Are Natural Resources Harmful to the Ecology? Fresh Insights from Middle East and North African Resource-Abundant Countries

Abstract

1. Introduction

2. Literature Review

2.1. The Previous Literature

2.2. Empirical Studies on MENA Countries

2.3. Research Gaps

3. Data and Methodology

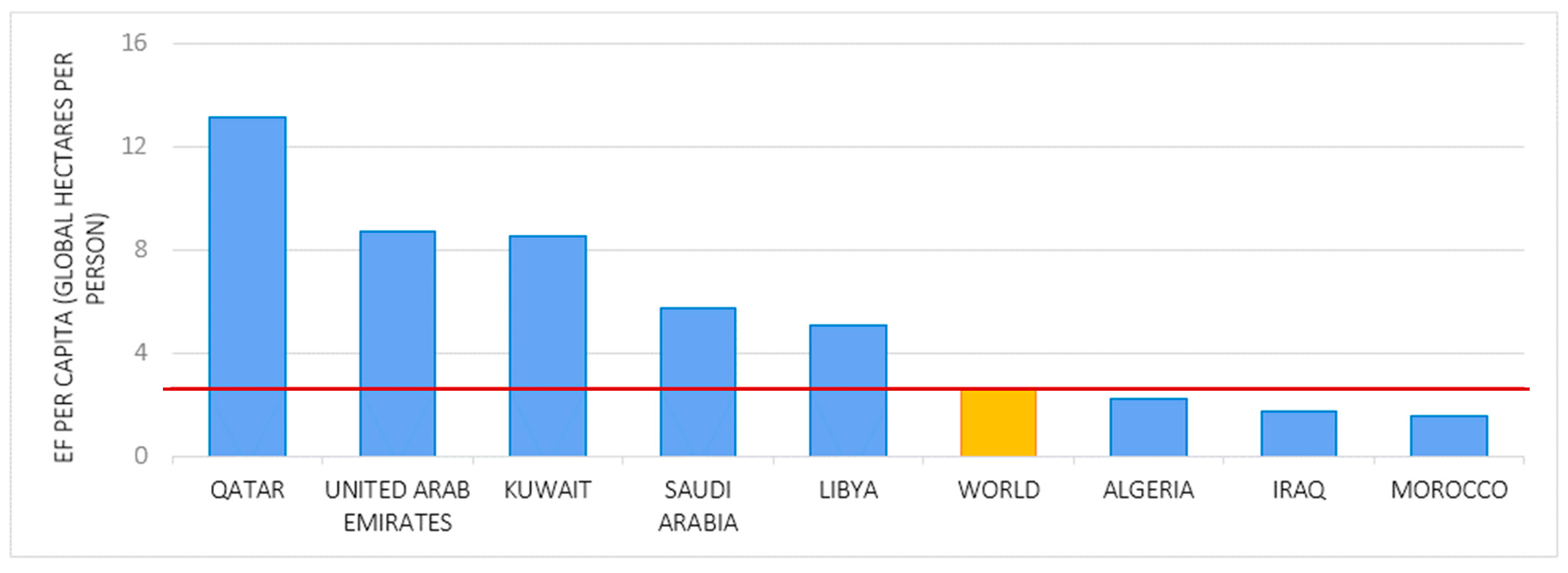

3.1. Data

3.2. Empirical Methodology

4. Empirical Results

4.1. Slope Homogeneity Test Results

4.2. CSD Analysis

4.3. Stationarity Analysis

4.4. Cointegration Analysis

4.5. Short- and Long-Run Effects

4.5.1. Total Resource Rents and EFP

4.5.2. Disaggregate Resource Rents and EFP

4.6. Discussion of Results

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zaman, K.; Abdullah, I.; Ali, M. Decomposing the linkages between energy consumption, air pollution, climate change, and natural resource depletion in Pakistan. Environ. Prog. Sustain. Energy 2017, 36, 638–648. [Google Scholar] [CrossRef]

- Wilting, H.C.; Schipper, A.M.; Ivanova, O.; Ivanova, D.; Huijbregts, M.A. Subnational greenhouse gas and land-based biodiversity footprints in the European Union. J. Ind. Ecol. 2021, 25, 79–94. [Google Scholar] [CrossRef]

- Azwardi Andaiyani, S.; Igamo, A.M.; Wijaya, W.A. The Environmental Impacts of Natural Resources Depletion. In International Conference on Indonesian Architecture and Planning; Springer Nature: Singapore, 2022; pp. 705–714. [Google Scholar]

- Xiong, Y.; Guo, H.; Nor, D.D.M.M.; Song, A.; Dai, L. Mineral resources depletion, environmental degradation, and exploitation of natural resources: COVID-19 aftereffects. Resour. Policy 2023, 85, 103907. [Google Scholar] [CrossRef]

- Tufail, M.; Song, L.; Adebayo, T.S.; Kirikkaleli, D.; Khan, S. Do fiscal decentralization and natural resources rent curb carbon emissions? Evidence from developed countries. Environ. Sci. Pollut. Res. 2021, 28, 49179–49190. [Google Scholar] [CrossRef] [PubMed]

- Mehmood, U. Natural resources and CO2 emissions nexus: Sustainable development path for South Asian countries. Kuwait J. Sci. 2022, 49, 1–13. [Google Scholar] [CrossRef]

- EL-Badri, A.S. The MENA Region in the International Arena. Transcript Presented at Middle East and North Africa Energy 2012 Conference. 2012. Available online: https://www.chathamhouse.org/sites/default/files/public/Meetings/Meeting%20Transcripts/300112elbadri.pdf (accessed on 18 January 2024).

- World Bank. Total Natural Resources Rents (% of GDP). 2024. Available online: https://data.worldbank.org/indicator/NY.GDP.TOTL.RT.ZS (accessed on 12 December 2023).

- Saud, S.; Haseeb, A.; Zafar, M.W.; Li, H. Articulating natural resource abundance, economic complexity, education, and environmental sustainability in MENA countries: Evidence from advanced panel estimation. Resour. Policy 2023, 80, 103261. [Google Scholar] [CrossRef]

- World Bank. Climate and Development in the Middle East and North Africa. 2023. Available online: https://www.worldbank.org/en/region/mena/brief/climate-and-development-in-the-middle-east-and-north-africa (accessed on 25 February 2024).

- Heger, M.P.; Lukas, V.; Anabella, P.; Mala, A.; Marjory-Anne, B.; Marcelo, A. Blue Skies, Blue Seas: Air Pollution, Marine Plastics, and Coastal Erosion in the Middle East and North Africa; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Khan, I.; Hou, F.; Le, H.P. The impact of natural resources, energy consumption, and population growth on environmental quality: Fresh evidence from the United States of America. Sci. Total Environ. 2021, 754, 142222. [Google Scholar] [CrossRef]

- Nathaniel, S.P.; Nwulu, N.; Bekun, F. Natural resource, globalization, urbanization, human capital, and environmental degradation in Latin American and Caribbean countries. Environ. Sci. Pollut. Res. 2021, 28, 6207–6221. [Google Scholar] [CrossRef]

- Jahanger, A.; Awan, A.; Anwar, A.; Adebayo, T.S. Greening the Brazil, Russia, India, China and South Africa (BRICS) economies: Assessing the impact of electricity consumption, natural resources, and renewable energy on environmental footprint. Nat. Resour. Forum 2023, 47, 484–503. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F.; Li, R. Revisiting the environmental Kuznets curve hypothesis in 208 counties: The roles of trade openness, human capital, renewable energy and natural resource rent. Environ. Res. 2023, 216, 114637. [Google Scholar] [CrossRef]

- Sun, Y.; Usman, M.; Radulescu, M.; Pata, U.K.; Balsalobre-Lorente, D. New insights from the STIPART model on how environmental-related technologies, natural resources and the use of the renewable energy influence load capacity factor. Gondwana Res. 2024, 129, 398–411. [Google Scholar] [CrossRef]

- Qamruzzaman, M.; Karim, S.; Kor, S. Nexus between Innovation–Openness–Natural Resources–Environmental Quality in N-11 Countries: What Is the Role of Environmental Tax? Sustainability 2024, 16, 3889. [Google Scholar] [CrossRef]

- Bekun, F.V.; Alola, A.A.; Sarkodie, S.A. Toward a sustainable environment: Nexus between CO2 emissions. resource rent. renewable and nonrenewable energy in 16-EU countries. Sci. Total Environ. 2019, 657, 1023–1029. [Google Scholar] [CrossRef] [PubMed]

- Wang, L.; Vo, X.V.; Shahbaz, M.; Ak, A. Globalization and carbon emissions: Is there any role of agriculture value-added, financial development, and natural resource rent in the aftermath of COP21? J. Environ. Manag. 2020, 268, 110712. [Google Scholar] [CrossRef]

- Ben-Salha, O.; Zmami, M. Analyzing the symmetric and asymmetric effects of disaggregate natural resources on the ecological footprint in Saudi Arabia: Insights from the dynamic ARDL approach. Environ. Sci. Pollut. Res. 2023, 30, 59424–59442. [Google Scholar] [CrossRef] [PubMed]

- Balsalobre-Lorente, D.; Shahbaz, M.; Roubaud, D.; Farhani, S. How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 2018, 113, 356–367. [Google Scholar] [CrossRef]

- Majeed, A.; Wang, L.; Zhang, X.; Kirikkaleli, D. Modeling the dynamic links among natural resources, economic globalization, disaggregated energy consumption, and environmental quality: Fresh evidence from GCC economies. Resour. Policy 2021, 73, 102204. [Google Scholar] [CrossRef]

- Hassan, S.T.; Xia, E.; Khan, N.H.; Shah, S.M.A. Economic growth, natural resources, and ecological footprints: Evidence from Pakistan. Environ. Sci. Pollut. Res. 2019, 26, 2929–2938. [Google Scholar] [CrossRef] [PubMed]

- Danish; Hassan, S. T. Investigating the interaction effect of urbanization and natural resources on environmental sustainability in Pakistan. Int. J. Environ. Sci. Technol. 2023, 20, 8477–8484. [Google Scholar] [CrossRef]

- Zhang, L.; Godil, D.I.; Bibi, M.; Khan, M.K.; Sarwat, S.; Anser, M.K. Caring for the environment: How human capital, natural resources, and economic growth interact with environmental degradation in Pakistan? A dynamic ARDL approach. Sci. Total Environ. 2021, 774, 145553. [Google Scholar] [CrossRef]

- Ahmed, Z.; Asghar, M.M.; Malik, M.N.; Nawaz, K. Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour. Policy 2020, 67, 101677. [Google Scholar] [CrossRef]

- Du, Y.; Wang, W. The role of green financing, agriculture development, geopolitical risk, and natural resource on environmental pollution in China. Resour. Policy 2023, 82, 103440. [Google Scholar] [CrossRef]

- Cho, J.S.; Kim, T.H.; Shin, Y. Quantile cointegration in the autoregressive distributed-lag modeling framework. J. Econom. 2015, 188, 281–300. [Google Scholar] [CrossRef]

- Sibanda, K.; Garidzirai, R.; Mushonga, F.; Gonese, D. Natural resource rents, institutional quality, and environmental degradation in resource-rich Sub-Saharan African countries. Sustainability 2023, 15, 1141. [Google Scholar] [CrossRef]

- Erdoğan, S.; Çakar, N.D.; Ulucak, R.; Danish; Kassouri, Y. The role of natural resources abundance and dependence in achieving environmental sustainability: Evidence from resource-based economies. Sustain. Dev. 2021, 29, 143–154. [Google Scholar]

- Danish; Ulucak, R.; Khan, S.U.-D. Determinants of the ecological footprint: Role of renewable energy, natural resources, and urbanization. Sustain. Cities Soc. 2019, 54, 101996. [Google Scholar] [CrossRef]

- Sicen, L.; Khan, A.; Kakar, A. The role of disaggregated level natural resources rents in economic growth and environmental degradation of BRICS economies. Biophys. Econ. Sustain. 2022, 7, 7. [Google Scholar] [CrossRef]

- Zafar, M.W.; Zaidi, S.A.H.; Khan, N.R.; Mirza, F.M.; Hou, F.; Kirmani, S.A.A. The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: The case of the United States. Resour. Policy 2019, 63, 101428. [Google Scholar] [CrossRef]

- Danish; Ulucak, R.; Baloch, M.A. An empirical approach to the nexus between natural resources and environmental pollution: Do economic policy and environmental-related technologies make any difference? Resour. Policy 2023, 81, 103361. [Google Scholar] [CrossRef]

- Hacıimamoğlu, T.; Cengiz, V. Are Natural Resource Rents and Renewable Energy Consumption Solutions for Environmental Degradation? Fresh Insights from a Modified Ecological Footprint Model. Sustainability 2024, 16, 2736. [Google Scholar] [CrossRef]

- Nguyen TT, H.; Tu, Y.T.; Diep, G.L.; Tran, T.K.; Tien, N.H.; Chien, F. Impact of natural resources extraction and energy consumption on the environmental sustainability in ASEAN countries. Resour. Policy 2023, 85, 103713. [Google Scholar] [CrossRef]

- Amer, E.A.A.A.; Meyad, E.M.A.; Gao, Y.; Niu, X.; Chen, N.; Xu, H.; Zhang, D. Exploring the link between natural resources, urbanization, human capital, and ecological footprint: A case of GCC countries. Ecol. Indic. 2022, 144, 109556. [Google Scholar] [CrossRef]

- Saqib, N.; Duran, I.; Hashmi, N.I. Impact of financial deepening, energy consumption and total natural resource rent on CO2 emission in the GCC countries: Evidence from advanced panel data simulation. Int. J. Energy Econ. Policy 2022, 12, 400–409. [Google Scholar] [CrossRef]

- Mahmood, H.; Saqib, N.; Adow, A.H.; Abbas, M. Oil and natural gas rents and CO2 emissions nexus in MENA: Spatial analysis. PeerJ 2023, 11, e15708. [Google Scholar] [CrossRef]

- Bilgili, F.; Soykan, E.; Dumrul, C.; Awan, A.; Önderol, S.; Khan, K. Disaggregating the impact of natural resource rents on environmental sustainability in the MENA region: A quantile regression analysis. Resour. Policy 2023, 85, 103825. [Google Scholar] [CrossRef]

- Moeinaddini, S.; Zare Mehrjerdi, M.R.; Amirtaimoori, S.; Mehrabi Boshrabadi, H. The Effect of Natural Resource Rent on the Environmental Quality (Case Study: A Selection of MENA Countries). J. Environ. Stud. 2024, 50, 97–110. [Google Scholar] [CrossRef]

- Dietz, T.; Rosa, E.A. Effects of population and affluence on CO2 emissions. Proc. Natl. Acad. Sci. USA 1997, 94, 175–179. [Google Scholar] [CrossRef]

- Touati, K.; Ben-Salha, O. Reconsidering the Long-Term Impacts of Digitalization, Industrialization, and Financial Development on Environmental Sustainability in GCC Countries. Sustainability 2024, 16, 3576. [Google Scholar] [CrossRef]

- Raggad, B.; Ben-Salha, O.; Zrelly, H.; Jbir, R. How do financial institutions and markets impact the ecological footprint in Saudi Arabia? A nonlinear cointegration approach. Stoch. Environ. Res. Risk Assess. 2024, 38, 1099–1119. [Google Scholar] [CrossRef]

- United States Geological Survey. Mineral Commodity Summaries 2022; United States Geological Survey: Boulder, CO, USA, 2022. Available online: https://pubs.er.usgs.gov/publication/mcs2022 (accessed on 29 January 2024).

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Pedroni, P. Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef]

- Westerlund, J. New simple tests for panel cointegration. Econom. Rev. 2005, 24, 297–316. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross-sectional dependence in panels. Empir. Econ. 2021, 60, 13–50. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Feng, Q.; Kao, C. A Lagrange Multiplier test for cross-sectional dependence in a fixed effects panel data model. J. Econom. 2012, 170, 164–177. [Google Scholar] [CrossRef]

- Samargandi, N.; Fidrmuc, J.; Ghosh, S. Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income countries. World Dev. 2015, 68, 66–81. [Google Scholar] [CrossRef]

- Ben-Salha, O.; Zmami, M. The effect of economic growth on employment in GCC countries. Sci. Ann. Econ. Bus. 2021, 68, 25–41. [Google Scholar] [CrossRef]

- World Bank. Renewable Energy Consumption (% of Total Final Energy Consumption). 2024. Available online: https://data.worldbank.org/indicator/EG.FEC.RNEW.ZS (accessed on 12 February 2024).

- Agboola, M.O.; Bekun, F.V.; Joshua, U. Pathway to environmental sustainability: Nexus between economic growth, energy consumption, CO2 emission, oil rent and total natural resources rent in Saudi Arabia. Resour. Policy 2021, 74, 102380. [Google Scholar] [CrossRef]

- Berg, A.; Portillo, R.; Yang, S.C.S.; Zanna, L.F. Public investment in resource-abundant developing countries. IMF Econ. Rev. 2013, 61, 92–129. [Google Scholar] [CrossRef]

- Zmami, M.; Ben-Salha, O.; Almarshad, S.O.; Chekki, H. The contribution of mining sector to sustainable development in Saudi Arabia. J. Sustain. Min. 2021, 20, 122–136. [Google Scholar] [CrossRef]

- International Energy Agency. Methane Tracker 2021; IEA: Paris, France, 2021; Available online: https://www.iea.org/reports/methane-tracker-2021 (accessed on 12 February 2024).

- Lacroix, K.; Goldberg, M.H.; Gustafson, A.; Rosenthal, S.A.; Leiserowitz, A. Should It Be Called “Natural Gas” or “Methane”? Yale Program on Climate Change Communication: New Haven, CT, USA, 2020.

- United Nations Environment Programme and Climate and Clean Air Coalition. Global Methane Assessment: Benefits and Costs of Mitigating Methane Emissions; United Nations Environment Programme: Nairobi, Kenya, 2021. [Google Scholar]

| Variable | Acronym | Definition | Source |

|---|---|---|---|

| Ecological footprint | EFP | Ecological footprint (gha) | GFN |

| Total resource rent | TRENT | Total natural resources rents (% of GDP) | WDI |

| Oil rents | ORENT | Oil rents (% of GDP) | WDI |

| Natural gas rents | NRENT | Natural gas rents (% of GDP) | WDI |

| Mineral rents | MRENT | Mineral rents (% of GDP) | WDI |

| Income | GDP | Real GDP per capita (constant 2015 US$) | WDI |

| Urbanization | URB | Urban population | WDI |

| Energy consumption | TEC | Total energy consumption (MTOE) | EIA |

| Variable | Mean | Median | Maximum | Minimum |

|---|---|---|---|---|

| EFP | 6.03 × 107 | 4.82 × 107 | 2.24 × 108 | 6.36 × 106 |

| TEC | 63.170 | 38 | 309 | 10 |

| GDP | 2.26 × 104 | 1.46 × 104 | 7.35 × 104 | 1.95 × 103 |

| URB | 1.34 × 107 | 1.17 × 107 | 3.28 × 107 | 6.22 × 105 |

| TRENT | 31.481 | 31.838 | 66.059 | 0.194 |

| ORENT | 29.165 | 28.211 | 65.157 | 0.0008 |

| GRENT | 1.966 | 1.095 | 12.011 | 0.002 |

| MRENT | 0.300 | 0.000 | 7.204 | 0.000 |

| Statistic | p-Value | |

|---|---|---|

| Model 1. LNTRENT | 3.130 *** | 0.000 |

| Model 2. LNORENT | 2.400 ** | 0.010 |

| Model 3. LNGRENT | 2.980 *** | 0.000 |

| Model 4. LNMRENT | 2.600 *** | 0.000 |

| CD Test | Bias-Corrected Scaled LM Test | |||

|---|---|---|---|---|

| Statistic | p-Value | Statistic | p-Value | |

| LNEFP | 21.575 *** | 0.000 | 471.432 *** | 0.000 |

| LNTEC | 15.12 *** | 0.000 | 419.974 *** | 0.000 |

| LNGDP | 0.952 | 0.340 | 214.005 *** | 0.000 |

| LNURB | 23.713 *** | 0.000 | 563.244 *** | 0.000 |

| LNTRENT | 15.236 *** | 0.000 | 294.787 *** | 0.000 |

| LNORENT | 19.807 *** | 0.000 | 401.624 *** | 0.000 |

| LNGRENT | 13.569 *** | 0.000 | 215.844 *** | 0.000 |

| LNMRENT | NA | NA | NA | NA |

| Variables | Level | 1st Difference | ||

|---|---|---|---|---|

| C | C + T | C | C + T | |

| LNEFP | −2.18 | −2.54 | −4.16 *** | −4.28 *** |

| LNTEC | −2.30 * | −2.25 | −4.77 *** | −5.23 *** |

| LNGDP | −1.96 | −2.12 | −4.10 *** | −4.56 *** |

| LNGDP2 | −1.97 | −2.14 | −4.12 *** | −4.56 *** |

| LNURB | −3.08 *** | −2.38 | −4.12 *** | −4.61 *** |

| LNTRENT | −2.07 | −2.10 | −3.21 *** | −3.66 *** |

| LNORENT | −1.93 | −2.11 | −4.96 *** | −4.95 *** |

| LNGRENT | −1.73 | −2.14 | −3.30 *** | −4.10 *** |

| LNMRENT | 0.59 | −0.38 | −4.48 *** | −3.96 *** |

| Model 1 Total Resource Rents | Model 2 Oil Rents | Model 3 Natural Gas Rents | Model 4 Mineral Rents | |||||

|---|---|---|---|---|---|---|---|---|

| Statistic | p-Value | Statistic | p-Value | Statistic | p-Value | Statistic | p-Value | |

| Demeaned Pedroni panel cointegration test | ||||||||

| Modified Phillips–Perron t | 1.63 ** | 0.050 | 1.74 ** | 0.040 | 1.68 ** | 0.040 | 1.89 ** | 0.020 |

| Phillips–Perron t | −2.65 *** | 0.000 | −2.25 ** | 0.010 | −2.73 *** | 0.000 | −2.22 ** | 0.010 |

| Augmented Dickey–Fuller t | −2.17 ** | 0.010 | −1.72 ** | 0.010 | −1.94 ** | 0.020 | −1.56 * | 0.060 |

| Westerlund ECM-based panel cointegration test | ||||||||

| Variance ratio | −3.19 *** | 0.000 | −4.13 *** | 0.000 | −4.26 *** | 0.000 | −4.25 *** | 0.000 |

| Variables | PMG | MG | DFE | |||

|---|---|---|---|---|---|---|

| Coeff. | p-Value | Coeff. | p-Value | Coeff. | p-Value | |

| Long-run estimation | ||||||

| LNGDP | 6.851 *** | (1.425) | −2.154 | (19.86) | −3.765 | (3.899) |

| LNGDP2 | −0.129 *** | (0.028) | 0.056 | (0.391) | 0.075 | (0.078) |

| LNURB | 0.269 *** | (0.052) | 0.570 ** | (0.268) | 0.409 * | (0.219) |

| LNTRENT | 0.053 *** | (0.019) | 0.0008 | (0.063) | 0.019 | (0.051) |

| LNTEC | 0.414 *** | (0.057) | 0.462 *** | (0.141) | 0.405 | (0.310) |

| Constant | −40.10 *** | (8.386) | −72.160 | (158.0) | 13.210 | (11.22) |

| Short-run estimation | ||||||

| ECT | −0.506 *** | (0.105) | −0.953 *** | (0.097) | −0.233 *** | (0.060) |

| D.LNGDP | −5.279 | (21.03) | −5.412 | (21.56) | 1.586 | (3.038) |

| D.LNGDP2 | 0.092 | (0.409) | 0.094 | (0.419) | −0.027 | (0.061) |

| D.LNURB | −0.098 | (1.557) | −0.931 | (3.988) | 0.761 *** | (0.192) |

| D.LNTRENT | 0.001 | (0.022) | −0.016 | (0.030) | 0.034 * | (0.017) |

| D.LNTEC | 0.069 | (0.089) | −0.052 | (0.079) | 0.129 | (0.082) |

| Hausman test | ||||||

| Ho: PMG is more efficient than DFE/H1: DFE is more efficient than PMG | 1.60 (0.750) | |||||

| Ho: PMG is more efficient than MG/H1: MG is more efficient than PMG | 1.65 (0.770) | |||||

| Variables | Model 2. Oil Rents | Model 3. Natural Gas Rents | Model 4. Mineral Rents | ||||||

|---|---|---|---|---|---|---|---|---|---|

| PMG | MG | DFE | PMG | MG | DFE | PMG | MG | DFE | |

| Long-run estimation | |||||||||

| LNGDP | 7.121 *** | 3.659 | −3.520 | 6.406 *** | −22.47 | −5.470 | 7.000 *** | −7.712 | −3.655 |

| (1.437) | (17.840) | (3.671) | (1.281) | (29.03) | (3.836) | (1.439) | (19.810) | (3.847) | |

| LNGDP2 | −0.136 *** | −0.055 | 0.070 | −0.122 *** | 0.462 | 0.109 | −0.132 *** | 0.168 | 0.0726 |

| (0.028) | (0.353) | (0.073) | (0.0254) | (0.577) | (0.077) | (0.028) | (0.389) | (0.077) | |

| LNURB | 0.305 *** | 0.405 * | 0.437 ** | 0.339 *** | 0.301 | 0.380 * | 0.270 *** | 0.396 | 0.419 * |

| (0.050) | (0.237) | (0.207) | (0.044) | (0.441) | (0.208) | (0.052) | (0.381) | (0.215) | |

| LNTEC | 0.466 *** | 0.588 *** | 0.371 | 0.419 *** | 0.536 ** | 0.355 | 0.428 *** | 0.446 *** | 0.423 |

| (0.053) | (0.188) | (0.300) | (0.042) | (0.238) | (0.297) | (0.051) | (0.146) | (0.307) | |

| LNRENT | 0.117 *** | −0.352 | 0.059 | 0.040*** | 0.172 * | 0.280 ** | −0.004 | 0.005 | 0.042 |

| (0.042) | (0.566) | (0.093) | (0.013) | (0.0969) | (0.114) | (0.026) | (0.061) | (0.072) | |

| Constant | −43.630 *** | −112.400 | 12.990 | −38.520*** | −16.28 | 17.840 * | −42.27 *** | 7.788 | 12.710 |

| (9.119) | (178.200) | (11.240) | (9.079) | (187.100) | (10.660) | (9.031) | (154.100) | (11.070) | |

| Short-run estimation | |||||||||

| ECT | −0.532 *** | −0.972 *** | −0.244 *** | −0.523*** | −0.960 *** | −0.226 *** | −0.524 *** | −0.914 *** | −0.230 *** |

| (0.111) | (0.112) | (0.059) | (0.123) | (0.147) | (0.056) | (0.112) | (0.082) | (0.059) | |

| D.LNGDP | 1.485 | −6.783 | 1.666 | −2.731 | −13.42 | −0.469 | −12.80 | 0.057 | 1.724 |

| (21.940) | (24.020) | (3.062) | (17.010) | (25.25) | (2.925) | (19.390) | (22.420) | (3.050) | |

| D.LNGDP2 | −0.041 | 0.113 | −0.028 | 0.042 | 0.246 | 0.014 | 0.241 | −0.012 | −0.0305 |

| (0.429) | (0.470) | (0.061) | (0.328) | (0.491) | (0.058) | (0.377) | (0.435) | (0.061) | |

| D.LNURB | 0.339 | 1.425 | 0.747 *** | 3.205 | −2.406 | 0.878 *** | 1.636 ** | 1.467 | 0.748 *** |

| (2.081) | (4.450) | (0.194) | (2.301) | (1.869) | (0.185) | (0.814) | (2.232) | (0.195) | |

| D.LNTEC | 0.051 | −0.100 | 0.142 * | −0.006 | −0.171 * | 0.147 * | 0.0572 | −0.034 | 0.121 |

| (0.092) | (0.077) | (0.083) | (0.099) | (0.104) | (0.077) | (0.094) | (0.077) | (0.082) | |

| D.LNRENT | −0.180 | −0.052 | 0.024 | −0.009 | 0.0673 | 0.038 | 0.008 | −0.014 | 0.0322 |

| (0.201) | (0.365) | (0.041) | (0.052) | (0.0438) | (0.029) | (0.021) | (0.030) | (0.020) | |

| Hausman test | |||||||||

| Ho: PMG is more efficient than DFE/H1: DFE is more efficient than PMG | 1.44 (0.830) | 0.88 (0.980) | 3.29 (0.650) | ||||||

| Ho: PMG is more efficient than MG/H1: MG is more efficient than PMG | 1.51 (0.790) | 0.95 (0.910) | 3.30 (0.660) | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Touati, K.; Ben-Salha, O. Are Natural Resources Harmful to the Ecology? Fresh Insights from Middle East and North African Resource-Abundant Countries. Sustainability 2024, 16, 4435. https://doi.org/10.3390/su16114435

Touati K, Ben-Salha O. Are Natural Resources Harmful to the Ecology? Fresh Insights from Middle East and North African Resource-Abundant Countries. Sustainability. 2024; 16(11):4435. https://doi.org/10.3390/su16114435

Chicago/Turabian StyleTouati, Kamel, and Ousama Ben-Salha. 2024. "Are Natural Resources Harmful to the Ecology? Fresh Insights from Middle East and North African Resource-Abundant Countries" Sustainability 16, no. 11: 4435. https://doi.org/10.3390/su16114435

APA StyleTouati, K., & Ben-Salha, O. (2024). Are Natural Resources Harmful to the Ecology? Fresh Insights from Middle East and North African Resource-Abundant Countries. Sustainability, 16(11), 4435. https://doi.org/10.3390/su16114435