Abstract

Recent developments in blockchain technology have enabled the development of wallet applications for storing peoples’ cryptocurrency reserves. Cryptocurrency wallet applications could deploy affiliate marketing processes to increase the visibility of their products. From these affiliate marketing processes, supply chain firms in the air forwarding sector that seek to advertise their services to a larger audience could be benefited. This research examines whether affiliate marketing initials of cryptocurrency wallet applications affect their digital marketing efficiency, as well as whether air forwarding firms’ website visibility could be benefited from them. After collecting the required Web Analytic data, the authors performed statistical analysis (correlations and linear regressions), followed by Fuzzy Cognitive Mapping (FCM) macroanalysis and Hybrid Modeling (HM) microanalysis to assess the outcomes of cryptocurrency wallet applications’ affiliate marketing programs. Hence, from the deployed methodology, valuable insights arose. The first part of the produced outcomes concerns the effect of cryptocurrency wallet application affiliate marketing metrics on their digital marketing results. The increased implications of affiliate marketing metrics (referring domains, backlinks, etc.) decrease the number of pages their visitors see. Regarding the air forwarder firms’ website visibility, specific metrics (branded and referral traffic) were increased and others (social traffic) were decreased from the increment of cryptocurrency wallet application affiliate marketing metrics (backlinks, internal links, etc.). Supply chain firms, in the air forwarding sector, could have increased website visibility by deploying advertisements and affiliate marketing initiatives with cryptocurrency wallet organizations. Summing up, specific affiliate marketing metrics of cryptocurrency wallet applications are capable of significantly impacting their digital marketing performance and also constitute determinant factors of supply chain firms’ website visibility.

1. Introduction

1.1. Importance of Supply Chain Firms’ Website Visibility

Organizations throughout the digital era are working hard to gain a competitive edge and achieve long-term financial expansion in increasingly competitive industries. Strong commercial contacts could be essential. Supply chain firms seek to enhance their website visibility and attract more potential customers at the same time. Linking with exterior suppliers, consumers, or other distribution partners, as well as tightly merging resources from within and outside of corporate activities, are examples of this [1,2]. Such connections have been seen as valuable supply chain management (SCM) advantages for organizations seeking to preserve trade success, sustainability processes, and expansion. Companies might also seek to maintain their competitive advantage depending on cooperative commerce (c-commerce) behavior and dynamic sustainability processes [3].

Developing, expanding, and altering supplementary assets to empower enterprises to fulfill market needs and establish a sustained competitive advantage could help a company’s recognizability. Several scholars contend that website services and product promotion have an impact on company efficiency, either directly or indirectly [3,4]. It could be deduced that a company must modify its inner assets or functional procedures, as well as harness exterior assets or uncover possibilities, in order to successfully boost good results and product promotion.

To achieve desired levels of corporate efficiency, Formentini & Taticchi [5] indicated that various initiatives and processes could be utilized for this goal. Redefinition of an organization’s strategy could be on par with other processes, similar to the development of products, as an efficient way to promote their recognizability [6]. Website customer engagement is a common practice of supply chain firms in order to enhance their competitiveness [7], both in the offline and online product/service marketing concepts. Therefore, a main objective for supply chain firms should be the enhancement of their website visibility, so as to improve their marketing and digital marketing results. This outcome would then enhance the level of competitiveness of supply chain firms and boost their presence in the e-commerce context.

Competition from e-commerce heightens the requirement for velocity and rapid stock rotation. Supply chain executives are always facing strain to enhance sustainable operations by reducing expenses. Businesses must also be able to adjust their services and products to fluctuating customer preferences and behaviors [8]. Then, the desired level of revenues and sustainability could emerge. Supply chain administrators are under obligation to make supply networks more agile in order to keep up with the pace of innovation and the escalating competitiveness in marketplaces [9]. The core business within a supply chain would get the flexibility necessary to handle issues by implementing and utilizing online collaboration platforms, monitoring tools, tracking, and tracing, in addition to integrating supply chain management systems with the ERP challenges offered by competitors and clients [10].

1.2. Structure of the Paper

The following chapters of the present study are organized to provide the necessary information, more specifically, an introduction to the topic of the research and the literature related to the paper’s emphasis; then, in the Materials and Methods section, a reference to the study’s research hypotheses and sample collection has been made, while in the Results section, the analytical tools (linear regression, Fuzzy Cognitive Mapping, and Hybrid Modeling) and their outcomes are explained. Finally, in the Discussion and Conclusions sections, the basic results of the applied research methodology are analyzed in order to provide valuable insights for both supply chain firms, in the air forwarding sector, and cryptocurrency application marketers. Topics of the authors’ future work are also part of the Conclusions section.

1.3. Affiliate Marketing and Cryptocurrency Applications

Bloggers and influencers comprise the most prevalent sorts of affiliate marketers. Furthermore, benchmarkers and e-mail addresses are very widespread. Approximately 84% of publications participate in a certain form of the affiliate scheme. It is critical for affiliate marketers to advertise affiliate programs that are relevant to their desired audience. Furthermore, this may have an impact on the conversion efficiency and brand of both the affiliate advertiser or domain and the client firm [11]. It is really critical to understand the value of various sorts of affiliate referrals while handling affiliate marketing. A topic that is frequently overlooked is search engine optimization (SEO). It is crucial to obtain traffic from affiliate domains that are trending on organic searches and terms that attract a firm’s target market [12].

Affiliate marketing blends strong efficiency advantages with the wider benefits of web advertising. Affiliate marketing revenue, for example, is often solely achievement-related, with a 10% advertising charge for every transaction. According to normal guidelines, an affiliate receives a fee only when a visitor (1) visits an affiliate’s website, (2) selects the affiliate’s particular link to the retailer, and (3) initiates a transaction from the seller [13].

In the analogous context of sites deciding whether to charge advertisers for ads being displayed versus clicked, Zhu & Wilbur [14] note the role of advertiser heterogeneity, as well as uncertain levels of advertiser effort, to attract clicks. If an advertiser pays for every click, it should design its ads to attract only clicks from users who are genuinely interested. In contrast, an advertiser paying for displays might as well invite every click possible, even if an increased proportion of clickers do not make purchases. In the context of affiliate marketing, merchants are generally perceived to be trustworthy, but affiliates are highly heterogeneous. As Zhu & Wilbur note [14], cost-per-action affiliate marketing is to cost-per-click ads as cost-per-click is to cost-per-impression, and their principles flow through accordingly.

Cryptocurrency websites and applications, such as wallets that preserve individuals’ cryptocurrencies, have experienced a large increase in demand in the recent years. This is due to blockchain technology and the creation of a plethora of cryptocurrencies, as well as their benefits of use. Once it pertains to advertising in the cryptocurrency area, it shall be highlighted that the proper execution of the plan to engage the public is critical. The initial and most critical step in marketing is determining your goal demographic. Simply by determining the target clients’ preferences, demands, and demographic information can one develop a marketing plan [15]. As stated by recent studies [16,17,18], a large number of decentralized and centralized payment organizations, such as cryptocurrency trading and issuing platforms, can be benefited from digital marketing strategies and plans (SEO, SEM, social media). Cryptocurrency application (such as wallets, etc.) usage and visibility are increasing, opening the way for the capitalization of additional digital marketing strategies, such as affiliate marketing programs, content management, chatbots, etc.

1.4. Big Data Analytics and Website Innovative Optimization

Generally speaking, big data handling aims to retrieve or “mine” (find) information through vast volumes of data [19]. Datasets and data stores, analytics, advanced analytics, high-performance processing, machine learning, artificial neural, visual analytics, web mining, picture and signals analysis, and geographical or chronological data analysis are all part of data mining [19]. Search engine optimization (SEO) and Search Engine Marketing (SEM) or else, organic and paid search engine placement, which cover a number of criteria that enable organizations to position themselves among the highest positions in search results [20], can positively affect the effectiveness and visibility of firms.

To improve the visibility of a website, the enhancement of the firm’s SEO and SEM programs is required. Towards this aim, organizations plan to harvest organic and paid keywords to boost the traffic that lands on their websites through various sources (social, direct, referral, etc.). Innovative ways for exploiting firms’ big data and Web Analytics have been stressed [16,17,18], where the ascendant role was given to the enhancement of key indicators of their digital marketing performance (KPIs). A more advanced and innovative approach could be deployed from the need to utilize various types of digital marketing strategies of other firms, through proper collaboration between organizations.

Big data analytics may be utilized to boost efficiency and visibility in the market while also improving data content monitoring and user experience. Managing the integrity of big data has additionally been demonstrated to have a favorable association with organizations’ opinions of implementing big data analytics through both inner and exterior data sources [21]. Despite the numerous advantages of using big data in supply chains, a few obstacles arise to integrating forecasting analytics, such as the shortage of specialists, the shortage of information, and the scarcity of resources for preparing the future era of data analysts [22].

Referring to supply chain firms, studies have pointed out the importance of digital marketing techniques and initiatives to enhance their results and performance. To this point, supply chain firms, like air forwarders and airlines, have harvested their own cryptocurrency and crowdsourcing organizations’ big data to improve their sustainability process results. Further digital marketing strategies could be applied to ensure higher efficacy levels to supply chain firms, through innovative big data analytics processes.

1.5. Approach of the Study

The aim of this study was to provide accurate insights regarding the potential exploitation of cryptocurrency applications’ affiliate marketing programs, in favor of supply chain firms’ website visibility. Many studies have focused on the effect of digital marketing strategies, mostly those of social media marketing, on their own organization, but little research has been conducted as to whether uprising technologies and applications’ roles could be of any importance for organizational sustainability through websites’ visibility [23,24,25]. For this reason, the authors seek to examine the effect of cryptocurrency applications’ innovative affiliate marketing processes, via big data analytics, to supply chain firms’ efficiency based on enhanced website visibility.

Accordingly, similar research has been performed by Raman et al. [26], where the application of big data technologies has contributed to financial gains and demand prediction to supply chain firms that enhance the firms’ website visibility. Raman et al. [26] focused on added value to supply chain firms by utilizing big data originating from their organization, whereas the authors examined supply chain firms’ benefits from the capitalization of other organizations’ big data (cryptocurrency wallet organizations). Wang et al. [27], highlighted that firms should focus their activities on enhancing relationships with suppliers, customers, etc., thus gaining dynamic capabilities and a competitive advantage. Furthermore, due to the quick improvements in Technology, businesses must be inventive in order to deal with obstacles. Developing dynamic capacities necessitates the integration of internal and external resources, such as innovative goods [28].

Generally, affiliate marketing is a low-cost, albeit time-consuming, approach, which emphasizes driving traffic via affiliate websites to advertising domains. Digital marketing approaches, including SEO, webpage optimization, social media visibility, and content development, play an important role in integrating initiatives for efficient affiliate marketing use [29]. Eldeman & Brandi [30] emphasize the prospective advantages of affiliate marketing techniques for every firm.

Thus, the authors proceeded to explore whether supply chain firms’ website visibility (an increase of organic and social traffic metrics), and thus efficacy (branded traffic metrics), could benefit from the affiliate marketing processes of cryptocurrency applications. A potential cooperation between these organizations that favors both parties constitutes an interesting research topic.

2. Materials and Methods

For the development of a sufficient methodological context for supporting the requirements of the paper’s research path, the authors utilized innovative and complex methodologies. The authors focused on gathering big data from the websites of supply chains, in the air forwarding sector, as well as from cryptocurrency wallet apps, to assess their potential connection. To do so, the utilization of specific website and application KPIs was required. Apart from the collection of the referred datasets, the methodological framework’s stages are elaborated on below:

The performance of suitable statistical analysis follows the gathering of the website analytical data and the selection of the appropriate KPIs. Through this stage, the variables that are connected with the necessary KPIs underwent correlation and linear regression analyses. In this way, important coefficients to evaluate the variables’ relationships were produced, which will be later used as inputs for the deployed models.

Moving to the second stage, an exploratory model was developed, aiming to illustrate the macroscale environment of the study’s variables. To do so, the authors opted to use the Fuzzy Cognitive Mapping models, which can effectively represent the macro environment of a firm’s factors and performance relationships [31]. FCM provides a static representation of the total factors of cryptocurrency wallet applications’ affiliate marketing and air forwarding firms’ website visibility metrics. In this model, the correlation coefficients that will be produced from the Results section will be used as inputs for its deployment. FCM is broadly utilized for various projects, varying from construction problem-solving [32] to aid businesses’ accounting processes [33]. More relevant studies analyzed customer satisfaction and behavioral factors, in the broader financial sector, by utilizing fuzzy logic approaches [34], similar to the FCM context.

In the last stage of the methodological context, the utilization of Hybrid Modeling (HM) processes has prevailed. As per the selected models for the HM deployment, an Agent-Based Model (ABM) and System Dynamic Model (SDM) methodologies were discerned. ABM was chosen due to its ability to simulate agent–people movement through a specified environment, based on basic commands. Liang et al. [35] reviewed many ABM studies and emphasize the enhancement of knowledge, offered by this methodology, in corporate decision-making, modeling validation, text mining, etc. On the other hand, SDM was selected for its ability to depict complex and dynamic organizational processes [36]. This methodology offers plenty of insights for business model innovation through computational approaches, by connecting dynamic factors of a business environment.

The benefits of using the referred methodologies to the hybrid simulation development originate from their combined ability to simulate two different types of factors/variables (agents and complex/dynamic processes) in one single model (hybrid). The correlation and regression coefficients will be used as inputs to the united hybrid model, and through its application, all the selected variables will interact with each other. The outputs of the model will be presented in chronological diagrams, where potential connections between them will be investigated. Thus, by simulating the affiliate marketing metrics from cryptocurrency wallet applications (backlinks, referral domains, etc.) and supply chain firms’ website visibility metrics (organic, social, and branded traffic), the authors will be able to discern the factors of cryptocurrency wallet apps that affect supply chain firms’ website visibility.

2.1. Research Hypotheses

The role of affiliate marketing variables has been studied and analyzed, among many firms and applications, for their effect on various marketing metrics. Their implication in the development of firms’ digital marketing efforts and achievement of organizational goals is crucial. In this way, supply chain firms should seek to harvest any affiliate marketing initiatives and emerging technologies’ application to strengthen their visibility and effectiveness. Thus, the authors discern the need to analyze the connection between cryptocurrency wallet applications, as an emerging market trend, and supply chain firms’ visibility. If from these outcomes a strong bond between cryptocurrency applications’ affiliate marketing metrics and supply chain firms’ digital marketing performance arises, then supply chain firms could boost their websites’ visibility process outcomes by collaborating with them for building backlinks and references. Enhanced website visibility could lead to increased customer turnovers and higher customer-to-visitor rates, meaning higher organizational effectiveness. To do so, the authors should first examine whether cryptocurrency wallet applications’ affiliate marketing programs benefit their own website visibility results. To test whether the settled research hypotheses are seen below, the authors opted to evaluate the statistical significance of the developed linear regressions.

To validate or reject the necessary findings of the research and to conclude on the impact of cryptocurrency wallet applications’ affiliate marketing metrics on their digital marketing metrics and those of supply chain firms, the authors list the following hypotheses:

Hypothesis 1 (H1).

The affiliate marketing metrics of cryptocurrency wallet applications can affect the number of visitors that enter their website through search engines.

A key feature for cryptocurrency applications is to obtain valuable insights into the efficiency of their performed affiliate marketing campaigns. These insights could shape the decisions regarding their digital marketing performance. Organic website traffic (organic traffic refers to visitors that land on a website through search engines) holds the lion’s share regarding the number of search engine queries [37]. Thus, it is highlighted as one of the most representative metrics of a firm’s website visibility [38]. The more organic traffic a website generates, the higher its visibility gets. Therefore, the connection between cryptocurrency wallet applications’ affiliate marketing analytics and their organic traffic is of high interest.

Hypothesis 2 (H2).

The more cryptocurrency wallet applications increase their affiliate marketing metrics, the more the number of website pages their visitors open is reduced.

Apart from the impact of affiliate marketing metrics on cryptocurrency wallet applications’ organic traffic, their connection with the average pages that website visitors see is also important. If cryptocurrency applications are able to increase the average number of pages that their visitors see, then their turnover rates could also be enhanced with a potential increase in customer engagement.

Hypothesis 3 (H3).

The number of supply chain firms’ brand-engaged website visitors is related to the applied affiliate marketing metrics of cryptocurrency wallet applications.

Next, the interest of the research hypotheses is shifted to the effect that cryptocurrency applications’ affiliate marketing metrics have on supply chain firms’ traffic. Firstly, their impact on the branded traffic (branded traffic concerns the number of website visitors that are familiar with a firm’s brand name) of supply chain firms might indicate a useful analysis for predicting the engagement of their customers to their brand. The enhancement of supply chain firms’ digital marketing performance is strongly related to the amount of their branded traffic.

Hypothesis 4 (H4).

The number of visitors from referral sources that land on supply chain firms’ websites is connected with cryptocurrency wallet applications’ affiliate marketing metrics.

Referral traffic (referral traffic sums the number of visitors that enter a website through links on other sources) aims to understand the landing of visitors on a firm’s website that is generated from referral sources. Thus, by understanding that cryptocurrency applications’ affiliate marketing metrics affect the referral traffic of supply chain firms, an optimal strategy could be deployed to increase their traffic. This traffic increase means that firms are able to advertise on cryptocurrency wallet applications’ sites and adjust their generated traffic properly from referral websites.

Hypothesis 5 (H5).

There is a positive relationship between cryptocurrency wallet applications’ affiliate marketing metrics and supply chain firms’ traffic generated from social sources.

The final research hypothesis has to do with the effect that cryptocurrency wallet applications’ affiliate marketing metrics have on supply chain firms’ social traffic. Usually, an enhanced affiliate marketing campaign tends to increase the traffic that originates from social sources. That is the reason the authors opted to examine whether the exploitation of cryptocurrency wallet applications’ affiliate marketing programs could benefit supply chain firms’ social traffic.

2.2. Sample and Data Retrieval

Regarding the study sample and the acquired data for analysis, the authors discerned 5 well-established supply chain firms and the 5 most known cryptocurrency wallet applications. The 5 well-established supply chain firms of the air forwarding sector were selected based on their transferred tons of product in 2019 [39], while the 5 cryptocurrency wallet applications were chosen based on their users’ preferences, cost, etc. [40]. The 5 supply chain firms that were selected are DHL [41], Kuehne & Nagel [42], DB Schenker [43], DSV [44], and UPS [45], while the 5 cryptocurrency wallet applications are Ledger [46], Trezor [47], Exodus [48], Electrum [49], and MyCellium [50]. Having selected the websites of interest, the authors proceeded to extract Web Analytic metrics from the above websites, by harvesting the platform-based Decision Support System (DSS) of Semrush [51], by paying a proper financial amount. Then, the referred data were collected through daily observations of the data metrics that appear in Table 1. Those data represent a time frame of 180 days of observation and collection, which started from 1 October 2021, until 1 May 2022.

Table 1.

Web analytic metrics of the study.

3. Results

In order to perform the necessary statistical elaboration of data and gather the required regression coefficients for the study’s following steps, the authors carried out linear regression models. Prior to that step, the basic descriptive statistics of the referred variables of the study were as shown in Table 1. Following the descriptive statistics of the dependent and independent variables, the authors also deployed a correlation analysis (Pearson’s correlation coefficient). The correlation coefficients deployed in Table 2, as well as the regression coefficients, will also be utilized in developing both the exploratory and the simulation model in the later stages of the study. The correlation matrix of Table 3 was prepared in order to obtain the necessary correlation coefficients (presented in the contents of the correlation matrix) and use them as inputs for the following Fuzzy Cognitive Modeling (FCM) development. FCM utilizes variables’ correlation coefficients to depict the overall connection of an environment’s factors [31]. Through all the Tables of the statistical analysis, the symbols of * and ** were used to indicate statistical significance at the 95% and 99% levels, accordingly.

Table 2.

Descriptive statistics of the five supply chain and five cryptocurrency wallet websites during a six-month period.

Table 3.

Correlation analysis matrix.

Leading to Table 4 and Table 5, the authors deployed linear regression models with cryptocurrency wallet applications’ organic traffic analytical metrics and their website users’ visited pages used as dependent variables. The independent variables of the regressions will be cryptocurrency wallet applications’ affiliate marketing metrics. In Table 4, cryptocurrency wallet applications’ organic traffic regression is not verified overall, with a p-value = 0.48 > a = 0.05 level of significance, despite the significance of backlinks as an independent variable (p-value = 0.042 < a = 0.05). On the other hand, in Table 5, cryptocurrency wallet applications’ pages per visit regression appears to be overall verified, with a p-value = 0.001 < a = 0.01 and R2 = 1.00. Each of the independent variables had a significant impact on cryptocurrency wallet applications with p-values below the 0.05 level of significance. For every 1% of referring domains, backlinks, referral traffic, and external and internal link variation, cryptocurrency wallet applications’ pages per visit varied up to −104.3%, −6.9%, −4%, 6.1%, and −4.3, respectively. Thus, our first research hypothesis was not verified, while our second hypothesis was verified, which means that the affiliate marketing metrics of cryptocurrency wallet applications can affect the number of visitors that enter their website through search engines; the more cryptocurrency wallet applications increase their affiliate marketing metrics, the more the number of website pages that their visitors open reduces.

Table 4.

Impact of cryptocurrency wallets’ affiliate marketing metrics on their organic traffic.

Table 5.

Impact of cryptocurrency wallets’ affiliate marketing metrics on their websites’ pages per visit.

Furthermore, the authors proceeded to test the impact of cryptocurrency wallet applications’ affiliate marketing metrics on supply chain firms’ website traffic variables. In Table 6, we can see the linear regression of supply chain firms’ branded traffic with cryptocurrency wallet applications’ affiliate marketing metrics. This regression was overall verified with a p-value = 0.021 < a = 0.05 level of significance and R2 = 1.00. From the independent variables, the significant ones are the backlinks and the external and internal links with p-values < a = 0.05. Every 1% variation in backlinks, external and internal links and supply chain firms’ branded traffic varied up to 68%, −209.7%, and 189%, accordingly. The paper’s third research hypothesis was verified, which means that the number of supply chain firms’ brand-engaged website visitors is related to the applied affiliate marketing metrics of cryptocurrency wallet applications.

Table 6.

Impact of cryptocurrency wallets’ affiliate marketing metrics on supply chain firms’ branded traffic.

Moving to Table 7, the linear regression of supply chain firms’ referral traffic was verified overall, with a p-value = 0.000 < a = 0.01 and R2 = 1.00. All of the cryptocurrency wallet applications’ affiliate marketing metrics were significant with p-values below the significance level of a = 0.01. When referring domains, backlinks, referral traffic, external links, and internal links rise by 1%, supply chain firms’ referral traffic variates up to −13.1%, −44.9%, −29.4%, 124.9%, and −167.9%, respectively. Hence, the fourth research hypothesis was verified, and the number of visitors from referral sources that land on supply chain firms’ websites is connected with cryptocurrency wallet applications’ affiliate marketing metrics.

Table 7.

Impact of cryptocurrency wallets’ affiliate marketing metrics on supply chain firms’ referral traffic.

Finally, in Table 8, the linear regression of supply chain firms’ social traffic was also verified overall with a p-value = 0.000 < a = 0.01 level of significance and R2 = 1.00. Again, the total of the independent variables was significant with p-values = 0.000, below the a = 0.01 level of significance. The variation of 1% in referring domains, backlinks, referral traffic, external links, and internal links, causes the supply chain firms’ social traffic to variate by 64.1%, 142.6%, −2.7%, −200.1%, and 217% accordingly. Thus, the research paper’s fifth and final hypothesis was verified, meaning that there is a positive relationship between cryptocurrency wallet applications’ affiliate marketing metrics and supply chain firms’ traffic generated from social sources.

Table 8.

Impact of cryptocurrency wallets’ affiliate marketing metrics on supply chain firms’ social traffic.

3.1. Exploratory Process

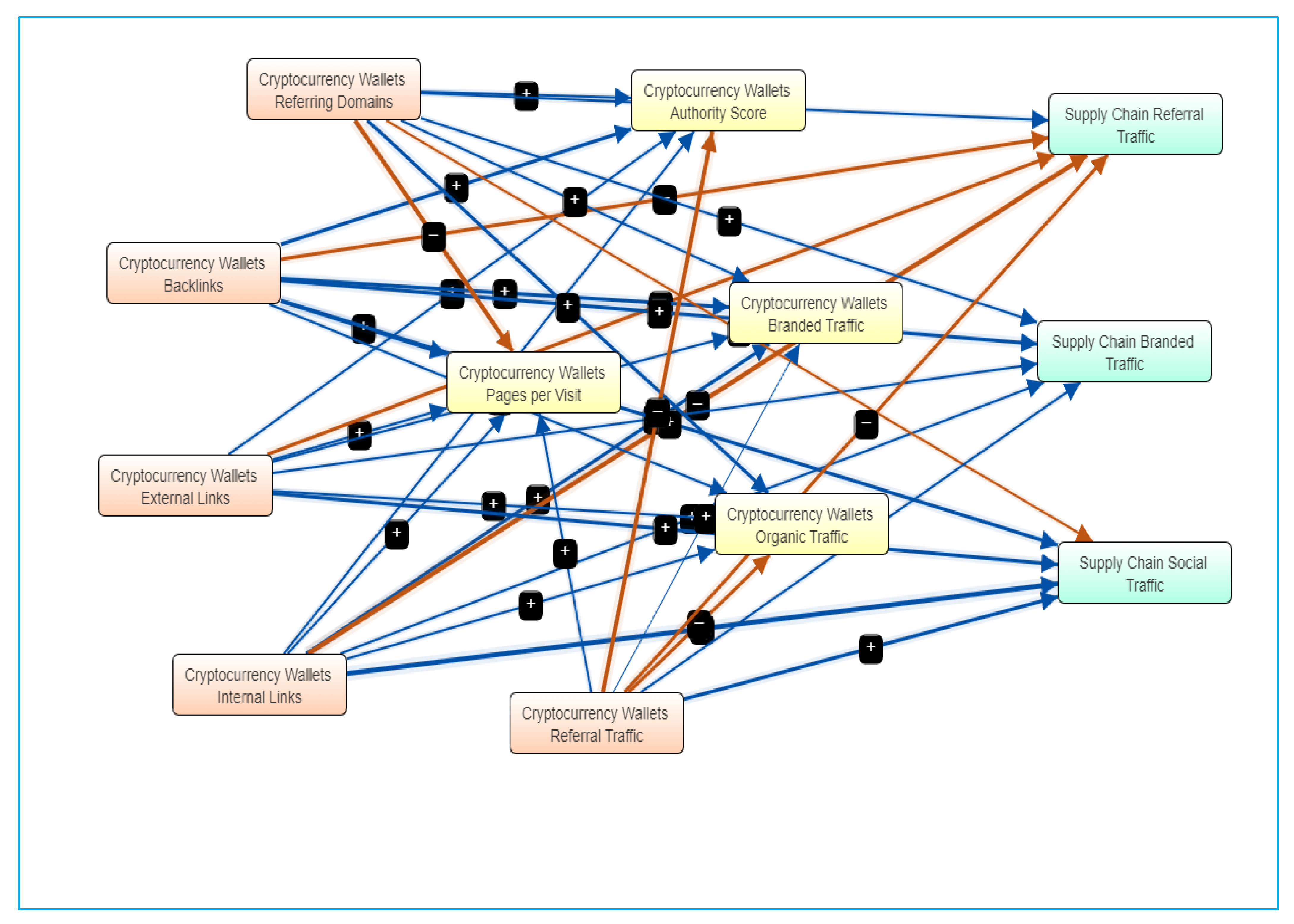

Through the next section of the research, the authors created an exploratory model to depict the context of the study’s selected variables’ relationships. Such a model deployment offers a macro-scale perspective over a selected environment and the intercorrelations of its units that arise from it [32]. The normality and linearity of the input data were assured to enhance the model’s credibility, already from the results section. Therefore, the input data of the model are the correlations of the data that were developed, as well as the coefficients of the performed linear regressions. The authors depicted the macro-scale framework of cryptocurrency wallet applications’ affiliate marketing and digital marketing performance metrics with the selected variables of supply chain firms’ website traffic.

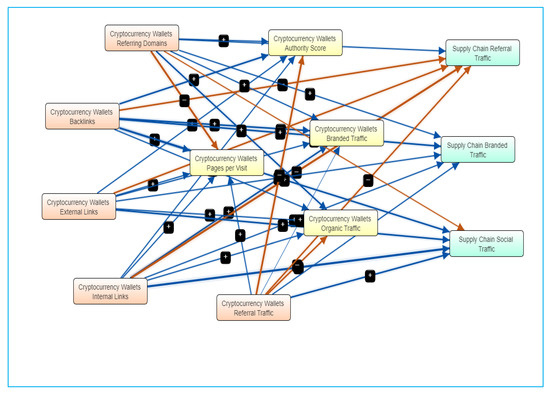

The performed Fuzzy Cognitive model is able to illustrate the total units of a chosen environment and their unrolled cause-and-effect relationships. The authors selected the deployment of Fuzzy Cognitive Mapping models, via the exploitation of the website platform MentalModeler [56]. Through this platform, the created model (shown in Figure 1) presents the stationary effect of the variables’ interaction [57,58]. Blue and red arrows can be seen that show the positive and negative correlations of the variables, where their thickness responds to their correlation strength.

Figure 1.

Fuzzy Cognitive Mapping process.

FCM modeling offers a chance for depicting the most important variables’ relationships, which presents a model’s macro-environment. Their intercorrelations are discerned through quantitative weights and arrows, that depending on their strength, have increased width. Hence, marketers are capable of presenting the perspective of their firm’s macro-environment and designing their digital marketing strategy based on the relationships that are deployed among the factors.

3.2. Simulation Process

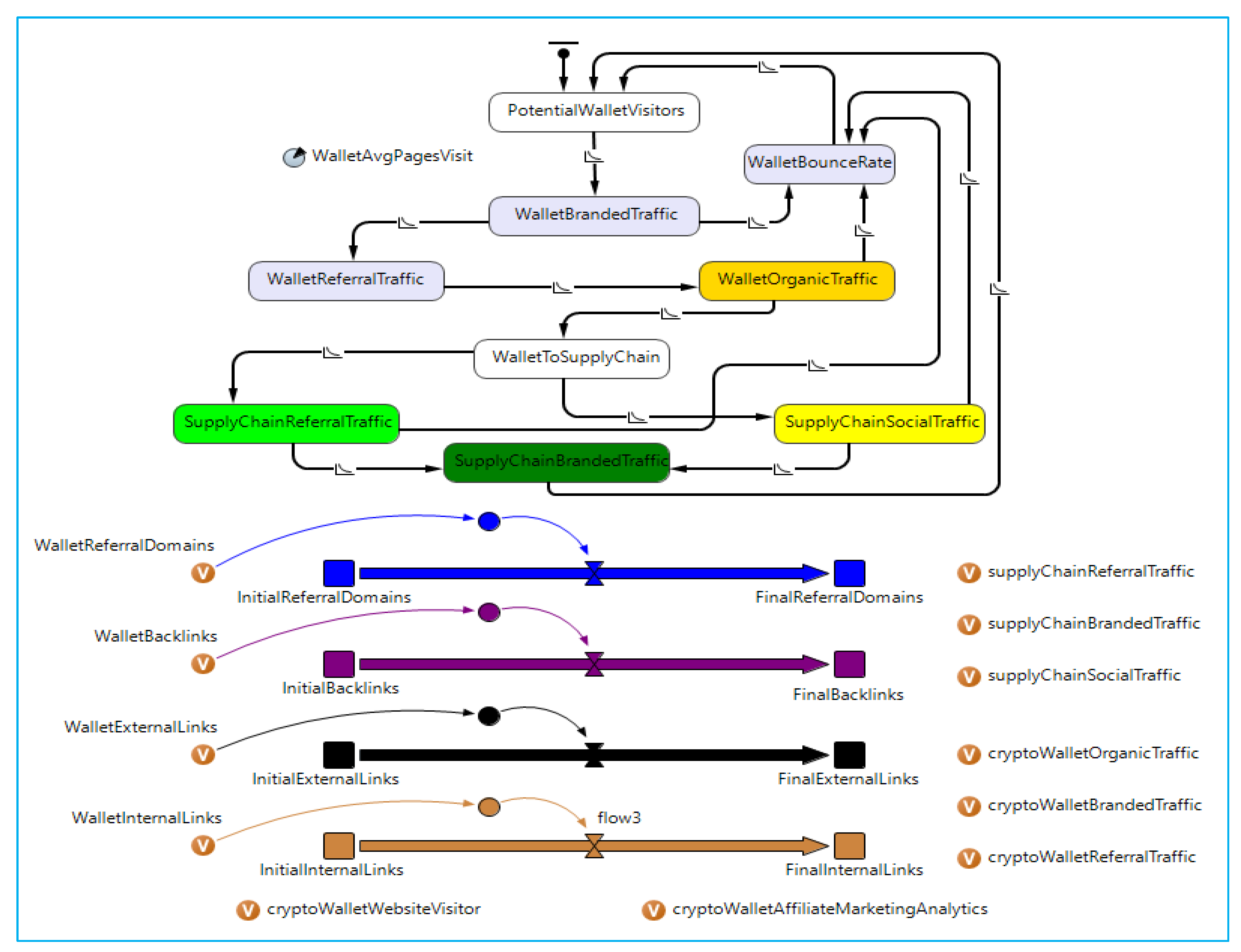

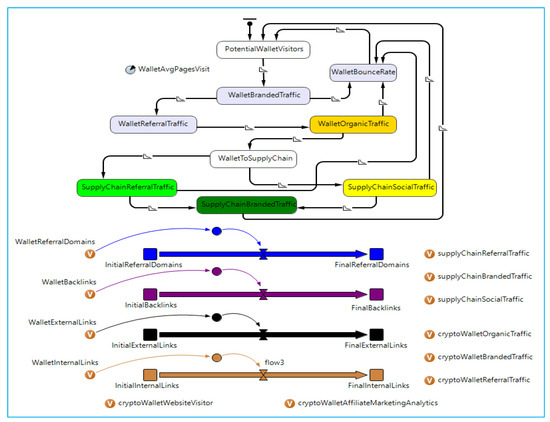

By reaching the section of the simulation analysis, the authors opted to utilize the Hybrid Model (HM) deployment, which includes both Agent-Based Modeling (ABM) and Dynamic Modeling (DM). To develop a consistent and representative deployment, of the examined simulation model, the authors supplied the model with the selected variables’ correlations and regression coefficients [59]. The hybrid model seeks to simulate the variation of supply chain firms’ website traffic metrics (branded, referral, and social traffic) and cryptocurrency wallet applications’ digital marketing performance metrics (organic traffic, pages per visitor) that originate from cryptocurrency wallet applications affiliate marketing variables (backlinks, referral domains, referral traffic, internal, and external links).

Through the Hybrid Modeling process, the outcomes of this study will focus on the simulation of 10,000 agents that move based on basic commands (or, if, and, etc.), through the model’s statecharts. Cryptocurrency applications and supply chain firms’ website visitors are aligned with the model’s agents, while the dynamic variables are depicted by the model’s flows. The simulation process is set to 180 days, through a one-time snapshot image, and was performed by utilizing the Anylogic software [60].

Type of Data: To perform the HM simulation, quantitative data originated from linear regression, and correlation coefficients were inserted into the model. Such data refer to numbers that indicate the relationship status among the analysis variables.

Repetition of Data measurement: A one-time snapshot procedure for the dataset was utilized for the illustration of the simulation, so as to gather date–range specific data. In this way, the Hybrid Model is granted real-time data that refer to the analytical metrics, enabling the development of an efficient affiliate marketing strategy.

Therefore, in Figure 2, the Hybrid Model’s process begins at the statechart of cryptocurrency wallets’ potential visitors. From there the agents move to the branded traffic statechart, based on their connection to the crypto-wallets brand, and proceed to the referral traffic statechart or leave the wallet application following its abandoning rate. At this point, the agents are summed to the next statechart to calculate the variation of cryptocurrency wallets’ organic traffic. In order to assess the impact caused to supply chain firms’ referral, social, as well as branded, traffic, the agents from the cryptocurrency wallet applications move to supply chain firms’ websites from referral or social sources (referral and social traffic statechart), based on their bounce rate and the connection between crypto-wallets organic traffic and supply chain websites’ referral/social traffic. Then, the social and referral traffic’s relationship with supply chain firms’ branded traffic will determine the brand-engaged agents (branded traffic statechart). Through cryptocurrency wallets’ referral traffic statechart, the dynamic variables of cryptocurrency wallet applications’ affiliate marketing variables interact and impact their organic traffic, as well as supply chain firms’ social, referral, and branded traffic, by following the normal distribution. The Java routine deployed for the model is presented in Table S1 in the Supplementary Materials.

Figure 2.

Hybrid simulation model process.

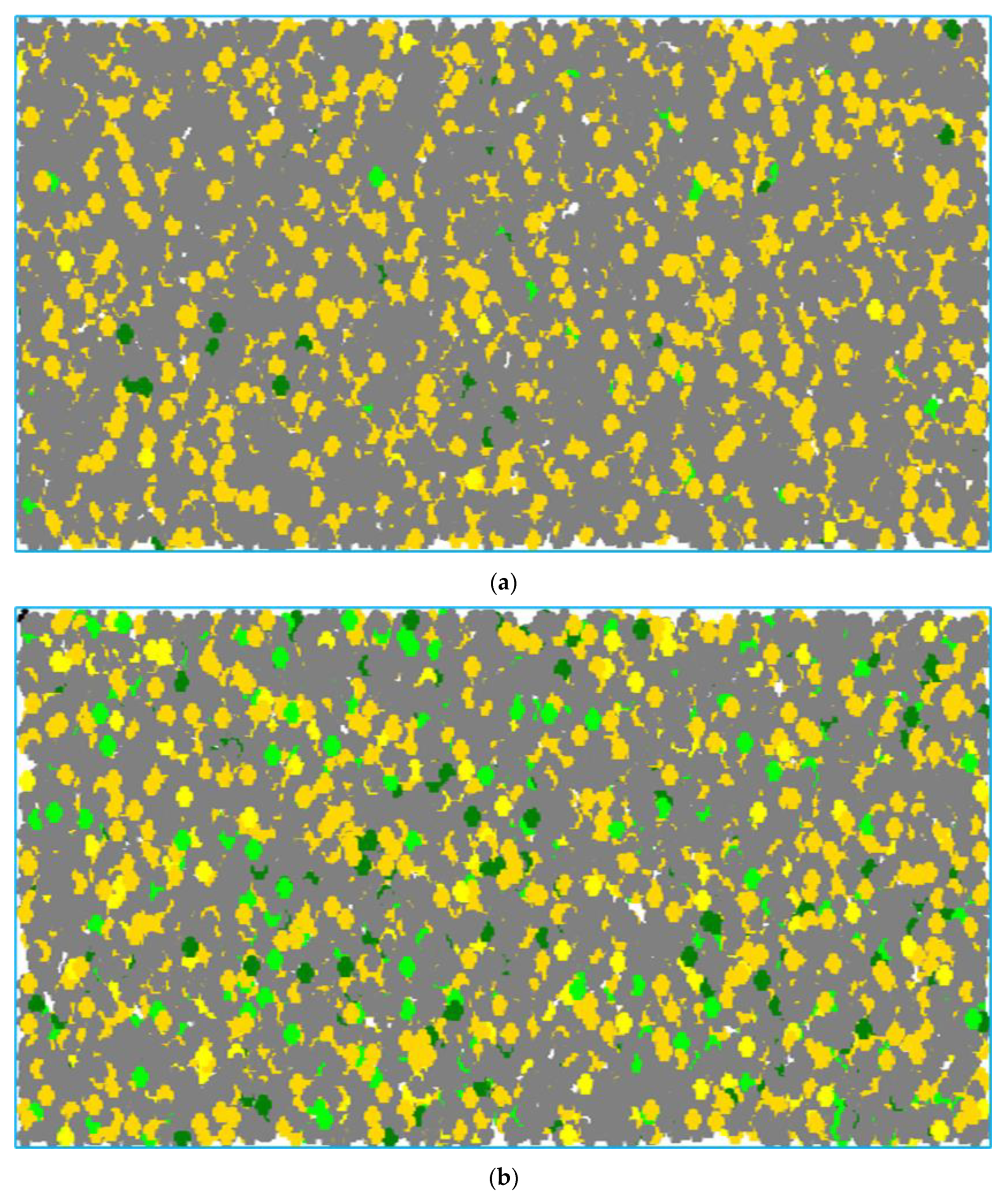

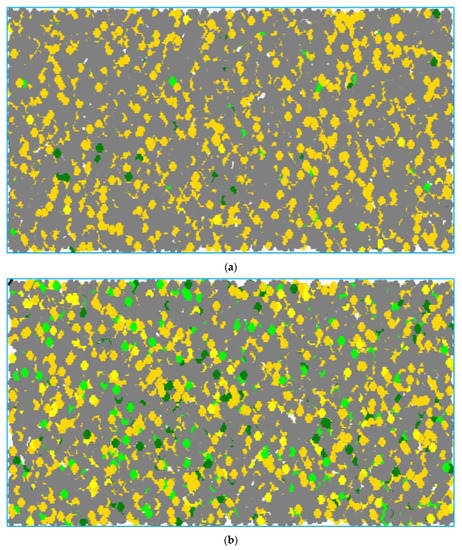

In Figure 3a,b, the allocation of 10,000 agents is depicted, based on the application of affiliate marketing programs in cryptocurrency wallet apps. Based on Niemann et al.’s [61] findings, the usage of more than 1000 agents highly promotes the validity of ABM’s outcomes. Following these findings, the authors opted to use 10,000 agents to strengthen the ABM results’ validity. The gray color presents agents that do not interact with any statechart or abandon the website/application. The orange color shows the number of agents that affect the organic traffic of cryptocurrency wallet applications, while the yellow, lime, and green color show the number of agents that supply chain firms’ social, referral, and branded traffic comprise. Branded traffic is the ultimate target to increase, so both social and referral agents are included in its sum. In Figure 3a, the allocation of the agents prior to the application of affiliate marketing techniques is presented, while in Figure 3b, the same allocation of agents after the affiliate marketing techniques’ implementation can be seen. It is obvious that the implementation of affiliate marketing techniques of cryptocurrency wallet apps has increased the amount of branded, social, and referral traffic that lands to supply chain firms’ websites, without negatively affecting crypto-wallet apps’ organic traffic.

Figure 3.

Population allocation for 10,000 agents, (a) with low usage of cryptocurrency wallets’ affiliate marketing analytics and (b) with increased usage of cryptocurrency wallets’ affiliate marketing analytics.

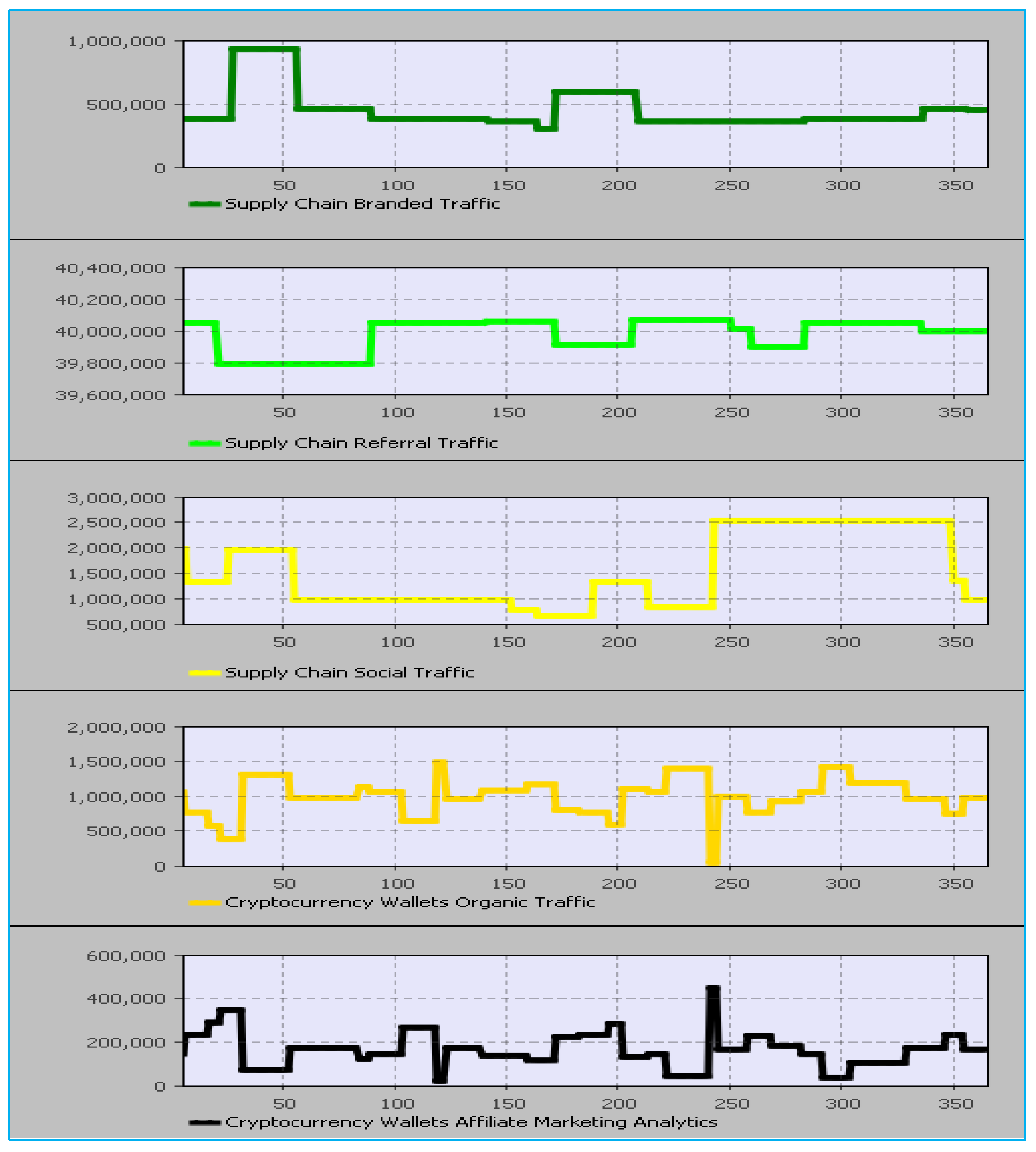

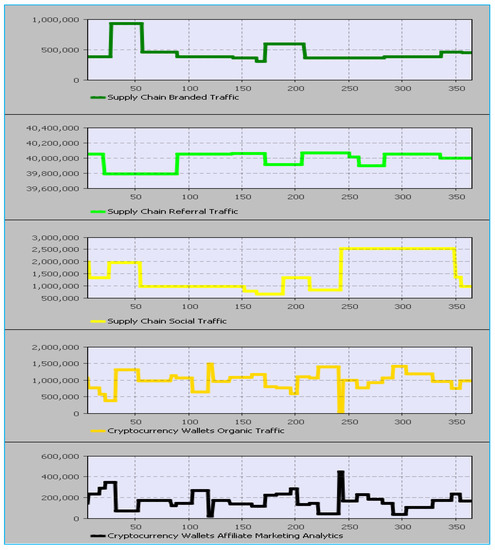

Furthermore, in Figure 4, the outcomes of the 360-day simulation of cryptocurrency wallet application affiliate marketing and supply chain firms’ website visibility metrics are discerned. It is noted that the referred affiliate marketing metrics (referral traffic, backlinks, referral domains, external, and internal links) tend to covariate with cryptocurrency wallet applications’ organic traffic and supply chain firms’ referral, social, and branded traffic. More specifically, in the 360 days of simulation, cryptocurrency wallet apps’ organic traffic is seen to decrease with the rise of the total of their affiliate marketing metrics, while supply chain firms’ branded traffic increases. Meanwhile, supply chain firms’ social and referral traffic decreases slightly, highlighting the fact that their marketers could harvest each metric individually to increase specific digital marketing performance indicators (e.g., branded traffic, etc.).

Figure 4.

Illustration of cryptocurrency wallet affiliate marketing metrics’ 360 day-simulation.

4. Discussion

This part of the study aims to gather the main results of the research and provide accurate insights in terms of its scope. The authors aimed to analyze the effect of cryptocurrency applications’ affiliate marketing metrics on supply chain firms’ website visibility. To do so, web analytic metrics, such as the number of backlinks, referral domains, organic, branded, referral, and social traffic, etc., were harvested. From the collected data, linear regression models were produced, and exploratory (FCM) and simulation (HM) models were deployed to provide further insights for the paper’s research.

As affiliate marketing variables, the web analytic metrics of backlinks, referral domains, referral traffic, and external and internal links were used, and for the websites’ visibility metrics, those of referral, social, and branded traffic metrics were utilized. These metrics have been found to be closely related to organizations’ sustainability metrics [23,24,25]. The impact of cryptocurrency wallet applications’ affiliate marketing strategies is being assessed based on their digital marketing performance (expressed from the organic traffic metric and pages per visit), as well as on supply chain firms’ website visibility (expressed from the referral, social, and branded traffic metric).

From the regression models that were produced, almost all of them were verified overall. More specifically, cryptocurrency wallet applications’ organic traffic was not impacted significantly by affiliate marketing metrics, while the average pages per visit was affected significantly. Supply chain firms’ referral, social, and branded traffic regressions were all verified, with significant variations caused by cryptocurrency wallet apps’ affiliate marketing strategies.

Regarding the rejection of the paper’s first research hypothesis (H1), a few comments should be made. The hypothesis tests the effect of cryptocurrency wallet applications’ affiliate marketing metrics on the number of visitors that enter their websites through search engines. Such a hypothesis rejection indicates that by applying more affiliate marketing metrics, cryptocurrency wallet organizations cannot enhance their organic traffic metric. In their quest for increased visitors from search engines, cryptocurrency wallet organizations should not focus on their affiliate marketing strategy because it seems to be irrelevant to their aim to increase the application’s visibility through organic traffic. Nevertheless, only one metric of their affiliate marketing factors seems capable of affecting their organic traffic variable. This concerns the number of backlinks the application has deployed to other websites. It has been observed that, by building more backlinks with other domains, cryptocurrency wallet organizations tend to reduce their organic traffic metric, which is ultimately not a favorable decision.

Furthermore, cryptocurrency wallet applications’ organic traffic is decreased with the rise of their backlink number, while their pages per visit metric is decreased by the total of the affiliate marketing metrics. Considering supply chain firms’ branded traffic and social traffic, their values increase as cryptocurrency wallet applications’ affiliate marketing metrics increase, while at the same time, their referral traffic decreases. More precise predictions of cryptocurrency wallet applications and supply chain firms’ sustainability process metrics could be performed by individually examining each of the affiliate marketing metrics’ impact.

The deployed Hybrid Modeling process resulted in outcomes similar to the linear regressions. Cryptocurrency wallet applications’ organic traffic seems to get decreased values when their affiliate marketing analytics increase in numbers. From the increase in cryptocurrency wallet applications’ affiliate marketing analytics, supply chain firms branded and social traffic are increased, with their referral traffic being decreased. These metrics give a good picture of supply chain firms’ website visibility results. Thus, the fact that cryptocurrency wallet applications’ affiliate marketing analytics affect supply chain firms’ website visibility, supply chain firms’ marketers should take advantage of it and deploy suitable strategies.

Although present studies conducted on cryptocurrencies focus on their characteristics and implications in digital technologies, based on their connection with tax and accounting treatment, other researchers highlight the need for improved cryptocurrency monitoring and evaluations in an accounting context [62]. Our research did not stand on the potential risks that are connected with cryptocurrency usage, but instead, emphasized the benefits of air forwarding firms’ website visibility, through the deployment of affiliate marketing campaigns with cryptocurrency wallet organizations. Furthermore, following Pejić Bach et al.’s [63] study, for supply chain firms to achieve higher levels of organizational performance and adapt to customers’ changing demands, their agility and innovativeness should be improved. To this point, our research shows an innovative way to enhance supply chain firms’ performance, by deploying affiliate marketing campaigns with cryptocurrency wallet organizations, so as to improve the efficacy of the firms with respect to changing consumer needs.

5. Conclusions

5.1. Theoretical and Practical Implications

Coming from the Discussion section, the authors aimed to clarify that the theoretical implications of the study indicate a connection between cryptocurrency applications’ affiliate marketing metrics and their digital marketing performance, as well as supply chain firms’ website visibility enhancement. Regarding cryptocurrency wallet affiliate marketing metrics, increased organic traffic occurs when the total of affiliate marketing metrics decreases. Moreover, supply chain firms’ website visibility increases with the decrease in cryptocurrency wallet applications’ affiliate marketing analytics, positively affecting their website visibility outcomes. These findings highlight the importance of cryptocurrency wallet applications as potential places for air forwarding firms to advertise their services. To extract such results, the authors used a total of 10,000 agents in the simulation process to estimate the overall website visibility of supply chain firms in the air forwarding sector, combined with dynamic systems to represent the variation in affiliate marketing and website performance KPIs. Thus, from the deployed affiliate marketing bonds with these organizations, air forwarders could see an increase in the visibility of their website, based on the solid scientifical foundations provided by ABM [Liang et al. [35] and SDM [36].

The present study’s outcomes, which assess the impact of cryptocurrency applications’ affiliate marketing processes, provide further insights into the existing literature. More specifically, the study’s results are aligned with the study of Raman et al. [26], where big data innovations, in conjunction with supply chain management, supplier evaluation, analytics, data storage, IoT, and information technology, are a critical component in improving website efficiency and offering financial benefits, visitors’ gratification, and genuine visibility [26]. The basis of this investigation lies in the observation that the primary search engine has begun to assess various informative websites quite strictly [64]. Supply chain firms should utilize costless affiliate marketing initiatives of blockchain applications, such as cryptocurrency wallets, in their aim to enhance their sustainability processes and results and effectiveness. Gao et al. [65] highlight that information originating from websites and applications could be used in favor of supply chain firms to boost their organizational results. For increased operational and digital marketing performance, supply chain firms could improve information exchange and collaboration processes, such as blockchain applications, between other organizations [66].

Affiliate marketing provides several firms with a reasonably priced option for internet marketing strategies. Via membership and affiliate programs, the company may reach out to visitors and potential customers that would otherwise be impossible to reach using standard marketing tactics or would require a substantial investment [67]. Patrick & Hee [68] discerned a gap in the assessment of affiliate marketing programs and focused on the context of SMEs, offering an evaluation of innovative affiliate marketing technological models. On the same track, Tumwesigye & Nkansah-Asamoah [69] suggested the need for firms to cooperate with specific key partners to promote their services through affiliate marketing initiatives and the usage of modem technologies, as well as to improve their website visibility results.

The practical implications that arose from the present study’s results indicate that the role of supply chain firms’ marketers and marketing strategists is highly important. Our research proposes a novel methodology to indicate potential organizations for deploying affiliate marketing programs, through collaboration, which is based on blockchain technology, in order to improve the website visibility of supply chain firms. On the same page, Ahmed et al. [70] addressed the benefits and challenges connected with innovative technologies’ adoption (IoT) for supply chain firms, while Iftikhar et al. [71] highlighted the fruitful paths for practical advantages for supply chain firms through the adoption of big data analytics. Moreover, our results state that multiple benefits for customer satisfaction, organizational flexibility, and sustainability could emerge for supply chain firms from the utilization of website analytical data, such as affiliate marketing and generally digital marketing metrics, and their evaluation of strategies [72]. At the same time, improved customer satisfaction, flexibility, and sustainability of supply chain firms, through the capitalization of big data analytics, enhances levels of organizational performance [73] and supply chain operations’ efficacy [74].

Overall, our research highlights the fact that supply chain firms’ marketers should collaborate with emerging cryptocurrency applications to promote their own products and services. The proposed methodological context could boost the entrepreneurship of supply chain firms. This could be achieved by analyzing what specific cryptocurrency applications ‘affiliate marketing analytics affect their website metrics, and to what extent, so as to draw up a more precise strategy. Such a strategy, for example, could be based on increased supply chain website’s referral domain and backlink deployment over cryptocurrency wallet applications. This would lead to improved supply chain firms’ branded and social traffic results. Supply chain firms’ efficiency and digital marketing efficiency would then be enhanced through the improved website visibility results. Cryptocurrency wallet applications’ pages per visit would then be decreased, meaning that their marketers should focus on placing ads and product/service promotions on the main pages of their website/app.

5.2. Limitations

It is worth mentioning the limitations that are connected with the execution of the paper’s research. These are mainly concentrated on the data range and firms’ selection of the sample and KPIs. The authors evaluated the impact of five affiliate marketing campaign variables, based on improving air forwarders’ website visibility. Although these variables of affiliate marketing campaigns appear to be very effective in enhancing website visibility and digital marketing efficacy [75], the effect of other affiliate marketing metrics could also be assessed (e.g., conversion rates, type of active affiliates, etc.). The capitalization of such metrics could widen the context of cryptocurrency wallet organizations’ affiliate marketing metrics and provide supply chain firms, in the air forwarding sector, with more insights for settling the correct KPIs for observation of their website visibility performance.

To this point, the authors would like to point out the fact that although there is a strong relationship observed between users of cryptocurrency wallet applications and the services of air forwarding firms, no far-reaching generalizations can be made. This is due to the limited knowledge of the permanent nature of those relationships. The referred findings were based on a specific time period (from 1 October 2021 to 1 May 2022), and therefore, for the extraction of a generalized pattern, further research should be performed.

5.3. Future Work

The results that originated from analyzing cryptocurrency applications’ affiliate marketing processes indicate the need for increased application of digital marketing techniques to decentralized (DeFi) and centralized finance (CeFi). A more concise overall marketing strategy for the firms’ promotion and sustainability could arise. Thus, the tools of affiliate marketing could be more efficient and provide further intel regarding the factors that affect supply chain firms, as well as cryptocurrency applications’ digital marketing performance and sustainability.

More precisely, future research from the authors could be focused on the capitalization of other digital marketing tools, such as video marketing strategies, etc., for supply chain firms in various sectors. Due to the fact that the present paper analyzed only a specific application of the cryptocurrency context, the wallet apps, a broader assessment of the plethora of cryptocurrency applications could provide more insights. The referred applications, such cryptocurrency cards, exchange platforms, etc., could be assessed towards their effect on the digital marketing performance of supply chain firms, in various sectors. Despite this being a study that solely focused on specific cryptocurrency applications (wallets) and supply chain firms (air forwarders), the examination of the selected affiliate marketing KPIs could be expanded to the evaluation of other organizations for potential collaborations for supply chain firms.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/su15097326/s1, Table S1. Java coding route of supply chain and cryptocurrency wallet applications’ simulation.

Author Contributions

Conceptualization, D.P.S.; methodology, D.P.S., N.T.G. and D.K.N.; software, N.T.G. and D.K.N.; validation, D.P.S., N.K. and G.T.T.; formal analysis, N.T.G. and D.K.N.; investigation, N.T.G.; resources, N.T.G.; data curation, N.T.G., G.T.T. and N.K.; writing—original draft preparation, N.T.G.; writing—review and editing, N.T.G.; visualization, D.P.S., D.K.N. and N.T.G.; supervision, D.P.S. and D.K.N.; project administration, D.P.S. and N.K.; funding acquisition, D.P.S., N.T.G., D.K.N., G.T.T. and N.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors acknowledge the support of this work by the project “Smart Agriculture and Circular Bio-Economy—SmartBIC.” (MIS MIS5047106), which was implemented under the Action “Reinforcement of the Research and Innovation Infrastructure”, funded by the Operational Programme “Competitiveness, Entrepreneurship and Innovation” (NSRF 2014–2020) co-financed by Greece and the European Union (European Regional Development Fund).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Huang, Y.; Han, W.; Macbeth, D.K. The complexity of collaboration in supply chain networks. Supply Chain Manag. 2020, 25, 393–410. [Google Scholar] [CrossRef]

- Lee, V.H.; Ooi, K.B.; Chong, A.Y.L.; Sohal, A. The effects of supply chain management on technological innovation: The mediating role of guanxi. Int. J. Prod. Econ. 2018, 205, 15–29. [Google Scholar] [CrossRef]

- Chen, I.S.; Fung, P.K.; Yuen, S.S. Dynamic capabilities of logistics service providers: Antecedents and performance implications. Asia Pac. J. Mark. Logist. 2019, 31, 1058–1075. [Google Scholar] [CrossRef]

- McDougall, N.; Wagner, B.; MacBryde, J. Leveraging competitiveness from sustainable operations: Frameworks to understand the dynamic capabilities needed to realise NRBV supply chain strategies. Supply Chain Manag. 2021, 27, 12–29. [Google Scholar] [CrossRef]

- Formentini, M.; Taticchi, P. Corporate sustainability approaches and governance mechanisms in sustainable supply chain management. J. Clean. Prod. 2016, 12, 1920–1933. [Google Scholar] [CrossRef]

- Marshal, D.; McCarthy, L.; Heavey, C.; McGrath, P. Environmental and social supply chain management sustainability practices: Construct development and measurement. Prod. Plan. Control 2015, 26, 673–690. [Google Scholar] [CrossRef]

- Closs, D.J.; Speier, C.; Meacham, N. Sustainability to support end-to-end value chains: The role of supply chain management. J. Acad. Mark. Sci. 2011, 39, 101–116. [Google Scholar] [CrossRef]

- Stank, T.; Autry, C.; Bell, J.; Gilgor, D.; Petersen, K.; Dittmann, P.; Moon, M.; Tate, W.; Bradley, R. Game Changing Trends in Supply Chains; Technical Report; University of Tennessee: Knoxville, TN, USA, 2013; Available online: https://supplychainmanagement.utk.edu/research/white-papers/2013-04-game-changing-trends-in-supply-chain/ (accessed on 12 January 2023).

- Hummels, D.; Schaur, G. Time as a Trade Barrier; Working Paper 17758; National Bureau of Economic Research: Cambridge, MA, USA, 2012. [Google Scholar] [CrossRef]

- Brusset, X. Does supply chain visibility enhance agility? Int. J. Prod. Econ. 2016, 171, 46–59. [Google Scholar] [CrossRef]

- Mileva, G. Top Affiliate Marketing Statistics for 2022; Influencer Marketing Hub: Copenhagen, Denmark, 2022; Available online: https://influencermarketinghub.com/affiliate-marketing-stats/ (accessed on 12 January 2023).

- Rastas, J. Affiliate Commission: Best Affiliate Marketing Compensation Models; Supermetrics: Helsinki, Finland, 2022; Available online: https://supermetrics.com/blog/affiliate-commission (accessed on 12 January 2023).

- Edelman, B. The design of online advertising markets. In The Handbook of Market Design; Vulkan, N., Roth, A., Neeman, Z., Eds.; Oxford University Press: Oxford, UK, 2013. [Google Scholar]

- Zhu, T.; Wilbur, K. Hybrid advertising auctions. Mark. Sci. 2011, 30, 249–273. [Google Scholar] [CrossRef]

- Hardik, B.B. Role of Cryptocurrency in Digital Marketing. In Blockhain Technology and Applications for Digital Marketing; IGI Global: Hershey, PA, USA, 2021. [Google Scholar]

- Sakas, D.P.; Giannakopoulos, N.T.; Kanellos, N.; Tryfonopoulos, C. Digital Marketing Enhancement of Cryptocurrency Websites through Customer Innovative Data Process. Processes 2022, 10, 960. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Kanellos, N.; Migkos, S.P. Innovative Cryptocurrency Trade Websites’ Marketing Strategy Refinement, via Digital Behavior. IEEE Access 2022, 10, 63163–63176. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Terzi, M.C.; Kamperos, I.D.G.; Nasiopoulos, D.K.; Reklitis, D.P.; Kanellos, N. Social Media Strategy Processes for Centralized Payment Network Firms after a War Crisis Outset. Processes 2022, 10, 1995. [Google Scholar] [CrossRef]

- Miloslavskaya, N.; Tolstoy, A. Big Data, Fast Data and Data Lake Concepts. Procedia Comput. Sci. 2016, 88, 300–305. [Google Scholar] [CrossRef]

- Yalçin, N.; Köse, U. What is search engine optimization: SEO? Procedia-Soc. Behav. Sci. 2010, 9, 487–493. [Google Scholar] [CrossRef]

- Schoenherr, T.; Speier-Pero, C. Data Science, Predictive Analytics, and Big Data in Supply Chain Management: Current State and Future Potential. J. Bus. Logist. 2015, 36, 120–132. [Google Scholar] [CrossRef]

- Kwon, O.; Lee, N.; Shin, B. Data Quality Management, Data Usage Experience and Acquisition Intention of Big Data Analytics. Int. J. Inf. Manag. 2014, 34, 387–394. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T. Harvesting Crowdsourcing Platforms’ Traffic in Favour of Air Forwarders’ Brand Name and Sustainability. Sustainability 2021, 13, 8222. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T. Big Data Contribution in Desktop and Mobile Devices Comparison, Regarding Airlines’ Digital Brand Name Effect. Big Data Cogn. Comput. 2021, 5, 48. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Reklitis, D.P.; Dasaklis, T.K. The Effects of Cryptocurrency Trading Websites on Airlines’ Advertisement Campaigns. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 3099–3119. [Google Scholar] [CrossRef]

- Raman, S.; Patwa, N.; Niranjan, I.; Ranjan, U.; Moorthy, K.; Mehta, A. Impact of big data on supply chain management. Int. J. Logist. Res. Appl. 2018, 21, 579–596. [Google Scholar] [CrossRef]

- Wang, W.T.; Lin, Y.-L.; Chen, T.J. Exploring the effects of relationship quality and c-commerce behavior on firms’ dynamic capability and c-commerce performance in the supply chain management context. Decis. Support Syst. 2023, 164, 113865. [Google Scholar] [CrossRef]

- Graham, K.; Moore, R. The role of dynamic capabilities in firm-level technology adoption processes: A qualitative investigation. Int. J. Innov. Manag. 2021, 9, 25–50. [Google Scholar] [CrossRef]

- Tiihonen, J. Guide on Affiliate Marketing Management with SaaS Products. Bachelor’s Thesis, Oulu University, Oulu, Finland, 2022. Available online: https://www.theseus.fi/bitstream/handle/10024/781010/Tiihonen_Jarkko.pdf?sequence=2&isAllowed=y (accessed on 12 January 2023).

- Eldeman, B.; Brandi, W. Risk, Information, and Incentives in Online Affiliate Marketing. J. Mark. Res. 2015, 51, 1–12. [Google Scholar] [CrossRef]

- Mpelogianni, V.; Groumpos, P.P. Re-approaching fuzzy cognitive maps to increase the knowledge of a system. AI Soc. 2018, 33, 175–188. [Google Scholar] [CrossRef]

- Case, D.M.; Blackburn, T.; Stylios, C. Modelling Construction Management Problems with Fuzzy Cognitive Maps. In Fuzzy Hybrid Computing in Construction Engineering and Management; Fayek, A.R., Ed.; Emerald Publishing Limited: Bingley, WA, USA, 2018; pp. 413–449. [Google Scholar] [CrossRef]

- Čičak, J.; Vašiček, D. Determining the Level of Accounting Conservatism through the Fuzzy Logic System. Bus. Syst. Res. 2019, 10, 88–101. [Google Scholar] [CrossRef]

- Alaoui, Y.L.; Tkiouat, M. Modeling customer satisfaction in microfinance sector: A fuzzy Bayesian networks approach. Int. J. Eng. Bus. Manag. 2019, 11, 1–13. [Google Scholar] [CrossRef]

- Liang, X.; Luo, L.; Hu, S.; Li, Y. Mapping the knowledge frontiers and evolution of decision making based on agent-based modeling. Knowl. Based Syst. 2022, 250, 108982. [Google Scholar] [CrossRef]

- Ammirato, S.; Linzalone, R.; Felicetti, A.M. The value of system dynamics’ diagrams for business model innovation. Manag. Decis. 2022, 60, 1056–1075. [Google Scholar] [CrossRef]

- Baye, M.R.; Santos, B.D.S.; Wildenbeest, M.R. Search Engine Optimization: What Drives Organic Traffic to Retail Sites? J. Econ. Manag. Strategy 2015, 25, 6–31. [Google Scholar] [CrossRef]

- Saura, J.R.; Palos-Sánchez, P.; Cerdá Suárez, L.M. Understanding the Digital Marketing Environment with KPIs and Web Analytics. Future Internet 2017, 9, 76. [Google Scholar] [CrossRef]

- Brett, D. Top 25 Air Forwarders 2019: DHL Leads the Pack in a Tough Year. 2020. Available online: https://www.aircargonews.net/business/statistics/top-25-air-forwarders-dhl-leads-the-pack-in-a-tough-year/ (accessed on 20 March 2022).

- Conway, L. The Best Bitcoin Wallets. 2022. Available online: https://www.investopedia.com/best-bitcoin-wallets-5070283 (accessed on 15 March 2022).

- DHL. 2022. Available online: https://www.dhl.com/ (accessed on 20 March 2022).

- Kuehne-Nagel. 2022. Available online: https://kuehne-nagel.com/ (accessed on 20 March 2022).

- DB Schenker. 2022. Available online: https://www.dbschenker.com/ (accessed on 20 March 2022).

- DSV. 2022. Available online: https://www.dsv.com/ (accessed on 20 March 2022).

- UPS. 2022. Available online: https://www.ups.com/ (accessed on 20 March 2022).

- Ledger. 2022. Available online: https://www.ledger.com/ (accessed on 15 March 2022).

- Trezor. 2022. Available online: https://trezor.io/ (accessed on 15 March 2022).

- Exodus. 2022. Available online: https://www.exodus.com/ (accessed on 15 March 2022).

- Electrum. 2022. Available online: https://electrum.org/ (accessed on 15 March 2022).

- MyCellium. 2022. Available online: https://wallet.mycelium.com/ (accessed on 15 March 2022).

- Semrush. 2022. Available online: https://www.semrush.com/ (accessed on 30 March 2022).

- WillMarlow. 2022. Available online: https://willmarlow.com/resources-2/digital-marketing-encyclopedia/ (accessed on 20 August 2022).

- Ahrefs. What’s the Difference between Referring Domains and Backlinks? 2022. Available online: https://help.ahrefs.com/en/articles/2791107-what-s-the-difference-between-referring-domains-and-backlinks#:~:text=What%20is%20a%20referring%20domain,it%20has%20two%20referring%20domains (accessed on 20 August 2022).

- Sproutsocial. Referral Traffic. 2023. Available online: https://sproutsocial.com/glossary/referral-traffic/ (accessed on 20 August 2022).

- SeoClarity. Why External and Internal Links Are Important for SEO. 2020. Available online: https://www.seoclarity.net/resources/knowledgebase/why-internal-and-external-links-important-for-seo-16559/ (accessed on 20 August 2022).

- MentalModeler. 2022. Available online: https://dev.mentalmodeler.com/ (accessed on 15 January 2023).

- Bao, Z.; Shang, B. Self-efficacy and continuance intention of Web 2.0 platforms: A meta-analysis. Data Technol. Appl. 2021, 55, 511–526. [Google Scholar] [CrossRef]

- Migkos, S.P.; Sakas, D.P.; Giannakopoulos, N.T.; Konteos, G.; Metsiou, A. Analyzing Greece 2010 Memorandum’s Impact on Macroeconomic and Financial Figures through FCM. Economies 2022, 10, 178. [Google Scholar] [CrossRef]

- Retzlaff, C.O.; Ziefle, M.; Calero-Valdez, A. The history of agent-based modeling in the social sciences. In Digital Human Modeling and Applications in Health, Safety, Ergonomics and Risk Management. Human Body, Motion and Behavior; Duffy, V.G., Ed.; HCII 2021. Lecture Notes in Computer Science; Springer: Cham, Switzerland, 2021; p. 12777. [Google Scholar] [CrossRef]

- Anylogic. 2022. Available online: https://www.anylogic.com/ (accessed on 20 January 2023).

- Niemann, J.H.; Winkelmann, S.; Wolf, S.; Schütte, C. Agent-based modeling: Population limits and large timescales. Chaos 2021, 31, 033140. [Google Scholar] [CrossRef]

- Martinčević, I.; Sesar, V.; Buntak, K. Implications of Accounting and Tax Treatment of Cryptocurrencies. Entren. Enterp. Res. Innov. 2021, 7, 376–388. [Google Scholar] [CrossRef]

- Pejić Bach, M.; Klinčar, A.; Aleksić, A.; Rašić Jelavić, S.; Zeqiri, J. Supply Chain Management Maturity and Business Performance: The Balanced Scorecard Perspective. Appl. Sci. 2023, 13, 2065. [Google Scholar] [CrossRef]

- Strzelecki, A. Google Medical Update: Why Is the Search Engine Decreasing Visibility of Health and Medical Information Websites? Int. J. Environ. Res. Public Health 2020, 17, 1160. [Google Scholar] [CrossRef] [PubMed]

- Gao, S.; Qiao, R.; Lim, M.; Li, C.; Qu, Y.; Xia, L. Integrating corporate website information into qualitative assessment for benchmarking green supply chain management practices for the chemical industry. J. Clean. Prod. 2021, 311, 127590. [Google Scholar] [CrossRef]

- Jabbour, A.B.L.S.; Frascareli, F.C.O.; Jabbour, C.J.C. Green supply chain management and firms’ performance: Understanding potential relationships and the role of green sourcing and some other green practices. Resour. Conserv. Recycl. 2015, 104, 366–374. [Google Scholar] [CrossRef]

- Haikal, E.K.; Freihat, S.M.; Homsi, D.; Joudeh, J.M.M. The Role of Supply Chain Strategy and Affiliate Marketing in Increasing the Demand for Ecommerce—Social Media POV. Int. J. Supply Chain Manag. 2020, 9, 832. [Google Scholar]

- Patrick, Z.; Hee, O.C. Affiliate Marketing in SMEs: The Moderating Effect of Developmental Culture. Pertanika J. Soc. Sci. Hum. 2021, 29, 1249–1271. [Google Scholar] [CrossRef]

- Tumwesigye, G.; Nkansah-Asamoah, C. Affiliate Marketing as a Paradigm of the 21st Century: An Assessment of its Impact in the Developing World. J. Bus. Retail. Manag. Res. 2008, 2, 56–63. [Google Scholar]

- Ahmed, S.; Kalsoom, T.; Ramzan, N.; Pervez, Z.; Azmat, M.; Zeb, B.; Rehman, M.U. Towards Supply Chain Visibility Using Internet of Things: A Dyadic Analysis Review. Sensors 2021, 21, 4158. [Google Scholar] [CrossRef] [PubMed]

- Iftikhar, A.; Ali, I.; Arslan, A.; Tarba, S. Digital Innovation, Data Analytics, and Supply Chain Resiliency: A Bibliometric-based Systematic Literature Review. Ann. Oper. Res. 2022. [Google Scholar] [CrossRef]

- Gopal, P.R.C.; Rana, N.P.; Krishna, T.V.; Ramkumar, M. Impact of big data analytics on supply chain performance: An analysis of influencing factors. Ann. Oper. Res. 2022. [Google Scholar] [CrossRef]

- Bahrami, M.; Shokouhyar, S.; Seifian, A. Big data analytics capability and supply chain performance: The mediating roles of supply chain resilience and innovation. Mod. Supply Chain Res. Appl. 2022, 4, 62–84. [Google Scholar] [CrossRef]

- Hasan, R.; Mustafa Kamal, M.; Daowd, A.; Eldabi, T.; Koliousis, I.; Papadopoulos, T. Critical analysis of the impact of big data analytics on supply chain operations. Prod. Plan. Control. 2020. [Google Scholar] [CrossRef]

- Sakas, D.P.; Giannakopoulos, N.T.; Trivellas, P. Exploring affiliate marketing’s impact on customers’ brand engagement and vulnerability in the online banking service sector. Int. J. Bank Mark. 2023. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).