Abstract

Developing new productivity adapted to local conditions and actively promoting the green transformation of industries is the key to improving environmental pollution control levels. Based on data from 697 listed companies in heavily polluting industries nationwide from 2012 to 2022, this paper empirically examines the impact mechanisms, paths, and heterogeneity of technological finance, technological innovation, and financing constraints on environmental pollution control levels. The study shows that technological finance significantly improves the environmental pollution control levels of heavily polluting enterprises. However, there is some greenwashing behavior in the utilization of technological finance funds. Technological innovation and financing constraints play a partial mediating role in the process of improving environmental pollution control levels through technological finance. Compared with non-state-owned enterprises, state-owned enterprises are more sensitive to the enhancement of environmental pollution control through technological finance. To improve the environmental pollution control levels of heavily polluting enterprises, those located in strictly regulated “dual control areas” are less influenced by technological finance compared to those outside these areas. This paper also attempts to explore the factors affecting the sustainable green development of heavily polluting industries and provides policy recommendations for improving the environmental pollution control levels of heavily polluting enterprises.

1. Introduction

With rapid development, China has increasingly prioritized environmental pollution issues, balancing ecological protection with strategic goals of carbon peaking and carbon neutrality [1]. Since the 18th National Congress of the Communist Party of China, ecological civilization construction has been an overarching plan, promoting the comprehensive layout of the ‘five-in-one’ framework and enhancing ecological environmental protection. The report of the 20th National Congress of the Communist Party of China clearly states the need to “coordinate the adjustment of industrial structures, control pollution, protect the ecology, and respond to climate change”, aiming to promote “carbon reduction, pollution reduction, greening, and growth” in a coordinated manner, fostering a development process that prioritizes ecology, efficiency, and low carbon. At the second session of the 14th National Committee of the Chinese People’s Political Consultative Conference, President Xi Jinping proposed the following: “Develop new quality productivity according to local conditions, and actively promote the high-end, intelligent, and green transformation of industries”. Environmental pollution control is one of the most important issues China faces, requiring urgent solutions. Recently, China has increasingly focused on addressing environmental pollution from heavily polluting industries that consume large amounts of fossil fuels. A feasible direction is to utilize technological innovation and the transformation of scientific achievements, along with the application of various financial tools and financial systems by heavily polluting industries. In this process, technological finance has become a key factor in environmental pollution control.

Data from the GTA database indicate that there are approximately 1947 listed companies in heavily polluting industries in China, comprising over a quarter of all listed companies on the Shanghai and Shenzhen Stock Exchanges. These industries urgently need to transition to green and low-carbon operations, posing a significant challenge for environmental pollution control and having a crucial impact on achieving ecological economy and dual carbon goals. To enhance environmental pollution control and achieve green transformation, heavily polluting industries must produce high-quality scientific and technological results and foster a favorable innovation ecosystem. This necessitates a large and urgent demand for R&D funding in technological innovation.

Technological finance is an innovative arrangement providing financial support for technological development and achievement transformation through various financial tools, systems, policies, and services [2]. It involves multiple stakeholders, including the government, enterprises, markets, and social intermediaries, and plays a role in financing technological innovation. As a crucial part of the national technological innovation and financial systems, technological finance is a catalyst for green technological innovation. It not only promotes the quantity and quality of green technological innovation but also improves the overall quality of green technological innovation [3].

Most existing literature focuses on technological finance and enterprise innovation [4], financing constraints [5], or digital finance and environmental pollution control levels [6]. However, there is limited research on environmental pollution control levels, and even fewer studies focus on the enterprise level rather than city-level data. Furthermore, different scholars use varying concepts of technological finance when focusing on this indicator. This paper adopts a more comprehensive evaluation system, using the entropy method to calculate technological finance from three dimensions. This paper studies the relationship between technological finance and the environmental pollution control levels of heavily polluting industry enterprises, exploring the impact mechanisms of technological finance on these enterprises’ environmental pollution control levels and proposing feasible paths for integrating technological finance and environmental pollution control levels. This aims to assist the government in establishing mechanisms for coordinated governance of technological finance and environmental pollution, achieving the harmonized development of regional technology, economy, and environmental pollution prevention.

This paper’s main contributions are as follows: (1) Exploring the impact mechanisms of technological finance on the environmental pollution control levels of heavily polluting industries. From the dual perspectives of finance and technology, it examines if the mediating roles of technological innovation and financing constraints are paths through which technological finance development impacts the environmental pollution control levels of heavily polluting industry enterprises. (2) From a micro perspective, it collects environmental pollution data at the enterprise level in heavily polluting industries, rather than aggregated city or regional data. By considering the unique data characteristics of different regions and enterprises, it provides more scientifically reliable evidence for studying the impact of technological finance on the environmental pollution control levels of heavily polluting industries.

2. Literature and Research Hypotheses

2.1. The Development and Characteristics of Technological Finance

In recent years, with the increasing integration of technology and finance, more and more scholars have paid attention to the field of technological finance. Scholars have not clearly defined technological finance, primarily studying the interaction between technology and finance. King (1993) [7] examined the situation of local banks obtaining financing for local technological innovation and analyzed the potential significant role of combining finance and technological innovation in promoting economic development. Carlota (2003) [8] noted that financial capital’s endless pursuit of profits and the high returns from technological innovation have tightly integrated finance and technology, promoting economic prosperity. Doh S (2014) [9] found that government financial support had a positive impact on technological innovation in SMEs. Chirkunova et al. (2016) [10] pointed out that there is a significant important relationship between technological innovation and finance, and they mutually influence each other; without financial support, technological innovation cannot be realized.

In China, the concept of technological finance was proposed as early as 1994, but systematic research was incomplete until Zhao Changwen’s [2] book Technological Finance gained recognition in 2009. This paper also references this viewpoint in defining technological finance, considering it as an innovative and systematic arrangement of financial tools, institutions, policies, and services to provide funding support for technological development, results transformation, and industrial development. Shao Chuanlin and Wang Liping (2016) [11] argue that technological finance offers the most convenient and efficient way to effectively combine technology and finance, making it the most effective method to implement China’s innovation-driven strategy.

As research on technological finance deepens, scholars have begun to focus on scientific evaluation systems, specific measurement methods, and influencing factors of technological finance. Shen L et al. (2022) [12] constructed a comprehensive index model of technological finance and financial stability using the spatial SAC model and PVAR model. Their research found that technological finance has a significant negative impact on financial stability in the short term. Huang J (2019) [13] established a VAR model based on Shanghai’s technological finance investment and the output value of high-tech industries to study the relationship between the development of technological finance and economic growth in Shanghai. Jiang L et al. (2022) [14] tested the role of technological finance in China’s green and high-quality development using the static spatial Durbin model, dynamic spatial Durbin model, and semi-parametric spatial lag model. Their research found that technological finance significantly promotes overall green and high-quality development in China.

Li Z et al. (2022) [15] explored the mechanism of different types of technological finance on regional technological collaborative innovation using the Beijing–Tianjin–Hebei region as an example. Guo Jinlu et al. (2023) [16] used the entropy method to measure technological finance from the environmental index, funding index, and output index and analyzed the relationship between technological finance and enterprise financing efficiency. Lü Yanwei et al. (2024) [1] divided technological finance into government technology funding, enterprise R&D investment, and technological finance loans, and explored the impact mechanisms of technological finance on high-quality economic development from the perspective of innovation motivation.

After in-depth research on the measurement methods of technological finance, many scholars have begun exploring the relationship between technological finance and technological innovation, financing constraints, green loans, pollution reduction, and more. Fan Wenxiao et al. (2023) [17] studied the coupling and coordination of technological finance and industrial structure transformation and upgrading and found that technological finance can promote industrial structure upgrading and transformation. Gao C et al. (2022) [18] used the DID method to study the impact of technological finance on urban green development levels, concluding that technological finance policies significantly enhance urban green development, with the effect of policy implementation initially rising and then declining over time. Yang Rui et al. (2023) [19] explored the impact and mechanisms of technological finance policies on relationship loans from the perspective of state-owned enterprises and found that technological finance policies significantly promoted the growth of relationship loans for state-owned enterprises in the short term. Lin Yongsheng et al. (2023) [20] used difference-in-differences to study technological finance and enterprise pollution reduction and found that the emission reduction effect of heavily polluting industry enterprises is higher.

2.2. Mechanisms of Technological Finance’s Impact on Environmental Pollution Control Levels

Based on the economic development concept of “innovation, coordination, green, openness, and sharing”, green development has become an important topic today. The primary obligation for green development is to solve environmental pollution problems from the source and improve the environmental pollution control levels of heavily polluting industries. Technological finance, as a major tool that integrates technological resources and financial capital, may play an important role in improving environmental pollution control levels. Chen Shiyi et al. (2021) [21] found that green credits can promote green innovation in enterprises and further reduce emissions. Technological finance provides funds through policy guidance or fiscal subsidies for environmental pollution control projects in heavily polluting industries to alleviate the financing constraints of heavily polluting enterprises and reduce their financing costs. Lin Yongsheng et al. (2023) [20] constructed an equilibrium model of technological finance and enterprise pollution, finding that technological finance can significantly reduce enterprise pollution emissions and improve their environmental pollution control levels. Technological finance can also encourage heavily polluting enterprises to take environmental control measures through environmental policy guidance. Yan Y (2022) [22] used the propensity score matching method to examine the positive impact of the first batch of technological finance pilot policies implemented in 2012 on technological innovation in small and medium-sized enterprises.

Previous studies have examined the impact of technological finance on the environmental pollution control levels of enterprises from various perspectives, consistently showing that technological finance can enhance these levels. However, they did not establish a comprehensive evaluation system for technological finance, leading to results that lack comprehensiveness. Therefore, this paper uses the entropy method to comprehensively calculate the development level of technological finance from multiple dimensions, enabling a more thorough investigation of the factors influencing technological finance and environmental pollution control levels.

Although technological finance can benefit certain projects, it is essential to adapt to local conditions to prevent different regions’ varying levels of technological finance development, company scale, and the debt conditions of heavily polluting enterprises from affecting their environmental pollution control levels. Shen Yue et al. (2021) [23] found that some enterprises choose to transfer industries in response to policy pressures, leading to asymmetric environmental regulations in different regions and causing pollution transfer and pollution rebound, which do not fundamentally solve environmental pollution problems.

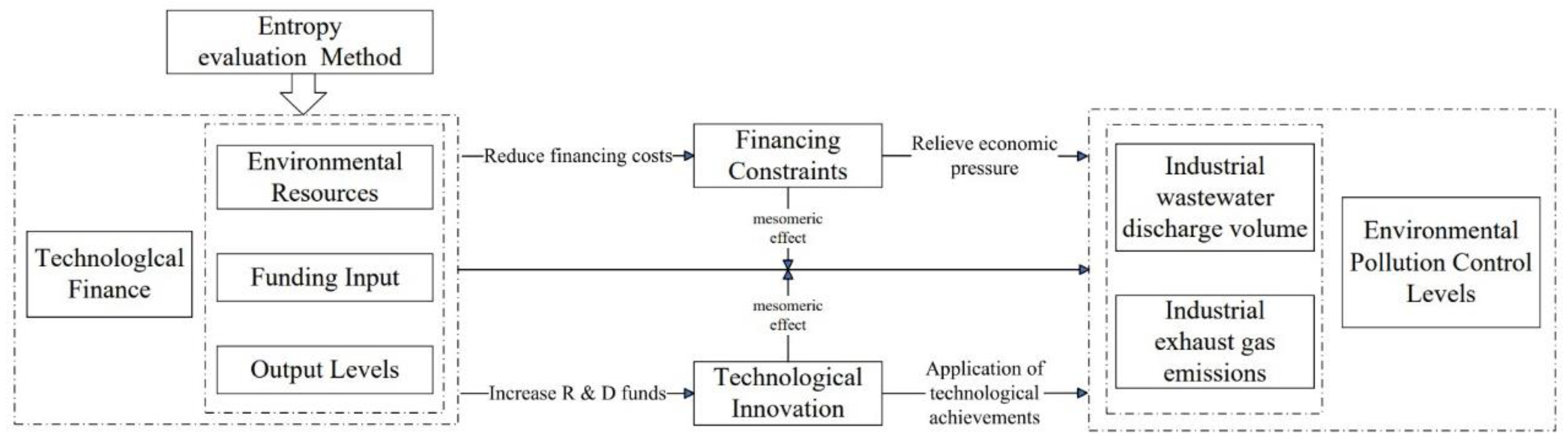

As ‘economic agents’, enterprises require significant time and funds to perform upgrades and transformations during production changes, which may temporarily decrease their environmental pollution control levels. The operating mechanism of technological finance reduces and mitigates the financial constraints on heavily polluting enterprises through government regulation, financial institutions, and capital markets. It transfers financial risks from heavily polluting industries, alleviates significant economic pressures, ensures the financial needs of various stages of innovation in heavily polluting industries, accelerates the technological upgrading of traditional industries, and the application of technological achievements, thereby promoting improvements in the environmental pollution control levels of heavily polluting industries. The theoretical framework is illustrated in Figure 1.

Figure 1.

Mechanism of how technological finance affects environmental pollution control levels.

Technological finance directs social resources through targeted channels, constructing a multi-channel financing structure to lower financing costs, thereby enabling heavily polluting industries to flexibly accelerate their environmental pollution control levels. The fewer financing constraints a heavily polluting enterprise faces, the more conducive it is to developing technological innovation [24]. Increased technological innovation helps reduce the external carbon emissions of enterprises [25], enhancing their environmental pollution control levels. With funds provided by technological finance, enterprises can not only apply existing control technologies but also develop and implement new environmental control technologies, promoting green technological innovation and improving their environmental pollution control levels [26].

Accordingly, this paper proposes the following hypotheses for verification:

H1.

Technological finance improves the environmental pollution control levels of heavily polluting industries.

H2.

Technological innovation plays a significant mediating role in the impact of technological finance on the environmental pollution control levels of heavily polluting industries.

H3.

Financing constraints play a significant mediating role in the impact of technological finance on the environmental pollution control levels of heavily polluting industries.

3. Empirical Strategy and Data Description

The empirical testing of the above hypotheses follows these steps: First, we examine whether technological finance significantly impacts the environmental pollution control levels of heavily polluting industries, establishing it as a necessary condition for Hypothesis 1. Next, we assess the robustness of the model by altering environmental pollution control indicators and conducting lag tests. Then, we test whether technological innovation and financing constraints serve as mediating effects on the influence of technological finance on the environmental pollution control levels of heavily polluting industries. Finally, we conduct heterogeneity analysis by distinguishing different samples based on the nature of the heavily polluting enterprises and their geographical location.

3.1. Empirical Models

3.1.1. Baseline Regression Model

To verify Hypothesis 1 and examine the impact of technological finance on the environmental pollution control levels of heavily polluting industries, we construct the following baseline regression model:

In Equation (1), represents the level of environmental pollution control of heavily polluting industry enterprises in region at time , and indicates the regional technological and financial level of heavily polluting industry enterprises in region at time . In Equation (2), represents the regional technological and financial environment, financial, and output levels of heavily polluting industry enterprises in region at time . denotes control variables, including leverage ratio (Lev), firm size (Size), Tobin’s Q (TobinQ), the proportion of shares held by the top ten shareholders (Top10), and the number of years since the company was established (FirmAge). Additionally, firm-specific fixed effects and year fixed effects are included as control variables, and is the random disturbance term.

3.1.2. Mediation Effect Models

To verify Hypotheses 2 and 3 and examine whether financing constraints and technological innovation play a mediating role in the impact of technological finance on environmental pollution control levels, this study employs a stepwise regression method to test the mediation effect [27]. Based on the baseline regression model, we construct the following mediation effect models:

In Equations (3) and (4), represents the mediating variables, namely financing constraints and technological innovation, while other variables remain the same as in Equation (1). In these equations, coefficient from Equation (1) represents the total effect of technological finance on the level of environmental pollution control in heavily polluting industries. Coefficient from Equation (3) indicates the effect of technological finance on the mediating variables (financing constraints or technological innovation). Coefficient from Equation (4) shows the impact of the mediating variables on the level of environmental pollution control in heavily polluting industries after controlling for the direct influence of technological finance. Coefficient represents the direct effect of technological finance on the level of environmental pollution control in heavily polluting industries after controlling for the indirect influence of the mediating variables. In the stepwise regression testing method, the significance of is tested sequentially to determine the presence of a mediating effect, as well as whether it is a partial or complete mediating effect.

3.2. Variable Description

3.2.1. Dependent Variable

The dependent variable is the environmental pollution control levels (PE). Due to the diversity of environmental pollution control measurement methods, there is no unified observation data, and different scholars select different measurement methods based on their research perspectives.

Wang K L et al. (2022) [28] studied the impact of digital finance on haze pollution using haze concentration as an indicator of environmental pollution. Jiang L et al. (2019) [29] measured pollution control levels using a comprehensive index of sulfur dioxide and soot emissions when studying the transfer of polluting industries in different regions. Chen X et al. (2020) [30] calculated the comprehensive index of environmental pollution by using the horizontal and vertical divergence method to measure industrial pollutant emissions and employed spatial econometric methods to analyze the impact of environmental regulation under fiscal decentralization on environmental pollution. Wang Linhui et al. (2020) [31] measured pollution control by using environmental taxes on non-clean products and policies implemented by the government for non-clean production sectors. Liu Pingkuo et al. (2023) [32] studied environmental pollution from the perspective of carbon neutrality, using the number of green patents for carbon-neutral technologies as a measure. Considering the characteristics of heavily polluting enterprises at the firm level and data availability, this paper follows the approach of Mao Jie et al. (2022) [33] by using the emissions of chemical oxygen demand, ammonia nitrogen, sulfur dioxide (SO2), and nitrogen oxides (NOx) from enterprises. These emissions are converted according to the pollution equivalent values specified in the “Measures for the Administration of Pollution Charges Collection Standards”. These standardized emissions are then summed to obtain a comprehensive pollution equivalent value (taking the natural logarithm after adding 1) to assess the environmental pollution control levels of enterprises.

3.2.2. Independent Variable

The independent variable is technological finance (TF). Domestic and foreign scholars have not established a unified quantitative evaluation index for technological finance. Some scholars analyze from the perspective of technological finance policies [34], using DEA to measure the efficiency of technological finance allocation [35] and utilizing regional technological finance development levels [36]. Due to regional differences, heavily polluting industry enterprises experience significant regional heterogeneity. Therefore, this paper measures technological finance from the perspective of regional technological finance development levels. Referring to the construction ideas of technological finance evaluation indicators by Ding Yong et al. (2023) [37] and Zhang Teng et al. (2023) [38], this study uses the entropy method to measure technological finance based on the evaluation method of existing resources—technological finance funding input—technological finance output, specifically focusing on technological finance environmental resources, technological finance funding input, and technological finance output levels.

The specific calculation of the entropy method is as follows: Suppose there are evaluation objects in a certain year, with b evaluation indicators. The comprehensive rating of these b indicators, , represents the data of the j-th indicator of the i-th evaluation object. The steps are as follows:

(1) Standardize the data of each indicator to eliminate the dimensional impact, obtaining a standardized matrix:

(2) Calculate the weight of each indicator:

(3) Calculate the entropy value of each indicator:

(4) Determine the entropy weight of each indicator:

(5) Calculate the comprehensive evaluation value:

Technological finance environmental resources refer to the relevant human, economic, and environmental factors that can promote the development of technological finance. This study mainly considers technological human resources and technological R&D resources. The term technological human resources refers to the full-time equivalent of R&D personnel in a region as a proportion of the total population, reflecting the intensity of technological human resources. Technological R&D resources are measured by the number of R&D institutions in a region as a proportion of the total population, reflecting the hardware resource level of technological finance development. Technological finance funding focuses on the supply of financial funds for scientific research activities, described by the proportion of regional scientific and technological expenditure in the general public budget and the proportion of regional R&D expenditure in the regional GDP. The output level of technological finance is measured by the proportion of regional patent applications to regional R&D expenditure.

The components of the Technological Finance Development Index are shown in Table 1. Using the entropy method, the technological finance development levels of 31 provinces (excluding Taiwan, Hong Kong, and Macau) in China from 2012 to 2022 were measured, and the technological finance development index for each city was obtained.

Table 1.

Measurement of regional technological finance development.

3.2.3. Mediating Variables

The mediating variables are financing constraints (SA) and technological innovation (TE). Technological innovation is measured by the logarithm of the number of patents granted to the company in the year plus one. Financing constraints are measured using the SA index constructed by Hadlock and Pierce (2010) [39], as referenced by Jia Yidan (2023) [40]. The specific formula is:

where is the current year minus the year the enterprise was established and is the natural logarithm of the enterprise’s total annual assets.

3.2.4. Control Variables

This paper draws on the research of Guo Jinlu et al. [16] and Kang Yanling et al. [41] to select the following control variables: firm size (Size), leverage ratio (Lev), shareholding ratio of the top ten shareholders (Top10), Tobin’s Q, and firm age (FirmAge). The specific variable definitions are shown in Table 2.

Table 2.

Variable definitions.

3.3. Data Description and Analysis

This study selects listed companies in heavily polluting industries on the Shanghai and Shenzhen A-share markets from 2012 to 2022 as research objects. The sample screening is performed as follows: excluding ST companies with abnormal situations and *ST companies with delisting risks, and removing companies with missing data, ultimately selecting 697 listed companies in heavily polluting industries, with a total of 5622 observations.

The relevant indicator data for technological finance are sourced from provincial “Statistical Yearbooks”, “Science and Technology Statistical Yearbooks”, and “Statistical Bulletins”. The data for environmental pollution control, technological innovation, financing constraints, firm size, leverage ratio, shareholding ratio of the top ten shareholders, Tobin’s Q, and firm age are obtained from the CNRDS, CSMAR (GTA) databases, and company annual reports.

Table 3 presents the descriptive statistics of the main variables. From the standard deviation of the environmental pollution control levels (0.00389), it can be seen that the pollutant emissions of heavily polluting industry enterprises do not vary significantly, and none of the sample enterprises have zero emissions of exhaust gas and wastewater. The maximum (0.683) and minimum (0.0654) values of technological finance indicate substantial differences in technological finance levels across different regions, suggesting that regional heterogeneity should be considered in the analysis. Similarly, the large gap in technological innovation, with a maximum value of 8.892 and a minimum value of 0, suggests significant disparities in innovation capabilities among different enterprises. The average value of financing constraints is −3.809, indicating that the selected heavily polluting enterprises face certain financing pressures. Other variables are within reasonable ranges. Additionally, a correlation test was conducted on the variables, and the results show that there is no serious multicollinearity issue among the variables.

Table 3.

Descriptive statistics.

4. Empirical Testing

4.1. Full Sample Regression

As shown in Table 4, the results of the baseline regression for the full sample indicate that columns (1) and (2) represent the regression results without and with individual and year fixed effects, respectively. It can be observed that the regression coefficients of technological finance (TF) are −0.0097 and −0.0058, both of which are significant at the 1% level, having passed the significance test. This indicates that technological finance has a suppressive effect on pollutant emissions from heavily polluting enterprises and promotes environmental pollution control, thus verifying Hypothesis 1.

Table 4.

Baseline regression.

Columns (3) and (5) present the regression results for technological finance environmental resources and technological finance output levels on environmental pollution control levels. The regression coefficients are −0.0099 and −0.002, respectively, both significant at the 1% level, thus confirming Hypothesis 1. However, column (4) shows a positive correlation between technological finance funding input and environmental pollution control levels, despite being significant at the 1% level. This indicates that, as heavily polluting enterprises increase their technological finance funding input, their environmental pollution control levels decrease. Huang Rongbing et al. (2019) [42] found that, compared to enterprises with no financing needs, those with external financing needs, especially heavily polluting enterprises, exhibit more severe greenwashing behavior. The results of this study are similar, for three main reasons: The first reason is the input–output ratio problem, where the total factor productivity is relatively insufficient. Although there is investment, the management level is not up to par, leading to relatively low investment efficiency. The second reason is the degree of emphasis local governments place on economic development, inevitably leading to this result. As economic development deepens, pollution emissions also increase. Despite enterprises purchasing pollution control equipment, in many places, due to local protectionism, environmental protection enforcement is not in place to prioritize local economic development. The third reason indicates that heavily polluting enterprises, upon obtaining financial resources, increase their investment in green activities. However, these enterprises might only purchase green equipment on paper, acquiring environmental governance equipment and various measures without actual operation. This means the funds do not fully play their role, leading to partial or ineffective greenwashing behavior.

The remaining control variables also generally passed the significance level tests. The results show that the larger the firm size, the higher the shareholding ratio of the top ten shareholders, the higher the Tobin’s Q, and the longer the firm age, the more pollutant emissions (exhaust gas and wastewater) are produced by heavily polluting enterprises. Conversely, a lower leverage ratio is associated with lower pollutant emissions. This may be because a lower leverage ratio indicates ample liquidity, reducing financing constraints. This hypothesis is further supported by the finding that financing constraints mediate the impact of technological finance on environmental pollution control levels, as discussed in the following sections.

4.2. Endogeneity Test

The difference-in-differences (DID) method can effectively avoid endogeneity issues. This paper utilizes the DID method, starting from the technological finance pilot policy, to illustrate that technological finance significantly improves the environmental pollution control levels of heavily polluting enterprises. According to the “Second Batch of Pilot Policies to Promote the Integration of Technology and Finance” jointly implemented by the Ministry of Science and Technology, the People’s Bank of China, the China Banking Regulatory Commission, the China Securities Regulatory Commission, and the China Insurance Regulatory Commission in 2016, enterprises located in the regions of the second batch of pilot policies were screened out from the total sample. Considering that the first batch of technological finance pilot projects started in 2011, and the sample period of this paper is after 2012, the second batch of pilot policy areas was selected for this study. The new sample excludes enterprises from the areas covered by the first batch of technological finance pilot policies. A DID variable was added to the screened sample. If the new sample enterprises were in the pilot areas and the time was 2016 (inclusive) or later, the value was set to 1; otherwise, it was set to 0. The regression results are shown in columns (1) and (2) of Table 5. The results indicate that the DID variable passes the significance level test as to whether control variables are added or not, indicating that the technological finance pilot policy improves the environmental pollution control levels of heavily polluting enterprises.

Table 5.

Endogeneity and robustness test results.

4.3. Robustness Test

To further test the robustness and reliability of the above results, this study conducts robustness tests from the following two aspects:

4.3.1. Replacing the Measurement Method of Environmental Pollution Control

The pollutants discharged by enterprises into the external environment are generally based on the pollution caused by their production and business activities. Since these activities are entirely determined by their output value, this study follows Mao Jie et al. (2022) [32] by selecting the ratio of enterprise pollutant emissions to the total output value of the enterprise as a measure of environmental pollution control levels, instead of the natural logarithm of pollutant emissions plus one. The regression results in column (3) of Table 5 show that the robustness test results are consistent with the previous regression results.

4.3.2. Introducing Lagged Terms of Technological Finance

Considering that China is currently in the “14th Five-Year Plan” period, where the development environment has shifted from high-speed to high-quality development, and various industries are undergoing transformation and upgrading, the resources invested during this period may not yield substantial progress in the short term. Therefore, this study introduces the lagged term of technological finance by one period into the regression model to conduct robustness tests. The regression results in column (4) of Table 5 show that technological finance remains significant in affecting the environmental pollution control of heavily polluting industries, consistent with the baseline regression results, indicating that the findings are robust.

5. Extended Analysis

5.1. Mediation Effect Analysis

Table 6 presents the regression results of two mediating variables in the process of technological finance influencing the level of environmental pollution control.

Table 6.

Results of mediation effect analysis.

5.1.1. Mediation Effect Test of Technological Innovation

In the stepwise mediation effect test of technological innovation, the results in column (2) show that the regression coefficient of technological finance (TF) is 0.3238, significant at the 1% level. This indicates that an increase in technological finance facilitates the enhancement of technological innovation capability in heavily polluting enterprises. Column (3) shows that the regression coefficient of technological innovation (TE) is −0.0001, significant at the 1% level, while the regression coefficient of technological finance (TF) is −0.0058, also significant at the 1% level. This suggests that technological innovation in heavily polluting enterprises plays a partial mediating role in the influence of technological finance on environmental pollution control levels, thereby validating Hypothesis 2.

The results indicate that, with the support of technological finance, heavily polluting enterprises can more easily access research and development funds to enhance their technological innovation capabilities. The improvement in technological innovation enhances the environmental pollution control levels of these enterprises, thereby reducing pollutant emissions and improving overall environmental quality. This finding is similar to the results of Lin et al. (2023) [20], although their study focuses on the balanced perspective between technological finance and corporate environmental pollution control levels, without considering the mediating role of technological innovation and the heterogeneity of regions and enterprise characteristics. In contrast, this study provides a more precise examination from the perspective of heavily polluting industries, exploring the differential impact of technological finance on environmental pollution control levels and the mediating role of technological innovation therein.

The support from technological finance drives heavily polluting enterprises to utilize funds for acquiring advanced and environmentally friendly technologies, promoting the widespread adoption of green technologies. This encourages enterprises to prioritize environmental protection in their production processes, positively impacting their environmental pollution control levels. Simultaneously, investments in technological finance optimize resource allocation for research and application in heavily polluting enterprises, enabling more efficient resource utilization and reduced environmental pollution, thereby effectively enhancing corporate environmental pollution control levels.

5.1.2. Mediation Effect Test of Financing Constraints

The results in column (4) of Table 6 show that the regression coefficient of technological finance (TF) is −0.1747, significant at the 1% level, indicating that an increase in technological finance helps alleviate financing constraints in heavily polluting enterprises. Column (5) reveals that the regression coefficient of financing constraints (SA) is −0.0095, significant at the 1% level, while the regression coefficient of technological finance (TF) is −0.0041, also significant at the 1% level. This suggests that financing constraints in heavily polluting enterprises play a partial mediating role in the impact of technological finance on environmental pollution control levels, thereby validating Hypothesis 3.

Research by various scholars has demonstrated a significant relationship between financing constraints and technological finance, albeit from different perspectives. Guo et al. (2023) [16] discuss the impact of technological finance on the efficiency of financing constraints in high-tech industries, showing that technological finance can reduce financing costs, improve financing efficiency, and enhance the efficiency of financing constraints. Their study focuses on the Yangtze River Delta region’s high-tech industries, aligning closely with the findings of this paper. However, this study provides a more balanced exploration of technological finance and financing constraints in heavily polluting industries across different regions nationwide. Unlike high-tech industries, heavily polluting industries face greater challenges in accessing financing, especially in underdeveloped regions of technological finance. The scope of their research is not as extensive and does not encompass the role of financing constraints on the impact of technological finance on environmental pollution control levels.

The findings of this study indicate that technological finance effectively reduces financing barriers in heavily polluting enterprises, providing more loan or credit opportunities, reducing financing costs, alleviating financing constraints, and enabling these enterprises to better manage environmental pollution issues. With reduced pressure from financing constraints, heavily polluting enterprises may increase investments in environmentally friendly technological innovations and environmental management projects, such as constructing pollution control facilities and monitoring pollutant emissions. These measures can decrease the pollutant content in the emissions of gases and wastewater from heavily polluting enterprises, thereby enhancing environmental pollution control levels.

5.2. Heterogeneity Test

5.2.1. State-Owned Enterprises Respond Promptly to Regional Technological Finance, Demonstrating Stronger Environmental Pollution Control

Based on the ownership structure of heavily polluting enterprises in the studied sample, they are categorized into state-owned enterprises (SOEs) and non-state-owned enterprises. Table 7, columns (1) and (2), present the regression coefficients of technological finance (PE) for SOEs and non-SOEs. Both results pass the significance test at the 1% level, with coefficients of −0.0059 and −0.0045, respectively. These results indicate that SOEs respond more promptly to regional technological finance compared to non-SOEs, thereby reducing external environmental pollution more effectively at the level of environmental pollution control.

Table 7.

Heterogeneity regression.

5.2.2. Heavily Polluting Enterprises outside the Dual Control Zones Are More Sensitive

To address the worsening air pollution problem, China passed relevant laws on acid rain control zones and sulfur dioxide pollution control zones (hereinafter referred to as dual control zones) in 1998. Therefore, this paper divides the sample according to the cities where the enterprises are located into dual control zones and non-dual control zones, examining the impact of technological finance on environmental pollution control levels under the dual control zone policy. The regression results are shown in Table 7. The regression coefficients for dual control zones and non-dual control zones are −0.0044 and −0.0082, respectively, both passing the 1% significance test. The results show that the environmental pollution control levels of heavily polluting enterprises in the stringent dual control zones are less influenced by technological finance than those of heavily polluting enterprises outside the dual control zones.

6. Conclusions and Recommendations

6.1. Research Conclusion

The “14th Five-Year Plan” explicitly prioritizes ecology and green development, aiming to promote the coordinated development of a high-quality economy and robust ecological protection. Furthermore, it is imperative to expedite the establishment of legal frameworks and policy guidelines for green production and consumption, and to enhance the economic system for green, low-carbon, and circular development to steer China’s future efficient transformation. Technological finance, as a pivotal driver of transformation, has played a significant role in green development.

This paper examines the impact and mechanisms of regional technological finance on environmental pollution control in heavily polluting enterprises from three perspectives—environmental resources, financial input, and output levels—utilizing the entropy method. It empirically analyzes the influence of technological finance on heavily polluting enterprises in the A-share market from 2012 to 2022. The study concludes the following:

- Technological finance significantly enhances the environmental pollution control levels of heavily polluting enterprises. However, there is a degree of “greenwashing” in the allocation and use of technological finance funds.

- Technological innovation and financing constraints partially mediate the effect of technological finance on environmental pollution control levels in heavily polluting enterprises.

- State-owned enterprises are more responsive to technological finance’s impact on environmental pollution control levels compared to non-state-owned enterprises.

- The environmental pollution control levels of heavily polluting enterprises in the stringent dual control zones are less influenced by technological finance than those of heavily polluting enterprises outside the dual control zones.

6.2. Policy Recommendations

Based on these conclusions, the following policy recommendations are made:

Firstly, enhance support for technological finance. The government should guide and leverage fiscal funds through fiscal policies, continually strengthening support for environmental pollution control levels in heavily polluting enterprises and improving the efficiency and effectiveness of fiscal fund allocation. Secondly, the innovation status of heavily polluting enterprises should be bolstered to encourage the aggregation of various innovation elements within these enterprises. Lastly, financial institutions should be encouraged to innovate technological finance products and services, introducing offerings that better align with the characteristics of technological innovation, such as cross-disciplinary technological finance products like investment-loan linkage, to improve financing accessibility for heavily polluting enterprises.

Secondly, develop technological finance tailored to local conditions. In regions with uneven economic development and limited financial resources, efforts should persist to support technological finance, promote the deep integration of technology and finance, and thereby facilitate high-quality economic development and enhance environmental pollution control levels in heavily polluting enterprises.

Thirdly, bolster technological finance support for regions with non-state-owned heavily polluting enterprises. Compared to state-owned enterprises, non-state-owned enterprises face greater risks due to volatile economic policy environments. Technological finance should accurately address the financing constraints of non-state-owned enterprises, allocating resources such as scientific banks, technological credit, and venture capital more towards these enterprises.

6.3. Limitations and Future Prospects

In analyzing the impact of technological finance on the environmental pollution control levels of heavily polluting enterprises, this paper faced data disclosure issues and could not obtain enterprise-level data on technological finance, relying instead on regional data. As a result, the findings have certain limitations. China, as a developing country, provides results that are similar to those of other developing countries and hold some reference value. Therefore, future research can extend to other developing countries to ensure that the research results have broader applicability.

Author Contributions

Conceptualization, J.L. and X.W.; methodology, J.L. and X.W.; software, J.L. and X.W.; validation, J.L. and X.W.; formal analysis, J.L. and X.W.; investigation, J.L. and X.W.; resources, J.L. and X.W.; data curation, J.L. and X.W.; writing—original draft preparation, X.W.; writing—review and editing, J.L.; visualization, J.L. and X.W.; supervision, W.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by The National Natural Science Foundation of China, grant number 62073008.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data set used in the study is available on request.

Conflicts of Interest

The authors declare no conflicts of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- Lv, Y.; Li, Y. Has Technological Finance Empowered High-Quality Economic Development?—A Study Based on the Perspective of Innovation Motivation. Stud. Sci. Sci. 2024, 42, 1–16. [Google Scholar] [CrossRef]

- Zhao, C. Technological Finance; Science Press: Beijing, China, 2009. [Google Scholar]

- Zhang, B.; Sun, M.; Qian, X.; Huang, Y. Technological Finance, Intelligent Manufacturing, and Green Technological Innovation—An Empirical Study Based on Provincial Panel Data. Sci. Technol. Manag. Res. 2023, 43, 236–246. [Google Scholar] [CrossRef]

- Liu, Y.; Zhou, S.; Chen, X. Research on the Impact of Technological Finance Development on Corporate Green Innovation. Theory Pract. Financ. Econ. 2022, 43, 17–23. [Google Scholar] [CrossRef]

- Xue, Q.; Jiao, W. Digital Technology, Technological Finance, and Corporate Innovation Investment—A Quasi-Natural Experiment Based on the “Pilot Project Combining Technology and Finance”. J. Northwest Univ. (Philos. Soc. Sci. Ed.) 2022, 52, 137–146. [Google Scholar] [CrossRef]

- Zheng, W.; Zhao, H.; Zhao, M. Does the Development of Digital Finance Facilitate Environmental Pollution Control?—Discussing the Moderating Role of Local Resource Competition. Ind. Econ. Res. 2022, 1–13. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance, entrepreneurship and growth. N. Holl. 1993, 32, 513–542. [Google Scholar] [CrossRef]

- Perez, C. Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. J. Econ. Hist. 2003, 63, 615–616. [Google Scholar] [CrossRef]

- Doh, S.; Kim, B. Government support for SME innovations in the regional industries: The case of government financial support program in South Korea. Res. Policy 2014, 43, 1557–1569. [Google Scholar] [CrossRef]

- Chirkunova, E.K.; Kireeva, E.E.; Kornilova, A.D.; Pschenichnikova, J.S. Research of instruments for financing of innovation and investment construction projects. Procedia Eng. 2016, 153, 112–117. [Google Scholar] [CrossRef]

- Shao, C.; Wang, L. High Investment Rate, Institutional Environment Quality, and Innovation-Driven Development. J. Guangdong Univ. Financ. Econ. 2016, 31, 15–25. [Google Scholar]

- Shen, L.; He, G.; Yan, H. Research on the Impact of Technological Finance on Financial Stability: Based on the Perspective of High-Quality Economic Growth. Complexity 2022, 2022, 2552520. [Google Scholar] [CrossRef]

- Huang, J. Relationship between science and technology finance and economic growth—Based on VAR model. In Proceedings of the Big Data Analytics for Cyber-Physical System in Smart City: BDCPS 2019, Shenyang, China, 28–29 December 2019; Springer: Singapore, 2020; pp. 1215–1222. [Google Scholar] [CrossRef]

- Jiang, L.; Wang, H.; Wang, S.; Hu, Z.; Tong, A.; Wang, Y. The spatial correlation between green high-quality development and technology finance. Front. Environ. Sci. 2022, 10, 888547. [Google Scholar] [CrossRef]

- Li, Z.; Li, H.; Wang, S.; Lu, X. The Impact of Science and Technology Finance on Regional Collaborative Innovation: The Threshold Effect of Absorptive Capacity. Sustainability 2022, 14, 15980. [Google Scholar] [CrossRef]

- Guo, J.; Jin, N.; Zhang, J.; Zhang, Y. Technological Finance and Corporate Financing Efficiency—Empirical Evidence from High-Tech Enterprises in the Yangtze River Delta Urban Agglomeration. J. Cent. Univ. Financ. Econ. 2023, 68–80. [Google Scholar] [CrossRef]

- Fan, W.; Shen, L. The Coupled Coordination of Technological Finance and Industrial Structure Transformation and Upgrading in China. Inq. Into Econ. Issues 2023, 8, 103–116. [Google Scholar]

- Gao, C.; Song, P.; Wen, Y.; Yang, D. Effect of science and technology finance policy on urban green development in China. Front. Environ. Sci. 2022, 10, 918422. [Google Scholar] [CrossRef]

- Yang, R.; Hou, X. Technological Finance Policy and Relationship-Based Loans—Based on the Perspective of State-Owned Enterprises. J. Shanxi Univ. Financ. Econ. 2023, 45, 54–68. [Google Scholar] [CrossRef]

- Lin, Y.; Cao, Z. Can Technological Finance Promote Corporate Pollution Reduction?—A Quasi-Natural Experiment Based on the “Pilot Project to Combine Technology and Finance”. J. Beijing Inst. Technol. (Soc. Sci. Ed.) 2023, 25, 1–14. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, J.; Liu, Z. Environmental Regulation, Financing Constraints, and Corporate Pollution Reduction—Evidence from the Adjustment of Pollution Fees Standards. Financ. Res. 2021, 9, 51–71. [Google Scholar]

- Yan, Y. Investigate the Impact of Technology Finance Policy on Technological Innovation of Smalland Medium Sized Enterprises using PSM Method. In Proceedings of the 2020 2nd International Conference on Economic Management and Model Engineering (ICEMME), Chongqing, China, 20–22 November 2020; IEEE: New York, NY, USA, 2020; pp. 49–54. [Google Scholar] [CrossRef]

- Shen, Y.; Ren, Y. The Spatial Spillover Effect of Environmental Regulation and Inter-Provincial Industrial Transfer on Pollution Migration. China Population. Resour. Environ. 2021, 31, 52–60. [Google Scholar]

- Yang, Y.; Li, Q. Influencing Factors and Mitigation Paths of Financing Constraints for Green Enterprises. Sci. Technol. Manag. Res. 2023, 43, 251–258. [Google Scholar]

- Zhao, S.; Zhao, D. The Impact and Mechanism of Technological Innovation Efficiency on Agricultural Carbon Emission Efficiency. Ecol. Econ. 2023, 39, 114–121. [Google Scholar]

- Cheng, F.; Shi, J. Environmental Regulation, Endogenous Innovation Effort, and Corporate Technological Innovation Performance. Sci. Technol. Entrep. Mon. 2022, 35, 30–36. [Google Scholar]

- Wen, Z.; Ye, B. Analysis of Mediation Effects: Methods and Model Development. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Wang, K.L.; Zhu, R.R.; Cheng, Y.H. Does the development of digital finance contribute to haze pollution control? Evidence from China. Energies 2022, 15, 2660. [Google Scholar] [CrossRef]

- Jiang, L.; He, S.; Zhou, H.; Kong, H.; Wang, J.; Cui, Y.; Wang, L. Coordination between sulfur dioxide pollution control and rapid economic growth in China: Evidence from satellite observations and spatial econometric models. Struct. Chang. Econ. Dyn. 2021, 57, 279–291. [Google Scholar] [CrossRef]

- Chen, X.; Liu, J. Fiscal decentralization and environmental pollution: A spatial analysis. Discret. Dyn. Nat. Soc. 2020, 2020, 9254150. [Google Scholar] [CrossRef]

- Wang, L.; Wang, H.; Dong, Z. Policy Conditions for Compatibility between Economic Growth and Environmental Quality—Testing the Policy Bias Effect from the Perspective of Environmental Technological Progress Direction. Manag. World 2020, 36, 39–60. [Google Scholar] [CrossRef]

- Liu, P.; Gui, J. Technical Spillover and Energy Rebound of Regional Carbon Neutrality in China: Mechanism, Empirical Evidence, and Insights. J. Nat. Resour. 2023, 38, 3003–3023. [Google Scholar]

- Mao, J.; Guo, Y.; Cao, J.; Xu, J. Financing Platform Debt and Environmental Pollution Control. Manag. World 2022, 38, 96–118. [Google Scholar] [CrossRef]

- Tong, Y.; Jin, L.; Zhang, Y. The Carbon Emission Reduction Effect of Technological Finance—Based on a Quasi-Natural Experiment Analysis of the “Pilot Project to Promote the Combination of Technology and Finance”. J. Southwest Univ. (Nat. Sci. Ed.) 2023, 45, 175–187. [Google Scholar] [CrossRef]

- Gao, Y.; Wang, G. Factors Influencing the Efficiency of Technological Finance in Shandong Province and Regional Differences. East China Econ. Manag. 2023, 37, 92–99. [Google Scholar] [CrossRef]

- Liu, L.; Liu, Y. Coupled Coordination Research on Technological Finance and High-Quality Development of the Real Economy—Taking Beijing-Tianjin-Hebei as an Example. Econ. Issues 2022, 96–102. [Google Scholar] [CrossRef]

- Ding, Y.; Wang, X.; Liu, Y. The Impact of Technological Finance on Technological Innovation in China’s High-Tech Industry. Sci. Technol. Manag. Res. 2023, 43, 17–23. [Google Scholar]

- Zhang, T.; Jiang, F. Technological Finance, Technological Innovation, and High-Quality Economic Development. Stat. Decis. 2023, 39, 142–146. [Google Scholar] [CrossRef]

- Hadlock, J.C.; Pierce, R.J. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Jia, Y. Tax Policy, Financing Constraints, and Corporate Green Development. Econ. Issues 2023, 37–43. [Google Scholar] [CrossRef]

- Kang, Y.; Wang, M.; Chen, K. Can Technological Finance Promote High-Quality Corporate Development? Sci. Res. Manag. 2023, 44, 83–96. [Google Scholar] [CrossRef]

- Huang, R.; Chen, W.; Wang, K. External Financing Demand, Impression Management, and Corporate Greenwashing. Comp. Econ. Soc. Syst. 2019, 3, 81–93. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).