Abstract

Amidst the tremendous evolution of the digital economy and the expedited establishment of a new development paradigm, the use of artificial intelligence (AI) technologies holds significant importance in achieving superior economic development. While much of the previous research focused on the macroeconomic impact of AI, this study examined how AI technology affects food processing firm performance, productivity, and labor skill structure at the food processing firm level. This study utilized panel data from listed food processing enterprises in Shanghai and Shenzhen spanning from 2010 to 2021, performing textual analysis on the annual reports of listed companies and then creating enterprise-level AI indicators to empirically examine the influence of AI applications on enterprise performance and its underlying mechanisms. The findings indicate a substantial improvement in business performance due to the application of artificial intelligence, which is a conclusion corroborated through a series of stability tests. Exploring channels and mechanisms, the analysis revealed that AI-driven advancements in production technologies stimulated the requirement for highly skilled labor, thereby inducing shifts in the labor force’s structure. Further investigation demonstrated that artificial intelligence contributed to enhancing the total factor productivity, consequently bolstering the overall enterprise performance. A heterogeneity analysis showed that firm-level factors, such as the nature of property rights and factor intensity, had an impact on the influence of AI on firm performance. In addition, the geographic location and time of year of a company also had impacts on the productivity benefits of artificial intelligence. This research deepened the cognition and understanding of the role played by AI in the production process at the micro-enterprise level and provided suggestions for promoting the development of artificial intelligence technologies at the micro-enterprise level, which will facilitate the transformation of the labor structure to further augment enterprise efficiency.

1. Introduction

In view of the fact that the existing research on artificial intelligence and enterprise performance basically stays at the macro level, such as countries and industries, and enterprises are the real subjects of production activities, we conducted research at the enterprise level. This study innovatively incorporated labor skill structure and total factor productivity into the research framework of the impact of artificial intelligence on enterprise performance, explored which specific type of labor force combined with artificial intelligence had a significant positive impact on enterprise performance, and used China’s micro-data for empirical tests. It answered the important question, “How does artificial intelligence affect the performance of food processing enterprises?”.

Successive scientific and technological revolutions have had a broad and far-reaching impact on human society. As artificial intelligence technology undergoes rapid expansion, its influence permeates diverse realms of economic activities, including production, distribution, exchange, and consumption. This integration significantly contributes to an overarching enhancement of social productivity. Positioned as the central driving force behind a contemporary scientific and technological revolution, artificial intelligence catalyzes an array of demands for intelligence across various sectors, ultimately fostering a substantial leap in social productivity. Against the backdrop of China’s economic development entering a new normal phase, artificial intelligence has emerged as a catalyst for fresh opportunities in the country’s economic transformation. Consequently, artificial intelligence’s effects on manufacturing companies’ operational effectiveness are drawing a lot of attention.

Previous studies explored the synergy between intelligence and economic development from various perspectives. First, at the macro or industry level, researchers investigated the role of digitization in economic development [1,2]. For instance, in the realm of digital finance, studies delved into the repercussions of technological advancements, such as the Internet, artificial intelligence, and automation, on the labor market [3]. Second, at the micro-level, scholars conducted in-depth examinations into the role of relevant technology applications within enterprises [4,5]. Within the domain of firm-level analysis, a substantial body of research focused on corporate performance, efficiency, division of labor, and innovation. Academic studies on the effects of artificial intelligence on enterprise performance increased the transition from the early observation stage to systematic empirical analysis as the depth of artificial intelligence increased. Simultaneously, an increasing number of studies evaluated such effects that utilize quantitative mathematical methods, like big data and statistical analysis [6]. Research indicated that artificial intelligence holds considerable potential for enhancing productivity, fostering novel economic frameworks, and bringing about structural change [7].

Nonetheless, the majority of scholars prioritize the function of artificial intelligence in enterprise performance, whereas barely any have studied food processing businesses. As a pivotal upstream industry of agricultural products, the food processing industry plays a crucial role in driving rural revitalization; facilitating rural supply-side structure reform; and fostering the harmonization of primary, secondary, and tertiary industries. It serves as a cross-sectoral, multi-faced, and comprehensive sub-sector of agriculture, with the aim to benefit those engaged in land cultivation. Simultaneously, it significantly influences the optimization and upgrading of China’s agricultural trade structure and enhances the international competitiveness of Chinese agricultural products. The level to which the food corporation has modernized has come to represent an essential symbol that reflects the average living situation for individuals and the degree of development of the country and allows for stabilizing the economy, promoting people’s livelihoods, and making an important contribution to employment. Systematic analysis of the implications of artificial intelligence on the performance of food processing enterprises is crucial for fully comprehending the development of agricultural new quality productivity, optimizing resource allocation, improving agricultural production efficiency and economic benefits, and thereby, promoting high-quality economic development.

In summary, while significant progress has been made in individual research areas, such as artificial intelligence, labor employment structure, food processing enterprise performance, and total factor productivity, there remains a dearth of research that combines these elements. Moreover, many of the previous studies tended to rely on qualitative analysis. This study sought to contribute by conducting further empirical testing based on existing research. The potential contributions of this study are threefold. First, unlike previous research that primarily focused on macro-level analysis, this study zeroed in on the micro-level examination of artificial intelligence’s impact on the production efficiency of the food processing manufacturing industry, which is a sector closely linked to people’s livelihoods. Second, it utilized conceptual models to investigate the relationships between artificial intelligence, labor structure, and the performance of the food processing manufacturing industry. By analyzing two important dimensions—labor structure and total factor productivity—this study aimed to assess the degree of impact and empowerment of AI technology applications on firms. Third, this study endeavored to uncover the underlying mechanisms behind the application of AI and labor force structure, providing new research perspectives within the framework of digital transformation intelligence. The findings of this research offer workable suggestions for raising the food processing sector’s economic efficiency, encouraging technological innovation, directing industrial policy, and advancing sustainable development, which are also instructional for the superior advancement of agriculture.

This paper is organized into six sections as follows. This paper’s introduction illustrates the problem’s applicability and offers an inventory of the relevant literature. The research methods and theoretical foundation are presented in Section 2. It indicates the link between artificial intelligence and food enterprise performance. Section 3 proposes a list of indicators for measuring changes in the productivity of food processing firms, addresses the mechanism analysis, and examines the labor structure and total factor productivity indicators. The baseline regression results are presented in Section 4, where they are interpreted as evidence relevant to the study problem. Section 5 shows the result of the channel mechanism test and states the impact of the labor structure and total factor productivity on the food processing manufacturing industry. The scientific discussion, critical analysis, comparison of the study’s findings with those of other studies, and general conclusions are the main topics of the paper’s Section 6.

2. Theoretical Analysis and Research Hypotheses

Industry intelligence, epitomized by artificial intelligence technology, heralds the onset of a new Industrial Revolution. This intelligence is poised to gradually replace manual labor with automated machinery, facilitating the widespread substitution of various forms of repetitive labor in contemporary society through capital intelligence. This transformation is anticipated to occur as capital intelligence is harnessed, enabling intelligence to progressively supplant human labor on a large scale [8,9]. Existing literature on the effects and implications of artificial intelligence for enterprise performance predominantly focuses on three key areas. First of all, artificial intelligence technology makes the production processes of enterprises more standardized, and the production efficiency of enterprises is improved. In a study of automation utilizing industrial robots to assess automation, Guo (2024) [10] found that productivity was boosted by automation both immediately and over time. Second, artificial intelligence can achieve human–machine collaboration, which can not only play an important role as a labor tool but can even play the role of a worker or even a protagonist, thus promoting a leap in productivity. Third, it is the promotion of technological innovation. Wang (2024) [11] found that smart manufacturing will have a favorable effect on the company’s financial condition in the short and long runs.

On the one hand, food processing companies are replacing a substantial amount of labor in the production process with completely automated intelligent production lines [12]. The implementation of intelligent systems cuts the costs of employment and production and enhances the efficiency of the food processing businesses. Traditional food processing production lines often require an adequate number of workers, which entails paying for the corresponding operational training costs, holiday benefits, and other expenses, in addition to the workers’ base pay. The wide adoption of intelligence in bread production lines, quail-egg-shelling machines, egg crackers, and egg white separators has drastically lowered the need for human labor in the food processing industry by replacing laborers who would otherwise perform repetitive tasks [13]. By the use of automation and machine learning technologies, artificial intelligence technology has made it possible to streamline and track the entire food processing system in real time, ensuring accuracy and safety. This reduces prolonged worker fatigue, interruptions in production, accidental injuries from mishaps, loss of raw materials, waste occurrence, and production costs [14].

Alternatively, food processing companies may boost their level of expertise and creativity via the utilization of industrial robots and upcoming artificial intelligence capabilities, which can substantially elevate the total factor productivity [15]. Operators in tradition food processing lines typically do repetitive tasks on a regularly basis for just one chain, which naturally leads to drawbacks, like low productivity and time waste. Artificial intelligence technology ensures that every link is precise and quick through the linking operation of robots and automation equipment, reducing the production downtime and increasing the production efficiency. This maximizes the optimal utilization of inputs, assists the food processing business in acquiring more favorable resources, fulfills greater production outcomes, and captures a larger market share.

As a new wave of disruptive technologies, artificial intelligence is obviously task-biased and accelerates the reshaping of labor skills [16]. The prerequisites for automation and intelligence in the labor force differ based on the level of competence, as noted by Acemoglu (2001) [17]. The demand for work requiring a college degree or more education rises, whereas the demand for labor with only a high school diploma or less education falls. By exploring automation (the substitution of low-skilled individuals with machines) and horizontal innovation (the creation of new products), Hémous and Olsen (2022) [18] developed an endogenous growth model and discovered that automation stimulates the necessity for high-skilled labor and lowers the necessity for low-skilled labor. The proliferation of intelligence and new tasks enhances and displaces the labor force, as revealed by Acemoglu and Restrepo (2019) [19]. Nevertheless, the financial result of the labor force recovery is rather small and cannot keep up with the advancement of technology.

In the food processing industry, automated manufacturing lines present both managerial and technical issues. Automated production lines require the right category of technological assistance for every area. In terms of workforce quality, low-skilled labor engaged in repetitive tasks faces a greater risk of being replaced by automation compared with high-skilled labor, making it easier to secure quality employment in society. For instance, the properly specialized technicians must do routine machine maintenance, machine learning algorithm checks, equipment debugging, and raw material placement. The manufacturing system must be equipped with a properly trained workforce and management mechanisms in order to adapt quickly to changes in the market and to efficiently plan and schedule production to satisfy consumer demand [20]. A workforce skilled in operating food, AI engineers and technicians, AI algorithm engineers, and executives at the right level is bound to be in higher demand as a result of the above specificities. There is less demand for labor to perform repetitive, high-frequency, and rule-specific production tasks and increased demand for highly trained individuals to optimize the workforce structures of food processing enterprises and boost their overall performance [21]. This aligns with the researchers Sun Zao, Hou Yulin, and Hao Nan’s data analysis of how employment in China is polarized based on educational attainment levels [22,23].

In light of the investigation presented above, this study suggested hypothesis 2: artificial intelligence promotes business performance by increasing the demand for high-level skilled labor in firms.

Through highly sophisticated control of the production process, computational intelligence and other intelligence technologies have driven up the total factor productivity while simultaneously boosting the product quality and utilizing value. According to Graetz and Michaels (2018) [24], the use of industrial robots lifted the economic growth in these nations by an average of 0.37% annually and upgraded the labor productivity, as well as the total factor productivity. The adoption of new technologies, procedures, tools, and techniques for production has accelerated the velocity at which businesses use their capital, increased the added value of their output, shortened the production cycle, and used less energy [25]. Corporations use intelligence to extend their existing production scale and master “smart capital” over time in a bid to optimally integrate labor, capital, and intelligent technology [26]. On top of this, firms that engage in further R&D urge the fabrication of new technologies and products, which enriches the market and raises the added value of merchandise [27]. Human resources are a crucial component of production that businesses may successfully utilize to increase the total factor productivity. Following the introduction of cutting-edge artificial intelligence technology, food processing companies typically upgrade training for staff members to aid them in rendering better use of the cutting-edge equipment. At the same time, enterprises fulfill employee responsibilities; comfort employees; raise wages; enhance workers’ sense of belonging and loyalty; and stimulate workers’ enthusiasm, initiative, and creativity. The intelligent operation and management of the enterprise optimize the internal personnel structure, increase in the proportion of decision-making and high-skill-level labor force, and promote the internal and professional division of labor, and thus, improve the organizational management processes. It also promotes the internal and professional division of labor and improves the organizational management process. This achieves efficient management and reduces the management costs and improves the total factor productivity, organizational structure efficiency, and enterprise performance [28]. In the process of food processing and production, artificial intelligence is based on rich data, machine learning, and deep learning algorithms to help food processing enterprises break through the cognitive and capacity limitations to make more scientific and reasonable decisions [29]. Big data also allows workers to comprehend more quickly and conveniently while propelling their technical level, knowledge, and talents. While running a broad empirical analysis of a wide sample of company data, Brynjolfsson and Kim (2011) [30] discovered a correlation between data-driven decision making (DDD) competence and the capital utilization rate and return on equity (ROE), which are two metrics of organizational profitability and productivity. Apart from this, DDD can improve business performance, profitability, and output.

Building on this analysis, this study posited hypothesis 3: artificial intelligence promotes business performance by increasing the total factor productivity of businesses.

3. Model and Indicator Selection

3.1. Data Sources

This study opted for publicly traded organizations within China’s Shanghai and Shenzhen markets in the food processing manufacturing industry as the empirical research sample spanning from 2010 to 2021. The selected time frame aligned with the developmental cycle of industrial intelligence, the escalating adoption of industrial robots, and the advancements in artificial intelligence technology. Particularly noteworthy is the statistical report published by the International Federation of Robotics (IFR) in 2014, which revealed a substantial increase in global robot sales that commenced in 2009. Since the issuance of the “Made in China 2025” strategy document by the State Council in 2015, manufacturing enterprises have widely applied intelligence and achieved rapid development and more and more manufacturing enterprises have achieved transformation and upgrades through artificial intelligence integration, where food processing and manufacturing industries are no exception, with more and more complete disclosure of relevant intelligent information and data at the enterprise level. To ensure the data’s representativeness and accuracy, this study followed the methodology employed by scholars such as Lou and Wang (2021) [31]. It involved manual screening of annual reports within specific intervals to identify relevant keywords, such as “artificial intelligence”, “intelligent equipment”, and “digital”, that are associated with food processing enterprises. The annual report data were sourced from the China Information website, while information regarding the education levels of enterprise employees was extracted from the China Stock Market & Accounting Research (CSMAR) database. The final dataset comprised 194 enterprises with a total of 1702 observations. The data processing utilized Stata software, including the application of upper and lower 1% quantile trimming for all continuous variables (excluding dummy variables) to lessen the weights of outliers on the regression results. Subsequently, descriptive statistics and empirical tests were conducted.

3.2. Variables Selection

(1) Explained variable: The enterprise performance explained variable is usually measured by the return on assets (ROA), which is obtained by dividing the net profit by the total assets. The ROA is a measure of how much profit is created per unit of assets and can effectively reflect the profitability of enterprises.

(2) Explanatory variables: AI is used as a dummy variable for artificial intelligence applications. There are virtual indicators about the application of artificial intelligence through the disclosure of annual reports by listed companies through “artificial intelligence”, “intelligent manufacturing”, “intelligent production line”, and other relevant keywords for screening; if there is disclosure in the annual report, it is given as “1”, and otherwise, it is assigned a “0”. As for how to determine the starting year of AI application in a company, the primary source was the annual report’s contents, specifically, mentioning the practical use of industrial robots for the first time in the annual report’s main business revenue, including AI-related products and technologies: the “Company Business Overview” and “Business Discussion and Analysis” initial focus on information related to artificial intelligence and smart manufacturing, companies starting to own or participate in AI-related businesses, or the completion time of the construction of smart factories and intelligent production lines in the company’s “projects under construction”. It is through the above methodology that this study determined the starting year of AI application in food processing and manufacturing firms and obtained the values of the explanatory variables for each sample firm.

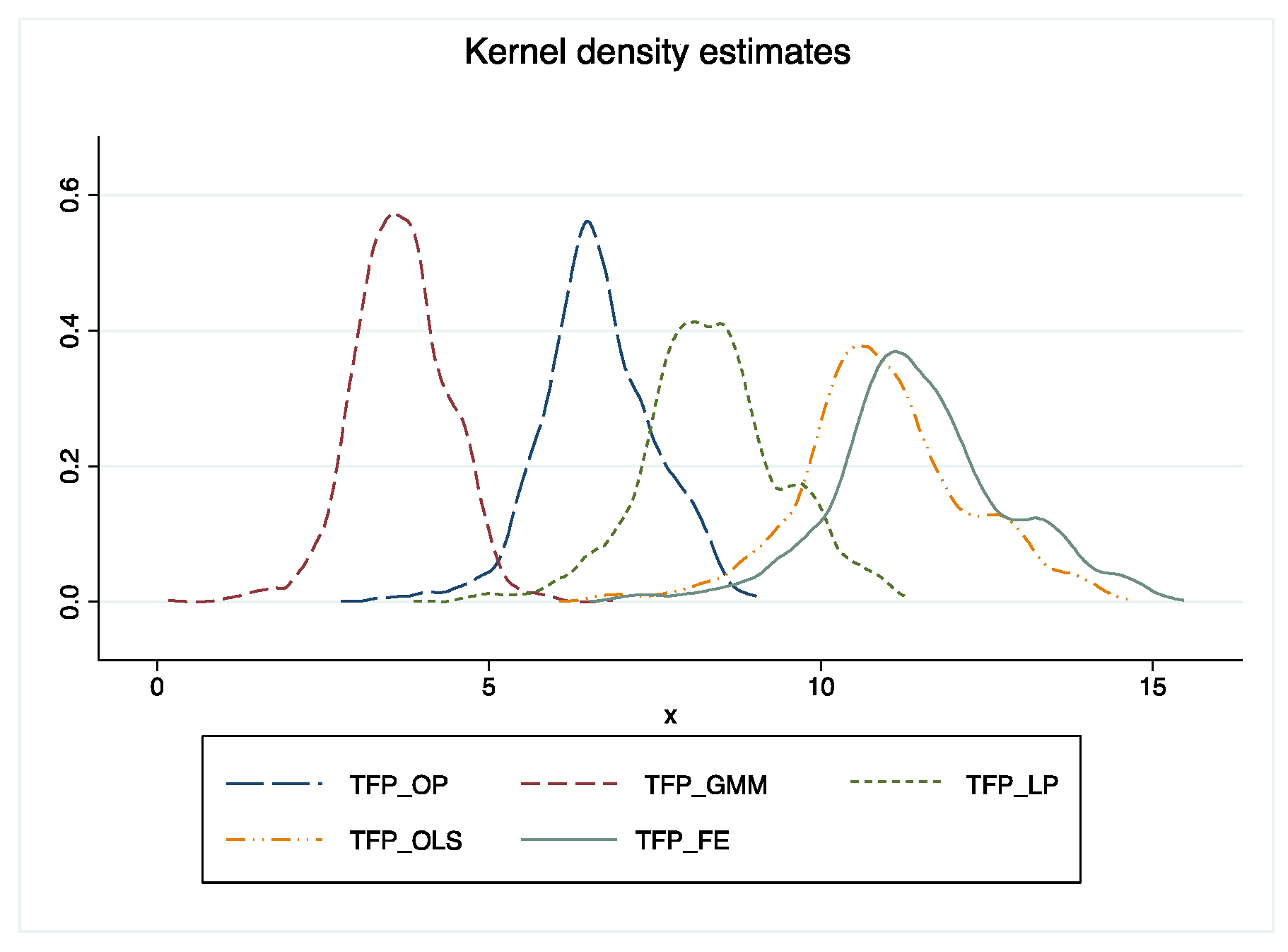

(3) Mechanism analysis variables: total factor productivity, usually expressed as TFP; the results of different algorithms for total factor productivity are shown in Figure 1. Based on the skewness–kurtosis test, the TFP level values estimated by the four methods rejected the normality hypothesis at a very high confidence level; the mean value of the TFP was maximized by the FE method estimation, followed by the OLS, LP, OP, and GMM methods in this order; and then, all the remaining methods, except GMM, had an amplifying effect on the absolute value of the TFP. Although the TFP traits estimated by the five methods were similar, some differences could still be found by comparing the statistics: First, the skewness of the remaining four, except for the GMM method, was significantly less than 0, which meant that the distribution was negatively skewed, with the actual magnitude of the skewness of the TFP predicted by the OP method being the largest such that more values under this method fell to the right of the median, and the mean was less than the median. Second, the highest kurtosis was also found in the TFP estimates based on the OP method, suggesting that the distribution was steeper. The total factor productivity for this study was determined using the OP approach under review of the above findings, used the lag term of investment and self-variable as the instrumental variables, and used the LP method and GMM technique to test the stability of the variables.

Figure 1.

Kernel density maps for different algorithms of total factor productivity.

Highly skilled labor force (Labor): Previous research by scholars showed that the level of education may reflect the skill level of the labor force structure [22]. According to the different levels of education, this study used the total number of employees with junior college, undergraduate, postgraduate, and doctoral degrees to measure the high-level skilled labor force. Referring to Shuo (2020) [32], this study used hand-curated data on the types of firms’ employee compositions from the CSMAR database to measure three levels of skilled labor, using the ratio of the number of their respective employees to the overall amount of employees within the firms. As the listed companies did not have consistent criteria for the division of employee categories, the relevant information on employee categories in this database was not very clear, and thus, this study first categorized the education level of the employees of the listed manufacturing companies in the China CSMAR database, and then summarized it. Eventually, the enterprise employees were divided into high-level, medium-level, and low-skilled labor forces, and the high-level skilled labor force was selected by referring to previous literature for empirical research and analysis.

(4) Control variables: To mitigate endogeneity problems due to omitted indicators, this study controlled for the following variables: whether it was a state-owned enterprise (SOE) or not, where if it is, the value was set to 1, and otherwise, it was set to 0; the level of corporate leverage (Lev), expressed as the whole asset to overall liability ratio; the growth was measured by the growth rate of a business revenue; the cash flow (Cashflow) was measured by cash flows from operating activities; and the establishment years of enterprises (FirmAge). Table 1 defines the specific variables.

Table 1.

Variable names, symbols, basic meanings, and calculation methods.

As illustrated in Table 2, the return on net worth, which served as an index of business performance, possessed a mean of 0.062, a standard deviation of 0.055, a maximum value of 0.287, and a minimum value of −0.224, indicating a comparable level of performance among the selected food processing manufacturing industries, with no major disparities. The relative stability of each control variable contained differentiation, indicating that the sample chosen for this study was appropriate, which could better reflect the situation of enterprises and was not affected by extreme values, making the study representative.

Table 2.

Descriptive statistics of variables.

3.3. Model

This study developed the model that is shown below to empirically evaluate the application of artificial intelligence on the performance of companies in the food processing industry:

In Formula (1), i represents the enterprise; t represents the year; the explanatory variable ROA is derived by dividing the net profit by the total assets; AIi,t is the application status of artificial intelligence by food processing enterprise i in year t; Controls comprises a series of control variables, where Table 1 lists the detailed definitions of the variables; δi, θk, and λp represent fixing the time, industry, and province, respectively; and εi,t is the random disturbance term. The key focus was the importance of the coefficient α1 of AI in Formula (1). According to the preliminary hypothesis, if the coefficient α1 was significantly positive, this meant that using artificial intelligence enhanced the performance improvement of food processing enterprises.

Then, this study used the idea of Acemoglu and Restrepo (2019) [19], which involved setting the following two Formulas (2) and (3) on the basis of model (1) to further investigate the channel mechanism in the impact of AI on firm performance and total factor productivity:

AI*Labor stands for the interacting term between AI and high-level skilled labor in the labor structure, while AI*TFP_OP symbolizes the interacting term between AI and the firms’ total factor productivity. In addition, the data were centered so as to improve the model reliability and precision and to mitigate the endogeneity issues brought by the interdetermination bias of the sample data and the bias problem raised by the sample selection bias; the OP method was adopted for the calculation of TFP. The following section explores the potential channels of impact around the above logic: whether the application of artificial intelligence promoted the upgrading of human capital by increasing the demand for high-skilled labor through the upgrading of production technology, and whether this mechanism, in turn, positively impacted the firm performance and total factor productivity.

4. Empirical Tests and Results Analysis

4.1. Results of Baseline Regression

For the model selection, based on the results of the Hausman test, this study opted for a multi-part fixed-effects model for estimation. This model incorporated one or more fixed effects to capture the relationship between multiple predicator variables and the target variable, regardless of the number of observations.

As for model selection, according to results of the Hausman test, this study settled on a multi-part fixed effects model for estimation, which contained one or more fixed effects for detecting the relationship between multiple predictor variables and the target variable, independent of the number of observations. This section discusses a stepwise regression and reports the results of the ROA, which are shown in Table 3, with notably positive coefficients. Column (6) demonstrates that the regression on the coefficient of artificial intelligence was 0.008 (p < 0.005), after controlling for the variables of enterprise leverage level, cash flow, and growth, which means that the application of artificial intelligence in food processing enterprises could significantly promote the improvement of enterprise performance. Hypothesis H1 was verified. Compared with the other variables in the model, this estimated coefficient was relatively small, which could have been because the food processing industry has not deepened its application of intelligent technology due to technical and financial support and industry specificity, resulting in overall competitiveness being improved. In the context of widespread digitization and the gradual advancement of intelligence, the expansion of artificial intelligence applications in the food processing industry still effectively promotes the improvement of enterprise performance. According to the regression findings of the high-dimensional fixed-effects model with control variables, both corporate cash flow and growth positively affected the ROA at the 1% estimation level, indicating that in the food processing industry, a sufficient cash flow and a higher financial risk resistance and operating income growth rate promoted technological research and development and innovation, expanded the scale of production, caused the introduction of more skilled personnel, and further promoted the performance of the enterprise. The estimated coefficient of the corporate debt level on corporate performance was −0.132, that is, every 1% increase in debt level reduced the corporate performance by 13.2 percentage points; this is to state that the operating conditions and capital level of enterprises are very crucial factors that affected enterprise performance, and the increase in debt level further aggravated the problem of financing constraints and limited the enhancement of business performance. The estimated coefficient of −0.009 in the firm attributes variable was quite negative at the 5% level, suggesting that differences in the capital, management, and policies involved in different holding firms had an impact on firm performance. The estimated coefficient of the firm’s age variable was −0.000, and this factor greatly hampered the food processing firms’ performance, which revealed that the food processing firms did not reap the benign enhancement in the performance of the firms due to technological advancement and other factors as a result of aging.

Table 3.

Stepwise regression results for food processing enterprise performance.

4.2. Robustness Test

4.2.1. Remeasurement of Performance of Food Processing Enterprises

For the purpose of guaranteeing that the findings drawn are valid, the regression test was re-run using the measure of firm performance with the replacement of the dependent variable to avoid the possibility that the function of artificial intelligence applications on the performance of food processing firms may have been affected by measurement error. In this paper, we chose to replace the explanatory variables to be measured with the return on equity ROE, and Table 4 displays the outcomes. The findings indicate that the effect of artificial intelligence on the performance of the food processing industry measured by the net return rate was significant at the 5% level, which supported the basic conclusion of this study.

Table 4.

Robustness test.

4.2.2. Replacement of Sample Intervals

The major health events in 2019 had a major impact on all industries, especially for the food processing industry due to embargoes and restrictions, rising prices of raw materials on the supply side, increased logistics costs that challenged the food processing industry with transportation difficulties and disruptions in the industry chain, and possible shortages of some raw materials that further impacted production. Some food processing companies faced labor shortages, and protective measures that were taken to protect the health of employees, such as the implementation of social distancing, could also lead to reduced productivity. The choice behavior of demand-side consumers has changed, and they are more inclined toward online purchasing and food delivery services. The cost rise, the drop in demand for purchases, and the limitation of production efficiency seriously affects the operating capacity, profitability, and development capacity of the food processing industry, which, in turn, affects the enterprise performance. Therefore, this study took 2019 as the node of the sample and conducted basic regression on the samples before and after 2019, and the outcomes are displayed in Table 5. From 2010 to 2019, the coefficient α1 was 0.015, which was significantly positive at the level of 1%, while from 2019 to 2021, the coefficient α1 was negative, but it did not show strong significance, which was consistent with the above conclusion.

Table 5.

Heterogeneity test.

4.2.3. Winsorize

In an attempt to minimize the influence of outliers on the estimation findings of this study, as well as eliminate or reduce the skewness and extremes of the data distribution, 5% shrinkage of the original data before and after was adopted. As demonstrated by the Table 4 column (5) robustness test results, the explanatory variable AI’s regression coefficient α1 was significant at the 5% confidence level. The conclusions drawn in this research appear to be more robust because the direction and size of the coefficients were almost identical with the outcomes of the benchmark regression, and the directions of the control variable regression coefficients were essentially the same.

4.3. Heterogeneity Test

4.3.1. Effect of the Enterprise’s Nature

Both SOEs and non-SOEs faced similar opportunities and challenges in using artificial intelligence. The resource advantages, supportive policies, and industry leadership positions that state-owned enterprises have, including technological resources, financial resources, and talent resources, can provide support and assurance for state-owned enterprises to better implement their artificial intelligence strategies. The improvement of state-owned businesses in the artificial intelligence sector has received significant backing from the government, such as the introduction of relevant policies and development plans to encourage the adoption and advancement of artificial intelligence in key areas of the country. State-owned enterprises have a more stable organizational structure and business environment and a more predictable operating situation, which makes them more capable of executing long-term artificial intelligence development strategies. In addition, given the leading position occupied by state-owned enterprises in energy, manufacturing, telecommunications, and other important industries, the large-scale data and complex operational processes of these industries make the application of artificial intelligence in these areas more advantageous.

To verify the above analysis, the sample was split based on the ownership nature into state-owned enterprises and non-state-owned enterprises for regression; the outcomes are shown in Table 5 columns (1) and (2). According to the regression analysis, state-owned firms’ use of artificial intelligence in the food processing sector performed much better than expected at the 1% level, in contrast to the less-than-ideal effect on non-state-owned enterprises. Given the distinctive characteristics of the food processing industry, the operators of non-state-owned food processing enterprises are more inclined to pursue short-term gains and neglect long-term development, while the state-owned food processing industry has strong financial strength and is more able to engage in R&D and innovation projects that cannot earn profits within a brief time frame and involve long cycles and high risks. This effect greatly promotes the growth of the total factor productivity of state-owned enterprise operators, which is in line with the study that was done above.

4.3.2. Impact of Geographical Location

There are large spatial and geographic differences in the utilization of artificial intelligence across China, with the impact of infrastructure, education, and manufacturing agglomerations being greater in the eastern seaboard compared with the country’s western and central regions; the eastern region’s natural geographical advantages, political tilt, and more complete labor market make it the first region to start benefiting from intelligent transformation. At the same time, the western region is also actively promoting intelligent transformation and is committed to the use of new technologies to promote enterprise development. Therefore, this study divided all samples into eastern, central, and western regions for the grouping regression; Table 5 columns (3), (4), and (5) exhibit the results.

As column (5) shows, the promoting coefficient of artificial intelligence on the performance of the food processing industry in the western region was 0.024, which represented a major positive at the 5% level, while the eastern and central regions showed no significant effects. This phenomenon may have been a consequence of the concentration of high skill levels and concentration of investment efforts in the eastern seaboard of the country.

Early small-scale intelligence can help enterprises to expand production and promote local economic development; with the continuous introduction of smart technologies, such as artificial intelligence, new companies are joining in order to reap the benefits of intelligence, but the blind use of intelligent technology, as well as the failure to establish a supporting regional intelligent infrastructure in a timely manner, leads to an increased competitive pressure between enterprises, the crowding effect emerges, there is an inability of highly skilled personnel to utilize the industrial intelligent equipment and technology, the marginal effect continues to diminish, and thus, this impedes economic development. China’s western region is relatively late in its development compared with the central and eastern regions, and it is still in the stage of increasing marginal effects, with a faster growth rate, and thus, the results were significantly positive.

4.3.3. Impact of Enterprise Factor Intensity

There are some differences between capital-intensive enterprises and labor-intensive enterprises in terms of productivity effectiveness, inventiveness, labor cost, and so on. The capital-intensive enterprises usually adopt advanced production technology and equipment, which can realize higher productivity and production capacity, and these enterprises rely on the support of technology to be able to produce products or provide services quickly and efficiently, thus increasing productivity and reducing costs. In contrast, labor-intensive enterprises may rely more on manual labor, be less productive, and be vulnerable to fluctuations in labor supply and costs. At the same time, capital-intensive enterprises usually increase funding support for R&D and innovation to continuously enhance goods or services and introduce new technologies or solutions, which allows technology-intensive enterprises to better meet consumer needs in the market and maintain a competitive edge. The labor-intensive enterprises are relatively weak in innovation ability due to their relatively low capital and resources, and labor-intensive enterprises usually rely on a large low-skilled labor force, and thus, the labor cost may be one of its main costs. When labor costs rise, the profitability of labor-intensive enterprises may be suppressed. Capital-intensive enterprises rely less on labor and are therefore less sensitive to labor costs; therefore, it may be that the role of artificial intelligence on firm performance is more pronounced in capital-intensive enterprises. To validate the above analysis, this study divided the entire sample size into capital- and labor-intensive categories according to the manufacturing business classification. Table 6 column (1) displays how artificial intelligence affected the labor-intensive enterprises’ performances at the 5% significance level; there was a coefficient of 0.014, which implies a considerable positive influence. Column (2) illustrates artificial intelligence’s effect on the performance of capital-intensive enterprises, with a coefficient of 0.015, which was considerably positive at the 1% level. These results are compatible with the above conjecture that the higher level of skilled labor that capital-intensive enterprises possess is more conducive to firms’ total factor productivity.

Table 6.

Heterogeneity test.

4.3.4. Time Heterogeneity

According to the IFR data calculation and taking into account the timing of the “Made in China 2025” action plan released on May 8 2015, the apparent shift in China’s food production industry’s use of industrial robots increased by 80% from 2010–2015 and by 40% from 2015–2019. To be able to delve into the effects of applying artificial intelligence on employment throughout time periods, this study divided its sample into two groups: 2010–2014 and 2015–2021. The results are displayed in Table 6. The findings in Table 6 columns (3) and (4) demonstrate that after 2015, artificial intelligence had a remarkably favorable effect on food processing firms’ performance at the 1% level. This suggests that as the use of industrial robots grows, AI will continue to have a positive impact on firm performance.

5. Channel Mechanism Test

The previous section provided evidence to support the claim that artificial intelligence applications positively promote the performance of food processing firms, and this section further examines the channeling mechanisms involved. As the previous theory points out, production technology will advance as a consequence of the deployment of technology for artificial intelligence, which will create the need for highly skilled workers in the labor structure and raise the total factor productivity, which will boost business performance. The following section explores the potential impact mechanisms around the above logic: whether artificial intelligence causes shifts in the labor force’s composition and businesses’ total factor productivity and whether changes in both lead to improvements in the performance of food processing firms. The analysis of the cross-regulation effect can effectively avoid endogeneity in the three steps of Zhonglin Wen’s method, which is widely used in the related literature.

5.1. Impact of Labor Structure on Firm Performance in the Food Processing Industry

As intelligent and automated technology advances rapidly, intelligence is expected to become a new engine of economic growth in China, and the substitution role of the labor force structure has led to more and more jobs facing the risk of being overtaken by robots and artificial intelligence, while there are more important complementary relationships and creative roles, which explains why automation has not caused mass unemployment in the past [33]. Different levels of the labor force are affected to varying degrees by these effects; while technology advancements in automation and artificial intelligence make it feasible for “robots to replace people on a large scale”, it also leads to the loss of workers’ comparative advantage in procedural work but greatly expands people’s comparative advantage in problem solving, variability, and creativity, and plays a complementary role in unconventional cognitive work. All these show that the application of artificial intelligence needs a substantial amount of high-level skilled labor to match it, and consequently, increases the demand for the high-level skilled labor of enterprises, promotes the upgrading of human capital, and then increases the improvement of enterprise performance.

This study, with reference to Hu et al. (2024) [34], portrayed the workforce structure in terms of a high-level skilled workforce, identifying university and above as a high-level skilled workforce based on the difference in the workforce’s level of education and measuring the level of the workforce structure in relation to its percentage of all employees. Table 7 reports the results of the corresponding tests. Column (2) shows the outcomes of adding the interaction term between the advanced skilled labor structure and AI on firm performance. The AI coefficient γ1 was 0.023, which was significantly positive at the 1% level and improved from the AI coefficient of 0.011 in Column (1). The Labor coefficient of high-level skilled labor was 0.028, which was highly positive at the 10% level. The interaction term coefficient γ2 was 0.042, which was considerably positive at the 1% level, indicating that the inclusion of high-level skilled labor in the labor structure had a reinforcing effect on the facilitating effect of AI on firm performance.

Table 7.

Channel test of artificial intelligence for performance improvement in food processing enterprises.

5.2. Impact of Total Factor Productivity on the Food Processing Manufacturing Industry

The growing prevalence of industrial robots is the most striking outcome of the execution of artificial intelligence in smart workflows. The improvement of production technological advances and the heightened level of capital and skilled labor company investment have been supported by industrial robots, which escalate the synthesis and intelligence integration and spur corresponding innovation and technical advancement. To prop up the total factor productivity, new factor combinations and production conditions are set up. A better total factor productivity can help food processing companies to overcome production process bottlenecks and efficiency hurdles. By taking advantage of the upward trend in the total factor productivity, businesses are more competent at grasping the chances and potential of technological innovation, and thus, boosting businesses’ competitiveness in the market’s intense rivalry, along with industrial modernization and sustainable development.

This study applied the OP technique, LP method, and GMM to measure the total factor productivity of firms in order to test the aforementioned assumptions and successfully avoid the difficulties of selection bias and sample loss. Table 8 column (1) shows that the coefficient of the explanatory variable ROA was significantly positive at the 5% level. Column (2) shows the results after adding the interaction term between AI and the total factor productivity. The artificial intelligence AI coefficient μ1 was 0.024, which was significantly positive at the 1% level; the total factor productivity coefficient was 0.025, which was significant at the 10% level; and the interaction term coefficient μ2 was 0.042, which was significantly positive at the 1% level. This shows that along with the increase in the total factor productivity of the firms, the performance of the firms could be significantly improved. This hints at AI applications boosting business performance in China’s food processing industry by raising firms’ total factor productivity levels; consequently, the total factor productivity had a positive enabling pass-through effect. Columns (3) and (4) show the results of the stability test using the LP method and GMM method, and the estimation results show that the coefficients of the interaction terms between AI and both total factor measures were significantly positive at 1% level, which again confirmed hypothesis H3.

Table 8.

Channel test of artificial intelligence for performance improvement in food processing enterprises.

6. Discussion and Conclusions

Artificial intelligence (AI) has enormous potential to stimulate economic growth and enhance corporate performance as it becomes a key driving force for a new wave of scientific and technical revolution and industrial transformation [3]. The role of AI in business performance at the organization level, as well as the changes in the skill structure of the enterprise labor force and total factor productivity in this process, remains unclear though because of the data bottleneck [7].

The topic of this study stemmed from the policy context of China’s accelerated promotion of artificial intelligence technology to facilitate high-quality economic development. The collection and review of research progress in related fields of artificial intelligence in enterprise performance is hindered by the lack of micro-level AI-related data. Considering the wealth of textual data available at the company level in recent years and the maturity of analytics techniques, this study proposed constructing an enterprise-level artificial intelligence index through the textual analysis of annual reports of listed companies [22]. Utilizing the mechanism paths of “labor skill structure adjustment” and “total factor productivity”, this study analyzed the influential mechanisms of artificial intelligence on food processing industry performance from these two perspectives. We examined, at the firm level, how AI technology affected firm performance and the mechanisms in which labor skill structure and total factor productivity play a role. More importantly, this study explored in detail the heterogeneity of the performance enhancement effect of AI firms in terms of four aspects: firm, geographic location, factor intensity, and time [35].

The contributions of this study are twofold:

First, it constructed micro-enterprise level AI indictors through textual analysis, offering an effective tool and metrics for subsequent research related to micro-enterprise level AI.

Second, this study focused on the micro-firm level, specifically within the food processing industry, and analyzed how AI impacted firm performance and explored the significant role played by the workforce skill structure and productivity in this context.

On a practical level, this study’s results deepen our knowledge and understanding of AI’s role in the production process of micro-enterprises. It provides guidance for enterprises to adjust their labor structure and improve productivity to better utilize AI for performance enhancement. Furthermore, it offers suggestions on leveraging AI technology at both the enterprise and policy levels to enhance the total factor productivity.

Future research avenues could include expanding into other critical industries and studying the contribution of artificial intelligence in sectors such as banking, asset management, securities, and insurance. Additionally, exploring alternative channels, such as resource-optimized combinations, to enhance the performance impact of AI at the micro-enterprise level would be valuable. Moreover, further interdisciplinary research at the intersection of AI and economics within the micro-enterprise context could also be explored.

Author Contributions

Conceptualization: Y.W. and Z.Y.; methodology, Z.Y.; Software, Y.W.; Validation, H.L.; Formal analysis, Y.W. and Z.Y.; Investigation, H.L.; Resources, Z.Y.; Data curation, Y.W. and Z.Y.; Writing—original draft, Y.W. and Z.Y.; Writing—review & editing, Z.Y.; Visualization, Y.W. and Z.Y.; Supervision, Z.Y.; Project administration, Z.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within article.

Conflicts of Interest

The author declare no conflict of interest.

References

- Zhang, X.; Xu, Y.Y.; Ma, L. Information technology investment and digital transformation: The roles of digital transformation strategy and top management. Bus. Process Manag. J. 2023, 29, 528–549. [Google Scholar] [CrossRef]

- Nwankpa, J.K.; Datta, P. Balancing exploration and exploitation of IT resources: The influence of Digital Business Intensity on perceived organizational performance. Eur. J. Inf. Syst. 2017, 26, 469–488. [Google Scholar] [CrossRef]

- Agrawal, A.; Gans, J.S.; Goldfarb, A. Artificial intelligence: The ambiguous labor market impact of automating prediction. J. Econ. Perspect. 2019, 33, 31–50. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; McElheran, K. The rapid adoption of data-driven decision-making. Am. Econ. Rev. 2016, 106, 133–139. [Google Scholar] [CrossRef]

- Goldfarb, A.; Tucker, C. Digital economics. J. Econ. Lit. 2019, 57, 3–43. [Google Scholar] [CrossRef]

- Enholm, I.M.; Papagiannidis, E.; Mikalef, P.; Krogstie, J. Artificial intelligence and business value: A literature review. Inf. Syst. Front. 2022, 24, 1709–1734. [Google Scholar] [CrossRef]

- Li, L.; Ye, F.; Zhan, Y.; Kumar, A.; Schiavone, F.; Li, Y. Unraveling the performance puzzle of digitalization: Evidence from manufacturing firms. J. Bus. Res. 2022, 149, 54–64. [Google Scholar] [CrossRef]

- Chen, L.; Qi, B. The “Supply-Side Reform Policy” and the Share of Labor Income in Enterprises. Sustainability 2024, 16, 5231. [Google Scholar] [CrossRef]

- Cao, J.; Zhou, Y.L. Research progress on the impact of artificial intelligence on economy. Econ. Dyn. 2018, 1, 103–115. [Google Scholar]

- Guo, M. Does Industrial Intelligence Promote Sustainable Employment? Sustainability 2024, 16, 3896. [Google Scholar] [CrossRef]

- Wang, M. Artificial intelligence empowers the construction of first-class financial management system. Appl. Math. Nonlinear Sci. 2024, 9. [Google Scholar] [CrossRef]

- Frey, C.B.; Osborne, M.A. The future of employment: How susceptible are jobs to computerisation? Technol. Forecast. Soc. Chang. 2017, 114, 254–280. [Google Scholar] [CrossRef]

- Li, Q. The Roles of AI in Productivity. J. East China Norm. Univ. Philos. Soc. Sci. 2023, 55, 6–12. [Google Scholar]

- Lv, R.; Hao, L. Research on the influence of artificial intelligence and other technologies on labor market. J. Ind. Technol. Econ. 2018, 37, 131–137. [Google Scholar]

- Zhao, F.; Xu, Z.; Xie, X. Exploring the Role of Digital Economy in Enhanced Green Productivity in China’s Manufacturing Sector: Fresh Evidence for Achieving Sustainable Development Goals. Sustainability 2024, 16, 4314. [Google Scholar] [CrossRef]

- Acemoglu, D.; Autor, D. Skills, tasks and technologies: Implications for employment and earnings. In Handbook of Labor Economics; Elsevier: Amsterdam, The Netherlands, 2011; Volume 4, pp. 1043–1171. [Google Scholar]

- Acemoglu, D.; Johnson, S.; Robinson, J.A. The colonial origins of comparative development: An empirical investigation. Am. Econ. Rev. 2001, 91, 1369–1401. [Google Scholar] [CrossRef]

- Hémous, D.; Olsen, M. The rise of the machines: Automation, horizontal innovation, and income inequality. Am. Econ. J. Macroecon. 2022, 14, 179–223. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. Automation and new tasks: How technology displaces and reinstates labor. J. Econ. Perspect. 2019, 33, 3–30. [Google Scholar] [CrossRef]

- Sarvesh, S.; Abe, Z. Artificial Intelligence-Based Smart Quality Inspection for Manufacturing. Micromachines 2023, 14, 570. [Google Scholar] [CrossRef] [PubMed]

- Jiaquan, Y.; Kunpeng, Z.; Lipeng, G.; Xu, F. How Does Artificial Intelligence Improve Firm Productivity? Based on the Perspective of Labor Skill Structure Adjustment. J. Manag. World 2024, 40, 101–116+133+117–122. [Google Scholar]

- Sun, Z.; Hou, Y.L. How Does Industrial Intelligence Reshape the Employment Structure of Chinese Labor Force. China Ind. Econ. 2019, 5, 61–79. [Google Scholar]

- Maarek, P.; Moiteaux, E. Polarization, employment and the minimum wage: Evidence from European local labor markets. Labour Econ. 2021, 73, 102076. [Google Scholar] [CrossRef]

- Graetz, G.; Michaels, G. Robots at work. Rev. Econ. Stat. 2018, 100, 753–768. [Google Scholar] [CrossRef]

- Iyer, P.; Bright, F.L. Navigating a paradigm shift: Technology and user acceptance of big data and artificial intelligence among advertising and marketing practitioners. J. Bus. Res. 2024, 180, 114699. [Google Scholar] [CrossRef]

- Korinek, A.; Stiglitz, J.E. Artificial intelligence and its implications for income distribution and unemployment. In The Economics of Artificial Intelligence: An Agenda; University of Chicago Press: Chicago, IL, USA, 2018; pp. 349–390. [Google Scholar]

- Shao, W.; Kuang, X.; Lin, W. Informationization and the Demand for Skilled Labor: Empirical Evidence Based on Micro-level Enterprises in China. J. Econ. Perspect. 2018, 15–29. [Google Scholar] [CrossRef]

- Autor, D.H. Why are there still so many jobs? The history and future of workplace automation. J. Econ. Perspect. T 2015, 29, 3–30. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. The race between man and machine: Implications of technology for growth, factor shares, and employment. Am. Econ. Rev. 2018, 108, 1488–1542. [Google Scholar] [CrossRef]

- Brynjolfsson, E.; Hitt, L.M.; Kim, H.H. Strength in Numbers: How Does Data-Driven Decision Making Affect Firm Performance? 2011. Available online: https://ssrn.com/abstract=1819486 (accessed on 12 December 2011).

- Lou, Y.; Wang, S.; Hao, F. The Impact of Industrial Intelligence on Enterprise Performance: Research on the Mediation Effect Based on the Perspective of Salary. J. Ind. Technol. Econ. 2021, 40, 3–12. [Google Scholar]

- Zhao, S. Corporate performance under the influence of intelligent manufacturing: Empirical evidence based on text analysis of Chinese listed companies’ annual reports. Ind. Technol. Econ. 2023, 42, 95–101. [Google Scholar]

- Holzer, H. Job market polarization and US worker skills: A tale of two middles. Econ. Stud. Brook. Inst. 2015. Available online: https://www.brookings.edu/wp-content/uploads/2016/06/polarization_jobs_policy_holzer.pdf (accessed on 3 July 2024).

- Hu, S.; Lin, K.; Liu, B.; Wang, H. Does robotization improve the skill structure? The role of job displacement and structural transformation. Appl. Econ. 2024, 56, 3415–3430. [Google Scholar] [CrossRef]

- Peng, X.; Guan, X.; Zeng, Y.; Zhang, J. Artificial Intelligence-Driven Multi-Energy Optimization: Promoting Green Transition of Rural Energy Planning and Sustainable Energy Economy. Sustainability 2024, 16, 4111. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).