Industry and Regional Peer Effects in Corporate Digital Transformation: The Moderating Effects of TMT Characteristics

Abstract

:1. Introduction

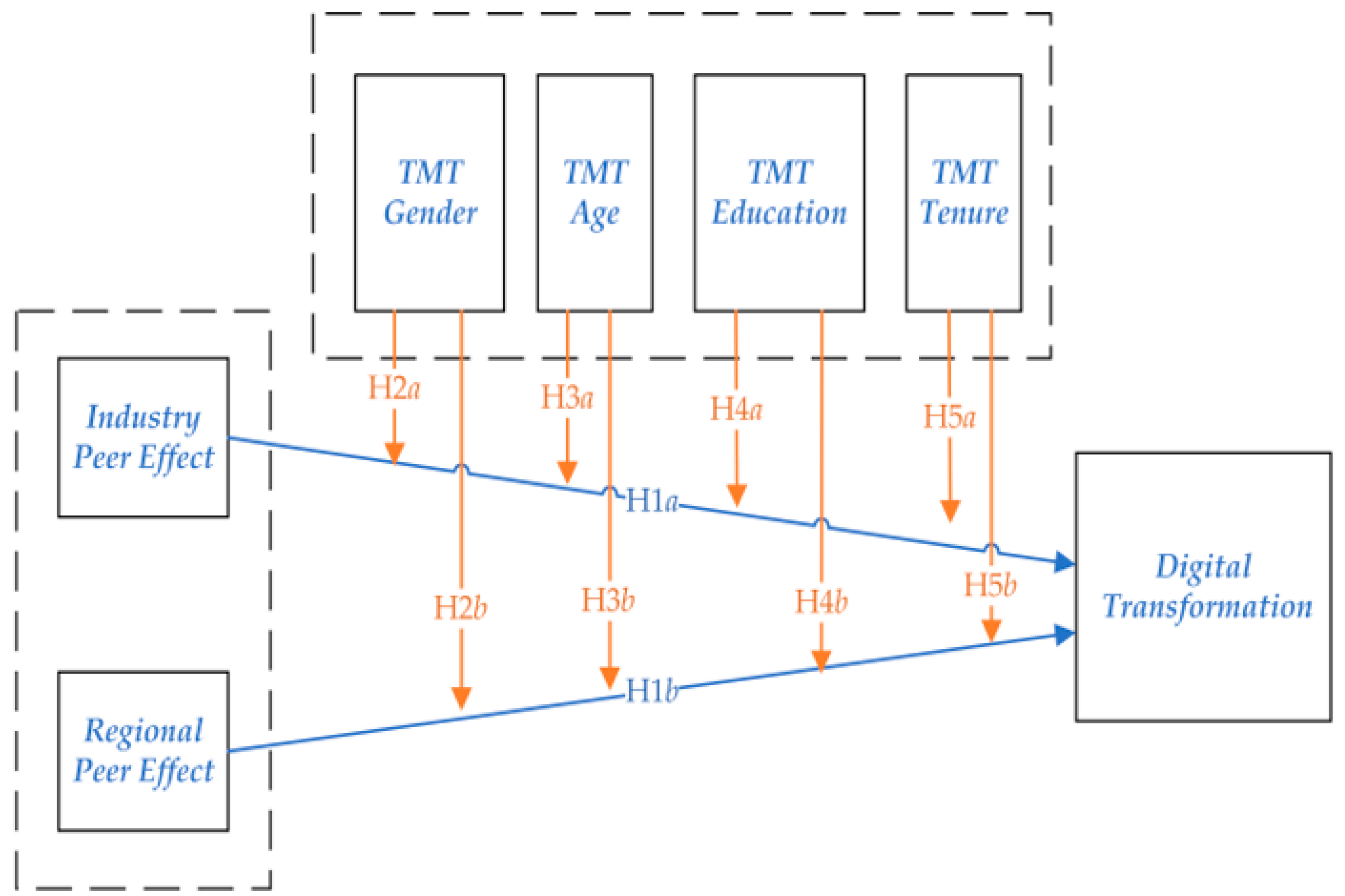

2. Hypothesis Development

2.1. Peer Effect in Digital Transformation

2.2. The Moderating Effects of TMT Gender

2.3. The Moderating Effects of TMT Age

2.4. The Moderating Effects of TMT Education

2.5. The Moderating Effects of TMT Tenure

3. Research Methodology

3.1. Variable Definition

3.1.1. Explained Variable

3.1.2. Explanatory Variable

3.1.3. Moderating Variable

3.1.4. Control Variable

3.2. Model Design

3.2.1. Baseline Empirical Model

3.2.2. Moderating Effect Model

3.3. Data

4. Empirical Results and Analyses

4.1. Descriptive Statistics and Correlation Analysis

4.2. Test of the Peer Effect in Digital Transformation

4.3. Testing the Moderating Effect of TMT Characteristics

4.4. Robustness Tests

4.5. Further Analysis

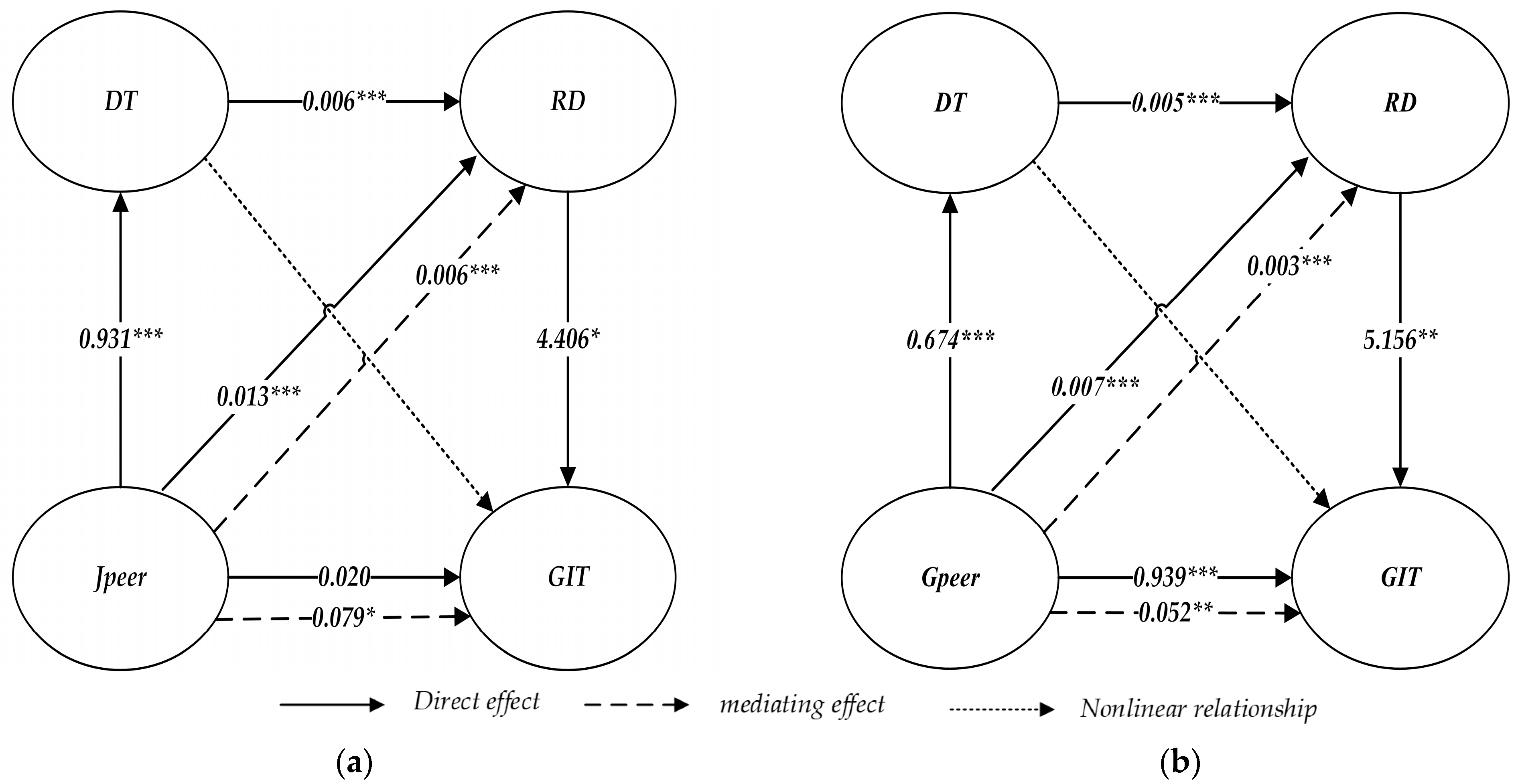

4.5.1. The Impact of Digital Transformation on Corporate Green Technology Innovation

4.5.2. The Impact Mechanism of Digital Transformation on Corporate Green Innovation

5. Conclusions and Discussion

5.1. New Finding and Discussion

5.2. Management Enlightenment and Policy Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adner, R.; Puranam, P.; Zhu, F. What is different about digital strategy? From quantitative to qualitative change. Strategy Sci. 2019, 4, 253–261. [Google Scholar] [CrossRef] [Green Version]

- Zhao, M.; Liu, R.; Dai, D. Synergistic effect between China’s digital transformation and economic development: A study based on sustainable development. Sustainability 2021, 13, 13773. [Google Scholar] [CrossRef]

- Zhao, S.; Zhang, Y.; Iftikhar, H.; Ullah, A.; Mao, J.; Wang, T. Dynamic Influence of Digital and Technological Advancement on Sustainable Economic Growth in Belt and Road Initiative (BRI) Countries. Sustainability 2022, 14, 15782. [Google Scholar] [CrossRef]

- Pilipczuk, O. Transformation of the Business Process Manager Profession in Poland: The Impact of Digital Technologies. Sustainability 2021, 13, 13690. [Google Scholar] [CrossRef]

- Zhai, H.; Yang, M.; Chan, K.C. Does digital transformation enhance a firm’s performance? Evidence from China. Technol. Soc. 2022, 68, 101841. [Google Scholar] [CrossRef]

- Palanisamy, S.; Chelliah, S.; Muthuveloo, R. Optimization of Organisational Performance among Malaysian Manufacturing SMEs in Digital Age via Talent Farming. J. Entrep. Bus. Econ. 2021, 9, 82–120. [Google Scholar]

- Chen, H.; Zhu, H.; Sun, T.; Chen, X.; Wang, T.; Li, W. Does Environmental Regulation Promote Corporate Green Innovation? Empirical Evidence from Chinese Carbon Capture Companies. Sustainability 2023, 15, 1640. [Google Scholar] [CrossRef]

- Ren, Y.; Li, B. Digital Transformation, Green Technology Innovation and Enterprise Financial Performance: Empirical Evidence from the Textual Analysis of the Annual Reports of Listed Renewable Energy Enterprises in China. Sustainability 2022, 15, 712. [Google Scholar] [CrossRef]

- Xu, P.; Chen, L.; Dai, H. Pathways to Sustainable Development: Corporate Digital Transformation and Environmental Performance in China. Sustainability 2022, 15, 256. [Google Scholar] [CrossRef]

- Dana, L.-P.; Salamzadeh, A.; Mortazavi, S.; Hadizadeh, M.; Zolfaghari, M. Strategic futures studies and entrepreneurial resiliency: A focus on digital technology trends and emerging markets. Tec. Empres. 2022, 16, 87–100. [Google Scholar]

- Salamzadeh, Y.; Farzad, F.S.; Salamzadeh, A.; Palalić, R. Digital leadership and organizational capabilities in manufacturing industry: A study in Malaysian context. Period. Eng. Nat. Sci. 2021, 10, 195–211. [Google Scholar]

- Soon, C.C.; Salamzadeh, Y. The impact of digital leadership competencies on virtual team effectiveness in mnc companies in penang, Malaysia. J. Entrep. Bus. Econ. 2021, 8, 219–253. [Google Scholar]

- Li, D.; Shen, W. Can corporate digitalization promote green innovation? The moderating roles of internal control and institutional ownership. Sustainability 2021, 13, 13983. [Google Scholar] [CrossRef]

- Niu, S.; Park, B.I.; Jung, J.S. The Effects of Digital Leadership and ESG Management on Organizational Innovation and Sustainability. Sustainability 2022, 14, 15639. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A systematic review of the literature on digital transformation: Insights and implications for strategy and organizational change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Baierle, I.C.; da Silva, F.T.; de Faria Correa, R.G.; Schaefer, J.L.; Da Costa, M.B.; Benitez, G.B.; Benitez Nara, E.O. Competitiveness of Food Industry in the Era of Digital Transformation towards Agriculture 4.0. Sustainability 2022, 14, 11779. [Google Scholar] [CrossRef]

- Zhang, Z.; Shang, Y.; Cheng, L.; Hu, A. Big data capability and sustainable competitive advantage: The mediating role of ambidextrous innovation strategy. Sustainability 2022, 14, 8249. [Google Scholar] [CrossRef]

- Manski, C.F. Identification of endogenous social effects: The reflection problem. Rev. Econ. Stud. 1993, 60, 531–542. [Google Scholar] [CrossRef] [Green Version]

- Foell, A.; Pitzer, K.A.; Nebbitt, V.; Lombe, M.; Yu, M.; Villodas, M.L.; Newransky, C. Exposure to community violence and depressive symptoms: Examining community, family, and peer effects among public housing youth. Health Place 2021, 69, 102579. [Google Scholar] [CrossRef]

- Wu, G.; Cheng, J.; Yang, F. The Influence of the Peer Effect on Farmers’ Agricultural Insurance Decision: Evidence from the Survey Data of the Karst Region in China. Sustainability 2022, 14, 11922. [Google Scholar] [CrossRef]

- Zwier, D.; Geven, S.; Bol, T.; Van de Werfhorst, H.G. Let’s Stick Together: Peer Effects in Secondary School Choice and Variations by Student Socio-Economic Background. Eur. Sociol. Rev. 2023, 39, 67–84. [Google Scholar] [CrossRef]

- Coveney, M.; Oosterveen, M. What drives ability peer effects? Eur. Econ. Rev. 2021, 136, 103763. [Google Scholar] [CrossRef]

- Gu, Y.; Ben, S.; Lv, J. Peer effect in merger and acquisition activities and its impact on corporate sustainable development: Evidence from China. Sustainability 2022, 14, 3891. [Google Scholar] [CrossRef]

- ZHANG, X.; YAO, H.; DU, X. The Peer Effect of Serial Mergers and Acquisitions and the Internal Control of Enterprises. J. Northeast. Univ. (Soc. Sci.) 2021, 23, 22. [Google Scholar]

- Leary, M.T.; Roberts, M.R. Do peer firms affect corporate financial policy? J. Financ. 2014, 69, 139–178. [Google Scholar] [CrossRef]

- Ajirloo, B.F.; Switzer, L.N. Self-disclosed peer effects on corporate capital structure. J. Int. Financ. Mark. Inst. Money 2022, 78, 101562. [Google Scholar] [CrossRef]

- Fairhurst, D.; Nam, Y. Corporate governance and financial peer effects. Financ. Manag. 2020, 49, 235–263. [Google Scholar] [CrossRef]

- Zhuang, Y.; Nie, J.; Wu, W. Peer influence and the value of cash holdings. J. Empir. Financ. 2022, 69, 265–284. [Google Scholar] [CrossRef]

- Chen, Y.-W.; Chan, K.; Chang, Y. Peer effects on corporate cash holdings. Int. Rev. Econ. Financ. 2019, 61, 213–227. [Google Scholar] [CrossRef]

- Machokoto, M.; Chipeta, C.; Ibeji, N. The institutional determinants of peer effects on corporate cash holdings. J. Int. Financ. Mark. Inst. Money 2021, 73, 101378. [Google Scholar] [CrossRef]

- Liang, Q.; Li, Q.; Lu, M.; Shan, Y. Industry and geographic peer effects on corporate tax avoidance: Evidence from China. Pac.-Basin Financ. J. 2021, 67, 101545. [Google Scholar] [CrossRef]

- Seo, H. Peer effects in corporate disclosure decisions. J. Account. Econ. 2021, 71, 101364. [Google Scholar] [CrossRef]

- Li, C.; Wang, X. Local peer effects of corporate social responsibility. J. Corp. Financ. 2022, 73, 102187. [Google Scholar] [CrossRef]

- Pan, X.; Xu, G.; Zhu, N. Spatial Peer Effect of Enterprises’ Digital Transformation: Empirical Evidence from Spatial Autoregressive Models. Sustainability 2022, 14, 12576. [Google Scholar] [CrossRef]

- Cerqueti, R.; Lucarelli, C.; Marinelli, N.; Micozzi, A. Teams in new ventures: Gender, human capital and motivation. Int. J. Gend. Entrep. 2020, 12, 145–171. [Google Scholar] [CrossRef]

- Firk, S.; Gehrke, Y.; Hanelt, A.; Wolff, M. Top management team characteristics and digital innovation: Exploring digital knowledge and TMT interfaces. Long Range Plan. 2022, 55, 102166. [Google Scholar] [CrossRef]

- Chen, Y.; Li, R.; Song, T. Does TMT internationalization promote corporate digital transformation? A study based on the cognitive process mechanism. Bus. Process Manag. J. 2023, 29, 309–338. [Google Scholar] [CrossRef]

- De Lomana, G.G.; Strese, S.; Brinckmann, J. Adjusting to the digital age: The effects of TMT characteristics on the digital orientation of firms. Acad Manag Proc 2019, 2019, 13589. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Shepherd, D.A.; Mcmullen, J.S.; Ocasio, W. Is that an opportunity? An attention model of top managers’ opportunity beliefs for strategic action. Strateg. Manag. J. 2017, 38, 626–644. [Google Scholar] [CrossRef]

- Zhao, W.; Ye, G.; Xu, G.; Liu, C.; Deng, D.; Huang, M. CSR and Long-Term Corporate Performance: The Moderating Effects of Government Subsidies and Peer Firm’s CSR. Sustainability 2022, 14, 5543. [Google Scholar] [CrossRef]

- Uzo, U.; Mair, J. Source and Patterns of Organizational Defiance of Formal Institutions: Insights from Nollywood, the N igerian Movie Industry. Strateg. Entrep. J. 2014, 8, 56–74. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef] [Green Version]

- Chelli, M.; Durocher, S.; Richard, J. France’s new economic regulations: Insights from institutional legitimacy theory. Account. Audit. Account. J. 2014, 27, 283–316. [Google Scholar] [CrossRef]

- Scharfstein, D.S.; Stein, J.C. Herd behavior and investment. Am. Econ. Rev. 1990, 80, 465–479. [Google Scholar]

- Johnsson, I.; Moon, H.R. Estimation of peer effects in endogenous social networks: Control function approach. Rev. Econ. Stat. 2021, 103, 328–345. [Google Scholar] [CrossRef] [Green Version]

- Lieberman, M.B.; Asaba, S. Why do firms imitate each other? Acad. Manag. Rev. 2006, 31, 366–385. [Google Scholar] [CrossRef] [Green Version]

- Core, J.E.; Abramova, I.; Verdi, R.S. Geographic spillovers and corporate decisions. SSRN Electron. J. 2016. [Google Scholar] [CrossRef]

- Parsons, C.A.; Sulaeman, J.; Titman, S. The geography of financial misconduct. J. Financ. 2018, 73, 2087–2137. [Google Scholar] [CrossRef]

- Bathelt, H.; Malmberg, A.; Maskell, P. Clusters and knowledge: Local buzz, global pipelines and the process of knowledge creation. Prog. Hum. Geogr. 2004, 28, 31–56. [Google Scholar] [CrossRef]

- Gao, W.; Ng, L.; Wang, Q. Does corporate headquarters location matter for firm capital structure? Financ. Manag. 2011, 40, 113–138. [Google Scholar] [CrossRef]

- Beugnot, J.; Fortin, B.; Lacroix, G.; Villeval, M.C. Gender and peer effects on performance in social networks. Eur. Econ. Rev. 2019, 113, 207–224. [Google Scholar] [CrossRef]

- Ullah, I.; Fang, H.; Jebran, K. Do gender diversity and CEO gender enhance firm’s value? Evidence from an emerging economy. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 44–66. [Google Scholar] [CrossRef]

- Bogdan, V.; Popa, D.-N.; Beleneşi, M.; Rus, L.; Scorțe, C.-M. Gender Diversity and Business Performance Nexus: A Synoptic Panorama Based on Bibliometric Network Analysis. Sustainability 2023, 15, 1801. [Google Scholar] [CrossRef]

- Usman, M.; Gull, A.A.; Zalata, A.M.; Wang, F.; Yin, J. Female board directorships and related party transactions. Br. J. Manag. 2022, 33, 678–702. [Google Scholar] [CrossRef]

- Proença, C.; Augusto, M.; Murteira, J. Political connections and banking performance: The moderating effect of gender diversity. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 1001–1028. [Google Scholar] [CrossRef]

- Ma, R.; Lv, W.; Zhao, Y. The Impact of TMT Experience Heterogeneity on Enterprise Innovation Quality: Empirical Analysis on Chinese Listed Companies. Sustainability 2022, 14, 16571. [Google Scholar] [CrossRef]

- Xie, X.; Han, Y.; Hoang, T.T. Can green process innovation improve both financial and environmental performance? The roles of TMT heterogeneity and ownership. Technol. Forecast. Soc. Change 2022, 184, 122018. [Google Scholar] [CrossRef]

- Wang, Y.; Su, Q.; Sun, W. CEO relational leadership and product innovation performance: The roles of TMT behavior and characteristics. Front. Psychol. 2022, 13, 2040. [Google Scholar] [CrossRef]

- Heyden, M.L.; Reimer, M.; Van Doorn, S. Innovating beyond the horizon: CEO career horizon, top management composition, and R&D intensity. Hum. Resour. Manag. 2017, 56, 205–224. [Google Scholar]

- Bengtsson, M.; Raza-Ullah, T.; Srivastava, M.K. Looking different vs thinking differently: Impact of TMT diversity on coopetition capability. Long Range Plan. 2020, 53, 101857. [Google Scholar] [CrossRef]

- Xi, Z.; Tiebo, S.; Weihong, C.; Yimin, W. CEO Tenure, TMT Characteristics and Strategic Change. Foreign Econ. Manag. 2019, 41, 3–16. [Google Scholar]

- Wiersema, M.F.; Bantel, K.A. Top management team demography and corporate strategic change. Acad. Manag. J. 1992, 35, 91–121. [Google Scholar] [CrossRef]

- Mojambo, G.; Tulung, J.E.; Saerang, R.T. The Influence of Top Management Team (TMT) Characteristics toward Indonesian Banks Performance during the Digital Era (2014–2018); University Library of Munich: München, Germany, 2020. [Google Scholar]

- Pham, T.-D.T.; Lo, F.-Y. How does top management team diversity influence firm performance? A causal complexity analysis. Technol. Forecast. Soc. Change 2023, 186, 122162. [Google Scholar] [CrossRef]

- Wangrow, D.B.; Schepker, D.J.; Barker III, V.L. When does CEO succession lead to strategic change? The mediating role of top management team replacement. J. Gen. Manag. 2022, 03063070221126267. [Google Scholar] [CrossRef]

- Michel, J.G.; Hambrick, D.C. Diversification posture and top management team characteristics. Acad. Manag. J. 1992, 35, 9–37. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Wei, J.; Zhang, Y. The Impact of Tom Management Team Heterogeneity on Corporate Performance-An Empirical Study Based on Chinese Listed Companies from 2008–2019. Adv. Manag. Appl. Econ. 2023, 13, 71–92. [Google Scholar]

- Huang, J.; Kisgen, D.J. Gender and corporate finance: Are male executives overconfident relative to female executives? J. Financ. Econ. 2013, 108, 822–839. [Google Scholar] [CrossRef]

- Raza-Ullah, T.; Stadtler, L.; Fernandez, A.-S. The individual manager in the spotlight: Protecting sensitive knowledge in inter-firm coopetition relationships. Ind. Mark. Manag. 2023, 110, 85–95. [Google Scholar] [CrossRef]

- Gul, F.A.; Srinidhi, B.; Ng, A.C. Does board gender diversity improve the informativeness of stock prices? J. Account. Econ. 2011, 51, 314–338. [Google Scholar] [CrossRef]

- Malmendier, U.; Tate, G. CEO overconfidence and corporate investment. J. Financ. 2005, 60, 2661–2700. [Google Scholar] [CrossRef] [Green Version]

- Liu, X.; Huang, Y.; Kim, J.; Na, S. How Ethical Leadership Cultivates Innovative Work Behaviors in Employees? Psychological Safety, Work Engagement and Openness to Experience. Sustainability 2023, 15, 3452. [Google Scholar] [CrossRef]

- McClelland, P.L.; Liang, X.; Barker III, V.L. CEO commitment to the status quo: Replication and extension using content analysis. J. Manag. 2010, 36, 1251–1277. [Google Scholar] [CrossRef]

- El-Kassar, A.-N.; Singh, S.K. Green innovation and organizational performance: The influence of big data and the moderating role of management commitment and HR practices. Technol. Forecast. Soc. Change 2019, 144, 483–498. [Google Scholar] [CrossRef]

- Mubarak, M.F.; Tiwari, S.; Petraite, M.; Mubarik, M.; Raja Mohd Rasi, R.Z. How Industry 4.0 technologies and open innovation can improve green innovation performance? Manag. Environ. Qual. Int. J. 2021, 32, 1007–1022. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Fathi, M. Industry 4.0 and opportunities for energy sustainability. J. Clean. Prod. 2021, 295, 126427. [Google Scholar] [CrossRef]

- Chiarini, A. Industry 4.0 technologies in the manufacturing sector: Are we sure they are all relevant for environmental performance? Bus. Strategy Environ. 2021, 30, 3194–3207. [Google Scholar] [CrossRef]

- Bai, Y.; Song, S.; Jiao, J.; Yang, R. The impacts of government R&D subsidies on green innovation: Evidence from Chinese energy-intensive firms. J. Clean. Prod. 2019, 233, 819–829. [Google Scholar]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef] [PubMed]

- Brunetti, F.; Matt, D.T.; Bonfanti, A.; De Longhi, A.; Pedrini, G.; Orzes, G. Digital transformation challenges: Strategies emerging from a multi-stakeholder approach. TQM J. 2020, 32, 697–724. [Google Scholar] [CrossRef]

- Garzoni, A.; De Turi, I.; Secundo, G.; Del Vecchio, P. Fostering digital transformation of SMEs: A four levels approach. Manag. Decis. 2020, 58, 1543–1562. [Google Scholar] [CrossRef]

- Manita, R.; Elommal, N.; Baudier, P.; Hikkerova, L. The digital transformation of external audit and its impact on corporate governance. Technol. Forecast. Soc. Change 2020, 150, 119751. [Google Scholar] [CrossRef]

- Fenwick, M.; Vermeulen, E.P. Technology and corporate governance: Blockchain, crypto, and artificial intelligence. Tex. J. Bus. L. 2019, 48, 1. [Google Scholar] [CrossRef] [Green Version]

- Porfírio, J.A.; Carrilho, T.; Felício, J.A.; Jardim, J. Leadership characteristics and digital transformation. J. Bus. Res. 2021, 124, 610–619. [Google Scholar] [CrossRef]

- Nicolas-Agustin, A.; Jimenez-Jimenez, D.; Maeso-Fernandez, F. The role of human resource practices in the implementation of digital transformation. Int. J. Manpow. 2022, 43, 395–410. [Google Scholar] [CrossRef]

- Blanka, C.; Krumay, B.; Rueckel, D. The interplay of digital transformation and employee competency: A design science approach. Technol. Forecast. Soc. Change 2022, 178, 121575. [Google Scholar] [CrossRef]

- Fenech, R.; Baguant, P.; Ivanov, D. The changing role of human resource management in an era of digital transformation. J. Manag. Inf. Decis. Sci. 2019, 22, 166–175. [Google Scholar]

- Chen, C.-L.; Lin, Y.-C.; Chen, W.-H.; Chao, C.-F.; Pandia, H. Role of government to enhance digital transformation in small service business. Sustainability 2021, 13, 1028. [Google Scholar] [CrossRef]

- Bin, M.; Hui, G. A systematic review of factors influencing digital transformation of SMEs. Turk. J. Comput. Math. Educ. (TURCOMAT) 2021, 12, 1673–1686. [Google Scholar]

- Khanna, M. Digital transformation of the agricultural sector: Pathways, drivers and policy implications. Appl. Econ. Perspect. Policy 2021, 43, 1221–1242. [Google Scholar] [CrossRef]

- Schneck, S.; Nejadhossein Soudani, S. CEO Overconfidence and Corporate Social Performance: The Moderating Effect of TMT Overconfidence. In Academy of Management Proceedings; Academy of Management: Briarcliff Manor, NY, USA, 2022; p. 15689. [Google Scholar]

- Saeed, A.; Baloch, M.S.; Riaz, H. Global insights on TMT gender diversity in controversial industries: A legitimacy perspective. J. Bus. Ethics 2021, 179, 711–731. [Google Scholar] [CrossRef]

- Ozdemir, O.; Erkmen, E. Top management team gender diversity and firm risk-taking in the hospitality industry. Int. J. Contemp. Hosp. Manag. 2022, 34, 1739–1767. [Google Scholar] [CrossRef]

- Zhang, Y.; Cao, C.; Gu, J.; Garg, H. The Impact of Top Management Team Characteristics on the Risk Taking of Chinese Private Construction Enterprises. Systems 2023, 11, 67. [Google Scholar] [CrossRef]

- Fraseur, S.; Terry, R.P. Behind in the count: TMT gender diversity in male-dominated industries. Int. J. Employ. Stud. 2022, 30, 6–32. [Google Scholar]

- Rong, P.; Wang, C. CEO turnover, leadership identity, and TMT creativity in a cross-cultural context. Front. Psychol. 2021, 12, 610526. [Google Scholar] [CrossRef]

- Ahmed, U. Imitation in Foreign Location Choice: The Role of Upper Echelons’ Diversity. Ph.D. Thesis, Victoria University of Wellington, Wellington, New Zealand, 2019. [Google Scholar]

- Cortes-Mejia, S.; Cortes, A.F.; Herrmann, P. Pursuing greater good by reducing power: CEO humility, TMT decentralization, and ethical culture. In Academy of Management Proceedings; Academy of Management: Briarcliff Manor, NY, USA, 2020; p. 13927. [Google Scholar]

- Chen, S.; Ma, H. Peer effects in decision-making: Evidence from corporate investment. China J. Account. Res. 2017, 10, 167–188. [Google Scholar] [CrossRef]

- Usai, A.; Fiano, F.; Petruzzelli, A.M.; Paoloni, P.; Briamonte, M.F.; Orlando, B. Unveiling the impact of the adoption of digital technologies on firms’ innovation performance. J. Bus. Res. 2021, 133, 327–336. [Google Scholar] [CrossRef]

- Shen, L.; Sun, C.; Ali, M. Role of servitization, digitalization, and innovation performance in manufacturing enterprises. Sustainability 2021, 13, 9878. [Google Scholar] [CrossRef]

- Xue, L.; Zhang, Q.; Zhang, X.; Li, C. Can digital transformation promote green technology innovation? Sustainability 2022, 14, 7497. [Google Scholar] [CrossRef]

- Feng, H.; Wang, F.; Song, G.; Liu, L. Digital transformation on enterprise green innovation: Effect and transmission mechanism. Int. J. Environ. Res. Public Health 2022, 19, 10614. [Google Scholar] [CrossRef] [PubMed]

- He, J.; Su, H. Digital Transformation and Green Innovation of Chinese Firms: The Moderating Role of Regulatory Pressure and International Opportunities. Int. J. Environ. Res. Public Health 2022, 19, 13321. [Google Scholar] [CrossRef] [PubMed]

| Type | Name | Symbol | Definition |

|---|---|---|---|

| Explained variable | Digital transformation | DT | Logarithm is taken after adding 1 to the number of keywords for digital transformation in the annual report |

| Explanatory variables | Industry peer effect | Jpeer | See model (1) |

| Regional peer effect | Gpeer | See model (2) | |

| Moderating variables | TMT Gender | Gen | Number of female executives/total number of executives |

| TMT Age | Age | Average age of all executives plus 1 to take logarithm | |

| TMT Education | Edu | Average education of executives averaged according to 1 = other, 2 = specialist, 3 = bachelor, 4 = master, and 5 = doctor | |

| TMT Tenure | Tenu | Average number of years of service from the beginning of the executive’s tenure to the end of the tenure or the end of the year | |

| Control variables | Enterprise scale | FS | Total corporate assets |

| Asset-liability ratio | FL | Total liabilities/total assets | |

| Return on assets | FR | Net profit/average total assets | |

| Cash flow | FC | Cash and cash equivalents balance/Operating income | |

| Management shareholding | GM | Number of shares held by executives/total number of shares | |

| Board size | GB | Total number of board of directors | |

| Independent director | GI | Number of independent directors/total number of board of directors | |

| Audit quality | OA | Dummy variable; when the auditor is from the top 10 audit companies, take 1, otherwise, take 0 | |

| Institutional shareholding | OI | Number of shares held by institutional investors/total number of shares | |

| Year | Year-fixed effects | ||

| Variable | Mean | Std.Dev. | Median | (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) | DT | 1.630 | 1.347 | 1.386 | 1.000 | ||||||

| (2) | Jpeer | 1.630 | 0.737 | 1.687 | 0.530 *** | 1.000 | |||||

| (3) | Gpeer | 1.502 | 0.550 | 1.510 | 0.379 *** | 0.247 *** | 1.000 | ||||

| (4) | Gen | 0.189 | 0.106 | 0.177 | 0.086 *** | 0.144 *** | 0.041 *** | 1.000 | |||

| (5) | Age | 3.898 | 0.067 | 3.900 | −0.015 *** | 0.072 *** | −0.124 *** | −0.226 *** | 1.000 | ||

| (6) | Edu | 3.348 | 0.448 | 3.357 | 0.209 *** | 0.165 *** | 0.091 *** | −0.086 *** | 0.060 *** | 1.000 | |

| (7) | Tenu | 3.732 | 1.498 | 3.614 | 0.249 *** | 0.138 *** | −0.008 | −0.023 * | 0.377 *** | 0.077 *** | 1.000 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Model 3 | Model 4 | |||

| Jpeer | 0.931 *** | 0.931 *** | ||

| (30.07) | (29.69) | |||

| Gpeer | 0.673 *** | 0.674 *** | ||

| (24.99) | (25.37) | |||

| Control Variables | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| Constant | 0.050 | −3.448 *** | −0.562 *** | −3.531 *** |

| (1.03) | (−8.91) | (−9.95) | (−8.45) | |

| N | 5314 | 5314 | 5314 | 5314 |

| R2 | 0.281 | 0.299 | 0.295 | 0.312 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Model 5 | Model 6 | Model 7 | Model 8 | Model 9 | Model 10 | Model 11 | Model 12 | |

| Jpeer × Gen | 0.146 * | |||||||

| (1.69) | ||||||||

| Jpeer × Age | −0.754 *** | |||||||

| (−5.14) | ||||||||

| Jpeer × Edu | 0.224 *** | |||||||

| (10.23) | ||||||||

| Jpeer × Tenu | 0.026 *** | |||||||

| (4.01) | ||||||||

| Gpeer × Gen | 0.347 *** | |||||||

| (3.52) | ||||||||

| Gpeer × Age | −1.064 *** | |||||||

| (−6.84) | ||||||||

| Gpeer × Edu | 0.247 *** | |||||||

| (10.13) | ||||||||

| Gpeer × Tenu | 0.026 *** | |||||||

| (3.43) | ||||||||

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −3.482 *** | −3.586 *** | −3.688 *** | −3.898 *** | −2.624 *** | −2.693 *** | −3.075 *** | −3.182 *** |

| (−8.98) | (−8.60) | (−9.48) | (−9.34) | (−6.67) | (−6.37) | (−7.80) | (−7.42) | |

| N | 5314 | 5314 | 5314 | 5314 | 5314 | 5314 | 5314 | 5314 |

| R2 | 0.300 | 0.314 | 0.303 | 0.318 | 0.313 | 0.326 | 0.302 | 0.314 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Change Variable | Tobit Model | Lag Period | IV | |||||

| Jpeer | 1.736 *** | 1.241 *** | 0.559 *** | 0.974 *** | ||||

| (6.13) | (42.11) | (27.16) | (30.70) | |||||

| Gpeer | 4.088 *** | 1.141 *** | 0.482 *** | 1.138 *** | ||||

| (16.32) | (28.83) | (19.81) | (22.03) | |||||

| (4.01) | (−5.68) | (−4.58) | (−12.49) | (−8.56) | (−11.97) | (−4.67) | (−12.53) | |

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −27.845 *** | −26.253 *** | −4.997 *** | −6.782 *** | −2.041 *** | −3.074 *** | −3.386 *** | −5.169 *** |

| (−7.51) | (−6.99) | (−9.70) | (−12.25) | (−4.78) | (−6.79) | (−8.86) | (−11.25) | |

| N | 5314 | 5314 | 5314 | 5314 | 5314 | 5314 | 5314 | 5314 |

| R2 | 0.089 | 0.083 | 0.193 | 0.140 | 0.298 | 0.201 | ||

| Kleibergen–Paap rk LM | 1540.549 (0.000) | 499.979 (0.000) | ||||||

| Cragg–Donald Wald F | 4757.691 (16.38) | 2670.506 (16.38) | ||||||

| Variable | Coefficient | T-Value | p-Value | 95% Confidence Interval | |

|---|---|---|---|---|---|

| DT2 | −0.170 | −2.31 | 0.021 | −0.315 | −0.026 |

| DT | 0.677 | 2.37 | 0.018 | 0.117 | 1.238 |

| Effect | Coefficient | T-Value | p-Value | ||

|---|---|---|---|---|---|

| Jpeer ↓ DT ↓ RD | Total effect | Jpeer→RD | 0.018 | 16.27 | 0.000 |

| Direct effect | Jpeer→RD | 0.013 | 10.83 | 0.000 | |

| Mediating effect | Jpeer→DT | 0.931 | 29.69 | 0.000 | |

| DT→RD | 0.006 | 10.18 | 0.000 | ||

| Jpeer→RD | 0.931 × 0.006 ≈ 0.006 | ||||

| Jpeer ↓ RD ↓ GTI | Total effect | Jpeer→GTI | 0.101 | 0.33 | 0.739 |

| Direct effect | Jpeer→GTI | 0.020 | 0.006 | 0.951 | |

| Mediating effect | Jpeer→RD | 0.018 | 16.27 | 0.000 | |

| RD→GTI | 4.406 | 1.64 | 0.100 | ||

| Jpeer→GTI | 0.018 × 4.406 ≈ 0.079 | ||||

| Gpeer ↓ DT ↓ RD | Total effect | Gpeer→RD | 0.010 | 5.63 | 0.000 |

| Direct effect | Gpeer→RD | 0.007 | 3.75 | 0.000 | |

| Mediating effect | Gpeer→DT | 0.674 | 25.37 | 0.000 | |

| DT→RD | 0.005 | 9.06 | 0.000 | ||

| Gpeer→RD | 0.674 × 0.005 ≈ 0.003 | ||||

| Gpeer ↓ RD ↓ GTI | Total effect | Gpeer→GTI | 0.991 | 3.76 | 0.000 |

| Direct effect | Gpeer→GTI | 0.939 | 3.55 | 0.000 | |

| Mediating effect | Gpeer→RD | 0.010 | 5.63 | 0.000 | |

| RD→GTI | 5.156 | 2.17 | 0.030 | ||

| Gpeer→GTI | 0.010 × 5.156 ≈ 0.052 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Du, X. Industry and Regional Peer Effects in Corporate Digital Transformation: The Moderating Effects of TMT Characteristics. Sustainability 2023, 15, 6003. https://doi.org/10.3390/su15076003

Zhang X, Du X. Industry and Regional Peer Effects in Corporate Digital Transformation: The Moderating Effects of TMT Characteristics. Sustainability. 2023; 15(7):6003. https://doi.org/10.3390/su15076003

Chicago/Turabian StyleZhang, Xiaoxu, and Xinyu Du. 2023. "Industry and Regional Peer Effects in Corporate Digital Transformation: The Moderating Effects of TMT Characteristics" Sustainability 15, no. 7: 6003. https://doi.org/10.3390/su15076003