Charting the Course: Navigating Decarbonisation Pathways in Greece, Germany, The Netherlands, and Spain’s Industrial Sectors

Abstract

:1. Introduction

2. Methodology

2.1. Overall Literature Analysis Approach

2.2. Country Selection

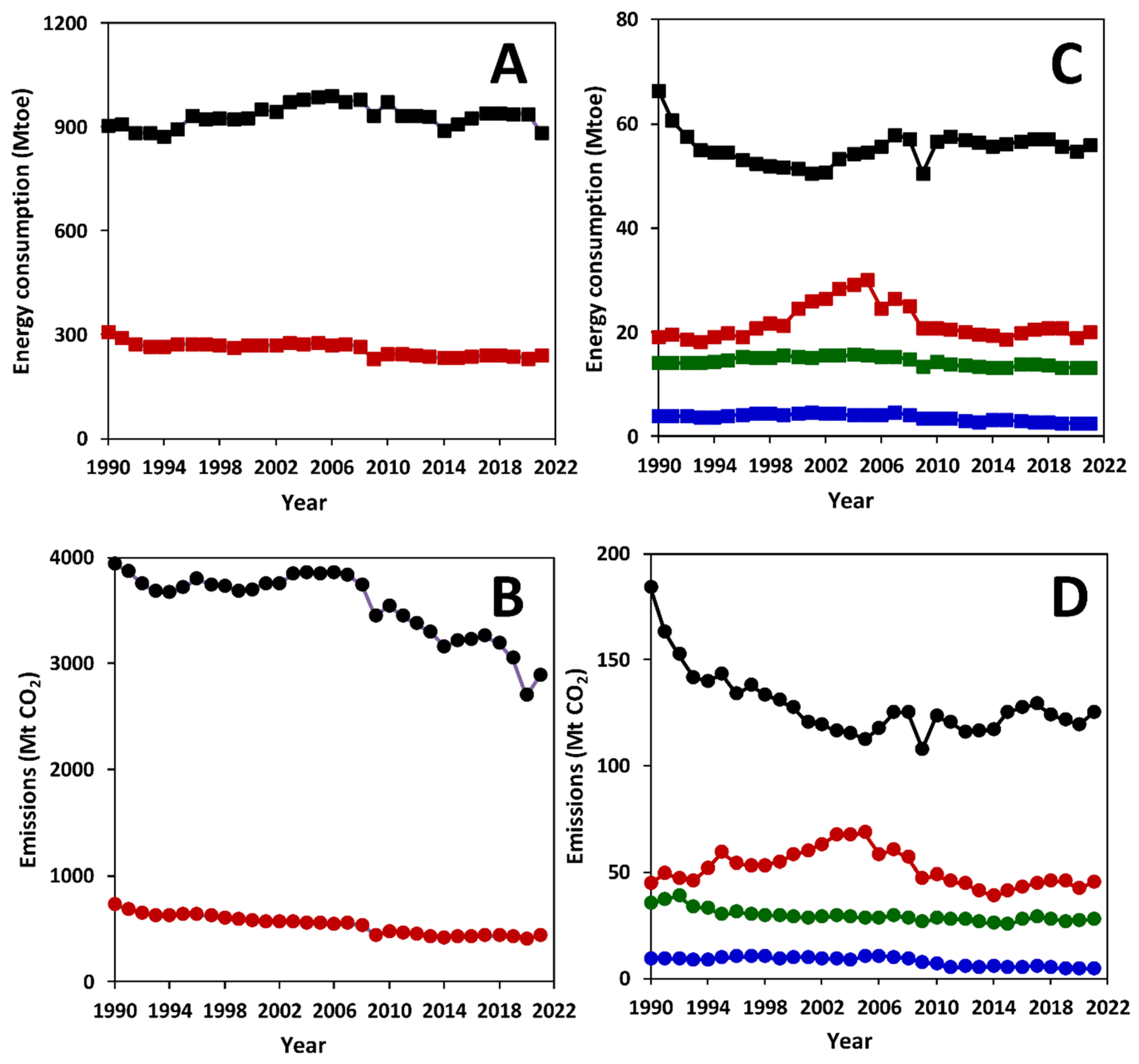

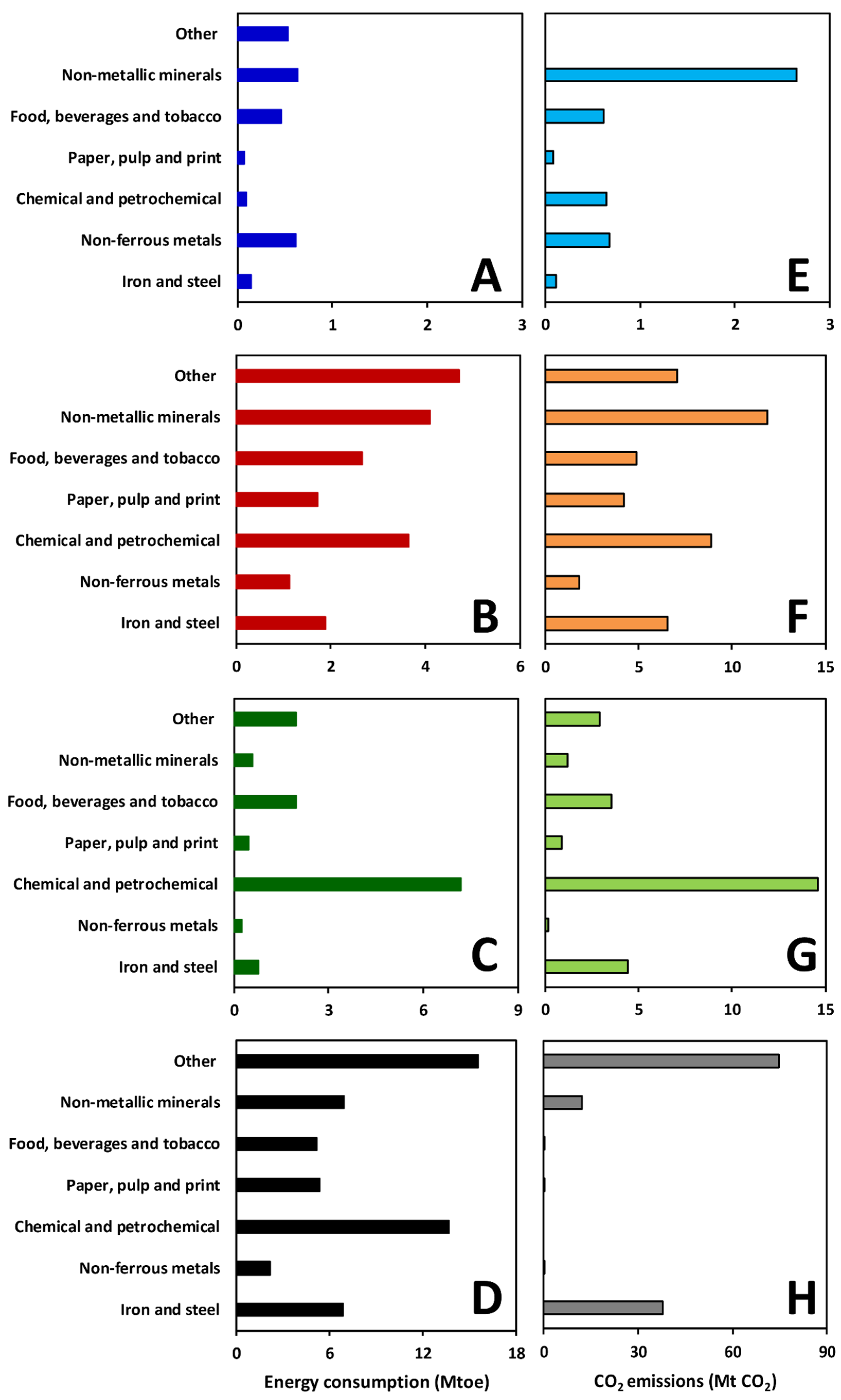

3. Status of EIIs in Four Representative European Economies

4. Decarbonisation Actions across Different Sectors

4.1. Decarbonisation Actions for the Non-Ferrous Metals Industry

4.2. Decarbonisation of the Cement and Lime Industry

4.3. Decarbonisation of the Chemical and Fertiliser Industry

4.4. Decarbonisation of the Ceramics Industry

4.5. Decarbonisation of the Glass Industry

| Novel technologies |

|

| Combustion innovations | |

| Reduce combustion emissions | |

| Circularity |

4.6. Decarbonisation of the Steel Industry

| Hydrogen | CCS | Electrolysis | Biomass |

|---|---|---|---|

| -Commercial e-H2 as the primary reducing agent expected by the mid-2030s [92] -By 2050, the highest demand for e-H2 in steel production will be in India and China [93] -All existing hydrogen applications will necessitate 3600 TWh | -By 2070, it is estimated that 75% of all CO2 produced globally in iron and steel production can be captured -To achieve this, 10 steel plants with CO2 capture capacity need to be built annually every year through to 2070 | -In 2020, over 1800 million tons (Mt) of steel were produced globally [94] -A typical blast furnace (BF) can produce in the order of 2.5 Mt of iron per year -Today, kilograms of iron are being manufactured using electrolysis [95] | -Robust supply chains are required to make large amounts of biomass available to the industry [96] |

5. Challenges for EIIs in Europe

- The importance of international, European, and national policies, such as the Paris Agreement and the EU ETS that set ambitious targets for GHG emissions reduction.

- Carbon pricing, including taxes and cap-and-trade systems, is highlighted as a critical economic tool for incentivising emission reductions, particularly in Europe, which has successfully implemented CO2 taxes since 1991 in some EU countries.

- Energy efficiency measures are also crucial, with directives like the amended EED setting targets for improved energy efficiency by 2030.

- Lastly, RD&D and technology support are identified as essential for promoting low-carbon technologies and avoiding carbon leakage, with funding programs like the EU’s Innovation Fund supporting this transition.

- Collectively, these drivers underscore the need for comprehensive policy support to achieve long-term climate goals and industrial competitiveness.

5.1. The Case of Spain

5.2. The Case of the Netherlands

5.3. The Case of Germany

5.4. The Case of Greece

6. Political Measures and Policy Instruments

6.1. Financing and Investments

6.2. Barriers to Overcome and Possible Solutions

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Schlacke, S.; Wentzien, H.; Thierjung, E.-M.; Köster, M. Implementing the EU Climate Law via the ‘Fit for 55’ Package. Oxf. Open Energy 2022, 1, oiab002. [Google Scholar] [CrossRef]

- Bataille, C.; Åhman, M.; Neuhoff, K.; Nilsson, L.J.; Fischedick, M.; Lechtenböhmer, S.; Solano-Rodriquez, B.; Denis-Ryan, A.; Stiebert, S.; Waisman, H.; et al. A Review of Technology and Policy Deep Decarbonization Pathway Options for Making Energy-Intensive Industry Production Consistent with the Paris Agreement. J. Clean. Prod. 2018, 187, 960–973. [Google Scholar] [CrossRef]

- Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs (European Commission). Masterplan for a Competitive Transformation of EU Energy-Intensive Industries Enabling a Climate-Neutral, Circular Economy by 2050; Publication Office of the European Union: Luxembourg, 2019. [Google Scholar]

- Madurai Elavarasan, R.; Pugazhendhi, R.; Irfan, M.; Mihet-Popa, L.; Khan, I.A.; Campana, P.E. State-of-the-Art Sustainable Approaches for Deeper Decarbonization in Europe—An Endowment to Climate Neutral Vision. Renew. Sustain. Energy Rev. 2022, 159, 112204. [Google Scholar] [CrossRef]

- Wesseling, J.H.; Lechtenböhmer, S.; Åhman, M.; Nilsson, L.J.; Worrell, E.; Coenen, L. The Transition of Energy Intensive Processing Industries towards Deep Decarbonization: Characteristics and Implications for Future Research. Renew. Sustain. Energy Rev. 2017, 79, 1303–1313. [Google Scholar] [CrossRef]

- França, A.; López-Manuel, L.; Sartal, A.; Vázquez, X.H. Adapting Corporations to Climate Change: How Decarbonization Impacts the Business Strategy–Performance Nexus. Bus. Strategy Environ. 2023, 32, 5615–5632. [Google Scholar] [CrossRef]

- Perathoner, S.; Van Geem, K.M.; Marin, G.B.; Centi, G. Reuse of CO2 in Energy Intensive Process Industries. Chem. Commun. 2021, 57, 10967–10982. [Google Scholar] [CrossRef]

- Xiao, Z.; Zhang, C.; Li, P.; Wang, D.; Zhang, X.; Wang, L.; Zou, J.; Li, G. Engineering Oxygen Vacancies on Tb-Doped Ceria Supported Pt Catalyst for Hydrogen Production through Steam Reforming of Long-Chain Hydrocarbon Fuels. Chin. J. Chem. Eng. 2024, 68, 181–192. [Google Scholar] [CrossRef]

- European Commission; Directorate-General for Energy. EU Energy in Figures—Statistical Pocketbook 2023; Publications Office of the European Union: Luxembourg, 2023. [Google Scholar]

- d’Aprile, P.; Engel, H.; Helmcke, S.; Hieronimus, S.; Naucler, T.; Pinner, D.; van Gendt, G.; Walter, D.; Witteveen, M. How the European Union Could Achieve Net-Zero Emissions at Net-Zero Cost; McKinsey & Company: Chicago, IL, USA, 2020. [Google Scholar]

- Serrano González, J.; Álvarez Alonso, C. Industrial Electricity Prices in Spain: A Discussion in the Context of the European Internal Energy Market. Energy Policy 2021, 148, 111930. [Google Scholar] [CrossRef]

- Sanjuán, M.A.; Argiz, C.; Mora, P.; Zaragoza, A. Carbon Dioxide Uptake in the Roadmap 2050 of the Spanish Cement Industry. Energies 2020, 13, 3452. [Google Scholar] [CrossRef]

- Pisciotta, M.; Pilorgé, H.; Feldmann, J.; Jacobson, R.; Davids, J.; Swett, S.; Sasso, Z.; Wilcox, J. Current State of Industrial Heating and Opportunities for Decarbonization. Prog. Energy Combust. Sci. 2022, 91, 100982. [Google Scholar] [CrossRef]

- Fleiter, T.; Rehfeldt, M.; Neuwirth, M.; Herbst, A. Deep Decarbonisation of the German Industry via Electricity or Gas? A Scenario-Based Comparison of Pathways. In Proceedings of the ECEEE Industrial Summer Study Proceedings, 2020. Available online: https://www.eceee.org/library/conference_proceedings/eceee_Industrial_Summer_Study/2020/6-deep-decarbonisation-of-industry/deep-decarbonisation-of-the-german-industry-via-electricity-or-gas-a-scenario-based-comparison-of-pathways/2020/6-141-20_Fleiter.pdf/ (accessed on 6 June 2024).

- Albertone, G.; Allen, S.; Redpath, A. Key Figures on European Business; Publication Office of the European Union: Luxembourg, 2021. [Google Scholar]

- Bauernhansl, T.; Miehe, R. Industrielle Produktion—Historie, Treiber Und Ausblick. In Fabrikbetriebslehre 1: Management in der Produktion; Bauernhansl, T., Ed.; Springer: Berlin/Heidelberg, Germany, 2020; pp. 1–33. ISBN 978-3-662-44538-9. [Google Scholar]

- International Energy Agency. Germany 2020; International Energy Agency: Paris, France, 2020. [Google Scholar]

- Bremer, L.; den Nijs, S.; de Groot, H.L.F. The Energy Efficiency Gap and Barriers to Investments: Evidence from a Firm Survey in The Netherlands. Energy Econ. 2024, 133, 107498. [Google Scholar] [CrossRef]

- Anderson, B.; Cammeraat, E.; Dechezleprêtre, A.; Dressler, L.; Gonne, N.; Lalanne, G.; Guilhoto, J.M.; Theodoropoulos, K. Policies for a Climate-Neutral Industry: Lessons from the Netherlands. In OECD Science, Technology and Industry Policy Papers; OECD Publishing: Paris, France, 2021. [Google Scholar]

- Xavier, C.; Oliveira, C. Decarbonisation Options for the Dutch Cement Industry; PBL Netherlands Environment Assessment Agency: Hague, The Netherlands, 2021.

- Directorate-General for Research and Innovation (European Commission). Scaling up Innovative Technologies for Climate Neutrality—Mapping of EU Demonstration Projects in Energy-Intensive Industries; Publications Office of the European Union: Brussels, Belguam, 2023. [Google Scholar]

- Wei, M.; McMillan, C.A.; de la Rue du Can, S. Electrification of Industry: Potential, Challenges and Outlook. Curr. Sustain./Renew. Energy Rep. 2019, 6, 140–148. [Google Scholar] [CrossRef]

- Simakov, D.S.A. Renewable Synthetic Fuels and Chemicals from Carbon Dioxide: Fundamentals, Catalysis, Design Considerations and Technological Challenges; Springer: Berlin/Heidelberg, Germany, 2017; ISBN 3319611127. [Google Scholar]

- Malico, I.; Nepomuceno Pereira, R.; Gonçalves, A.C.; Sousa, A.M.O. Current Status and Future Perspectives for Energy Production from Solid Biomass in the European Industry. Renew. Sustain. Energy Rev. 2019, 112, 960–977. [Google Scholar] [CrossRef]

- Tzelepi, V.; Zeneli, M.; Kourkoumpas, D.-S.; Karampinis, E.; Gypakis, A.; Nikolopoulos, N.; Grammelis, P. Biomass Availability in Europe as an Alternative Fuel for Full Conversion of Lignite Power Plants: A Critical Review. Energies 2020, 13, 3390. [Google Scholar] [CrossRef]

- Kuramochi, T.; Ramírez, A.; Turkenburg, W.; Faaij, A. Comparative Assessment of CO2 Capture Technologies for Carbon-Intensive Industrial Processes. Prog. Energy Combust. Sci. 2012, 38, 87–112. [Google Scholar] [CrossRef]

- Xiao, Z.; Li, P.; Zhang, H.; Zhang, S.; Tan, X.; Ye, F.; Gu, J.; Zou, J.; Wang, D. A Comprehensive Review on Photo-Thermal Co-Catalytic Reduction of CO2 to Value-Added Chemicals. Fuel 2024, 362, 130906. [Google Scholar] [CrossRef]

- Neuwirth, M.; Fleiter, T.; Manz, P.; Hofmann, R. The Future Potential Hydrogen Demand in Energy-Intensive Industries—A Site-Specific Approach Applied to Germany. Energy Convers. Manag. 2022, 252, 115052. [Google Scholar] [CrossRef]

- Genovese, M.; Schlüter, A.; Scionti, E.; Piraino, F.; Corigliano, O.; Fragiacomo, P. Power-to-Hydrogen and Hydrogen-to-X Energy Systems for the Industry of the Future in Europe. Int. J. Hydrogen Energy 2023, 48, 16545–16568. [Google Scholar] [CrossRef]

- Wang, Z.; Huang, Z.; Huang, Y.; Wittram, C.; Zhuang, Y.; Wang, S.; Nie, B. Synergy of Carbon Capture, Waste Heat Recovery and Hydrogen Production for Industrial Decarbonisation. Energy Convers. Manag. 2024, 312, 118568. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Del Rio, D.F.; Herman, K.; Iskandarova, M.; Uratani, J.M.; Griffiths, S. Reconfiguring European Industry for Net-Zero: A Qualitative Review of Hydrogen and Carbon Capture Utilization and Storage Benefits and Implementation Challenges. Energy Environ. Sci. 2024, 17, 3523–3569. [Google Scholar] [CrossRef]

- Boldrini, A.; Koolen, D.; Crijns-Graus, W.; Worrell, E.; van den Broek, M. Flexibility Options in a Decarbonising Iron and Steel Industry. Renew. Sustain. Energy Rev. 2024, 189, 113988. [Google Scholar] [CrossRef]

- Barbhuiya, S.; Kanavaris, F.; Das, B.B.; Idrees, M. Decarbonising Cement and Concrete Production: Strategies, Challenges and Pathways for Sustainable Development. J. Build. Eng. 2024, 86, 108861. [Google Scholar] [CrossRef]

- Rietveld, E.; Bastein, T.; van Leeuwen, T.; Wieclawska, S.; Bonenkamp, N.; Peck, D.; Klebba, M.; Le Mouel, M.; Poitiers, N. Strengthening the Security of Supply of Products Containing Critical Raw Materials for the Green Transition and Decarbonisation; European Parliament: Luxembourg, 2022; ISBN 9284800501. [Google Scholar]

- Jowitt, S.M. Mineral Economics of the Rare-Earth Elements. MRS Bull. 2022, 47, 276–282. [Google Scholar] [CrossRef]

- Kermeli, K.; Crijns-Graus, W.; Johannsen, R.M.; Mathiesen, B.V. Energy Efficiency Potentials in the EU Industry: Impacts of Deep Decarbonization Technologies. Energy Effic. 2022, 15, 68. [Google Scholar] [CrossRef]

- Chan, Y.; Petithuguenin, L.; Fleiter, T.; Herbst, A.; Arens, M.; Stevenson, P. Industrial Innovation: Pathways to Deep Decarbonisation of Industry. Part 1: Technology Analysis; CF Consulting Services Limited: London, UK, 2019. [Google Scholar]

- IEA. Innovations Gaps; IEA: Paris, France, 2019. [Google Scholar]

- Maitra, D.; Ramaswamy, S.; Krause, C.; Waymer, T. Pathways to Net Zero Emissions in Manufacturing and Materials Production- HVAC OEMs Perspective. In Technology Innovation for the Circular Economy; Wiley: Berlin, Germany, 2024; pp. 755–765. ISBN 9781394214297. [Google Scholar]

- Antonio, M.R.; Aikaterini, B.O.; Slingerland, S.; Van Der Veen, R.; Gancheva, M.; Rademaekers, K.; Kuenen, J.; Visschedijk, A. Energy Efficiency and GHG Emissions: Prospective Scenarios for the Aluminium Industry; Publications Office of the European Union: Luxembourg, 2015. [Google Scholar]

- Bruno, M.J. Aluminum Carbothermic Technology; U. S. Department of Energy: Golden, CO, USA, 2005. [Google Scholar]

- Ratvik, A.P.; Mollaabbasi, R.; Alamdari, H. Aluminium Production Process: From Hall–Héroult to Modern Smelters. ChemTexts 2022, 8, 10. [Google Scholar] [CrossRef]

- Sørhuus, A.; Ose, S.; Holmefjord, E.; Olsen, H.; Nilsen, B. Update on the Abart Gas Treatment and Alumina Handling at the Karmøy Technology Pilot. In Proceedings of the Light Metals 2020; Tomsett, A., Ed.; Springer International Publishing: Cham, Switzerland, 2020; pp. 785–790. [Google Scholar]

- Rehfeldt, M.; Worrell, E.; Eichhammer, W.; Fleiter, T. A Review of the Emission Reduction Potential of Fuel Switch towards Biomass and Electricity in European Basic Materials Industry until 2030. Renew. Sustain. Energy Rev. 2020, 120, 109672. [Google Scholar] [CrossRef]

- Samuelsson, C.; Björkman, B. Chapter 7—Copper Recycling. In Handbook of Recycling; Worrell, E., Reuter, M.A., Eds.; Elsevier: Boston, MA, USA, 2014; pp. 85–94. ISBN 978-0-12-396459-5. [Google Scholar]

- Vinck, N. The Fit for 55 Package and the European Climate Ambitions an Assessment of Their Impacts on the European Metallurgical Silicon Industry. In Proceedings of the Silicon for the Chemical & Solar Industry XVI, Trondheim, Norway, 14–16 June 2022. [Google Scholar]

- Kortes, H.; van Dril, T. Decarbonisation Options for the Dutch Zinc Industry; PBL Netherlands Environmental Assessment Agency: Hague, The Netherlands, 2019.

- Habert, G.; Miller, S.A.; John, V.M.; Provis, J.L.; Favier, A.; Horvath, A.; Scrivener, K.L. Environmental Impacts and Decarbonization Strategies in the Cement and Concrete Industries. Nat. Rev. Earth Environ. 2020, 1, 559–573. [Google Scholar] [CrossRef]

- Fennell, P.S.; Davis, S.J.; Mohammed, A. Decarbonizing Cement Production. Joule 2021, 5, 1305–1311. [Google Scholar] [CrossRef]

- Ding, K.; Li, A.; Lv, J.; Gu, F. Decarbonizing Ceramic Industry: Technological Routes and Cost Assessment. J. Clean. Prod. 2023, 419, 138278. [Google Scholar] [CrossRef]

- Hossain, M.U.; Poon, C.S.; Kwong Wong, M.Y.; Khine, A. Techno-Environmental Feasibility of Wood Waste Derived Fuel for Cement Production. J. Clean. Prod. 2019, 230, 663–671. [Google Scholar] [CrossRef]

- Schorcht, F.; Kourti, I.; Scalet, B.M.; Roudier, S.; Sancho, L.D. Best Available Techniques (BAT) Reference Document for the Production of Cement, Lime and Magnesium Oxide: Industrial Emissions Directive 2010/75/EU (Integrated Pollution Prevention and Control); Joint Research Centre, Publications Office of the European Union: Luxembourg, 2013. [Google Scholar]

- Olabi, A.G.; Wilberforce, T.; Elsaid, K.; Sayed, E.T.; Maghrabie, H.M.; Abdelkareem, M.A. Large Scale Application of Carbon Capture to Process Industries—A Review. J. Clean. Prod. 2022, 362, 132300. [Google Scholar] [CrossRef]

- Kusuma, R.T.; Hiremath, R.B.; Rajesh, P.; Kumar, B.; Renukappa, S. Sustainable Transition towards Biomass-Based Cement Industry: A Review. Renew. Sustain. Energy Rev. 2022, 163, 112503. [Google Scholar] [CrossRef]

- Zhang, X.; Xiang, N.; Pan, H.; Yang, X.; Wu, J.; Zhang, Y.; Luo, H.; Xu, C. Performance Comparison of Cement Production before and after Implementing Heat Recovery Power Generation Based on Emergy Analysis and Economic Evaluation: A Case from China. J. Clean. Prod. 2021, 290, 125901. [Google Scholar] [CrossRef]

- Boscaro, F.; Palacios, M.; Flatt, R.J. Formulation of Low Clinker Blended Cements and Concrete with Enhanced Fresh and Hardened Properties. Cem. Concr. Res. 2021, 150, 106605. [Google Scholar] [CrossRef]

- Schneider, M.; Hoenig, V.; Ruppert, J.; Rickert, J. The Cement Plant of Tomorrow. Cem. Concr. Res. 2023, 173, 107290. [Google Scholar] [CrossRef]

- Lopez, G.; Keiner, D.; Fasihi, M.; Koiranen, T.; Breyer, C. From Fossil to Green Chemicals: Sustainable Pathways and New Carbon Feedstocks for the Global Chemical Industry. Energy Environ. Sci. 2023, 16, 2879–2909. [Google Scholar] [CrossRef]

- Saygin, D.; Gielen, D. Zero-Emission Pathway for the Global Chemical and Petrochemical Sector. Energies 2021, 14, 3772. [Google Scholar] [CrossRef]

- Nyhus, A.H.; Yliruka, M.; Shah, N.; Chachuat, B. Green Ethylene Production in the UK by 2035: A Techno-Economic Assessment. Energy Environ. Sci. 2024, 17, 1931–1949. [Google Scholar] [CrossRef]

- Sheppard, A.; Del Angel Hernandez, V.; Faul, C.F.J.; Fermin, D.J. Can We Decarbonise Methanol Production by Direct Electrochemical CO2 Reduction? ChemElectroChem 2023, 10, e202300068. [Google Scholar] [CrossRef]

- Lakshmanan, S.; Murugesan, T. The Chlor-Alkali Process: Work in Progress. Clean Technol. Environ. Policy 2014, 16, 225–234. [Google Scholar] [CrossRef]

- Kloo, Y.; Nilsson, L.J.; Palm, E. Reaching Net-Zero in the Chemical Industry—A Study of Roadmaps for Industrial Decarbonisation. Renew. Sustain. Energy Transit. 2024, 5, 100075. [Google Scholar] [CrossRef]

- Gabrielli, P.; Gazzani, M.; Mazzotti, M. The Role of Carbon Capture and Utilization, Carbon Capture and Storage, and Biomass to Enable a Net-Zero-CO2 Emissions Chemical Industry. Ind. Eng. Chem. Res. 2020, 59, 7033–7045. [Google Scholar] [CrossRef]

- Rissman, J.; Bataille, C.; Masanet, E.; Aden, N.; Morrow, W.R.; Zhou, N.; Elliott, N.; Dell, R.; Heeren, N.; Huckestein, B.; et al. Technologies and Policies to Decarbonize Global Industry: Review and Assessment of Mitigation Drivers through 2070. Appl. Energy 2020, 266, 114848. [Google Scholar] [CrossRef]

- Nemmour, A.; Inayat, A.; Janajreh, I.; Ghenai, C. Green Hydrogen-Based E-Fuels (E-Methane, E-Methanol, E-Ammonia) to Support Clean Energy Transition: A Literature Review. Int. J. Hydrogen Energy 2023, 48, 29011–29033. [Google Scholar] [CrossRef]

- Faria, J.A. Renaissance of Ammonia Synthesis for Sustainable Production of Energy and Fertilizers. Curr. Opin. Green Sustain. Chem. 2021, 29, 100466. [Google Scholar] [CrossRef]

- Gaidajis, G.; Kakanis, I. Life Cycle Assessment of Nitrate and Compound Fertilizers Production—A Case Study. Sustainability 2021, 13, 148. [Google Scholar] [CrossRef]

- Ausfelder, F.; Herrmann, E.O.; González, L.F.L. Perspective Europe 2030 Technology Options for CO2-Emission Reduction of Hydrogen Feedstock in Ammonia Production; DECHEMA e.V.: Frankfurt am Main, Germany, 2022. [Google Scholar]

- Yao, Y.; Lan, K.; Graedel, T.E.; Rao, N.D. Models for Decarbonization in the Chemical Industry. Annu. Rev. Chem. Biomol. Eng. 2024, 15. [Google Scholar] [CrossRef]

- Navas-Anguita, Z.; García-Gusano, D.; Dufour, J.; Iribarren, D. Revisiting the Role of Steam Methane Reforming with CO2 Capture and Storage for Long-Term Hydrogen Production. Sci. Total Environ. 2021, 771, 145432. [Google Scholar] [CrossRef]

- International Fertilizer Association. IEA’s Ammonia Technology Roadmap IFA Summary for Policymakers; IFA: Paris, France, 2021. [Google Scholar]

- Furszyfer Del Rio, D.D.; Sovacool, B.K.; Foley, A.M.; Griffiths, S.; Bazilian, M.; Kim, J.; Rooney, D. Decarbonizing the Ceramics Industry: A Systematic and Critical Review of Policy Options, Developments and Sociotechnical Systems. Renew. Sustain. Energy Rev. 2022, 157, 112081. [Google Scholar] [CrossRef]

- Besier, J.; Marsidi, M. Decarbonisation Options for the Ducth Ceramic Industry; PBL Netherlands Environment Assessment Agency: Hague, The Netherlands, 2020.

- de Carvalho, F.S.; Reis, L.C.B.d.S.; Lacava, P.T.; de Araújo, F.H.M.; de Carvalho, J.A., Jr. Substitution of Natural Gas by Biomethane: Operational Aspects in Industrial Equipment. Energies 2023, 16, 839. [Google Scholar] [CrossRef]

- Khalil, A.M.E.; Velenturf, A.P.M.; Ahmadinia, M.; Zhang, S. Context Analysis for Transformative Change in the Ceramic Industry. Sustainability 2023, 15, 12230. [Google Scholar] [CrossRef]

- Castro Oliveira, M.; Iten, M.; Cruz, P.L.; Monteiro, H. Review on Energy Efficiency Progresses, Technologies and Strategies in the Ceramic Sector Focusing on Waste Heat Recovery. Energies 2020, 13, 6096. [Google Scholar] [CrossRef]

- Griffin, P.W.; Hammond, G.P.; McKenna, R.C. Industrial Energy Use and Decarbonisation in the Glass Sector: A UK Perspective. Adv. Appl. Energy 2021, 3, 100037. [Google Scholar] [CrossRef]

- Zier, M.; Stenzel, P.; Kotzur, L.; Stolten, D. A Review of Decarbonization Options for the Glass Industry. Energy Convers. Manag. X 2021, 10, 100083. [Google Scholar] [CrossRef]

- Hubert, M. Industrial Glass Processing and Fabrication. In Springer Handbook of Glass; Musgraves, J.D., Hu, J., Calvez, L., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 1195–1231. ISBN 978-3-319-93728-1. [Google Scholar]

- Jouhara, H.; Khordehgah, N.; Almahmoud, S.; Delpech, B.; Chauhan, A.; Tassou, S.A. Waste Heat Recovery Technologies and Applications. Therm. Sci. Eng. Prog. 2018, 6, 268–289. [Google Scholar] [CrossRef]

- Cappelli, M. State of the Art and Decarbonization Options for Glass Industry: The Case of Bormioli Pharma. 2020. Available online: https://www.politesi.polimi.it/handle/10589/187066 (accessed on 4 June 2024).

- Gärtner, S.; Rank, D.; Heberl, M.; Gaderer, M.; Dawoud, B.; Haumer, A.; Sterner, M. Simulation and Techno-Economic Analysis of a Power-to-Hydrogen Process for Oxyfuel Glass Melting. Energies 2021, 14, 8603. [Google Scholar] [CrossRef]

- Rehfeldt, M.; Fleiter, T.; Herbst, A.; Eidelloth, S. Fuel Switching as an Option for Medium-Term Emission Reduction—A Model-Based Analysis of Reactions to Price Signals and Regulatory Action in German Industry. Energy Policy 2020, 147, 111889. [Google Scholar] [CrossRef]

- Favaro, N.; Ceola, S. Glass Cullet. In Encyclopedia of Glass Science, Technology, History, and Culture; Wiley: Berlin, Germany, 2021; pp. 1179–1189. ISBN 9781118801017. [Google Scholar]

- Eid, J. Glass Is the Hidden Gem in a Carbon-Neutral Future. Nature 2021, 599, 7–8. [Google Scholar]

- Barón, C.; Perpiñán, J.; Bailera, M.; Peña, B. Techno-Economic Assessment of Glassmaking Decarbonization through Integration of Calcium Looping Carbon Capture and Power-to-Gas Technologies. Sustain. Prod. Consum. 2023, 41, 121–133. [Google Scholar] [CrossRef]

- Vögele, S.; Grajewski, M.; Govorukha, K.; Rübbelke, D. Challenges for the European Steel Industry: Analysis, Possible Consequences and Impacts on Sustainable Development. Appl. Energy 2020, 264, 114633. [Google Scholar] [CrossRef]

- Draxler, M.; Schenk, J.; Bürgler, T.; Sormann, A. The Steel Industry in the European Union on the Crossroad to Carbon Lean Production—Status, Initiatives and Challenges. BHM Berg-und Hüttenmännische Monatshefte 2020, 165, 221–226. [Google Scholar] [CrossRef]

- Lopez, G.; Farfan, J.; Breyer, C. Trends in the Global Steel Industry: Evolutionary Projections and Defossilisation Pathways through Power-to-Steel. J. Clean. Prod. 2022, 375, 134182. [Google Scholar] [CrossRef]

- Bhaskar, A.; Assadi, M.; Nikpey Somehsaraei, H. Decarbonization of the Iron and Steel Industry with Direct Reduction of Iron Ore with Green Hydrogen. Energies 2020, 13, 758. [Google Scholar] [CrossRef]

- Lopez, G.; Galimova, T.; Fasihi, M.; Bogdanov, D.; Breyer, C. Towards Defossilised Steel: Supply Chain Options for a Green European Steel Industry. Energy 2023, 273, 127236. [Google Scholar] [CrossRef]

- Bararzadeh Ledari, M.; Khajehpour, H.; Akbarnavasi, H.; Edalati, S. Greening Steel Industry by Hydrogen: Lessons Learned for the Developing World. Int. J. Hydrogen Energy 2023, 48, 36623–36649. [Google Scholar] [CrossRef]

- Matykowski, R.; Tobolska, A. Global Steel Production in the First Two Decades of the 21st Century: A Period of Economic Fluctuations and Attempts to Control Globalisation Processes. Pr. Kom. Geogr. Przemysłu Pol. Tow. Geogr. 2021, 35, 64–82. [Google Scholar] [CrossRef]

- Lopes, D.V.; Quina, M.J.; Frade, J.R.; Kovalevsky, A. V Prospects and Challenges of the Electrochemical Reduction of Iron Oxides in Alkaline Media for Steel Production. Front. Mater. 2022, 9, 1010156. [Google Scholar] [CrossRef]

- Fan, Z.; Friedmann, S.J. Low-Carbon Production of Iron and Steel: Technology Options, Economic Assessment, and Policy. Joule 2021, 5, 829–862. [Google Scholar] [CrossRef]

- Rattle, I.; Gailani, A.; Taylor, P.G. Decarbonisation Strategies in Industry: Going beyond Clusters. Sustain. Sci. 2024, 19, 105–123. [Google Scholar] [CrossRef]

- Verde, S.F. The Impact of the EU Emissions Trading System on Competitiveness and Carbon Leakage: The Econometric Evidence. J. Econ. Surv. 2020, 34, 320–343. [Google Scholar] [CrossRef]

- Nurdiawati, A.; Urban, F. Towards Deep Decarbonisation of Energy-Intensive Industries: A Review of Current Status, Technologies and Policies. Energies 2021, 14, 2408. [Google Scholar] [CrossRef]

- Aranda Usón, A.; López-Sabirón, A.M.; Ferreira, G.; Llera Sastresa, E. Uses of Alternative Fuels and Raw Materials in the Cement Industry as Sustainable Waste Management Options. Renew. Sustain. Energy Rev. 2013, 23, 242–260. [Google Scholar] [CrossRef]

- Gómez-Calvet, R.; Martínez-Duart, J.M.; Serrano-Calle, S. Current State and Optimal Development of the Renewable Electricity Generation Mix in Spain. Renew Energy 2019, 135, 1108–1120. [Google Scholar] [CrossRef]

- Conte, S.; Buonamico, D.; Magni, T.; Arletti, R.; Dondi, M.; Guarini, G.; Zanelli, C. Recycling of Bottom Ash from Biomass Combustion in Porcelain Stoneware Tiles: Effects on Technological Properties, Phase Evolution and Microstructure. J. Eur. Ceram. Soc. 2022, 42, 5153–5163. [Google Scholar] [CrossRef]

- Álvarez Coomonte, A.; Grande Andrade, Z.; Porras Soriano, R.; Lozano Galant, J.A. Review of the Planning and Distribution Methodologies to Locate Hydrogen Infrastructure in the Territory. Energies 2024, 17, 240. [Google Scholar] [CrossRef]

- Huclin, S.; Chaves, J.P.; Ramos, A.; Rivier, M.; Freire-Barceló, T.; Martín-Martínez, F.; Román, T.G.S.; Miralles, Á.S. Exploring the Roles of Storage Technologies in the Spanish Electricity System with High Share of Renewable Energy. Energy Rep. 2022, 8, 4041–4057. [Google Scholar] [CrossRef]

- Hendriks, C.; de Gooyert, V. Towards Sustainable Port Areas: Dynamics of Industrial Decarbonization and the Role of Port Authorities. 2023. Available online: https://repository.ubn.ru.nl/bitstream/handle/2066/291818/291818.pdf (accessed on 4 June 2024).

- Anderson, B.; Cammeraat, E.; Dechezleprêtre, A.; Dressler, L.; Gonne, N.; Lalanne, G.; Martins Guilhoto, J.; Theodoropoulos, K. Designing Policy Packages for a Climate-Neutral Industry: A Case Study from the Netherlands. Ecol. Econ. 2023, 205, 107720. [Google Scholar] [CrossRef]

- van Dijk, J.; Wieczorek, A.J.; Ligtvoet, A. Regional Capacity to Govern the Energy Transition: The Case of Two Dutch Energy Regions. Environ. Innov. Soc. Transit. 2022, 44, 92–109. [Google Scholar] [CrossRef]

- Macquart, T.; Kucukbahar, D.; Prinsen, B. Dutch Offshore Wind Market Report; Netherlands Enterprise Agency (RVO): Utrecht, The Netherlands, 2023.

- Kappner, K.; Letmathe, P.; Weidinger, P. Causes and Effects of the German Energy Transition in the Context of Environmental, Societal, Political, Technological, and Economic Developments. Energy Sustain. Soc. 2023, 13, 28. [Google Scholar] [CrossRef]

- Agora Energiewende and Wuppertal Institute. Climate-Neutral Industry (Executive Summary): Key Technologies and Policy Options for Steel, Chemicals and Cement; Agora Energiewende and the Wuppertal Institute: Berlin, Germany, 2019. [Google Scholar]

- Treibhausgasneutrales Deutschland im Jahr 2050—Studie. Available online: https://www.umweltbundesamt.de/sites/default/files/medien/376/publikationen/treibhausgasneutrales_deutschland_im_jahr_2050_langfassung.pdf (accessed on 6 June 2024).

- Energiewende in Der Industrie Potenziale, Kosten Und Wechselwirkung Mit Dem Energiesektor. Available online: https://www.bmwk.de/Redaktion/DE/Artikel/Energie/energiewende-in-der-industrie.html (accessed on 6 June 2024).

- Alexopoulos, D.K.; Anastasiadis, A.G.; Vokas, G.A.; Kaminaris, S.D.; Psomopoulos, C.S. A Review of Flexibility Options for High RES Penetration in Power Systems—Focusing the Greek Case. Energy Rep. 2021, 7, 33–50. [Google Scholar] [CrossRef]

- Ecke, J.; Zervas, M. The Green Pool Concept. A Concept for Decarbonizing the Electro-Intensive Industry of Greece; Enervis Energy Advisors GmbH: Berlin, Germany, 2021. [Google Scholar]

- Simon, F. Dismay after EU Rejects ‘Green Pool’ for Industrial Energy Users in Greece. Available online: https://www.euractiv.com/section/energy-environment/news/dismay-after-eu-rejects-green-pool-for-industrial-energy-users-in-greece/ (accessed on 10 May 2024).

- Paravantis, J.A.; Stigka, E.; Mihalakakou, G.; Michalena, E.; Hills, J.M.; Dourmas, V. Social Acceptance of Renewable Energy Projects: A Contingent Valuation Investigation in Western Greece. Renew. Energy 2018, 123, 639–651. [Google Scholar] [CrossRef]

- Unknown SRF Factory Planned at Volos. Available online: https://www.cemnet.com/News/story/169203/srf-factory-planned-at-volos.html (accessed on 10 May 2024).

- Caferra, R.; D’Adamo, I.; Morone, P. Wasting Energy or Energizing Waste? The Public Acceptance of Waste-to-Energy Technology. Energy 2023, 263, 126123. [Google Scholar] [CrossRef]

- Paletto, A.; Bernardi, S.; Pieratti, E.; Teston, F.; Romagnoli, M. Assessment of Environmental Impact of Biomass Power Plants to Increase the Social Acceptance of Renewable Energy Technologies. Heliyon 2019, 5, e02070. [Google Scholar] [CrossRef] [PubMed]

- Joas, F. Climate-Neutral Industry—Key Technologies and Policy Options for Steel, Chemicals and Cement; Agora Energiewende: Berlin, Germany, 2019. [Google Scholar]

- Calipel, C.; Bizien, A.; Pellerin-Carlin, T. European Climate Investment Deficit Report: An Investment Pathway for Europe’s Future; I4CE—Institute for Climate Economics: Paris, France, 2024. [Google Scholar]

- Munta, M. The European Green Deal. In Climate Change Energy and Environment; Friedrich-Ebert-Stiftung: Berlin, Germany, 2020. [Google Scholar]

- Cameron, A.; Claeys, G.; Midões, C.; Tagliapietra, S. How Good Is the European Commission’s Just Transition Fund Proposal? Bruegel Policy Contribution; Bruegel: Brussels, Belgium, 2020. [Google Scholar]

- Dutton, J.; Pilsner, L. Delivering Climate Neutrality: Accelerating Eu Decarbonisation with Research and Innovation Funding; JSTOR: New York, NY, USA, 2019. [Google Scholar]

- Hafner, S.; Speich, M.; Bischofberger, P.; Ulli-Beer, S. Governing Industry Decarbonisation: Policy Implications from a Firm Perspective. J. Clean. Prod. 2022, 375, 133884. [Google Scholar] [CrossRef]

- Mahdavi, P.; Martinez-Alvarez, C.B.; Ross, M.L. Why Do Governments Tax or Subsidize Fossil Fuels? J. Politics 2022, 84, 2123–2139. [Google Scholar] [CrossRef]

- Bataille, C.G.F. Physical and Policy Pathways to Net-Zero Emissions Industry. WIREs Clim. Change 2020, 11, e633. [Google Scholar] [CrossRef]

- Jafari, M.; Botterud, A.; Sakti, A. Decarbonizing Power Systems: A Critical Review of the Role of Energy Storage. Renew. Sustain. Energy Rev. 2022, 158, 112077. [Google Scholar] [CrossRef]

| Subsector | Prospective Technologies and Pilot Applications |

|---|---|

| Aluminium |

|

| Copper |

|

| Silicon and ferroalloys |

|

| Nickel |

|

| Zinc |

|

| Cement Industry Materials | Emissions Reductions Measurements |

|---|---|

| Clinker: its chemical process causes 60–65% of cement manufacturing emissions |

|

| Cement: use of low ratio clinker cement or even alternatives to decrease emissions related to cement itself |

|

| Concrete |

|

| Ethylene: | The production process for low-carbon ethylene relies on methanol production from hydrogen and CO2, followed by the methanol-to-olefin (MTO) process. While the methanol-to-olefin process is currently in commercial use, operational facilities are primarily situated in China, with none of these plants operating in Europe thus far [60]. |

| Methanol: | In conventional methanol production, the hydrogenation of CO2 serves to fine-tune the CO/H2 ratio in the syngas by introducing small amounts of CO2. The synthesis of methanol from both CO and CO2 is interconnected through the water–gas shift reaction. Electrochemically converting CO2 directly into methanol, where the reduction occurs at the cathode and is paired with oxygen evolution at the anode, represents a highly promising strategy for making methanol production more sustainable by integrating renewable energy as the electricity supply [61]. |

| Chlorine: | The transition could involve converting mercury cell plants to membrane cell technology, shifting from monopolar to bipolar membrane technology, and retrofitting membrane cell plants that were operational in 2010 with oxygen-depolarised cathodes [62]. |

| Technology | Benefits | Energy and/or Emissions Reductions |

|---|---|---|

| Microwave-assisted drying and firing | By using microwave heating, energy is delivered more efficiently to dry and fire products [74]. | Significant reductions in energy end use of around 99% |

| Hybrid kiln | Instead of employing a sulphurised kiln and dryer, exhaust gases are supplemented through a gas-driven heat pump to enhance thermal energy [76]. | This option can deliver up to 65% in energy savings |

| Heat pipe heat exchanger | Heat pipe heat exchanger applied to a ceramic kiln employing exhaust gases to preheat water delivered energy recovery rates of about 15% [74]. | Energy savings could reach up to 65% |

| Controlled dehumidification | The water that is condensed within the chamber releases heat that is supplied in the drying process. | This system is entirely closed; therefore, the energy savings can be as high as 80% |

| Heat recovery facilities in dryers | Heat recovery enables the drying air to be replaced with hotter gases from other manufacturing processes [77]. | Such gases can come from cogeneration engines or the kiln and help mitigate emissions between 57 and 73% and energy savings ranging from 60 to 80% |

| Kiln cars and furniture with low thermal mass | The use of thermal mass in kiln cars helps in reducing the thermal energy requirement for the heating of supporting refractories. | This technique reduces running costs, repairs, and maintenance and leads to fuel savings of up to 70% |

| Market-Based Instruments | Regulatory Instruments |

|---|---|

A. Carbon Pricing Mechanisms:

| C. Demand Creation and Standards:

|

B. Financial and Investment Incentives:

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Carmona-Martínez, A.A.; Rontogianni, A.; Zeneli, M.; Grammelis, P.; Birgi, O.; Janssen, R.; Di Costanzo, B.; Vis, M.; Davidis, B.; Reumerman, P.; et al. Charting the Course: Navigating Decarbonisation Pathways in Greece, Germany, The Netherlands, and Spain’s Industrial Sectors. Sustainability 2024, 16, 6176. https://doi.org/10.3390/su16146176

Carmona-Martínez AA, Rontogianni A, Zeneli M, Grammelis P, Birgi O, Janssen R, Di Costanzo B, Vis M, Davidis B, Reumerman P, et al. Charting the Course: Navigating Decarbonisation Pathways in Greece, Germany, The Netherlands, and Spain’s Industrial Sectors. Sustainability. 2024; 16(14):6176. https://doi.org/10.3390/su16146176

Chicago/Turabian StyleCarmona-Martínez, Alessandro A., Anatoli Rontogianni, Myrto Zeneli, Panagiotis Grammelis, Olgu Birgi, Rainer Janssen, Benedetta Di Costanzo, Martijn Vis, Bas Davidis, Patrick Reumerman, and et al. 2024. "Charting the Course: Navigating Decarbonisation Pathways in Greece, Germany, The Netherlands, and Spain’s Industrial Sectors" Sustainability 16, no. 14: 6176. https://doi.org/10.3390/su16146176