Mobile Banking Service Design Attributes for the Sustainability of Internet-Only Banks: A Case Study of KakaoBank

Abstract

:1. Introduction

- What UX design antecedents affect the use of mobile banking services by users?

- What factors differentiate the mobile banking services of Internet-only banks from the Internet banking and telebanking services provided by existing banks?

- What mobile banking service design attributes affect user usage intention?

2. Theoretical Framework

2.1. Internet-Only Banks and Mobile Banking Services

2.2. Theory of Planned Behavior

2.3. Conceptual Framework

3. Research Model and Hypotheses

3.1. Research Purpose and Model

3.2. Research Hypotheses

3.2.1. Perceived Information Quality

3.2.2. Perceived Service Quality

3.2.3. Perceived Utilitarian Value

3.2.4. Perceived Hedonic Value

3.2.5. Perceived Ease of Use

3.2.6. Perceived Usefulness

3.2.7. Perceived Aesthetics

3.2.8. Attitude toward the Use of a Mobile Banking Service

4. Research Method

4.1. Sample and Data Collection

4.2. Measurement of Research Variables

5. Research Analysis and Results

5.1. Demographic Characteristics

5.2. Validation of the Measurement Model

5.3. Validation of the Structure Model

6. Conclusions and Implications

6.1. Study Results

6.2. Implications, Limitations, and Directions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Moniruzzaman, M.; Ryan, W. The emergence of digital banking accelerated by COVID-19: Modeling the adoption of mobile banking for small business. J. Financ. Serv. Mark. 2021, 26, 128–237. [Google Scholar]

- Vermeulen, F. How Capitec Became South Africa’s Biggest Bank. Harv. Bus. Rev. 2018, 47, 325. [Google Scholar]

- Choi, J.; Kim, K.K. Moderating Effects of Product Types on the Relationship between Online Category Killer Store Characteristics and Shopping Attitudes. Knowl. Manag. Res. 2014, 15, 79–103. [Google Scholar]

- Zhu, D.; Xu, Y.; Ma, H.; Liao, J.; Sun, W.; Chen, Y.; Liu, W. Building a Three-Level User Experience (UX) Measurement Framework for Mobile Banking Applications in a Chinese Context: An Analytic Hierarchy Process (AHP) Analysis. Multimodal Technol. Interact. 2022, 6, 83. [Google Scholar] [CrossRef]

- Park, C.J.; Ryu, D.J. Internet-only Banks: An Introductory Overview. Korean Acad. Soc. Bus. Admin. 2018, 47, 549–576. [Google Scholar]

- Kumar, R.; Singh, R.; Kumar, K.; Khan, S.; Corvello, V. How Does Perceived Risk and Trust Affect Mobile Banking Adoption? Empirical Evidence from India. Sustainability 2023, 15, 4053. [Google Scholar] [CrossRef]

- Kakao Bank. We Will Achieve Innovation in Finance beyond Banks. Available online: https://www.kakaobank.com/products/mini (accessed on 7 December 2022).

- Kakao Bank. ‘Everyone’s Bank’ Based on 19 Million Customers… Continued Growth through Expansion of Banking and Platform Businesses. Available online: https://www.kakaobank.com/Corp/News/PressRelease/view/13128 (accessed on 7 December 2022).

- Banking Statistics System. Available online: http://bss.kfb.or.kr/ (accessed on 10 December 2022).

- Kyeong, S.; Kim, D.; Shin, J. Can System Log Data Enhance the Performance of Credit Scoring?—Evidence from an Internet Bank in Korea. Sustainability 2022, 14, 130. [Google Scholar] [CrossRef]

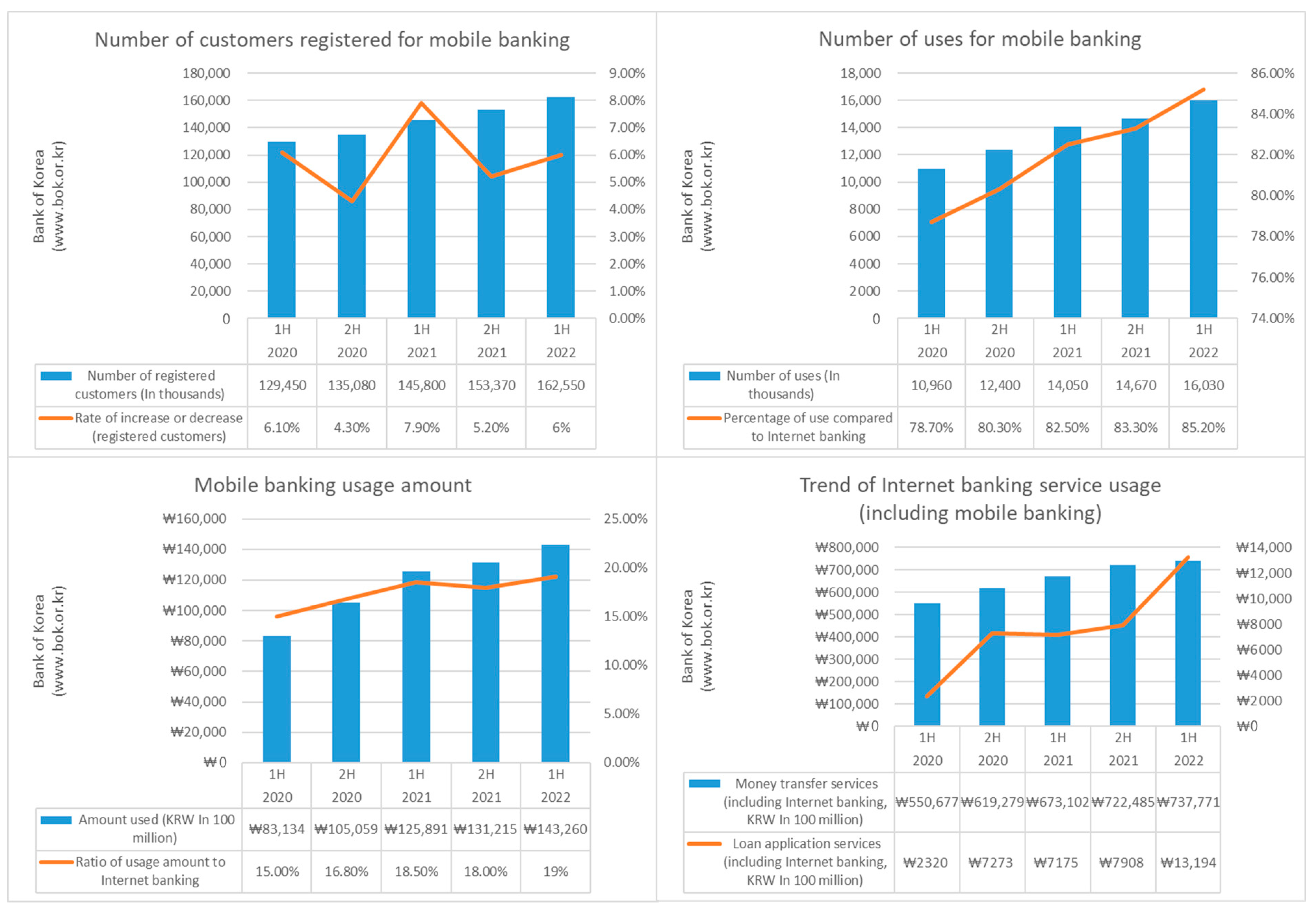

- Internet Banking Service Use of Domestic Banks in the First Half of 2022. Available online: http://www.bok.or.kr (accessed on 3 October 2022).

- Park, C.W.; Park, J.S. Payment and Settlement Statistics: Internet Banking Service Usage Status of Domestic Banks. The Bank of Korea, 24 September 2022. Available online: https://www.bok.or.kr/portal/bbs/P0000559/view.do?nttId=10072757&menuNo=200690 (accessed on 3 October 2022).

- Bădîrcea, R.M.; Manta, A.G.; Florea, N.M.; Popescu, J.; Manta, F.L.; Puiu, S. E-Commerce and the Factors Affecting Its Development in the Age of Digital Technology: Empirical Evidence at EU–27 Level. Sustainability 2022, 14, 101. [Google Scholar] [CrossRef]

- Sandesara, M.; Bodkhe, U.; Tanwar, S.; Alshehri, M.D.; Sharma, R.; Neagu, B.-C.; Grigoras, G.; Raboaca, M.S. Design and Experience of Mobile Applications: A Pilot Survey. Mathematics 2022, 10, 2380. [Google Scholar] [CrossRef]

- Ajzen, I. The theory of planned behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Fishbein, M. A theory of reasoned action: Some applications and implications. Neb. Symp. Motiv. 1979, 27, 65–116. [Google Scholar]

- Hoffman, D.L.; Novak, T.P. Marketing in hypermedia computer-mediated environments: Conceptual foundations. J. Mark. 1996, 60, 50–68. [Google Scholar] [CrossRef]

- DeLone, W.H.; McLean, E.R. Measuring e-commerce success: Applying the DeLone & McLean information systems success model. Int. J. Electron. Commer. 2004, 9, 31–47. [Google Scholar]

- Rai, A.; Lang, S.S.; Welker, R.B. Assessing the validity of IS success models: An empirical test and theoretical analysis. Inf. Syst. Res. 2002, 13, 50–69. [Google Scholar] [CrossRef] [Green Version]

- Doll, W.J.; Torkzadeh, G. Developing a multidimensional measure of system-use in an organizational context. Inf. Manag. 1998, 33, 171–185. [Google Scholar] [CrossRef]

- Boulding, W.; Kirmani, A. A consumer-side experimental examination of signaling theory: Do consumers perceive warranties as signals of quality? J. Consum. Res. 1993, 20, 111–123. [Google Scholar] [CrossRef]

- Teo, T.S.; Choo, W.Y. Assessing the impact of using the Internet for competitive intelligence. Inf. Manag. 2001, 39, 67–83. [Google Scholar] [CrossRef]

- Babin, B.J.; Darden, W.R.; Griffin, M. Work and/or fun: Measuring hedonic and utilitarian shopping value. J. Consum. Res. 1994, 20, 644–656. [Google Scholar] [CrossRef]

- Parasuraman, A.; Zeithaml, V.A.; Berry, L. SERVQUAL: A multiple-item scale for measuring consumer perceptions of service quality. J. Retail. 1988, 64, 12–40. [Google Scholar]

- Zeithaml, V.A. Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. J. Mark. 1988, 52, 2–22. [Google Scholar] [CrossRef]

- Kotler, P. Reconceptualizing marketing: An interview with Philip Kotler. Eur. Manag. J. 1994, 12, 353–361. [Google Scholar] [CrossRef]

- Blake, R.; Mouton, J. HRD Controversy: A la Blake and Mouton. Train. Dev. J. 1980, 34, 106–108. [Google Scholar]

- Hirschman, E.C.; Holbrook, M.B. Hedonic consumption: Emerging concepts, methods and propositions. J. Mark. 1982, 46, 92–101. [Google Scholar] [CrossRef] [Green Version]

- Kim, B.; Han, I. The role of utilitarian and hedonic values and their antecedents in a mobile data service environment. Expert. Syst. Appl. 2011, 38, 2311–2318. [Google Scholar] [CrossRef]

- Yang, K.; Lee, H.J. Gender differences in using mobile data services: Utilitarian and hedonic value approaches. J. Res. Interact. Mark. 2010, 4, 142–156. [Google Scholar] [CrossRef]

- Venkatesh, V.; Davis, F.D. A theoretical extension of the technology acceptance model. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef] [Green Version]

- Park, S.; Choi, Y.J. The study of educational mobile application usage based on technology acceptance model. Korean J. Broadcast. Telecommun. Res 2013, 82, 9–35. [Google Scholar]

- Agarwal, R.; Karahanna, E. Time flies when you’re having fun: Cognitive absorption and beliefs about information technology usage. MIS Q. 2000, 24, 665–694. [Google Scholar] [CrossRef]

- Chau, P.Y. An empirical assessment of a modified technology acceptance model. J. Manag. Inf. Syst. 1996, 13, 185–204. [Google Scholar] [CrossRef]

- Bae, G.-S. A Study on the Factors Which Affect the Intention to Users in Using Mobile Commerce in the View of Technology Acceptance Model. Master’s Thesis, Sookmyung Women’s University, Seoul, Republic of Korea, 2004. Unpublished. [Google Scholar]

- Sayaf, A.M.; Alamri, M.M.; Alqahtani, M.A.; Alrahmi, W.M. Factors Influencing University Students’ Adoption of Digital Learning Technology in Teaching and Learning. Sustainability 2022, 14, 493. [Google Scholar] [CrossRef]

- Agarwal, R.; Prasad, J. Are individual differences germane to the acceptance of new information technologies? Decis. Sci. 1999, 30, 361–391. [Google Scholar] [CrossRef]

- Ruth, C.J. Applying a Modified Technology Acceptance Model to Determine Factors Affecting Behavioral Intentions to Adopt Electronic Shopping on the World Wide Web: A Structural Equation Modeling Approach. Doctoral Dissertation, Drexel University, Philadelphia, PA, USA, 2000. [Google Scholar]

- Ju, K.W.; Lee, E.J. The effect of shopping orientation, fashion innovativeness and perceived mobile benefits on mobile clothing. J. Korean Soc. Fash. Des. 2015, 15, 147–164. [Google Scholar]

- Porteous, J.D. Environmental Aesthetics: Ideas, Politics and Planning; Routledge: London, UK, 1996. [Google Scholar]

- Coates, D. Watches Tell More than Time; McGraw-Hill: New York, NY, USA, 2003. [Google Scholar]

- Norman, D.A. Emotional Design: Why We Love (or Hate) Everyday Things; Basic Books: New York, NY, USA, 2004. [Google Scholar]

- Vincent, J. Emotional attachment to mobile phones: An extraordinary relationship. In Mobile World: Past, Present and Future; Hamill, L., Lasen, A., Eds.; Springer: New York, NY, USA, 2005; pp. 93–104. [Google Scholar]

- Nanda, P.; Bos, J.; Kramer, K.L.; Hay, C.; Ignacz, J. Effect of smartphone aesthetic design on users’ emotional reaction: An empirical study. TQM J. 2008, 20, 348–355. [Google Scholar] [CrossRef]

- Hassenzahl, M.; Tractinsky, N. User experience: A research agenda. Behav. Inf. Technol. 2006, 25, 91–97. [Google Scholar] [CrossRef]

- Schmidt, K.E.; Liu, Y.L.; Sridharan, S. Webpage aesthetics, performance, and usability: Design variables and their effects. Ergonomics 2009, 52, 641–643. [Google Scholar] [CrossRef] [PubMed]

- Eagly, A.H.; Chaiken, S. The Psychology of Attitudes; Harcourt Brace Jovanovich College Publishers: San Diego, CA, USA, 1993. [Google Scholar]

- Bruner, G.C.; Kumar, A. Web commercials and advertising hierarchy-of-effects. J. Advert. Res. 2000, 40, 35–42. [Google Scholar] [CrossRef]

- Lim, H.; Dubinsky, A.J. The theory of planned behavior in e-commerce: Making a case for interdependencies between salient beliefs. Psychol. Mark. 2005, 22, 833–855. [Google Scholar] [CrossRef]

- Kuan, H.H.; Bock, G.W.; Vathanophas, V. Comparing the effects of website quality on customer initial purchase and continued purchase at e-commerce websites. Behav. Inf. Technol. 2008, 27, 3–16. [Google Scholar] [CrossRef]

- Oh, H. Service quality, customer satisfaction, and customer value: A holistic perspective. Int. J. Hosp. Manag. 1999, 18, 67–82. [Google Scholar] [CrossRef]

- Tractinsky, N.; Cokhavi, A.; Kirschenbaum, M.; Sharfi, T. Evaluating the consistency of immediate aesthetic perceptions of web pages. Int. J. Hum. Comput. Stud. 2006, 64, 1071–1083. [Google Scholar] [CrossRef]

- Ashari, H.; Abbas, I.; Abdul-Talib, A.-N.; Mohd Zamani, S.N. Entrepreneurship and Sustainable Development Goals: A Multigroup Analysis of the Moderating Effects of Entrepreneurship Education on Entrepreneurial Intention. Sustainability 2022, 14, 431. [Google Scholar] [CrossRef]

- Sadyk, D.; Islam, D.M.Z. Brand Equity and Usage Intention Powered by Value Co-Creation: A Case of Instagram in Kazakhstan. Sustainability 2022, 14, 500. [Google Scholar] [CrossRef]

- Lucas, H.C., Jr.; Nielsen, N.R. The impact of the mode of information presentation on learning and performance. Manag. Sci. 1980, 26, 982–993. [Google Scholar] [CrossRef]

| Tossbank | Kakaobank | Kbank | |

|---|---|---|---|

| Number of customers (in thousands) | 4400 | 19,380 | 7380 |

| CSS model | TSS (Toss Scoring System) | Kakaobank Scoring | Development of CCS Model Using Telecommunication Company Data |

| Medium interest rate loan ratio | 40% | 24% | 24% |

| Target of mid-interest loans by the end of 2022 | 42% | 25% | 25% |

| No. | Hypothesis | |

|---|---|---|

| H1 | Perceived information quality → Attitude toward use | Perceived information quality positively affects attitude toward the use of a mobile banking application. |

| H2 | Perceived service quality → Attitude toward use | Perceived service quality positively affects attitude toward the use of a mobile banking application. |

| H3 | Utilitarian value → Attitude toward use | Perceived utilitarian value positively affects attitude toward the use of a mobile banking application. |

| H4 | Hedonic value → Attitude toward use | Perceived hedonic value positively affects attitude toward the use of a mobile banking application. |

| H5 | Perceived ease of use → Attitude toward use | Perceived ease of use positively affects attitude toward the use of a mobile banking application. |

| H6 | Perceived usefulness → Attitude toward use | Perceived usefulness positively affects attitude toward the use of a mobile banking application. |

| H7 | Perceived aesthetics → Attitude toward use | Perceived aesthetics positively affects attitude toward the use of a mobile banking application. |

| H8 | Attitude toward use → Use intention | Attitude toward using the mobile banking service positively affects usage intention. |

| Constructs | Operational Definitions and Measurement Items | References |

|---|---|---|

| Perceived information quality (IQ) | Consumer evaluation of information provided by mobile banking (1) This mobile banking platform provides accurate information necessary for using its services. (2) This mobile banking platform provides sufficient information necessary for using its services. (3) The information provided by this mobile banking platform is useful to me. (4) The information obtained from this mobile banking platform is valuable to me. | Kuan et al. [50] |

| Perceived service quality (SQ) | Consumer judgment of the overall superiority or excellence of service (1) The services provided by this mobile bank are reliable. (2) The services provided by this mobile bank are trustworthy. (3) The services provided by this mobile bank are worth using continuously. | Oh [51] |

| Utilitarian value (UV) | Belief in cognitive rewards for goals that can be obtained by using the mobile banking service (1) I always complete what I intend to (e.g., account transfer and remittance) while using mobile banking. (2) I can immediately use the function I want to use on this mobile banking platform. (3) This mobile banking platform has the functions I need. (4) This mobile banking platform is convenient to use. | Babin et al. [23] |

| Hedonic value (EV) | Belief in pleasure as well as sensory and emotional rewards that can be obtained by using the mobile banking service (1) Compared to other things I can do at this time, I truly enjoy spending time using the mobile banking platform. (2) I feel excited and my heart flutters when using the mobile banking platform. (3) I feel curious about using the mobile banking platform when I use it. (4) I feel that using mobile banking is beneficial. | Babin et al. [23] |

| Perceived ease of use (UE) | Expectation that using the mobile banking technology or system will not require much effort from the user (1) I can easily make a deposit, transfer money to other accounts, or make a wire transfer on the mobile banking platform. (2) I can easily use the mobile banking platform. (3) I can easily access the service I want on the mobile banking platform. (4) It will be easy to learn how to make a new account or complete a wire transfer on the mobile banking platform. | Sayaf, A.M. [36] |

| Perceived usefulness (UF) | Subjective expectation that using the mobile banking service will increase task efficiency (1) I can obtain useful information from the mobile banking platform. (2) Mobile banking efficiently provides services, such as account transfers, remittance, and deposits. (3) Using mobile banking will be useful. (4) Mobile banking has more advantages than disadvantages. | Sayaf, A.M. [36] |

| Perceived aesthetics (ET) | Outward beauty of the mobile banking application or the pleasure associated with it (1) I think the design of the mobile banking platform is creative. (2) I think the design of the mobile banking platform is fascinating. (3) I think the design of the mobile banking platform makes me feel good. (4) I think the design of the mobile banking platform is pretty. | Tractinsky et al. [52] |

| Attitude toward use (AT) | Psychological tendency and preference determined by the customer’s evaluation of the mobile banking service (1) I am developing a close relationship with the mobile bank. (2) I feel relaxed when using this mobile banking service. (3) I have a positive attitude about spending time using the mobile banking platform. (4) I have a favorable opinion of this mobile bank. | Ashari, H. et al. [53] |

| Usage intention (IT) | Intention to purchase this product due to consumer attitude toward mobile banking (1) I think I will definitely use this mobile banking service in the future. (2) If I have to decide right now, I may use the mobile bank. (3) I intend to use this mobile bank in the future. (4) I would like to recommend this mobile bank to others. | Sadyk et al. [54] |

| Category | Frequency | Percentage (%) | Category | Frequency | Percentage (%) | ||

|---|---|---|---|---|---|---|---|

| Gender | Male | 98 | 49% | Occupation | Self-employed | 4 | 2% |

| Female | 102 | 51% | Sales/service | 6 | 3% | ||

| Age | 20s | 64 | 32% | Functional jobs | 6 | 3% | |

| 30s | 44 | 22% | Clerical/technical jobs | 70 | 35% | ||

| 40s | 50 | 25% | Executive/management jobs | 18 | 9% | ||

| 50s | 42 | 21% | Freelance/specialized jobs | 24 | 12% | ||

| Region | Seoul | 60 | 30% | College students | 28 | 14% | |

| Busan | 14 | 7% | Graduate students | 2 | 1% | ||

| Daegu | 12 | 6% | Homemakers | 24 | 12% | ||

| Incheon | 8 | 4% | Unemployed | 12 | 6% | ||

| Daejeon | 4 | 2% | Others | 6 | 3% | ||

| Gwangju | 6 | 3% | Current service | KakaoBank | 51 | 26% | |

| Ulsan | 2 | 1% | Kookmin Bank | 29 | 15% | ||

| Gyeonggi | 74 | 37% | Shinhan Bank | 29 | 15% | ||

| Chungbuk | 4 | 2% | NongHyup Bank | 25 | 13% | ||

| Jeonbuk | 4 | 2% | Woori Bank | 20 | 10% | ||

| Jeonnam | 2 | 1% | Hana Bank | 17 | 9% | ||

| Gyeongbuk | 2 | 1% | Kbank | 16 | 8% | ||

| Gyeongnam | 4 | 2% | Industrial Bank of Korea | 9 | 5% | ||

| Jeju | 4 | 2% | Other banks (enter the name of bank) | 5 | 3% | ||

| Measurement Variable | Number of Measurement Items | Mean | SD | AVE | Composite Reliability | Cronbach’s Alpha | VIF |

|---|---|---|---|---|---|---|---|

| IQ | 4 | 5.676 | 0.844 | 0.712 | 0.886 | 0.844 | 2.458 |

| SQ | 3 | 4.566 | 0.924 | 0.854 | 0.932 | 0.911 | 1.320 |

| UV | 4 | 4.121 | 0.906 | 0.821 | 0.893 | 0.891 | 2.221 |

| EV | 4 | 5.100 | 0.901 | 0.811 | 0.944 | 0.886 | 2.512 |

| UE | 4 | 4.336 | 0.854 | 0.729 | 0.912 | 0.932 | 1.612 |

| UF | 4 | 4.276 | 0.903 | 0.816 | 0.902 | 0.954 | 2.145 |

| ET | 4 | 4.439 | 0.912 | 0.832 | 0.892 | 0.863 | 2.321 |

| AT | 4 | 5.116 | 0.872 | 0.761 | 0.912 | 0.911 | 2.201 |

| IT | 4 | 5.136 | 0.874 | 0.764 | 0.956 | 0.941 | · |

| IQ | SQ | UV | EV | UE | UF | ET | AT | IT | |

|---|---|---|---|---|---|---|---|---|---|

| IQ | 0.952 | ||||||||

| SQ | 0.632 | 0.883 | |||||||

| UV | 0.461 | 0.452 | 0.824 | ||||||

| EV | 0.361 | 0.255 | 0.256 | 0.799 | |||||

| UE | 0.794 | 0.665 | 0.543 | 0.432 | 0.867 | ||||

| UF | 0.564 | 0.556 | 0.500 | 0.346 | 0.667 | 0.838 | |||

| ET | 0.652 | 0.602 | 0.417 | 0.452 | 0.625 | 0.632 | 0.813 | ||

| AT | 0.289 | 0.156 | 0.140 | 0.227 | 0.172 | 0.228 | 0.238 | 0.895 | |

| IT | 0.375 | 0.421 | 0.224 | 0.186 | 0.283 | 0.357 | 0.267 | 0.192 | 0.798 |

| Hypothesis | Path | Path Coefficient | t-Value | p-Value | Accepted or Rejected |

|---|---|---|---|---|---|

| H1 | Perceived information quality (IQ) > Attitude toward use (AT) | 0.145 | 1.826 | 0.032 | Accepted |

| H2 | Perceived service quality (SQ) > Attitude toward use (AT) | 0.072 | 0.921 | 0.178 | Rejected |

| H3 | Utilitarian value (UV) > Attitude toward use (AT) | 0.133 | 1.793 | 0.039 | Accepted |

| H4 | Hedonic value (EV) > Attitude toward use (AT) | −0.042 | 0.746 | 0.273 | Rejected |

| H5 | Perceived ease of use (UE) > Attitude toward use (AT) | 0.289 | 2.945 | 0.008 | Accepted |

| H6 | Perceived usefulness (UF) > Attitude toward use (AT) | 0.147 | 1.835 | 0.03 | Accepted |

| H7 | Perceived aesthetics (ET) > Attitude toward use (AT) | 0.094 | 0.946 | 0.161 | Rejected |

| H8 | Attitude toward use (AT) > Usage intention (IT) | 0.559 | 14.148 | 0 | Accepted |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, S.; Kwon, H.-J.; Kim, H. Mobile Banking Service Design Attributes for the Sustainability of Internet-Only Banks: A Case Study of KakaoBank. Sustainability 2023, 15, 6428. https://doi.org/10.3390/su15086428

Kim S, Kwon H-J, Kim H. Mobile Banking Service Design Attributes for the Sustainability of Internet-Only Banks: A Case Study of KakaoBank. Sustainability. 2023; 15(8):6428. https://doi.org/10.3390/su15086428

Chicago/Turabian StyleKim, Seongho, Hyuk-Jun Kwon, and Hyeob Kim. 2023. "Mobile Banking Service Design Attributes for the Sustainability of Internet-Only Banks: A Case Study of KakaoBank" Sustainability 15, no. 8: 6428. https://doi.org/10.3390/su15086428

APA StyleKim, S., Kwon, H.-J., & Kim, H. (2023). Mobile Banking Service Design Attributes for the Sustainability of Internet-Only Banks: A Case Study of KakaoBank. Sustainability, 15(8), 6428. https://doi.org/10.3390/su15086428