Understanding the Relationship between Big Data Analytics Capabilities and Sustainable Performance: The Role of Strategic Agility and Firm Creativity

Abstract

1. Introduction

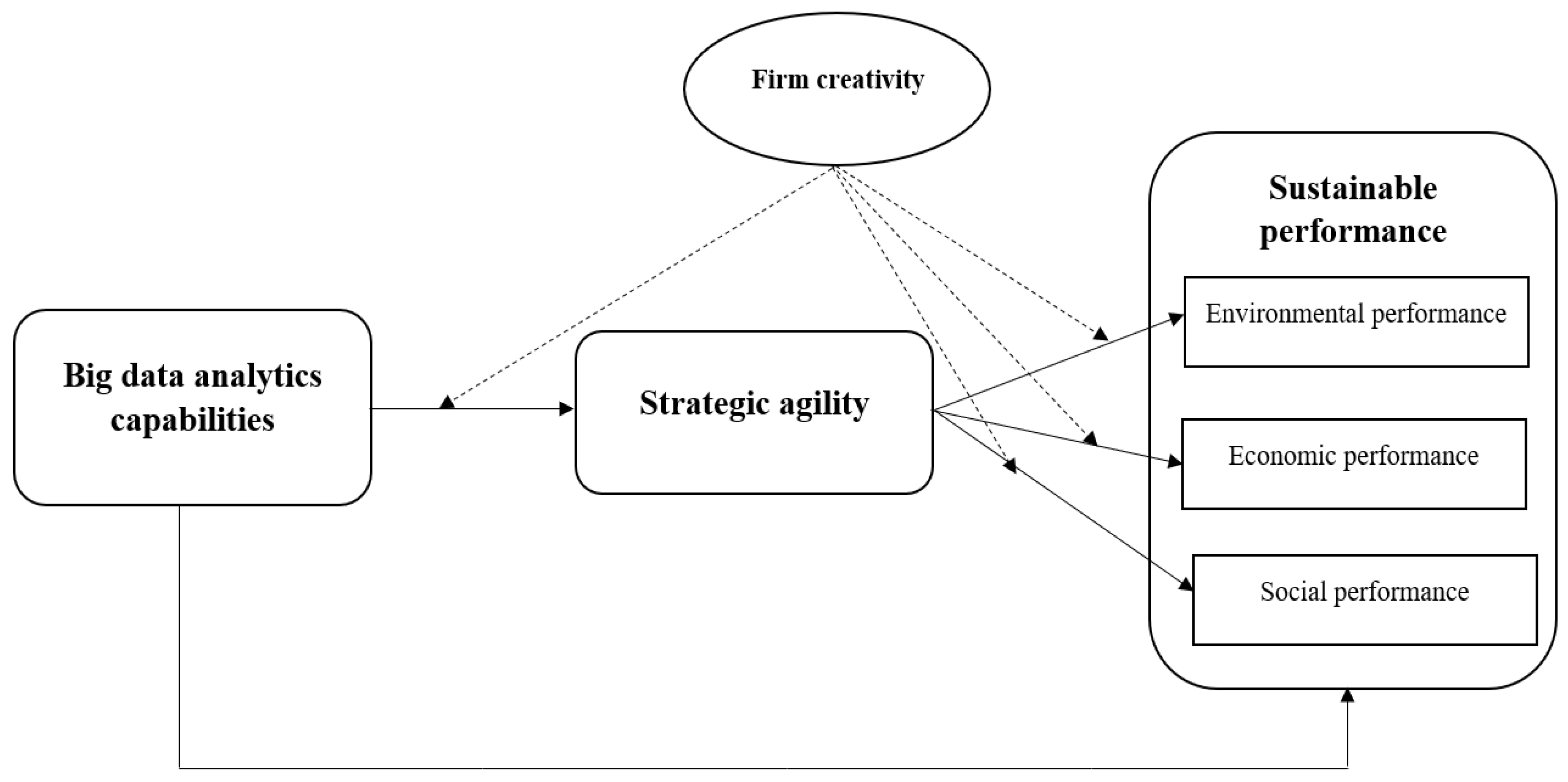

- RQ1: What is the influence of big data analytics capabilities on sustainable performance?

- RQ2: Does strategic agility mediate the link between big data analytics capabilities and sustainable performance?

- RQ3: Does firm creativity moderate the link between big data analytics capabilities, strategic agility, and sustainable performance?

2. Literature Review and Hypotheses Development

2.1. Dynamic Capabilities View

2.2. Big Data Analytics Capabilities

2.3. Big Data Analytics Capabilities and Sustainable Performance

2.4. Big Data Analytics Capabilities and Strategic Agility

2.5. Strategic Agility and Sustainable Performance

2.6. The Moderating Role of Firm Creativity

3. Research Methodology

3.1. Sampling and Data Collection

3.2. Measures

3.3. Common Method Bias Assessment

4. Data Analysis and Results

4.1. Measurement Model

4.2. Structural Model Assessment

5. Discussion and Conclusions

5.1. Key Findings

5.2. Theoretical Implications

5.3. Practical Implications

5.4. Limitations and Suggestions for the Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Akhtar, P.J.G.; Frynas, K.K.; Mellahi, K.; Ullah, S. Big data-savvy teams’ skills, big data-driven actions and business performance. Br. J. Manag. 2019, 30, 252–271. [Google Scholar] [CrossRef]

- Mikalef, P.; Krogstie, J.; Pappas, I.O.; Pavlou, P. Exploring the relationship between big data analytics capability and competitive performance: The mediating roles of dynamic and operational capabilities. Inf. Manag. 2020, 57, 103–169. [Google Scholar] [CrossRef]

- Ferreira, J.; Coelho, A.; Moutinho, L. Dynamic capabilities, creativity and innovation capability and their impact on competitive advantage and firm performance: The moderating role of entrepreneurial orientation. Technovation 2020, 92/93, 102061. [Google Scholar] [CrossRef]

- Rothwell, R. Successful industrial innovation: Critical factors for the 1990s. RD Manag. 1992, 22, 221–240. [Google Scholar] [CrossRef]

- Runyan, R.; Droge, C.; Swinney, J. Entrepreneurial orientation versus small business orientation: What are their relationships to firm performance? J. Small Bus. Manag. 2008, 46, 567–588. [Google Scholar] [CrossRef]

- Melnyk, S.A.; Flynn, B.B.; Awaysheh, A. The Best of Times and the Worst of Times: Empirical Operations and Supply Chain Management Research. Int. J. Prod. Res. 2018, 56, 164–192. [Google Scholar] [CrossRef]

- Merendino, A.; Dibb, S.; Meadows, M.; Quinn, L.; Wilson, D.; Simkin, L.; Canhoto, A. Big Data, Big Decisions: The Impact of Big Data on Board Level Decision-Making. J. Bus. Res. 2018, 93, 67–78. [Google Scholar] [CrossRef]

- Sambamurthy, V.; Bharadwaj, A.; Grover, V. Shaping agility through digital options: Reconceptualizing the role of information technology in contemporary firms. MIS Q. 2003, 27, 237–263. [Google Scholar] [CrossRef]

- Sandberg, B. Creating the market for disruptive innovation: Market proactiveness at the launch stage. J. Target. Meas. Anal. Mark. 2002, 11, 184–196. [Google Scholar] [CrossRef]

- Sandvik, I.L.; Sandvik, K. The impact of market orientation on product innovativeness and business performance. Int. J. Res. Mark. 2003, 20, 355–376. [Google Scholar] [CrossRef]

- Schilke, O. On the contingent value of dynamic capabilities for competitive advantage: The nonlinear moderating effect of environmental dynamism. Strateg. Manag. J. 2014, 35, 179–203. [Google Scholar] [CrossRef]

- Setia, P.; Sambamurthy, V.; Closs, D.J. Realizing business value of agile it applications: Antecedents in the supply chain networks. Inf. Technol. Manag. 2008, 9, 5–19. [Google Scholar] [CrossRef]

- Sharifi, H.; Zhang, Z. A methodology for achieving agility in manufacturing organisations: An introduction. Int. J. Prod. Econ. 1999, 62, 7–22. [Google Scholar] [CrossRef]

- Sherehiy, B.; Karwowski, W.; Layer, J.K. A review of enterprise agility: Concepts, frameworks, and attributes. Int. J. Ind. Ergon. 2007, 37, 445–460. [Google Scholar] [CrossRef]

- Amabile, T.M. Motivating creativity in organizations: On doing what you love and loving what you do. Calif. Manag. Rev. 1997, 1, 39–58. [Google Scholar] [CrossRef]

- Amabile, T.M.; Conti, R.; Coon, H.; Lazenby, J.; Herron, M. Assessing the work environment for creativity. Acad. Manag. J. 1996, 39, 1154–1184. [Google Scholar] [CrossRef]

- Anderson, N.; Potocnik, K.; Zhou, J. Innovation and creativity in organizations: A state-of -the-science review, prospective commentary, and guiding framework. J. Manag. 2014, 40, 1297–1333. [Google Scholar] [CrossRef]

- Anning-Dorson, T. Customer involvement capability and service firm performance: The mediating role of innovation. J. Bus. Res. 2018, 86, 269–280. [Google Scholar] [CrossRef]

- Ashrafi, A.; Ravasan, A.Z.; Trkman, P.; Afshari, S. The role of business analytics capabilities in bolstering firms’ agility and performance. Int. J. Inf. Manag. 2019, 47, 1–15. [Google Scholar] [CrossRef]

- Augier, M.; Teece, D.J. Dynamic capabilities and multinational enterprise: Penrosean insights and omissions. Manag. Int. Rev. 2007, 47, 175–192. [Google Scholar] [CrossRef]

- Awan, U.; Sroufe, R.; Kraslawski, A. Creativity enables sustainable development: Supplier engagement as a boundary condition for the positive effect on green innovation. J. Clean. Prod. 2019, 226, 172–185. [Google Scholar] [CrossRef]

- Chen, Y.S.; Chang, C.H. The determinants of green product development performance: Green dynamic capabilities, green transformational leadership, and green creativity. J. Bus. Ethics 2013, 116, 107–119. [Google Scholar] [CrossRef]

- Côrte-Real, N.; Oliveira, T.; Ruivo, P. Assessing business value of big data analytics in European firms. J. Bus. Res. 2017, 70, 379–390. [Google Scholar] [CrossRef]

- Cua, K.O.; McKone, K.E.; Schroeder, R.G. Relationships between implementation of TQM, JIT, and TPM and manufacturing performance. J. Oper. Manag. 2001, 19, 675–694. [Google Scholar] [CrossRef]

- Cui, A.S.; Wu, F. Utilizing customer knowledge in innovation: Antecedents and impact of customer involvement on new product performance. J. Acad. Mark. Sci. 2016, 44, 516–538. [Google Scholar] [CrossRef]

- Cui, A.S.; Wu, F. The impact of customer involvement on new product development: Contingent and substitutive effects. J. Prod. Innov. Manag. 2017, 34, 60–80. [Google Scholar] [CrossRef]

- Blome, C.; Schoenherr, T.; Rexhausen, D. Antecedents and enablers of supply chain agility and its effect on performance: A dynamic capabilities perspective. Int. J. Prod. Res. 2013, 51, 1295–1318. [Google Scholar] [CrossRef]

- Braunscheidel, M.J.; Suresh, N.C. The organizational antecedents of a firm’s supply chain agility for risk mitigation and response. J. Oper. Manag. 2009, 27, 119–140. [Google Scholar] [CrossRef]

- Camisón, C.; Villar-López, A. Organizational innovation as an enabler of technological innovation capabilities and firm performance. J. Bus. Res. 2014, 67, 2891–2902. [Google Scholar] [CrossRef]

- Chandy, R.K.; Tellis, G.J. The incumbent’s curse? Incumbency, size, and radical product innovation. J. Mark. 2000, 64, 1–17. [Google Scholar] [CrossRef]

- Chang, S.; Gong, Y.; Way, S.A.; Jia, L. Flexibility-oriented hrm systems, absorptive capacity, and market responsiveness and firm innovativeness. J. Manag. 2013, 39, 1924–1951. [Google Scholar] [CrossRef]

- Day, G.S. Closing the marketing capabilities gap. J. Mark. 2011, 75, 183–195. [Google Scholar] [CrossRef]

- Drnevich, P.L.; Kriauciunas, A.P. Clarifying the conditions and limits of the contributions of ordinary and dynamic capabilities to relative firm performance. Strateg. Manag. J. 2011, 32, 254–279. [Google Scholar] [CrossRef]

- Easterby-Smith, M.; Lyles, M.A.; Peteraf, M.A. Dynamic capabilities: Current debates and future directions. Br. J. Manag. 2009, 20, 1–8. [Google Scholar] [CrossRef]

- Eckstein, D.; Goellner, M.; Blome, C.; Henke, M. The performance impact of supply chain agility and supply chain adaptability: The moderating effect of product complexity. Int. J. Prod. Res. 2015, 53, 3028–3046. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Dahlstedt, P. Big data and creativity. Eur. Rev. 2019, 27, 411–439. [Google Scholar] [CrossRef]

- Darvishmotevali, M.; Altinay, L.; Köseoglu, M.A. The link between environmental uncertainty, organizational agility, and organizational creativity in the hotel industry. Int. J. Hosp. Manag. 2020, 87, 102–499. [Google Scholar] [CrossRef]

- de Vasconcellos, S.L.; Garrido, I.L.; Parente, R.C. Organizational creativity as a crucial resource for building international business competence. Int. Bus. Rev. 2019, 28, 438–449. [Google Scholar] [CrossRef]

- Awan, U.; Sroufe, R.; Shahbaz, M. Industry 4.0 and circular economy: A literature review and recommendations for future research. Bus. Strategy Environ. 2021, 30, 2038–2060. [Google Scholar] [CrossRef]

- Pavlou, P.A.; El Sawy, O.A. Understanding the elusive black box of dynamic capabilities. Decis. Sci. 2011, 42, 239–273. [Google Scholar] [CrossRef]

- Poolton, J. Agile marketing for the manufacturing-based same. Mark. Intell. Plan. 2006, 24, 681–693. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Protogerou, A.; Caloghirou, Y.; Lioukas, S. Dynamic capabilities and their indirect impact on firm performance. Ind. Corp. Change 2008, 21, 615–647. [Google Scholar] [CrossRef]

- Reio, T.G. The threat of common method variance bias to theory building. Hum. Resour. Dev. Rev. 2010, 9, 405–411. [Google Scholar] [CrossRef]

- Roberts, N.; Grover, V. Investigating firm’s customer agility and firm performance: The importance of aligning sense and respond capabilities. J. Bus. Res. 2012, 65, 579–585. [Google Scholar] [CrossRef]

- Stadler, C.; Helfat, C.E.; Verona, G. The impact of dynamic capabilities on resource access and development. Organ. Sci. 2013, 24, 1782–1804. [Google Scholar] [CrossRef]

- Queiroz, M.; Tallon, P.P.; Sharma, R.; Coltman, T. The role of IT application orchestration capability in improving agility and performance. J. Strateg. Inf. Syst. 2018, 27, 4–21. [Google Scholar] [CrossRef]

- Akter, S.; Wamba, S.F.; Gunasekaran, A.; Dubey, R.; Childe, S. How to improve firm performance using big data analytics capability and business strategy alignment? Int. J. Prod. Econ. 2019, 182, 113–131. [Google Scholar] [CrossRef]

- Alinezhad, A.; Amini, A.; Alinezhad, A. Sensitivity analysis of simple additive weighting method (SAW): The results of change in the weight of one attribute on the final ranking of alternatives. J. Ind. Eng. 2009, 4, 13–18. [Google Scholar]

- Amankwah-Amoah, J.; Adomako, S. Big data analytics and business failures in data-rich environments: An organizing framework. Comput. Ind. 2019, 105, 204–212. [Google Scholar] [CrossRef]

- Arda, O.A.; Delen, D.; Tatoglu, E.; Zaim, S. An analytic approach to assessing organizational citizenship behavior. Decis. Support Syst. 2017, 103, 9–23. [Google Scholar] [CrossRef]

- Aydiner, A.S.; Tatoglu, E.; Bayraktar, E.; Zaim, S.; Delen, D. Business analytics and firm performance: The mediating role of business process performance. J. Bus. Res. 2019, 96, 228–237. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Barton, D.; Court, D. Making advanced analytics work for you. Harv. Bus. Rev. 2012, 90, 78–83. [Google Scholar] [PubMed]

- Rialti, R.; Zollo, L.; Ferraris, A.; Alon, I. Big data analytics capabilities and performance: Evidence from a moderated multi-mediation model. Technol. Forecast. Soc. Chang. 2019, 149, 119781. [Google Scholar] [CrossRef]

- Saaty, T. Decision making with dependence and feedback: The analytic network process. RWS 1996, 34, 56–69. [Google Scholar]

- Saaty, T.L.; Vargas, L.G. Decision Making with the Analytic Network Process, 2nd ed.; International Series in Operations Research & Management Science; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Lycett, M. Datafication: Making Sense of (Big) Data in a Complex World. Eur. J. Inf. Syst. 2013, 22, 381–386. [Google Scholar] [CrossRef]

- Manovich, L. The Science of Culture? Social Computing, Digital Humanities and Cultural Analytics. In The Datafied Society: Social Research in the Age of Big Data; Schaefer, M.T., Van Es, K., Eds.; Amsterdam University Press: Amsterdam, The Netherlands, 2016; pp. 1–14. [Google Scholar]

- Marshall, A.; Mueck, S.; Shockley, R. How Leading Organizations Use Big Data and Analytics to Innovate. Strategy Leadersh. 2015, 4, 32–39. [Google Scholar] [CrossRef]

- Martel, L.; Loehr, J. Reinventing Your Company for the Networked Era. OD Pract. 2016, 48, 4–11. [Google Scholar]

- Santhanam, R.; Hartono, E. Issues in linking information technology capability to firm performance. MIS Q. 2003, 27, 125–153. [Google Scholar] [CrossRef]

- Sena, V.; Bhaumik, S.; Sengupta, A.; Demirbag, M. Big data and performance: What can management research tell us? Br. J. Manag. 2019, 30, 219–228. [Google Scholar] [CrossRef]

- Singh, S.K.; El-Kassar, A.N. Role of big data analytics in developing sustainable capabilities. J. Clean. Prod. 2019, 213, 1264–1273. [Google Scholar] [CrossRef]

- Teece, D.J. Essays in Technology Management and Policy: Selected Papers of David J. Teece; World Scientific: Singapore, 2003. [Google Scholar]

- Teece, D.J.; Pisano, G. The dynamic capabilities of the firm. Ind. Corp. Chang. 1994, 3, 537–556. [Google Scholar] [CrossRef]

- Tippins, M.J.; Sohi, R.S. IT competency and firm performance: Is organizational learning a missing link? Strateg. Manag. J. 2003, 24, 745–761. [Google Scholar] [CrossRef]

- Varma, K.; Sunil Kumar, K. Criteria analysis aiding portfolio selection using dematel. Procedia Eng. 2012, 38, 3649–3661. [Google Scholar] [CrossRef]

- Vidgen, R.; Shaw, S.; Grant, D.B. Management challenges in creating value from business analytics. Eur. J. Oper. Res. 2017, 12, 626–639. [Google Scholar] [CrossRef]

- Wang, Y.; Kung, L.A.; Byrd, T.A. Big data analytics: Understanding its capabilities and potential benefits for healthcare organizations. Technol. Forecast. Soc. Chang. 2018, 126, 3–13. [Google Scholar] [CrossRef]

- Wang, Y.; Kung, L.; Gupta, S.; Ozdemir, S. Leveraging big data analytics to improve quality of care in healthcare organizations: A configurational perspective. Br. J. Manag. 2019, 30, 362–388. [Google Scholar] [CrossRef]

- Wegener, R.; Sinha, V. The value of big data: How analytics differentiates winners. Bain Brief 2013, 5, 65–69. [Google Scholar]

- Wixom, B.H.; Yen, B.; Relich, M. Maximizing value from business analytics. MIS Q. Exec. 2013, 12, 61–71. [Google Scholar]

- Ketchen, D.J.; Crook, T.R.; Craighead, C.W. From supply chains to supply ecosystems: Implications for strategic sourcing research and practice. J. Bus. Logist. 2014, 35, 165–171. [Google Scholar] [CrossRef]

- Kim, G.; Shin, B.; Kwon, O. Investigating the value of sociomaterialism in conceptualizing IT capability of a firm. J. Manag. Inf. Syst. 2012, 29, 327–362. [Google Scholar] [CrossRef]

- Kim, G.; Shin, B.; Kim, K.K.; Lee, H.G. IT capabilities, process-oriented dynamic capabilities, and firm financial performance. J. Assoc. Inf. Syst. 2011, 12, 487–517. [Google Scholar] [CrossRef]

- Krittika; Vishvakarma, N.K.; Sharma, R.R.K.; Lai, K.K. Linking big data analytics to a few industrial applications: A conceptual review. J. Inf. Optim. Sci. 2017, 38, 803–812. [Google Scholar]

- Liu, H.; Ke, W.; Wei, K.K.; Hua, Z. The impact of IT capabilities on firm performance: The mediating roles of absorptive capacity and supply chain agility. Decis. Support Syst. 2013, 54, 1452–1462. [Google Scholar] [CrossRef]

- Liu, J.; Li, J.; Li, W.; Wu, J. Rethinking big data: A review on the data quality and usage issues. ISPRS J. Photogramm. Remote Sens. 2016, 115, 134–142. [Google Scholar] [CrossRef]

- Liu, Y. Big data and predictive business analytics. J. Bus. Forecast. 2014, 33, 40–42. [Google Scholar]

- Luthra, S.; Govindan, K.; Kannan, D.; Mangla, S.K.; Garg, C.P. An integrated framework for sustainable supplier selection and evaluation in supply chains. J. Clean. Prod. 2017, 140, 1686–1698. [Google Scholar] [CrossRef]

- McAfee, A.; Brynjolfsson, E.; Davenport, T.H.; Patil, D.J.; Barton, D. Big data: The management revolution. Harv. Bus. Rev. 2012, 90, 60–68. [Google Scholar] [PubMed]

- Manogaran, G.; Lopez, D. Health data analytics using scalable logistic regression with stochastic gradient descent. Int. J. Adv. Intell. Paradig. 2018, 10, 118–132. [Google Scholar] [CrossRef]

- Manyika, J.; Chui, M.; Brown, B.; Bughin, J.; Dobbs, R.; Roxburgh, C.; Byers, A.H. Big Data: The Next Frontier for Innovation, Competition and Productivity; McKinsey Global Institute: New York, NY, USA, 2011. [Google Scholar]

- Wu, S.P.; Straub, D.W.; Liang, T.-P. How information technology governance mechanisms and strategic alignment influence organizational performance: Insights from a matched survey of business and IT managers. MIS Q. 2015, 39, 497–518. [Google Scholar] [CrossRef]

- Wu, W.W. Choosing knowledge management strategies by using a combined ANP and DEMATEL approach. Expert Syst. Appl. 2008, 35, 828–835. [Google Scholar] [CrossRef]

- Xie, H.; Duan, W.; Sun, Y.; Du, Y. Dynamic DEMATEL group decision approach based on the intuitionistic fuzzy number. Telkomnika (Telecommun. Comput. Electron. Control) 2014, 12, 1064–1072. [Google Scholar] [CrossRef]

- Xu, Z. Intuitionistic fuzzy aggregation operators. IEEE Trans. Fuzzy Syst. 2007, 15, 1179–1187. [Google Scholar]

- Yoon, K.P.; Hwang, C.L. Multiple Attribute Decision Making: An Introduction; Sage Publications: Thousand Oaks, CA, USA, 1995; p. 104. [Google Scholar]

- Bharadawaj, A. A resource-based perspective on information technology capability and firm performance: An empirical investigation. MIS Q. 2000, 24, 169–196. [Google Scholar] [CrossRef]

- Bhatt, G.D.; Grover, V. Types of information technology capabilities and their role in competitive advantage: An empirical study. J. Manag. Inf. Syst. 2005, 22, 253–277. [Google Scholar] [CrossRef]

- Loss, L.; Crave, S. Agile Business Models: An Approach to Support Collaborative Networks. Prod. Plan. Control 2011, 22, 571–580. [Google Scholar] [CrossRef]

- Lundquist, E. Five Big New Responsibilities for Today’s CIO. eWeek 2013, 27, 23–45. [Google Scholar]

- Matthews, K. 5 Industries Becoming Defined by Big Data and Analytics. Towards Data Science. 2018. Available online: https://towardsdatascience.com/5-industries-becoming-defined-by-big-dataand-analytics-e3e8cc0c0cf (accessed on 22 February 2023).

- Mayor-Schonberger, V.; Cukier, K. Big Data: A Revolution That Will Transform How we Live. Work Think 2014, 34, 34–51. [Google Scholar]

- Mariner, U.K.; Dolan, E.; McKeen, J.D.; Smith, H.A. Strategic Experimentation with IT. Commun. AIS 2007, 19, 132–141. [Google Scholar]

- McQuivey, J. How CIOs Can Be Disruptors and Exploit Digital Economies of Scale. Comput. Wkly. 2013, 34, 17–21. [Google Scholar]

- Ponomarov, S. Antecedents and Consequences of Supply Chain Resilience: A Dynamic Capabilities Perspective. Ph.D. Thesis, University of Tennessee, Knoxville, TE, USA, 2012. [Google Scholar]

- Ponomarov, S.Y.; Holcomb, M.C. Understanding the concept of supply chain resilience. Int. J. Logist. Manag. 2009, 20, 124–143. [Google Scholar] [CrossRef]

- Sankaranarayanan, K.; Castañeda, J.A.; Villa, S. Future research in humanitarian operations: A behavioral operations perspective. In The Palgrave Handbook of Humanitarian Logistics and Supply Chain Management; Palgrave Macmillan: London, UK, 2018; Volume 21, pp. 71–117. [Google Scholar]

- Schoenherr, T.; Speier-Pero, C. Data science, predictive analytics, and big data in supply chain management: Current state and future potential. J. Bus. Logist. 2015, 36, 120–132. [Google Scholar] [CrossRef]

- Srinivasan, M.; Mukherjee, D.; Gaur, A.S. Buyer–supplier partnership quality and supply chain performance: Moderating role of risks, and environmental uncertainty. Eur. Manag. J. 2011, 29, 260–271. [Google Scholar] [CrossRef]

- Swafford, P.M.; Ghosh, S.; Murthy, N. Achieving supply chain agility through IT integration and flexibility. Int. J. Prod. Econ. 2008, 116, 288–297. [Google Scholar] [CrossRef]

- Tatoglu, E.; Bayraktar, E.; Golgeci, I.; Koh, S.L.; Demirbag, M.; Zaim, S. How do supply chain management and information systems practices influence operational performance? Evidence from emerging country SMEs. Int. J. Logist. Res. Appl. 2016, 19, 181–199. [Google Scholar] [CrossRef]

- Teece, D.J. Dynamic capabilities and entrepreneurial management in large organizations: Toward a theory of the (entrepreneurial) firm. Eur. Econ. Rev. 2016, 86, 202–216. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Tenenhaus, M.; Vinzi, V.E.; Chatelin, Y.M.; Lauro, C. PLS path modelling. Comput. Stat. Data Anal. 2005, 48, 159–205. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, F.D. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Todo, Y.; Matous, P.; Inoue, H. The strength of long ties and the weakness of strong ties: Knowledge diffusion through supply chain networks. Res. Policy 2016, 45, 1890–1906. [Google Scholar] [CrossRef]

- Vassakis, K.; Petrakis, E.; Kopanakis, I. Big data analytics: Applications, prospects and challenges. In Mobile Big Data; Springer: Berlin, Germany, 2018; Volume 34, pp. 3–20. [Google Scholar]

- Yang, J. Supply chain agility: Securing performance for Chinese manufacturers. Int. J. Prod. Econ. 2014, 150, 104–113. [Google Scholar] [CrossRef]

- MacKinnon, D.P.; Fairchild, A.J.; Fritz, M.S. Mediation analysis. Annu. Rev. Psychol. 2007, 58, 593–614. [Google Scholar] [CrossRef]

- Boran, F.E.; Genc, S.; Hurt, M.; Akay, D. A multi-criteria interval-valued intuitionistic fuzzy group decision making for supplier selection with TOPSIS method. Expert Syst. Appl. 2009, 36, 11363–11368. [Google Scholar] [CrossRef]

- Bronzo, M.; McCormack, K.P.; de Sousa, P.R.; de Oliveira, M.P.V.; Ferreira, R.L.; de Resende, P.T.V. Improving performance aligning business analytics with process orientation. Int. J. Inf. Manag. 2013, 33, 300–307. [Google Scholar] [CrossRef]

- Yauch, C.A. Measuring agility as a performance outcome. J. Manuf. Technol. Manag. 2011, 22, 384–404. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Güleryüz, S.; Karpak, B. A new combined IF-DEMATEL and IFANP approach for CRM partner evaluation. Int. J. Prod. Econ. 2017, 191, 194–206. [Google Scholar] [CrossRef]

- Chen, H.; Chiang, R.H.; Storey, V.C. Business intelligence and analytics: From big data to big impact. MIS Q. 2012, 36, 1165–1188. [Google Scholar] [CrossRef]

- Chen, J.; Sohal, A.S.; Prajogo, D.I. Supply chain operational risk mitigation: A collaborative approach. Int. J. Prod. Res. 2013, 51, 2186–2199. [Google Scholar] [CrossRef]

- Chiang, C.Y.; Kocabasoglu-Hillmer, C.; Suresh, N. An empirical investigation of the impact of strategic sourcing and flexibility on firm’s supply chain agility. Int. J. Oper. Prod. Manag. 2012, 32, 49–78. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach to structural equation modelling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Christopher, M.; Holweg, M. Supply chain 2.0 revisited: A framework for managing volatility-induced risk in the supply chain. Int. J. Phys. Distrib. Logist. Manag. 2017, 47, 2–17. [Google Scholar] [CrossRef]

- Cao, G.; Duan, Y.; Li, G. Linking business analytics to decision making effectiveness: A path model analysis. IEEE Trans. Eng. Manag. 2015, 62, 384–395. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Teece, D.J. Dynamic capabilities: Routines versus entrepreneurial action. J. Manag. Stud. 2012, 49, 1395–1401. [Google Scholar] [CrossRef]

- Teece, D.J. The foundations of enterprise performance: Dynamic and ordinary capabilities in an (economic) theory of firms. Acad. Manag. Perspect. 2014, 28, 328–352. [Google Scholar] [CrossRef]

- Teece, D.J.; Peteraf, M.A.; Leih, S. Dynamic capabilities and organizational agility: Risk, uncertainty and entrepreneurial management in the innovation economy. Uncertain. Entrep. Manag. Innov. Econ. 2016, 58, 13–35. [Google Scholar] [CrossRef]

- Narasimhan, R.; Swink, M.; Kim, S.W. Disentangling leanness and agility: An empirical investigation. J. Oper. Manag. 2006, 24, 440–457. [Google Scholar] [CrossRef]

- Theoharakis, V.; Hooley, G. Organizational resources enabling service responsiveness: Evidence from Greece. Ind. Mark. Manag. 2003, 32, 695–702. [Google Scholar] [CrossRef]

- Tseng, H.T.; Aghaali, N.; Hajli, N. Customer agility and big data analytics in new product context. Technol. Forecast. Soc. Chang. 2022, 180, 121690. [Google Scholar] [CrossRef]

- Awan, U.; Bhatti, S.H.; Shamim, S.; Khan, Z.; Akhtar, P.; Balta, M. The role of big data analytics in manufacturing agility and performance: Moderation–mediation analysis of organizational creativity and of the involvement of customers as data analysts. Br. J. Manag. 2022, 33, 1200–1220. [Google Scholar] [CrossRef]

- Dubey, R.; Bryde, D.J.; Dwivedi, Y.K.; Graham, G.; Foropon, C. Impact of artificial intelligence-driven big data analytics culture on agility and resilience in humanitarian supply chain: A practice-based view. Int. J. Prod. Econ. 2022, 250, 108618. [Google Scholar] [CrossRef]

- Zheng, L.J.; Zhang, J.Z.; Wang, H.; Hong, J.F. Exploring the impact of Big Data Analytics Capabilities on the dual nature of innovative activities in MSMEs: A Data-Agility-Innovation Perspective. Ann. Oper. Res. 2022, 23, 1–29. [Google Scholar] [CrossRef]

- Tarn, D.D.; Wang, J. Can data analytics raise marketing agility?-A sense-and-respond perspective. Inf. Manag. 2023, 60, 103743. [Google Scholar] [CrossRef]

- Tseng, H.T. Customer-centered data power: Sensing and responding capability in big data analytics. J. Bus. Res. 2023, 158, 113689. [Google Scholar] [CrossRef]

- Mangalaraj, G.; Nerur, S.; Dwivedi, R. Digital transformation for agility and resilience: An exploratory study. J. Comput. Inf. Syst. 2023, 63, 11–23. [Google Scholar] [CrossRef]

- Chen, Z.; Liang, M. How do external and internal factors drive green innovation practices under the influence of big data analytics capability: Evidence from China. J. Clean. Prod. 2023, 34, 136862. [Google Scholar] [CrossRef]

| Number of employees | <50 (19.5%) |

| 50–100 (31.5%) | |

| 101–200 (16.8%) | |

| 201–400 (12.5%) | |

| 401–999 (11.5%) | |

| >1000 (8.2%) | |

| Firm age (years) | <3 (13.5%) |

| 3–5 (17.5%) | |

| 6–10 (23.5%) | |

| 11–15 (13%) | |

| >15 (32.5%) | |

| Position | General manager (21.5%) |

| Director (16.5%) | |

| Senior Manager (62%) |

| Construct/Indicators | Indicator Loading | Mean | Standard Deviation | Cronbach’s α | CR | AVE |

|---|---|---|---|---|---|---|

| Environmental performance (ENP) | 0.915 | 0.946 | 0.618 | |||

| ENP1 | 0.93 | 2.12 | 1.02 | |||

| ENP2 | 0.95 | 2.36 | 1.16 | |||

| ENP3 | 0.91 | 3.06 | 1.34 | |||

| ENP4 | 0.89 | 2.19 | 1.45 | |||

| Social performance (SOP) | 0.901 | 0.927 | 0.691 | |||

| SOP1 | 0.88 | 2.78 | 1.76 | |||

| SOP2 | 0.91 | 2.29 | 1.28 | |||

| SOP3 | 0.89 | 2.81 | 1.05 | |||

| Economic performance (ECP) | 0.936 | 0.971 | 0.518 | |||

| ECP1 | 0.93 | 3.12 | 1.26 | |||

| ECP2 | 0.96 | 2.38 | 1.08 | |||

| ECP3 | 0.92 | 2.67 | 1.25 | |||

| ECP4 | 0.05 | 3.10 | 1.20 | |||

| Strategic agility (STA) | 0.910 | 0.937 | 0.617 | |||

| STA1 | 0.89 | 2.78 | 1.08 | |||

| STA2 | 0.86 | 2.12 | 1.26 | |||

| STA3 | 0.94 | 2.07 | 1.11 | |||

| STA4 | 0.91 | 2.75 | 1.56 | |||

| STA5 | 0.92 | 3.10 | 1.20 | |||

| Big data analytics (BDAC) | 0.907 | 0.931 | 0.680 | |||

| BDAC1 | 0.91 | 2.38 | 1.26 | |||

| BDAC2 | 0.93 | 2.30 | 1.20 | |||

| BDAC3 | 0.94 | 2.12 | 1.07 | |||

| BDAC4 | 0.90 | 2.07 | 1.16 | |||

| BDAC5 | 0.89 | 2.18 | 1.25 | |||

| BDAC6 | 0.92 | 2.76 | 1.08 | |||

| Firm creativity (FRC) | 0.926 | 0.951 | 0.519 | |||

| FRC1 | 0.95 | 3.10 | 1.20 | |||

| FRC2 | 0.92 | 2.36 | 1.17 | |||

| FRC3 | 0.91 | 2.19 | 1.29 | |||

| FCR4 | 0.88 | 2.41 | 1.05 |

| Construct | Correlations and Square Roots of AVE | |||||

|---|---|---|---|---|---|---|

| ENP | SOP | ECP | STA | BDAC | FRC | |

| ENP | 0.786 | |||||

| SOP | 0.239 | 0.831 | ||||

| ECP | 0.319 | 0.328 | 0.719 | |||

| STA | 0.418 | 0.345 | 0.526 | 0.785 | ||

| BDAC | 0.527 | 0.266 | 0.418 | 0.429 | 0.825 | |

| FRC | 0.279 | 0.518 | 0.296 | 0.220 | 0.418 | 0.721 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alyahya, M.; Aliedan, M.; Agag, G.; Abdelmoety, Z.H. Understanding the Relationship between Big Data Analytics Capabilities and Sustainable Performance: The Role of Strategic Agility and Firm Creativity. Sustainability 2023, 15, 7623. https://doi.org/10.3390/su15097623

Alyahya M, Aliedan M, Agag G, Abdelmoety ZH. Understanding the Relationship between Big Data Analytics Capabilities and Sustainable Performance: The Role of Strategic Agility and Firm Creativity. Sustainability. 2023; 15(9):7623. https://doi.org/10.3390/su15097623

Chicago/Turabian StyleAlyahya, Mansour, Meqbel Aliedan, Gomaa Agag, and Ziad H. Abdelmoety. 2023. "Understanding the Relationship between Big Data Analytics Capabilities and Sustainable Performance: The Role of Strategic Agility and Firm Creativity" Sustainability 15, no. 9: 7623. https://doi.org/10.3390/su15097623

APA StyleAlyahya, M., Aliedan, M., Agag, G., & Abdelmoety, Z. H. (2023). Understanding the Relationship between Big Data Analytics Capabilities and Sustainable Performance: The Role of Strategic Agility and Firm Creativity. Sustainability, 15(9), 7623. https://doi.org/10.3390/su15097623