How Financial Inclusion and Green Innovation Promote Green Economic Growth in Developing Countries

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Literature Related to Financial Inclusion and Green Economic Growth

2.2. Empirical Literature

2.2.1. Financial Inclusion (FI) and Economic Growth

2.2.2. Determinants of Financial Inclusion

2.2.3. Financial Inclusion and Green Economic Growth

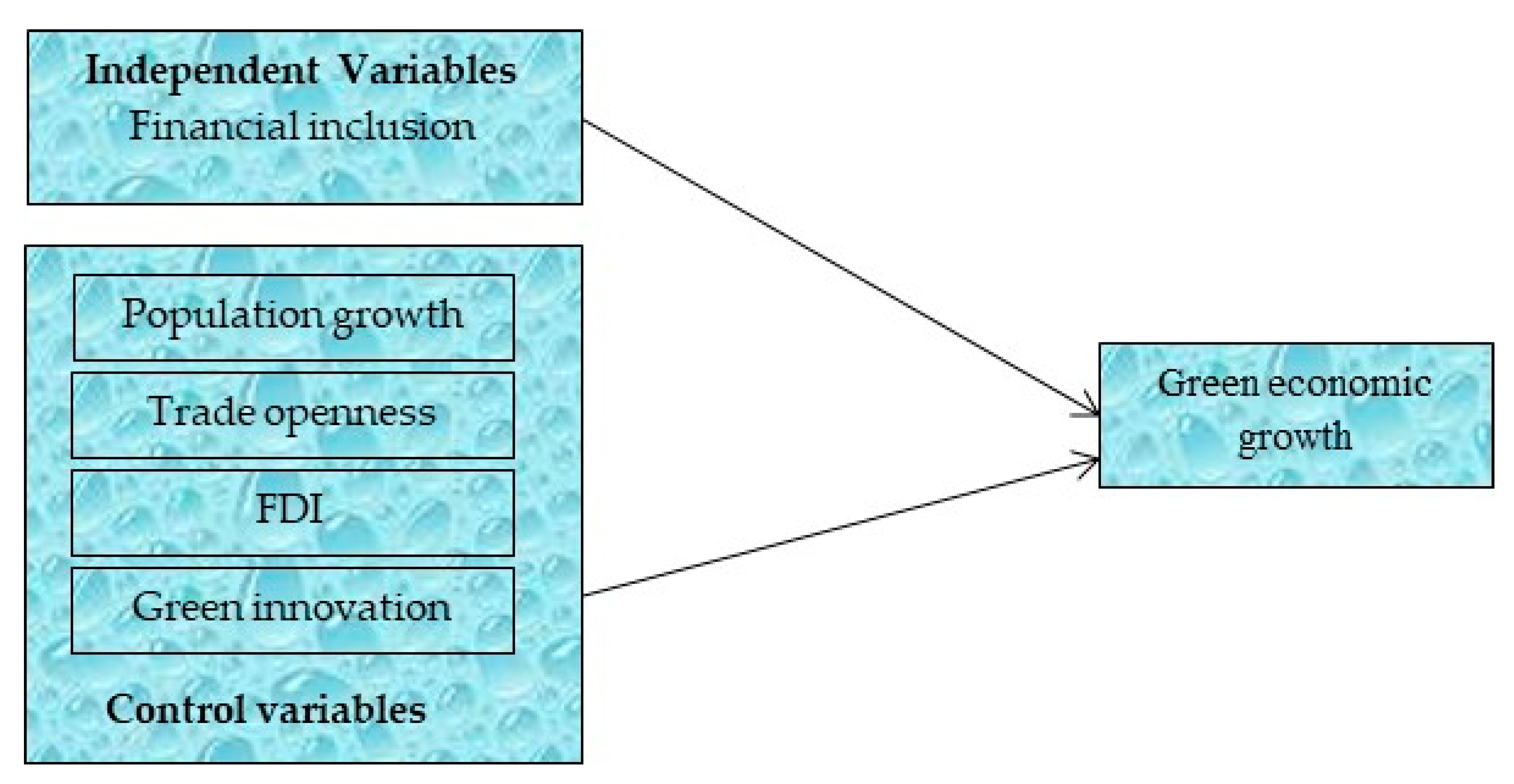

3. Econometric Methodology

3.1. Dependent Variables

3.2. Descriptive Statistics

4. Methods and Results

4.1. Cross-Sectional Dependence Test

4.2. Panel Unit Root Test

4.3. Panel Co-Integration Tests (PCTs)

4.4. Fully Modified Ordinary Least Squares (FMOLS)

4.5. Causality Test

5. Discussion of Results

6. Conclusions

Policy Implications

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Component | Eigenvalue | Difference | Proportion | Cumulative |

|---|---|---|---|---|

| PC1 | 2.163 | 1.148 | 0.540 | 0.540 |

| PC2 | 1.014 | 0.454 | 0.253 | 0.794 |

| PC3 | 0.560 | 0.299 | 0.140 | 0.934 |

| PC4 | 0.261 | - | 0.065 | 1.000 |

| Principal Components (Eigenvectors) | ||||

| Variable | PC1 | PC2 | PC3 | PC4 |

| Fi1 | 0.353 | 0.726 | 0.585 | 0.061 |

| Fi2 | 0.505 | 0.335 | −0.749 | 0.265 |

| Fi3 | 0.602 | −0.250 | 0.026 | −0.757 |

| Fi4 | 0.505 | −0.544 | 0.307 | 0.593 |

| Practices to Promote Financial Inclusion | Regions | ||||

|---|---|---|---|---|---|

| Sub-Saharan Africa | South Asia | Latin America | East Asia Pacific | Middle East and North Africa | |

| Mobile money adoption | High | Growing | Increasing | Advanced | Growing |

| Agent banking growth | Extensive expansion | Moderate growth | Moderate growth | High growth | Moderate growth |

| Policy and regulatory environment | Evolving | Progressive | Stable | Progressive | Reforming |

| Financial literacy initiatives | Increasing | Varied | Varied | Strengthening | Developing |

| Gender inclusion efforts | Prominent | Significant | Significant | Notable | Progressing |

| Digital infrastructure | Growing | Improving | Advanced | Robust | Developing |

| COVID-19 impact | Rise in mobile transactions | Shift towards digital payments | Rush in digital payments | Increasing reliance on digital channels | Rapid adoption of digital financial tools |

References

- Sarkodie, S.A.; Adams, S.; Owusu, P.A.; Leirvik, T.; Ozturk, I. Mitigating degradation and emissions in China: The role of environmental sustainability, human capital and renewable energy. Sci. Total. Environ. 2020, 719, 137530. [Google Scholar] [CrossRef] [PubMed]

- Luo, J.; Zhuo, W.; Liu, S.; Xu, B. The optimization of carbon emission prediction in low carbon energy economy under big data. IEEE Access 2024, 12, 14690–14702. [Google Scholar] [CrossRef]

- Li, T.; Yu, L.; Ma, Y.; Duan, T.; Huang, W.; Zhou, Y.; Jin, D.; Li, Y.; Jiang, T. Carbon emissions of 5G mobile networks in China. Nat. Sustain. 2023, 6, 1620–1631. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M.J.R.e. Estimation of environmental Kuznets curve for CO2 emission: Role of renewable energy generation in India. Renew. Energy 2018, 119, 703–711. [Google Scholar] [CrossRef]

- Wang, K.; Hu, Y.; Zhou, J.; Hu, F. Fintech, financial constraints and OFDI: Evidence from China. Glob. Econ. Rev. 2023, 52, 326–345. [Google Scholar] [CrossRef]

- Hu, F.; Zhang, S.; Gao, J.; Tang, Z.; Chen, X.; Qiu, L.; Hu, H.; Jiang, L.; Wei, S.; Guo, B. Digitalization empowerment for green economic growth: The impact of green complexity. Environ. Eng. Manag. J. 2024, 23, 519–536. [Google Scholar]

- Xu, J.; Hu, W. How do external resources influence a firm's green innovation? A study based on absorptive capacity. Econ. Model. 2024, 133, 106660. [Google Scholar] [CrossRef]

- Xu, H.; Yang, C.; Li, X.; Liu, R.; Zhang, Y. How do fintech, digitalization, green technologies influence sustainable environment in CIVETS nations? An evidence from CUP FM and CUP BC approaches. Resour. Policy 2024, 92, 104994. [Google Scholar] [CrossRef]

- Zhao, S.; Zhang, L.; Peng, L.; Zhou, H.; Hu, F. Enterprise pollution reduction through digital transformation? Evidence from Chinese manufacturing enterprises. Technol. Soc. 2024, 77, 102520. [Google Scholar] [CrossRef]

- Babajide, A.A.; Adegboye, F.B.; Omankhanlen, A.E. Financial inclusion and economic growth in Nigeria. Int. J. Econ. Financ. Issues 2015, 5, 629–637. [Google Scholar]

- Allen, F.; Demirguc-Kunt, A.; Klapper, L.; Peria, M.S.M. The foundations of financial inclusion: Understanding ownership and use of formal accounts. J. Financ. Intermed. 2016, 27, 1–30. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Alam, A.; Azam, M.; Abdullah, A.B.; Malik, I.A.; Khan, A.; Hamzah, T.A.A.T.; Faridullah; Khan, M.M.; Zahoor, H.; Zaman, K.J.E.S.; et al. Environmental quality indicators and financial development in Malaysia: Unity in diversity. Environ. Sci. Pollut. Res. 2015, 22, 8392–8404. [Google Scholar] [CrossRef] [PubMed]

- Khan, Z.; Ali, S.; Dong, K.; Li, R.Y.M.J.E.E. How does fiscal decentralization affect CO2 emissions? The roles of institutions and human capital. Energy Econ. 2021, 94, 105060. [Google Scholar] [CrossRef]

- Zheng, C.; Chen, H. Revisiting the linkage between financial inclusion and energy productivity: Technology implications for climate change. Sustain. Energy Technol. Assess. 2023, 57, 103275. [Google Scholar] [CrossRef]

- Barajas, A.; Beck, T.; Belhaj, M.; Naceur, S.B.; Cerra, V.; Qureshi, M.S. Financial Inclusion: What Have We Learned So Far? What Do We Have to Learn? International Monetary Fund: Washington, DC, USA, 2020. [Google Scholar]

- Wüstenhagen, R.; Menichetti, E. Strategic choices for renewable energy investment: Conceptual framework and opportunities for further research. Energy Policy 2012, 40, 1–10. [Google Scholar] [CrossRef]

- Usman, M.; Makhdum, M.S.A.; Kousar, R. Does financial inclusion, renewable and non-renewable energy utilization accelerate ecological footprints and economic growth? Fresh evidence from 15 highest emitting countries. Sustain. Cities Soc. 2021, 65, 102590. [Google Scholar] [CrossRef]

- Sahay, M.R.; Cihak, M.; N'Diaye, M.P.; Barajas, M.A.; Mitra, M.S.; Kyobe, M.A.; Mooi, M.; Yousefi, M.R. Financial Inclusion: Can It Meet Multiple Macroeconomic Goals? International Monetary Fund: Washington, DC, USA, 2015. [Google Scholar]

- Bagheri, M.; Guevara, Z.; Alikarami, M.; Kennedy, C.A.; Doluweera, G.J.E.E. Green growth planning: A multi-factor energy input-output analysis of the Canadian economy. Energy Econ. 2018, 74, 708–720. [Google Scholar] [CrossRef]

- Qiu, L.; Yu, R.; Hu, F.; Zhou, H.; Hu, H. How can China's medical manufacturing listed firms improve their technological innovation efficiency? An analysis based on a three-stage DEA model and corporate governance configurations. Technol. Forecast. Soc. Change 2023, 194, 122684. [Google Scholar] [CrossRef]

- Koh, S.; Morris, J.; Ebrahimi, S.M.; Obayi, R. Integrated resource efficiency: Measurement and management. Int. J. Oper. Prod. Manag. 2016, 36, 1576–1600. [Google Scholar] [CrossRef]

- Kirikkaleli, D. Resource efficiency, energy productivity, and environmental quality in Japan. Resour. Policy 2023, 85, 104006. [Google Scholar] [CrossRef]

- Peet, R.; Watts, M. Introduction: Development Theory and Environment in An Age of Market Triumphalism; Taylor & Francis: Abingdon-on, UK, 1993; Volume 69, pp. 227–253. [Google Scholar]

- Wang, L.; Wang, Y.; Sun, Y.; Han, K.; Chen, Y. Financial inclusion and green economic efficiency: Evidence from China. J. Environ. Plan. Manag. 2022, 65, 240–271. [Google Scholar] [CrossRef]

- Oruo, J. The Relationship between Financial Inclusion and GDP Growth in Kenya; University of Nairobi: Nairobi, Kenya, 2013. [Google Scholar]

- Bagli, S.; Adhikary, M. Financial inclusion and human development: A cross-section study in India. Indian Econ. J. 2013, 61, 390–406. [Google Scholar] [CrossRef]

- Evans, O. The effects of economic and financial development on financial inclusion in Africa. Rev. Econ. Dev. Stud. 2015, 1, 21–32. [Google Scholar] [CrossRef]

- Nkwede, F. Financial inclusion and economic growth in Africa: Insight from Nigeria. Eur. J. Bus. Manag. 2015, 7, 71–80. [Google Scholar]

- Okoye, L.U.; Adetiloye, K.A.; Erin, O.; Modebe, N.J. Financial inclusion as a strategy for enhanced economic growth and development. J. Internet Bank. Commer. 2017, 22, 1–144. [Google Scholar]

- Dabla-Norris, E.; Ji, Y.; Townsend, R.M.; Unsal, D.F. Distinguishing constraints on financial inclusion and their impact on gdp and inequality. J. Monet. Econ. 2017, 117, 1–18. [Google Scholar] [CrossRef]

- Williams, H.T. Role of financial inclusion in economic growth and poverty reduction in a developing economy. Intern. J. Res. Econ. Soc. Sci. 2017, 7, 265–271. [Google Scholar]

- Evans, O.; Alenoghena, O. Financial inclusion and GDP per capita in Africa: A Bayesian VAR model. J. Econ. Sustain. Dev. 2017, 8, 44–57. [Google Scholar]

- Erlando, A.; Riyanto, F.D.; Masakazu, S. Financial inclusion, economic growth, and poverty alleviation: Evidence from eastern Indonesia. Heliyon 2020, 6, e05235. [Google Scholar] [CrossRef]

- Ratnawati, K.; Prabandari, S.P.; Kurniasari, I. The impact of financial inclusion on national development and national financial system stability. HOLISTICA–J. Bus. Public Adm. 2022, 13, 63–82. [Google Scholar] [CrossRef]

- Park, C.-Y.; Mercado, R.V. Financial inclusion: New measurement and cross-country impact assessment 1. In Financial Inclusion in Asia and beyond; Routledge: Abingdon-on-Thames, UK, 2021; pp. 98–128s. [Google Scholar]

- David, O.; Oluseyi, A.S.; Emmanuel, A. Empirical analysis of the determinants of financial inclusion in Nigeria: 1990–2016. J. Financ. Econ. 2018, 6, 19–25. [Google Scholar]

- Raza, M.S.; Tang, J.; Rubab, S.; Wen, X. Determining the nexus between financial inclusion and economic development in Pakistan. J. Money Laund. Control 2019, 22, 195–209. [Google Scholar] [CrossRef]

- Le, T.T.; Dang, N.D.L.; Nguyen, T.D.T.; Vu, T.S.; Tran, M.D. Determinants of financial inclusion: Comparative study of Asian countries. Asian Econ. Financ. Rev. 2019, 9, 1107. [Google Scholar] [CrossRef]

- Stromquist, N.P. World Development Report 2019: The Changing Nature of Work: By the World Bank; World Bank: Washington, DC, USA, 2019; p. 151. ISBN 978-1-4648-1342-9/978-1-4648-1328-3/978-1-4648-1356-6. [Google Scholar] [CrossRef]

- Zaidi, S.A.H.; Hussain, M.; Zaman, Q.U. Dynamic linkages between financial inclusion and carbon emissions: Evidence from selected OECD countries. Resour. Environ. Sustain. 2021, 4, 100022. [Google Scholar] [CrossRef]

- Liu, N.; Hong, C.; Sohail, M.T. Does financial inclusion and education limit CO2 emissions in China? A new perspective. Environ. Sci. Pollut. Res. 2022, 29, 18452–18459. [Google Scholar] [CrossRef] [PubMed]

- Singh, A.K.; Raza, S.A.; Nakonieczny, J.; Shahzad, U. Role of financial inclusion, green innovation, and energy efficiency for environmental performance? Evidence from developed and emerging economies in the lens of sustainable development. Struct. Chang. Econ. Dyn. 2023, 64, 213–224. [Google Scholar]

- Sohag, K.; Husain, S.; Hammoudeh, S.; Omar, N. Innovation, militarization, and renewable energy and green growth in OECD countries. Environ. Sci. Pollut. Res. 2021, 28, 36004–36017. [Google Scholar] [CrossRef]

- Amin, N.; Song, H. The role of renewable, non-renewable energy consumption, trade, economic growth, and urbanization in achieving carbon neutrality: A comparative study for South and East Asian countries. Environ. Sci. Pollut. Res. 2023, 30, 12798–12812. [Google Scholar] [CrossRef]

- Mehmood, U.; Tariq, S.; Haq, Z.u.; Nawaz, H.; Ali, S.; Murshed, M.; Iqbal, M. Evaluating the role of renewable energy and technology innovations in lowering CO2 emission: A wavelet coherence approach. Environ. Sci. Pollut. Res. 2023, 30, 44914–44927. [Google Scholar] [CrossRef] [PubMed]

- Dahal, A.; Dhakal, P.; Farooqui, A.A. Role of information technology for the improvement of climate change in the context of nepal. 2020. Available online: https://www.researchgate.net/profile/Pratima-Dhakal/publication/343390922_Role_of_Information_Technology_for_the_Improvement_of_Climate_Change_in_the_Context_of_Nepal/links/5f2796df92851cd302d57a54/Role-of-Information-Technology-for-the-Improvement-of-Climate-Change-in-the-Context-of-Nepal.pdf (accessed on 18 June 2024).

- Kemp, R.; Pearson, P. MEI Project about Measuring Eco-Innovation. Final Report. 2008. Available online: http://www.merit.unu.edu/MEI/index.php (accessed on 18 June 2024).

- Paramati, S.R.; Mo, D.; Huang, R. The role of financial deepening and green technology on carbon emissions: Evidence from major OECD economies. Financ. Res. Lett. 2021, 41, 101794. [Google Scholar] [CrossRef]

- Usman, A.; Ozturk, I.; Naqvi, S.M.M.A.; Zafar, S.M.; Javed, M.I. Green versus conventional growth in the EKC framework of top pollutant footprint countries: Evidence based on advanced panel data techniques. Geol. J. 2023, 58, 3368–3384. [Google Scholar] [CrossRef]

- Hussain, Z.; Mehmood, B.; Khan, M.K.; Tsimisaraka, R.S.M.J.F.i.P.H. Green growth, green technology, and environmental health: Evidence from high-GDP countries. Front. Public Health 2022, 9, 816697. [Google Scholar] [CrossRef] [PubMed]

- Tram, T.X.H.; Lai, T.D.; Nguyen, T.T.H. Constructing a composite financial inclusion index for developing economies. Q. Rev. Econ. Finance 2023, 87, 257–265. [Google Scholar] [CrossRef]

- Wang, Q.; Qu, J.; Wang, B.; Wang, P.; Yang, T. Green technology innovation development in China in 1990–2015. 2019, 696, 134008. Sci. Total Environ. 2019, 696, 134008. [Google Scholar] [CrossRef] [PubMed]

- Usman, M.; Kousar, R.; Makhdum, M.S.A.; Yaseen, M.R.; Nadeem, A.M. Do financial development, economic growth, energy consumption, and trade openness contribute to increase carbon emission in Pakistan? An insight based on ARDL bound testing approach. Environ. Dev. Sustain. 2022, 25, 444–473. [Google Scholar] [CrossRef]

- Sohag, K.; Taşkın, F.D.; Malik, M.N. Green economic growth, cleaner energy and militarization: Evidence from Turkey. Resour. Policy 2019, 63, 101407. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Schuermann, T.; Weiner, S.M. Modeling regional interdependencies using a global error-correcting macroeconometric model. J. Bus. Econ. Stat. 2004, 22, 129–162. [Google Scholar] [CrossRef]

- De Hoyos, R.E.; Sarafidis, V. Testing for cross-sectional dependence in panel-data models. Stata J. 2006, 6, 482–496. [Google Scholar] [CrossRef]

- Hsiao, C.; Pesaran, M.H. Random coefficient models. In The Econometrics of Panel Data: Fundamentals and Recent Developments in Theory and Practice; Springer: Berlin/Heidelberg, Germany, 2008; pp. 185–213. [Google Scholar]

- Baltagi, B.H.; Li, Q. A transformation that will circumvent the problem of autocorrelation in an error-component model. J. Econom. 1991, 48, 385–393. [Google Scholar] [CrossRef]

- Pesaran, M.H. Estimation and inference in large heterogenous panels with cross section dependence. 2003. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=385123 (accessed on 18 June 2024).

- Bai, J.; Ng, S. Panel unit root tests with cross-section dependence: A further investigation. Econom. Theory 2010, 26, 1088–1114. [Google Scholar] [CrossRef]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Hall, S.G.; Asteriou, D. Applied Econometrics; Palgrave MacMillan: London, UK, 2016. [Google Scholar]

- Phillips, P.C. Fully modified least squares and vector autoregression. Econom. J. Econom. Soc. 1995, 63, 1023–1078. [Google Scholar] [CrossRef]

- Zellner, A. Statistical analysis of econometric models. J. Am. Stat. Assoc. 1979, 74, 628–643. [Google Scholar] [CrossRef]

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Zhang, L.; Saydaliev, H.B.; Ma, X. Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renew. Energy 2022, 193, 991–1000. [Google Scholar] [CrossRef]

- Chen, C.; Pan, J. The effect of the health poverty alleviation project on financial risk protection for rural residents: Evidence from Chishui City, China. Int. J. Equity Health 2019, 18, 79. [Google Scholar] [CrossRef]

- Mushtaq, N.; Manjiang, X.; Bakhtawar, A.; Mufti, M.A. Elevating the Influence of HR Analytics on Organizational Performance: An Empirical Investigation in Hi-Tech Manufacturing Industry of a Developing Economy. J. Chin. Hum. Resour. Manag. 2024, 15, 3–40. [Google Scholar]

- Ali, N.; Phoungthong, K.; Techato, K.; Ali, W.; Abbas, S.; Dhanraj, J.A.; Khan, A. FDI, green innovation and environmental quality nexus: New insights from BRICS economies. Sustainability 2022, 14, 2181. [Google Scholar] [CrossRef]

- Duan, W.; Madasi, J.D.; Khurshid, A.; Ma, D. Industrial structure conditions economic resilience. Technol. Forecast. Soc. Chang. 2022, 183, 121944. [Google Scholar] [CrossRef]

- Zheng, C.; Wu, S.; Teng, Y.-P.; Wu, S.; Wang, Z. Natural resources, tourism resources and economic growth: A new direction to natural resources perspective and investment. Resour. Policy 2023, 86, 104134. [Google Scholar] [CrossRef]

- Xu, A.; Jin, L.; Yang, J. Balancing tourism growth, Fintech, natural resources, and environmental sustainability: Findings from top tourist destinations using MMQR approach. Resour. Policy 2024, 89, 104670. [Google Scholar] [CrossRef]

| Variable | Symbol | Measurement | Source |

|---|---|---|---|

| Green economic growth | GEG | Green economic growth = GDP + EE − NFD–CO2, where GDP is gross domestic product growth (annual %); EE stands for education expenditure (% of GDP); NFD is net forest deterioration, CO2 is carbon emissions (% of fuel) | WDI |

| Financial inclusion index | FINDX | Index developed on the basis of “number of bank branches per 100,000 population, Number of ATMs per 100,000 population, Outstanding deposit with commercial bank (share of GDP), Outstanding loan with commercial bank (share of GDP)”. | Authors’ calculation; IMF |

| Foreign direct investment | FDI | Net inflow (% of GDP) | WDI |

| Green innovation | GI | Environment-related technologies | OECD |

| Trade openness | TR | Trade % (GDP) | WDI |

| Population | POP | Population growth (annual %) | WDI |

| Variables | GEG | FI | FDI | GI | TR | POP |

|---|---|---|---|---|---|---|

| Mean | −13.976 | 35.588 | 4.281 | 14.289 | 63.338 | 1.333 |

| S.D. | 30.015 | 25.962 | 0 6.951 | 10.581 | 28.621 | 0.873 |

| Maximum | 16.517 | 100 | 27.83 | 63.6 | 140.437 | 2.829 |

| Jarque–Bera | 87.704 (0.00) | 24.454 (0.00) | 54.018 (0.00) | 59.662 (0.00) | 32.174 (0.00) | 2.951 (0.00) |

| Correlation Analysis | ||||||

| GEG | 1 | |||||

| FDI | 0.264 | 1 | ||||

| GI | 0.219 | −0.002 | 1 | |||

| FI | −0.105 | 0.186 | −0.101 | 1 | ||

| TR | 0.134 | −0.176 | 0.082 | 0.067 | 1 | |

| POP | 0.176 | −0.525 | −0.055 | −0.468 | −0.055 | 1 |

| Variables | Statistics | p-Value | Decision |

|---|---|---|---|

| GEG | 6.966 | 0.0000 | CS dependency exists |

| FDI | 6.700 | 0.0000 | CS dependency exists |

| GI | 7.363 | 0.0000 | CS dependency exists |

| FI | 13.74 | 0.0000 | CS dependency exists |

| TR | 9.915 | 0.0000 | CS dependency exists |

| POP | 2.709 | 0.0000 | CS dependency exists |

| Variables | Level | First Difference | Order of Integration |

|---|---|---|---|

| GEG | −1.752 (0.498) | −2.650 (0.001) | I(1) |

| FDI | −1.773 (0.469) | −2.326 (0.025) | I(1) |

| GI | −.1.894 (0.313) | −3.683 (0.001) | I(1) |

| FI | −1.959 (0.239) | −2.590 (0.002) | I(1) |

| TR | −2.025 (0.176) | −.2.708 (0.001) | I(1) |

| POP | −1.409 (0.877) | −2.366 (0.018) | I(1) |

| Pedroni Co-Integration Test | ||||

|---|---|---|---|---|

| Statistic | p-Value | Within Weight | p-Value | |

| Within dimension | ||||

| Panel v-Statistic | −1.101 | 0.864 | −1.109 | 0.866 |

| Panel rho-Statistic | 2.493 | 0.993 | 2.375 | 0.991 |

| Panel PP-Statistic | −3.382 *** | 0.000 | −2.908 *** | 0.001 |

| Panel ADF-Statistic | −3.693 *** | 0.000 | −3.267 *** | 0.000 |

| Between dimensions | ||||

| Group rho-Statistic | 3.825 | 0.999 | ||

| Group PP-Statistic | −2.216 *** | 0.013 | ||

| Group ADF-Statistic | −2.959 *** | 0.001 | ||

| Kao Co-Integration Test | ||||

| ADF | −4.496 *** | 0.000 | ||

| Independent Variables | GI | FDI | FI | POP | TR |

|---|---|---|---|---|---|

| Statistic | 0.052 * | 0.438 * | −0.241 *** | −0.291 * | 0.016 *** |

| p-Value | 0.074 | 0.008 | 0.000 | 0.091 | 0.001 |

| Null Hypothesis | W-Stat | Z-Stat | p-Value |

|---|---|---|---|

| FDI does not homogeneously cause GEG | 2.945 * | 1.423 | 0.071 |

| GEG does not homogeneously cause FDI | 1.697 | 0.925 | 0.354 |

| GI does not homogeneously cause GEG | 2.663 * | 1.858 | 0.090 |

| GEG does not homogeneously cause GI | 1.487 | 0.544 | 0.585 |

| FI does not homogeneously cause GEG | 2.207 * | 3.046 | 0.062 |

| GEG does not homogeneously cause FI | 0.776 | -0.727 | 0.467 |

| TR does not homogeneously cause GEG | 2.268 * | 1.950 | 0.051 |

| GEG does not homogeneously cause TR | 1.809 | 1.126 | 0.261 |

| POP does not homogeneously cause GEG | 1.567 | 0.692 | 0.488 |

| GEG does not homogeneously cause POP | 2.835 | 2.967 | 0.003 * |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abbas, S.; Dastgeer, G.; Nasreen, S.; Kousar, S.; Riaz, U.; Arsh, S.; Imran, M. How Financial Inclusion and Green Innovation Promote Green Economic Growth in Developing Countries. Sustainability 2024, 16, 6430. https://doi.org/10.3390/su16156430

Abbas S, Dastgeer G, Nasreen S, Kousar S, Riaz U, Arsh S, Imran M. How Financial Inclusion and Green Innovation Promote Green Economic Growth in Developing Countries. Sustainability. 2024; 16(15):6430. https://doi.org/10.3390/su16156430

Chicago/Turabian StyleAbbas, Sohail, Ghulam Dastgeer, Samia Nasreen, Shazia Kousar, Urooj Riaz, Saira Arsh, and Muhammad Imran. 2024. "How Financial Inclusion and Green Innovation Promote Green Economic Growth in Developing Countries" Sustainability 16, no. 15: 6430. https://doi.org/10.3390/su16156430