Abstract

The energy sector’s long-term sustainability increasingly relies on widespread renewable energy generation. Shared energy storage embodies sharing economy principles within the storage industry. This approach allows storage facilities to monetize unused capacity by offering it to users, generating additional revenue for providers, and supporting renewable energy prosumers’ growth. However, high investment costs and long payback periods often hinder the development of battery storage. To address this challenge, we propose a shared storage investment framework. In this framework, a storage investor virtualizes physical storage equipment, enabling prosumers to access storage services as though they owned the batteries themselves. We adopt a cooperative game approach to incorporate storage sharing into the design phase of energy systems. To ensure a fair distribution of cooperative benefits, we introduce a benefit allocation mechanism based on contributions to energy storage sharing. Utilizing realistic data from three buildings, our simulations demonstrate that the shared storage mechanism creates a win–win situation for all participants. It also enhances the self-sufficiency and self-consumption of renewable energy. This paper provides valuable insights for shared storage investors regarding optimal design and benefit allocation among multiple stakeholders.

1. Introduction

The implementation of China’s ambitious “dual carbon” goals has catalyzed a substantial increase in the deployment of distributed renewable energy systems within the framework of the emerging power infrastructure [1]. There has been a significant increase in renewable energy systems operating as prosumers within local communities, such as microgrids, in the pursuit of a low-carbon society [2]. These systems, which both consume and produce energy, are emerging as pivotal elements in the energy transition towards low-carbon and sustainable paradigms [3]. Despite the numerous advantages of renewable energy sources, their inherent variability and intermittency pose significant challenges to the stability and reliability of community power systems [4,5]. In response to these challenges, the concept of shared energy storage has emerged as a promising approach, leveraging the principles of the sharing economy to provide crucial support for renewable energy development. It effectively mitigates the temporal and spatial imbalances between stochastic power generation and consumption in communities, and it capitalizes on the fact that the net loads of multiple prosumers can differ at the same time [6,7]. In light of the Chinese government’s strong policy support for both energy storage and renewable energy development, coupled with the demonstrated advantages of the sharing economy model, there is a pressing need for comprehensive research into the planning and operation of shared storage systems in community settings [8,9].

The operational intricacies of shared energy storage systems have garnered substantial scholarly interest within the domain of energy storage sharing [10]. Researchers typically approach the management of these systems by formulating it as an optimization problem, which is generally categorized as either single-level or bi-level in nature [11,12]. In the case of bi-level structures, researchers often employ the alternating direction multiplier method to address the intricate interactions between different levels [13]. Game theory has emerged as a powerful alternative framework for analyzing storage-sharing dynamics among multiple stakeholders [14]. For instance, Modified auction-based methods have been proposed to examine storage ownership sharing between multiple shared facility controllers and residents [15]. A periodically organized auction mechanism has been developed to allocate shared storage resources among various market players and their associated applications [16]. Drawing inspiration from the sharing economy model, researchers have introduced the concept of an energy bank system. This system serves as a trading platform for multiple microgrids and energy storage devices, utilizing a call-auction method for energy sharing [17]. In auction-based mechanisms, participants can place single bids or combinations of bids called packages [18]. Furthermore, coalitional game theory has been applied to investigate the potential benefits of power systems where end-users share storage resources. These studies have demonstrated the effectiveness of cooperative storage sharing in enhancing overall system performance [19]. To optimize the utilization of shared storage, researchers have proposed an energy capacity trading and operation game. This approach aims to minimize energy operation costs by allowing each participant to determine capacity trading and day-ahead charging–discharging profiles based on their assigned capacity [20]. While the existing literature has made significant strides in addressing the optimal operation of shared storage systems, there is a notable gap in research concerning the investment planning of energy storage facilities. This oversight is particularly significant given that effective planning for shared energy storage is crucial for achieving optimal economic performance during the operational stage.

The rapid proliferation of renewable energy systems has underscored the critical importance of designing robust energy storage systems capable of managing high penetrations of variable renewable energy generation [21]. Conventional planning models typically encompass installation, operation, and maintenance costs [22] while also incorporating scenarios such as ancillary services participation [23], demand response mechanisms [24], and network reconfiguration strategies [25]. However, there remains a notable paucity of research addressing the investment planning of shared storage. In the context of shared storage design, two primary cooperation frameworks have emerged: one where end-users individually invest in battery storage and share their unused capacities within the community [26], and another where a third-party investor installs the storage and interacts with prosumers [27]. The latter framework involves a third-party investor coordinating storage information to implement energy storage sharing within the community. An investment decision model under this framework analyzes sizing strategies for shared storage systems and energy trading behaviors among participants, with the Nash bargaining solution method allocating collective benefits [28]. Furthermore, a Stackelberg game-theoretic approach embedded in the shared storage planning model has been proposed, considering storage sharing among energy prosumers at the design phase, with the storage investor as the leader and energy prosumers as followers [29]. Focusing on the role of community storage systems, a cooperative game model is developed to study the investment cost sharing among consumers who invest in the storage [30]. The cost sharing is based on three factors: investment cost, the correlation coefficient between consumer i and others, and the variance of energy deviation. Despite the exploration of shared storage planning in existing literature, little literature focus on cooperative game theory, which integrates local supply and demand resources to maximize social welfare, the primary concern of sharing participants.

In light of these research gaps, two key challenges emerge: (1) Optimizing the investment strategy of shared storage systems by effectively coordinating prosumer resources; (2) developing a fair and efficient method for allocating the cooperative surplus of the shared storage mechanism among participants. To address these challenges, this paper optimizes the design strategy of shared storage systems among prosumers with renewable generators in community settings while ensuring equitable profit allocation. The proposed storage capacity sharing mechanism coordinates economic interactions among stakeholders and balances participant interests, providing valuable guidelines for managers to allocate cooperative surplus among sharing participants.

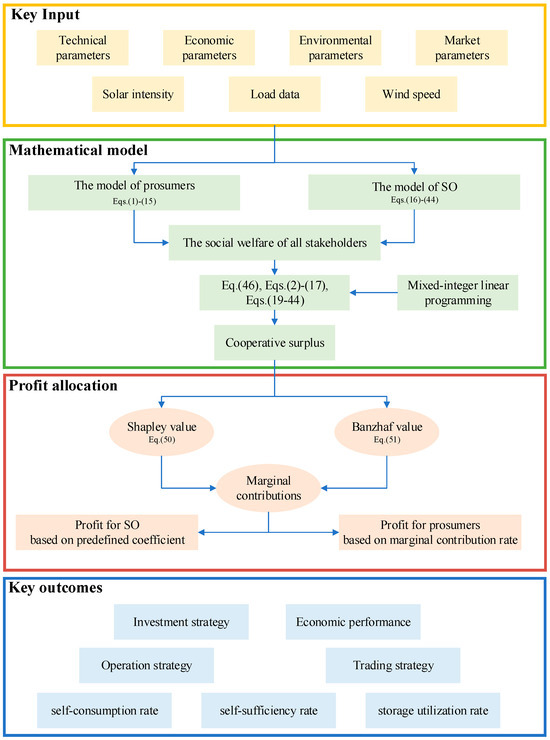

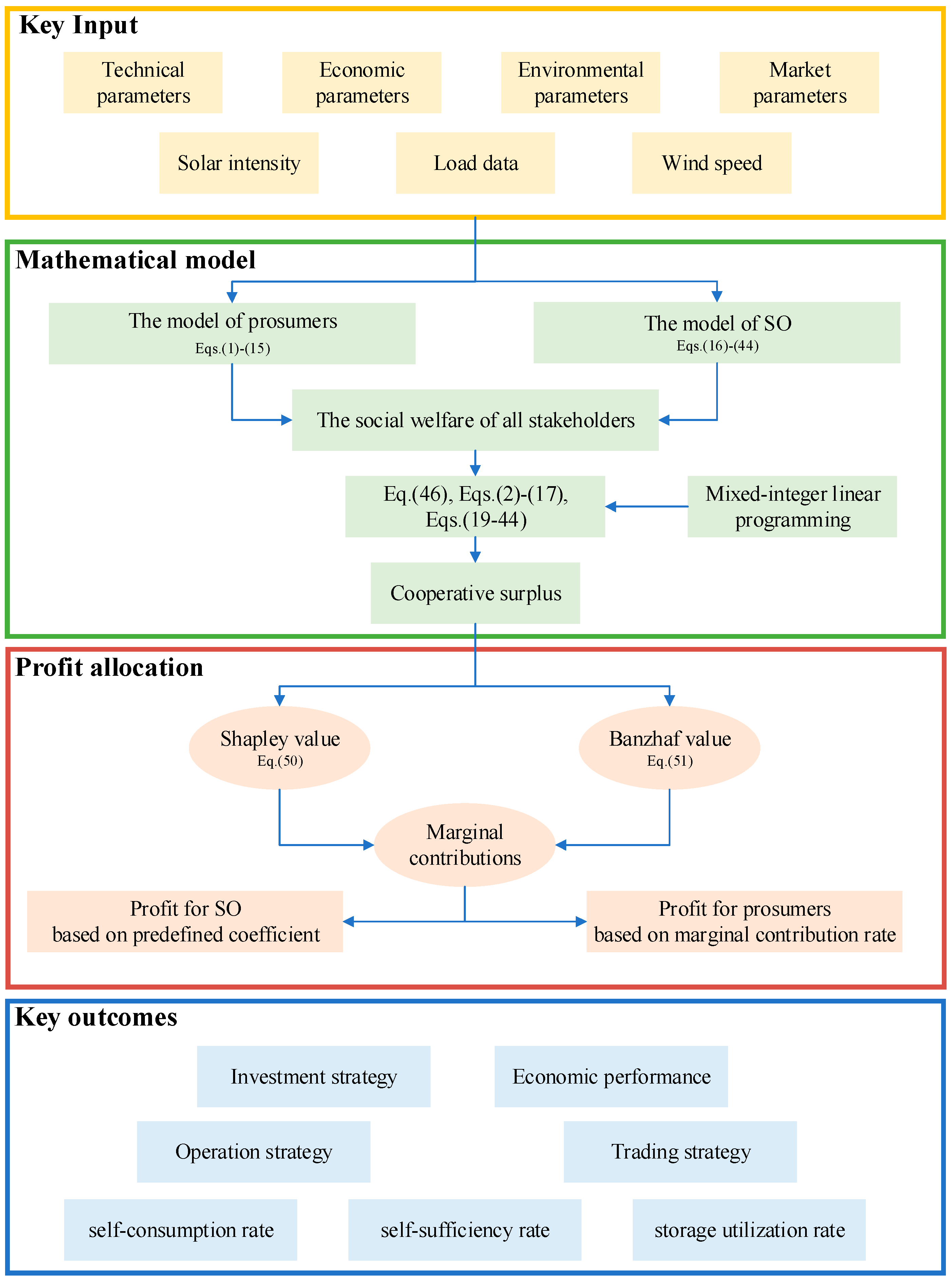

The main contributions of this paper are two-fold:

(1) Development of a comprehensive demand-side storage sharing framework that encompasses both the investment model and profit allocation method for shared energy storage systems, designed to maximize resource utilization efficiency;

(2) Application of cooperative game theory to the planning of shared energy storage, with the introduction of the Shapley value and Banzhaf value to evaluate each participant’s contribution to storage sharing. The proposed approach ensures a realistic and cost-effective maximization of resource utilization.

The structure of this paper is organized as follows. Section 2 introduces the storage-sharing framework. Section 3 establishes the mathematical models for prosumers and the storage investor. Section 4 develops the benefit allocation scheme for storage sharing among the investors and prosumers. Section 5 presents a case study as an illustrative example of the proposed framework. Section 6 summarizes the main findings and draws conclusions.

2. Storage Sharing Framework

In community-based energy systems, prosumers typically employ grid-connected renewable energy systems without integrated storage capabilities. These prosumers can purchase electricity from the utility grid and export excess power back to it. However, to maximize renewable energy utilization and further reduce costs, prosumers are increasingly incentivized to invest in storage technologies.

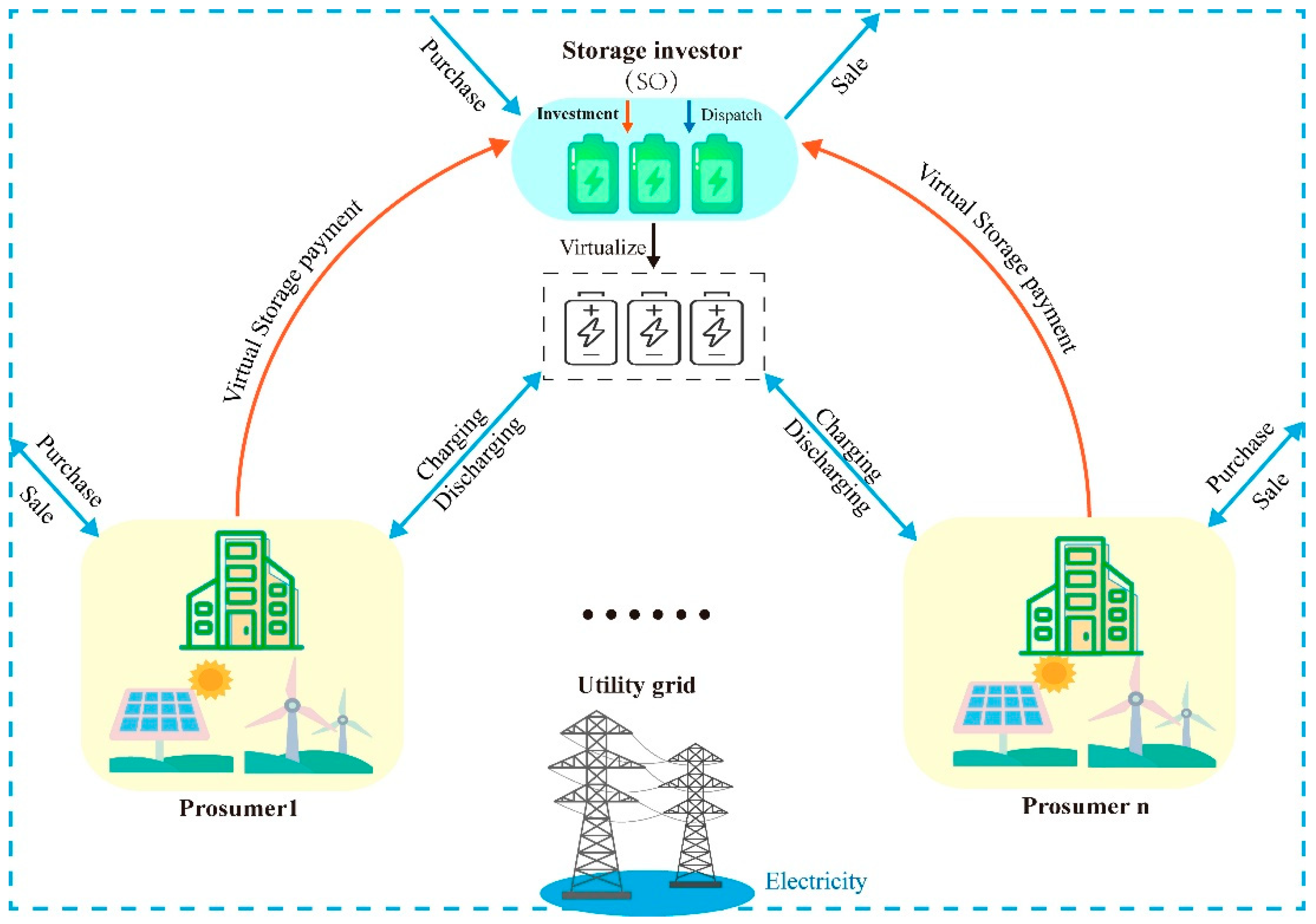

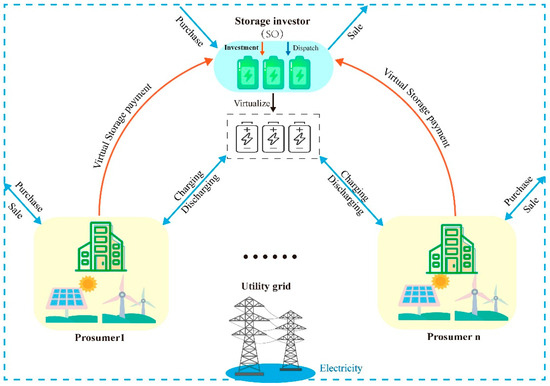

This paper examines two distinct models for energy storage investment within a community setting. (1) Individual Storage Mode: in this model, individual prosumers invest in their own battery ESS for exclusive personal use. This approach allows for a degree of decoupling between supply and demand, thereby enhancing energy system flexibility. The individual mode serves as the baseline for comparison in this study. (2) Shared Storage Mode: this mode introduces the concept of storage capacity sharing as a service provided by a third-party investor, referred to as the Storage Operator (SO), as illustrated in Figure 1. The SO invests in and operates the shared storage. The shared energy storage mode is characterized by the following key features. (a) Contractual agreement: The SO and prosumers enter into a contractual arrangement wherein prosumers purchase capacities from the SO. (b) Virtual storage service: The SO manages a shared ESS, offering charging and discharging services to all energy prosumers who signed the contract. This service is essentially virtual, not solely dependent on a physical storage system. (c) Complementary behavior exploitation: The SO capitalizes on the complementary charging and discharging behaviors among all prosumers, arising from their varying renewable generation and load curves, to offset a portion of the storage demands. (d) Grid interaction: The SO engages in real-time electricity trading with the grid to provide storage services when the prosumers’ total charging or discharging requirements exceed the physical storage capacity. (e) Virtual capacity: The SO does not need to own all the storage capacity it sells to prosumers; it just needs to satisfy the charging and discharging schedules of prosumers, effectively making the storage virtually shared.

Figure 1.

System structure of shared energy storage mode.

Despite the virtual nature of the storage service, prosumers can perform real-time charging and discharging operations as if using actual batteries without compromising their comfort. The shared storage mode offers several advantages over the personal energy storage mode. (a) Economic efficiency: The SO creates profit margins by leveraging both the discrepancy between real and virtual storage capacities and market price variations. (b) Win–Win scenario: The shared model creates a mutually beneficial situation for both the SO and prosumers.

The establishment of the storage-sharing mode necessitates the development of an appropriate profit allocation mechanism. To address this critical aspect and balance individual and collective interests, we employ cooperative game theory to design a fair and efficient profit allocation mechanism. This approach not only optimizes the economic benefits for all participants but also ensures the long-term sustainability of the shared energy storage model. By leveraging cooperative game theory, we can account for the diverse contributions and needs of each participant, fostering a more equitable and robust energy-sharing ecosystem.

The subsequent sections of this paper will delve into the mathematical formulation of this model, the specific allocation mechanisms derived from cooperative game theory, and a case study demonstrating the practical implications of this innovative approach to community energy storage.

5. Case Study

5.1. Data Description

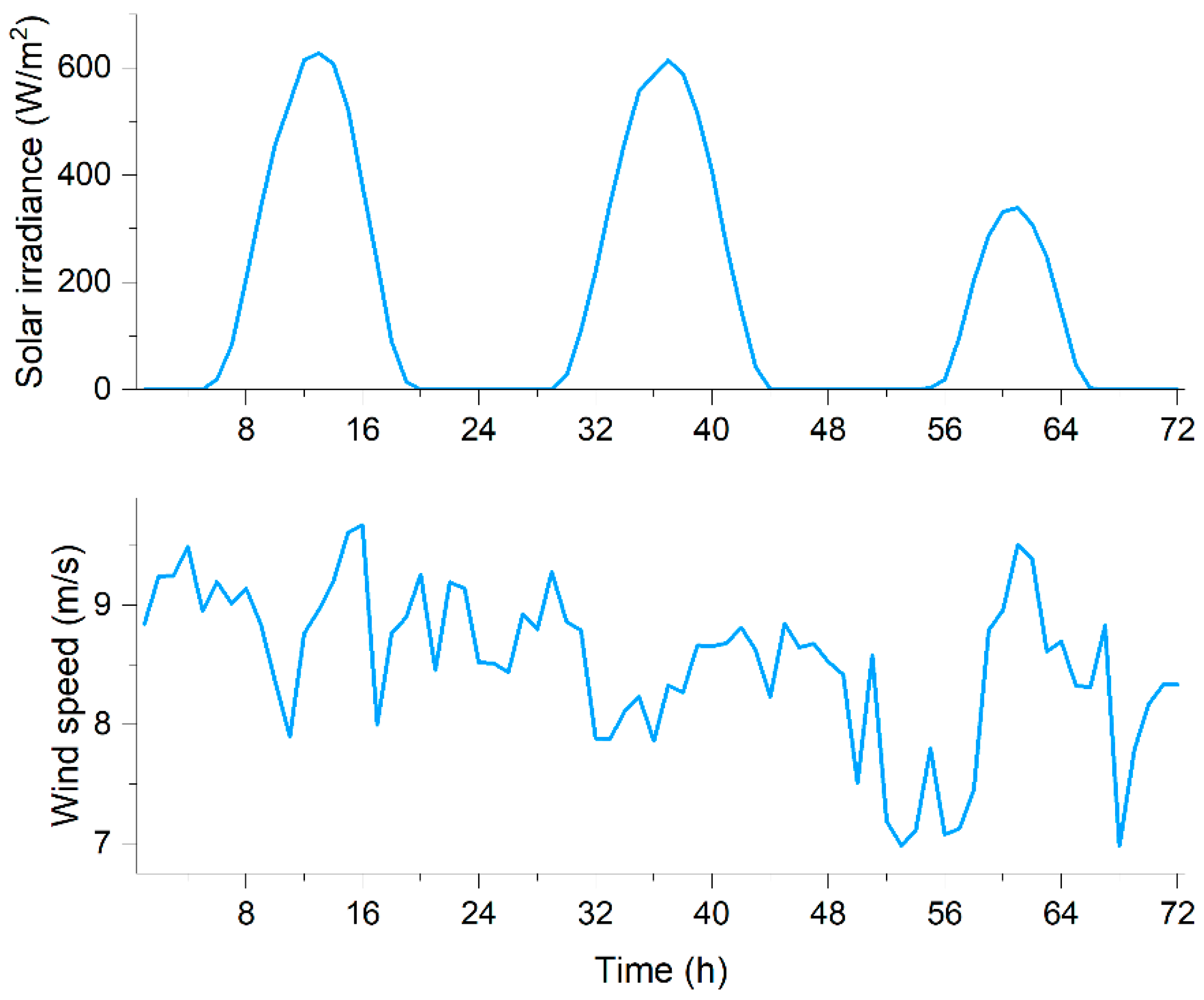

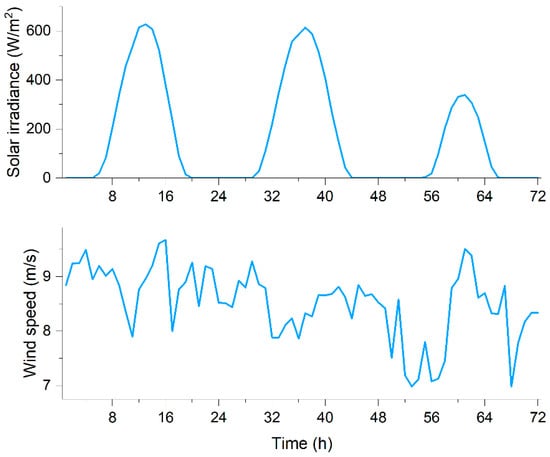

To assess the efficacy of the proposed shared framework, three prosumers were selected. Prosumer 1 has a PV system with an installed capacity of 250 kW and no wind turbine. Prosumer 2 possesses a PV system with a 200 kW installed capacity and a wind turbine with a 150 kW capacity. Prosumer 3 has a PV system with a 250 kW installed capacity and a wind turbine with a 1000 kW capacity. The battery has a rated capacity of 13.2 kWh, with charging and discharging efficiencies of 94%. The maximum, minimum, and initial state of charge (SOC) are 0.95, 0.05, and 0.2, respectively. The battery has a 10-year lifetime and costs $216.27 per kWh. Load data for three buildings within the community were sourced from the literature [31]. Our simulation focused on the investment and operational strategies of the energy storage system across three distinct seasonal scenarios. We chose a typical day from spring, summer, and winter to capture the varying energy demands and usage patterns throughout the year. Solar irradiance and wind speed data are presented in Figure 3. The time-of-use power prices ($/kWh) for different periods are as follows: from 1–4 h and 22–24 h: $0.06; from 5–7 h and 11–16 h: $0.12; from 8–10 h and 17–21 h: $0.18. The feed-in tariff is set at $0.04/kWh [32]. Additional parameters can be referenced in [28].

Figure 3.

Hourly solar irradiance and wind speed.

Two scenarios, individual and shared, were defined to assess the performance of shared storage. In the individual scenario, each prosumer installs its own energy storage system. In contrast, in the shared scenario, prosumers share a storage system, with the physical storage device being invested in and controlled by a storage operator. This operator provides energy storage services to the prosumers in the form of virtual storage capacity, fully capitalizing on the inherent complementarity and diversity of charging and discharging behaviors among different prosumers. This approach optimizes the utilization of idle resources.

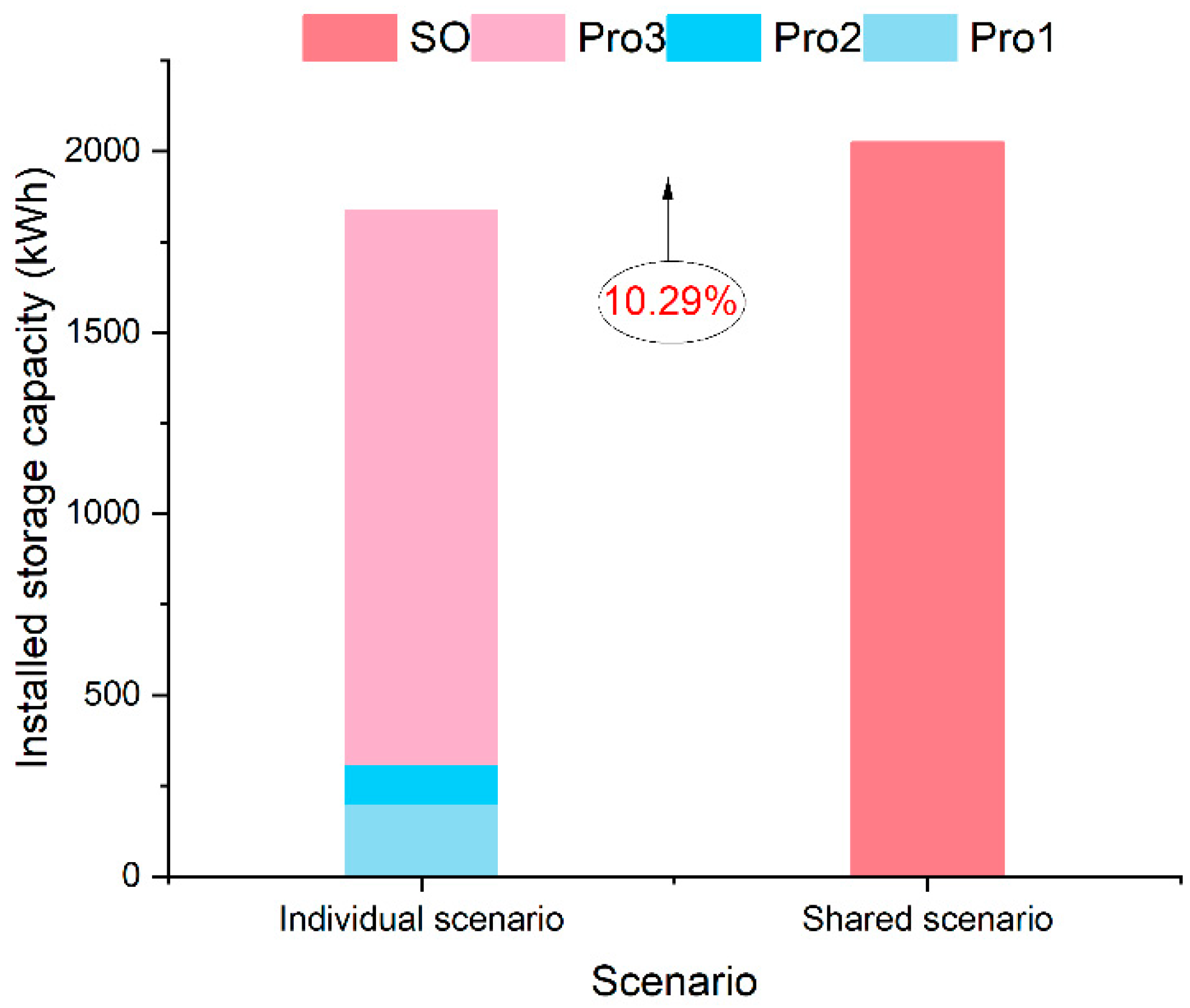

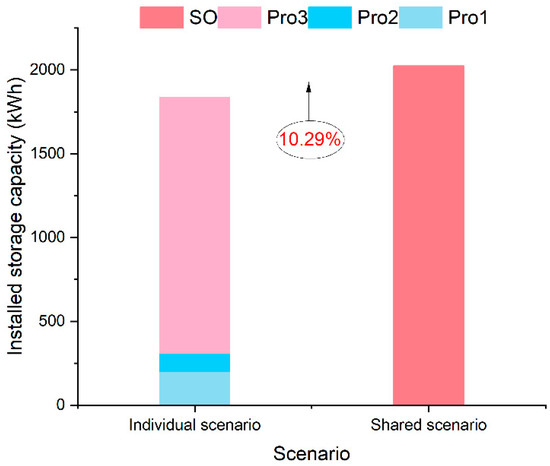

5.2. Optimal Configuration of Energy Storage

The investment strategies under individual and shared scenarios are illustrated in Figure 4. Based on the generation and consumption characteristics of each prosumer, the storage capacities for prosumers 1, 2, and 3 are 202.5 kWh, 108 kWh, and 1525.5 kWh, respectively. The cumulative storage capacity in this individual approach totaled 1836 kWh. Contrastingly, the shared scenario yielded an optimal storage capacity of 2025 kWh. This represents a notable 10.29% increase over the individual scenario. The primary reason for this increase is that all participants share the physical storage cost of investment. It can be inferred that the costs of storage for prosumers are lower than the cost of investing in individual energy storage systems. Additionally, under the shared scenario, prosumers do not bear the O&M costs as well as the power losses incurred by charging and discharging. Consequently, prosumers have more flexible charging and discharging decisions and can achieve greater storage capacities compared to the individual scenario. In conclusion, the shared model incentivizes greater investment in battery storage.

Figure 4.

The optimal storage capacity under the individual scenario and shared scenario.

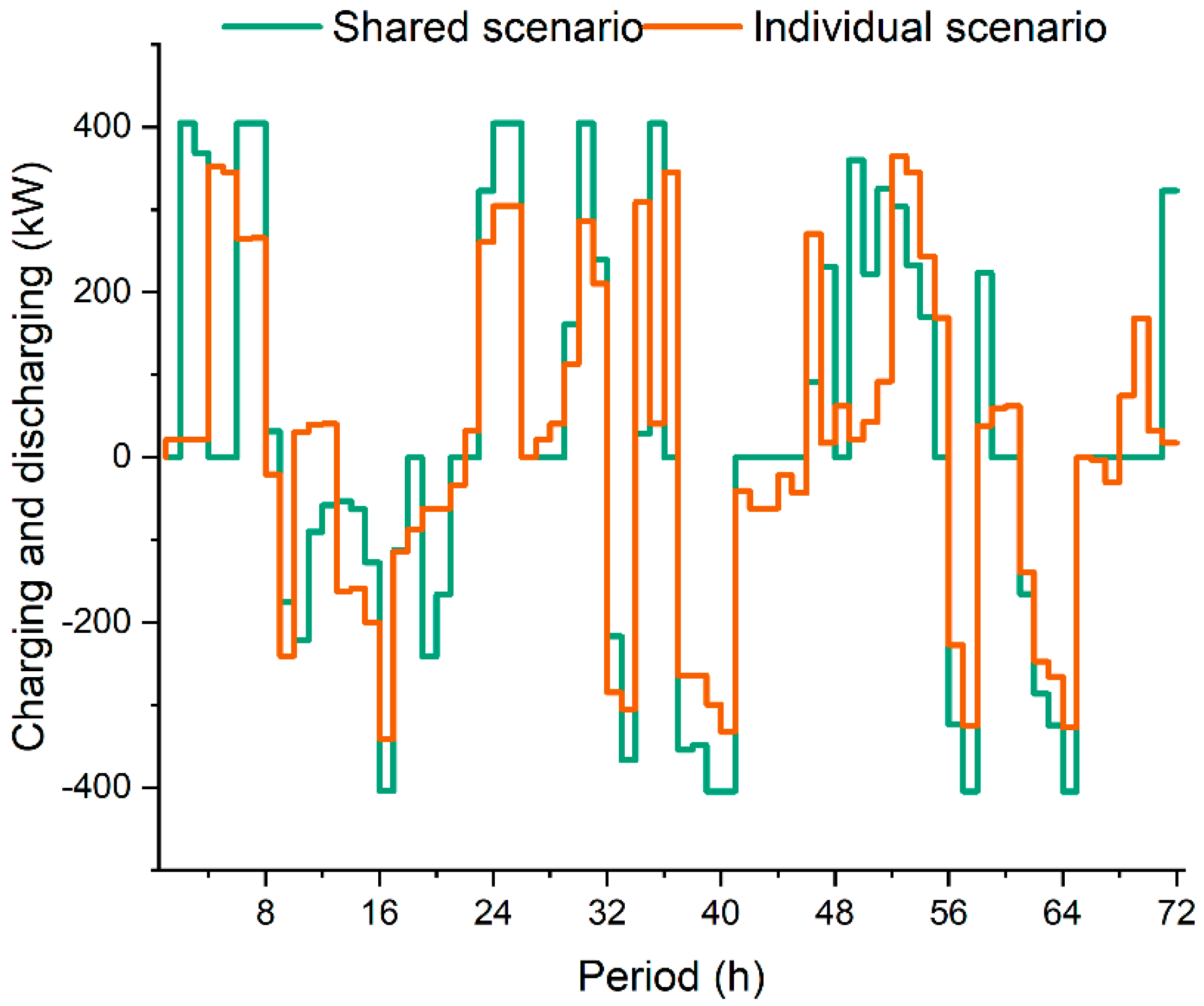

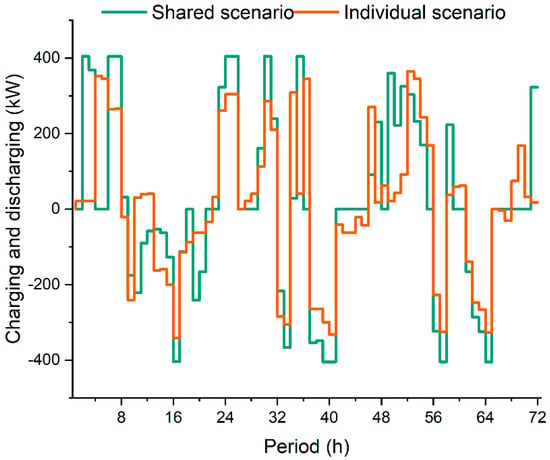

5.3. Optimal Scheduling of Energy Storage

Figure 5 shows the optimal storage schedule of each prosumer in three typical days under individual and shared scenarios. The positive and negative kilowatts represent the charging and discharging quantity. The charging and discharging decisions of three prosumers in the individual scenario are summarized, with the orange line representing the total charging and discharging electricity of all participants. It can be seen that the charging and discharging schedules of prosumers in the individual scenario are similar to those in the shared scenario. Moreover, in the shared scenario, the charging and discharging quantity is higher, indicating better utilization of storage in the shared scenario.

Figure 5.

Charging and discharging schedules of stakeholders in two scenarios.

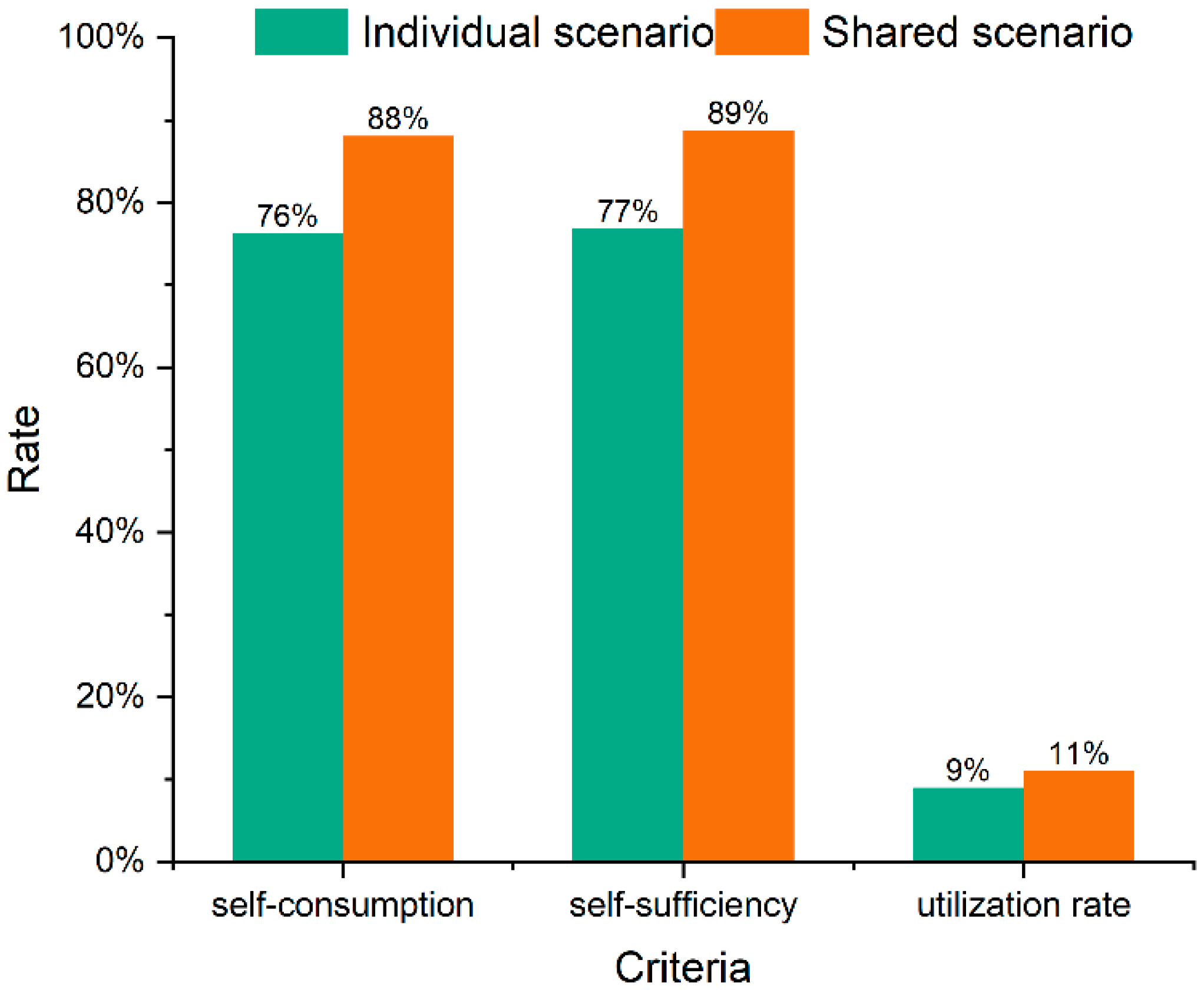

In addition, three criteria are introduced to assess the performance of shared storage.

The self-consumption rate (sc) measures the proportion of locally generated renewable energy that is consumed on-site to meet the community’s energy needs. This indicator shows how much of the locally produced renewable energy is directly used by the community rather than being exported to the grid.

where is the renewable electricity used directly to satisfy the load, is the renewable electricity discharged from storage to meet the load, is the photovoltaic power generated, and is the wind power generated.

The self-sufficiency rate (ss) indicates the extent to which the community’s energy demand can be satisfied by its own renewable energy production. This metric reflects how much of the total energy demand is met by local renewable sources, either directly or through stored energy.

where is the total electricity demand at time t for participant i.

The energy storage utilization rate (eu) measures the percentage of energy demand that is fulfilled through discharging stored energy. It reflects the community’s reliance on energy storage systems to meet its energy needs.

where represents the quantity of electricity discharged from energy storage to meet the load at time t for participant i.

These indicators are important for evaluating the performance of renewable energy systems and the efficiency of energy storage solutions in a community setting. They provide insight into how well a community is utilizing its renewable resources and how dependent it is on energy storage.

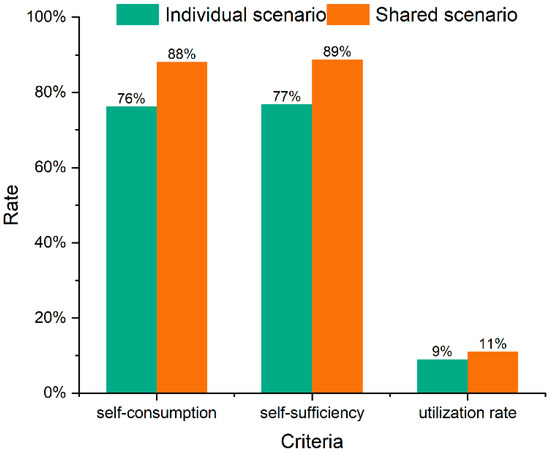

The implementation of storage sharing significantly enhances prosumers’ willingness to utilize storage systems, as illustrated in Figure 6. Compared to the individual scenario, the shared approach increases the community’s self-consumption rate by 11.82% and the self-sufficiency rate by 12.01%. In the shared scenario, prosumers more effectively utilize storage capacities. Most excess renewable energy is stored in batteries to meet future demand, thereby improving renewable energy utilization. Moreover, by primarily sharing charging/discharging needs, prosumers avoid storing all surplus electricity in storage systems, eliminating power losses and consequently boosting the community’s self-consumption and self-sufficiency rates. The utilization rate of energy storage in the shared scenario reaches 11.04%, surpassing the individual scenario by 2.06%. This metric indicates the community’s reliance on stored energy to meet power demands. For prosumers, most energy needs are met through renewable power and grid electricity, resulting in utilization rates below 12% in both scenarios. Despite this seemingly low percentage, it can be inferred that prosumers in the shared scenario make more efficient use of energy storage compared to those in the individual scenario.

Figure 6.

The assessment criteria for the community under two scenarios.

5.4. Economic Performance of Shared Storage

A comprehensive cooperation scheme is devised using cooperative game theory. The game comprises four players: one storage operator (SO) and three prosumers, denoted as N = {SO, Pro1, Pro2, Pro3}. These players can form 15 distinct non-empty coalitions, as detailed in Table 1. The SO is tasked with storage installation. It is assumed that without shared storage, each prosumer can only engage in transactions with the utility grid, precluding inter-prosumer interactions. Table 1 outlines the costs associated with different alliances. To align with the aforementioned objective function, all values are expressed as costs rather than profits.

Table 1.

Costs of coalitions.

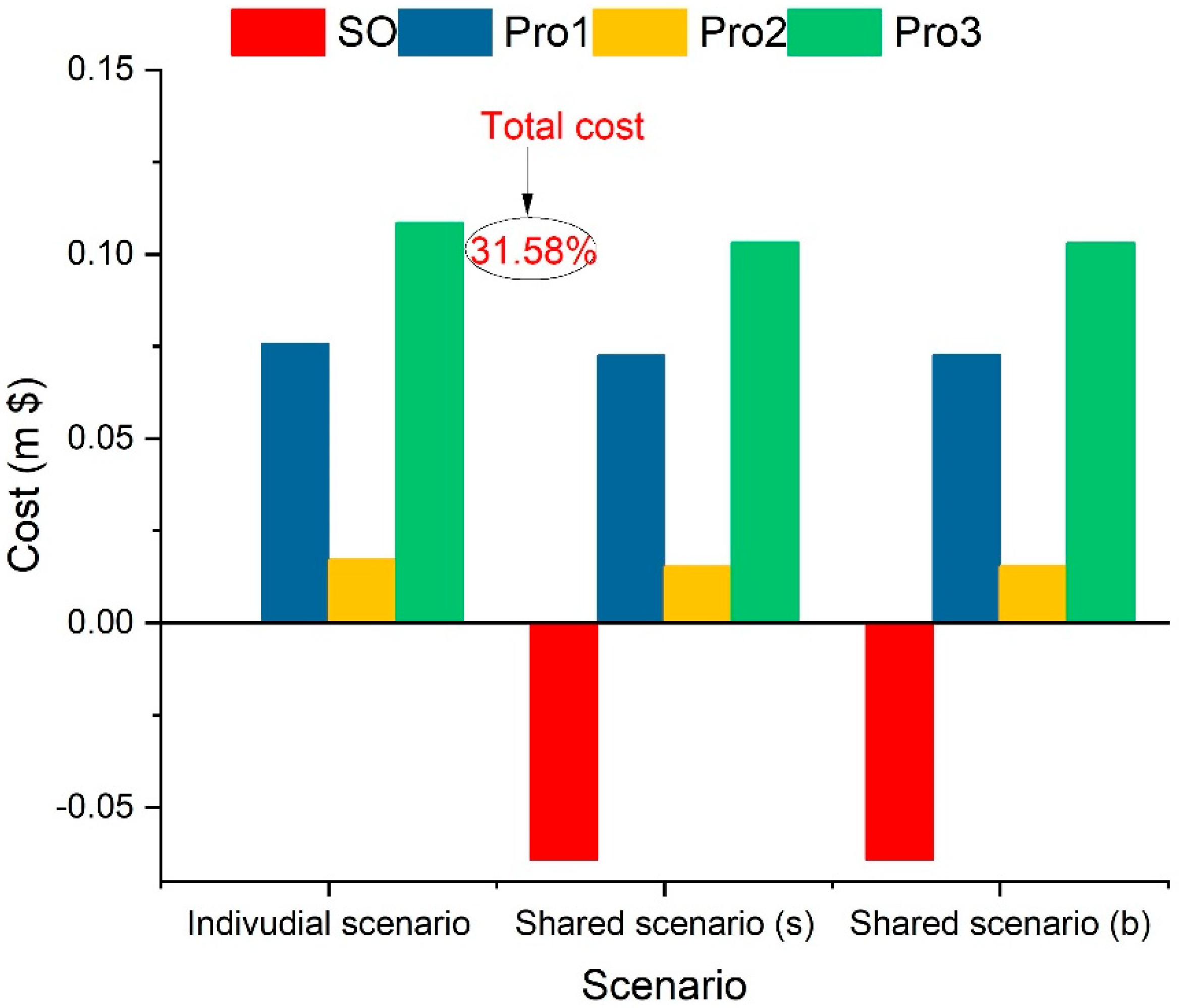

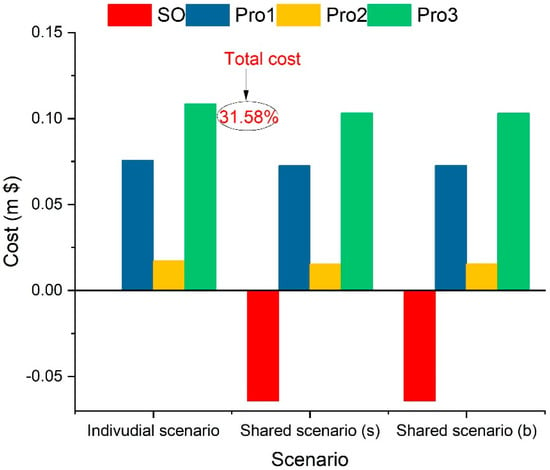

The Shapley value and Banzhaf value methods are employed to derive cost allocation strategies for storage-sharing participants. For any rational allocation scheme, each player’s cost must fall within the Core. Equations (47)–(49) confirm that the cost post-allocation strategy satisfies the Core requirements. Figure 7 illustrates a cost comparison between the two scenarios. In the shared scenario, the allocation strategies based on Shapley value (s) and Banzhaf value (b) are also depicted.

Figure 7.

The cost of stakeholders in individual and shared scenarios.

The grand coalition’s total annual cost amounts to $0.89 million, representing a 31.58% reduction compared to the individual scenario. Notably, the SO derives the greatest benefit among all participants. The SO, investing in and providing the physical infrastructure for inter-prosumer sharing, is a crucial stakeholder and justifiably receives a higher profit than the prosumers. Based on the current allocation strategies, we calculate the payback period and the net present value for the SO. The payback period for investing in physical storage is 6.73 years, and the net present value is $0.037 million. This indicates that the project is feasible and that the SO’s profit is reasonable.

Based on the Shapley value, the cost savings for Pro1, Pro2, and Pro3 are 4.71%, 13.15%, and 4.98%, respectively, compared to their costs in the individual scenario. When considering the Banzhaf value method, the cost savings for the three prosumers are 4.45%, 12.90%, and 5.20%, respectively. It can be observed that the marginal contributions of prosumers are similar under both the Shapley and Banzhaf values. Among the prosumers, Pro2 achieves the most cost-saving ratio. This is primarily due to Pro2’s lower costs compared to the others. In terms of actual cost-saving contribution, from largest to smallest, the order is Pro3, Pro1, and Pro2. This is attributed to Pro3 having the highest generation capacity among the three and making a substantial marginal contribution due to complementary supply and demand dynamics from the perspective of the whole system. However, due to the high cost of Pro3, although it has obtained the most profit distribution, its cost-saving rate is still low. In conclusion, full cooperation optimally coordinates resource dispatch at the district level, generating considerable cooperative surplus. This shared scheme demonstrates the potential for significant cost savings and improved resource utilization through collaborative energy management strategies.

5.5. Practical Implications and Potential Applications

The findings from this study present several practical implications and potential applications for the shared energy storage model. The implementation of shared energy storage, as outlined in our proposed framework, has the potential to significantly enhance the efficiency and financial viability of renewable energy systems. By allowing storage facilities to monetize unused capacity, the shared storage model not only generates additional revenue streams for storage providers but also provides renewable energy prosumers with affordable and accessible storage solutions.

Practical Implications: (1) The virtualization of physical storage equipment allows investors to distribute the high costs and long payback periods associated with battery storage over multiple users. This cost-sharing mechanism makes the investment in battery storage more attractive and financially feasible. Investors can achieve quicker returns on investment through the additional revenue generated by offering storage services to prosumers. (2) The shared storage model promotes the efficient use of renewable energy by increasing the self-sufficiency and self-consumption rates among prosumers. By having access to shared storage, prosumers can store excess energy generated from renewable sources and use it during periods of low generation or high demand. This capability reduces reliance on the grid and enhances the overall stability and reliability of the energy system. (3) The cooperative game approach used in our framework ensures the optimal allocation and utilization of storage resources. By incorporating storage sharing into the design phase of energy systems, we can achieve a more balanced and efficient distribution of storage capacity. This leads to a reduction in energy waste and improves the overall performance of the energy system.

Potential Applications: (1) The shared storage model can be applied to residential, office, and commercial buildings to optimize energy usage and reduce costs. For example, multiple buildings within a community or business park can share a centralized storage facility, enabling them to collectively manage their energy needs more effectively. This application not only lowers individual energy costs but also enhances the community’s energy resilience. (2) Shared storage can be a crucial component in the development of microgrid and VPP projects. By integrating shared storage into these projects, system operators can better manage their energy resources, improve grid stability, and support the transition to renewable energy sources. This model fosters participants cooperation and investment, leading to more sustainable and resilient energy systems.

6. Conclusions

The primary objective of this paper is to strategically plan the optimal investment size for shared energy storage under various investment models and to effectively distribute the cooperative surplus among storage-sharing participants, aiming for a mutually beneficial outcome. To this end, we propose a comprehensive storage-sharing framework involving key stakeholders, including a storage investor and multiple prosumers, all bound by a contractual agreement. The storage investor determines the optimal storage capacity by integrating the charging and discharging profiles of all participants and subsequently provides storage services to them. Moreover, we introduce a benefit allocation method with Shapley value and Banzhaf value to quantify the contributions of different stakeholders within the storage-sharing arrangement.

Numerical simulations indicate that our proposed model achieves a total cost reduction of 31.58%, with all participants benefiting from the shared storage arrangement compared to individual investment scenarios. Additionally, there are marked improvements in self-sufficiency rates, self-consumption rates, and storage utilization rates. Prosumers gain more flexibility in their charging and discharging decisions and can access greater storage capacities tailored to their needs, leading to more efficient storage utilization compared to the individual investment scenario.

While our methodology demonstrates significant potential, it is important to acknowledge its limitations. The model assumes perfect information and rational decision-making, which may not always hold in real-world scenarios. Furthermore, the study does not account for potential regulatory barriers or changes in energy policies that could impact the implementation of shared storage systems. Future research directions could include exploring the impact of bounded rationality on storage sharing in a cooperative manner and investigating the effects of different regulatory frameworks and policy scenarios on the viability of shared storage systems.

Author Contributions

Conceptualization, L.L.; Methodology, J.Z.; Software, M.L.; Validation, G.H. (Guori Huang); Formal analysis, X.L. and G.H. (Gengsheng He); Data curation, S.Y.; Writing—original draft, Q.W., J.Z. and B.C.; Writing—review & editing, S.Y., P.W. and L.L.; Supervision, B.C. and L.L.; Project administration, P.W. and L.L. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Natural Science Foundation of China (72274184, 71904179).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset available on request from the authors.

Conflicts of Interest

Authors Qin Wang, Jincan Zeng, Guori Huang, Xi Liu, Gengsheng He and Shangheng Yao were employed by the company China Southern Power Grid. Author Minwei Liu was employed by the company Yunnan Power Grid Corp. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

- Xiang, Y.; Qing, G.; Fang, M.; Li, Z.; Yao, H.; Liu, J.; Guo, Z.; Liu, J.; Zeng, P. A Carbon Emission Allowance Bargaining Model For Energy Transactions Among Prosumers. IEEE Trans. Power Syst. 2024, 39, 6095–6098. [Google Scholar] [CrossRef]

- Peng, J.; Fan, B.; Liu, W. Voltage-Based Distributed Optimal Control for Generation Cost Minimization and Bounded Bus Voltage Regulation in DC Microgrids. IEEE Trans. Smart Grid 2021, 12, 106–116. [Google Scholar] [CrossRef]

- McKenna, R.; Bertsch, V.; Mainzer, K.; Fichtner, W. Combining local preferences with multi-criteria decision analysis and linear optimization to develop feasible energy concepts in small communities. Eur. J. Oper. Res. 2018, 268, 1092–1110. [Google Scholar] [CrossRef]

- Jiang, Y.; Kang, L.; Liu, Y. Multi-objective design optimization of a multi-type battery energy storage in photovoltaic systems. J. Energy Storage 2021, 39, 102604. [Google Scholar] [CrossRef]

- Yang, L.; Li, X.; Sun, M.; Sun, C. Hybrid Policy-Based Reinforcement Learning of Adaptive Energy Management for the Energy Transmission-Constrained Island Group. IEEE Trans. Ind. Inform. 2023, 19, 10751–10762. [Google Scholar] [CrossRef]

- Bian, Y.; Xie, L.; Ye, J.; Ma, L.; Cui, C. Peer-to-peer energy sharing model considering multi-objective optimal allocation of shared energy storage in a multi-microgrid system. Energy 2024, 288, 129864. [Google Scholar] [CrossRef]

- Kusakana, K. Optimal peer-to-peer energy management between grid-connected prosumers with battery storage and photovoltaic systems. J. Energy Storage 2020, 32, 101717. [Google Scholar] [CrossRef]

- National Development and Reform Commission. Reform Commission, Guidance on Accelerating the Development of New Energy Storage, (n.d.). Available online: https://www.gov.cn/zhengce/zhengceku/2021-07/24/content_5627088.htm (accessed on 18 July 2024).

- National Development and Reform Commission. Reform Commission, Notice on the Issuance of the 14th Five-Year Plan for the Development of Renewable Energy, (n.d.). Available online: https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202206/t20220601_1326719.html (accessed on 18 July 2024).

- Roberts, M.B.; Bruce, A.; MacGill, I. Impact of shared battery energy storage systems on photovoltaic self-consumption and electricity bills in apartment buildings. Appl. Energy 2019, 245, 78–95. [Google Scholar] [CrossRef]

- Wang, Y.; Li, K.; Li, S.; Ma, X.; Zhang, X. A bi-level scheduling strategy for integrated energy systems considering integrated demand response and energy storage co-optimization. J. Energy Storage 2023, 66, 107508. [Google Scholar] [CrossRef]

- Ivanov, O.; Luca, M.-A.; Neagu, B.-C.; Grigoras, G.; Gavrilas, M. Flexible Energy Storage for Sustainable Load Leveling in Low-Voltage Electricity Distribution Grids with Prosumers. Sustainability 2024, 16, 3905. [Google Scholar] [CrossRef]

- Zhao, W.; Xu, S.; Guo, P. Optimization Decision Study of Business Smart Building Clusters Considering Shared Energy Storage. Sustainability 2024, 16, 3422. [Google Scholar] [CrossRef]

- Dai, R.; Esmaeilbeigi, R.; Charkhgard, H. The Utilization of Shared Energy Storage in Energy Systems: A Comprehensive Review. IEEE Trans. Smart Grid 2021, 12, 3163–3174. [Google Scholar] [CrossRef]

- Tushar, W.; Chai, B.; Yuen, C.; Huang, S.; Smith, D.B.; Poor, H.V.; Yang, Z. Energy Storage Sharing in Smart Grid: A Modified Auction-Based Approach. IEEE Trans. Smart Grid 2016, 7, 1462–1475. [Google Scholar] [CrossRef]

- Brijs, T.; Huppmann, D.; Siddiqui, S.; Belmans, R. Auction-based allocation of shared electricity storage resources through physical storage rights. J. Energy Storage 2016, 7, 82–92. [Google Scholar] [CrossRef]

- Sun, L.; Qiu, J.; Zhang, W.; Meng, K.; Yin, X.; Dong, Z. Energy sharing strategy based on call auction trading: Energy bank system. Int. J. Electr. Power Energy Syst. 2020, 123, 106320. [Google Scholar] [CrossRef]

- Zaidi, B.H.; Bhatti, D.M.S.; Ullah, I. Combinatorial auctions for energy storage sharing amongst the households. J. Energy Storage 2018, 19, 291–301. [Google Scholar] [CrossRef]

- Chakraborty, P.; Baeyens, E.; Poolla, K.; Khargonekar, P.P.; Varaiya, P. Sharing Storage in a Smart Grid: A Coalitional Game Approach. IEEE Trans. Smart Grid 2019, 10, 4379–4390. [Google Scholar] [CrossRef]

- Jo, J.; Park, J. Demand-Side Management With Shared Energy Storage System in Smart Grid. IEEE Trans. Smart Grid 2020, 11, 4466–4476. [Google Scholar] [CrossRef]

- Auguadra, M.; Ribó-Pérez, D.; Gómez-Navarro, T. Planning the deployment of energy storage systems to integrate high shares of renewables: The Spain case study. Energy 2023, 264, 126275. [Google Scholar] [CrossRef]

- Xia, S.; Chan, K.W.; Luo, X.; Bu, S.; Ding, Z.; Zhou, B. Optimal sizing of energy storage system and its cost-benefit analysis for power grid planning with intermittent wind generation. Renew. Energy 2018, 122, 472–486. [Google Scholar] [CrossRef]

- Abdeltawab, H.; Mohamed, Y.A.-R.I. Energy Storage Planning for Profitability Maximization by Power Trading and Ancillary Services Participation. IEEE Syst. J. 2022, 16, 1909–1920. [Google Scholar] [CrossRef]

- Nazari, A.; Keypour, R. A two-stage stochastic model for energy storage planning in a microgrid incorporating bilateral contracts and demand response program. J. Energy Storage 2019, 21, 281–294. [Google Scholar] [CrossRef]

- Bai, L.; Jiang, T.; Li, F.; Chen, H.; Li, X. Distributed energy storage planning in soft open point based active distribution networks incorporating network reconfiguration and DG reactive power capability. Appl. Energy 2018, 210, 1082–1091. [Google Scholar] [CrossRef]

- Huang, P.; Sun, Y.; Lovati, M.; Zhang, X. Solar-photovoltaic-power-sharing-based design optimization of distributed energy storage systems for performance improvements. Energy 2021, 222, 119931. [Google Scholar] [CrossRef]

- Liu, J.; Chen, X.; Xiang, Y.; Huo, D.; Liu, J. Optimal planning and investment benefit analysis of shared energy storage for electricity retailers. Int. J. Electr. Power Energy Syst. 2021, 126, 106561. [Google Scholar] [CrossRef]

- Li, L.; Cao, X.; Zhang, S. Shared energy storage system for prosumers in a community: Investment decision, economic operation, and benefits allocation under a cost-effective way. J. Energy Storage 2022, 50, 104710. [Google Scholar] [CrossRef]

- Li, L.; Peng, K.; Yang, X.; Liu, K. Coordinated design of multi-stakeholder community energy systems and shared energy storage under uncertain supply and demand: A game theoretical approach. Sustain. Cities Soc. 2023, 100, 105028. [Google Scholar] [CrossRef]

- Wu, C.; Porter, J.; Poolla, K. Community storage for firming. In Proceedings of the 2016 IEEE International Conference on Smart Grid Communications (SmartGridComm), Sydney, Australia, 6–9 November 2016; pp. 570–575. [Google Scholar] [CrossRef]

- Li, L.; Mu, H.; Li, N.; Li, M. Economic and environmental optimization for distributed energy resource systems coupled with district energy networks. Energy 2016, 109, 947–960. [Google Scholar] [CrossRef]

- Li, L. Coordination between smart distribution networks and multi-microgrids considering demand side management: A trilevel framework. Omega 2021, 102, 102326. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).