Exploitation or Exploration? Managerial Myopia, Economic Policy Uncertainty and Ambidextrous Innovation Investment

Abstract

1. Introduction

2. Literature Review

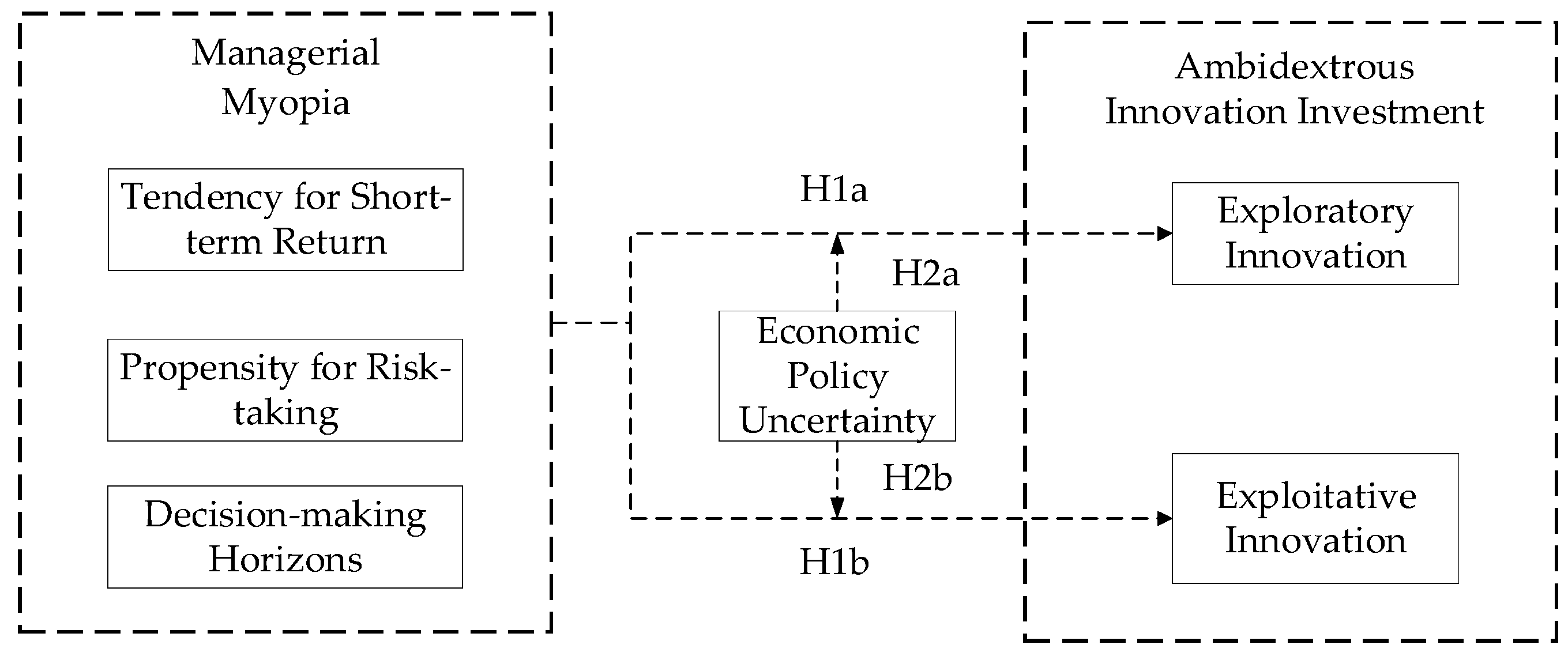

3. Theoretical Analysis and Research Hypotheses

3.1. Managerial Myopia and Ambidextrous Innovation Investment

3.2. Moderating Effect of Economic Policy Uncertainty

4. Methodology and Data

4.1. Sample and Data

4.2. Key Variables

4.2.1. Ambidextrous Innovation Investment

4.2.2. Managerial Myopia

4.2.3. Economic Policy Uncertainty

4.2.4. Control Variables

4.3. Econometric Models

5. Empirical Analysis Results

5.1. Descriptive Statistics and Correlation Analysis

5.2. Regression Results

5.3. Moderating Effect of Economic Policy Uncertainty

5.4. Grouping Test for the Agency Cost

5.5. Robustness Test

5.5.1. Substitutional Variable Test

5.5.2. Alternative Model Regression

5.5.3. 2SLS Regression

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- O’Reilly, C.A.; Tushman, M.L. Organizational Ambidexterity: Past, Present, and Future. Acad. Manag. Perspect. 2013, 27, 324–338. [Google Scholar] [CrossRef]

- Benner, M.J.; Tushman, M.L. Exploitation, exploration, and process management: The productivity dilemma revisited. Acad. Manag. Rev. 2003, 28, 238–256. [Google Scholar] [CrossRef]

- Gupta, A.K.; Smith, K.G.; Shalley, C.E. The interplay between exploration and exploitation. Acad. Manag. J. 2006, 49, 693–706. [Google Scholar] [CrossRef]

- Koryak, O.; Lockett, A.; Hayton, J.; Nicolaou, N.; Mole, K. Disentangling the antecedents of ambidexterity: Exploration and exploitation. Res. Policy 2018, 47, 413–427. [Google Scholar] [CrossRef]

- Lavie, D.; Klarner, P. When Does a CEO’s Risk Propensity Drive Exploration in Product Development? Strategy Sci. 2023, 8, 1–23. [Google Scholar] [CrossRef]

- Zhu, D.H.; Jia, L.; Li, F. Too much on the plate? How executive job demands harm firm innovation and reduce share of exploratory innovations. Acad. Manag. J. 2022, 65, 606–633. [Google Scholar] [CrossRef]

- Ma, J.; Duan, Y.; Wang, J.; Luo, M. Impact of Self-Efficacy on Entrepreneurs’ Ambidextrous Behavior in New Ventures: Moderating Effect of Status. Behav. Sci. 2023, 13, 108. [Google Scholar] [CrossRef]

- Ben Rejeb, W.; Berraies, S.; Talbi, D. The contribution of board of directors’ roles to ambidextrous innovation. Eur. J. Innov. Manag. 2019, 23, 40–66. [Google Scholar] [CrossRef]

- Mizik, N. The theory and practice of myopic management. J. Mark. Res. 2010, 47, 594–611. [Google Scholar] [CrossRef]

- Brochet, F.; Loumioti, M.; Serafeim, G. Speaking of the short-term: Disclosure horizon and managerial myopia. Rev. Acc. Stud. 2015, 20, 1122–1163. [Google Scholar] [CrossRef]

- Cao, Q.; Ju, M.; Li, J.; Zhong, C. Managerial Myopia and Long-Term Investment: Evidence from China. Sustainability 2023, 15, 708. [Google Scholar] [CrossRef]

- Berraies, S.; Rejeb, W.B. Boards of directors’ roles and size: What effects on exploitative and exploratory innovations? Case of listed Tunisian firms. Int. J. Entrep. Innov. Manag. 2019, 23, 161–179. [Google Scholar] [CrossRef]

- Zimbardo, P.G.; Boyd, J.N. Putting Time in Perspective: A Valid, Reliable Individual-Differences Metric; Springer International Publishing: Cham, Switzerland, 2015; pp. 17–55. [Google Scholar]

- Wilden, R.; Lin, N.; Hohberger, J.; Randhawa, K. Selecting innovation projects: Do middle and senior managers differ when it comes to radical innovation? J. Manag. Stud. 2022. [Google Scholar] [CrossRef]

- Bluedorn, A.C.; Martin, G. The time frames of entrepreneurs. J. Bus. Ventur. 2008, 23, 1–20. [Google Scholar] [CrossRef]

- He, J.J.; Tian, X. The dark side of analyst coverage: The case of innovation. J. Financ. Econ. 2013, 109, 856–878. [Google Scholar] [CrossRef]

- Marginson, D.; McAulay, L. Exploring the debate on short-termism: A theoretical and empirical analysis. Strateg. Manag. J. 2008, 29, 273–292. [Google Scholar] [CrossRef]

- Tunyi, A.A.; Ntim, C.G.; Danbolt, J. Decoupling management inefficiency: Myopia, hyperopia and takeover likelihood. Int. Rev. Financ. Anal. 2019, 62, 1–20. [Google Scholar] [CrossRef]

- Mishra, C.S. Does institutional ownership discourage investment in corporate R&D? Technol. Soc. 2022, 182, 121837. [Google Scholar]

- Graham, J.R.; Harvey, C.R.; Rajgopal, S. The economic implications of corporate financial reporting. J. Account. Econ. 2005, 40, 3–73. [Google Scholar] [CrossRef]

- Narayanan, M.P. Managerial Incentives for Short-term Results. J. Financ. 1985, 40, 1469–1484. [Google Scholar] [CrossRef]

- Edmans, A.; Fang, V.W.; Lewellen, K.A. Equity Vesting and Investment. Rev. Financ. Stud. 2017, 30, 2229–2271. [Google Scholar] [CrossRef]

- Seo, H.J.; Kang, S.J.; Baek, Y.J. Managerial myopia and short-termism of innovation strategy: Financialisation of Korean firms. Camb. J. Econ. 2020, 44, 1197–1220. [Google Scholar] [CrossRef]

- Constant, F.; Calvi, R.; Johnsen, T.E. Managing tensions between exploitative and exploratory innovation through purchasing function ambidexterity. J. Purch. Supply Manag. 2020, 26, 100645. [Google Scholar] [CrossRef]

- March, J.G. Exploration and exploitation in organizational learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Buckley, P.J.; Chen, L.; Clegg, L.J.; Voss, H. The role of endogenous and exogenous risk in FDI entry choices. J. World Bus 2020, 55, 101040. [Google Scholar] [CrossRef]

- Holman, E.A.; Zimbardo, P.G. The Social Language of Time: The Time Perspective-Social Network Connection. Basic Appl. Soc. Psych. 2009, 31, 136–147. [Google Scholar] [CrossRef]

- Nadkarni, S.; Chen, J. Bridging yesterday, today, and tomorrow: CEO temporal focus, environmental dynamism, and rate of new product introduction. Acad. Manag. J. 2014, 57, 1810–1833. [Google Scholar] [CrossRef]

- Luger, J.; Raisch, S.; Schimmer, M. Dynamic balancing of exploration and exploitation: The contingent benefits of ambidexterity. Organ. Sci. 2018, 29, 449–470. [Google Scholar] [CrossRef]

- Cho, M.; Bonn, M.A.; Han, S.J. Innovation ambidexterity: Balancing exploitation and exploration for startup and established restaurants and impacts upon performance. Ind. Innov. 2020, 27, 340–362. [Google Scholar] [CrossRef]

- Osiyevskyy, O.; Shirokova, G.; Ritala, P. Exploration and exploitation in crisis environment: Implications for level and variability of firm performance. J. Bus. Res. 2020, 114, 227–239. [Google Scholar] [CrossRef]

- Filippetti, A.; Archibugi, D. Innovation in times of crisis: National Systems of Innovation, structure, and demand. Res. Policy 2011, 40, 179–192. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Has Economic Policy Uncertainty Hampered the Recovery? Q. J. Econ. 2016, 134, 1593–1636. [Google Scholar] [CrossRef]

- Ang, J.S.; Cole, R.A.; Lin, J.W. Agency Costs and Ownership Structure. J. Financ. 2000, 55, 81–106. [Google Scholar] [CrossRef]

- Lin, Y.L.; Shi, W.; Prescott, J.E.; Yang, H. In the Eye of the Beholder: Top Managers’ Long-Term Orientation, Industry Context, and Decision-Making Processes. J. Manag. 2018, 45, 3114–3145. [Google Scholar] [CrossRef]

- Bi, X.F. Government Subsidies, Financial Slack and Ambidextrous Innovation. Account. Res. 2017, 1, 46–52. [Google Scholar]

- Liu, Z.; Chi, G.-D.; Han, L. Board Human Capital and Enterprise Growth: A Perspective of Ambidextrous Innovation. Sustainability 2019, 11, 3993. [Google Scholar] [CrossRef]

| Variable | Symbol | Definition |

|---|---|---|

| Exploratory innovation | R | The one-period lag expenditures in the research phase of the R&D project/total assets × 100%. |

| Exploitative innovation | D | The one-period lag expenditures in the development phase of the R&D project/total assets × 100%. |

| Managerial myopia | Myopia | (The word frequency of the vocabulary that reflects managerial myopia/MD & A total word frequency) × 100. |

| Economic Policy Uncertainty | EPU | The geometric mean of the monthly economic policy uncertainty/100. |

| Agency cost | AC | The management costs over revenue. |

| Company size | size | The natural logarithm of total assets. |

| Company age | Age | The number of years since the firm was established. |

| Board size | Board | The natural logarithm of the board members. |

| Proportion of independent directors | ID | The proportion of independent directors of the board. |

| Manager payment | Mpay | The natural logarithm of the total payment of the top three managers. |

| Asset-liability ratio | Lev | The total liabilities over total assets. |

| Returns on Assets | ROA | The net profit over total assets. |

| Revenue growth rate | Growth | (Revenue of the current period − revenue of the previous period)/revenue of the previous period. |

| Investment opportunities | Tobinq | The market value over total assets. |

| Cash flow | Cash | The net cash flow from operating activities over total assets. |

| Capital intensity | TA | The net fixed assets over total assets. |

| Institutional investor holdings | Inst | Institutional investor shareholding ratio × 100%. |

| The largest shareholder | Top1 | The shareholding ratio of the largest shareholder. |

| Year | YEAR | The value equals 1 if it is in the year and 0 otherwise. |

| Industry | IND | The value equals 1 if it is in the industry and 0 otherwise. |

| Variable | Obs | Mean | SD | Min | p50 | Max |

|---|---|---|---|---|---|---|

| R | 23,093 | 1.785 | 1.838 | 0 | 1.444 | 9.568 |

| D | 18,446 | 0.268 | 0.668 | 0 | 0 | 3.830 |

| Myopia | 23,093 | 0.080 | 0.069 | 0 | 0.065 | 0.343 |

| EPU | 23,093 | 2.436 | 1.139 | 3.639 | 7.919 | 4.126 |

| Size | 23,093 | 22.10 | 1.262 | 19.34 | 21.90 | 26.16 |

| Lev | 23,093 | 0.397 | 0.199 | 0.051 | 0.385 | 0.908 |

| ROA | 23,093 | 0.042 | 0.060 | −0.293 | 0.041 | 0.205 |

| Growth | 23,093 | 0.167 | 0.371 | −0.577 | 0.110 | 2.486 |

| Tobinq | 23,093 | 2.027 | 1.256 | 0.855 | 1.624 | 8.890 |

| Cash | 23,093 | 0.047 | 0.067 | −0.172 | 0.047 | 0.248 |

| TA | 23,093 | 0.205 | 0.146 | 0.002 | 0.176 | 0.690 |

| Inst | 23,093 | 41.86 | 25.27 | 0.310 | 43.38 | 91.84 |

| Mpay | 23,093 | 14.41 | 0.688 | 12.74 | 14.38 | 16.44 |

| Top1 | 23,093 | 34.26 | 14.50 | 8.650 | 32.27 | 74.98 |

| Id | 23,093 | 37.57 | 5.342 | 33.33 | 35.71 | 57.14 |

| Board | 23,093 | 2.123 | 0.196 | 1.609 | 2.197 | 2.708 |

| Variable | R | D | Myopia | EPU | Size | Lev | ROA | Growth | Tobinq | Cash | TA | Inst | Mpay | Top1 | Id | Board | Age |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| R | 1 | ||||||||||||||||

| D | 0.035 *** | 1 | |||||||||||||||

| Myopia | −0.092 *** | −0.073 *** | 1 | ||||||||||||||

| EPU | −0.108 *** | 0.196 *** | −0.143 *** | 1 | |||||||||||||

| Size | −0.191 *** | −0.019 ** | 0.056 *** | 0.124 *** | 1 | ||||||||||||

| Lev | −0.184 *** | −0.067 *** | 0.097 *** | 0.0110 | 0.552 *** | 1 | |||||||||||

| ROA | 0.127 *** | 0.011 | −0.075 *** | −0.034 *** | −0.047 *** | −0.356 *** | 1 | ||||||||||

| Growth | 0.060 *** | 0.025 *** | −0.081 *** | −0.059 *** | 0.031 *** | 0.030 *** | 0.231 *** | 1 | |||||||||

| Tobinq | 0.136 *** | 0.161 *** | −0.041 *** | −0.072 *** | −0.339 *** | −0.264 *** | 0.178 *** | 0.039 *** | 1 | ||||||||

| Cash | 0.040 *** | 0.015 ** | −0.021 *** | 0.129 *** | 0.074 *** | −0.150 *** | 0.390 *** | 0.015 ** | 0.125 *** | 1 | |||||||

| TA | −0.157 *** | −0.112 *** | 0.140 *** | −0.071 *** | 0.147 *** | 0.139 *** | −0.088 *** | −0.075 *** | −0.107 *** | 0.205 *** | 1 | ||||||

| Inst | −0.081 *** | −0.075 *** | 0.082 *** | −0.035 *** | 0.429 *** | 0.216 *** | 0.075 *** | 0.015 ** | −0.039 *** | 0.113 *** | 0.157 *** | 1 | |||||

| Mpay | 0.081 *** | 0.112 *** | −0.092 *** | 0.334 *** | 0.427 *** | 0.109 *** | 0.161 *** | 0.034 *** | −0.031 *** | 0.204 *** | −0.086 *** | 0.198 *** | 1 | ||||

| Top1 | −0.069 *** | −0.115 *** | 0.053 *** | −0.072 *** | 0.164 *** | 0.049 *** | 0.127 *** | −0.008 | −0.088 *** | 0.092 *** | 0.100 *** | 0.480 *** | −0.018 *** | 1 | |||

| Id | 0.002 | 0.025 *** | −0.035 *** | 0.047 *** | −0.004 | −0.017 *** | −0.009 | −0.012 * | 0.039 *** | 0.001 | −0.040 *** | −0.070 *** | −0.002 | 0.054 *** | 1 | ||

| Board | −0.053 *** | −0.041 *** | 0.071 *** | −0.088 *** | 0.267 *** | 0.166 *** | −0.005 | −0.0110 | −0.120 *** | 0.019 *** | 0.138 *** | 0.228 *** | 0.084 *** | 0.008 | −0.556 *** | 1 | |

| Age | −0.128 *** | 0.024 *** | 0.037 *** | 0.342 *** | 0.210 *** | 0.181 *** | −0.087 *** | −0.072 *** | −0.0100 | 0.056 *** | 0.043 *** | 0.071 *** | 0.187 *** | −0.094 *** | −0.014 ** | 0.053 *** | 1 |

| Variable | (1) R | (2) D |

|---|---|---|

| Myopia | −0.547 *** (−3.753) | −0.087 (−1.436) |

| Size | −0.201 *** (−14.803) | 0.019 *** (3.263) |

| Lev | −0.225 *** (−3.053) | −0.053 * (−1.698) |

| ROA | 1.132 *** (4.275) | −0.151 (−1.513) |

| Growth | 0.071 ** (2.340) | 0.019 (1.633) |

| Tobinq | 0.064 *** (4.730) | 0.059 *** (9.873) |

| Cash | 1.279 *** (6.449) | −0.095 (−1.291) |

| TA | −0.899 *** (−11.077) | −0.204 *** (−5.794) |

| Inst | 0.003 *** (5.228) | −0.001 ** (−2.347) |

| Mpay | 0.463 *** (23.957) | 0.067 *** (8.209) |

| Top1 | −0.002 ** (−2.184) | −0.002 *** (−5.324) |

| Id | 0.001 (0.422) | 0.002 * (1.913) |

| Board | 0.072 (1.000) | 0.014 (0.460) |

| Age | −0.253 *** (−7.054) | −0.062 *** (−4.353) |

| _cons | −0.689 * (−1.900) | −1.208 *** (−7.742) |

| YEAR | Yes | Yes |

| IND | Yes | Yes |

| N | 23,093 | 18,446 |

| r2_a | 0.256 | 0.171 |

| Variable | (1) R | (2) D |

|---|---|---|

| Myopia × EPU | 0.191 *** (2.944) | −0.053 (−1.274) |

| EPU | −0.141 *** (−13.523) | 0.075 *** (12.561) |

| Myopia | −1.241 *** (−4.875) | 0.064 (0.580) |

| Size | −0.200 *** (−14.793) | 0.019 *** (3.262) |

| Lev | −0.218 *** (−2.953) | −0.055 * (−1.734) |

| ROA | 1.133 *** (4.278) | −0.151 (−1.510) |

| Growth | 0.070 ** (2.294) | 0.020 * (1.647) |

| Tobinq | 0.065 *** (4.788) | 0.059 *** (9.848) |

| Cash | 1.283 *** (6.471) | −0.096 (−1.299) |

| TA | −0.901 *** (−11.106) | −0.203 *** (−5.753) |

| Inst | 0.003 *** (5.258) | −0.001 ** (−2.352) |

| Mpay | 0.462 *** (23.916) | 0.067 *** (8.248) |

| Top1 | −0.002 ** (−2.211) | −0.002 *** (−5.322) |

| Id | 0.001 (0.444) | 0.002 * (1.904) |

| Board | 0.071 (0.987) | 0.014 (0.463) |

| Age | −0.254 *** (−7.077) | −0.063 *** (−4.368) |

| _cons | −0.408 (−1.131) | −1.344 *** (−8.700) |

| YEAR | Yes | Yes |

| IND | Yes | Yes |

| N | 23,093 | 18,446 |

| r2_a | 0.257 | 0.171 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| R | D | |||

| AC = 1 | AC = 0 | AC = 1 | AC = 0 | |

| Myopia | −1.021 *** (−2.698) | −0.882 ** (−2.566) | 0.081 (0.418) | 0.033 (0.298) |

| Myopia × EPU | 0.097 (0.859) | 0.121 (1.527) | −0.073 (−0.924) | −0.032 (−0.794) |

| EPU | −0.170 *** (−10.089) | −0.096 *** (−7.441) | 0.099 *** (9.775) | 0.059 *** (8.457) |

| Size | −0.258 *** (−11.342) | −0.153 *** (−9.035) | 0.023 ** (2.281) | 0.021 *** (2.900) |

| Lev | −0.170 (−1.571) | −0.112 (−1.091) | −0.056 (−1.179) | 0.029 (0.712) |

| ROA | 1.020 *** (2.826) | 1.252 *** (3.235) | −0.010 (−0.070) | −0.052 (−0.399) |

| Growth | 0.186 *** (3.884) | −0.012 (−0.308) | 0.033 * (1.765) | 0.018 (1.189) |

| Tobinq | 0.079 *** (4.335) | 0.036 * (1.694) | 0.056 *** (7.322) | 0.053 *** (5.747) |

| Cash | 1.885 *** (6.063) | 0.654 *** (2.618) | −0.169 (−1.441) | −0.029 (−0.325) |

| TA | −1.371 *** (−10.915) | −0.583 *** (−5.531) | −0.291 *** (−5.108) | −0.110 ** (−2.565) |

| Inst | 0.003 *** (3.730) | 0.003 *** (4.444) | −0.001 (−1.601) | −0.000 (−0.824) |

| Mpay | 0.650 *** (21.518) | 0.299 *** (12.271) | 0.088 *** (6.795) | 0.039 *** (3.960) |

| Top1 | −0.003 ** (−2.497) | −0.001 (−0.532) | −0.002 *** (−4.309) | −0.001 *** (−3.336) |

| Id | 0.004 (1.191) | −0.003 (−1.000) | 0.002 (1.241) | 0.001 (0.836) |

| Board | 0.348 *** (3.159) | −0.261 *** (−2.796) | −0.011 (−0.232) | 0.022 (0.560) |

| Age | −0.330 *** (−6.271) | −0.152 *** (−3.141) | −0.091 *** (−4.080) | −0.017 (−1.051) |

| _cons | −1.993 *** (−3.286) | 1.046 ** (2.407) | −1.592 *** (−6.433) | −1.128 *** (−5.845) |

| YEAR | Yes | Yes | Yes | Yes |

| IND | Yes | Yes | Yes | Yes |

| N | 11,546 | 11,547 | 10,085 | 8361 |

| r2_a | 0.279 | 0.216 | 0.174 | 0.150 |

| Variable | (1) R1 | (2) D1 |

|---|---|---|

| Myopia | −1.648 *** (−5.315) | −0.120 (−0.798) |

| Size | −0.139 *** (−4.892) | 0.096 *** (6.506) |

| Lev | −4.278 *** (−24.680) | −0.740 *** (−9.117) |

| ROA | −3.990 *** (−6.243) | −1.321 *** (−4.830) |

| Growth | −0.182 *** (−2.589) | 0.002 (0.067) |

| Tobinq | 0.277 *** (9.263) | 0.168 *** (10.650) |

| Cash | −0.819 * (−1.931) | −0.888 *** (−4.866) |

| TA | −2.692 *** (−15.575) | −0.513 *** (−5.941) |

| Inst | 0.002 (1.615) | −0.002 *** (−3.179) |

| Mpay | 0.679 *** (16.390) | 0.114 *** (5.900) |

| Top1 | −0.011 *** (−6.031) | −0.006 *** (−6.240) |

| Id | 0.013 ** (2.502) | 0.005 ** (1.987) |

| Board | 0.256 * (1.703) | −0.043 (−0.576) |

| Age | −0.917 *** (−11.436) | −0.175 *** (−4.825) |

| _cons | −0.793 (−1.039) | −2.771 *** (−7.457) |

| YEAR | Yes | Yes |

| IND | Yes | Yes |

| N | 23,093 | 18,446 |

| r2_a | 0.293 | 0.167 |

| Variable | (1) R | (2) D |

|---|---|---|

| Myopia | −0.492 *** (−2.693) | −0.207 (−1.196) |

| Size | −0.184 *** (−11.972) | 0.155 *** (10.862) |

| Lev | −0.262 *** (−3.103) | −0.148 * (−1.891) |

| ROA | 1.191 *** (4.622) | −0.842 *** (−3.539) |

| Growth | 0.072 ** (2.088) | 0.085 *** (2.838) |

| Tobinq | 0.068 *** (5.869) | 0.141 *** (13.542) |

| Cash | 1.193 *** (5.593) | −0.526 *** (−2.610) |

| TA | −0.992 *** (−9.689) | −0.753 *** (−7.781) |

| Inst | 0.004 *** (6.473) | −0.001 (−1.357) |

| Mpay | 0.484 *** (21.920) | 0.153 *** (7.439) |

| Top1 | −0.001 (−1.355) | −0.006 *** (−6.774) |

| Id | 0.001 (0.382) | 0.006 ** (2.364) |

| Board | 0.128 (1.589) | 0.058 (0.793) |

| Age | −0.263 *** (−6.443) | −0.117 *** (−3.035) |

| _cons | −1.580 *** (−3.791) | −6.786 *** (−17.289) |

| YEAR | Yes | Yes |

| IND | Yes | Yes |

| N | 23,093 | 18,446 |

| r2_a | 0.293 | 0.167 |

| Variable | (1) R | (2) D |

|---|---|---|

| Myopia | −25.335 *** (−3.111) | 3.636 (1.465) |

| Size | −0.182 *** (−9.046) | 0.015 ** (2.239) |

| Lev | −0.007 (−0.055) | −0.096 ** (−2.156) |

| ROA | −0.001 (−0.003) | 0.038 (0.230) |

| Growth | −0.202 ** (−2.053) | 0.063 ** (1.978) |

| Tobinq | 0.054 *** (3.161) | 0.058 *** (9.198) |

| Cash | 1.395 *** (5.008) | −0.118 (−1.421) |

| TA | −0.040 (−0.130) | −0.342 *** (−3.415) |

| Inst | 0.005 *** (4.895) | −0.001 *** (−2.583) |

| Mpay | 0.344 *** (7.296) | 0.087 *** (5.560) |

| Top1 | −0.001 (−1.036) | −0.002 *** (−5.000) |

| Id | −0.002 (−0.636) | 0.002 ** (2.026) |

| Board | 0.171 (1.589) | 0.001 (0.032) |

| Age | 0.186 (1.222) | −0.124 *** (−2.842) |

| _cons | 1.284 (1.566) | −1.492 *** (−5.856) |

| YEAR | Yes | Yes |

| IND | Yes | Yes |

| N | 23,093 | 18,446 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, T.; Cui, Y.; Li, R. Exploitation or Exploration? Managerial Myopia, Economic Policy Uncertainty and Ambidextrous Innovation Investment. Sustainability 2023, 15, 7173. https://doi.org/10.3390/su15097173

Yang T, Cui Y, Li R. Exploitation or Exploration? Managerial Myopia, Economic Policy Uncertainty and Ambidextrous Innovation Investment. Sustainability. 2023; 15(9):7173. https://doi.org/10.3390/su15097173

Chicago/Turabian StyleYang, Tingyu, Yongmei Cui, and Rui Li. 2023. "Exploitation or Exploration? Managerial Myopia, Economic Policy Uncertainty and Ambidextrous Innovation Investment" Sustainability 15, no. 9: 7173. https://doi.org/10.3390/su15097173

APA StyleYang, T., Cui, Y., & Li, R. (2023). Exploitation or Exploration? Managerial Myopia, Economic Policy Uncertainty and Ambidextrous Innovation Investment. Sustainability, 15(9), 7173. https://doi.org/10.3390/su15097173