1. Introduction

Financial Technologies (FinTech), as a scholarly field, has appeared recently, with promising prospects of enhancing operational effectiveness and efficiencies [

1]. Because of the positively influential relationship of FinTech with activities (i.e., transaction management, fund management, and insurance) related to the global financial sector, the field has already garnered noticeable research interest internationally [

2]. Additionally, as the shared aspects of the field and sustainability [

3,

4] indicate, FinTech has the potential to guide future organizations within the banking sector to promote, nurture, and facilitate environmentally, economically, and socially sustainable practices. Moreover, the emergence of further disruptive technologies, including Artificial Intelligence, Cloud Computing, Blockchain, and Machine Learning, is rapidly expanding the field’s width [

5]. Attributing to the benefits of FinTech regarding the efficiency of operation, output quality, management transparency, security, and added convenience for customers, previously identified growth in the field, in terms of annual production numbers [

1,

5,

6,

7,

8], can be justified. Besides, FinTech is actively facilitating financial inclusion, with technologies such as Mobile Banking, Online Banking, and Agent Banking [

9,

10]. Hence, the multidimensional need for this field’s evolution can be acknowledged.

Despite being a distinct research area, the development of the field remained scattered [

7], mainly for the dependency of the field on different technology-related domains [

2,

11,

12]. Furthermore, the expanding horizon of the field due to rapid technological advancement [

13,

14,

15] has resulted in incongruent perspectives regarding FinTech among researchers [

6,

10], which complexifies the synchronized development of the field. However, the present research acknowledges the dearth of conceptual uniformity and unanimity within the field, as argued by Bajwa, Ur Rehman [

5], which may lead to misinterpretation and improper identification of research gaps. The present research aims to solve these issues by revealing the current state of development, and prominent authors whose contributions have been seminal to noticeable scientific works in the field, as well as current trends and possible future research directions.

The present study answers the research questions of what the current state of development is, who the most prominent contributors are, which sources, including countries and journals, have the most noticeable impact, what the publication trend in the field is, what the breadth and spread of existing knowledge is, and what the future research directions in the scholarly field of FinTech are. This study answers these questions with bibliometric analyses, together with citation and co-citation analyses conducted on the existing scientific works. The contribution of this research is manifolded. First, the revealed publication trend indicates the field’s current development and life-cycle stage. This finding can enable future researchers to estimate the fit of their research intentions. Second, the identification of the most contributing papers and authors and their most used keywords can enable future researchers to recognize the dominant contributors in the field and congregate conceptual bases that can lead to harmonized development of the field. Third, the cluster analysis conducted for this research divulges the current extent of knowledge and future research scopes. Finally, with the recognition of the most contributing countries, which signifies the current state of FinTech adoption in the respective regions, this research facilitates the discerning of international collaboration scopes for future researchers that can foster knowledge transfer and contextualization of the adoption, thus expediting financial inclusion and sustainability in the global financial sector through FinTech.

The rest of the study is structured as follows. The next section presents the background of this study. In the third section, the methodology this research has adapted has been described. Then, the results of the analysis are presented and discussed in sections four and five. Finally, this paper concludes with practical and theoretical implications, as well as a recognition of the limitations of this research.

2. Background of the Study

The historical development of FinTech started in early 1988. Based on the Consumer International [

4] report, we can present the historical evaluation period of FinTech in three phases. The progress story of FinTech started in early 1986. The first evaluation period of FinTech was counted between 1986 to 1967, and, during this period, this remarkable development was invented by the telegraph and set up by transatlantic cable. The second phase, between 1967 and 2008, includes the major achievement of the emergence of ATM machines and online banking services. The third phase began in 2008, and started a new paradigm in the era of digitalization [

5].

The financial service sector globally is confronting thoroughgoing changes, due to rapid technological advancements, prompting process automation, interconnectivity among different institutes, and efficiency of service delivery [

2,

6]. This unprecedented reformation of the global financial service sector is embraced by the scientific works produced in the academic domain of FinTech. Researchers around the world are working to contextualize the impact and implementation, as well as developing new technologies and novel implementations for existing innovations.

Despite being a new research field, FinTech has proliferated, indicating its wider acceptances and implementations. However, the contribution and impact of distinct authors and scientific papers are unknown to a great extent, which may lead to a lack of conceptual similarities among future research works. Moreover, the field’s present contexts and future directions are still vague, as previous studies conducted with these objectives are limited to fewer keywords and, therefore, directions. Besides, the sources contributing to the field and their publishing trend remained unrevealed. Additionally, the contributions made by different countries and their tendency toward international collaboration have not been studied previously. The country-based publication numbers may indicate the advancement of the financial service sector in these regions. Further, insight into the international collaboration tendency may help future researchers collaborate across frontiers to channel the advancements.

Thus, FinTech continues to be highlighted in research related to finance, focused primarily on digitalized products and services because of its secure, easy, and transparent procedures. Moreover, the advancement of finance and technology is closely related to the industry 4.0 revolution, including Blockchain, Big data, Robbo Advisor, Internet of Things (IoT), Cybersecurity, Cloud Computing, and Crowdsourcing. The number of annual publications increased gradually, until 2018. However, COVID-19 brings crucial implications for international finance, and is growing and reshaping the phenomenon of research in finance [

7,

8]. Onward from 2019, the field enticed massive research interest, which resulted in an escalation of annual publication numbers.

To explore the current trends and future directions in the field of FinTech, this research applied bibliometric techniques for conducting quantitative analysis. The analysis revealed the characteristics and contributions made by different authors and countries, the impact of different authors, and development trends, as well as research directions, in the mentioned scholarly field. This research has been structured and executed revolving around the aim of facilitating future scientific producers to advance the field in a more informed and organized way.

3. Methodology

To analyze the emerging patterns and characteristics in the scholarly field of FinTech, bibliometric analyses, together with citation and co-citation analyses, have been conducted on published scientific papers. Bibliometric analysis has been proven to be an effective way of identifying common keywords and ideas evolving over time, along with future trends [

9,

10]. It employs quantitative measurements and investigation techniques on written documents, following an objectivist philosophy [

11]. Citation and co-citation analysis focus on revealing emerging trends and the impact of different journals, authors, similar keywords, and shared ideas. It also identifies the course of formation and development of a scholarly field attributed to individual authors and collaborations [

12].

Bibliometric studies (e.g., citation and co-citation analyses) can extract trends and characteristics from written documents. Bibliometric studies also ease the process of exploration, organization, and articulation of works done in any specific field during any specific period by analyzing the growth, institutional scholarship strengths, and possible school(s) of thought [

13,

14]. Citation and co-citation analyses enable researchers to administer analytical capabilities, techniques, and tools on written documents published in academic sources, such as journals, books, and articles, to explore and observe any particular field of research, or a portion of a discipline [

3,

15]. Bibliometric studies provide a comprehensive overview of the past, present, and future directions of the field, or sub-field, that is being studied [

9,

11].

As an effective and objective procedure of applying quantitative tools and analyzing capabilities to published written documents, adopting bibliometric research techniques allowed the researchers to respect the objectivist research philosophy and to understand and present the findings in quantitative terms [

3,

9,

16,

17]. A summary of the methodological process has been presented in

Figure 1. The written documents used in the bibliometric analyses were mined by the researchers from the Scopus Database by employing “FinTech” as a search keyword. “FinTech” itself is the most common keyword for papers written in the selected scholarly field. However, other closely related keywords, such as “Financial Technologies”, “Innovation in Finance”, “Technology in Banking”, “Digital Banking”, and “Financial Inclusion”, were also considered when searching the papers. The deployment of only these keywords can be acknowledged as a limitation of the present study. Additionally, databases other than Scopus were not selected and utilized by the authors, due to a deficit in authorized access. The authors had authorized access only to the Scopus Database, which, thereby, left the opportunity to use other relevant keywords and mine from other respected databases (e.g., Web of Science, ScienceDirect, DOAJ, and JSTOR) in future research.

After loading the database, the authors used the periodic filtering strategy to extract the documents from 2010 to 2021. As a relatively new academic field, the database contains 1359 documents in total, starting from 2010. The period between 2010 and 2021 has been selected because the proliferation of the field started after the year 2010. The year 2022 has been excluded, as the total number of documents published was unknown at the culmination of this research. The authors have not applied “Document Type” filters, as they have considered all types of documents (e.g., articles, books, book chapters, conference papers, short surveys, and note previews) applicable for, and relevant to, bibliometric analyses. The authors had not excluded any particular document types, as the application of the keyword “FinTech”, and other related ones, only retrieved 3224 results. Furthermore, the authors set an objective of investigating the theoretical and applied development of FinTech in every scholarly field to identify the associated research areas limited to “Business, Management and Accounting” AND “Economics, Econometrics and Finance”, AND “Social Sciences”. Other studies conducted in recent years administrated similar strategies to constitute the whole FinTech research [

1,

13,

14]. To calculate “Average citations per document” the researchers considered both highly cited and lowly cited papers, which facilitates the process of identifying good and mediocre studies. Additionally, all the sources of scholarly works were considered to maximize the number of total papers. With these filtration techniques, the authors retrieved 1359 documents. The bibliometric package of R programming has been exerted on these documents from the Scopus Database for the analyses. The VOS viewer (latest version of 1.6.18) has also been used to present networking analysis.

5. Discussion

This paper presents the bibliometric analysis conducted on the documents published in the field of FinTech from 2010 to 2021. From the Scopus Database, 1359 scientific publications were retrieved. The analysis identified that, in 2015, the first document on this field was published, indicating the recent emergence of the term “FinTech”, which is also argued by Tepe, Geyikci [

14]. The number of annual publications increased gradually until 2018. Onward from 2019, the field enticed massive research interest, which resulted in an escalation of annual publication numbers (

Figure 2). During the same period, the adoption rate of FinTech in financial institutes globally also increases rapidly [

14,

18]. Hassan, Rabbani [

7], Toumi, Najaf [

19] argued that the COVID-19 pandemic proliferated the application of technology-laden banking products, which can justify the increased number of publications in this field onward from 2019, revealed by this research. This paper analyzed publications on this field from various bibliometric aspects, and presented the findings through visualized figures and tables.

To start with, terms such as Blockchain and Artificial Intelligence appeared most frequently (

Figure 3 and

Figure 4), indicating a one-way dependency of FinTech on different technological factors. This dependency on other technological domains has also been suggested by [

6,

20,

21,

22,

23,

24]. Moreover, financial inclusion is the second-most frequently used keyword (

Figure 3), which implies a probable strategic shift in the objective of the banking businesses and governments to integrate a wider population within banking facilities. Recent studies conducted by Gabor and Brooks [

25], Demir, Pesqué-Cela [

26] show that FinTech, as a disruptive technology, has the potential to expedite financial inclusion in all sorts of economic contexts. The recognition of financial inclusion as one of the most used keywords, through the bibliometric analysis conducted for this research, signifies that scholars globally are actively pursuing the materialization of this potential. The bibliometric analyses also revealed the impact of distinct authors with different nationalities on the field (

Figure 7). Authors from the USA have accumulated the highest number of citations, indicating the advancement of financial services in the region. Technological advancement in the USA has also been proclaimed by Matousek and Xiang [

27]. Further, evidence of international collaboration was identified (

Figure 8). Authors from countries such as the United States, the United Kingdom, China, Germany, and Australia have collaborated several times with different nations within the specified research period. Individual authors, namely, Arner D.W., Buckley R.P. and Wojcik D, scored the highest in the case of individual impact measurement. However, the annual citation numbers decreased after 2016, which also experienced exponential growth from 2014 to 2016. The bibliometric analysis has also recognized the publications made through 672 different sources (

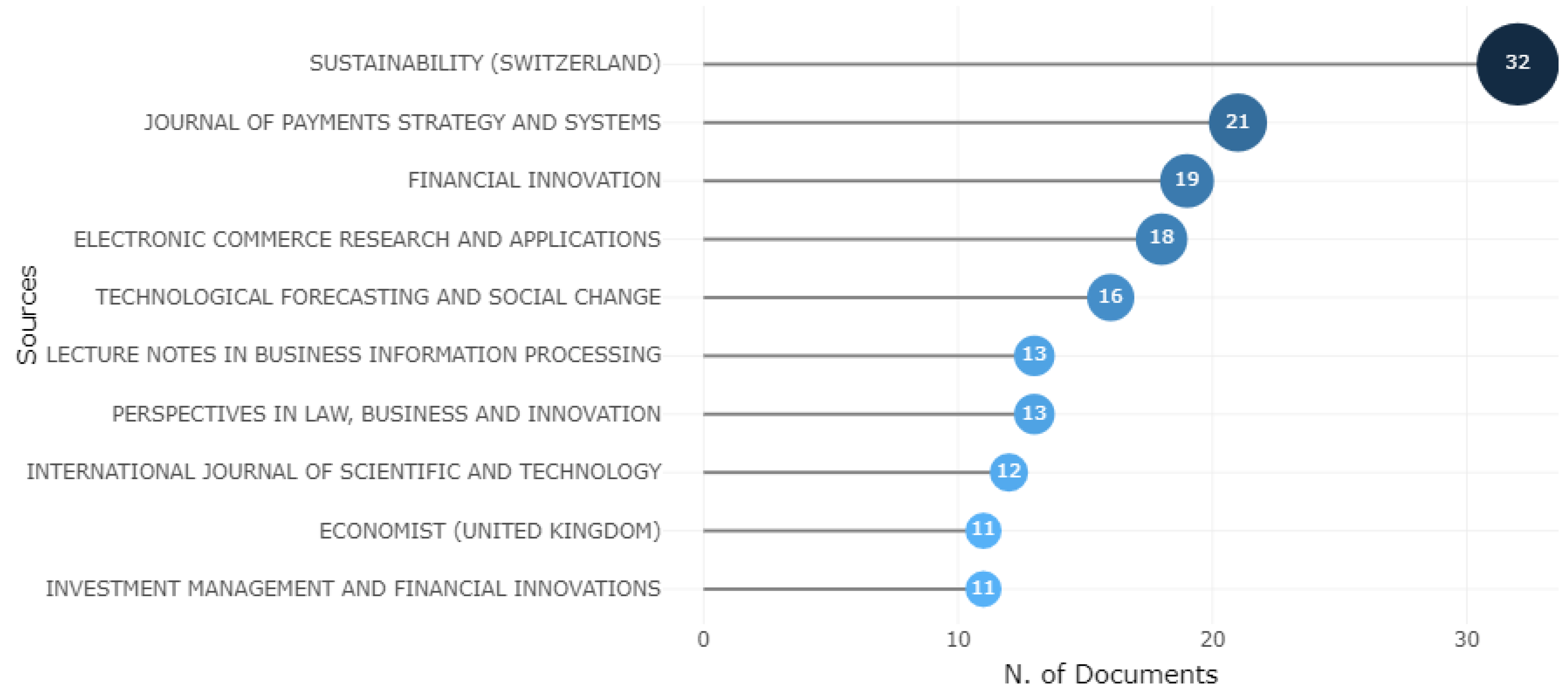

Figure 5). Among these sources, the Switzerland-based journal, “Sustainability”, published the highest number of scientific papers. This journal and other sources with significant contributions are discerning rapid growth in publication numbers (

Figure 6).

The conceptual structure map presented two different research directions in the field (

Figure 9). Besides, the three fields and the word CloudAnalysis showed that the keywords Blockchain, Artificial Intelligence, electronic money and trading, Machine Learning, and Financial Inclusion are gradually catching the momentum of being mainstreamed research sub-fields. Regardless of how and where, the annual publication numbers are increasing steadily (

Figure 2), indicating the liveliness of the field and the scope for other researchers to contribute. Similar types of research themes in the field have also been revealed by a previous bibliometric study conducted by Li and Xu [

13].

This paper shows the current and future research direction that can significantly encourage further scientific enrichment in the academic field of FinTech. However, this paper presented the analysis conducted on the publications listed in the Scopus Database and retrieved using specific keywords, which limits the research span. Future scientific works will be able to integrate more directions for studying the dynamic development of the field.

6. Conclusions

This research conducted a bibliometric analysis of the FinTech field to identify its current state of development, prominent authors, publication trends, and possible future research directions. The findings of the research indicate that FinTech is a dynamic and rapidly expanding field, with significant growth in annual publication numbers in recent years. The analysis also revealed that the field is heavily dependent on various technological domains, with Blockchain and Artificial Intelligence being the most frequently used keywords. Financial Inclusion is another crucial aspect of the field that has gained significant attention in recent years. The research identified the highest contributing authors, countries, and sources, which can facilitate the identification of the most relevant scientific productions, international collaboration, and knowledge transfer in the field. The conceptual structure map showed two different research directions in the field, and the word Cloud Analysis indicated the increasing mainstreaming of sub-fields such as Blockchain, Artificial Intelligence, and Financial Inclusion. The present research contributes to the field by providing insights into the current state of development, prominent contributors, and possible future research directions. Future research can expand on the present study by considering more comprehensive databases and integrating other research methods to enhance the understanding of the field’s dynamic development. Overall, the present research provides valuable insights and contributes to the harmonized development of the FinTech field.

7. Implications for Practitioners and Academia

7.1. Managerial Implications

The findings of this study on the evolution of FinTech have several managerial implications: First, the study can provide valuable insights to financial institutions, regulators, and policymakers to make strategic decisions related to the adoption and regulation of FinTech. For instance, understanding the emerging trends in FinTech research can help institutions identify areas of potential growth and investment. Second, the study highlights prolific objects, such as journals, authors, institutions, countries, and regions, and the corresponding cooperative relationship mapping. This information can be used by financial institutions and other stakeholders to identify key players in the FinTech industry, understand their areas of expertise, and establish partnerships for mutual benefit. Third, the study can inform the development of innovative FinTech products and services by identifying emerging technologies and themes in FinTech research. Institutions can use this information to develop new products and services that meet the evolving needs of customers. Fourth, the study can help financial institutions to identify and manage potential risks associated with the adoption of FinTech. For example, the study highlights the ethical considerations associated with the use of FinTech, such as privacy and security. Institutions can use this information to develop appropriate risk management strategies. Fifth, the study can provide valuable information for talent management in financial institutions, including identifying key researchers and institutions in the field of FinTech, which can help in recruiting and retaining talented employees. Finally, the findings of this research can be used by financial institutions, regulators, policymakers, and other stakeholders to make strategic decisions related to the adoption, regulation, and development of FinTech.

7.2. Theoretical Implications

The theoretical implications of this bibliometric research could be significant in several ways. First, it can provide a better understanding of the evolution of the FinTech research field, including its fundamental issues, characteristics, and trends. This can help scholars to identify new research areas and directions and guide future research in FinTech.

Second, by identifying the most prolific journals, authors, institutions, countries, and regions in FinTech research, this study can help researchers to find potential collaboration partners and networks, as well as understand the dominant research paradigms and research communities in the field. Third, the citation structures analysis can provide insights into the most influential authors, journals, and references in the field. This can help researchers to identify the most relevant and impactful research and understand the evolution of FinTech research over time. Finally, this bibliometric research can contribute to the theoretical development of the FinTech research field by providing a comprehensive overview of the existing literature and identifying areas for future research.

7.3. Practical Implications

The practical implications of this bibliometric research on FinTech are significant. It provides valuable insights for practitioners and decision-makers in the financial industry, including policymakers, regulators, financial institutions, and FinTech startups. First, the analysis of the publication trends can help these stakeholders stay up-to-date with the latest research and developments in FinTech. This can inform their strategic decisions and investment choices in the FinTech space. Second, the identification of the prolific journals, authors, institutions, countries, and regions in FinTech research can help practitioners and decision-makers identify potential collaboration opportunities and build partnerships with relevant stakeholders. Third, the analysis of citation structures can help identify the most influential authors, journals, and references in the FinTech field. This can help practitioners and decision-makers identify and learn from best practices and successful cases. Finally, the discussion of the challenges and future development opportunities in FinTech can inform the strategic planning and innovation strategies of financial institutions and FinTech startups. It can also provide insights for policymakers and regulators to develop regulatory frameworks that foster innovation while maintaining financial stability and consumer protection.

Limitations and Future Research Directions

There are several potential limitations to this research on the evolution of FinTech in research using the Scopus database:

First, the Scopus database is a vast and reputable source of bibliographic information, but it may not include all relevant publications in the field of FinTech. Some articles may be published in other databases or in non-indexed journals, which may not be captured in this study. Second, the study only considers publications in English, which may exclude important research in other languages. Additionally, there may be a publication bias towards more prominent authors or institutions, which may skew the results. Third, while bibliometric analysis can provide an overview of the field, it does not necessarily reflect the quality of the publications included. Some publications may be of higher quality than others, and this may not be captured in the analysis. Fourth, bibliometric analysis is a quantitative approach that does not consider the context or content of the publications. The analysis may not capture important nuances or trends in the field that are not reflected in the keywords or citations used. Finally, the study only looks at publications from 2010 to 2021, which may not capture the full evolution of FinTech in research. Some important developments in the field may have occurred outside of this time frame, and these may not be reflected in the analysis.

Based on the findings of this bibliometric research on the evolution of FinTech in research, several potential future research areas could be explored: FinTech is a rapidly evolving field that intersects with many other disciplines, such as economics, computer science, and law. Future research could explore the interdisciplinary nature of FinTech and investigate how different fields contribute to its development. It is driven by advances in technology, such as Blockchain, Artificial Intelligence, and Machine Learning. Future research could explore how these emerging technologies are being applied in FinTech, and their impact on the financial industry. The regulatory landscape for FinTech is complex and evolving. Future research could investigate how regulatory frameworks are adapting to the emergence of FinTech, and the potential implications for the financial industry. FinTech is ultimately designed to serve the needs of users, and their adoption and behavior are crucial to its success. Future research could investigate how users are adopting and using FinTech products and services, and how their behavior is changing. FinTech raises important ethical considerations, such as privacy, security, and fairness. Future research could explore how these ethical considerations are being addressed in FinTech, and their potential impact on the financial industry.