The Effect of Carbon Quota Policy on Environmental Sustainability of Power Supply Chain

Abstract

:1. Introduction

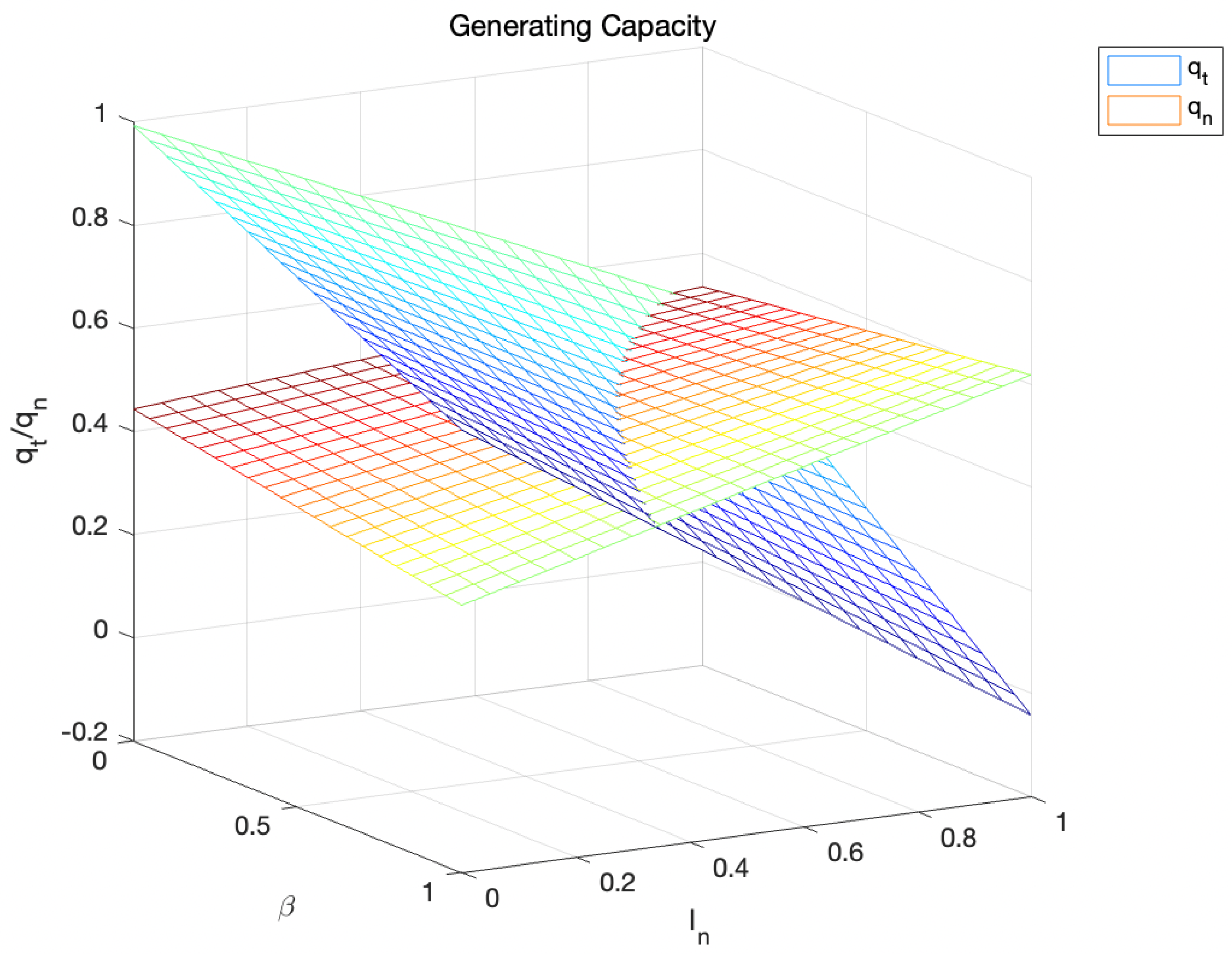

- The implementation of carbon quota policies increases the level of technological innovation investment in clean energy power generation enterprises more than in thermal power generation enterprises.

- Higher levels of competition within the power supply chain reduce the overall production output of thermal power generation enterprises but do not significantly affect the output of clean energy power generation enterprises.

- The implementation of a carbon quota policy will effectively reduce the environmental cost borne by the power supply chain.

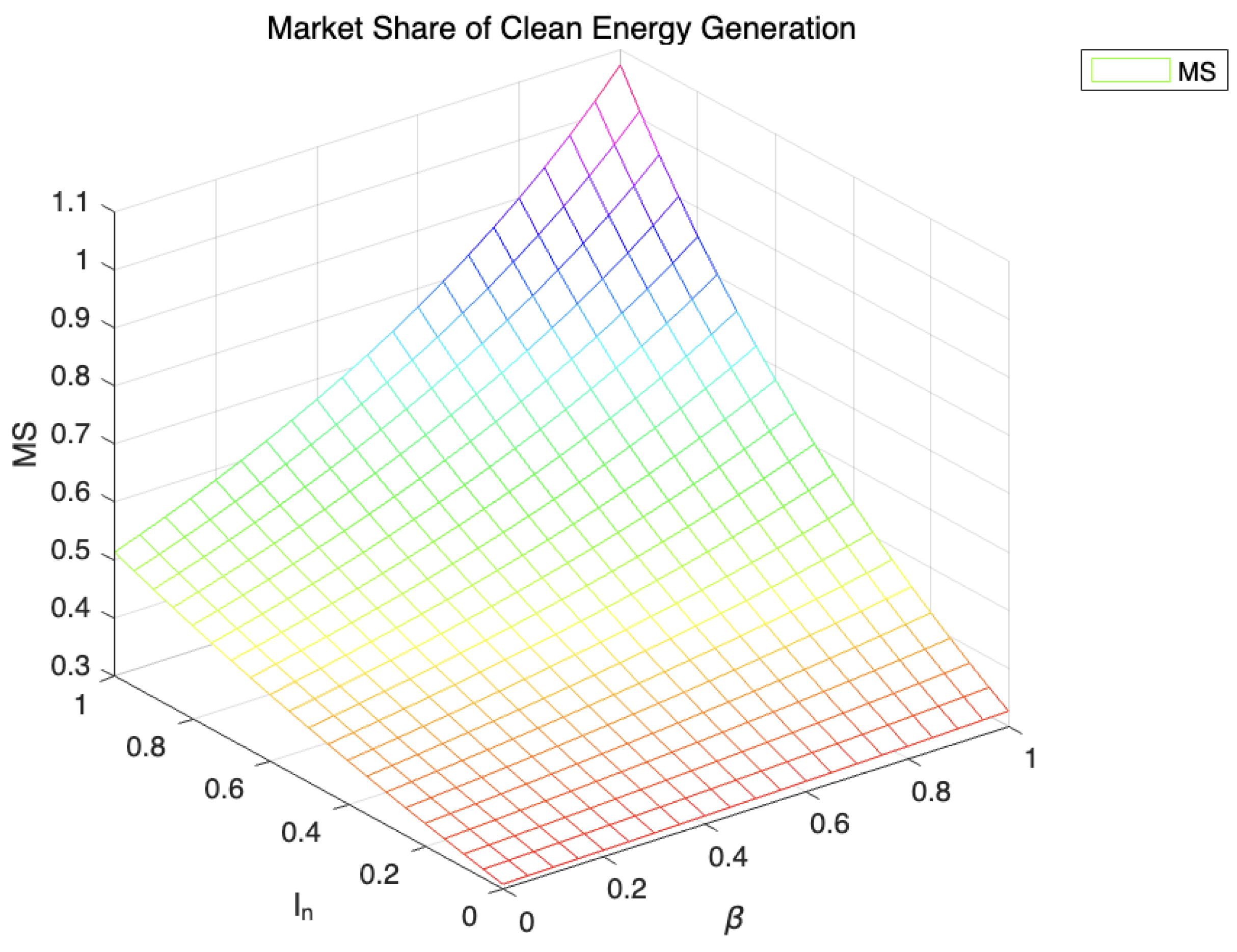

- The market share of clean energy power generation enterprises increases as a result of carbon quota policies, especially in environments with higher competition levels.

2. Literature Review

2.1. Carbon Quota Policy

2.2. Supply Chain Modeling and Analysis

3. Model Establishment and Analysis

3.1. Initial State of the Power Generation Enterprise

3.2. Carbon Emission Cost

3.3. Decision-Making of Power Generation Enterprises

3.4. Government Decisions—Total Environmental Costs

3.5. Market Share

4. Optimal Decisions

4.1. Optimal Decision of Power Generation Enterprise

- 1.

- 2.

- When the level of competition β increases, declines. The increased level of β helps increase when . Conversely, declines.

- 3.

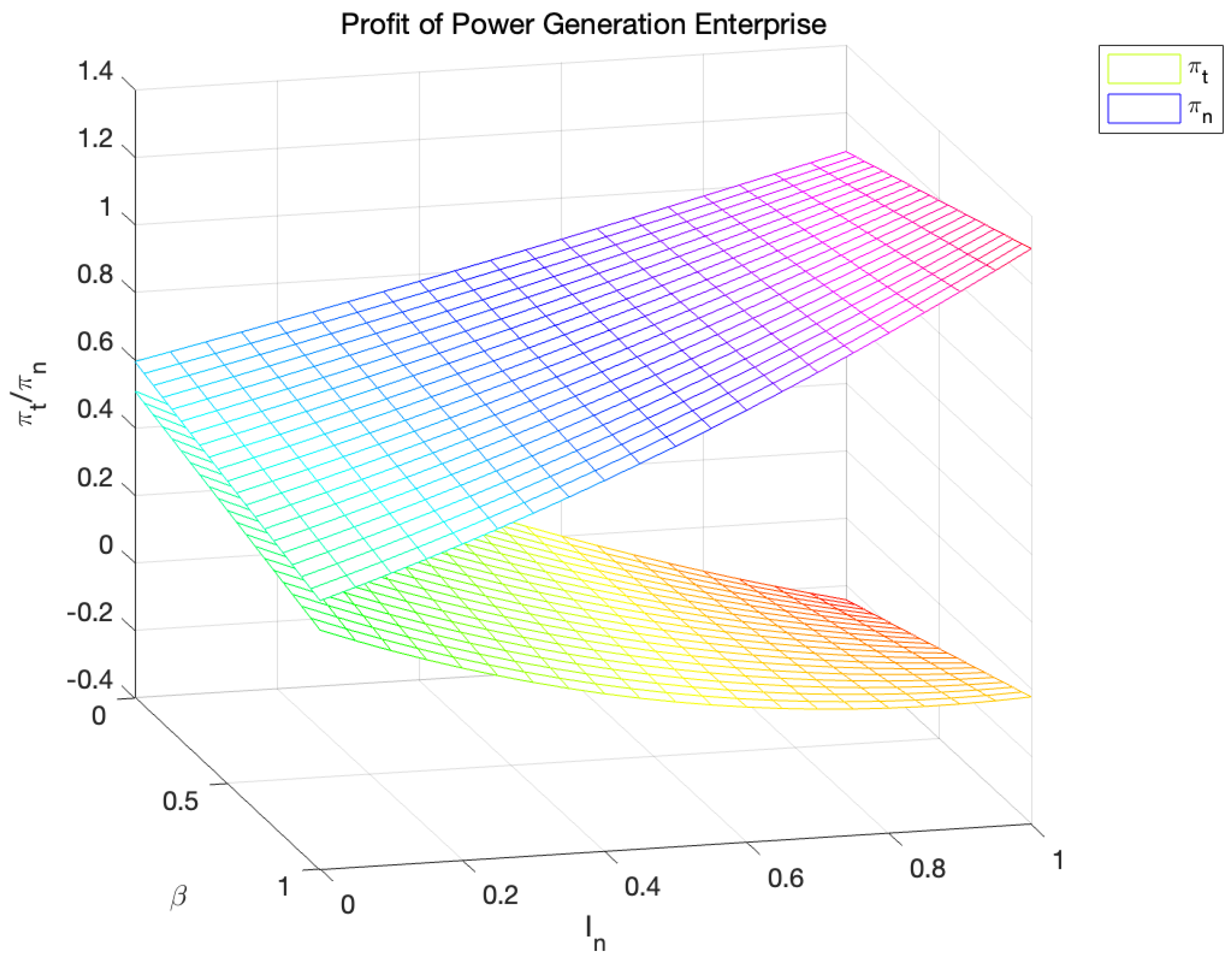

- When decreases with the increase in β, conversely, increases.

4.2. Environmental Cost

4.3. Market Share of Clean Energy Power Generation Enterprises

5. Numerical Analysis

5.1. Changes in Power Generation of Power Generation Enterprises

5.2. Changes in the Profits of Power Generation Enterprises

5.3. Environmental Cost

5.4. Market Share

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1

Appendix A.2

Appendix A.3

Appendix B

Appendix B.1

Appendix B.2

References

- Allen, M.R.; Frame, D.J.; Huntingford, C.; Jones, C.D.; Meinshausen, N. Warming caused by cumulative carbon emissions towards the trillionth tonne. Nature 2009, 458, 1163–1166. [Google Scholar] [CrossRef] [PubMed]

- Gasser, T.; Kechiar, M.; Ciais, P.; Burke, E.J.; Kleinen, T.; Zhu, D.; Huang, Y.; Ekici, A.; Obersteiner, M. Path-dependent reductions in CO2 emission budgets caused by permafrost carbon release. Nat. Geoence 2018, 11, 830. [Google Scholar] [CrossRef]

- Travis, J.M.J. Climate change and habitat destruction: A deadly anthropogenic cocktail. Proc. R. Soc. B Biol. Sci. 2003, 270, 467–473. [Google Scholar] [CrossRef] [PubMed]

- Church, J.A.; White, N.J.; Coleman, R.; Lambeck, K.; Mitrovica, J.X. Estimates of the regional distribution of sea level rise over the 1950–2000 period. J. Clim. 2004, 17, 2609–2625. [Google Scholar] [CrossRef]

- Cline, W. Global warming and agriculture: Impact estimates by country. J. Clean. Prod. 2008, 46, 448–450. [Google Scholar]

- Sanghi, A.; Mendelsohn, R. The impacts of global warming on farmers in Brazil and India. Glob. Environ. Chang. 2008, 18, 655–665. [Google Scholar] [CrossRef]

- Bhardwaj, B.R. Role of green policy on sustainable supply chain management: A model for implementing corporate social responsibility (CSR). Benchmarking Int. J. 2016, 23, 456–468. [Google Scholar] [CrossRef]

- Zhang, D.; Shi, L.; Liu, G. Supply chain in transition navigating economic growth and environmental sustainability through education. Environ. Sci. Pollut. Res. 2024, 31, 12321–12339. [Google Scholar] [CrossRef] [PubMed]

- Yang, C.L.; Lien, S. Governance Mechanisms for Green Supply Chain Partnership. Sustainability 2018, 10, 2681. [Google Scholar] [CrossRef]

- Bello, M.O.; Solarin, S.A.; Yen, Y.Y. Hydropower and potential for interfuel substitution: The case of electricity sector in malaysia. Energy 2018, 151, 966–983. [Google Scholar] [CrossRef]

- Raza, M.; Lin, B. Renewable energy substitution and energy technology impact in a transitional economy: A perspective from pakistan. J. Clean. Prod. 2022, 360, 132163. [Google Scholar] [CrossRef]

- Papageorgiou, C.; Saam, M.; Schulte, P. Substitution between Clean and Dirty Energy Inputs: A Macroeconomic Perspective. Rev. Econ. Stat. 2017, 99, 281–290. [Google Scholar] [CrossRef]

- Macdougall, A.H.; Zickfeld, K.; Knutti, R.; Matthews, H.D. Sensitivity of carbon budgets to permafrost carbon feedbacks and non-CO2 forcings. Environ. Res. Lett. 2015, 10, 125003. [Google Scholar] [CrossRef]

- Kuramochi, T.; Höhne, N.; Schaeffer, M.; Cantzler, J.; Hare, B.; Deng, Y.; Sterl, S.; Hagemann, M.; Rocha, M.; Yanguas-Parra, P.A.; et al. Ten key short-term sectoral benchmarks to limit warming to 1.5 °C. Clim. Policy 2018, 18, 287–305. [Google Scholar] [CrossRef]

- Jewell, J.; Cherp, A. On the political feasibility of climate change mitigation pathways: Is it too late to keep warming below 1.5 °C? Wiley Interdiscip. Rev. Clim. Chang. 2019, 11, 6309. [Google Scholar] [CrossRef]

- Bernow, S.; Dougherty, W.; Duckworth, M.; Browne, J. An integrated approach to climate policy in the US electric power sector. Energy Policy 1998, 26, 375–393. [Google Scholar] [CrossRef]

- Zhai, Q.; Cao, H.; Zhao, X.; Yuan, C. Cost benefit analysis of using clean energy supplies to reduce greenhouse gas emissions of global automotive manufacturing. Energies 2011, 4, 1478–1494. [Google Scholar] [CrossRef]

- Jgemann, C.; Michaela, F.; Hagspiel, S.; Nagl, S. Decarbonizing europe’s power sector by 2050—Analyzing the economic implications of alternative decarbonization pathways. Energy Econ. 2013, 40, 622–636. [Google Scholar] [CrossRef]

- Cao, K.; Xu, X.; Wu, Q.; Zhang, Q. Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. J. Clean. Prod. 2017, 167, 505–513. [Google Scholar] [CrossRef]

- Sinayi, M.; Rasti-Barzoki, M. A game theoretic approach for pricing, greening, and social welfare policies in a supply chain with government intervention. J. Clean. Prod. 2018, 196, 1443–1458. [Google Scholar] [CrossRef]

- Aslani, A.; Mohaghar, A. Business structure in renewable energy industry: Key areas. Renew. Sustain. Energy Rev. 2013, 27, 569–575. [Google Scholar] [CrossRef]

- Jiang, Y.Z.; Yang, Y.Z.; Guo, Q.W. China power source structure and CO2 emissions reduction. Adv. Mater. Res. 2012, 17, 946–953. [Google Scholar]

- Liu, H.T.; Liu, W.J. The analysis of effects of clean energy power generation. Energy Procedia 2018, 152, 947–952. [Google Scholar]

- Gerbelova, H.; Amorim, F.; Pina, A.; Melo, M.; Ioakimidis, C.; Ferrao, P. Potential of CO2 (carbon dioxide) taxes as a policy measure towards low-carbon Portuguese electricity sector by 2050. Energy 2014, 69, 113–119. [Google Scholar] [CrossRef]

- Liu, J. China’s renewable energy law and policy: A critical review. Renew. Sustain. Energy Rev. 2019, 99, 212–219. [Google Scholar] [CrossRef]

- Fareeduddin, M.; Hassan, A.; Syed, M.N.; Selim, S.Z. The impact of carbon policies on closed-loop supply chain network design. Procedia CIRP 2015, 26, 335–340. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, C. How carbon offsetting scheme impacts the duopoly output in production and abatement: Analysis in the context of carbon cap-and-trade. J. Clean. Prod. 2015, 103, 715–723. [Google Scholar] [CrossRef]

- Khan, K.; Khurshid, A.; Cifuentesfaura, J.; Xianjun, D.; Beecher, J. Does renewable energy development enhance energy security? Util. Policy 2024, 87, 101725. [Google Scholar] [CrossRef]

- Mao, H.Y.; Wang, W.B.; Liu, C.H.; Xu, Y.; Zhao, S.Y. Effects of the carbon emission quota policy on the quality and sales of manufactured and remanufactured products. Int. J. Prod. Econ. 2023, 266, 109058. [Google Scholar] [CrossRef]

- Rose, A.; Stevens, B. The efficiency and equality of marketable permits for CO2 emission. Resour. Energy Econ. 1993, 15, 117–146. [Google Scholar] [CrossRef]

- Zhou, P.; Wen, W. Carbon-constrained firm decisions: From business strategies to operations modeling. Eur. J. Oper. Res. 2020, 281, 1–15. [Google Scholar] [CrossRef]

- Narassimhan, E.; Gallagher, K.S.; Koester, S.; Alejo, J.R. Carbon pricing in practice: A review of existing emissions trading systems. Clim. Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- Wang, L.; Liu, C.; Yang, X. Research on Carbon Emission Reduction Effect of China’s Carbon Trading Pilot. Adv. Soc. Sci. Res. J. 2020, 7, 240–250. [Google Scholar] [CrossRef]

- Wang, B.J.; Zhao, J.L.; Wei, Y.X. Carbon emission quota allocating on coal and electric power enterprises under carbon trading pilot in China: Mathematical formulation and solution technique. J. Clean. Prod. 2019, 239, 118104.1–118104.12. [Google Scholar] [CrossRef]

- Qi, C.; Choi, Y. A study on the CO2 marginal abatement cost of coal-fueled power plants: Is the current price of China pilot carbon emission trading market rational? Carbon Manag. 2020, 11, 1–12. [Google Scholar] [CrossRef]

- Chen, P.; Dagestani, A.A. Urban planning policy and clean energy development Harmony—Evidence from smart city pilot policy in China. Renew. Energy 2023, 210, 251–257. [Google Scholar] [CrossRef]

- Wesseh, P.K.; Lin, B.Q.; Atsagli, P. Carbon taxes, industrial production, welfare and the environment. Energy 2017, 123, 305–313. [Google Scholar] [CrossRef]

- Bristow, A.L.; Wardman, M.; Zanni, A.M.; Chintakayala, P.K. Public acceptability of personal carbon trading and carbon tax. Ecol. Econ. 2010, 69, 1824–1837. [Google Scholar] [CrossRef]

- Wu, W.; Ren, Y.; Shi, L. Comparison of Renewable Energy Policy Based on Electricity Supply Chain Benefit. China Popul. Resour. Environ. 2013, 23, 44–48. [Google Scholar]

- Liu, X.; He, H.; Ma, C.; Zhang, H. Pricing decisions of two products with carbon emissions trading and green technology investment. In Proceedings of the 2016 International Conference on Logistics, Informatics and Service Sciences (LISS), Sydney, Australia, 24–27 July 2016. [Google Scholar]

- Dou, X.; Li, Y.; Wang, B.; Xue, C. Power supply chain incentive mechanism based on overall profit. Electr. Power Autom. Equip. 2010, 30, 58–62. [Google Scholar]

- Zeng, S.; Jiang, C.; Ma, C.; Su, B. Investment efficiency of the new energy industry in China. Energy Econ. 2018, 70, 536–544. [Google Scholar] [CrossRef]

- Chen, W.; Zhao, H. Integrated impact of the carbon quota constraints on enterprises within supply chain: Direct cost and indirect cost. Renew. Sustain. Energy Rev. 2018, 92, 774–783. [Google Scholar]

- Sun, J.; Li, G.; Wang, Z. Optimizing China’s energy consumption structure under energy and carbon constraints. Struct. Change Econ. Dyn. 2018, 47, 57–72. [Google Scholar] [CrossRef]

- Xia, C.; Wang, Z.; Xia, Y. The drivers of China’s national and regional energy consumption structure under environmental regulation. J. Clean. Prod. 2021, 285, 124913. [Google Scholar] [CrossRef]

- Cong, R.G.; Wei, Y.M. Potential impact of (CET) carbon emissions trading on China’s power sector: A perspective from different allowance allocation options. Energy 2010, 35, 3921–3931. [Google Scholar] [CrossRef]

- Shen, B.; Yang, X.; Xu, Y.; Ge, W.; Liu, G.; Su, X.; Zhao, S.; Dagestani, A.A.; Ran, Q. Can carbon emission trading pilot policy drive industrial structure low carbon restructuring: New evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 41553–41569. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable and non-renewable electricity consumption–growth nexus: Evidence from emerging market economies. Appl. Energy 2011, 10, 5226–5230. [Google Scholar] [CrossRef]

- Frondel, M.; Ritter, N.; Schmidt, C.M.; Vance, C. Economic impacts from the promotion of renewable energy technologies: The German experience. Energy Policy 2010, 38, 4048–4056. [Google Scholar] [CrossRef]

- Al-Nory, M.T. Optimal decision guidance for the electricity supply chain integration with renewable energy: Aligning smart cities research with sustainable development goals. IEEE Access 2019, 7, 74996–75006. [Google Scholar] [CrossRef]

- Barari, S.; Agarwal, G.; Zhang, W.J.C.; Mahanty, B.; Tiwari, M.K. A decision framework for the analysis of green supply chain contracts: An evolutionary game approach. Expert Syst. Appl. 2012, 39, 2965–2976. [Google Scholar] [CrossRef]

- Vasnani, N.N.; Chua, F.L.S.; Ocampo, L.A.; Pacio, L.B.M. Game theory in supply chain management: Current trends and applications. Int. J. Appl. Decis. Sci. 2018, 12, 56. [Google Scholar] [CrossRef]

- Huang, C.; Du, S.; Wang, B.; Tang, W. Accelerate or hinder it? Manufacturer transformation under competition and carbon emission trading. Int. J. Prod. Res. 2023, 61, 6230–6250. [Google Scholar] [CrossRef]

- Xia, T.; Wang, Y.; Lv, L.; Shen, L.; Cheng, T.C.E. Financing decisions of low-carbon supply Chain under Chain-to-Chain competition. Int. J. Prod. Res. 2023, 61, 6153–6176. [Google Scholar] [CrossRef]

- Jian, M.; He, H.; Ma, C.; Wu, Y.; Yang, H. Reducing greenhouse gas emissions: A duopoly market pricing competition and cooperation under the carbon emissions cap. Environ. Sci. Pollut. Res. 2019, 26, 16847–16854. [Google Scholar] [CrossRef] [PubMed]

- Zhao, L.; Zhang, J. Analysis of a duopoly game with heterogeneous players participating in carbon emission trading. Nonlinear Anal. Model. Control 2014, 19, 118–131. [Google Scholar] [CrossRef]

- Chen, X.; Hao, G. Sustainable pricing and production policies for two competing firms with carbon emissions tax. Int. J. Prod. Res. 2014, 53, 6408–6420. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhou, W.; Chen, X.; Huang, W. The effect of emission permit allocation in an early-stage cap-and-trade for a duopoly market. Int. J. Prod. Res. 2021, 59, 909–925. [Google Scholar] [CrossRef]

- Zhao, X.G.; Chen, H.; Hu, S.; Zhou, Y. The impact of carbon quota allocation and low-carbon technology innovation on carbon market effectiveness: A system dynamics analysis. Environ. Sci. Pollut. Res. 2023, 30, 96424–96440. [Google Scholar] [CrossRef] [PubMed]

- Poddar, S.; Banerjee (Chatterjee), T.; Banerjee, S. Taxation on duopoly e-commerce platforms and their search environments. Bus. Econ. 2023, 3, 140. [Google Scholar] [CrossRef]

- Belleflamme, P.; Toulemonde, E. Tax incidence on competing two-sided platforms. J. Public Econ. Theory 2018, 20, 9–21. [Google Scholar] [CrossRef]

- Giri, B.C.; Mondal, C.; Maiti, T. Analysing a closed-loop supply chain with selling price, warranty period and green sensitive consumer demand under revenue sharing contract. J. Clean. Prod. 2018, 190, 822–837. [Google Scholar] [CrossRef]

- Hossain, M.R.; Singh, S.; Sharma, G.D.; Apostu, S.A.; Bansal, P. Overcoming the shock of energy depletion for energy policy? Tracing the missing link between energy depletion, renewable energy development and decarbonization in the USA. Energy Policy 2023, 174, 113469. [Google Scholar] [CrossRef]

- Ma, C.; Tan, L.; Zhou, S.; Wang, X.; Zhang, X. Joint production and pricing strategy under carbon cap-and-trade policy. In Proceedings of the 2014 International Conference on Logistics Engineering and Management. System Planning, Supply Chain Management and Safety (ICLEM 2014), Shanghai, China, 9–11 October 2014; pp. 427–433. [Google Scholar]

- What Is Emissions Trading? Available online: https://www.epa.gov/emissions-trading-resources/what-emissions-trading (accessed on 17 June 2024).

- EU Emissions Trading System (EU ETS). Available online: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets_en (accessed on 15 June 2024).

- Zhang, Y.J.; Wang, W. How does china’s carbon emissions trading (cet) policy affect the investment of cet-covered enterprises? Energy Econ. 2021, 98, 105224. [Google Scholar] [CrossRef]

| Symbol | Implication |

|---|---|

| a | Unit output of thermal power generation |

| b | Unit output of clean energy power generation |

| Power supply chain competition level | |

| P | Unit electricity price |

| k | Unit carbon price |

| Technological innovation investment level of thermal power generation | |

| Technological innovation investment level of clean energy power generation | |

| Actual output of thermal power generation | |

| Actual output of renewable energy generating | |

| Cost coefficient of technological innovation in thermal power generation | |

| Cost coefficient of technological innovation in clean energy power generation | |

| Profits of thermal power | |

| Profits of clean energy power | |

| Unit carbon quota of thermal power generation | |

| Unit carbon quota of clean energy power generation | |

| Environment cost of thermal power generation | |

| Environment cost of clean energy power generation | |

| E | Total environmental cost of electricity supply chain |

| Market share of clean energy generation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Su, G.; Gao, B. The Effect of Carbon Quota Policy on Environmental Sustainability of Power Supply Chain. Sustainability 2024, 16, 5787. https://doi.org/10.3390/su16135787

Su G, Gao B. The Effect of Carbon Quota Policy on Environmental Sustainability of Power Supply Chain. Sustainability. 2024; 16(13):5787. https://doi.org/10.3390/su16135787

Chicago/Turabian StyleSu, Guanxuan, and Benhe Gao. 2024. "The Effect of Carbon Quota Policy on Environmental Sustainability of Power Supply Chain" Sustainability 16, no. 13: 5787. https://doi.org/10.3390/su16135787