Traffic Safety, Fuel Tax Intensity and Sustainable Development Efficiency of Transportation: Evidence from China

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

3. Methods and Data

3.1. Methods

3.2. Data and Variables

4. Results and Discussion

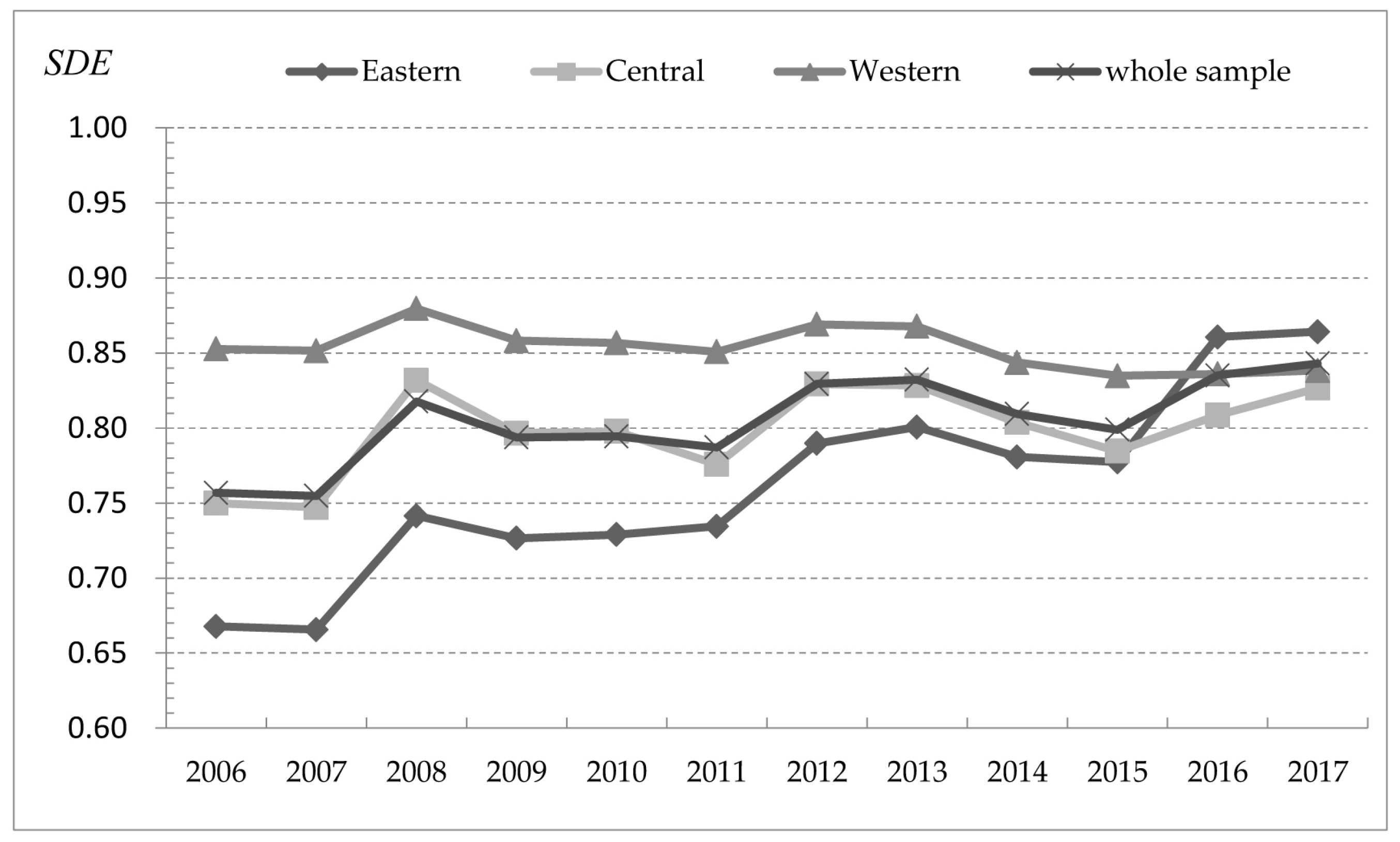

4.1. Results

4.2. Impact of Fuel Tax on SDE

4.3. Further Discussion

5. Conclusions

5.1. Main Conclusions

5.2. Policy Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- China Ministry of Transport. The 12th Five-Year Plan for Energy Conservation and Emission Reduction in Highway and Waterway Transportation. 2011. Available online: https://www.gov.cn/gongbao/content/2012/content_2076113.htm (accessed on 8 July 2019).

- Sterner, T. Fuel taxes: An important instrument for climate policy. Energy Policy 2007, 35, 3194–3202. [Google Scholar] [CrossRef]

- Santos, G. Road fuel taxes in Europe: Do they internalize road transport externalities? Transp. Policy 2017, 53, 120–134. [Google Scholar] [CrossRef]

- Fukui, H.; Miyoshi, C. The impact of aviation fuel tax on fuel consumption and carbon emissions: The case of the US airline industry. Transp. Res. Part D Transp. Environ. 2017, 50, 234–253. [Google Scholar] [CrossRef]

- Xia, C.; Liu, Y. Dynamic CGE Study on the Impact of Fuel Tax Reform on Energy Conservation and Emission Reduction in China. Econ. Probl. 2010, 2, 64–69. [Google Scholar]

- Liu, X.; Sheng, H.; Li, H. Innovation of environmental regulation tools for Developing Green Transportation: An Analysis based on Externality theory. J. Hunan Univ. (Soc. Sci.) 2016, 30, 79–84. [Google Scholar]

- Lin, B.; Jia, Z. How does tax system on energy industries affect energy demand, CO2 emissions, and economy in China? Energy Econ. 2019, 84, 104496. [Google Scholar] [CrossRef]

- Gao, X.; Li, J.; Yan, H. Research on the impact of Gasoline Consumption Tax on Carbon Emission of Private Vehicles. China Popul. Resour. Environ. 2019, 29, 135–142. [Google Scholar]

- Wang, D.D. Assessing road transport sustainability by combining environmental impacts and safety concerns. Transp. Res. Part D Transp. Environ. 2019, 77, 212–223. [Google Scholar] [CrossRef]

- Lu, M.; Chen, P. Sustainable total factor productivity of transport: Considering safety issues and environmental impacts. Environ. Sci. Pollut. Res. 2023, 30, 56094–56107. [Google Scholar] [CrossRef]

- Greene, D.L.; Wegener, M. Sustainable transport. J. Transp. Geogr. 1997, 5, 177–190. [Google Scholar] [CrossRef]

- Holden, E.; Gilpin, G.; Banister, D. Sustainable Mobility at Thirty. Sustainability 2019, 11, 1965. [Google Scholar] [CrossRef]

- Bakker, S.; Dematera Contreras, K.; Kappiantari, M.; Anh Tuan, N.; Guillen, M.D.; Gunthawong, G.; Zuidgeest, M.; Liefferink, D.; Van Maarseveen, M. Low-Carbon Transport Policy in Four ASEAN Countries: Developments in Indonesia, the Philippines, Thailand and Vietnam. Sustainability 2017, 9, 1217. [Google Scholar] [CrossRef]

- Beltrán-Esteve, M.; Picazo-Tadeo, A.J. Assessing environmental performance trends in the transport industry: Eco-innovation or catching-up? Energy Econ. 2015, 51, 570–580. [Google Scholar] [CrossRef]

- Nijkamp, P. Roads toward environmentally sustainable transport. Transp. Res. Part A Policy Pract. 1994, 28, 261–271. [Google Scholar] [CrossRef]

- Charmondusit, K.; Phatarachaisakul, S.; Prasertpong, P. The quantitative eco-efficiency measurement for small and medium enterprise: A case study of wooden toy industry. Clean Technol. Environ. Policy 2014, 16, 935–945. [Google Scholar] [CrossRef]

- Rosen, M.A. The role of energy efficiency in sustainable development. In Proceedings of the 1995 Interdisciplinary Conference: Knowledge Tools for a Sustainable Civilization. Fourth Canadian Conference on Foundations and Applications of General Science Theory, Toronto, ON, Canada, 8–10 June 1995. [Google Scholar]

- Hoffrén, J.; Apajalahti, E. Emergent eco-efficiency paradigm in corporate environment management. Sustain. Dev. 2009, 17, 233–243. [Google Scholar] [CrossRef]

- Zhang, B.; Bi, J.; Fan, Z.; Yuan, Z.; Ge, J. Eco-efficiency analysis of industrial system in China: A data envelopment analysis approach. Ecol. Econ. 2008, 68, 306–316. [Google Scholar] [CrossRef]

- Kim, C.K.; Chung, K.; Kim, Y.; Lee, K.D. The effects of transportation energy policy on fuel consumption and transportation safety. Multimed. Tools Appl. 2015, 74, 2535–2557. [Google Scholar] [CrossRef]

- Litman, T. Pricing for Traffic Safety How Efficient Transport Pricing Can Reduce Roadway Crash Risks. Transp. Res. Rec. 2012, 2318, 16–22. [Google Scholar] [CrossRef]

- Tan, J.; Xiao, J.; Zhou, X. Market equilibrium and welfare effects of a fuel tax in China: The impact of consumers’ response through driving patterns. J. Environ. Econ. Manag. 2019, 93, 20–43. [Google Scholar] [CrossRef]

- Chang, Y.; Zhang, N.; Danao, D.; Zhang, N. Environmental efficiency analysis of transportation system in China: A non-radial DEA approach. Energy Policy 2013, 58, 277–283. [Google Scholar] [CrossRef]

- Chang, Y.; Park, H.K.; Lee, S.; Kim, E. Have Emission Control Areas (ECAs) harmed port efficiency in Europe? Transp. Res. Part D Transp. Environ. 2018, 58, 39–53. [Google Scholar] [CrossRef]

- Li, Y.; Huang, Y.P.; Liang, Y.; Song, C.; Liao, S. Economic and carbon reduction potential assessment of vehicle-to-grid development in guangdong province. Energy 2024, 302, 131742. [Google Scholar] [CrossRef]

- Tostes, B.; Henriques, S.T.; Brockway, P.E.; Heun, M.K.; Domingos, T.; Sousa, T. On the right track? Energy use, carbon emissions, and intensities of world rail transportation, 1840–2020. Appl. Energy 2024, 367, 123344. [Google Scholar] [CrossRef]

- Tang, B.J.; Li, X.Y.; Yu, B.; Wei, Y. Sustainable development pathway for intercity passenger transport: A case study of China. Appl. Energy 2019, 254, 113632. [Google Scholar] [CrossRef]

- Lyu, W.; Hu, Y.; Liu, J.; Chen, K.; Liu, P.; Deng, J.; Zhang, S. Impact of battery electric vehicle usage on air quality in three Chinese first-tier cities. Sci. Rep. 2024, 14, 21. [Google Scholar] [CrossRef] [PubMed]

- Hu, J.; Wang, S. Total-factor energy efficiency of regions in China. Energy Policy 2006, 34, 3206–3217. [Google Scholar] [CrossRef]

- Lin, T.T.; Lee, C.-C.; Chiu, T.-F. Application of DEA in analyzing a bank’s operating performance. Expert Syst. Appl. 2009, 36, 8883–8891. [Google Scholar] [CrossRef]

- Staub, R.B.; da Silva e Souza, G.; Tabak, B.M. Evolution of bank efficiency in Brazil: A DEA approach. Eur. J. Oper. Res. 2010, 202, 204–213. [Google Scholar] [CrossRef]

- Chen, S.Y. China’s Green Industrial Revolution: An Explanation from the Perspective of Environmental Total Factor Productivity (1980–2008). Econ. Res. J. 2010, 44, 21–34. [Google Scholar]

- Chaofan, C. China’s Industrial Green Total Factor Productivity and Its Influencing Factors: An Empirical Study Based on ML Productivity Index and Dynamic Panel Model. Stat. Res. 2016, 33, 53–62. [Google Scholar]

- Sueyoshi, T.; Goto, M. DEA approach for unified efficiency measurement: Assessment of Japanese fossil fuel power generation. Energy Econ. 2011, 33, 292–303. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Sekitani, K. Measurement of returns to scale using a non-radial DEA model: A range-adjusted measure approach. Eur. J. Oper. Res. 2007, 176, 1918–1946. [Google Scholar] [CrossRef]

- Cooper, W.W.; Park, K.S.; Pastor, J.T. RAM: A Range Adjusted Measure of Inefficiency for Use with Additive Models, and Relations to Other Models and Measures in DEA. J. Product. Anal. 1999, 11, 5–42. [Google Scholar] [CrossRef]

- Wang, K.; Lu, B.; Wei, Y.-M. China’s regional energy and environmental efficiency: A Range-Adjusted Measure based analysis. Appl. Energy 2013, 112, 1403–1415. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Environmental assessment for corporate sustainability by resource utilization and technology innovation: DEA radial measurement on Japanese industrial sectors. Energy Econ. 2014, 46, 295–307. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Returns to Scale, Damages to Scale, Marginal Rate of Transformation and Rate of Substitution in DEA Environmental Assessment. Energy Econ. 2012, 34, 905–917. [Google Scholar] [CrossRef]

- Wan, Y. An international comparative study of excise tax rate and tax burden level of refined oil. Contemp. Financ. Econ. 2016, 2, 43–51. [Google Scholar]

- Romer, P. Endogenous Technological Change. J. Political Econ. 1990, 98, 70–102. [Google Scholar] [CrossRef]

- Lucas, R.E. (Ed.) The Industrial Revolution: Past and Future. Lectures on Economic Growth; Harvard University Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Wen, Z.; Ye, B. Analysis of mediation effects: Development of methods and models. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Baron, R.; Kenny, D. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1217. [Google Scholar] [CrossRef] [PubMed]

| Variables | FE | System GMM | |||||

|---|---|---|---|---|---|---|---|

| (1) lnVeh | (2) lnSDE | (3) lnSDE | (4) lnVeh | (5) lnSDE | (6) lnSDE | ||

| L.lnSDE | 0.500 *** (4.18) | 0.424 ** (2.20) | |||||

| lnDtaxI | 2.061 ** (2.11) | −0.339 (0.54) | −0.152 (0.24) | −0.232 *** (4.55) | −0.311 (−0.37) | 0.003 (0.12) | |

| lnVeh | −0.091 ** (2.51) | −0.050 * (−1.66) | |||||

| lnAGDP | 0.325 * (1.77) | −0.662 *** (5.54) | −0.632 *** (5.31) | −0.724 *** (2.98) | −0.409 ** (−2.46) | −0.494 * (−1.77) | |

| (lnAGDP)2 | −0.567 *** (7.67) | 0.207 *** (4.32) | 0.155 *** (3.00) | 0.405 *** (2.71) | 0.217 ** (2.44) | 0.259 * (1.67) | |

| lnES | 0.243 ** (1.98) | 0.005 (0.06) | 0.027 (0.34) | −0.033 (0.30) | −0.114 * (−1.66) | −0.139 * (−1.76) | |

| lnRoadD | −0.388 *** (−2.42) | −0.217 ** (2.09) | −0.252 ** (2.42) | −0.073 (1.34) | −0.064 *** (−4.08) | −0.055 * (−1.84) | |

| lnCI | 0.147 *** (4.65) | −0.237 *** (11.61) | −0.224 *** (10.69) | −0.061 (2.21) | −0.121 *** (−5.76) | −0.135 *** (−3.86) | |

| Constant | 1.620 (1.33) | 0.924 (1.17) | 1.071 (1.36) | 0.990 * (1.77) | 1.738 (0.66) | 0.973 ** (2.22) | |

| R2 | 0.843 | 0.493 | 0.480 | ||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | |

| AR(2) | 0.487 | 0.393 | 0.515 | ||||

| Sargan | 0.021 | 0.000 | 0.000 | ||||

| Hansen | 0.248 | 0.284 | 0.085 | ||||

| F | 233.30 | 30.33 | 18.59 | ||||

| Wald chi2 | 6261.08 | 1467.71 | 440.70 | ||||

| N | 360 | 360 | 360 | 360 | 330 | 330 | |

| Variables | FE | System GMM | |||||

|---|---|---|---|---|---|---|---|

| (1) lnVeh | (2) lnSDE2 | (3) lnSDE2 | (4) lnVeh | (5) lnSDE2 | (6) lnSDE2 | ||

| L.lnSDE2 | 0.379 *** (8.68) | 0.328 *** (7.65) | |||||

| lnDtaxI | 2.061 ** (2.11) | 2.347 (1.65) | 2.125 (1.49) | −0.197 *** (−5.17) | 2.259 (0.83) | 2.992 (0.008) | |

| lnVeh | −0.057 ** (−1.94) | −0.270 ** (−2.13) | |||||

| lnAGDP | 0.325 * (1.77) | −1.07 *** (−4.00) | −1.107 *** (−4.12) | −0.741 *** (−3.00) | −1.681 *** (−2.88) | −0.974 ** (−2.24) | |

| (lnAGDP)2 | −0.567 *** (−7.67) | 0.170 * (1.83) | 0.231 ** (1.97) | 0.471 *** (3.08) | 1.015 ** (3.16) | 0.576 ** (2.45) | |

| lnES | 0.243 ** (1.98) | −0.145 (0.81) | −0.171 (−0.95) | −0.111 (−0.97) | 0.078 (0.21) | −0.020 (−0.09) | |

| lnRoadD | −0.388 *** (−2.42) | −1.218 *** (−5.23) | −1.176 *** (−5.00) | −0.101 * (−1.69) | −0.291 ** (−2.26) | −0.154 ** (−2.05) | |

| lnCI | 0.147 *** (4.65) | −0.823 *** (−17.96) | −0.839 *** (−17.72) | −0.069 ** (−2.05) | −0.889 *** (−6.28) | −0.817 *** (−7.05) | |

| Constant | 1.620 (1.33) | 1.674 (−0.94) | 1.500 (0.84) | 1.056 ** (2.19) | −7.160 (−0.85) | −8.626 (−1.02) | |

| R2 | 0.843 | 0.750 | 0.437 | ||||

| Control | Yes | Yes | Yes | Yes | Yes | Yes | |

| AR(2) | 0.519 | 0.484 | 0.505 | ||||

| Sargan | 0.033 | 0.000 | 0.002 | ||||

| Hansen | 0.171 | 0.406 | 0.247 | ||||

| F | 233.30 | 35.83 | 16.5 | ||||

| Wald chi2 | 5772.17 | 2174.72 | 1056.75 | ||||

| N | 360 | 360 | 360 | 360 | 330 | 330 | |

| Variables | East | Central | West | |||

|---|---|---|---|---|---|---|

| (1) lnSDE | (2) lnSDE | (3) lnSDE | (4) lnSDE | (5) lnSDE | (6) lnSDE | |

| lnDtaxI | 1.333 (1.26) | 1.626 (1.26) | 2.716 (0.65) | 5.353 (1.24) | −0.757 (−0.75) | −1.270 * (−1.72) |

| lnVeh | −0.174 ** (−2.33) | −0.262 ** (−3.75) | 0.040 (0.93) | 0.027 (0.64) | 0.069 ** (2.37) | 0.064 ** (2.46) |

| lnAGDP | −0.636 (−1.64) | −1.085 *** (−2.74) | 0.127 (0.69) | 0.114 (0.62) | −0.458 *** (−6.53) | −0.363 *** (−4.97) |

| (lnAGDP)2 | 0.035 (0.21) | 0.110 (0.72) | −0.405 ** (−3.02) | −0.435 ** (−3.27) | 0.106 ** (2.39) | 0.078 ** (1.92) |

| lnRoadD | 0.157 (0.51) | −0.165 (−0.58) | −0.301 ** (−2.59) | −0.200 * (−1.68) | −0.033 (−0.5) | −0.083 (−1.42) |

| lnCI | −0.336 *** (−8.01) | −0.370 *** (−8.67) | −0.138 *** (−6.61) | −0.135 *** (−6.68) | −0.067 *** (3.49) | −0.056 *** (−3.24) |

| ln_NAcci | 0.266 *** (4.49) | 2.716 (0.65) | −0.044 ** (−2.43) | −0.059 *** (−5.27) | ||

| R2 | 0.591 | 0.654 | 0.677 | 0.714 | 0.501 | 0.617 |

| control | Yes | Yes | Yes | Yes | Yes | Yes |

| F | 19.43 | 15.04 | 9.56 | 5.63 | 14.63 | 12.22 |

| N | 132 | 132 | 96 | 96 | 132 | 132 |

| Variables | Scale = 1 | Scale = 2 | ||||

|---|---|---|---|---|---|---|

| (1) lnVeh | (2) lnSDE | (3) lnSDE | (4) lnVeh | (5) lnSDE | (6) lnSDE | |

| lnDtaxI | −0.256 (−0.09) | 0.119 (0.05) | 0.044 (0.02) | 2.922 *** (2.98) | 0.481 ** (2.07) | 0.406 * (1.71) |

| lnVeh | −0.292 *** (−4.15) | 0.025 (1.45) | ||||

| lnAGDP | 0.459 * (0.95) | −1.22 *** (−3.23) | −1.087 *** (−3.07) | 0.370 * (1.72) | −0.206 *** (−4.01) | −0.214 *** (−4.18) |

| (lnAGDP)2 | −0.552 *** (−2.73) | 0.509 *** (3.23) | 0.348 ** (2.29) | −0.451 *** (−5.55) | 0.052 *** (2.67) | 0.063 *** (3.03) |

| lnRoadD | −0.407 * (−1.67) | −0.297 (−1.56) | −0.416 ** (−2.32) | −0.105 (−0.52) | 0.051 (1.06) | 0.053 (1.12) |

| lnCI | 0.152 *** (2.32) | −0.499 *** (−9.78) | −0.455 *** (−9.33) | 0.126 *** (3.49) | −0.073 *** (−8.52) | −0.076 *** (−8.64) |

| ln_NAcci | 0.115 (1.42) | 0.085 (1.35) | 0.119 ** (2.00) | 0.023 (0.69) | −0.056 *** (−7.02) | −0.057 *** (−7.11) |

| R2 | 0.846 | 0.732 | 0.769 | 0.882 | 0.588 | 0.592 |

| Control | Yes | Yes | Yes | Yes | Yes | Yes |

| F | 22.19 | 16.10 | 18.49 | 94.94 | 43.41 | 40.16 |

| N | 139 | 139 | 139 | 221 | 221 | 221 |

| Variables | Model (5) | Model (6) | Model (7) | Model (8) | ||||

|---|---|---|---|---|---|---|---|---|

| Coef. | p Value | Coef. | p Value | Coef. | p Value | Coef. | p Value | |

| DtaxI | 0.064 | 0.013 | −4.102 | 0.055 | 0.420 | 0.071 | ||

| NAcci | −0.055 | 0.000 | −0.053 | 0.000 | ||||

| Control | Yes | Yes | Yes | Yes | ||||

| R2 | 0.483 | 0.464 | 0.577 | 0.551 | ||||

| N | 221 | 221 | 221 | 221 | ||||

| β2β3/β1 | 0.354 | |||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, M.; Chen, P. Traffic Safety, Fuel Tax Intensity and Sustainable Development Efficiency of Transportation: Evidence from China. Sustainability 2024, 16, 5930. https://doi.org/10.3390/su16145930

Lu M, Chen P. Traffic Safety, Fuel Tax Intensity and Sustainable Development Efficiency of Transportation: Evidence from China. Sustainability. 2024; 16(14):5930. https://doi.org/10.3390/su16145930

Chicago/Turabian StyleLu, Mingxuan, and Peirong Chen. 2024. "Traffic Safety, Fuel Tax Intensity and Sustainable Development Efficiency of Transportation: Evidence from China" Sustainability 16, no. 14: 5930. https://doi.org/10.3390/su16145930

APA StyleLu, M., & Chen, P. (2024). Traffic Safety, Fuel Tax Intensity and Sustainable Development Efficiency of Transportation: Evidence from China. Sustainability, 16(14), 5930. https://doi.org/10.3390/su16145930