Industry Experts’ Perspectives on the Difficulties and Opportunities of the Integration of Bio-Based Insulation Materials in the European Construction Sector

Abstract

:1. Introduction

1.1. Background

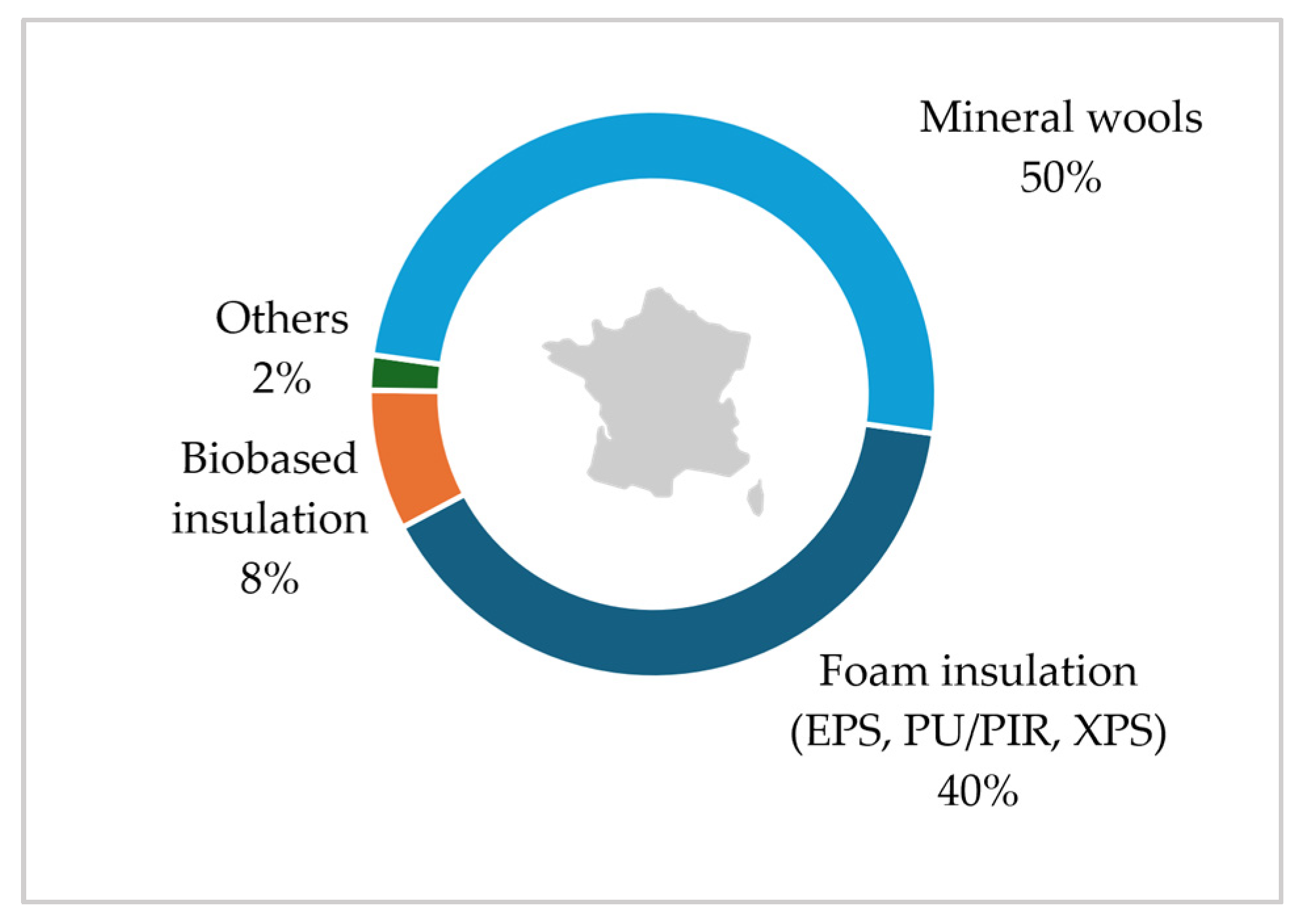

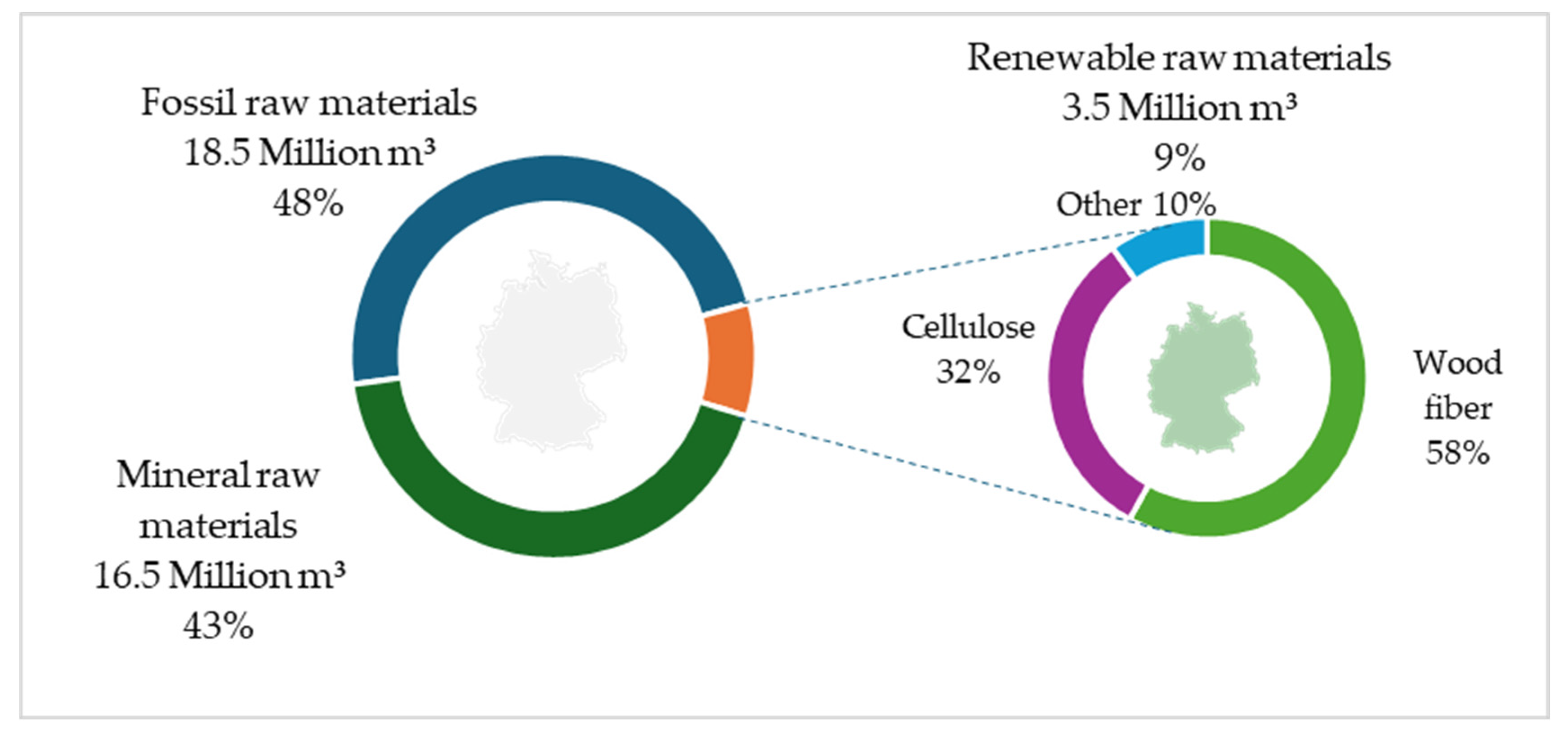

1.2. Literature Review

Q1: What are the in-situ challenges and opportunities for integrating bio-based insulation materials for construction in Europe?

2. Materials and Methods

3. Results and Discussion

3.1. Background of the Participants

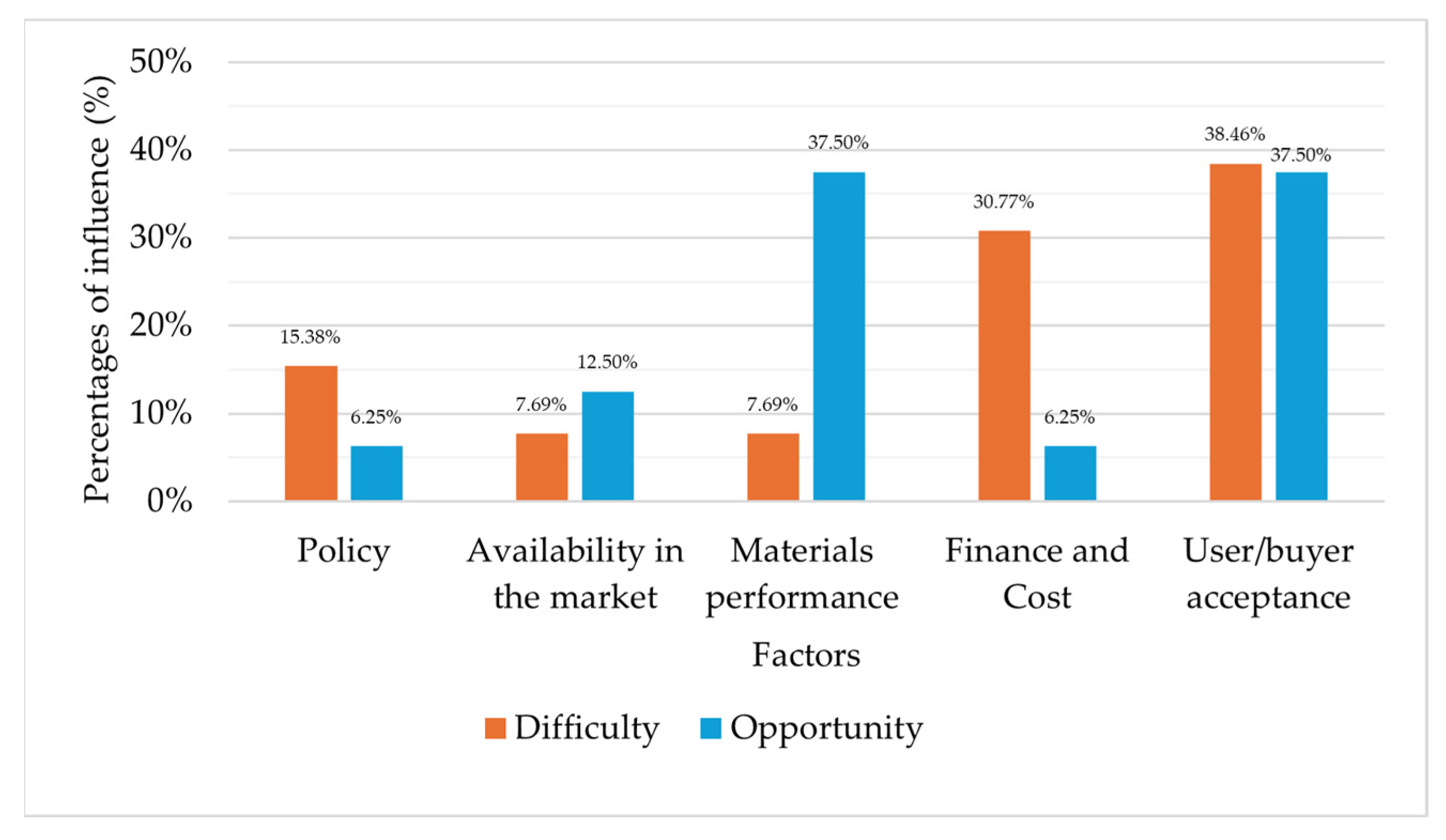

3.2. Integration Difficulties and Opportunities

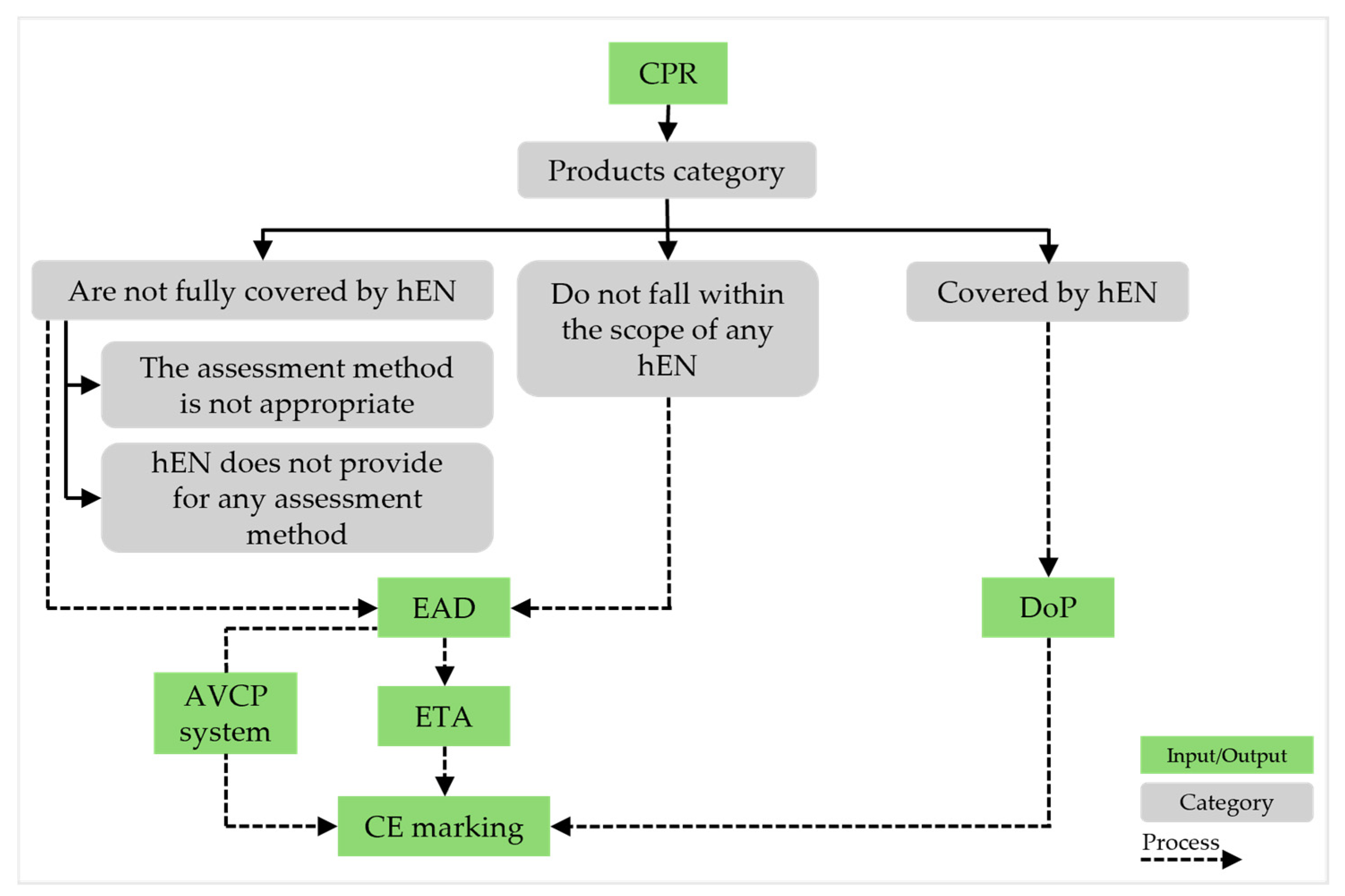

3.2.1. Regulations and Policy

Italy

Spain

Germany

France

The Netherlands

Switzerland

Portugal

3.2.2. Availability in the Market

Italy

Spain

Germany

France

The Netherlands

Switzerland

Portugal

3.2.3. Techniques and Performance

Italy

Spain

Germany

France

The Netherlands, Switzerland, and Portugal

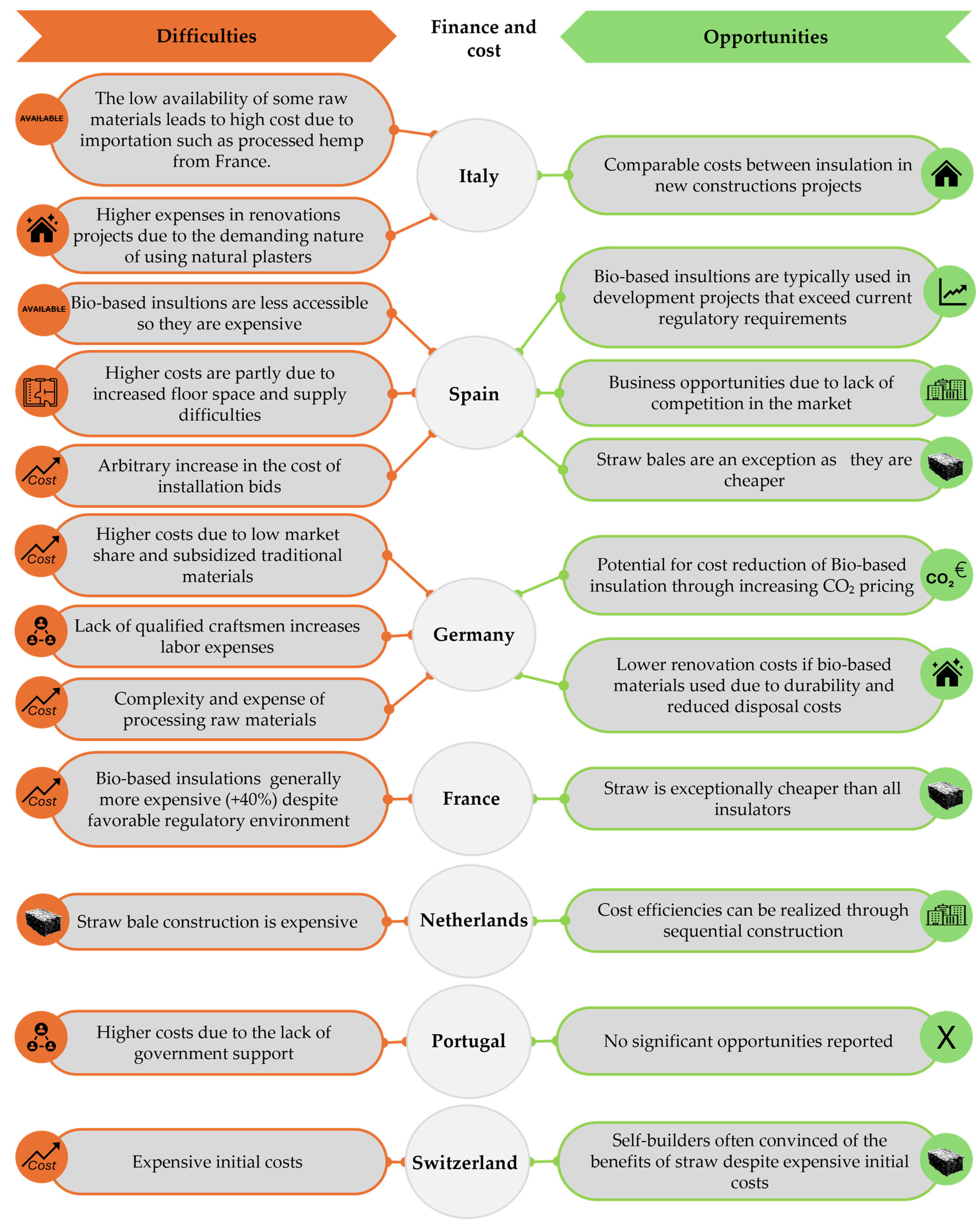

3.2.4. Finance and Cost

Italy

Spain

Germany

France

The Netherlands, Switzerland, and Portugal

3.2.5. User/Buyer Acceptance

Italy

Spain

Germany

France

The Netherlands

Switzerland, and Portugal

3.2.6. The Most Potential Key Factor Affecting BbIMs Implementation in the Construction Industry

3.3. Future Perceptions

3.3.1. Recommendation for Best Practices to Promote BbIMs in the Industry

3.3.2. The Current State of BbIMs Integration in BIM Practices within the Sector

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ingrao, C.; Arcidiacono, C.; Bezama, A.; Ioppolo, G.; Winans, K.; Koutinas, A.; Gallego-Schmid, A. Sustainability issues of by-product and waste management systems, to produce building material commodities: A comprehensive review of findings from a virtual special issue. Resour. Conserv. Recycl. 2019, 146, 358–365. [Google Scholar] [CrossRef]

- Uihlein, A.; Eder, P. Towards Additional Policies to Improve the Environmental Performance of Buildings; Office for Official Publications of the European Communities: Luxembourg, 2009. [Google Scholar] [CrossRef]

- González, M.J.; Navarro, J.G. Assessment of the decrease of CO2 emissions in the construction field through the selection of materials: Practical case study of three houses of low environmental impact. Build. Environ. 2006, 41, 902–909. [Google Scholar] [CrossRef]

- Santos, R.; Costa, A.A.; Silvestre, J.D.; Pyl, L. Integration of LCA and LCC analysis within a BIM-based environment. Autom. Constr. 2019, 103, 127–149. [Google Scholar] [CrossRef]

- Zhou, C.; Shi, S.Q.; Chen, Z.; Cai, L.; Smith, L. Comparative environmental life cycle assessment of fiber reinforced cement panel between kenaf and glass fibers. J. Clean Prod. 2018, 200, 196–204. [Google Scholar] [CrossRef]

- Zerari, S.; Franchino, R.; Pisacane, N. The potential impacts of using bio-based building materials on human health and wellbeing. E3S Web Conf. 2023, 436, 01006. [Google Scholar] [CrossRef]

- Pittau, F.; Krause, F.; Lumia, G.; Habert, G. Fast-growing bio-based materials as an opportunity for storing carbon in exterior walls. Build Environ. 2018, 129, 117–129. [Google Scholar] [CrossRef]

- IAL Consultants. The European Market for Thermal Insulation Products. Available online: https://www.ialconsultants.com/media/1118/thermal-insulation-press-release-2023.pdf (accessed on 13 April 2024).

- Rabbat, C.; Awad, S.; Villot, A.; Rollet, D.; Andres, Y. Sustainability of biomass-based insulation materials in buildings: Current status in France, end-of-life projections and energy recovery potentials. Renew. Sust. Energ. Rev. 2022, 156, 111962. [Google Scholar] [CrossRef]

- Sustainable and Circular Construction: A Policy Brief from the Policy Learning Platform for a Greener Europe. March 2024. Available online: https://www.interregeurope.eu/sites/default/files/2024-03/Policy%20brief%20on%20Sustainable%20construction.pdf (accessed on 19 June 2024).

- European Commission. First Circular Economy Action Plan. Available online: https://environment.ec.europa.eu/topics/circular-economy/first-circular-economy-action-plan_en (accessed on 12 August 2024).

- Loonela, V.; Stoycheva, D. Changing How We Produce and Consume: New Circular Economy Action Plan Shows the Way to a Climate-neutral, Competitive Economy of Empowered Consumers; European Commission-Press: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Waste Framework Directive. Available online: https://environment.ec.europa.eu/topics/waste-and-recycling/waste-framework-directive_en (accessed on 12 August 2024).

- Cardellini, G.; Mijnendonckx, J. ETC CM report 2022/01: Synergies, Energy Efficiency and Circularity in the Renovation Wave. Bio-Based Products for the Renovation Wave. Jun. 2022. Available online: https://climate-energy.eea.europa.eu/topics/energy-1/energy-and-buildings/reports/synergies-energy-efficiency-and-circularity-in-the-renovation-wave (accessed on 23 June 2024).

- European Union. Regulation of the European Parliament and of the Council of 9 March 2011 Laying down Harmonised Conditions for the Marketing of Construction Products and Repealing Council Directive 89/106/EEC; Official Journal of the European Union: Luxembourg, 2011. [Google Scholar]

- The Construction Technologies Institute (ITC). Eta—European Technical Assessment. Available online: https://www.itc.cnr.it/home/innovazione/certificazione-volontaria/eta/?lang=en (accessed on 12 May 2024).

- Kutnik, M.; Suttie, E.; Brischke, C. Durability, efficacy and performance of bio-based construction mate-rials: Standardisation background and systems of evaluation and authorisation for the European market. Perform. Bio-Based Build. Mater. 2017, 593–610. [Google Scholar] [CrossRef]

- Bos, H.; Van den Oever, M.; Dammer, L.; Babayan, T. D2.1 Market Entry Barriers Report. 2018. Available online: https://www.biobasedeconomy.eu/app/uploads/sites/2/2018/09/Please-click-here-to-access-deliverable-2.1.pdf (accessed on 23 June 2024).

- Cintura, E.; Nunes, L.; Esteves, B.; Faria, P. Agro-industrial wastes as building insulation materials: A re-view and challenges for Euro-Mediterranean countries. Ind. Crops Prod. 2021, 171, 113833. [Google Scholar] [CrossRef]

- Raja, P.; Murugan, V.; Ravichandran, S.; Behera, L.; Mensah, R.A.; Mani, S.; Kasi, A.; Balasubramanian, K.B.N.; Sas, G.; Vahabi, H.; et al. A Review of Sustainable Bio-Based Insulation Materials for Energy-Efficient Buildings. Macromol. Mater. Eng. 2023, 308, 2300086. [Google Scholar] [CrossRef]

- Zhao, J.R.; Zheng, R.; Tang, J.; Sun, H.J.; Wang, J. A mini-review on building insulation materials from perspective of plastic pollution: Current issues and natural fibres as a possible solution. J. Hazard Mater. 2022, 438, 129449. [Google Scholar] [CrossRef] [PubMed]

- Cosentino, L.; Fernandes, J.; Mateus, R. A Review of Natural Bio-Based Insulation Materials. Energies 2023, 16, 4676. [Google Scholar] [CrossRef]

- Wiprächtiger, M.; Haupt, M.; Heeren, N.; Waser, E.; Hellweg, S. A framework for sustainable and circular system design: Development and application on thermal insulation materials. Resour. Conserv. Recycl. 2020, 154, 104631. [Google Scholar] [CrossRef]

- Romano, A.; Grammatikos, S.; Riley, M.; Bras, A. Physicochemical characterisation of bio-based insula-tion to explain their hygrothermal behaviour. Constr. Build. Mater. 2020, 258, 120163. [Google Scholar] [CrossRef]

- Schulte, M.; Lewandowski, I.; Pude, R.; Wagner, M. Comparative life cycle assessment of bio-based insulation materials: Environmental and economic performances. GCB Bioenergy 2021, 13, 979–998. [Google Scholar] [CrossRef]

- Platt, S.L.; Walker, P.; Maskell, D.; Shea, A.; Bacoup, F.; Mahieu, A.; Zmamou, H.; Gattin, R. Sustainable bio & waste resources for thermal insulation of buildings. Constr. Build. Mater. 2023, 366, 130030. [Google Scholar] [CrossRef]

- Fedorik, F.; Zach, J.; Lehto, M.; Kymäläinen, H.-R.; Kuisma, R.; Jallinoja, M.; Illikainen, K.; Alitalo, S. Hygrothermal properties of advanced bio-based insulation materials. Energy Build. 2021, 253, 111528. [Google Scholar] [CrossRef]

- E. Commission, D.-G. for Research, and Innovation, European Bioeconomy Policy—Stocktaking and Future Developments—Report from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions; Publications Office of the European Union: Luxembourg, 2022. Available online: https://data.europa.eu/doi/10.2777/997651 (accessed on 18 June 2024).

- Msinka, S.; Bajare, D.; Gendelis, S.; Jakovics, A. In-situ measurements of hemp-lime insulation materials for energy efficiency improvement. Energy Procedia 2018, 147, 242–248. [Google Scholar] [CrossRef]

- Richter, M.; Horn, W.; Juritsch, E.; Klinge, A.; Radeljic, L.; Jann, O. Natural Building Materials for Interior Fitting and Refurbishment-What about Indoor Emissions? Materials 2021, 14, 234. [Google Scholar] [CrossRef]

- Markström, E.; Bystedt, A.; Fredriksson, M.; Sandberg, D. Use of bio-based building materials: Perceptions of Swedish architects and contractors. In Forest Products Society International Convention; Forest Products Society: Madison, WI, USA, 2016. [Google Scholar]

- Maniak-Huesser, M.; Tellnes, L.G.F.; Escamilla, E.Z. Mind the gap: A policy gap analysis of pro-grammes promoting timber construction in nordic countries. Sustainability 2021, 13, 11876. [Google Scholar] [CrossRef]

- Dams, B.; Maskell, D.; Shea, A.; Allen, S.; Cascione, V.; Walker, P. Upscaling bio-based construction: Challenges and opportunities. Build. Res. Inf. 2023, 51, 764–782. [Google Scholar] [CrossRef]

- CAM EDILIZIA 2022. Available online: https://www.anit.it/wp-content/uploads/2022/08/Gazzetta6agosto22-CAM.pdf (accessed on 18 June 2024).

- Mandatory Italian GPP Minimum Environmental Criteria for Buildings. Available online: https://www.interregeurope.eu/good-practices/mandatory-italian-gpp-minimum-environmental-criteria-for-buildings (accessed on 23 June 2024).

- Kfw Group. Your Promotion for New Houses and Condominiums. Available online: https://www.kfw.de/inlandsfoerderung/Privatpersonen/Neubau/index-2.html (accessed on 15 May 2024).

- B. und V. Bayerisches Staatsministerium für Wonhnen. Bayerisches Holzbauförderprogramm—BayFHolz. Available online: https://www.stmb.bayern.de/buw/bauthemen/gebaeudeundenergie/foerderprogramme/bayfholz/index.php (accessed on 15 May 2024).

- Ministère de la Transition Ecologique et Solidaire. RE2020: Eco-Construire Pour le Confort de tous. Dossier de Presse. Mars, 2021. Available online: https://www.ecologie.gouv.fr/sites/default/files/documents/2021.02.18_DP_RE2020_EcoConstruire_0.pdf (accessed on 19 June 2024).

- MINISTÈRE DE LA TRANSITION ÉCOLOGIQUE. Décret no 2021-1004 du 29 Juillet 2021 Relatif Aux Exigences de Performance Energétique et Environnementale des Constructions de Bâtiments en France Métropolitaine. Available online: https://www.legifrance.gouv.fr/download/pdf?id=Y9LyRJ3tkBWsZEVIQZBXMJOztP5gCXMNFUg5VvtB7GA= (accessed on 19 June 2024).

- Credit Suisse. Green Homes: Four Measures for Environmentally Friendly Construction. Available online: https://www.credit-suisse.com/ch/en/articles/private-banking/gruenes-wohnen-vier-massnahmen-fuer-oekologisches-bauen-202006.html (accessed on 29 June 2024).

- L’agence Romande de Minergie. Certification Avec le Complément ECO. Available online: https://www.minergie.ch/fr/certification/eco/ (accessed on 29 June 2024).

- Presidência do Conselho de Ministros. Diário da República n.o 23/2021, 1o Suplemento, Série I de 2021-02-03. Available online: https://diariodarepublica.pt/dr/detalhe/resolucao-conselho-ministros/8-a-2021-156295372 (accessed on 24 June 2024).

- Ascione, F.; de Masi, R.F.; Mastellone, M.; Ruggiero, S.; Vanoli, G.P. Improving the building stock sustainability in European Countries: A focus on the Italian case. J. Clean Prod. 2022, 365, 132699. [Google Scholar] [CrossRef]

- Fachagentur Nachwachsende Rohstoffe (FNR). Marktanteil von Nawaro-Dämmstoffen Wächst. Available online: https://www.fnr.de/presse/pressemitteilungen/aktuelle-mitteilungen/aktuelle-nachricht/marktanteil-von-nawaro-daemmstoffen-waechst (accessed on 18 June 2024).

- Consulting, L.E.K. L’isolation Biosourcée: Un Marché Qui Sort du Bois? Available online: https://www.lek.com/sites/default/files/insights/pdf-attachments/2204_Bio-Source-Insulation.pdf (accessed on 24 June 2024).

- l’Association des Industriels de la Construction Biosourcée (AICB). Chiffres clés: Le Marché des Isolants Biosourcés. Available online: https://www.batiment-biosource.fr/chiffres-cles-isolants-biosources/ (accessed on 23 June 2024).

- Brief de Filière Biosourcés Les Messages Clés. Available online: https://www.ifpeb.fr/wp-content/uploads/2021/06/IFPEB-Carbone-4_Messages-cles_Brief-Filiere-Biosource-VF-1.0_VF.pdf (accessed on 23 June 2024).

- Nan, C.; Schroeder, T.; Bekkering, J. Circularity and Biobased Materials in Architecture and Design, Commissioned Report. 2021. Available online: https://downloads.ctfassets.net/h0msiyds6poj/4cUyquZDX8Zx6WlmEgw94/b32f801bbb24050527d10a00108617b9/CIRCULAR_Report.pdf (accessed on 24 June 2024).

- Yang, Y.; Haurie, L.; Wang, D.-Y. Bio-based materials for fire-retardant application in construction products: A review. J. Therm. Anal. Calorim. 2022, 147, 6563–6582. [Google Scholar] [CrossRef]

- Ruf, J.; Menrad, K.; Emberger-Klein, A. Consumer perceptions and assessments of the local range of bio-based building products for renovation and refurbishment in Germany. EFB Bioecon. J. 2024, 4, 100063. [Google Scholar] [CrossRef]

- MNEXT. Biobased Building. Available online: https://www.mnext.nl/en/over-mnext/lectoraten/biobased-construction/ (accessed on 29 June 2024).

- MNEXT. Biobased and Circular Construction Knowledge Base. Available online: https://www.biobasedbouwen.nl/ (accessed on 29 June 2024).

- Boom Landscape. Bio-Based Building, Zuid-Holland. Available online: https://boomlandscape.nl/en/work/bio-based-building-zuid-holland/ (accessed on 29 June 2024).

- LLatas, C.; Soust-Verdaguer, B.; Hollberg, A.; Palumbo, E.; Quiñones, R. BIM-based LCSA application in early design stages using IFC. Autom. Constr. 2022, 138, 104259. [Google Scholar] [CrossRef]

- Hollberg, A.; Genova, G.; Habert, G. Evaluation of BIM-based LCA results for building design. Autom. Constr. 2020, 109, 102972. [Google Scholar] [CrossRef]

- Interreg NWE. UP STRAW. Available online: https://www.bimobject.com/en/up-straw?location=it (accessed on 27 June 2024).

| Participants | Role | Years of Experience | Insulations |

|---|---|---|---|

| IT01 | Manufacturer | 10 | Hemp fiber panels, hemp wood blocks, hemp insulating plasters |

| IT02 | Manufacturer | 18 | Hemp and lime bio-composite materials |

| IT03 | Architect | 20 | Hemp Panels, EPS, Jute Panels |

| IT04 | Distributor | 15 | Cork panels and granules, hemp mats |

| IT05 | Architect | 12 | Straw, cork, hemp, rice husks |

| ES01 | Distributor | 12 | Structural wood panels with straw insulation |

| ES02 | Architect | 15 | Wheat, barley, rice straw, wood fiber, recycled cotton, cellulose, natural cork. |

| ES03 | Architect | 25 | Straw, cork, cellulose, wood fibers |

| ES04 | Architect | 20 | Bales of straw, wood fiber, and recycled cotton. |

| DE01 | Distributor | 20 | Wood fiber products, hemp products, sheep’s wool products |

| DE02 | Supplier | 30 | Hemp, wood fiber, cellulose, cork, reed |

| DE03 | Distributor | 30 | Cellulose (flakes), wood fiber, hemp, flax |

| DE04 | Supplier | 18 | Straw |

| FR01 | Architect | 25 | wood, straw, earth, thatch, cellulose wadding, algae |

| FR02 | Architect | - | Straw, wood, hemp |

| NE01 | Contractors | 35 | wood fiber, straw bales, straw panels |

| CH01 | Architect | 10 | Straw, wood fiber |

| PT01 | Manufacturer | 50 | Expanded Cork Agglomerate |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zerari, S.; Franchino, R.; Pisacane, N. Industry Experts’ Perspectives on the Difficulties and Opportunities of the Integration of Bio-Based Insulation Materials in the European Construction Sector. Sustainability 2024, 16, 7314. https://doi.org/10.3390/su16177314

Zerari S, Franchino R, Pisacane N. Industry Experts’ Perspectives on the Difficulties and Opportunities of the Integration of Bio-Based Insulation Materials in the European Construction Sector. Sustainability. 2024; 16(17):7314. https://doi.org/10.3390/su16177314

Chicago/Turabian StyleZerari, Salima, Rossella Franchino, and Nicola Pisacane. 2024. "Industry Experts’ Perspectives on the Difficulties and Opportunities of the Integration of Bio-Based Insulation Materials in the European Construction Sector" Sustainability 16, no. 17: 7314. https://doi.org/10.3390/su16177314