Structuring and Measuring Environmental Sustainability in the Steel Sector: A Single Case Study

Abstract

:1. Introduction

- (a)

- Mitigation: eliminating CO2 net emissions by 2050 and limiting the increase in planet temperature to no more than 1.5 degrees;

- (b)

- Adaptation: supporting the most vulnerable countries to reduce the impacts on climate change;

- (c)

- Finance for the climate: supporting financing to developing countries, reaching the goal of USD 100 billion per year;

- (d)

- Operational finalization of the United Nations (UN) Paris Agreement (December 2015 on climate change): focusing on the methods for reporting on greenhouse gas emissions and monitoring the commitments of the different countries [4].

- (1)

- What is the current environmental strategy in the supply-chain of steel industries, in particular looking at the customers’ perspective?

- (2)

- What are the environmental key performance indicators (KPIs) mainly used in order to measure environmental sustainability in the steel sector and with which goal?

2. Literature Review

2.1. Environmental Sustainability Strategies in the Steel Sector

- (a)

- Technological dimension: energy efficiency best practices (e.g., low carbon production);

- (b)

- Social dimension: servitization (service-oriented contracts rather than ownership);

- (c)

- Organizational dimension: repurpose for society and environment (hybrid businesses, such as social enterprises).

2.2. Metrics for Environmental Sustainability

- (1)

- The Global Reporting Initiative (GRI—https://www.globalreporting.org/ (accessed on 20 January 2022)): The GRI was founded in Boston in 1997, after the environmental scandal of the Exxon Valdez oil spill, with the goal to create a transparent framework to assess environmental, social and governance sustainability; in 2016, GRI guidelines became global standards for sustainability reporting, also starting to provide specified sector standards.

- (2)

- The Climate Disclosure Standards Board (CDSB—https://www.cdsb.net/ (accessed on 2 February 2022)): The CDSB was set up at the World Economic Forum in 2007 as a specific climate-related standard. Its main goal is to explain to investors the risks and opportunities that climate change has on organization strategy and financial performance.

- (3)

- The International Integrated Reporting Council (IIRC—https://integratedreporting.org/ (accessed on 23 January 2022)): In 2009, an International Integrated Reporting Committee was set up, including the GRI and the International Federation of Accountants (IFAC), in order to create a globally accepted integrated framework. The goal is to make companies disclose strategy, governance and performance in a clear and transparent format.

- (4)

- The Sustainability Accounting Standards Board (SASB—https://www.sasb.org/ (accessed on 15 January 2022)): The SASB was founded in 2011 to help disclose company financial material sustainability information to the market, identifying a subset of environmental, social and governance issues relevant for investors. It develops specific guidelines for 77 industries. In 2021, the SASB and the IIRC merged into the Value Reporting Foundation (VFR), as a step towards framework simplification. In 2022, with the goal to create a unified base of high-quality standard framework, the IFRS merged with the VFR and the CDSB to create the International Sustainability Standard Board (ISSB).

- (1)

- The framework of the Task-Force on Climate Related Financial Disclosures (TFCD—https://www.fsb-tcfd.org/ (accessed on 20 January 2022)): In 2017, the Financial Stability Board created the TFCD recommendations structured in four areas (metrics and targets, risk management, and strategy and governance) to support investors in the assessment on risks related to climate change.

- (2)

- The Carbon Disclosure Project framework (CDP—https://www.cdp.net/en (accessed on 2 February 2022)): Created in 2000, the CDP has focused climate disclosure on three main environmental sustainability topics—climate, forest and water—for companies, cities, regions, governments and investors. Focusing on targets and plans to mitigate climate change, the CDP aligned to the recommendation of the TFCD to guide businesses to a transition to a carbon-neutral global economy.

- (3)

- The Science Based Targets Initiative (https://sciencebasedtargets.org/ (accessed on 15 January 2022)): The Science Based Targets Initiative is a collaboration since 2015 between the CDP, the United Nations Global Compact, the World Resources Institute (WRI) and the World Wide Fund for Nature (WWF), aiming to support companies of various sectors to achieve the net zero emission goal by 2050. This is a precise pathway to reduce greenhouse gas emissions, in line with the latest climate science pursuing efforts to limit warming to 1.5 °C [67].

- (4)

3. Methodology: Exploring the Steel Sector with a Single Case Study

3.1. Presentation of the Case Study

3.2. Development of Qualitative Interviews

- (a)

- Construction sector, intermediates: These are significant customers of Feralpi who are in the intermediate phase of product commercialization; either they are reshaping final products of Feralpi and selling them to the final stage of product delivery, the construction site, or they are commercial partners selling steel products to service centers for product transformation. This point of view in the supply-chain is important, since it is an intermediate one before the final step in the value chain, so being influenced both by steel producers and final customers constraints. We conducted a total of 5 interviews.

- (b)

- Construction sector, final customers: These are engineering and construction companies, leading projects by public or private hands in the civil construction sector. Their point of view is determinant to understand the trends and pressure of the market, which is pushed by ESG (environmental social governance) ratings of financial funds and investors. We conducted a total of 5 interviews.

- (c)

- Special steel: Producers or traders who deal directly with the automotive sector or sector of special steel products; in this sector, environmental sustainability is pushed by high sensibilization of final customers, who want more tailor-made products with specific and transparent environmental information. We conducted a total of 5 interviews.

- (d)

- Experts: Technical experts in the field of green sustainable steel, who can give a more detached and objective view on the trend of decarbonization strategies and metrics, and they can contextualize Feralpi customers’ responses in a more neutral and comprehensive way. We conducted a total of 5 interviews.

3.3. Selected Metrics

| 1. | CO2 emissions: | Tons CO2 /ton crude steel cast |

| (comparable to GRI 305-1, Scope 1, direct emissions | ||

| and GRI 305-2, Scope 2, indirect emissions) | ||

| 2. | Energy intensity: | GJ/ton crude steel cast |

| (comparable to GRI 302-3) | ||

| 3. | Material efficiency: | % of materials converted to products & co-products |

| (comparable to GRI 306) |

| 4. | CO2 emissions: | GRI 305-3 indirect transport emissions Scope 3 |

| (ton/year) | ||

| 5. | Energy intensity: | GRI 302-1 energy from renewable sources |

- Climate change: absolute and specific data of CO2 yearly;

- Energy efficiency: yearly consumption of electrical energy, in specific numbers;

- CE: percentage of recycled steel (use of scrap or iron ore).

4. Findings

4.1. Environmental Sustainability: The Market Point of View on Achievable Decarbonization Goals

4.2. Strategic KPIs: Finding a Shared Path for Measurement and Implementation

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

A.1. Semi-Structured Interview Questionnaires for Customers and Experts

A.1.1. Questionnaire for Customers for Qualitative Interviews, June–August 2022

A.1.2. Questionnaire for Experts for Qualitative Interviews, June–August 2022

References

- European Environment Agency. Climate Change, Impacts and Vulnerability in Europe 2016—Key findings; European Environment Agency: Copenhagen, Denmark, 2016.

- European Parliament. What is Carbon Neutrality and How Can It Be Achieved by 2050? 21 June 2021. Available online: https://www.europarl.europa.eu/news/en/headlines/society/20190926STO62270/what-is-carbon-neutrality-and-how-can-it-be-achieved-by-2050 (accessed on 1 January 2022).

- García-García, P.; Carpintero, O.; Buendía, L. Just energy transitions to low carbon economies: A review of the concept and its effects on labour and income. Energy Res. Soc. Sci. 2020, 70, 101664. [Google Scholar] [CrossRef]

- United Nations. Climate Change Conference. COP26. The Glasgow Climate Pact. The Conference of the Parties Serving as the Meeting of the Parties to the Paris Agreement. 12 November 2021. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/the-glasgow-climate-pact-key-outcomes-from-cop26 (accessed on 20 January 2022).

- Senato della Repubblica. Pacchetto Clima-Energia. Atti Comunitari n. 11, 12, 13, 14, 15, 16. n. 13/DN. 7 November 2008. XVI Legislatura. Unione Europea. Available online: https://www.senato.it/documenti/repository/lavori/affarieuropei/dossier/XVI/Dossier%2013_DN.pdf (accessed on 25 January 2022).

- European Commission. 2030 Climate and Energy Framework. Available online: https://ec.europa.eu/clima/eu-action/climate-strategies-targets/2030-climate-energy-framework_en (accessed on 2 January 2022).

- European Commission. Delivering the European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en#leading-the-third-industrial-revolution (accessed on 2 January 2022).

- European Commission. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions. The European Green Deal. 11 December 2019. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:b828d165-1c22-11ea-8c1f-01aa75ed71a1.0002.02/DOC_1&format=PDF (accessed on 5 February 2022).

- European Commission. A European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en (accessed on 3 January 2022).

- European Commission. Recovery and Resilience Scoreboard. Pillars. Available online: https://ec.europa.eu/economy_finance/recovery-and-resilience-scoreboard/pillar_overview.html?lang=en (accessed on 2 January 2022).

- European Commission. Recovery Plan for Europe. 2021. Available online: https://commission.europa.eu/strategy-and-policy/recovery-plan-europe_en (accessed on 1 December 2021).

- #Next Generation Italia. Piano Nazionale di Ripresa e Resilienza. Bozza Aggiornata al 12 gennaio. 2021. Available online: https://www.governo.it/sites/new.governo.it/files/PNRR_2021_0.pdf (accessed on 5 January 2022).

- Magnani, A. Next Generation EU, Cos’è e Come Funziona. Il Sole 24 Ore. 4 March 2021. Available online: https://www.ilsole24ore.com/art/next-generation-eu-cos-e-e-perche-l-europa-deve-correre-fondi-la-ripresa-covid-ADlKpzMB (accessed on 15 December 2021).

- Trainer, T. A technical critique of the Green New Deal. Ecol. Econ. 2022, 195, 107378. [Google Scholar] [CrossRef]

- McKinsey & Company. The Net Zero Transition. Report. What It Would Cost, What It Would Bring. McKinsey Global Institute in Collaboration with McKinsey Sustainability and McKinsey’s Global Energy & Materials and Advanced Industries Practices. January 2022. Available online: https://www.mckinsey.com/capabilities/sustainability/our-insights/the-net-zero-transition-what-it-would-cost-what-it-could-bring (accessed on 3 February 2022).

- Zumente, I.; Lace, N. ESG Rating—Necessity for the Investor or the Company? Sustainability 2021, 13, 8940. [Google Scholar] [CrossRef]

- Mobarakeh, M.R.; Kienberger, T. Climate neutrality strategies for energy-intensive industries: An Austrian case study. Clean. Eng. Technol. 2022, 10, 100545. [Google Scholar] [CrossRef]

- Bataille, C.G.F. Physical and Policy Pathways to Net-Zero Emissions Industry. WIREs Clim. Chang. 2020, 11, e633. [Google Scholar] [CrossRef]

- Baste, I.A.; Watson, R.T. Tackling the climate, biodiversity and pollution emergencies by making peace with nature 50 years after the Stockholm Conference. Glob. Environ. Chang. 2022, 73, 102466. [Google Scholar] [CrossRef]

- Vogl, V.; Åhman, M.; Nilsson, L.J. Assessment of Hydrogen Direct Reduction for Fossil-Free Steelmaking. J. Clean. Prod. 2018, 203, 736–745. [Google Scholar] [CrossRef]

- Mallet, A.; Pal, P. Green transformation in the iron and steel industry in India: Rethinking patterns of innovation. Energy Strategy Rev. 2022, 44, 100968. [Google Scholar] [CrossRef]

- Yu, X.; Tan, C. China’s pathway to carbon neutrality for the iron and steel industry. Glob. Environ. Chang. 2022, 76, 102574. [Google Scholar] [CrossRef]

- Toktaş-Palut, P. Analyzing the effects of Industry 4.0 technologies and coordination on the sustainability of supply chains. Sustain. Prod. Consum. 2022, 30, 341–358. [Google Scholar] [CrossRef]

- Majeed, M.A.A.; Rupasinghe, T.D. Internet of things (IoT) embedded future supply chains for industry 4.0: An assessment from an ERP-based fashion apparel and footwear industry. Int. J. Supply Chain Manag. 2017, 6, 5–40. [Google Scholar]

- Jensen, J.P.; Prendeville, S.M.; Bocken, N.M.P.; Peck, D. Creating sustainable value through remanufacturing: Three industry cases. J. Clean. Prod. 2019, 218, 304–314. [Google Scholar] [CrossRef] [Green Version]

- Mebratu, D. Sustainability and sustainable development. Environ. Impact Assess. Rev. 2018, 18, 493–520. [Google Scholar] [CrossRef]

- Jackson, T. Prosperity without Growth: Economics for a Finite Planet; Earthscan: London, UK, 2011. [Google Scholar]

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, R.S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef] [Green Version]

- Geissdoerfer, M.; Savage, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy- A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef] [Green Version]

- Ellen MacArthur Foundation. Towards the Circular Economy. Economic and Business Rationale for an Accelerated Transition; Ellen MacArthur Foundation: Cowes, UK, 2013. [Google Scholar]

- Bag, S.; Yadav, G.; Dhamija, P.; Kataria, K.K. Key resources for industry 4.0 adoption and its effect on sustainable production and circular economy: An empirical study. J. Clean. Prod. 2021, 281, 125233. [Google Scholar] [CrossRef]

- Berg, H.; Bendix, P.; Jansen, M.; Le Blévennec, K.; Bottermann, P.; Magnus-Melgar, M.; Pohjalainen, E.; Wahlström, M. Unlocking the Potential of Industry 4.0 to Reduce the Environmental Impact of Production; Eionet Report—ETC/WMGE 2021/5; European Environment Agency, European Topic Center on Waste and Materials in a Green Economy: Boeretang, Belgium, 2021.

- Birkel, H.; Hartmann, E. Internet of Things—The future of managing supply chain risks. Supply Chain Manag. 2020, 25, 535–548. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Iranmanesh, M.; Faraz Mubarak, M.; Mubarik, M.; Rejeb, A.; Nilashi, M. Identifying industry 5.0 contributions to sustainable development: A strategy roadmap for delivering sustainability values. Sustain. Prod. Consum. 2022, 33, 716–737. [Google Scholar] [CrossRef]

- Beltrami, M.; Orzes, G.; Sarkis, J.; Sartor, M. Industry 4.0 and sustainability: Towards conceptualization and theory. J. Clean. Prod. 2021, 312, 127733. [Google Scholar] [CrossRef]

- De Marchi, V.; Di Maria, E. Achieving Circular Economy Via The Adoption of Industry 4.0 Technologies: A Knowledge Management Perspective. 163–178E. In Knowledge Management and Industry 4.0; Bettiol, M., Di Maria, E., Micelli, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Romero, C.A.T.; Castro, D.F.; Ortiz, J.H.; Khalaf, O.I.; Vargas, M.A. Synergy between Circular Economy and Industry 4.0: A Literature Review. Sustainability 2021, 13, 4331. [Google Scholar] [CrossRef]

- Sarkis, J.; Zhu, Q. Environmental sustainability and production: Taking the road less traveled. Int. J. Prod. Res. 2018, 56, 743–759. [Google Scholar] [CrossRef]

- Razzaq, A.; Sharif, A.; Najmi, A.; Tseng, M.L.; Lim, M.K. Dynamic and causality interrelationships from municipal solid waste recycling to economic growth, carbon emissions and energy efficiency using a novel bootstrapping autoregressive distributed lag. Resour. Conserv. Recycl. 2021, 166, 105372. [Google Scholar] [CrossRef]

- Kang, M.; Yang, M.G.; Park, Y.; Huo, B. Supply chain integration and its impact on sustainability. Ind. Manag. Data Syst. 2018, 118, 1749–1765. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Razzaq, A.; Yu, Z.; Miller, S. Industry 4.0 and circular economy practices: A new era business strategies for environmental sustainability. Bus. Strategy Environ. 2021, 30, 4001–4014. [Google Scholar] [CrossRef]

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Resour. Conserv. Recycl. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- Picard, F.; Tanguy, C. Innovations and Techno-Ecological Transition; Wiley: New York, NY, USA, 2016. [Google Scholar]

- OECD. Organization for Economic Co-Operation and Development. Business Models for the Circular Economy: Opportunities and Challenges for Policy; OECD Publishing: Berlin, Germany, 2019. [Google Scholar]

- Bekaert, F.; Hagenbruch, T.; Kastl, E.; Mareels, S.; Van Hoey, M.; Vercammen, S.; Zeumer, B. The future of the European Steel Industry. A Road Map toward Economic and Environmental Sustainability; Metals & Mining Practice; McKinsey & Company: Hong Kong, China, 2021. [Google Scholar]

- Heading, S.; Dhawan, R.; Walrecht, A.; Hasdell, J. Resourcing the Energy Transition: Making the World Go Round; Geographical and Geopolitical Constraints to the Supply of Resources Critical to the Energy Transition Call for a Circular Economy Solution; KPMG International: Amstelveen, The Netherlands, 2021. [Google Scholar]

- Somers, J. Technologies to Decarbonize the EU Steel Industry; EUR 30982 EN; Publications Office of the European Union: Luxembourg, 2022.

- Smol, M. Towards Zero Waste in Steel Industry: Polish Case Study. J. Steel Struct. Constr. 2015, 1, 102. [Google Scholar] [CrossRef] [Green Version]

- Shi, G.V.; Baldwin, J.; Koh, S.C.L.; Choi, T.Y. Fragmented institutional fields and their impact on manufacturing environmental practices. Int. J. Prod. Res. 2018, 56, 431–446. [Google Scholar] [CrossRef]

- Baldassarre, B.; Schepers, M.; Bocken, N.; Cuppen, E.; Korevaar, G.; Calabretta, G. Industrial Symbiosis: Towards a design process for eco-industrial clusters by integrating Circular Economy and Industrial Ecology perspectives. J. Clean. Prod. 2019, 216, 446–460. [Google Scholar] [CrossRef]

- Mendez-Alva, F.; Cervo, H.; Krese, G.; Van Eetvelde, G. Industrial symbiosis profiles in energy-intensive industries: Sectoral insights from open databases. J. Clean. Prod. 2021, 314, 128031. [Google Scholar] [CrossRef]

- Sellitto, M.A.; Murakami, F.K.; Butturi, M.A.; Marinelli, S.; Kadel, N., Jr.; Rimini, B. Barriers, drivers, and relationships in industrial symbiosis of a network of Brazilian manufacturing companies. Sustain. Prod. Consum. 2021, 26, 443–454. [Google Scholar] [CrossRef]

- Colla, V.; Pietrosanti, C.; Malfa, E.; Peters, K. Environment 4.0: How digitalization and machine learning can improve the environmental footprint of the steel production processes. Matér. Tech. 2020, 108, 507. [Google Scholar] [CrossRef]

- Sellitto, M.A.; Murakami, F.K. Destination of the waste generated by a steelmaking plant: A case study in Latin America. Aestimum 2020, 77, 127–144. [Google Scholar] [CrossRef]

- Branca, T.A.; Fornai, B.; Colla, V.; Murri, M.M.; Streppa, E.; Schröder, A.J. The Challenge of Digitalization in the Steel Sector. Metals 2020, 10, 288. [Google Scholar] [CrossRef] [Green Version]

- de Oliveira, U.R.; Kanbach, M.L.; Lemos, B.; De Barros Avila Canedo, A.C.; Ferreira de Abreu, P.A. Evaluation of the green supply chain management of a steelmaker based on environmental indicators. Rev. Gestão Soc. Ambient. 2022, 16, e02830. [Google Scholar] [CrossRef]

- Ito, A.; Langefeld, B.; Goetz, N. The Future of Steel Making. How the European Steel Industry Can Achieve Carbon Neutrality; Roland Berger: Munich, Germany, 2020. [Google Scholar]

- Grewal, J.; Serafeim, G. Research on Corporate Sustainability: Review and Directions for Future Research. Found. Trends Account. 2020, 14, 73–127. [Google Scholar] [CrossRef]

- Walter, J. Measuring Stakeholder Capitalism towards Common Metrics and Consistent Reporting of Sustainable Value Creation; White Paper; World Economic Forum: Geneva, Switzerland, 2020. [Google Scholar]

- Cheema-Fox, A.; LaPerla, B.R.; Serafeim, G.; Turkington, D.; Wang, H.S. Decarbonizing Everything. Financ. Anal. J. 2021, 77, 93–108. [Google Scholar] [CrossRef]

- Bell, S.; Morse, S. Sustainability Indicators: Measuring the Immeasurable, 2nd ed.; Earthscan: London, UK, 2008. [Google Scholar]

- Walker, S.; Coleman, N.; Hodgson, P.; Collins, N.; Brimacombe, L. Evaluating the Environmental Dimension of Material Efficiency Strategies relating to the Circular Economy. Sustainability 2018, 10, 666. [Google Scholar] [CrossRef] [Green Version]

- Saidani, M.; Yannou, B.; Leroy, Y.; Cluzel, F.; Kendall, A. A taxonomy of circular economy indicators. J. Clean. Prod. 2019, 207, 542–559. [Google Scholar] [CrossRef] [Green Version]

- Lopes de Sousa, A.B.; Chiappetta Jabbour, C.J.; Filho, M.G.; Roubaud, D.; Roubaud, A. Industry 4.0 and the circular economy: A proposed research agenda and original roadmap for sustainable operations. Ann. Oper. Res. 2018, 270, 273–286. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Göçe, F. Digital Supply Chain: Literature review and a proposed framework for future research. Comput. Ind. 2018, 97, 157–177. [Google Scholar] [CrossRef]

- United Nations (UN). Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2015.

- Science Based Targets. Science Based Targets. Driving Ambitious Corporate Climate Action. Science-Based Net-Zero. Scaling Urgent Corporate Climate. Action Worldwide. Science Based Targets Initiative Annual Progress Report, Version 1.2—Updated June 2022. Available online: https://sciencebasedtargets.org/resources/files/SBTiProgressReport2021.pdf (accessed on 1 July 2022).

- World Business Council for Sustainable Development, World Resource Institute. The Greenhouse Gas Protocol. A Corporate Accounting and Reporting Standard; Revised Edition; World Resource Institute: Washington, DC, USA, 2022. [Google Scholar]

- WBCSD. Value Chain Carbon Transparency Pathfinder: Enabling Decarbonization through Scope 3 Emissions Transparency; WBCSD: Geneva, Switzerland, 2022. [Google Scholar]

- Official Journal of the European Union. Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the Establishment of a Framework to Facilitate Sustainable Investment, and Amending Regulation (EU) 2019/2088. Available online: https://climate-laws.org/geographies/european-union/laws/regulation-eu-2020-852-on-the-establishment-of-a-framework-to-facilitate-sustainable-investment-commission-delegated-regulations-eu-2021-2139-and-2021-2178-eu-taxonomy (accessed on 11 March 2023).

- European Commission. JRC Science for Policy Report. Best Environmental Management Practice in the Fabricated Metal Product Manufacturing Sector. Learning from Frontrunners. 2020. Available online: https://susproc.jrc.ec.europa.eu/product-bureau/sites/default/files/inline-files/JRC_BEMP_fabricated_metal_product_manufacturing_report.pdf (accessed on 5 December 2021).

- Circle Economy. Circular Metrics for Business. Finding Opportunities in the Circular Economy. PACE. Platform for Accelerating Circular Economy. 2020. Available online: https://pacecircular.org/node/282 (accessed on 15 December 2021).

- Liute, A.; De Giacomo, M.R. The environmental performance of UK-based B Corp companies: An analysis based on the triple bottom line approach. Bus. Strategy Environ. 2022, 31, 810–827. [Google Scholar] [CrossRef]

- Gonzalez, C.; Agrawal, V.; Johansen, V.; Johansen, D.; Hooker, R. Green supply chain practices: The role of institutional pressure, market orientation, and managerial commitment. Clean. Logist. Supply Chain 2022, 5, 100067. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications: Design and Methods; Sage: New York, NY, USA, 2018. [Google Scholar]

- Nechifor, V.; Calzadilla, A.; Bleischwitz, R.; Winning, M.; Tian, X.; Usubiaga, A. Steel in a circular economy: Global implications of a green shift in China. World Dev. 2020, 127, 104775. [Google Scholar] [CrossRef]

- Feralpi Group. Sustainability Report. Year 2004; Feralpi Holding S.p.A.: Lonato del Garda, Italy, 2004. [Google Scholar]

- Atteslander, P. Methoden der Empirischen Sozialforschung; Erich Schmidt Verlag: Berlin, Germany, 2008. [Google Scholar]

- Feralpi Group. Consolidated Voluntary Non-Financial Disclosure. Year 2019; Feralpi Holding S.p.A.: Lonato del Garda, Italy, 2020. [Google Scholar]

- Feralpi Group. Consolidated Voluntary Non-Financial Disclosure. Year 2020; Feralpi Holding S.p.A.: Lonato del Garda, Italy, 2021. [Google Scholar]

- Feralpi Group. Consolidated Voluntary Non-Financial Disclosure. Year 2021; Feralpi Holding S.p.A.: Lonato del Garda, Italy, 2022. [Google Scholar]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges, Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef] [Green Version]

- Cassell, C.; Symon, G. Essential Guide to Qualitative Methods in Organizational Research; Sage: New York, NY, USA, 2004. [Google Scholar]

- Dasovic, B.; Klanšek, U. A Review of Energy-Efficient and Sustainable Construction Scheduling Supported with Optimization Tools. Energies 2022, 15, 2330. [Google Scholar] [CrossRef]

- Steven, P.; Chun, J.-H.; Lanza, G. Digitalization of Automotive Industry—Scenarios for Future Manufacturing. Manuf. Rev. 2016, 3, 1. [Google Scholar]

- Gioia, D.A.; Corley, K.G.; Hamilton, A.L. Seeking qualitative rigor in inductive research: Notes on the Gioia methodology. Organ. Res. Methods 2013, 16, 15–31. Available online: http://orm.sagepub.com/cgi/alerts (accessed on 5 February 2021). [CrossRef]

- Bryman, A.; Bell, E. Business Research Methods, 3rd ed.; Oxford University Press: Oxford, UK, 2011. [Google Scholar]

- World Steel Association. Sustainability Indicators. 2021 Report. Indicator Trends and Participation 2003–2020. Available online: https://worldsteel.org/wp-content/uploads/Sustainability-Indicators-2021-Report.pdf (accessed on 5 January 2022).

- Federacciai. Rapporto di Sostenibilità 2021; Federacciai: Milan, Italy, 2022. [Google Scholar]

- Govindan, K.; Khodaverdi, R.; Jafarian, A. A fuzzy multi criteria approach for measuring sustainability performance of a supplier based on triple bottom line approach. J. Clean. Prod. 2013, 47, 345–354. [Google Scholar] [CrossRef]

- Elkington, J. Partnerships from cannibals with forks: The triple bottom line of 21st-century business. Environ. Qual. Manag. 1998, 8, 37–51. [Google Scholar] [CrossRef]

- ISO 9000; Quality Management Principles. International Organization for Standardization: London, UK, 2022.

- ISO 14001; Key Benefits. International Organization for Standardization: London, UK, 2022.

- European Commission. Categorization System for the Circular Economy; A Sector-Agnostic Approach for Activities Contributing to the Circular Economy; European Commission: Brussels, Belgium, 2020.

- ISO 50001; Energy Management Systems. International Organization for Standardization: London, UK, 2022.

- ISO 45001; Occupational Health and Safety. International Organization for Standardization: London, UK, 2022.

- SOA. Certificazione SOA. Available online: https://www.attestazionesoa.it/certificazione-soa/ (accessed on 20 January 2022).

- IATF. International Automotive Task Force. About IATF. Available online: https://www.iatfglobaloversight.org/about-iatf/ (accessed on 15 February 2022).

- Leed. Mission and Vision. Available online: https://www.usgbc.org/about/mission-vision (accessed on 4 April 2022).

- Breeam. The World’s Leading Science-Based Suite of Validation and Certification Systems for a Sustainable Built Environment. 2022. Available online: bregroup.com/products/breeam (accessed on 3 March 2022).

- GRESB. Real Estate Scoring Document. 2022. Available online: https://documents.gresb.com/generated_files/real_estate/2022/real_estate/scoring_document/complete.html (accessed on 14 February 2022).

- European Commission. Carbon Border Adjustment Mechanism: Questions and Answers. 14 July 2021. Available online: https://ec.europa.eu/commission/presscorner/detail/en/qanda_21_3661 (accessed on 5 January 2022).

- CRU. Emissions Analysis Executive Summary. Prepared for the Steel Manufacturers Association. 14 June 2022. Available online: steelnet.org/steelmaking-emissions-report-2022/ (accessed on 3 March 2022).

- Tosini, G. Il futuro dell’industria Siderurgica Europea. Un Percorso Verso la Sostenibilità Economica e Ambientale; Siderweb: Brescia, Italy, 2022. [Google Scholar]

- Colla, V.; Matino, I.; Cirilli, F.; Jochler, G.; Kleimt, B.; Rosemann, H.; Unamuno, I.; Tosato, S.; Gussago, F.; Baragiola, S.; et al. Improving energy and resource efficiency of electric steelmaking through simulation tools and process data analyses. Mater. Tech. 2016, 104, 602. [Google Scholar] [CrossRef]

- Eurofer. The European Steel Association; Annual Report; Eurofer AISBL: Brussels, Belgium, 2022. [Google Scholar]

- EPD. The international EPD System. A Short Introduction to EPD’s. Available online: https://www.environdec.com/home (accessed on 15 February 2022).

- European Commission. European Platform on Life Cycle Assessment. Available online: https://ec.europa.eu/environment/ipp/lca.htm#:~:text=Life%20Cycle%20Assessment%20(LCA)%20is,life%2Dcycle%20of%20the%20product (accessed on 5 February 2022).

- ISO 14067; Product Carbon Footprint. International Organization for Standardization: London, UK, 2018. Available online: https://www.iso.org/standard/71206.html (accessed on 5 February 2022).

- Rubio-Jovel, K. The voluntary sustainability standards and their contribution towards the achievement of the Sustainable Development Goals: A systematic review on the coffee sector. J. Int. Dev. 2022, 1–40. [Google Scholar] [CrossRef]

- Weskamp, T.; Witte, C. Making Everyday Products Greener; McKinsey & Company: Hong Kong, China, 2022; Available online: https://www.mckinsey.com/industries/chemicals/our-insights/making-everyday-products-greener (accessed on 5 September 2022).

- Swennenhuis, F.; de Gooyert, V.; de Coninck, H. Towards a CO2-neutral steel industry: Justice aspects of CO2 capture and storage, biomass- and green hydrogen-based emission reductions. Energy Res. Soc. Sci. 2022, 88, 102598. [Google Scholar] [CrossRef]

- Bressanelli, G.; Adrodegari, F.; Pigosso, D.C.A.; Parida, V. Towards the Smart Circular Economy Paradigm: A Definition, Conceptualization, and Research Agenda. Sustainability 2022, 14, 4960. [Google Scholar] [CrossRef]

- Bankvall, L.; Dubois, A.; Lind, F. Conceptualizing business models in industrial networks. Ind. Mark. Manag. 2017, 60, 196–203. [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R. Transitioning of Steel Producers to the Steelworks 4.0—Literature Review with Case Studies. Energies 2021, 14, 4109. [Google Scholar] [CrossRef]

- Carrillo-Hermosilla, J.; del Río, P.; Könnola, T. Diversity of eco-innovations: Reflections from selected case studies. J. Clean. Prod. 2010, 18, 1073–1083. [Google Scholar] [CrossRef]

- Porter, M.E. From Competitive Advantage to Corporate Strategy. Organizational Transformation. Harvard Business Review. 1987. Available online: https://hbr.org/1987/05/from-competitive-advantage-to-corporate-strategy (accessed on 5 September 2022).

- De Marchi, V.; Molina-Morales, F.X.; Martinez-Chafer, L. Environmental innovation and cooperation: A configurational approach. Technol. Forecast. Soc. Chang. 2022, 182, 121835. [Google Scholar] [CrossRef]

- Astone, F. Acciaio e Economia Circolare: Tenova Trasforma i Rifiuti da Costo a Risorsa (Granulazione a Secco e Biomasse). Videointervista. Available online: https://www.industriaitaliana.it/tenova-acciaio-scarti-biomasse-ori-martin/ (accessed on 5 September 2022).

- Arens, M. Policy support for and R&D activities on digitizing the European steel industry. Resour. Conserv. Recycl. 2019, 143, 244–250. [Google Scholar] [CrossRef]

- Bartos, K.E.; Schwarzkopf, J.; Mueller, M.; Hofmann-Stoelting, C. Explanatory factors for variation in supplier sustainability performance in the automotive sector—A quantitative analysis. Clean. Logist. Supply Chain 2022, 5, 100068. [Google Scholar] [CrossRef]

- Bai, C.; Orsez, G.; Sarkis, J. Exploring the impact of Industry 4.0 technologies on social sustainability through a circular economy approach. Ind. Mark. Manag. 2022, 101, 176–190. [Google Scholar] [CrossRef]

| Framework | Date of Creation | Scope | Evolution |

|---|---|---|---|

| Global Reporting Initiative | 1997 | Environmental, social and governance reporting | Creation of specified industry standards |

| Climate Disclosure Standards Board | 2007 | Climate change impact on organizational and financial performance | Merged into the ISSB |

| International Integrated Reporting Council | 2009 | Integrated framework for information to investors | Merged into the ISSB |

| Sustainability Accounting Standards Board | 2011 | Financially material sustainability information | Merged into the ISBB |

| Taskforce on Climate Related Financial Disclosures | 2017 | Assessment on climate-change-related risks | Guidelines for the IFRS |

| Carbon Disclosure Project | 2000 | Focus on climate, water and forest | Merged into the ISBB |

| Science Based Targets Initiative | 2015 | Certified target to reach zero emissions | Covering more industrial sectors |

| GHG Protocol Corporate Accounting and Reporting Standard | 1998 | Quantification of GHG emissions | GHG explanation for the financial industry |

| List of Interviewees (June–August 2022) | |||

|---|---|---|---|

| Company | Company Size | Unit | Market |

| Customer A (engineering and construction) | 135 employees | Environmental Specialist | Construction industry |

| Customer B (civil engineering and infrastructure) | 6500 employees | Sustainability manager of the Head Quarter and Environmental Specialist | Construction industry |

| Customer C (civil engineering and real estate) | 22 employees | Owner and technical director | Construction industry |

| Customer D (civil engineering) | 120 employees | Environmental specialist and technical director and board member | Construction industry |

| Customer E (steel service center) | 100 employees | Owner and business developer | Construction industry |

| Customer F (dealer) | 10 employees | Chief executive officer | Construction industry |

| Customer G (dealer) | 10 employees | Chief executive officer | Construction industry |

| Customer H (construction and engineering) | 350 employees | Technical director and business developer | Construction industry |

| Customer I (international trader) | 30 employees | Commercial director | Construction industry |

| Customer J (service center) | 50 employees | Owner and technical director Owner and technical developer | Construction industry |

| Customer K (fastener producers) | 100 employees | Owner and purchasing director | Special steel |

| Customer L (special wire rod) | 100 employees | Chief executive officer | Special steel |

| Customer M (fastener producer) | 3500 employees | Sustainability manager | Special steel (automotive) |

| Customer N (special wire rod) | 110 employees | Managing director | Special steel (automotive) |

| Customer O (international trader) | 40 employees | Chief financial officer | Construction and automotive industry |

| Expert A (foundry) | 150 employees | Owner and vice president | Special steel |

| Expert B (consultant) | 30 employees | President | International association |

| Expert C (technical expert) | 8500 employees | Metallurgy professor (Circular Economy, innovation) | International institution |

| Expert D (technical expert) | 100 employees | Business developer | Innovation service center |

| Expert E (technical expert) | 2400 Employees | Strategy and innovation expert | International consultancy service |

| Indicator | Framework | Reference | Definition |

|---|---|---|---|

| 1. CO2 Emissions | World Steel Association | CO2 emissions | Tons CO2/ ton crude steel cast (including Scope 1, Scope 2, Scope 3, according to the GHG emission) |

| GRI | Scope 1 305-1 | Total direct GHG emissions Scope 1 (tCO2eq) | |

| Scope 2 305-2 | Indirect greenhouse gas emissions (GHG) resulting from electricity use Scope 2 (tCO2eq) | ||

| Scope 3 305-3 | Other indirect greenhouse emissions (GHG) (Scope 3) | ||

| SASB | EM-IS-110a.1 | Greenhouse gas emissions | |

| CDSB | REQ-04 | Sources of environmental and social impact | |

| IIRC | 4° | Organizational overview and external environment | |

| TFCD | Climate related targets | Reduce net Scope 1, 2 and 3 emissions to zero by 2050 | |

| EU taxonomy | Climate related hazards | Climate-related hazards, temperature-related hazards | |

| CDP | 2. Definition of operational and organizational boundaries | All GHG emission sources (Scope 1, 2, 3) | |

| GHG | Overview of GHG calculation tools | E.g., calculation of GHG for iron and steel sector | |

| SBTI | Energy-intensive sector | Under construction | |

| Benefit Corporation | Emissions | Total Scope 1, 2 and 3 | |

| Emissions efficiency | % of Scope 1 and 2 emissions due to efficiency improvements | ||

| 2. Energy Intensity | World Steel Association | Energy intensity | Energy consumed in the organization in GJ/ tons crude steel cast |

| GRI | Energy intensity 302-3 | Energy intensity in GJ per ton of product | |

| Renewable resources 302-1 | Use of energy by source, expressed in GJ | ||

| SASB | EM-IS-130a.1 | (1) Total energy consumed, (2) percentage grid electricity, (3) percentage renewable | |

| CDSB | REQ-04 | Sources of environmental and social impact | |

| IIRC | - | - | |

| TFCD | - | - | |

| EU taxonomy | Annex B | Climate-related hazards, temperature-related hazards | |

| CDP | - | - | |

| GHG | - | - | |

| SBTI | Energy-intensive sector | Under construction | |

| Benefit Corporation | Reduction of energy consumption | Systems used for energy conservation or efficiency measures for a majority of corporate facilities (by square feet); if energy improvements led to energy savings | |

| Energy usage | Reporting and monitoring of energy consumption | ||

| Renewable energy | % of energy used produced by low-impact renewable resources | ||

| 3. Material Efficiency | World Steel Association | Energy intensity | % of raw materials used onsite to make crude steel converted to products and coproducts. |

| GRI | 301-1, 301-2 | Use of materials and % recycled | |

| 306-3, 306-4, 306-5 | Waste generated (t) and breakdown by waste composition; waste not intended for disposal (t); waste for disposal (t) | ||

| SASB | EM-IS-150a.1 | Amount of waste generated, percentage hazardous, percentage recycled | |

| CDSB | - | - | |

| IIRC | - | - | |

| TFCD | - | - | |

| EU taxonomy Circular Economy | Circular Design and production | Development and deployment of process technologies that enable Circular Economy strategies | |

| CDP | - | - | |

| GHG | - | - | |

| SBTI | Energy-intensive sector | Under construction | |

| Benefit Corporation | Non-hazardous and hazardous waste | Company sites have experienced accidental discharges to air, land or water of hazardous substances; company can verify that your hazardous waste is always disposed of responsibly; how non-hazardous waste is disposed |

| Indicator | Framework | Reference | Definition |

|---|---|---|---|

| 3. Material Efficiency | Circular Transition Indicators (WBCSD) | % material circularity | Weighted average of % circular inflow % of circular outflow |

| % critical material | Mass of inflow defined as critical/ total mass of linear inflow | ||

| Actual lifetime | Product actual lifetime/ average product actual lifetime | ||

| Circular material productivity | (% circular inflow + % circular outflow)/2 × revenue | ||

| Onsite water circulation (reuse and recycle) | (Quantity water used—quantity water withdrawal)/+1 quantity total water withdrawal | ||

| % renewable energy | renewable energy (annual consumption)/ total energy (annual consumption) | ||

| Circulytics (Ellen McArthur Foundation) | Mwaste2 | Total annual outflow mass of materials processing waste and byproducts originating from products to be used | |

| Water | Total annual water demand and total annual water outflow volume (megaliters) | ||

| Energy | Total annual energy usage and production (MWh) | ||

| Strategy | Centrality of Circular Economy (CE) in CEO agenda and presence of measurable CE targets |

| Decarbonization Strategies in the Steel Sector | |

|---|---|

| Strategy | Details |

| Reaching highest certification standards as sign of internal process and structure quality for customers | EMAS covers the three pillars of decarbonization (CO2 emissions, energy efficiency, CE) as highest environmental standard; Breeam and LEED strategic standards for construction sector; IATF 16949 essential certification for automotive special steel suppliers. |

| CE practices focusing on the use of renewable input materials in the process | Use of scrap as main recyclable material for steel production. Use of alternative products, such as biomass, creating new supply-chain collaboration in an Industrial Symbiosis strategy. Advantage of decreasing CO2 emissions. |

| Energy efficiency practices | Use of renewable sources, such as photovoltaic, to create alternatives to expensive traditional sources. |

| Green steel as market opportunity | Creating competitive advantage through specific marketing for green products, also in the construction sector. Suppliers’ selection pushed by the green market financed by ESG funds. |

| Main Strategic KPIs in the Steel Sector | |

|---|---|

| KPI | Details |

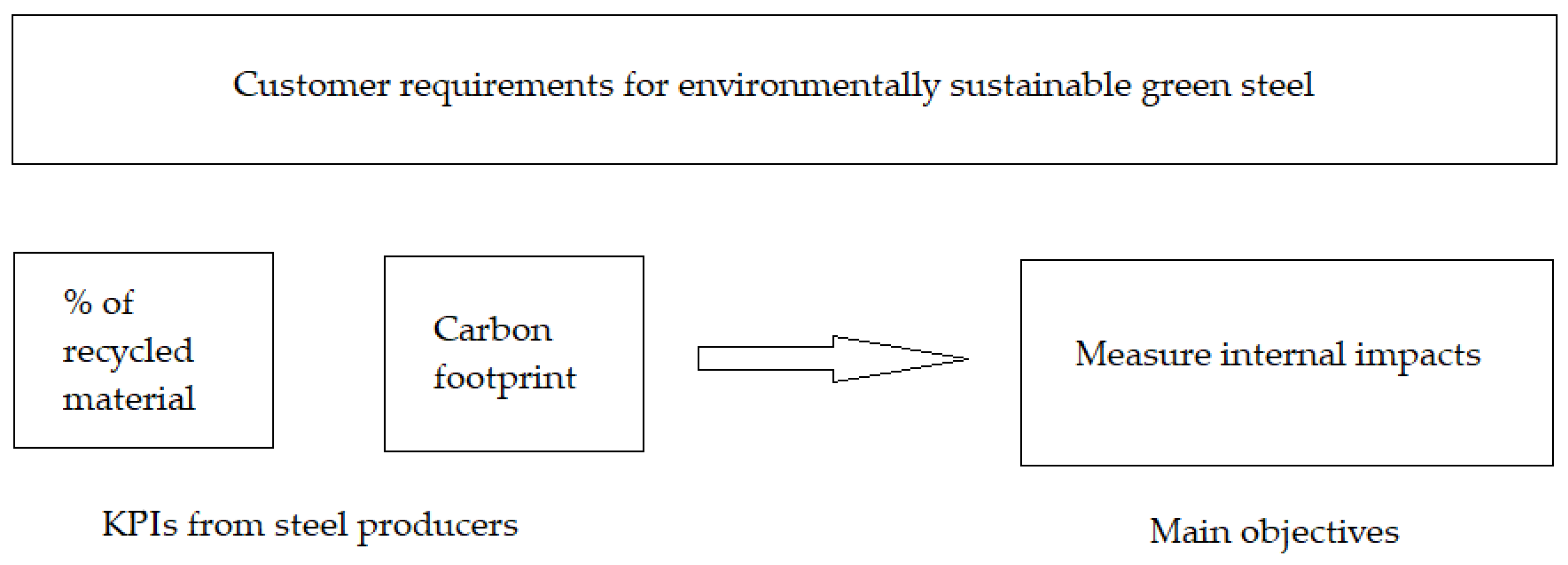

| CO2 emissions | Scope 1, 2 and 3 are important to measure. Scope 3 is indispensable to measure for special steel, but it starts to become important also for the construction sector due to ESG funds. Carbon footprint is gaining importance. Origin of the material in the construction sector: the smaller the distance from the producer, the better the CO2 emissions due to less transportation. Both are important external information for the market. |

| CE | Percentage of post-consumer recyclable material. Fundamental to get contracts in the construction sector. Driving innovation in founding more recyclable effective resources. Important external information for the market. |

| Energy efficiency | Internal indicator to measure production process effectiveness. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tolettini, L.; Di Maria, E. Structuring and Measuring Environmental Sustainability in the Steel Sector: A Single Case Study. Sustainability 2023, 15, 6272. https://doi.org/10.3390/su15076272

Tolettini L, Di Maria E. Structuring and Measuring Environmental Sustainability in the Steel Sector: A Single Case Study. Sustainability. 2023; 15(7):6272. https://doi.org/10.3390/su15076272

Chicago/Turabian StyleTolettini, Laura, and Eleonora Di Maria. 2023. "Structuring and Measuring Environmental Sustainability in the Steel Sector: A Single Case Study" Sustainability 15, no. 7: 6272. https://doi.org/10.3390/su15076272

APA StyleTolettini, L., & Di Maria, E. (2023). Structuring and Measuring Environmental Sustainability in the Steel Sector: A Single Case Study. Sustainability, 15(7), 6272. https://doi.org/10.3390/su15076272