Analyzing the Attractiveness of Businesses to Receive Investments for a Creative and Innovative Transition to a Circular Economy: The Case of the Textile and Fashion Industry

Abstract

:1. Introduction

2. Materials and Methods

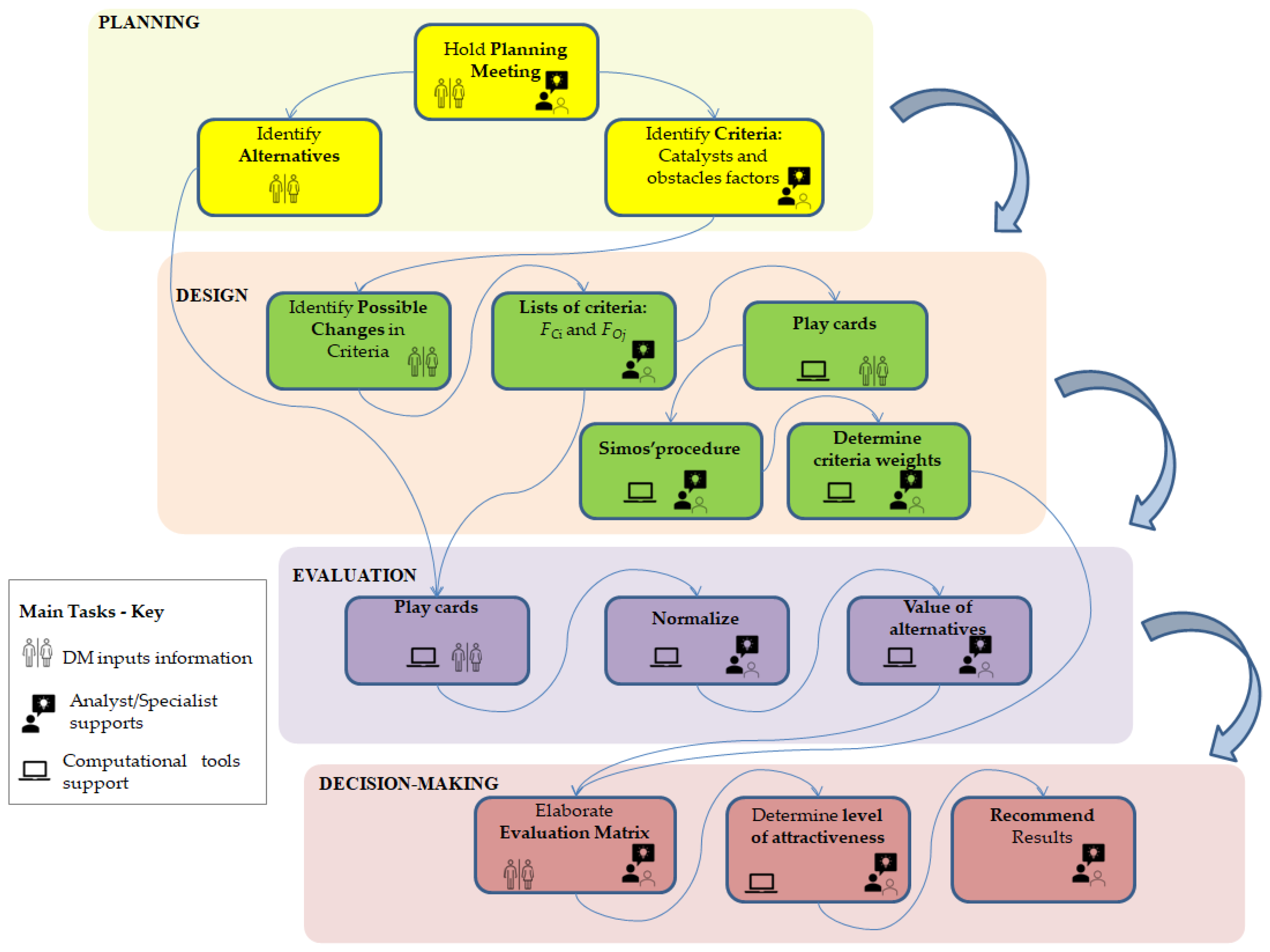

2.1. Planning

2.2. Design

- Comprehensive assessment, as the Simos’ procedure provides comprehensive assessment of alternatives based on multiple criteria, which can help to identify the best alternative or rank them in order of preference.

- Consistency, as the Simos’ procedure provides a consistent and standardized approach to decision making, which helps to ensure that the criteria are applied consistently across different alternatives and contexts.

- Transparency, as the use of a decision-making methodology based on the Simos’ procedure provides a transparent and systematic approach to decision making, which can increase confidence in the decision-making process.

- Flexibility, as the Simos’ procedure can be adapted to different decision-making contexts and can incorporate different criteria depending on the specific needs of the decision maker.

- Validity and reliability, as the Simos’ procedure has been validated and shown to be reliable in decision making, which increases confidence in the accuracy and consistency of the decision-making process.

2.3. Evaluation

2.4. Decision Making

3. Results

4. Discussion

Sensitivity Analysis

5. Conclusions

Theoretical, Practical and Social Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bukhari, M.A.; Carrasco-Gallego, R.; Ponce-Cueto, E. Developing a national programme for textiles and clothing recovery. Waste Manag. Res. 2018, 36, 321–331. [Google Scholar] [CrossRef] [PubMed]

- Riba, J.-R.; Cantero, R.; Canals, T.; Puig, R. Circular economy of post-consumer textile waste: Classification through infrared spectroscopy. J. Clean. Prod. 2020, 272, 123011. [Google Scholar] [CrossRef]

- Oliveira Silva, W.D.; Morais, D.C. Impacts and insights of circular business models’ outsourcing decisions on textile and fashion waste management: A multi-criteria decision model for sorting circular strategies. J. Clean. Prod. 2022, 370, 133551. [Google Scholar] [CrossRef]

- Stål, H.I.; Corvellec, H. A decoupling perspective on circular business model implementation: Illustrations from Swedish apparel. J. Clean. Prod. 2018, 171, 630–643. [Google Scholar] [CrossRef]

- Silva, W.D.O.; Fontana, M.E. Integrative multi-attribute negotiation model to define stakeholders’ responsibilities in the reverse flow channel. J. Clean. Prod. 2021, 279, 123752. [Google Scholar] [CrossRef]

- Dragomir, V.D.; Dumitru, M. Practical solutions for circular business models in the fashion industry. Clean. Logist. Supply Chain 2022, 4, 100040. [Google Scholar] [CrossRef]

- Niinimäki, K. Fashion in a Circular Economy. In Sustainability in Fashion; Henninger, C., Alevizou, P., Goworek, H., Ryding, D., Eds.; Palgrave Macmillan: Cham, Switzerland, 2017. [Google Scholar]

- Evans, S.; Peirson-Smith, A. The sustainability word challenge Exploring consumer interpretations of frequently used words to promote sustainable fashion brand behaviors and imagery. J. Fash. Mark. Manag. 2018, 22, 252–269. [Google Scholar]

- Spathas, T. The Environmental Performance of High Value Recycling for the Fashion Industry LCA for Four Case Studies. Ph.D. Thesis, Chalmers University of Technology, Gothenburg, Sweden, 2017. [Google Scholar]

- Cai, Y.-J.; Choi, T.-M.; Zhang, T. Commercial used apparel collection operations in retail supply chains. Eur. J. Oper. Res. 2021, 298, 169–181. [Google Scholar] [CrossRef]

- Mejías, A.M.; Bellas, R.; Pardo, J.E.; Paz, E. Traceability management systems and capacity building as new approaches for improving sustainability in the fashion multi-tier supply chain. Int. J. Prod. Econ. 2019, 217, 143–158. [Google Scholar] [CrossRef]

- Wu, H.J.; Su, J.; Hodges, N.N. Investigating the Role of Open Costing in the Buyer-Supplier Relationship: Implications for Global Apparel Supply Chain Management. Cloth. Text. Res. J. 2023, 41, 154–169. [Google Scholar] [CrossRef]

- Jensen, F.; Whitfield, L. Leveraging participation in apparel global supply chains through green industrialization strategies: Implications for low-income countries. Ecol. Econ. 2022, 194, 107331. [Google Scholar] [CrossRef]

- Jesus, G.M.K.; Jugend, D.; Paes, L.A.B.; Siqueira, R.M.; Leandrin, M.A. Barriers to the adoption of the circular economy in the Brazilian sugarcane ethanol sector. Clean Technol. Environ. Policy 2023, 25, 381–395. [Google Scholar] [CrossRef]

- Wang, Y.; Fan, D.; Fung, Y.-N.; Luo, S. Consumer-to-consumer product exchanges for original fashion brands in the sharing economy: Good or bad for fashion knockoffs? Transp. Res. Part E Logist. Transp. Rev. 2022, 158, 102599. [Google Scholar] [CrossRef]

- Ostermann, C.M.; da Nascimento, L.S.; Steinbruch, F.K.; Callegaro-de-Menezes, D. Drivers to implement the circular economy in born-sustainable business models: A case study in the fashion industry. Rev. Gestão 2021, 28, 223–240. [Google Scholar] [CrossRef]

- Prieto-Sandoval, V.; Jaca, C.; Santos, J.; Baumgartner, R.J.; Ormazabal, M. Key strategies, resources, and capabilities for implementing circular economy in industrial small and medium enterprises. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 1473–1484. [Google Scholar] [CrossRef]

- Sarja, M.; Onkila, T.; Mäkelä, M. A systematic literature review of the transition to the circular economy in business organizations: Obstacles, catalysts and ambivalences. J. Clean. Prod. 2021, 286, 125492. [Google Scholar] [CrossRef]

- Bressanelli, G.; Visintin, F.; Saccani, N. Circular Economy and the evolution of industrial districts: A supply chain perspective. Int. J. Prod. Econ. 2022, 243, 108348. [Google Scholar] [CrossRef]

- Rumble, R.; Minto, N.A. How to use analogies for creative business modelling. J. Bus. Strat. 2017, 38, 76–82. [Google Scholar] [CrossRef]

- Daňo, F.; Drábik, P.; Hanuláková, E. Circular Business Models in Textiles and Apparel Sector in Slovakia. Cent. Eur. Bus. Rev. 2020, 9, 1–19. [Google Scholar] [CrossRef]

- Han, S.L.C.; Chan, P.Y.L.; Venkatraman, P.; Apeagyei, P.; Cassidy, T.; Tyler, D.J. Standard vs. Upcycled Fashion Design and Production. Fash. Pract. 2017, 9, 69–94. [Google Scholar] [CrossRef]

- Chae, Y.; Hinestroza, J. Building Circular Economy for Smart Textiles, Smart Clothing, and Future Wearables. Mater. Circ. Econ. 2020, 2, 2. [Google Scholar] [CrossRef]

- Yousef, S.; Tatariants, M.; Tichonovas, M.; Kliucininkas, L.; Lukošiūtė, S.-I.; Yan, L. Sustainable green technology for recovery of cotton fibers and polyester from textile waste. J. Clean. Prod. 2020, 254, 120078. [Google Scholar] [CrossRef]

- Fischer, A.; Pascucci, S. Institutional incentives in circular economy transition: The case of material use in the Dutch textile industry. J. Clean. Prod. 2017, 155, 17–32. [Google Scholar] [CrossRef]

- Paras, M.; Curteza, A.; Varshneya, G. Identification of best reverse value chain alternatives A study of Romanian used clothing industry. J. Fash. Mark. Manag. 2019, 23, 396–412. [Google Scholar]

- Pal, R.; Gander, J. Modelling environmental value: An examination of sustainable business models within the fashion industry. J. Clean. Prod. 2018, 184, 251–263. [Google Scholar] [CrossRef]

- Mura, M.; Longo, M.; Zanni, S. Circular economy in Italian SMEs: A multi-method study. J. Clean. Prod. 2020, 245, 118821. [Google Scholar] [CrossRef]

- Binda, J.B.; Prokopenko, M.; Ramskyi, A.; Shuplat, O.; Halan, L.; Mykhaylenko, D. Assessment of investment attractiveness of industrial enterprises. Int. J. Manag. 2020, 11, 27–35. [Google Scholar]

- Strokov, A.I. The methodological aspects of assessing the attractiveness of investments made into financial assets and real projects. Life Sci. J. 2014, 11, 682–686. [Google Scholar]

- Akhmetshin, E.M.; Artemova, E.I.; Vermennikova, L.V.; Shichiyakh, R.A.; Prodanova, N.A.; Kuchukova, N.M. Management of investment attractiveness of enterprises: Principles, methods, organization. Int. J. Appl. Bus. Econ. Res. 2017, 15, 71–82. [Google Scholar]

- Urbinati, A.; Rosa, P.; Sassanelli, C.; Chiaroni, D.; Terzi, S. Circular business models in the European manufacturing industry: A multiple case study analysis. J. Clean. Prod. 2020, 274, 122964. [Google Scholar] [CrossRef]

- Simos, J. L’évaluation Environnementale: Un Processus Cognitif Négocié. Ph.D. Thesis, DGF-EPFL, Lausanne, Switzerland, 1990. [Google Scholar]

- Figueira, J.; Roy, B. Determining the weights of criteria in the ELECTRE type methods with a revised Simos’ procedure. Eur. J. Oper. Res. 2002, 139, 317–326. [Google Scholar] [CrossRef]

- Fontana, M.E.; Nepomuceno, V.S. Computational system for quantitative intra-criterion evaluation in subjective criterion. In Proceedings of the International Conference of Production Research, ICPR—Americas 2020, Bahía Blanca, Argentina, 9–11 December 2020. [Google Scholar]

- Al-Awlaqi, M.A.; Aamer, A.M. Individual entrepreneurial factors affecting adoption of circular business models: An empirical study on small businesses in a highly resource-constrained economy. J. Clean. Prod. 2022, 379, 134736. [Google Scholar] [CrossRef]

- Barford, A.; Ahmad, S.R. Levers for a corporate transition to a plastics circular economy. Bus. Strat. Environ. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- De Vass, T.; Nand, A.A.; Bhattacharya, A.; Prajogo, D.; Croy, G.; Sohal, A.; Rotaru, K. Transitioning to a circular economy: Lessons from the wood industry. Int. J. Logist. Manag. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Guzzo, D.; Pigosso, D.; Videira, N.; Mascarenhas, J. A system dynamics-based framework for examining Circular Economy transitions. J. Clean. Prod. 2022, 333, 129933. [Google Scholar] [CrossRef]

- Khan, S.A.; Mubarik, M.S.; Paul, S.K. Analyzing cause and effect relationships among drivers and barriers to circular economy implementation in the context of an emerging economy. J. Clean. Prod. 2022, 364, 132618. [Google Scholar] [CrossRef]

- von Kolpinski, C.; Yazan, D.M.; Fraccascia, L. The impact of internal company dynamics on sustainable circular business development: Insights from circular startups. Bus. Strat. Environ. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Luthra, S.; Kumar, A.; Sharma, M.; Garza-Reyes, J.A.; Kumar, V. An analysis of operational behavioural factors and circular economy practices in SMEs: An emerging economy perspective. J. Bus. Res. 2022, 141, 321–336. [Google Scholar] [CrossRef]

- Mathivathanan, D.; Mathiyazhagan, K.; Khorana, S.; Rana, N.P.; Arora, B. Drivers of circular economy for small and medium enterprises: Case study on the Indian state of Tamil Nadu. J. Bus. Res. 2022, 149, 997–1015. [Google Scholar] [CrossRef]

- Shooshtarian, S.; Hosseini, M.R.; Kocaturk, T.; Arnel, T.; Garofano, N.T. Circular economy in the Australian AEC industry: Investigation of barriers and enablers. Build. Res. Inf. 2023, 51, 56–68. [Google Scholar] [CrossRef]

- Piila, N.; Sarja, M.; Onkila, T.; Mäkelä, M. Organisational Drivers and Challenges in Circular Economy Implementation: An Issue Life Cycle Approach. Organ. Environ. 2022, 35, 523–550. [Google Scholar] [CrossRef]

- Agyemang, M.; Kusi-Sarpong, S.; Khan, S.A.; Mani, V.; Rehman, S.T.; Kusi-Sarpong, H. Drivers and barriers to circular economy implementation: An explorative study in Pakistan’s automobile industry. Manag. Decis. 2019, 57, 971–994. [Google Scholar] [CrossRef]

- Albertsen, L.; Richter, J.L.; Peck, P.; Dalhammar, C.; Plepys, A. Circular business models for electric vehicle lithium-ion batteries: An analysis of current practices of vehicle manufacturers and policies in the EU. Resour. Conserv. Recycl. 2021, 172, 105658. [Google Scholar] [CrossRef]

- Barbaritano, M.; Bravi, L.; Savelli, E. Sustainability and Quality Management in the Italian Luxury Furniture Sector: A Circular Economy Perspective. Sustainability 2019, 11, 3089. [Google Scholar] [CrossRef]

- Cantú, A.; Aguiñaga, E.; Scheel, C. Learning from Failure and Success: The Challenges for Circular Economy Implementation in SMEs in an Emerging Economy. Sustainability 2021, 13, 1529. [Google Scholar] [CrossRef]

- Çetin, S.; Gruis, V.; Straub, A. Towards Circular Social Housing: An Exploration of Practices, Barriers, and Enablers. Sustainability 2021, 13, 2100. [Google Scholar] [CrossRef]

- Corral-Marfil, J.-A.; Arimany-Serrat, N.; Hitchen, E.L.; Viladecans-Riera, C. Recycling Technology Innovation as a Source of Competitive Advantage: The Sustainable and Circular Business Model of a Bicentennial Company. Sustainability 2021, 13, 7723. [Google Scholar] [CrossRef]

- Dey, P.K.; Malesios, C.; De, D.; Budhwar, P.; Chowdhury, S.; Cheffi, W. Circular economy to enhance sustainability of small and medium-sized enterprises. Bus. Strat. Environ. 2020, 29, 2145–2169. [Google Scholar] [CrossRef]

- Eikelenboom, M.; De Jong, G. The Impact of Managers and Network Interactions on the Integration of Circularity in Business Strategy. Organ. Environ. 2021, 35, 365–393. [Google Scholar] [CrossRef]

- Gandolfo, A.; Lupi, L. Circular economy, the transition of an incumbent focal firm: How to successfully reconcile environmental and economic sustainability? Bus. Strategy Environ. 2021, 30, 3297–3308. [Google Scholar] [CrossRef]

- Garrido-Prada, P.; Lenihan, H.; Doran, J.; Rammer, C.; Perez-Alaniz, M. Driving the circular economy through public environmental and energy R&D: Evidence from SMEs in the European Union. Ecol. Econ. 2021, 182, 106884. [Google Scholar] [CrossRef]

- Jugend, D.; de Camargo Fiorini, P.; Pinheiro, M.A.P.; Da Silva, H.M.R.; Pais Seles, B.M.R. Building circular products in an emerging economy: An Initial Exploration Regarding Practices, Drivers and Barriers Case studies of new product development from medium and large Brazilian companies. Johns. Matthey Technol. Rev. 2020, 64, 59–68. [Google Scholar] [CrossRef]

- Mendoza, J.M.F.; Gallego-Schmid, A.; Azapagic, A. A methodological framework for the implementation of circular economy thinking in higher education institutions: Towards sustainable campus management. J. Clean. Prod. 2019, 226, 831–844. [Google Scholar] [CrossRef]

- Moktadir, M.A.; Ahmadi, H.B.; Sultana, R.; Fatema-Tuj-Zohra; Liou, J.J.H.; Rezaei, J. Circular economy practices in the leather industry: A practical step towards sustainable development. J. Clean. Prod. 2020, 251, 119737. [Google Scholar] [CrossRef]

- Ortega-Gras, J.-J.; Bueno-Delgado, M.-V.; Cañavate-Cruzado, G.; Garrido-Lova, J. Twin Transition through the Implementation of Industry 4.0 Technologies: Desk-Research Analysis and Practical Use Cases in Europe. Sustainability 2021, 13, 13601. [Google Scholar] [CrossRef]

- Pereira, Á.; Vence, X. The role of KIBS and consultancy in the emergence of Circular Oriented Innovation. J. Clean. Prod. 2021, 302, 127000. [Google Scholar] [CrossRef]

- Pesce, M.; Tamai, I.; Guo, D.; Critto, A.; Brombal, D.; Wang, X.; Cheng, H.; Marcomini, A. Circular Economy in China: Translating Principles into Practice. Sustainability 2020, 12, 832. [Google Scholar] [CrossRef]

- Piyathanavong, V.; Garza-Reyes, J.A.; Kumar, V.; Maldonado-Guzmán, G.; Mangla, S.K. The adoption of operational environmental sustainability approaches in the Thai manufacturing sector. J. Clean. Prod. 2019, 220, 507–528. [Google Scholar] [CrossRef]

- Ramkumar, S. Influence of Inter-Firm Network Relationships on Circular Economy Eco-Innovation Adoption. Sustainability 2020, 12, 7607. [Google Scholar] [CrossRef]

- Torres-Guevara, L.E.; Prieto-Sandoval, V.; Mejia-Villa, A. Success Drivers for Implementing Circular Economy: A Case Study from the Building Sector in Colombia. Sustainability 2021, 13, 1350. [Google Scholar] [CrossRef]

- Santa-Maria, T.; Vermeulen, W.J.V.; Baumgartner, R.J. Framing and assessing the emergent field of business model innovation for the circular economy: A combined literature review and multiple case study approach. Sustain. Prod. Consum. 2021, 26, 872–891. [Google Scholar] [CrossRef]

- Sharma, Y.K.; Mangla, S.K.; Patil, P.P.; Liu, S. When challenges impede the process: For circular economy-driven sustainability practices in food supply chain. Manag. Decis. 2019, 57, 995–1017. [Google Scholar] [CrossRef]

- Umeda, Y.; Kitagawa, K.; Hirose, Y.; Akaho, K.; Sakai, Y.; Ohta, M.; Center, T.J.P.; Shimbun, L.T.N.K. Potential Impacts of the European Union’s Circular Economy Policy on Japanese Manufacturers. Int. J. Autom. Technol. 2020, 14, 857–866. [Google Scholar] [CrossRef]

- Ünal, E.; Urbinati, A.; Chiaroni, D.; Manzini, R. Value Creation in Circular Business Models: The case of a US small medium enterprise in the building sector. Resour. Conserv. Recycl. 2019, 146, 291–307. [Google Scholar] [CrossRef]

- Uvarova, I.; Atstaja, D.; Korpa, V. Challenges of the introduction of circular business models within rural SMEs of EU. Int. J. Econ. Sci. 2020, 9, 128–149. [Google Scholar] [CrossRef]

- zu Castell-Rüdenhausen, M.; Wahlström, M.; Astrup, T.F.; Jensen, C.; Oberender, A.; Johansson, P.; Waerner, E.R. Policies as Drivers for Circular Economy in the Construction Sector in the Nordics. Sustainability 2021, 13, 9350. [Google Scholar] [CrossRef]

- Parida, V.; Burström, T.; Visnjic, I.; Wincent, J. Orchestrating industrial ecosystem in circular economy: A two-stage transformation model for large manufacturing companies. J. Bus. Res. 2019, 101, 715–725. [Google Scholar] [CrossRef]

- Urbinati, A.; Chiaroni, D.; Toletti, G. Managing the Introduction of Circular Products: Evidence from the Beverage Industry. Sustainability 2019, 11, 3650. [Google Scholar] [CrossRef]

- Mishra, J.L.; Chiwenga, K.D.; Ali, K. Collaboration as an enabler for circular economy: A case study of a developing country. Manag. Decis. 2019, 59, 1784–1800. [Google Scholar] [CrossRef]

- Sopelana, A.; Auriault, C.; Bansal, A.; Fifer, K.; Paiva, H.; Maurice, C.; Westin, G.; Rios, J.; Oleaga, A.; Cañas, A. Innovative Circular Economy Models for the European Pulp and Paper Industry: A Reference Framework for a Resource Recovery Scenario. Sustainability 2021, 13, 10285. [Google Scholar] [CrossRef]

- Bielecka, A.; Kulczycka, J. Coal Combustion Products Management toward a Circular Economy—A Case Study of the Coal Power Plant Sector in Poland. Energies 2020, 13, 3603. [Google Scholar] [CrossRef]

- Jäger, J.K.; Piscicelli, L. Collaborations for circular food packaging: The set-up and partner selection process. Sustain. Prod. Consum. 2021, 26, 733–740. [Google Scholar] [CrossRef]

- Charnley, F.; Knecht, F.; Muenkel, H.; Pletosu, D.; Rickard, V.; Sambonet, C.; Schneider, M.; Zhang, C. Can Digital Technologies Increase Consumer Acceptance of Circular Business Models? The Case of Second Hand Fashion. Sustainability 2022, 14, 4589. [Google Scholar] [CrossRef]

- Neligan, A.; Baumgartner, R.J.; Geissdoerfer, M.; Schöggl, J. Circular disruption: Digitalisation as a driver of circular economy business models. Bus. Strat. Environ. 2022, 32, 1175–1188. [Google Scholar] [CrossRef]

- Stumpf, L.; Schöggl, J.-P.; Baumgartner, R.J. Climbing up the circularity ladder?—A mixed-methods analysis of circular economy in business practice. J. Clean. Prod. 2021, 316, 128158. [Google Scholar] [CrossRef]

- Zucchella, A.; Previtali, P. Circular business models for sustainable development: A “waste is food” restorative ecosystem. Bus. Strat. Environ. 2019, 28, 274–285. [Google Scholar] [CrossRef]

- Mendoza, J.M.F.; Gallego-Schmid, A.; Azapagic, A. Building a business case for implementation of a circular economy in higher education institutions. J. Clean. Prod. 2019, 220, 553–567. [Google Scholar] [CrossRef]

- Brendzel-Skowera, K. Circular Economy Business Models in the SME Sector. Sustainability 2021, 13, 7059. [Google Scholar] [CrossRef]

- Bressanelli, G.; Saccani, N.; Perona, M.; Baccanelli, I. Towards Circular Economy in the Household Appliance Industry: An Overview of Cases. Resources 2020, 9, 128. [Google Scholar] [CrossRef]

- Cantele, S.; Moggi, S.; Campedelli, B. Spreading Sustainability Innovation through the Co-Evolution of Sustainable Business Models and Partnerships. Sustainability 2020, 12, 1190. [Google Scholar] [CrossRef]

- Cornejo-Ortega, J.L.; Dagostino, R.M.C. The Tourism Sector in Puerto Vallarta: An Approximation from the Circular Economy. Sustainability 2020, 12, 4442. [Google Scholar] [CrossRef]

- De Angelis, R.; Feola, R. Circular business models in biological cycles: The case of an Italian spin-off. J. Clean. Prod. 2020, 247, 119603. [Google Scholar] [CrossRef]

- Kumar, V.; Sezersan, I.; Garza-Reyes, J.A.; Gonzalez, E.D.; Al-Shboul, M.A. Circular economy in the manufacturing sector: Benefits, opportunities and barriers. Manag. Decis. 2019, 57, 1067–1086. [Google Scholar] [CrossRef]

- Aarikka-Stenroos, L.; Chiaroni, D.; Kaipainen, J.; Urbinati, A. Companies’ circular business models enabled by supply chain collaborations: An empirical-based framework, synthesis, and research agenda. Ind. Mark. Manag. 2022, 105, 322–339. [Google Scholar] [CrossRef]

- Rhein, S.; Sträter, K.F. Corporate self-commitments to mitigate the global plastic crisis: Recycling rather than reduction and reuse. J. Clean. Prod. 2021, 296, 126571. [Google Scholar] [CrossRef]

- Rincón-Moreno, J.; Ormazabal, M.; Álvarez, M.; Jaca, C. Shortcomings of Transforming a Local Circular Economy System through Industrial Symbiosis: A Case Study in Spanish SMEs. Sustainability 2020, 12, 8423. [Google Scholar] [CrossRef]

- Zuofa, T.; Ochieng, E.G.; Ode-Ichakpa, I. An evaluation of determinants influencing the adoption of circular economy principles in Nigerian construction SMEs. Build. Res. Inf. 2023, 51, 69–84. [Google Scholar] [CrossRef]

- Pham, T.T.; Kuo, T.-C.; Tseng, M.-L.; Tan, R.R.; Tan, K.; Ika, D.S.; Lin, C.J. Industry 4.0 to Accelerate the Circular Economy: A Case Study of Electric Scooter Sharing. Sustainability 2019, 11, 6661. [Google Scholar] [CrossRef]

- Silva, F.C.; Shibao, F.Y.; Kruglianskas, I.; Barbieri, J.C.; Sinisgalli, P.A.A. Circular economy: Analysis of the implementation of practices in the Brazilian network. Rev. Gestão 2019, 26, 39–60. [Google Scholar] [CrossRef]

- Malik, A.; Sharma, P.; Vinu, A.; Karakoti, A.; Kaur, K.; Gujral, H.S.; Munjal, S.; Laker, B. Circular economy adoption by SMEs in emerging markets: Towards a multilevel conceptual framework. J. Bus. Res. 2022, 142, 605–619. [Google Scholar] [CrossRef]

- Aminoff, A.; Sundqvist-Andberg, H. Constraints leading to system-level lock-ins—The case of electronic waste management in the circular economy. J. Clean. Prod. 2021, 322, 129029. [Google Scholar] [CrossRef]

- Garcés-Ayerbe, C.; Rivera-Torres, P.; Suárez-Perales, I.; Leyva-De La Hiz, D.I. Is It Possible to Change from a Linear to a Circular Economy? An Overview of Opportunities and Barriers for European Small and Medium-Sized Enterprise Companies. Int. J. Environ. Res. Public Health 2019, 16, 851. [Google Scholar] [CrossRef] [PubMed]

- Silvius, G.; Ismayilova, A.; Sales-Vivó, V.; Costi, M. Exploring Barriers for Circularity in the EU Furniture Industry. Sustainability 2021, 13, 11072. [Google Scholar] [CrossRef]

- Majumdar, A.; Ali, S.M.; Agrawal, R.; Srivastava, S. A triple helix framework for strategy development in circular textile and clothing supply chain: An Indian perspective. J. Clean. Prod. 2022, 367, 132954. [Google Scholar] [CrossRef]

- Takacs, F.; Brunner, D.; Frankenberger, K. Barriers to a circular economy in small- and medium-sized enterprises and their integration in a sustainable strategic management framework. J. Clean. Prod. 2022, 362, 132227. [Google Scholar] [CrossRef]

- Hanuláková, E.; Daňo, F.; Kukura, M. Transition of business companies to circular economy in Slovakia. Entrep. Sustain. Issues 2021, 9, 204–220. [Google Scholar] [CrossRef] [PubMed]

- Jaeger, B.; Upadhyay, A. Understanding barriers to circular economy: Cases from the manufacturing industry. J. Enterp. Inf. Manag. 2020, 33, 729–745. [Google Scholar] [CrossRef]

- Vehmas, K.; Raudaskoski, A.; Heikkila, P.; Harlim, A.; Mensonen, A. Consumer attitudes and communication in circular fashion. J. Fash. Mark. Manag. 2018, 22, 285–300. [Google Scholar] [CrossRef]

- Frei, R.; Jack, L.; Krzyzaniak, S. Sustainable reverse supply chains and circular economy in multichannel retail returns. Bus. Strat. Environ. 2020, 29, 1925–1940. [Google Scholar] [CrossRef]

- Moorhouse, D.; Moorhouse, D. Sustainable Design: Circular Economy in Fashion and Textiles. Des. J. 2017, 20, S1948–S1959. [Google Scholar] [CrossRef]

- Cai, Y.-J.; Choi, T.-M. A United Nations’ Sustainable Development Goals perspective for sustainable textile and apparel supply chain management. Transp. Res. Part E Logist. Transp. Rev. 2020, 141, 102010. [Google Scholar] [CrossRef]

- Määttänen, M.; Asikainen, S.; Kamppuri, T.; Ilen, E.; Niinimäki, K.; Tanttu, M.; Harlin, A. Colour management in circular economy: Decolourization of cotton waste. Res. J. Text. Appar. 2019, 23, 134–152. [Google Scholar] [CrossRef]

- Mukendi, A.; Henninger, C.E. Exploring the spectrum of fashion rental. J. Fash. Mark. Manag. Int. J. 2020, 24, 455–469. [Google Scholar] [CrossRef]

- Wilson, L. The sustainable future of the Scottish textiles sector: Challenges and opportunities of introducing a circular economy model. Text. Cloth. Sustain. 2015, 1, 5. [Google Scholar] [CrossRef]

- Virtanen, M.; Manskinen, K.; Uusitalo, V.; Syvänne, J.; Cura, K. Regional material flow tools to promote circular economy. J. Clean. Prod. 2019, 235, 1020–1025. [Google Scholar] [CrossRef]

- Bana e Costa, C.A.; De Corte, J.M.; Vansnick, J.C. MACBETH (Measuring Attractiveness by a Categorical-Based Evaluation Technique). In Wiley Encyclopedia in Operational Research and Management Science; Cochrane, J.J., Ed.; Wiley: New York, NY, USA, 2011; Volume 4, pp. 2945–2950. [Google Scholar]

| Play Cards | Subset of Criteria | Number of Cards | Position | Non-Normalized Weight | Normalized Weight | |

|---|---|---|---|---|---|---|

| Least |  | 1 | 1 | 1 | ||

| white card | 1 | (2) | ---- | ----- | ||

| and | 2 | 3 and 4 | ||||

| Most | 1 | 5 | 5 | |||

| Sum | 13 * | |||||

| Alternatives | Number of Cards | Position | Normalized |

|---|---|---|---|

| x1 | 1 | 1 | v′k(x1) = 100 × ([4 − 1]/[4 − 1]) = 100 |

| x3, x4 | 2 | 2 | v′k(x3) = v′k(x4) = 100 × ([4 − 2]/[4 − 1]) ≈ 66.67 |

| White card | (1) * | 3 | -------- |

| x2, x5 | 2 | 4 | v′k(x2) = v′k(x5) = 100 × ([4 − 4]/[4 − 1]) = 0 |

| Alternatives (), | … | … | ||||||

| … | … | |||||||

| … | … | |||||||

| … | … | … | … | … | … | |||

| … | … | … | … | … | … | … | … | … |

| … | … | … | … | |||||

| Code | Subcategories | Number of Articles | Authors |

|---|---|---|---|

| C1 | Organizational and business model (innovative/flexible organizational culture, leadership strategy, manager awareness, etc.) | 37 | [16,17,28,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70] |

| C2 | Company reputation (brand) and market share | 09 | [14,38,40,43,45,55,59,71,72] |

| C3 | Regulatory aspects (laws, certifications, etc.) | 14 | [16,28,32,37,39,40,42,46,50,58,62,71,73,74] |

| C4 | Customer awareness and engagement trend, and social concern | 19 | [37,39,40,42,43,45,46,48,50,51,54,55,57,58,65,66,70,75,76] |

| C5 | Available technology and innovation in production process (resource efficiency) | 29 | [16,17,21,32,37,39,40,43,46,49,50,51,52,54,58,59,61,69,70,71,73,74,76,77,78,79,80] |

| C6 | Environmental, economic, and social benefits (triple bottom line) | 26 | [14,32,54,56,57,59,60,62,63,68,69,70,72,75,79,80,81,82,83,84,85,86,87] |

| C7 | Supply chain management (collaboration, integration, modernization, partnerships, outsourcing, “green suppliers”, globalization, geographical proximity, and networking) | 29 | [14,17,28,32,37,40,50,51,52,53,54,57,61,63,64,65,68,69,71,73,74,76,80,81,83,84,88,89,90] |

| C8 | Economic aspects: financial resource available or cost reduction | 10 | [21,40,41,43,45,46,50,51,52,91] |

| C9 | New product, eco-design, and/or circular design (product/materials) | 10 | [17,38,39,40,43,45,47,67,72,79] |

| C10 | Knowledge/skills and information management | 15 | [8,21,47,58,65,66,69,70,71,73,74,81,91,92,93] |

| C11 | Public policies, governance, and local initiatives | 9 | [8,28,39,42,58,68,70,71,91] |

| Code | Subcategories | Number of Articles | Authors |

|---|---|---|---|

| O1 | Legal and/or regulatory aspects that make it difficult to reuse by-products | 22 | [8,14,28,44,45,50,51,58,60,62,65,68,74,79,87,91,94,95,96,97,98] |

| O2 | Cultural barriers (absence of innovative organizational culture) | 29 | [21,28,39,40,41,46,50,51,56,57,58,60,61,65,66,69,81,82,87,89,91,93,94,96,98,99,100,101] |

| O3 | Economic and/or financial barriers (more expensive materials and technologies) | 31 | [14,17,21,37,39,40,41,45,46,50,52,56,57,62,63,69,70,71,79,82,85,87,95,96,97,98,99,100,101] |

| O4 | Barriers in the supply chain (lack of integration and alignment between links) | 17 | [16,42,45,46,50,57,58,63,69,70,81,87,95,97,98,99,101] |

| O5 | Technical and/or operational barriers (difficulties in disassembling, inspecting, and reusing products/immaturity of technological solutions) | 20 | [16,37,38,40,46,50,52,57,62,63,66,79,81,87,94,96,97,98,99,101,102] |

| O6 | Technological barriers (lack/cost) | 17 | [14,38,39,40,46,50,51,58,66,81,87,93,95,97,98,99,101] |

| O7 | Lack of government support (external support) and/or public policies | 18 | [14,21,37,40,44,45,46,52,58,62,65,66,69,73,87,91,97,100] |

| O8 | Lack of performance indicators | 6 | [57,70,81,85,86,98] |

| O9 | Lack of infrastructure | 10 | [37,56,57,58,66,69,93,95,98,99] |

| O10 | Lack of strategic vision (company’s current business model) | 11 | [28,40,58,62,69,75,88,93,95,97,98,99] |

| O11 | Lack of commitment and/or leadership from organizational management | 13 | [40,44,46,50,52,57,62,65,81,90,97,98,99] |

| O12 | Market barriers: immaturity of the market, lack of consumer awareness | 13 | [45,52,53,67,72,76,77,80,83,84,85,103,104] |

| O13 | Uncertainties about the associated risks or risk aversion | 16 | [14,40,41,46,47,60,61,63,65,71,80,87,97,98,99,103] |

| O14 | quality and quantity (availability) of inputs that affect production and consequent quality of the final product | 11 | [14,40,47,52,65,70,79,97,98,99,101] |

| Catalysts | ||||

|---|---|---|---|---|

| Play Cards | Code | Position | Weight | |

| Least important |  | C1 | 6 | 0.18 |

| C2 | 7 | 0.21 | ||

| C5 | 3.5 | 0.10 | ||

| C7 | 11 | 0.32 | ||

| C8 | 1 | 0.03 | ||

| C9 | 3.5 | 0.10 | ||

| C10 | 2 | 0.06 | ||

| Most important | ||||

| Obstacles | ||||

| Play Cards | Code | Position | Weight | |

| Least important |  | O4 | 8 | 0.40 |

| O5 | 1 | 0.05 | ||

| O6 | 4.5 | 0.225 | ||

| O8 | 2 | 0.10 | ||

| O10 | 4.5 | 0.225 | ||

| Most important | ||||

| Catalysts | Obstacles | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weight | 0.18 | 0.21 | 0.1 | 0.32 | 0.03 | 0.1 | 0.06 | 0.40 | 0.05 | 0.225 | 0.10 | 0.225 |

| 5 | 1 | 3 | 8 | 1 | 8 | 5 | 4 | 5 | 1 | 7 | 4 | |

| 1 | 2 | 5 | 2 | 3 | 4 | 3 | 1 | 6 | 3 | 10 | 1 | |

| 7 | 3 | 6 | 6 | 7 | 1 | 1 | 2 | 1 | 4 | 1 | 4 | |

| 6 | 1 | 1 | 9 | 2 | 8 | 1 | 8 | 1 | 5 | 5 | 4 | |

| 8 | 5 | 7 | 1 | 4 | 6 | 2 | 3 | 6 | 2 | 5 | 5 | |

| Alternatives | Catalysts | Obstacles | ||

|---|---|---|---|---|

| Ranking | ||||

| 42.38 | 55.30 | −12.90 | 4th | |

| 75.80 | 73.80 | 2.00 | 2nd | |

| 42.74 | 60.50 | −17.80 | 5th | |

| 44.64 | 16.20 | 28.50 | 1st | |

| 40.86 | 51.00 | −10.10 | 3rd |

| Alternative | Scenario 0 | Scenario 1 | ||||

|---|---|---|---|---|---|---|

| Original Weights | Ranking | Equal Weights (1/n) | Ranking | |||

| −12.9 | 4th | −1.1 | 3rd | |||

| 2.0 | 2nd | 17.1 | 2nd | |||

| −17.8 | 5th | −21.6 | 5th | |||

| 28.5 | 1st | 22.7 | 1st | |||

| −10.1 | 3rd | −4.2 | 4th | |||

| Scenario 2 | ||||||

| Alternative | −5% | Ranking | −15% | Ranking | −25% | Ranking |

| −12.3 | 4th | −11.0 | 4th | −9.7 | 4th | |

| 1.9 | 2nd | 1.7 | 2nd | 1.5 | 2nd | |

| −16.9 | 5th | −15.1 | 5th | −13.3 | 5th | |

| 27.0 | 1st | 24.2 | 1st | 21.3 | 1st | |

| −9,6 | 3rd | −8.6 | 3rd | −7.6 | 3rd | |

| Scenario 3 | ||||||

| Alternative | +5% | Ranking | +15% | Ranking | +25% | Ranking |

| −13.6 | 4th | −14.9 | 4th | −16.2 | 4th | |

| 2.2 | 2nd | 2.4 | 2nd | 2.6 | 2nd | |

| −18.7 | 5th | −20.5 | 5th | −22.2 | 5th | |

| 29.9 | 1st | 32.7 | 1st | 35.6 | 1st | |

| −10.7 | 3rd | −11.7 | 3rd | −12.7 | 3rd | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Silva, W.D.O.; Fontana, M.E.; de Almeida, B.M.J.; Carmona Marques, P.; Vidal, R. Analyzing the Attractiveness of Businesses to Receive Investments for a Creative and Innovative Transition to a Circular Economy: The Case of the Textile and Fashion Industry. Sustainability 2023, 15, 6593. https://doi.org/10.3390/su15086593

Silva WDO, Fontana ME, de Almeida BMJ, Carmona Marques P, Vidal R. Analyzing the Attractiveness of Businesses to Receive Investments for a Creative and Innovative Transition to a Circular Economy: The Case of the Textile and Fashion Industry. Sustainability. 2023; 15(8):6593. https://doi.org/10.3390/su15086593

Chicago/Turabian StyleSilva, Wesley Douglas Oliveira, Marcele Elisa Fontana, Bianca Maria Jacinto de Almeida, Pedro Carmona Marques, and Raphaela Vidal. 2023. "Analyzing the Attractiveness of Businesses to Receive Investments for a Creative and Innovative Transition to a Circular Economy: The Case of the Textile and Fashion Industry" Sustainability 15, no. 8: 6593. https://doi.org/10.3390/su15086593