Research on the Inhibitory Effect of the EU’s Carbon Border Adjustment Mechanism on Carbon Leakage

Abstract

1. Introduction

2. Literature Review

3. Conceptual Framework

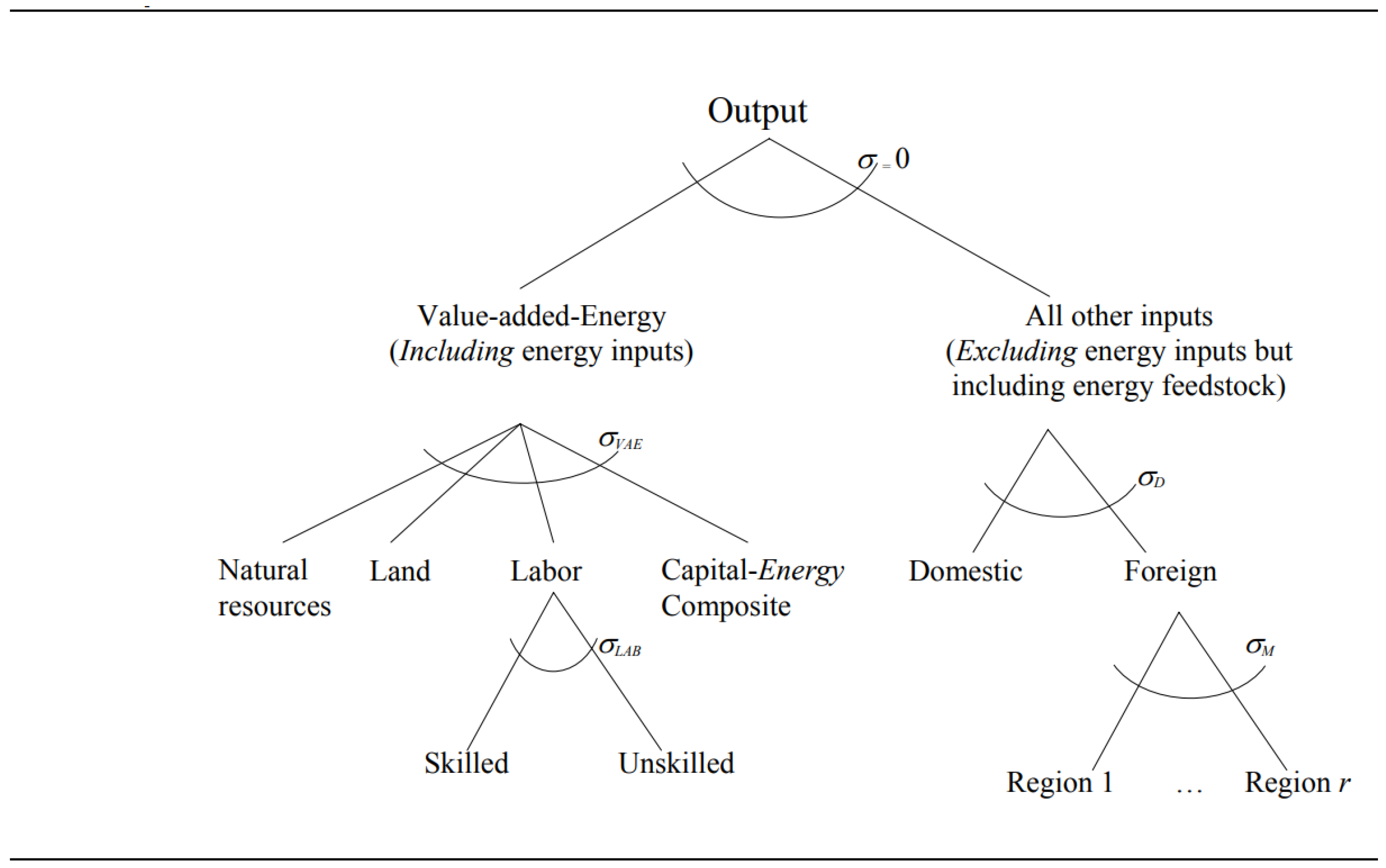

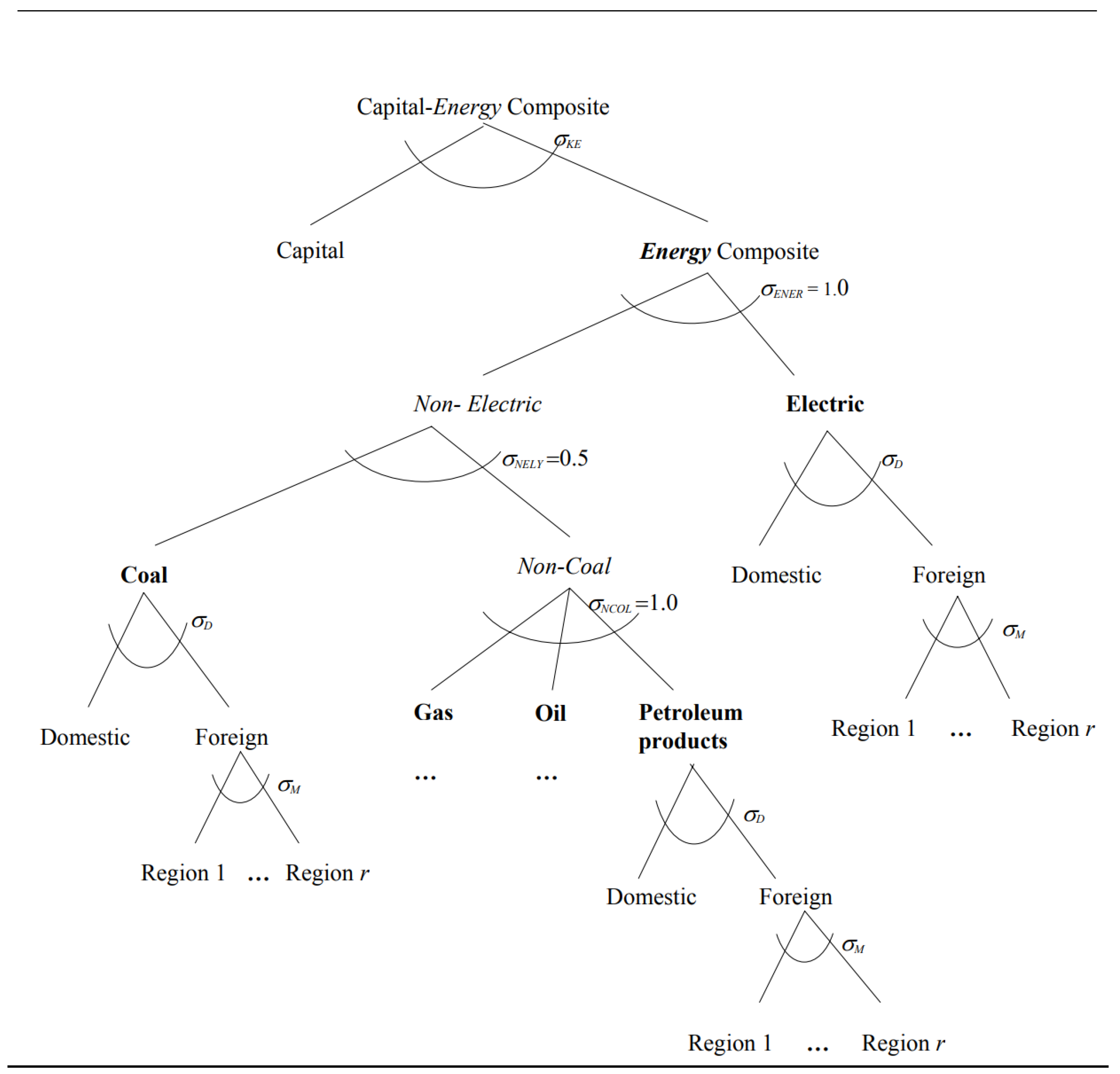

3.1. Modeling Framework

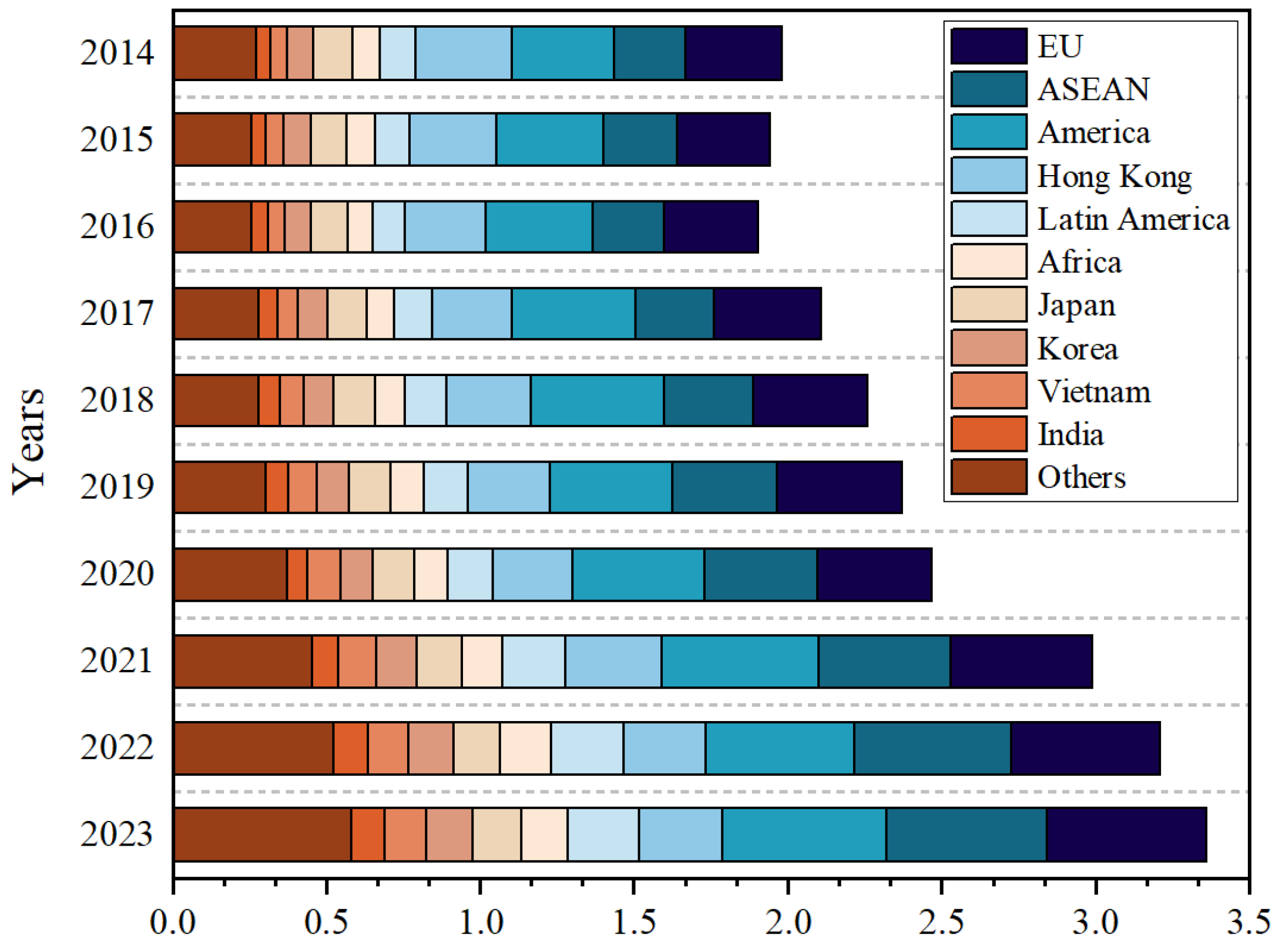

3.2. Data and Aggregation

3.3. Scenario Settings

4. Simulation Results and Discussion

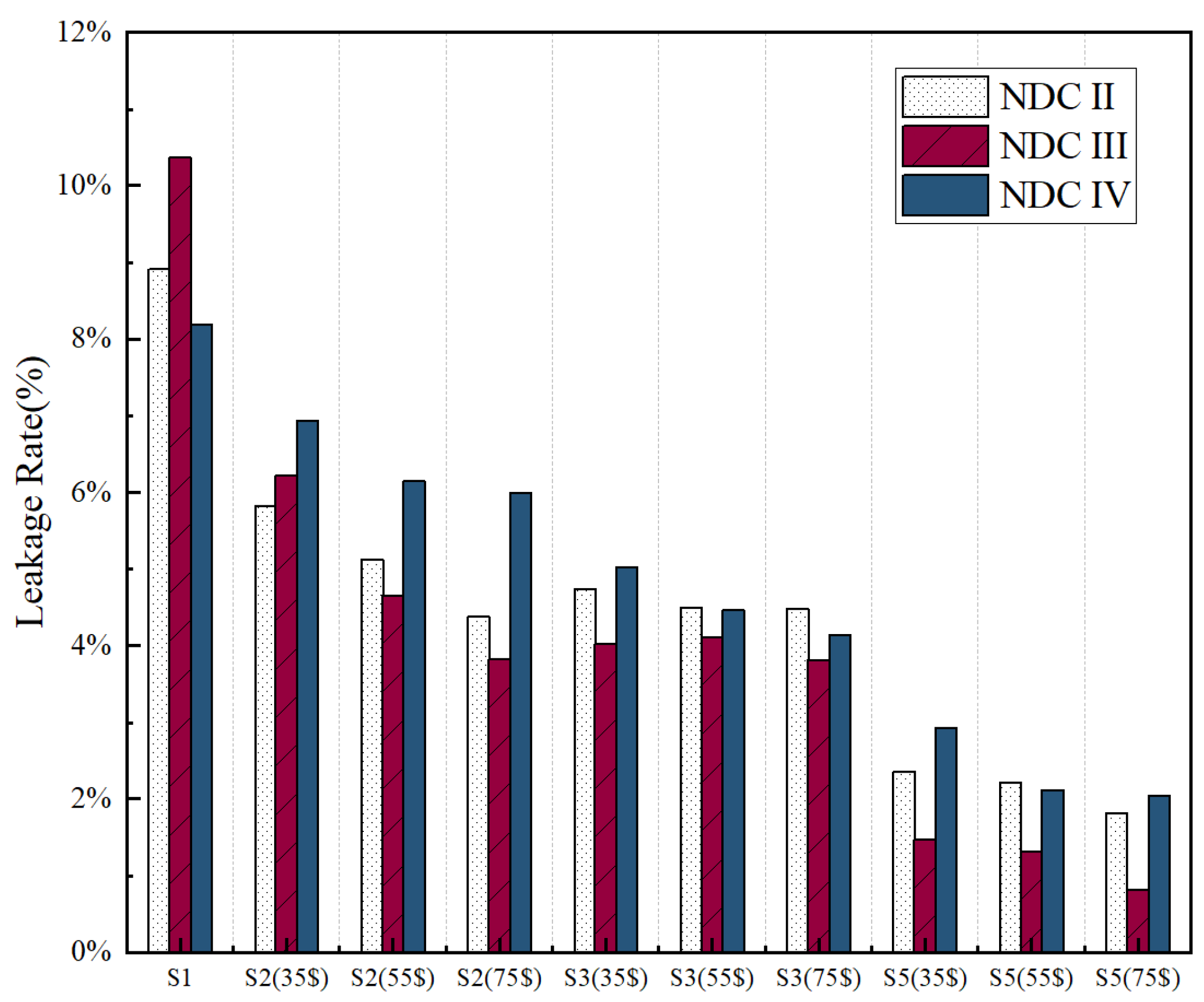

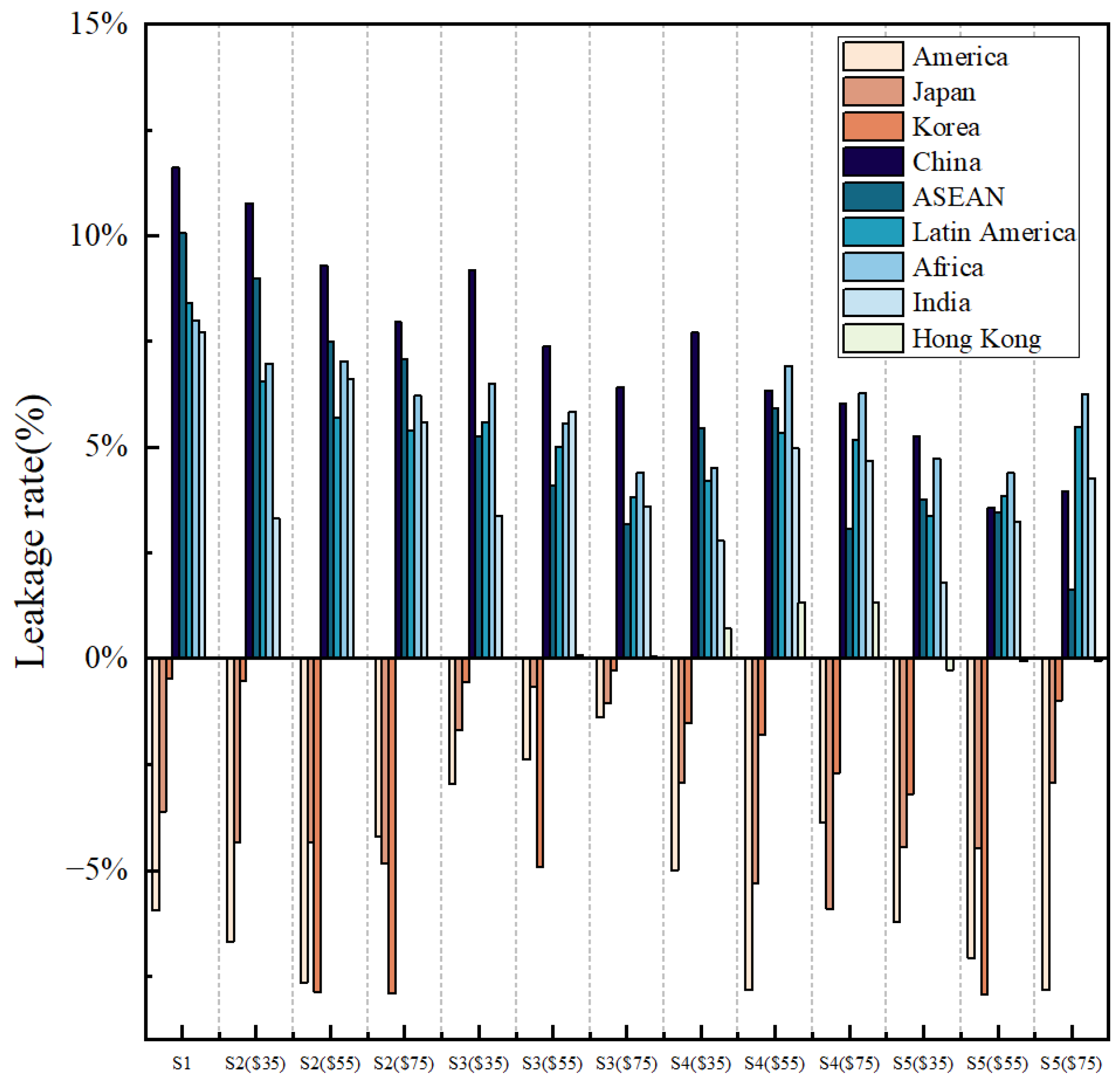

4.1. The Inhibitory Effect of CBAM on Carbon Leakage

4.2. CBAM’s Impact on China’s Trade and Output of Different Industries

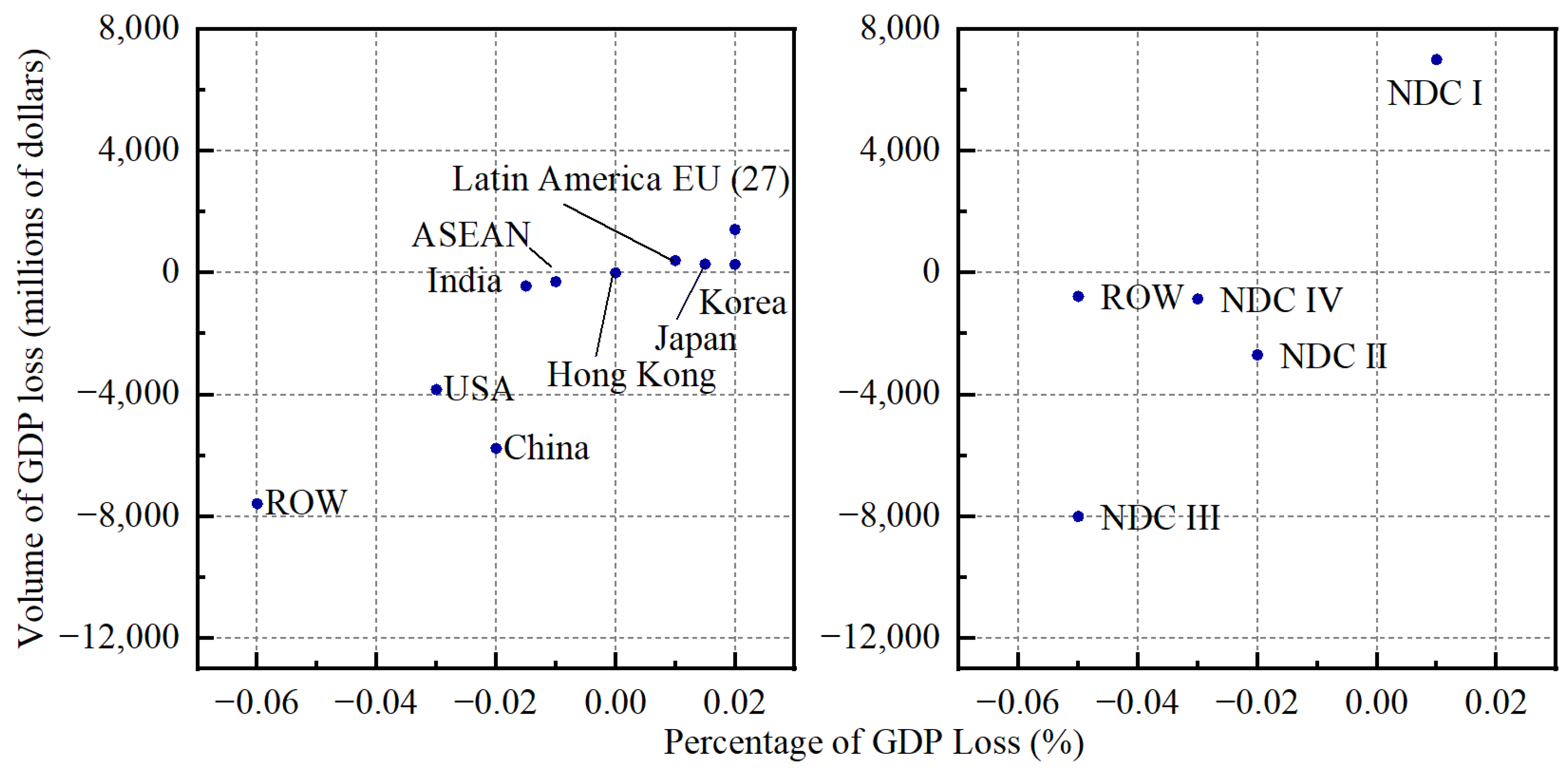

4.3. Regional Macroeconomic Impacts

4.4. Sensitivity Analysis

4.5. Further Discussion of Carbon Border Adjustment

5. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

| Aggregation Name | Countries and Regions in GTAP-11 Database |

|---|---|

| Aggregation I | |

| NDC I | Australia, New Zealand, Japan, Vietnam, Canada, United States, Brazil, Venezuela, Costa Rica, Dominica, France, Germany, Italy, Netherlands, Belgium, Luxembourg, United Kingdom, Denmark, Ireland, Greece, Portugal, Spain, Austria, Sweden, Finland, Malta, Cyprus, Poland, Hungary, Czech Republic, Slovakia, Slovenia, Estonia, Latvia, Lithuania, Romania, Bulgaria, United Kingdom, Norway, Switzerland, Serbia, Belarus, Russia, Ukraine, Kazakhstan, Tajikistan, Azerbaijan, Guinea, Equatorial Guinea, Zambia, Botswana. |

| NDC II | Korea, Mongolia, Cambodia, Indonesia, Thailand, Afghanistan, Bangladesh, Pakistan, Mexico, Argentina, Colombia, Paraguay, Peru, Guatemala, Honduras, Haiti, Trinidad and Tobago, Albania, Kyrgyzstan, Armenia, Georgia, Iran, Iraq, Israel, Jordan, Lebanon, Oman, Turkey, Morocco, Benin, Burkina Faso, Cameroon, Ghana, Mali, Niger, Nigeria, Senegal, Togo, Central African Republic, Chad, Congo, Gabon, Comoros, Ethiopia, Kenya, Madagascar, Mauritius, Uganda, Namibia, South Africa. |

| NDC III | China, Malaysia, Singapore, India, Chile, Uruguay, Uzbekistan, Tunisia |

| NDC IV | Brunei Darussalam, Laos, Philippines, Nepal, Sri Lanka, Bolivia, Ecuador, Panama, El Salvador, Jamaica, Bahrain, Kuwait, Qatar, Saudi Arabia, United Arab Emirates, Algeria, Egypt, Malawi, Rwanda, Sudan, Zimbabwe. |

| Aggregation II | |

| China | China |

| EU (27) | France, Germany, Italy, Netherlands, Belgium, Luxembourg, Denmark, Ireland, Greece, Portugal, Spain, Austria, Sweden, Finland, Malta, Cyprus, Poland, Hungary, Czech Republic, Slovakia, Slovenia, Estonia, Latvia, Lithuania, Romania, Bulgaria |

| ASEAN | Brunei, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand, Myanmar, other parts of South-East Asia |

| USA | USA |

| Hong Kong | Hong Kong |

| Latin America | Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Venezuela, rest of South America, Costa Rica, Guatemala, Honduras, Nicaragua, Panama, El Salvador, rest of Central America, Dominica, Haiti, Jamaica, Puerto Rico, Trinidad and Tobago, Caribbean Sea |

| Africa | Algeria, Egypt, Morocco, Tunisia, rest of North Africa, Benin, Burkina Faso, Cameroon, Côte d’Ivoire, Ghana, Guinea, Mali, Niger, Nigeria, Senegal, Togo, rest of West Africa, Central African Republic, Chad, Congo, Democratic Republic of the Congo, Equatorial Guinea, Gabon, Central and Southern Africa, Comoros, Ethiopia, Kenya, Madagascar, Malawi, Mauritius, Mozambique, Rwanda, Sudan, Tanzania, Uganda, Zambia, Zimbabwe, rest of East Africa, Botswana, Swaziland, Namibia, South Africa, rest of South Africa. |

| Japan | Japan |

| Korea | Korea |

| India | India |

| Row | Countries and territories in the database not listed above |

Appendix D

| Aggregation Name | Emissions in 2014 | Conditional Emissions in 2030 | Projected Change (%) |

|---|---|---|---|

| Aggregation I | |||

| NDC I | 18.927 | 16.369 | −13.52% |

| NDC II | 10.502 | 13.729 | 30.73% |

| NDC III | 15.194 | 23.164 | 52.45% |

| NDC IV | 2.645 | 3.480 | 31.57% |

| Aggregation II | |||

| China | 12.000 | 14.494 | 20.80% |

| EU (27) | 4.180 | 3.525 | −15.70% |

| ASEAN | 3.813 | 4.916 | 22.42% |

| USA | 6.500 | 5.044 | −22.40% |

| Hong Kong | - | - | - |

| Latin America | 3.292 | 3.659 | 10.04% |

| Africa | 3.512 | 4.039 | 13.05% |

| Japan | 1.380 | 1.088 | −21.20% |

| Korea | 0.668 | 0.562 | −15.80% |

| India | 2.670 | 7.707 | 188.60% |

| Row | 4.841 | 5.816 | 16.76% |

Appendix E

| Sector Aggregation | Sectors Covered in GTAP-11 Database |

|---|---|

| Agriculture | Paddy rice, wheat, cereal grains nec, vegetables, fruit, nuts, oil seeds, sugar cane, sugar beet, plant-based fibers, crops nec, bovine cattle, sheep and goats, animal products nec, raw milk, wool, silk-worm cocoons, forestry, fishing, processed rice |

| Food_pcts | Bovine meat products, meat products nec, vegetable oils and fats, dairy products, sugar, food products nec, beverages and tobacco products |

| Coal | Coal mining |

| Oil | Crude oil |

| Gas | Natural gas extraction |

| Oil_pcts | Refined oil products |

| Electricity | Electricity |

| Textiles | Textiles, wearing apparel, leather products |

| Min_pcts | Minerals nec, mineral products nec |

| Wood_pcts | Wood products, paper products, publishing |

| Chemical_pcts | Chemical products, basic pharmaceutical products, rubber and plastic products |

| Metl_pcts | Ferrous metals, metals nec, metal products |

| Electronic_pcts | Computer, electronic and optic, electrical equipment |

| Equipment | Machinery and equipment nec |

| Lightmnfc | Motor vehicles and parts, transport equipment nec, manufactures nec |

| Others | Sectors in the database not listed above |

References

- UNFCCC. Nationally determined contributions under the Paris Agreement. In Proceedings of the UN Climate Change Conference. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement/nationally-determined-contributions-ndcs (accessed on 2 June 2024).

- WorldBank. State and Trends of Carbon Pricing 2023; WorldBank: Washington, DC, USA, 2023. [Google Scholar]

- Tarr, D.G.; Kuznetsov, D.E.; Overland, I.; Vakulchuk, R. Why carbon border adjustment mechanisms will not save the planet but a climate club and subsidies for transformative green tech49nologies may. Energy Econ. 2023, 122, 106695. [Google Scholar] [CrossRef]

- Kuik, O.; Hofkes, M. Border adjustment for European emissions trading: Competitiveness and carbon leakage. Energy Policy 2010, 38, 1741–1748. [Google Scholar] [CrossRef]

- Kee, H.L.; Ma, H.; Mani, M. The Effects of Domestic Climate Change Measures on International Competitiveness. World Econ. 2010, 33, 820–829. [Google Scholar] [CrossRef]

- Qi, W. Review on border carbon adjustments under climate change. Master’s Thesis, Nankai University, Tianjin, China, 2011. [Google Scholar]

- IPCC. Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC: London, UK; New York, NY, USA, 2014. [Google Scholar]

- Copeland, B.R.; Taylor, M.S. Free trade and global warming: A trade theory view of the Kyoto protocol. J. Environ. Econ. Manag. 2005, 49, 205–234. [Google Scholar] [CrossRef]

- Peters, G.P. From production-based to consumption-based national emission inventories. Ecol. Econ. 2008, 65, 13–23. [Google Scholar] [CrossRef]

- Franzen, A.; Mader, S. Consumption-based versus production-based accounting of CO2 emissions: Is there evidence for carbon leakage? Environ. Sci. Policy 2018, 84, 34–40. [Google Scholar] [CrossRef]

- Jiborn, M.; Kander, A.; Kulionis, V.; Nielsen, H.; Moran, D.D. Decoupling or delusion? Measuring emissions displacement in foreign trade. Glob. Environ. Chang. -Hum. Policy Dimens. 2018, 49, 27–34. [Google Scholar] [CrossRef]

- Yu, B.Y.; Zhao, Q.Y.; Wei, Y.M. Review of carbon leakage under regionally differentiated climate policies. Sci. Total Environ. 2021, 782, 146765. [Google Scholar] [CrossRef]

- Michalek, G.; Schwarze, R. Carbon leakage: Pollution, trade or politics? Environ. Dev. Sustain. 2015, 17, 1471–1492. [Google Scholar] [CrossRef]

- Tan, X.; Liu, Y.; Cui, J.; Su, B. Assessment of carbon leakage by channels: An approach combining CGE model and decomposition analysis. Energy Econ. 2018, 74, 535–545. [Google Scholar] [CrossRef]

- Weitzel, M.; Hübler, M.; Peterson, S. Fair, optimal or detrimental? Environmental vs. strategic use of border carbon adjustment. Energy Econ. 2012, 34, S198–S207. [Google Scholar] [CrossRef]

- Antimiani, A.; Costantini, V.; Martini, C.; Salvatici, L.; Tommasino, M.C. Assessing alternative solutions to carbon leakage. Energy Econ. 2013, 36, 299–311. [Google Scholar] [CrossRef]

- Gerlagh, R.; Kuik, O. Spill or leak? Carbon leakage with international technology spillovers: A CGE analysis. Energy Econ. 2014, 45, 381–388. [Google Scholar] [CrossRef]

- Fischer, C.; Greaker, M.; Rosendahl, K.E. Robust technology policy against emission leakage: The case of upstream subsidies. J. Environ. Econ. Manag. 2017, 84, 44–61. [Google Scholar] [CrossRef]

- Pan, W.; Kim, M.K.; Ning, Z.; Yang, H. Carbon leakage in energy/forest sectors and climate policy implications using meta-analysis. For. Policy Econ. 2020, 115, 102161. [Google Scholar] [CrossRef]

- King, L.C.; van den Bergh, J.C.J.M. Potential carbon leakage under the Paris Agreement. Clim. Chang. 2021, 165, 52. [Google Scholar] [CrossRef]

- Zhang, Y.Y. Climate change, trade policy and the wto rules: In case of border adjustments. Master’s Thesis, Nankai University, Tianjin, China, 2010. [Google Scholar]

- Monjon, S.; Quirion, P. A border adjustment for the EU ETS: Reconciling WTO rules and capacity to tackle carbon leakage. Clim. Policy 2011, 11, 1212–1225. [Google Scholar] [CrossRef]

- Winchester, N.; Paltsev, S.; Reilly, J.M. Will Border Carbon Adjustments Work? B.E. J. Econ. Anal. Policy 2011, 11. [Google Scholar] [CrossRef]

- Kortum, S.; Weisbach, D. The design of border adjustments for carbon prices. Natl. Tax J. 2017, 70, 421–446. [Google Scholar] [CrossRef]

- Mehling, M.A.; Van Asselt, H.; Das, K.; Droege, S.; Verkuijl, C. Designing Border Carbon Adjustments for Enhanced Climate Action. Am. J. Int. Law 2019, 113, 433–481. [Google Scholar] [CrossRef]

- Korpar, N.; Larch, M.; Stöllinger, R. The European carbon border adjustment mechanism: A small step in the right direction. Int. Econ. Econ. Policy 2022, 20, 95–138. [Google Scholar] [CrossRef]

- Evans, S.; Mehling, M.A.; Ritz, R.A.; Sammon, P. Border carbon adjustments and industrial competitiveness in a European Green Deal. Clim. Policy 2021, 21, 307–317. [Google Scholar] [CrossRef]

- Keen, M.; Parry, I.; Roaf, J. Border carbon adjustments: Rationale, design and impact. Fisc. Stud. 2022, 43, 209–234. [Google Scholar] [CrossRef]

- Böhringer, C.; Carbone, J.C.; Rutherford, T.F. The Strategic Value of Carbon Tariffs. Am. Econ. J. -Econ. Policy 2016, 8, 28–51. [Google Scholar] [CrossRef]

- Chen, G. Impact of carbon border adjustment mechanism on China’s manufacturing sector: A dynamic recursive CGE model based on an evolutionary game. J. Environ. Manag. 2023, 347, 119029. [Google Scholar] [CrossRef]

- Magacho, G.; Espagne, E.; Godin, A. Impacts of the CBAM on EU trade partners: Consequences for developing countries. Clim. Policy 2023, 241, 243–259. [Google Scholar] [CrossRef]

- Beck, U.R.; Kruse-Andersen, P.K.; Stewart, L.B. Carbon leakage in a small open economy: The importance of international climate policies. Energy Econ. 2023, 117, 106447. [Google Scholar] [CrossRef]

- Siy, A.L.; Wang, A.; Zheng, T.; Hu, X. Research on the Impact of the EU’s Carbon Border Adjustment Mechanism: Based on the GTAP Model. Sustainability 2023, 15, 4761. [Google Scholar] [CrossRef]

- Ambec, S.; Yang, Y. Climate policy with electricity trade. Resour. Energy Econ. 2024, 76, 101422. [Google Scholar] [CrossRef]

- Banerjee, S. Carbon adjustment in a consumption-based emission inventory accounting: A CGE analysis and implications for a developing country. Environ. Sci. Pollut. Res. 2021, 28, 19984–20001. [Google Scholar] [CrossRef]

- Clora, F.; Yu, W.; Corong, E. Alternative carbon border adjustment mechanisms in the European Union and international responses: Aggregate and within-coalition results. Energy Policy 2023, 174, 113454. [Google Scholar] [CrossRef]

- Zhong, J.; Pei, J. Carbon border adjustment mechanism: A systematic literature review of the latest developments. Clim. Policy 2024, 24, 228–242. [Google Scholar] [CrossRef]

- Dong, Y.; Ishikawa, M.; Hagiwara, T. Economic and environmental impact analysis of carbon tariffs on Chinese exports. Energy Econ. 2015, 50, 80–95. [Google Scholar] [CrossRef]

- Wu, L.; Zhou, Y.; Qian, H. Global actions under the Paris agreement: Tracing the carbon leakage flow and pursuing countermeasures. Energy Economics 2022, 106, 105804. [Google Scholar] [CrossRef]

- ICAP. Emissions Trading Worldwide: Status Report 2023; International Carbon Action Partnership: Berlin, Germany, 2023. [Google Scholar]

- Paltsev, S.V. The Kyoto Protocol: Regional and sectoral contributions to the carbon leakage. Energy J. 2001, 22, 53–79. [Google Scholar] [CrossRef]

- Böhringer, C.; Fischer, C.; Rosendahl, K.E.; Rutherford, T.F. Potential impacts and challenges of border carbon adjustments. Nat. Clim. Chang. 2022, 12, 22–29. [Google Scholar] [CrossRef]

- Cramton, P.; MacKay, D.J.; Ockenfels, A.; Stoft, S. Global Carbon Pricing: The Path to Climate Cooperation; MIT Press: Cambridge, MA, USA, 2017. [Google Scholar]

- WHO; Bekkers, E.; Gianmarco, C. Comparing different approaches to tackle the challenges of global carbon pricing. In World Trade Organization Working Paper ERSD-2022-10; WHO: Geneva, Switzerland, 2022. [Google Scholar]

- Nordhaus, W. Climate Clubs: Overcoming Free-riding in International Climate Policy. Am. Econ. Rev. 2015, 105, 1339–1370. [Google Scholar] [CrossRef]

- Grubb, M.; Jordan, N.D.; Hertwich, E.; Neuhoff, K.; Das, K.; Bandyopadhyay, K.R.; Oh, H. Carbon Leakage, Consumption, and Trade. Annu. Rev. Environ. Resour. 2022, 47, 753–795. [Google Scholar] [CrossRef]

- Burniaux, J.-M.; Truong, T.P. GTAP-E: An energy-environmental version of the GTAP model. GTAP Tech. Pap. 2002, 18. Available online: https://www.gtap.agecon.purdue.edu/resources/res_display.asp?RecordID=923 (accessed on 3 July 2024).

| S1 | All countries meet their Paris Agreement emission reduction commitments by 2030. |

| S2 | CBAM imposes carbon tariffs on sectors covered by Phase I in accordance with the actual collection criteria. |

| S3 | CBAM imposes carbon tariffs on all sectors in accordance with actual collection criteria. |

| S4 | China sets an export carbon tax of USD 20 Mt/CO2 under the CBAM Phase I carbon tariff. |

| S5 | All countries set an export carbon tax of USD 40 Mt/CO2 under the CBAM Phase I carbon tariff. |

| Country Aggregations | S2 | S3 | S4 | S5 |

|---|---|---|---|---|

| EU (27) | −1.4 | −2.54 | −4.34 | −1.08 |

| ASEAN | 0.22 | 0.64 | −0.25 | 0.53 |

| USA | 0.25 | 0.13 | −0.08 | 0.05 |

| Hong Kong | −0.02 | −0.05 | −0.06 | −0.01 |

| Latin America | 0.17 | 0.27 | −0.25 | 0.04 |

| Africa | 0.07 | 0.29 | −0.23 | 0.03 |

| Japan | −0.49 | −0.28 | −0.03 | −0.31 |

| Korea | 2.74 | 0.84 | −2.11 | 0.64 |

| India | 0.18 | 0.13 | −1.72 | 0.18 |

| Change in total export | −0.04 | −0.09 | −0.26 | −0.14 |

| Change in total export (billion of dollars) | −1.874 | −4.118 | −12.176 | −6.526 |

| Sector Aggregations | S2 | S3 | ||||

|---|---|---|---|---|---|---|

| USD 35 | USD 55 | USD 75 | USD 35 | USD 55 | USD 75 | |

| Agriculture | 0.01 | 0.03 | 0.04 | −0.02 | −0.05 | −0.09 |

| Food_pcts | 0.01 | 0.02 | 0.03 | −0.03 | −0.03 | −0.10 |

| Coal | −0.08 | −0.21 | −0.24 | −0.06 | −0.14 | −0.52 |

| Oil | 0.46 | 0.42 | 0.37 | 0.82 | 1.13 | 1.24 |

| Gas | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Oil_pcts | −0.02 | −0.07 | −0.17 | 0.04 | 0.08 | 0.20 |

| Electricity | −0.03 | −0.11 | −0.13 | −0.18 | −0.20 | −0.52 |

| Textiles | 0.02 | 0.03 | 0.05 | −0.04 | −0.11 | −0.21 |

| Min_pcts | −0.04 | −0.13 | −0.14 | −0.13 | −0.13 | −0.14 |

| Wood_pcts | 0.03 | 0.04 | 0.04 | −0.01 | −0.04 | −0.04 |

| Chemical_pcts | −0.04 | −0.07 | −0.12 | −0.15 | −0.55 | −0.68 |

| Metl_pcts | −0.03 | −0.05 | −0.14 | −0.08 | −0.54 | −0.91 |

| Electronic_pcts | 0.04 | 0.09 | 0.10 | 0.15 | 0.33 | 0.43 |

| Equipment | 0.04 | 0.05 | 0.07 | 0.09 | 0.24 | 0.77 |

| Lightmnfc | 0.00 | 0.05 | 0.05 | 0.24 | 0.42 | 0.46 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lan, T.; Tao, R. Research on the Inhibitory Effect of the EU’s Carbon Border Adjustment Mechanism on Carbon Leakage. Sustainability 2024, 16, 7429. https://doi.org/10.3390/su16177429

Lan T, Tao R. Research on the Inhibitory Effect of the EU’s Carbon Border Adjustment Mechanism on Carbon Leakage. Sustainability. 2024; 16(17):7429. https://doi.org/10.3390/su16177429

Chicago/Turabian StyleLan, Tian, and Ran Tao. 2024. "Research on the Inhibitory Effect of the EU’s Carbon Border Adjustment Mechanism on Carbon Leakage" Sustainability 16, no. 17: 7429. https://doi.org/10.3390/su16177429

APA StyleLan, T., & Tao, R. (2024). Research on the Inhibitory Effect of the EU’s Carbon Border Adjustment Mechanism on Carbon Leakage. Sustainability, 16(17), 7429. https://doi.org/10.3390/su16177429