The Role of Labor Force, Physical Capital, and Energy Consumption in Shaping Agricultural and Industrial Output in Pakistan

Abstract

:1. Introduction

2. Literature Review

2.1. The Labor Force, Physical Capital, and Sectoral Output

2.2. Energy Consumption and Sectoral Output

3. Theoretical Framework

4. Materials and Methods

4.1. Data

4.2. Methods and Model Specifications

- Model 1:

- ARDL Framework of Model 1:

5. Results

5.1. Descriptive Statistics

5.2. Correlation Matrix and Variance Inflation Factor

5.3. Unit Root Analysis

5.4. Regression Analysis

5.5. Robustness Analysis

5.6. Diagnostic Tests

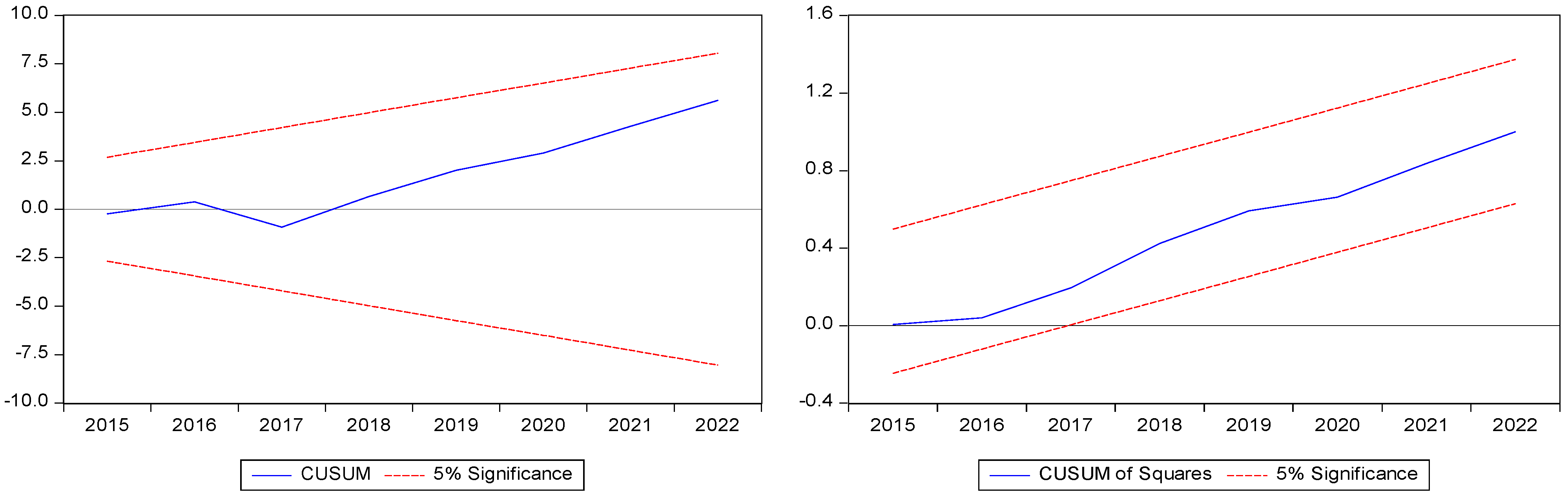

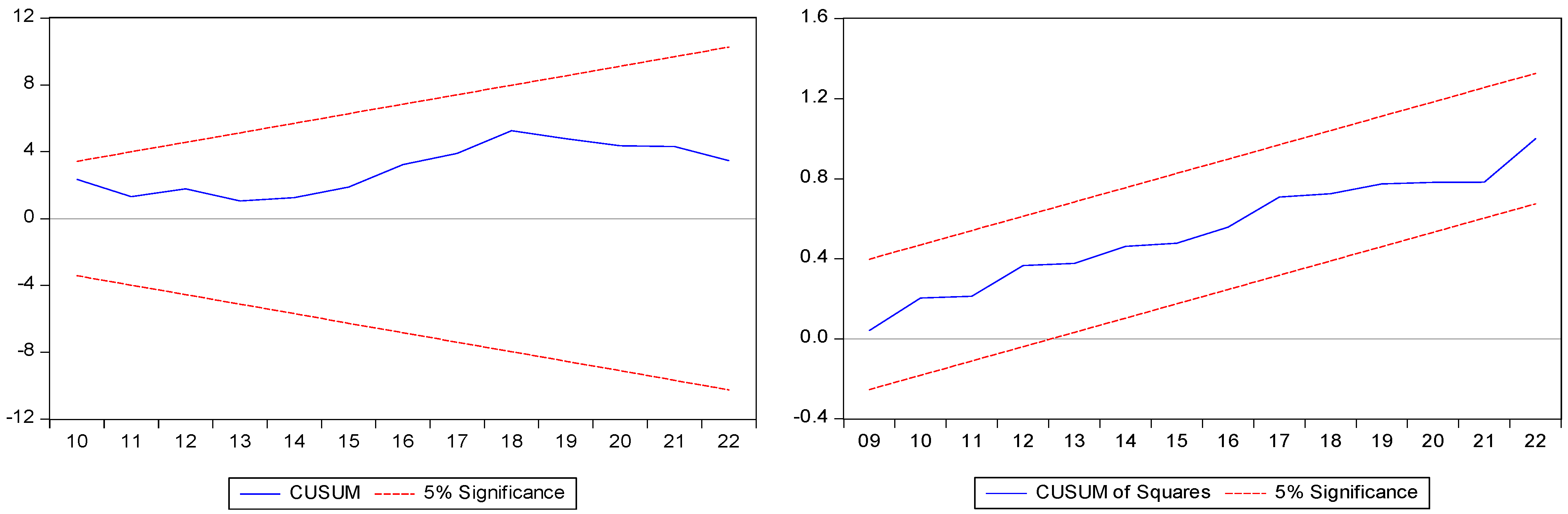

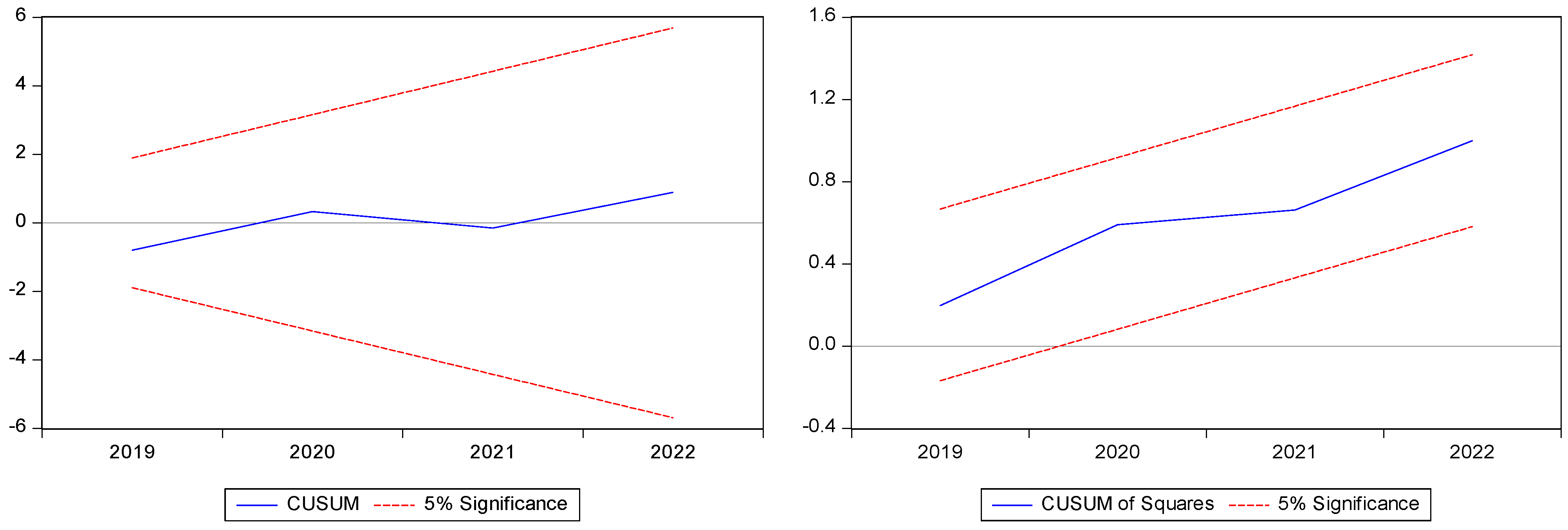

5.7. Stability Estimates

6. Discussion

6.1. The Role of the Labor Force and Physical Capital

6.2. The Role of Energy Consumption: Oil, Electricity, and Gas

6.3. Sustainability and Economic Growth

7. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Solow, R.M. A contribution to the theory of economic growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Swan, T.W. Economic growth and capital accumulation. Econ. Rec. 1956, 32, 334–361. [Google Scholar] [CrossRef]

- Schultz, T.W. Investment in human capital. Am. Econ. Rev. 1961, 51, 1–17. [Google Scholar]

- Romer, P.M. Increasing returns and long-run growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Lucas, R.E., Jr. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98, 71–102. [Google Scholar] [CrossRef]

- Umair, M.; Ahmad, W.; Hussain, B.; Fortea, C.; Zlati, M.L.; Antohi, V.M. Empowering Pakistan’s economy: The role of health and education in shaping labor force participation and economic growth. Economies 2024, 12, 113. [Google Scholar] [CrossRef]

- Vander Donckt, M.; Chan, P.; Silvestrini, A. A new global database on agriculture investment and capital stock. Food Policy 2021, 100, 101961. [Google Scholar] [CrossRef]

- Dogan, E.; Sebri, M.; Turkekul, B. Exploring the relationship between agricultural electricity consumption and output: New evidence from Turkish regional data. Energy Policy 2016, 95, 370–377. [Google Scholar] [CrossRef]

- Zhang, L.; Pang, J.; Chen, X.; Lu, Z. Carbon emissions, energy consumption and economic growth: Evidence from the agricultural sector of China’s main grain-producing areas. Sci. Total Environ. 2019, 665, 1017–1025. [Google Scholar] [CrossRef]

- Chandio, A.A.; Jiang, Y.; Rehman, A. Energy consumption and agricultural economic growth in Pakistan: Is there a nexus? Int. J. Energy Sect. Manag. 2019, 13, 597–609. [Google Scholar] [CrossRef]

- Chen, N.; Sun, D.; Chen, J. Digital transformation, labour share, and industrial heterogeneity. J. Innov. Knowl. 2022, 7, 100173. [Google Scholar] [CrossRef]

- Li, Y.; Wang, X.; Westlund, H.; Liu, Y. Physical capital, human capital, and social capital: The changing roles in China’s economic growth. Growth Chang. 2015, 46, 133–149. [Google Scholar] [CrossRef]

- Abbasi, K.R.; Shahbaz, M.; Jiao, Z.; Tufail, M. How energy consumption, industrial growth, urbanization, and CO2 emissions affect economic growth in Pakistan? A novel dynamic ARDL simulations approach. Energy 2021, 221, 119793. [Google Scholar] [CrossRef]

- Ahmad, T.; Zhang, D. A critical review of comparative global historical energy consumption and future demand: The story told so far. Energy Rep. 2020, 6, 1973–1991. [Google Scholar] [CrossRef]

- Lifset, R.D. A new understanding of the American energy crisis of the 1970s. Hist. Soc. Res. 2014, 39, 22–42. [Google Scholar]

- Wang, Y.; Wu, C.; Yang, L. Oil price shocks and agricultural commodity prices. Energy Econ. 2014, 44, 22–35. [Google Scholar] [CrossRef]

- IEA. Global Energy Report. In Global Energy and CO2 Status Report 2019; International Energy Agency: Paris, France, 2019. [Google Scholar]

- Fatima, N.; Li, Y.; Ahmad, M.; Jabeen, G.; Li, X. Analyzing long-term empirical interactions between renewable energy generation, energy use, human capital, and economic performance in Pakistan. Energy Sustain. Soc. 2019, 9, 42. [Google Scholar] [CrossRef]

- Ali, L.; Akhtar, N. The effectiveness of export, FDI, human capital, and R&D on total factor productivity growth: The case of Pakistan. J. Knowl. Econ. 2024, 15, 3085–3099. [Google Scholar]

- Pomi, S.S.; Sarkar, S.M.; Dhar, B.K. Human or physical capital, which influences sustainable economic growth most? A study on Bangladesh. Can. J. Bus. Inf. Stud. 2021, 3, 101–108. [Google Scholar]

- Nasir, A.; Faridi, M.Z.; Hussain, H.; Mehmood, K.A. Energy consumption and bi-sectoral output in Pakistan: A disaggregated analysis. iRASD J. Econ. 2021, 3, 68–79. [Google Scholar] [CrossRef]

- Umair, M.; Sheikh, M.R.; Saeed, K. A historical and econometric analysis of energy consumption and industrial output in Pakistan (1990–2019). Perenn. J. Hist. 2021, 2, 353–382. [Google Scholar] [CrossRef]

- Rehman, H.; Bashir, D.F. Energy consumption and agriculture sector in middle income developing countries: A panel data analysis. Pak. J. Soc. Sci. 2015, 35, 479–496. [Google Scholar]

- Khan, M.A.; Rehan, R.; Chhapra, I.U.; Bai, A. Inspecting energy consumption, capital formation and economic growth nexus in Pakistan. Sustain. Energy Technol. Assess. 2022, 50, 101845. [Google Scholar]

- Abokyi, E.; Appiah-Konadu, P.; Sikayena, I.; Oteng-Abayie, E.F. Consumption of electricity and industrial growth in the case of Ghana. J. Energy 2018, 2018, 8924835. [Google Scholar] [CrossRef]

- Rastegaripour, F.; Karbasi, A.; Pirmalek, F. Relationship between CO2 emissions, energy consumption, and economic growth in Iran. J. Energy Dev. 2019, 45, 197–212. [Google Scholar]

- Ishioro, B.O. Energy consumption and performance of sectoral outputs: Results from an energy-impoverished economy. J. Environ. Manag. Tour. 2018, 7, 1539–1558. [Google Scholar] [CrossRef]

- Olofin, O.P.; Olayeni, O.R.; Abogan, O.P. Economic consequences of disaggregate energy consumption in West African countries. J. Sustain. Dev. 2014, 7, 71–77. [Google Scholar] [CrossRef]

- Mitic, P.; Fedajev, A.; Radulescu, M.; Rehman, A. The relationship between CO2 emissions, economic growth, available energy, and employment in SEE countries. Environ. Sci. Pollut. Res. 2023, 30, 16140–16155. [Google Scholar] [CrossRef]

- Grovermann, C.; Wossen, T.; Muller, A.; Nichterlein, K. Eco-efficiency and agricultural innovation systems in developing countries: Evidence from macro-level analysis. PLoS ONE 2019, 14, e0214115. [Google Scholar] [CrossRef]

- Roman-Collado, R.; Economidou, M. The role of energy efficiency in assessing the progress towards the EU energy efficiency targets of 2020: Evidence from the European productive sectors. Energy Policy 2021, 156, 112441. [Google Scholar] [CrossRef]

- Mankiw, N.G.; Romer, D.; Weil, D.N. A contribution to the empirics of economic growth. Q. J. Econ. 1992, 107, 407–437. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis; Department of Applied Economics, University of Cambridge: Cambridge, UK, 1995; Volume 9514, pp. 371–413. [Google Scholar]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Narayan, P.K. The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Potapov, A.P. Modeling the impact of resource factors on agricultural output. Ekon. I Sotsialnye Peremeny 2020, 13, 154–168. [Google Scholar] [CrossRef]

- Arfah, A. The effect of labor, private investment and government investment on productivity in the industrial sector. Gold. Ratio Soc. Sci. Educ. 2021, 1, 50–60. [Google Scholar] [CrossRef]

- Ikpesu, F.; Okpe, A.E. Capital inflows, exchange rate and agricultural output in Nigeria. Future Bus. J. 2019, 5, 3. [Google Scholar] [CrossRef]

- Ayeomoni, I.O.; Aladejana, S.A.; Tunde, K. Disaggregated energy consumption and industrial output in Nigeria. Econ. Manag. 2019, 8, 15–26. [Google Scholar]

- Rokicki, T.; Perkowska, A.; Klepacki, B.; Borawski, P.; Bełdycka-Borawska, A.; Michalski, K. Changes in energy consumption in agriculture in the EU countries. Energies 2021, 14, 1570. [Google Scholar] [CrossRef]

- Tapsın, G. The link between industry value added and electricity consumption. Eur. Sci. J. 2019, 13, 41–56. [Google Scholar] [CrossRef]

- Mesagan, E.P.; Adenuga, J.I. Effects of oil resource endowment, natural gas and agriculture output: Policy options for inclusive growth. AGDI Work. Pap. 2019, 19, 073. [Google Scholar]

- Shaari, M.S.; Majekodunmi, T.B.; Zainal, N.F.; Harun, N.H.; Ridzuan, A.R. The linkage between natural gas consumption and industrial output: New evidence based on time series analysis. Energy 2023, 284, 129395. [Google Scholar] [CrossRef]

- Soliman, A.M.; Lau, C.K.; Cai, Y.; Sarker, P.K.; Dastgir, S. Asymmetric effects of energy inflation, agri-inflation and CPI on agricultural output: Evidence from NARDL and SVAR models for the UK. Energy Econ. 2023, 126, 106920. [Google Scholar] [CrossRef]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for testing the constancy of regression relationships over time. J. R. Stat. Soc. Ser. B Stat. Methodol. 1975, 37, 149–163. [Google Scholar] [CrossRef]

| Variables | Description | Signs | Source |

|---|---|---|---|

| Dependent variables | |||

| Agricultural Output (AO) | Log of agricultural value added (constant LCU in millions) | WDI, World Bank | |

| Industrial Output (IO) | Log of industrial value added (constant LCU in millions) | WDI, World Bank | |

| Core variables | |||

| Labor in Agriculture (LBA) | Log of number of labor working in agricultural sector (millions) | + | PBS |

| Capital in Agriculture (CPA) | Log of capital use in agricultural sector (constant LCU in millions) | + | PBS |

| Electricity Consumption in Agriculture (ELA) | Log of electricity consumption in agricultural sector (Gwh) | + | PBS |

| Oil Consumption in Agriculture (OILA) | Log of oil consumption in agricultural sector (tons) | + | PBS |

| Gas Consumption in Agriculture (GSA) | Log of gas consumption in agricultural sector (mm cft) | + | PBS |

| Labor in Industry (LABI) | Log of number of labor working in industrial sector (million) | + | PBS |

| Capital in Industry (CPI) | Log of capital use in industrial sector (constant LCU in millions) | + | PBS |

| Electricity Consumption in Industry (ELI) | Log of electricity consumption in industrial sector (Gwh) | + | PBS |

| Oil Consumption in Industry (OILI) | Log of oil consumption in industrial sector (tons) | + | PBS |

| Gas Consumption in Industry (GSI) | Log of gas consumption in industrial sector (mm cft) | + | PBS |

| Control variables | |||

| Inflation (INF) | Consumer price index (2010 = 100) | − | WDI, World Bank |

| Trade Openness (OPN) | Trade openness (% of GDP) | + | WDI, World Bank |

| Variables | AO | IO | LBA | CPA | OILA | ELA | GSA | LBI | CPI | OILI | ELI | GSI | INF | OPN |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 15.54 | 15.13 | 3.00 | 11.62 | 11.25 | 8.91 | 12.15 | 17.76 | 13.13 | 14.24 | 9.81 | 12.16 | 4.22 | 0.24 |

| Median | 15.59 | 15.21 | 3.02 | 11.81 | 11.48 | 8.98 | 12.17 | 17.78 | 13.40 | 14.28 | 9.89 | 12.31 | 4.10 | 0.14 |

| Std. Dev. | 0.28 | 0.45 | 0.21 | 1.47 | 1.22 | 0.22 | 0.25 | 0.28 | 0.94 | 0.25 | 0.31 | 0.44 | 0.77 | 0.22 |

| Skewness | −0.34 | −0.12 | −0.20 | −0.07 | −0.31 | −0.42 | −0.74 | −0.21 | −0.37 | −0.25 | −0.17 | −0.39 | 0.02 | 0.86 |

| Kurtosis | 2.03 | 1.63 | 1.46 | 1.52 | 1.49 | 2.00 | 2.97 | 1.74 | 1.97 | 2.20 | 1.53 | 1.62 | 1.80 | 2.56 |

| Jarque-Bera | 1.92 | 2.65 | 3.48 | 3.03 | 3.69 | 2.34 | 3.05 | 2.43 | 2.20 | 1.23 | 3.14 | 3.44 | 1.97 | 4.37 |

| Probability | 0.38 | 0.27 | 0.18 | 0.22 | 0.16 | 0.31 | 0.22 | 0.30 | 0.33 | 0.54 | 0.21 | 0.18 | 0.37 | 0.11 |

| Maximum | 15.99 | 15.82 | 3.26 | 13.73 | 12.64 | 9.22 | 12.53 | 18.18 | 14.37 | 14.70 | 10.27 | 12.72 | 5.57 | 0.73 |

| Minimum | 14.99 | 14.38 | 2.64 | 9.36 | 9.45 | 8.42 | 11.53 | 17.32 | 11.23 | 13.78 | 9.33 | 11.39 | 2.89 | 0.03 |

| Observations | 33 | 33 | 33 | 33 | 33 | 33 | 33 | 33 | 33 | 33 | 33 | 33 | 33 | 33 |

| Variables | AO | IO | LBA | CPA | OILA | ELA | GSA | LBI | CPI | OILI | ELI | GSI | INF | OPN |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AO | 1 | |||||||||||||

| IO | 0.74 | 1 | ||||||||||||

| LBA | 0.67 | 0.66 | 1 | |||||||||||

| CPA | 0.76 | 0.67 | 0.56 | 1 | ||||||||||

| OILA | 0.57 | 0.75 | −0.62 | −0.66 | 1 | |||||||||

| ELA | 0.58 | 0.77 | 0.61 | 0.78 | −0.77 | 1 | ||||||||

| GSA | 0.73 | 0.74 | 0.60 | 0.62 | −0.75 | 0.67 | 1 | |||||||

| LBI | 0.67 | 0.69 | 0.56 | 0.69 | −0.84 | 0.83 | 0.70 | 1 | ||||||

| CPI | 0.45 | 0.69 | 0.64 | 0.78 | −0.81 | 0.83 | 0.76 | 0.78 | 1 | |||||

| OILI | 0.31 | 0.36 | −0.42 | −0.39 | 0.31 | −0.41 | −0.18 | −0.36 | −0.29 | 1 | ||||

| ELI | 0.67 | 0.78 | 0.53 | 0.78 | −0.74 | 0.86 | 0.70 | 0.67 | 0.87 | −0.40 | 1 | |||

| GSI | 0.87 | 0.65 | 0.85 | 0.55 | −0.73 | 0.80 | 0.83 | 0.74 | 0.86 | −0.44 | 0.86 | 1 | ||

| INF | −0.82 | −0.78 | 0.66 | 0.58 | −0.85 | 0.82 | 0.83 | 0.79 | 0.87 | −0.30 | 0.75 | 0.78 | 1 | |

| OPN | 0.75 | 0.81 | 0.57 | 0.72 | −0.63 | 0.80 | 0.69 | 0.70 | 0.86 | −0.37 | 0.88 | 0.60 | 0.83 | 1 |

| Variables | VIF | 1/VIF |

|---|---|---|

| LBA | 2.10 | 0.47 |

| CPA | 3.12 | 0.32 |

| OILA | 1.03 | 0.97 |

| ELA | 0.62 | 1.61 |

| GSA | 2.13 | 0.47 |

| LBI | 3.32 | 0.30 |

| CPI | 3.76 | 0.27 |

| OILI | 1.23 | 0.81 |

| ELI | 2.53 | 0.39 |

| GSI | 1.28 | 0.78 |

| INF | 2.10 | 0.48 |

| OPN | 0.33 | 3.03 |

| Variables | Level | 1st Difference | ||||

|---|---|---|---|---|---|---|

| KPSS | DF-GLS | Ng-Perron | KPSS | DF-GLS | Ng-Perron | |

| IO | <0.1 | >0.1 | >0.1 | <0.01 | <0.01 | >0.01 |

| AO | <0.1 | >0.1 | >0.1 | <0.05 | <0.01 | <0.05 |

| LBA | >0.05 | <0.1 | <0.05 | >0.1 | >0.01 | >0.01 |

| CPA | >0.05 | >0.1 | >0.1 | <0.05 | <0.01 | <0.01 |

| OILA | >0.1 | <0.05 | <0.05 | <0.01 | <0.05 | <0.01 |

| ELA | <0.05 | >0.1 | >0.1 | >0.1 | <0.01 | <0.01 |

| GSA | >0.05 | >0.1 | >0.05 | >0.1 | >0.05 | <0.01 |

| LBI | >0.05 | >0.1 | >0.1 | >0.1 | <0.01 | <0.05 |

| CPI | <0.01 | >0.1 | >0.1 | >0.1 | <0.01 | <0.01 |

| OILI | >0.1 | <0.01 | >0.1 | <0.05 | <0.01 | <0.01 |

| ELI | <0.05 | >0.1 | >0.1 | >0.1 | <0.01 | <0.01 |

| GSI | <0.05 | >0.1 | >0.1 | <0.01 | <0.01 | <0.01 |

| INF | >0.05 | >0.1 | >0.1 | >0.1 | <0.05 | <0.05 |

| OPN | >0.05 | >0.1 | >0.1 | >0.1 | <0.01 | <0.01 |

| Model 1 | Model 2 | Model 3 | Model 4 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Test-Stat | Significant | I(0) | I(1) | I(0) | I(1) | I(0) | I(1) | I(0) | I(1) |

| 1% | 2.73 | 3.9 | 2.62 | 3.77 | 2.73 | 3.9 | 2.62 | 3.77 | |

| 5% | 2.17 | 3.21 | 2.11 | 3.15 | 2.17 | 3.21 | 2.11 | 3.15 | |

| 10% | 1.92 | 2.89 | 1.85 | 2.85 | 1.92 | 2.89 | 1.85 | 2.85 | |

| F-stat | 9.64 | 7.92 | 9.83 | 8.80 | |||||

| k | 7 | 8 | 7 | 8 | |||||

| Dep. Var: Agricultural Output | Model 1 | Model 2 |

|---|---|---|

| LBA | 0.516 *** | 0.496 *** |

| (0.182) | (0.139) | |

| CPA | 0.165 *** | 0.421 *** |

| (0.032) | (0.121) | |

| OILA | 0.137 * | 0.165 *** |

| (0.076) | (0.033) | |

| ELA | 0.333 *** | 0.848 *** |

| (0.08) | (0.182) | |

| GSA | 0.049 ** | 0.592 *** |

| (0.02) | (0.171) | |

| OILA × ELA | 1.184 ** | |

| (0.495) | ||

| INF | −0.341 | −0.349 *** |

| (0.094) | (0.123) | |

| OPN | 0.502 *** | 1.277 ** |

| (0.149) | (0.623) | |

| C | 5.857 *** | 8.598 *** |

| (1.107) | (1.011) |

| Dep. Var: Industrial Output | Model 3 | Model 4 |

|---|---|---|

| LBI | 0.156 | 0.396 ** |

| (0.102) | (0.165) | |

| CPI | 0.126 *** | 0.205 *** |

| (0.022) | (0.022) | |

| OILI | 0.037 ** | 0.749 ** |

| (0.019) | (0.290) | |

| ELI | 0.002 *** | 0.479 *** |

| (0.001) | (0.102) | |

| GSI | 0.296 *** | 0.186 *** |

| (0.037) | (0.038) | |

| OILI × ELI | 1.269 *** | |

| (0.618) | ||

| INF | −0.035 | 0.249 *** |

| (0.078) | (0.058) | |

| OPN | 0.110 | 0.322 *** |

| (0.089) | (0.063) | |

| C | 9.047 *** | 10.743 *** |

| (0.696) | (2.464) |

| Dep. Var: Agricultural Output | Model 1 | Model 2 |

|---|---|---|

| Constant | 12.041 *** | 13.916 ** |

| (2.766) | (5.976) | |

| D(AO(−1)) | −0.355 ** | −0.087 |

| (0.137) | (0.043) | |

| D(LBA) | 0.119 ** | 0.171 *** |

| (0.051) | (0.033) | |

| D(CPA) | 0.196 *** | 0.049 *** |

| (0.012) | (0.012) | |

| D(CPA(−1)) | 0.12 *** | 0.180 *** |

| (0.018) | (0.012) | |

| D(OILA) | 0.135 *** | 0.154 |

| (0.018) | (0.227) | |

| D(OILA(−1)) | 0.154 *** | 2.639 *** |

| (0.017) | (0.251) | |

| D(ELA) | 0.268 *** | 0.438 *** |

| (0.02) | (0.037) | |

| D(ELA(−1)) | 0.292 *** | 0.551 |

| (0.021) | (0.041) | |

| D(GSA) | 0.118 *** | −0.042 * |

| (0.006) | (0.019) | |

| D(GSA(−1)) | 0.046 *** | 2.041 *** |

| (0.006) | (0.188) | |

| D(OILA × ELA) | 2.489 *** | |

| (0.167) | ||

| D(OILA × ELA(−1)) | 2.143 *** | |

| (0.143) | ||

| D(INF) | 0.066 * | 0.142 ** |

| (0.035) | (0.045) | |

| D(INF(−1)) | −0.456 *** | −1.119 *** |

| (0.101) | (0.105) | |

| D(OPN) | −0.052 | 1.320 *** |

| (0.082) | (0.075) | |

| D(OPN(−1)) | −0.314 *** | 1.137 *** |

| (0.096) | (0.066) | |

| ECM(−1) * | −0.311 *** | −2.191 *** |

| (0.059) | (0.082) |

| Dep. Var: Industrial Output | Model 3 | Model 4 |

|---|---|---|

| Constant | 13.799 *** | 48.204 *** |

| (3.194) | (15.666) | |

| D(IO(−1)) | 0.661 *** | 0.529 *** |

| (0.139) | (0.068) | |

| D(LI) | 0.027 | 1.841 *** |

| (0.055) | (0.175) | |

| D(LI(−1)) | 0.401 *** | 1.083 *** |

| (0.066) | (0.146) | |

| D(CPI) | 0.074 *** | 0.096 *** |

| (0.022) | (0.014) | |

| D(CPI(−1)) | 0.085 *** | 0.109 *** |

| (0.026) | (0.015) | |

| D(OILI) | 0.064 *** | 0.551 |

| (0.012) | (0.321) | |

| D(OILI(−1)) | 0.074 *** | 0.129 *** |

| (0.015) | (0.028) | |

| D(ELI) | 0.541 *** | 0.749 *** |

| (0.068) | (0.065) | |

| D(ELI(−1)) | 0.172 ** | 0.310 |

| (0.066) | (0.070) | |

| D(GSI) | 0.281 *** | 0.332 *** |

| (0.029) | (0.019) | |

| D(GSI(−1)) | 0.236 *** | 0.104 *** |

| (0.055) | (0.019) | |

| D(OILI × ELI) | 10.743 *** | |

| (0.816) | ||

| D(OILI × ELI(−1)) | 7.519 *** | |

| (0.574) | ||

| D(INF) | −0.002 *** | −0.310 *** |

| (0.001) | (0.070) | |

| D(OPN) | 0.207 *** | 0.027 |

| (0.057) | (0.029) | |

| D(OPN(−1)) | 0.328 *** | −0.334 *** |

| (0.068) | (0.048) | |

| ECM(−1) * | −2.462 *** | −2.045 *** |

| (0.254) | (0.107) |

| Dep. Var: Agricultural Output | DOLS | FMOLS | ||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 1 | Model 2 | |

| LBA | 0.178 * | 0.157 * | 0.335 *** | 0.301 ** |

| (0.091) | (0.088) | (0.030) | (0.066) | |

| CPA | 0.134 *** | 0.131 *** | 0.418 ** | 0.302 *** |

| (0.020) | (0.020) | (0.146) | (0.029) | |

| OILA | 0.066 *** | 0.279 *** | 0.487 *** | 1.515 *** |

| (0.015) | (0.057) | (0.075) | (0.131) | |

| ELA | 0.082 * | 0.296 * | 1.542 *** | 1.518 *** |

| (0.044) | (0.127) | (0.132) | (0.130) | |

| GSA | 0.144 *** | 0.349 ** | 0.149 *** | 0.248 *** |

| (0.019) | (0.046) | (0.049) | (0.080) | |

| OILA × ELA | 1.624 *** | 2.054 ** | ||

| (0.367) | (0.811) | |||

| INF | −0.104 | −0.164 ** | −0.057 | −0.274 |

| (0.100) | (0.079) | (0.155) | (0.131) | |

| OPN | 0.290 ** | 0.131 | 2.815 *** | 0.166 |

| (0.048) | (0.583) | (0.583) | (0.094) | |

| C | 3.598 *** | 7.029 * | 3.397 *** | 9.492 * |

| (0.861) | (1.654) | (0.777) | (4.597) | |

| Dep. Var: Industrial Output | DOLS | FMOLS | ||

|---|---|---|---|---|

| Model 3 | Model 4 | Model 3 | Model 4 | |

| LBI | 0.477 *** | 0.276 ** | 0.477 *** | 0.285 ** |

| (0.090) | (0.136) | (0.090) | (0.436) | |

| CPI | 0.200 *** | 0.158 *** | 0.200 *** | 0.269 *** |

| (0.017) | (0.025) | (0.017) | (0.066) | |

| OILI | 1.934 *** | 0.327 *** | 1.934 *** | 1.767 ** |

| (0.421) | (0.048) | (0.421) | (0.874) | |

| ELI | 1.358 *** | 0.319 *** | 1.854 *** | 0.738 *** |

| (0.283) | (0.034) | (0.326) | (0.147) | |

| GSI | 0.196 *** | 0.193 *** | 0.196 *** | 0.315 *** |

| (0.015) | (0.024) | (0.015) | (0.045) | |

| OILI × ELI | 2.113 ** | 2.854 *** | ||

| (1.006) | (0.626) | |||

| INF | −0.203 *** | −0.194 *** | 0.048 | −0.365 |

| (0.032) | (0.042) | (0.030) | (1.743) | |

| OPN | 0.335 *** | 0.203 *** | 0.005 | 0.124 |

| (0.030) | (0.032) | (0.019) | (0.152) | |

| C | 9.736 * | 6.443 *** | 9.963 * | 7.622 ** |

| (5.614) | (2.290) | (6.918) | (3.109) | |

| Tests | Model 1 | Model 2 | Model 3 | Model 4 | ||||

|---|---|---|---|---|---|---|---|---|

| Test-Stat | Prob. | Test-Stat | Prob. | Test-Stat | Prob. | Test-Stat | Prob. | |

| Serial Correlation LM | 1.184 | 0.369 | 8.546 | 0.105 | 1.109 | 0.364 | 14.721 | 0.064 |

| Durbin–Watson | 1.978 | - | 1.981 | - | 2.170 | - | 2.458 | - |

| White’s test | 0.794 | 0.685 | 0.714 | 0.755 | 2.376 | 0.142 | 2.529 | 0.046 |

| Breusch–Pagan–Godfrey | 0.630 | 0.812 | 1.407 | 0.408 | 1.361 | 0.284 | 0.330 | 0.965 |

| Normality Test | 0.317 | 0.853 | 1.216 | 0.544 | 1.803 | 0.406 | 1.954 | 0.376 |

| Ramsey RESET Test | 0.034 | 0.866 | 0.119 | 0.741 | 0.259 | 0.800 | 0.683 | 0.508 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Umair, M.; Ahmad, W.; Hussain, B.; Antohi, V.M.; Fortea, C.; Zlati, M.L. The Role of Labor Force, Physical Capital, and Energy Consumption in Shaping Agricultural and Industrial Output in Pakistan. Sustainability 2024, 16, 7425. https://doi.org/10.3390/su16177425

Umair M, Ahmad W, Hussain B, Antohi VM, Fortea C, Zlati ML. The Role of Labor Force, Physical Capital, and Energy Consumption in Shaping Agricultural and Industrial Output in Pakistan. Sustainability. 2024; 16(17):7425. https://doi.org/10.3390/su16177425

Chicago/Turabian StyleUmair, Muhammad, Waqar Ahmad, Babar Hussain, Valentin Marian Antohi, Costinela Fortea, and Monica Laura Zlati. 2024. "The Role of Labor Force, Physical Capital, and Energy Consumption in Shaping Agricultural and Industrial Output in Pakistan" Sustainability 16, no. 17: 7425. https://doi.org/10.3390/su16177425