Correction: Cheng, Y. Carbon Derivatives-Directed International Supervision Laws and Regulations and Carbon Market Mechanism. Sustainability 2022, 14, 16157

- (1)

- Adding missing subfigure(a) in Figure 9:

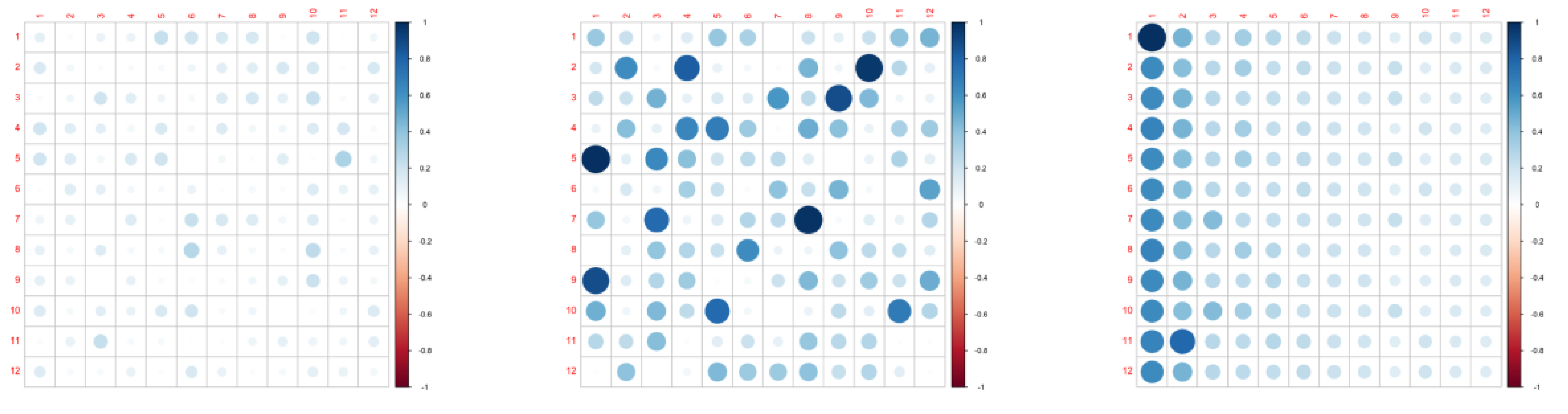

- with:Figure 9. Sparse graph of the coefficient estimation matrix. (a) Carbon Market trading volume Weighted yield. (b) Carbon Market Turnover Volume Weighted yield. Note: From left to right are Componentwise HVAR, lag-weighted Lasso and Lag Group. The sequence of variables in the figure is the same as above.Figure 9. Sparse graph of the coefficient estimation matrix. (a) Carbon Market trading volume Weighted yield. (b) Carbon Market Turnover Volume Weighted yield. Note: From left to right are Componentwise HVAR, lag-weighted Lasso and Lag Group. The sequence of variables in the figure is the same as above.

- (2)

- Adding explanation of Figure 9 in “Section 3”:

“the rise in the regional carbon emissions price will significantly increase the national level...Otherwise, there will be no positive spillover effect of rising energy prices leading to rising carbon emission rights prices.”

- with:

“It can be seen from the above tables that, when carbon emission weighted yield rate and national carbon yield rate data are introduced at the same time, thermal coal continuous and asphalt recent months will have a positive impact on the result, which has a certain effect on volume weighting, and asphalt futures also have a positive impact on the national carbon yield rate. So, the energy market has an impact on both the industry and all carbon revenue data. Additionally, relatively speaking, most of the other energy sources will have a positive impact on either the volume-weighted yield or the turnover-weighted yield, as well as the national carbon data yield.”

- (3)

- Replacing the sentences in “Section 3” on page 9:

- with:

- (4)

- Deleting the following sentences in “Section 3” on page 11:

- From the stock market, fuel futures and crude oil futures have a negative impact on the weighted yield of related industries, while coke futures have a positive impact on the weighted yield of related industries. The impact of industry-weighted yield on steam coal futures is negative. (in the paragraph before Table 2)

- and “, namely Lag-Weighted Lasso” (before Equation (2))

- (5)

- Correcting clerical errors:

- Replacing the sentences in “Section 2.5” on page 8:

- with

- Replacing the words in “Section 5” on page 12:

- with

- Replacing the sentences in “Section 2.3” on page 6:

- with

- Change Equation (3) to:

- (6)

- Replacing Tables with clerical errors:

| Carbon Market Trading Volume Weighted Yield | Carbon Market Business Volume Weighted Yield | |

|---|---|---|

| Componentwise HVAR | 0.0000221 | 0.00000503 |

| Lag-Weighted Lasso | 0.000889679 | 0.000442365 |

| Lag group | 0.01001355 | 0.000152958 |

- with

| Carbon Market Trading Volume Weighted Yield | Carbon Market Turnover Volume Weighted Yield | |

|---|---|---|

| Lag group | 0.0000221 | 0.00000503 |

| Componentwise HVAR | 0.000889679 | 0.000442365 |

| Lag-Weighted Lasso | 0.01001355 | 0.000152958 |

- Changing “Strong” influence into “General” influence

- Changing Carbon Market “trading” volume Weighted yield Carbon Market “turnover” volume Weighted yield

| Variables Affecting the Price of Carbon Emission Rights | |||||

|---|---|---|---|---|---|

| Lag Group | Strong Influence | Strong Influence | Lag Group | Strong Influence | Strong Influence |

| Carbon Market trading volume Weighted yield | Steam coal continuous (+) Asphalt in the recent month (+) Coke in the recent month (-) | corporate debt index(+) Crude oil in the recent month (+) Fuel in the recent month (+) | Carbon Market trading volume Weighted yield | Steam coal continuous * (+) Crude oil in the recent month (+) * | |

| National carbon market yield | Steam coal continuous(-) National debt index−) Asphalt in the recent month (+) Coke in the recent month (-) | CSI300(+) corporate debt index(+) Crude oil in the recent month (+) Fuel in the recent month (+) USD to RMB (CFETS) (+) | |||

| variables affected by the carbon emission market | |||||

| Carbon Market trading volume Weighted yield | corporate debt index(-) USD to RMB (CFETS)(+) SHIBOR Overnight (+) | National debt index(+) Asphalt in the recent month (+) Fuel in the recent month (+) | Carbon Market trading volume Weighted yield | Asphalt in the recent month (+) Fuel in the recent month (+) USD to RMB (CFETS) (+) | SHIBOR Overnight (+) |

| National carbon market yield | corporate debt index(-) National debt index(-) Asphalt in the recent month (+) Coke in the recent month (-) | Industry weighted yield (+) CSI300(+) Crude oil in the recent month (+) Fuel in the recent month (+) | |||

- with:

| Variables Affecting the Price of Carbon Emission Rights | |||||

|---|---|---|---|---|---|

| Lag Group | Strong Influence | General Influence | Lag Group | Strong Influence | General Influence |

| Carbon Market trading volume Weighted yield | Steam coal continuous (+) Asphalt in the recent month (+) Coke in the recent month (-) | corporate debt index(+) Crude oil in the recent month (+) Fuel in the recent month (+) | Carbon Market turnover volume Weighted yield | Steam coal continuous * (+) Crude oil in the recent month (+) * | |

| National carbon market yield | Steam coal continuous(-) National debt index(-) Asphalt in the recent month (+) Coke in the recent month (-) | CSI300(+) corporate debt index(+) Crude oil in the recent month (+) Fuel in the recent month (+) USD to RMB (CFETS) (+) | |||

| variables affected by the carbon emission market | |||||

| Carbon Market trading volume Weighted yield | corporate debt index(-) USD to RMB (CFETS)(+) SHIBOR Overnight (+) | National debt index(+) Asphalt in the recent month (+) Fuel in the recent month (+) | Carbon Market turnover volume Weighted yield | Asphalt in the recent month (+) Fuel in the recent month (+) USD to RMB (CFETS) (+) | SHIBOR Overnight (+) |

| National carbon market yield | corporate debt index(-) National debt index(-) Asphalt in the recent month (+) Coke in the recent month (-) | Industry weighted yield (+) CSI300(+) Crude oil in the recent month (+) Fuel in the recent month (+) | |||

- (7)

- The authors wish to add a reference citation in Section 2.3 (page 5)

- with

- (8)

- Adding a reference in the citation list:

- Replacing the original reference 24:

- with

Reference

- Cheng, Y. Carbon Derivatives-Directed International Supervision Laws and Regulations and Carbon Market Mechanism. Sustainability 2022, 14, 16157. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, Y. Correction: Cheng, Y. Carbon Derivatives-Directed International Supervision Laws and Regulations and Carbon Market Mechanism. Sustainability 2022, 14, 16157. Sustainability 2023, 15, 5976. https://doi.org/10.3390/su15075976

Cheng Y. Correction: Cheng, Y. Carbon Derivatives-Directed International Supervision Laws and Regulations and Carbon Market Mechanism. Sustainability 2022, 14, 16157. Sustainability. 2023; 15(7):5976. https://doi.org/10.3390/su15075976

Chicago/Turabian StyleCheng, Yao. 2023. "Correction: Cheng, Y. Carbon Derivatives-Directed International Supervision Laws and Regulations and Carbon Market Mechanism. Sustainability 2022, 14, 16157" Sustainability 15, no. 7: 5976. https://doi.org/10.3390/su15075976

APA StyleCheng, Y. (2023). Correction: Cheng, Y. Carbon Derivatives-Directed International Supervision Laws and Regulations and Carbon Market Mechanism. Sustainability 2022, 14, 16157. Sustainability, 15(7), 5976. https://doi.org/10.3390/su15075976