Looking Back Deeper, Recovering up Better: Resilience-Oriented Contrarian Thinking about COVID-19 Economic Impact

Abstract

1. Introduction

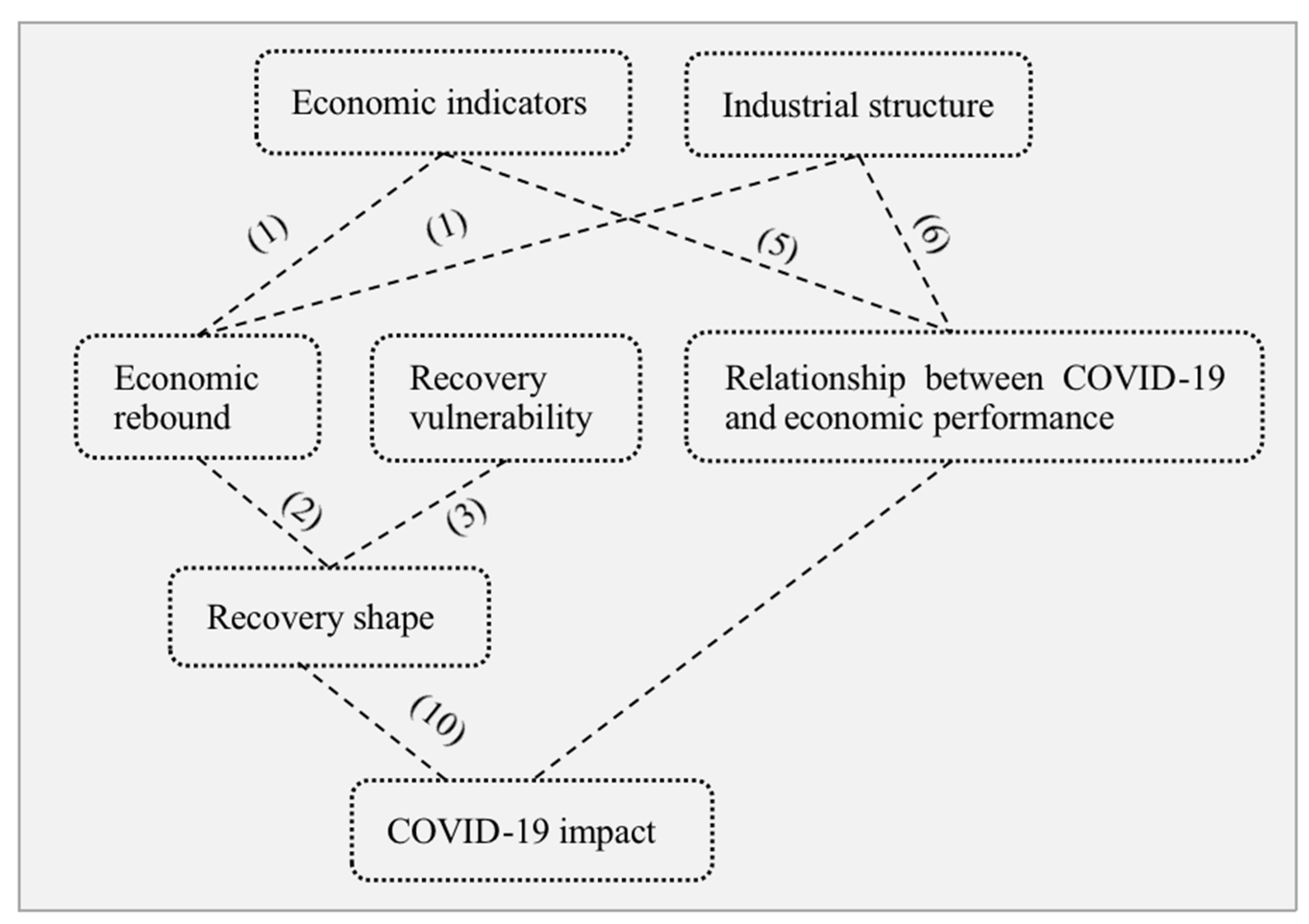

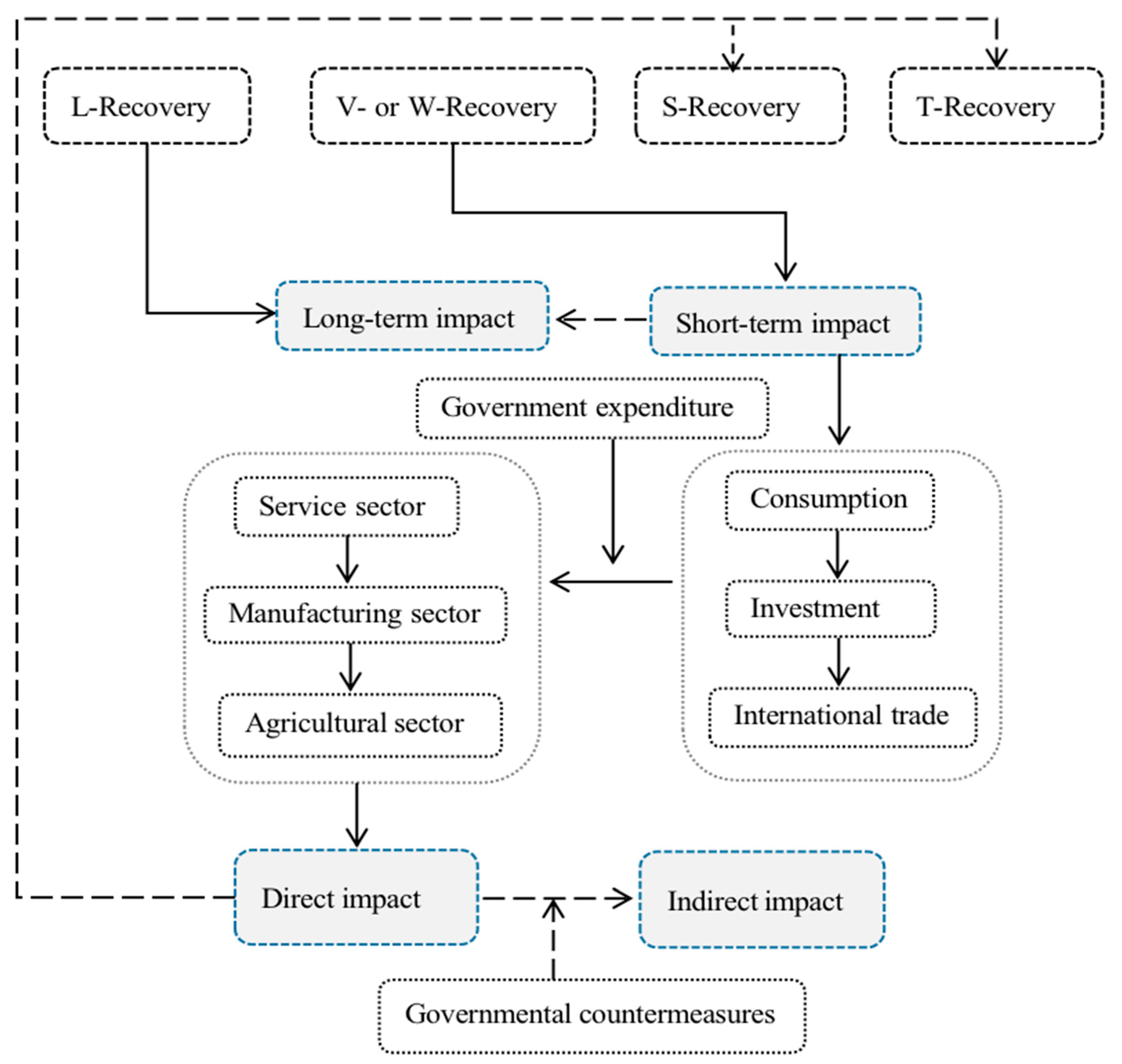

2. Literature Review and Theoretical Framework

2.1. Economic Resilience

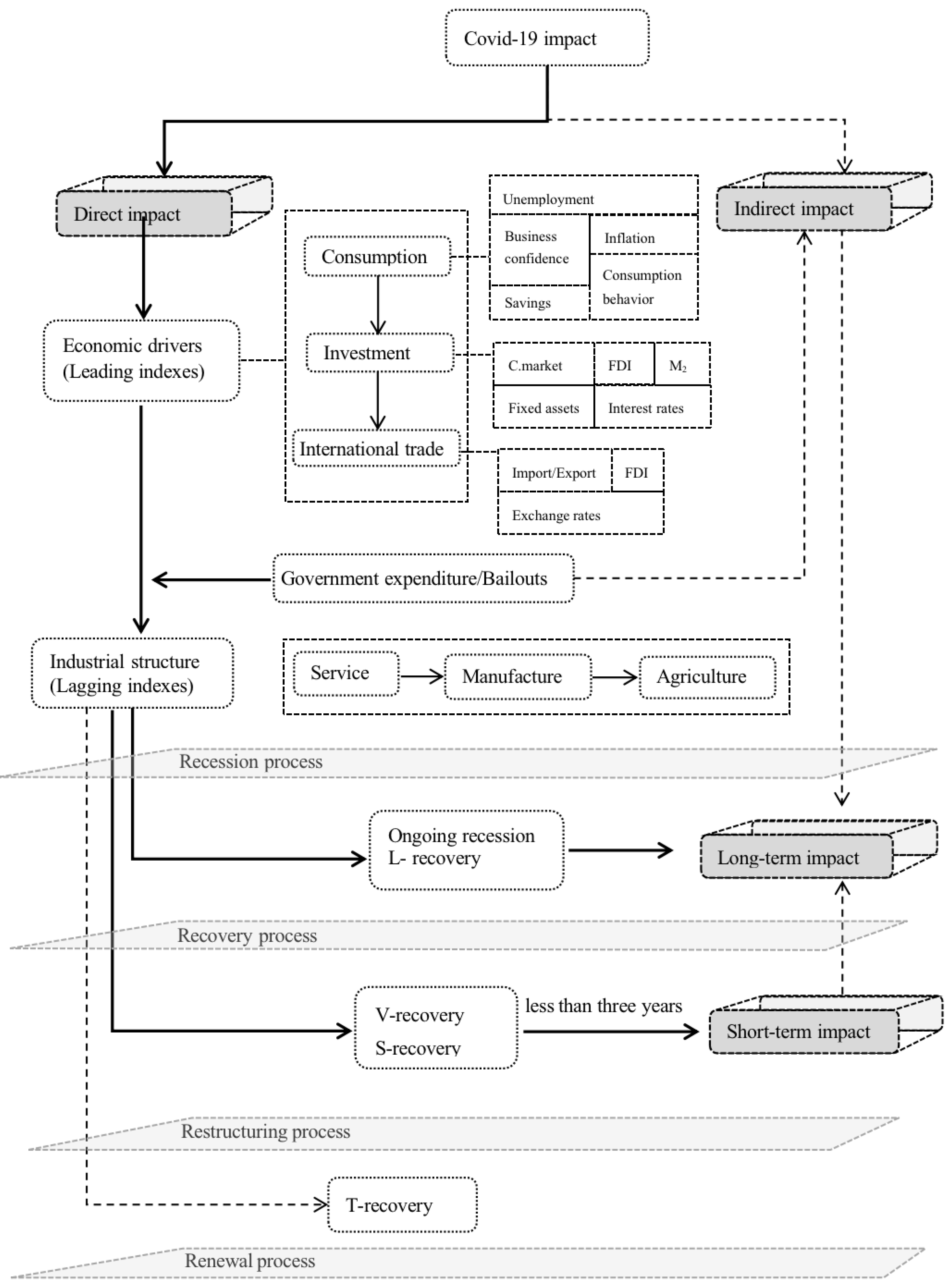

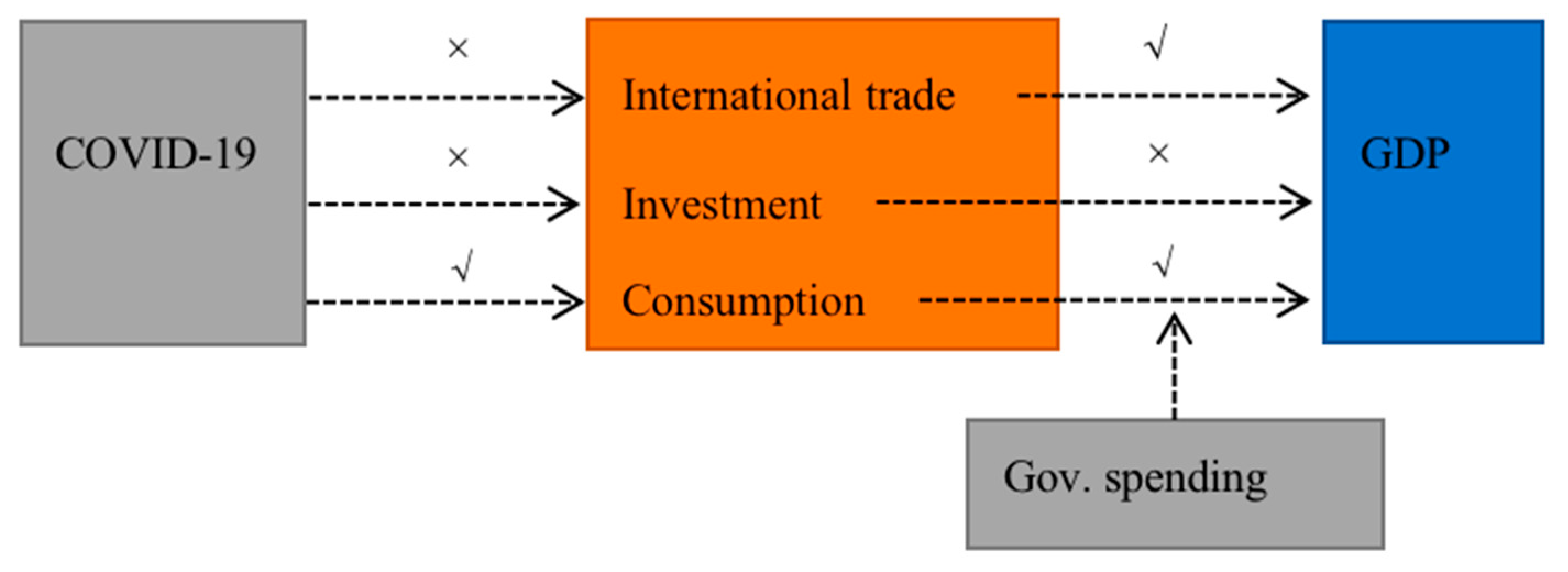

2.2. COVID-19 Impact

3. Data and Methodology

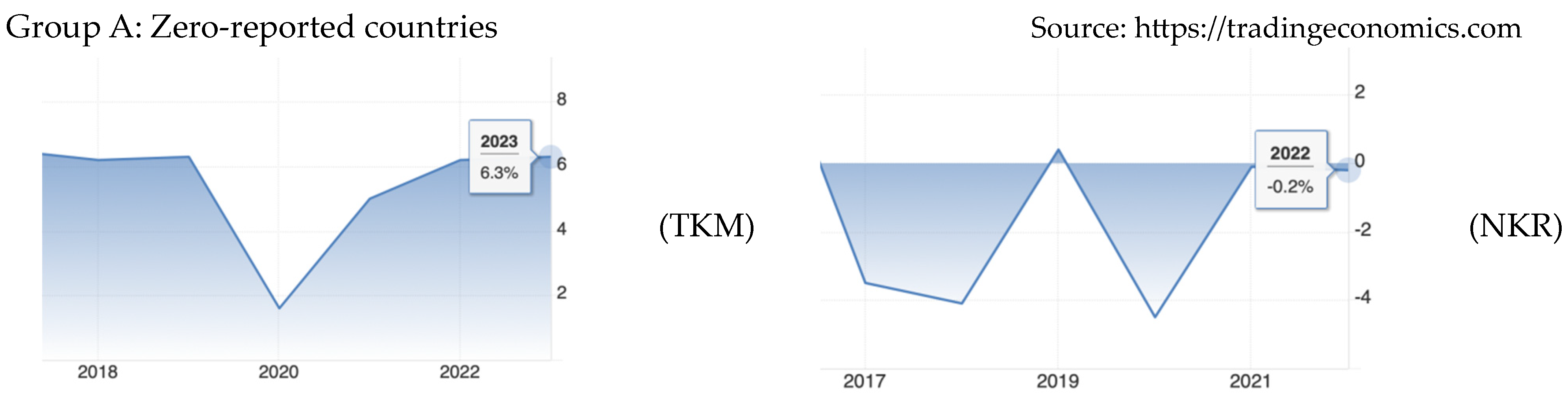

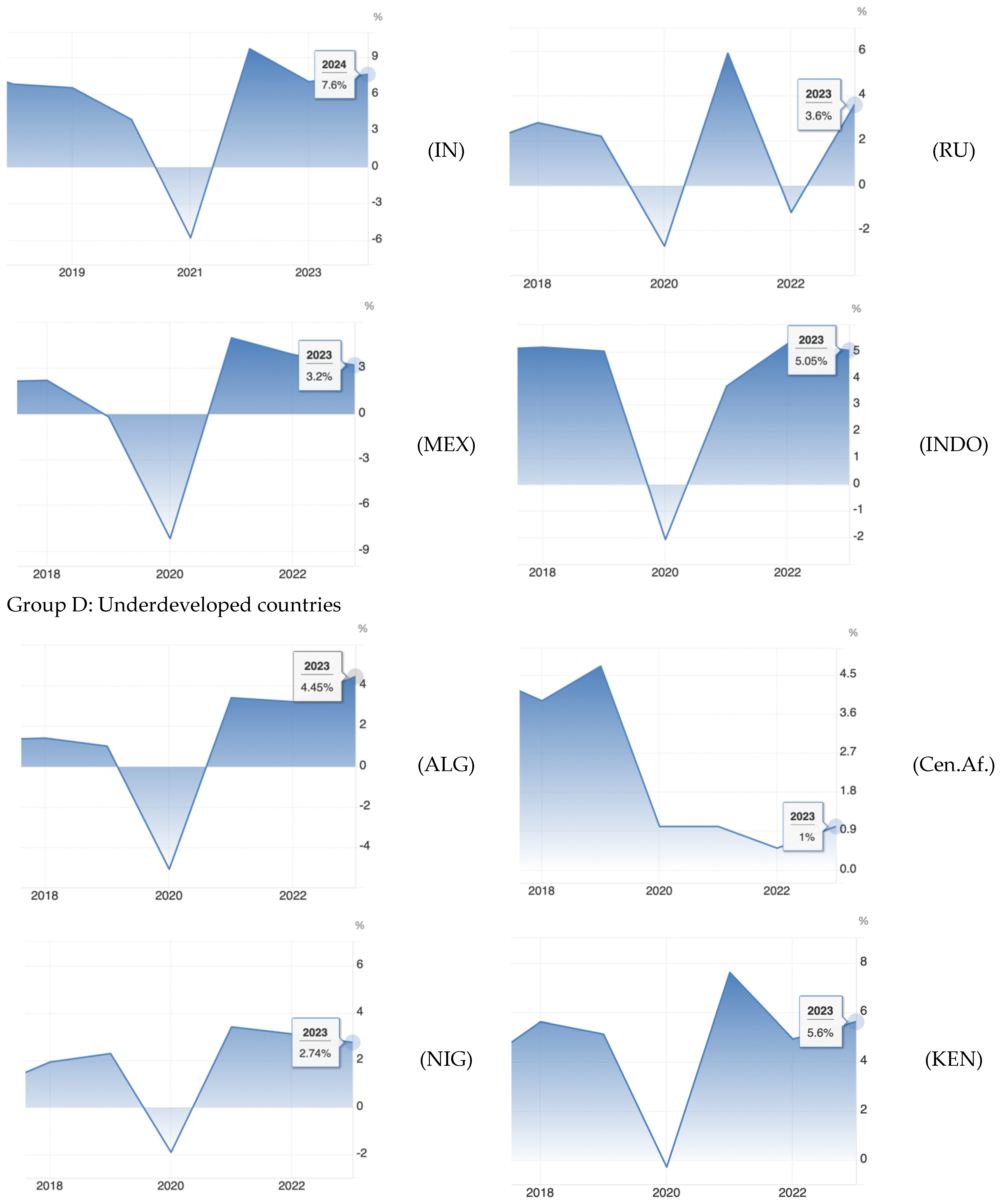

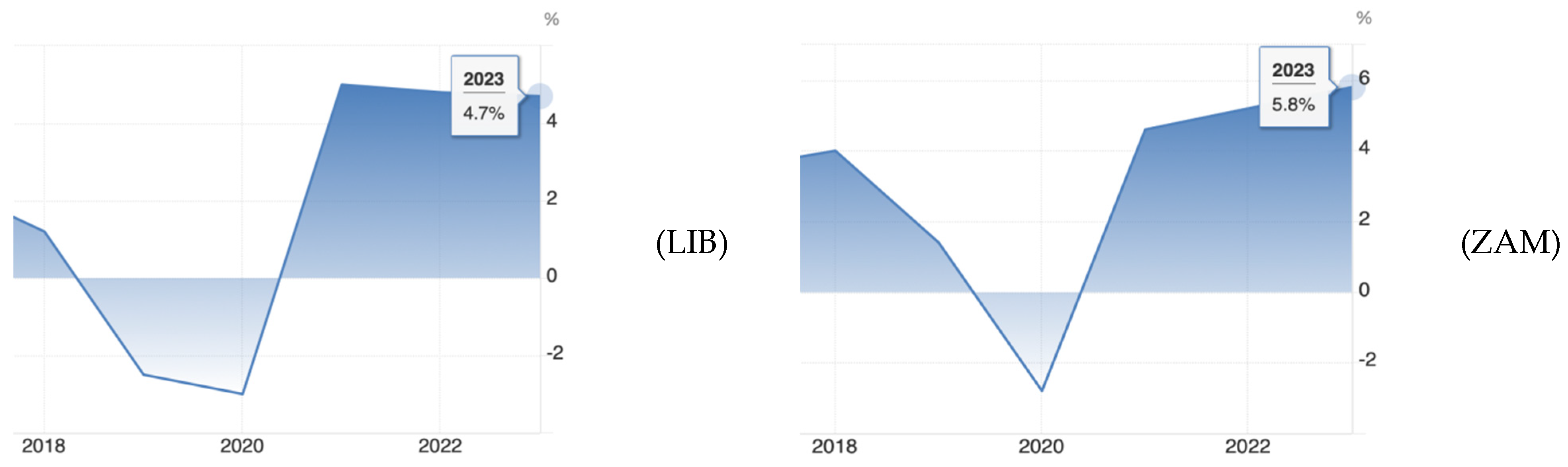

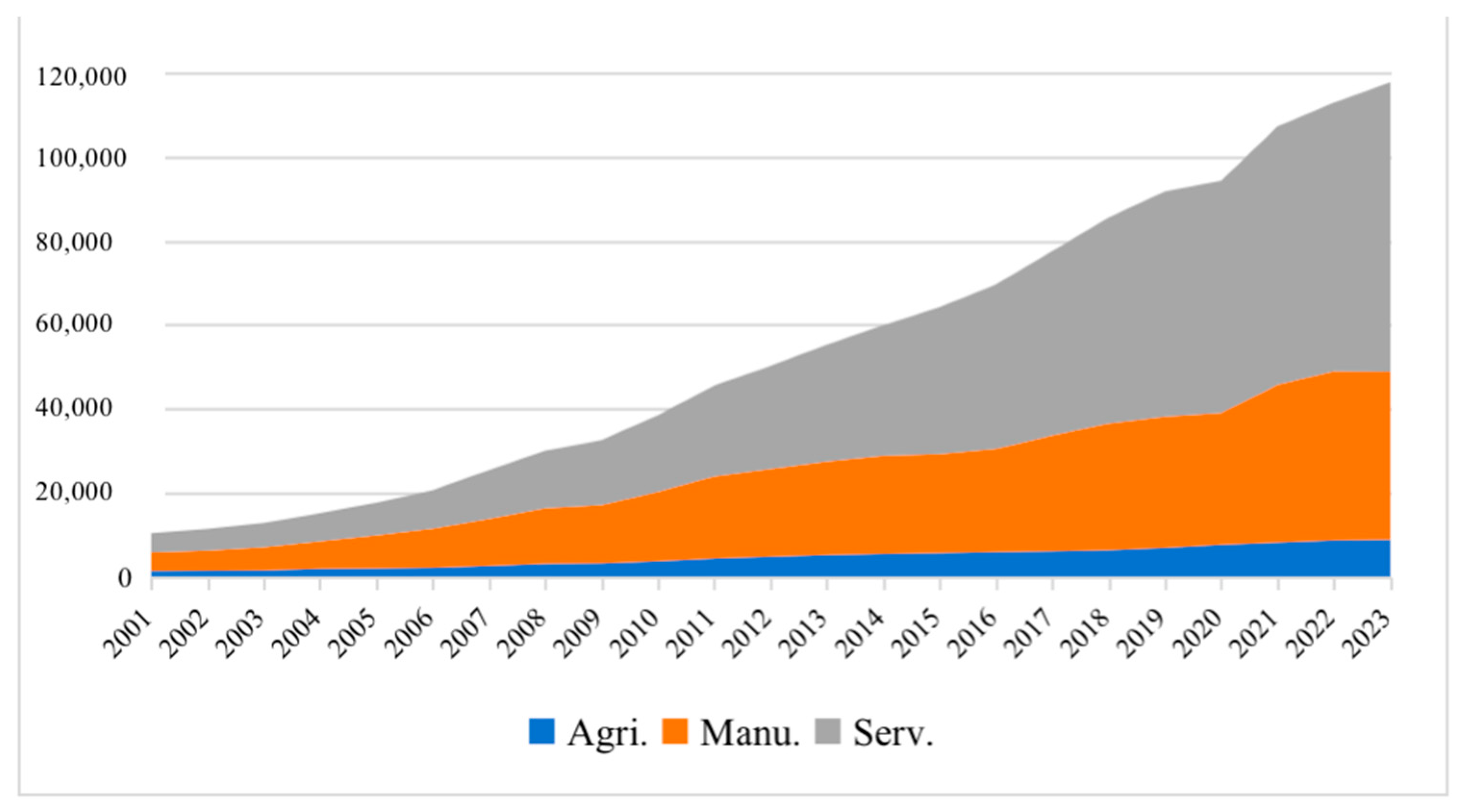

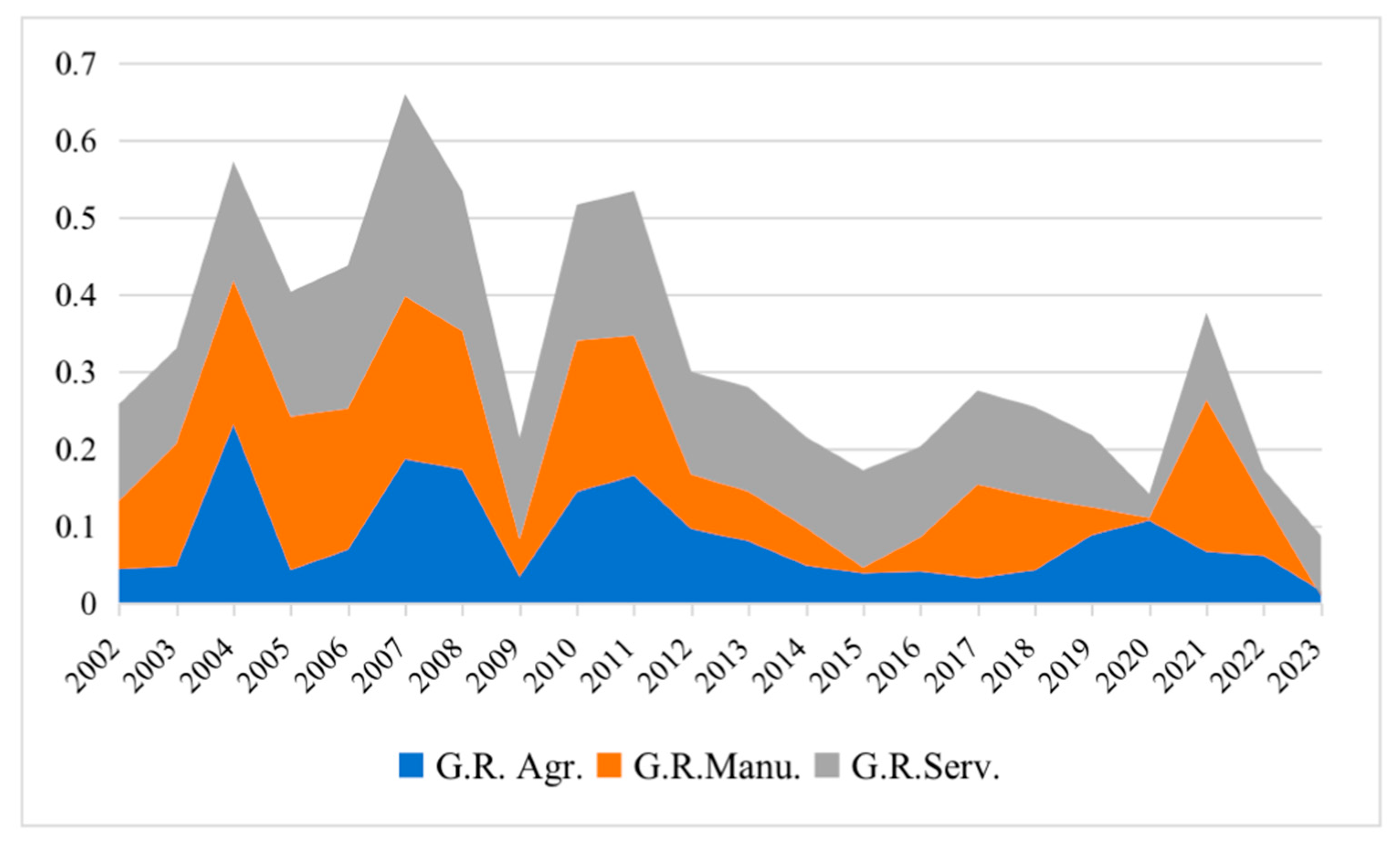

3.1. Data

3.2. Methodology

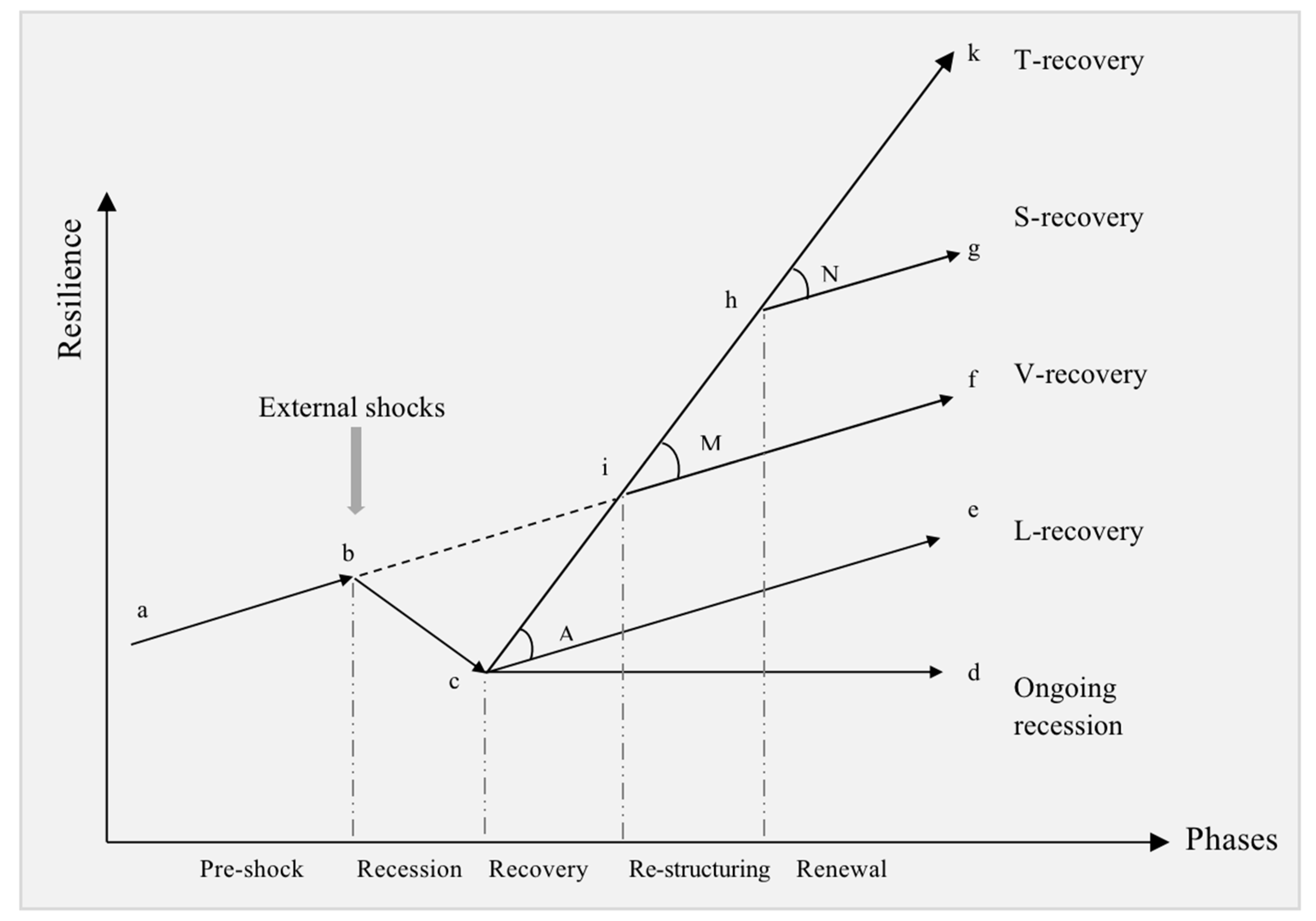

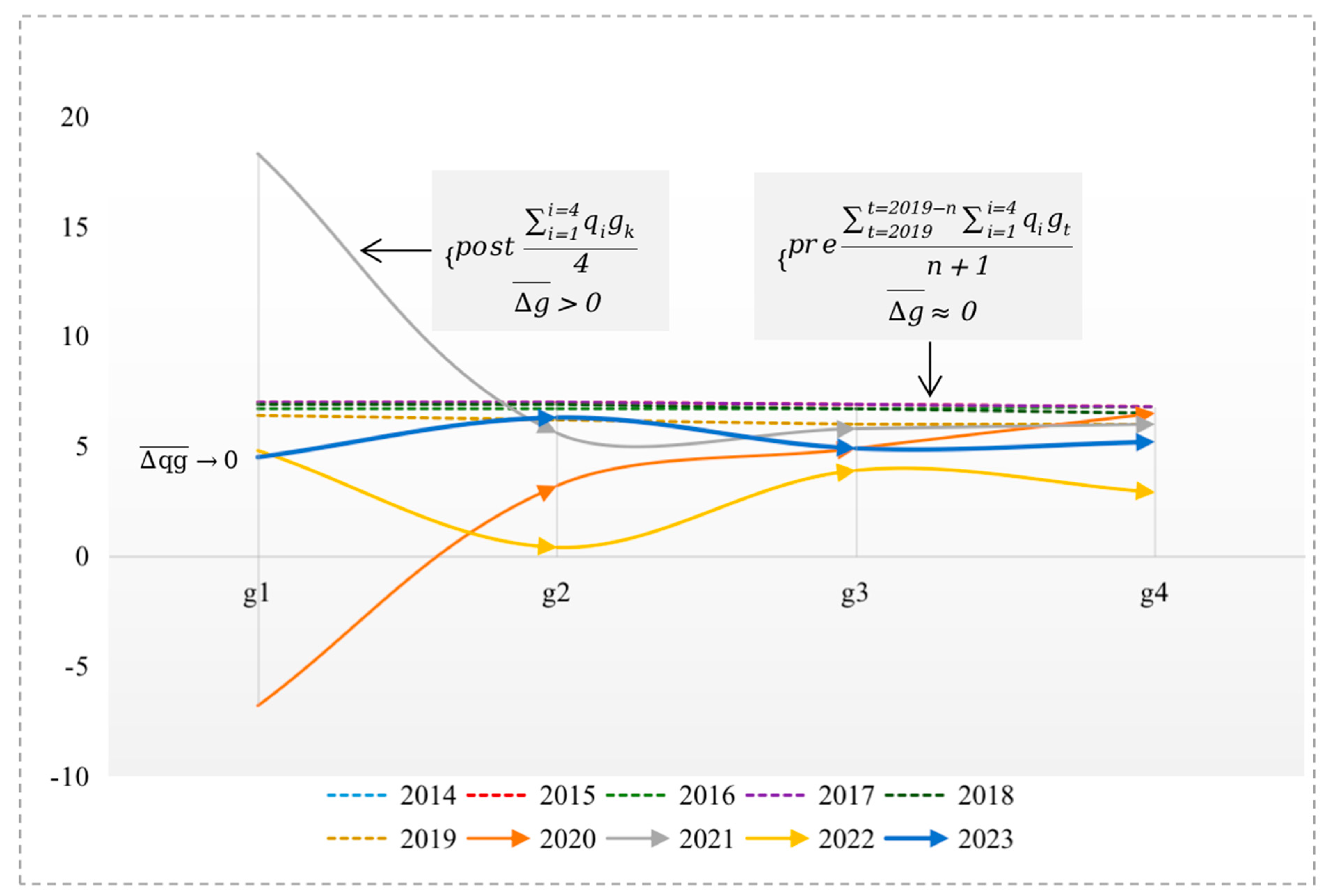

3.2.1. Economic Resilience Measurement

3.2.2. Measuring Recovery Vulnerability

3.2.3. Regression Models

3.2.4. Assessing the Default Value for V-Recovery

4. Results and Analysis

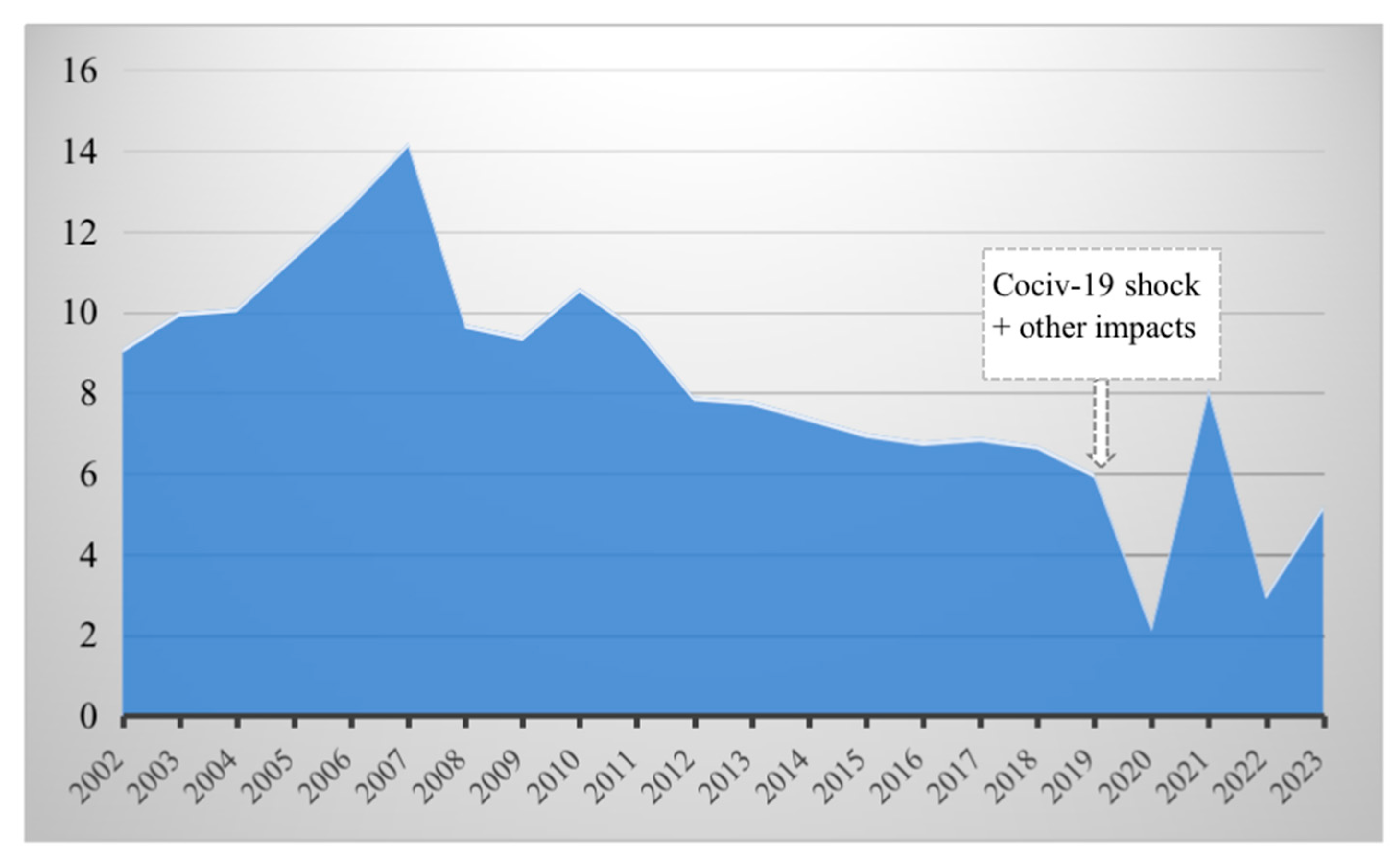

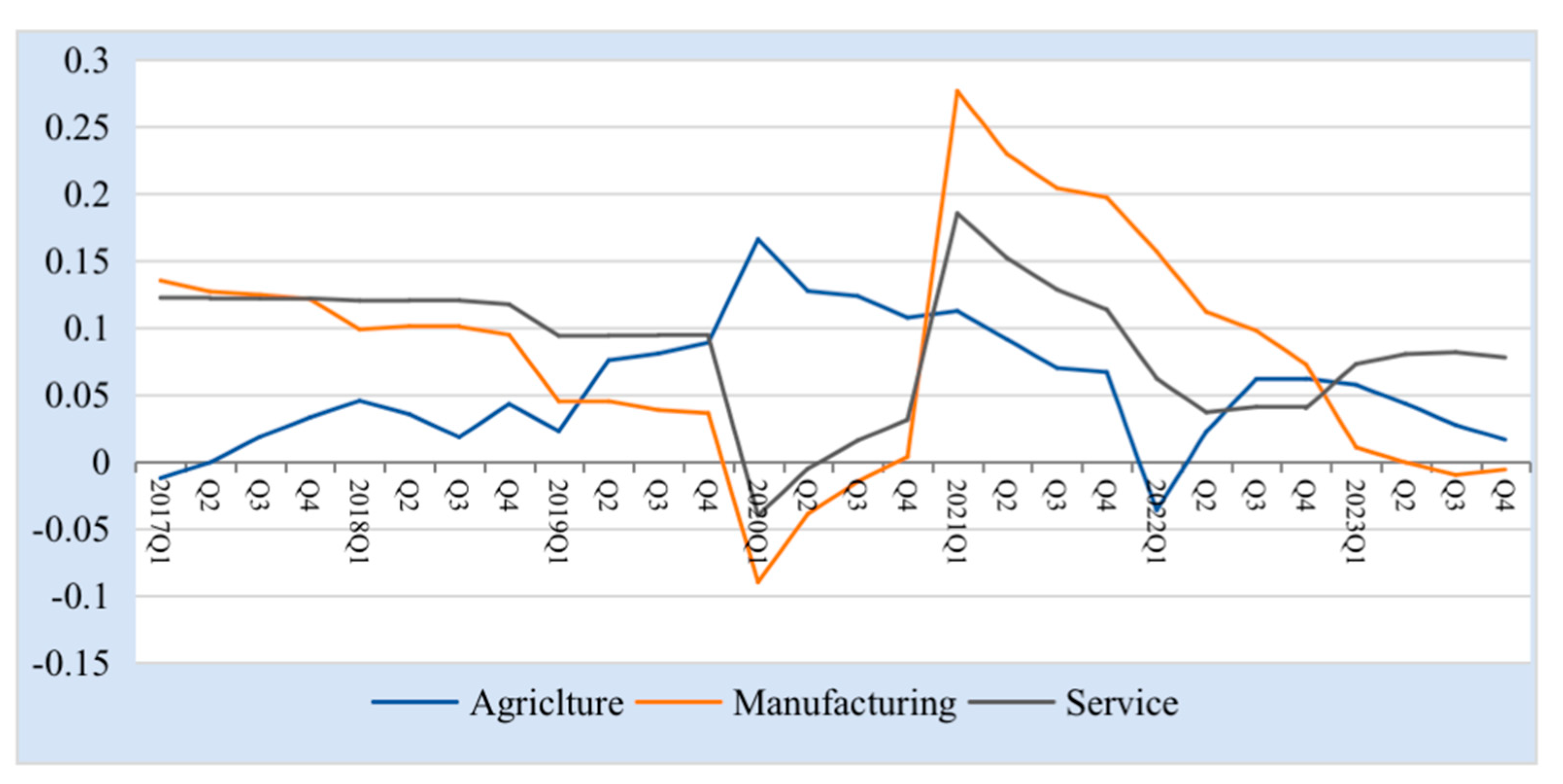

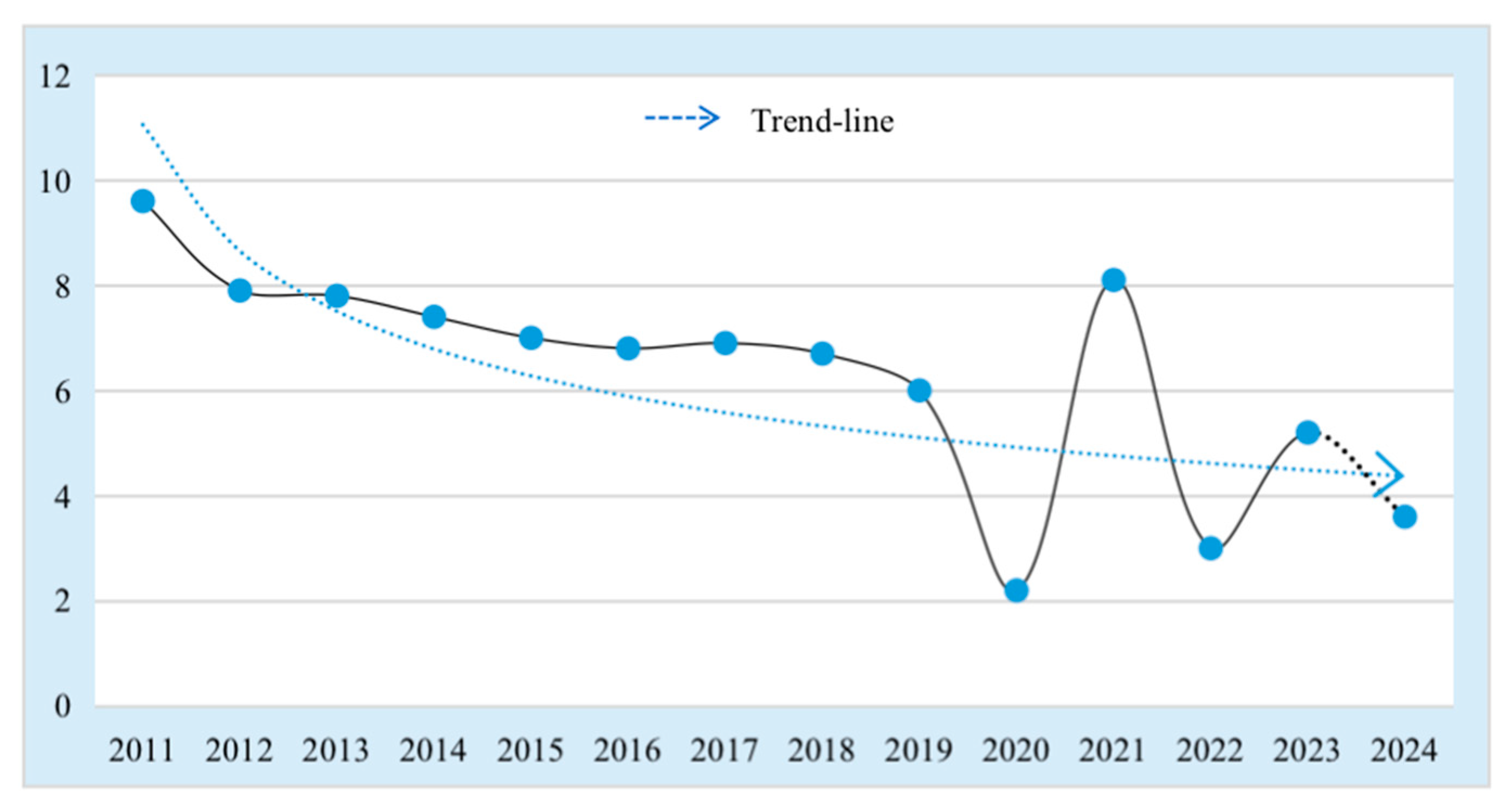

4.1. Economic Rebound and Resilience

4.2. Economic Impact of COVID-19

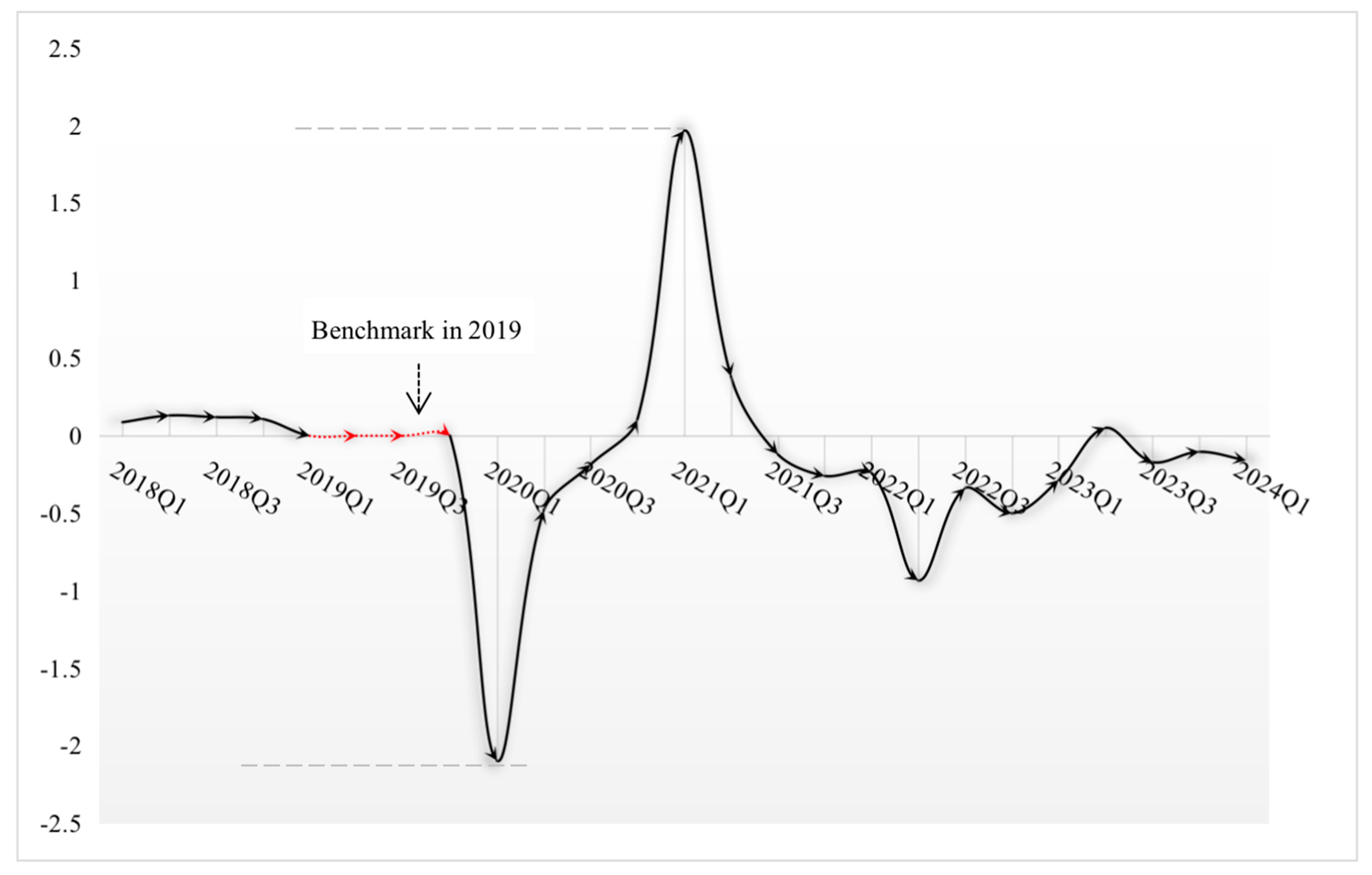

4.3. Assessment of the Default Value for V-Recovery

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

| Years | GDP Volume (US$ Billion) | Growth Rates % |

|---|---|---|

| 2010 | 6087 | 10.6 |

| 2011 | 7551 | 9.6 |

| 2012 | 8532 | 7.9 |

| 2013 | 9570 | 7.8 |

| 2014 | 10,475 | 7.4 |

| 2015 | 11,061 | 7 |

| 2016 | 11,233 | 6.8 |

| 2017 | 12,310 | 6.9 |

| 2018 | 13,894 | 6.7 |

| 2019 | 14,279 | 6 |

| 2020 | 14,687 | 2.2 |

| 2021 | 17,820 | 8.1 |

| 2022 | 17,963 | 3 |

| 2023 | 18,490 | 5.2 |

| 2024 …… | Default value λ |

References

- Ibn-Mohammed, T.; Mustapha, K.B.; Godsell, J.; Adamu, Z.; Babatunde, K.A.; Akintade, D.D.; Acquaye, A.; Fujii, H.; Ndiaye, M.M.; Yamoah, F.A.; et al. A critical analysis of the impacts of COVID-19 on the global economy and ecosystems and opportunities for circular economy strategies. Resour. Conserv. Recycl. 2021, 164, 105169. [Google Scholar] [CrossRef] [PubMed]

- Malliet, P.; Reynes, F.; Landa, G.; Hamdi-Cherif, M.; Saussay, A. Assessing short-term and long-term economic and environmental effects of the COVID-19 crisis in France. Environ. Resour. Econ. 2020, 76, 867–883. [Google Scholar] [CrossRef]

- Pan, W.; Huang, G.; Shi, Y.; Hu, C.; Dai, W.; Pan, W.; Huang, R. COVID-19: Short-term influence on China’s economy considering different scenarios. Glob. Chall. 2021, 5, 2000090. [Google Scholar] [CrossRef] [PubMed]

- Wu, F.; Liu, G.; Guo, N.; Li, Z.; Deng, X. The impact of COVID-19 on China’s regional economies and industries. J. Geogr. Sci. 2021, 31, 565–583. [Google Scholar] [CrossRef]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Tan, J.; Hu, X.; Hassink, R.; Ni, J. Industrial structure or agency: What affects regional economic resilience? Evidence from resource-based cities in China. Cities 2020, 106, 102906. [Google Scholar] [CrossRef]

- Chacon-Hurtado, D.; Kumarb, I.; Gkritza, K.; Fricker, J.D.; Beaulieu, L.J. The role of transportation accessibility in regional economic resilience. J. Transp. Geogr. 2020, 84, 102695. [Google Scholar] [CrossRef]

- Altig, D.; Baker, S.; Barrero, J.M.; Bloom, N.; Bunn, P.; Chen, S.; Davis, S.J.; Leather, J.; Meyer, B.; Mihaylov, E.; et al. Economic uncertainty before and during the COVID-19 pandemic. J. Public Econ. 2020, 191, 104274. [Google Scholar] [CrossRef] [PubMed]

- Woodside, A.G. Embrace performance model: Complexity theory, contrarian case analysis, and multiple realities. J. Bus. Res. 2014, 67, 2495–2503. [Google Scholar] [CrossRef]

- Wang, Z.; Wei, W. Regional economic resilience in China: Measurement and determinants. Reg. Stud. 2021, 55, 1228–1239. [Google Scholar] [CrossRef]

- Singhal, K.; Singhal, J. Technology and manufacturing in China before the industrial revolution and glimpses of the future. Prod. Oper. Manag. 2019, 28, 505–515. [Google Scholar] [CrossRef]

- Doran, J.; Fingleton, B. Employment resilience in Europe and the 2008 economic crisis: Insights from micro-level data. Reg. Stud. 2016, 50, 644–656. [Google Scholar] [CrossRef]

- Cerra, V.; Panizza, U.; Saxena, S.C. International evidence of recovery from recessions. Contemp. Econ. Policy 2013, 31, 424–439. [Google Scholar] [CrossRef]

- Giannakis, E.; Bruggeman, A. Economic crisis and regional resilience: Evidence from Greece. Pap. Reg. Sci. 2017, 96, 451–476. [Google Scholar] [CrossRef]

- Iacobucci, D.; Perugini, F. Entrepreneurial ecosystem and economic resilience at local level. Entrep. Reg. Dev. 2021, 33, 689–716. [Google Scholar] [CrossRef]

- Chowdhury, M.M.H.; Quaddus, M. Supply chain resilience: Conceptualization and scale development using dynamic capability theory. Int. J. Prod. Econ. 2017, 188, 185–204. [Google Scholar] [CrossRef]

- Hamilton, J.D. A new approach to the economic analysis of non-stationary time series and the business cycle. Econometrica 1989, 57, 357–384. [Google Scholar] [CrossRef]

- Gong, H.; Hassink, R.; Tan, J.; Huang, D. Regional resilience in times of a pandemic crisis: The case of COVID-19 in China. Tijdschr. Voor Econ. En Soc. Geogr. 2020, 111, 497–512. [Google Scholar] [CrossRef] [PubMed]

- Norouzi, N.; Rubens, G.Z.; Choupaniesheh, S.; Enevoldsen, P. When pandemics impact economies and climate change: Exploring the impacts of COVID-19 on oil and electricity demand in China. Energy Res. Soc. Sci. 2020, 68, 101654. [Google Scholar] [CrossRef]

- Engelhardt, N.; Krause, M.; Neukirchen, D.; Posch, P. What drives stocks during the corona-crash? News attention vs. rational expectation. Sustainability 2020, 12, 5014. [Google Scholar] [CrossRef]

- Papadamou, S.; Fassas, A.P.; Kenourgios, D.; Dimitriou, D. Flight-to-quality between global stock and bond markets in the COVID era. Financ. Res. Lett. 2021, 38, 101852. [Google Scholar] [CrossRef]

- Liu, H.; Yi, X.; Yin, L. The impact of operating flexibility on firms’ performance during the COVID-19 outbreak: Evidence from China. Financ. Res. Lett. 2021, 38, 101808. [Google Scholar] [CrossRef]

- Liu, X.; Burridge, P.; Sinclair, P.J.N. Relationships between economic growth, foreign direct investment and trade: Evidence from China. Appl. Econ. 2002, 34/11, 1433–1440. [Google Scholar] [CrossRef]

- Shan, J. A VAR approach to the economics of FDI in China. Appl. Econ. 2002, 7, 885–893. [Google Scholar] [CrossRef]

- Yueh, L. What drives China’s Growth? Natl. Inst. Econ. Rev. 2013, 223, 4–15. [Google Scholar] [CrossRef][Green Version]

- Duan, H.; Wang, S.; Yang, C. Coronavirus: Limit short-term economic damage. Nature 2020, 578, 515. [Google Scholar] [CrossRef]

- Pantano, E.; Pizzi, G.; Scarpi, D.; Dennis, C.H. Competing during a pandemic? Retailers’ ups and downs during the COVID19 outbreak. J. Bus. Res. 2020, 116, 209–213. [Google Scholar] [CrossRef] [PubMed]

- Verma, S.; Gustafsson, A. Investigating the emerging COVID-19 research trends in the field of business and management: A bibliometric analysis approach. J. Bus. Res. 2020, 118, 253–261. [Google Scholar] [CrossRef] [PubMed]

- Hamilton, R.; Thompson, D.; Bone, S.; Chaplin, L.N.; Griskevicius, K.; Hill, R.; John, D.R.; Mittal, C.; O’Guinn, T.; Piff, P. The effects of scarcity on consumer decision journeys. J. Acad. Mark. Sci. 2019, 47, 532–550. [Google Scholar] [CrossRef]

- Martin, A.; Markhvida, M.; Hallegatte, S.; Walsh, B. Socio-Economic impact of COVID-19 on household consumption and poverty. Econ. Disaster Clim. Change 2020, 4, 453–479. [Google Scholar] [CrossRef]

- Hoarty, B.; Muri, S.M.; Pallotta, D.J.; Rogers, M.; Weinhagen, J.C.; Wilson, J.S. PPI and CPI seasonal adjustment during the COVID-19 pandemic. Mon. Labor Rev. 2022, 1–18. [Google Scholar] [CrossRef]

- Liu, X.; Liu, Y.; Yan, Y. China macroeconomic report 2020: China’s macroeconomy is on the rebound under the impact of COVID-19. Econ. Political Stud. 2020, 8, 395–435. [Google Scholar] [CrossRef]

- Asgary, A.; Anjum, M.I.; Azimi, N. Disaster recovery and business continuity after the 2010 flood in Pakistan: Case of small businesses. Int. J. Disaster Risk Reduct. 2012, 2, 46–56. [Google Scholar] [CrossRef]

- Gassebner, M.; Keck, A.; The, R. Shaken, not stirred: The impact of disasters on international trade. Rev. Int. Econ. 2010, 18, 351–368. [Google Scholar] [CrossRef]

- Allayannis, G.; Ofek, E. Exchange rate exposure, hedging, and the use of foreign currency derivatives. J. Int. Money Financ. 2001, 20, 273–296. [Google Scholar] [CrossRef]

- Ghosh, S.; Gregoriou, A. The composition of government spending and growth: Is current or capital spending better? Oxf. Econ. Pap. 2008, 60, 484–516. [Google Scholar] [CrossRef]

- Al-kasasbeh, O.; Alzghoul, A.; Alghraibeh, K. 2022. Global FDI inflows and outflows in emerging economies post-COVID-19 era. Future Bus. J. 2022, 8, 53. [Google Scholar] [CrossRef]

- Kocak, S.; Barıs-Tuzemen, O. Impact of the COVID-19 on foreign direct investment inflows in emerging economies: Evidence from panel quantile regression. Future Bus. J. 2022, 8, 22. [Google Scholar] [CrossRef]

- Martin, F.M.; Sanchez, J.M.; Wilkinson, O. The economic impact of COVID-19 around the world. Fed. Reserve Bank St. Louis REVIEW 2023, 105, 74–88. [Google Scholar] [CrossRef]

- Makin, A.J.; Layton, A. The global fiscal responses to COVID-19: Risks and repercussions. Econ. Anal. Policy 2021, 69, 340–349. [Google Scholar] [CrossRef]

- Pearson, M.M. Governing the Chinese economy: Regulatory reform in the service of the state. Public Adm. Rev. 2007, 67, 718–730. [Google Scholar] [CrossRef]

- Tian, W. How China managed the COVID-19 Pandemic. Asian Econ. Pap. 2020, 20, 101–134. [Google Scholar] [CrossRef]

- Duchin, R.; Sosyura, D. Safer ratios, riskier portfolios: Banks’ response to government aid. J. Financ. Econ. 2014, 113, 1–28. [Google Scholar] [CrossRef]

- Cambra-Fierro, J.; Gao, L.; Melero-Polo, I.; Patrício, L. Theories, constructs, and methodologies to study COVID-19 in the service industries. Serv. Ind. J. 2022, 42, 551–582. [Google Scholar] [CrossRef]

- Workie, E.; Mackolil, J.; Nyika, J.; Ramadas, S. Deciphering the impact of COVID-19 pandemic on food security, agriculture, and livelihoods: A review of the evidence from developing countries. Curr. Res. Environ. Sustain. 2020, 2, 100014. [Google Scholar] [CrossRef]

- Fernandes, N. Economic effects of Coronavirus Outbreak (COVID-19) on the World Economy. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Ivanov, D. Predicting the impacts of epidemic outbreaks on global supply chain: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101922. [Google Scholar] [CrossRef] [PubMed]

- Kumar, A.; Luthra, S.; Mangla, S.K.; Kazancoglu, Y. COVID-19 impact on sustainable production and operations management. Sustain. Oper. Comput. 2020, 1, 1–7. [Google Scholar] [CrossRef]

- Hu, X.; Yang, C. Institutional change and divergent economic resilience: Path development of two resource-depleted cities in China. Urban Stud. 2019, 56, 3466–3485. [Google Scholar] [CrossRef]

- Riley, T.; Sully, E.; Ahmed, Z.; Biddlecom, A. Estimates of the potential impact of the COVID-19 pandemic on sexual and reproductive health in low- and middle-income countries. Int. Perspect. Sex. Reprod. Health 2020, 46, 73–76. [Google Scholar] [CrossRef]

- Zurayk, R. Pandemic and food security: A view from the global south. J. Agric. Food Syst. Community Dev. 2020, 9, 17–21. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, T. Impact of the COVID-19 pandemic on agricultural exports. J. Integr. Agric. 2020, 19, 2937–2945. [Google Scholar] [CrossRef]

- Zambrano-Monserrate, M.A.; Ruano, M.A.; Sanchez-Alcalde, L. Indirect effects of COVID-19 on the environment. Sci. Total Environ. 2020, 728, 138813. [Google Scholar] [CrossRef]

- Briguglio, L.; Cordina, G.; Farrugia, N.; Vella, S. Economic vulnerability and resilience concepts and measurements. Oxf. Dev. Stud. 2009, 37, 229–247. [Google Scholar] [CrossRef]

- Jiang, D.; Wang, X.; Zhao, R. Analysis on the economic recovery in the post-COVID-19 era: Evidence from China. Front. Public Health 2022, 9, 787190. [Google Scholar] [CrossRef] [PubMed]

- Albulescu, C.T. COVID-19 and the United States financial markets volatility. Financ. Res. Lett. 2020, 38, 101699. [Google Scholar] [CrossRef]

- Lee, H.S. Exploring the initial impact of COVID-19 sentiment on US stock market using big data. Sustainability 2020, 12, 6648. [Google Scholar] [CrossRef]

- Verma, P.; Dumka, A.; Bhardwaj, A.; Ashok, A.; Kestwal, M.C.; Kumar, P. A statistical analysis of impact of COVID19 on the global economy and stock index returns. SN Comput. Sci. 2021, 2, 1–13. [Google Scholar] [CrossRef]

- Shelley, G.L.; Wallace, F.H. Further evidence regarding nonlinear trend reversion of real GDP and the CPI. Econ. Lett. 2011, 112, 56–59. [Google Scholar] [CrossRef][Green Version]

- Angeon, V.; Bates, S. Reviewing composite vulnerability and resilience indexes: A sustainable approach and application. World Dev. 2015, 72, 140–162. [Google Scholar] [CrossRef]

- Cutter, S.L.; Barnes, L.; Berry, M.; Burton, C.; Evans, E.; Tate, E.; Webb, J. A place-based model for understanding community resilience to natural disasters. Glob. Environ. Change 2008, 18, 598–606. [Google Scholar] [CrossRef]

- Wong, J. China’s economy in 2007/2008: Coping with problems of runaway growth. ChinaWorld Econ. 2008, 16, 1–18. [Google Scholar] [CrossRef]

- Drehmann, M.; Oechssler, J.; Roider, A. Herding and contrarian behavior in financial markets: An internet experiment. Am. Econ. Rev. 2005, 95, 1403–1426. [Google Scholar] [CrossRef]

- Park, A.; Sabourian, H. Herding and contrarian behavior in financial markets. Econometrica 2011, 79, 973–1026. [Google Scholar] [CrossRef][Green Version]

- Sharma, D.; Bouchaud, J.-P.; Gualdi, S.; Tarzia, M.; Zamponi, F. V–, U–, L– or W–shaped economic recovery after COVID-19: Insights from an Agent Based Model. PLoS ONE 2021, 16, e0247823. [Google Scholar] [CrossRef]

- Han, Y. The impact of the COVID-19 pandemic on China’s economic structure: An input-output approach. Struct. Change Econ. Dyn. 2022, 63, 181–195. [Google Scholar] [CrossRef] [PubMed]

- Pozo, R.F.; Wilby, M.R.; Díaz, J.J.V.; Gonzalez, A.B.R. Data-driven analysis of the impact of COVID-19 on Madrid’s public transport during each phase of the pandemic. Cities 2022, 127, 103723. [Google Scholar] [CrossRef]

- Soliku, O.; Kyiire, B.; Mahama, A.; Kubio, C. Tourism amid COVID-19 pandemic: Impacts and implications for building resilience in the ecotourism sector in Ghana’s Savannah region. Heliyon 2021, 7, E07892. [Google Scholar] [CrossRef]

- Hepburn, C.; O’Callaghan, B.; Stern, N.; Stiglitz, J.; Zenghelis, D. Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change? Oxf. Rev. Econ. Policy 2020, 36, S359–S381. [Google Scholar] [CrossRef]

- Muhammad, S.; Long, X.; Salman, M. COVID-19 pandemic and environmental pollution: A blessing in disguise? Sci. Total Environ. 2020, 728, 138820. [Google Scholar] [CrossRef]

- IEA. Global Energy Review 2020: The Impacts of the COVID-19 Crisis on Global Energy Demand and CO2 Emissions; International Energy Agency 2020; IEA Publications: Paris, France, 2020; pp. 1–56. [Google Scholar]

| (1) National Economy (GDP) | (2) Investment | (3) International Trade | (4) Consumption | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Beta | t | Sig. | Beta | t | Sig. | Beta | t | Sig. | Beta | t | Sig. | |

| COVID-19 | 0.183 | 1.518 | 0.140 | −0.326 | 1.578 | 0.126 | 0.006 | 0.092 | 0.927 | −1.364 | −3.543 | 0.001 |

| Investment | 0.021 | 0.273 | 0.787 | |||||||||

| International trade | 0.657 | 4.112 | 0.000 | |||||||||

| Consumption | 0.508 | 7.708 | 0.000 | |||||||||

| Gov. spending | −0.180 | −4.482 | 0.000 | |||||||||

| PMI | −0.036 | −0.635 | 0.537 | 0.079 | 1.425 | 0.161 | ||||||

| CPI | 0.085 | 1.101 | 0.280 | −0.215 | −1.646 | 0.110 | ||||||

| Capital market | 0.028 | 0.361 | 0.721 | 0.383 | 2.155 | 0.040 | ||||||

| Unemployment | 0.011 | 0.984 | 0.903 | −0.276 | −1.469 | 0.056 | ||||||

| Imports | −0.262 | −1.834 | 0.077 | −0.251 | −1.915 | 0.065 | ||||||

| Savings | 10.31 | 5.094 | 0.000 | 0.529 | 8.415 | 0.000 | −6.996 | −4.785 | 0.000 | |||

| Business Confidence | 0.391 | 3.728 | 0.001 | |||||||||

| Consumer Confidence | 0.251 | 1.884 | 0.069 | |||||||||

| FDI | 0.559 | 11.15 | 0.000 | |||||||||

| Interest | 0.512 | 2.179 | 0.038 | |||||||||

| M2 | −10.16 | −4.665 | 0.000 | 9.116 | 5.998 | 0.000 | ||||||

| Export price | 0.096 | 0.416 | 0.164 | |||||||||

| Exchange rate | −0.258 | −5.17 | 0.000 | |||||||||

| α | 0.465 | 0.645 | −0.646 | 0.523 | 0.401 | 0.690 | −0.865 | 0.393 | ||||

| Adjust R2 | 0.948 | 0.693 | 0.903 | 0.750 | ||||||||

| F | 72.511 | 10.873 | 68.844 | 17.747 | ||||||||

| ANOVA | 0.000 | 0.000 | 0.000 | 0.000 | ||||||||

| (1) Manufacturing | (2) Service | (3) Agriculture | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Beta | t | Sig. | Beta | t | Sig. | Beta | t | Sig. | |

| COVID-19 | −0.391 | −2.423 | 0.021 | −0.238 | −1.965 | 0.050 | −0.312 | −1.229 | 0.227 |

| Savings | 0.825 | 4.868 | 0.000 | −2.400 | −2.361 | 0.024 | −9.923 | −5.105 | 0.000 |

| Industry production | 0.045 | 0.550 | 0.586 | ||||||

| FDI | 0.562 | 9.748 | 0.000 | ||||||

| Gov spending | −0.211 | −3.238 | 0.003 | −0.112 | −2.123 | 0.041 | −0.261 | −2.507 | 0.016 |

| Exchange rate | −0.264 | −3.924 | 0.000 | ||||||

| Export price | −0.576 | 3.820 | 0.000 | ||||||

| PMI | −0.031 | −2.5 | 0.804 | ||||||

| Unemployment | −0.213 | −3.493 | 0.001 | ||||||

| Business confidence | −0.025 | −0.437 | 0.665 | ||||||

| M2 | 3.496 | 3.594 | 0.001 | 10.665 | 5.645 | 0.000 | |||

| CPI | 0.026 | 0.371 | 0.713 | 0.192 | 1.576 | 0.123 | |||

| Revenue | 0.137 | 1.701 | 0.017 | ||||||

| α | 2.042 | 0.049 | −0.292 | 0.772 | −2.835 | 0.007 | |||

| F | 47.9 | 174.075 | 11.920 | ||||||

| Adjust R2 | 0.897 | 0.907 | 0.556 | ||||||

| ANOVA | 0.000 | 0.000 | 0.000 | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, X.; Long, H.; Chen, Y. Looking Back Deeper, Recovering up Better: Resilience-Oriented Contrarian Thinking about COVID-19 Economic Impact. Sustainability 2024, 16, 6687. https://doi.org/10.3390/su16156687

Lin X, Long H, Chen Y. Looking Back Deeper, Recovering up Better: Resilience-Oriented Contrarian Thinking about COVID-19 Economic Impact. Sustainability. 2024; 16(15):6687. https://doi.org/10.3390/su16156687

Chicago/Turabian StyleLin, Xiaochen, Hai Long, and Yu Chen. 2024. "Looking Back Deeper, Recovering up Better: Resilience-Oriented Contrarian Thinking about COVID-19 Economic Impact" Sustainability 16, no. 15: 6687. https://doi.org/10.3390/su16156687

APA StyleLin, X., Long, H., & Chen, Y. (2024). Looking Back Deeper, Recovering up Better: Resilience-Oriented Contrarian Thinking about COVID-19 Economic Impact. Sustainability, 16(15), 6687. https://doi.org/10.3390/su16156687