Assessment of Economic Viability of Direct Current Fast Charging Infrastructure Investments for Electric Vehicles in the United States

Abstract

:1. Introduction

- Understand various components that contribute to the lifecycle cost of owning and operating DCFC stations;

- Evaluate the economic viability of deploying DCFC stations by analyzing various investment scenarios using the Net Present Value analysis;

- Conduct sensitivity analysis to evaluate the impact of key variables such as electricity prices, charging tariffs, and utilization rates on the economic viability of DCFC deployment.

2. Literature Review

2.1. Need of Fast Charging Infrastructure

2.2. Ownership Costs of a DC Fast Charger Station

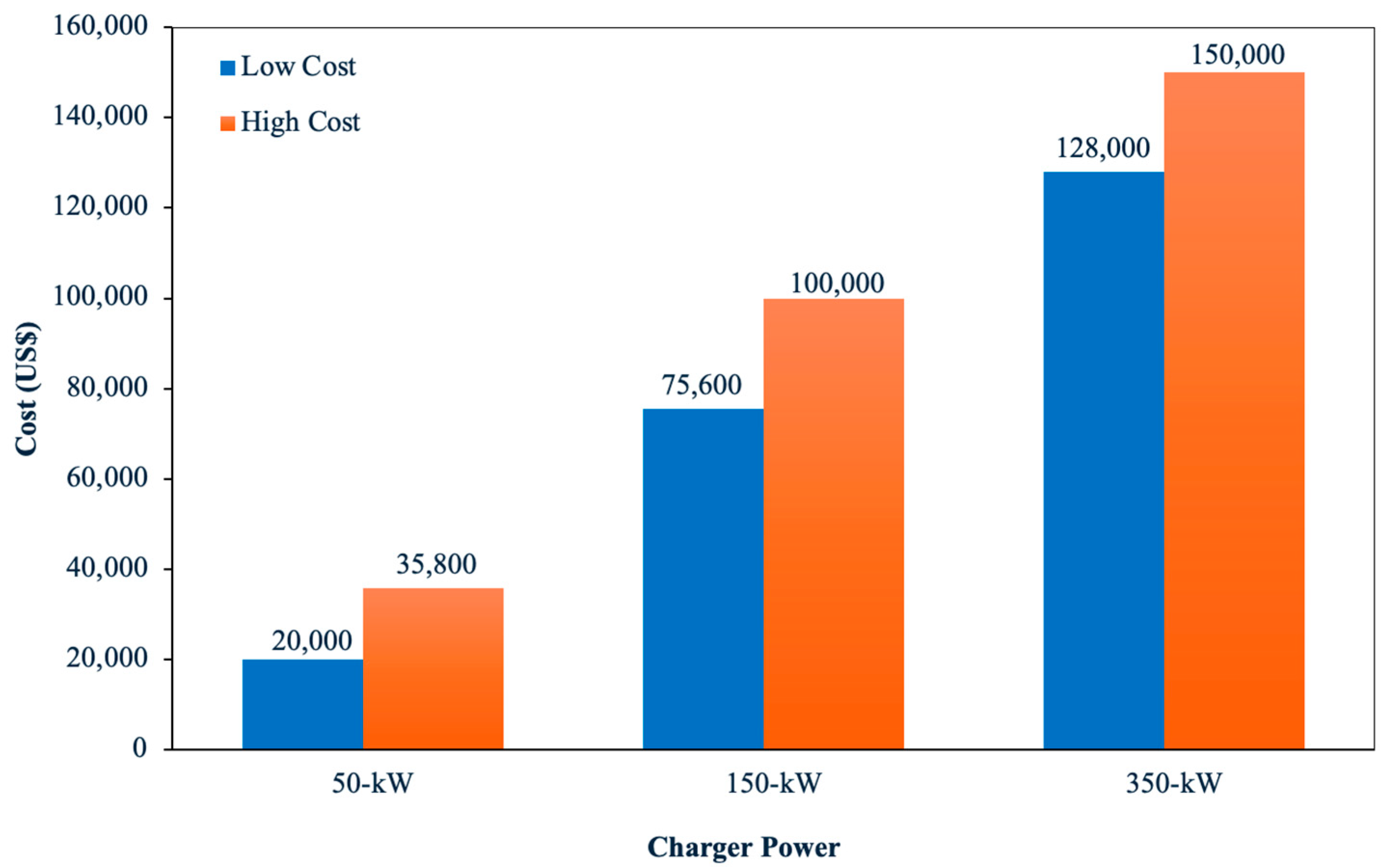

2.2.1. Capital Cost

2.2.2. Maintenance and Operation Cost

2.2.3. Infrastructure Development Incentives and Private Investment

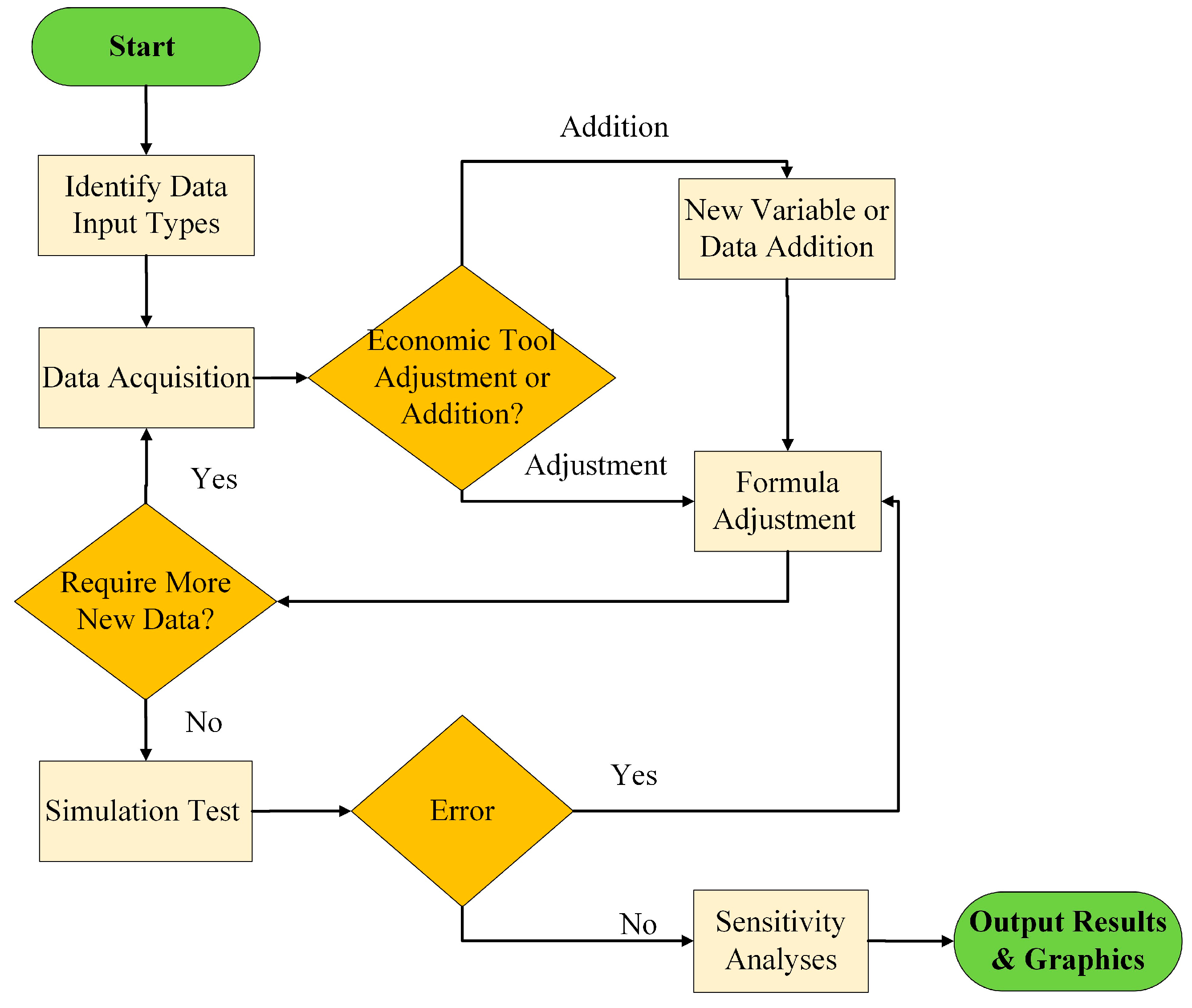

3. Methodology

3.1. Data Acquisition

3.2. Economic Analysis

3.3. Sensitivity Analysis

4. Data Analysis and Results

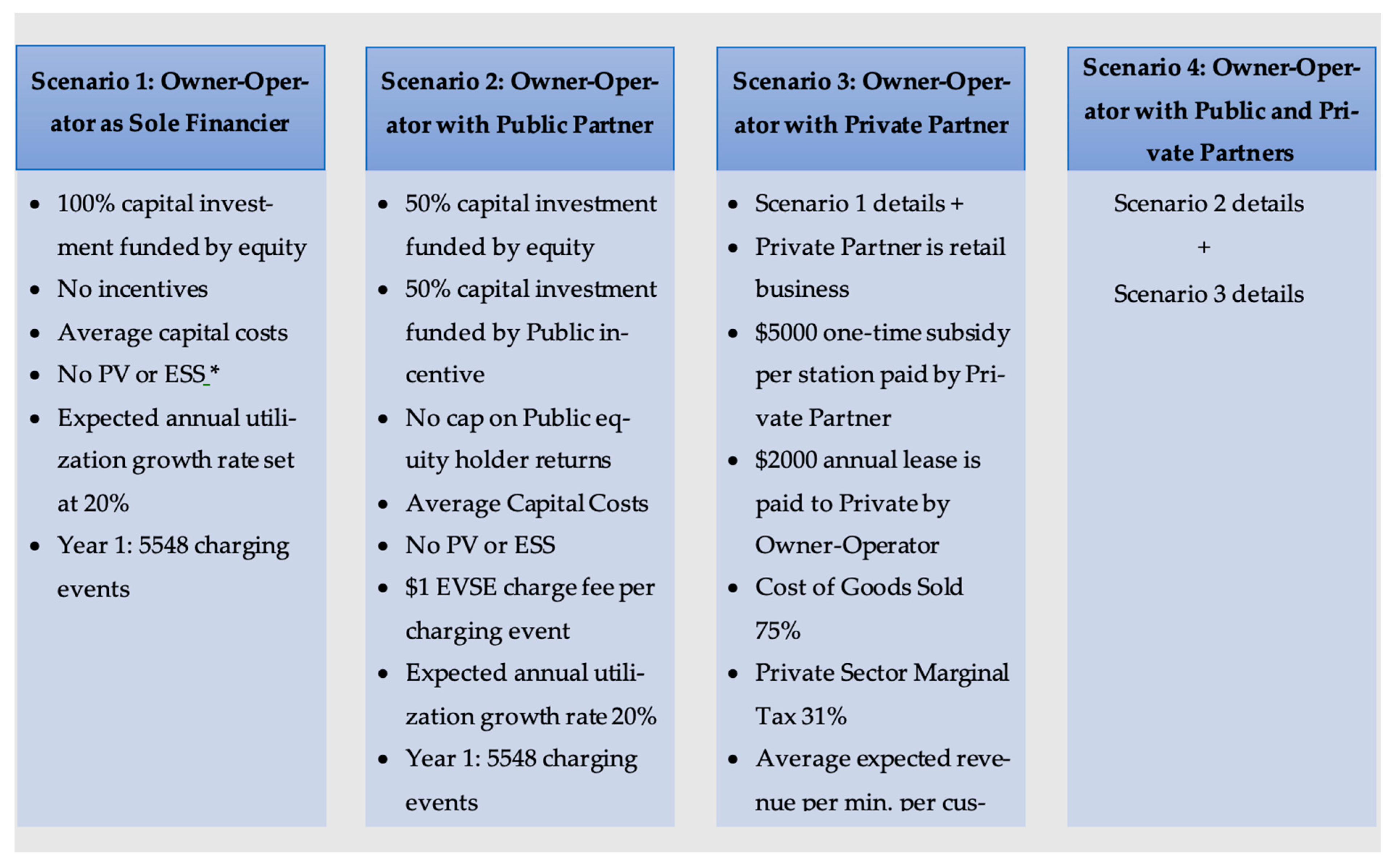

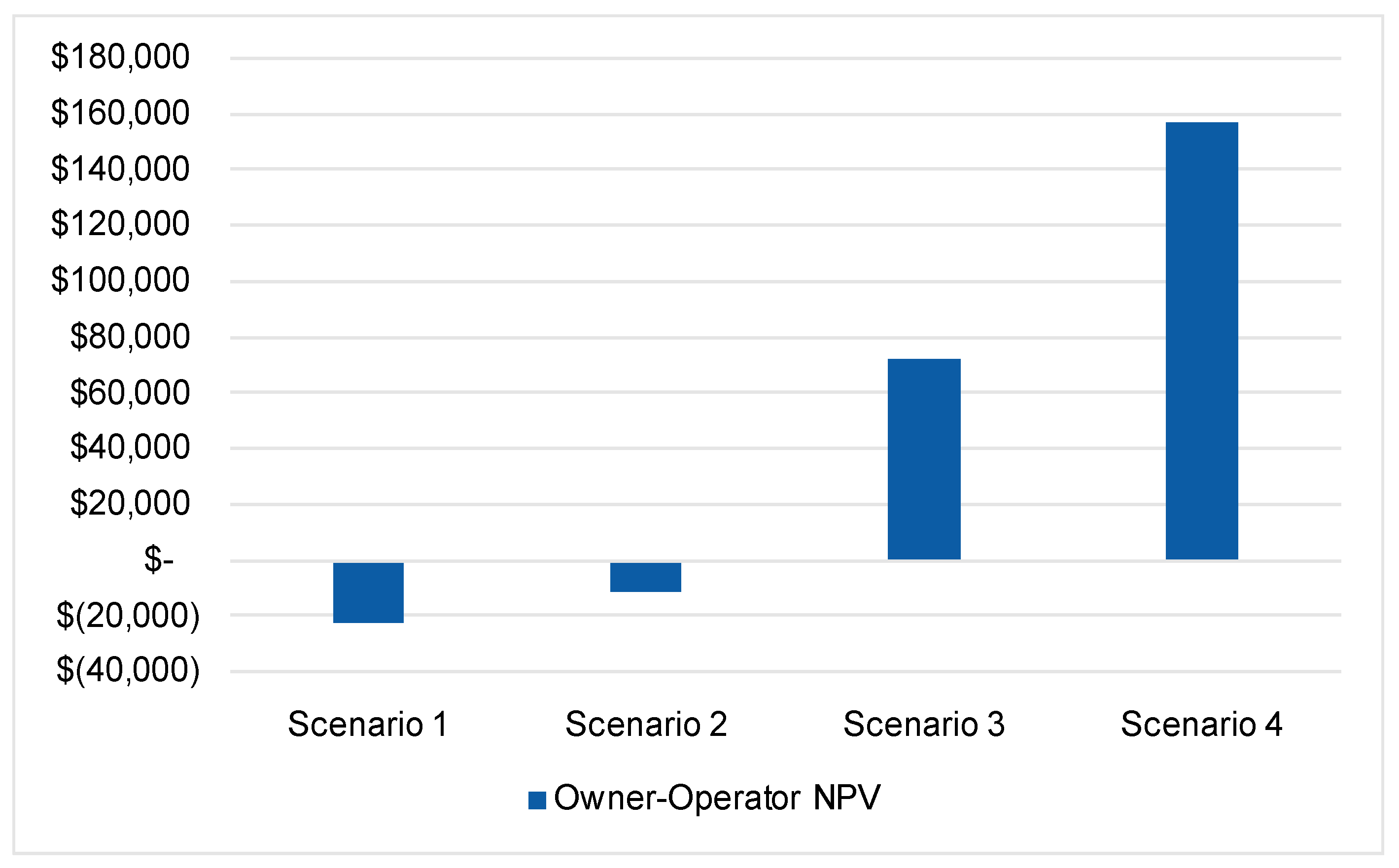

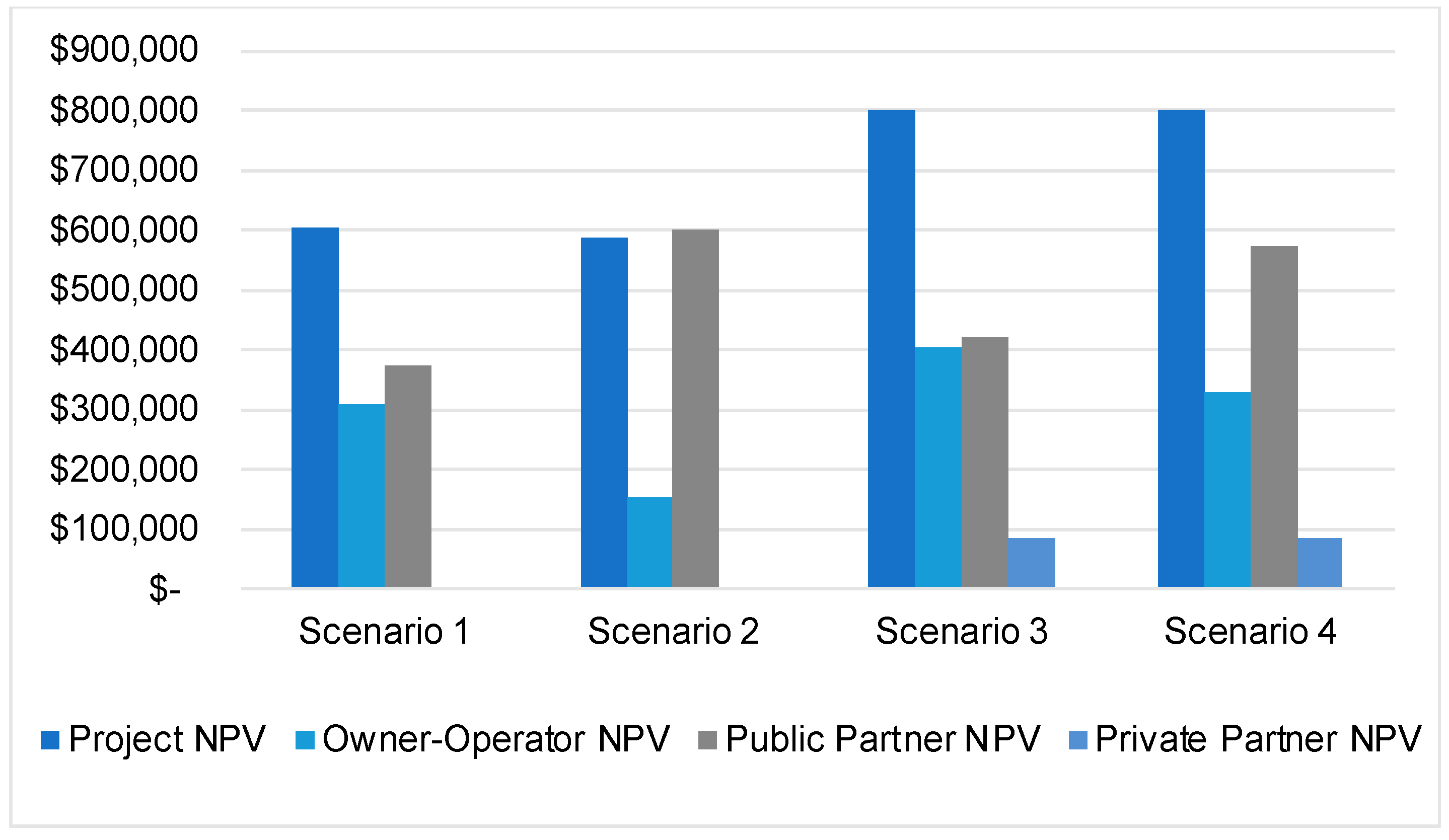

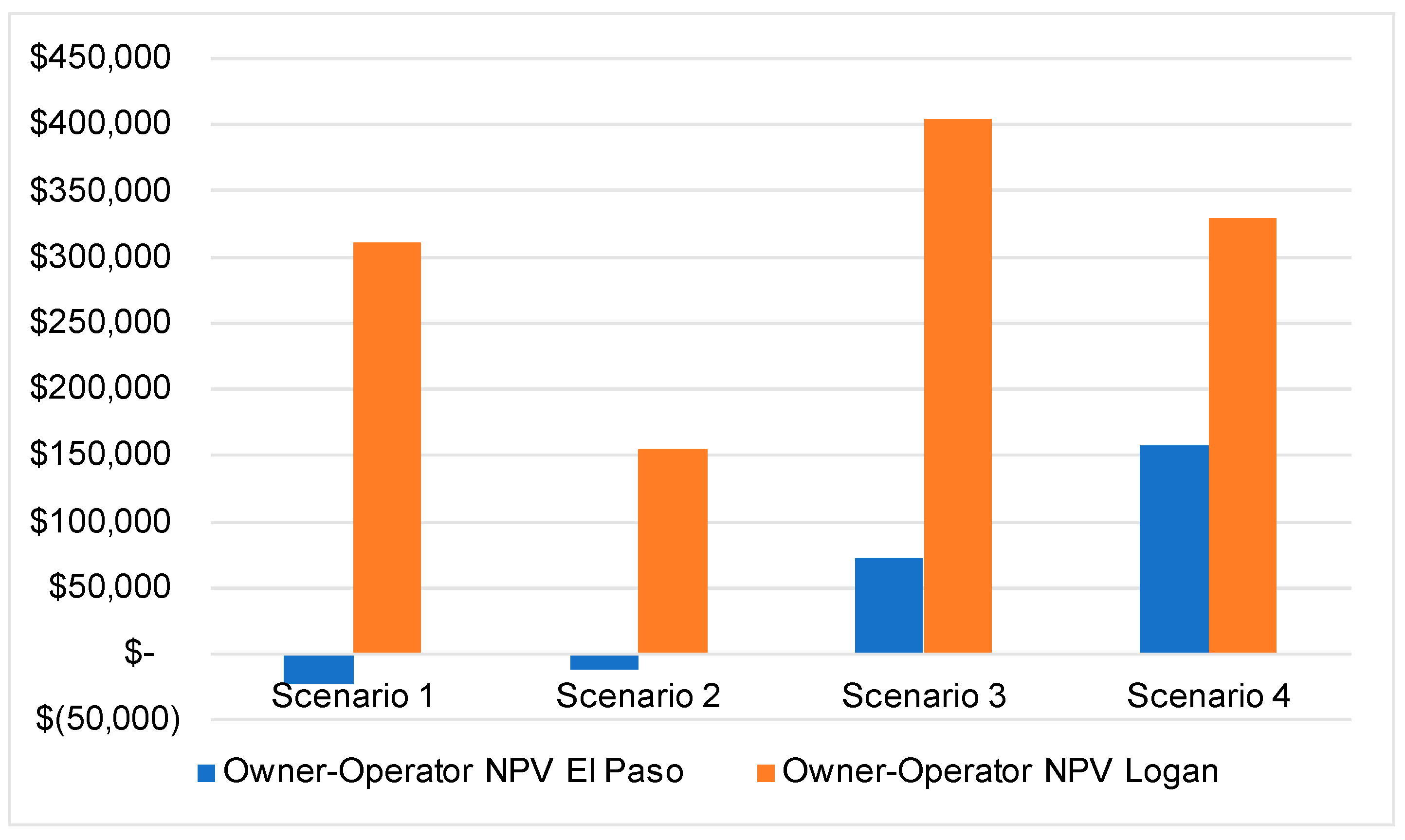

4.1. DCFC Investment Scenarios in El Paso, Texas

4.2. DCFC Investment Scenarios in Logan, Utah

5. Sensitivity Analyses

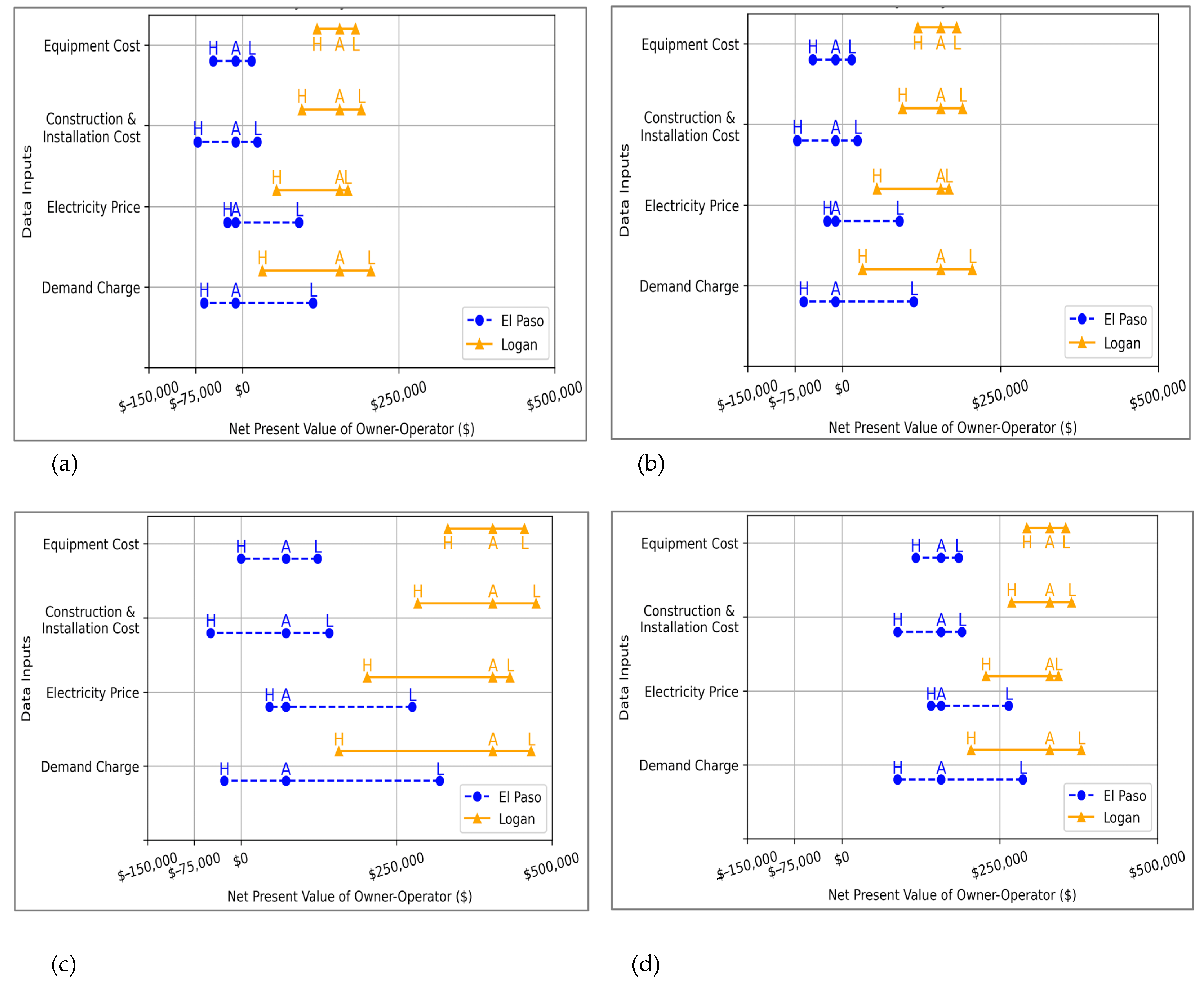

- Operational vs. Capital Cost Sensitivity: In scenarios where operational costs dominate, such as in Scenarios 1 and 3, the profitability of the Owner-Operator is significantly more sensitive to fluctuations in utility-related expenses like demand charges. This sensitivity analysis indicates that the control and reduction of these costs are pivotal for maintaining and improving profitability. In contrast, Scenario 2, which introduces additional financial support for capital costs, shows that capital costs can be managed more predictably through external financial mechanisms such as subsidies or partnerships, which cushion the impact of these costs on the NPV.

- Partnership Impact on Financial Outcomes: Scenario 2 introduces the complexity of partnerships where external support lessens the financial burden but also dilutes the ultimate profitability. This suggests a strategic dilemma: gaining financial support and sharing risk at the cost of potentially higher profits. Scenario 4, with a multi-partner model, demonstrates that having more stakeholders can provide a buffer against cost volatility. This model offers a more stable, albeit potentially less lucrative, financial outcome as risks and profits are spread across more entities, reducing the financial impact of negative shifts in cost or demand factors.

- Strategic Focus on Demand Charges: Demand charges emerge as a critical lever in all scenarios. For instance, in Scenario 1, Logan and El Paso show drastically different outcomes based on the same cost factor, emphasizing the local regulatory and operational environment’s role in financial modeling. The potential for strategic management of demand charges, whether through negotiation with utility providers or technological solutions to reduce peak demand, can be a crucial strategy for enhancing NPV.

- Risk Mitigation vs. Profit Maximization: Scenarios 2 and 4 offer insights into the trade-offs between mitigating risks through partnerships and maximizing profits when operating independently. Scenario 2 shows that while partnerships that provide capital can reduce the burden of initial expenses, they can also lead to lower returns due to the sharing of generated revenue. Scenario 4 illustrates that while multi-partner models add complexity, they also distribute the financial risks, making the business model more resilient to economic or regulatory changes.

- Flexibility and Adaptability: Across all scenarios, a theme of needing flexibility and adaptability emerges. Owner-Operators need to stay agile, adapting their business strategies based on evolving market conditions and regulatory environments. This might include shifting from solo operations to partnerships, renegotiating financial terms with partners, or investing in technologies that mitigate the most sensitive costs.

6. Conclusions, Limitations, and Future Work

- The demand charge and electricity cost factors are most indicative of financially profitable DCFC investments.

- A multi-partner business model that includes a public and private partner can best ensure profitability but also shields the business profitability from any unexpected cost increases.

- There must be greater collaboration between public, private, and utility stakeholders when designing incentives and energy regulations to grow DCFC infrastructure.

- There must be more diversity in public incentives aimed at utilities and DCFC operating costs rather than those only focused on capital investment.

- A private partnership can be greatly beneficial to a DCFC business model as long as the site attracts new customers and additional spending to the private partner’s business.

- A limitation of this study is its focus on the net present value (NPV) for each partner without considering other potential outcomes or performance metrics. Future research should analyze additional performance metrics such as internal rate of return, return on investment, and operating margin, among others, to provide more comprehensive insights for investors and policymakers [47].

- The study was limited to specific economic factors, such as capital costs, demand charges, and electricity retail prices, potentially overlooking other relevant variables like insurance costs, carbon credits, and environmental incentives, etc.

- Given the insight on the demand charge being an integral cost to the profitability of a DCFC site, future work may include investigating the technological and financial pathways for utilities, DCFC site owners, and governments to reduce the cost of demand charges.

- This study conducted economic viability analyses for El Paso, TX, and Logan, UT. Given that demand charges are utility-related costs and vary across the U.S., a comprehensive comparative analysis across utilities in the U.S. could identify trends and rank optimal locations for profitable DCFC sites.

- Additionally, expanding the economic analysis to include photovoltaic and energy storage systems at DCFC sites could help reduce energy loads during peak hours and lower energy charges.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Abbreviated Term | Term |

|---|---|

| Discounted Cash Flow | |

| Net Present Value | |

| Rsite | Revenue of the DCFC Site |

| δ | Change |

| Earnings Before Interest and Taxes | |

| Discount Factor | |

| CFt | Net Cash Flow |

| Cash Inflow | |

| Cash Outflow | |

| R | Revenue Generated |

References

- Nie, Y.M.; Ghamami, M. A corridor-centric approach to planning electric vehicle charging infrastructure. Transp. Res. B 2013, 57, 172–190. [Google Scholar] [CrossRef]

- Funke, S.Á.; Sprei, F.; Gnann, T.; Plötz, P. How much charging infrastructure do electric vehicles need? A review of the evidence and international comparison. Transp. Res. D 2019, 77, 224–242. [Google Scholar] [CrossRef]

- Bauer, G.; Hsu, C.-W.; Nicholas, M.; Lutsey, N. Charging up America: Assessing the Growing Need for U.S. Charging Infrastructure through 2030; International Council on Clean Transportation: Washington, DC, USA, 2021. [Google Scholar] [CrossRef]

- Abby, B.; Cappellucci, J.; Heinrich, A.; Cost, E. Electric Vehicle Charging Infrastructure Trends from the Alternative Fueling Station Locator: Third Quarter 2023; NREL/TP-5400-88223; National Renewable Energy Laboratory: Golden, CO, USA, 2024. Available online: https://www.nrel.gov/docs/fy24osti/88223.pdf (accessed on 2 April 2024).

- Wood, E.; Brennan, B.; Matt, M.; Dong-Yeon, D.-Y.L.; Yanbo, G.; Fan, Y.; Zhaocai, L. The 2030 National Charging Network: Estimating U.S. Light-Duty Demand for Electric Vehicle Charging Infrastructure; NREL/TP-5400-85654; National Renewable Energy Laboratory: Golden, CO, USA, 2023. Available online: https://www.nrel.gov/docs/fy23osti/85654.pdf (accessed on 10 January 2024).

- The White House. A Guidebook to the Bipartisan Infrastructure Law for State, Local, Tribal, and Territorial Governments, and other Partners. Available online: https://www.whitehouse.gov/wp-content/uploads/2022/05/BUILDING-A-BETTER-AMERICA-V2.pdf#page=138 (accessed on 15 March 2024).

- Snyder, J.; Chang, D.; Erstad, D.; Lin, E.; Falken Rice, A.; Tzun Goh, C.; Tsao, A.; Financial Viability of Non-Residential Electric Vehicle Charging Stations. UCLA Luskin Center for Innovation. Available online: https://innovation.luskin.ucla.edu/wp-content/uploads/2019/03/Financial_Viability_of_Non-Residential_EV_Charging_Stations.pdf (accessed on 15 March 2024).

- Jabbari, P.; MacKenzie, D. EV everywhere or EV anytime? Co-locating multiple DC fast chargers to improve both operator cost and access reliability. In Proceedings of the Transportation Research Board 96th Annual Meeting, Washington, DC, USA, 8–12 January 2017. [Google Scholar]

- Lee, H.; Clark, A. Charging the Future: Challenges and Opportunities for Electric Vehicle Adoption; HKS Working Paper RWP18-026; Belfer Center for Science and International Affairs Harvard Kennedy School: Cambridge, MA, USA, 2018. [Google Scholar] [CrossRef]

- Fröde, P.; Lee, M.; Sahdev, S. Can Public EV-Fast Charging Stations Be Profitable in the United States? McKinsey & Company. 5 October 2023. Available online: https://www.mckinsey.com/features/mckinsey-center-for-future-mobility/our-insights/can-public-ev-fast-charging-stations-be-profitable-in-the-united-states#/ (accessed on 15 January 2024).

- Dimanchev, E.; Fleten, S.; MacKenzie, D.; Korpås, M. Accelerating electric vehicle charging investments: A real options approach to policy design. Energy Policy 2023, 181, 113703. [Google Scholar] [CrossRef]

- Burnham, A.; Dufek, E.J.; Stephens, T.; Francfort, J.; Michelbacher, C.; Carlson, R.B.; Zhang, J.; Vijayagopal, R.; Dias, F.; Mohanpurkar, M.; et al. Enabling fast charging—Infrastructure and economic considerations. J. Power Sources 2017, 367, 237–249. [Google Scholar] [CrossRef]

- Gamage, T.; Tal, G.; Jenn, A.T. The costs and challenges of installing corridor DC fast chargers in California. Case Stud. Transp. Policy 2023, 11, 100969. [Google Scholar] [CrossRef]

- International Energy Agency. Technology Needs in Long-Distance Transport. Energy Techn. Perspectives. 2020. Available online: https://www.iea.org/reports/energy-technology-perspectives-2020/technology-needs-in-long-distance-transport (accessed on 10 January 2024).

- REN21-Renewables 2023 Global Status Report Collection. Renewables in Energy Demand. 2023. Available online: http://www.ren21.net/gsr2023-demand-modules (accessed on 2 March 2024).

- International Energy Agency. Global EV Outlook-Securing Supplies for an Electric Future. 2023. Available online: https://www.oecd-ilibrary.org/energy/global-ev-outlook-2022_c83f815c-en (accessed on 2 January 2024).

- Rivera, S.; Goetz, S.M.; Kouro, S.; Lehn, P.W.; Pathmanathan, M.; Bauer, P.; Mastromauro, R.A. Charging infrastructure and grid integration for electromobility. Proc. IEEE 2023, 111, 371–396. [Google Scholar] [CrossRef]

- Savari, G.; Jagabar, M.; Anantha, L.; El-Shahat, A.; Hasanien, H.; Almakhles, D.; Aleem, S.; Omar, A. Assessment of charging technologies, infrastructure and charging station recommendation schemes of electric vehicles: A review. Ain Shams Eng. J. 2023, 14, 4. [Google Scholar] [CrossRef]

- Irle, R. Global EV Sales for 2022. EV Volume. 2023. Available online: https://ev-volumes.com/news/ev/global-ev-sales-for-2022/ (accessed on 10 January 2024).

- Bernard, M.R.; Nicholas, M.; Wappelhorst, S.; Hall, D. A Review of the AFIR Proposal: How much Power Output Is Needed for Public Charging Infrastructure in the European Union? 2022. Available online: https://theicct.org/publication/europe-ldv-review-of-afir-proposal-how-much-power-output-needed-for-public-charging-infrastructure-in-the-eu-mar22/ (accessed on 20 February 2024).

- Cooper, A.; Schefter, K. Electric Vehicle Sales Forecast and the Charging Infrastructure Required through 2030. 2018. Available online: https://www.edisonfoundation.net/-/media/Files/IEI/publications/IEI_EEI-EV-Forecast-Report_Nov2018.ashx (accessed on 11 January 2024).

- Powar, V.; Singh, R. End-to-End direct-current-based extreme fast electric vehicle charging infrastructure using Lithium-Ion battery storage. Batteries 2023, 9, 169. [Google Scholar] [CrossRef]

- Dimitriadou, K.; Rigogiannis, N.; Fountoukidis, S.; Kotarela, F.; Kyritsis, A.; Papanikolaou, N. Current trends in electric vehicle charging infrastructure; opportunities and challenges in wireless charging integration. Energies 2023, 16, 2057. [Google Scholar] [CrossRef]

- Kakkar, R.; Gupta, R.; Agrawal, S.; Tanwar, S.; Sharma, R.; Alkhayyat, A.; Neagu, B.C.; Raboaca, M.S. A Review on standardizing electric vehicles community charging service operator infrastructure. Appl. Sci. 2022, 12, 12096. [Google Scholar] [CrossRef]

- Nelder, C.; Rogers, E. Reducing EV Charging Infrastructure Costs. 2019. Available online: https://rmi.org/wp-content/uploads/2020/01/RMI-EV-Charging-Infrastructure-Costs.pdf (accessed on 4 January 2024).

- California Energy Commission. EV Charger Selection Guide. 2018. Available online: https://afdc.energy.gov/files/u/publication/EV_Charger_Selection_Guide_2018-01-112.pdf (accessed on 4 January 2024).

- California Energy Commission. California Electric Vehicle Infrastructure Project (CALeVIP) Cost Data. 2022. Available online: https://calevip.org/electric-vehicle-charging-101 (accessed on 15 December 2023).

- Khan, H.A.U.; Price, S.; Avraam, C.; Dvorkin, Y. Inequitable access to EV charging infrastructure. Electr. J. 2022, 35, 107096. [Google Scholar] [CrossRef]

- Nicholas, M. Estimating Electric Vehicle Charging Infrastructure Costs Across Major U.S. Metropolitan Areas. The International Council on Clean Transportation (ICCT). 2019. Available online: https://theicct.org/publication/estimating-electric-vehicle-charging-infrastructure-costs-across-major-u-s-metropolitan-areas/ (accessed on 6 January 2024).

- Botsford, C. The Economics of Non-Residential Level 2 EVSE Charging Infrastructure. In Proceedings of the EVS26 International Battery, Hybrid and Fuel Cell Electric Vehicle Symposium, Los Angeles, CA, USA, 6–9 May 2012. [Google Scholar]

- Idaho National Laboratory (INL). What Were the Cost Drivers for the Direct Current Fast Charging Installations? INL/MIS-15-35060. The EV Project; 2015. Available online: https://avt.inl.gov/sites/default/files/pdf/EVProj/WhatWereTheCostDriversForDCFCinstallations.pdf (accessed on 10 March 2024).

- Idaho National Laboratory (INL). How do Publicly Accessible Charging Infrastructure Installation Costs Vary by Geographic Location? INL/MIS-15-35319; The EV Project; 2014. Available online: https://avt.inl.gov/sites/default/files/pdf/EVProj/HowDoPubliclyAccessibleInfrastructureInstallationCostsVaryByGeographicLocation.pdf (accessed on 21 January 2024).

- Margaret, S.; Castellano, J. Costs Associated with Non-Residential Electric Vehicle Supply Equipment: Factors to Consider in the Implementation of Electric Vehicle Charging Stations; No. DOE/EE-1289; Department of Energy: Washington, DC, USA, 2015.

- U.S. Department of Energy. Federal Workplace Charging Program Guide. 2020. Available online: https://www.energy.gov/sites/default/files/2020/11/f80/federal-workplace-charging-guide.pdf (accessed on 3 January 2024).

- Tong, L.; Xing, J.; Zhou, Y. The market for electric vehicles: Indirect network effects and policy design. J. Assoc. Environ. Resour. Econ. 2017, 4, 89–133. [Google Scholar] [CrossRef]

- Münzel, C.; Plötz, P.; Sprei, F.; Gnann, T. How large is the effect of financial incentives on electric vehicle sales?—A global review and European analysis. Energy Econ. 2019, 84, 104493. [Google Scholar] [CrossRef]

- Cole, W.; Frazier, A.W.; Augustine, C. Cost Projections for Utility-Scale Battery Storage: 2021. Available online: https://www.nrel.gov/docs/fy21osti/79236.pdf (accessed on 21 February 2024).

- Egbue, O.; Long, S. Barriers to widespread adoption of electric vehicles: An analysis of consumer attitudes and perceptions. Energy Policy 2012, 48, 717–729. [Google Scholar] [CrossRef]

- Chakraborty, A.; Kumar, R.; Bhaskar, K. A game-theoretic approach for electric vehicle adoption and policy decisions under different market structures. J. Operat. Res. Soc. 2020, 72, 594–611. [Google Scholar] [CrossRef]

- Kumar, R.; Chakraborty, A.; Mandal, P. Promoting electric vehicle adoption: Who should invest in charging infrastructure? Transp. Res. Part E Logist. Transp. Rev. 2021, 149, 102295. [Google Scholar] [CrossRef]

- Christensen, C.; Salmon, J. EV adoption influence on air quality and associated infrastructure costs. World Electr. Veh. J. 2021, 12, 207. [Google Scholar] [CrossRef]

- Shao, L.; Yang, J.; Zhang, M. Subsidy scheme or price discount scheme? Mass adoption of electric vehicles under different market structures. Eur. J. Operat. Res. 2017, 262, 1181–1195. [Google Scholar] [CrossRef]

- Pearre, N.S.; Swan, L.G. Observational Evaluation of the Maximum Practical Utilization of Electric Vehicle DCFC Infrastructure. World Electr. Veh. J. 2022, 13, 190. [Google Scholar] [CrossRef]

- PricewaterhouseCoopers, PwC|Electric Vehicles and the Charging Infrastructure: A New Mindset? 2021. Available online: https://www.pwc.com/us/en/industrial-products/publications/assets/pwc-electric-vehicles-charging-infrastructure-mindset.pdf (accessed on 1 January 2024).

- Borlaug, B.; Yang, F.; Pritchard, E.; Wood, E.; Gonder, J. Public electric vehicle charging station utilization in the United States. Transport. Res. Part D Transp. Environ. 2023, 114, 103564. [Google Scholar] [CrossRef]

- PacifiCorp. PacifiCorp Facts. 2009. Available online: https://www.nrc.gov/docs/ML1018/ML101810206.pdf (accessed on 13 January 2024).

- Lei, X.; Yu, H.; Shao, Z.; Jian, L. Optimal bidding and coordinating strategy for maximal marginal revenue due to V2G operation: Distribution system operator as a key player in China’s uncertain electricity markets. Energy 2023, 283, 128354. [Google Scholar] [CrossRef]

- Lei, X.; Yu, H.; Yu, B.; Shao, Z.; Jian, L. Bridging electricity market and carbon emission market through electric vehicles: Optimal bidding strategy for distribution system operators to explore economic feasibility in China’s low-carbon transitions. Sustain. Cities Soc. 2023, 94, 104557. [Google Scholar] [CrossRef]

| Charging Station Type | Maintenance Recommendation |

|---|---|

| DCFC | Replacement of parts |

| Vandalism repairs | |

| Cords or entire station over time | |

| Cost of adding a network | |

| Cost of connecting to the network | |

| Software updates or resets | |

| Cooling systems or additional filters (exclusive to DCFC) |

| Data Sources | ||

|---|---|---|

| Partner | Data Types | Sources * |

| Market Inputs | EV Fuel Economy | U.S. EPA, Office of EERE, Dept of Energy |

| Conventional Vehicle replacement Fuel Economy | Electric Power Research Institute | |

| Energy Security Benefit | Oak Ridge National Lab | |

| Electrical Grid Benefit | Electric Power Research Institute | |

| Electrical Grid Emission Rate | EPA | |

| Climate Benefit | EPA | |

| Owner-Operator | Capital Costs (EVSE, installation, construction, etc.) | Literature, NREL, EIA |

| Site Details (# of stations, # of sites) | IIJA, TX Department of Transportation | |

| Utility Energy Costs | Rocky Mountain Power, Logan Light and Power, El Paso Electric (EPE), NREL, U.S. URDB | |

| Sale of Energy (energy usage, utilization, etc.) | Literature | |

| Operating Costs (maintenance, network, etc.) | IIJA, literature | |

| Public Partner | Utility Incentives | EPE, EEI, Austin Energy |

| Local, State, Federal Incentives | Alternative Fuels Data Center, Office of EERE, Utah Dept of Env. Quality, Dept of Energy, NEHC | |

| Private Partner | Capital Cost Contribution | Literature |

| Revenue Cut from Charging Site | Literature | |

| Expected Increase in Revenue due to Increased Traffic | Literature | |

| Marginal Tax Rate | Government websites | |

| Site Lease Revenue | Literature | |

| Utility Provider | Customer Charge (per Meter per Month) | Utility Costs ($/kWh) | Demand Charge (per Month) | |||

|---|---|---|---|---|---|---|

| Summer Charge | Summer Charge | Winter Charge | Winter Charge | |||

| (On-Peak) | (Off-Peak) | (On-Peak) | (Off-Peak) | |||

| Pacific Gas and Electric | 185.198 | 0.258 | 0.231 | 0.208 | 0.207 | 19.490 |

| El Paso Electric | 250.000 | 0.224 | 0.003 | 0.009 | 0.009 | 21.780 |

| Rocky Mountain Power | 90.170 | 0.074 | 0.038 | 0.066 | 0.033 | 18.830 |

| Logan Light and Power | 50.000 | 0.038 | 0.038 | 0.038 | 0.038 | 16.860 |

| Duke Energy | 23.910 | 0.051 | 0.051 | 0.051 | 0.051 | 4.017 |

| Independent Variables for Sensitivity Analyses | |

|---|---|

| Data Type | Data Input |

| Capital Costs | Construction and Installation Costs EVSE Costs |

| Utility Energy Costs | Demand Charge ($/kWh/month) Retail Electricity Cost ($/kWh) Annual Compound Growth Rate in Electricity Cost (%) |

| Sale of Energy to EV Users | Expected Annual Utilization Growth Rate (%) Energy Cost to User per kWh ($/kWh) Per-Charge Event User Fee ($/session) Average Charge Event (kWh) Maximum Power Draw (kW per Charging Station) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bernal, D.; Raheem, A.A.; Inti, S.; Wang, H. Assessment of Economic Viability of Direct Current Fast Charging Infrastructure Investments for Electric Vehicles in the United States. Sustainability 2024, 16, 6701. https://doi.org/10.3390/su16156701

Bernal D, Raheem AA, Inti S, Wang H. Assessment of Economic Viability of Direct Current Fast Charging Infrastructure Investments for Electric Vehicles in the United States. Sustainability. 2024; 16(15):6701. https://doi.org/10.3390/su16156701

Chicago/Turabian StyleBernal, Daniel, Adeeba A. Raheem, Sundeep Inti, and Hongjie Wang. 2024. "Assessment of Economic Viability of Direct Current Fast Charging Infrastructure Investments for Electric Vehicles in the United States" Sustainability 16, no. 15: 6701. https://doi.org/10.3390/su16156701

APA StyleBernal, D., Raheem, A. A., Inti, S., & Wang, H. (2024). Assessment of Economic Viability of Direct Current Fast Charging Infrastructure Investments for Electric Vehicles in the United States. Sustainability, 16(15), 6701. https://doi.org/10.3390/su16156701