Enhancing Sustainability through Weather Derivative Option Contracts: A Risk Management Tool in Greek Agriculture

Abstract

1. Introduction

2. Materials and Methods

2.1. Pricing Weather Derivatives

2.2. Design of Different Option Strategies

2.3. Value at Risk (VaR) Methodology

- μ is the mean (average) value the total market value of tree crops for all winter periods.

- σ is the standard deviation of total market value of tree crops for all winter periods.

- Ζα is the Z-value corresponding to the confidence level (95%).

- VaRα represents the value at risk at the α confidence level, which represents the maximum expected loss.

2.4. Study Area and Temperature Data

3. Results

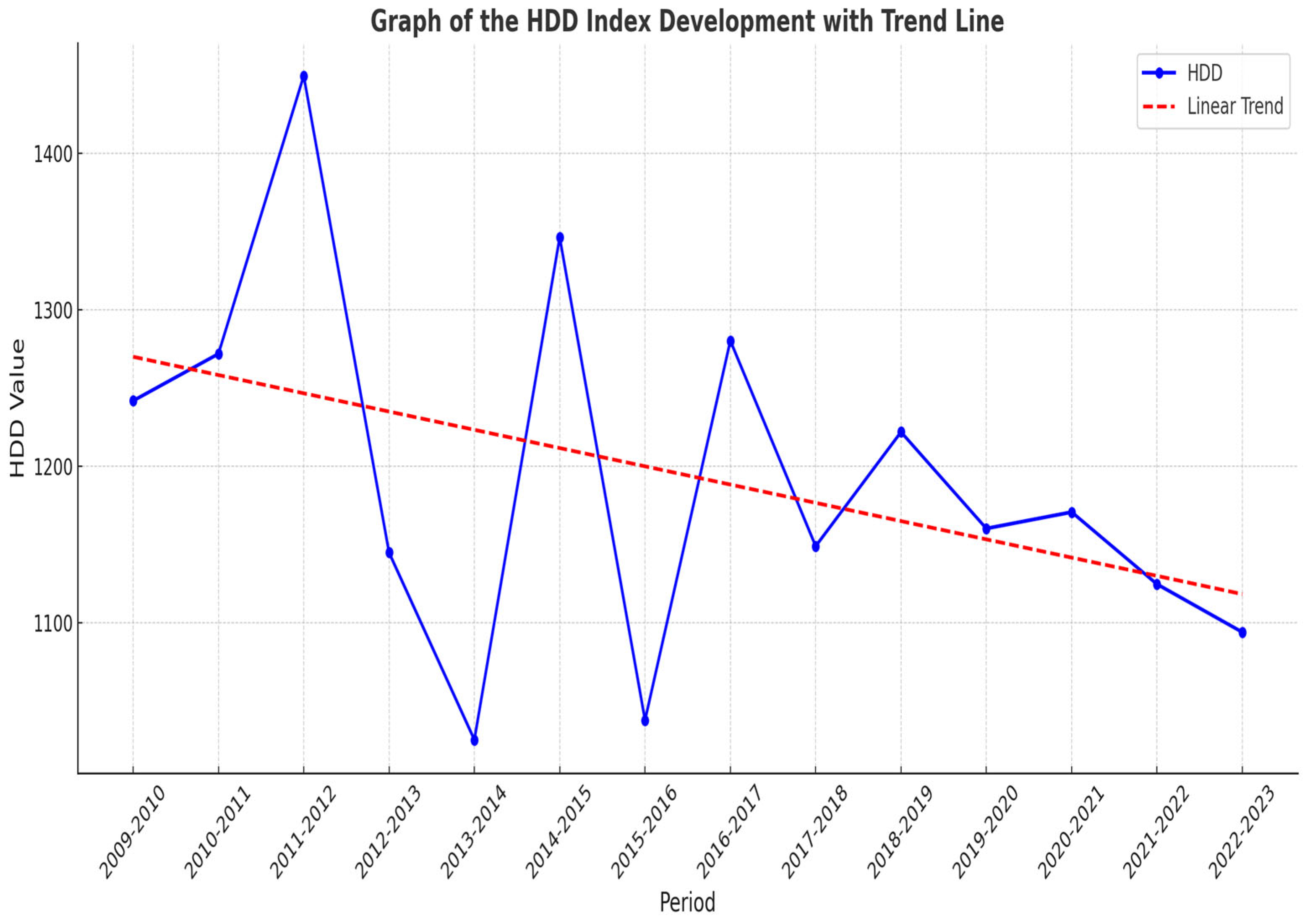

3.1. Basis Statistical Characteristics of HDD Index and the Graph of Index Development

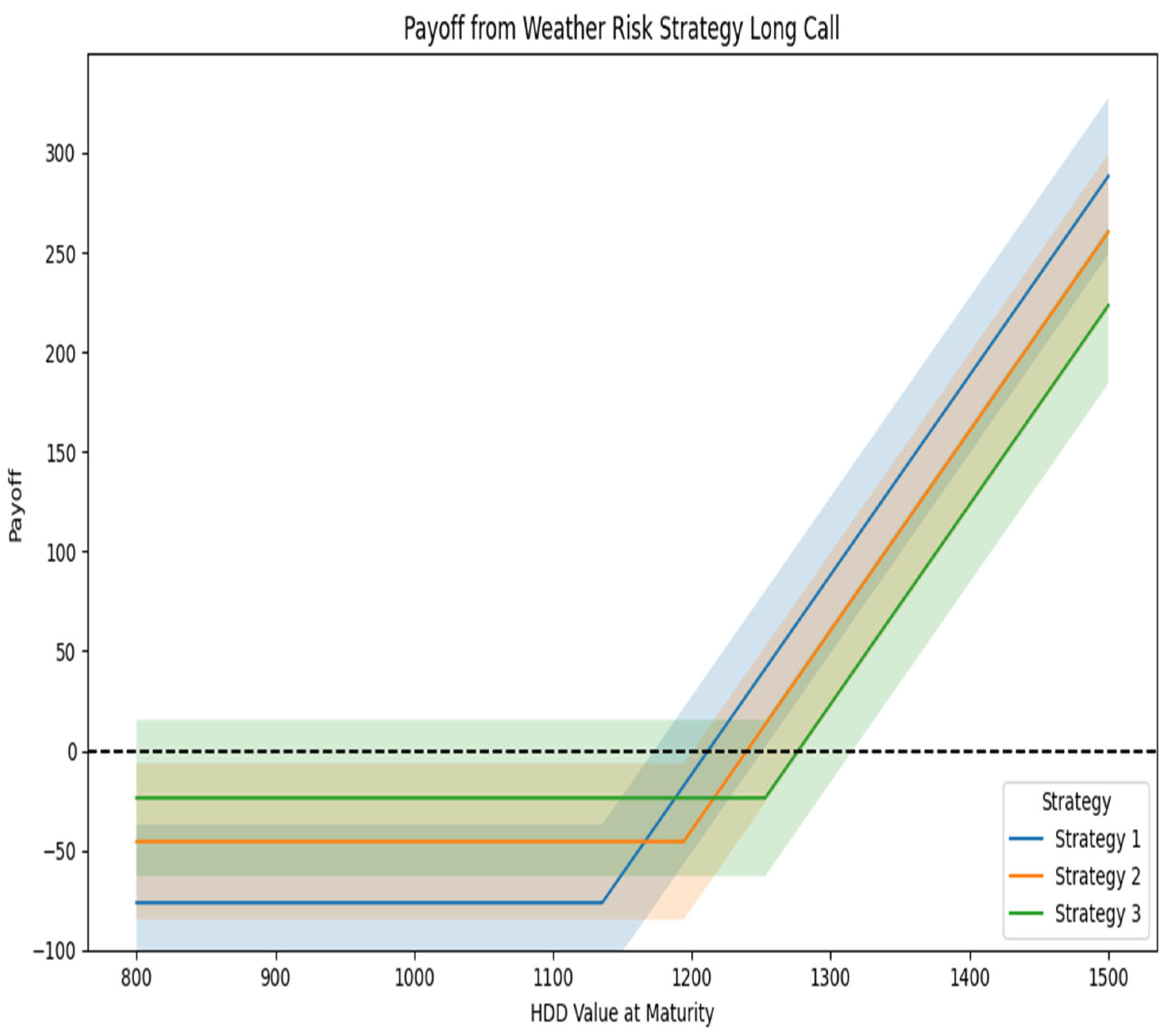

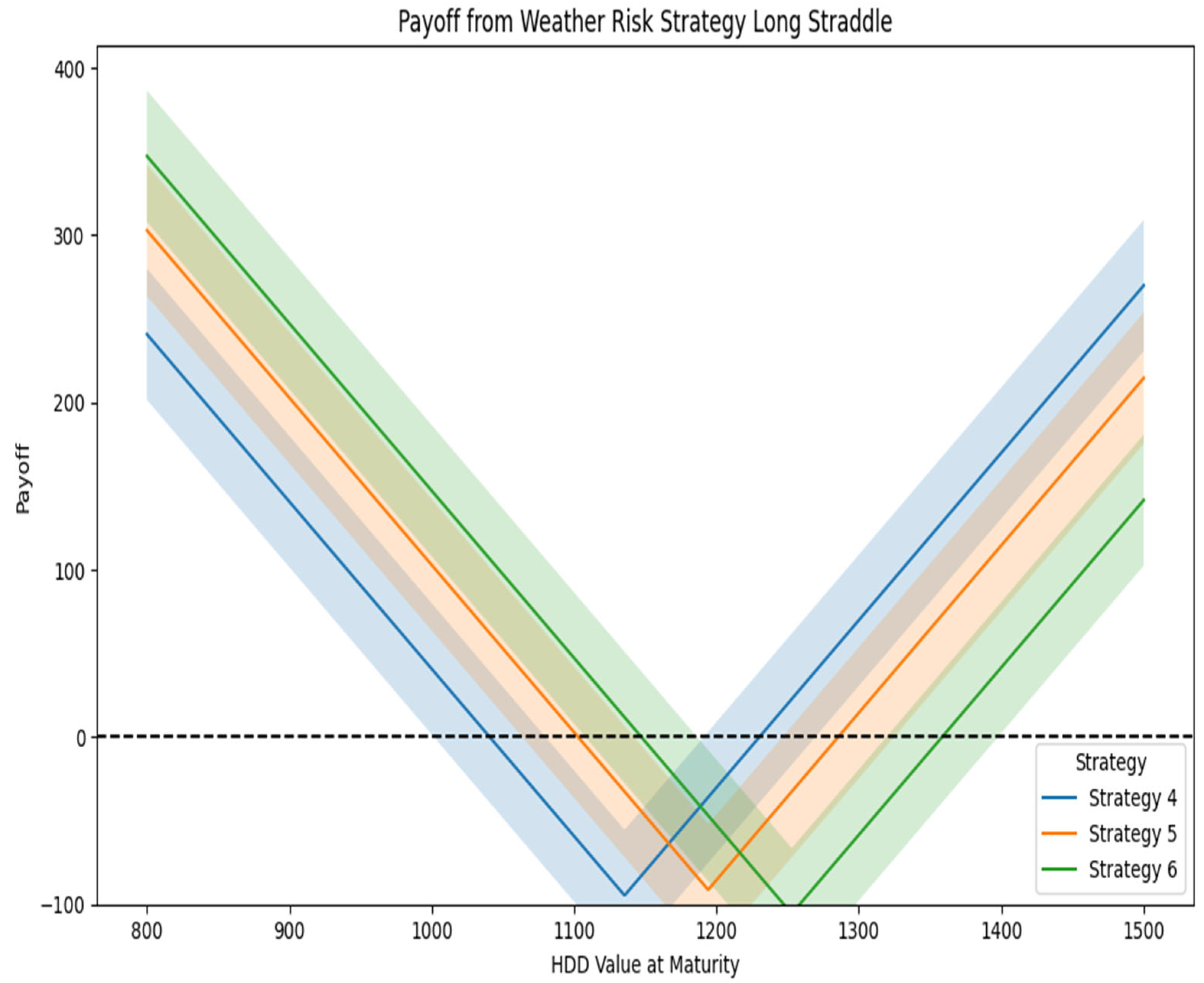

3.2. Analysis of HDD Options Strategies

3.3. Hedging Effectiveness

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Štulec, I. Effectiveness of Weather Derivatives as a Risk Management Tool in Food Retail: The Case of Croatia. Int. J. Financ. Stud. 2017, 5, 2. [Google Scholar] [CrossRef]

- Bobriková, M. Weather Risk Management in Agriculture Using Weather Derivatives. Ital. Rev. Agric. Econ. 2022, 77, 15–26. [Google Scholar] [CrossRef]

- Fu, H.; Li, J.; Li, Y.; Huang, S.; Sun, X. Risk Transfer Mechanism for Agricultural Products Supply Chain Based on Weather Index Insurance. Complexity 2018, 2018, 2369423. [Google Scholar] [CrossRef]

- Jaffee, S.; Siegel, P.; Andrews, C. Rapid Agricultural Supply Chain Risk Assessment: A Conceptual Framework; The World Bank: Washington, DC, USA, 2010. [Google Scholar]

- Chen, F.; Yano, C. Improving Supply Chain Performance and Managing Risk Under Weather-Related Demand Uncertainty. Manag. Sci. 2010, 56, 1380–1397. [Google Scholar] [CrossRef]

- Brusset, X.; Bertrand, J.-L. Hedging Weather Risk and Coordinating Supply Chains. J. Oper. Manag. 2018, 64, 41–52. [Google Scholar] [CrossRef]

- Černý, I.; Veverková, A.; Kovar, M.; Mátyás, M. The Variability of Sunflower (Helianthus Annuus L.) Yield and Quality Influenced by Wheater Conditions. Acta Univ. Agric. Et Silvic. Mendel. Brun. 2013, 61, 595–600. [Google Scholar] [CrossRef]

- Zara, C. Weather Derivatives in the Wine Industry. Int. J. Wine Bus. Res. 2008, 22, 222–237. [Google Scholar] [CrossRef]

- Brockett, P.L.; Wang, M.; Yang, C. Weather Derivatives and Weather Risk Management. Risk Manag. Insur. Rev. 2005, 8, 127–140. [Google Scholar] [CrossRef]

- Bartkowiak, M. Weather Derivatives. Math. Econ. 2009, 5–17. [Google Scholar]

- Pérez-González, F.; Yun, H. Risk Management and Firm Value: Evidence from Weather Derivatives; Wiley: Hoboken, NJ, USA, 2010. [Google Scholar]

- Vernooy, R. Does Crop Diversification Lead to Climate-Related Resilience? Improving the Theory through Insights on Practice. Agroecol. Sustain. Food Syst. 2022, 46, 877–901. [Google Scholar] [CrossRef]

- Kopeć, P. Climate Change—The Rise of Climate-Resilient Crops. Plants 2024, 13, 490. [Google Scholar] [CrossRef] [PubMed]

- Bobriková, M. Weather Risk Management in Agriculture. Acta Univ. Agric. Et Silvic. Mendel. Brun. 2016, 64, 1303–1309. [Google Scholar] [CrossRef]

- Moschini, G.; Hennessy, D. Uncertainty, Risk Aversion, and Risk Management for Agricultural Producers. Handb. Agric. Econ. 2001, 1, 88–153. [Google Scholar] [CrossRef]

- Kramer, B.; Hazell, P.; Alderman, H.; Ceballos, F.; Kumar, N.; Timu, A.G. Is Agricultural Insurance Fulfilling Its Promise for the Developing World? A Review of Recent Evidence. Annu. Rev. Resour. Econ. 2022, 14, 291–311. [Google Scholar] [CrossRef]

- Turvey, C. Weather Derivatives for Specific Event Risks in Agriculture. Rev. Agric. Econ. 2001, 23, 333–351. [Google Scholar] [CrossRef]

- Quiggin, J.; Karagiannis, G.; Stanton, J. Crop Insurance and Crop Production: An Empirical Study of Moral Hazard and Adverse Selection. In Economics of Agricultural Crop Insurance: Theory and Evidence; Hueth, D.L., Furtan, W.H., Eds.; Springer: Dordrecht, The Netherlands, 1994; pp. 253–272. ISBN 978-94-011-1386-1. [Google Scholar]

- Stoppa, A.; Hess, U.; Stoppa, A.; Hess, U. Design and Use of Weather Derivatives in Agricultural Policies: The Case of Rainfall Index Insurance in Morocco. In Proceedings of the International Conference “Agricultural Policy Reform and the WTO: Where Are We Heading”, Capri, Italy, 23–26 June 2003. [Google Scholar]

- Alexandridis, A.; Zapranis, A. Weather Derivatives: Modeling and Pricing Weather-Related Risk; Springer Science & Business Media: Berlin, Germany, 2013; ISBN 9781461460701. [Google Scholar]

- Musshoff, O.; Odening, M.; Xu, W. Management of Climate Risks in Agriculture—Will Weather Derivatives Permeate? Appl. Econ. 2011, 43, 1067–1077. [Google Scholar] [CrossRef]

- Yang, C.; Li, L.; Wen, M.-M. Weather Risk Hedging in the European Markets and International Investment Diversification. Geneva Risk Insur. Rev. 2010, 36, 74–94. [Google Scholar] [CrossRef]

- Platen, E.; West, J. Fair Pricing of Weather Derivatives; University of Technology Sydney: Ultimo, Australia, 2004. [Google Scholar]

- Oetomo, T.; Stevenson, M. Hot or Cold? A Comparison of Different Approaches to the Pricing of Weather Derivatives. J. Emerg. Mark. Financ. 2005, 4, 101–133. [Google Scholar] [CrossRef]

- Chavas, J.-P.; Di Falco, S.; Adinolfi, F.; Capitanio, F. Weather Effects and Their Long-Term Impact on the Distribution of Agricultural Yields: Evidence from Italy. Eur. Rev. Agric. Econ. 2019, 46, 29–51. [Google Scholar] [CrossRef]

- Trnka, M.; Olesen, J.; Kersebaum, K.; Rötter, R.P.; Brázdil, R.; Eitzinger, J.; Jansen, S.; Skjelvåg, A.; Peltonen-Sainio, P.; Hlavinka, P.; et al. Changing Regional Weather-Crop Yield Relationships across Europe between 1901 and 2012. Clim. Res. 2016, 70, 195–214. [Google Scholar] [CrossRef]

- Stulec, I.; Petljak, K.; Bakovic, T. Effectiveness of Weather Derivatives as a Hedge against the Weather Risk in Agriculture. Agric. Econ. 2016, 62, 356–362. [Google Scholar] [CrossRef]

- Ender, M.; Zhang, R. Efficiency of Weather Derivatives for Chinese Agriculture Industry. China Agric. Econ. Rev. 2015, 7, 102–121. [Google Scholar] [CrossRef]

- Sharma, A.K.; Vashishtha, A. Weather Derivatives: Risk-Hedging Prospects for Agriculture and Power Sectors in India. J. Risk Financ. 2007, 8, 112–132. [Google Scholar] [CrossRef]

- Buchholz, M.; Musshoff, O. The Role of Weather Derivatives and Portfolio Effects in Agricultural Water Management. Agric. Water Manag. 2014, 146, 34–44. [Google Scholar] [CrossRef]

- Fleege, T.; Richards, T.; Manfredo, M.; Sanders, D. The Performance of Weather Derivatives in Managing Risks of Specialty Crops. 2004. Available online: https://ageconsearch.umn.edu/record/19026/?v=pdf (accessed on 10 July 2024).

- Alaton, P.; Djehiche, B.; Stillberger, D. On Modelling and Pricing Weather Derivatives. Appl Math Financ. 2002, 9, 1–20. [Google Scholar] [CrossRef]

- Cramer, S.; Kampouridis, M.; Freitas, A.; Alexandridis, A. Stochastic Model Genetic Programming: Deriving Pricing Equations for Rainfall Weather Derivatives. Swarm Evol. Comput. 2019, 46, 184–200. [Google Scholar] [CrossRef]

- Alexandridis, G.; Mavrovitis, C.F.; Travlos, N.G. How Have M&As Changed? Evidence from the Sixth Merger Wave. Eur. J. Financ. 2012, 18, 663–688. [Google Scholar] [CrossRef]

- Wassan, S.; Xi, C.; Jhanjhi, N.; Imran, L. Effect of Frost on Plants, Leaves, and Forecast of Frost Events Using Convolutional Neural Networks. Int. J. Distrib. Sens. Netw. 2021, 17, 155014772110537. [Google Scholar] [CrossRef]

- Jones, T. Agricultural Applications of Weather Derivatives. Int. Bus. Econ. Res. J. (IBER) 2011, 6, 56. [Google Scholar] [CrossRef]

- Müller, A.; Grandi, M. Weather Derivatives: A Risk Management Tool for Weather-Sensitive Industries. Geneva Pap. Risk Insurance. Issues Pract. 2000, 25, 273–287. [Google Scholar] [CrossRef]

- Asseldonk, M. Insurance against Weather Risk: Use of Heating Degree-Days from Non-Local Stations for Weather Derivatives. Theor. Appl. Clim. 2003, 74, 137–144. [Google Scholar] [CrossRef]

- Cao, M.; Wei, J. Weather Derivatives Valuation and Market Price of Weather Risk. J. Futures Mark. 2004, 24, 1065–1089. [Google Scholar] [CrossRef]

- Alramadan, N.; Hasan, M.F. Using Options Futures Derivatives Weather in Hedging. Technium Soc. Sci. J. 2022, 31, 430–436. [Google Scholar]

- Zapranis, A.; Alexandridis, A. Weather Derivatives Pricing: Modeling the Seasonal Residual Variance of an Ornstein–Uhlenbeck Temperature Process with Neural Networks. Neurocomputing 2009, 73, 37–48. [Google Scholar] [CrossRef]

- Benth, F.E.; Benth, J.Š. Weather Derivatives and Stochastic Modelling of Temperature. Int. J. Stoch. Anal. 2011, 2011, 576791. [Google Scholar] [CrossRef]

- Jewson, S.; Brix, A. Weather Derivative Pricing and the Year Ahead Forecasting of Temperature Part 1: Empirical Results. SSRN Electron. J. 2004, 1. [Google Scholar] [CrossRef]

- Alexandridis, A.K.; Gzyl, H.; ter Horst, E.; Molina, G. Extracting Pricing Densities for Weather Derivatives Using the Maximum Entropy Method. J. Oper. Res. Soc. 2021, 72, 2412–2428. [Google Scholar] [CrossRef]

- Garcia, A.F.; Sturzenegger, F. Hedging Corporate Revenues with Weather Derivatives: A Case Study. Master’s Thesis, Universite de Lausanne, Ecole des Hautes Etudes Commerciales, Lausanne, Switzerland, 2001. [Google Scholar]

- Roustant, O.; Laurent, J.-P.; Bay, X.; Carraro, L. Model Risk in the Pricing of Weather Derivatives. Bank. Mark. Invest. Acad. Prof. Rev. 2003, 72, 77. [Google Scholar]

- Luedeling, E.; Girvetz, E.; Semenov, M.; Brown, P. Climate Change Affects Winter Chill for Temperate Fruit and Nut Trees. PLoS ONE 2011, 6, e20155. [Google Scholar] [CrossRef]

- Vedenov, D.; Barnett, B. Efficiency of Weather Derivatives as Primary Crop Insurance Instruments. J. Agric. Resour. Econ. 2004, 29, 387–403. [Google Scholar] [CrossRef]

- Jewson, S. Weather Derivative Pricing and Risk Management: Volatility and Value at Risk. SSRN Electron. J. 2002, 16. [Google Scholar] [CrossRef]

- Zong, L.; Ender, M. Spatially-Aggregated Temperature Derivatives: Agricultural Risk Management in China. Int. J. Financ. Stud. 2016, 4, 17. [Google Scholar] [CrossRef]

- Gyamerah, S.; Ngare, P.; Ikpe, D. Hedging Crop Yields Against Weather Uncertainties-A Weather Derivative Perspective. Math. Comput. Appl. 2019, 24, 71. [Google Scholar] [CrossRef]

- Sun, B.; van Kooten, G. Financial Weather Options for Crop Production. 2014. Available online: https://ageconsearch.umn.edu/record/164323/?v=pdf (accessed on 10 July 2024).

- Göncü, A. Pricing Temperature-Based Weather Derivatives in China. J. Risk Financ. 2011, 13, 32–44. [Google Scholar] [CrossRef]

- Bressan, G.; Romagnoli, S. Climate Risks and Weather Derivatives: A Copula-Based Pricing Model. J. Financ. Stab. 2021, 54, 100877. [Google Scholar] [CrossRef]

- Schiller, F.; Seidler, G.; Wimmer, M. Temperature Models for Pricing Weather Derivatives. Quant Financ. 2010, 12, 489–500. [Google Scholar] [CrossRef]

- Candoi-Savu, R.-A. Using Meteorological Derivatives for Weather Risk Management in Agriculture. Theor. Approach 2022, 13, 13–22. [Google Scholar]

- Spicka, J.; Hnilica, J. A Methodical Approach to Design and Valuation of Weather Derivatives in Agriculture. Adv. Meteorol. 2013, 2013, 146036. [Google Scholar] [CrossRef]

- Lee, J.; Craine, R. Temperature Modeling in the Weather Derivative Pricing. Am. J. Sci. Res. 2012, 93–109. [Google Scholar]

- Berg, E.; Schmitz, B.; Starp, M.; Trenkel, H. Weather Derivatives as an Risk Management Tool in Agriculture. In Proceedings of the 86th EAAE Seminar: Income Stabilization in Agriculture, The Role of Public Policies; 2006; pp. 379–396. Available online: http://wpage.unina.it/cafiero/pubs/13.pdf#page=389 (accessed on 20 April 2024).

- Wang, H.; Zhao, Y. Do Weather Derivatives Mitigate the Revenue Risk of Farmers?—The Case of Tongliao, Inner Mongolia, China. Sustainability 2024, 16, 1038. [Google Scholar] [CrossRef]

- Richards, T.J.; Manfredo, M.R.; Sanders, D.R. Pricing Weather Derivatives. Am. J. Agric. Econ. 2004, 86, 1005–1017. [Google Scholar] [CrossRef]

- Geyser, J.M. Weather Derivatives: Concept and Application for Their Use In South Africa. Univ. Pretoria Dep. Agric. Econ. Ext. Rural Dev. Work. Pap. 2004, 43, 444–464. [Google Scholar] [CrossRef]

- Young, S.J. Temperature-Based Weather Derivatives as a Technique for Maize Production Hedging; University of Johannesburg: Johannesburg, South Africa, 2014. [Google Scholar]

- Lai, S.; Qiu, J.; Tao, Y.; Liu, Y. Risk Hedging Strategies for Electricity Retailers Using Insurance and Strangle Weather Derivatives. Int. J. Electr. Power Energy Syst. 2022, 134, 107372. [Google Scholar] [CrossRef]

- Manfredo, M.; Richards, T. Hedging with Weather Derivatives: A Role for Options in Reducing Basis Risk. Appl. Financ. Econ. 2009, 19, 87–97. [Google Scholar] [CrossRef]

- Raucci, G.; Lanna Franco da Silveira, R.; Capitani, D. Development of Weather Derivatives: Evidence from the Brazilian Soybean Market. Riv. Econ. Agrar. 2019, 74, 17–28. [Google Scholar] [CrossRef]

- Wang, Z.; Li, P.; Li, L.; Huang, C.; Liu, M. Modeling and Forecasting Average Temperature for Weather Derivative Pricing. Adv. Meteorol. 2015, 2015, 837293. [Google Scholar] [CrossRef]

| Month | Avg High (°C) | Avg Low (°C) |

|---|---|---|

| January | 8.5 | 2.4 |

| February | 10.8 | 4.3 |

| March | 14.0 | 6.7 |

| April | 19.1 | 10.5 |

| May | 22.9 | 14.6 |

| June | 27.5 | 19.7 |

| July | 31.1 | 21.4 |

| August | 31.0 | 21.5 |

| September | 25.7 | 18.7 |

| October | 20.2 | 13.2 |

| November | 15.1 | 9.8 |

| December | 10.5 | 5.1 |

| Statistical Characteristics | HDD Index |

|---|---|

| Average | 1194.13 |

| Median | 1165.45 |

| Standard Deviation | 117.39 |

| Range (Dispersion) | 424.6 |

| Minimum | 1025.1 |

| Maximum | 1449.7 |

| Coefficient of Variation | 0.0983 |

| Skewness | 0.552 |

| Kurtosis | −0.185 |

| Premium of Call Option | Strike Price Based on HDD Index | Premium of Put Option |

|---|---|---|

| EUR 76.34 | 1135.44 | EUR 18.38 |

| EUR 45.62 | 1194.14 | EUR 45.68 |

| EUR 23.77 | 1252.83 | EUR 81.80 |

| HDD Index Range HDDT | Strike Price (K) | Payoff from Long Strategy | Premium of Call (cL) | Net Payoff HDDT-cL |

|---|---|---|---|---|

| Strategy 1 | ||||

| HDDT ≤ K | 1135.44 | 0 | 77.3 | −76.3 |

| HDDT ≥ K | 1135.44 | HDDT- 1135.44 | 77.3 | (HDDT-1135.44)-76.3 |

| Strategy 2 | ||||

| HDDT ≤ K | 1194.14 | 0 | 45.6 | −46.26 |

| HDDT ≥ K | 1194.14 | HDDT- 1194.14 | 45.6 | (HDDT-1194.14)-45.6 |

| Strategy 3 | ||||

| HDDT ≤ K | 1252.83 | 0 | 23.7 | −23.7 |

| HDDT ≥ K | 1252.83 | HDDT- 1252.83 | 23.7 | (HDDT-1252.83)-23.7 |

| HDD Index Range HDDT | Strike Price (K) | Payoff of Long | Premium of Call (cL) | Payoff of Put | Premium of Put (pL) | Long Straddle Payoff (LP) | Net Payoff (LP-cL-pL) |

|---|---|---|---|---|---|---|---|

| Strategy 4 | |||||||

| HDDT ≤ K | 1135.44 | HDDT-1135.44 | 76.3 | 1135.4-HDDT | 18.3 | Call + Put Payoff | LP- 76.3-18.3 |

| HDDT ≥ K | 1135.44 | HDDT-1135.44 | 76.3 | 1135.4-HDDT | 18.3 | Call + Put Payoff | LP- 76.3-18.3 |

| Strategy 5 | |||||||

| HDDT ≤ K | 1194.14 | HDDT-1135.44 | 45.6 | 1194.1-HDDT | 45.6 | Call + Put Payoff | LP- 45.6-45.6 |

| HDDT ≥ K | 1194.14 | HDDT-1194.14 | 45.6 | 1194.1-HDDT | 45.6 | Call + Put Payoff | LP- 45.6-45.6 |

| Strategy 6 | |||||||

| HDDT ≤ K | 1252.8 | HDDT-1252.83 | 23.7 | 1252.8-HDDT | 81.8 | Call + Put Payoff | LP- 23.7-81.8 |

| HDDT ≥ K | 1252.8 | HDDT-1252.8 | 23.7 | 1252.8-HDDT | 81.8 | Call + Put Payoff | LP- 23.7-81.8 |

| Without Hedging (WH) | WH+S1 | WH+S2 | WH+S3 | WH+S4 | WH+S5 | WH+S6 | |

|---|---|---|---|---|---|---|---|

| 2010–2011 | 25,607,030 | 27,239,047 | 26,480,587 | 25,479,384 | 26,740,104 | 25,240,558 | 23,258,841 |

| 2011–2012 | 26,909,954 | 33,385,185 | 32,624,769 | 31,621,043 | 32,884,954 | 31,381,542 | 29,394,774 |

| 2012–2013 | 8,864,050 | 7,041,122 | 7,622,456 | 8,217,126 | 6,540,891 | 7,722,066 | 8,931,001 |

| 2013–2014 | 26,339,425 | 24,525,892 | 25,255,676 | 25,774,745 | 26,710,494 | 28,186,216 | 29,241,457 |

| 2014–2015 | 14,426,559 | 17,614,898 | 16,953,168 | 16,079,701 | 17,179,587 | 15,871,283 | 14,142,350 |

| 2015–2016 | 17,254,713 | 15,513,245 | 16,214,030 | 16,712,472 | 17,325,886 | 18,742,967 | 19,756,276 |

| 2016–2017 | 20,374,437 | 21,872,626 | 21,261,719 | 20,450,392 | 21,470,747 | 20,262,926 | 18,661,835 |

| 2017–2018 | 17,579,560 | 16,113,073 | 16,515,610 | 17,025,196 | 15,684,414 | 16,505,348 | 17,541,311 |

| 2018–2019 | 21,037,211 | 21,252,817 | 20,657,556 | 20,530,791 | 20,861,231 | 19,684,344 | 19,447,005 |

| 2019–2020 | 22,780,021 | 21,623,906 | 21,757,494 | 22,247,240 | 21,211,937 | 21,494,354 | 22,489,983 |

| 2020–2021 | 22,156,986 | 21,164,863 | 21,055,217 | 21,582,917 | 20,720,967 | 20,518,099 | 21,590,886 |

| SUM | 223,329,946 | 227,346,673 | 226,398,283 | 225,721,006 | 227,331,213 | 225,609,703 | 224,455,719 |

| Without Hedging | S1 | S2 | S3 | S4 | S5 | S6 | |

|---|---|---|---|---|---|---|---|

| Value at Risk (VaR) | 11,706,580 | 9,972,597 | 10,412,175 | 10,886,208 | 9,899,086 | 10,524,241 | 11,044,387 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Prentzas, A.; Bournaris, T.; Nastis, S.; Moulogianni, C.; Vlontzos, G. Enhancing Sustainability through Weather Derivative Option Contracts: A Risk Management Tool in Greek Agriculture. Sustainability 2024, 16, 7372. https://doi.org/10.3390/su16177372

Prentzas A, Bournaris T, Nastis S, Moulogianni C, Vlontzos G. Enhancing Sustainability through Weather Derivative Option Contracts: A Risk Management Tool in Greek Agriculture. Sustainability. 2024; 16(17):7372. https://doi.org/10.3390/su16177372

Chicago/Turabian StylePrentzas, Angelos, Thomas Bournaris, Stefanos Nastis, Christina Moulogianni, and George Vlontzos. 2024. "Enhancing Sustainability through Weather Derivative Option Contracts: A Risk Management Tool in Greek Agriculture" Sustainability 16, no. 17: 7372. https://doi.org/10.3390/su16177372

APA StylePrentzas, A., Bournaris, T., Nastis, S., Moulogianni, C., & Vlontzos, G. (2024). Enhancing Sustainability through Weather Derivative Option Contracts: A Risk Management Tool in Greek Agriculture. Sustainability, 16(17), 7372. https://doi.org/10.3390/su16177372