Abstract

Promoting green technology innovation is essential for sustainable development and the transition to a low-carbon economy. Using data from listed manufacturing companies in China from 2000 to 2020, this paper takes the establishment of permanent normal trade relations with the United States after China’s accession to the WTO as a quasi-natural experiment and uses the difference-in-differences method to study the impact of the decline in trade policy uncertainty on firms’ green technology innovation. The results show the following: (1) Reduced trade policy uncertainty significantly enhances green technology innovation in firms. (2) Further research finds that the decline in trade policy uncertainty mainly promotes the level of the green technology innovation of firms by alleviating financing constraints faced by firms and intensifying market competition. (3) A heterogeneity analysis reveals that the impact is more pronounced in firms with lower capital intensity, higher growth, export firms, and firms exporting to the United States. This study offers micro-level empirical evidence from China on the economic outcomes of external trade policy changes from the perspective of firms’ green technology innovation and provides insights into how the government should respond to the risks of external trade frictions and improve firms’ sustainable development in the future.

1. Introduction

China’s economy has achieved remarkable achievements over the past 40 years due to its reform and opening up. However, as the overall economic volume and growth rate have begun to encounter bottlenecks in recent years, the crude economic development model has revealed several drawbacks. One of the most prominent points is that it has increased the burden on the ecological environment, which will obviously further restrict China’s economic transition to a sustainable development path. Green technology, as a critical driver of green development, is essential for promoting ecological civilization and high-quality development [1]. Especially in the current context of tightening resource constraints and the difficulty of relying on simple factor inputs for sustainable economic development [2], green technology innovation has become a crucial factor for Chinese enterprises to gain a foothold in international competition [3]. Therefore, in order to address the environmental shortcomings of the crude development model and achieve healthy and sustainable economic development, the Chinese government issued the “Guidance Opinions on Market-Oriented Green technology innovation System” in 2019. This initiative focuses on promoting the development of green innovation technologies and sets ambitious targets of peaking carbon emissions from economic activities by 2030 and achieving carbon neutrality by 2060.

The existing research shows that international trade can promote innovation through competition [4], expanded market access [5], and the complementarity of R&D investments [6]. As a high-risk investment activity, innovation not only requires continuous investment of huge amounts of capital, but is also affected by external uncertainties. From the perspective of China’s innovation and development in recent years, changes in the international trade environment have brought great uncertainties to the behavior of Chinese enterprises, and further caused a series of impacts on their innovation activities. Since 2018, the United States has renegotiated the North American Free Trade Agreement (NAFTA), launched the United States–Mexico–Canada Agreement (USMCA), and withdrawn from the Trans-Pacific Partnership Agreement (TPP). These policy changes have further increased uncertainty in global trade. Research shows that trade agreements can promote innovation by reducing trade policy uncertainty, making market conditions more transparent and predictable [7]. For instance, the European Union’s Carbon Border Adjustment Mechanism (CBAM) imposes carbon taxes on imported goods, encouraging companies to adopt green technologies and reduce carbon emissions, thereby promoting green technology innovation [8,9]. Additionally, with the changing environment and growing public concern over environmental issues, firms are inclined to engage in green innovation in response to trade uncertainty. Therefore, reducing trade policy uncertainty not only promotes innovation activities in general, but also significantly boosts the research and application of green technologies. The United States and China have been two major participants in the global green innovation market, investing heavily in renewable energy, electric vehicles, and other sustainable technologies. These investments have been hindered by the trade policies between the two countries [10]. Given the increasing uncertainty of trade policies worldwide and the lack of empirical evidence on the relationship between trade policy changes and green innovation, we investigate whether trade policy uncertainty affects green innovation.

To further investigate the mechanism behind the effect of trade policy uncertainty on green technology innovation in firms, this study employs the permanent normal trade relation (PNTR) agreement between China and the United States, established after China’s accession to the WTO as a quasi-natural experiment, and assesses the effect of declining trade policy uncertainty on firms’ green technology innovation. Specifically, we construct an industry-level trade policy uncertainty index using the difference between the Smoot–Hawley tariff rate and the most-favored-nation tariff rate in 2001 at the four-digit industry level. By comparing the changes in the number of green patent applications of firms in industries with significant reductions in trade policy uncertainty to those with smaller reductions before and after China’s WTO accession, the study identifies the impact of trade policy uncertainty changes on firms’ green technology innovation.

Compared to the existing research, the marginal contribution of this paper is mainly reflected in the following three aspects: First, from the research perspective, the existing literature mainly focuses on the impact of environmental policies and regulations, market competition and demand, and internal factors on green technology innovation; they often overlook the role of trade. This paper explores how trade policy uncertainty affects firms’ green technology innovation from the perspective of external trade shocks, revealing that reduced trade policy uncertainty significantly boosts the green technology innovation of firms. Our findings provide a novel perspective and enhance the understanding of the factors influencing green technology innovation under trade uncertainty. Second, in terms of long-term effects, the existing literature rarely addresses the long-term and dynamic effects of trade policy uncertainty on firms. Since the impact of trade policy uncertainty may change over time, this paper analyzes firm data over an extended period, offering a more comprehensive understanding of its long-term effects. Third, from the perspective of the underlying channels, we identify that the easing of financing constraints and the intensification of competitive effects are key mechanisms through which reduced trade policy uncertainty promotes green innovation, which may provide new directions for future research.

2. Literature Review and Theoretical Analysis

2.1. Factors Influencing Green Innovation

Green innovation, also known as “sustainable innovation”, “eco-innovation”, or “environmental innovation”, originates from traditional concepts that focus on sustainable development and green ecological principles. It aims to improve both green efficiency and innovation efficiency [10]. Unlike traditional innovation, green innovation emphasizes the adoption of new technologies and ideas to achieve efficient resource utilization and significant pollution reduction, while simultaneously achieving corresponding economic performance [11].

Studies on the factors influencing firms’ green technology innovation primarily focus on three main aspects: First, the impact of environmental policies. The literature shows conflicting conclusions on whether environmental policies promote technological innovation. Some scholars, following Porter’s hypothesis, have found through case studies that well-designed stringent environmental regulations positively affect firms’ green innovation [12]. However, the neoclassical “compliance cost” theory suggests that such regulations may increase pollution control and compliance costs, thereby hindering innovation [13]. For example, Yuan and Xiang [14] report that strict environmental regulations in China increase firms’ pollution control and compliance costs, which inhibit innovation activities in the short run. Second, market theory-based research suggests that consumer demand [15], market competition [16], and efficient supply chain management [17] all positively affect green technology innovation. Third, internal factors such as green value orientation, profitability, and financing capacity play an important role. Wang et al. [18] find that green learning orientation enhances green knowledge acquisition and promotes both exploitative and exploratory green innovation. Fan and Zhou [19] empirically show that financing constraints negatively affect firms’ green innovation. From the existing studies, we find that most scholars primarily focus on the effects of policy incentives, market demand, and technological R&D investment on green innovation technology while overlooking the potential impact of trade policy changes, which may influence corporate green technology innovation through mechanisms such as financing constraints and market competition pressure.

2.2. Trade Policy Uncertainty and Green Technology Innovation

Research on trade policy uncertainty can be divided into two main areas: First, the measurement of trade policy uncertainty. Baker et al. [20] constructed an uncertainty index by analyzing the frequency of news reports to quantify fluctuations in economic policy uncertainty. While this method is intuitive and easy to understand, it is highly subjective and does not accurately reflect changes in trade policy. To overcome this shortcoming, Handley et al. [21] propose to measure trade policy uncertainty by the difference between actual tariffs and tariff ceilings. This approach is simple, easy to compute, and highly accurate, and it has been widely adopted by other scholars. Second, the impact of trade policy uncertainty. Researchers have examined the effects of changes in trade policy uncertainty from various perspectives, including firms’ import and export activities [21,22], business investment [23], labor market employment and wages [24], and corporate innovation [7]. They find that a reduction in trade policy uncertainty promotes import and export activities, increases investment, and significantly enhances corporate innovation. The main reason is that firms are more confident in a stable environment, which leads to increased risky investment. However, there is a lack of research focusing on the impact of trade policy changes on green technology innovation.

In fact, the reduction in trade policy uncertainty can impact firms’ green technology innovation through various mechanisms. Firstly, the decline in trade policy uncertainty may promote green technology innovation by alleviating financing constraints. Schumpeter’s theory of innovation highlights the critical role of funding availability in technological innovation. Innovation activities, due to uncertain returns, information asymmetry, and high regulatory costs, often face significant financing constraints that inhibit firms’ innovation efforts [7,25]. Green technology innovation, compared to traditional technological innovation, involves higher technological complexity, is more influenced by external factors, requires greater investment, faces higher risks, and has longer development cycles, making it more vulnerable to financing constraints. This implies that green innovation requires substantial capital for transformative change, making firms more susceptible to severe financing constraints [26,27]. As a result, firms often rely on external financing. However, according to the theory of information asymmetry, due to market imperfections and information asymmetry, firms struggle to secure adequate external financing. Investors and financial institutions, unable to fully assess the potential of firms’ green innovations, make more cautious investment decisions [28]. This further exacerbates the financial pressure on firms engaged in green technology innovation, limiting their ability and willingness to innovate. Reducing trade policy uncertainty can alleviate financing constraints in two important ways: first, a stable trade environment reduces operational risks and enhances financial stability, thereby easing financial pressures; second, the expansion of export markets due to reduced trade policy uncertainty broadens firms’ financing sources [5,22,29], shifting from a purely domestic financial market to a combined domestic and international financial market, thereby easing financing constraints. Similarly, research by Mao and Huang [30] finds that trade policy uncertainty increases firms’ financing costs, thereby inhibiting innovation.

Second, reducing trade policy uncertainty can promote green technology innovation through market competition. As trade barriers fall and trade restrictions are weakened, more firms enter the trade market, fostering a competitive environment. To succeed in this environment, firms are more motivated to improve their innovation capabilities. According to market competition theory, Xu et al. [31] suggest that trade openness promotes the efficiency of green development through competitive effects. Increased competition accelerates the survival-of-the-fittest mechanism, which pushes domestic firms to innovate and update their products, thereby improving productivity and competitiveness. Cai and Zhou [32] empirically studied the main factors influencing green technology innovation in Chinese firms, finding that the green demands of customers and competitors drive green innovation. In support of this, Li [33] argues that government institutional pressure, foreign customer pressure, and competitive pressure positively influence green innovation in China. More directly, using data on new patents, IT, R&D, and production, Bloom et al. [4] show that trade competition forces low-tech firms out of the market and encourages incumbents to accelerate technological innovation and shift production to more sustainable and environmentally friendly products and technologies. Based on the above analysis, this paper proposes the following hypotheses:

H1:

The reduction in trade policy uncertainty significantly promotes firms’ green technology innovation.

H1a:

The alleviation of financing constraints is a channel through which reduced trade policy uncertainty promotes green technology innovation.

H1b:

Reduced trade policy uncertainty enhances green technology innovation through competitive effects.

3. Model Design and Data

3.1. The Difference-in-Differences Model

Based on Liu and Ma [7] and Handley et al. [21] (Liu and Ma [7] analyzed the impact of the decrease in trade policy uncertainty following China’s accession to the WTO using DID methods, combining data from Chinese firms, trade, and micro-level patents. Handley et al. [21] employed the DID method to study the effects of the reduced trade policy uncertainty following China’s WTO accession on firms’ import decisions), we utilize the permanent normal trade relation (PNTR) agreement between China and the United States, signed after China’s accession to the WTO, to examine the impact of reduced trade policy uncertainty on firms’ green technology innovation using a difference-in-differences (DID) approach. The baseline DID model is specified as follows:

In Equation (1), the subscripts , , and denote firms, industries, and years, respectively. represents the dependent variable, which reflects the green innovation performance of enterprises. Since green patents most directly reflect the output of enterprises’ green technology innovation activities, which can be directly quantified and have a clear technology classification, the patent data can be further categorized according to the type of technology. At the same time, considering the long patent application process, the use of patent application data rather than patent licensing data can be more time-sensitive to examine the impact of policies on enterprises’ green technology innovation activities. Specifically, this study uses the natural logarithm of the total number of a firm’s green patent applications plus one. In addition, green patent applications are categorized into green invention patents () and green utility patents () for separate analysis.

is the key explanatory variable, representing the level of trade policy uncertainty in industry before China joined the WTO. We follow the methodology of Handley [34] to construct the TPU index. The trade policy uncertainty index at the HS six-digit product level is defined as follows:

In Equation (2), and represent the US Smoot–Hawley and most-favored-nation (MFN) tariff rates, respectively, at the product level in 2001. is the substitution elasticity, which is set at three based on the existing literature. Since there is a zero value for tariffs, and in order to avoid missing values for the indicators of trade policy uncertainty, which would reduce the total number of samples, we follow Handley and Limão [29] by adding one to the tariff rates before calculation. The six-digit product-level TPU index is then averaged to the four-digit industry level . is a dummy variable for the time of policy implementation, which is set to one for 2002 and the subsequent years. The estimated coefficient of the interaction term reflects the difference in firms’ green patent applications between industries with high and low tariff differential before and after China’s WTO accession, illustrating the impact of reduced trade policy uncertainty on firms’ green technology innovation. suggests that firms in high-tariff-difference industries increased their green patent applications more than those in low-tariff-difference industries, indicating that reduced trade policy uncertainty promotes firms’ green technology innovation.

Given the potential impact of other firm-level factors on green technology innovation, this study includes a number of firm economic characteristics as the control variables: (1) Enterprise size: Based on the production function framework, where patents are considered outputs, and capital and labor are input factors. It is generally believed that larger enterprises will make more stable investments to maintain their development level for the sustainability of their own development [35]. Therefore, we use the total assets and total number of employees of the firms in the sample to measure the firm size, and use and to represent them after taking the logarithm. (2) Enterprise age: It is generally believed that firms with a longer history have a stronger sense of innovation. Therefore, the age of the firms in the sample is selected as a control variable to represent the maturity of the enterprise, and is expressed as after taking the logarithm. (3) Market value to capital replacement value ratio: It is generally believed that the ability of firms to create social wealth is related to their ability to create value that exceeds the cost of investment. The stronger this ability, the stronger the innovation consciousness of the company. is the ratio of the company’s market value to the replacement value of its capital. The larger the ratio, the more social wealth the company has created. Therefore, this paper selects the of the firms in the sample as the control variable to measure the social wealth creation ability of the enterprise, and takes the logarithm of it to express it as (4) Debt ratio: Research indicates that a firm’s debt level reflects its creditworthiness as perceived by the market [36]. A moderate level of debt can allow a company to have more funds for innovation activities. The ratio of total debt to total assets of the sampled listed companies is used as a control variable to represent a company’s credit rating, and is expressed as after taking the logarithm. (5) Proportion of R&D employees: Research shows that R&D expenditure is directly related to innovation activities [37]. We use the ratio of R&D personnel to total employees () as a control variable to represent the proportion of R&D employees in the sample firms. (6) Enterprise performance and governance structure: Considering the impact of the variables related to corporate performance and governance structure on the green technology innovation of enterprises, we also control the return on assets (), capital intensity (), the shareholding ratio of the top ten shareholders (), and the proportion of independent directors (). Among them, the return on assets is expressed as the ratio of net profit to the total equity attributable to the parent company’s owners at the end of the period. Capital intensity is measured by the logarithm of the ratio of fixed assets to total employees. Top ten shareholder ownership is the fraction of shares held by the top ten shareholders. The proportion of independent directors is the ratio of independent directors to the total number of board directors. The regression also controls for firm fixed effects and year fixed effects , and is a random error term.

3.2. Data

The main research object of this paper is the manufacturing listed companies in the Chinese stock market from 2000 to 2020. The patent data of the listed firms are mainly obtained from the State Intellectual Property Office of China, and the firm-level economic data are obtained from the China Stock Market & Accounting Research Database (CSMAR) database. The data to measure trade policy uncertainty are taken from Feenstra et al. [38], including the Smoot–Hollis tariff rate and the MFN tariff rate at the HS eight-digit product level. Green patents for the listed companies are identified and extracted based on the “Green Inventory of International Patent Classification” launched by the World Intellectual Property Organization (WIPO) in 2010, combined with the International Patent Classification codes. The Green Inventory classifies patents into seven major categories according to the United Nations Framework Convention on Climate Change standards: Transportation, Waste Management, Energy Conservation, Alternative Energy Production, Administrative Regulatory or Design Aspects, Agriculture or Forestry, and Nuclear Power Generation.

The sample data are processed as follows: financial, real estate, and other service industries are excluded, retaining only the listed companies in the manufacturing sector; listed companies under ST and ST* status during the sample period are excluded; listed companies with a debt ratio less than 0 and greater than 1 are removed. After processing, 25,286 valid “firm-year” observations were obtained, covering 2754 listed manufacturing companies. Due to incomplete data for some control variables, the sample size may vary across different regressions. The descriptive statistics of the main explanatory variables are shown in Table 1.

Table 1.

Descriptive statistics.

4. Empirical Analysis

4.1. Basic Regression Results

To test hypothesis H1, this study uses the difference-in-differences method to perform a regression on Equation (1). Table 2 presents the baseline regression results of the impact of trade policy uncertainty reduction on firms’ green technology innovation. Columns (1) and (2) show the total number of green patent applications, columns (3) and (4) show the number of green invention patent applications, and columns (5) and (6) show the number of green utility patent applications. Columns (1), (3), and (5) include only firm- and time fixed effects, while columns (2), (4), and (6) add all the control variables. According to the estimation results in column (1) of Table 2, the coefficient of the interaction term is significantly positive at the 1% statistical level (β = 0.5386, p < 1%), indicating that the number of green patent applications by firms in the treatment group (industries with a greater reduction in trade policy uncertainty) increased significantly compared to the control group (industries with a smaller reduction in trade policy uncertainty) after China joined the WTO. This supports hypothesis 1, suggesting that the reduction in trade policy uncertainty has promoted the level of green technology innovation in firms. In column (2), after adding all the control variables, the significance and sign of the coefficient remain unchanged, but its absolute value increases slightly, indicating the presence of internal factors within firms that further enhance green innovation.

Table 2.

Benchmark regression.

When distinguishing between different types of green patents, the coefficient is significantly positive in columns (4) and (6) at the 1% and 5% levels (β = 0.5109, p < 1%; β = 0.3622, p < 5%), respectively, indicating that reduced trade policy uncertainty increases both green invention and green utility patent applications. Moreover, the absolute values of the coefficients suggest that the reduction in trade policy uncertainty has a greater impact on green invention patents than on green utility patents. Green invention patents represent major technological innovations, while utility patents are improvements to the existing technologies. The larger coefficient for green invention patents suggests that in a stable policy environment, firms are more optimistic about future market demand and are more inclined to invest in forward-looking and strategically significant invention patent innovations.

The estimation results of the control variables indicate that labor and capital inputs, the proportion of R&D personnel, the market value to capital replacement value ratio, and return on equity positively influence firms’ green technology innovation, aligning with the theoretical expectations. However, the estimation coefficients for firm age, debt ratio, capital intensity, shareholding ratio of the top ten shareholders, and the proportion of independent directors are not significant, suggesting that these factors may not be crucial determinants of firms’ green technology innovation.

4.2. Validity Tests of the DID Method

4.2.1. Anticipation Effect

To ensure the effectiveness of the difference-in-differences (DID) method, this paper first examines whether firms exhibit the anticipated effects. If certain firms anticipated the outcomes of trade negotiations between China and the United States due to domestic regulations or technological advancements before China joined the WTO, and thus formed expectations regarding green technology innovation investments, this would undermine the assumption of “common time trends” between the treatment and control groups, leading to biased empirical estimation results. To test for this, a dummy variable for the year before China joined the WTO () and its interaction with () are added to the baseline DID model. As shown by the estimation results in column (1) of Table 3, the coefficient of the added interaction term is not significant, while the coefficient of the main interaction term remains significantly positive (β = 0.5702, p < 1%). This indicates that the firms did not form expectations for adjusting green technology innovation investments prior to the implementation of PNTR.

Table 3.

Validity test of the DID identification.

4.2.2. Placebo Test

This section further employs data samples from before China joined the World Trade Organization (WTO) for a placebo test. Specifically, since the trade policy uncertainty index did not show significant changes between 2000 and 2001, we expect that the trade policy uncertainty coefficient will not be significant when conducting ordinary least squares (OLS) regression on the firm data from this period. This analysis allows us to verify that the coefficient should be insignificant when there are no significant fluctuations in trade policy uncertainty, thus supporting the validity of the difference-in-differences estimation results. The placebo test results in column (2) of Table 3 indicate that the coefficient is indeed not significant, further confirming the reliability of the difference-in-differences estimates in this paper. By performing this verification step, we ensure the robustness of the study’s conclusions, ruling out the potential impact of the periods with no significant changes in trade policy uncertainty on the results. This finding further reinforces the credibility of the conclusion that reduced trade policy uncertainty promotes firms’ green technology innovation. estimation results.

4.2.3. Two-Period DID Method

The estimation of multi-period difference-in-differences (DID) models may be subject to serial correlation, potentially affecting the results. To mitigate this issue, the sample data are divided into two periods: 2000–2001 and 2002 onwards. Within each period, firm variables are averaged, and the DID method is applied for analysis. This approach compares changes in firms’ green technology innovation levels across different time periods to assess the impact of trade policy uncertainty. Here, the first period (2000–2001) is treated as the control group, while the second period (2002 onwards) is treated as the treatment group to observe the effects of policy changes. This period-based division helps to control for serial correlation more effectively. The estimation results in column (3) of Table 3 show that the coefficient of the interaction term is significantly positive, and the estimation results in column (3) of Table 3 show that the coefficient of the interaction term is 0.4335 and significantly positive at the 1% level. This result aligns with those obtained using the multi-period DID method, further validating the positive impact of reduced trade policy uncertainty on firms’ green technology innovation.

4.2.4. Dynamic Effects and Parallel Trends Tests

The difference-in-differences method used previously estimated the average difference in green patent applications between the control and treatment groups before and after China obtained permanent normal trade relation (PNTR) status, assessing the average impact of reduced trade policy uncertainty on firms’ green technology innovation. Building on this, the study replaces the policy implementation time dummy variable with annual dummy variables to estimate the dynamic effects of annual coefficient differences. The specific extended model is as follows:

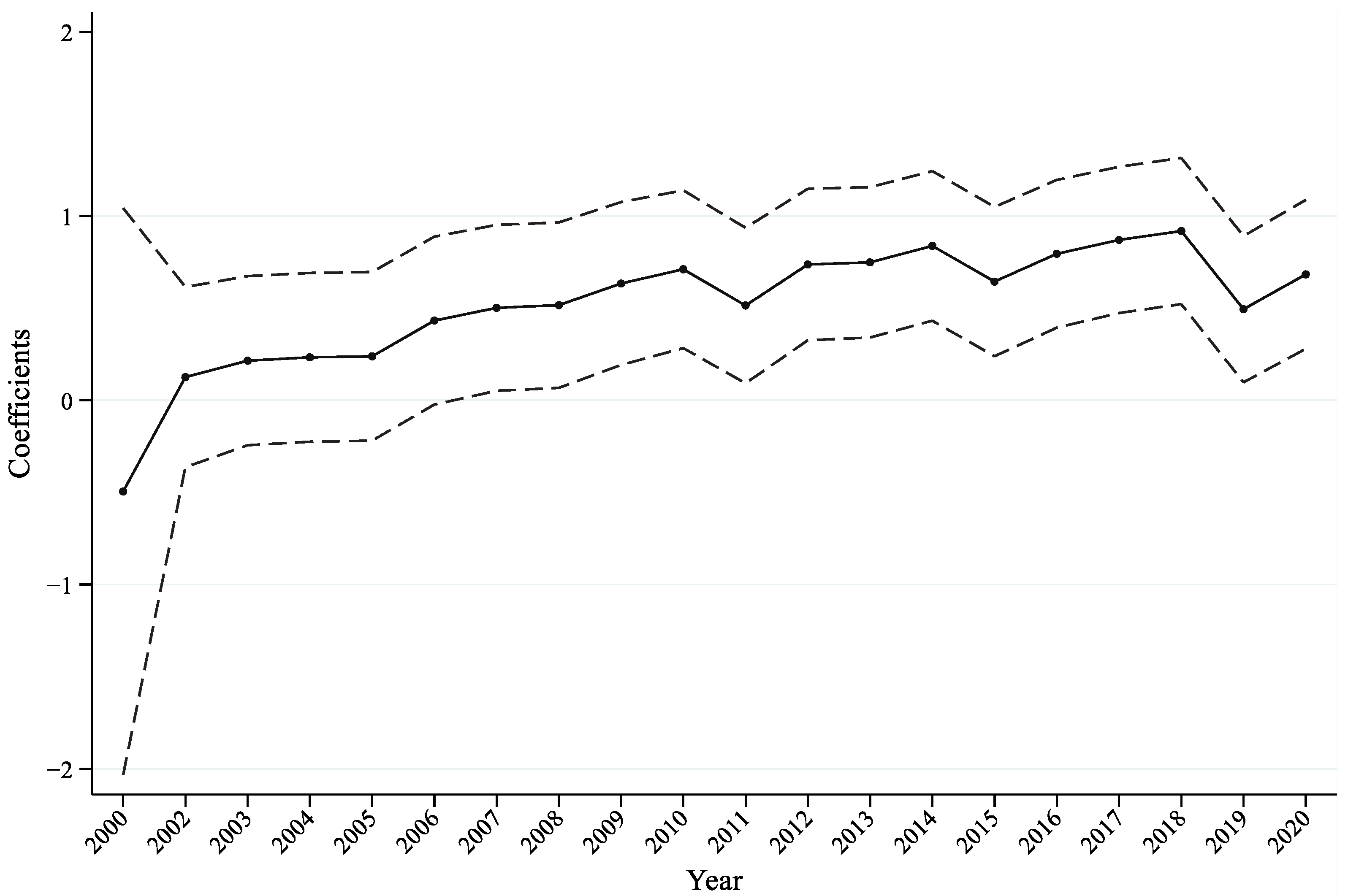

where represents the time dummy variable and according to Jia [39], t the year before policy implementation, 2001, is used as the baseline group. The advantage of estimating Equation (3) is twofold; on one hand, it allows us to test whether the green technology innovations of the treatment and control groups meet the parallel trends assumption prior to the policy shock. On the other hand, it enables us to examine the dynamic effects of reduced trade policy uncertainty on firms’ green technology innovation. Column (4) of Table 3 shows the estimation results for selected years based on Equation (3). The coefficients of the interaction terms indicate that the coefficient for 2000 is not significant, suggesting no significant differences between the control and treatment groups before obtaining PNTR, thus satisfying the parallel trend assumption prior to policy implementation. Starting from 2002, the coefficients are positive but not significant, while from 2006 onwards, the coefficients are significantly positive (β = 0.4323, p < 10%), indicating that the impact of reduced trade policy uncertainty on firms’ green patent applications is lagged but has long-term effects. To illustrate this more clearly, Figure 1 presents the estimation results of Equation (3).

Figure 1.

Coefficients and 95% confidence intervals for the interaction term . The solid line represents the dynamic effect over time of reduced trade policy uncertainty on the number of firms’ green patent applications, and the dashed lines indicate the 95% confidence interval.

4.3. Other Robustness Tests

4.3.1. Controlling for Industry Time Trends

Green technology innovation in firms may be influenced by industry-specific factors that are unobserved, leading to varying time trends in employment changes across different industries. If this is the case, then the interaction term may be correlated with the random error term , and the outcome variables for the treatment and control groups could follow different time trends, potentially biasing the DID estimation results. To test whether unobserved industry-specific factors substantively impact the results of this study, we follow the approach of Liu and Qiu [40] by including industry-specific linear time trends as the control variables in the baseline DID model for estimation. The estimation results from columns (1) to (3) of Table 4 show that the coefficients for the interaction term are significantly positive (β = 0.2781, p < 1%; β = 0.1828, p < 1%; β = 0.3309, p < 1%), indicating that unobserved industry-specific factors do not substantively affect the core conclusions of this paper.

Table 4.

Other robustness tests.

4.3.2. Alternative Measures of Green Technology Innovation

To enhance the robustness of our estimation results, this section employs the number of green patents obtained by the firms within the same year as a measure of corporate green technology innovation. Similar to the baseline regression, the number of green patents obtained in the current year is subdivided into the number of green invention patents and the number of green utility model patents obtained. Columns (4)–(6) of Table 4 list the dependent variables as the number of green invention patents, the number of green utility model patents, and the total number of green patents obtained within the year, respectively. The estimation results show that the coefficients for the interaction term are significantly positive (β = 0.3216, p < 1%; β = 0.3298, p < 1%; β = 0.4778, p < 1%), indicating that the conclusion that the decline in TPU enhances firms’ green technology innovation remains robust regardless of the measurement method of the dependent variable.

5. Mechanism and Heterogeneity Analysis

5.1. Mechanism

5.1.1. Financing Constraints

As discussed in the theoretical framework above, the availability of finance plays an important role in firms’ innovation activities. Green technology innovation requires substantial capital investment for transformative changes, so firms are more susceptible to financing constraints when engaging in green technology innovation. However, the reduction in trade policy uncertainty can lower operational risks and financial pressures for enterprises. It can also broaden enterprises’ access to financial markets, shifting from relying solely on domestic financial markets to utilizing both domestic and international markets. This expansion helps to ease the financing constraints faced by firms. This section adopts the measure of financing constraints developed by Manova et al. [41] to test hypothesis H1a, investigating whether the alleviation of financing constraints is a mechanism through which reduced trade policy uncertainty affects firms’ green technology innovation. Four dimensions are used for this measurement: (1) External financing dependence: The proportion of capital expenditure funded by non-operating cash flow, representing the external funds required for long-term investments. (2) Inventory ratio: The ratio of inventory to sales, indicating producers’ short-term working capital needs. (3) Tangible assets: The proportion of property, plant, and equipment in the total book value of assets. (4) Trade credit: The ratio of accounts payable to total assets, indicating the availability of trade credit.

Higher values for external financing dependence, inventory ratio, and trade credit indicate greater financing constraints, while higher values for tangible assets indicate lower financing constraints. This study maps the three-digit SITC codes provided by Manova et al. [42] to eight-digit HS product codes, and then to four-digit industry codes under the GB4754/T-2002 [43] standard using arithmetic averages to obtain the industry financing constraint indicator (). Higher values of this indicator suggest lower financing constraints. First, the following regression model is constructed to estimate the impact of trade policy uncertainty on financing constraints:

In Equation (4), is the mechanism variable, which here is represented by the industry-level financing constraints (). The results of estimating Equation (4) are presented in column (1) of Table 5. The coefficient of the interaction term is significantly positive (β = 0.4908, p < 1%), indicating that reduced trade policy uncertainty alleviates the financing constraint at the industry level. To further examine whether the alleviation of financing constraints is the channel through which reduced trade policy uncertainty affects firms’ green technology innovation, the mechanism variable and its interaction term with are introduced into the baseline model:

Table 5.

Mechanism test of financing constraints.

If the coefficient of the triple interaction term in Equation (5) is significantly positive, it indicates that the easing of financing constraints is an effective mechanism for the reduction in trade policy uncertainty to promote green technology innovation in firms. The estimated results in columns (2) to (4) of Table 5 demonstrate that the coefficient of the triple interaction term is significantly positive (β = 0.3895, p < 1%; β = 0.3421; p < 1%; β = 0.1979; p < 10%). This confirms that the reduction in trade policy uncertainty promotes firms’ green technology innovation by easing financing constraints.

5.1.2. Competitive Effects

The reduction in trade policy uncertainty promotes technological upgrades in firms, leading to lower product costs [29]. While costs decrease, competition among firms intensifies, which constrains their market opportunities. To thrive in this competitive environment, firms must innovate to update their products and increase added value, thereby enhancing production performance and competitiveness. To test whether the competitive effect is another mechanism through which reduced trade policy uncertainty promotes firms’ green technology innovation (hypothesis H1b), we use the inverse of the Herfindahl–Hirschman Index () to measure the level of market competition faced by firms. The is calculated as follows:

where is the market share of firm in industry , and the market share measured by the firm’s operating revenue. The is used as an inverse indicator of market competition within the industry: a lower value indicates a larger number of firms, more intense market competition, and a lower degree of monopolization. Column (1) of Table 6 presents the regression results with market competition () as the dependent variable. The coefficient of the interaction term is significantly positive at the 1% level, suggesting that market competition increased more in industries with initially high tariff differentials compared to those with initially low tariff differentials after China joined the WTO; that is, the reduction in trade policy uncertainty has intensified market competition, fostering a competitive market environment. Additionally, replacing the in Equation (5) with , the estimation results are shown in columns (2) to (4) of Table 6. It can be seen that the triple interaction term is significantly positive (β = 0.4955, p < 1%; β = 0.4234; p < 1%; β = 0.2977; p < 5%), indicating that market competition is indeed a significant mechanism through which reduced trade policy uncertainty influences firms’ green technology innovation.

Table 6.

Mechanism test of competitive effect.

5.2. Heterogeneity Analysis

5.2.1. Capital Intensity

Firms with different levels of capital intensity may respond differently to changes in trade policy due to variations in financial reserves and resource allocation. We divide the sample into two subsamples of high and low capital intensity based on the median capital intensity per capita, and analyze the heterogeneous response of the firms with different capital intensities to the decline in trade policy uncertainty. Table 7 reports the regression results for the above subsamples. In the low-capital-intensity group, the interaction term coefficients in columns (1) to (3) are all significantly positive (β = 0.4657, p < 1%; β = 0.3138, p < 5%; β = 0.3372; p < 5%). Conversely, in the high-capital-intensity group, the interaction term coefficient is only significant in column (5) (β = 0.5003; p < 10%). This suggests that the effect of reduced trade policy uncertainty on green technology innovation varies by capital intensity. Specifically, reduced trade policy uncertainty significantly promotes green technology innovation in low-capital-intensity firms. For high-capital-intensity firms, the overall effect is not significant, though there is a positive impact on green invention patent applications. This could be because high-capital-intensity firms, with substantial financial reserves, can bear high R&D costs and continually invest in equipment and technology, making them less susceptible to external financing constraints [42]. In contrast, low-capital-intensity firms are more vulnerable to market fluctuations and generally face greater financing constraints, making them more responsive to reduced trade policy uncertainty. A stable trade policy environment reduces financing risks, enabling low-capital-intensity firms to more easily secure the necessary funds for green technology innovation.

Table 7.

Heterogeneity analysis of capital intensity.

5.2.2. Growth Rate

A firm’s growth rate is a critical indicator of its development and operations. High-growth firms expand rapidly and may be more sensitive to changes in trade policy uncertainty. We use the year-over-year revenue growth rate to measure growth potential and divide firms into two subsamples: high-growth and low-growth. This division allows for the analysis of the differential effects of reduced trade policy uncertainty on firms with varying growth potentials. The results in Table 8 show that, except for column (3), the coefficients of the interaction terms are significantly positive, indicating that reduced trade policy uncertainty enhances the overall level of green technology innovation in both the high-growth and low-growth firms. However, the significance levels and the absolute values of the coefficients are higher for the high-growth firms. This phenomenon may be attributed to the rapid expansion and high economic efficiency of high-growth firms, which enable them to respond more swiftly to external trade shocks, engaging in higher value-added and more sustainable green innovation to maintain higher profits. In contrast, low-growth firms, due to their slower development, may experience delays in responding to trade policy changes, leading to relatively smaller improvements in their green technology innovation levels.

Table 8.

Heterogeneity analysis of growth.

5.2.3. Export Decisions

Although changes in external trade policies can impact non-exporting firms through spillover effects, the reduction in trade policy uncertainty has a direct impact on exporting firms [7]. Consequently, the green technology innovation of exporting firms is more likely to be influenced by reduced trade policy uncertainty. Since export information is lacking in the listed company data, this study matches the listed company data with Chinese customs data based on the year and company name. With micro-level export trade data available up to 2016, the matching sample period spans from 2000 to 2016, resulting in 15,954 firm-year observations. To test this hypothesis, we construct a dummy variable for exporting firms , which is set to one if a firm exports during the sample period. This dummy variable forms a triple interaction term with , which is then included in the baseline regression model for estimation. The regression results in columns (1) to (3) of Table 9 show that the coefficients of the triple interaction terms are significantly positive at the 1% level (β = 0.1908, p < 1%; β = 0.1996, p < 1%; β = 0.0869; p < 1%). This indicates that, compared to non-exporting firms, exporting firms’ overall green technology innovation levels are more positively influenced by reduced trade policy uncertainty.

Table 9.

Heterogeneity analysis of export decisions.

Furthermore, since the United States is the largest market for Chinese manufacturing exports, firms exporting to the United States are more directly affected by PNTR. Based on this, the study predicts that the green patent applications of firms exporting to the United States are more likely to be influenced by trade policy uncertainty. To test this, we construct a dummy variable for firms exporting to the , set to one if a firm exports to the United States during the sample period. This variable, along with the triple interaction term , is included in the baseline regression model (Equation (1)). The results in columns (4) to (6) of Table 9 show that the coefficients of the triple interaction terms are significantly positive (β = 0.1799, p < 1%; β = 0.1785, p < 1%; β = 0.0777; p < 10%), indicating that firms exporting to the United States experience a greater positive impact on their green technology innovation levels from reduced trade policy uncertainty compared to firms not exporting to the United States. Additionally, the absolute values of the coefficients indicate that the reduction in trade policy uncertainty has a relatively larger impact on green invention patent applications. Overall, the results in Table 9 suggest that the reduction in trade policy uncertainty due to PNTR implementation significantly enhances the green technology innovation levels of directly affected exporting firms and firms exporting to the United States, aligning with the theoretical expectations. This analysis further confirms the differential impact of reduced trade policy uncertainty on firms’ green technology innovation and provides empirical evidence for relevant policy formulation.

5.2.4. Regional Differences in Enterprises

Given that firms’ green technology innovation may be influenced by their location, this section divides the sample firms into two subsamples based on whether they are located in coastal regions. Table 10 reports the regression results for these subsamples, with columns (1)–(3) referring to enterprises in coastal regions and columns (4)–(6) referring to enterprises in inland regions. The estimation coefficients indicate that the reduction in trade policy uncertainty has a positive impact on green technology innovation in inland enterprises at a significance level of at least 5% (β = 0.5672, p < 1%; β = 0.5244, p < 1%; β = 0.3388, p < 5%). For firms in coastal regions, the reduction in trade policy uncertainty positively affects the total green patent applications and green invention patent applications at the 10% significance level (β = 0.4984, p < 10%; β = 0.3636, p < 10%), while the effect on green utility patent applications is not significant. This suggests that, compared to coastal enterprises, the reduction in trade policy uncertainty has a greater effect on promoting green technology innovation for inland enterprises. This may be because although coastal enterprises also benefit from stable trade policies, their relatively higher market maturity and diversified resource acquisition channels make the marginal impact of policy changes smaller.

Table 10.

Heterogeneity analysis of enterprise regional differences.

6. Discussion

Green technology innovation, as a crucial catalyst for maintaining environmental and economic sustainability, has attracted increasing research interest in recent years. Trade is an important channel for technology transfer across regions. However, its potential role in promoting green technological innovation is often overlooked in empirical studies. Research has shown that international trade can promote firm innovation through competition [4], expanded market access [28], and R&D investment complementarities [6]. Other scholars have examined the relationship between trade policy uncertainty and innovation, finding that trade policy uncertainty hinders innovation efforts, particularly for firms facing financing constraints [31]. Market uncertainty obstructs innovation as it typically requires substantial irreversible upfront investments [42], which in turn delays the transition to a sustainable green economy. We examine the impact of reduced trade policy uncertainty on firms’ green technology innovation through the lenses of financing costs and market competition. We find that reduced trade policy uncertainty significantly increases firms’ green patenting. In particular, the effect is more pronounced for green invention patents compared to green utility patents. This suggests that in a stable policy environment, firms are more optimistic about future market demand and more likely to invest in forward-looking and strategically significant invention patent innovations.

This study, however, has certain limitations that future research could address. First, it focuses on the impact of trade policy uncertainty on firm green technology innovation in the context of China joining the World Trade Organization (WTO) and signing the PNTR agreement with the US. However, it does not consider other multilateral agreements that China has entered into after WTO accession, such as the Regional Comprehensive Economic Partnership (RCEP) and the Trans-Pacific Partnership (TPP), as well as initiatives like the Belt and Road Initiative and the establishment of free trade zones. These subsequent trade policies provide valuable natural experiments for examining the impact of trade policy uncertainty and offer promising avenues for future research. Second, beyond financing constraints and competition effects, factors like R&D expenditure and human capital may also play significant roles in how trade policy uncertainty affects firms’ green technology innovation. Future research should explore these mechanisms to gain a more comprehensive understanding of the impact of trade policy uncertainty. Third, we use the number of green patent applications to represent a firm’s green technology innovation, which is a common measurement method but has certain limitations. For example, this method cannot exclude other unobservable factors that promote corporate innovation outside the pilot policy, such as innovation subsidy policies. Therefore, other methods to measure the green technology innovation of enterprises may be explored in the future.

7. Conclusions and Policy Implications

This study uses China’s accession to the WTO and the subsequent granting of PNTR status by the United States as a natural experiment. It systematically examines the effect of trade policy uncertainty on firms’ green patent applications using the difference-in-differences method. The results indicate that a reduction in trade policy uncertainty significantly increases firms’ green technology innovation, which remains robust to various validity checks. The reduction in trade policy uncertainty promotes green technology innovation by easing financing constraints and intensifying industry competition. Further analysis shows that the reduction in trade policy uncertainty significantly promotes green technology innovation in low-capital-intensive firms, while its impact on high-capital-intensive firms is not significant overall, but it does promote green invention patenting to some extent. In terms of firm growth, the reduction in trade policy uncertainty has a more pronounced impact on green technology innovation in high-growth firms. An examination of the differential impact on exporting firms using Chinese customs data shows that exporting firms, especially those exporting to the United States, experience a larger boost in green technology innovation from reduced trade policy uncertainty.

These findings provide micro-level evidence on how changes in foreign trade policy affect the development of green technology innovation by domestic firms and have important policy implications. First, understanding how reduced trade policy uncertainty promotes green technological innovation can help firms optimize innovation strategies, improve environmental technologies, and enhance competitiveness and sustainability. This is crucial for maintaining innovation momentum and market competitiveness in the face of external changes. Second, the Chinese government should focus on reducing trade policy uncertainty and maintaining a stable and favorable external trade environment. This approach would promote green technology innovation, reduce R&D risks and costs, and lay a solid foundation for a green economic transition. Given that a stable trade policy environment will further promote investment in green technology, enterprises should actively increase R&D investment in green technology, improve innovation management systems, and enhance resource-using efficiency. Third, enterprises need to establish sound innovation mechanisms, optimize internal resource allocation, and enhance technological R&D capabilities to achieve higher environmental performance and technological advancement. In addition, to continuously improve their innovation level and market competitiveness, enterprises should strengthen exchange and cooperation with international advanced technologies and experience, and learn from world-leading green technologies and management models. By adopting international best practices, enterprises can more effectively promote green technology innovation and achieve sustainable development.

Author Contributions

Methodology, X.Z.; Validation, X.Z.; Formal analysis, Y.C.; Investigation, M.P., X.W. and R.X.; Resources, X.Z., M.P., R.X. and Y.C.; Data curation, M.P., X.W., R.X. and Y.C.; Writing—original draft, X.W. and R.X.; Project administration, M.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fundation of China: No. 22CJY014.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hu, J.; Hu, M.; Zhang, H. Has the construction of ecological civilization promoted green technology innovation? Environ. Technol. Innov. 2023, 29, 102960. [Google Scholar] [CrossRef]

- Tu, Y.; Wu, W. How does green innovation improve enterprises’ competitive advantage? The role of organizational learning. Sustain. Prod. Consum. 2021, 26, 504–516. [Google Scholar] [CrossRef]

- Hao, X.; Li, Y.; Ren, S.; Wu, H.; Hao, Y. The role of digitalization on green economic growth: Does industrial structure optimization and green innovation matter? J. Environ. Manag. 2023, 325, 116504. [Google Scholar] [CrossRef] [PubMed]

- Bloom, N.; Draca, M.; Van Reenen, J. Trade induced technical change? The impact of Chinese imports on innovation, IT and productivity. Rev. Econ. Stud. 2016, 83, 87–117. [Google Scholar] [CrossRef]

- Handley, K.; Limao, N. Trade and investment under policy uncertainty: Theory and firm evidence. Am. Econ. J. Econ. Policy 2015, 7, 189–222. [Google Scholar] [CrossRef]

- Bøler, E.A.; Moxnes, A.; Ulltveit-Moe, K.H. R&D, international sourcing, and the joint impact on firm performance. Am. Econ. Rev. 2015, 105, 3704–3739. [Google Scholar]

- Liu, Q.; Ma, H. Trade policy uncertainty and innovation: Firm level evidence from China’s WTO accession. J. Int. Econ. 2020, 127, 103387. [Google Scholar] [CrossRef]

- Mehling, M.A.; van Asselt, H.; Das, K.; Droege, S.; Verkuijl, C. What a European ‘carbon border tax’ might look like. Nat. Clim. Chang. 2019, 9, 431–432. [Google Scholar]

- Branger, F.; Quirion, P. Would border carbon adjustments prevent carbon leakage and heavy industry competitiveness losses? Insights from a meta-analysis of recent economic studies. Ecol. Econ. 2014, 99, 29–39. [Google Scholar] [CrossRef]

- Peng, X.Y.; Zou, X.Y.; Zhao, X.X.; Chang, C.P. How does economic policy uncertainty affect green innovation? Technol. Econ. Dev. Econ. 2023, 29, 114–140. [Google Scholar] [CrossRef]

- Trencher, G.; Truong, N.; Temocin, P.; Duygan, M. Top-down sustainability transitions in action: How do incumbent actors drive electric mobility diffusion in China, Japan, and California? Energy Res. Soc. Sci. 2021, 79, 102184. [Google Scholar] [CrossRef]

- Borsatto, J.M.L.S.; Amui, L.B.L. Green innovation: Unfolding the relation with environmental regulations and competitiveness. Resour. Conserv. Recycl. 2019, 149, 445–454. [Google Scholar] [CrossRef]

- Petroni, G.; Bigliardi, B.; Galati, F. Rethinking the Porter hypothesis: The underappreciated importance of value appropriation and pollution intensity. Rev. Policy Res. 2019, 36, 121–140. [Google Scholar] [CrossRef]

- Yuan, B.; Xiang, Q. Environmental regulation, industrial innovation and green development of Chinese manufacturing: Based on an extended CDM model. J. Clean. Prod. 2018, 176, 895–908. [Google Scholar] [CrossRef]

- Borsatto, J.M.L.S.; Bazani, C.L. Green innovation and environmental regulations: A systematic review of international academic works. Environ. Sci. Pollut. Res. 2021, 28, 63751–63768. [Google Scholar] [CrossRef]

- Song, M.; Wang, S. Market competition, green technology progress and comparative advantages in China. Manag. Decis. 2018, 56, 188–203. [Google Scholar] [CrossRef]

- Wong, C.Y.; Wong, C.W.Y.; Boon-itt, S. Effects of green supply chain integration and green innovation on environmental and cost performance. Int. J. Prod. Res. 2020, 58, 4589–4609. [Google Scholar] [CrossRef]

- Wang, J.; Xue, Y.; Sun, X.; Yang, J. Green learning orientation, green knowledge acquisition and ambidextrous green innovation. J. Clean. Prod. 2020, 250, 119475. [Google Scholar] [CrossRef]

- Fan, J.; Zhou, Y. Empirical analysis of financing efficiency and constraints effects on the green innovation of green supply chain enterprises: A case study of China. Sustainability 2023, 15, 5300. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Handley, K.; Limão, N.; Ludema, R.D.; Yu, Z. Firm input choice under trade policy uncertainty. J. Int. Econ. 2024, 150, 103909. [Google Scholar] [CrossRef]

- Feng, L.; Li, Z.; Swenson, D.L. Trade Policy Uncertainty and Exports: Evidence from China’s WTO Accession. J. Int. Econ. 2017, 106, 20–36. [Google Scholar] [CrossRef]

- Pierce, J.R.; Schott, P.K. Investment Responses to Trade Liberalization: Evidence from US Industries and Plants; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Pierce, J.R.; Schott, P.K. The surprisingly swift decline of US manufacturing employment. Am. Econ. Rev. 2016, 106, 1632–1662. [Google Scholar] [CrossRef]

- Aghion, P.; Dechezleprêtre, A.; Hemous, D.; Martin, R.; Van Reenen, J. CEP Discussion Paper No 1178 November 2012 Carbon Taxes, Path Dependency and Directed Technical Change: Evidence from the Auto Industry. 2012. Available online: https://citeseerx.ist.psu.edu/document?repid=rep1&type=pdf&doi=e86b9076f33a272e5029207dd62448966c2ae7b6 (accessed on 14 July 2024).

- Huang, L.; Ying, Q.; Yang, S.; Hassan, H. Trade credit financing and sustainable growth of firms: Empirical evidence from China. Sustainability 2019, 11, 1032. [Google Scholar] [CrossRef]

- Tang, D.; Chen, W.; Zhang, Q.; Zhang, J. Impact of digital finance on green technology innovation: The mediating effect of financial constraints. Sustainability 2023, 15, 3393. [Google Scholar] [CrossRef]

- Hashmi, R.; Alam, K. Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: A panel investigation. J. Clean. Prod. 2019, 231, 1100–1109. [Google Scholar] [CrossRef]

- Handley, K.; Limão, N. Policy uncertainty, trade, and welfare: Theory and evidence for China and the United States. Am. Econ. Rev. 2017, 107, 2731–2783. [Google Scholar] [CrossRef]

- Mao, K.; Huang, J. How does climate policy uncertainty affect green innovation? Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 15745. [Google Scholar] [CrossRef] [PubMed]

- Xu, Y.; Dong, B.; Chen, Z. Can foreign trade and technological innovation affect green development: Evidence from countries along the Belt and Road. Econ. Chang. Restruct. 2022, 55, 1063–1090. [Google Scholar] [CrossRef]

- Cai, W.; Zhou, X. On the drivers of eco-innovation: Empirical evidence from China. J. Clean. Prod. 2014, 79, 239–248. [Google Scholar] [CrossRef]

- Li, D.; Zheng, M.; Cao, C.; Chen, X.; Ren, S.; Huang, M. The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. J. Clean. Prod. 2017, 141, 41–49. [Google Scholar] [CrossRef]

- Handley, K. Exporting under trade policy uncertainty: Theory and evidence. J. Int. Econ. 2014, 94, 50–66. [Google Scholar] [CrossRef]

- Bu, M.; Qiao, Z.; Liu, B. Voluntary Environmental Regulation and Firm Innovation in China. Econ. Model. 2020, 89, 10–18. [Google Scholar] [CrossRef]

- Kaur, J.; Vij, M.; Chauhan, A.K. Signals influencing corporate credit ratings—A systematic literature review. Decision 2023, 50, 91–114. [Google Scholar] [CrossRef]

- Autor, D.; Dorn, D.; Hanson, G.H.; Pisano, G.; Shu, P. Foreign competition and domestic innovation: Evidence from US patents. Am. Econ. Rev. Insights 2020, 2, 357–374. [Google Scholar] [CrossRef]

- Feenstra, R.C.; Romalis, J.; Schott, P.K.U.S. Imports, Exports, and Tariff Data, 1989–2001. National Bureau of Economic Research. 2002. Available online: https://www.nber.org/papers/w9387 (accessed on 14 July 2024).

- Jia, R. The legacies of forced freedom: China’s treaty ports. Rev. Econ. Stat. 2014, 96, 596–608. [Google Scholar] [CrossRef]

- Liu, Q.; Qiu, L.D. Intermediate input imports and innovations: Evidence from Chinese firms’ patent filings. J. Int. Econ. 2016, 103, 166–183. [Google Scholar] [CrossRef]

- Manova, K.; Wei, S.J.; Zhang, Z. Firm exports and multinational activity under credit constraints. Rev. Econ. Stat. 2015, 97, 574–588. [Google Scholar] [CrossRef]

- Hall, B.H.; Lerner, J. The financing of R&D and innovation. In Handbook of the Economics of Innovation; North-Holland: Amsterdam, The Netherlands, 2010; Volume 1, pp. 609–639. [Google Scholar]

- GB 4754-2002; National Economy Industry Classification. China Standards Press: Beijing, China, 2002.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).