The Role of Data-Driven Agritech Startups—The Case of India and Japan

Abstract

:1. Introduction

- India’s growing agritech market potential encompasses a three-layer structure for government, business, and consumers. As well as the slow and steadfast growth of Japanese companies such as Sagri Co. Ltd. (Tamba, Japan) in Himachal Pradesh, innumerable upcoming Indian agritech startups are extending indigenous partnerships and thereby facilitating the reach of local farmers with trust and confidence [13].

- Japan’s agricultural production costs are high, and developments in agritech could ease or alleviate them. With a dwindling and aging workforce, agrotech collaboration can make agriculture more appealing to younger generations.

- What are the core agricultural issues in India and Japan?

- What are the potentials of India and Japan agritech collaboration?

- How will the data-driven agritech startup ecosystems in India and Japan reshape the agricultural landscape?

- What are the strengths, opportunities, and challenges in the India and Japan agritech startup ecosystems?

2. Literature Study

2.1. Deciphering Agritech and Agrifood Tech

- Physical agritech application: Disruptive technologies replace human labor and include agritech hardware, which is synonymous with machinery and tools for agricultural tasks.

- Cyber agritech applications: These are related to platform software and are synonymous with data analytics and decision support systems for performing agricultural tasks.

- Cyber-physical agritech applications: These combine the above two application types. These are the smart agricultural machinery or robotics, including hardware and software for data analysis, predictive/prescriptive tailored decision-making, advice, and recommendations [18].

2.2. Data-Driven Farming—the Need of the Hour and Its Significance

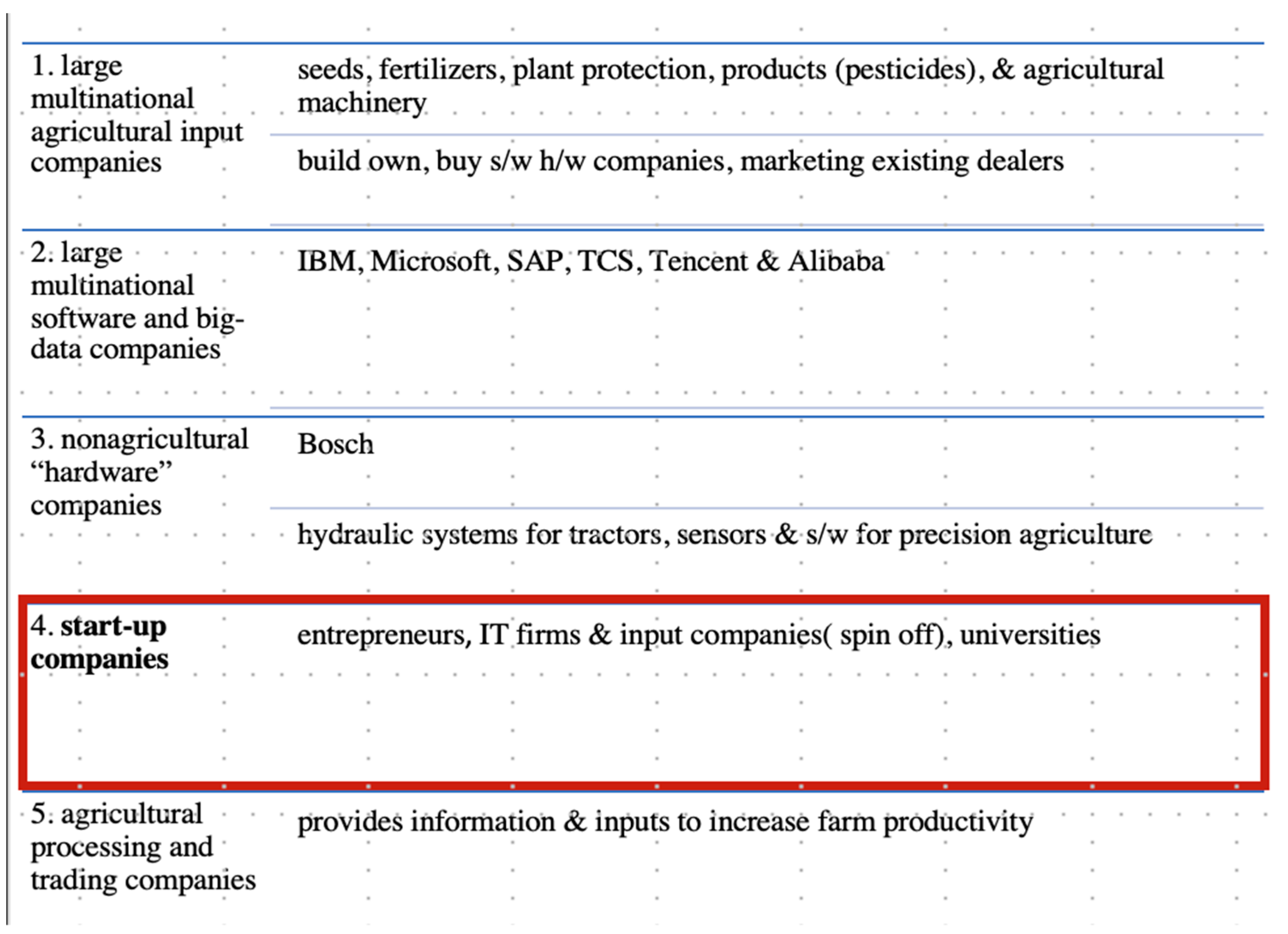

2.3. Who Drives Agricultural Technology?

- Large multinational agricultural input companies: These companies are suppliers of seeds, fertilizers, agricultural machinery, and pesticides. They mostly build digital agricultural services internally and outsource the development of small software or hardware to external companies. They market their existing digital agricultural technologies and services through their existing network of dealers.

- Large multinational software and big-data companies: These are companies like TCS in India, Alibaba in China, and Microsoft and IBM in the USA that are investing in digital agricultural technologies.

- Nonagricultural “hardware” companies: Some companies like Bosch, which initially provided hydraulic systems for tractors, now provide sensors and software for precision agriculture.

- Startup companies: These are the origins for providing the most creative digital agricultural technologies. The startups are established by independent entrepreneurs or financed by venture capitalists or multinational input and tech firms.

- Agricultural processing and trading companies: These companies provide inputs and information to improve farm productivity and the quality of products that farmers sell to them.

2.4. What Do Data-Driven Agritech Startups Do?

3. Methodology

4. Analysis and Results

5. Discussion

- RQ 1: What are the core agricultural issues in India and Japan?

- RQ 2: What are the potentials of India and Japan agritech collaboration?

- RQ 3: How will data-driven agritech startup ecosystem in India and Japan reshape the agricultural landscape?

- RQ 4: What are the strengths, opportunities, and challenges in the India and Japan agritech startup ecosystems?

6. Interview Results

6.1. Tenchijin (Japan)

6.2. Terracemile (Japan)

6.3. SATSURE (India)

6.4. Farmonaut (India)

7. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- UN. The Sustainable Development Goals Report; United Nations Department of Economic and Social Affairs: New York, NY, USA, 2021. [Google Scholar]

- McKinsey. Digital America: A Tale of the Haves and Have-Mores. 2015. Available online: https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/digital-america-a-tale-of-the-haves-and-have-mores (accessed on 18 June 2023).

- Burwood-Taylor, L. What Is Agri-FoodTech? 2017. Available online: https://agfundernews.com/what-is-agrifood-tech (accessed on 1 September 2023).

- Lezoche, M.; Hernandez, J.E.; Díaz, M.D.M.E.A.; Panetto, H.; Kacprzyk, J. Agri-food 4.0: A survey of the supply chains and technologies for the future agriculture. Comput. Ind. 2020, 117, 103187. [Google Scholar] [CrossRef]

- Clara Eli-Chukwu, N. Applications of Artificial Intelligence in Agriculture: A Review. Technol. Appl. Sci. Res. 2019, 9, 4377–4383. [Google Scholar] [CrossRef]

- Apat, S.K.; Mishra, J.; Raju, K.S.; Padhy, N. An Artificial Intelligence-based Crop Recommendation System using Machine Learning. J. Sci. Ind. Res. 2023, 82, 558–567. [Google Scholar] [CrossRef]

- Arvanitis, K.G.; Symeonaki, E.G. Agriculture 4.0: The Role of Innovative Smart Technologies Towards Sustainable Farm Management. Open Agric. J. 2020, 14, 130–135. [Google Scholar] [CrossRef]

- Da Silveira, F.; Lermen, F.H.; Gonçalves Amaral, F. An overview of agriculture 4.0 development: Systematic review of descriptions, technologies, barriers, advantages, and disadvantages. Comput. Electron. Agric. 2021, 189, 106405. [Google Scholar] [CrossRef]

- Mühl, D.D.; de Oliveira, L. A bibliometric and thematic approach to agriculture 4.0. Heliyon 2022, 8, e09369. [Google Scholar] [CrossRef]

- Tetteh Quarshie, P.; Abdulai, A.R.; Duncan, E.; Bahadur KC, K.; Roth, R.; Sneyd, A.; D. G Fraser, E. Myth or reality? The Digitalization of Climate-Smart Agriculture (DCSA) practices in smallholding agriculture in the Bono East Region of Ghana. Clim. Risk Manag. 2023, 42, 100553. [Google Scholar] [CrossRef]

- Maraveas, C.; Piromalis, D.; Arvanitis, K.G.; Bartzanas, T.; Loukatos, D. Applications of IoT for optimized greenhouse environment and resources management. Comput. Electron. Agric. 2022, 198, 106993. [Google Scholar] [CrossRef]

- Finger, R.; Swinton, S.M.; El Benni, N.; Walter, A. Precision Farming at the Nexus of Agricultural Production and the Environment. Annu. Rev. Resour. Econ. 2019, 11, 313–335. [Google Scholar]

- JICA. 2022. Available online: https://www.jica.go.jp/ (accessed on 18 May 2024).

- World Bank. Data-Driven Digital Agriculture; World Bank: Washington, DC, USA, 2023. [Google Scholar]

- Kaloxylos, A.; Eigenmann, R.; Teye, F.; Politopoulou, Z.; Wolfert, S.; Shrank, C.; Dillinger, M.; Lampropoulou, I.; Antoniou, E.; Pesonen, L.; et al. Farm management systems and the Future Internet era. Comput. Electron. Agric. 2012, 89, 130–144. [Google Scholar] [CrossRef]

- Wolfert, S.; Ge, L.; Verdouw, C.; Bogaardt, M.J. Big Data in Smart Farming—A review. Agric. Syst. 2017, 153, 69–80. [Google Scholar] [CrossRef]

- Tsolakis, N.; Bechtsis, D.; Srai, J.S. Intelligent autonomous vehicles in digital supply chains: From conceptualisation, to simulation modelling, to real-world operations. Bus. Process Manag. J. 2017, 25, 414–437. [Google Scholar] [CrossRef]

- Spanaki, K.; Sivarajah, U.; Fakhimi, M.; Despoudi, S.; Irani, Z. Disruptive technologies in agricultural operations: A systematic review of AI-driven AgriTech research. Ann. Oper. Res. Res. 2022, 308, 491–524. [Google Scholar] [CrossRef]

- AgFunder. AgriFoodTech Investment Report; AgFunder: San Francisco, CA, USA, 2022. [Google Scholar]

- Steup, R.; Dombrowski, L.; Su, N.M. Feeding the world with data: Visions of data-driven farming. In Proceedings of the 2019 on Designing Interactive Systems Conference, San Diego, CA, USA, 23–28 June 2019; pp. 1503–1515. [Google Scholar]

- Pham, X.; Stack, M. How data analytics is transforming agriculture. Bus. Horiz. 2018, 61, 125–133. [Google Scholar] [CrossRef]

- Sonka, S. Big Data: From hype to agricultural tool. Farm Policy J. 2015, 12, 1–9. [Google Scholar]

- Renwick, A. A European Perspective on the Economics of Big Data. Farm Policy J. 2015, 12, 11–19. [Google Scholar]

- Boshkoska, B.M.; Liu, S.; Zhao, G.; Fernandez, A.; Gamboa, S.; del Pino, M.; Zarate, P.; Hernandez, J.; Chen, H. A decision support system for evaluation of the knowledge sharing crossing boundaries in agri-food value chains. Comput. Indus 2019, 64, 110. [Google Scholar] [CrossRef]

- Jiménez, D.; Delerce, S.; Dorado, H.; Cock, J.; Muñoz, L.A.; Agamez, A.; Jarvis, A. A scalable scheme to implement data-driven agriculture for small-scale farmers. Glob. Food Secur. 2019, 23, 256–266. [Google Scholar] [CrossRef]

- Mehrabi, Z.; McDowell, M.J.; Ricciardi, V.; Levers, C.; Martinez, J.D.; Mehrabi, N.; Wittman, H.; Ramankutty, N.; Jarvis, A. The global divide in data-driven farming. Nat. Sustain. 2020, 4, 154–160. [Google Scholar] [CrossRef]

- Birner, R.; Daum, T.; Pray, C. Who drives the digital revolution in agriculture? A review of supply-side trends, players and challenges. Appl. Econ. Perspect. Policy 2021, 43, 1260–1285. [Google Scholar] [CrossRef]

- Arksey, H.; O’Malley, L. Scoping studies: Towards a methodological framework. Int. J. Soc. Res. Methodol. 2005, 8, 19–32. [Google Scholar] [CrossRef]

- Braun, V.; Clarke, V. Using thematic analysis in psychology. Qual. Res. Psychol. 2006, 3, 77–101. [Google Scholar] [CrossRef]

- Pilyugina, A.V.; Vasyutkina, L.V.; Borodin, D.V.; Poletaev, S.A. Agricultural Technology (AgriTech) Startup and Disruptive Technology as a Direction of Agricultural Industry Development. Smart Innov. Syst. Technol. 2022, 264, 245–253. [Google Scholar]

- Campoverde, D.J.M.; Abad, C.R.V. Study of Startups in the cloud to innovate (IoT, data in the cloud). J. Bus. Entrep. Stud. 2023, 7, 1–6. [Google Scholar]

- Tripathi, N. BigHaat: A Crop Advisory For Farmers—Forbes India. 2022. Available online: https://www.forbesindia.com/article/agritech-special-2022/bighaat-a-crop-advisory-for-farmers/79567/1 (accessed on 1 September 2023).

- Jain, R. Growth of AgriTech Startups in India: Government Initiatives, Leading Agritech Startups and More. 2022. Available online: https://startuptalky.com/indian-agritech-startups-growth/ (accessed on 1 September 2023).

- ThinkAg. AgFoodTech in India: Innovation and Investment Report; ThinkAg: Headingley, MB, Canada, 2023. [Google Scholar]

- Temmen, N.; Schilling, J. Smart Farming Technology in Japan and Opportunities for EU Companies. 2021. Available online: http://www.EUbusinessinJapan.eu (accessed on 1 September 2023).

- MoEA India. India-Japan Sustainable Development Initiative for the North Eastern Region of India. 2022. Available online: https://www.mea.gov.in/bilateral-documents.htm?dtl/34993/IndiaJapan+Sustainable+Development+Initiative++for+the+North+Eastern+Region+of+India (accessed on 22 May 2024).

- JICA. A Revolution for a Billion People—Agri-Tech Challenges in India/About JICA; JICA: Tokyo, Japan, 2022. [Google Scholar]

- Medvediev, A. Agritech—Towards Transforming Indian Agriculture; EY—Ernst & Young Private Limited: Bengaluru, India, 2020. [Google Scholar]

- World Economic Forum. Scaling Agritech at the Last Mile: Converging Efforts for Farmers’ Prosperity; World Economic Forum: Geneva, Switzerland, 2023. [Google Scholar]

- Adhya, P.S.; Sahoo, S.K. Agritech Startups in India: A Revolutionary Idea Giving Birth to Agripreneurs. Int. J. Innov. Res. Technol. 2022, 9, 687–702. [Google Scholar]

- Bholane, K.P. Growth, Problems and Prospects for Agri Startups in India. Int. J. Res. Manag. Soc. Sci. 2023, 11, 133–136. [Google Scholar]

- Inoue, H.; Yamaguchi, E. Evaluation of the Small Business Innovation Research Program in Japan. SAGE Open 2017, 7, 2158244017690791. [Google Scholar] [CrossRef]

- Techijin. Solving Challenges with Smart Big Data and a Perspective from Space. 2023. Available online: https://tenchijin.co.jp/?hl=en (accessed on 1 September 2023).

- Terracemile. Terracemile. 2023. Available online: https://terracemile.jp/ (accessed on 1 September 2023).

- SatSure. Delivering Decision Intelligence from Space to Create an Impact. 2023. Available online: https://www.satsure.co/ (accessed on 1 September 2023).

- Farmonaut. Satellite Based Crop Health Monitoring, Crop Issue Identification System, Farmers’ Social Network. 2023. Available online: https://farmonaut.com/ (accessed on 1 September 2023).

| Country | No. of Patents Originating (in %) |

|---|---|

| China | 70 |

| United States | 6 |

| India | 4 |

| South Korea | 3 |

| Russia | 3 |

| Germany | 3 |

| Japan | 1 |

| European Union | 1 |

| Others | 4 |

| Agritech Startup Ecosystem in India | Agritech Startup Ecosystem in Japan | |

|---|---|---|

| CATALYST serve as opportunities for agritech startups to provide. innovative solutions |

|

|

| MARKET |

|

|

| TECHNOLOGY |

|

|

| USE CASE (Major) |

|

|

| GAP AREA |

|

|

| SYNERGY (India and Japan) | Drone technology is receiving a large amount of attention in both Japan and India Environmental solution and climate resilience agricultural opportunities could be explored for sustainability | |

| Startup | Country | Key Solution | Technology | Customer Segments | Challenges Faced by Respective Country’s Agriculture Community |

|---|---|---|---|---|---|

| Terracemile | Japan | Digital Infrastructure for data interpretation | Data, Analytics | Agricultural equipment manufacturer, Agri corporation, agro cooperatives, government | Income structure and supply chain not adapted to environment, and production structure’s dependency on foreign countries |

| Tenchijin | Japan | Data based insights from satellite data and AI powered analysis | Satellite, Remote Sensing | Governments, Companies, Infrastructure management companies and Renewable Energy business | Shortage of successors due to an aging population and climate change |

| Farmonaut | India | Satellite based health monitoring and remote sensing | Satellite based sensing and tele-communication network | Farmers, agricultural consumer goods companies | Small land ownership, Climate change, Lack of awareness on solutions available |

| Satsure | India | Farm credit risk assessment, monitoring health and predicting crop yield through satellite data analysis | Satellite Remote Sensing, Machine Learning, Artificial | Banks, Financial institutions and government. | Access to market, access to timely and reasonable credit, and policy and schemes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suresh, D.; Choudhury, A.; Zhang, Y.; Zhao, Z.; Shaw, R. The Role of Data-Driven Agritech Startups—The Case of India and Japan. Sustainability 2024, 16, 4504. https://doi.org/10.3390/su16114504

Suresh D, Choudhury A, Zhang Y, Zhao Z, Shaw R. The Role of Data-Driven Agritech Startups—The Case of India and Japan. Sustainability. 2024; 16(11):4504. https://doi.org/10.3390/su16114504

Chicago/Turabian StyleSuresh, Divya, Abhishek Choudhury, Yinjia Zhang, Zhiying Zhao, and Rajib Shaw. 2024. "The Role of Data-Driven Agritech Startups—The Case of India and Japan" Sustainability 16, no. 11: 4504. https://doi.org/10.3390/su16114504

APA StyleSuresh, D., Choudhury, A., Zhang, Y., Zhao, Z., & Shaw, R. (2024). The Role of Data-Driven Agritech Startups—The Case of India and Japan. Sustainability, 16(11), 4504. https://doi.org/10.3390/su16114504