1. Introduction

Financial technology (fintech) is transforming the financial service industry at an unparalleled pace. The rapid development of financial technology and the accessibility of financial markets to non-professional investors have led to a large number of young people trading in shares. According to a study by BofA Global Research, Generation Z investors are seeking to take advantage of market opportunities and make quick short-term profits. The authors showed that they frequently trade, take more risks, closely monitor their portfolios, and develop other conventionally “bad” investment habits. Such habits are criticised by investment experts [

1].

In recent decades, the field of financial theories, behavioural finance, has been widely studied by incorporating various psychological insights to find out howemotions, experiences, other people’s behaviour, trust, and other psychological causes influence the behaviour of investors [

2,

3,

4]. A research group investigated the effect of investment sentiments and risk on financial behaviour in financial markets, generally supported by mathematical methods [

5,

6,

7,

8]. A large and growing flow of research is related to young adults and their financial behaviour patterns, in which two indications are seen: the importance of strengthening the level of financial knowledge of Gen Z and the peculiarities of their investment behaviour [

9,

10,

11,

12,

13,

14,

15]. More recent research complements studies on financial behaviour by including green investment issues, highlighting internal and external factors that impact such phenomena [

16]. One of the reasons influencing the choice of green investment products is the fear of climate change and environmental catastrophe, as well as particular values [

17,

18]. The whole positive surroundings, in a particular state, are also important, especially some legal aspects [

19]. For the green investing performance of Gen Z, who highly values communication, the impact of social platforms is significant [

20].

Generation Z is characterised by great consumerism, infantilism, and narcissism; is perfectly suited for digital transformation; and values sustainability in the most diverse dimensions [

21]. In the investment process, Gen Z demonstrates a high level of self-confidence [

13], but, when there is more information, its decisions become more responsible and sustainable [

14]). Generation Z’s investment behaviour in financial markets attracts many researchers and leaves a gap for future studies.

The aim of this paper is to identify the types of Generation Z investors according to their tendency towards rationality and to find out how these groups react to green investments. This article uses a systematic literature analysis, a questionnaire survey, and graphical data representation methods. The authors conducted a survey of Generation Z at the Vilnius Higher Education Institution to investigate the rationality of the behaviour of young non-professional investors in financial markets and to improve the education of students about financial literacy.

The rest of the paper is organised as follows.

Section 2 presents the literature review, and

Section 3 presents the methodological part and shows the structure of the survey.

Section 4 describes the empirical results.

Section 5 and

Section 6 provide a discussion and the conclusions.

3. Methodology

In order to investigate the behaviour of Generation Z investors in financial markets, the Pompian MBTI model was chosen [

46].

There are many articles in psychological journals [

2,

4,

26] that combine the special set of personal characteristics and particular financial behaviour. Such studies lead to better understanding of various internal determinants and help in self-assessment and decision-making understanding, as well as in improving consulting and teaching processes. The Pompian model was chosen as the very clearly systemised methodological approach suitable for the first exploratory research. Furthermore, the method is very useful for promoting smart educational processes by incorporating self-assessment.

Pompian argues that some investors have little time and patience to manage their finances, others start investing too late, and some show more discipline in investing in the financial markets than others. The model of M. M. Pompian identifies eight possible types of investor personalities based on the three dimensions of the investor personality profile. The Pompian MBTI model and the questionnaire survey research method were applied to investigate the behaviour of Generation Z students studying at the Vilnius Higher Education Institution who invest in the financial markets.

The survey questionnaire consisted of 15 diagnostic questions divided into three blocks of five questions each, according to the personality dimensions of investors. The questionnaire was designed using closed-ended questions. The first block of questions was designed to determine whether the investor is an idealist or a pragmatist (I or P) according to their personality profile. The second block of questions identified whether the investor is a framer or an integrator (F or N), and the third block of questions asked whether the investor is a reflector or a realist (T or R). The letters in the Pompian model represent the good and bad characteristics of investors. The bad characteristics, i.e., irrational behaviour in financial markets, are typical of the idealist (letter I from the first dimension), whose main distinguishing features are overconfidence and a reluctance to seek out more information; the framer (letter F from the second dimension) is characterised by attachment to certain information and reluctance to analyse external factors. The reflector (letter T from the third dimension) is characterised by fear and reluctance to take proactive action. Conversely, the pragmatist (letter P from the first dimension) has good qualities, i.e., rational behaviour in financial markets, demonstrates a good understanding of reality and of oneself, and tends to extensively analyse. The integrator (letter N from the second dimension) is characterised by a systematic approach and the ability to structure their portfolio. The realist (letter R from the third dimension), unlike the reflector, has the courage to make decisions. Following the questionnaire survey and the analysis of the responses of the respondents, in order to identify the predominant trait in each of the three dimensions, eight three-letter acronyms (IFT, IFR, INT, PFT, INR, PFR, PNT, and PNR) were created, indicating the combination of traits that to the classification of the investor in one of the eight investor personality types. This model was supplemented with questions on green investment propensity to determine which types of students were more likely to consider the environmental impact of their financial decisions.

The study population consisted of all students of the Faculty of Electronics and Informatics, Faculty of Economics, and Faculty of Business Management of Vilnius Higher Education Institution, born in 2000 and later, i.e., 2446 students in total. The survey questionnaire was sent to students at Vilnius Higher Education Institution by e-mail. The MS Office 365 Forms package was used for the survey, and the obtained data were processed in MS Excel. The survey was carried out between February and March 2023.

The initial decision for error with a statistical precision of 95% was to keep it close to 5%, resulting in a sample size estimate of 273 cases, where the maximum variance of the binomial distribution was reached with probability. After this prior estimation and collecting and, finally, discarding invalid responses, we obtained a satisfactory number,

n = 379, of valid responses for cases of a smaller proportion of the responses than 50%, as the smaller proportion further decreases required

n for the error chosen. Frequencies of the types were gleaned in numbers and converted to percentages. Due to the stochastic character of answers, for making extended generalisations about population of students with similar characteristics, we decided to solve a problem of estimating the error for the obtained proportion of responses. Responses were structured in a way that belonging to each dimension of the students were read in the Boolean format; therefore, the binomial distribution could be applied for description of the whole population of similar students in terms of a percentage of a particular dimension within the population, with probability of success equal to the percentage rate of positive responses. The dispersion is known to be equal to the product of the probability of success and failure. Inference relates to stochasticity, and, therefore, it needs additional exploration in terms of reliability of qualitative interpretation. We used the above-described parameters for estimation the error margin,

e%, for each dimension with a precision of 95% and for the number of valid elicited responses. The formula for such estimation was derived by substitution boundaries of 95% probability interval of the standardised normal distribution (which is asymptotic to the binomial one), to the following formula of required number of respondents [

47,

48]:

where

α is the confidence level;

Zα is the boundary of the standardised normal distribution that cuts the zone of probabilities around zero of the chosen reliability of the statistical model;

S is the estimation of dispersion from the sample; and

e is the acceptable error expressed in percentage that expresses the boundary of the confidence interval.

Confidence intervals are, therefore, derived using the previously described parameters in accordance from the modified Formula (1).

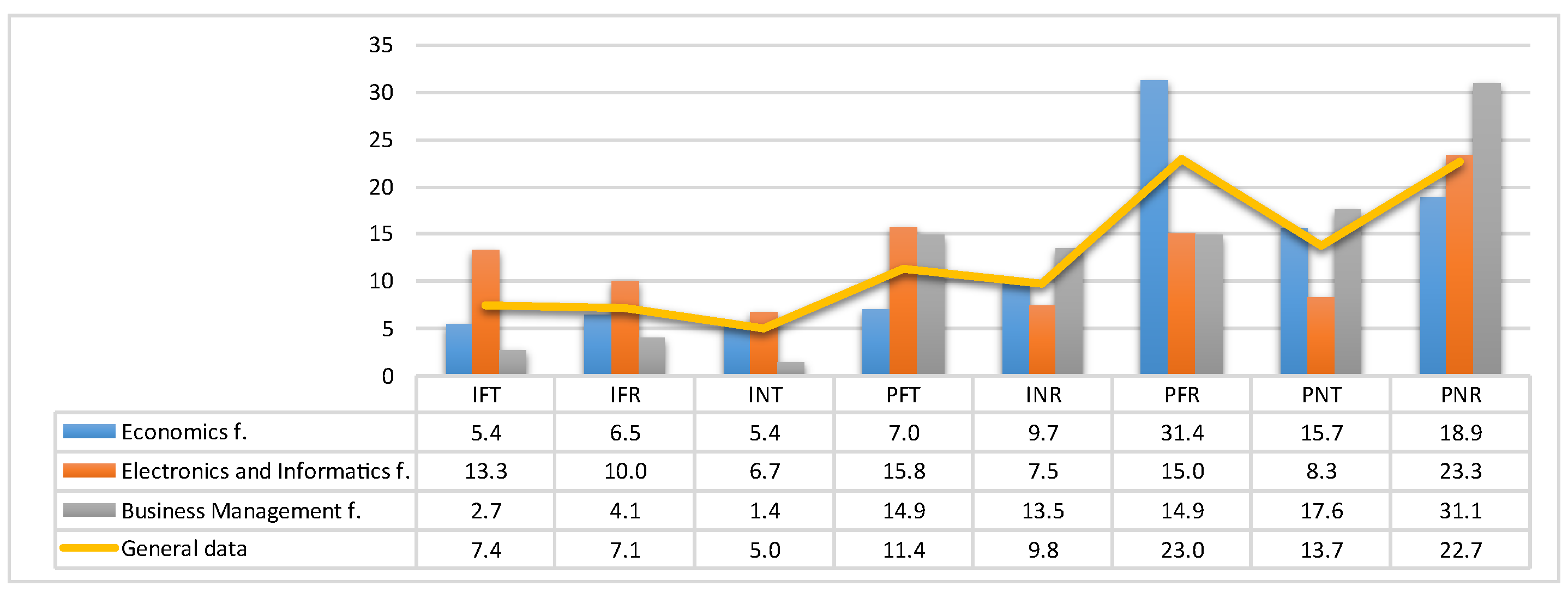

Such errors of inference represent boundaries of confidence intervals; they are shown in

Figure 1. Analysis of the results can be carried out based on exact percentage numbers elicited from responses because statistical confidence appears to be rather moderate: up to 4.23%.

Proportions shown in

Figure 1 reveal the structure of investors by personality dimensions and lead to the following results and conclusions. Assessment of the general preference of all respondents towards green investment is made by testing the following statistical hypothesis:

H0. Students are not inclined to be in favour of green investment.

H1. Students are inclined to be in favour of green investment.

The limitations of this study are that the results were obtained from one country and one educational institution. The data cover the respondents referring to Generation Z from two faculties—economics and electronics. Students in both faculties have enough knowledge to manage investments. To secure anonymity, the decision not to collect data based on gender was confirmed.

4. Results

A comparative theoretical analysis between Generation Z’s theoretical traits and those presented by M. M. Pompian shows that researchers attribute more traits from the negative traits scale (idealist, framer, and reflector) to Generation Z and that this is in line with other studies [

3,

13,

37]. Overoptimism and self-confidence make them similar to idealists, and they are not inclined to think much about external actions, relying on what the situation looks like at the time, like framers, and trying to rationalise decisions that are not always correct, like reflectors. The questionnaire survey aims to observe the predominant characteristics among current students as current and potential investors.

It is important to note that not all of the respondents claimed to have no experience in investing and answered the questionnaire by imagining they were investors. A lack of funds is one of the reasons why students studying these subjects do not actively try real opportunities, but a lack of self-confidence may also play a role.

The visualisation of the distribution of personality types of investors, as presented in

Figure 1, could be used to perceive the proportions of the combined dimensions of more general personality types. Overall, 46.5% of the respondents belong to the group of “good” investor personality types (INR, PFR, and PNT types), which are more rational, and 22.7% are “excellent” (PNR type), according to Pompian’s model. And only 24% need improvement (IFT, IFR, INT, and PFT types). Almost a quarter of them belong to the pragmatist/framer/realist (PFR) investor personality type.

Similar to above, the errors of inference or boundaries of confidence intervals that estimate the magnitudes of each group with a precision of 95% are as follows:

e = 5.02% for the group that comprises the INR, PFR, and PNT types;

e = 5.02% for the group that comprises the INR, PFR, and PNT types;

e = 4.30% for the estimation of the magnitude of the group of the IFT, IFR, INT, and PFT types, while inference error margins for the group PNR and the group PFR type are shown in

Figure 1.

Among respondents with more rational behaviour, the personality type of pragmatist/framer/realist (PFR) for the investor is among the most dominant (see

Figure 1). A further 23% of respondents have fully rational investment behaviour (PNR investor personality type). And 31% of respondents need to improve their behaviour in financial markets because their behaviour is irrational (IFT, IFR, INT, and PFT investor personality types combined). Even students who are studying such pragmatic programmes (social and technical sciences) have some irrationality in their behaviour in financial markets. The inference error margins for such groups are provided above.

Initial observations are provided based on responses within each group, although similar estimates of reasoning errors cannot be made due to the small number of group members; however, we intend to increase the group of respondents in future studies and provide better estimations.

The personality type PNR, described by Pompian as an excellent type with reasonable behaviour, is shared by 31.1% of students in the Business Management faculty (

Figure 2). The highest scores are 18.9% from the Faculty of Economics and 23.3% from the faculties of electronics and informatics. Students from the business management faculty tend to have the most favourable opinions towards rational behaviour in the financial markets, which supports the logical conclusion that these kinds of studies may have a significant influence on more rational behaviour.

Therefore, this exploratory study reveals that Generation Z respondents tend to be rational investors, similar to the results of a study conducted by Bikas and Kavaliauskas, which surveyed Lithuanian investors (in this study, the majority of respondents were from the older generation) [

49]. However, it should be remembered that these are students of the Faculty of Economics, and, according to many researchers, more rational decisions are made by those who have more financial knowledge [

3,

13,

14].

Generation Z is described by many scholars as a materialistic generation, with a strong consumerist streak, as was also presented in [

21] but with an appreciation for sustainable ideas confirmed by other studies [

16,

40,

41,

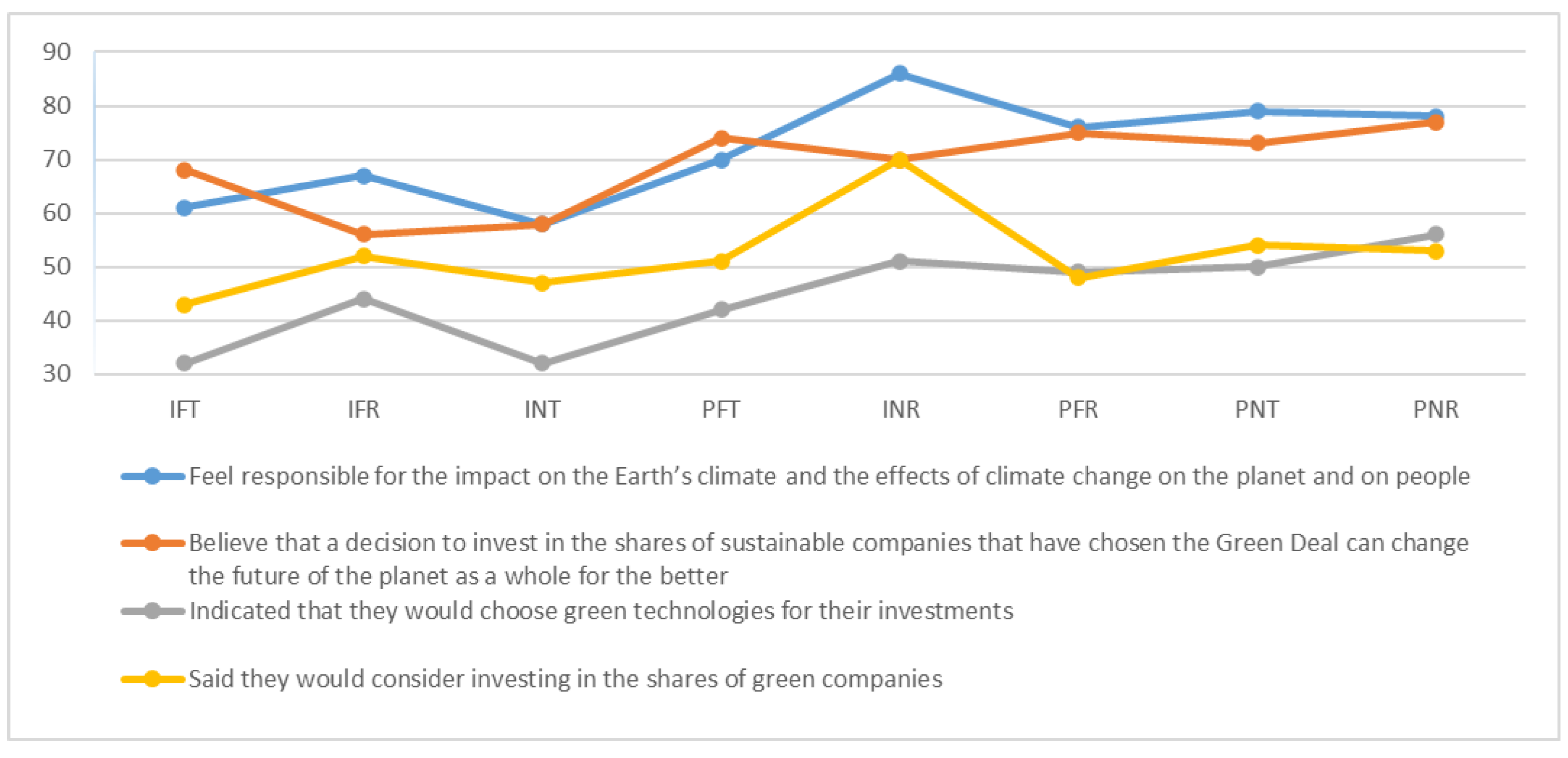

42]. According the research’s results (are shown in

Figure 3), the majority (75%) of the respondents feel responsible for the impact on the Earth’s climate and the negative effects of climate change on the planet and on people. Also, 72% of the respondents believe that a decision to invest in the shares of sustainable companies that have chosen to go green can have a positive impact on the future of the planet. Almost half (48%) of the respondents would invest in green technology companies because they believe that the sector is promising and that the company’s choice of a green course is in line with their approach to responsible investment. In addition, 53% of the respondents say that they would consider investing in green companies’ shares after the survey, while 12% say they are already choosing green investments.

The analysis of the survey results provides possible links between the personality types of the identified investors and their propensity to green invest. The relation between investor types and green investment preferences can be observed in

Figure 3.

Students with the idealist/integrator/realist (INR) investor personality type are the most likely to green invest. As many as 86% of this type of investor indicate that they feel responsible for the impact on the Earth’s climate and the effects of climate change on the planet and people. Also, 70% of this type of investor believe that investing in sustainable green companies can change the future of the planet for the better, and they are investing now or plan to do so in the future. In addition, 51% of the respondents belonging to the INR investor type say that they would invest in green technology companies because the companies’ choice of a green course is in line with their approach to responsible investment. However, 35% of this investor type still believe that investing is all about maximising returns and would, therefore, choose potentially more profitable stocks, regardless of the company’s choice of exchange rate. The INR investor type is characterised by high self-confidence, broad-mindedness, and courageous decision making.

The survey shows that idealist/integrator/reflector (INT) investor personality-type students are the least likely to think about green investments: 58% of this investor personality type feel responsible for the impact on the Earth’s climate and the effects of climate change on the planet and on people, while 32% indicate that they would choose green technologies for their investments; 47% of students of this type indicate that, for them, earning the highest possible return is the most important goal, regardless of the nature of the company’s activities, so they would choose to invest in a company whose shares have a better chance of generating a higher return.

All responses to the four questions outlined in

Figure 3 make a total of 740 answers, while the number of positive responses in the sample make 496 in total. This makes 67% of the responses positive. The standard deviation of the mean of such replies makes up 1.73%, calculated by using the formula for the standard deviation for the mean of a binomially distributed random variable expressed as a percentage. The difference between the mark of 50%, which would mean perfect indifference, and 67% is much greater in terms of such standard deviations than the right-hand side threshold of the standardised normal distribution for a 95% probability, which is 1.645. We, therefore, can reject hypothesis H0, with the stated degree of statistical precision, and claim that the students of Generation Z have a propensity for green investment.

Despite the fact that most students feel responsible for the impact on the Earth’s climate (blue line on the graph), they mostly think about it and consider it, instead of actually being ready to choose green investments at the moment (grey line). In this case, there is a scope for further study on green investments. Better psychological knowledge leads to a more realistic perception of oneself and the world. Analysing fears and influences and channelling them towards positive goals can facilitate decision making and increase financial well-being, as well as more effectively contribute to the green transformation. Hence, it is clearly seen that Generation Z sympathises with a sustainable world, and this notion was confirmed by many other studies [

16,

20,

21,

42]; the rational basis to choose faster profit is also very strong, as other authors noticed [

36,

37]. However, it should be remembered that the more Generation Z knows about environmental economics and improves their sustainability and financial literacy, the more they are responsible consumers and investors [

9,

14,

19,

21,

34].

5. Discussion

The growing concern about the rapid environmental degradation impact increases the attention to the green concept at investment levels. The transformation of investment patterns, which has only been orientated to make profit in the early days, should include environmental risk. Generation Z, whose attitude analysis is very important for practitioners and politicians, will soon be leaders. First, the results of research provide a better understanding of the existing academic literature on young investor behaviour, consolidating its knowledge, and identifying gaps to facilitate future studies; second, this study provides valuable research findings for investors, academics, policymakers, businesses, professionals, and society. The assessment of Generation Z investment patterns often falls under the concepts of finance and psychology. Researchers’ have conducted surveys of students, and their research shows that the more information young people have, the more responsible their decisions are, which is why it is important to understand their attitudes towards investing and to nurture them, which is in line with other studies [

9,

14,

19,

21,

34].

We suggest that green attitudes should be encouraged, and such behaviour fosters ecological well-being. Generation Z is keen to be more sustainable [

16,

20,

21,

42], but, in many cases, short-term profit impacts its real decision [

36,

37]. Our results show that positive attitudes towards the green economy are often not linked to actual actions.

Limitations of the Study

Most students of economics know what the correct answer should be according to the theoretical approach being taught, and this may have introduced bias into the survey responses. In the future, the survey will be expanded to include more students from other fields, with a subsequent comparison of their responses. Another direction can be the analysis of comparing survey results and the real situation and what factors impact mismatching.

Assuming that the accuracy of the model estimating the size of investor personality profiles was achieved by using statistical inference for the elicited 379 valid responses, for the binomial distribution with the probability parameter equal to the percentage of individuals with a particular dimension, and by taking a reasonable level of statistical precision of 95%. The number of responses represented a large part of the above-described population of students and, therefrom, produced moderate inference errors. Consequently, it is probable that the derived proportions represent the corresponding population well in terms of the dimensions of the investor personality profile. The probabilities in the binomial distribution are quite strongly divergent from 0.5; consequently, the hypothesis about the propensity of the students towards green investment is formulated and accepted. The sizes of each dimension appear to be too small for estimating the precision of the responses within each group; consequently, this investigation will be extended in future studies.

The limitation is that the sample includes only one educational institution and only one country. Expanding the sample to different countries and having a broader comparative analysis can enrich the results and impact.

6. Conclusions

Classical financial theory states that investors operating in an efficient market are rational. Rational investors in financial markets seek to maximise their own financial gain by using their analytical skills. However, experts in cognitive psychology dispute this, arguing that individuals do not always behave rationally. Investors’ decisions are often influenced by emotions, preconceptions, personal experience or the experiences of others, and other psychological reasons; therefore, researchers in this field classify investors into types according to the factors that determine their behaviour. Research on cognitive psychology confirms that some non-professional investors behave irrationally in financial markets, which reduces their wealth and negatively affects their financial performance. Irrational behaviour in financial markets is also a characteristic of Generation Z due to the characteristics attributed to them, such as a lack of patience, a desire for quick solutions, an intolerance of monotonous and consistent activity, and excessive self-confidence. Each generation is unique, with positive and negative traits. The positive thing is that the life of Generation Z is much more dynamic: they are quick at decision making, good at managing information, and active in investing thanks to their excellent use of investment apps. Materialism or consumerism can be mentioned as a negative characteristic of Generation Z. It is a materialistic generation that pays a lot of attention to brands, chasing fashion and innovation.

According to the Pompian scale and theoretical research on generations, it was observed that Generation Z has more problematic traits (idealist, framer, and reflector), which have to be improved during educational and consulting procedures. It was hypothesized that, according to the general characteristics, the representatives of Generation Z can be classified as a group of personalities that are less rational. However, this was not observed during the study of VIKO students. This study showed that most of the students in the study behave rationally in financial markets, while only a small proportion of them are more likely to rely on emotions and other psychological factors when investing. The results by type of investor showed that Generation Z has relatively good investment skills and intuition. Many students demonstrated pragmatist qualities, such as a good understanding of reality and themselves, and the ability to justify actions through analytical analysis. Only a small proportion (24%) of them fell into investment types whose overoptimism and self-confidence still need to be reduced. Their technical and social studies, which are based on a logical approach, may also have an impact on these results. The Faculty of Business Management was found to have the most favourable attitudes towards rational behaviour in financial markets.

An additional study aimed to identify students’ attitudes towards green investing. Most of the study students felt responsible for the individual impact of each investor on Earth’s climate and the effects of climate change on the planet and people and are, therefore, inclined to invest in green securities; however, there was a significant gap between their understanding and their actual willingness and commitment to do so. Overall, 86% of the INR cluster have felt responsibility for their investment decisions’ impact on the global environmental state. Hence, as they are rational enough investors, 35% of them still believe that they should choose potentially more profitable stocks.

This article’s findings expanded financial behaviour studies by combing psychological analysis and the attitudes towards greenness of Generation Z. It confirmed that, in addition to Generation Z’s sympathy for sustainability, it is not very quick to choose green investments.

Our results showed that Generation Z could be more responsible in its actions, as its affinity for sustainability should be confirmed by its green investment choices. In contrast, policy makers should improve education curricula to make green and/or sustainable subjects compulsory in all subjects taught. Expanding such a kind of research to other countries could add a broader comparison of the cultural aspects. It would also be of great interest for further research to involve researchers from psychological fields to explore the links between the various attributes and the actual actions that influence ecological transformation.