What Drives Profit Income in Mexico’s Main Banks? Evidence Using Machine Learning

Abstract

:1. Introduction

2. Theoretical Framework

2.1. Creation of Shared Value: Importance, Conceptualization, and Measurement

- Redesign products and markets to provide appropriate services and meet unmet needs. For example, to promote customer prosperity in the financial sector, initiatives such as supporting existing customers’ financial health, expanding banking services to the unbanked population, and financing small and medium-sized enterprises are useful.

- Redefine productivity in the value chain to mitigate risks and increase productivity.

- Enable on-premises cluster development by improving the external framework that supports enterprise operations. For example, banks can act by boosting the growth of regional economies and by providing venture capital or financing investor resources to cluster members and their value chain partners, thereby increasing social value. In addition, banks can boost less developed regions by financing the development of public facilities, such as transport infrastructure. This would help to increase the productivity of all cluster members and benefit the community. A more prosperous community, in return, creates more business opportunities for banks, i.e., increases economic value [23].

- The social purpose: Identify the requirements that need to be addressed with the social goal.

- A defined need: Understanding the particular needs of a region—the environment–helps define areas that demand to be improved and the extent of these improvements, and the value of that change to the business.

- Measurement: Establish immediate measures and track progress to validate the early links.

- The appropriate innovation structure: The degree to which the shared value potential can be anticipated and aligned with the company’s financial criteria determines the optimal innovation structure for the social enterprise, as well as the requirements to deliver business and social value.

- Co-creation forms the basis for relationships of trust [24].

2.2. Bank Performance Indicators

3. Materials and Methods

- Total average volume of the current loan portfolio in millions of Mexican pesos (hereinafter Mx) (CVIG).

- Total average volume of the portfolio of past due loans in millions of Mx (CVENC).

- Total volume of write-offs accepted during the year in millions of Mx from uncollectable loans (QYC).

- Total average annual volume of deposits in millions of Mx (DEPDISP).

- Average annual volume of total savings and investments with a fixed maturity in millions of Mx (DEPPZO).

- Average annual volume of demand deposits, savings, and investments with a fixed maturity in millions of Mx (CAPTRAD).

- Average annual ratio of return on assets (ROA). For each month of the year, the month’s net profit or loss is divided by the last 12-month average of total assets.

- Average annual return on equity ratio (ROE). For each month of the year, the month’s net profit or loss is divided by the average of the last 12 months of total capital.

- Average delinquency ratio of loan portfolio during the year (IMOR). For each month of the year, the volume of past due loans in millions of Mx at the end of the month is divided by the average of the last 12 months of the total loan portfolio.

- Average delinquency ratio of credit portfolio adjusted for write-offs accepted during the year (IMORA). For each month of the year, the volume of past-due loans in millions of Mx plus the volume of write-offs in millions of Mx related to irrecoverable loans at the end of the month is divided by the average total portfolio of the last 12 months.

- Net profit or accumulated loss at the end of the year (RESNETO).

- The variables Year and Bank were defined as categorical so as to perform an analysis with panel data. (Year-Bank).

3.1. Procedure for Applying Machine Learning Tools

3.1.1. Model I

3.1.2. Model II

3.2. Procedure for Calculating the Bank Performance Index

3.2.1. Index I

3.2.2. Index II

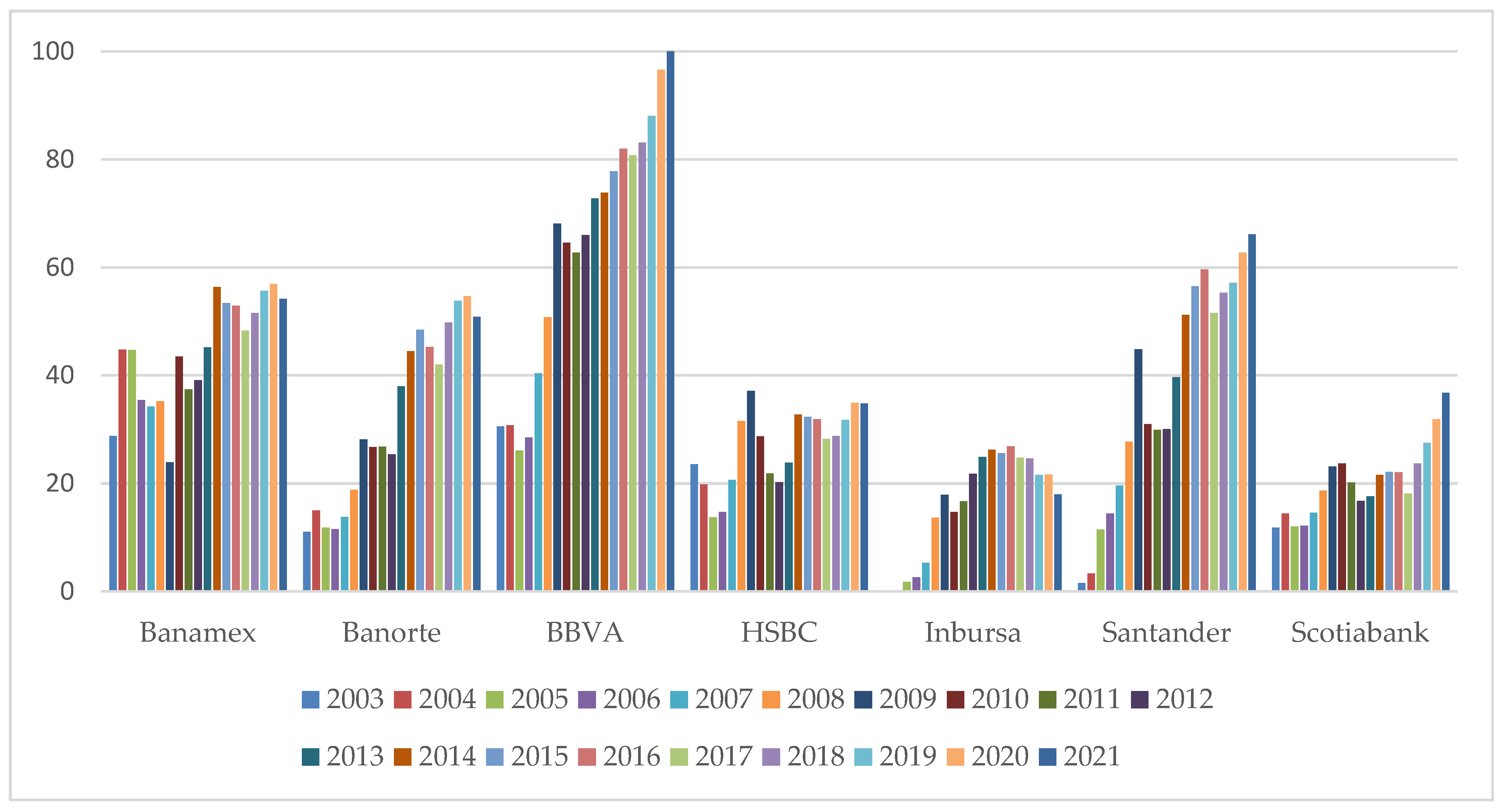

4. Results

5. Discussion

6. Conclusions

- Reconceive products and markets to support existing and potential customers’ financial health, opening up banking services to the unbanked population.

- Finance small and medium-sized enterprises or production clusters members to boost regional economies.

- Redefine internal processes to enhance their commercial activities and productivity, thereby improving their potential to produce economic value.

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Porter, M.E.; Kramer, M.R. Strategy and society: The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar]

- Porter, M.E.; Kramer, M.R. Creation of shared value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Islam, M.; Hossain, S. Conceptual mapping of shared value creation by the private commercial banks in Bangladesh. Asian J. Sustain. Soc. Responsib. 2019, 4, 3. [Google Scholar] [CrossRef]

- Hicks, J. A Theory of Economic History; Oxford University Press: Oxford, UK, 1969; Volume 163. [Google Scholar]

- Festré, A.; Nasica, E. Schumpeter on Money, Banking, and Finance: An Institutionalist Perspective. Eur. J. Hist. Econ. Thought 2009, 16, 325–356. [Google Scholar] [CrossRef] [Green Version]

- Paulet, E.; Mavoori, H. Conventional banks and Fintechs: How digitization has transformed both models. J. Bus. Strategy 2020, 41, 19–29. [Google Scholar] [CrossRef]

- Salmony, M. Banks taking back control. J. Paym. Strategy Syst. 2019, 13, 13–19. [Google Scholar]

- Corner, P.D.; Pavlovich, K. Shared Value Through Inner Knowledge Creation. J. Bus. Ethics 2016, 135, 543–555. [Google Scholar] [CrossRef]

- Jallo, M.; Ticona, L.; Apazca, C.M.; Ticona, M.; Rodríguez, I. Analysis of the determining factors that influence on credit delay, Puno, Perú. Veritas Sci. 2022, 11, 125–137. [Google Scholar]

- Caselli, M.; Somekh, B. Access to Banking and the Role of Inequality and the Financial Crisis. B.E. J. Econ. Anal. Policy 2021, 21, 1373–1410. [Google Scholar] [CrossRef]

- Cepni, O.; Demirer, R.; Gupta, R.; Sensoy, A. Interest rate uncertainty and the predictability of bank revenues. J. Forecast. 2022, 41, 1559–1569. [Google Scholar] [CrossRef]

- Ronquillo, D.; Aguilasocho, D.; Galeana, E. Financial Factors that Determine The Mexican Banking Market Profitability. Merc. Neg. 2018, 38, 23–44. [Google Scholar]

- Apolo Cárdenas, C.A. Eficiencia Técnica de los Bancos del Ecuador y sus Determinantes Durante el Período de 2015–2019. Bachelor’s Thesis, PUCE-Ecuador, Quito, Ecuador, 2022. [Google Scholar]

- Chavarín, R. Determinants of Commercial Bank Profitability in Mexico. EconoQuantum 2015, 12, 97–123. [Google Scholar] [CrossRef] [Green Version]

- Gurley, J.G.; Shaw, E.S. Money in a Theory of Finance; The Brookings Institution: Washington, DC, USA, 1960. [Google Scholar]

- Mustafina, K.; Limanskis, A. Profitability growth factors as a driver of sustainability in the banking sector. J. Bus. Manag. 2017, 14, 69–84. [Google Scholar]

- Jones, S.; Wright, C. Fashion or future: Does creating shared value pay? Account. Financ. 2018, 58, 1111–1139. [Google Scholar] [CrossRef]

- Burrell, L.; Hewlett, S.A.; Luce, C.B.; Frohman, D. ACM International Conference Proceeding Series, Proceedings of the 1st International Conference on Information Interaction in Context, Copenhagen, Denmark, 18–20 October; Association for Computing Machinery: New York, NY, USA, 2006; Volume 176. [Google Scholar]

- Mendy, J. Supporting the creation of shared value. Strateg. Chang. 2019, 28, 157–161. [Google Scholar] [CrossRef]

- Dembek, K.; Singh, P.; Bhakoo, V. Literature Review of Shared Value: A Theoretical Concept or a Management Buzzword? J. Bus. Ethics 2016, 137, 231–267. [Google Scholar] [CrossRef]

- Moon, H.C.; Parc, J. Shifting corporate social responsibility to corporate social opportunity through creating shared value. Strateg. Chang. 2019, 28, 115–122. [Google Scholar] [CrossRef]

- Bockstette, V.; Stamp, M. Creating Shared Value: A How to Guide for the New Corporate (R) Evolution. 2011. Available online: http://www.FSG.org/publications/creating-shared-value-how--guide-new-corporate-revolution (accessed on 5 December 2022).

- Ilmarinen, P.; Akpinar, M. Creating Shared Value in the Banking Industry: A Case Study from Finland. 2018. Available online: https://www.researchgate.net/publication/325284745_Creating_shared_value_in_the_banking_industry_A_case_study_from_Finland (accessed on 7 February 2023).

- Pfitzer, M.; Bockstette, V.; Stamp, M. Innovating for Shared Value. Companies that deliver both social benefit and business value rely on five mutually reinforcing element. Harv. Bus. Rev. 2013, 89, 3–9. [Google Scholar]

- Spitzeck, H.; Chapman, S. Creating shared value as a differentiation strategy—The example of BASF in Brazil. Corp. Gov. 2012, 12, 499–513. [Google Scholar] [CrossRef] [Green Version]

- Spitzeck, H. Normative versus instrumental corporate responsibility. In Encyclopedia of Corporate Social Responsibility; Springer: Berlin/Heidelberg, Germany, 2013; pp. 1768–1770. [Google Scholar] [CrossRef]

- Maltz, E.; Thompson, F.; Ringold, D.J. Assessing and maximizing corporate social initiatives: A strategic view of corporate social responsibility. J. Public Aff. 2011, 11, 344–352. [Google Scholar] [CrossRef]

- Mohammed, M. Conceptual framework for corporate accountability in the context of sustainability—A Literature Review. In Proceedings of the 5th Annual EuroMed Conference of the EuroMed Academy of Business, Montreux, Switzerland, 4–5 October 2012; pp. 1131–1140. [Google Scholar]

- Yang, T.K.; Yan, M.R. The corporate shared value for sustainable development: An ecosystem perspective. Sustainability 2020, 12, 2348. [Google Scholar] [CrossRef] [Green Version]

- Johan, S.; Sari, W.R. The influence of the CEO characteristics on banking performance. In Proceedings of the International Conference on Management, Accounting, and Economy (ICMAE 2020), Jakarta, Indonesia, 13–14 February 2020. [Google Scholar]

- Simpson, W.G.; Kohers, T. The Link Between Corporate Social and Financial Performance: Evidence from the Banking Industry. J. Bus. Ethics 2002, 35, 97–109. [Google Scholar] [CrossRef]

- Brotons, J.; Sansalvador, M. The relationship between corporate social responsibility certification and financial performance: An empirical study in Spain. Corp. Soc. Resp. Env. 2020, 27, 1465–1477. [Google Scholar] [CrossRef]

- Jiménez-Hernández, I.; Palazzo, G.; Sáez-Fernández, F.J. Determinants of banking efficiency: Evidence from the Latin American banking industry. Appl. Econ. Anal. 2019, 27, 184–206. [Google Scholar] [CrossRef] [Green Version]

- Arteaga, J. Market Power or Efficiency: Origin of the Profits of the Mexican Banking System from 1995 to 1999. Master’s Thesis, Universidad Autónoma de Nuevo León, Monterrey, Mexico, 2001; pp. 35–48. [Google Scholar]

- Chortareas, G.; Garza-García, J.; Girardone, C. Market structure, profits and spreads in the Mexican banking industry. Banks Bank Syst. 2009, 4, 43–52. [Google Scholar]

- Garza-Garcia, J.G. Does market power influence banks’ profits in Mexico? A study on market power and efficiency. Appl. Financ. Econ. 2012, 22, 21–32. [Google Scholar] [CrossRef]

- Guerrero, R.; Villalpando, M. Profitability, concentration and efficiency in the Mexican banking system. El Trimest. Económica 2009, 76, 237–263. [Google Scholar] [CrossRef] [Green Version]

- Montemayor, E.R. Industrial concentration and profitability of banking in Mexico-Evaluation after the 1995 recession. Trimest. Econ. 2003, 70, 371–404. [Google Scholar]

- Pampurini, F.; Quaranta, A. Measurement of efficiency in the banking market. An empirical investigation of the performance of the last decade. SSRN Electron. J. 2020, 1–33. [Google Scholar] [CrossRef]

- Gaul, L.; Jones, J.; Uysal, P. Forecasting High-Risk Composite CAMELS Ratings. Int. Financ. Discuss. Pap. 2019, 2019, 1252. [Google Scholar] [CrossRef]

- Demsar, J.; Curk, T.; Erjavec, A.; Gorup, C.; Hocevar, T.; Milutinovic, M.; Mozina, M.; Polajnar, M.; Toplak, M.; Staric, A.; et al. Orange: Data Mining Toolbox in Python. J. Mach. Learn. Res. 2013, 14, 2349–2353. [Google Scholar] [CrossRef] [Green Version]

- Goodfellow, I.; Bengio, Y.; Courville, A. Deep Learning; MIT Press: Cambridge, MA, USA, 2016. [Google Scholar] [CrossRef]

- Ho, T.K. The Random Subspace Method for Constructing Decision Forests. IEEE Trans. PatternAnalysis Mach. Intell. 1998, 20, 832–844. [Google Scholar] [CrossRef] [Green Version]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef] [Green Version]

- Quinlan, J.R. Induction of decision trees. Mach. Learn. 1986, 1, 81–106. [Google Scholar] [CrossRef] [Green Version]

| Correlation | Variable 1 | Variable 2 |

|---|---|---|

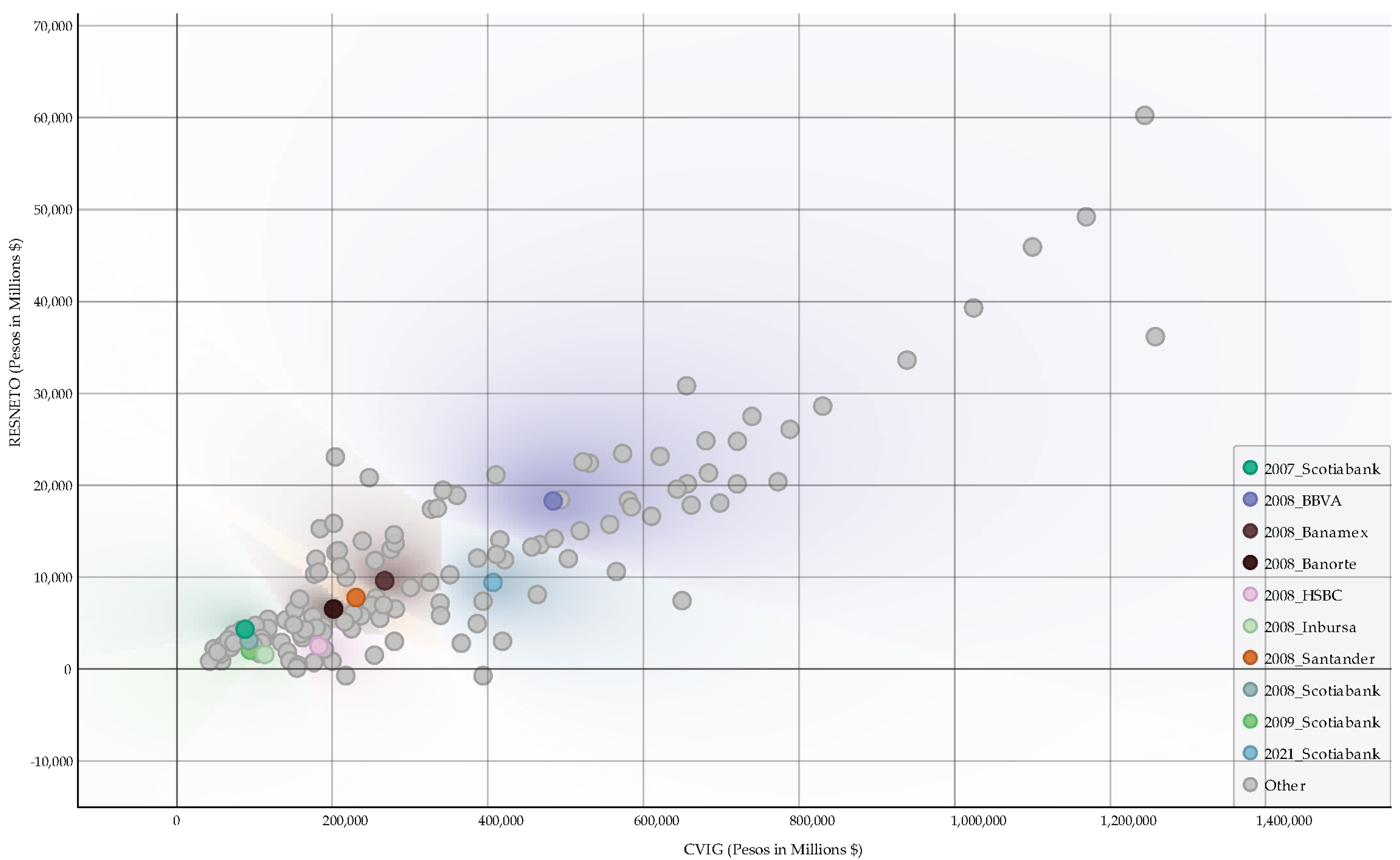

| 0.804 | CVIG | RESNETO |

| 0.752 | DEPPZO | RESNETO |

| CVIG | CVENC | QYC | DEPDISP | DEPPZO | ROA | ROE | IMOR | IMORA | RESNETO | |

|---|---|---|---|---|---|---|---|---|---|---|

| CVIG | 1.000 | |||||||||

| CVENC | 0.858 | 1.000 | ||||||||

| QYC | 0.858 | 0.824 | 1.000 | |||||||

| DEPDISP | 0.952 | 0.850 | 0.910 | 1.000 | ||||||

| DEPPZO | 0.925 | 0.811 | 0.857 | 0.857 | 1.000 | |||||

| ROA | −0.176 | −0.247 | −0.245 | −0.287 | −0.159 | 1.000 | ||||

| ROE | −0.115 | −0.202 | −0.172 | −0.172 | −0.015 | 0.761 | 1.000 | |||

| IMOR | −0.226 | 0.109 | −0.222 | −0.222 | −0.193 | 0.390 | 0.313 | 1.000 | ||

| IMORA | 0.106 | 0.188 | 0.310 | 0.171 | 0.051 | 0.384 | 0.297 | 0.623 | 1.000 | |

| RESNETO | 0.804 | 0.628 | 0.697 | 0.745 | 0.752 | 0.257 | 0.291 | −0.135 | 0.185 | 1.000 |

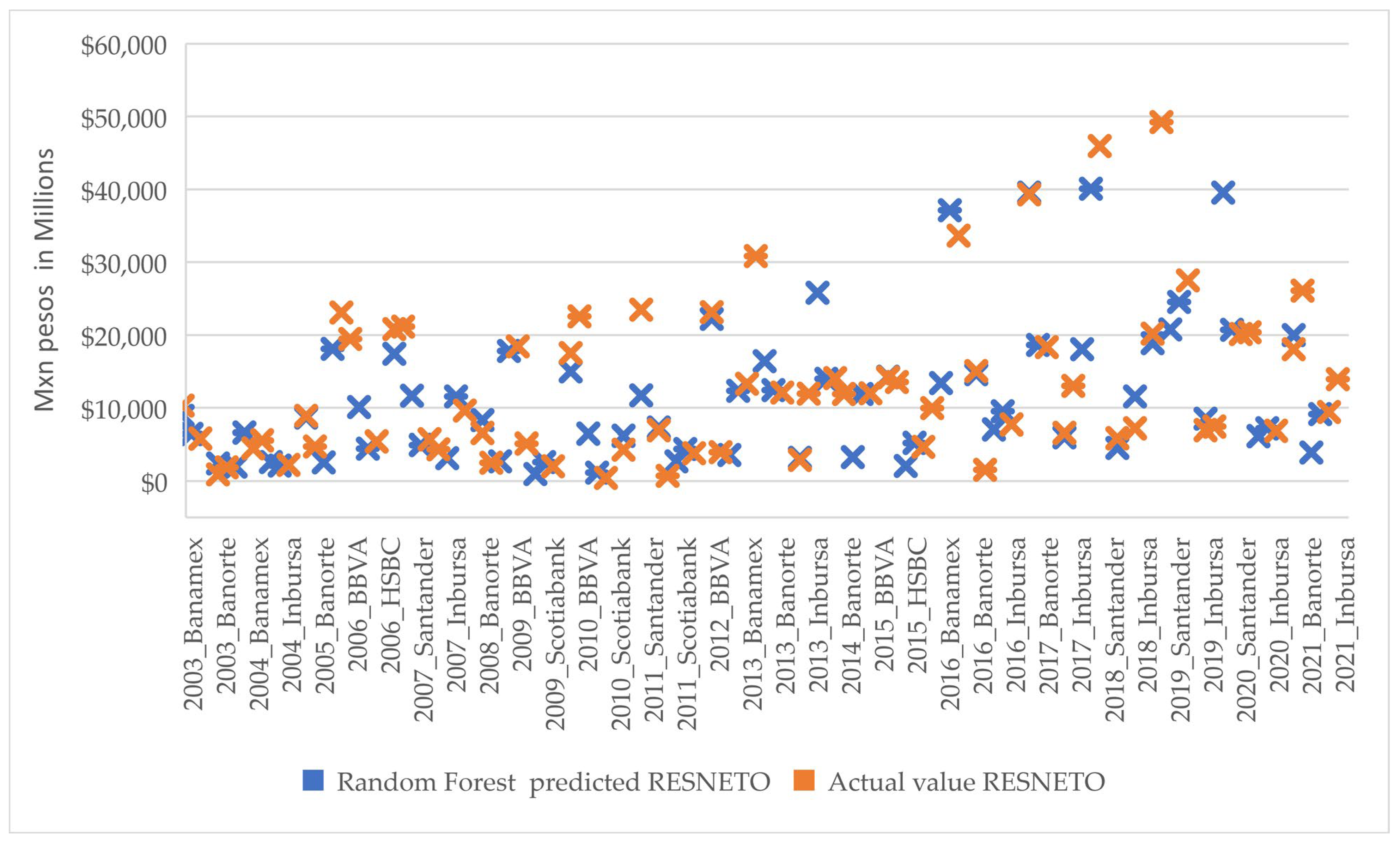

| Model | MAE Train Data Set | MAE Test Data Set |

|---|---|---|

| Random Forest | 1378.3 | 2605.4 |

| Linear Regression | 3873.9 | 5017.9 |

| Decision Tree | 1495.8 | 3090.3 |

| Component | Variance (%) | Cumulative Variance (%) |

|---|---|---|

| 1 | 50.791 | 50.791 |

| 2 | 22.558 | 73.350 |

| 3 | 12.843 | 86.193 |

| 4 | 6.362 | 92.555 |

| 5 | 3.418 | 95.973 |

| 6 | 2.505 | 98.479 |

| 7 | 0.783 | 99.262 |

| 8 | 0.060 | 99.864 |

| 9 | 0.001 | 100.000 |

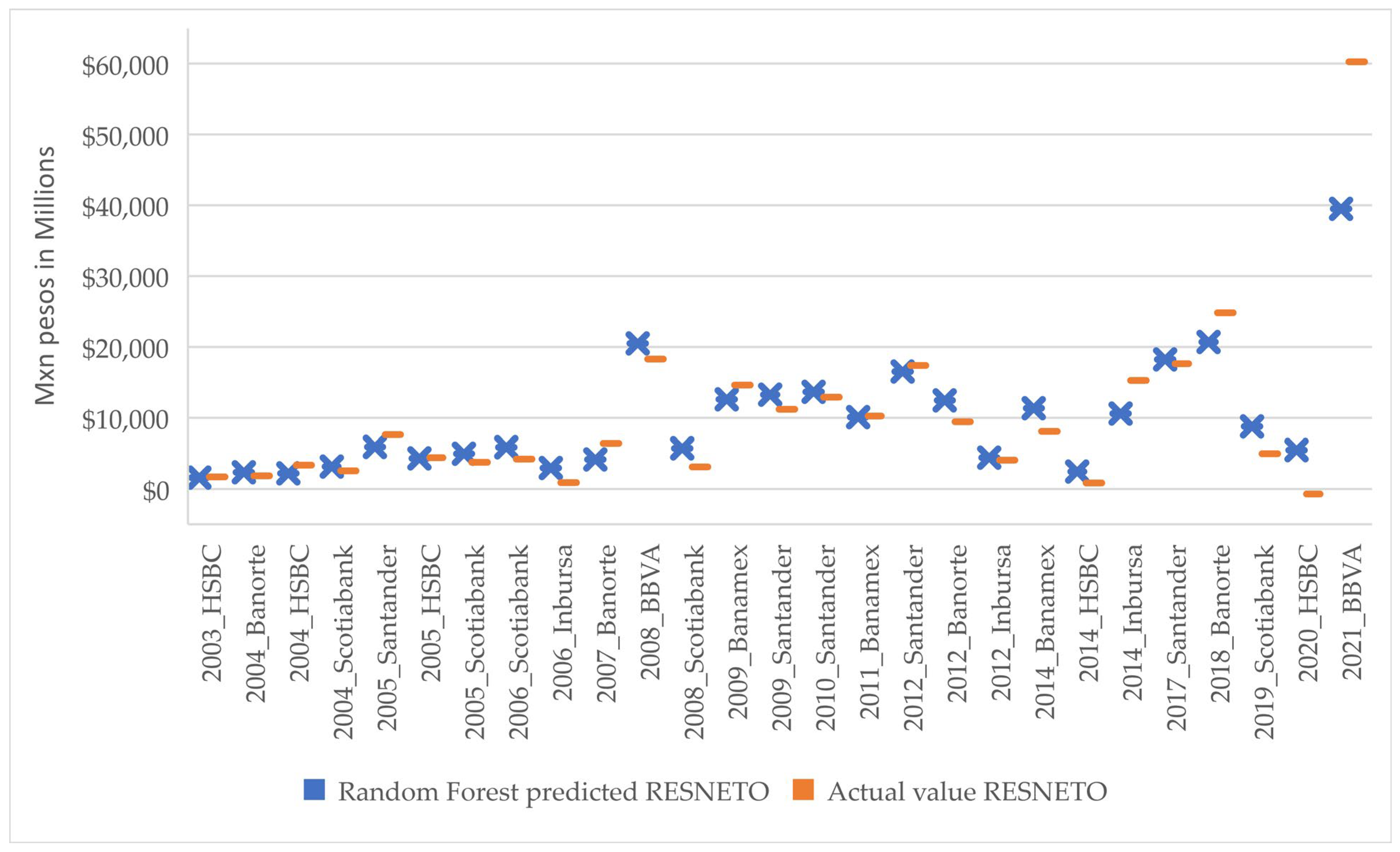

| Model | MAE Train Data Set | MAE Test Data Set |

|---|---|---|

| Random Forest | 1523.2 | 3372.7 |

| Linear Regression | 2740.3 | 3902.2 |

| Decision Tree | 1672.7 | 3771.2 |

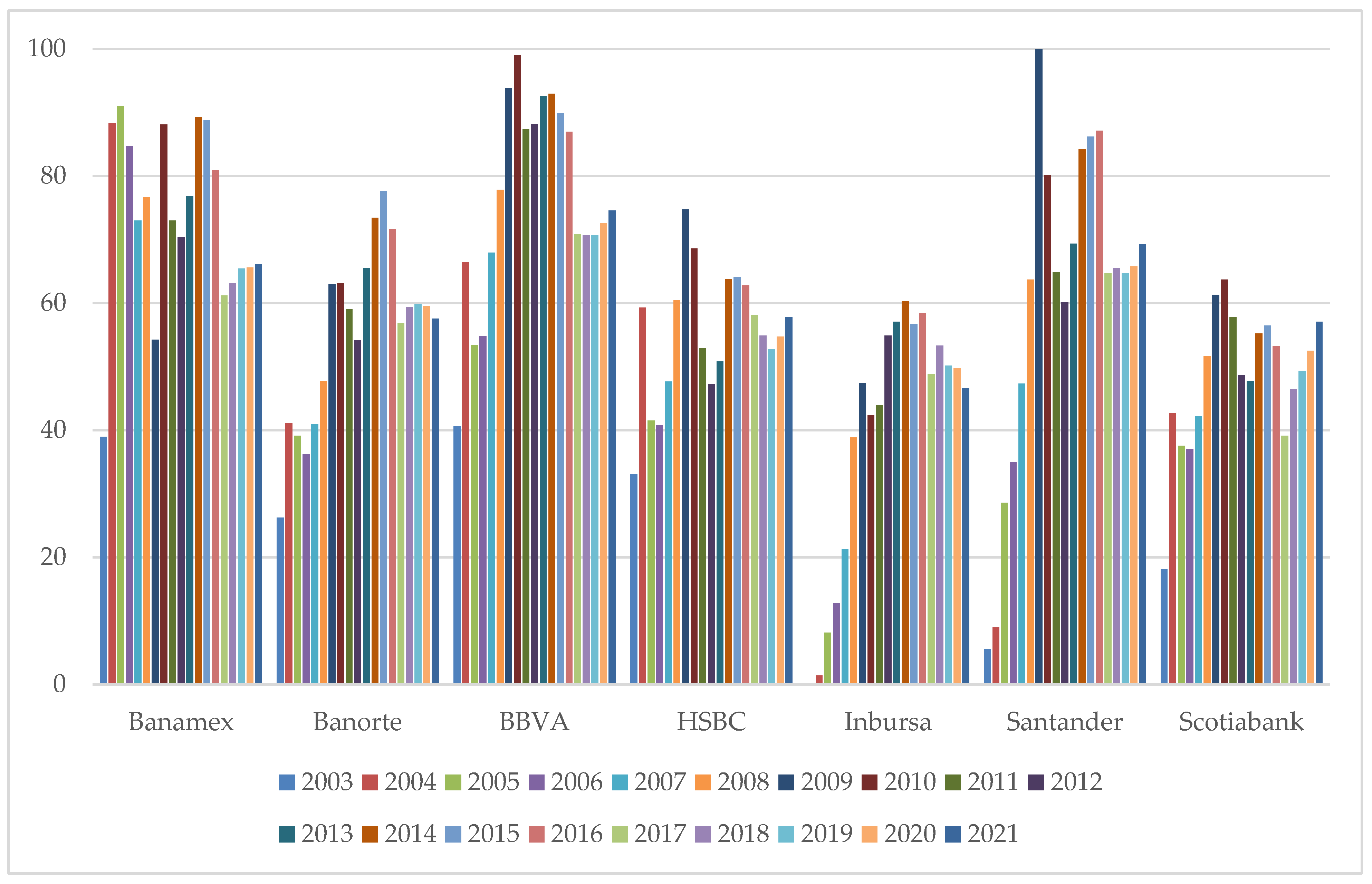

| Bank Performance Indicator | Bank Ranking Position by Year | Difference | |||

|---|---|---|---|---|---|

| Year_Bank | Index I | Index II | Index I | Index II | Ranking (Index I-II) |

| 2003_Banamex | 17.4 | 28.8 | 1 | 2 | −1 |

| 2003_Banorte | 10.0 | 11.1 | 4 | 5 | −1 |

| 2003_BBVA | 17.3 | 30.6 | 2 | 1 | 1 |

| 2003_Scotiabank | 8.9 | 11.9 | 5 | 4 | 1 |

| 2004_Banorte | 31.4 | 15.0 | 5 | 4 | 1 |

| 2004_Scotiabank | 43.0 | 14.5 | 4 | 3 | 1 |

| 2005_Banorte | 35.0 | 11.9 | 4 | 5 | −1 |

| 2005_HSBC | 32.1 | 13.8 | 5 | 3 | 2 |

| 2005_Scotiabank | 35.6 | 12.1 | 3 | 4 | −1 |

| 2006_Banorte | 29.3 | 11.6 | 4 | 6 | −2 |

| 2006_HSBC | 29.0 | 14.8 | 5 | 3 | 2 |

| 2006_Santander | 24.4 | 14.5 | 6 | 4 | 2 |

| 2006_Scotiabank | 33.2 | 12.2 | 3 | 5 | −2 |

| 2007_Banamex | 63.5 | 34.2 | 1 | 2 | −1 |

| 2007_BBVA | 49.4 | 40.4 | 2 | 1 | 1 |

| 2007_HSBC | 32.9 | 20.6 | 5 | 3 | 2 |

| 2007_Scotiabank | 37.5 | 14.7 | 3 | 5 | −2 |

| 2008_Banamex | 66.4 | 35.2 | 1 | 2 | −1 |

| 2008_Banorte | 35.9 | 18.8 | 6 | 5 | 1 |

| 2008_BBVA | 59.4 | 50.8 | 2 | 1 | 1 |

| 2008_HSBC | 46.5 | 31.5 | 5 | 3 | 2 |

| 2008_Santander | 53.9 | 27.7 | 3 | 4 | −1 |

| 2008_Scotiabank | 48.0 | 18.7 | 4 | 6 | −2 |

| 2009_Banamex | 43.6 | 23.9 | 6 | 5 | 1 |

| 2009_Banorte | 51.8 | 28.1 | 5 | 4 | 1 |

| 2009_BBVA | 77.3 | 68.1 | 2 | 1 | 1 |

| 2009_Santander | 100.0 | 44.8 | 1 | 2 | −1 |

| 2009_Scotiabank | 58.8 | 23.1 | 4 | 6 | −2 |

| 2010_Banorte | 52.6 | 26.7 | 6 | 5 | 1 |

| 2010_HSBC | 61.0 | 28.7 | 5 | 4 | 1 |

| 2010_Scotiabank | 61.5 | 23.7 | 4 | 6 | −2 |

| 2011_Banorte | 44.4 | 26.8 | 5 | 4 | 1 |

| 2011_HSBC | 40.8 | 21.8 | 6 | 5 | 1 |

| 2011_Santander | 52.2 | 29.9 | 4 | 3 | 1 |

| 2011_Scotiabank | 54.2 | 20.1 | 3 | 6 | −3 |

| 2012_Banorte | 37.4 | 25.4 | 6 | 4 | 2 |

| 2012_HSBC | 34.0 | 20.2 | 7 | 6 | 1 |

| 2012_Inbursa | 43.6 | 21.7 | 4 | 5 | −1 |

| 2012_Scotiabank | 42.7 | 16.8 | 5 | 7 | −2 |

| 2014_Inbursa | 48.4 | 26.2 | 5 | 6 | −1 |

| 2015_Banamex | 76.0 | 53.4 | 1 | 3 | −2 |

| 2015_BBVA | 67.5 | 77.8 | 3 | 1 | 2 |

| 2015_Inbursa | 41.9 | 25.6 | 7 | 6 | 1 |

| 2015_Scotiabank | 44.9 | 22.1 | 6 | 7 | −1 |

| 2016_Banamex | 65.3 | 52.9 | 2 | 3 | −1 |

| 2016_BBVA | 62.7 | 81.9 | 3 | 1 | 2 |

| 2016_Santander | 69.0 | 59.6 | 1 | 2 | −1 |

| 2017_Banamex | 38.3 | 48.3 | 4 | 3 | 1 |

| 2017_Banorte | 31.7 | 42.0 | 5 | 4 | 1 |

| 2017_BBVA | 40.7 | 80.8 | 2 | 1 | 1 |

| 2017_HSBC | 41.2 | 28.2 | 1 | 5 | −4 |

| 2017_Santander | 40.1 | 51.6 | 3 | 2 | 1 |

| 2018_Banorte | 32.5 | 49.8 | 6 | 4 | 2 |

| 2018_Inbursa | 36.6 | 24.6 | 4 | 6 | −2 |

| 2019_Banamex | 40.6 | 55.7 | 1 | 3 | −2 |

| 2019_Banorte | 32.1 | 53.8 | 5 | 4 | 1 |

| 2019_BBVA | 38.8 | 88.1 | 2 | 1 | 1 |

| 2019_HSBC | 31.6 | 31.8 | 6 | 5 | 1 |

| 2019_Inbursa | 34.6 | 21.5 | 4 | 7 | −3 |

| 2019_Santander | 38.1 | 57.2 | 3 | 2 | 1 |

| 2019_Scotiabank | 26.3 | 27.5 | 7 | 6 | 1 |

| 2020_Banamex | 40.8 | 56.9 | 1 | 3 | −2 |

| 2020_Banorte | 33.5 | 54.7 | 5 | 4 | 1 |

| 2020_BBVA | 40.0 | 96.6 | 2 | 1 | 1 |

| 2020_HSBC | 33.0 | 34.9 | 6 | 5 | 1 |

| 2020_Inbursa | 34.2 | 21.6 | 4 | 7 | −3 |

| 2020_Santander | 38.3 | 62.7 | 3 | 2 | 1 |

| 2020_Scotiabank | 28.3 | 31.9 | 7 | 6 | 1 |

| 2021_Banamex | 43.2 | 54.2 | 1 | 3 | −2 |

| 2021_Banorte | 31.0 | 50.9 | 7 | 4 | 3 |

| 2021_BBVA | 42.8 | 100.0 | 2 | 1 | 1 |

| 2021_HSBC | 36.6 | 34.8 | 4 | 6 | −2 |

| 2021_Inbursa | 31.5 | 18.0 | 6 | 7 | −1 |

| 2021_Santander | 42.4 | 66.2 | 3 | 2 | 1 |

| Year | Bank | Capital Adequacy 1/ | Asset Quality 2/ | Management 3/ | Earnings | Liquidity | Sensitivity 8/ | Camels index 9/ | ||

|---|---|---|---|---|---|---|---|---|---|---|

| ROA 4/ | ROE 5/ | L1 6/ | L2 7/ | |||||||

| 2021 | Banamex | 1.0 | 2.0 | 1.0 | 3.0 | 5.0 | 3.0 | 5.0 | 4.0 | 3.0 |

| 2021 | BBVA | 1.0 | 2.0 | 1.0 | 2.0 | 4.0 | 5.0 | 5.0 | 1.0 | 2.6 |

| 2021 | Santander | 1.0 | 2.0 | 1.0 | 3.0 | 5.0 | 5.0 | 5.0 | 3.0 | 3.1 |

| 2021 | Banorte | 1.0 | 1.0 | 1.0 | 2.0 | 4.0 | 5.0 | 5.0 | 1.0 | 2.5 |

| 2021 | HSBC | 3.0 | 2.0 | 1.0 | 5.0 | 5.0 | 4.0 | 5.0 | 1.0 | 3.3 |

| 2021 | Scotiabank | 2.0 | 2.0 | 1.0 | 3.0 | 5.0 | 5.0 | 5.0 | 1.0 | 3.0 |

| 2021 | Inbursa | 1.0 | 2.0 | 1.0 | 1.0 | 5.0 | 5.0 | 5.0 | 1.0 | 2.6 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

González-Rossano, C.; Terán-Bustamante, A.; Velázquez-Salazar, M.; Martínez-Velasco, A. What Drives Profit Income in Mexico’s Main Banks? Evidence Using Machine Learning. Sustainability 2023, 15, 5696. https://doi.org/10.3390/su15075696

González-Rossano C, Terán-Bustamante A, Velázquez-Salazar M, Martínez-Velasco A. What Drives Profit Income in Mexico’s Main Banks? Evidence Using Machine Learning. Sustainability. 2023; 15(7):5696. https://doi.org/10.3390/su15075696

Chicago/Turabian StyleGonzález-Rossano, Carlos, Antonia Terán-Bustamante, Marisol Velázquez-Salazar, and Antonieta Martínez-Velasco. 2023. "What Drives Profit Income in Mexico’s Main Banks? Evidence Using Machine Learning" Sustainability 15, no. 7: 5696. https://doi.org/10.3390/su15075696