Closed-Loop Supply Chain Decision-Making and Coordination Considering Fairness Concerns under Carbon Neutral Rewards and Punishments

Abstract

:1. Introduction

2. Literature Review

2.1. Carbon Neutral in Supply Chain

2.2. Cost-Sharing Contract

2.3. Revenue-Sharing Contract

2.4. Multiple Contracts

2.5. Research Gap and Conclusion

3. Problem Description and Assumption

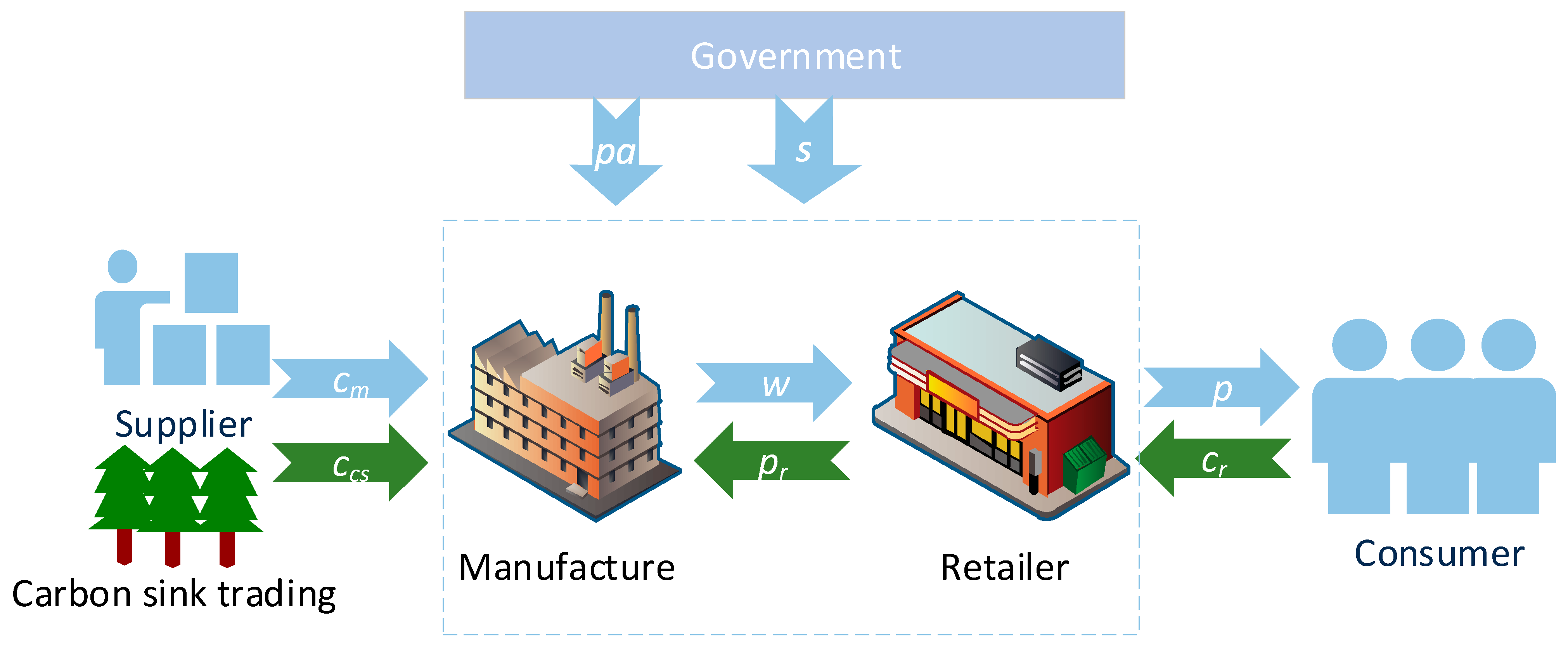

3.1. Problem Description

3.2. Parameters and Assumptions

4. Model and Analysis

4.1. CLSC Game Model under Carbon Neutral Rewards and Punishments

4.1.1. Centralized Decision-Making

4.1.2. Decentralized Decision-Making

4.2. CLSC Model with Fairness Concerns

4.3. Supply Chain Coordination

4.3.1. The Cost-Sharing Contract

4.3.2. The Revenue-Sharing Contract

4.3.3. Cost-Revenue Sharing Contract

5. Numerical Analysis

5.1. Enterprise

5.1.1. Fairness Concern Coefficient

5.1.2. Cost-Sharing Coefficient

5.1.3. Carbon Sink Trading

5.2. The Government

5.3. The Market

6. Conclusions and Outlook

6.1. Conclusions

6.2. Contributions

6.3. Limitations and Future Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Li, C.; Zhu, C.; Wang, X.; Ren, S.; Xu, P.; Xiang, H. Green finance: How can it help Chinese power enterprises transition towards carbon neutrality. Environ. Sci. Pollut. Res. 2023, 1–19. [Google Scholar] [CrossRef] [PubMed]

- Era, I.; Jia, M.; Yang, Q. Carbon Neutrality Strategy of Chinese Firms: Theory and Practice. Foreign Econ. Manag. 2022, 44, 3–20. [Google Scholar]

- Chen, J.; Zheng, Y.; Liang, S.; Wang, P.; Chen, W.; Liu, W. Review on Social Responsibility of Chinese Companies in the Context of Carbon Neutrality and Performance. J. Sociol. Ethnol. 2022, 4, 110–119. [Google Scholar]

- Apple Environmental Progress Report 2022. 2022. Available online: https://www.apple.com.cn/environment/pdf/Apple_Environmental_Progress_Report_2022.pdf (accessed on 19 April 2022).

- Zhu, J.; Dou, Z.; Yan, X.; Yu, L.; Lu, Y. Exploring the influencing factors of carbon neutralization in Chinese manufacturing enterprises. Environ. Sci. Pollut. Res. 2022, 30, 2918–2944. [Google Scholar] [CrossRef] [PubMed]

- Pasternack, B.A. Optimal Pricing and Return Policies for Perishable Commodities. Mark. Sci. 1985, 4, 166–176. [Google Scholar] [CrossRef]

- Waltho, C.; Elhedhli, S.; Gzara, F. Green supply chain network design: A review focused on policy adoption and emission quantification. Int. J. Prod. Econ. 2018, 208, 305–318. [Google Scholar] [CrossRef]

- Xia, X.; Li, M.; Lu, M. Comparative study on the impact of carbon emission reduction policies on authorized remanufacturing. Syst. Eng. Theory Pract. 2023, 1–19. Available online: https://kns.cnki.net/kcms/detail/11.2267.N.20230227.1914.004.html (accessed on 28 February 2023).

- McDonough, W. Carbon is not the enemy. Nature 2016, 539, 349–351. [Google Scholar] [CrossRef] [Green Version]

- Awan, U.; Sroufe, R.; Bozan, K. Designing Value Chains for Industry 4.0 and a Circular Economy: A Review of the Literature. Sustainability 2022, 14, 7084. [Google Scholar] [CrossRef]

- Khan, H.U.R.; Usman, B.; Zaman, K.; Nassani, A.A.; Haffar, M.; Muneer, G. The impact of carbon pricing, climate financing, and financial literacy on COVID-19 cases: Go-for-green healthcare policies. Environ. Sci. Pollut. Res. 2022, 29, 35884–35896. [Google Scholar] [CrossRef]

- Sedjo, R.A.; Marland, G. Inter-trading permanent emissions credits and rented temporary carbon emissions offsets: Some issues and alternatives. Clim. Policy 2003, 3, 435–444. [Google Scholar] [CrossRef]

- Shekarian, E. A review of factors affecting closed-loop supply chain models. J. Clean. Prod. 2019, 253, 119823. [Google Scholar] [CrossRef]

- Keohane, N.O. Cap and Trade, Rehabilitated: Using Tradable Permits to Control U.S. Greenhouse Gases. Rev. Environ. Econ. Policy 2009, 3, 42–62. [Google Scholar] [CrossRef] [Green Version]

- Stavins, R.N. Addressing climate change with a comprehensive US cap-and-trade system. Oxf. Rev. Econ. Policy 2008, 24, 298–321. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon Footprint and the Management of Supply Chains: Insights From Simple Models. IEEE Trans. Autom. Sci. Eng. 2012, 10, 99–116. [Google Scholar] [CrossRef]

- Kahneman, D.; Knetsch, J.L.; Thaler, R.H. Fairness and the Assumptions of Economics. J. Bus. 1986, 59, S285. [Google Scholar] [CrossRef]

- Cui, T.H.; Raju, J.S.; Zhang, Z.J. Fairness and Channel Coordination. Manag. Sci. 2007, 53, 1303–1314. [Google Scholar] [CrossRef] [Green Version]

- Zang, L.; Liu, M.; Wang, Z.; Wen, D. Coordinating a two-stage supply chain with external failure cost-sharing and risk-averse agents. J. Clean. Prod. 2022, 334, 130012. [Google Scholar] [CrossRef]

- Chen, H.; Dong, Z.; Li, G.; He, K. Remanufacturing process innovation in closed-loop supply chain under cost-sharing mechanism and different power structures. Comput. Ind. Eng. 2021, 162, 107743. [Google Scholar] [CrossRef]

- Ma, N.; Gao, R.; Wang, X.; Li, P. Green supply chain analysis under cost sharing contract with uncertain information based on confidence level. Soft Comput. 2020, 24, 2617–2635. [Google Scholar] [CrossRef]

- Kuchesfehani, E.K.; Parilina, E.M.; Zaccour, G. Revenue and cost sharing contract in a dynamic closed-loop supply chain with uncertain parameters. Ann. Oper. Res. 2022, 322, 851–877. [Google Scholar] [CrossRef]

- Lee, D.-H.; Yoon, J.-C. Decisions on Pricing, Sustainability Effort, and Carbon Cap under Wholesale Price and Cost-Sharing Contracts. Sustainability 2022, 14, 4863. [Google Scholar] [CrossRef]

- Li, J.; Gong, S. Coordination of Closed-Loop Supply Chain with Dual-Source Supply and Low-Carbon Concern. Complexity 2020, 2020, 7506791. [Google Scholar] [CrossRef]

- Wen, D.; Mushegh, H.; Baojun, J. Consumer Fairness Concerns and Dynamic Pricing in a Channel. Mark. Sci. 2022. ahead of print. [Google Scholar] [CrossRef]

- Xia, X.; Chen, W.; Liu, B. Optimal production decision and financing strategy for a capital-constrained closed loop supply chain under fairness concern. J. Clean. Prod. 2022, 376, 134256. [Google Scholar] [CrossRef]

- Cachon, G.P.; Lariviere, M.A. Supply Chain Coordination with Revenue-Sharing Contracts: Strengths and Limitations. Manag. Sci. 2005, 51, 30–44. [Google Scholar] [CrossRef] [Green Version]

- Yuan, J.; Ma, J.; Yang, W. Revenue-sharing contract for supply chain under a Cap and Trade system. In Proceedings of the 2016 International Conference on Logistics, Informatics and Service Sciences (LISS), Sydney, NSW, Australia, 24–27 July 2016; pp. 1–6. [Google Scholar] [CrossRef]

- Ran, W.; Xu, T. Low-Carbon Supply Chain Coordination Based on Carbon Tax and Government Subsidy Policy. Sustainability 2023, 15, 1135. [Google Scholar] [CrossRef]

- Wang, B.; Ji, F.; Zheng, J.; Xie, K.; Feng, Z. Carbon emission reduction of coal-fired power supply chain enterprises under the revenue sharing contract: Perspective of coordination game. Energy Econ. 2021, 102, 105467. [Google Scholar] [CrossRef]

- Yang, H.; Chen, W. Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus Cost-sharing. Omega 2018, 78, 179–191. [Google Scholar] [CrossRef]

- Qiao, A.; Choi, S.; Pan, Y. Multi-party coordination in sustainable supply chain under consumer green awareness. Sci. Total. Environ. 2021, 777, 146043. [Google Scholar] [CrossRef]

- Yin, Y.; Liu, F. Carbon Emission Reduction and Coordination Strategies for New Energy Vehicle Closed-Loop Supply Chain under the Carbon Trading Policy. Complexity 2021, 2021, 3720373. [Google Scholar] [CrossRef]

- Li, T.; Zhang, R.; Zhao, S.; Liu, B. Low carbon strategy analysis under revenue-sharing and cost-sharing contracts. J. Clean. Prod. 2019, 212, 1462–1477. [Google Scholar] [CrossRef]

- Dehghan-Bonari, M.; Bakhshi, A.; Aghsami, A.; Jolai, F. Green supply chain management through call option contract and revenue-sharing contract to cope with demand uncertainty. Clean. Logist. Supply Chain 2021, 2, 100010. [Google Scholar] [CrossRef]

- Bai, Q.; Chen, M.; Nikolaidis, Y.; Xu, J. Improving sustainability and social responsibility of a two-tier supply chain investing in emission reduction technology. Appl. Math. Model. 2021, 95, 688–714. [Google Scholar] [CrossRef]

- Wang, W.; Zhang, Y.; Zhang, K.; Bai, T.; Shang, J. Reward–penalty mechanism for closed-loop supply chains under responsibility-sharing and different power structures. Int. J. Prod. Econ. 2015, 170, 178–190. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Moshtagh, M.S.; Moon, I. Pricing, product quality, and collection optimization in a decentralized closed-loop supply chain with different channel structures: Game theoretical approach. J. Clean. Prod. 2018, 189, 406–431. [Google Scholar] [CrossRef]

- Zhang, X.P.; Yin, G.F. Research on evaluation method of product green degree based on layered grey relation. Proceeding CSEE 2005, 25, 78–82. [Google Scholar]

- Sarkar, S.; Bhala, S. Coordinating a closed loop supply chain with fairness concern by a constant wholesale price contract. Eur. J. Oper. Res. 2021, 295, 140–156. [Google Scholar] [CrossRef]

- Yu, N.; Wang, S.; Liu, Z. Managing brand competition with consumer fairness concern via manufacturer incentive. Eur. J. Oper. Res. 2021, 300, 661–675. [Google Scholar] [CrossRef]

| Author(s) | Carbon Policy? | Green Efforts? (Carbon Trading and so on) | Fairness Concern? | Cost-Sharing? | Revenue-Sharing? | Other Contracts |

|---|---|---|---|---|---|---|

| Benjaafar et al. [16] | √ | |||||

| Kahneman et al. [17] | √ | |||||

| Cui et al. [18] | √ | |||||

| Zang et al. [19] | √ | |||||

| Chen et al. [20] | √ | |||||

| Ma et al. [21] | √ | |||||

| Kuchesfehani et al. [22] | √ | √ | ||||

| Li and Gong [24] | √ | √ | √ | |||

| Cachon et al. [27] | √ | √ | ||||

| Xia et al. [26] | √ | √ | ||||

| Yuan et al. [28] | √ | √ | √ | |||

| Wang et al. [30] | √ | √ | √ | |||

| Ran and Xu [29] | √ | √ | ||||

| Yang et al. [31] | √ | √ | √ | √ | ||

| Qiao et al. [32] | √ | √ | √ | |||

| Yin and Liu [33] | √ | √ | √ | |||

| Bai et al. [36] | √ | √ | √ | √ |

| Parameter | Meaning | Parameter | Meaning | ||

|---|---|---|---|---|---|

| Decision variables | The wholesale price | Consumer | Actual quantity demand | ||

| The retail price | Actual quantity recycling | ||||

| Quantity of carbon sink reserves | The expected price of recycling | ||||

| Unit price of recycling products | Nominal quantity demanded | ||||

| Price of recycled materials | Nominal quantity recycled | ||||

| The consumer price-sensitive coefficient | |||||

| Government | Government subsidy per unit | Coefficient of recovery efforts | |||

| Government rewards and punishments for each unit | The coefficient of recycling price sensitivity | ||||

| Proportion of subsidy distribution in the supply chain | The coefficient of consumer green perception | ||||

| Manufacturer | Cost of new products | Retailer | The coefficient of fairness concerns | ||

| Cost of remanufacturing | Recycling efforts | ||||

| Price per unit of carbon sink | |||||

| Carbon emission per unit of new products | Contract | Coefficient of cost-sharing | |||

| Carbon emissions per unit of remanufactured products | Coefficient of revenue-sharing |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shen, Y.; Gao, T.; Song, Z.; Ma, J. Closed-Loop Supply Chain Decision-Making and Coordination Considering Fairness Concerns under Carbon Neutral Rewards and Punishments. Sustainability 2023, 15, 6466. https://doi.org/10.3390/su15086466

Shen Y, Gao T, Song Z, Ma J. Closed-Loop Supply Chain Decision-Making and Coordination Considering Fairness Concerns under Carbon Neutral Rewards and Punishments. Sustainability. 2023; 15(8):6466. https://doi.org/10.3390/su15086466

Chicago/Turabian StyleShen, Yan, Tian Gao, Zizhao Song, and Ji Ma. 2023. "Closed-Loop Supply Chain Decision-Making and Coordination Considering Fairness Concerns under Carbon Neutral Rewards and Punishments" Sustainability 15, no. 8: 6466. https://doi.org/10.3390/su15086466