Abstract

This study focuses on the factors affecting the financial performance of pharmaceutical manufacturing enterprises. Based on dynamic capability theory and ambidextrous innovation theory, this study adopts the Resource–Behavior–Performance framework to investigate how green supply chain integration (GSCI) and ambidextrous green innovation affect financial performance. The proposed hypotheses were tested through structural equation modeling using data from 400 China’s pharmaceutical manufacturing enterprises. The results indicate that the various dimensions of GSCI and ambidextrous green innovation yield distinct outcomes. Among the three dimensions of GSCI, only green supplier integration and green customer integration significantly impact financial performance directly, unlike green internal integration. Among the two dimensions of ambidextrous green innovation, only exploitative green innovation significantly influences financial performance, acting as a mediator between the GSCI dimensions and financial performance, while exploratory green innovation does not. The main advantages of this study include considering the connotation and value of GSCI from a green dynamic capability perspective, as well as the effects of exploratory and exploitative green innovation as intermediary behaviors while simultaneously considering the performance effects of GSCI and ambidextrous green innovation. This study offers novel academic insights and practical guidelines for pharmaceutical manufacturing enterprises to integrate GSCI and ambidextrous green innovation, with the aim of achieving better financial performance in their sustainable development efforts.

1. Introduction

Manufacturing enterprises face challenges related to integrating economic and environmental goals as they pursue sustainable development in the context of the global environmental agenda [1]. These challenges are particularly pronounced in emerging economies, where the entrenched traditional model of reckless development is difficult to change in the short term, but where reform is imperative [2].

Ambidextrous green innovation behavior has begun to gain attention in helping enterprises to better balance traditional business with green development [3]. The existing literature has mainly addressed the enablers of ambidextrous green innovation, with less emphasis on the outcomes of these behaviors. Wang and Liu (2020) investigated the impact of ambidextrous green innovation on the competitive edge of Chinese manufacturing enterprises, discovering a significant enhancement through the advantage provided by ambidextrous green innovation [4]. Asiaei et al. (2023) demonstrated the favorable impact of ambidextrous green innovation on environmental performance in IT, banking, and manufacturing industries in Iran [5].

Scholars categorize ambidextrous green innovation into two dimensions, based on ambidextrous innovation theory: exploratory green innovation and exploitative green innovation [4,5,6]. As exploratory and exploitative green innovation differ significantly in terms of innovation degree and needs [7], their influence on the performance of an enterprise may vary. However, previous studies have typically treated ambidextrous green innovation as a single concept when evaluating its environmental impact and competitive advantages [4,5]. As such, the relationships between ambidextrous green innovation, its dimensions, and financial performance have not yet been scrutinized.

Financial performance remains a pivotal concern for enterprises aiming for sustainable development [8]. Sustainable development requires long-term economic support and resource security, and decision makers must not only consider ethics and values in the pursuit of sustainable development, but also ensure sustainable economic success [9]. The economic success pursued in the commitment to sustainable development can be defined as financial performance within sustainable development-based ideas. Vasileiou et al. (2022) contended that an analysis of green innovation effects is more valuable when differentiated by innovation type [1]. Through examining the impacts of different types of green innovation on financial performance within sustainable development-based ideas, enterprises can better formulate sustainable development strategies [10]. Therefore, the first objective of this study is posed as follows:

Objective 1: To investigate the effect of different ambidextrous green innovation dimensions on financial performance within sustainable development-based ideas. This will provide a new theoretical and empirical basis for improving financial performance through ambidextrous green innovation, by identifying which dimension is more important for financial performance.

In the pursuit of sustainable development by enterprises, green supply chain integration (GSCI) is also a novel research interest among scholars. Scholars have mainly explored the impacts of GSCI on financial performance, environmental performance, and green innovation in the entire manufacturing industry [11,12,13], while fewer studies have been conducted in individual industries, limited to construction and IT industries [14,15]. Sun and Sun (2021) pioneered the study of the impact of GSCI on ambidextrous green innovation [6]. The literature has analyzed the functions of GSCI from a static perspective, primarily drawing on natural resource theory and resource dependence theory. Such a static analytical approach fails to fully capture the value of GSCI in enterprises’ pursuit of sustainable development [11]. In the process of pursuing sustainable development, enterprises must integrate ecological, social, and economic factors, thereby confronting increasingly complex challenges. Dynamic capability theory—an expansion of resource dependence theory—has been employed to tackle these emerging challenges in the realm of environmental sustainability [16].

However, existing research lacks an in-depth understanding of how GSCI, as a dynamic capability, affects ambidextrous green innovation behavior. Lee (2023) conducted the inaugural study on the functionality of GSCI from a dynamic capability perspective, exploring its impact on green product innovation [17]. Nevertheless, this study focused solely on GSCI’s resource reconfiguration and overlooked its potential for opportunity sensing and seizing. Dynamic capabilities encompass not just the passive adaptation of enterprises to complex external environments, but also their proactive ability to utilize and even shape these environments—an aspect termed higher-order dynamic capabilities in the literature [18]. Dynamic capabilities with this definition should include three core components: opportunity sensing, seizing, and resource reconfiguring [16]. To fill the research gap, a second research objective of this study is proposed:

Objective 2: Within the framework of higher-order dynamic capabilities theory, the three considered components of dynamic capabilities are extended to the field of supply chain management to construct the concept of GSCI. Combined with the green characteristics of GSCI, GSCI is defined as a green dynamic capability, and the impact of GSCI on ambidextrous green innovation is investigated.

Furthermore, to the best of our knowledge, scant research has been conducted on the influence of green dynamic capabilities and ambidextrous green innovation behavior on financial performance within sustainable development-based ideas. Algarni et al. (2022) were pioneers in exploring how green dynamic capabilities and pro-environmental behaviors affect financial performance within sustainable development-based ideas [9], yet they did not examine the interconnection between green dynamic capabilities and pro-environmental behaviors. Capability represents an intangible resource. Ketchen et al. (2007) argued that resource is the basis of behavior but, without putting effective and efficient behaviors into practice, it is difficult to transform the resource into performance [19]. The Resource–Behavior–Performance (RBP) framework provides scholars with a robust methodology for empirically examining the links among the capabilities, behaviors, and performance of enterprises [20]. To help enterprises utilize green-oriented capabilities and behaviors in their pursuit of sustainable development, and to achieve significant financial performance, the third research objective of this study is posed:

Objective 3: Adopt the RBP framework to deeply analyze the relationships between green dynamic capabilities (GSCI), green innovative behaviors (ambidextrous green innovation), and financial performance. Specifically, we examine the relationship between the three dimensions of GSCI and the two dimensions of ambidextrous green innovation and determine whether the two dimensions of ambidextrous green innovation have mediating effects between the three dimensions of GSCI and financial performance.

This study focuses on the pharmaceutical manufacturing industry. The pharmaceutical manufacturing industry is pivotal for the nation’s well-being, economic growth, and security, attracting significant interest due to its developmental potential [21]. IQVIA’s 2023 research report forecasted that the global pharmaceutical market will likely generate revenues of USD 1.393 trillion and exhibit a compound annual growth rate of 3.9%, indicating positive growth potential. However, the pharmaceutical manufacturing industry is a major polluter, generating significant environmental pollution and even causing diseases [22]. In response to these challenges, green innovation has become the need of the hour in the pharmaceutical manufacturing industry [23].

Governments support green development in pharmaceutical manufacturing with policy documents, offering policy assurances for green innovation [23]. Industry 4.0 brings new technological opportunities, and increasing public demand for green solutions and personalized healthcare has created new market prospects for green innovation [22,24]. However, current green innovation practices in the pharmaceutical industry primarily focus on end-of-pipe technologies to reduce pollution, while academic research has emphasized the utilization of green biotechnology and chemistry for sustainable development in the industry [21,25]. As such, the ambidexterity of green innovation has been overlooked. An exclusive emphasis on the technological aspects of green innovation might lead to missed opportunities for potential additional benefits [1].

Furthermore, pharmaceutical supply chains, which are notably more complex than those in other industries, face not only severe pollution challenges but also numerous potential risks in their pursuit of environmental sustainability [26]. The integration of expertise and competencies from supply chain partners is instrumental in tackling these challenges [27]. Nevertheless, research on GSCI in the pharmaceutical industry is still in its infancy, predominantly focusing on potential green supply chain management risks and eco-friendly supplier selection [26,28]. Urgent exploration and in-depth investigation are essential to comprehend the critical roles of GSCI in pharmaceutical production.

Therefore, the originality and significance of this study are evident in several aspects. First, the application of ambidextrous green innovation within the pharmaceutical manufacturing industry is unprecedented, and this study pioneers the application of this concept in the context of the pharmaceutical manufacturing industry. At the same time, this is the first study to investigate the impacts of both ambidextrous green innovation dimensions (exploratory green innovation and exploitative green innovation) on the variation in financial performance. By determining which dimension is more important for an enterprise’s financial performance, our study provides a new perspective on these two dimensions of ambidextrous green innovation. Second, to the best of our knowledge, the impact of GSCI on financial performance in the pharmaceutical manufacturing industry has not been studied before. This study explores the impact of GSCI on financial performance in the pharmaceutical manufacturing industry based on a dynamic capability perspective, comprising a novel academic exploration. Existing studies have only recently begun advocating for the implementation of green supply chain management in the pharmaceutical manufacturing industry [27]. Third, this study reveals how GSCI indirectly affects enterprise performance through ambidextrous green innovation based on the RBP framework. This theoretical framework is unique and unexplored and provides new perspectives for improving the financial performance of pharmaceutical manufacturing enterprises.

2. Theory Construction and Literature Review

2.1. Green Supply Chain Integration as a Green Dynamic Capability

Green supply chain management has attracted significant attention due to its ability to overcome the dilemma between production efficiency and environmental protection [29]. There are three methods for implementing green supply chain management: (1) functional approaches; (2) green collaborative approaches; and (3) GSCI. GSCI is considered to be the most effective way to implement green supply chain management [30]. In comparison to other approaches, the distinctive characteristics of this approach mainly involve (1) highlighting not only the importance of green transactions and external green collaboration, but also emphasizing green internal integration, recognized as the cornerstone of external integration [12]; and (2) GSCI underscores not just the sharing of resources with supply chain partners, such as technology and information, but also stresses operational efficiency and strategic effectiveness. This entails strategic collaboration with external supply chain partners and the coordination of internal and external processes to optimally configure, adjust, and utilize an organization’s internal and external resources in support of green initiatives [31]. Wong et al. (2015) contended that GSCI promotes collaborative management of green processes within and between organizations through central companies and their supply chain partners, enabling coordination and integration across the supply chain [32]. GSCI is categorized into three dimensions: green internal integration (GII), green supplier integration (GSI), and green customer integration (GCI) [31].

Dynamic capabilities have been widely studied in academia. They include opportunity sensing, seizing, and resource reconfiguring [16]. Dynamic capabilities allow companies to quickly identify opportunities, make rapid decisions, and integrate resources in complex environments [33,34]. Research has indicated that manufacturers can identify green business opportunities through GCI and GSI through understanding customer needs and technological possibilities [35]. They then undertake green projects with their supply chain partners through strategic collaboration, in order to seize these opportunities [11]. Collaborating with supply chain partners also enables the bundling, utilization, and integration of internal and external resources, increasing the success rate of green strategic cooperation projects [32]. According to Zhou et al. (2020), GSCI can not only rapidly integrate internal and external resources of supply chain partners through internal and external process management, thus improving the efficiency of corporate operations, but also allows for the sharing of environmental risks and responsibilities through strategic cooperation and collaborative green innovation to achieve common green development goals [13].

It is evident that GSCI reflects the combined effects of dynamic capabilities. However, many studies lack an in-depth explanation of how GSCI, as a dynamic capability, affects ambidextrous green innovation and performance. Lee (2023) was the first to attempt to study the function of GSCI from a dynamic capability perspective [17]. However, they only focused on the function of GSCI’s resource integration and re-organization, ignoring the function of GSCI’s opportunity sensing and seizing.

Indeed, dynamic capabilities involve not only how enterprises passively adapt to complex external environments, but also how they proactively utilize and shape these environments, encompassing three components: opportunity sensing, opportunity seizing, and resource integration reconfiguration [16]. To bridge this research gap, this study extends the three components of dynamic capabilities to the domain of green supply chain management. GSCI is considered a green dynamic capability in conjunction with its green characteristics. This green dynamic capability is defined as the capability of manufacturers and supply chain partners to strategically collaborate in environmental protection through information sharing, process synergy, and strategic alignment. This definition combines the three components of dynamic capability theory. From this perspective, GSCI will more effectively generate competitive advantage. GII refers to the ability of a manufacturer’s departments to share information, collaborate on processes, and pursue a common green development vision. GSI and GCI refer to the ability of manufacturers to engage in strategic environmental cooperation with key suppliers and customers through information sharing, process coordination, and strategic alignment.

2.2. Ambidextrous Green Innovation as a Green Innovation Behavior

Green innovation behavior is the environmental improvement and innovation activities related to pollution prevention and control, energy conservation, green product design, and environmental management carried out by enterprises through product and manufacturing process innovation to achieve resource conservation and environmental friendliness [36]. Research on green innovation behavior is often problem driven; in the context of escalating environmental, ethical, and social pressure issues, the necessity of implementation of green innovation strategies has become a consensus among governments, academics, and businesses [37].

As research on green innovation behavior progresses, scholars have increasingly focused on ambidextrous green innovation behavior. Ambidextrous green innovation behavior involves enterprises simultaneously pursuing both exploitative and exploratory green innovation to achieve a better balance between economic and environmental considerations [5,6,38]. This concept is derived from ambidextrous innovation theory and applies to the environmental domain. Based on ambidextrous innovation theory, ambidextrous green innovation is categorized into exploratory green innovation and exploitative green innovation, depending on the degree of innovation [5,6,38]. Exploratory green innovation—which focuses on the creation and application of new environmental technologies, products, or solutions aimed at exploring uncharted markets or catering to emerging needs—is typically longer in duration and carries relatively higher risks and costs [5,6,38]. Conversely, exploitative green innovation emphasizes incremental enhancements of current products, services, or processes to better utilize resources, diminish energy usage, and curtail emissions, building upon and refining established technologies and methods [5,6,38].

There are two views on exploration versus exploitation: The first, known as the exploration–exploitation paradox, highlights the divergent objectives and traits of exploratory and exploitative innovations, with each imposing distinct resource and environmental requirements. Due to resource limitations, early studies, such as that of Ghemawat (1993), highlighted the trade-off between exploration and exploitation, suggesting that enterprises are unable to concurrently pursue both and must, instead, choose one or the other [39]. The other view, which is now widely embraced, is ambidextrous balance theory, which suggests that a sole focus on either exploration or exploitation not only fails to yield superior outcomes, but may even accelerate the demise of the enterprise [40]. Specifically, too many exploitative innovation behaviors, while yielding more short-term gains and efficient returns, may lock the enterprise into an established capability pattern, blocking the horizon for exploring new technologies and making it difficult to dynamically adapt to changes in the environment, gradually falling into a ‘capability trap’ [40]. Exploration innovation generally involves the long-term development of new technology with high variables, which makes the enterprise more adaptable to market changes; however, the failure rate of innovation is high, and enterprises that often interrupt their regular operations and focus their limited resources on exploratory innovation will fall into the “innovation trap” and form a vicious cycle of “exploration–failure–no return” which will have a negative impact on enterprise performance [41]. A strategy that combines exploration and exploitation can empower enterprises with longer-lasting viability, as well as superior performance.

In the realm of ambidextrous green innovation, scholars have predominantly adopted the view of ambidextrous balance theory, arguing that enterprises should navigate environmental challenges and enhance their competitive advantage through implementing ambidextrous green innovation behaviors that encompass both exploratory and exploitative green innovations [4]. Ambidextrous green innovation holds the potential to better address the challenges faced by businesses in the green transition period; namely, the need for companies to balance the utilization of current practices with the exploration of new opportunities in the field of sustainable development [3]. Through balancing these two innovation behaviors, ambidextrous green innovation can promote short-term environmental improvements while laying the foundation for long-term sustainable development [3,42]. This two-pronged approach endows ambidextrous green innovation with significant advantages for the promotion of environmental protection and economic growth. Therefore, this study considers ambidextrous green innovation as a key green innovation behavior for enterprises actively seeking sustainable development.

Research on ambidextrous green innovation is still in its infancy. While prior studies have examined the influence of ambidextrous green innovation on the competitive advantage and environmental performance of enterprises [4,5], the impact of ambidextrous green innovation on financial performance remains unexplored. In addition, no attention has been paid to whether the two dimensions of ambidextrous green innovation—exploratory green innovation and exploitative green innovation—affect enterprise performance in different ways. To address this research gap, we specifically examine whether there is a difference between the impacts of these two dimensions on the financial performance of enterprises.

2.3. Financial Performance within Sustainable Development-Based Ideas

Sustainability requires companies to maintain long-term attention and continuous efforts [3]. Financial performance is a major concern for companies pursuing sustainability [8]. However, realizing financial performance within sustainable development-based ideas presents challenges. This is because sustainability places higher demands on enterprises: they must integrate ecological and social issues with economic goals through green innovation. This implies that enterprises will face more complex uncertainties in their pursuit of sustainability and, thus, need to develop green dynamic capabilities [16]. Consistent with this, Amui et al. (2017) emphasized the importance of green dynamic capabilities in managing the complexities of the sustainability process, and called for further research to identify the specific types of green dynamic capabilities that should be developed [43]. Beske et al. (2014) and Lee (2023) argued that integrating dynamic capabilities with green supply chain management is essential [17,44]. The increase in managerial complexity affects pharmaceutical manufacturing enterprises [21]. Companies cannot overcome environmental challenges and achieve sustainability goals alone; they must integrate the strengths of their supply chain partners to handle these uncertainties [15,45]. Therefore, this study integrates the theory of dynamic capabilities with GSCI, developing the concept of GSCI’s dynamic level from the perspective of dynamic capabilities theory. GSCI is viewed as a green dynamic capability and responds to this call by considering it as an antecedent for enterprises to achieve financial performance within sustainable development-based ideas.

Additionally, another research stream has emphasized the crucial role of behavior in the process of transforming capabilities and resources into firm performance, arguing that resources and capabilities are necessary but insufficient conditions for firm performance [46]. Resources and capabilities constrain behavior; yet, without behavior, resources and capabilities cannot effectively translate into performance [47]. The potential value of resources and capabilities is realized only through behavior [19]. Similarly, Algarni et al. (2022) advocated for focusing on the role of firm capabilities and behaviors in studying firm performance within the context of sustainable development-based ideas [9]. The RBP framework has opened a window for scholars to empirically study the relationships between the capabilities, behaviors, and performance of enterprises [20]. Therefore, leveraging the RBP framework, this study integrates GSCI, ambidextrous green innovation, and financial performance into the same framework to examine the relationship between GSCI (as a green dynamic capability) and ambidextrous green innovation (as a green innovation behavior), as well as the direct and indirect impacts of these two types of green activities on financial performance within sustainable development-based ideas.

3. Conceptual Framework and Hypothesis Development

3.1. Green Supply Chain Integration and Enterprise Performance

Financial performance within the context of sustainable development-based ideas denotes the economic benefits that enterprises garner through balancing economic growth with environmental and social responsibilities. Attaining financial performance within sustainable development-based ideas is contingent upon the accurate sensing and seizing of green opportunities [9,48], posing greater challenges for enterprises. Green dynamic capabilities encompass opportunity sensing, seizing, and resource reconfiguring, which are crucial for effectively navigating such challenges [16].

GSCI, as a green dynamic capability, focuses on three core elements: (1) green information sharing, which entails the real-time exchange of green data, information, and requirements with suppliers and customers; (2) green process collaboration, which involves suppliers and customers actively participating in all stages of the green supply chain, from sourcing and design to manufacturing, delivery, and waste management, aiming for synergistic cooperation with supply chain partners; and (3) green strategy collaboration, which is the joint development of green strategies and visions with supply chain partners to advance sustainability efforts collectively [30].

In this study, the three core elements of GSCI are mapped to the three components of green dynamic capabilities. Through this lens, GSCI is posited to extend the realm of traditional dynamic capability theory, grounding it in a more robust theoretical backing. Consequently, GSCI can more effectively enhance an enterprise’s competitive edge. Specifically, opportunity sensing focuses on gathering information about the green needs of customers, integrating supplier feedback, and monitoring other ecological factors [34]. GCI and CSI enable manufacturers to search for business opportunities and technological possibilities together with customers and suppliers through green information sharing. Furthermore, GII facilitates the exchange of essential information between an enterprise’s departments to anticipate and address environmental issues within production processes, thereby circumventing the substantial costs associated with post-issue remediation.

Opportunity seizing is the process of mobilizing resources to take action on and realize the worth of perceived opportunities [34]. De Marchi (2012) highlighted that seizing opportunities in sustainability necessitates deeper collaboration with external partners [49]. Through green process collaboration, various departments within an enterprise and its supply chain partners can jointly formulate multi-participant green plans, strategies, and visions to seize green opportunities. Such collaborations can lead to more cost-effective decisions and facilitate the sharing of risks and costs, thereby resulting in improved economic benefits [30]. Additionally, this type of strategic green collaboration with suppliers and customers contributes to establishing a strong green image for enterprises, helping to attract more customers and achieve higher sales [30].

The resource re-organization function highlights the continuous renewal of resources and capabilities to meet evolving external demands [16]. Enterprises are bound to face contingencies and unpredictable situations as they strive to implement green strategies and realize green visions [9]. Leveraging information sharing and process collaboration across departments and with supply chain partners enables enterprises to enhance and re-structure their resources, allowing for flexible responses to uncertainty [16]. This supports the more efficient implementation of green strategies and visions, leading to superior financial performance [16,30].

From the above analysis, the following hypotheses are proposed:

H1.

(a) GII, (b) GCI, and (c) GSI are positively related to financial performance.

3.2. Green Supply Chain Integration and Ambidextrous Green Innovation

Any innovation faces uncertainty and dynamics. Uncertainty and dynamics in exploratory green innovation and exploitative green innovation include difficulties in selecting green innovation projects, risks associated with green innovation failure, and resource constraints [11,50,51]. GSCI, as a green dynamic capability, helps to address these challenges in exploratory and exploitative green innovation processes.

From the perspective of opportunity sensing and seizing, exploratory and exploitative green innovation-based inspirations mostly require knowledge external to the firm [52]. GSI and GCI, as externally integrated capabilities, can help companies to break through the boundaries of innovation at the intersection of green needs and green technological frontiers, inspire exploratory and exploitative green innovation, and identify innovation opportunities [11,42,53]. GII, as the absorptive capacity for acquiring knowledge from customers and suppliers, is the cornerstone for developing GSI and GCI [53]. This capacity facilitates the dissemination, interpretation, utilization, and evaluation of information and resources provided by suppliers and customers, driving the development of exploratory and exploitative green innovation programs that meet market expectations [5,35].

From the perspective of resource re-configuration, GSCI, as a resource integration and re-configuration capability, helps firms to collaborate and deploy resources across organizational boundaries [17], as well as addressing the challenge of exploratory and exploitative green innovation competing for the firms’ limited resources. In addition, technological and business uncertainties during the implementation of exploratory and exploitative green innovation may require firms to adjust their balance in a dynamic manner [51]. GCI helps firms to gain insights into consumer expectations and opinions about green products, such that they can continually optimize the direction and strategy of exploratory and exploitative green innovation. GSI, in turn, provides the technical and resource support for this purpose. GII further facilitates the development of GSI and GCI [53].

Therefore, GSCI will facilitate firms to carry out exploratory and exploitative green innovation and, so, this study proposes the following hypotheses:

H2.

GCI is positively associated with (a) exploratory green innovation and (b) exploitative green innovation.

H3.

GSI is positively associated with (a) exploratory green innovation and (b) exploitative green innovation.

H4.

GII is positively associated with (a) exploratory green innovation and (b) exploitative green innovation.

3.3. Ambidextrous Green Innovation and Enterprise Performance

Like other sectors, the entrenched high-pollution development approach of pharmaceutical manufacturers is unlikely to be quickly revamped [23]. Yet, with the escalating rigor of government environmental policies, pharmaceutical manufacturing enterprises can be expected to encounter more stringent regulations.

According to ambidextrous innovation theory, firms engaging in both exploitative and exploratory innovation behaviors are more likely to achieve better business performance [54]. Specifically, in the environmental domain, exploitative green innovation—which aims to improve the green operations of existing businesses and enhance the green performance of products—provides enterprises with a feasible solution to respond to the basic requirements of environmental laws [4], thereby preventing financial losses due to non-compliance. Comparatively, exploratory green innovation involves the pursuit of novel and pioneering green technologies. Despite its lengthy, risky, and complex nature, achieving a breakthrough in exploratory green innovation can elevate enterprises to the high-end of the global pharmaceutical industry chain and value chain, fostering the development of new green markets and securing a dominant global position [4].

In addition, as consumers are increasingly concerned about both their health and the environment, the demand for eco-friendly and personalized pharmaceutical products is also on the rise. Through exploratory green innovation, companies can develop new and greener pharmaceutical products to capture emerging markets and gain a head start; on the other hand, exploitative green innovation focuses on improving existing products to better meet consumer needs through enhancing their environmental attributes and personalized features, thereby maintaining existing customer loyalty and stabilizing enterprise performance [4]. The successful implementation of both exploratory and exploitative green innovation will create a favorable green brand image for the firm, attract more consumers, enhance customer loyalty, and strengthen brand competitiveness [42]. Together, these factors will help companies to expand their market share and increase sales revenue which, in turn, will contribute to improved financial performance.

Consequently, we suggest the following hypotheses:

H5.

(a) Exploratory green innovation and (b) exploitative green innovation are positively associated with financial performance.

3.4. The Mediating Role of Ambidextrous Green Innovation

While extensive research has supported the positive effects of capabilities on performance, certain theories suggest these capabilities must be operationalized into performance via behaviors [19,46,47]. This study views GSCI as the firm’s green dynamic capabilities, ambidextrous green innovation as its green innovation behaviors, and financial performance as the outcome of both. Drawing from the preceding analysis and the RBP framework, we propose the following hypotheses:

H6.

Exploitative green innovation mediates the relationships between (a) GII, (b) GSI, and (c) GCI with financial performance.

H7.

Exploratory green innovation mediates the relationships between (a) GII, (b) GSI, and (c) GCI with financial performance.

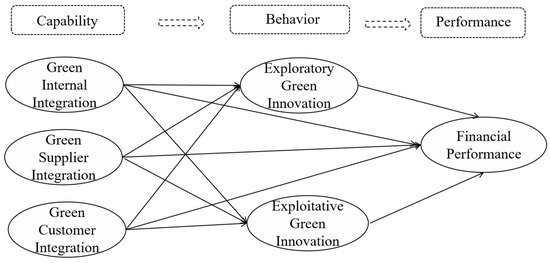

Ultimately, this study’s conceptual model is depicted in Figure 1.

Figure 1.

Conceptual model.

4. Methodology

4.1. Sample and Procedure

This study focuses on pharmaceutical manufacturing enterprises in the Yangtze River Delta region of China. The purpose of this study is to examine the relationship between GSCI, a green dynamic capability, and ambidextrous green innovation, a green innovative behavior, based on the RBP framework, as well as the direct and indirect impacts of these two types of green activities on financial performance within sustainable development-based ideas. The pharmaceutical manufacturing enterprises in the Yangtze River Delta region were considered to be appropriate for empirical research in this study. The main reasons for this choice are mainly twofold: (1) The Yangtze River Delta region, which covers Shanghai, Jiangsu, Zhejiang, and Anhui, is one of the most dynamic and competitive economic regions in China. It has prominent industrial clusters and an extensive logistics supply chain that has penetrated the international market [55]. The pharmaceutical manufacturing industry has been fully developed in this region, attracting a large number of pharmaceutical manufacturing enterprises, forming a complete industrial chain and a high industrial agglomeration effect, with a relatively high degree of supply chain integration [55,56]. (2) Pharmaceutical manufacturing enterprises in this region have undergone continuous growth and development in green innovation, positioning themselves at the forefront and playing a leading role in driving green innovation within the national pharmaceutical manufacturing industry [57,58].

To ensure the development of high-quality questionnaires and measurement items, we mainly used the following steps to design the questionnaire: (1) Referring to mature scales in the fields of GSCI, ambidextrous green innovation, and financial performance, we translated and back-translated them to develop the initial scale. (2) Two experts in GSCI and green innovation, along with three senior managers possessing practical experience, were invited to review the questionnaire. They assessed the semantics, wording, and logical relationships of items, making modifications to better align with the management and operational practices of China’s pharmaceutical manufacturing enterprises. (3) Thirty pharmaceutical manufacturing enterprises were selected to conduct a pre-survey in order to preliminarily assess the questionnaire’s credibility and gather feedback on its comprehensibility and language usage. (4) Finally, based on the pre-survey results, the questionnaire was revised to form the final version.

The questionnaire survey in the YRD region was administered in three ways: (1) across diverse pharmaceutical industry meeting venues; (2) with the assistance of acquaintances; and (3) by e-mail. Considering the aims of the study, only respondents in roles such as supply chain manager, purchasing manager, marketing manager, vice president, or CEO/president were selected, ensuring they had a comprehensive knowledge of their GSCI practices and ambidextrous green innovation behaviors. Respondents were drawn from various sub-sectors of the pharmaceutical manufacturing industry, including Chemical Raw Materials, Chemical Pharmaceutical Preparations, Chinese Herbal Pieces, Chinese Patent Medicines, Veterinary Drugs, and Biopharmaceuticals. The study spanned four months, during which 647 questionnaires were disseminated. Of these, 472 were retrieved and, after discarding 72 invalid responses, 400 valid questionnaires remained, yielding an effective response rate of 65.57%, as detailed in Table 1.

Table 1.

Distribution and return of questionnaires.

4.2. Measurements

The measurement items of all constructs were sourced from established scales, which have been validated in prior research, and adapted to the environmental management context. Every construct was measured with a five-point Likert scale, as detailed in Table 2. The GSCI construct was evaluated with 18 items based on Kong et al. (2021) and Lee (2023) [12,17], while the GCI, GII, and GSI constructs were each assessed using six items. Financial performance was assessed using 5 items from Kong et al. (2021) [12], and ambidextrous green innovation—including exploratory and exploitative green innovation—was evaluated with 13 items (7 for exploratory and 6 for exploitative green innovation), as informed by the studies conducted by Jansen et al. (2006) [59] and Wang et al. (2020) [38].

Table 2.

Properties of measurement items.

4.3. Construct Validity and Reliability Test

Before hypothesis testing, the reliability and validity of the scales were evaluated. First, Cronbach’s alpha for each construct were calculated to confirm their reliability. The outcomes are presented in Table 2, which reveals that the lowest Cronbach’s alpha was 0.891, surpassing the threshold of 0.70. This indicates that our scale has good reliability. Second, we employed the AMOS 23.0 software for CFA modeling in order to evaluate the convergent and discriminant validity of the constructs. The CFA model demonstrated a good fit, with values of , , , , , and , as detailed in Table 2. Every standardized factor loading surpassed 0.6, the CR for each construct exceeded 0.7, and the AVE for each construct exceeded 0.5, demonstrating good convergent validity. We computed the means, standard deviations, and correlation coefficients for discriminant validity assessment, as presented in Table 3. The correlation coefficients were below 0.7 and less than the square roots of the AVEs, confirming the ideal discriminant validity of the constructs.

Table 3.

Descriptive statistics and correlations.

4.4. Common Method Biases

To minimize common method bias, this study implemented both ex-ante control and an ex-post-test. The ex-ante control included separating the survey items for independent and dependent variables onto different pages and ensuring respondent anonymity and confidentiality. In the ex-post-test, the Harman single-factor method was applied to assess common method bias through conducting an exploratory factor analysis of the questionnaire items. The results revealed the presence of six factors with eigenvalues exceeding one. Specifically, the first factor contributed to 23.876% of the variance, which does not constitute the majority of the total variance [60]. Furthermore, the marker variable technique, with the respondent’s tenure as the marker, was employed to analyze its correlation with the constructs of interest [61]. Table 3 indicates a lack of significant correlations between the marker variable and other variables. Consequently, this study appears to be free from significant common method bias.

5. Results

5.1. Main Effect Test

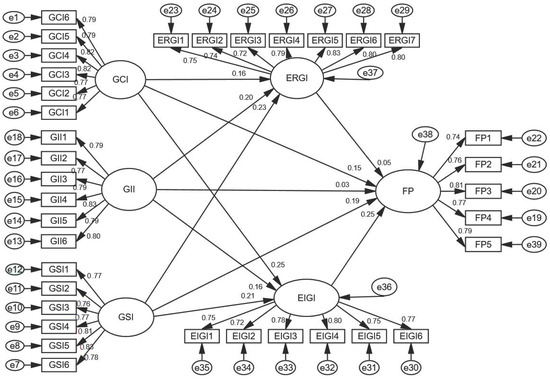

Structural Equation Modeling (SEM) utilizes a diverse range of fit evaluation metrics, facilitating the concurrent management of several independent and dependent variables, thereby catering to the complex modeling requirements in the context of social sciences [62]. Additionally, SEM accommodates measurement errors in variables and ensures high precision in the estimation of parameters. The capability of SEM to analyze both manifest and latent variables aligns with the intangible nature of variables in the social sciences, thus addressing the limitations of conventional regression approaches. Consequently, this study employed structural equation modeling through the AMOS 23.0 software in order to elucidate the inherent relationships among GSCI, ambidextrous green innovation, and financial performance, as depicted in Figure 2. The constructed model presented good fit indices (; ; ; ; ; ).

Figure 2.

SEM model diagram.

Table 4 reveals that, within the three dimensions of GSCI, only GCI () and GSI () had significant positive impacts on financial performance (FP), supporting H1b and H1c. Conversely, GII () did not significantly influence financial performance (FP) and, so, H1a was rejected. Furthermore, Table 4 indicates that all three dimensions of GSCI had significant positive effects on exploratory green innovation (ERGI) (; ; ) and exploitative green innovation (EIGI) (; ; ), supporting H2a, H2b, H3a, H3b, H4a, and H4b. However, among the two dimensions of ambidextrous green innovation, only exploitative green innovation (EIGI) () significantly influenced financial performance (FP) positively, while exploratory green innovation (ERGI) () did not. Consequently, hypothesis H5b was confirmed, whereas H5a was rejected.

Table 4.

Direct effects test results for structural equation models.

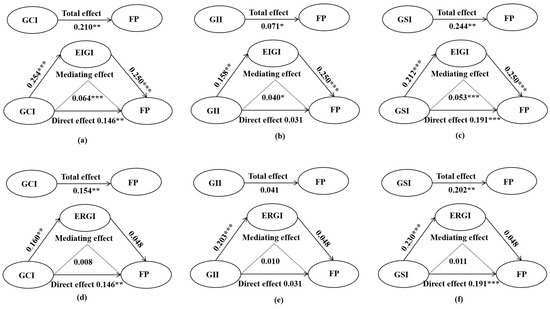

5.2. Mediating Effect Test

In line with the recommendations of Preacher and Hayes (2008) [63], we employed the Bootstrap method with 5000 re-samples to explore the potential mediating roles of exploratory and exploitative green innovation in the relationship between GSCI and financial performance. This approach offers greater testing power and precision, compared to stepwise regression and Sobel’s test, without necessitating that the test statistic adheres to a normal distribution. Table 5 presents the results of the Bootstrap analysis for assessment of the mediation effect. Figure 3a–c illustrate the direct, indirect, and total impacts of the GSCI dimensions on financial performance through exploitative green innovation, while Figure 3d–f illustrate these impacts through exploratory green innovation.

Table 5.

Bootstrap mediating effects test results.

Figure 3.

Standardized direct, indirect, and total effects among variables. * p < 0.05, ** p < 0.01, *** p < 0.001.

First, we analyzed the mediating effects of exploitative green innovation. According to Table 5, the indirect standardized path coefficients for GII → EIGI → FP (), GCI → EIGI → FP (), and GSI → EIGI → FP () were all significant. At the same time, as shown in Figure 3, the direct standardized path coefficients for GCI → FP () and GSI → FP () were significant, while that for GII → FP () was not significant. This suggests that exploitative green innovation partially mediates the relationships between GCI and financial performance and GSI and financial performance, while fully mediating the relationship between GII and financial performance, supporting H6a, H6b, and H6c.

Next, we assessed the mediating effects of exploratory green innovation. According to Table 5, the indirect standardized path coefficients of GII → ERGI → FP (), GCI → ERGI → FP (), and GSI → ERGI → FP () were all not significant. Therefore, H7a, H7b, and H7c were rejected.

6. Discussion and Conclusions

Based on dynamic capability theory and ambidextrous innovation theory, this study adopted the RBP framework to construct a comprehensive model of financial performance improvement in pharmaceutical manufacturing enterprises. This study aimed to explore the correlation between GSCI (representing green dynamic capabilities) and ambidextrous green innovation (representing green innovative behaviors), as well as the direct and indirect effects of these two green activities on financial performance within sustainable development-based ideas. The findings revealed that, among the three dimensions of GSCI (i.e., GII, GSI, and GCI), only GSI and GCI have a direct and significant positive effect on financial performance, while the direct effect of GII on financial performance is not significant. One possible explanation for this observation is that pharmaceutical products usually contain active sensitive molecular entities, and their production, storage, and transportation require strict temperature monitoring and control [28]. At the same time, their production process usually involves multiple steps and substance transformation processes [25]. More importantly, the quality of pharmaceutical products is related to human life and health, and the green reform of pharmaceutical manufacturing enterprises needs to be based on ensuring product quality [64]. This requires that pharmaceutical manufacturing enterprises integrate the resources and capabilities of their supply chain partners, and it is difficult to obtain a significant direct impact on performance through internal integration alone [65].

Moreover, we found evidence that, in green practice activities, GSCI is a significant precursor to ambidextrous green innovation. This implies that GSCI, as a green dynamic capability, integrates various external and internal factors of the enterprise, including customer feedback, supplier technologies, and the synchronization and collaboration of internal strategies and processes, to identify and exploit opportunities for ambidextrous green innovation, thus promoting the implementation of ambidextrous green innovation behaviors [66,67]. This finding is consistent with the suggestion of Gumusluoğlu and Ilsev (2009) that the implementation of innovations requires support from external knowledge and resources, as well as a supportive internal environment for innovation [68].

Third, although researchers have identified ambidextrous green innovation as a crucial determinant of enterprise competitive advantage and environmental performance [4,5], the investigation of how ambidextrous green innovation—along with its various dimensions—impacts financial performance has been neglected to date. Our empirical evidence indicated a positive (but insignificant) correlation between exploratory green innovation and financial performance, while only exploitative green innovation significantly positively impacts financial performance. These findings are in alignment with previous research by Azar and Ciabuschi (2017), who suggested that exploitative innovation significantly boosts the export performance of Swedish exporting enterprises, unlike exploratory innovation [69], but were not in line with Jia et al. (2022), who concluded that both exploratory and exploitative green innovation promote enterprise performance [42].

An explanation for the obtained results (i.e., the positive effect of exploitative green innovation and lack of effect of exploratory green innovation) may lie in the specific context of the China’s pharmaceutical manufacturing industry and studies on ambidextrous innovation. While both exploratory and exploitative innovation behaviors aim to enhance enterprise performance, their effectiveness is influenced by industrial factors [59]. In their research, Sorescu et al. further highlighted the special attributes of pharmaceutical manufacturing enterprises, noting that exploratory innovations are predominantly introduced by larger enterprises, and the conversion of exploratory innovations to financial performance is affected by the degree of patent protection and marketing capabilities [70]. However, China’s pharmaceutical patent protection system is weak, and there is a distinct separation between production and marketing within these enterprises, indicating that the marketing system needs to be further improved [71].

In addition, exploratory green innovation requires a high level of innovation capacity, with a long cycle and high risk, for China’s pharmaceutical manufacturing industry, which is weak in independent innovation capacity, the effect of exploratory green innovation needs a long observation cycle [38,72]. In contrast, exploitative green innovation is low risk, has a short cycle, and helps enterprises quickly respond to green market demands [4]. In the case of China’s Yiling Pharmaceutical, for example, the company has successfully reduced costs, improved product quality, and expanded its market share through a variety of exploitative green innovation behaviors, such as waste re-use, green base construction, and clean technology renovation, which, in turn, led to 12.533 billion yuan of revenue in 2022.

These insights are crucial, offering a plausible reason for the differences observed between this study’s outcomes and those of prior research, as well as highlighting the necessity to examine the ambidextrous green innovation–financial performance relationship across varied research settings. Thus, this study represents an academic endeavor to reveal the significance of this association within China’s pharmaceutical manufacturing industry. It also enriches the current academic discourse through offering a viewpoint that acknowledges the intricate and context-dependent nature of the link between ambidextrous green innovation and enterprise performance.

Finally, our results demonstrated that exploitative green innovation partially mediates the links between GSI, GCI, and financial performance, and fully mediates the relationship between GII and financial performance. Meanwhile, exploratory green innovation does not mediate between the three dimensions of GSCI and financial performance. Notably, the findings indicate that GSCI—as a green dynamic capability—can improve enterprise financial performance both directly and through enhancing exploitative green innovation. In other words, the findings support the argument that coping with change and uncertainty and achieving high-quality financial performance in the pursuit of a sustainable development path requires the introduction of both dynamic capabilities and green behaviors [9,16], shedding new light on the relationships between GSCI and ambidextrous green innovation in relation to financial performance.

6.1. Theoretical Contributions

(1) This study combines the three components of opportunity sensing, opportunity seizing, and resource reconfiguring of dynamic capabilities to expand GSCI under the dynamic capabilities perspective from the passive adaptation to active utilization level and, furthermore, analyzes its impact on the financial performance of pharmaceutical manufacturing enterprises. This enhancement not only enriches the literature on GSCI, but also deepens the understanding of supply chain management in pharmaceutical manufacturing enterprises. At present, theoretical studies on pharmaceutical manufacturing enterprises supply chain management are nascent, primarily emphasizing the significance of adopting green supply chain practices [27], thus lagging behind the practice of pharmaceutical manufacturing enterprises. This study helps pharmaceutical manufacturing enterprises to better understand the value of GSCI and provides valuable guidelines for them to decide how to manage GSCI to enhance their financial performance.

(2) The obtained findings provide valuable insights on the impacts of ambidextrous green innovation. Prior studies have primarily focused on the effects of ambidextrous green innovation on enterprise environmental performance and competitive advantage [4,5], while the association between ambidextrous green innovation and its components—namely, exploratory green innovation and exploitative green innovation—in relation to financial performance has received trivial attention. To the best of our knowledge, this study is the first to concurrently explore the distinct effects of exploratory and exploitative green innovation on financial performance. Our study sheds new light on these two dimensions of ambidextrous green innovation through determining which is more important in terms of financial performance.

(3) This study advances green practice effectiveness research by highlighting the critical role of integrating two green practices for enterprises to secure high-quality financial performance along their sustainable development trajectory. It is crucial for enterprises to recognize that the development of their resources, capabilities, and strategic behaviors are inter-related [73], and that the combination of capabilities and behaviors yields better performance [20]. In the sustainable development trajectory, enterprises must expand beyond mere green innovation actions. GSCI, as a green dynamic capability, plays a pivotal role in achieving high-quality financial performance. However, when considering green innovation behavior, exploratory green innovation is more important than exploitative green innovation.

6.2. Practical Implications

(1) Pharmaceutical manufacturing enterprises should realize that it is difficult to achieve high-quality financial performance in the pursuit of sustainable development on their own, and that they need to integrate the resources and capabilities of their suppliers and customers. Managers should adopt a holistic view of GSCI to manage their GSCI and develop not only GCI and GSI capabilities—which have a direct impact on the enterprise’s exploitative green innovation, exploratory green innovation, and financial performance—but also GII capabilities, as GII is the foundation of GSI and GCI. If there is poor communication of information within the organization and conflicts between departments, it will be difficult for the organization to share information and work collaboratively with its key suppliers and customers. In addition, GII can also promote financial performance through exploitative green innovation.

(2) Managers should evaluate enterprise green practices through the lens of the RBP framework. It is important for managers to not only practice green innovative behaviors in terms of green processes, products, and so on, but also to invest as much attention as possible in the supply chain, in order to develop green dynamic capabilities (GSCI) at the supply chain level. GSCI is essential to ensure the success of green innovation behaviors in enterprises. Managers should also be aware that GSCI, as a special resource, will not have a value-added effect if it is not utilized. Managers should pay attention to designing the green innovation actions needed to utilize each resource, as matching green resources with green innovation behaviors will improve green practice performance.

(3) Notably, this study’s findings revealed that, within the two dimensions of ambidextrous green innovation, only exploitative green innovation significantly impacts financial performance, whereas exploratory green innovation does not. Despite repeated emphasis on the critical role of exploratory green innovation in long-term enterprise growth, China’s pharmaceutical manufacturing industry suffers from a delayed onset and limited capacity for independent innovation. The R&D efforts of enterprises are focused primarily on generic drugs and Active Pharmaceutical Ingredients, with insufficient capacity and practice of exploratory innovation, coupled with the difficulty in developing key technologies in the pharmaceutical manufacturing industry and a high rate of risk and failure. Under such a background, for managers to obtain high-quality financial performance with the progress of green development, they need to carry out less risky exploitative green innovation behaviors, instead of focusing only on radical exploratory green innovation behaviors.

6.3. Limitation and Future Research

(1) The data of the study were cross-sectional. The utilization of cross-sectional data partially undermines the interpretive validity of causal inferences and the elucidation of the study’s mechanisms. Cross-sectional data, offering only a snapshot at a single time point, fail to reflect the temporal dynamics among variables. Consequently, the current results cannot verify the persistence of variable relationships over time. In order to overcome this limitation and obtain more rigorous conclusions, future studies may consider using longitudinal or experimental research methods. Longitudinal research enables the tracking of changes in individual variables over time, yielding deeper insights into causality and action mechanisms. Experimental research facilitates control over confounding variables through the direct manipulation of independent variables via random assignment, thereby strengthening causal inference.

(2) The conclusions of this study are exclusively based on data from China’s pharmaceutical manufacturing enterprises, limiting its external validity; thus, the findings may not extend to other industries. If the research results are not widely applicable to varied contexts or industries, our confidence in their generalizability diminishes. To enhance the study’s external validity and affirm the generalizability of the findings, future research should replicate these tests in different industries. This could not only validate the adaptability of the findings but may also uncover inter-industry nuances. Additionally, employing a multi-industry sample could aid in detecting heterogeneity in the business context, offering more targeted insights and recommendations for individual sectors.

(3) The results of this study indicate that exploratory green innovation behavior is not significantly related to financial performance, but the boundary conditions affecting the conversion of exploratory green innovation to financial performance were not analyzed in depth. This limits comprehensive understanding of the relationship between exploratory green innovation and financial performance conversion. Given that exploratory green innovation is the high point of future industrial competition [74] and China’s pharmaceutical manufacturing enterprises have the ability to conduct exploratory green innovation after long-term development [75], future research should further explore the boundary conditions that convert exploratory green innovation behaviors to financial performance. This will help lead China’s pharmaceutical manufacturing enterprises to the high end of the global industrial and value chain through exploratory green innovation.

(4) This study on the mechanism of GSCI on finance performance only opens the corner of the “black box” and some studies have begun to focus on the negative effects of GSCI; for example, in the process of GSCI, enterprises and supply chain partners aim to maximize their own interests, thus generating opportunism, which may impede the ultimate realization of financial performance through GSCI [76]. Future research can try to explore the joint influence of both positive and negative paths of action and attempt to improve this mechanism of action in order to provide valuable guidance for enterprises to manage both positive and negative effects in a targeted manner.

Author Contributions

Conceptualization, P.S. and G.Y.; methodology, P.S. and G.Y.; software, G.Y.; validation, P.S.; formal analysis, G.Y.; investigation, G.Y. and F.L.; writing—original draft preparation, G.Y.; writing—review and editing, P.S., G.Y. and F.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data for this work are available through the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Vasileiou, E.; Georgantzis, N.; Attanasi, G.; Llerena, P. Green innovation and financial performance: A study on Italian firms. Res. Policy 2022, 51, 104530. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Tse, D.K.; Li, J.J. Organizational changes in emerging economies: Drivers and consequences. J. Int. Bus. Stud. 2006, 37, 248–263. [Google Scholar] [CrossRef]

- Martínez-Falcó, J.; Sánchez-García, E.; Marco-Lajara, B.; Visser, G. Green ambidexterity innovation as the cornerstone of sustainable performance: Evidence from the Spanish wine industry. J. Clean. Prod. 2024, 452, 142186. [Google Scholar] [CrossRef]

- Wang, J.; Liu, J. The impact of ambidextrous green innovation on the competitive advantage of Chinese manufacturing Firms: The moderating role of technological turbulence. Sci. Technol. Manag. Res. 2020, 40, 196–204. [Google Scholar] [CrossRef]

- Asiaei, K.; O’Connor, N.G.; Barani, O.; Joshi, M. Green intellectual capital and ambidextrous green innovation: The impact on environmental performance. Bus. Strategy Environ. 2023, 32, 369–386. [Google Scholar] [CrossRef]

- Sun, Y.; Sun, H. Green Innovation Strategy and Ambidextrous Green Innovation: The Mediating Effects of Green Supply Chain Integration. Sustainability 2021, 13, 4876. [Google Scholar] [CrossRef]

- Zeng, W.; Li, B.Z. Driving paths of enterprise green ambidextrous innovation from the configuration perspective. China Popul. Resour. Environ. 2022, 32, 151–161. [Google Scholar] [CrossRef]

- Roffé, M.A.; González, F.A.I. The impact of sustainable practices on the financial performance of companies: A review of the literature. Visión Futuro 2024, 28, 221–240. [Google Scholar] [CrossRef]

- Algarni, M.A.; Ali, M.; Albort-Morant, G.; Leal-Rodríguez, A.L.; Latan, H.; Ali, I.; Ullah, S. Make green, live clean! Linking adaptive capability and environmental behavior with financial performance through corporate sustainability performance. J. Clean. Prod. 2022, 346, 131156. [Google Scholar] [CrossRef]

- Wang, Y.Z.; Ahmad, S. Green process innovation, green product innovation, leverage, and corporate financial performance; evidence from system GMM. Heliyon 2024, 10, e25819. [Google Scholar] [CrossRef]

- Wong, C.Y.; Wong, C.W.; Boon-itt, S. Effects of green supply chain integration and green innovation on environmental and cost performance. Int. J. Prod. Res. 2020, 58, 4589–4609. [Google Scholar] [CrossRef]

- Kong, T.; Feng, T.; Huo, B. Green supply chain integration and financial performance: A social contagion and information sharing perspective. Bus. Strategy Environ. 2021, 30, 2255–2270. [Google Scholar] [CrossRef]

- Zhou, C.; Xia, W.; Feng, T.; Jiang, J.; He, Q. How environmental orientation influences firm performance: The missing link of green supply chain integration. Sustain. Dev. 2020, 28, 685–696. [Google Scholar] [CrossRef]

- Pham, T.; Pham, H. Improving green performance of construction projects through supply chain integration: The role of environmental knowledge. Sustain. Prod. Consum. 2021, 26, 933–942. [Google Scholar] [CrossRef]

- Wu, G. The influence of green supply chain integration and environmental uncertainty on green innovation in Taiwan’s IT industry. Supply Chain. Manag. Int. J. 2013, 18, 539–552. [Google Scholar] [CrossRef]

- Mousavi, S.; Bossink, B.; van Vliet, M. Dynamic capabilities and organizational routines for managing innovation towards sustainability. J. Clean. Prod. 2018, 203, 224–239. [Google Scholar] [CrossRef]

- Lee, H. Drivers of green supply chain integration and green product innovation: A motivation-opportunity-ability framework and a dynamic capabilities perspective. J. Manuf. Technol. Manag. 2023, 34, 476–495. [Google Scholar] [CrossRef]

- O’Reilly, C.A., III; Tushman, M.L. Ambidexterity as a dynamic capability: Resolving the innovator’s dilemma. Res. Organ. Behav. 2008, 28, 185–206. [Google Scholar]

- Ketchen, D.J., Jr.; Hult, G.T.M.; Slater, S.F. Toward greater understanding of market orientation and the resource-based view. Strateg. Manag. J. 2007, 28, 961–964. [Google Scholar] [CrossRef]

- Garousi Mokhtarzadeh, N.; Amoozad Mahdiraji, H.; Jafarpanah, I.; Jafari-Sadeghi, V.; Cardinali, S. Investigating the impact of networking capability on firm innovation performance: Using the resource-action-performance framework. J. Intellect. Cap. 2020, 21, 1009–1034. [Google Scholar] [CrossRef]

- Milanesi, M.; Runfola, A.; Guercini, S. Pharmaceutical industry riding the wave of sustainability: Review and opportunities for future research. J. Clean. Prod. 2020, 261, 121204. [Google Scholar] [CrossRef]

- Helwig, K.; Niemi, L.; Stenuick, J.Y.; Alejandre, J.C.; Pfleger, S.; Roberts, J.; Harrower, J.; Nafo, I.; Pahl, O. Broadening the perspective on reducing pharmaceutical residues in the environment. Environ. Toxicol. Chem. 2024, 43, 653–663. [Google Scholar] [CrossRef] [PubMed]

- Sahoo, S.; Kumar, A.; Mani, V.; Venkatesh, V.G.; Kamble, S. Big data management activities for sustainable business performance during the COVID-19 pandemic: Evidence from the Indian pharmaceutical sector. IEEE Trans. Eng. Manag. 2022, 71, 10611–10625. [Google Scholar] [CrossRef]

- Sharma, D.; Patel, P.; Shah, M. A comprehensive study on Industry 4.0 in the pharmaceutical industry for sustainable development. Environ. Sci. Pollut. Res. 2023, 30, 90088–90098. [Google Scholar] [CrossRef] [PubMed]

- Ang, K.L.; Saw, E.T.; He, W.; Dong, X.; Ramakrishna, S. Sustainability framework for pharmaceutical manufacturing (PM): A review of research landscape and implementation barriers for circular economy transition. J. Clean. Prod. 2021, 280, 124264. [Google Scholar] [CrossRef]

- Sheykhzadeh, M.; Ghasemi, R.; Vandchali, H.R.; Sepehri, A.; Torabi, S.A. A hybrid decision-making framework for a supplier selection problem based on lean, agile, resilience, and green criteria: A case study of a pharmaceutical industry. Environ. Dev. Sustain. 2024, 1–28. [Google Scholar] [CrossRef]

- Ricardianto, P.; Kholdun, A.; Fachrey, K.; Nofrisel, N.; Agusinta, L.; Setiawan, E.; Abidin, Z.; Purba, O.; Perwitasari, E.; Endri, E. Building green supply chain management in pharmaceutical companies in Indonesia. Uncertain Supply Chain. Manag. 2022, 10, 453–462. [Google Scholar] [CrossRef]

- Kumar, A.; Zavadskas, E.K.; Mangla, S.K.; Agrawal, V.; Sharma, K.; Gupta, D. When risks need attention: Adoption of green supply chain initiatives in the pharmaceutical industry. Int. J. Prod. Res. 2019, 57, 3554–3576. [Google Scholar] [CrossRef]

- Xie, X.M.; Zhu, Q.W. Innovative pivots or conservative shackles: How can green supply chain management practices spur corporate performance? Chin. J. Manag. Sci. 2022, 30, 131–143. [Google Scholar] [CrossRef]

- Han, Z.; Huo, B. The impact of green supply chain integration on sustainable performance. Ind. Manag. Data Syst. 2020, 120, 657–674. [Google Scholar] [CrossRef]

- Yisa, J.; Taiwen, F. A literature review and prospects of green supply chain integration. Foreign Econ. Manag. 2022, 44, 135–152. [Google Scholar] [CrossRef]

- Wong, C.Y.; Wong, C.W.; Boon-Itt, S. Integrating environmental management into supply chains: A systematic literature review and theoretical framework. Int. J. Phys. Distrib. Logist. 2015, 45, 43–68. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Lai, K.; Wong, C.W.; Lam, J.S.L. Sharing environmental management information with supply chain partners and the performance contingencies on environmental munificence. Int. J. Prod. Econ. 2015, 164, 445–453. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, J.; Ortiz-de-Mandojana, N. Green innovation and financial performance: An institutional approach. Organ. Environ. 2013, 26, 365–385. [Google Scholar] [CrossRef]

- Li, J.; Zhang, G.; Xie, L. Environmental Knowledge Learning, Green Innovation Behavior and Environmental Performance. Sci. Technol. Prog. Policy 2019, 36, 122–128. [Google Scholar] [CrossRef]

- Wang, J.; Xue, Y.; Sun, X.; Yang, J. Green learning orientation, green knowledge acquisition and ambidextrous green innovation. J. Clean. Prod. 2020, 250, 119475. [Google Scholar] [CrossRef]

- Ghemawat, P.; Ricart Costa, J.E.I. The organizational tension between static and dynamic efficiency. Strateg. Manag. J. 1993, 14, 59–73. [Google Scholar] [CrossRef]

- Christensen, C.M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail; Harvard Business Review Press: Brighton, MA, USA, 2013. [Google Scholar]

- Gupta, A.K.; Smith, K.G.; Shalley, C.E. The interplay between exploration and exploitation. Acad. Manag. J. 2006, 49, 693–706. [Google Scholar] [CrossRef]

- Jia, T.; Yan, R.; Wang, Y.; Chen, Q. Customer involvement, ambidextrous green innovations and firm Performance: The moderating role of product intelligence. Sci. Technol. Prog. Policy 2023, 40, 91–101. [Google Scholar] [CrossRef]

- Amui, L.B.L.; Jabbour, C.J.C.; de Sousa Jabbour, A.B.L.; Kannan, D. Sustainability as a dynamic organizational capability: A systematic review and a future agenda toward a sustainable transition. J. Clean. Prod. 2017, 142, 308–322. [Google Scholar] [CrossRef]

- Beske, P.; Land, A.; Seuring, S. Sustainable supply chain management practices and dynamic capabilities in the food industry: A critical analysis of the literature. Int. J. Prod. Econ. 2014, 152, 131–143. [Google Scholar] [CrossRef]

- de Sousa Jabbour, A.B.L.; Vazquez-Brust, D.; Jabbour, C.J.C.; Latan, H. Green supply chain practices and environmental performance in Brazil: Survey, case studies, and implications for B2B. Ind. Mark. Manag. 2017, 66, 13–28. [Google Scholar] [CrossRef]

- Kauppila, O. Alliance management capability and firm performance: Using resource-based theory to look inside the process black box. Long Range Plan. 2015, 48, 151–167. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D. Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef]

- Memon, A.; An, Z.Y.; Memon, M.Q. Does financial availability sustain financial, innovative, and environmental performance? Relation via opportunity recognition. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 562–575. [Google Scholar] [CrossRef]

- De Marchi, V. Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Res. Policy 2012, 41, 614–623. [Google Scholar]

- March, J.G. Continuity and change in theories of organizational action. Adm. Sci. Q. 1996, 41, 278–287. [Google Scholar] [CrossRef]

- Eslami, M.H.; Melander, L. Exploring uncertainties in collaborative product development: Managing customer-supplier collaborations. J. Eng. Technol. Manag. 2019, 53, 49–62. [Google Scholar] [CrossRef]

- Dai, J.; Cantor, D.E.; Montabon, F.L. How environmental management competitive pressure affects a focal firm’s environmental innovation activities: A green supply chain perspective. J. Bus. Logist. 2015, 36, 242–259. [Google Scholar] [CrossRef]

- Huo, B. The impact of supply chain integration on company performance: An organizational capability perspective. Supply Chain. Manag. Int. J. 2012, 17, 596–610. [Google Scholar] [CrossRef]

- Benner, M.J.; Tushman, M.L. Exploitation, exploration, and process management: The productivity dilemma revisited. Acad. Manag. Rev. 2003, 28, 238–256. [Google Scholar] [CrossRef]

- Ding, H.; Liu, Y.; Zhang, Y.; Wang, S.; Guo, Y.; Zhou, S.; Liu, C. Data-driven evaluation and optimization of the sustainable development of the logistics industry: Case study of the Yangtze River Delta in China. Environ. Sci. Pollut. Res. 2022, 29, 68815–68829. [Google Scholar] [CrossRef] [PubMed]

- Zhang, K.; Liu, W. The current status, trend, and development strategies of Chinese biopharmaceutical industry with a challenging perspective. Sage Open 2020, 10, 1479825049. [Google Scholar] [CrossRef]

- Wu, Q.; Li, Y.; Wu, Y.; Li, F.; Zhong, S. The spatial spillover effect of environmental regulation on the total factor productivity of pharmaceutical manufacturing industry in China. Sci. Rep. 2022, 12, 11642. [Google Scholar] [CrossRef] [PubMed]

- Xiao, X.; Cheng, Y.; Zhang, Y. Sustainable Innovation in the Biopharmaceutical Industry: An Analysis of the Impact of Policy Configuration. Sustainability 2024, 16, 2339. [Google Scholar] [CrossRef]

- Jansen, J.J.; Van Den Bosch, F.A.; Volberda, H.W. Exploratory innovation, exploitative innovation, and performance: Effects of organizational antecedents and environmental moderators. Manag. Sci. 2006, 52, 1661–1674. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Lindell, M.K.; Whitney, D.J. Accounting for common method variance in cross-sectional research designs. J. Appl. Psychol. 2001, 86, 114. [Google Scholar] [CrossRef]

- Tian, H.; Han, J.; Sun, M.; Lv, X. Keeping pace with the times: Research on the impact of digital leadership on radical green innovation of manufacturing enterprises. Eur. J. Innov. Manag. 2023; ahead of print. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

- Li, X.; Hamblin, D. Factors impacting on cleaner production: Case studies of Chinese pharmaceutical manufacturers in Tianjin, China. J. Clean. Prod. 2016, 131, 121–132. [Google Scholar] [CrossRef]

- Gölgeci, I.; Gligor, D.M.; Tatoglu, E.; Arda, O.A. A relational view of environmental performance: What role do environmental collaboration and cross-functional alignment play? J. Bus. Res. 2019, 96, 35–46. [Google Scholar] [CrossRef]

- Lii, P.; Kuo, F. Innovation-oriented supply chain integration for combined competitiveness and firm performance. Int. J. Prod. Econ. 2016, 174, 142–155. [Google Scholar] [CrossRef]

- Kumar, V.; Jabarzadeh, Y.; Jeihouni, P.; Garza-Reyes, J.A. Learning orientation and innovation performance: The mediating role of operations strategy and supply chain integration. Supply Chain. Manag. Int. J. 2020, 25, 457–474. [Google Scholar] [CrossRef]

- Gumusluoğlu, L.; Ilsev, A. Transformational leadership and organizational innovation: The roles of internal and external support for innovation. J. Prod. Innov. Manag. 2009, 26, 264–277. [Google Scholar] [CrossRef]

- Azar, G.; Ciabuschi, F. Organizational innovation, technological innovation, and export performance: The effects of innovation radicalness and extensiveness. Int. Bus. Rev. 2017, 26, 324–336. [Google Scholar] [CrossRef]

- Sorescu, A.B.; Chandy, R.K.; Prabhu, J.C. Sources and financial consequences of radical innovation: Insights from pharmaceuticals. J. Mark. 2003, 67, 82–102. [Google Scholar] [CrossRef]

- Yi, Z.; Li, L. New medical reform and the sustainable development of the pharmaceutical industry in China. Chin. Med. J. 2013, 126, 775–782. [Google Scholar] [CrossRef]

- Zhong, S.; Liang, S.; Zhong, Y.; Zheng, Y.; Wang, F. Measure on innovation efficiency of China’s pharmaceutical manufacturing industry. Front. Public Health 2022, 10, 1024997. [Google Scholar] [CrossRef]

- Wei, Y.S.; Wang, Q. Making sense of a market information system for superior performance: The roles of organizational responsiveness and innovation strategy. Ind. Mark. Manag. 2011, 40, 267–277. [Google Scholar] [CrossRef]