How Can Financial Innovation Curb Carbon Emissions in China? Exploring the Mediating Role of Industrial Structure Upgrading from a Spatial Perspective

Abstract

1. Introduction

1.1. Financial Innovation and Carbon Emissions

1.2. Industrial Structure Upgrading and Carbon Emissions

1.3. Mediating Role of Industrial Structure Upgrading

1.4. Discussion on Existing Literature

2. Materials and Methods

2.1. Models

2.1.1. Spatial Durbin Model

2.1.2. Mediation Models with Spatial Effect

2.2. Selection and Measurement of Variables

2.2.1. Dependent Variable

2.2.2. Independent Variable

2.2.3. Mediating Variable

- Standardization of data. In order to evaluate the financial innovation capacity, the individual indicators need to be standardized. The specific methods of processing are Equation (5) for positive indicators and Equation (6) for inverse indicators.

- Varying indicators for weighting. Xij denotes the value of the j-th indicator of the sample. m and n represent the number of samples and the number of indicators, respectively, as shown in Equation (7).

- Calculating the entropy value of each indicator.

- Standardizing entropy values.

- Calculating the weights for indicator Xj.

2.2.4. Control Variables

3. Results

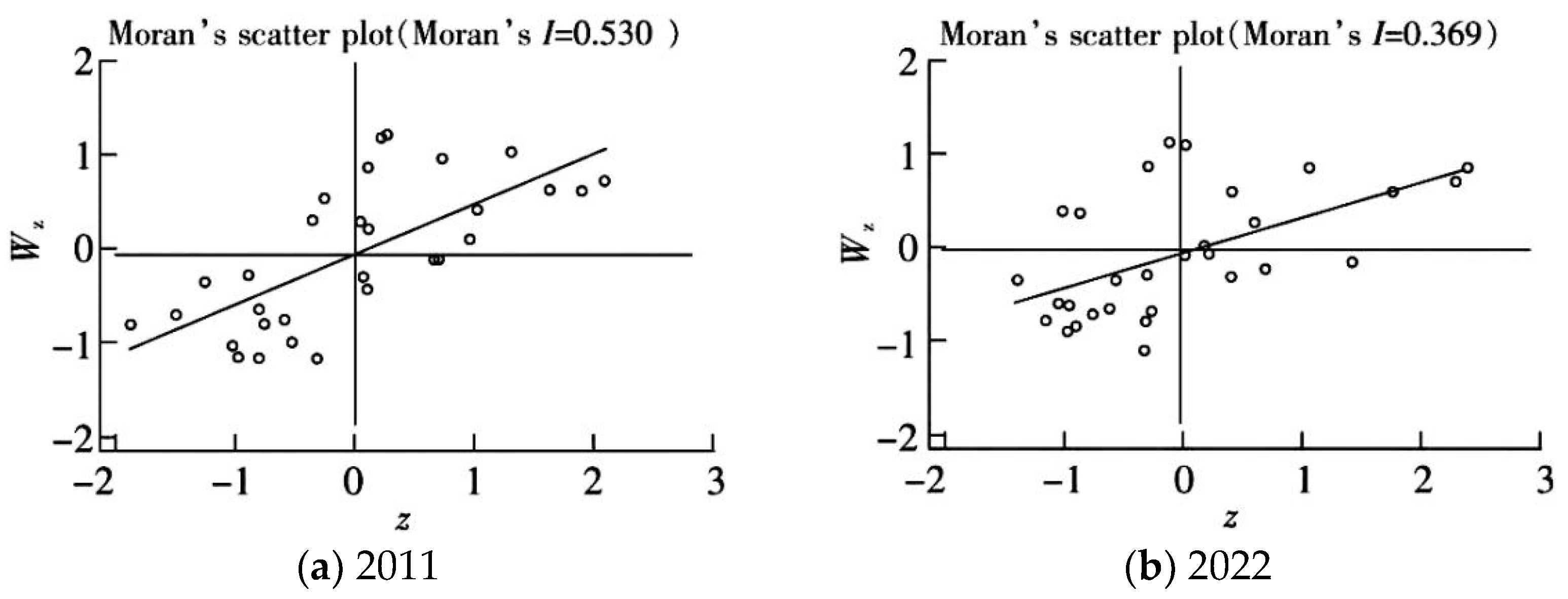

3.1. Spatial Clustering Analysis

3.2. Overall Regression Analysis of Fixed Panel Data based on Spatial Durbin Model

3.3. Test for Mediating Effect

3.4. Robustness Test

4. Discussion

4.1. Research Findings

4.2. Contribution

4.3. Limitations and Prospects

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Wilson, C. Disruptive low-carbon innovations. Energy Res. Soc. Sci. 2018, 37, 216–223. [Google Scholar] [CrossRef]

- Markandya, A.; Arto, I.; Gonzalez-Eguino, M.; Roman, M.V. Towards a green energy economy? Tracking the employment effects of low-carbon technologies in the European Union. Appl. Energy 2016, 179, 1342–1350. [Google Scholar] [CrossRef]

- Manaf, N.A.; Abbas, A. Economic and environmental sustainability of low-carbon power generation: Relevancy in the Malaysia green technology master plan (GTMP). J. Chem. Technol. Biotechnol. 2019, 94, 1425–1432. [Google Scholar] [CrossRef]

- Naqi, A.; Jang, J.G. Recent progress in green cement technology utilizing low-carbon emission fuels and raw materials: A review. Sustainability 2019, 11, 537. [Google Scholar] [CrossRef]

- Azam, A.; Rafiq, M.; Shafique, M.; Yuan, J. Mitigating carbon emissions in China: The role of clean energy, technological innovation, and political-institutional quality. Front. Environ. Sci. 2022, 10, 814439. [Google Scholar] [CrossRef]

- Zhang, M.; Liu, Y. Influence of digital finance and green technology innovation on China’s carbon emission efficiency: Empirical analysis based on spatial metrology. Sci. Total Environ. 2022, 838, 156463. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W.; Xu, H. Effects of land urbanization and land finance on carbon emissions: A panel data analysis for Chinese provinces. Land Use Policy 2017, 63, 493–500. [Google Scholar] [CrossRef]

- Okere, K.I.; Onuoha, F.C.; Muoneke, O.B.; Oyeyemi, A.M. Towards sustainability path in Argentina: The role of finance, energy mix, and industrial value-added in low or high carbon emission-application of DARDL simulation. Environ. Sci. Pollut. Res. 2021, 28, 55053–55071. [Google Scholar] [CrossRef] [PubMed]

- Yuan, G.; Ye, Q.; Sun, Y. Financial innovation, information screening and industries’ green innovation-industry-level evidence from the OECD. Technol. Forecast. Soc. 2021, 171, 120998. [Google Scholar] [CrossRef]

- Ullah, H.; Wang, Z.; Mohsin, M.; Jiang, W.; Abbas, H. Multidimensional perspective of green financial innovation between green intellectual capital on sustainable business: The case of Pakistan. Environ. Sci. Pollut. Res. 2022, 29, 5552–5568. [Google Scholar] [CrossRef]

- Zhang, W.; Zhu, Z.R.; Liu, X.M.; Cheng, J. Can green finance improve carbon emission efficiency? Environ. Sci. Pollut. Res. 2022, 29, 68976–68989. [Google Scholar] [CrossRef] [PubMed]

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Energy 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Song, X.L.; Yao, Y.M.; Wu, X.K. Digital finance, technological innovation, and carbon dioxide emissions. Econ. Anal. Policy 2023, 80, 482–494. [Google Scholar] [CrossRef]

- Hsu, P.-H.; Tian, X.; Xu, Y. Financial development and innovation: Cross-country evidence. J. Financ. Econ. 2014, 112, 116–135. [Google Scholar] [CrossRef]

- Frame, W.S.; White, L.J. Empirical studies of financial innovation: Lots of talk, little action. J. Econ. Lit. 2004, 42, 116–144. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R.; Michalopoulos, S. Financial innovation and endogenous growth. J. Financ. Intermed. 2015, 24, 1–24. [Google Scholar] [CrossRef]

- Hall, S.; Foxon, T.J.; Bolton, R. Investing in low-carbon transitions: Energy finance as an adaptive market. Clim. Policy 2017, 17, 280–298. [Google Scholar] [CrossRef]

- Ben Arfi, W.; Hikkerova, L.; Sahut, J.-M. External knowledge sources, green innovation and performance. Technol. Forecast. Soc. 2018, 129, 210–220. [Google Scholar] [CrossRef]

- Cegarra-Navarro, J.-G.; Reverte, C.; Gomez-Melero, E.; Wensley, A.K.P. Linking social and economic responsibilities with financial performance: The role of innovation. Eur. Manag. J. 2016, 34, 530–539. [Google Scholar] [CrossRef]

- Oskouei, Z.H. Linking social and economic responsibilities and financial performance: The assisting role of innovation for an oil engineering and development company. Int. J. Financ. Econ. 2019, 24, 1345–1354. [Google Scholar] [CrossRef]

- Erikson, S.L.; Johnson, L. Will financial innovation transform pandemic response? Lancet Infect. Dis. 2020, 20, 529–530. [Google Scholar] [CrossRef] [PubMed]

- Hussain, M.; Papastathopoulos, A. Organizational readiness for digital financial innovation and financial resilience. Int. J. Prod. Econ. 2022, 243, 108326. [Google Scholar] [CrossRef]

- Li, Z.; Sun, L.; Geng, Y.; Dong, H.; Ren, J.; Liu, Z.; Tian, X.; Yabar, H.; Higano, Y. Examining industrial structure changes and corresponding carbon emission reduction effect by combining input-output analysis and social network analysis: A comparison study of China and Japan. J. Clean. Prod. 2017, 162, 61–70. [Google Scholar] [CrossRef]

- Dong, B.; Xu, Y.; Fan, X. How to achieve a win-win situation between economic growth and carbon emission reduction: Empirical evidence from the perspective of industrial structure upgrading. Environ. Sci. Pollut. Res. 2020, 27, 43829–43844. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Tang, L.; Liu, G. Carbon dioxide emissions reduction through technological innovation: Empirical evidence from Chinese provinces. Int. J. Environ. Res. Public Health 2022, 19, 9543. [Google Scholar] [CrossRef] [PubMed]

- Zheng, Y.; Xiao, J.; Huang, F.; Tang, J. How do resource dependence and technological progress affect carbon emissions reduction effect of industrial structure transformation? Empirical research based on the rebound effect in China. Environ. Sci. Pollut. Res. 2022, 30, 81823–81838. [Google Scholar] [CrossRef] [PubMed]

- Jing, L.; Jia, W.; Bo, Z. Are industrial structure adjustment and technical progress conducive to environmental improvement? J. Glob. Inf. Manag. 2022, 30. [Google Scholar] [CrossRef]

- Chen, L.; Xu, L.; Xu, Q.; Yang, Z. Optimization of urban industrial structure under the low-carbon goal and the water constraints: A case in Dalian, China. J. Clean. Prod. 2016, 114, 323–333. [Google Scholar] [CrossRef]

- Wang, K.; Wu, M.; Sun, Y.; Shi, X.; Sun, A.; Zhang, P. Resource abundance, industrial structure, and regional carbon emissions efficiency in China. Resour. Policy 2019, 60, 203–214. [Google Scholar] [CrossRef]

- Tian, X.; Bai, F.L.; Jia, J.H.; Liu, Y.; Shi, F. Realizing low-carbon development in a developing and industrializing region: Impacts of industrial structure change on CO2 emissions in southwest China. J. Environ. Manag. 2019, 233, 728–738. [Google Scholar] [CrossRef]

- Morshedy, A.S.; Taha, M.H.; El-Aty, D.M.A.; Bakry, A.; El Naggar, A.M.A. Solid waste sub-driven acidic mesoporous activated carbon structures for efficient uranium capture through the treatment of industrial phosphoric acid. Environ. Technol. 2021, 21, 101363. [Google Scholar] [CrossRef]

- Sun, J.; Tang, D.; Kong, H.; Boamah, V. Impact of industrial structure upgrading on green total factor productivity in the Yangtze river economic belt. Int. J. Environ. Res. Public Health 2022, 19, 3718. [Google Scholar] [CrossRef]

- Casotto, C.; Silva, V.; Crowley, H.; Nascimbene, R.; Pinho, R. Seismic fragility of Italian RC precast industrial structures. Eng. Struct. 2015, 94, 122–136. [Google Scholar] [CrossRef]

- Borgersen, T.-A.; King, R.M. Industrial structure and jobless growth in transition economies. Post-Communist Econ. 2016, 28, 520–536. [Google Scholar] [CrossRef]

- Frizziero, L.; Donnici, G.; Liverani, A.; Alessandri, G.; Menozzi, G.C.; Varotti, E. Developing innovative crutch using IDES (industrial design structure) methodology. Appl. Sci. 2019, 9, 5032. [Google Scholar] [CrossRef]

- Hu, W.; Tian, J.; Chen, L. An industrial structure adjustment model to facilitate high-quality development of an eco-industrial park. Sci. Total Environ. 2021, 766, 142502. [Google Scholar] [CrossRef] [PubMed]

- Nezhad, N.G.; Abd Rahman, R.N.Z.R.; Normi, Y.M.; Oslan, S.N.; Shariff, F.M.; Leow, T.C. Thermostability engineering of industrial enzymes through structure modification. Appl. Microbiol. Biotechnol. 2022, 106, 4845–4866. [Google Scholar] [CrossRef] [PubMed]

- Busch, T. Industrial ecology, climate adaptation, and financial risk. J. Ind. Ecol. 2020, 24, 285–290. [Google Scholar] [CrossRef]

- Khan, H.H.; Ahmad, R.B.; Gee, C.S. Market structure, financial dependence and industrial growth: Evidence from the banking industry in emerging Asian economies. PLoS ONE 2016, 11, e0160452. [Google Scholar] [CrossRef] [PubMed]

- Jiang, M.; Luo, S.; Zhou, G. Financial development, ofdi spillovers and upgrading of industrial structure. Technol. Forecast. Soc. 2020, 155, 119974. [Google Scholar] [CrossRef]

- Gong, Q.; Lin, J.Y.; Zhang, Y. Financial structure, industrial structure, and economic development: A new structural economics perspective. Manch. Sch. 2019, 87, 183–204. [Google Scholar] [CrossRef]

- Yumei, H.; Iqbal, W.; Irfan, M.; Fatima, A. The dynamics of public spending on sustainable green economy: Role of technological innovation and industrial structure effects. Environ. Sci. Pollut. Res. 2022, 29, 22970–22988. [Google Scholar] [CrossRef] [PubMed]

- Jiang, H.; Chen, Z.H.; Liang, Y.W.; Zhao, W.C.; Liu, D.; Chen, Z.Y. The impact of industrial structure upgrading and digital economy integration on China’s urban carbon emissions. Front. Ecol. Evol. 2023, 11. [Google Scholar] [CrossRef]

- Gu, R.D.; Li, C.F.; Yang, Y.Y.; Zhang, J.; Liu, K. Impact of digital economy development on carbon emission intensity in the Beijing-Tianjin-Hebei region: A mechanism analysis based on industrial structure optimization and green innovation. Environ. Sci. Pollut. Res. 2023, 30, 41644–41664. [Google Scholar] [CrossRef] [PubMed]

- Zhu, B.; Zhang, T.L. The impact of cross-region industrial structure optimization on economy, carbon emissions and energy consumption: A case of the Yangtze River Delta. Sci. Total Environ. 2021, 778, 146089. [Google Scholar] [CrossRef] [PubMed]

- Chang, H.; Ding, Q.Y.; Zhao, W.Z.; Hou, N.; Liu, W.W. The digital economy, industrial structure upgrading, and carbon emission intensity-empirical evidence from China’s provinces. Energy Strategy Rev. 2023, 50, 101218. [Google Scholar] [CrossRef]

- Bhatti, U.A.; Marjan, S.; Wahid, A.; Syam, M.S.; Huang, M.X.; Tang, H.; Hasnain, A. The effects of socioeconomic factors on particulate matter concentration in China’s: New evidence from spatial econometric model. J. Clean. Prod. 2023, 417, 137969. [Google Scholar] [CrossRef]

- An, H.; Xu, J.; Ma, X. Does technological progress and industrial structure reduce electricity consumption? Evidence from spatial and heterogeneity analysis. Struct. Chang. Econ. Dynam. 2020, 52, 206–220. [Google Scholar] [CrossRef]

- Ciminelli, J.T.; Love, T.; Wu, T.T. Social network spatial model. Spat. Stat. 2019, 29, 129–144. [Google Scholar] [CrossRef]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Energy 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Miao, X.; Feng, E.H.; Siu, Y.L.; Li, S.S.; Wong, C.W.Y. Can China’s carbon intensity constraint policies improve carbon emission performance? Evidence from regional carbon emissions. J. Environ. Manag. 2023, 348, 119268. [Google Scholar] [CrossRef]

- Hailemariam, A.; Dzhumashev, R.; Shahbaz, M. Carbon emissions, income inequality and economic development. Empir. Econ. 2020, 59, 1139–1159. [Google Scholar] [CrossRef]

- Wu, Y.Z.; Shi, K.F.; Cui, Y.Z.; Liu, S.R.; Liu, L.L. Differentiated effects of morphological and functional polycentric urban spatial structure on carbon emissions in China: An empirical analysis from remotely sensed nighttime light approach. Int. J. Digit. Earth 2023, 16, 532–551. [Google Scholar] [CrossRef]

- Allen, F.; Walther, A. Financial Architecture and Financial Stability. Annu. Rev. Financ. Econ. 2021, 13, 129–151. [Google Scholar] [CrossRef]

- Pitluck, A.Z. The interpretive and relational work of financial innovation: A resemblance of assurance in Islamic finance. J. Cult. Econ. 2023, 16, 793–811. [Google Scholar] [CrossRef]

- Shiller, R.J. Capitalism and financial innovation. Financ. Anal. J. 2013, 69, 21–25. [Google Scholar] [CrossRef]

- Wei, S.P.; Jiang, F.X.; Pan, J.W.; Cai, Q.H. Financial innovation, government auditing and corporate high-quality development: Evidence from China. Financ. Res. Lett. 2023, 58, 104567. [Google Scholar] [CrossRef]

- Hardy, B.; Sever, C. Financial crises and innovation. Eur. Econ. Rev. 2021, 138, 103856. [Google Scholar] [CrossRef]

- Westerholm, M.; Castillo, M.D.P.; Andersson, A.C.; Nilsen, P.J.; Schnurer, A. Effects of thermal hydrolytic pre-treatment on biogas process efficiency and microbial community structure in industrial- and laboratory-scale digesters. Waste Manag. 2019, 95, 150–160. [Google Scholar] [CrossRef] [PubMed]

- Atsu, F.; Adams, S. Financial development and innovation: Do institutions and human capital matter. Heliyon 2023, 9, e19015. [Google Scholar] [CrossRef]

- Bickenbach, F.; Mbelu, A.; Nunnenkamp, P. Is foreign aid concentrated increasingly on needy and deserving recipient countries? An analysis of Theil indices, 1995–2015. World Dev. 2019, 115, 1–16. [Google Scholar] [CrossRef]

- Li, G.; Wei, W. Financial development, openness, innovation, carbon emissions, and economic growth in China. Energy Econ. 2021, 97, 105194. [Google Scholar] [CrossRef]

- Ali, R.; Meraj, M.; Mubarik, M.S. In the pursuit of financial innovation-Led financial inclusion: A proposed construct for financial trust. Borsa Istanb. Rev. 2023, 23, 1399–1413. [Google Scholar] [CrossRef]

- Babus, A.; Hachem, K. Markets for financial innovation. J. Econ. Theory 2023, 208, 105615. [Google Scholar] [CrossRef]

- Fang, H.; Jiang, C.; Hussain, T.; Zhang, X.; Huo, Q. Input digitization of the manufacturing industry and carbon emission intensity based on testing the world and developing countries. Int. J. Environ. Res. Public Health 2022, 19, 12855. [Google Scholar] [CrossRef] [PubMed]

- Kollenbach, G.; Schopf, M. Unilaterally optimal climate policy and the green paradox. J. Environ. Econ. Manag. 2022, 113, 102649. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Newell, P.; Carley, S.; Fanzo, J. Equity, technological innovation and sustainable behaviour in a low-carbon future. Nat. Hum. Behav. 2022, 6, 326–337. [Google Scholar] [CrossRef] [PubMed]

- Wahab, S. Does technological innovation limit trade-adjusted carbon emissions? Environ. Sci. Pollut. Res. 2021, 28, 38043–38053. [Google Scholar] [CrossRef] [PubMed]

- Irshaid, J.; Mochizuki, J.; Schinko, T. Challenges to local innovation and implementation of low-carbon energy-transition measures: A tale of two Austrian regions. Energy Policy 2021, 156, 112432. [Google Scholar] [CrossRef]

- Sun, Z.; Cao, C.; He, Z.; Feng, C. Examining the coupling coordination relationship between digital inclusive finance and technological innovation from a spatial spillover perspective: Evidence from China. Emerg. Mark. Financ. Trade 2023, 59, 1219–1231. [Google Scholar] [CrossRef]

- Zhou, Y.; Kong, Y.; Sha, J.; Wang, H. The role of industrial structure upgrades in eco-efficiency evolution: Spatial correlation and spillover effects. Sci. Total Environ. 2019, 687, 1327–1336. [Google Scholar] [CrossRef] [PubMed]

- Chishti, M.Z.; Sinha, A. Do the shocks in technological and financial innovation influence the environmental quality? Evidence from BRIGS economies. Technol. Soc. 2022, 68, 101828. [Google Scholar] [CrossRef]

- Gonzalez, O.; Millechek, J.R.; Georgeson, A.R. Estimating latent baseline-by-treatment interactions in statistical mediation analysis. Struct. Equ. Model. 2023, 30, 914–925. [Google Scholar] [CrossRef]

- Qin, X. An introduction to causal mediation analysis. Asia Pac. Educ. Rev. 2024. [Google Scholar] [CrossRef]

- Alamgir, M.; Cheng, M.C. Do green bonds play a role in achieving sustainability? Sustainability 2023, 15, 10177. [Google Scholar] [CrossRef]

- Teti, E.; Baraglia, I.; Dallocchio, M.; Mariani, G. The green bonds: Empirical evidence and implications for sustainability. J. Clean. Prod. 2022, 366, 132784. [Google Scholar] [CrossRef]

- Isensee, J.; Datseris, G.; Parlitz, U. Predicting spatio-temporal time series using dimension reduced local states. J. Nonlinear Sci. 2020, 20, 713–735. [Google Scholar] [CrossRef]

- Harikumar, E.; Panja, S.K.; Rajagopal, V. Time-space noncommutativity and casimir effect. Nucl. Phys. B 2020, 950, 114842. [Google Scholar] [CrossRef]

- Balsa-Barreiro, J.; Li, Y.; Morales, A.; Pentland, A.S. Globalization and the shifting centers of gravity of world’s human dynamics: Implications for sustainability. J. Clean. Prod. 2019, 239, 117923. [Google Scholar] [CrossRef]

| Dimensions | Indicators | Unit |

|---|---|---|

| Foundations of Innovation | Non-performing loan ratio | % |

| Current ratio | % | |

| Capital adequacy ratio | % | |

| New local financial regulation documents | pcs | |

| Number of non-compliant financial institutions in the jurisdiction | pcs | |

| R&D Strength | Percentage of R&D staff | % |

| Percentage of middle and senior technical staff | % | |

| Success rate of R&D | % | |

| Incentive actions by companies for innovation | pcs | |

| Technological Advancement | Value of annual financial innovation as a percentage of R&D expenses | % |

| Number of joint developments of innovative financial products | pcs | |

| Replacement rate by e-commerce | % | |

| Replacement rate by Internet finance | % | |

| Number of financial patents | pcs | |

| Number of financial papers published | pcs | |

| Market Growth | Market capacity for new products | Billion¥ |

| Market share of new products | % | |

| Growth rate of operating income from new products | % | |

| Ratio of operating income from new products to total revenue | % | |

| Input–output Indicators for Innovation | Growth rate of R&D expenses | % |

| R&D expenses as a percentage of operating income | % | |

| R&D expenses as a percentage of net profit | % | |

| Growth rate of profit from new products | % |

| Dimensions | Indicators | Unit | Weights Determined by Entropy Method |

|---|---|---|---|

| Rationalization of Industrial Structures | Theil index | / | 0.133 |

| Advancement of Industrial Structures | GDP of high-tech industries as a percentage of total GDP GDP of secondary and tertiary sectors as a percentage of total GDP | % | 0.156 |

| % | 0.114 | ||

| Efficiency of Industrial Structures | Input–output ratio of the secondary sector Input–output ratio of the tertiary sector Output per capita in the secondary sector Output per capita in the tertiary sector | / | 0.085 |

| / | 0.187 | ||

| Billion¥/10,000 people | 0.149 | ||

| Billion¥/10,000 people | 0.176 |

| Categories | Variables | Notes | Calculations |

|---|---|---|---|

| Dependent Variable | Carbon emissions | CE | Natural log of carbon emissions per capita |

| Independent Variable | Financial innovation | FI | Calculated by factor analysis |

| Mediating Variable | Industrial structure upgrading | ISU | Calculated by the entropy method |

| Control Variables | Openness level | OL | Total imports and exports/GDP |

| Energy intensity | EI | Total energy consumption/GDP (units of 10,000) | |

| Urbanization level | UL | Urban population as a percentage of total | |

| Technological advances | TA | Natural log of the number of patents granted | |

| Economic growth | EG | Natural log of GDP per capita | |

| Environmental regulation | ER | Natural log of industrial governance investment |

| Variables | Notes | Mean | Standard Deviation |

|---|---|---|---|

| Carbon emissions | CE | 2.04 | 0.16 |

| Financial innovation | FI | 71.27 | 0.78 |

| Industrial structure upgrading | ISU | 0.39 | 0.09 |

| Openness level | OL | 0.37 | 0.04 |

| Energy intensity | EI | 0.61 | 0.10 |

| Urbanization level | UL | 0.64 | 0.19 |

| Technological advances | TA | 12.48 | 0.32 |

| Economic growth | EG | 9.07 | 0.25 |

| Environmental regulation | ER | 15.73 | 0.24 |

| Year | FI | ISU | CE | |||

|---|---|---|---|---|---|---|

| Moran’s I | p | Moran’s I | p | Moran’s I | p | |

| 2011 | 0.187 | 0.022 | 0.108 | 0.092 | 0.530 | 0.000 |

| 2012 | 0.145 | 0.039 | 0.139 | 0.058 | 0.500 | 0.000 |

| 2013 | 0.153 | 0.032 | 0.195 | 0.019 | 0.507 | 0.000 |

| 2014 | 0.246 | 0.005 | 0.198 | 0.018 | 0.483 | 0.000 |

| 2015 | 0.250 | 0.005 | 0.204 | 0.016 | 0.472 | 0.000 |

| 2016 | 0.292 | 0.002 | 0.210 | 0.014 | 0.441 | 0.000 |

| 2017 | 0.246 | 0.004 | 0.195 | 0.019 | 0.440 | 0.000 |

| 2018 | 0.289 | 0.001 | 0.173 | 0.032 | 0.419 | 0.000 |

| 2019 | 0.214 | 0.011 | 0.184 | 0.027 | 0.402 | 0.000 |

| 2020 | 0.203 | 0.015 | 0.208 | 0.015 | 0.378 | 0.000 |

| 2021 | −0.007 | 0.396 | 0.204 | 0.017 | 0.376 | 0.000 |

| 2022 | 0.194 | 0.021 | 0.254 | 0.005 | 0.369 | 0.000 |

| Variables |

Non-Spatially Fixed Effect Model | Spatial Durbin Model | ||

|---|---|---|---|---|

| Time Fixed | Spatial Fixed | Double Fixed in Time and Space | ||

| FI | −0.063 *** | −0.164 *** | −0.054 ** | −0.063 ** |

| (−2.07) | (−3.00) | (−2.05) | (−2.41) | |

| ISU | −0.665 *** | −0.924 *** | −0.780 *** | −0.750 *** |

| (−3.03) | (−2.03) | (−4.33) | (−3.84) | |

| OL | 0.129 * | −0.126 | 0.042 | 0.070 |

| (1.95) | (−1.40) | (0.76) | (1.20) | |

| EI | 0.281 *** | 0.483 *** | 0.309 *** | 0.334 *** |

| (6.82) | (20.06) | (7.81) | (8.39) | |

| UL | 0.023 *** | 0.021 *** | 0.016 *** | 0.020 *** |

| (5.52) | (5.00) | (4.07) | (4.92) | |

| TA | 0.007 | −0.057 *** | 0.011 | −0.005 |

| (0.27) | (−1.92) | (0.46) | (−0.18) | |

| EG | −0.051 | 0.416 *** | 0.318 ** | 0.197 |

| (0.748) | (4.91) | (2.06) | (1.25) | |

| ER | 0.023 * | 0.180 *** | 0.024 ** | 0.025 * |

| (1.92) | (9.58) | (2.42) | (1.88) | |

| R2 | 0.57 | 0.15 | 0.53 | 0.23 |

| Log-likelihood | 21.87 | 51.32 | 364.66 | 375.93 |

| Rho | 0.110 | 0.465 *** | 0.394 *** | |

| (1.48) | (7.11) | (5.58) | ||

| Variables | Direct Effects | Indirect Effects | Total Effect | |||

|---|---|---|---|---|---|---|

| Coefficients | t-Value | Coefficients | t-Value | Coefficients | t-Value | |

| FI | −0.067 ** | −2.18 | −0.171 | −1.51 | −0.237 *** | −1.80 |

| ISU | −0.753 *** | −4.11 | 0.446 | 0.92 | −0.309 | −0.54 |

| OL | 0.050 | 0.92 | 0.026 | 0.20 | 0.076 | 0.49 |

| EI | 0.305 *** | 8.03 | −0.043 | −0.40 | 0.263 ** | 2.23 |

| UL | 0.017 *** | 4.34 | 0.009 | 0.67 | 0.026 * | 1.73 |

| TA | 0.025 | 1.04 | 0.155 * | 2.07 | 0.180 ** | 2.22 |

| EG | 0.284 ** | 1.97 | −0.324 | −1.05 | −0.040 | −0.14 |

| ER | 0.025 *** | 2.61 | 0.013 | 0.48 | 0.039 | 1.26 |

| Variables | Spatial Durbin Model | |

|---|---|---|

| ISU (Model I) | CE (Model II) | |

| FI | 0.020 *** | −0.061 ** |

| ISU | −0.553 *** | |

| Control Variables | YES | YES |

| R2 | 0.64 | 0.52 |

| Log-likelihood | 613.12 | 354.91 |

| Rho | 0.248 *** | 0.433 *** |

| Direct effects | 0.028 *** | −0.078 *** |

| Indirect effects | 0.151 *** | −0.237 *** |

| Total effect | 0.179 *** | −0.315 *** |

| c | a | b | a × b | a × b (p-Value) | a × b (95% BootCI) | c′ | Conclusion |

|---|---|---|---|---|---|---|---|

| −0.065 ** | 0.036 *** | −0.698 *** | −0.025 | 0.000 *** | −0.187~−0.347 | −0.058 ** | Partial mediating role |

| Variables | Weighting Matrix for Geographical Distance | Weighting Matrix for Economic Distance | ||||

|---|---|---|---|---|---|---|

| CE | CE | ISU | CE | CE | ISU | |

| FI | −0.053 * | −0.063 ** | 0.020 *** | −0.052 * | −0.077 *** | 0.018 ** |

| ISU | −0.612 *** | −0.600 *** | ||||

| Control Variables | YES | YES | YES | YES | YES | YES |

| R2 | 0.54 | 0.50 | 0.53 | 0.59 | 0.56 | 0.55 |

| Rho | 0.400 *** | 0.409 *** | 0.251 *** | 0.178 * | 0.300 *** | 0.434 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

An, J.; Di, H. How Can Financial Innovation Curb Carbon Emissions in China? Exploring the Mediating Role of Industrial Structure Upgrading from a Spatial Perspective. Sustainability 2024, 16, 4618. https://doi.org/10.3390/su16114618

An J, Di H. How Can Financial Innovation Curb Carbon Emissions in China? Exploring the Mediating Role of Industrial Structure Upgrading from a Spatial Perspective. Sustainability. 2024; 16(11):4618. https://doi.org/10.3390/su16114618

Chicago/Turabian StyleAn, Jiaji, and He Di. 2024. "How Can Financial Innovation Curb Carbon Emissions in China? Exploring the Mediating Role of Industrial Structure Upgrading from a Spatial Perspective" Sustainability 16, no. 11: 4618. https://doi.org/10.3390/su16114618

APA StyleAn, J., & Di, H. (2024). How Can Financial Innovation Curb Carbon Emissions in China? Exploring the Mediating Role of Industrial Structure Upgrading from a Spatial Perspective. Sustainability, 16(11), 4618. https://doi.org/10.3390/su16114618