; Ju, M.; Li, J.; Zhong, C. Managerial Myopia and Long-Term Investment: Evidence from China. Sustainability 2023, 15, 708. [Google Scholar] [CrossRef]

- Sheng, X.; Guo, S.; Chang, X. Managerial Myopia and Firm Productivity: Evidence from China. Financ. Res. Lett. 2022, 49, 103083. [Google Scholar] [CrossRef]

- Jiang, Y.; Hong, Y. State Media, Institutional Environment, and Analyst Forecast Quality: Evidence from China. Emerg. Mark. Financ. Trade 2021, 57, 3929–3943. [Google Scholar] [CrossRef]

- Sun, H.; Edziah, B.K.; Sun, C.; Kporsu, A.K. Institutional Quality, Green Innovation and Energy Efficiency. Energy Policy 2019, 135, 111002. [Google Scholar] [CrossRef]

- Chen, L.; Zhou, R.; Chang, Y.; Zhou, Y. Does Green Industrial Policy Promote the Sustainable Growth of Polluting Firms? Evidences from China. Sci. Total Environ. 2021, 764, 142927. [Google Scholar] [CrossRef] [PubMed]

- Song, W.; Yu, H. Green Innovation Strategy and Green Innovation: The Roles of Green Creativity and Green Organizational Identity. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 135–150. [Google Scholar] [CrossRef]

- Soewarno, N.; Tjahjadi, B.; Fithrianti, F. Green Innovation Strategy and Green Innovation: The Roles of Green Organizational Identity and Environmental Organizational Legitimacy. Manag. Decis. 2019, 57, 3061–3078. [Google Scholar] [CrossRef]

- Ozaki, R. Adopting Sustainable Innovation: What Makes Consumers Sign up to Green Electricity? Bus. Strategy Environ. 2011, 20, 1–17. [Google Scholar] [CrossRef]

- Fan, G.; Wang, X.; Ma, G. Contribution of Marketization to China’s Economic Growth. Econ. Res. J. 2011, 46, 4–16. (In Chinese) [Google Scholar]

- Triguero, A.; Córcoles, D. Understanding Innovation: An Analysis of Persistence for Spanish Manufacturing Firms. Res. Policy 2013, 42, 340–352. [Google Scholar] [CrossRef]

- Suarez, D. Persistence of Innovation in Unstable Environments: Continuity and Change in the Firm’s Innovative Behavior. Res. Policy 2014, 43, 726–736. [Google Scholar] [CrossRef]

- Kuzior, A.; Vyshnevskyi, O.; Trushkina, N. Assessment of the Impact of Digitalization on Greenhouse Gas Emissions on the Example of EU Member States. Prod. Eng. Arch. 2022, 28, 407–419. [Google Scholar] [CrossRef]

- Kuzior, A.; Postrzednik-Lotko, K.A.; Postrzednik, S. Limiting of Carbon Dioxide Emissions through Rational Management of Pro-Ecological Activities in the Context of CSR Assumptions. Energies 2022, 15, 1825. [Google Scholar] [CrossRef]

- Li, B.; Wang, B.; Qing, X. Corporate Social Responsibility (CSR), Media Supervision, and Financial Performance: Empirical Data Based on A-Share Heavy Pollution Industry. Account. Res. 2018, 39, 64–71. (In Chinese) [Google Scholar]

| Variable | Obs. | Mean | Std. Dev. | Min | Median | Max |

|---|---|---|---|---|---|---|

| CGI1 | 30,937 | 0.838 | 1.159 | 0.000 | 0.000 | 4.663 |

| CGI2 | 30,937 | 0.354 | 0.637 | 0.000 | 0.000 | 2.454 |

| AGC | 30,937 | 0.460 | 0.933 | 0.000 | 0.000 | 3.611 |

| CEID | 30,937 | 0.164 | 0.168 | 0.000 | 0.079 | 1.000 |

| Size | 30,937 | 22.105 | 1.298 | 19.613 | 21.923 | 26.059 |

| Lev | 30,937 | 0.426 | 0.207 | 0.051 | 0.420 | 0.886 |

| Age | 30,937 | 10.652 | 7.120 | −1.000 | 9.000 | 31.000 |

| Growth | 30,937 | 0.171 | 0.417 | −0.589 | 0.107 | 2.694 |

| Tobin | 30,937 | 2.017 | 1.278 | 0.871 | 1.603 | 8.366 |

| Cflow | 30,937 | 0.046 | 0.071 | −0.174 | 0.046 | 0.249 |

| Cash | 30,937 | 0.200 | 0.145 | 0.014 | 0.158 | 0.698 |

| EPInvest | 30,937 | 0.290 | 1.487 | 0.000 | 0.000 | 9.259 |

| RDS | 30,937 | 0.022 | 0.036 | 0.000 | 0.000 | 0.196 |

| RDS_MV | 30,937 | 0.510 | 0.500 | 0.000 | 1.000 | 1.000 |

| Total_Patent | 30,937 | 1.346 | 1.757 | 0.000 | 0.000 | 6.205 |

| Duality | 30,937 | 0.267 | 0.442 | 0.000 | 0.000 | 1.000 |

| Top1 | 30,937 | 0.349 | 0.149 | 0.089 | 0.329 | 0.750 |

| Remuner | 30,937 | 15.412 | 0.772 | 13.087 | 15.410 | 17.392 |

| CEO_Holding | 30,937 | 0.055 | 0.121 | 0.000 | 0.000 | 0.570 |

| SOE | 30,937 | 0.381 | 0.486 | 0.000 | 0.000 | 1.000 |

| Subsidy | 30,937 | 0.012 | 0.018 | 0.000 | 0.006 | 0.106 |

| Tax_Benefit | 30,937 | 0.136 | 0.180 | −0.712 | 0.140 | 0.879 |

| Industry_HP | 30,937 | 0.279 | 0.448 | 0.000 | 0.000 | 1.000 |

| MTI | 30,937 | 9.179 | 1.697 | −0.161 | 9.438 | 11.494 |

| MC | 30,937 | 3.432 | 1.439 | 0.000 | 3.434 | 7.302 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| CGI1 | CGI1 | CGI1 | CGI2 | CGI2 | CGI2 | |

| AGC | 0.056 *** | 0.057 *** | 0.022 * | 0.014 ** | 0.014 ** | 0.002 |

| (5.23) | (5.32) | (1.65) | (2.12) | (2.18) | (1.20) | |

| CEID | 0.007 *** | 0.010 *** | 0.005 *** | 0.005 *** | ||

| (3.91) | (5.07) | (3.24) | (3.87) | |||

| AGC*CEID | 0.005 *** | 0.002 ** | ||||

| (3.70) | (2.55) | |||||

| Size | 0.310 *** | 0.299 *** | 0.300 *** | 0.178 *** | 0.171 *** | 0.172 *** |

| (19.40) | (18.74) | (18.83) | (14.66) | (14.32) | (14.37) | |

| Lev | 0.196 *** | 0.208 *** | 0.209 *** | 0.118 *** | 0.126 *** | 0.126 *** |

| (3.11) | (3.32) | (3.32) | (2.64) | (2.83) | (2.83) | |

| Age | −0.005 ** | −0.005 ** | −0.005 ** | −0.002 | −0.002 | −0.002 |

| (−2.23) | (−2.27) | (−2.34) | (−1.46) | (−1.50) | (−1.53) | |

| Growth | 0.026 ** | 0.029 ** | 0.028 ** | 0.007 | 0.009 | 0.009 |

| (2.05) | (2.32) | (2.23) | (0.76) | (0.99) | (0.95) | |

| Tobin | 0.019 ** | 0.018 ** | 0.019 ** | 0.016 *** | 0.016 *** | 0.016 *** |

| (2.49) | (2.34) | (2.50) | (3.11) | (2.97) | (3.04) | |

| Cflow | −0.392 *** | −0.420 *** | −0.418 *** | −0.305 *** | −0.322 *** | −0.321 *** |

| (−3.93) | (−4.24) | (−4.22) | (−4.33) | (−4.62) | (−4.61) | |

| Cash | 0.226 *** | 0.235 *** | 0.218 *** | 0.220 *** | 0.226 *** | 0.220 *** |

| (3.40) | (3.56) | (3.29) | (4.40) | (4.55) | (4.42) | |

| EPInvest | 0.025 *** | 0.019 *** | 0.017 *** | 0.014 *** | 0.010 ** | 0.009 ** |

| (4.80) | (3.50) | (3.19) | (3.16) | (2.18) | (2.04) | |

| RDS | 1.118 *** | 1.183 *** | 1.179 *** | 1.376 *** | 1.417 *** | 1.416 *** |

| (3.38) | (3.58) | (3.56) | (5.26) | (5.41) | (5.41) | |

| RDS_MV | 0.008 | 0.014 | 0.020 | 0.064 *** | 0.068 *** | 0.070 *** |

| (0.36) | (0.64) | (0.89) | (3.92) | (4.14) | (4.29) | |

| Total_Patent | 0.231 *** | 0.231 *** | 0.232 *** | 0.147 *** | 0.146 *** | 0.147 *** |

| (28.62) | (28.52) | (28.58) | (23.22) | (23.16) | (23.14) | |

| Duality | 0.004 | 0.005 | 0.006 | 0.025 | 0.026 | 0.026 |

| (0.17) | (0.21) | (0.25) | (1.57) | (1.60) | (1.62) | |

| Top1 | −0.221 *** | −0.226 *** | −0.224 *** | −0.155 *** | −0.158 *** | −0.157 *** |

| (−2.73) | (−2.79) | (−2.77) | (−2.58) | (−2.64) | (−2.63) | |

| Remuner | 0.011 | 0.007 | 0.007 | 0.012 | 0.010 | 0.010 |

| (0.65) | (0.43) | (0.43) | (1.00) | (0.81) | (0.81) | |

| CEO_Holding | −0.028 | −0.022 | −0.026 | 0.016 | 0.020 | 0.019 |

| (−0.33) | (−0.25) | (−0.30) | (0.24) | (0.30) | (0.28) | |

| SOE | 0.024 | 0.016 | 0.017 | 0.042 * | 0.037 | 0.038 |

| (0.77) | (0.53) | (0.56) | (1.82) | (1.61) | (1.63) | |

| Subsidy | 2.524 *** | 2.533 *** | 2.525 *** | 1.735 *** | 1.740 *** | 1.737 *** |

| (4.75) | (4.78) | (4.78) | (4.06) | (4.08) | (4.08) | |

| Tax_Benefit | 0.095 *** | 0.093 *** | 0.092 *** | 0.050 ** | 0.048 ** | 0.048 ** |

| (3.15) | (3.09) | (3.04) | (2.38) | (2.32) | (2.30) | |

| Industry_HP | 0.056 * | 0.070 ** | 0.069 ** | 0.033 * | 0.041 ** | 0.040 ** |

| (1.96) | (2.40) | (2.37) | (1.85) | (1.99) | (1.98) | |

| MTI | 0.020 | 0.020 | 0.020 | 0.008 | 0.009 | 0.008 |

| (1.54) | (1.57) | (1.53) | (0.95) | (0.98) | (0.96) | |

| MC | 0.044 *** | 0.043 *** | 0.043 *** | 0.054 *** | 0.053 *** | 0.053 *** |

| (4.33) | (4.23) | (4.19) | (6.91) | (6.85) | (6.83) | |

| Cons | −7.171 | −6.899 | −6.959 | −4.407 | −4.236 | −4.260 |

| (−0.00) | (.) | (.) | (.) | (.) | (.) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.45 | 0.45 | 0.45 | 0.35 | 0.36 | 0.36 |

| N | 30,937 | 30,937 | 30,937 | 30,937 | 30,937 | 30,937 |

| Panel A: Substituting Core Variables | Panel B: Poisson Regression | Panel C: Panel Fixed Effect Regression | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| CGI_Grant | CGI_Ratio | CGI1 | CGI2 | CGI1 | CGI2 | |

| Net_AGC | 0.048 *** | 0.010 *** | ||||

| (5.26) | (4.74) | |||||

| AGC | 0.061 *** | 0.027 ** | 0.103 *** | 0.038 *** | ||

| (2.99) | (2.00) | (11.04) | (5.82) | |||

| Size | 0.273 *** | 0.019 *** | 0.507 *** | 0.464 *** | 0.299 *** | 0.152 *** |

| (18.29) | (9.41) | (14.77) | (10.44) | (14.92) | (11.39) | |

| Lev | 0.184 *** | 0.018 * | 0.442 *** | 0.389 ** | 0.069 ** | 0.056 |

| (3.20) | (1.90) | (2.80) | (2.02) | (2.09) | (1.44) | |

| Age | −0.003 * | −0.000 | −0.002 | −0.001 | −0.350 *** | −0.077 *** |

| (−1.72) | (−0.90) | (−0.34) | (−0.18) | (−20.63) | (−7.39) | |

| Growth | 0.013 | 0.006 *** | 0.089 *** | 0.091 ** | 0.002 ** | 0.001 ** |

| (1.15) | (2.73) | (2.71) | (2.20) | (2.12) | (1.97) | |

| Tobin | 0.014 ** | 0.002 * | 0.007 | 0.017 | 0.004 | 0.001 |

| (2.03) | (1.76) | (0.34) | (0.68) | (0.69) | (0.25) | |

| Cflow | −0.257 *** | −0.061 *** | −0.764 *** | −1.140 *** | −0.040 ** | −0.077 *** |

| (−2.86) | (−3.64) | (−2.62) | (−3.25) | (−2.54) | (−2.60) | |

| Cash | 0.081 | 0.037 *** | 0.062 | 0.406 | 0.087 | 0.040 |

| (1.38) | (3.21) | (0.30) | (1.58) | (1.63) | (1.18) | |

| EPInvest | 0.023 *** | 0.002 ** | 0.001 | 0.001 | 0.011 *** | 0.003 |

| (4.91) | (2.10) | (0.17) | (0.13) | (3.09) | (0.95) | |

| RDS | 0.572 ** | 0.471 *** | 1.312 ** | 2.362 *** | 0.877 *** | 0.941 *** |

| (2.02) | (6.64) | (2.12) | (2.90) | (3.54) | (5.13) | |

| RDS_MV | −0.009 | 0.017 *** | −0.049 | 0.001 | −0.016 | 0.007 |

| (−0.46) | (4.23) | (−0.92) | (0.01) | (−0.90) | (0.59) | |

| Total_Patent | 0.156 *** | 0.030 *** | 0.330 *** | 0.310 *** | 0.108 *** | 0.075 *** |

| (22.63) | (24.22) | (11.65) | (9.55) | (18.23) | (16.95) | |

| Duality | −0.008 | 0.006 | −0.027 | 0.041 | 0.014 | 0.028 ** |

| (−0.40) | (1.55) | (−0.55) | (0.62) | (0.76) | (2.13) | |

| Top1 | −0.137 * | −0.045 *** | −0.085 | −0.121 | −0.107 | −0.119 * |

| (−1.84) | (−4.06) | (−0.48) | (−0.53) | (−0.94) | (−1.65) | |

| Remuner | 0.009 | 0.007 ** | 0.114 *** | 0.148 *** | 0.006 | 0.002 |

| (0.62) | (2.49) | (3.03) | (3.18) | (0.40) | (0.24) | |

| CEO_Holding | 0.006 | 0.014 | 0.040 | 0.199 | 0.110 | 0.019 |

| (0.07) | (0.83) | (0.21) | (0.74) | (1.45) | (0.34) | |

| SOE | 0.005 | 0.013 *** | 0.090 | 0.005 | 0.068 | 0.045 |

| (0.20) | (2.91) | (1.22) | (0.05) | (1.49) | (1.40) | |

| Subsidy | 1.868 *** | 0.358 *** | 4.763 *** | 5.768 *** | 0.604 ** | 0.403 ** |

| (3.87) | (4.07) | (4.05) | (3.35) | (2.51) | (2.03) | |

| Tax_Benefit | 0.050 * | 0.015 *** | 0.019 | 0.012 | 0.034 | 0.021 |

| (1.81) | (2.72) | (0.24) | (0.13) | (1.45) | (1.36) | |

| Industry_HP | 0.058 ** | 0.004 * | 0.251 *** | 0.241 ** | 0.020 ** | 0.022 * |

| (2.23) | (1.94) | (3.25) | (2.30) | (2.39) | (1.77) | |

| MTI | 0.023 ** | 0.003 | 0.021 | 0.025 | 0.002 | 0.004 |

| (2.05) | (1.25) | (0.60) | (0.55) | (0.15) | (0.47) | |

| MC | 0.036 *** | 0.003 ** | 0.040 ** | 0.105 *** | 0.032 *** | 0.030 *** |

| (3.85) | (2.36) | (2.02) | (4.05) | (3.84) | (5.31) | |

| Cons | −6.320 | −0.520 | −31.712 | −33.215 | −0.862 | −1.991 *** |

| (−0.00) | (.) | (−0.01) | (.) | (−1.52) | (−5.70) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Firm FE | No | No | No | No | Yes | Yes |

| Adj. R2/Pseudo R2 /Within R2 | 0.42 | 0.18 | 0.57 | 0.49 | 0.26 | 0.12 |

| N | 30,937 | 30,937 | 30,937 | 30,937 | 30,937 | 30,937 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Ret_1Year | CGI1 | CGI2 | Rep_Score | CGI1 | CGI2 | WWIndex | CGI1 | CGI2 | |

| AGC | 0.033 *** | 0.054 *** | 0.013 | 0.133 *** | 0.045 *** | 0.017 * | −0.002 *** | 0.289 * | 0.018 |

| (9.50) | (5.05) | (1.62) | (9.52) | (3.92) | (1.93) | (−6.74) | (1.90) | (1.55) | |

| Ret_1Year | 0.030 *** | 0.014 ** | |||||||

| (2.74) | (2.55) | ||||||||

| AGC*Ret_1Year | 0.014 ** | 0.007 ** | |||||||

| (2.27) | (2.08) | ||||||||

| Rep_Score | 0.086 *** | 0.051 *** | |||||||

| (6.64) | (5.06) | ||||||||

| AGC*Rep_Score | 0.021 *** | 0.007 ** | |||||||

| (4.60) | (2.19) | ||||||||

| WWIndex | −0.897 *** | −0.436 ** | |||||||

| (−3.38) | (−2.30) | ||||||||

| AGC* WWIndex | 0.338 ** | 0.091 * | |||||||

| (2.29) | (1.81) | ||||||||

| Size | 0.015 *** | 0.309 *** | 0.178 *** | 0.604 *** | 0.254 *** | 0.155 *** | −0.048 *** | 0.273 *** | 0.164 *** |

| (4.64) | (19.34) | (14.61) | (25.73) | (12.99) | (10.09) | (−124.72) | (12.70) | (10.11) | |

| Lev | 0.077 *** | 0.195 *** | 0.118 *** | 0.305 *** | 0.133 * | 0.088 | 0.040 *** | 0.145 ** | 0.104 ** |

| (5.07) | (3.10) | (2.64) | (3.29) | (1.79) | (1.61) | (22.24) | (2.09) | (2.09) | |

| Age | −0.002 *** | −0.005 ** | −0.002 | 0.020 *** | −0.006 *** | −0.003 * | 0.001 *** | −0.005 ** | −0.002 |

| (−5.92) | (−2.19) | (−1.44) | (7.21) | (−2.66) | (−1.86) | (11.03) | (−2.13) | (−1.12) | |

| Growth | 0.102 *** | 0.023 * | 0.006 | 0.208 *** | −0.005 | −0.013 | −0.047 *** | −0.015 | −0.015 |

| (14.84) | (1.87) | (0.66) | (10.50) | (−0.33) | (−1.25) | (−56.51) | (−0.85) | (−1.11) | |

| Tobin | 0.071 *** | 0.017 ** | 0.016 *** | 0.074 *** | 0.014 | 0.012 * | 0.001 *** | 0.030 *** | 0.021 *** |

| (21.69) | (2.25) | (2.95) | (6.87) | (1.61) | (1.85) | (5.59) | (3.59) | (3.43) | |

| Cflow | 0.330 *** | −0.399 *** | −0.307 *** | 1.213 *** | −0.567 *** | −0.400 *** | −0.121 *** | −0.498 *** | −0.378 *** |

| (8.76) | (−3.99) | (−4.36) | (8.26) | (−4.98) | (−4.78) | (−37.01) | (−4.59) | (−4.82) | |

| Cash | 0.056 *** | 0.225 *** | 0.220 *** | 0.091 | 0.275 *** | 0.239 *** | −0.012 *** | 0.256 *** | 0.244 *** |

| (2.95) | (3.39) | (4.39) | (0.94) | (3.57) | (4.00) | (−6.07) | (3.47) | (4.29) | |

| EPInvest | 0.004 *** | 0.025 *** | 0.014 *** | 0.009 | 0.023 *** | 0.010 ** | −0.000 | 0.023 *** | 0.011 ** |

| (2.96) | (4.79) | (3.15) | (1.45) | (3.94) | (2.12) | (−1.00) | (4.09) | (2.38) | |

| RDS | 0.318 *** | 1.114 *** | 1.375 *** | 1.525 *** | 0.861 ** | 1.387 *** | 0.003 | 0.848 ** | 1.317 *** |

| (3.33) | (3.37) | (5.25) | (3.46) | (2.24) | (4.42) | (0.31) | (2.36) | (4.59) | |

| RDS_MV | 0.022 *** | 0.007 | 0.064 *** | −0.019 | 0.020 | 0.068 *** | 0.002 *** | 0.011 | 0.059 *** |

| (3.15) | (0.33) | (3.90) | (−0.59) | (0.83) | (3.69) | (3.65) | (0.47) | (3.44) | |

| Total_Patent | 0.007 *** | 0.231 *** | 0.147 *** | 0.078 *** | 0.240 *** | 0.147 *** | −0.000 *** | 0.240 *** | 0.148 *** |

| (3.93) | (28.62) | (23.21) | (7.76) | (26.45) | (20.55) | (−2.84) | (27.91) | (22.22) | |

| Duality | −0.001 | 0.004 | 0.025 | −0.020 | 0.017 | 0.029 | 0.001 | 0.015 | 0.030 * |

| (−0.24) | (0.16) | (1.56) | (−0.67) | (0.69) | (1.56) | (1.55) | (0.65) | (1.67) | |

| Top1 | 0.076 *** | −0.223 *** | −0.156 *** | 0.136 | −0.192 ** | −0.141 ** | −0.012 *** | −0.246 *** | −0.168 *** |

| (5.32) | (−2.76) | (−2.60) | (1.30) | (−2.19) | (−2.12) | (−6.04) | (−2.89) | (−2.62) | |

| Remuner | 0.010 *** | 0.011 | 0.012 | 0.162 *** | −0.015 | −0.002 | −0.004 *** | −0.006 | 0.005 |

| (2.59) | (0.62) | (0.98) | (6.52) | (−0.79) | (−0.16) | (−9.57) | (−0.32) | (0.36) | |

| CEO_Holding | 0.111 *** | −0.031 | 0.015 | −0.165 | −0.034 | 0.034 | −0.008 *** | −0.056 | 0.014 |

| (5.01) | (−0.36) | (0.23) | (−1.49) | (−0.35) | (0.45) | (−4.01) | (−0.59) | (0.18) | |

| SOE | −0.013 ** | 0.024 | 0.042 * | −0.039 | 0.034 | 0.047 * | −0.002 *** | 0.029 | 0.043 * |

| (−2.37) | (0.78) | (1.82) | (−1.00) | (1.02) | (1.84) | (−2.64) | (0.90) | (1.74) | |

| Subsidy | −0.105 | 2.531 *** | 1.738 *** | 2.064 *** | 2.638 *** | 1.888 *** | −0.047 *** | 2.225 *** | 1.697 *** |

| (−0.75) | (4.76) | (4.07) | (2.82) | (4.51) | (3.98) | (−3.37) | (3.91) | (3.67) | |

| Tax_Benefit | 0.004 | 0.096 *** | 0.050 ** | 0.167 *** | 0.120 *** | 0.058 ** | −0.016 *** | 0.107 *** | 0.053 ** |

| (0.35) | (3.15) | (2.38) | (3.20) | (2.99) | (2.05) | (−13.04) | (3.41) | (2.45) | |

| Industry_HP | 0.019 *** | 0.057 ** | 0.033 | 0.098 ** | 0.046 | 0.027 | 0.002 ** | 0.047 | 0.028 |

| (3.35) | (1.98) | (1.61) | (2.14) | (1.43) | (1.17) | (2.44) | (1.54) | (1.26) | |

| MTI | 0.008 ** | 0.020 | 0.008 | 0.017 | 0.019 | 0.008 | −0.001 | 0.021 | 0.008 |

| (2.01) | (1.53) | (0.94) | (0.66) | (1.28) | (0.78) | (−1.06) | (1.53) | (0.85) | |

| MC | 0.009 *** | 0.044 *** | 0.054 *** | 0.023 * | 0.057 *** | 0.062 *** | 0.000 * | 0.050 *** | 0.059 *** |

| (3.84) | (4.31) | (6.90) | (1.71) | (4.85) | (6.83) | (1.71) | (4.39) | (6.67) | |

| Cons | −0.600 | −7.166 | −4.405 | −7.463 *** | −5.595 *** | −3.704 *** | 0.102 *** | −6.977 *** | −4.327 *** |

| (−0.00) | (.) | (.) | (−33.77) | (−12.94) | (−10.98) | (7.33) | (−17.16) | (−14.22) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.13 | 0.45 | 0.35 | 0.78 | 0.48 | 0.37 | 0.87 | 0.47 | 0.37 |

| N | 30,937 | 30,937 | 30,937 | 24,277 | 24,277 | 24,277 | 26,974 | 26,974 | 26,974 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| ExPerk | CGI1 | CGI2 | Myopia | CGI1 | CGI2 | |

| AGC | −0.001 *** | 0.071 *** | 0.024 *** | −0.002 *** | 0.039 *** | 0.008 * |

| (−4.72) | (6.57) | (2.87) | (−3.46) | (2.89) | (1.72) | |

| ExPerk | −0.786 *** | −0.56 9 ** | ||||

| (−2.68) | (−2.46) | |||||

| AGC*ExPerk | 0.135 ** | 0.042 * | ||||

| (2.19) | (1.75) | |||||

| Myopia | −0.276 *** | −0.189 *** | ||||

| (−2.82) | (−2.73) | |||||

| AGC*Myopia | 0.198 ** | 0.080 ** | ||||

| (2.43) | (2.11) | |||||

| Size | −0.006 *** | 0.323 *** | 0.186 *** | −0.001 | 0.307 *** | 0.175 *** |

| (−14.37) | (19.03) | (14.46) | (−0.86) | (19.23) | (14.47) | |

| Lev | 0.010 *** | 0.203 *** | 0.130 *** | 0.007 | 0.215 *** | 0.133 *** |

| (5.67) | (3.05) | (2.71) | (1.44) | (3.43) | (3.02) | |

| Age | 0.000 *** | −0.002 | −0.001 | 0.001 *** | −0.004 * | −0.002 |

| (6.74) | (−0.86) | (−0.52) | (8.04) | (−1.86) | (−1.03) | |

| Growth | −0.000 | 0.033 ** | 0.016 | −0.010 *** | 0.022 * | 0.007 |

| (−0.37) | (2.45) | (1.60) | (−9.28) | (1.72) | (0.69) | |

| Tobin | 0.000 | 0.035 *** | 0.025 *** | −0.001 | 0.019 ** | 0.016 *** |

| (0.86) | (4.23) | (4.30) | (−0.81) | (2.46) | (3.04) | |

| Cflow | 0.023 *** | −0.363 *** | −0.290 *** | 0.012 | −0.392 *** | −0.314 *** |

| (6.77) | (−3.35) | (−3.81) | (1.39) | (−3.92) | (−4.46) | |

| Cash | 0.004 * | 0.075 | 0.150 ** | −0.019 *** | 0.225 *** | 0.228 *** |

| (1.69) | (0.98) | (2.55) | (−3.75) | (3.41) | (4.62) | |

| EPInvest | −0.000 * | 0.021 *** | 0.012 ** | −0.001 *** | 0.025 *** | 0.014 *** |

| (−1.78) | (3.54) | (2.37) | (−2.58) | (4.69) | (3.12) | |

| RDS | 0.142 *** | 1.469 *** | 1.507 *** | −0.018 | 1.149 *** | 1.387 *** |

| (11.26) | (4.25) | (5.50) | (−0.89) | (3.46) | (5.28) | |

| RDS_MV | 0.005 *** | 0.065 *** | 0.017 | 0.005 *** | 0.006 | 0.057 *** |

| (6.74) | (2.68) | (0.97) | (3.11) | (0.27) | (3.55) | |

| Total_Patent | 0.002 *** | 0.254 *** | 0.159 *** | −0.001 * | 0.227 *** | 0.143 *** |

| (10.50) | (28.56) | (23.13) | (−1.72) | (28.23) | (22.76) | |

| Duality | −0.001 | 0.003 | 0.028 | −0.002 | 0.003 | 0.026 |

| (−0.88) | (0.13) | (1.63) | (−1.09) | (0.12) | (1.59) | |

| Top1 | 0.004 | −0.269 *** | −0.189 *** | −0.001 | −0.244 *** | −0.181 *** |

| (1.62) | (−3.17) | (−2.97) | (−0.17) | (−3.02) | (−3.06) | |

| Remuner | 0.006 *** | 0.006 | 0.005 | −0.001 | 0.011 | 0.013 |

| (11.26) | (0.32) | (0.34) | (−1.29) | (0.66) | (1.05) | |

| CEO_Holding | −0.002 | −0.059 | 0.009 | −0.022 *** | −0.036 | 0.014 |

| (−0.66) | (−0.62) | (0.13) | (−4.05) | (−0.42) | (0.22) | |

| SOE | 0.002 ** | 0.033 | 0.051 ** | 0.010 *** | 0.022 | 0.041 * |

| (2.01) | (1.04) | (2.11) | (4.42) | (0.72) | (1.77) | |

| Subsidy | −0.005 | 2.048 *** | 1.593 *** | −0.023 | 2.515 *** | 1.727 *** |

| (−0.36) | (3.64) | (3.50) | (−0.67) | (4.70) | (4.02) | |

| Tax_Benefit | −0.001 | 0.020 | 0.003 | −0.001 | 0.093 *** | 0.049 ** |

| (−0.96) | (0.61) | (0.11) | (−0.30) | (3.05) | (2.33) | |

| Industry_HP | −0.002 *** | 0.053 * | 0.030 | 0.011 *** | 0.053 * | 0.030 |

| (−2.93) | (1.71) | (1.34) | (5.37) | (1.83) | (1.48) | |

| MTI | 0.001 | 0.027 * | 0.012 | −0.002 * | 0.017 | 0.005 |

| (1.33) | (1.93) | (1.23) | (−1.71) | (1.33) | (0.64) | |

| MC | 0.000 | 0.030 *** | 0.047 *** | −0.003 *** | 0.043 *** | 0.053 *** |

| (0.35) | (2.70) | (5.55) | (−4.47) | (4.18) | (6.83) | |

| Cons | 0.020 * | −5.545 *** | −4.185 *** | 0.129 *** | −7.963 *** | −4.455 *** |

| (1.84) | (−12.95) | (−13.04) | (5.86) | (−24.26) | (−17.27) | |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.18 | 0.46 | 0.36 | 0.15 | 0.45 | 0.35 |

| N | 26,846 | 26,846 | 26,846 | 30,253 | 30,253 | 30,253 |

| Panel A: The influence of regional institutional environment | ||||

| LawIndex_High | LawIndex_Low | LawIndex_High | LawIndex_Low | |

| (1) | (2) | (3) | (4) | |

| CGI1 | CGI1 | CGI2 | CGI2 | |

| AGC | 0.063 *** | 0.036 ** | 0.015 * | 0.002 |

| (4.96) | (2.20) | (1.81) | (1.16) | |

| Control variables | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.49 | 0.43 | 0.39 | 0.32 |

| N | 13,712 | 17,225 | 13,712 | 17,225 |

| SUR Coefficient Diff. | p = 0.059 | p = 0.128 | ||

| Panel B: The influence of heavily polluting industries | ||||

| Industry_HP | Industry_Other | Industry_HP | Industry_Other | |

| (5) | (6) | (7) | (8) | |

| CGI1 | CGI1 | CGI2 | CGI2 | |

| AGC | 0.109 *** | 0.030 ** | 0.041 *** | 0.002 |

| (6.73) | (2.25) | (3.28) | (0.83) | |

| Control variables | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.51 | 0.47 | 0.38 | 0.38 |

| N | 8628 | 22,309 | 8628 | 22,309 |

| SUR Coefficient Diff. | p = 0.000 | p = 0.000 | ||

| Panel C: The influence of corporate continuous innovation strategy | ||||

| InnoStrategy_Con | InnoStrategy_Other | InnoStrategy_Con | InnoStrategy_Other | |

| (9) | (10) | (11) | (12) | |

| CGI1 | CGI1 | CGI2 | CGI2 | |

| AGC | 0.013 * | 0.062 *** | 0.001 | 0.009 ** |

| (1.77) | (4.93) | (1.08) | (1.98) | |

| Control variables | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes |

| City FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Adj. R2 | 0.49 | 0.43 | 0.39 | 0.33 |

| N | 11,448 | 19,489 | 11,448 | 19,489 |

| SUR Coefficient Diff. | p = 0.001 | p = 0.076 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, S.; Dong, W.; Huang, Y. Analysts’ Green Coverage and Corporate Green Innovation in China: The Moderating Effect of Corporate Environmental Information Disclosure. Sustainability 2023, 15, 5637. https://doi.org/10.3390/su15075637

Hu S, Dong W, Huang Y. Analysts’ Green Coverage and Corporate Green Innovation in China: The Moderating Effect of Corporate Environmental Information Disclosure. Sustainability. 2023; 15(7):5637. https://doi.org/10.3390/su15075637

Chicago/Turabian StyleHu, Shiliang, Wenhao Dong, and Yongchun Huang. 2023. "Analysts’ Green Coverage and Corporate Green Innovation in China: The Moderating Effect of Corporate Environmental Information Disclosure" Sustainability 15, no. 7: 5637. https://doi.org/10.3390/su15075637

APA StyleHu, S., Dong, W., & Huang, Y. (2023). Analysts’ Green Coverage and Corporate Green Innovation in China: The Moderating Effect of Corporate Environmental Information Disclosure. Sustainability, 15(7), 5637. https://doi.org/10.3390/su15075637